Commercial Aviation News and Analysis

LATAM updates its business plan

Photo: Daniel Martínez Garbuno

LATAM Airlines Group has released an updated Business Plan as part of its ongoing Chapter 11 bankruptcy proceedings in the United States. The airline expects total revenue to surpass pre-pandemic traffic levels by 2024, fueled by solid cargo income and recovery capacity levels in commercial passenger flights. LATAM updates its business plan.

Earlier this week, and in the context of the Chapter 11 process, LATAM Airlines Group provided an updated business plan , which contains 5-year financial projections (through 2027), adjusted to the new global macroeconomic context.

This updated business plan reports that LATAM has been actively working to improve its cost structure over the past few years. It has also been taking advantage of the restructuring opportunity via its Chapter 11 process. On June 18, the Bankruptcy Court of the Southern District of New York confirmed the group’s Plan of Reorganization and financing to exit the Chapter 11 process, which is expected to occur in the last quarter of this year.

In the new version of the plan, LATAM Airlines updated its cost savings estimate from US$900 million to more than US$1 billion annually, thanks to several initiatives that have already been implemented.

Additionally, LATAM has implemented an ongoing fleet renegotiation, has improved its relative cost position, strengthened its network, and reduced its total debt by approximately 36% compared to pre-pandemic levels.

In terms of fleet, LATAM Airlines expects to close the year with a fleet of 306 aircraft (compared to 340 when it filed for Chapter 11). By 2027, LATAM’s fleet size will be 326 aircraft. The company currently has an order for 100 Airbus A320neo-family-based jetliners and two Boeing 787-9 Dreamliners, plus taking new leases, including several Dreamliners in the coming years.

Domestic and international recovery

On the demand side, the group expects a recovery in the domestic markets of the subsidiaries to 2019 levels by the end of 2022. However, in the case of Colombia, such recovery was achieved in the first quarter of this year, and Brazil and Ecuador are expected to fully rebound within the third quarter.

Regarding international traffic, LATAM estimates that the recovery will be slower, reaching 2019 levels by mid-2023. It is worth noting that international traffic accounted for approximately 45% of 2019 revenues. Overall, LATAM estimates that it will return to 2019 capacity levels by 2024, when ASKs reach approximately 148 billion, driven primarily by demand recovery in affiliate domestic markets. Load factor will remain stable at 83% between 2023 and 2024.

For 2024, the group projects passenger operations measured in available seat kilometers (ASK), similar to 2019.

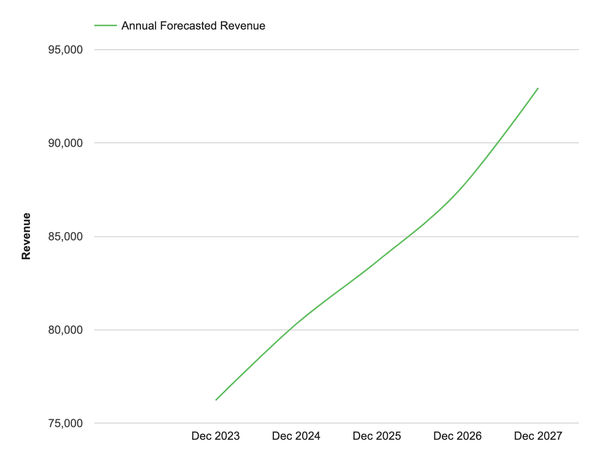

Finally, regarding revenue, LATAM Airlines Group expects to exceed 2019 levels by 2024, reaching US$11.5 billion. Operational cash flow is expected to exceed US$2 billion from 2023 onwards. EBIT margin is expected to be positive next year, going from 5.6% in 2023 to 12.1% in 2027.

LATAM Airlines Group CEO, Roberto Alvo, said:

“Our updated business plan reflects how LATAM group is better prepared to face future challenges, with a more competitive and flexible cost structure, a more complete offering for customers and important progress towards more sustainable aviation.”

Leave a Reply

Your email address will not be published. Required fields are marked *

This site uses Akismet to reduce spam. Learn how your comment data is processed .

Related News

BJP’s election manifesto focuses on civil aviation

US airline employment may have peaked

Alaska Airlines 1Q24 earnings

English (USA)

English (UK)

English (Canada)

English (India)

Deutsch (Deutschland)

Deutsch (Österreich)

Deutsch (Schweiz)

Français (France)

Français (Suisse)

Nederlands (Nederland)

Nederlands (België)

- Top Capitalization

- United States

- North America

- Middle East

- Sector Research

- Earnings Calendar

- Equities Analysis

- Most popular

- TESLA, INC.

- NIPPON ACTIVE VALUE FUND PLC

- THE EDINBURGH INVESTMENT TRUST PLC

- BLACKSTONE INC.

- NETFLIX, INC.

- NVIDIA CORPORATION

- Index Analysis

- Indexes News

- EURO STOXX 50

- Currency Cross Rate

- Currency Converter

- Forex Analysis

- Currencies News

- Precious metals

- Agriculture

- Industrial Metals

- Livestock and Cattle

- CRUDE OIL (WTI)

- CRUDE OIL (BRENT)

- Developed Nations

- Emerging Countries

- South America

- Analyst Reco.

- Capital Markets Transactions

- New Contracts

- Profit Warnings

- Appointments

- Press Releases

- Security Transactions

- Earnings reports

- New markets

- New products

- Corporate strategies

- Legal risks

- Share buybacks

- Mergers and acquisitions

- Call Transcripts

- Currency / Forex

- Commodities

- Cryptocurrencies

- Interest Rates

- Asset Management

- Climate and ESG

- Cybersecurity

- Geopolitics

- Central Banks

- Private Equity

- Business Leaders

- All our articles

- Most Read News

- All Analysis

- Satirical Cartoon

- Today's Editorial

- Crypto Recap

- Behind the numbers

- All our investments

- Asia, Pacific

- Virtual Portfolios

- USA Portfolio

- European Portfolio

- Asian Portfolio

- My previous session

- My most visited

- Undervalued stocks

- Quality stocks at a reasonable price

- Multibaggers

- Momentum stocks

- Quality stocks

- Strategic Metals

- US Basketball

- Quantum computing

- The genomic revolution

- Powerful brands

- Unusual volumes

- New Historical Highs

- New Historical Lows

- Top Fundamentals

- Sales growth

- Earnings Growth

- Profitability

- Rankings Valuation

- Enterprise value

- Top Consensus

- Analyst Opinion

- Target price

- Estimates Revisions

- Top ranking ESG

- Environment

- Visibility Ranking

- Stock Screener Home

- Oligopolies

- 3D Printing

- Space Exploration

- Pricing Power

- Oversold stocks

- Overbought stocks

- Close to resistance

- Close to support

- Accumulation Phases

- Most volatile stocks

- Top Investor Rating

- Top Trading Rating

- Top Dividends

- Low valuations

- All my stocks

- Stock Screener

- Stock Screener PRO

- Portfolio Creator

- Event Screener

- Dynamic Chart

- Economic Calendar

- ProRealTime Trading

- Our subscriptions

- Our Stock Picks

- Thematic Investment Lists

LATAM Airlines Group S.A.

Cl0000000423.

- LATAM Airlines S A : Updated Business Plan

LATAM AIRLINES GROUP

5 Years Business Plan Projection

Subject to Applicable Confidentiality Agreements and Requirements

August 2022

Updated Business Plan

Disclaimers

This presentation ("Presentation") is for informational purposes only. The purpose of this Presentation is to disclose the updated consolidated business plan projections of LATAM Airlines Group S.A. and its affiliated entities ("LATAM" or the "Company") to parties interested in the Company's ongoing chapter 11 proceeding and for no other purpose. This Presentation shall not constitute an offer to sell, or the solicitation of an offer to buy, any securities. Management does not endorse the use of any information in this Presentation for use in making an investment decision. Investors should consider only historical information on deciding whether to buy or sell securities. This information was prepared in connection with the Company's ongoing dialogue with its creditors.

Certain information included herein describes or assumes the expected terms of transactions the Company expects to execute in connection with its restructuring as contemplated under the Company's Plan of Reorganization. The consummation of such transactions is subject to other various risks and contingencies, including closing conditions. There can be no assurance that such transactions will be consummated with the terms assumed herein or otherwise. As such, the subject matter of these materials is evolving and is subject to further change by LATAM in its absolute discretion. No responsibility is taken for changes in market conditions and no obligation is assumed by LATAM to revise this Presentation to reflect the events or conditions that occur subsequent to the date hereof.

Neither the United States Securities and Exchange Commission ("SEC") nor the Chilean Comisión para el Mercado Financiero (the "CMF") nor any securities commission of any other U.S. or non-U.S. jurisdiction has reviewed, approved or disapproved of this Presentation, or determined that this Presentation is truthful or complete. No representations or warranties, express or implied, are given in, or in respect of, this Presentation. To the fullest extent permitted by law in no circumstances will LATAM or any of its respective subsidiaries, shareholders, affiliates, representatives, directors, officers, employees, advisers or agents be responsible or liable for a direct, indirect or consequential loss or loss of profit arising from the use of this Presentation, its contents, its omissions, reliance on the information contained within it, or on opinions communicated in relation thereto or otherwise arising in connection therewith. Industry and market data used in this Presentation have been obtained from third-party industry publications and sources as well as from research reports prepared for other purposes. LATAM has not independently verified the data obtained from these sources and cannot assure you of the data's accuracy or completeness. This data is subject to change. In addition, this Presentation does not purport to be all-inclusive or to contain all of the information that may be required to make a full analysis of LATAM or LATAM's business plan. Viewers of this Presentation should read the same in full together with the Company's SEC filings indicated herein and each make their own evaluation of LATAM and of the relevance and adequacy of the information taken as a whole and should make such other investigations as they deem necessary.

Forward Looking Statements

Certain statements included in this Presentation that are not historical facts are forward-looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied by words such as "believe", "may", "will", "estimate", "continue", "anticipate", "intend", "expect", "should", "would", "plan", "predict", "potential", "seem", "seek", "future", "outlook", and similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding estimates and forecasts of other financial and performance metrics and projections of market opportunity. These statements are based on various assumptions, whether or not identified in this Presentation, and on the current expectations of the respective management of LATAM and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by an investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of LATAM. These forward-looking statements are subject to a number of risks and uncertainties, including changes in domestic and foreign business, market, financial, political, and legal conditions; the inability of LATAM to emerge from the chapter 11 proceeding, including the risk that any regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the Company; risks relating to the uncertainty of the projected financial information with respect to LATAM, risks related to the performance of LATAM's business and the timing of expected business or revenue milestones; the effects of competition on LATAM's business; and those factors discussed in LATAM's annual report on Form 20-F for the year ended December 31, 2021 filed with the SEC on March 30, 2022 (the "Annual Report") under the heading "Risk Factors," and other documents LATAM has filed, or will file, with the SEC. If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that LATAM does not presently know, or that LATAM currently believes are immaterial, that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect LATAM's expectations, plans, or forecasts of future events and views as of the date of this Presentation. LATAM anticipates that subsequent events and developments will cause LATAM's assessments to change. However, while LATAM may elect to update these forward-looking statements at some point in the future, LATAM specifically disclaims any obligation to do so. These forward-looking statements at some point should not be relied upon as representing LATAM's assessments of any date subsequent to the date of this Presentation. Accordingly, undue reliance should not be placed upon the forward-looking statements contained in this Presentation.

Use of Projections and Use of Data

Use of Projections

This Presentation contains projected financial information. Such projected financial information constitutes forward-looking information, and is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results. The use of specific projections and estimates, valuation, appraisal in this Presentation is not intended to indicate management's belief that a particular projection, valuation, appraisal or estimate will be achieved, but rather that the projection, valuation, appraisal or estimate is within the scope of potential outcomes assuming other factors inherent in the business plan. The outcomes presented maybe at the midpoint, bottom or top of the scope. Pro forma estimates and assumptions, including estimates and assumptions related to the Company's financial position at emergence, remain subject to ongoing revision and change due to, among other things, the impact of the ongoing claims reconciliation process on cash at hand and the outcome of the Company's emergence financing transactions, and may vary upon emergence.

The assumptions and estimates underlying such financial forecast information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive, and other risks and uncertainties. See "Forward Looking Statements" above. Actual results may differ materially from the results contemplated by the financial forecast information contained in this Presentation, and the inclusion of such information in this Presentation should not be regarded as a representation by any person that the results reflected in such forecasts will be achieved.

Use of Data

The information contained in this Presentation, including, but not limited to, projections, analyses, third-party reports, appraisals, valuations and other information, is believed to be reliable, however, it has not been verified except as set forth in this Presentation. No warranty is given to the accuracy of such information. The data contained herein is derived from various internal and external sources. Valuation information is provided on a group basis unless otherwise indicated. No representation is made as to the reasonableness of the assumptions made within or the accuracy or completeness of any projections or modeling or any other information contained herein. Any data on past performance or modeling contained herein is not an indication as to future performance. LATAM assumes no obligation to update the information in this Presentation.

Use of Non-GAAP Financial Metrics and Other Key Financial Metrics

This Presentation includes certain non-IFRS financial measures (including on a forward-looking basis) such as EBIT (which consists of earnings for the period before income taxes and financial costs and financial income), EBITDA (which consists of earnings for the period before income taxes and financial costs and financial income, plus depreciation and amortization expense) and EBITDAR (which consists of earnings for the period before income taxes and financial costs and financial income, plus depreciation and amortization expenses and rentals expenses). In addition EBIT margin which is calculated by dividing EBIT by total operating revenue) These non-IFRS measures are an addition to, and not substitute for or superior to, measures of financial performance prepared in accordance with an IFRS alternative to net income or any other measures derived in accordance with IFRS.

LATAM believes that these non-IFRS measures of financial results (including on a forward-looking basis) provide useful supplemental information to investors about LATAM. LATAM's non-IFRS measures may not be directly comparable to similarly titled measures of other companies.

This is an excerpt of the original content. To continue reading it, access the original document here .

Attachments

- Original Link

- Original Document

LATAM Airlines Group SA published this content on 29 August 2022 and is solely responsible for the information contained therein. Distributed by Public , unedited and unaltered, on 30 August 2022 03:33:14 UTC .

Latest news about LATAM Airlines Group S.A.

Chart latam airlines group s.a..

Company Profile

Income statement evolution, ratings for latam airlines group s.a., analysts' consensus, eps revisions, quarterly earnings - rate of surprise, sector other airlines.

- Stock Market

- News LATAM Airlines Group S.A.

- Exclusive analysis

LATAM’s Chapter 11 Business Plan

Sep 11, 2021.

Earlier this week, LATAM released its five-year business plan as part of its financial reorganization. The South American airline group is forecasting when it will recover the profitability and how the market will behave in the coming years. Let’s review LATAM’s Chapter 11 Business Plan.

Back to profitability

Prior to the COVID -19 pandemic, LATAM Airlines Group had revenues of more than US$10 billion and a sound business in South America. Nevertheless, the crisis has overthrown everything and LATAM had to begin a Chapter 11 bankruptcy process in the United States.

The carrier has moved forward, and now it expects it will return to 2019’s profitability by 2024. Moreover, the company expects an operating margin (EBIT) of 11.2% in 2026, which would be the highest since 2010.

Total revenues are projected to increase 13% by 2026, with passenger revenues growing 8% and cargo revenues increasing 59% compared to 2019, said the airline in a statement.

All of this will be achieved because LATAM was able to reduce its cost base by US$900 million annually. The company also expects to improve its CASK ex-fuel by 3.3 cents in 2024.

LATAM Airlines Group CEO, Roberto Alvo, said,

“We will emerge from this process as a highly competitive and sustainable group of airlines, with a very efficient cost structure, all the while maintaining the unparalleled network and connectivity that LATAM offers in all the markets it serves.”

LATAM new financing offers

The South American giant has also received several offers from stakeholders, which would provide more than US$5 billion of new funds.

Each proposal contemplates raising the money through the issuance of new debt and equity. In consequence, if approved and implemented, it would result in the substantial dilution of existing shares. In the last few weeks, Avianca ’s shares have been in decline due to this same reason.

LATAM is also considering getting a possible additional third debtor-in-possession financing worth US$750 million. This money would come in addition to the existing US$1.3 billion Tranche A facility and the US$1.15 billion Tranche C facility, none of which are fully drawn.

The airline said,

“Given the currently favorable market conditions, LATAM is soliciting interest from potential lenders in providing a Tranche B Facility and will consider proposals to determine whether it is able to borrow funds at a more competitive rate than under the existing Tranche A and C facilities.”

What about LATAM’s demand recovery?

LATAM’s Chapter 11 business plan also included a vision of the demand recovery and operational projections through 2026.

The Group forecasts a return to pre-pandemic capacity by 2024 and a growth of 7% by 2026, compared to 2019. LATAM expects domestic markets to recovery by 2022 and international ones by 2024.

LATAM Airlines Brazil would lead the Group’s recovery. It is currently working at 77% of its pre-pandemic capacity, and LATAM expects to surpass 2019 levels earlier next year.

Meanwhile, the domestic markets in Colombia, Ecuador, Peru, and Chile are already at 72% of their pre-pandemic capacities.

Finally, LATAM is looking to extend the period of exclusivity to file a plan of reorganization through October 15, 2021. Additionally, the voting period would go all the way through December 15. LATAM and Aeromexico are facing similar timelines at the moment.

Originally published here .

Tags: LATAM , Chapter 11 , Latin America

- (no comments)

Website Created & Hosted with Website.com Website Builder

Simple Flying

Latam receives over $5bn in financing offers for bankrupty exit.

LATAM is preparing to exit Chapter 11 bankruptcy. On Thursday, the airline announced it has received over $5 billion in financing offers to exit bankruptcy. Alongside this announcement, the airline also released its five-year business plan in which it outlines a slower rebound of international travel, a quicker rebound of short-haul domestic and regional travel, and plans to become a stronger carrier.

LATAM reveals financing offers

LATAM has received over $5 billion in offers for funding to exit bankruptcy. In connection with its Chapter 11 Process, LATAM provided an indicative proposed structure for its reorganization, seeking approximately $5 billion of equity financing.

LATAM has received offers for financing from "its most significant claim holders and its majority shareholders." The carrier's largest shareholders include the US giant Delta Air Lines (20%), the Cueto Group (16.4%), and Qatar Airways (10%), according to the airline. Other shareholders have 34.4% ownership in LATAM.

LATAM's business plan highlights

The airline has also released its five-year projections for coming out of bankruptcy. This includes capacity guidance. The airline forecasts a return to pre-pandemic capacity, measured in available seat kilometers, by 2024. It expects to reach a growth of 7% compared to 2019-levels of capacity by 2026.

In the breakdown by market, LATAM expects a recovery of domestic markets in 2022 and international routes by 2024. LATAM's Brazil entity is doing quite well on the domestic side, with a 77% recovery in August. In early 2022, the airline expects Brazil to cross 100% of 2019 capacity levels.

In other markets, including Peru, Ecuador, Colombia, and Chile, the airline has already reached a 72% recovery in August, and it continues to progress. International recovery, however, remains hampered by travel restrictions.

The carrier expects a permanent structural reduction in business travel of roughly 15%. Although, it expects this to be offset by an approximately 12% improvement in US long-haul routes driven by the joint venture agreement with Delta . Come 2026, including demand associated with the Delta joint venture, the airline expects to recover to 105% of 2019 revenue passenger kilometer levels.

Total revenues are expected to increase 13% by 2026. Passenger revenues are expected to grow by 8% and cargo revenues are expected to increase a whopping 59% compared to 2019. This leads LATAM to project an operating margin (EBIT) of 11.2% in 2026, the highest for the airline since 2010.

LATAM Airlines CEO, Roberto Alvo, stated the following:

“Despite the dramatic crisis we have faced, we have taken full advantage of our restructuring, not only by becoming substantially more efficient, but also by cementing a better value proposition for customers, all of which has been reaffirmed by the significant interest we have received in providing exit financing . We will emerge from this process as a highly competitive and sustainable group of airlines, with a very efficient cost structure, all the while maintaining the unparalleled network and connectivity that LATAM offers in all the markets it serves."

LATAM's fleet changes

Heading into the crisis, the airline had 340 aircraft in its fleet. The airline has now brought it down to 286 aircraft with the complete withdrawal of the Airbus A350 fleet. In Brazil , the airline has consolidated its widebody operations around the Boeing 777 and 787 families.

There is a lot of flexibility in LATAM's fleet. It has negotiated amendments in fleet operating leases, which has led to increased power-by-the-hour leases based on aircraft usage and interest-only agreements. This covers roughly 60% of the airline's narrowbody fleet until 2022 and 50% of the airline's widebody fleet until 2023.

Further flexibility regarding fleet and cash flow can come with accelerating retirements of fleet types, if necessary. The airline also has limited further widebody commitments, which works in its favor as it projects a slower return of international long-haul travel.

The airline is expected to continue drawing down Boeing 767 aircraft in favor of the newer Boeing 787s . By the end of 2021, the airline is expecting to fly 10 Boeing 777s and 28 Boeing 787s, in addition to the 24 Boeing 767s.

What do you make of LATAM's recovery timelines and plans? Let us know in the comments!

© 1998-2024 ch-aviation GmbH. All rights reserved.

LATAM's adjusted business plan reflects bullish future

LATAM Airlines A320-200,

© Aeropuerto de Carrasco

Scheduled Carrier

- Santiago de Chile

LATAM Airlines Group is expected to save USD100 million more than initially expected, reduce its debt by 36%, and hopes to exceed 2019 revenue levels by reaching USD11.5 billion in 2024.

This is according to adjustments made to its five-year 2021-2027 business plan in line with new global macroeconomic conditions, the airline group announced in a statement.

"Our updated business plan reflects how LATAM group is better prepared to face future challenges, with a more competitive and flexible cost structure, a more complete offering for customers, and important progress towards more sustainable aviation," commented Group Chief Executive Officer Roberto Alvo.

As reported , on June 18, 2022, the US Bankruptcy Court in New York confirmed the group's plan of reorganisation and financing to exit Chapter 11, expected in the last quarter of 2022.

The new version of the plan updated LATAM’s cost savings estimate from USD900 million to more than USD1 billion annually, resulting from initiatives that have already been implemented. These include improvements in its cost structure and structural reform in fleet renegotiation, network strengthening, and a reduction of its total debt by 36% compared to pre-pandemic levels.

Regarding revenue, the group is expected to exceed 2019 levels by 2024, reaching USD11.5 billion.

It expects a recovery in the domestic markets of its subsidiaries to 2019 levels by the end of 2022. In the case of Colombia, such recovery was achieved in the first quarter of 2022 already, while Brazil and Ecuador are expected to achieve it within the third quarter of 2022.

Recovery of international traffic – which accounted for about 45% of 2019 revenues – is expected to be slower, reaching 2019 levels by mid-2023.

For 2024, the group projects passenger operations measured in available seat kilometres (ASK) similar to 2019.

- LATAM Airlines

- LATAM Airlines Group

- Investments/Finance

Also on ch-aviation

LATAM looking to refinance senior secured notes - CEO

LATAM Airlines Group looks to relist on the NYSE

Chile CAA renews battle against LATAM’s grandfathered slots

Cargo cartel carriers settle Dutch claims in lingering case

LATAM eyeing new base at Fortaleza, Brazil - report

Sociedad Uruguaya de Aviación eyes Airbus fleet for launch

Brazilian regulator approves expansion of LATAM-Delta JV

LATAM Group orders five incremental B787s, changes engines

Become a subscriber today!

Free 14 day pass

Perfect for a great start.

What we offer:

- Unlimited access for professionals

- No credit card required

- No commitment

- No long-term commitment

ch-aviation

Great choice for industry professionals.

Get full unrestricted access to all ch-aviation features and data including worldwide airline fleets, schedules and route network with drilldowns available at your fingertips on every screen - updated daily for industry professionals like you.

- Unlimited access on 3 devices

- One annual payment

- Credit card or bank transfer

- 3 user accounts included

- Add/remove features anytime

Request a complimentary 14-day trial or contact our sales department for a customised proposal that meets your requirements.

Recommend Article

If you wish to share the article "LATAM's adjusted business plan reflects bullish future" with a friend or colleague, please fill out the form below and we will send an e-mail containing the link.

LATAM updates business plan for the next five years

- by Aviación al Día

- August 31, 2022

LATAM group announced this Wednesday an update of the business plan presented a year ago that includes its five-year financial projections adjusted to the new macroeconomic context and an estimate of cost savings of more than 1,000 million dollars per year.

According to a statement released by the airline, LATAM “has been actively working to improve its cost structure and take advantage of the restructuring opportunity within the framework of its Chapter 11 process” in the United States.

→ LATAM Airlines recovers its route between Quito and Miami.

“In the new version of the plan, the group updates its estimate of cost savings from US$900 million to more than US$1 billion annually through initiatives already in place,” the note added.

The airline also revealed that it has “implemented structural transformations: fleet renegotiation, improving its relative cost position, strengthening its network and reducing its total debt by approximately 36% compared to pre-pandemic debt.”

“On demand, the group expects a recovery in the domestic markets of the subsidiaries to the levels of 2019 by the end of 2022. However, in the case of Colombia, said recovery was reached in the first quarter of this year and is expects Brazil and Ecuador to achieve it within the third quarter,” he detailed.

→ LATAM passengers experienced a Game of Thrones-style surprise and saw House of the Dragon at 30,000 feet.

Regarding international air operations, the company warned that “the recovery will be slower, reaching 2019 levels in mid-2023. It should be noted that international traffic represented approximately 45% of revenues in 2019.

«By 2024, the group projects a passenger operation measured in available seat kilometers (ASK) similar to that of 2019. It is expected that by 2024 the group will exceed the levels of 2019, reaching US$11.5 thousand million,” he noted.

“This updated business plan reflects how the LATAM group is better prepared to face future challenges, with a more competitive and flexible cost structure, with a more complete offer for customers and moving towards a more sustainable aviation,” he argued, for his part, Roberto Alvo, executive director of the LATAM group.

On June 18, the Bankruptcy Court for the Southern District of New York confirmed the Group’s Reorganization and Financing Plan to exit the Chapter 11 process, which is expected to occur in the last quarter of this year, reported EFE.

Related Topics

FAA to mandate charter airlines and aircraft manufacturers to use Safety Management Systems

FAA investigates incident between two aircraft at Ronald Reagan Washington Airport

Alaska Air sued over merger agreement with Hawaiian Airlines

US airline loyalty programs to probe in hearing

Plataforma Informativa de Aviación Comercial líder en América Latina.

Aviación al Día

Mexico: interjet declared in bankruptcy, certares, delta and air france-klm chosen by italy to buy ita airways.

History of LATAM Airlines

- On the 5th of March, 1929, Chilean Army Air Services Commander Arturo Merino Benitez founded Línea Aeropostal Santiago-Arica.

- In 1932, the name was changed to Línea Aérea Nacional de Chile (LAN Chile).

- In late February 1961, a small group of former air-taxi pilots formed Transportes Aéreos Marília, S.A. (Marília Air Transport), beginning operations with a fleet of 4 Cessna 180 and a single Cessna 170. Three years later, Orlando Ometto purchased a 50% stake in the company, soon buying the remaining 50% from the original pilot owners who left TAM.

- In August 1986, the company went public. During the same year, TAM – Transportes Aéreos Regionais (KK) acquired another regional airline, VOTEC, renaming it Brasil Central Linhas Aéreas. Four years later, Brasil Central was renamed TAM – Transportes Aéreos Meridionais, using the same color scheme of TAM (KK), but maintaining the IATA code JJ.

- In September 1989, LAN Chile was privatized by the Chilean government, a majority stake in the company being sold to Icarosan and Scandinavian Airlines System.

- In March 2004, Lan Chile and its subsidiaries LAN Perú, LAN Ecuador, LAN Dominicana and LANExpress became unified under the single LAN brand, instead of Linea Aerea Nacional, the one previously used. Later that year, the formal name of the company was changed from LAN Chile to LAN Airlines.

- In August 2006, LAN Airlines merged First and Business classes of service into a single class, namely Premium Business.

- In 2008, LAN Airlines was voted as 3rd best airline in the world, and first South American airline.

- In August 2010, LAN and TAM announced their plan to merge their holdings into a single company, called LATAM Airlines Group. Together, both companies have more than 40.000 employees and 280 aircraft, offering cargo services worldwide and serving 115 destinations in 23 countries.

- In January 2011, TAM S.A. and LAN Airlines S.A. announced the signing of the binding agreements between both companies and their respective controlling shareholders. These binding agreements include an Implementation Agreement and an Exchange Offer Agreement containing the definitive terms and conditions of the proposed business combination of LAN and TAM.

- In June 2012, LAN Airlines S.A and TAM S.A. report that they have successfully completed the exchange offer and mergers through which they have combined their businesses and created the LATAM Airlines Group S.A. The transaction was carried out through an exchange offer in which TAM’s shareholders could elect to exchange their TAM shares for LAN shares.

- In December 2012, American Airlines and LAN Colombia, a member of the LATAM Airlines Group announced that they have signed a codeshare agreement. The agreement provided more options for travelers between Colombia and the United States and Canada.

- In March 2013, LATAM Airlines Group chose Oneworld, an alliance with a strong presence in the Asia/Pacific region, as the global alliance for its airlines, thus establishing Oneworld as the leading alliance for flights within Latin America and from this region to both the United States and Europe. This was announced at the Oneworld meeting held in Hong Kong. LAN Colombia officially joined Oneworld in October.

- In April 2013, LAN Colombia upgraded its fleet for international flights adding three new Boeing 767s and increasing availability of international flights operating from Colombia. The investment reaching $ 360 million will allow LAN Colombia to offer better international flight schedules and more seat availability while providing world-class on-board service.

- In 2013, LATAM Airlines Group was the only airline selected from the Travel & Leisure category of the Dow Jones Sustainability Index – Emerging Markets, due to its sector leadership in corporate sustainability issues.

- In 2014, LAN and TAM, part of LATAM Airlines Group, South America’s largest airline group, announced the addition of more than 300 international flights to provide the best service to passengers during one of the biggest sporting events in the world that will take place in Brazil in June and July 2014, FIFA World Cup.

- In August 2015, it was announced that LAN Airlines, as well as TAM Airlines, would fully rebrand as LATAM. The rebranding will involve a new livery for both airlines, which will be applied to all aircraft by 2018.

- In spring 2016, LATAM Airlines Group unveiled its new Indigo and Coral livery when the first aircraft was repainted (or delivered new) in the new LATAM livery.

- In 2017, LATAM inaugurated new routes, including the longest flight in its history – Santiago to Melbourne. In December, LATAM received the first Airbus A320neo aircraft, but, due to an issue with the Pratt & Whitney PW1000G engines, some of the Airbus A320 neo aircraft have been grounded in 2018.

- In 2018, LATAM Airlines faced difficulties being forced to ground more than half of its Boeing B787-8 Dreamliners due to problems with the Rolls Royce engines.

- In December 2018, LATAM Airlines launched the first non-stop connection between Tel Aviv and South America, with a flight departing from Santiago, Chile, making a stop in Sao Paulo, Brazil, and continuing directly to Tel Aviv, Israel.

- In January 2019, OAG, the air travel intelligence company, released the 2019 Punctuality League report, which recognizes LATAM Airlines Group as a top airline for on-time performance in the Mega Airlines category with 85.60% on-time performance (defined as flights that arrive within 15 minutes of their scheduled arrival time using full-year data from 2018).

- On May 1st, 2020, LATAM Airlines officially departed the oneworld alliance, putting an end to a 20-year history.

- In 2020, the COVID-19 pandemic represented the greatest challenge in history for LATAM, which was forced to virtually halt almost all passenger operations in March and ended the year operating less than 40% of the planned flights. During most of the year, LATAM Group’s efforts were focused on creating the necessary conditions to cope with the crisis, including decisions such as reducing operations, canceling routes, letting employees go, adjusting the fleet, and filing for Chapter 11 bankruptcy protection in the U.S. in May.

- In May 2020, LATAM has begun the voluntary restructuring process under Chapter 11 of the U.S. Bankruptcy Act. This reorganization process provides LATAM with the opportunity to work with its creditors and other stakeholders to reduce its debt, convert its costs, access new sources of financing, and continue operating while enabling the group to transform its business to this new reality and to maintain a leading position in Latin American aviation in the post-COVID-19 era.

- In September 2021, LATAM released its five-year business plan as part of its financial reorganization. Before the COVID-19 pandemic, the LATAM Group had revenues of more than US$10 billion, which it expects to return to by 2024.

- In October 2021, the approval of the joint venture with Delta Air Lines in Chile added to the previous approvals in Brazil, Colombia, and Uruguay. This is a step closer toward the implementation of the trans-American Joint Venture Agreement that Delta Air Lines and LATAM Airlines Group signed in May 2020 that will combine the carriers’ highly complementary route networks between North and South America, providing customers with a seamless travel experience.

- In September 2022, the US DOT approved the Joint Venture Agreement between LATAM Airlines Group and Delta Air Lines, allowing the airlines to develop an unparalleled network connecting the Americas.

- Only two fatal incidents involving LAN Airlines or its predecessors were recorded, the worst of them occurring in February 1991, when 20 of the 66 passengers on board a chartered LAN Chile BAe146-200 perished after the aircraft overran the runway on landing and sank in the nearby waters. The first deadly TAM incident occurred in early February 1979, when a Bandeirante crashed near the town of Agudos, killing all 18 people on board. After a few smaller accidents, the last and – until now – considered the deadliest aviation accident in Latin America, took place in mid-July, 2007, when an Airbus 320 belonging to TAM overran the runway at Congonhas-São Paulo Airport, finally crashing into a TAM Express warehouse. 198 bodies were recovered from the crash site, including victims on the ground (186 people were on board).

LATAM Airlines info

- Covid Rules

- Baggage & carry-on

LATAM Airlines seating maps

- Airbus A319

- Airbus A320 200 V1

- Airbus A320 200 V2

- Airbus A321

- Boeing B767 300

- Boeing B787-8

- Boeing B787-9

Recent Travel Tips

Top airlines.

- Delta Airlines

- Turkish Airlines

- United Airlines

As featured on

How to Write a Five-Year Business Plan

Noah Parsons

15 min. read

Updated October 27, 2023

Learn why the traditional way of writing a five-year business plan is often a waste of time and how to use a one-page plan instead for smarter, easier strategic planning to establish your long-term vision.

In business, it can sometimes seem hard enough to predict what’s going to happen next month, let alone three or even five years from now. But, that doesn’t mean that you shouldn’t plan for the long term. After all, your vision for the future is what gets you out of bed in the morning and motivates your team. It’s those aspirations that drive you to keep innovating and figuring out how to grow.

- What is a long-term plan?

A long-term or long-range business plan looks beyond the traditional 3-year planning window, focusing on what a business might look like 5 or even 10 years from now. A traditional 5-year business plan includes financial projections, business strategy, and roadmaps that stretch far into the future.

I’ll be honest with you, though—for most businesses, long-range business plans that stretch 5 and 10 years into the future are a waste of time. Anyone who’s seriously asking you for one doesn’t know what they’re doing and is wasting your time. Sorry if that offends some people, but it’s true.

However, there is still real value in looking at the long term. Just don’t invest the time in creating a lengthy version of your business plan with overly detailed metrics and milestones for the next five-plus years. No one knows the future and, more than likely, anything you write down now could be obsolete in the next year, next month, or even next week.

That’s where long-term strategic planning comes in. A long-term business plan like this is different from a traditional business plan in that it’s lighter on the details and more focused on your strategic direction. It has less focus on financial forecasting and a greater focus on the big picture.

Think of your long-term strategic plan as your aspirational vision for your business. It defines the ideal direction you’re aiming for but it’s not influencing your day-to-day or, potentially, even your monthly decision making.

- Are long-term business plans a waste of time?

No one knows the future. We’re all just taking the information that we have available today and making our best guesses about the future. Sometimes trends in a market are pretty clear and your guesses will be well-founded. Other times, you’re trying to look around a corner and hoping that your intuition about what comes next is correct.

Now, I’m not saying that thinking about the future is a waste of time. Entrepreneurs are always thinking about the future. They have to have some degree of faith and certainty about what customers are going to want in the future. Successful entrepreneurs do actually predict the future — they know what customers are going to want and when they’re going to want it.

Entrepreneurship is unpredictable

Successful entrepreneurs are also often wrong. They make mistakes just like the rest of us. The difference between successful entrepreneurs and everyone else is that they don’t let mistakes slow them down. They learn from mistakes, adjust and try again. And again. And again. It’s not about being right all the time; it’s about having the perseverance to keep trying until you get it right. For example, James Dyson, inventor of the iconic vacuum cleaner, tried out 5,126 prototypes of his invention before he found a design that worked.

So, if thinking about the future isn’t a waste of time, why are 5-year business plans a waste of time? They’re a waste of time because they typically follow the same format as a traditional business plan, where you are asked to project sales, expenses, and cash flow 5 and 10 years into the future.

Let’s be real. Sales and expense projections that far into the future are just wild guesses, especially for startups and new businesses. They’re guaranteed to be wrong and can’t be used for anything. You can’t (and shouldn’t) make decisions based on these guesses. They’re just fantasy. You hope you achieve massive year-over-year growth in sales, but there’s no guarantee that’s going to happen. And, you shouldn’t make significant spending decisions today based on the hope of massive sales 10 years from now.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- Why write a long-term business plan?

So, what is the purpose of outlining a long-term plan? Here are a few key reasons why it’s still valuable to consider the future of your business without getting bogged down by the details.

Showcase your vision for investors

First, and especially important if you are raising money from investors, is your vision. Investors will want to know not only where you plan on being in a year, but where the business will be in five years. Do you anticipate launching new products or services? Will you expand internationally? Or will you find new markets to grow into?

Set long-term goals for your business

Second, you’ll want to establish goals for yourself and your team. What kinds of high-level sales targets do you hope to achieve? How big is your company going to get overtime? These goals can be used to motivate your team and even help in the hiring process as you get up and running.

That said, you don’t want to overinvest in fleshing out all the details of a long-range plan. You don’t need to figure out exactly how your expansion will work years from now or exactly how much you’ll spend on office supplies five years from now. That’s really just a waste of time.

Instead, for long-range planning, think in broad terms. A good planning process means that you’re constantly revising and refining your business plan. You’ll add more specifics as you go, creating a detailed plan for the next 6-12 months and a broader, vague plan for the long term.

You have a long development time

Businesses with extremely long research and development timelines do make spending decisions now based on the hope of results years from now. For example, the pharmaceutical industry and medical device industry have to make these bets all the time. The R&D required to take a concept from idea to proven product with regulatory approval can take years for these industries, so long-range planning in these cases is a must. A handful of other industries also have similar development timelines, but these are the exceptions, not the rule.

Your business is well-established and predictable

Long-term, detailed planning can make more sense for businesses that are extremely well established and have long histories of consistent sales and expenses with predictable growth. But, even for those businesses, predictability means quite the opposite of stability. The chances that you’ll be disrupted in the marketplace by a new company, or the changing needs and desires of your customers, is extremely high. So, most likely, those long-range predictions of sales and profits are pretty useless.

- What a 5-year plan should look like

With the exception of R&D-heavy businesses, most 5-year business plans should be more like vision statements than traditional business plans. They should explain your vision for the future, but skip the details of detailed sales projections and expense budgets.

Your vision for your business should explain the types of products and services that you hope to offer in the future and the types of customers that you hope to serve. Your plan should outline who you plan to serve now and how you plan to expand if you are successful.

This kind of future vision creates a strategic roadmap. It’s not a fully detailed plan with sales forecasts and expense budgets, but a plan for getting started and then growing over time to reach your final destination.

For example, here’s a short-form version of what a long-term plan for Nike might have looked like if one had been written in the 1960s:

Nike will start by developing high-end track shoes for elite athletes. We’ll start with a focus on the North West of the US, but expand nationally as we develop brand recognition among track and field athletes. We will use sponsored athletes to spread the word about the quality and performance of our shoes. Once we have success in the track & field market segment, we believe that we will be able to successfully expand both beyond the US market and also branch out into other sports, with an initial focus on basketball.

Leadership and brand awareness in a sport such as basketball will enable us to cross over from the athlete market into the consumer market. This will lead to significant business growth in the consumer segment and allow for expansion into additional sports, fashion, and casual markets in addition to building a strong apparel brand.

Interestingly enough, Nike (to my knowledge) never wrote out a long-range business plan. They developed their plans as they grew, building the proverbial airplane as it took off.

But, if you have this kind of vision for your business, it’s useful to articulate it. Your employees will want to know what your vision is and your investors will want to know as well. They want to know that you, as an entrepreneur, are looking beyond tomorrow and into the future months and years ahead.

- How to write a five-year business plan

Writing out your long-term vision for your business is a useful exercise. It can bring a sense of stability and solidify key performance indicators and broad milestones that drive your business.

Developing a long-range business plan is really just an extension of your regular business planning process. A typical business plan covers the next one to three years, documenting your target market, marketing strategy, and product or service offerings for that time period.

A five-year plan expands off of that initial strategy and discusses what your business might do in the years to come. However, as I’ve mentioned before, creating a fully detailed five-year business plan will be a waste of time.

Here’s a quick guide to writing a business plan that looks further into the future without wasting your time:

1. Develop your one-page plan

As with all business planning, we recommend that you start with a one-page business plan. It provides a snapshot of what you’re hoping to achieve in the immediate term by outlining your core business strategy, target market, and business model.

A one-page plan is the foundation of all other planning because it’s the document that you’ll keep the most current. It’s also the easiest to update and share with business partners. You will typically highlight up to three years of revenue and profit goals as well as milestones that you hope to achieve in the near term.

Check out our guide to building your one-page plan and download a free template to get started.

2. Determine if you need a traditional business plan

Unlike a one-page business plan, a traditional business plan is more detailed and is typically written in long-form prose. A traditional business plan is usually 10-20 pages long and contains details about your product or service, summaries of the market research that you’ve conducted, and details about your competition. Read our complete guide to writing a business plan .

Companies that write traditional business plans typically have a “business plan event” where a complete business plan is required. Business plan events are usually part of the fundraising process. During fundraising, lenders and investors may ask to see a detailed plan and it’s important to be ready if that request comes up.

But there are other good reasons to write a detailed business plan. A detailed plan forces you to think through the details of your business and how, exactly, you’re going to build your business. Detailed plans encourage you to think through your business strategy, your target market, and your competition carefully. A good business plan ensures that your strategy is complete and fleshed out, not just a collection of vague ideas.

A traditional business plan is also a good foundation for a long-term business plan and I recommend that you expand your lean business plan into a complete business plan if you intend to create plans for more than three years into the future.

3. Develop long-term goals and growth targets

As you work on your business plan, you’ll need to think about where you want to be in 5+ years. A good exercise is to envision what your business will look like. How many employees will you have? How many locations will you serve? Will you introduce new products and services?

When you’ve envisioned where you want your business to be, it’s time to turn that vision into a set of goals that you’ll document in your business plan. Each section of your business plan will be expanded to highlight where you want to be in the future. For example, in your target market section, you will start by describing your initial target market. Then you’ll proceed to describe the markets that you hope to reach in 3-5 years.

To accompany your long-term goals, you’ll also need to establish revenue targets that you think you’ll need to meet to achieve your goals. It’s important to also think about the expenses you’re going to incur in order to grow your business.

For long-range planning, I recommend thinking about your expenses in broad buckets such as “marketing” and “product development” without getting bogged down in too much detail. Think about what percentage of your sales you’ll spend on each of these broad buckets. For example, marketing spending might be 20% of sales.

4. Develop a 3-5 year strategic plan

Your goals and growth targets are “what” you want to achieve. Your strategy is “how” you’re going to achieve it.

Use your business plan to document your strategy for growth. You might be expanding your product offering, expanding your market, or some combination of the two. You’ll need to think about exactly how this process will happen over the next 3-5 years.

A good way to document your strategy is to use milestones. These are interim goals that you’ll set to mark your progress along the way to your larger goal. For example, you may have a goal to expand your business nationally from your initial regional presence. You probably won’t expand across the country all at once, though. Most likely, you’ll expand into certain regions one at a time and grow to have a national presence over time. Your strategy will be the order of the regions that you plan on expanding into and why you pick certain regions over others.

Your 3-5 year strategy may also include what’s called an “exit strategy”. This part of a business plan is often required if you’re raising money from investors. They’ll want to know how they’ll eventually get their money back. An “exit” can be the sale of your business or potentially going public. A typical exit strategy will identify potential acquirers for your business and will show that you’ve thought about how your business might be an attractive purchase.

5. Tie your long-term plan to your one-page plan

As your business grows, you can use your long-term business plan as your north star. Your guide for where you want to end up. Use those goals to steer your business in the right direction, making small course corrections as you need to.

You’ll reflect those smaller course corrections in your one-page plan. Because it is a simple document and looks at the shorter term, it’s easier to update. The best way to do this is to set aside a small amount of time to review your plan once a month. You’ll review your financial forecast, your milestones, and your overall strategy. If things need to change, you can make those adjustments. Nothing ever goes exactly to plan, so it’s OK to make corrections as you go.

You may find that your long-term plan may also need corrections as you grow your business. You may learn things about your market that change your initial assumptions and impacts your long-range plan. This is perfectly normal. Once a quarter or so, zoom out and review your long-range plan. If you need to make corrections to your strategy and goals, that’s fine. Just keep your plan alive so that it gives you the guidance that you need over time.

- Vision setting is the purpose of long-term planning

Part of what makes entrepreneurs special is that they have a vision. They have dreams for where they want their business to go. A 5-year business plan should be about documenting that vision for the future and how your business will capitalize on that vision.

So, if someone asks you for your 5-year business plan. Don’t scramble to put together a sales forecast and budget for 5 years from now. Your best guess today will be obsolete tomorrow. Instead, focus on your vision and communicate that.

Explain where you think your business is going and what you think the market is going to be like 5 years from now. Explain what you think customers are going to want and where trends are headed and how you’re going to be there to sell the solution to the problems that exist in 5 and 10 years. Just skip the invented forecasts and fantasy budgets.

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Noah is the COO at Palo Alto Software, makers of the online business plan app LivePlan. He started his career at Yahoo! and then helped start the user review site Epinions.com. From there he started a software distribution business in the UK before coming to Palo Alto Software to run the marketing and product teams.

.png?format=auto)

Table of Contents

Related Articles

6 Min. Read

Differences Between Single-Use and Standing Plans Explained

7 Min. Read

8 Steps to Write a Useful Internal Business Plan

11 Min. Read

Fundamentals of Lean Planning Explained

13 Min. Read

How to Write a Nonprofit Business Plan

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

How to write a 5-year business plan faster with the right tool

Did you know that 70% of firms still in business after five years, have a strategic plan in place?

A business plan helps outline your goals and explains how you plan to achieve them and is crucial if you want to raise financing and plan your outlook for both the short and long-term future.

However, writing a five-year business plan can be a daunting task, especially when you're juggling numerous responsibilities as a small business owner.

Incorporating the right tools into your strategy makes a creating 5-year business plan a breeze while ensuring accuracy and thoroughness.

In this guide, we'll cover what a five-year business plan is, why you need to write one, what tool you should use and the content that should be included!

Ready? Let's get started!

In this guide:

What is a 5-year business plan?

Why is a 5-year business plan crucial for business success, how does a 5-year business plan differ from a 3-year business plan, is a 5-year business plan right for you, how to write a 5-year business plan efficiently, 5-year business plan templates and examples, why you shouldn't be using excel and word to write a 5-year business plan, how do i write a 5-year business plan in practice, how to make sure your 5-year business plan stays relevant.

It follows the same structure as most other business plans. It contains all of the key sections from the executive summary to the financial statements.

A 5-year business plan serves as a roadmap for your company's future, guiding strategic decisions and ensuring alignment with your long-term goals.

In today's dynamic business landscape, having a clear and comprehensive plan in place is essential for navigating uncertainties and capitalizing on opportunities.

Consider a small manufacturing business seeking to invest in new equipment and technology to enhance production capabilities.

Without a 5-year plan outlining growth targets, market analysis, and financial projections, the company may struggle to secure funding or make informed investment decisions.

By developing a strategic roadmap that extends five years into the future, the business can anticipate challenges, capitalize on emerging trends, and adapt to evolving market conditions.

Furthermore, a 5-year business plan provides a framework for accountability and performance measurement. For instance, a construction and real estate company embarking on a major development project can use the plan to track progress against milestones, monitor expenses, and evaluate the project's overall feasibility.

By regularly revisiting and updating the plan, the company can ensure its strategies remain relevant and aligned with its overarching objectives.

Now that we've highlighted the importance of a 5-year plan, let's compare it to its shorter-term counterpart, the 3-year business plan.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

The key difference is that those financials are projected for 5 years instead of 3 years. This means that the business is providing a long(er) term outlook.

It also means that sections detailing the actions planned - such as business strategy, sales & marketing plan and milestones - have to be written in greater depth because a lot more will be implemented in a 5-year business plan (vs. a 3-year business plan).

Business plans can be highly volatile tools, especially for startups. If a business plan turns out to be inaccurate at the end of year one, it is likely that the following years will follow suit.

In essence, the further you plan into the future, the less certainty you have. This means that 5-year business plans tend to be higher level than 3-year business plans given that it’s difficult to accurately predict what might happen after year 3.

Because of the uncertainty regarding long-term projections we just explained in the section above, 5-year business plans tend to be quite rare.

As a rule of thumb, they are mostly useful in the following situations:

- When the business is highly predictable

- When the business is in transition

Highly predictable businesses

Some businesses are predictable with a high level of certainty and can therefore afford to take a long(er) term view.

This usually applies to businesses with the following characteristics:

- They have limited competition: monopolies or oligopolies

- They sell products or services with limited substitution options

Infrastructure companies are the perfect example of this. If you are the only water provider or train operator in the region and have been given a 10 years concession, you can comfortably project your financials over longer periods.

Businesses in transition

5-year business plans are also useful for businesses that want to model a transition from one state to another.

Good examples of this are when there is a one-off important change in the business, or a high level of inertia:

- The business is expected to go through a phase of reorganization or restructuring, after acquiring another business, or because it needs to shut down a division which is no longer competitive, for example

- The business is investing in a capital-intensive project that will take time before yielding a return on investment. If constructing a new factory takes two years before the business can benefit from the increased production capacity, for example

- There is inertia in the sales cycle. If the business is launching a new product marketed to big corporations with an expected 12-18 months sales cycle, for example

As you can see from above, 5-year business plans are often overkill for startups or small “brick and mortar” businesses such as retail shops and restaurants.

Now let’s look at how you should write your 5-year business plan, the benefits of doing so, the tools you can use to help you and the factors to consider when selecting a business plan software.

Need inspiration for your business plan?

The Business Plan Shop has dozens of business plan templates that you can use to get a clear idea of what a complete business plan looks like.

Use software to write a 5-year business plan

Utilizing business planning software offers numerous advantages for small business owners embarking on the journey of creating a 5-year business plan.

These tools are specifically designed to simplify the planning process, saving you time and effort whilst helping you avoid silly errors along the way.

By leveraging business planning software, you can access pre-built templates that contain industry-specific financial models and forecasting tools. This allows you to focus on refining your growth strategy rather than starting from scratch.

Now, let’s take a further look at how these tools allow you to streamline the process of writing a business plan.

How these tools simplify the planning process

Using an online business planning software such as the one offered by The Business Plan Shop is the most efficient and modern way to write a five-year business plan.

An online business planning software streamlines the process because:

- You can easily create your financial forecast by letting the software take care of the financial calculations for you without errors

- You are guided through the writing process by detailed instructions and examples for each part of the plan

- You can access a library of dozens of complete business plan samples and templates for inspiration

- You get a professional business plan, formatted and ready to be sent to your bank or investors

- You can easily track your actual financial performance against your financial forecast

- You can create scenarios to stress test your forecast's main assumptions

- You can easily update your forecast as time goes by to maintain visibility on future cash flows

- You have a friendly support team on standby to assist you when you are stuck

If you're interested in using this type of solution, you can try The Business Plan Shop for free by signing up here .

Above is an example of how a cover page and table of contents look like on The Business Plan Shop's online business planning software.

What to consider when choosing a business plan software

Now, let's explore key factors to consider when choosing the right business planning software to facilitate your 5-year business plan:

- Compatibility with 5-year planning: Ensure that the software you choose supports the creation and management of 5-year business plans, allowing you to set long-term goals, forecast financials, and track progress over an extended period.

- Ease of use: Look for software with an intuitive interface and user-friendly features that make it easy for small business owners to navigate and utilize effectively without extensive training or technical expertise.

- Customization options: Evaluate the software's ability to tailor templates, and forecasting models to your specific business needs and industry requirements. Seek solutions that allow for flexibility and customization, enabling you to adapt the plan to changing market conditions and internal priorities.

- Integration capabilities: Assess whether the software integrates seamlessly with other tools, such as accounting software. Integration ensures consistency and accuracy across your business operations, streamlining data management and decision-making. The Business Plan Shop offers integration with QuickBooks and Xero.

- Cost and scalability: Consider the pricing structure and scalability of the software, ensuring it aligns with your budget and growth trajectory. For example, The Business Plan Shop offers flexible pricing plans based on your business size and needs, with options to upgrade or downgrade as your business evolves.

Most of the business plan templates offered by The Business Plan Shop are examples of three-year business plans.

However, since there isn't any fundamental difference between a three-year and five-year business plan, you can use one of our templates to help structure your own plan (simply increase the number of years to 5 in the settings and adjust your forecast accordingly).

When considering using a tool like Word or Excel to craft a 5-year business plan, it is important to be aware of the drawbacks.

Though both programs may offer some basic formatting and calculations, they are not tailored for creating business plans.

Using Excel can be risky due to potential errors in data entry as a consequence of inputting data manually. A single mistake could lead to financial statements being inaccurate and with hundreds of lines of data, you might struggle to locate where the mistake was made.

Investors are likely to frown upon the use of Excel when creating a forecast for this reason, and it's unlikely that they would trust your numbers unless you have a background in accounting or finance.

Even if you do have a background in finance. With Excel, you'll need to compute key formulas yourself, which means that modelling complex elements is likely to be frustrating. Modelling D&A tables, advanced payment terms, or variable interest rate loans in the financial forecast are good examples of this.

If you're using Word to write up your business plan, you might find yourself overwhelmed by all the details that must be included. And unlike The Business Plan Shop, which offers you structured templates for each section of your plan, with Word there are no examples or instructions to guide you either.

Following a set structure makes it much easier to write a five-year business plan - which is why we've broken it down into simple questions and sections for you to follow!

How do you set 5-year business (growth) goals?

When writing a 5-year business plan, it's important to set achievable goals within that timeframe. Looking back at previous business performance can offer indications as to what your team can achieve with the resources they have at their disposal.

Be sure to set SMART (Specific, Measurable, Achievable, Relevant and Time-bound) objectives: there's no point in saying that you want to open 10 new stores within the next five years, if you know that's virtually impossible.

Similarly, an increase in customer satisfaction by itself is not a measurable goal and would need to lead to greater customer retention and repeat purchases for it to be quantified in numerical terms.

Remember that your goals are likely to shift as time goes by and you might want to make small changes to them. Whilst it's good to be specific, there's no need to mention every single aspect of your strategy in the business plan. You are trying to impress stakeholders such as investors, not bore them with the details!

Need a solid financial forecast?

The Business Plan Shop does the maths for you. Simply enter your revenues, costs and investments. Click save and our online tool builds a three-way forecast for you instantly.

What is the content of a 5-year business plan?

A 5-year business plan is composed of 7 main sections, let's have a look at each of them.

Executive Summary

The executive summary is arguably the most important part of your business plan. It provides readers (such as banks and investors) a rundown of your business as a whole.

You should explain what type of business you are, what goods or services you sell and to whom, forecasted revenues and profitability in the next five years, as well as the amount of financing that is required (if any).

Remember that this is the first section of your business plan. Keep it short and snappy to persuade stakeholders such as investors to continue reading.

Company Overview

The company overview section of a five-year business plan usually covers three key areas:

- Structure and Ownership

- Business Location

- Management team

You should start by summarising how your business is funded to date and who owns it (be sure to state shareholder names and percentage ownership if it is equity funded). Plus, you should declare what type of legal structure you've chosen (sole trader, limited company, partnership, etc.).

Then give an overview of the location(s) of your business Simply explain where you chose to set up your business(es) and why you chose that particular area(s) - strong transport links and parking facilities, large footfall of potential customers nearby are two such examples.

Finally, you should introduce the management team. This part is particularly important to demonstrate to investors that your management team has the necessary skills and experience to run the business successfully.

Market analysis

This is likely to be the lengthiest section of your 5-year business plan. In general, the market analysis should include the following sections:

- Demographics and segmentation

- Target market

- Competition

- Barriers at entry

Demographics are essential for understanding who is likely to be interested in purchasing your products or services. Segmenting demographics further can also provide insight into what types of goods customers prefer and the price that they are willing to pay for them.

This section can also help you understand any upcoming trends in the market that are likely to affect your strategy within the next five years.

Then comes the target market part, where you will explain which segments are targeted by your business and how you meet their needs.

For example, if you were running a wellness spa, your target market could be women aged between 20 and 45 who work full-time and are looking to relax and de-stress after their workday and on the weekends. They might be drawn to your salon because of your high-quality customer service and convenient opening times.

It's also important to explain who your business will be competing against in the local market. Think about direct and indirect competition so that you can devise strategies to gain an edge over them.

The next part of your market analysis will be to detail potential barriers to entry. Barriers to entry are best defined as any hurdles that prevent competing firms from entering the market and stealing your hard-earned market shares. A large investment in R&D or production capacities would be good examples.

Finally, you should state what regulations are already in place in the market and how you plan to abide by them. Examples of such regulations include The Data Protection Act (prominent for businesses with a website) and health and safety regulations.

Products and services

The products and services section of your 5-year business plan should include detailed descriptions of all the products and/or services that your business offers.

For example, if you run a coffee shop, you should detail the ingredients used, such as the type of milk, flavourings, and toppings available. The reader will want to understand what makes your coffee unique from other businesses in this competitive market.

You could also list any offers that customers can obtain (coffee and cake deals for example). You might also have delivery options available or loyalty programmes for customers who purchase multiple drinks over time.