11.3 Conducting a Feasibility Analysis

Learning objectives.

By the end of this section, you will be able to:

- Describe the purpose of a feasibility analysis

- Describe and develop the parts of a feasibility analysis

- Understand how to apply feasibility outcomes to a new venture

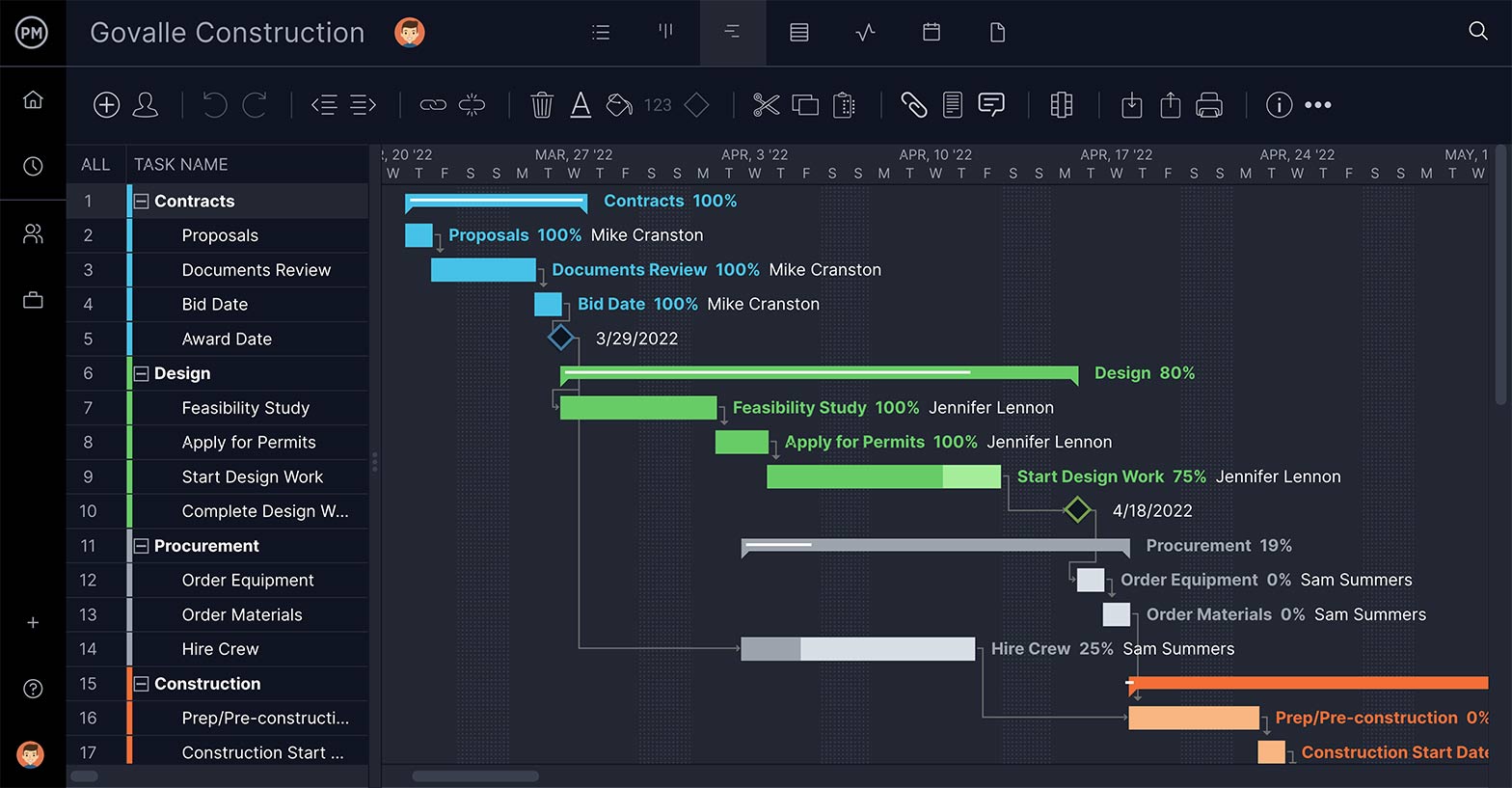

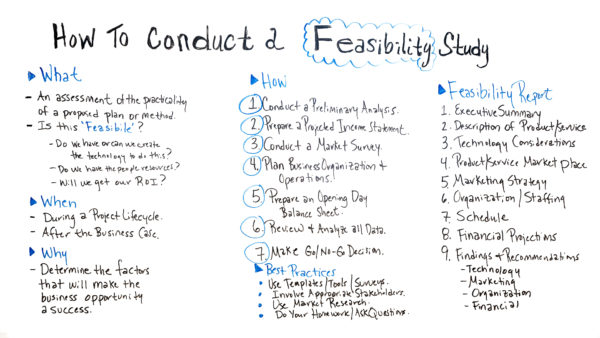

As the name suggests, a feasibility analysis is designed to assess whether your entrepreneurial endeavor is, in fact, feasible or possible. By evaluating your management team, assessing the market for your concept, estimating financial viability, and identifying potential pitfalls, you can make an informed choice about the achievability of your entrepreneurial endeavor. A feasibility analysis is largely numbers driven and can be far more in depth than a business plan (discussed in The Business Plan ). It ultimately tests the viability of an idea, a project, or a new business. A feasibility study may become the basis for the business plan, which outlines the action steps necessary to take a proposal from ideation to realization. A feasibility study allows a business to address where and how it will operate, its competition, possible hurdles, and the funding needed to begin. The business plan then provides a framework that sets out a map for following through and executing on the entrepreneurial vision.

Organizational Feasibility Analysis

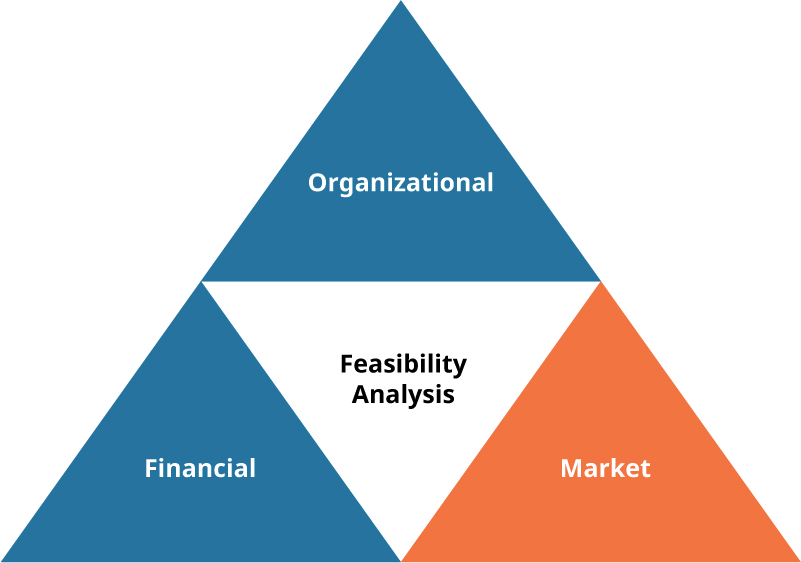

Organizational feasibility aims to assess the prowess of management and sufficiency of resources to bring a product or idea to market Figure 11.12 . The company should evaluate the ability of its management team on areas of interest and execution. Typical measures of management prowess include assessing the founders’ passion for the business idea along with industry expertise, educational background, and professional experience. Founders should be honest in their self-assessment of ranking these areas.

Resource sufficiency pertains to nonfinancial resources that the venture will need to move forward successfully and aims to assess whether an entrepreneur has a sufficient amount of such resources. The organization should critically rank its abilities in six to twelve types of such critical nonfinancial resources, such as availability of office space, quality of the labor pool, possibility of obtaining intellectual property protections (if applicable), willingness of high-quality employees to join the company, and likelihood of forming favorable strategic partnerships. If the analysis reveals that critical resources are lacking, the venture may not be possible as currently planned. 46

Financial Feasibility Analysis

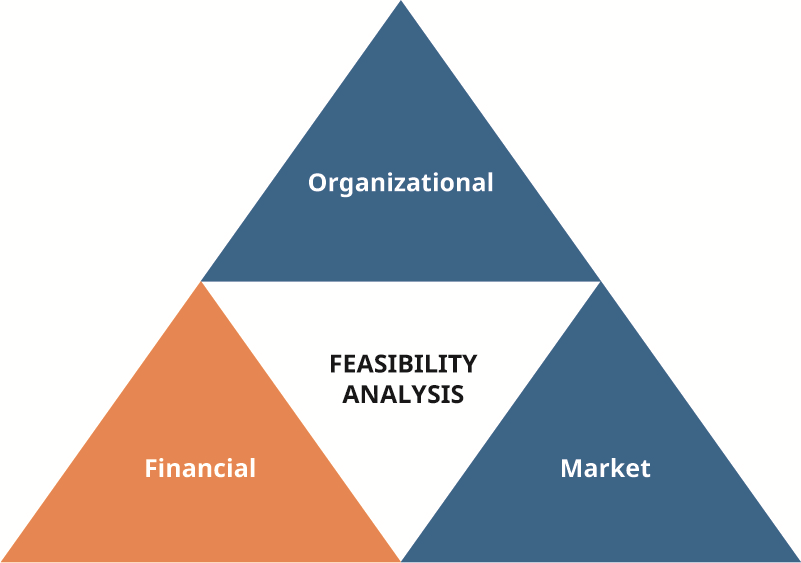

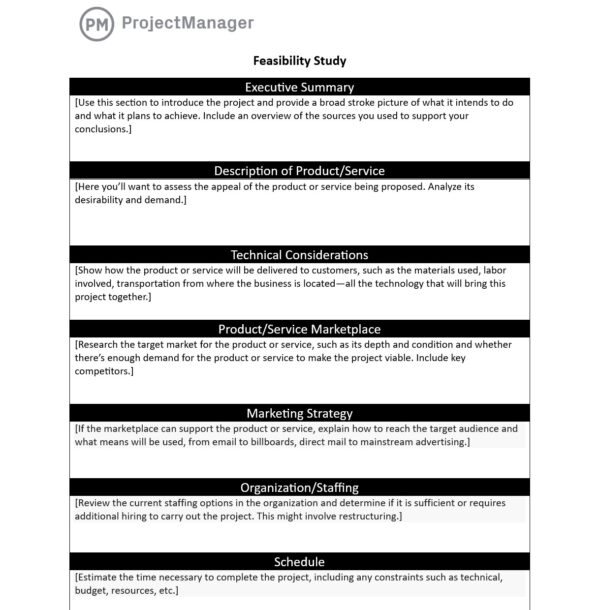

A financial analysis seeks to project revenue and expenses (forecasts come later in the full business plan); project a financial narrative; and estimate project costs, valuations, and cash flow projections Figure 11.13 .

The financial analysis may typically include these items:

- A twelve-month profit and loss projection

- A three- or four-year profit-and-loss projection

- A cash-flow projection

- A projected balance sheet

- A breakeven calculation

The financial analysis should estimate the sales or revenue that you expect the business to generate. A number of different formulas and methods are available for calculating sales estimates. You can use industry or association data to estimate the sales of your potential new business. You can search for similar businesses in similar locations to gauge how your business might perform compared with similar performances by competitors. One commonly used equation for a sales model multiplies the number of target customers by the average revenue per customer to establish a sales projection:

Another critical part of planning for new business owners is to understand the breakeven point , which is the level of operations that results in exactly enough revenue to cover costs (see Entrepreneurial Finance and Accounting for an in-depth discussion on calculating breakeven points and the breakdown of cost types). It yields neither a profit nor a loss. To calculate the breakeven point, you must first understand the two types of costs: fixed and variable. Fixed costs are expenses that do not vary based on the amount of sales. Rent is one example, but most of a business’s other costs operate in this manner as well. While some costs vary from month to month, costs are described as variable only if they will increase if the company sells even one more item. Costs such as insurance, wages, and office supplies are typically considered fixed costs. Variable costs fluctuate with the level of sales revenue and include items such as raw materials, purchases to be sold, and direct labor. With this information, you can calculate your breakeven point—the sales level at which your business has neither a profit nor a loss. 47 Projections should be more than just numbers: include an explanation of the underlying assumptions used to estimate the venture’s income and expenses.

Projected cash flow outlines preliminary expenses, operating expenses, and reserves—in essence, how much you need before starting your company. You want to determine when you expect to receive cash and when you have to write a check for expenses. Your cash flow is designed to show if your working capital is adequate. A balance sheet shows assets and liabilities, necessary for reporting and financial management. When liabilities are subtracted from assets, the remainder is owners’ equity. The financial concepts and statements introduced here are discussed fully in Entrepreneurial Finance and Accounting .

Market Feasibility Analysis

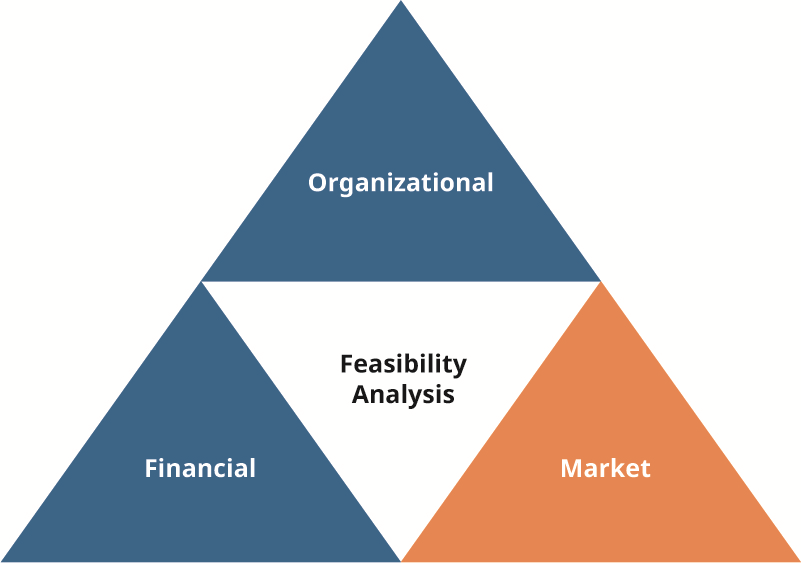

A market analysis enables you to define competitors and quantify target customers and/or users in the market within your chosen industry by analyzing the overall interest in the product or service within the industry by its target market Figure 11.14 . You can define a market in terms of size, structure, growth prospects, trends, and sales potential. This information allows you to better position your company in competing for market share. After you’ve determined the overall size of the market, you can define your target market, which leads to a total available market (TAM) , that is, the number of potential users within your business’s sphere of influence. This market can be segmented by geography, customer attributes, or product-oriented segments. From the TAM, you can further distill the portion of that target market that will be attracted to your business. This market segment is known as a serviceable available market (SAM) .

Projecting market share can be a subjective estimate, based not only on an analysis of the market but also on pricing, promotional, and distribution strategies. As is the case for revenue, you will have a number of different forecasts and tools available at your disposal. Other items you may include in a market analysis are a complete competitive review, historical market performance, changes to supply and demand, and projected growth in demand over time.

Are You Ready?

You’ve been hired by a leading hotel chain to determine the market and financial potential for the development of a mixed-use property that will include a full-service hotel in downtown Orlando, located at 425 East Central Boulevard, in Orlando, Florida. The specific address is important so you can pinpoint existing competitors and overall suitability of the site. Using the information given, conduct a market analysis that can be part of a larger feasibility study.

Work It Out

Location feasibility.

You’re considering opening a boutique clothing store in downtown Atlanta. You’ve read news reports about how downtown Atlanta and the city itself are growing and undergoing changes from previous decades. With new development taking place there, you’re not sure whether such a venture is viable. Outline what steps you would need to take to conduct a feasibility study to determine whether downtown Atlanta is the right location for your planned clothing store.

Applying Feasibility Outcomes

After conducting a feasibility analysis, you must determine whether to proceed with the venture. One technique that is commonly used in project management is known as a go-or-no-go decision . This tool allows a team to decide if criteria have been met to move forward on a project. Criteria on which to base a decision are established and tracked over time. You can develop criteria for each section of the feasibility analysis to determine whether to proceed and evaluate those criteria as either “go” or “no go,” using that assessment to make a final determination of the overall concept feasibility. Determine whether you are comfortable proceeding with the present management team, whether you can “go” forward with existing nonfinancial resources, whether the projected financial outlook is worth proceeding, and make a determination on the market and industry. If satisfied that enough “go” criteria are met, you would likely then proceed to developing your strategy in the form of a business plan.

What Can You Do?

Love beyond walls.

When Terence Lester saw a homeless man living behind an abandoned, dilapidated building, he asked the man if he could take him to a shelter. The man scoffed, replying that Lester should sleep in a shelter. So he did—and he saw the problem through the homeless man’s perspective. The shelter was crowded and smelly. You couldn’t get much sleep, because others would try to steal your meager belongings. The dilapidated building provided isolation away from others, but quiet and security in its own way that the shelter could not. This experience led Lester to voluntarily live as a homeless person for a few weeks. His journey led him to create Love Beyond Walls (www.lovebeyondwalls.org), an organization that aids the homeless, among other causes. Lester didn’t conduct a formal feasibility study, but he did so informally by walking in his intended customers’ shoes—literally. A feasibility study of homelessness in a particular area could yield surprising findings that might lead to social entrepreneurial pursuits.

- What is a social cause you think could benefit from a formal feasibility study around a potential entrepreneurial solution?

- 46 Ulrich Kaiser. “A primer in Entrepreneurship – Chapter 3 Feasibility analysis” University of Zurich Institute for Strategy and Business Economics . n.d. https://docplayer.net/7775267-A-primer-in-entrepreneurship-chapter-3-feasibility-analysis.html

- 47 In a preliminary financial model and business plan, startup costs should be allocated, as they are intended for one-time investments in development; pre-launch costs and other necessary expenses will not carry over once the product/solution has launched.

As an Amazon Associate we earn from qualifying purchases.

This book may not be used in the training of large language models or otherwise be ingested into large language models or generative AI offerings without OpenStax's permission.

Want to cite, share, or modify this book? This book uses the Creative Commons Attribution License and you must attribute OpenStax.

Access for free at https://openstax.org/books/entrepreneurship/pages/1-introduction

- Authors: Michael Laverty, Chris Littel

- Publisher/website: OpenStax

- Book title: Entrepreneurship

- Publication date: Jan 16, 2020

- Location: Houston, Texas

- Book URL: https://openstax.org/books/entrepreneurship/pages/1-introduction

- Section URL: https://openstax.org/books/entrepreneurship/pages/11-3-conducting-a-feasibility-analysis

© Jan 4, 2024 OpenStax. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution License . The OpenStax name, OpenStax logo, OpenStax book covers, OpenStax CNX name, and OpenStax CNX logo are not subject to the Creative Commons license and may not be reproduced without the prior and express written consent of Rice University.

- school Campus Bookshelves

- menu_book Bookshelves

- perm_media Learning Objects

- login Login

- how_to_reg Request Instructor Account

- hub Instructor Commons

- Download Page (PDF)

- Download Full Book (PDF)

- Periodic Table

- Physics Constants

- Scientific Calculator

- Reference & Cite

- Tools expand_more

- Readability

selected template will load here

This action is not available.

11.3: Conducting a Feasibility Analysis

- Last updated

- Save as PDF

- Page ID 50688

- Michael Laverty and Chris Littel et al.

Learning Objectives

By the end of this section, you will be able to:

- Describe the purpose of a feasibility analysis

- Describe and develop the parts of a feasibility analysis

- Understand how to apply feasibility outcomes to a new venture

As the name suggests, a feasibility analysis is designed to assess whether your entrepreneurial endeavor is, in fact, feasible or possible. By evaluating your management team, assessing the market for your concept, estimating financial viability, and identifying potential pitfalls, you can make an informed choice about the achievability of your entrepreneurial endeavor. A feasibility analysis is largely numbers driven and can be far more in depth than a business plan (discussed in The Business Plan ). It ultimately tests the viability of an idea, a project, or a new business. A feasibility study may become the basis for the business plan, which outlines the action steps necessary to take a proposal from ideation to realization. A feasibility study allows a business to address where and how it will operate, its competition, possible hurdles, and the funding needed to begin. The business plan then provides a framework that sets out a map for following through and executing on the entrepreneurial vision.

Organizational Feasibility Analysis

Organizational feasibility aims to assess the prowess of management and sufficiency of resources to bring a product or idea to market Figure 11.12 . The company should evaluate the ability of its management team on areas of interest and execution. Typical measures of management prowess include assessing the founders’ passion for the business idea along with industry expertise, educational background, and professional experience. Founders should be honest in their self-assessment of ranking these areas.

Resource sufficiency pertains to nonfinancial resources that the venture will need to move forward successfully and aims to assess whether an entrepreneur has a sufficient amount of such resources. The organization should critically rank its abilities in six to twelve types of such critical nonfinancial resources, such as availability of office space, quality of the labor pool, possibility of obtaining intellectual property protections (if applicable), willingness of high-quality employees to join the company, and likelihood of forming favorable strategic partnerships. If the analysis reveals that critical resources are lacking, the venture may not be possible as currently planned. 47

Financial Feasibility Analysis

A financial analysis seeks to project revenue and expenses (forecasts come later in the full business plan); project a financial narrative; and estimate project costs, valuations, and cash flow projections Figure 11.13 .

The financial analysis may typically include these items:

- A twelve-month profit and loss projection

- A three- or four-year profit-and-loss projection

- A cash-flow projection

- A projected balance sheet

- A breakeven calculation

The financial analysis should estimate the sales or revenue that you expect the business to generate. A number of different formulas and methods are available for calculating sales estimates. You can use industry or association data to estimate the sales of your potential new business. You can search for similar businesses in similar locations to gauge how your business might perform compared with similar performances by competitors. One commonly used equation for a sales model multiplies the number of target customers by the average revenue per customer to establish a sales projection:

T×A=ST×A=S

Target(ed) Customers/Users×Average Revenue per Customer=Sales ProjectionTarget(ed) Customers/Users×Average Revenue per Customer=Sales Projection

Another critical part of planning for new business owners is to understand the breakeven point , which is the level of operations that results in exactly enough revenue to cover costs (see Entrepreneurial Finance and Accounting for an in-depth discussion on calculating breakeven points and the breakdown of cost types). It yields neither a profit nor a loss. To calculate the breakeven point, you must first understand the two types of costs: fixed and variable. Fixed costs are expenses that do not vary based on the amount of sales. Rent is one example, but most of a business’s other costs operate in this manner as well. While some costs vary from month to month, costs are described as variable only if they will increase if the company sells even one more item. Costs such as insurance, wages, and office supplies are typically considered fixed costs. Variable costs fluctuate with the level of sales revenue and include items such as raw materials, purchases to be sold, and direct labor. With this information, you can calculate your breakeven point—the sales level at which your business has neither a profit nor a loss. 48 Projections should be more than just numbers: include an explanation of the underlying assumptions used to estimate the venture’s income and expenses.

Projected cash flow outlines preliminary expenses, operating expenses, and reserves—in essence, how much you need before starting your company. You want to determine when you expect to receive cash and when you have to write a check for expenses. Your cash flow is designed to show if your working capital is adequate. A balance sheet shows assets and liabilities, necessary for reporting and financial management. When liabilities are subtracted from assets, the remainder is owners’ equity. The financial concepts and statements introduced here are discussed fully in Entrepreneurial Finance and Accounting .

Market Feasibility Analysis

A market analysis enables you to define competitors and quantify target customers and/or users in the market within your chosen industry by analyzing the overall interest in the product or service within the industry by its target market Figure 11.14 . You can define a market in terms of size, structure, growth prospects, trends, and sales potential. This information allows you to better position your company in competing for market share. After you’ve determined the overall size of the market, you can define your target market, which leads to a total available market (TAM) , that is, the number of potential users within your business’s sphere of influence. This market can be segmented by geography, customer attributes, or product-oriented segments. From the TAM, you can further distill the portion of that target market that will be attracted to your business. This market segment is known as a serviceable available market (SAM) .

Figure 11.14

Projecting market share can be a subjective estimate, based not only on an analysis of the market but also on pricing, promotional, and distribution strategies. As is the case for revenue, you will have a number of different forecasts and tools available at your disposal. Other items you may include in a market analysis are a complete competitive review, historical market performance, changes to supply and demand, and projected growth in demand over time.

ARE YOU READY?

You’ve been hired by a leading hotel chain to determine the market and financial potential for the development of a mixed-use property that will include a full-service hotel in downtown Orlando, located at 425 East Central Boulevard, in Orlando, Florida. The specific address is important so you can pinpoint existing competitors and overall suitability of the site. Using the information given, conduct a market analysis that can be part of a larger feasibility study.

WORK IT OUT

Location feasibility.

You’re considering opening a boutique clothing store in downtown Atlanta. You’ve read news reports about how downtown Atlanta and the city itself are growing and undergoing changes from previous decades. With new development taking place there, you’re not sure whether such a venture is viable. Outline what steps you would need to take to conduct a feasibility study to determine whether downtown Atlanta is the right location for your planned clothing store.

Applying Feasibility Outcomes

After conducting a feasibility analysis, you must determine whether to proceed with the venture. One technique that is commonly used in project management is known as a go-or-no-go decision . This tool allows a team to decide if criteria have been met to move forward on a project. Criteria on which to base a decision are established and tracked over time. You can develop criteria for each section of the feasibility analysis to determine whether to proceed and evaluate those criteria as either “go” or “no go,” using that assessment to make a final determination of the overall concept feasibility. Determine whether you are comfortable proceeding with the present management team, whether you can “go” forward with existing nonfinancial resources, whether the projected financial outlook is worth proceeding, and make a determination on the market and industry. If satisfied that enough “go” criteria are met, you would likely then proceed to developing your strategy in the form of a business plan.

WHAT CAN YOU DO?

Love beyond walls.

When Terence Lester saw a homeless man living behind an abandoned, dilapidated building, he asked the man if he could take him to a shelter. The man scoffed, replying that Lester should sleep in a shelter. So he did—and he saw the problem through the homeless man’s perspective. The shelter was crowded and smelly. You couldn’t get much sleep, because others would try to steal your meager belongings. The dilapidated building provided isolation away from others, but quiet and security in its own way that the shelter could not. This experience led Lester to voluntarily live as a homeless person for a few weeks. His journey led him to create Love Beyond Walls (www.lovebeyondwalls.org), an organization that aids the homeless, among other causes. Lester didn’t conduct a formal feasibility study, but he did so informally by walking in his intended customers’ shoes—literally. A feasibility study of homelessness in a particular area could yield surprising findings that might lead to social entrepreneurial pursuits.

- What is a social cause you think could benefit from a formal feasibility study around a potential entrepreneurial solution?

- Media Coverage

- Media & Press Kit

- News & Events

- Business Ideation

- Feasibility Study

- Market Research

- Startup Consulting

- Business Planning

- Marketing Plan

- Business Plan Design

- Business Plan Review

- Startup Pitch Deck

- Investor Presentation

- Investment Proposal

- Startup Funding

- Implementation Support

- Design Services

- Web Development

- Digital Marketing

- Terms & Conditions

- Client Case Studies

- Client Testimonials

- Business Plan Pricing

- Investor Deck Pricing

- Feasibility Study Pricing

- Market Research Pricing

- Marketing Plan Pricing

- Consulting Support Pricing

- Business Plan Review Pricing

- Business Plan Design Pricing

- Business Ideation Workshop

- Design Services Pricing

- Web Development Pricing

- Digital Marketing Pricing

- Standard Business Plan

- Plus Business Plan

- Premium Business Plan

- Pro Business Plan

- Platinum Business Plan

- Compare Packages

- Smart Entrepreneur

- Funding Bundle

- eCommerce Combo

- Feasibility Combo

- Idea to Implementation

- Build your own

- Sample Business Plans

- Sample Investor Deck

- October 25, 2021

- Posted by: BPlan Experts

- Categories: Entrepreneurship, Planning, Startups

The term feasibility analysis, as its name implies, is a tool used to determine the viability of a company idea. A feasibility study identifies all the resources needed to start a company and analyze the financial and legal aspects of the business plan. So, what’s a business plan? A business plan is a document that details the business idea. The goal of the business plan is to accurately describe the project, its expected results, and financial requirements.

Table of Contents

What is feasibility analysis?

Most people think of feasibility analysis as a product like an automobile that needs to undergo various tests. There is no need to invest huge amounts of money testing a car that does not require it. In other words, the car should perform well but without a risk of an unexpected failure. Since most businesses are not as simple as the car, the concept of feasibility study also applies to business plans. Feasibility analysis are usually expensive but they are a must for any startup. A feasibility analysis identifies all the resources needed to start a company and projects the financial and legal aspects of the business plan. The following sections will help you with the feasibility study process.

First Step: Ideation & Defining the scope of the project

Ideation is the “getting it all off the ground” stage of a feasibility analysis. It involves identifying the problem, what needs to be done, the solution, and how the company will succeed. For example, you might get an idea for a baby pacifier glove. You want to make these baby gloves for day-care providers who deal with drooling and soap. What do you need to do? First, you need to identify the end goal. Will your pacifier glove be used for daycare providers or children?

You need to know what will be the focus of your business and how you plan to market your product. After all, a business plan without a marketing plan is like driving a car without a steering wheel. This is also the stage when you determine if the company is feasible.

Second Step: Market Analysis

The next step involves an in-depth assessment of the market for the product being developed. This assessment entails identifying the current market for the product or service, a detailed survey of current companies in the targeted market, and a list of competitors. The market analysis determines the market for the product, along with the legal and logistical requirements, who can make the investment required to market and produce the product, and how competitive the product will be.

Third Step: Industry Research

When thinking of your venture, go beyond marketing and sales and start looking for the industry. Is the industry niche? Does it require special expertise? What industries are similar to yours? How will these factors affect the overall cost of production? Determine who the competition is, what their market share is, and if the industry will still exist in the future.

Fourth Step: Opportunity Analysis

Following the industry research, we will perform an opportunity analysis to determine the market niche, business model, revenue, and other factors which may have the greatest impact on the financial success of the startup. An opportunity analysis takes into account factors such as the role that existing or potential markets have on an idea’s viability during the feasibility analysis.

Fifth Step: Operational Research

Operational research is a type of research that explores various options and contingencies to help an investor or entrepreneur understand the feasibility of a project. The process involves brainstorming and evaluating different options and problems, ultimately generating new options, potential outcomes, and solutions to the problems that were originally identified. These steps are just some of the fundamentals of startup feasibility analysis.

If you want to start a successful company, you must do the research required to understand your market and your competitors, along with every possible opportunity that can help your company grow. How else can you prepare your company for the future? As with any venture, preparation is the key.

Sixth Step: Competitor Analysis

The next step in the feasibility analysis process is the competitive analysis, to come up with a competitive advantage that is unique to your business idea. What’s a competitive advantage? It’s a strategy that can be used to take advantage of the existing market or a strategy that can allow a company to achieve market dominance. A competitive analysis is a quick visual inspection of your industry, looking at your competition to determine how they’re doing. Although this step may seem minor, it’s one of the most important steps in the feasibility study process.

Seventh Step: Industry Best Practices

There’s a lot of research to be done to determine which industry best practices are most pertinent for your business and your target market. However, as mentioned before, this research is not limited to the needs of the industry. Companies have found ways to adapt to different markets. From shoe manufacturing to sandal making, and even selling hot dogs for a living, each industry needs to determine what they need to change to stay competitive. Even the smallest companies have this process of constantly evolving to help them stay successful.

An industry best practice is a set of standards that members of an industry follow. To remain competitive, the standard defines how the industry behaves, how they adapt to change, and what they need to achieve in the future. While doing feasibility analysis you should do this in-depth.

Eighth Step: Business Model Generation

Once the financial and legal aspects have been analysed, the business plan can be generated. The name business model generation implies that, essentially, you should be able to generate a working business plan for your idea. Once you have a business model that would work, you can then develop it into a working business plan. If you are a first-time entrepreneur and want to write a business plan for your idea, take a look at my “Write a business plan like an expert in 2021”. Congratulations, you’re almost ready to start building your startup.

Ninth Step: Risks & Mitigation Study

The next step in the feasibility analysis is to conduct a risk analysis to determine the amount of risk the project poses. To do this, divide the business plan into smaller and more manageable sections. Allocate some time to go through each section and perform a risk analysis. First, you’ll need to determine the risk that the project faces by identifying the top threats. In many cases, the top threats will include cash flow concerns and threats of losing investment funds. You should also list all of how the project can be improved upon. The goal of this step is to gain more control over the project by addressing all of the top threats.

Tenth Step: Budgeting & Financial Assessment

Budgeting is an important part of the feasibility analysis. A company is only as good as its budget. The success of an organization depends on how well it manages its funds and resources. The financial assessment is another important part of the feasibility study. It helps to determine whether an organization can afford a new project or not. It also helps to predict future cash flow for the organization based on past financial information, which helps it decide if it can undertake new projects now or in the future.

As per this section, financial assessment and budgeting are integral parts of any feasibility analysis. They are needed to ensure that the company has done its due diligence before deciding on any investment opportunities or changes in management strategy.

Eleventh Step: Implementation Roadmap

The main purpose of the implementation roadmap is to put the actual project into motion. It’s all about executing the project that you have planned.

In conclusion, conducting a feasibility analysis can help you determine your chances of success. A well-done feasibility study will not only look at the market potential, but will also help you understand the people, processes, policies, costs, competition, and even the culture of the industry you are considering entering. The key to success with any business venture is to take the time to do your research. Hiring professional feasibility study services will help you with your feasibility analysis and make sure you don’t miss vital information. They can save you time and money in the long run.

References: – Feasibility Study – Investopedia – Business Planning for Startups & Entrepreneurs

Interested in startup resources like these?

Submit a business inquiry online or drop us an email or call us for a free consulting session.

Our Services

- Web Design & Development

Want to create or adapt books like this? Learn more about how Pressbooks supports open publishing practices.

5.3 Conducting a Feasibility Analysis

Learning Objectives

By the end of this section, you will be able to:

- Describe the purpose of a feasibility analysis

- Describe and develop the parts of a feasibility analysis

- Understand how to apply feasibility outcomes to a new venture

As the name suggests, a feasibility analysis is designed to assess whether your entrepreneurial endeavor is, in fact, feasible or possible. By evaluating your management team, assessing the market for your concept, estimating financial viability, and identifying potential pitfalls, you can make an informed choice about the achievability of your entrepreneurial endeavor. A feasibility analysis is largely numbers driven and can be far more in depth than a business plan. It ultimately tests the viability of an idea, a project, or a new business. A feasibility study may become the basis for the business plan, which outlines the action steps necessary to take a proposal from ideation to realization. A feasibility study allows a business to address where and how it will operate, its competition, possible hurdles, and the funding needed to begin. The business plan then provides a framework that sets out a map for following through and executing on the entrepreneurial vision.

Organizational Feasibility Analysis

Organizational feasibility aims to assess the prowess of management and sufficiency of resources to bring a product or idea to market Figure 5.12. The company should evaluate the ability of its management team on areas of interest and execution. Typical measures of management prowess include assessing the founders’ passion for the business idea along with industry expertise, educational background, and professional experience. Founders should be honest in their self-assessment of ranking these areas.

Resource sufficiency pertains to nonfinancial resources that the venture will need to move forward successfully and aims to assess whether an entrepreneur has a sufficient amount of such resources. The organization should critically rank its abilities in six to twelve types of such critical nonfinancial resources, such as availability of office space, quality of the labor pool, possibility of obtaining intellectual property protections (if applicable), willingness of high-quality employees to join the company, and likelihood of forming favorable strategic partnerships. If the analysis reveals that critical resources are lacking, the venture may not be possible as currently planned. [1]

Financial Feasibility Analysis

A financial analysis seeks to project revenue and expenses (forecasts come later in the full business plan); project a financial narrative; and estimate project costs, valuations, and cash flow projections Figure 5.13.

The financial analysis may typically include these items:

- A twelve-month profit and loss projection

- A three- or four-year profit-and-loss projection

- A cash-flow projection

- A projected balance sheet

- A breakeven calculation

The financial analysis should estimate the sales or revenue that you expect the business to generate. A number of different formulas and methods are available for calculating sales estimates. You can use industry or association data to estimate the sales of your potential new business. You can search for similar businesses in similar locations to gauge how your business might perform compared with similar performances by competitors. One commonly used equation for a sales model multiplies the number of target customers by the average revenue per customer to establish a sales projection:

T × A = S Target(ed) Customers / Users × Average Revenue per Customer = Sales Projection

Another critical part of planning for new business owners is to understand the breakeven point, which is the level of operations that results in exactly enough revenue to cover costs (see Entrepreneurial Finance and Accounting for an in-depth discussion on calculating breakeven points and the breakdown of cost types). It yields neither a profit nor a loss. To calculate the breakeven point, you must first understand the two types of costs: fixed and variable. Fixed costs are expenses that do not vary based on the amount of sales. Rent is one example, but most of a business’s other costs operate in this manner as well. While some costs vary from month to month, costs are described as variable only if they will increase if the company sells even one more item. Costs such as insurance, wages, and office supplies are typically considered fixed costs. Variable costs fluctuate with the level of sales revenue and include items such as raw materials, purchases to be sold, and direct labor. With this information, you can calculate your breakeven point—the sales level at which your business has neither a profit nor a loss. [2] Projections should be more than just numbers: include an explanation of the underlying assumptions used to estimate the venture’s income and expenses.

Projected cash flow outlines preliminary expenses, operating expenses, and reserves—in essence, how much you need before starting your company. You want to determine when you expect to receive cash and when you have to write a check for expenses. Your cash flow is designed to show if your working capital is adequate. A balance sheet shows assets and liabilities, necessary for reporting and financial management. When liabilities are subtracted from assets, the remainder is owners’ equity.

Market Feasibility Analysis

A market analysis enables you to define competitors and quantify target customers and/or users in the market within your chosen industry by analyzing the overall interest in the product or service within the industry by its target market Figure 5.14. You can define a market in terms of size, structure, growth prospects, trends, and sales potential. This information allows you to better position your company in competing for market share. After you’ve determined the overall size of the market, you can define your target market, which leads to a total available market (TAM), that is, the number of potential users within your business’s sphere of influence. This market can be segmented by geography, customer attributes, or product-oriented segments. From the TAM, you can further distill the portion of that target market that will be attracted to your business. This market segment is known as a serviceable available market (SAM).

Projecting market share can be a subjective estimate, based not only on an analysis of the market but also on pricing, promotional, and distribution strategies. As is the case for revenue, you will have a number of different forecasts and tools available at your disposal. Other items you may include in a market analysis are a complete competitive review, historical market performance, changes to supply and demand, and projected growth in demand over time.

Exercise – Market Feasibility Analysis

You’ve been hired by a leading hotel chain to determine the market and financial potential for the development of a mixed-use property that will include a full-service hotel in downtown Orlando, located at 425 East Central Boulevard, in Orlando, Florida. The specific address is important so you can pinpoint existing competitors and overall suitability of the site. Using the information given, conduct a market analysis that can be part of a larger feasibility study.

Exercise – Location Feasibility

Applying Feasibility Outcomes

After conducting a feasibility analysis, you must determine whether to proceed with the venture. One technique that is commonly used in project management is known as a go-or-no-go decision. This tool allows a team to decide if criteria have been met to move forward on a project. Criteria on which to base a decision are established and tracked over time. You can develop criteria for each section of the feasibility analysis to determine whether to proceed and evaluate those criteria as either “go” or “no go,” using that assessment to make a final determination of the overall concept feasibility. Determine whether you are comfortable proceeding with the present management team, whether you can “go” forward with existing nonfinancial resources, whether the projected financial outlook is worth proceeding, and make a determination on the market and industry. If satisfied that enough “go” criteria are met, you would likely then proceed to developing your strategy in the form of a business plan.

Love Beyond Walls

When Terence Lester saw a homeless man living behind an abandoned, dilapidated building, he asked the man if he could take him to a shelter. The man scoffed, replying that Lester should sleep in a shelter. So he did—and he saw the problem through the homeless man’s perspective. The shelter was crowded and smelly. You couldn’t get much sleep, because others would try to steal your meager belongings. The dilapidated building provided isolation away from others, but quiet and security in its own way that the shelter could not. This experience led Lester to voluntarily live as a homeless person for a few weeks. His journey led him to create Love Beyond Walls , an organization that aids the homeless, among other causes. Lester didn’t conduct a formal feasibility study, but he did so informally by walking in his intended customers’ shoes—literally. A feasibility study of homelessness in a particular area could yield surprising findings that might lead to social entrepreneurial pursuits.

- What is a social cause you think could benefit from a formal feasibility study around a potential entrepreneurial solution?

- Ulrich Kaiser. “A primer in Entrepreneurship – Chapter 3 Feasibility analysis” University of Zurich Institute for Strategy and Business Economics. n.d. https://docplayer.net/7775267-A-primer-in-entrepreneurship-chapter-3-feasibility-analysis.html ↵

- In a preliminary financial model and business plan, startup costs should be allocated, as they are intended for one-time investments in development; pre-launch costs and other necessary expenses will not carry over once the product/solution has launched. ↵

NSCC Foundations of Entrepreneurship Copyright © 2022 by OpenStax is licensed under a Creative Commons Attribution 4.0 International License , except where otherwise noted.

Share This Book

Starting a Business | What is

What Is a Feasibility Study for Small Business?

Published July 17, 2020

Published Jul 17, 2020

WRITTEN BY: Blake Stockton

This article is part of a larger series on Starting a Business .

A feasibility study for small business is an in-depth research and financial analysis that recommends if one should pursue a business idea or product. The study contains estimates of items such as income, costs, obstacles, and technical challenges. Typically, a feasibility study for a small business costs a minimum of $5,000. However, they can cost up to $100,000 for businesses that have a multimillion dollar startup budget.

Throughout this article, we discuss what a feasibility study is and how it differs from a business plan, so that you can decide whether or not you really need one for your business.

How the Feasibility Study Works

Usually, businesses conduct feasibility studies to determine if their idea or product is worth pursuing. It’s one of the more complicated and costly ways to test a business idea.

Depending on the idea’s complexity and scope, a study can take weeks or months to prepare. With the help of templates or programs, business owners can conduct feasibility studies on their own. However, because of the in-depth research and complicated financial projections, they often hire an expert to create the study.

Feasibility studies do not determine the final decision but present all the evidence and make a strong recommendation on whether or not it’s best to move forward. The entrepreneur, stakeholders, and/or other authorities decide whether to go ahead with the business idea or product, using the study as a guide.

Who Should Get a Feasibility Study?

Small business entrepreneurs use a feasibility study to prevent the costly mistake of launching an unsuccessful business, product, or project. You can use a study to help make strategic decisions, such as determining whether you should:

- Start a new business

- Open a new store or factory

- Change product lineup or approach

- Expand to a new area or market

- Acquire another company

- Make a significant investment in new technology

- Enter an already crowded or competitive market segment

- Invest personal capital into a project

Feasibility Study vs Business Plan

A feasibility study often comes before the business plan, because the information and data uncovered in the study are included in the business plan. Plus, if the feasibility gives a recommendation not to move forward, you may want to rethink your business idea or product altogether before creating a plan.

What Should Be in a Feasibility Study?

Depending on the project or business, you will use each of the aspects below to a certain degree. The feasibility study’s organization may vary depending on its focus—you may have a section for each of these topics:

- Executive Summary: This summarizes the project and business. The ultimate conclusions are outlined here. It should be about a page long.

- Demand: A marketing analysis determines the need for your product or business in the industry you want to sell. Even if you have a brick-and-mortar business, you should consider online aspects as well.

- Technical issues: What tool, hardware, or software do you need to create your business or product? Will you create the tech, buy it, or rent it? This section also includes the facilities, including layout, shelving, offices, and manufacturing space.

- Logistics issues: This piece outlines vendors, pricing schedules, exclusive agreements, and franchised product contracts. It may include getting supplies and delivering finished products or working online elements like an ecommerce site. Location issues can be placed here.

- Legal concerns: Do you need permits? Are there regulations or prohibitions to consider? What about environmental, historical, or legacy issues to negotiate?

- Marketing strategy: This section will define the target market as specific as possible: How you will meet their needs, and how you will target them?

- Required staffing: How many employees will you need? What are their qualifications? What is the typical salary in your area? You can include a sample organizational chart along with a corresponding discussion of who among your current employees may change jobs to fill new positions.

- Scheduling: This section includes milestones for financials as well as physical projects and a timeline for completion.

- Financials: In addition to anticipated expenses and potential profits, this section will include an opening day balance sheet that lists total assets and liabilities on your business’s first day. This financial data gives you an indication of your return on investment (ROI).

- ROI: If you don’t see a return on investment, it makes no sense to start or expand your business. A feasibility study estimates when you’ll earn profits and what or how much they may be.

- Analysis: You will see discussions answering questions like: Does it seem realistic? Are the sources strong? Are there outlying data points to consider? Also, analyze potential risks: What are the worst-case scenarios, and how likely are they?

- Recommendations: This gives a go or no-go recommendation and breaks down specific suggestions based on the main elements. If the project is not feasible, it may offer alternatives.

Cost of a Feasibility Study

A feasibility study for small business takes an average of 60 to 90 days to complete and may cost anywhere from $5,000 to $10,000. As a general rule of thumb, a feasibility study will cost 1% of the business’s total cost to open or a product’s cost to build. So if you’re requesting a feasibility study for a complicated business with millions in startup costs, be prepared to spend more than $10,000.

The cost is also determined by the study’s depth, the tools needed to conduct it—survey software, focus groups, and lawyers—and the scope of the project. For example, a study to determine if a business should bring manufacturing back to the US from overseas will cost more than a study on whether to open a restaurant.

Here are costs for various feasibility study projects:

Who Provides Feasibility Studies?

You may find it challenging to find a firm that only produces feasibility studies. Often, a market research firm will provide feasibility studies in addition to other services. For example, Drive Research in Syracuse, New York, offers a host of market research services, including feasibility studies .

There are also business plan writing companies that specialize in feasibility studies. Wise Business Plans provides a study with in-depth market research and industry analysis.

If you’d like to connect one-on-one and choose your own independent market researcher for a feasibility study, you could look to the freelancer platform Upwork . You can find several market research experts and analysts that may be interested in tackling your specific project. Upwork is an excellent platform to find market researchers, because you can review a freelancer’s past work to see if they’d be a good fit.

Tips and Best Practices to Follow When Purchasing a Feasibility Study

- Conduct a preliminary analysis first: Before paying thousands of dollars for a feasibility study, do a minor check to ensure there are no insurmountable technical, legal, or financial obstacles to the business idea or product.

- Involve stakeholders: Before, during, and after the study, keep people relevant to the business in the loop. Get their input, suggestions, and feedback.

- Review research: Review the feasibility study data and see if you come to a similar conclusion as the research analyst. You may also want to pay for a second expert’s opinion on the final determination.

- Assess your current company or situation: Before making any decision on a business idea or product, consider your own strengths, weaknesses, and financial situation in the final decision to move forward or not.

Frequently Asked Questions (FAQs) for a Feasibility Study

Is it better to hire out for a feasibility study.

Most likely, yes. Feasibility studies typically contain in-depth expert data analysis and financial projections. Hiring out the work will ensure you get an objective evaluation of the project and its potential downfalls and successes. It’s human nature to bias our own ideas, and a third party can avoid.

How much should I invest in a feasibility study?

For a simpler study on a business idea or product, expect to pay anywhere from $5,000 to $10,000. The general rule of thumb is that a feasibility study will cost 1% of the expected project budget or business’s cost to build.

Should feasibility studies include solutions as well as pointing out obstacles?

Yes, the more information the study provides, the better it will aid in the decision-making process. Feasibility studies should provide an objective determination because of the time and expense involved.

Can my feasibility study become my business plan?

Many times, yes. With some changes in focus and scope, a feasibility study can be re-imagined into a business plan. However, be sure it meets the purpose, which outlines the strategic and tactical steps needed to make the business work.

Bottom Line

Feasibility studies can cost thousands of dollars, but they can save you millions you may lose from making a poor business decision. They examine a new business or product idea by researching the endeavor’s technological, financial, and operational aspects. The study analyzes the data and offers a recommendation on if you should move ahead with your project or idea and how to maximize its success.

About the Author

Find Blake On LinkedIn Twitter

Blake Stockton

Blake Stockton is a staff writer at Fit Small Business focusing on how to start brick-and-mortar and online businesses. He is a frequent guest lecturer at several undergraduate business and MBA classes at University of North Florida . Prior to joining Fit Small Business, Blake consulted with over 700 small biz owners and assisted with starting and growing their businesses.

Join Fit Small Business

Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. Select the newsletters you’re interested in below.

- Starting a Business

- Growing a Business

- Small Business Guide

- Business News

- Science & Technology

- Money & Finance

- For Subscribers

- Write for Entrepreneur

- Entrepreneur Store

- United States

- Asia Pacific

- Middle East

- South Africa

Copyright © 2024 Entrepreneur Media, LLC All rights reserved. Entrepreneur® and its related marks are registered trademarks of Entrepreneur Media LLC

How to Prepare and Write the Perfect Business Plan for Your Company Here's how to write a business plan that will formalize your company's goals and optimize your organization.

By Matthew McCreary • May 5, 2021

Are you preparing to start your own business but uncertain about how to get started? A business plan ought to be one of the first steps in your entrepreneurial journey because it will organize the ideas that have been spinning around in your brain and prepare you to seek funding, partners and more.

What is a business plan?

A business plan is a detailed document that outlines a company's goals and how the business, well, plans to achieve those goals over the next three or more years. It helps define expected profits and challenges, providing a road map that will help you avoid bumps in the road.

Stever Robbins writes in an Entrepreneur article titled, "Why You Must Have a Business Plan," that a business plan "is a tool for understanding how your business is put together…. Writing out your business plan forces you to review everything at once: your value proposition, marketing assumptions, operations plan, financial plan and staffing plan." But, a business plan is about more than just reviewing the past state of your business or even what your business looks like today.

Robbins writes that a well-written business plan will help you drive the future by "laying out targets in all major areas: sales, expense items, hiring positions and financing goals. Once laid out, the targets become performance goals."

The business plan can help your company attract talent and funding, because when prospects ask about your business, you already have an articulated overview to offer them. How they react can allow you to quickly understand how others see your business and pivot if necessary.

What should you do before you write your business plan?

It might sound redundant, but you actually need to plan your business plan. Business plans can be complicated, and you'll be held accountable for the goals you set. For example, if you plan to open five locations of your business within the first two years, your investors might get angry if you only manage to open two.

That's why it's essential that, before writing your business plan, you spend some time determining exactly which objectives are essential to your business. If you're struggling to come up with a list of goals on your own, Entrepreneur article "Plan Your Business Plan" offers some questions you can ask yourself to spark some inspiration.

How determined am I to see this venture succeed?

Am I willing to invest my own money and work long hours for no pay, sacrificing personal time and lifestyle, maybe for years?

What's going to happen to me if this venture doesn't work out?

If it does succeed, how many employees will this company eventually have?

What will be the business's annual revenue in a year? What about in five years?

What will be the company's market share in that amount of time?

Will the business have a niche market, or will it sell a broad spectrum of goods and services?

What are my plans for geographic expansion? Should it be local or national? Can it be global?

Am I going to be a hands-on manager, or will I delegate a large proportion of tasks to others?

If I delegate, what sorts of tasks will I share? Will it be sales, technical work or something else?

How comfortable am I taking direction from others? Can I work with partners or investors who demand input into the company's management?

Is the business going to remain independent and privately owned, or will it eventually be acquired or go public?

It's also essential to consider your financial goals. Your business might not require a massive financial commitment upfront, but it probably will if you're envisioning rapid growth. Unless you're making your product or service from scratch, you'll have to pay your suppliers before your customers can pay you, and as "Plan Your Business Plan" points out, "this cash flow conundrum is the reason so many fast-growing companies have to seek bank financing or equity sales to finance their growth. They are literally growing faster than they can afford."

How much financing will you need to start your business? What will you be willing to accept? If you're desperate for that first influx of cash, you might be tempted to accept any offer, but doing so might force you to either surrender too much control or ask investors for a number that's not quite right for either side.

These eight questions can help you determine a few financial aspects of your planning stages:

What initial investment will the business require?

How much control of the business are you willing to relinquish to investors?

When will the business turn a profit?

When can investors, including you, expect a return on investment?

What are the business's projected profits over time?

Will you be able to devote yourself full-time to the business?

What kind of salary or profit distribution can you expect to take home?

What are the chances the business will fail, and what will happen if it does?

You should also consider who, primarily, is going to be reading your business plan, and how you plan to use it. Is it a means of raising money or attracting employees? Will suppliers see it?

Lastly, you need to assess the likelihood of whether you actually have the time and resources to see your plan through. It might hurt to realize the assumptions you've made so far don't actually make a successful business, but it's best to know early on, before you make further commitments.

Related: Need a Business Plan Template? Here Is Apple's 1981 Plan for the Mac.

How to Write a Business Plan

Once you've worked out all the questions above and you know exactly what goals you have for your business plan, the next step is to actually write the darn thing. A typical business plan runs 15 to 20 pages but can be longer or shorter, depending on the complexity of the business and the needs of your venture. Regardless of whether you intend to use the business plan for self-evaluation or to seek a seven-figure investment, it should include nine key components, many of which are outlined in Entrepreneur 's introduction to business plans:

1. Title page and contents

Presentation is important, and a business plan should be presented in a binder with a cover that lists the business's name, the principals' names and other relevant information like a working address, phone number, email and web address and date. Write the information in a font that's easy to read and include it on the title page inside, too. Add in the company logo and a table of contents that follows the executive summary.

2. Executive summary

Think of the executive summary as the SparkNotes version of your business plan . It should tell the reader in as few words as possible what your business wants and why. The executive summary should address these nine things:

The business idea and why it is necessary. (What problem does it solve?)

How much will it cost, and how much financing are you seeking?

What will the return be to the investor? Over what length of time?

What is the perceived risk level?

Where does your idea fit into the marketplace?

What is the management team?

What are the product and competitive strategies?

What is your marketing plan?

What is your exit strategy?

When writing the executive summary, remember that it should be somewhere between one-half page to a full page. Anything longer, and you risk losing your reader's attention before they can dig into your business plan. Try to answer each of the questions above in two or three sentences, and you'll wind up with an executive summary that's about the right length.

Related: First Steps: Writing the Executive Summary of Your Business Plan

3. Business description

You can fill anywhere from a few paragraphs to a few pages when writing your business description, but try again to keep it short, with the understanding that more sections will follow. The business description typically starts with a short explanation of your chosen industry, including its present outlook and future possibilities. Use data and sources (with proper footnotes) to explain the markets the industry offers, along with the developments that will affect your business. That way, everyone who reads the business description, particularly investors, will see that they can trust the various information contained within your business plan.

When you pivot to speaking of your business, start with its structure. How does your business work? Is it retail, service-oriented or wholesale? Is the business new or established? Is the company a sole proprietorship, partnership or corporation? Who are the principals and who are your customers? What do the distribution channels look like, and how can you support sales?

Next, break down your business's offerings. Are you selling a physical product, SaaS or a service? Explain it in a way that a reader knows what you're planning to sell and how it differentiates itself from the competition (investors call this a Unique Selling Proposition, or USP, and it's important that you find yours). Whether it's a trade secret or a patent, you should be specific about your competitive advantage and why your business is going to be profitable. If you plan to use your business plan for fundraising, you can use the business description section to explain why new investments will help make the business even more profitable.

This, like everything else, can be brief, but you can tell the reader about your business's efficiency or workflow. You can write about other key people within the business or cite industry experts' support of your idea, as well as your base of operations and reasons for starting in the first place.

4. Market strategies

Paint a picture about your market by remembering the four Ps: product, price, place and promotion.

Start this section by defining the market's size, structure and sales potential. What are the market's growth prospects? What do the demographics and trends look like right now?

Next, outline the frequency at which your product or service will be purchased by the target market and the potential annual purchase. What market share can you possibly expect to win? Try to be realistic here, and keep in mind that even a number like 25% might be a dominant share.

Next, break down your business's plan for positioning, which relates to the market niche your product or service can fill. Who is your target market, how will you reach them and what are they buying from you? Who are your competitors, and what is your USP?

The positioning statement within your business plan should be short and to the point, but make sure you answer each of those questions before you move on to, perhaps, the most difficult and important aspect of your market strategy: pricing.

In fact, settling on a price for your product or service is one of the most important decisions you have to make in the entire business plan. Pricing will directly determine essential aspects of your business, like profit margin and sales volume. It will influence all sorts of areas, too, from marketing to target consumer.

There are two primary ways to determine your price: The first is to look inward, adding up the costs of offering your product or service, and then adding in a profit margin to find your number. The second is called competitive pricing, and it involves research into how your competitors will either price their products or services now or in the future. The difficult aspect of this second pricing method is that it often sets a ceiling on pricing, which, in turn, could force you to adjust your costs.

Then, pivot the market strategies section toward your distribution process and how it relates to your competitors' channels. How, exactly, are you going to get your offerings from one place to the next? Walk the reader step by step through your process. Do you want to use the same strategy or something else that might give you an advantage?

Last, explain your promotion strategy. How are you going to communicate with your potential customers? This part should talk about not only marketing or advertising, but also packaging, public relations and sales promotions.

Related: Creating a Winning Startup Business Plan

5. Competitive analysis

The next section in your business plan should be the competitive analysis, which helps explain the differences between you and your competitors … and how you can keep it that way. If you can start with an honest evaluation of your competitors' strengths and weaknesses within the marketplace, you can also provide the reader with clear analysis about your advantage and the barriers that either already exist or can be developed to keep your business ahead of the pack. Are there weaknesses within the marketplace, and if so, how can you exploit them?

Remember to consider both your direct competition and your indirect competition, with both a short-term and long-term view.

6. Design and development plan

If you plan to sell a product, it's smart to add a design and development section to your business plan. This part should help your readers understand the background of that product. How have the production, marketing and company developed over time? What is your developmental budget?

For the sake of organization, consider these three aspects of the design and development plan:

Product development

Market development

Organizational development

Start by establishing your development goals, which should logically follow your evaluation of the market and your competition. Make these goals feasible and quantifiable, and be sure to establish timelines that allow your readers to see your vision. The goals should address both technical and marketing aspects.

Once the reader has a clear idea of your development goals, explain the procedures you'll develop to reach them. How will you allocate your resources, and who is in charge of accomplishing each goal?

The Entrepreneur guide to design and development plans offers this example on the steps of producing a recipe for a premium lager beer:

Gather ingredients.

Determine optimum malting process.

Gauge mashing temperature.

Boil wort and evaluate which hops provide the best flavor.

Determine yeast amounts and fermentation period.

Determine aging period.

Carbonate the beer.

Decide whether or not to pasteurize the beer.

Make sure to also talk about scheduling. What checkpoints will the product need to pass to reach a customer? Establish timeframes for each step of the process. Create a chart with a column for each task, how long that task will take and when the task will start and end.

Next, consider the costs of developing your product, breaking down the costs of these aspects:

General and administrative (G&A) costs

Marketing and sales

Professional services, like lawyers or accountants

Miscellaneous costs

Necessary equipment

The next section should be about the personnel you either have or plan to hire for that development. If you already have the right person in place, this part should be easy. If not, then this part of the business plan can help you create a detailed description of exactly what you need. This process can also help you formalize the hierarchy of your team's positions so that everyone knows their roles and responsibilities.

Finish the development and design section of your business plan by addressing the risks in developing the product and how you're going to address those risks. Could there be technical difficulties? Are you having trouble finding the right person to lead the development? Does your financial situation limit your ability to develop the product? Being honest about your problems and solutions can help answer some of your readers' questions before they ask them.

Related: The Essential Guide to Writing a Business Plan

7. Operations and management plan

Want to learn everything you'll ever need to know about the operations and management section of your business plan, and read a real, actual web article from 1997? Check out our guide titled, "Writing A Business Plan: Operations And Management."

Here, we'll more briefly summarize the two areas that need to be covered within your operations and management plan: the organizational structure is first, and the capital requirement for the operation are second.

The organizational structure detailed within your business plan will establish the basis for your operating expenses, which will provide essential information for the next part of the business plan: your financial statements. Investors will look closely at the financial statements, so it's important to start with a solid foundation and a realistic framework. You can start by dividing your organizational structure into these four sections:

Marketing and sales (including customer relations and service)

Production (including quality assurance)

Research and development

Administration

After you've broken down the organization's operations within your business plan, you can look at the expenses, or overhead. Divide them into fixed expenses, which typically remain constant, and variable, which will change according to the volume of business. Here are some of the examples of overhead expenses:

Maintenance and repair

Equipment leases

Advertising and promotion

Packaging and shipping

Payroll taxes and benefits

Uncollectible receivables

Professional services

Loan payments

Depreciation

Having difficulty calculating what some of those expenses might be for your business? Try using the simple formulas in "Writing A Business Plan: Operations And Management."

8. Financial factors

The last piece of the business plan that you definitely need to have covers the business's finances. Specifically, three financial statements will form the backbone of your business plan: the income statement, the cash-flow statement and balance sheet . Let's go through them one by one.

The income statement explains how the business can make money in a simple way. It draws on financial models already developed and discussed throughout the business plan (revenue, expenses, capital and cost of goods) and combines those numbers with when sales are made and when expenses are incurred. When the reader finishes going through your income statement, they should understand how much money your company makes or loses by subtracting your costs from your revenue, showing either a loss or a profit. If you like, you or a CPA can add a very short analysis at the end to emphasize some important aspects of the statement.

Second is the cash-flow statement, which explains how much cash your business needs to meet its obligations, as well as when you're going to need it and how you're going to get it. This section shows a profit or loss at the end of each month or year that rolls over to the next time period, which can create a cycle. If your business plan shows that you're consistently operating at a loss that gets bigger as time goes on, this can be a major red flag for both you and potential investors. This part of the business plan should be prepared monthly during your first year in business, quarterly in your second year and annually after that.

Our guide on cash-flow statements includes 17 items you'll need to add to your cash-flow statement.

Cash. Cash on hand in the business.

Cash sales . Income from sales paid for by cash.

Receivables. Income from collecting money owed to the business due to sales.

Other income. The liquidation of assets, interest on extended loans or income from investments are examples.

Total income. The sum of the four items above (total cash, cash sales, receivables, other income).

Material/merchandise . This will depend on the structure of your business. If you're manufacturing, this will include your raw materials. If you're in retail, count your inventory of merchandise. If you offer a service, consider which supplies are necessary.

Direct labor . What sort of labor do you need to make your product or complete your service?

Overhead . This includes both the variable expenses and fixed expenses for business operations.

Marketing/sales . All salaries, commissions and other direct costs associated with the marketing and sales departments.

Research and development . Specifically, the labor expenses required for research and development.

General and administrative expenses. Like the research and development costs, this centers on the labor for G&A functions of the business.

Taxes . This excludes payroll taxes but includes everything else.

Capital. Required capital for necessary equipment.

Loan payments. The total of all payments made to reduce any long-term debts.

Total expenses. The sum of items six through 14 (material/merchandise, direct labor, overhead, marketing/sales, research and development, general and administrative expenses, taxes, capital and loan payments).

Cash flow. Subtract total expenses from total income. This is how much cash will roll over to the next period.

Cumulative cash flow . Subtract the previous period's cash flow from your current cash flow.

Just like with the income statement, it's a good idea to briefly summarize the figures at the end. Again, consulting with a CPA is probably a good idea.

The last financial statement is the balance sheet. A balance sheet is, as our encyclopedia says, "a financial statement that lists the assets, liabilities and equity of a company at a specific point in time and is used to calculate the net worth of a business." If you've already started the business, use the balance sheet from your last reporting period. If the business plan you wrote is for a business you hope to start, do your best to project your assets and liabilities over time. If you want to earn investors, you'll also need to include a personal financial statement. Then, as with the other two sections, add a short analysis that hits the main points.

9. Supporting documents

If you have other documents that your readers need to see, like important contracts, letters of reference, a copy of your lease or legal documents, you should add them in this section.

Related: 7 Steps to a Perfectly Written Business Plan

What do I do with my business plan after I've written it?

The simplest reason to create a business plan is to help people unfamiliar with your business understand it quickly. While the most obvious use for a document like this is for financing purposes, a business plan can also help you attract talented employees — and, if you share the business plan internally, help your existing employees understand their roles.

But it's also important to do for your own edification, too. It's like the old saying goes, "The best way to learn something is to teach it." Writing down your plans, your goals and the state of your finances helps clarify the thoughts in your own mind. From there, you can more easily lead your business because you'll know whether the business is reaching the checkpoints you set out to begin with. You'll be able to foresee difficulties before they pop up and be able to pivot quickly.

That's why you should continue to update your business plan when the conditions change, either within your business (you might be entering a new period or undergoing a change in management) or within your market (like a new competitor popping up). The key is to keep your business plan ready so that you don't have to get it ready when opportunity strikes.

Entrepreneur Staff

Associate Editor, Contributed Content

Want to be an Entrepreneur Leadership Network contributor? Apply now to join.

Editor's Pick Red Arrow

- This 103-Year-Old Doctor Opened Her Medical Practice Before Women Could Have Bank Accounts — Here Are Her 6 Secrets to a Healthy, Successful Life