- Business Ideas

- Registered Agents

How to Start a Money Transfer Business in 14 Steps (In-Depth Guide)

Updated: February 22, 2024

BusinessGuru.co is reader-supported. When you buy through links on my site, we may earn an affiliate commission. Learn more

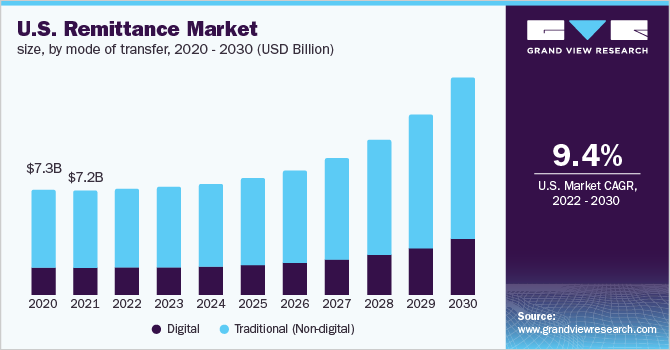

The money transfer industry is expected to reach $95.1 billion by 2032. With more people living abroad and sending money home, it’s a market ripe for new entrants.

The process of building your own money transfer business can seem daunting. You may wonder how to get started, what legal and regulatory requirements exist, and whether there is room to carve out a niche in this competitive space.

This guide breaks down startup costs, critical factors for long-term viability, and step-by-step instructions on acquiring licensure, launching marketing, and obtaining an EIN. With strategic planning and execution, you can be successful. Learn how to start a money transfer business here.

1. Conduct Money Transfer Market Research

Market research helps you develop a business plan for your remittance business. It offers insight into your target market, trends in the money transfer industry, and even which social media platforms are being used by competitors to get money transfer business posted online.

Some details you’ll learn through market research include:

- Global migration patterns mean more people than ever live abroad as expatriates and migrant workers.

- Improving economic conditions in developing countries leads to rises in disposable income available for family members to send home.

- Advances in digital transfer technology have significantly increased accessibility, convenience, and affordability compared to traditional cash-based means.

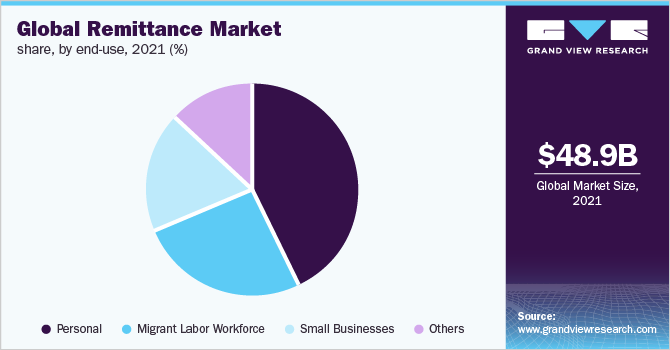

- A closer look at the underlying demographics reveals promising target consumer segments.

- Expatriate workers are the largest contributors, responsible for over 70% of money transfers.

- With over 164 million migrant workers globally, there is a huge addressable audience here.

- The end-user opportunity is immense, and systemic changes create space for new entrants.

- Stricter regulations have led some banks, including JP Morgan Chase and Bank of America , to pull back from the consumer remittance sector, opening a gap for non-bank specialists.

- Services like PayPal’s Xoom , Remitly and WorldRemit have all expanded operations, but still account for less than 5% of total volume, signaling ample remaining share up for grabs.

With accessible technology, low overhead costs compared to traditional models, and exponential end-market growth anticipated, the conditions for building a money transfer business are ideal. Capitalizing on this potential requires contending with regulatory requirements and significant competition.

2. Analyze the Competition

To understand the competitive landscape, first look at the traditional brick-and-mortar money transfer operators. Observe customer demographics, pain points in the process, and customer service quality. This will reveal targetable weaknesses alongside their brand dominance.

Complement this in-person competitive analysis by evaluating their online capabilities. Register accounts, try transferring funds, and scrutinize strengths like transfer speed, payment options, currency support, and loyalty programs.

While Western Union and MoneyGram ’s immense scale can seem daunting, don’t underestimate startups gaining traction in the digital space. Companies like Remitly and Azimo have managed to carve out multi-million dollar niches with more convenient, transparent, and affordable online-first offerings.

Replicate using their services to experience features that delight customers first-hand. Sign up for demos, explore integrations with payment platforms like PayPal , and evaluate customization for funding sources and payout methods. This reveals winning strategies to emulate and build upon.

By benchmarking both traditional big names and emerging digital disruptors, you gain invaluable insight into market positioning and customer priorities. Blend this with target user and region-specific research to identify strategic white space opportunities.

3. Costs to Start a Money Transfer Business

Launching a money transfer business demands a meticulous approach to financial planning. Let’s explore the initial expenses involved in getting your venture off the ground:

Startup Costs

- Licensing and Legal Fees: Ensuring compliance with regulatory requirements is paramount. Allocate funds for obtaining federal and state licenses, alongside adherence to regulations like the Bank Secrecy Act. Estimate these expenses to range from $1,000 to $5,000, varying by jurisdiction complexity.

- Location Costs: Securing a suitable commercial space is crucial for visibility and accessibility. Anticipate monthly rent or lease costs between $1,000 to $5,000, contingent on the location’s size and foot traffic.

- Equipment and Technology: Invest in essential equipment and technology infrastructure, including POS terminals and security systems. Initial expenses can range from $5,000 to $10,000, depending on operational scale.

- Staffing Expenses: Quality personnel are indispensable for customer service and regulatory compliance. Budget for salaries, benefits, and training, ranging from $3,000 to $10,000 monthly, based on staff numbers and local wage rates.

- Marketing and Advertising: Promotion is key to attracting customers. Allocate funds for marketing materials and online advertising, typically ranging from $500 to $5,000 initially.

- Insurance Coverage: Shield your business from potential risks with adequate insurance coverage. Estimate annual premiums between $1,000 to $5,000, factoring in coverage limits and operational risks.

Ongoing Costs

Maintaining operational continuity requires foresight in managing ongoing expenses. Let’s delve into the recurring costs:

- Rent or Lease Payments: Monthly rental or lease payments for commercial space are recurring. Expect costs between $1,000 to $5,000 per month, reflecting market rates and location.

- Staff Salaries and Benefits: Sustain business operations by budgeting for ongoing staff salaries, benefits, and training, ranging from $3,000 to $10,000 monthly.

- Technology Maintenance and Upgrades: Ensure seamless operations by allocating funds for technology upkeep and upgrades, typically ranging from $500 to $2,000 per period.

- Compliance and Regulatory Costs: Maintain adherence to regulatory standards with ongoing compliance costs, varying from $500 to $2,000 annually, dependent on operational complexity.

- Marketing and Advertising Expenses: Sustain brand visibility through periodic marketing campaigns, with expenses typically ranging from $500 to $2,000 per cycle.

- Insurance Premiums: Renew insurance coverage annually to mitigate risks, with premiums ranging from $1,000 to $5,000 per year.

By meticulously accounting for both startup and ongoing costs, aspiring entrepreneurs can chart a clear financial course for their money transfer business. Regular monitoring and adjustments are essential to ensure financial stability and adaptability in a dynamic market landscape.

4. Form a Legal Business Entity

When launching a money transfer business, one of the most important early decisions is selecting your legal entity structure. This carries major implications for legal liability, taxation, raising capital, and regulatory requirements. There are four main legal entities to choose from:

Limited Liability Company (LLC)

LLC maintenance tends to have less demand than corporations in most states. Record keeping and required meetings are typically simpler, with fewer forms and filings. LLC formalization separates legally from sole proprietors, makes clear financial accounting a necessity, and boosts perception among license-issuing bodies.

Sole Proprietorship

A sole proprietorship is best suited for a business with a single owner, or a married couple. It puts you in the driver’s seat in terms of ownership but comes with a downside. Sole proprietorships don’t separate personal and professional assets in cases of liability.

With money transmission licenses central to operations, the risks of non-compliance and handling client funds make limiting personal assets at stake prudent.

Partnership

A partnership works much the same as a sole proprietorship but is intended for a group of business owners. This is a good option for a business run by a family, where each member has an equal investment in the company. Like a sole proprietorship, a partnership doesn’t provide separation between personal and business assets.

Corporation

A corporation is the most advanced form of legal business entity there is. It offers the most protection and the greatest level of customization for owners. On the downside, a corporation is the most complicated and expensive to initiate.

5. Register Your Business For Taxes

One of the key regulatory requirements for launching a money transmission company is obtaining an Employer Identification Number (EIN) from the IRS. The EIN serves as a unique taxpayer ID that identifies your business to federal and state authorities for reporting and filing purposes.

Registering for an EIN is free and can be completed online via the IRS website in just minutes.

To apply, you will need to provide basic information about your LLC such as name, address, and ownership details. The online wizard will guide you through a simple 7-step process that includes reviewing and submitting supporting documentation for your entity.

Upon completion, you will be provided an EIN confirmation notice containing your new tax ID number. This universal business identifier will be used on state money transmitter license applications and down the line for employee onboarding, banking, and payment provider integrations.

In addition to the federal EIN, be sure to look at state and local licensing bureaus to understand sales tax permit requirements for money transfer provider services in your geographic areas of operation. The costs are typically minimal ($50 or less).

While EIN receipt alone does not require filing regular business tax returns, integration with payment systems and employing workers down the line will trigger tax and information reporting obligations. The EIN serves as the consistent tracking number tied to your LLC as these tax scenarios emerge over time.

Obtaining an EIN only takes a few minutes but is a mandatory step to operate legally as a money services business in the United States. With the EIN secured, you can proceed to acquire requisite state money transmitter licenses with confidence.

6. Setup Your Accounting

Maintaining rigorous accounting is crucial for money transfer businesses to track high transaction volumes across customer payments. Money transfer businesses must carefully reconcile payroll for expanding local agents and staff, monitor contractor payout pipelines, and more.

Some ways to optimize your accounting include:

Accounting Software

All complex financial workflows are made smoother by leveraging meticulous accounting software like QuickBooks . QuickBooks works to centralize real-time tracking to reconcile and organize every expense. It streamlines accounting services and allows small businesses to avoid an in-house accounting team.

Hire an Accountant

Along with using accounting software, you should work with an accountant part-time or at the end of the year. Accountants are trained in the intricate methods and tools involved in maintaining and balancing records and can help you meet the part-time requirements of your money transfer license as far as the government is concerned.

Open a Business Bank Account

Another way to organize business finances is to open a business bank account. Remittance services should never mix personal and business funds. Adhering to the Bank Secrecy Act is made easier by having separate accounts to remain transparent to shareholders, customers, and partners.

7. Obtain Licenses and Permits

Obtaining the proper money transmitter and related financial services licenses is essential for legally facilitating cross-border transactions and handling customer funds as a money transfer provider. Find federal license information through the U.S. Small Business Administration . The SBA also offers a local search tool for state and city requirements.

For example, requirements to research may include:

- Money transmitter licensing in states where operations will be based

- Registration as a licensed MSB (Money Services Business) with entities like FINCEN on the federal level

- Acquiring positive background checks and compliance histories for owners/officers

- Securing bonds and meeting minimum capitalization requirements

Because policies frequently evolve, it is advisable to enlist guidance from legal and compliance advisors with a specialized understanding of updated changes proposed by complex regulators like the Conference of State Bank Supervisors .

8. Get Business Insurance

Comprehensive business insurance is considered a prudent move for any company handling sensitive customer data and funds. For regulated financial services like money transmission, insurance can provide an added backstop that demonstrates good faith risk management to licensing authorities.

Potential risks include internal fraud, cybersecurity breaches, failing compliance audits, or events like fires or floods that physically destroy servers and records. Having policies that reimburse customers and restore business operations quickly after disasters minimizes business continuity disruptions.

Common coverage includes:

- Employee theft insurance

- Data breach plans

- Errors & omissions liability

- Property/casualty

With manufacturers crafting over 150 niche solutions, expert guidance is key. Evaluating local transmission regulations to quantify specific coverage gaps, projected customer base value, disaster likelihoods, and growth trajectories can inform smarter buys.

Collaborating closely with an independent broker well-versed in the financial technology sector can illuminate advantageous products unknown to laypersons. They can also assist in interfacing with carriers negotiating tailored solutions like enhanced cyber plans with breach coaches.

While more affordable than some industries, underinsured transmission businesses still risk major continuity threats, hefty non-compliance fines or lawsuits, and even shutdown orders. But those taking a proactive rather than reactive stance on comprehensive insurance enjoy peace of mind as a worthy investment.

9. Create an Office Space

Having a professional office can facilitate customer meetings, support staff collaboration, safely store sensitive documents, and establish legitimacy for licensing boards. Locations projecting security and financial competence may strengthen trust in handling client funds.

Home Office

Many founders launch from home offices minimizing overhead until revenue stabilizes. This allows concentrating resources on core business operations rather than real estate early on. Upgrading later as needs emerge can work well for web-based models.

Coworking Office

For location flexibility at affordable monthly rates, coworking spaces like WeWork provide turnkey environments configurable as teams grow. Built-in amenities, networking events, and central locations offer cost-efficient flexibility difficult to replicate elsewhere.

Retail Office

The option of a retail storefront could provide neighborhood visibility and convenience for cash pay-ins/payouts. But weigh higher fixed costs against target customer digital expectations and foot traffic potential.

Commercial Office

Long-term, strict security and compliance needs may merit eventually overseeing internal spaces like stand-alone commercial offices. This enables highly customized build-outs aligning to data and money-handling best practices as businesses scale up.

10. Source Your Equipment

Many money transmitters function predominantly through web-based platforms, minimizing extensive physical equipment needs early on. But some key components could include:

- Computer hardware/software for building digital platforms and interfaces

- Smartphones/tablets for testing, demos, communications

- Office equipment like printers, and scanners for customer onboarding

When starting, relying on modern personal devices to develop minimally viable technology can suffice and cost little. As efforts grow more sophisticated, upgrading to commercial-grade equipment may support resilience and capacity.

Buying new equipment ensures modern furniture and electronics, extended warranty options, and a longer life span. You can obtain new supplies for your business office through retailers like Staples and Office Depot .

To save money as you start, your transferring money business could invest in used equipment. Check platforms like Facebook Marketplace or Craigslist for deals. Be sure to check that everything is in working order before paying for products.

11. Establish Your Brand Assets

Entering an industry reliant on consumer confidence in the safe, reliable passage of hard-earned funds internationally. Branding your business helps potential clients recognize you, and for your brand to in turn grow in value online.

Some ways to begin developing your brand include:

Design a Logo

Logos offer a visual indicator of who your company is and what it can do. It helps set you apart from competitors and even inspires consumers and business owners to make a change from a competing service. A great place to get started with logo design is Looka .

Design a Website

In the digital age, it’s more important than ever before for businesses to develop easily navigable websites. Designing websites has become easy, even for newcomers. Wix is a great do-it-yourself option. You can also invest in freelance platforms like Fiverr for a more professional custom design.

Print Business Cards

Business cards provide a professional jumping-off point for referrals and word-of-mouth marketing. As a tangible marketing resource, business cards give potential customers memorable access to your business phone number, website, and more. Try Vistaprint for quick, affordable, and professionally printed business cards.

Get a Business Phone Number

Business phone services from RingCentral provide a focused point of contact for customers, investors, and more. A business phone line helps maintain organization between personal and business calls.

Get a Business Domain Name

An indicator of serious long-term market commitment comes through seemingly small touches. Official domain names, like your logo, help brand your business and offer a memorable way for customers to find you. Check out providers like Namecheap for affordable .com addresses.

12. Join Associations and Groups

Joining localized trade organizations, chambers of commerce chapters, or money transmitter alliances creates opportunities to regularly exchange guidance with specialists navigating similar regulatory nuances, banking bottlenecks, and risk climates within overlapping regions.

Local Associations

There are many groups designed to support newcomers in the financial business sector. The International Association of Money Transfer Networks and Money Services Business Association will connect you with like-minded professionals.

Local Meetups

In-person venues provide local mentorship opportunities. Meetup is a great avenue to find events and trade shows in your area. Don’t see one you like? Create a meetup of your own.

Facebook Groups

Tapping forums comprised of principal compliance officers and licensed transmitters via Facebook Groups is a good place to begin. Check out How to Money and Money Transfer Hub to get started. LinkedIn is also a great digital platform to network. It provides mentorship from long-tenured practitioners over common pitfalls.

13. How to Market a Money Transfer Business

Marketing is essential to starting a money transfer services business. It draws in new interest and encourages current customers to use your service again and share it with others. Some of the major ways to market your business as a money transfer operator include:

Referral Marketing

Gaining visibility and trust in a highly regulated industry often hinges on referral networks stemming from exemplary customer service. Providing transfer fee discounts or cash bonuses to satisfied customers who refer other senders could incentivize organic word-of-mouth promotion.

Digital Marketing

Digital tactics useful for amplifying reach may include:

- Search ads on Google Ads to drive users from relevant money-oriented keyword searches

- Social media ads on platforms like Facebook to target expatriate demographics

- Optimized blogging and video content to organically appear for searched money questions

- Email nurture tracks guiding interested leads through account signup

- Retargeting ads remarketing the brand to site visitors

Traditional Marketing

More traditional outlets typically demanding higher spending like billboards or radio may prove less traceable but still contextually valuable:

- Transit posters in high-traffic pickup and delivery locales

- TV or radio ads placed strategically around key cultural events when sending spikes

- Community sponsorships aligned with relevant diaspora organizations

With heavy compliance considerations, however, professional guidance would be advisable before deploying ads to confirm acceptable creative approaches across mediums.

14. Focus on the Customer

In an industry dependent on deep trust to protect clients’ sensitive, hard-earned money, delivering highly responsive, individualized support helps forge meaningful relationships that fuel referrals. Doing whatever it takes to ensure customers feel taken care of can pay dividends.

Consider this scenario: Throwing in a small transfer fee discount for a repeat customer who frequently sends remittances to cover a loved one’s medical bills abroad costs little but signals meaningful support. When their grateful friend later asks where to send their niece’s college tuition, a heartfelt personal recommendation carries far more weight than any advertisement.

Even providing customized guidance to new customers overwhelmed by the transfer options, compliance documentation required, and international policies cements your brand as an ongoing resource at their side rather than just a transactional platform.

By consistently making people the bottom line by nurturing consumer experiences you put yourself in a prime position for return customers.

You Might Also Like

April 9, 2024

0 comments

How to Start a Dog Clothing Business in 14 Steps (In-Depth Guide)

Have you ever considered turning your love for canine couture into a thriving business? ...

How to Start a Vintage Clothing Business in 14 Steps (In-Depth Guide)

The vintage apparel and second hand clothing industry reached an evaluation of $152.5 billion ...

How to Start a Bamboo Clothing Business in 14 Steps (In-Depth Guide)

The global bamboo fiber market is expected to grow at a compound annual growth ...

How to Start a Garage Cleaning Business in 14 Steps (In-Depth Guide)

Starting a garage cleaning business could be the perfect solution! The U.S. garage and ...

Check Out Our Latest Articles

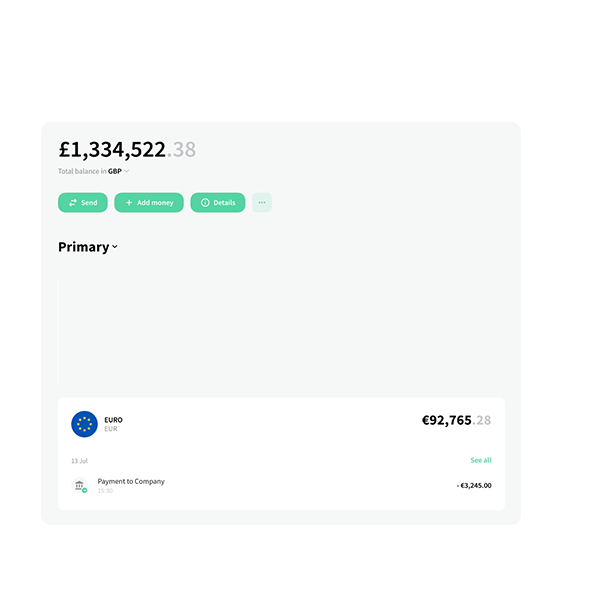

- Accounts Set a Flexible Business Model

- Transfers Payments Without Borders

- Cards Enhance your Horizons

- Dashboard Oversee, Manage and Control

- Price Lists & Fees Maximize your Profits

- White Labeled UIs Shorten your Time to Market

- Decision-Making System Optimize the verification process

- Compliance & Security Stay Compliant and Secure

- Support Use Our Knowledge and Touch

- Currency Exchange Manage and Control All Requests

- API Embed and Distribute

- Crypto Innovate and Earn

- Merchant Payments Enhance your Abilities

- Compliance Assistant

How To Start A Money Transfer Business: Everything You Need To Know

Establishing a money transfer business may be quite challenging due to numerous regulations and requirements. That is why it demands meticulous preparation, compliance with regulatory standards, and strategic collaborations. In this guide, you will find out about the fundamentals of money remittance and strategies on how to start a money transfer business.

Let's discuss your project and see how we can launch your digital banking product together

Overview of international money transfer industry.

Starting and expanding a money transfer business presents a highly profitable opportunity. A substantial amount of money is transferred globally daily, almost $4.8 trillion. Mobile device expansion in recent years has accelerated the global adoption of digital technology for international payments and remittance services. Since digital remittance services offer improved privacy and security along with time and cost savings, consumers are increasingly shifting toward them.

Is the money transfer business profitable? Well, it can be highly profitable, especially considering the substantial growth and transaction volumes observed in the international money transmission sector. With $530 billion in yearly transfers, this sector has expanded significantly since 2000, with a CAGR of 10.4%. Therefore, money transfer services are advantageous to businesses and customers alike, especially considering the significant amounts associated with international financial operations.

Remittance services offer enterprises revenue diversification, an expanded client base, and the ability to provide cross-border payment solutions. With high transaction volumes and opportunities to foster customer loyalty, remittance services become essential to payment operations, offering stable income sources and growth opportunities.

What Is A Money Transfer Business?

What is a money remittance business and how it works, forms of money transfers, bank transfer, wire transfer, in-person transfer, types of remittance or money transfer businesses, traditional brick-and-mortar services, online money transfer platforms, mobile money services, peer-to-peer (p2p) payment platforms, cryptocurrency-based remittance services, how to start a money transfer business step-by-step, conduct thorough market research, establish a suitable business structure, obtain required licenses and permits.

Gather all the papers needed for regulatory compliance, comprising financial invoices, proofs of identity, papers proving business registration, and any other paperwork requested by the regulatory authorities in the countries where you wish to run your business. Acquire the regulatory licenses or registrations required to run your remittance business to navigate the regulatory framework successfully. Adherence to national and international regulations is crucial for maintaining your business's legality and reputation.

If you are wondering how to start a money transfer business in the USA, you will need to comply with federal, state, and local regulations. This includes filing a FinCEN Form 107 with the US Treasury Department's Financial Crimes Enforcement Network for fraud prevention. As far as the UK is concerned, the remittance business requires obtaining a Payment Institution license. Businesses can opt for either an SPI or API license based on revenue. SPI licenses cost £500, while API licenses range from £1500 to £5000. Applicants must register on the FCA Connect Platform and provide FRNs and IRNs for processing.

Implement Robust Money Transfer Software

To comply with money transfer business requirements, establish a robust money transfer software infrastructure that includes stringent Know-your-customer (KYC) and Anti-money laundering (AML) protocols. Put compliance first in order to guarantee user confidence and transaction security. Consider employing compliance-as-a-service for remote and outsourced compliance services.

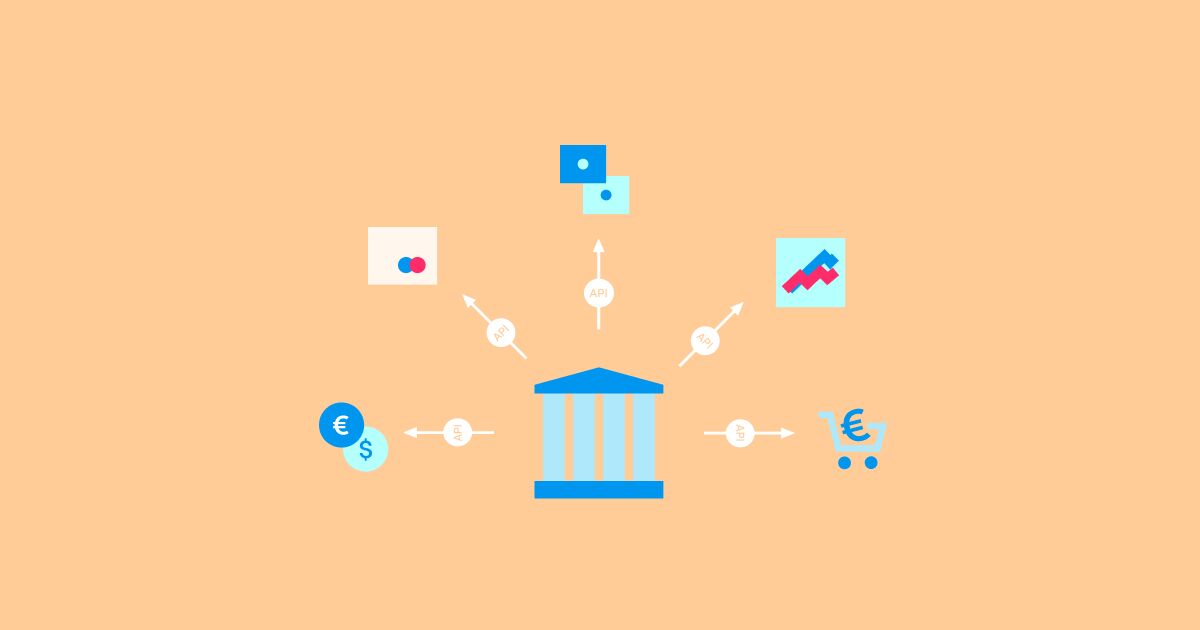

Additionally, investments in the appropriate infrastructure and technology are crucial to guarantee seamless and safe transactions. This entails creating user-friendly software and websites, incorporating safe payment mechanisms, and forming alliances with banks and other financial organizations.

Establish A Business Bank Account

Determine competitive pricing and fee structure, implement effective marketing strategies, maintain regulatory compliance and vigilance.

Continuously monitor and ensure compliance with applicable laws, financial regulations, and regulatory requirements to uphold the legality and reputation of your business. It involves staying updated on any changes or revisions to regulatory requirements. This may entail regularly reviewing and revising internal policies and procedures to ensure they align with current standards. Also, it is crucial to stay vigilant against fraud and illicit activities by implementing robust compliance measures and monitoring systems.

In addition, give your customers outstanding assistance and treatment to gain their trust and loyalty. This entails providing several options for customer communication and swiftly reacting to problems and inquiries. In order to reduce customer annoyance and raise overall satisfaction, strive for quick response times. When handling critical issues, consider establishing around-the-clock customer care, using automated chatbots, or outsourcing to outside service providers as needed.

Future Trends And Opportunities In The Remittance Business Market

Innovative technology constantly impacts the remittance business industry, and digital platforms continue to rise in popularity. These platforms offer secure, quick, and effective money transfer services using advanced technology like blockchain and artificial intelligence. Because of this development, traditional operators need to transition to remain viable in the digital market.

The increased emphasis on financial inclusion is a recent development in the money transfer industry. Many people without bank accounts or limited banking access depend on remittance services for financial needs. Market players are examining innovations like mobile money and agent networks to assist them. Businesses have many opportunities to take advantage of this trend to expand into new regions and help achieve the global goal of improving financial inclusion.

The money remittance business sector is likely to face more compliance requirements in the future. Governments and oversight organizations are stepping up their efforts to eliminate money laundering, funding terrorism, and other illegal acts associated with international money transfers. As a result, companies operating in this industry need to maintain a close eye on the regulatory landscape and implement robust compliance protocols to mitigate risks and preserve their image.

Final Thoughts

In summary, the remittance sector has expanded recently. Technology integration into remittance platforms is becoming a top priority for banks worldwide to facilitate more swift and smooth payments. If you are wondering how to become a money transfer agent, remember that prior to embarking on this business, you will need to grasp the regulations and compliance standards, select suitable technology and infrastructure, establish pricing strategies, and prioritize customer service.

Can I Start A Money Transfer Business?

What is meant by money transfer services, what is money remittance, how do i start a money transfer business, is money transfer business profitable, create a digital bank in a matter of days.

How to Develop a Business Plan for Remittance Services: Key Steps

Get Full Bundle

| $169$99 | $59$39 | $39$29 | $15$9 | $25$15 | $15$9 | $15$9 | $15$9 | $19 |

Total Bundle:

Launching a successful remittance services business requires meticulous planning and preparation. Before diving into the business plan, savvy entrepreneurs must navigate a comprehensive 9-step checklist to ensure their venture is poised for long-term growth and profitability. From in-depth market research to establishing strategic partnerships, this essential roadmap lays the foundation for a thriving remittance services enterprise.

Steps Prior To Business Plan Writing

| Step | Key Considerations |

|---|---|

| Conduct thorough market research on the remittance industry | Analyze industry trends, growth projections, and competitive dynamics. Identify key market drivers, pain points, and opportunities. Gather data on market size, transaction volumes, and average remittance amounts. |

| Identify target customer segments and their unique needs | Understand the demographic, geographic, and psychographic profiles of your target customers. Determine their specific needs, preferences, and pain points related to remittance services. Gather insights on their transaction patterns, service expectations, and willingness to pay. |

| Analyze the competitive landscape and differentiating factors | Identify your key competitors, their market positioning, product/service offerings, and pricing strategies. Assess their strengths, weaknesses, and areas of differentiation. Determine how you can position your remittance services to stand out and create a unique value proposition. |

| Determine the regulatory requirements and compliance measures | Familiarize yourself with the applicable laws, regulations, and licensing requirements for operating a remittance business in your target markets. Understand the compliance measures, reporting obligations, and operational guidelines you must adhere to. |

| Assess the financial viability and projected revenue streams | Estimate the start-up and ongoing operational costs, including technology infrastructure, personnel, marketing, and regulatory compliance. Develop financial projections based on anticipated transaction volumes, average remittance amounts, and target pricing. Assess the potential return on investment and breakeven timeline. |

| Outline the operational model and technological infrastructure | Define the end-to-end remittance process, including customer onboarding, transaction processing, fund disbursement, and customer support. Identify the technological systems, platforms, and integrations required to deliver a seamless and secure remittance experience. |

| Develop a pricing strategy that balances profitability and affordability | Analyze the market's pricing landscape and customer sensitivity to remittance fees. Determine the optimal pricing structure that aligns with your target customer segments, covers operational costs, and ensures a sustainable profit margin. |

| Establish strategic partnerships to enhance service offerings | Identify potential partners, such as financial institutions, payment gateways, and distribution channels, that can help expand your reach, offer complementary services, and provide access to a wider customer base. |

| Craft a compelling brand identity and marketing approach | Develop a strong brand identity that resonates with your target customers, including a distinct name, logo, and messaging. Outline a strategic marketing plan to effectively promote your remittance services and acquire new customers through various channels. |

Conduct Thorough Market Research on the Remittance Industry

Embarking on a successful Remittance Services business venture requires a deep understanding of the industry landscape. Conducting comprehensive market research is the foundation upon which a robust business plan can be built. By delving into the intricacies of the remittance industry, entrepreneurs can identify emerging trends, potential challenges, and lucrative opportunities that will shape the trajectory of their Remittance Services startup.

One of the key aspects of market research for Remittance Services is analyzing the current size and growth potential of the industry. According to the World Bank , the global remittance market was valued at $714 billion in 2020, with an expected annual growth rate of 5.3% from 2021 to 2023. This underscores the significant and steady demand for cross-border money transfer services, particularly among immigrant populations and expatriates.

Alongside the industry's overall size and trajectory, it is crucial to identify the key drivers and barriers shaping the remittance landscape. Factors such as economic conditions, immigration patterns, technological advancements, and regulatory changes can all impact the dynamics of the remittance industry. Understanding these factors can help entrepreneurs anticipate market shifts and devise strategic responses to capitalize on emerging opportunities.

- Analyze the top remittance corridors and the unique needs of the corresponding target markets.

- Investigate the pricing structures, transaction speeds, and customer satisfaction levels of existing remittance service providers.

- Identify the pain points and unmet needs of remittance customers that can be addressed through innovative service offerings.

Furthermore, segmenting the target customer base and understanding their preferences is crucial for tailoring the Remittance Services offering. Factors such as age, income level, country of origin, and digital literacy can influence the desired features, pricing, and communication channels for remittance customers. By aligning the business model with the specific needs of the target segments, Remittance Services startups can enhance their competitive edge and foster long-term customer loyalty.

Conducting a thorough analysis of the competitive landscape is another essential component of market research for Remittance Services. Identifying the key players, their market share, pricing strategies, and unique value propositions can help entrepreneurs assess their own positioning and differentiation opportunities. This knowledge can inform the development of a compelling value proposition and a strategic marketing approach that resonates with the target audience.

By dedicating time and resources to comprehensive market research, Remittance Services entrepreneurs can gain a deep understanding of the industry, identify lucrative opportunities, and develop a business plan that aligns with the evolving needs of the market. This foundational step lays the groundwork for a successful and sustainable Remittance Services venture.

| Remittance Services Business Plan Get Template |

Identify Target Customer Segments and Their Unique Needs

Identifying the target customer segments for a Remittance Services business is a crucial step in developing a comprehensive business plan. By understanding the unique needs and preferences of your potential customers, you can tailor your service offerings, pricing strategies, and marketing efforts to effectively address their pain points and deliver the most value.

According to industry data, the global remittance market is expected to reach a value of $700 billion by 2026 , driven by the growing number of international migrants and the increasing demand for affordable and convenient money transfer services. Within this expansive market, several distinct customer segments can be identified, each with its own distinct characteristics and requirements.

- Analyze demographic data, such as age, income levels, and geographic locations, to identify the most promising customer segments for your Remittance Services business.

- Conduct in-depth interviews and surveys to understand the specific financial needs, pain points, and transaction preferences of your target customers.

- Leverage market research and industry reports to stay informed about emerging trends, shifting customer behaviors, and evolving competitive dynamics in the remittance industry.

One of the primary target segments for Remittance Services businesses is international migrants and expatriates . This group often relies on remittance services to send money back to their home countries, supporting families, paying bills, or investing in local communities. These customers typically prioritize factors such as speed, reliability, and affordability when selecting a remittance provider.

Another key segment includes small businesses and entrepreneurs who need to make cross-border payments for various purposes, such as purchasing inventory, settling supplier invoices, or paying overseas employees. This segment may value features like real-time transaction tracking, multi-currency support, and seamless integration with accounting software .

Additionally, unbanked or underbanked individuals represent a significant opportunity for Remittance Services providers. This segment, which often includes low-income households and those living in remote or underserved areas, may require accessible, user-friendly mobile platforms and alternative identity verification methods to facilitate their financial transactions.

By thoroughly understanding the unique needs and preferences of these target customer segments, Remittance Services businesses can develop tailored solutions, pricing models, and marketing strategies that effectively address the pain points and deliver a superior customer experience. This, in turn, can help to build a loyal customer base, drive sustainable growth, and establish a competitive advantage in the dynamic remittance industry.

Analyze the Competitive Landscape and Differentiating Factors

Conducting a thorough analysis of the competitive landscape is a crucial step in developing a robust business plan for Remittance Services . By understanding the market dynamics, key players, and their offerings, GlobalLink Transfers can identify its unique selling propositions and position itself effectively within the industry.

The remittance services industry is highly competitive, with both established players and emerging fintech companies vying for market share. According to the latest industry reports, the global remittance market is expected to reach $700 billion by 2026, growing at a CAGR of 5.2% from 2021 . This presents a significant opportunity for GlobalLink Transfers to carve out a niche and capture a sizable portion of the market.

- Analyze the pricing structures, transaction speeds, and customer satisfaction levels of the top remittance service providers in the target markets.

- Identify the unique value propositions and differentiating factors that set GlobalLink Transfers apart from its competitors, such as innovative digital solutions, competitive pricing, or specialized services for specific customer segments.

- Assess the potential impact of emerging technologies, such as blockchain and digital wallets, on the remittance industry and how GlobalLink Transfers can leverage these advancements to stay ahead of the curve.

By conducting a detailed competitive analysis , GlobalLink Transfers can develop a comprehensive understanding of the market landscape and identify the areas where it can excel. This information will be crucial in shaping the company's Remittance Services planning , enabling it to craft a differentiated value proposition and a compelling Remittance Services startup strategy.

Additionally, GlobalLink Transfers should closely monitor industry trends, regulatory changes, and evolving customer preferences to continuously refine its Remittance Services industry analysis and Remittance Services market research . This will ensure that the company remains agile and responsive to the dynamic nature of the remittance services market.

Determine the Regulatory Requirements and Compliance Measures

Navigating the regulatory landscape is a crucial step in the planning process for your Remittance Services business. As a financial service provider, you will be subject to a range of regulations and compliance requirements that vary across different jurisdictions. Failure to adhere to these regulations can result in significant legal and financial consequences, making it essential to thoroughly understand and address them.

In the United States, the primary regulatory body overseeing the Remittance Services industry is the Consumer Financial Protection Bureau (CFPB). The CFPB has established a set of rules and guidelines known as the Remittance Transfer Rule, which outlines the disclosure requirements, error resolution procedures, and consumer protections that Remittance Services providers must follow. According to the CFPB, the Remittance Transfer Rule applies to any provider that sends more than $1 million in remittance transfers per year .

Beyond the CFPB regulations, Remittance Services businesses may also need to comply with state-level money transmission laws, anti-money laundering (AML) regulations, and know-your-customer (KYC) requirements. The Financial Crimes Enforcement Network (FinCEN) requires Remittance Services providers to register as money service businesses and implement robust AML and KYC procedures, with potential penalties of up to $250,000 for non-compliance .

- Familiarize yourself with the Remittance Transfer Rule and other relevant federal and state regulations to ensure your Remittance Services business is fully compliant.

- Develop a comprehensive compliance program that includes KYC procedures, transaction monitoring, and regular audits to mitigate the risk of regulatory infractions.

- Consult with legal and financial experts to stay up-to-date on the latest regulatory changes and ensure your business operations align with all applicable laws and guidelines.

In addition to regulatory compliance, Remittance Services providers must also consider the operational and technological infrastructure required to support secure and efficient money transfer services. This may include implementing robust cybersecurity measures, integrating with financial institutions and payment processors, and ensuring the seamless flow of cross-border transactions. A study by the World Bank found that the average cost of sending $200 internationally is approximately 6.5% of the transaction value , with regulatory compliance and operational expenses being significant contributors to these costs.

By thoroughly understanding and addressing the regulatory requirements and compliance measures, you can position your Remittance Services business for long-term success, build trust with your customers, and ensure the integrity of your financial operations.

| Remittance Services Financial Model Get Template |

Assess the Financial Viability and Projected Revenue Streams

Evaluating the financial viability and projected revenue streams is a critical step in developing a comprehensive business plan for Remittance Services. This analysis will help you understand the potential profitability of your venture and ensure its long-term sustainability.

To assess the financial viability of your Remittance Services business, you should begin by conducting a thorough market analysis to estimate the size and growth potential of the remittance industry. According to the World Bank, the global remittance market is expected to reach $630 billion by 2022, with a compound annual growth rate (CAGR) of 4.2% from 2019 to 2022.

Next, you should identify your target customer segments and their unique financial needs. For example, the average remittance transfer size for immigrants in the U.S. is $300 , with a frequency of 4-6 times per year . Understanding these customer behaviors will help you accurately project your potential revenue streams.

- Analyze the pricing structures and fee models of your competitors to ensure your Remittance Services offerings are competitively priced and profitable.

- Explore opportunities to generate additional revenue streams, such as offering currency exchange services, bill payment solutions, or value-added features for your customers.

To determine the financial viability of your Remittance Services business, you should develop a comprehensive financial model that includes projected income statements, cash flow statements, and balance sheets. This model should account for startup costs, operational expenses, and potential revenue streams, as well as any regulatory or compliance-related costs.

By conducting a thorough financial analysis, you can assess the breakeven point, projected profitability, and potential return on investment (ROI) for your Remittance Services business. This information will be crucial in securing funding, developing pricing strategies, and making informed decisions about the overall feasibility of your venture.

Outline the Operational Model and Technological Infrastructure

Developing a robust operational model and technological infrastructure is crucial for the success of GlobalLink Transfers, a Remittance Services business. By carefully designing these key components, the company can ensure efficient, secure, and scalable operations that meet the evolving needs of its diverse customer base.

The operational model for GlobalLink Transfers will be centered around a seamless digital experience, leveraging advanced technology to streamline the remittance process. At the core of this model will be a user-friendly web and mobile platform, enabling customers to initiate and track transactions with ease. The platform will feature intuitive navigation, real-time transaction monitoring, and secure payment gateways , ensuring a frictionless user experience.

To power this digital infrastructure, GlobalLink Transfers will invest in a robust technological stack, including cloud-based systems, data analytics tools, and integrated third-party APIs . This will allow the company to process transactions quickly, maintain data integrity, and provide valuable insights to enhance customer service and decision-making .

- Explore opportunities to leverage emerging technologies, such as blockchain, to further streamline the remittance process and enhance security.

- Prioritize the development of a mobile-friendly platform to cater to the growing preference for on-the-go financial services among the target customer base.

- Implement stringent cybersecurity measures, including data encryption, multi-factor authentication, and regular system audits, to protect customer information and maintain regulatory compliance.

In terms of the operational model, GlobalLink Transfers will establish strategic partnerships with global financial institutions, money transfer operators, and local agents to create a seamless network for cross-border money transfers. This will enable the company to leverage existing infrastructure, access competitive exchange rates, and provide a wider range of service locations for its customers .

The company will also invest in scalable back-office processes, including automated reconciliation, compliance monitoring, and customer support systems . This will ensure that the operational model can adapt to the anticipated growth in transaction volumes and customer base, maintaining high levels of efficiency and responsiveness.

- Explore opportunities to automate repetitive tasks, such as account verification and transaction processing, to enhance operational efficiency.

- Implement robust risk management protocols, including fraud detection algorithms and anti-money laundering (AML) measures, to ensure regulatory compliance and protect the company's reputation.

- Develop a comprehensive disaster recovery and business continuity plan to ensure the resilience of the operational model in the face of unexpected disruptions.

By aligning the operational model and technological infrastructure with the unique needs of the Remittance Services industry, GlobalLink Transfers can position itself as a trusted and innovative provider in the market. This strategic approach will enable the company to deliver a seamless customer experience, maintain operational efficiency, and adapt to the evolving industry landscape .

Develop a Pricing Strategy that Balances Profitability and Affordability

Establishing a pricing strategy for Remittance Services is a critical component of your business plan. The goal is to strike a balance between ensuring profitability for your operations and maintaining affordability for your target customers. This delicate equilibrium is essential for the long-term success and sustainability of your Remittance Services venture.

One of the key factors to consider when developing your pricing strategy is the competitive landscape. Analyze the fees and exchange rates offered by your competitors in the Remittance Services industry. This will help you identify the sweet spot where your pricing can undercut the competition while still generating sufficient revenue. According to industry data, the average transaction fee for Remittance Services in the U.S. is around $8-$15 , with some providers offering even lower rates of $5-$8 .

Another crucial aspect is understanding the price sensitivity of your target customer segments. Immigrants and expats often rely on Remittance Services to support their families back home, and even a small difference in fees can have a significant impact on their budgets. By conducting thorough market research, you can uncover the optimal price point that balances your profit margins and the affordability needs of your customers.

- Consider offering tiered pricing plans or volume-based discounts to cater to the diverse financial capabilities of your customers.

- Leverage technology and digital solutions to streamline your operations and reduce overhead costs, which can then be passed on to your customers through lower fees.

- Regularly monitor and adjust your pricing strategy based on changing market conditions, customer feedback, and your own financial performance.

In addition to pricing, the overall financial viability of your Remittance Services business should be carefully evaluated. Analyze the projected revenue streams, operating expenses, and potential profit margins to ensure the long-term sustainability of your venture. Industry data suggests that successful Remittance Services providers can achieve gross profit margins ranging from 20% to 35% , depending on their operational efficiency and pricing strategies.

By developing a pricing strategy that balances profitability and affordability, you can position your Remittance Services business as a trusted and competitive player in the market, attracting a loyal customer base and driving sustainable growth.

| Remittance Services Pitch Deck |

Establish Strategic Partnerships to Enhance Service Offerings

Establishing strategic partnerships is a crucial step in building a successful Remittance Services business. By collaborating with complementary organizations, GlobalLink Transfers can leverage their expertise, resources, and customer base to enhance its service offerings and reach a wider audience.

One key partnership opportunity lies in collaborating with banks and financial institutions. These partnerships can provide GlobalLink Transfers with access to a vast network of customers, as well as enable seamless integration of its remittance services into the banking ecosystem. This can lead to increased trust and credibility, as well as a more comprehensive financial solution for customers.

- Look for banks and financial institutions that have a strong presence in the remittance corridors you aim to serve, as this can help you tap into a ready-made customer base.

- Negotiate favorable revenue-sharing agreements to ensure that the partnership is mutually beneficial and aligns with your business objectives.

Another strategic partnership to consider is with money transfer operators (MTOs) and foreign exchange providers. By partnering with these entities, GlobalLink Transfers can expand its global reach and offer a wider range of services, such as cash-to-cash transfers, mobile money, and bill payments. This can further enhance the convenience and flexibility for customers, making GlobalLink Transfers a more attractive choice in the highly competitive remittance market.

- Prioritize partnerships with MTOs and foreign exchange providers that have a strong presence in your target remittance corridors and offer competitive exchange rates and fees.

- Ensure that the partnership agreements align with your brand identity, pricing strategy, and customer service standards to maintain a consistent user experience.

Additionally, GlobalLink Transfers can explore partnerships with diaspora organizations, community groups, and local businesses that serve immigrant and expat communities. These partnerships can provide valuable insights into customer preferences, as well as facilitate customer acquisition through trusted channels and referrals.

- Identify organizations that have a strong following and engagement within your target customer segments, and work to establish mutually beneficial arrangements.

- Consider offering co-branded products or services, or revenue-sharing models, to incentivize these partners and drive customer conversions.

By strategically aligning with complementary partners, GlobalLink Transfers can leverage their expertise, resources, and customer base to enhance its service offerings, improve operational efficiency, and ultimately deliver a more compelling value proposition to its customers.

Craft a Compelling Brand Identity and Marketing Approach

Developing a strong brand identity and an effective marketing strategy are critical components in establishing a successful Remittance Services business. By crafting a compelling brand, you can differentiate your offering, build trust with your target customers, and effectively communicate the unique value proposition of your Remittance Services.

Begin by conducting thorough market research to understand the preferences, pain points, and expectations of your target customer segments. Identify the key factors that influence their decision-making process when selecting a Remittance Services provider. Leverage this insights to create a distinctive brand that resonates with your audience and sets you apart from the competition.

Develop a strong brand identity that encompasses your company's mission, values, and unique selling points. Carefully consider your brand name, logo, color scheme, and overall visual aesthetic to ensure a cohesive and memorable brand image. Ensure that your brand identity aligns with the needs and aspirations of your target customers, reflecting their cultural, linguistic, and financial preferences.

- Conduct in-depth market research to understand your target audience's preferences and pain points.

- Craft a distinctive brand identity that resonates with your target customers and sets you apart from competitors.

- Ensure your brand messaging and visual elements align with the needs and expectations of your target market.

Alongside your brand identity, develop a comprehensive marketing strategy to effectively reach and engage your target customers. Leverage a mix of digital and traditional marketing channels, such as search engine optimization (SEO), social media, email marketing, and targeted advertising campaigns. Tailor your messaging and content to address the specific needs and concerns of your diverse customer base, ensuring that your Remittance Services are presented as a reliable, affordable, and user-friendly solution.

Establish strategic partnerships with key industry players, such as financial institutions, community organizations, and influencers, to amplify your brand's reach and credibility. Collaborate with these partners to create co-branded marketing campaigns, cross-promotional opportunities, and referral programs that can help you effectively acquire new customers and build brand loyalty.

- Implement a multi-channel marketing strategy to reach and engage your target customers effectively.

- Forge strategic partnerships with industry players to expand your brand's reach and credibility.

- Continuously monitor and adapt your marketing efforts based on customer feedback and market trends.

By crafting a compelling brand identity and a well-executed marketing approach, you can positioning your Remittance Services as a trusted and desirable choice for your target customers. This, in turn, can help you attract and retain a loyal customer base, drive sustainable growth, and establish your business as a leading player in the Remittance Services industry.

Related Blogs

- 7 Mistakes to Avoid When Starting a Remittance Services in the US?

- What Are The Top 9 Business Benefits Of Starting A Remittance Services Business?

- What Are The Nine Best Ways To Boost A Remittance Services Business?

- What Are Nine Methods To Effectively Brand A Remittance Services Business?

- How To Buy Remittance Services Business: Checklist

- What Are The Reasons For The Failure Of Remittance Services Businesses?

- How To Fund Or Get Money To Start A Remittance Services Business?

- How To Name A Remittance Services Business?

- Remittance Service Owner Earnings: A Deep Dive

- How to Start a Remittance Business: A Step-by-Step Guide for Beginners

- 7 Key KPIs for Effective Remittance Services Management

- What Are the Key Expenses for Remittance Services?

- What Are The Top Nine Pain Points Of Running A Remittance Services Business?

- Maximize Success: Get Your Winning Remittance Pitch Deck Now!

- How to Increase Profits in Your Remittance Service Business

- What Are Nine Strategies To Effectively Promote And Advertise A Remittance Services Business?

- The Complete Guide To Remittance Services Business Financing And Raising Capital

- Strategies To Increase Your Remittance Services Sales & Profitability

- What Are The Best Nine Strategies For Scaling And Growing A Remittance Services Business?

- How To Sell Remittance Services Business in 9 Steps: Checklist

- Key Financial Factors To Consider When Establishing A Remittance Business

- What Are The Key Factors For Success In A Remittance Services Business?

- Valuing a Remittance Services Business - Guide.

- How to Use No-Money Remittance Services: Your Complete Guide

| Expert-built startup financial model templates |

Leave a comment

Your email address will not be published. Required fields are marked *

Please note, comments must be approved before they are published

Money Transfer Business Plan Sample PDF Example | Free Download Presented by BizMove

Watch This Video Before Starting Your Money Transfer Business Plan PDF!

Checklist for Starting a Money Transfer Business: Essential Ingredients for Success

If you are thinking about going into business, it is imperative that you watch this video first! it will take you by the hand and walk you through each and every phase of starting a business. It features all the essential aspects you must consider BEFORE you start a Money Transfer business. This will allow you to predict problems before they happen and keep you from losing your shirt on dog business ideas. Ignore it at your own peril!

For more insightful videos visit our Small Business and Management Skills YouTube Chanel .

Here’s Your Free Money Transfer Business Plan DOC

Free book for you: how to start a business from scratch (pdf).

Copy the following link to your browser and save the file to your PC:

https://www.bizmove.com/free-pdf-download/how-to-start-a-business.pdf

A Box Full of Kisses

Some time ago, a man punished his 3-year-old daughter for wasting a roll of gold wrapping paper. Money was tight and he became infuriated when the child tried to decorate a box to put under the Christmas tree.

Nevertheless, the little girl brought the gift to her father the next morning and said, “This is for you, Daddy.”

The man became embarrassed by his overreaction earlier, but his rage continue when he saw that the box was empty. He yelled at her; “Don’t you know, when you give someone a present, there is supposed to be something inside?”

The little girl looked up at him with tears in her eyes and cried;

“Oh, Daddy, it’s not empty at all. I blew kisses into the box. They’re all for you, Daddy.”

The father was crushed. He put his arms around his little girl, and begged for her forgiveness.

Only a short time later, an accident took the life of the child. Her father kept the gold box by his bed for many years and, whenever he was discouraged, he would take out an imaginary kiss and remember the love of the child who had put it there.

Moral of the story: Love is the most precious gift in the world.

Puppies for Sale

A shop owner placed a sign above his door that said: “Puppies For Sale.”

Signs like this always have a way of attracting young children, and to no surprise, a boy saw the sign and approached the owner; “How much are you going to sell the puppies for?” he asked.

The store owner replied, “Anywhere from $30 to $50.”

The little boy pulled out some change from his pocket. “I only have $2.37,” he said. “Can I please look at them?”

The shop owner smiled and whistled. Out of the kennel came a Lady, who ran down the aisle of his shop followed by five teeny, tiny balls of fur. One puppy was lagging considerably behind. Immediately the little boy singled out the lagging, limping puppy and said, “What’s wrong with that little dog?”

The shop owner explained that the veterinarian had examined the little puppy and had discovered it didn’t have a hip socket. It would always limp. It would always be lame.

The little boy became excited. “That is the puppy that I want to buy.”

The shop owner said, “No, you don’t want to buy that little dog. If you really want him, I’ll just give him to you.”

The little boy got quite upset. He looked straight into the store owner’s eyes, pointing his finger, and said;

“I don’t want you to give him to me. That little dog is worth every bit as much as all the other dogs and I’ll pay full price. In fact, I’ll give you $2.37 now, and 50 cents a month until I have him paid for.”

The shop owner countered, “You really don’t want to buy this little dog. He is never going to be able to run and jump and play with you like the other puppies.”

To his surprise, the little boy reached down and rolled up his pant leg to reveal a badly twisted, crippled left leg supported by a big metal brace. He looked up at the shop owner and softly replied, “Well, I don’t run so well myself, and the little puppy will need someone who understands!”

Who's Counting?

Napoleon was involved in conversation with a colonel of a Hungarian battalion who had been taken prisoner in Italy. The colonel mentioned he had fought in the army of Maria Theresa. "You must have a few years under your belt!" exclaimed Napoleon. "I'm sure I've lived sixty or seventy years," replied the colonel. "You mean to say," Napoleon continued, "you have not kept track of the years you have lived?"

To that the colonel promptly replied, "Sir, I always count my money, my shirts, and my horses - but as for my years, I know nobody who wants to steal them, and I shall surely never lose them."

Manage a Business successfully, manage a company, is the key to the establishment and expansion of the business. The key to successful management is to inspect the market environment and create employment and profit opportunities that provide the possible growth and financial viability of the business. Regardless of the Significance of management, this region can be misunderstood and poorly executed, primarily because people concentrate on the output in place of the procedure for management. Toward the end Of the 1980s, company managers became absorbed in improving product quality, sometimes ignoring their function vis-a-vis personnel. The focus has been on reducing costs and increasing output, while ignoring the long-term advantages of motivating personnel. This shortsighted perspective tended to increase profits in the brief term, but made a dysfunctional long-term small business atmosphere. Simultaneously With the growth in concern about quality, entrepreneurship brought the interest of company. A sudden wave of successful entrepreneurs appeared to render sooner direction theories obsolete. The press focused on the new cult heroes Steve Jobs and Steve Wozniack (creators and developers of the Apple Computer) while ignoring the marketing and organizing talents of Mike Markula, the executive responsible for Apple's business plan. The story of two men selling their Volkswagen bus to build the first Apple computer was more romantic than that of their organizational genius that enabled Apple to develop, market and send its goods while quickly becoming a major corporation. In large Companies, effective manage business abilities requires preparation. Planning is vital for developing a firm's potential. However, many small businesses do not recognize the demand for long-term aims, because the few of people involved with operating the business implies equivalent responsibility in the planning and decision-making processes. Nevertheless, the need for planning is as vital in a small business as it is in a large one. This guide Focuses on the value of good management practices. Specifically, it addresses the responsibilities of handling the external and internal environments. Running A Business Effectively: The External Environment. Five decades ago, Alvin Toffler suggested that the vision of the citizen in the tight grasp of an omnipotent bureaucracy would be replaced through an organizational structure of ad-hocracy. The conventional company organization implied a social contract between employees and employers. By adhering to some predetermined set of duties and sharply defined functions and responsibilities, workers received a predefined set of benefits.The Organizational structure that Toffler predicted in 1970 became the standard 20 decades later, and with it came altered concepts of authority. As organizations became more transitory, the authority of the company and firm has been replaced with the jurisdiction of the individual supervisor. This entrepreneurial management version is now being replicated throughout society. Consequently, the individual business operator must internalize ever increasing organizational purposes. Another Shift In the present business environment is dealing with government agencies. Their influence on the behavior of company most recently seems to have increased. As businesses don't attain high levels of moral behaviour or individual companies exhibit specific lapses, the government rushes in to fill the breach with its regulations. Powerful Communications play an integral role in managing and operating any successful small business. With open communications modifications and their effects on the organization are rapidly shared. Your company then has the time and skills required to react to changes and take advantage of evolving opportunities. The following Checklist addressing how you'd respond to a worker's suggestion offers an assessment of the communication process in your company. Place a check beside the statements that are commonly heard in your business. Balancing Schedules Stress and Personnel. With no organization and decent management the compressed time schedules associated with contemporary business can cause stress and make extraordinary demands on people. A successful management structure can lessen stress and channel the effective capacity of employees into business growth and profits. Setting Duties Tasks and Responsibilities. An organization is characterized by the nature and determination of workers' responsibilities tasks and responsibilities. While many organizations use different procedures for discovering these it is essential that they be clearly defined. The center of any Business is its people and their own functions. Duties responsibilities and tasks often evolve in an ad hoc manner. A typical company starts with a few individuals often one doing all duties. As the company develops others are hired to fulfill specific roles often on a functional basis. Roles which were managed by consultants and experts outside the firm now are managed internally. As new demands emerge new roles have been developed. Another crucial to Successful management is located in controlling battle. Conflict cannot be eliminated from the company or the interpersonal actions of the enterprise. A measure of the business's success is that the degree to which conflict may be exposed and the energies related to it channeled to build up the firm. Though establishing policies and procedures represents the tangible aspect of organization and management the mechanisms to endure and embody barriers to the established operation serve as the actual gist of a firm which will survive and prosper. Even though you May find that certain events are affecting your company be careful not to alter the organizational structure of your firm without discussing it with your management staff. Employees generally can accomplish goals despite organizational structures imposed by management. Since restructuring involves spending a lot of time studying new rules implementing a new organizational structure is pricey. The essence of A successful organization can be simply outlined than employed. The Following checklist can help you determine steps to make sure your direction Structure is sufficient. Check the entries that apply to your firm and also find Out what measures your company needs to take to enhance its management Structure.

custom-clothing custom-jewelry custom-shirt custom-shoe custom-t-shirt-printing custom-wig dairy-farm dance-studio data-center data-entry dealership decal deck-building demolition departmental-store design-studio diagnostic-laboratory diamond-jewelry digital-marketing digital-printing direct-selling disc-jockey-service dispatcher distillery diy dog-breeding dog-grooming dog-kennel dog-training dog-walking dollar-store door driving-school drone dropshipping dry-cleaners drywall dsa dually-truck duck-farm dumpster-rental dump-trailer dump-truck durag earring egg-farm electric-scooter electronics engraving epoxy-countertop

Copyright © by Bizmove.com. All rights reserved.

Banking and Fintech Policies Templates

Streamline Your Banking and Fintech Compliance with Our Customizable Templates

Enter your search term below

Search for products only.

Business Plan Template for a Remittances and Money Transfer Service Platform

$ 790.00

Our Remittances and Money Transfer Service Business Plan offers a strategic blueprint for businesses in this sector. It focuses on enhancing accessibility, reducing costs, and expanding the customer base. With a detailed plan, you can navigate the competitive landscape, optimize operations, and leverage technology to thrive in the remittance industry.

Description

- Reviews (0)

Business Plan Outline: Remittances and Money Transfer Service

Executive Summary:

- Overview of the remittances and money transfer industry.

- Mission statement and vision for the business.

- Key objectives, including improving accessibility, cost reduction, and customer base expansion.

- Summary of the business plan.

Business Description:

- Detailed description of the remittances and money transfer service.

- Market analysis, including industry trends and competition.

- Target market identification and segmentation.

- Explanation of the need for improved accessibility, cost-efficiency, and customer base expansion.

Market Analysis:

- Assessment of the current market size and growth potential.

- Analysis of customer behavior and preferences in the remittance industry.

- Identification of key competitors and their strengths and weaknesses.

- Market trends and opportunities for innovation.

Business Strategy:

- Details on expanding physical and digital access points.

- Partnerships with banks, agents, and mobile money providers.

- Utilization of innovative technologies like mobile apps and online platforms.

- Analysis of existing costs and inefficiencies.

- Strategies for optimizing operational processes.

- Negotiating better deals with correspondent banks and service providers.

- Marketing and customer acquisition tactics.

- Customer retention strategies.

- Expansion into new geographical regions and target demographics.

Operational Plan:

- Detailed explanation of the day-to-day operations of the remittances and money transfer service.

- Staffing requirements and organizational structure.

- Compliance with regulatory requirements and licensing.

Technology and Innovation:

- Description of technology infrastructure.

- Security measures to protect customer data and transactions.

- Plans for continuous innovation and adoption of emerging technologies like blockchain.

Financial Plan:

- Projections for revenue, expenses, and profitability.

- Break-even analysis.

- Funding requirements and potential sources of capital.

Marketing and Sales Strategy:

- Branding and marketing tactics.

- Customer acquisition channels.

- Sales team structure and strategies.

Risk Analysis:

- Identification of potential risks and challenges.

- Mitigation strategies for regulatory changes, currency fluctuations, and cybersecurity threats.

Implementation Timeline:

- A detailed timeline for executing the strategies outlined in the business plan.

Conclusion:

- Summary of the key points in the business plan.

- Reiteration of the mission, vision, and objectives.

- Call to action for stakeholders and potential investors.

This business plan provides a roadmap for remittances and money transfer service providers to enhance their accessibility, reduce costs, and expand their customer base in a competitive market. It outlines strategies to address key challenges and seize opportunities in the remittance industry.

Customer reviews

There are no reviews yet.