Everything that you need to know to start your own business. From business ideas to researching the competition.

Practical and real-world advice on how to run your business — from managing employees to keeping the books

Our best expert advice on how to grow your business — from attracting new customers to keeping existing customers happy and having the capital to do it.

Entrepreneurs and industry leaders share their best advice on how to take your company to the next level.

- Business Ideas

- Human Resources

- Business Financing

- Growth Studio

- Ask the Board

Looking for your local chamber?

Interested in partnering with us?

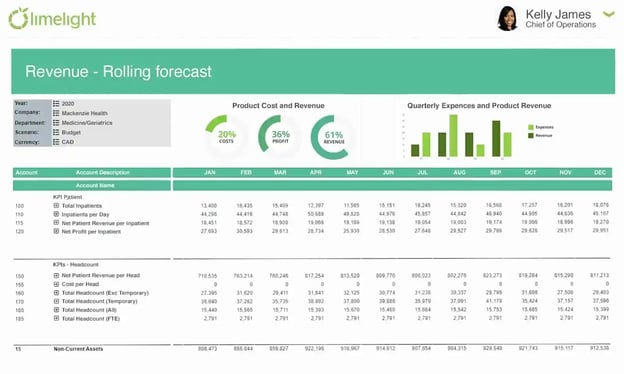

Run » finance, how to create a financial forecast for a startup business plan.

Financial forecasting allows you to measure the progress of your new business by benchmarking performance against anticipated sales and costs.

When starting a new business, a financial forecast is an important tool for recruiting investors as well as for budgeting for your first months of operating. A financial forecast is used to predict the cash flow necessary to operate the company day-to-day and cover financial liabilities.

Many lenders and investors ask for a financial forecast as part of a business plan; however, with no sales under your belt, it can be tricky to estimate how much money you will need to cover your expenses. Here’s how to begin creating a financial forecast for a new business.

[Read more: Startup 2021: Business Plan Financials ]

Start with a sales forecast

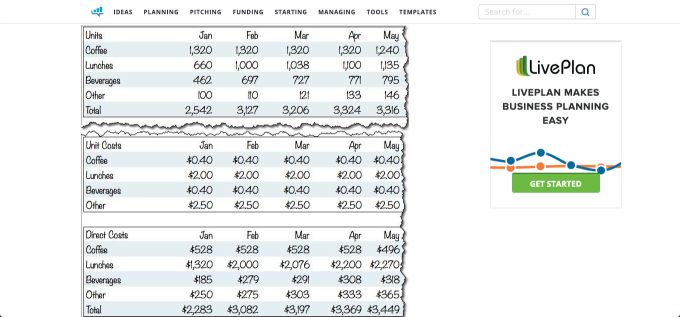

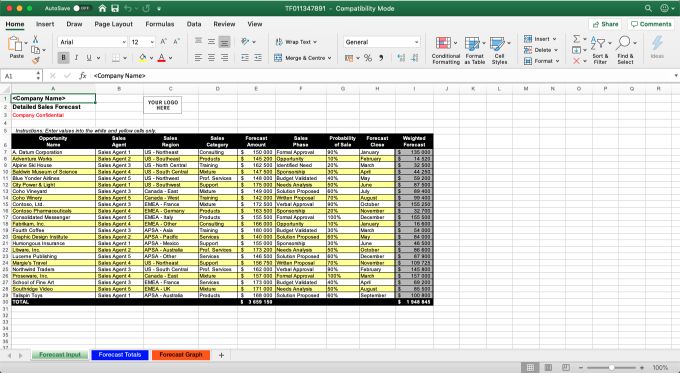

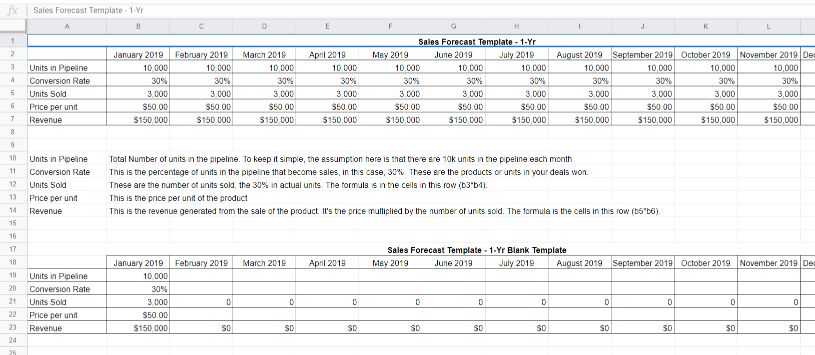

A sales forecast attempts to predict what your monthly sales will be for up to 18 months after launching your business. Creating a sales forecast without any past results is a little difficult. In this case, many entrepreneurs make their predictions using industry trends, market analysis demonstrating the population of potential customers and consumer trends. A sales forecast shows investors and lenders that you have a solid understanding of your target market and a clear vision of who will buy your product or service.

A sales forecast typically breaks down monthly sales by unit and price point. Beyond year two of being in business, the sales forecast can be shown quarterly, instead of monthly. Most financial lenders and investors like to see a three-year sales forecast as part of your startup business plan.

Lower fixed costs mean less risk, which might be theoretical in business schools but are very concrete when you have rent and payroll checks to sign.

Tim Berry, president and founder of Palo Alto Software

Create an expenses budget

An expenses budget forecasts how much you anticipate spending during the first years of operating. This includes both your overhead costs and operating expenses — any financial spending that you anticipate during the course of running your business.

Most experts recommend breaking down your expenses forecast by fixed and variable costs. Fixed costs are things such as rent and payroll, while variable costs change depending on demand and sales — advertising and promotional expenses, for instance. Breaking down costs into these two categories can help you better budget and improve your profitability.

"Lower fixed costs mean less risk, which might be theoretical in business schools but are very concrete when you have rent and payroll checks to sign," Tim Berry, president and founder of Palo Alto Software, told Inc . "Most of your variable costs are in those direct costs that belong in your sales forecast, but there are also some variable expenses, like ads and rebates and such."

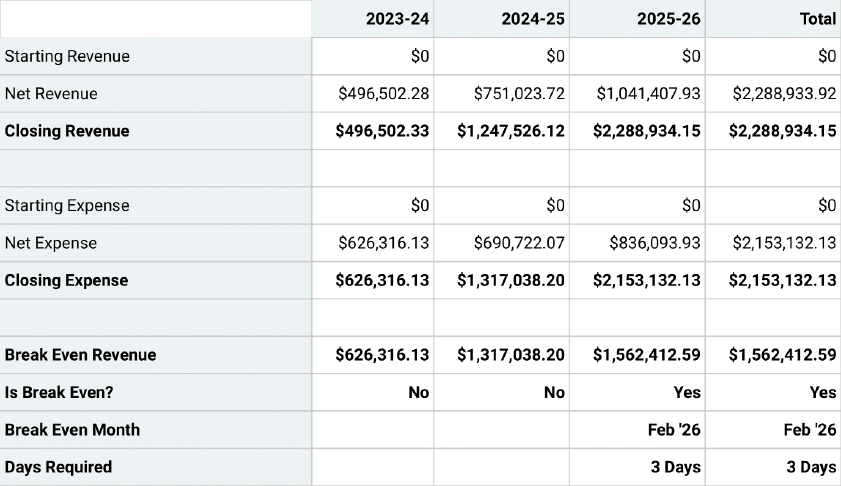

Project your break-even point

Together, your expenses budget and sales forecast paints a picture of your profitability. Your break-even projection is the date at which you believe your business will become profitable — when more money is earned than spent. Very few businesses are profitable overnight or even in their first year. Most businesses take two to three years to be profitable, but others take far longer: Tesla , for instance, took 18 years to see its first full-year profit.

Lenders and investors will be interested in your break-even point as a projection of when they can begin to recoup their investment. Likewise, your CFO or operations manager can make better decisions after measuring the company’s results against its forecasts.

[Read more: Startup 2021: Writing a Business Plan? Here’s How to Do It, Step by Step ]

Develop a cash flow projection

A cash flow statement (or projection, for a new business) shows the flow of dollars moving in and out of the business. This is based on the sales forecast, your balance sheet and other assumptions you’ve used to create your expenses projection.

“If you are starting a new business and do not have these historical financial statements, you start by projecting a cash-flow statement broken down into 12 months,” wrote Inc . The cash flow statement will include projected cash flows from operating, investing and financing your business activities.

Keep in mind that most business plans involve developing specific financial documents: income statements, pro formas and a balance sheet, for instance. These documents may be required by investors or lenders; financial projections can help inform the development of those statements and guide your business as it grows.

CO— aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

Follow us on Instagram for more expert tips & business owners’ stories.

CO—is committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here .

Subscribe to our newsletter, Midnight Oil

Expert business advice, news, and trends, delivered weekly

By signing up you agree to the CO— Privacy Policy. You can opt out anytime.

For more finance tips

Funding options for veteran-owned businesses, 5 inflation-beating deals your small business can offer, mobile credit card readers: choosing the best for your small businesses.

By continuing on our website, you agree to our use of cookies for statistical and personalisation purposes. Know More

Welcome to CO—

Designed for business owners, CO— is a site that connects like minds and delivers actionable insights for next-level growth.

U.S. Chamber of Commerce 1615 H Street, NW Washington, DC 20062

Social links

Looking for local chamber, stay in touch.

- Business Planning

Business Plan Financial Projections

Written by Dave Lavinsky

Financial projections are forecasted analyses of your business’ future that include income statements, balance sheets and cash flow statements. We have found them to be an crucial part of your business plan for the following reasons:

- They can help prove or disprove the viability of your business idea. For example, if your initial projections show your company will never make a sizable profit, your venture might not be feasible. Or, in such a case, you might figure out ways to raise prices, enter new markets, or streamline operations to make it profitable.

- Financial projections give investors and lenders an idea of how well your business is likely to do in the future. They can give lenders the confidence that you’ll be able to comfortably repay their loan with interest. And for equity investors, your projections can give them faith that you’ll earn them a solid return on investment. In both cases, your projections can help you secure the funding you need to launch or grow your business.

- Financial projections help you track your progress over time and ensure your business is on track to meet its goals. For example, if your financial projections show you should generate $500,000 in sales during the year, but you are not on track to accomplish that, you’ll know you need to take corrective action to achieve your goal.

Below you’ll learn more about the key components of financial projections and how to complete and include them in your business plan.

What Are Business Plan Financial Projections?

Financial projections are an estimate of your company’s future financial performance through financial forecasting. They are typically used by businesses to secure funding, but can also be useful for internal decision-making and planning purposes. There are three main financial statements that you will need to include in your business plan financial projections:

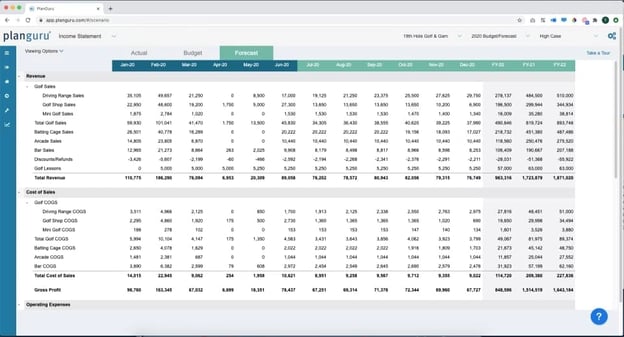

1. Income Statement Projection

The income statement projection is a forecast of your company’s future revenues and expenses. It should include line items for each type of income and expense, as well as a total at the end.

There are a few key items you will need to include in your projection:

- Revenue: Your revenue projection should break down your expected sales by product or service, as well as by month. It is important to be realistic in your projections, so make sure to account for any seasonal variations in your business.

- Expenses: Your expense projection should include a breakdown of your expected costs by category, such as marketing, salaries, and rent. Again, it is important to be realistic in your estimates.

- Net Income: The net income projection is the difference between your revenue and expenses. This number tells you how much profit your company is expected to make.

Sample Income Statement

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| Revenues | ||||||

| Total Revenues | $360,000 | $793,728 | $875,006 | $964,606 | $1,063,382 | |

| Expenses & Costs | ||||||

| Cost of goods sold | $64,800 | $142,871 | $157,501 | $173,629 | $191,409 | |

| Lease | $50,000 | $51,250 | $52,531 | $53,845 | $55,191 | |

| Marketing | $10,000 | $8,000 | $8,000 | $8,000 | $8,000 | |

| Salaries | $157,015 | $214,030 | $235,968 | $247,766 | $260,155 | |

| Initial expenditure | $10,000 | $0 | $0 | $0 | $0 | |

| Total Expenses & Costs | $291,815 | $416,151 | $454,000 | $483,240 | $514,754 | |

| EBITDA | $68,185 | $377,577 | $421,005 | $481,366 | $548,628 | |

| Depreciation | $27,160 | $27,160 | $27,160 | $27,160 | $27,160 | |

| EBIT | $41,025 | $350,417 | $393,845 | $454,206 | $521,468 | |

| Interest | $23,462 | $20,529 | $17,596 | $14,664 | $11,731 | |

| PRETAX INCOME | $17,563 | $329,888 | $376,249 | $439,543 | $509,737 | |

| Net Operating Loss | $0 | $0 | $0 | $0 | $0 | |

| Use of Net Operating Loss | $0 | $0 | $0 | $0 | $0 | |

| Taxable Income | $17,563 | $329,888 | $376,249 | $439,543 | $509,737 | |

| Income Tax Expense | $6,147 | $115,461 | $131,687 | $153,840 | $178,408 | |

| NET INCOME | $11,416 | $214,427 | $244,562 | $285,703 | $331,329 |

2. Cash Flow Statement & Projection

The cash flow statement and projection are a forecast of your company’s future cash inflows and outflows. It is important to include a cash flow projection in your business plan, as it will give investors and lenders an idea of your company’s ability to generate cash.

There are a few key items you will need to include in your cash flow projection:

- The cash flow statement shows a breakdown of your expected cash inflows and outflows by month. It is important to be realistic in your projections, so make sure to account for any seasonal variations in your business.

- Cash inflows should include items such as sales revenue, interest income, and capital gains. Cash outflows should include items such as salaries, rent, and marketing expenses.

- It is important to track your company’s cash flow over time to ensure that it is healthy. A healthy cash flow is necessary for a successful business.

Sample Cash Flow Statements

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| CASH FLOW FROM OPERATIONS | ||||||

| Net Income (Loss) | $11,416 | $214,427 | $244,562 | $285,703 | $331,329 | |

| Change in working capital | ($19,200) | ($1,966) | ($2,167) | ($2,389) | ($2,634) | |

| Depreciation | $27,160 | $27,160 | $27,160 | $27,160 | $27,160 | |

| Net Cash Flow from Operations | $19,376 | $239,621 | $269,554 | $310,473 | $355,855 | |

| CASH FLOW FROM INVESTMENTS | ||||||

| Investment | ($180,950) | $0 | $0 | $0 | $0 | |

| Net Cash Flow from Investments | ($180,950) | $0 | $0 | $0 | $0 | |

| CASH FLOW FROM FINANCING | ||||||

| Cash from equity | $0 | $0 | $0 | $0 | $0 | |

| Cash from debt | $315,831 | ($45,119) | ($45,119) | ($45,119) | ($45,119) | |

| Net Cash Flow from Financing | $315,831 | ($45,119) | ($45,119) | ($45,119) | ($45,119) | |

| Net Cash Flow | $154,257 | $194,502 | $224,436 | $265,355 | $310,736 | |

| Cash at Beginning of Period | $0 | $154,257 | $348,760 | $573,195 | $838,550 | |

| Cash at End of Period | $154,257 | $348,760 | $573,195 | $838,550 | $1,149,286 |

3. Balance Sheet Projection

The balance sheet projection is a forecast of your company’s future financial position. It should include line items for each type of asset and liability, as well as a total at the end.

A projection should include a breakdown of your company’s assets and liabilities by category. It is important to be realistic in your projections, so make sure to account for any seasonal variations in your business.

It is important to track your company’s financial position over time to ensure that it is healthy. A healthy balance is necessary for a successful business.

Sample Balance Sheet

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| ASSETS | ||||||

| Cash | $154,257 | $348,760 | $573,195 | $838,550 | $1,149,286 | |

| Accounts receivable | $0 | $0 | $0 | $0 | $0 | |

| Inventory | $30,000 | $33,072 | $36,459 | $40,192 | $44,308 | |

| Total Current Assets | $184,257 | $381,832 | $609,654 | $878,742 | $1,193,594 | |

| Fixed assets | $180,950 | $180,950 | $180,950 | $180,950 | $180,950 | |

| Depreciation | $27,160 | $54,320 | $81,480 | $108,640 | $135,800 | |

| Net fixed assets | $153,790 | $126,630 | $99,470 | $72,310 | $45,150 | |

| TOTAL ASSETS | $338,047 | $508,462 | $709,124 | $951,052 | $1,238,744 | |

| LIABILITIES & EQUITY | ||||||

| Debt | $315,831 | $270,713 | $225,594 | $180,475 | $135,356 | |

| Accounts payable | $10,800 | $11,906 | $13,125 | $14,469 | $15,951 | |

| Total Liability | $326,631 | $282,618 | $238,719 | $194,944 | $151,307 | |

| Share Capital | $0 | $0 | $0 | $0 | $0 | |

| Retained earnings | $11,416 | $225,843 | $470,405 | $756,108 | $1,087,437 | |

| Total Equity | $11,416 | $225,843 | $470,405 | $756,108 | $1,087,437 | |

| TOTAL LIABILITIES & EQUITY | $338,047 | $508,462 | $709,124 | $951,052 | $1,238,744 |

How to Create Financial Projections

Creating financial projections for your business plan can be a daunting task, but it’s important to put together accurate and realistic financial projections in order to give your business the best chance for success.

Cost Assumptions

When you create financial projections, it is important to be realistic about the costs your business will incur, using historical financial data can help with this. You will need to make assumptions about the cost of goods sold, operational costs, and capital expenditures.

It is important to track your company’s expenses over time to ensure that it is staying within its budget. A healthy bottom line is necessary for a successful business.

Capital Expenditures, Funding, Tax, and Balance Sheet Items

You will also need to make assumptions about capital expenditures, funding, tax, and balance sheet items. These assumptions will help you to create a realistic financial picture of your business.

Capital Expenditures

When projecting your company’s capital expenditures, you will need to make a number of assumptions about the type of equipment or property your business will purchase. You will also need to estimate the cost of the purchase.

When projecting your company’s funding needs, you will need to make a number of assumptions about where the money will come from. This might include assumptions about bank loans, venture capital, or angel investors.

When projecting your company’s tax liability, you will need to make a number of assumptions about the tax rates that will apply to your business. You will also need to estimate the amount of taxes your company will owe.

Balance Sheet Items

When projecting your company’s balance, you will need to make a number of assumptions about the type and amount of debt your business will have. You will also need to estimate the value of your company’s assets and liabilities.

Financial Projection Scenarios

Write two financial scenarios when creating your financial projections, a best-case scenario, and a worst-case scenario. Use your list of assumptions to come up with realistic numbers for each scenario.

Presuming that you have already generated a list of assumptions, the creation of best and worst-case scenarios should be relatively simple. For each assumption, generate a high and low estimate. For example, if you are assuming that your company will have $100,000 in revenue, your high estimate might be $120,000 and your low estimate might be $80,000.

Once you have generated high and low estimates for all of your assumptions, you can create two scenarios: a best case scenario and a worst-case scenario. Simply plug the high estimates into your financial projections for the best-case scenario and the low estimates into your financial projections for the worst-case scenario.

Conduct a Ratio Analysis

A ratio analysis is a useful tool that can be used to evaluate a company’s financial health. Ratios can be used to compare a company’s performance to its industry average or to its own historical performance.

There are a number of different ratios that can be used in ratio analysis. Some of the more popular ones include the following:

- Gross margin ratio

- Operating margin ratio

- Return on assets (ROA)

- Return on equity (ROE)

To conduct a ratio analysis, you will need financial statements for your company and for its competitors. You will also need industry average ratios. These can be found in industry reports or on financial websites.

Once you have the necessary information, you can calculate the ratios for your company and compare them to the industry averages or to your own historical performance. If your company’s ratios are significantly different from the industry averages, it might be indicative of a problem.

Be Realistic

When creating your financial projections, it is important to be realistic. Your projections should be based on your list of assumptions and should reflect your best estimate of what your company’s future financial performance will be. This includes projected operating income, a projected income statement, and a profit and loss statement.

Your goal should be to create a realistic set of financial projections that can be used to guide your company’s future decision-making.

Sales Forecast

One of the most important aspects of your financial projections is your sales forecast. Your sales forecast should be based on your list of assumptions and should reflect your best estimate of what your company’s future sales will be.

Your sales forecast should be realistic and achievable. Do not try to “game” the system by creating an overly optimistic or pessimistic forecast. Your goal should be to create a realistic sales forecast that can be used to guide your company’s future decision-making.

Creating a sales forecast is not an exact science, but there are a number of methods that can be used to generate realistic estimates. Some common methods include market analysis, competitor analysis, and customer surveys.

Create Multi-Year Financial Projections

When creating financial projections, it is important to generate projections for multiple years. This will give you a better sense of how your company’s financial performance is likely to change over time.

It is also important to remember that your financial projections are just that: projections. They are based on a number of assumptions and are not guaranteed to be accurate. As such, you should review and update your projections on a regular basis to ensure that they remain relevant.

Creating financial projections is an important part of any business plan. However, it’s important to remember that these projections are just estimates. They are not guarantees of future success.

Business Plan Financial Projections FAQs

What is a business plan financial projection.

A business plan financial projection is a forecast of your company's future financial performance. It should include line items for each type of asset and liability, as well as a total at the end.

What are annual income statements?

The Annual income statement is a financial document and a financial model that summarize a company's revenues and expenses over the course of a fiscal year. They provide a snapshot of a company's financial health and performance and can be used to track trends and make comparisons with other businesses.

What are the necessary financial statements?

The necessary financial statements for a business plan are an income statement, cash flow statement, and balance sheet.

How do I create financial projections?

You can create financial projections by making a list of assumptions, creating two scenarios (best case and worst case), conducting a ratio analysis, and being realistic.

Free Financial Projection and Forecasting Templates

By Andy Marker | January 3, 2024

- Share on Facebook

- Share on LinkedIn

Link copied

We’ve collected the top free financial projection and forecasting templates. These templates enable business owners, CFOs, accountants, and financial analysts to plan future growth, manage cash flow, attract investors, and make informed decisions. On this page, you'll find many helpful, free, customizable financial projection and forecasting templates, including a 1 2-month financial projection template , a startup financial projection template , a 3-year financial projection template , and a small business financial forecast template , among others. You’ll also find details on the elements in a financial projection template , types of financial projection and forecasting templates , and related financial templates .

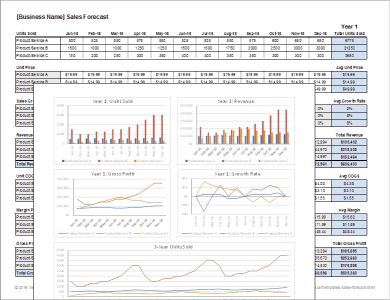

Simple Financial Projection Template

Download a Sample Simple Financial Projection Template for

Excel | Google Sheets

Download a Blank Simple Financial Projection Template for

Excel | Google Sheets

Small business owners and new entrepreneurs are the ideal users for this simple financial projection template. Just input your expected revenues and expenses. This template stands out due to its ease of use and focus on basic, straightforward financial planning, making it perfect for small-scale or early-stage businesses. Available with or without sample text, this tool offers clear financial oversight, better budget management, and informed decision-making regarding future business growth.

Looking for help with your business plan? Check out these free financial templates for a business plan to streamline the process of organizing your business's financial information and presenting it effectively to stakeholders.

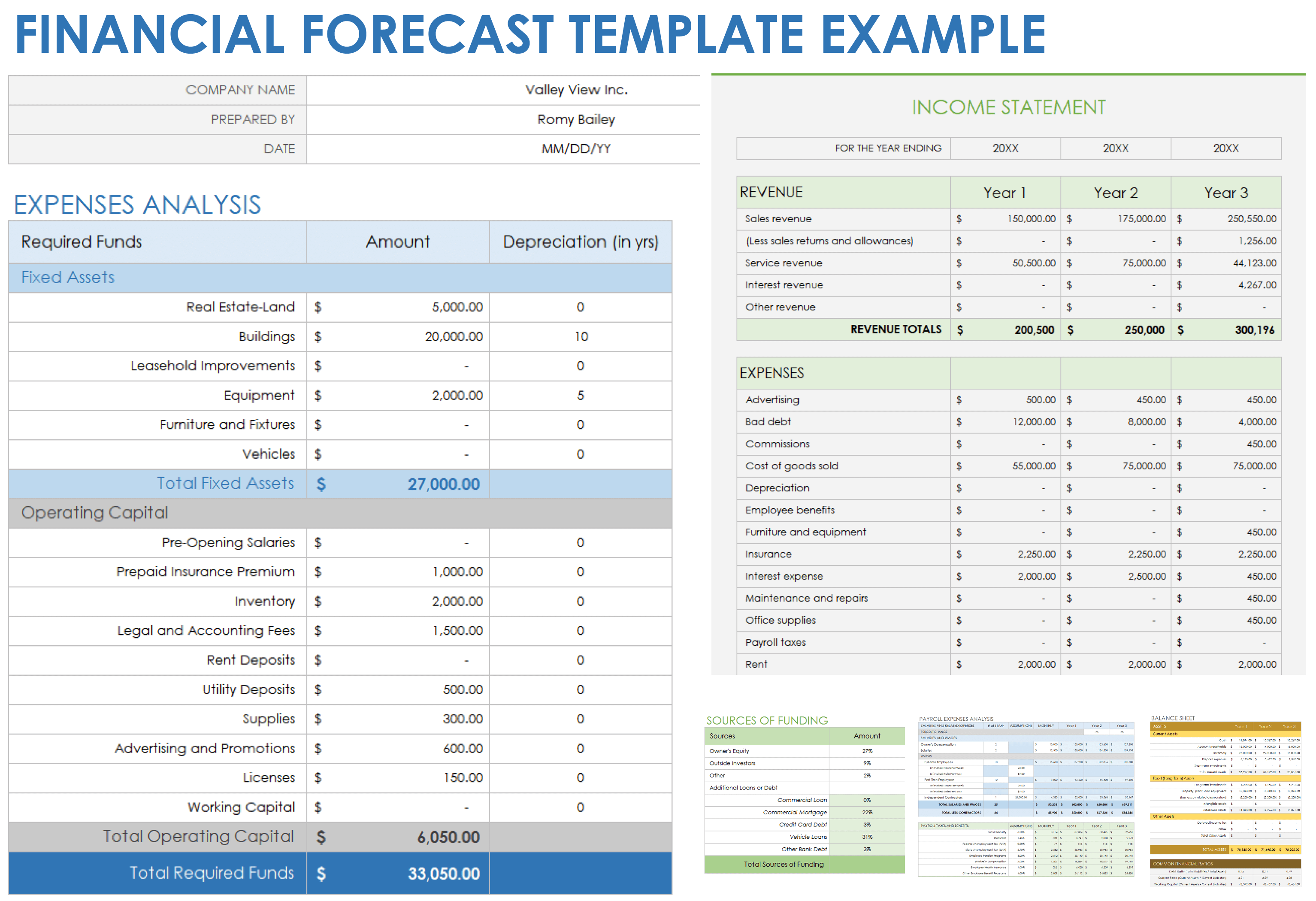

Financial Forecast Template

Download a Sample Financial Forecast Template for

Download a Blank Financial Forecast Template for

This template is perfect for businesses that require a detailed and all-encompassing forecast. Users can input various financial data, such as projected revenues, costs, and market trends, to generate a complete financial outlook. Available with or without example text, this template gives you a deeper understanding of your business's financial trajectory, aiding in strategic decision-making and long-term financial stability.

These free cash-flow forecast templates help you predict your business’s future cash inflows and outflows, allowing you to manage liquidity and optimize financial planning.

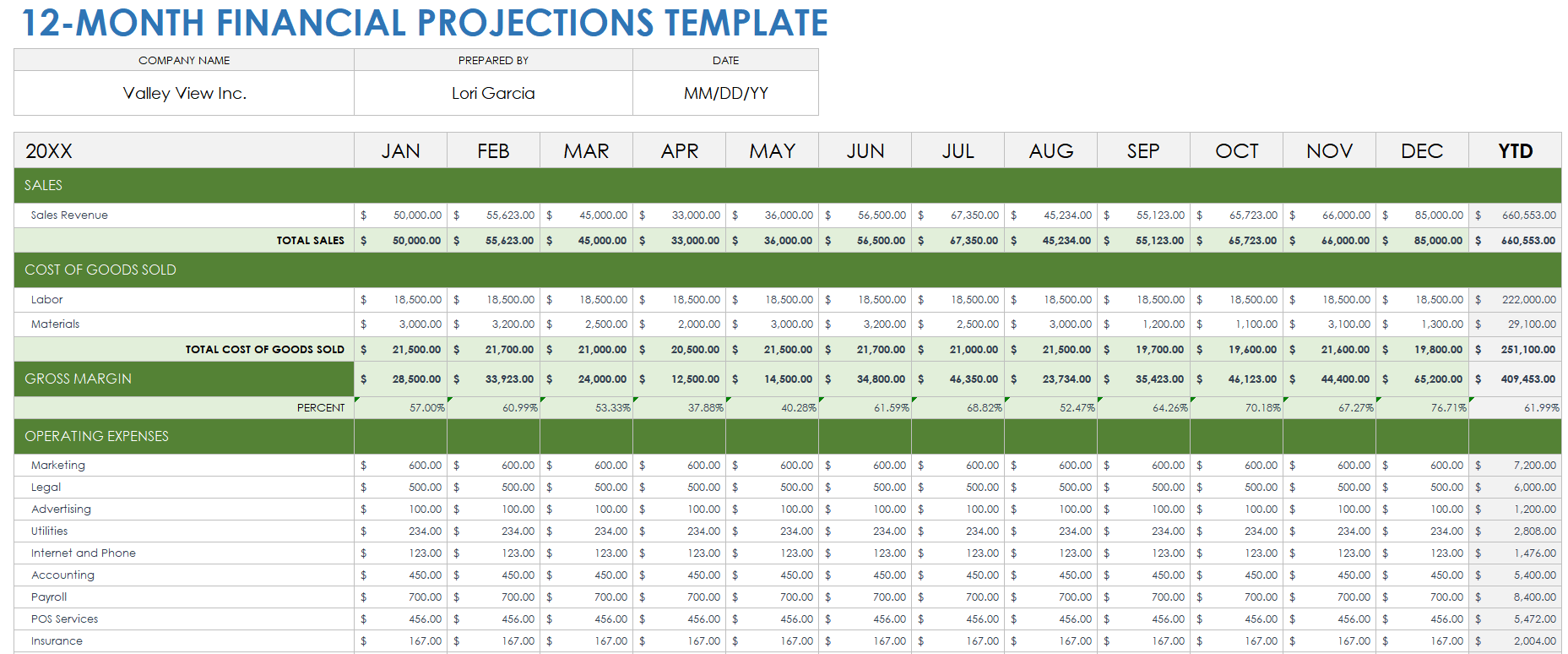

12-Month Financial Projection Template

Download a Sample 12-Month Financial Projection Template for

Download a Blank 12-Month Financial Projection Template for

Use this 12-month financial projection template for better cash-flow management, more accurate budgeting, and enhanced readiness for short-term financial challenges and opportunities. Input estimated monthly revenues and expenses, tracking financial performance over the course of a year. Available with or without sample text, this template is ideal for business owners who need to focus on short-term financial planning. This tool allows you to respond quickly to market shifts and plan effectively for the business's crucial first year.

Download free sales forecasting templates to help your business predict future sales, enabling better inventory management, resource planning, and decision-making.

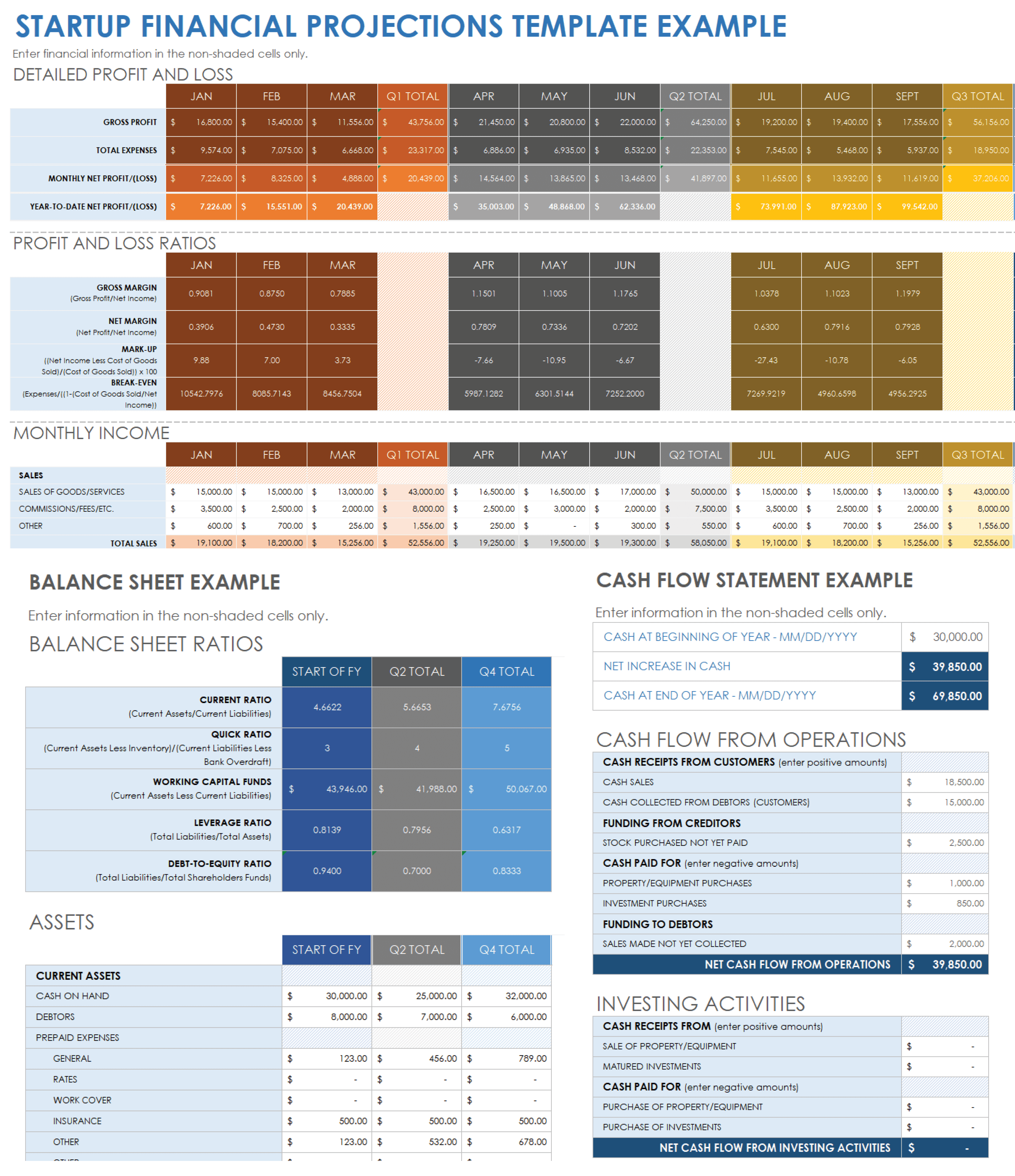

Startup Financial Projection Template

Download a Sample Startup Financial Projection Template for

Download a Blank Startup Financial Projection Template for

This dynamic startup financial projection template is ideal for startup founders and entrepreneurs, as it's designed specifically for the unique needs of startups. Available with or without example text, this template focuses on clearly outlining a startup's initial financial trajectory, an essential component for attracting investors. Users can input projected revenues, startup costs, and funding sources to create a comprehensive financial forecast.

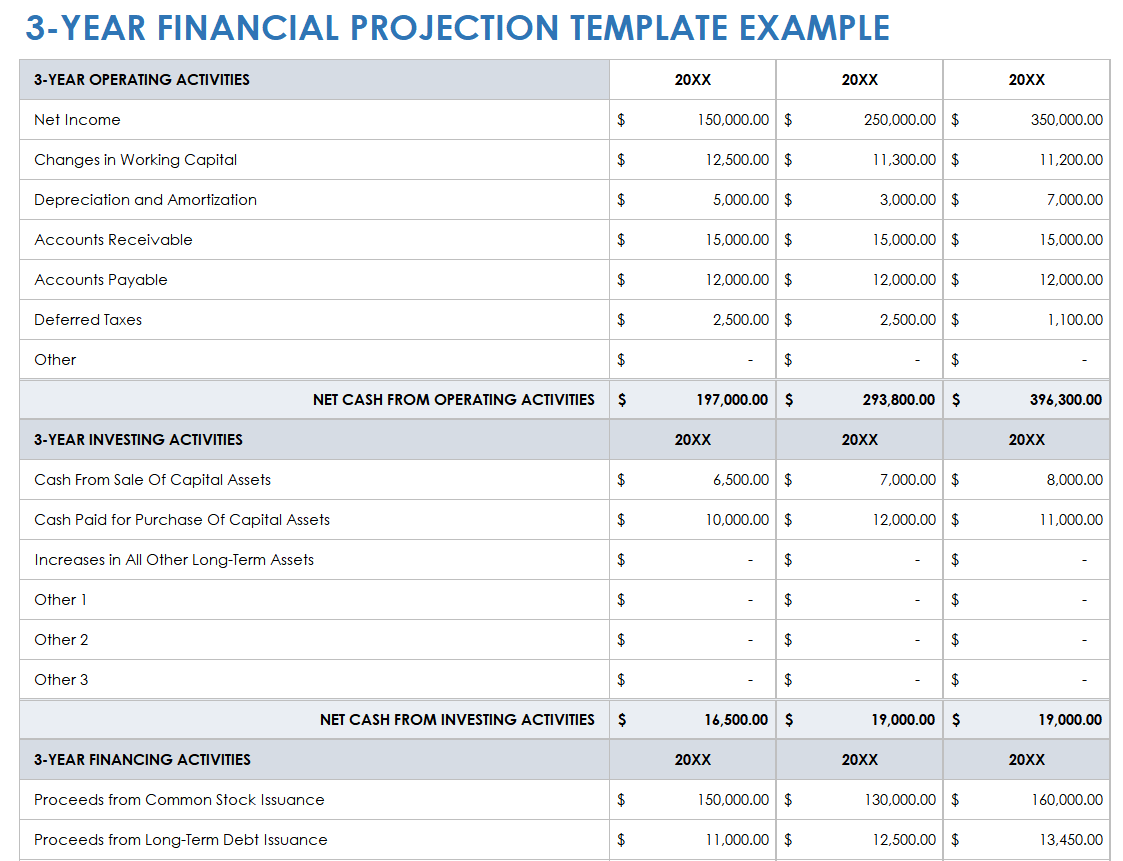

3-Year Financial Projection Template

Download a Sample 3-Year Financial Projection Template for

Download a Blank 3-Year Financial Projection Template for

This three-year financial projection template is particularly useful for business strategists and financial planners who are looking for a medium-term financial planning tool. Input data such as projected revenues, expenses, and growth rates for the next three years. Available with or without sample text, this template lets you anticipate financial challenges and opportunities in the medium term, aiding in strategic decision-making and ensuring sustained business growth.

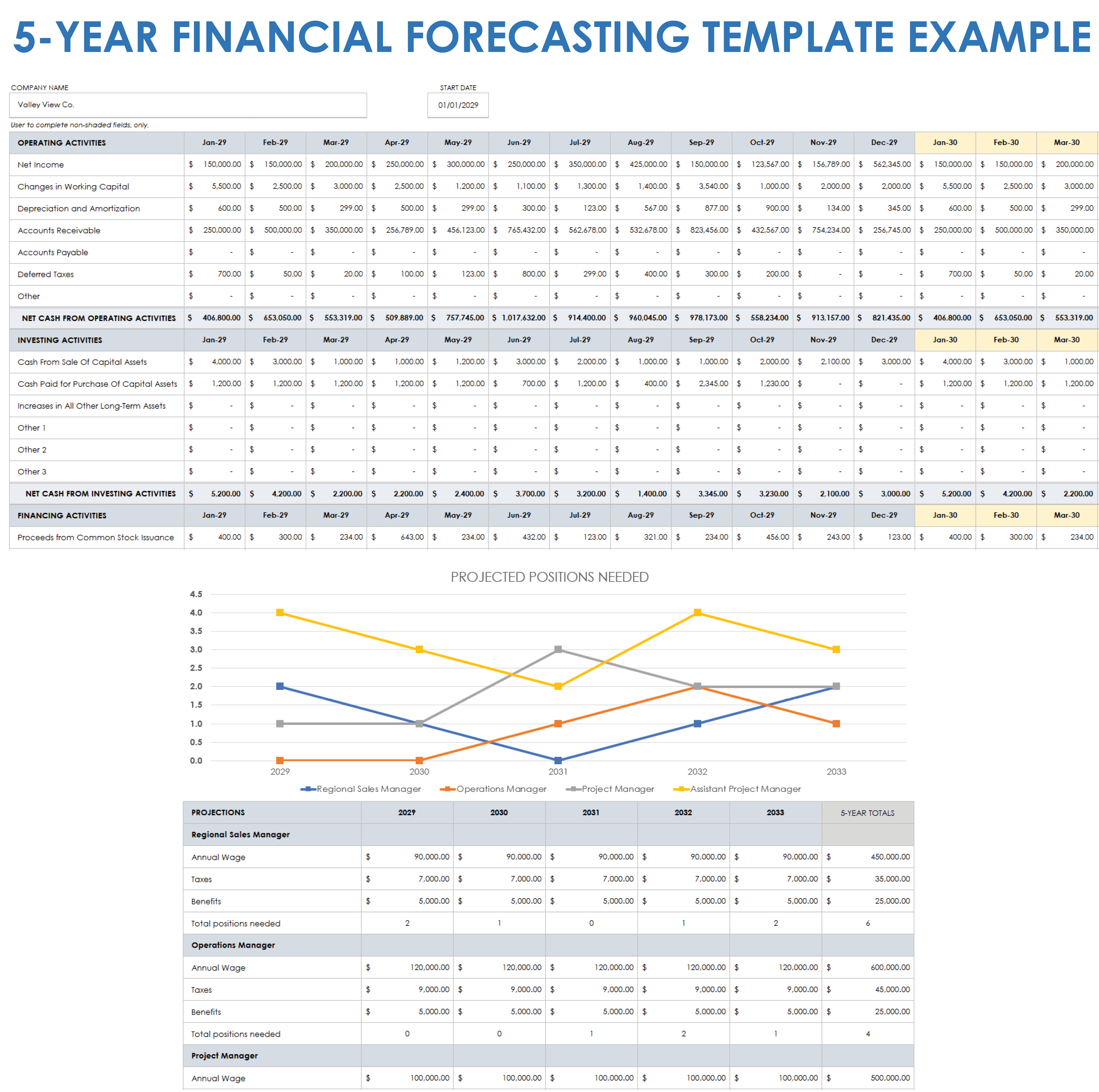

5-Year Financial Forecasting Template

Download a Sample 5-Year Financial Forecasting Template for

Download a Blank 5-Year Financial Forecasting Template for

CFOs and long-term business planners can use this five-year financial forecasting template to get a clear, long-range financial vision. Available with or without example text, this template allows you to plan strategically and invest wisely, preparing your business for future market developments and opportunities. This unique tool offers an extensive outlook for your business’s financial strategy. Simply input detailed financial data spanning five years, including revenue projections, investment plans, and expected market growth. Visually engaging bar charts of key metrics help turn data into engaging narratives.

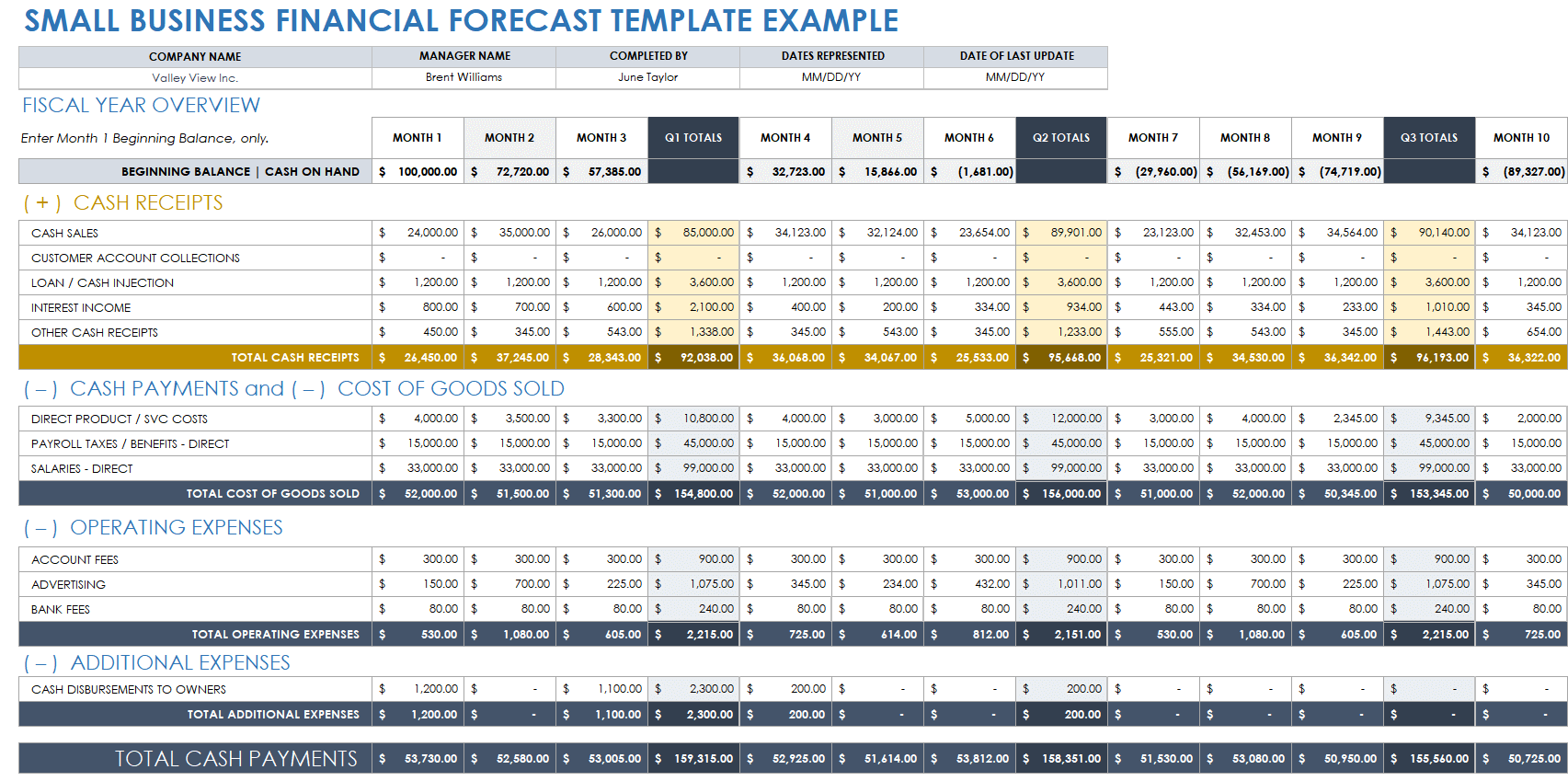

Small Business Financial Forecast Template

Download a Sample Small Business Financial Forecast Template for

Download a Blank Small Business Financial Forecast Template for

Excel | Google Sheets

The small business financial forecast template is tailored specifically for the scale and specific requirements of small enterprises. Business owners and financial managers can simply input data such as projected sales or expenses. Available with or without sample text, this tool offers the ability to do the following: envision straightforward financial planning; anticipate future financial needs and challenges; make informed decisions; and steer the business toward steady growth.

Elements in a Financial Projection Template

The elements in a financial projection template include future sales, costs, profits, and cash flow. This template illustrates expected receivables, payables, and break-even dates. This tool helps you plan for your business's financial future and growth.

Here are the standard elements in a financial projection template:

- Revenue Projection: This estimates future income from various sources over a specific period.

- Expense Forecast: This predicts future costs, including both fixed and variable expenses.

- Profit and Loss Forecast: This projects the profit or loss by subtracting projected expenses from projected revenues.

- Cash-Flow Projection: This assesses the inflows and outflows of cash, indicating liquidity over time.

- Balance Sheet Projection: This predicts the future financial position, showing assets, liabilities, and equity.

- Break-Even Analysis: This calculates the point at which total revenues equal total costs.

- Capital Expenditure Forecast: This estimates future spending on fixed assets such as equipment or property.

- Debt Repayment Plan: This outlines the schedule for paying back any borrowed funds.

- Sales Forecast: This predicts future sales volume, often broken down by product or service.

- Gross Margin Analysis: This looks at the difference between revenue and cost of goods sold.

Types of Financial Projection and Forecasting Templates

There are many types of financial projection and forecasting templates: basic templates for small businesses; detailed ones for big companies; special ones for startup businesses; and others. There are also sales forecasts, cash-flow estimates, and profit and loss projections.

In addition, financial projection and forecasting templates include long-term planning templates, break-even analyses, budget forecasts, and templates made for specific industries such as retail or manufacturing.

Each template serves different financial planning needs. Determine which one best suits your requirements based on the scale of your business, the complexity of its financial structure, and the specific department that you want to analyze.

Here's a list of the top types of financial projection and forecasting templates:

- Basic Financial Projection Template: Ideal for small businesses or startups, this template provides a straightforward approach to forecasting revenue, expenses, and cash flow.

- Detailed Financial Projection Template: Best for larger businesses or those with complex financial structures, this template offers in-depth projections, including balance sheets, income statements, and cash-flow statements.

- Startup Financial Projection Template: Tailored for startups, this template focuses on funding requirements and early-stage revenue forecasts, both crucial for attracting investors and planning initial operations.

- Sales Forecasting Template: Used by sales and marketing teams to predict future sales, this template helps you set targets and plan marketing strategies.

- Cash-Flow Forecast Template: Essential for financial managers who need to monitor the liquidity of the business, this template projects cash inflows and outflows over a period.

- Profit and Loss Forecast Template (P&L): Useful for business owners and financial officers who need to anticipate profit margins, this template enables you to forecast revenues and expenses.

- Three-Year / Five-Year Financial Projection Template: Suitable for long-term business planning, these templates provide a broader view of your company’s financial future, improving your development strategy and investor presentations.

- Break-Even Analysis Template: Used by business strategists and financial analysts, this template helps you determine when your business will become profitable.

- Budget Forecasting Template: Designed for budget managers, this template uses historical financial data to help you plan your future spending.

- Sector-Specific Financial Projection Template: Designed for specific industries (such as retail or manufacturing), these templates take into account industry-specific factors and benchmarks.

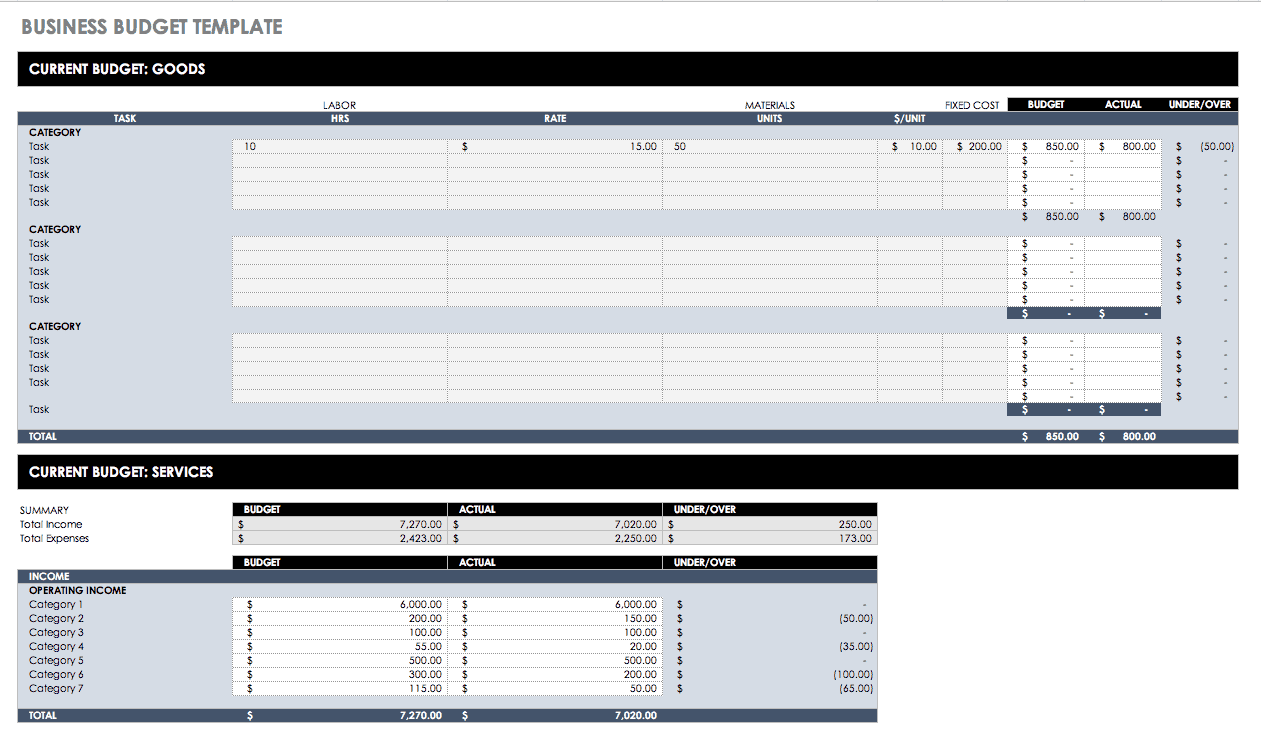

Related Financial Templates

Check out this list of free financial templates related to financial projections and forecasting. You'll find templates for budgeting, tracking profits and losses, planning your finances, and more. These tools help keep your company’s money matters organized and clear.

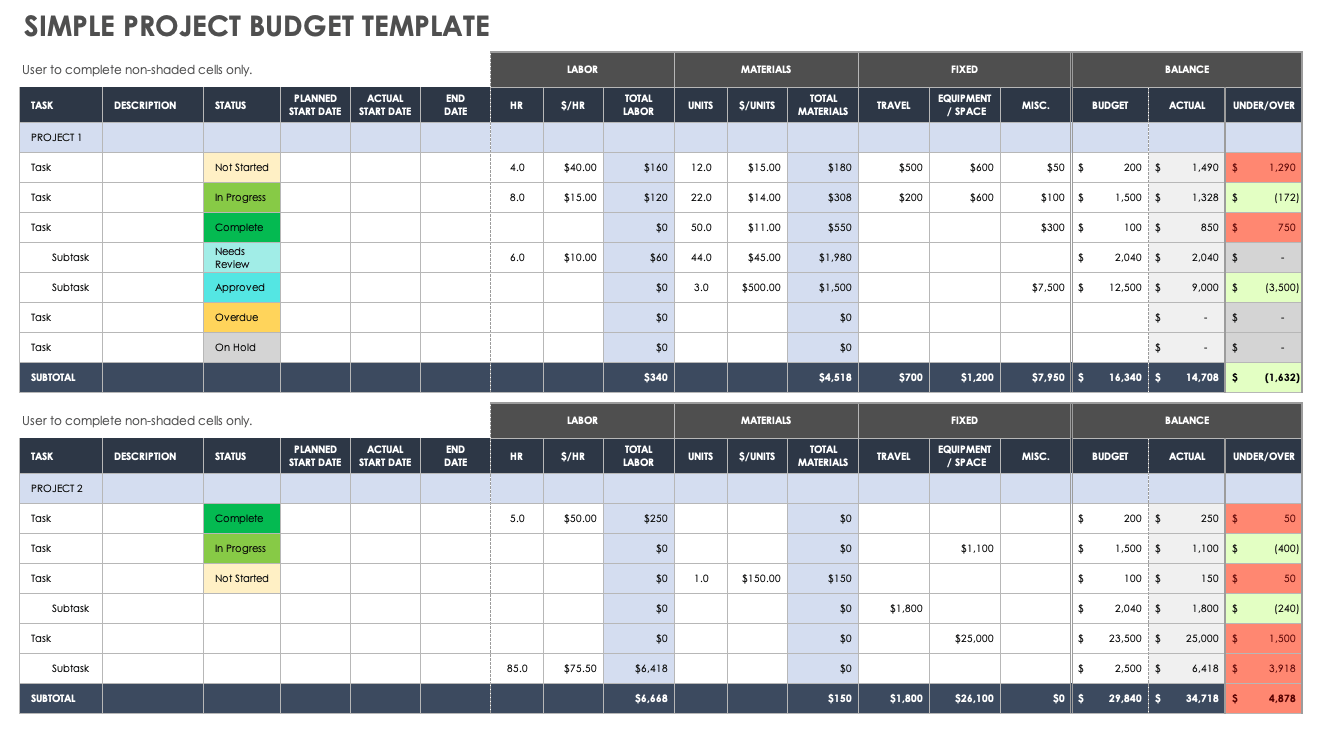

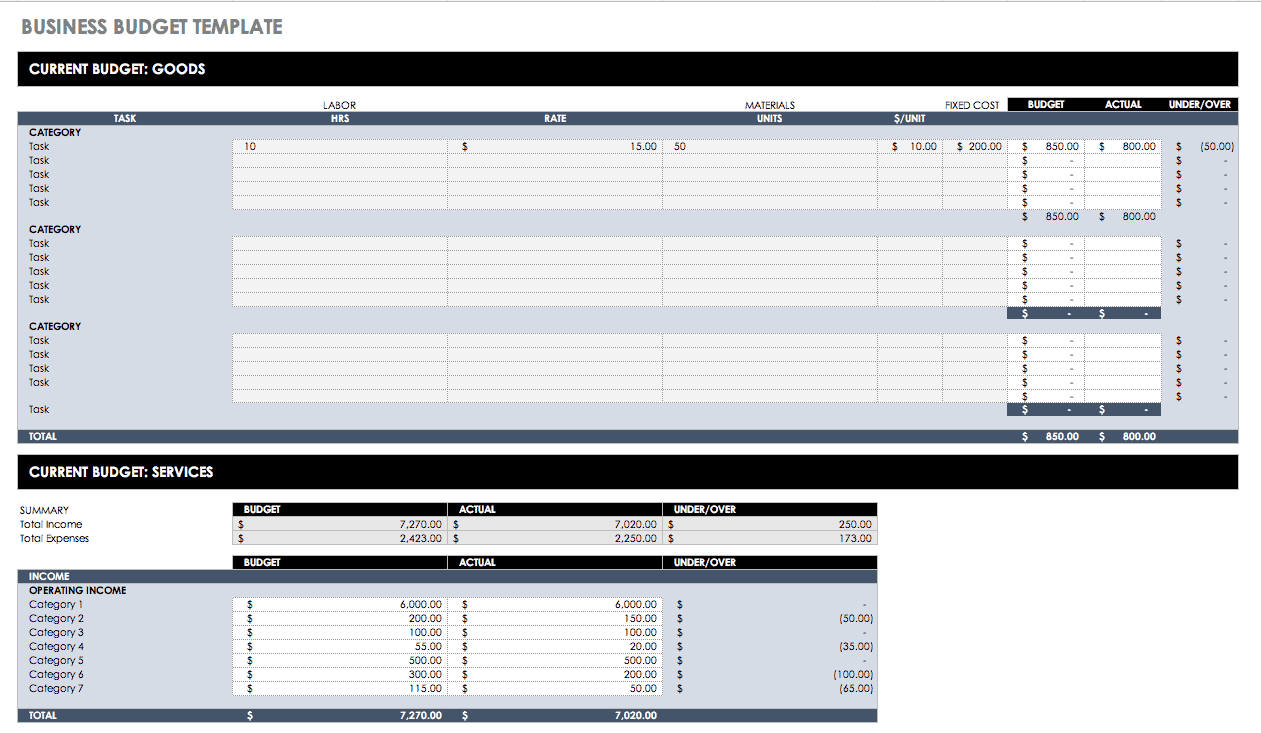

Free Project Budget Templates

Use one of these project budget templates to maintain control over project finances, ensuring costs stay aligned with the allocated budget and improving overall financial management.

Free Monthly Budget Templates

Use one of these monthly budget templates to effectively track and manage your business’s income and expenses, helping you plan financially and save money.

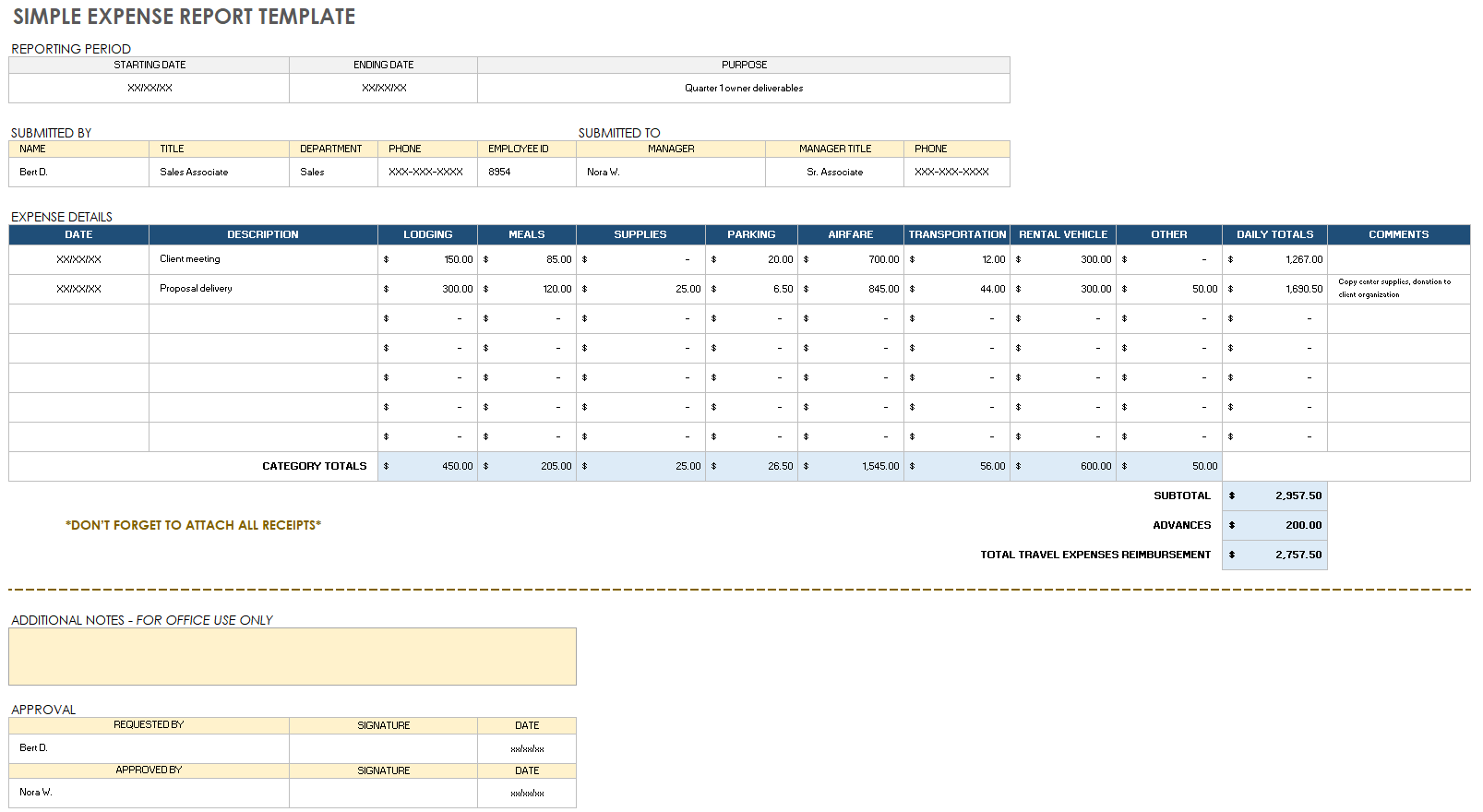

Free Expense Report Templates

Use one of these expense report templates to systematically track and document all business-related expenditures, ensuring accurate reimbursement and efficient financial record-keeping.

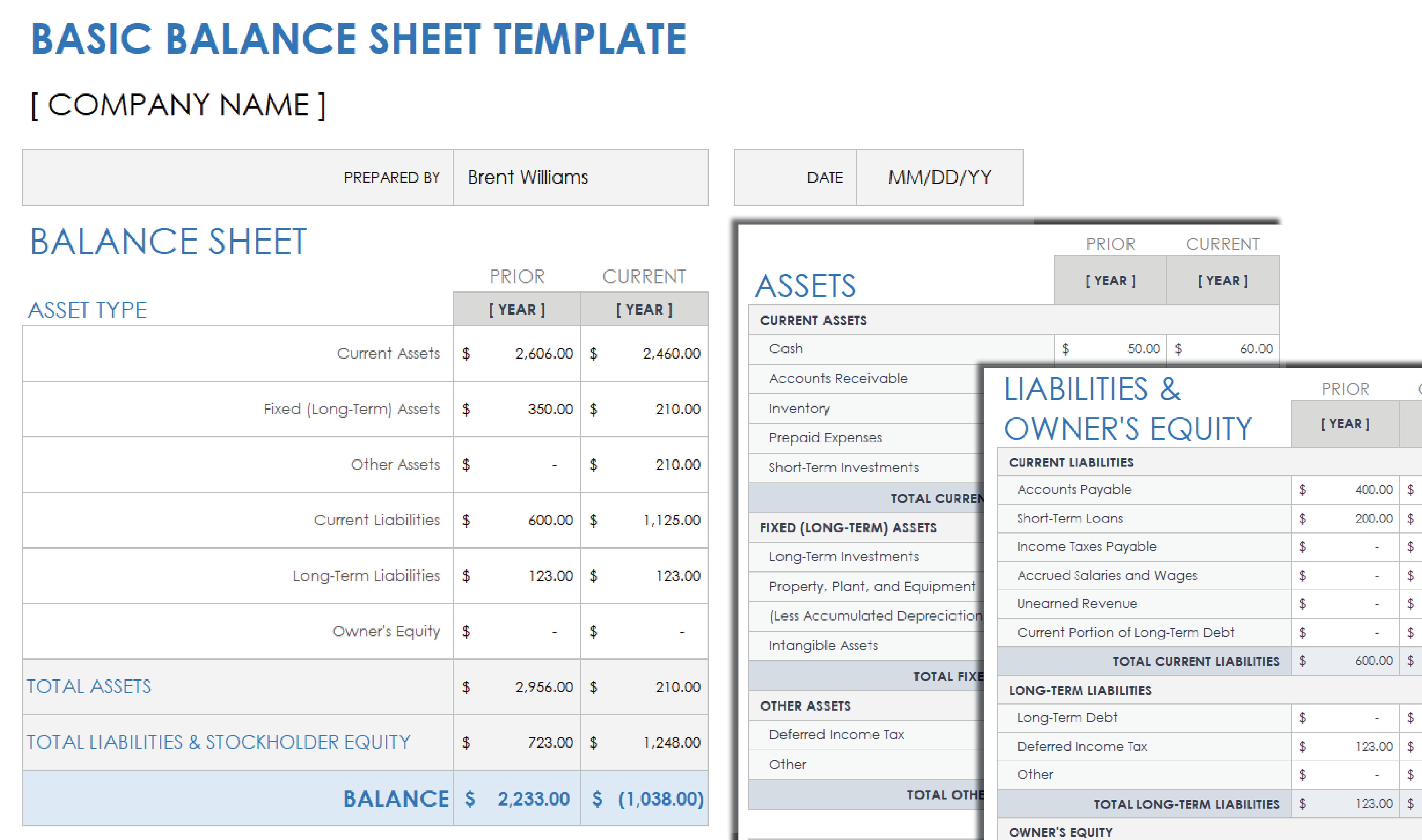

Free Balance Sheet Templates

Use one of these balance sheet templates to summarize your company's financial position at a given time.

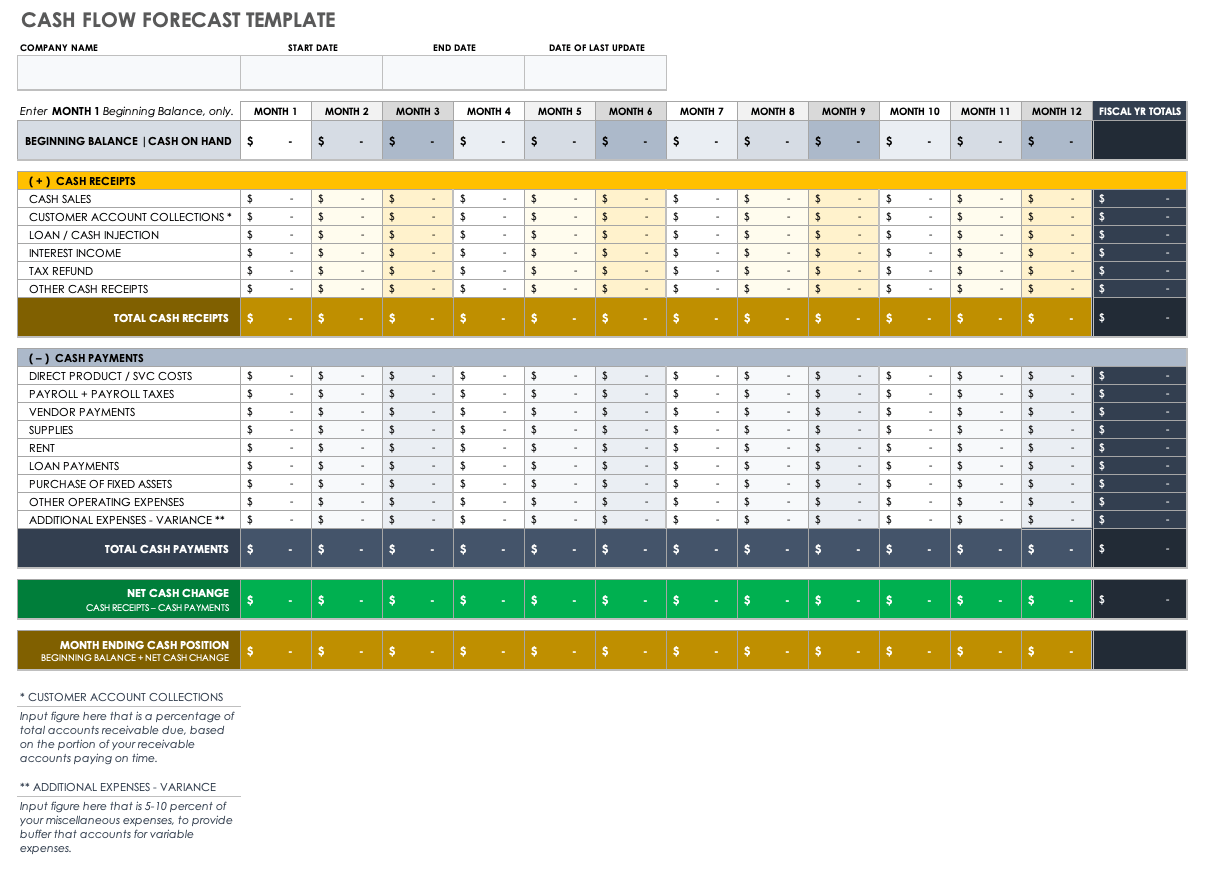

Free Cash-Flow Forecast Templates

Use one of these cash-flow forecast templates to predict future cash inflows and outflows, helping you manage liquidity and make informed financial decisions.

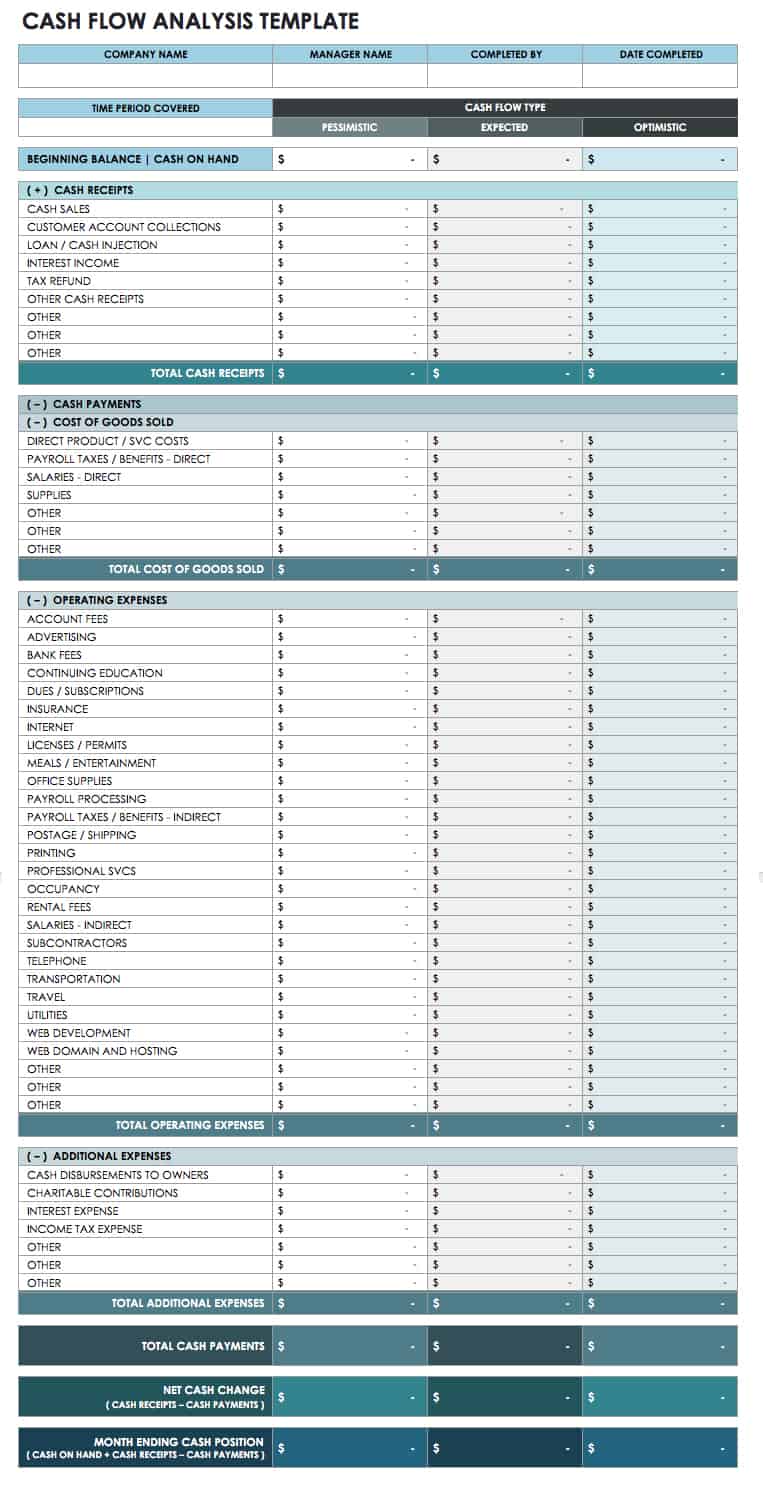

Free Cash-Flow Statement Templates

Use one of these cash-flow statement templates to track the movement of cash in and out of your business, so you can assess your company’s level of liquidity and financial stability.

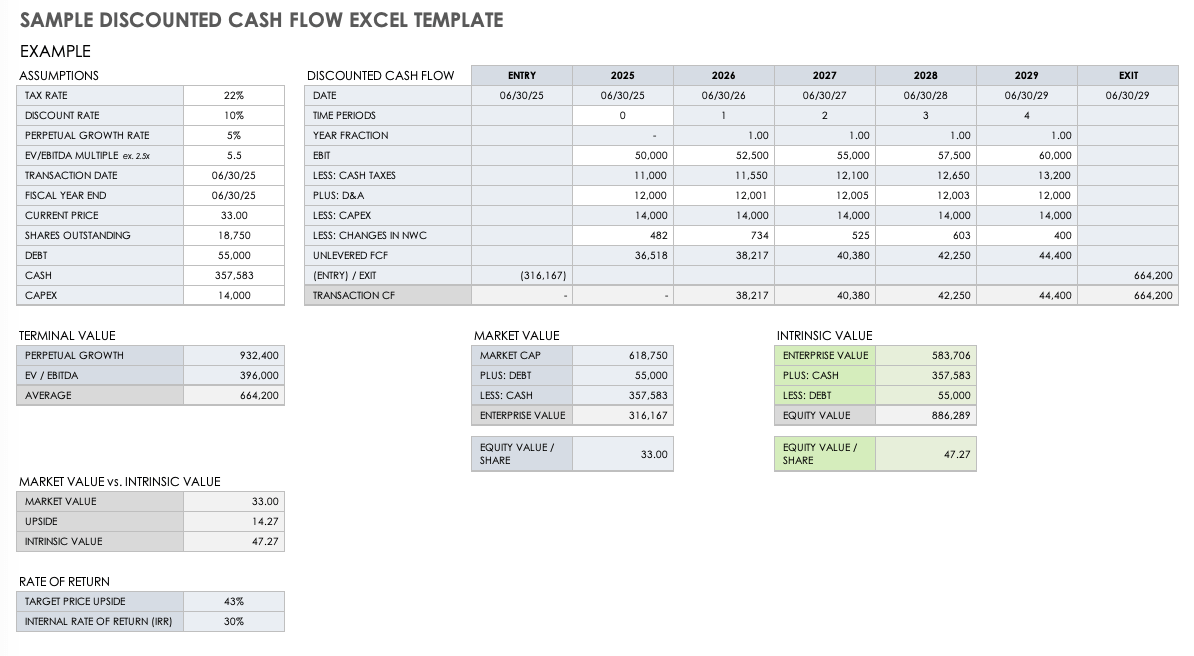

Free Discounted Cash-Flow (DCF) Templates

Use one of these discounted cash-flow (DCF) templates to evaluate the profitability of investments or projects by calculating their present value based on future cash flows.

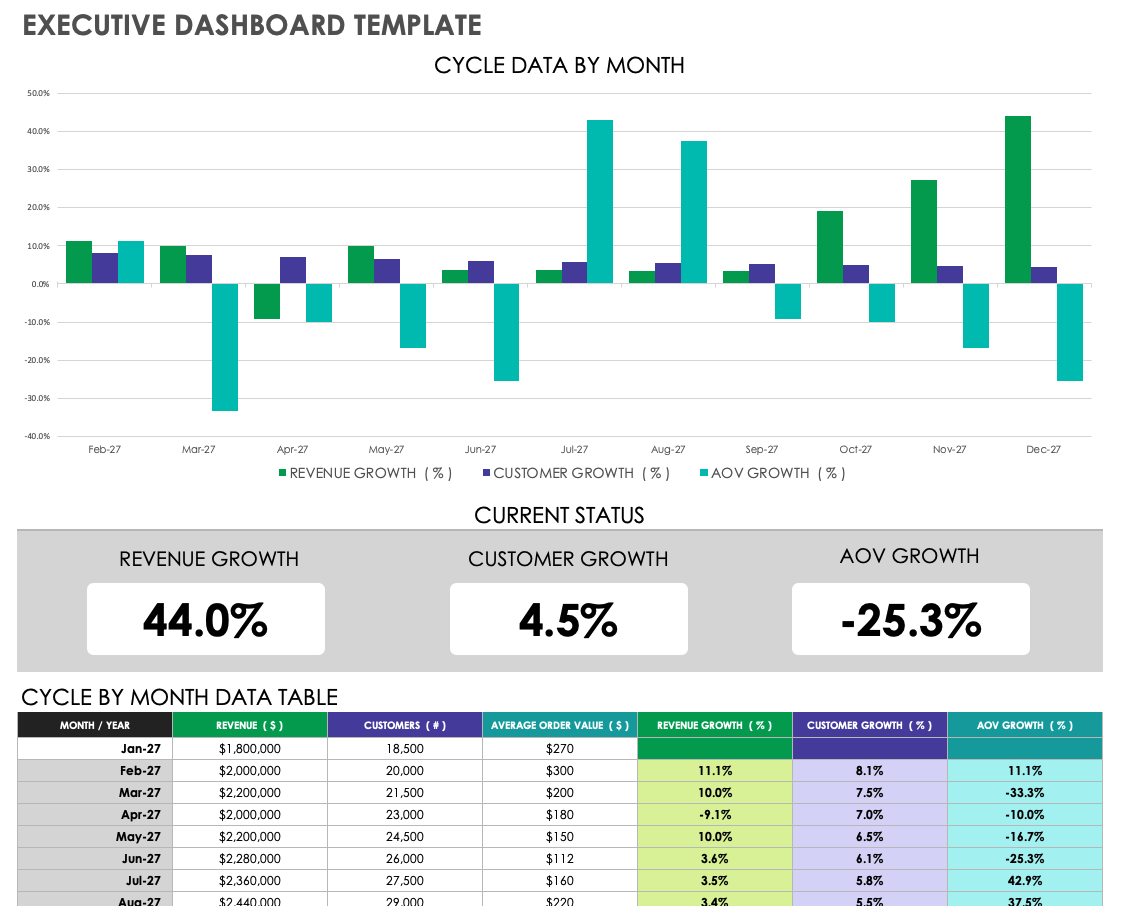

Free Financial Dashboard Templates

Use one of these financial dashboard templates to get an at-a-glance view of key financial metrics, so you can make decisions quickly and manage finances effectively.

Related Customer Stories

Free financial planning templates.

Use one of these financial planning templates to strategically organize and forecast future finances, helping you set realistic financial goals and ensure long-term business growth.

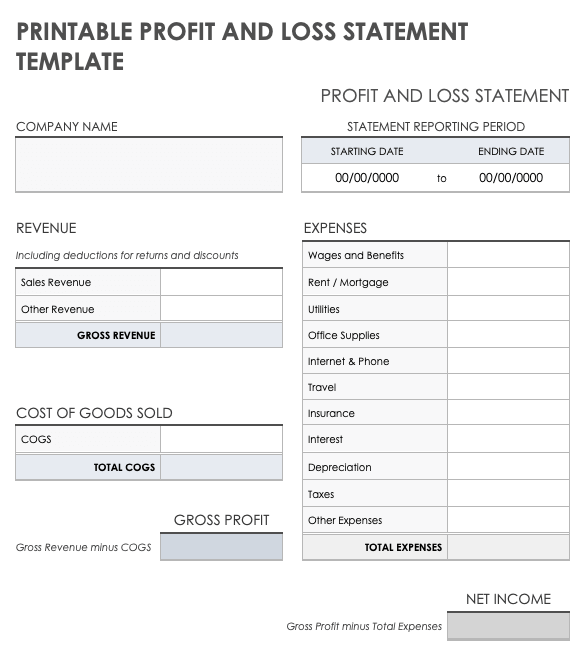

Free Profit and Loss (P&L) Templates

Use one of these profit and loss (P&L) templates to systematically track income and expenses, giving you a clear picture of your company's profitability over a specific period.

Free Billing and Invoice Templates

Use one of these billing and invoice templates to streamline the invoicing process and ensure that you bill clients accurately and professionally for services or products.

Plan and Manage Your Company’s Financial Future with Financial Projection and Forecasting Templates from Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

AI ASSISTANTS

Upmetrics AI Your go-to AI-powered business assistant

AI Writing Assist Write, translate, and refine your text with AI

AI Financial Assist Automated forecasts and AI recommendations

TOP FEATURES

AI Business Plan Generator Create business plans faster with AI

Financial Forecasting Make accurate financial forecasts faster

INTEGRATIONS

QuickBooks Sync and compare with your QuickBooks data

Strategic Planning Develop actionable strategic plans on-the-go

AI Pitch Deck Generator Use AI to generate your investor deck

Xero Sync and compare with your Xero data

See how easy it is to plan your business with Upmetrics: Take a Tour →

AI-powered business planning software

Very useful business plan software connected to AI. Saved a lot of time, money and energy. Their team is highly skilled and always here to help.

- Julien López

BY USE CASE

Secure Funding, Loans, Grants Create plans that get you funded

Starting & Launching a Business Plan your business for launch and success

Validate Your Business Idea Discover the potential of your business idea

E2 Visa Business Plan Create a business plan to support your E2 - Visa

Business Consultant & Advisors Plan with your team members and clients

Incubators & Accelerators Empowering startups for growth

Business Schools & Educators Simplify business plan education for students

Students & Learners Your e-tutor for business planning

- Sample Plans

WHY UPMETRICS?

Reviews See why customers love Upmetrics

Customer Success Stories Read our customer success stories

Blogs Latest business planning tips and strategies

Strategic Planning Templates Ready-to-use strategic plan templates

Business Plan Course A step-by-step business planning course

Help Center Help & guides to plan your business

Ebooks & Guides A free resource hub on business planning

Business Tools Free business tools to help you grow

How to Prepare a Financial Plan for Startup Business (w/ example)

Free Financial Statements Template

Ajay Jagtap

- December 7, 2023

13 Min Read

If someone were to ask you about your business financials, could you give them a detailed answer?

Let’s say they ask—how do you allocate your operating expenses? What is your cash flow situation like? What is your exit strategy? And a series of similar other questions.

Instead of mumbling what to answer or shooting in the dark, as a founder, you must prepare yourself to answer this line of questioning—and creating a financial plan for your startup is the best way to do it.

A business plan’s financial plan section is no easy task—we get that.

But, you know what—this in-depth guide and financial plan example can make forecasting as simple as counting on your fingertips.

Ready to get started? Let’s begin by discussing startup financial planning.

What is Startup Financial Planning?

Startup financial planning, in simple terms, is a process of planning the financial aspects of a new business. It’s an integral part of a business plan and comprises its three major components: balance sheet, income statement, and cash-flow statement.

Apart from these statements, your financial section may also include revenue and sales forecasts, assets & liabilities, break-even analysis , and more. Your first financial plan may not be very detailed, but you can tweak and update it as your company grows.

Key Takeaways

- Realistic assumptions, thorough research, and a clear understanding of the market are the key to reliable financial projections.

- Cash flow projection, balance sheet, and income statement are three major components of a financial plan.

- Preparing a financial plan is easier and faster when you use a financial planning tool.

- Exploring “what-if” scenarios is an ideal method to understand the potential risks and opportunities involved in the business operations.

Why is Financial Planning Important to Your Startup?

Poor financial planning is one of the biggest reasons why most startups fail. In fact, a recent CNBC study reported that running out of cash was the reason behind 44% of startup failures in 2022.

A well-prepared financial plan provides a clear financial direction for your business, helps you set realistic financial objectives, create accurate forecasts, and shows your business is committed to its financial objectives.

It’s a key element of your business plan for winning potential investors. In fact, YC considered recent financial statements and projections to be critical elements of their Series A due diligence checklist .

Your financial plan demonstrates how your business manages expenses and generates revenue and helps them understand where your business stands today and in 5 years.

Makes sense why financial planning is important to your startup, doesn’t it? Let’s cut to the chase and discuss the key components of a startup’s financial plan.

Say goodbye to old-school excel sheets & templates

Make accurate financial plan faster with AI

Plans starting from $7/month

Key Components of a Startup Financial Plan

Whether creating a financial plan from scratch for a business venture or just modifying it for an existing one, here are the key components to consider including in your startup’s financial planning process.

Income Statement

An Income statement , also known as a profit-and-loss statement(P&L), shows your company’s income and expenditures. It also demonstrates how your business experienced any profit or loss over a given time.

Consider it as a snapshot of your business that shows the feasibility of your business idea. An income statement can be generated considering three scenarios: worst, expected, and best.

Your income or P&L statement must list the following:

- Cost of goods or cost of sale

- Gross margin

- Operating expenses

- Revenue streams

- EBITDA (Earnings before interest, tax, depreciation , & amortization )

Established businesses can prepare annual income statements, whereas new businesses and startups should consider preparing monthly statements.

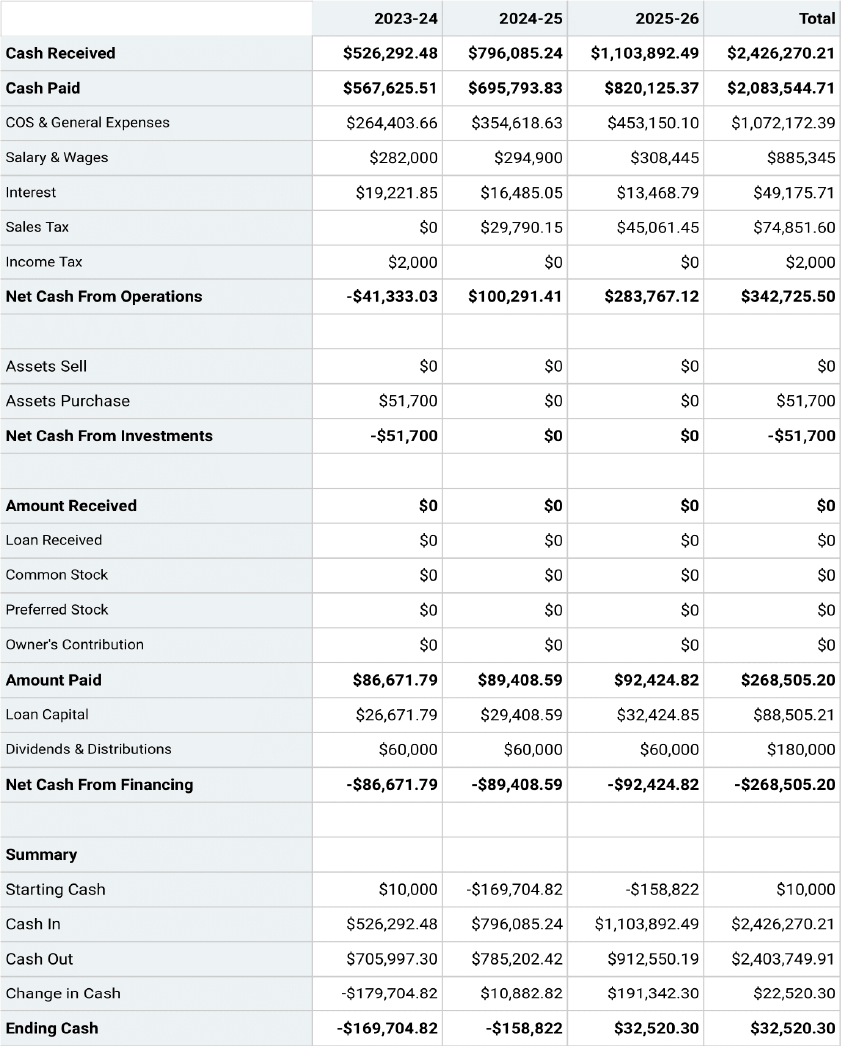

Cash flow Statement

A cash flow statement is one of the most critical financial statements for startups that summarize your business’s cash in-and-out flows over a given time.

This section provides details on the cash position of your business and its ability to meet monetary commitments on a timely basis.

Your cash flow projection consists of the following three components:

✅ Cash revenue projection: Here, you must enter each month’s estimated or expected sales figures.

✅ Cash disbursements: List expenditures that you expect to pay in cash for each month over one year.

✅ Cash flow reconciliation: Cash flow reconciliation is a process used to ensure the accuracy of cash flow projections. The adjusted amount is the cash flow balance carried over to the next month.

Furthermore, a company’s cash flow projections can be crucial while assessing liquidity, its ability to generate positive cash flows and pay off debts, and invest in growth initiatives.

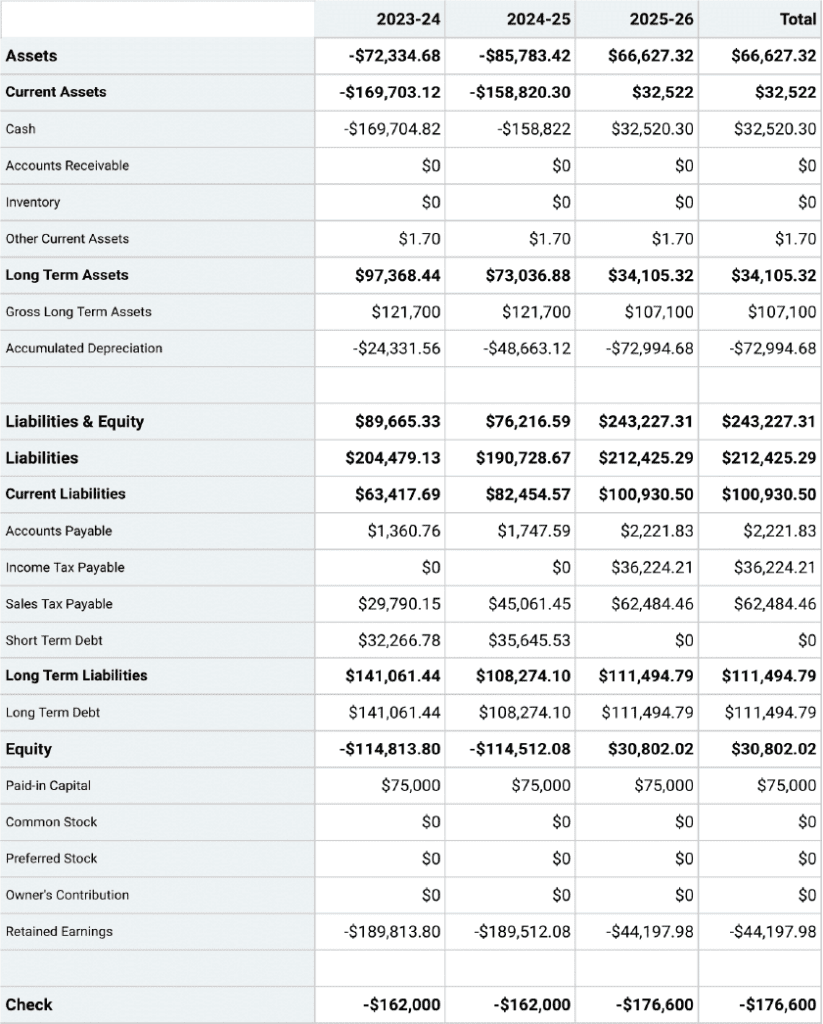

Balance Sheet

Your balance sheet is a financial statement that reports your company’s assets, liabilities, and shareholder equity at a given time.

Consider it as a snapshot of what your business owns and owes, as well as the amount invested by the shareholders.

This statement consists of three parts: assets , liabilities, and the balance calculated by the difference between the first two. The final numbers on this sheet reflect the business owner’s equity or value.

Balance sheets follow the following accounting equation with assets on one side and liabilities plus Owner’s equity on the other:

Here is what’s the core purpose of having a balance-sheet:

- Indicates the capital need of the business

- It helps to identify the allocation of resources

- It calculates the requirement of seed money you put up, and

- How much finance is required?

Since it helps investors understand the condition of your business on a given date, it’s a financial statement you can’t miss out on.

Break-even Analysis

Break-even analysis is a startup or small business accounting practice used to determine when a company, product, or service will become profitable.

For instance, a break-even analysis could help you understand how many candles you need to sell to cover your warehousing and manufacturing costs and start making profits.

Remember, anything you sell beyond the break-even point will result in profit.

You must be aware of your fixed and variable costs to accurately determine your startup’s break-even point.

- Fixed costs: fixed expenses that stay the same no matter what.

- Variable costs: expenses that fluctuate over time depending on production or sales.

A break-even point helps you smartly price your goods or services, cover fixed costs, catch missing expenses, and set sales targets while helping investors gain confidence in your business. No brainer—why it’s a key component of your startup’s financial plan.

Having covered all the key elements of a financial plan, let’s discuss how you can create a financial plan for your startup.

How to Create a Financial Section of a Startup Business Plan?

1. determine your financial needs.

You can’t start financial planning without understanding your financial requirements, can you? Get your notepad or simply open a notion doc; it’s time for some critical thinking.

Start by assessing your current situation by—calculating your income, expenses , assets, and liabilities, what the startup costs are, how much you have against them, and how much financing you need.

Assessing your current financial situation and health will help determine how much capital you need for your startup and help plan fundraising activities and outreach.

Furthermore, determining financial needs helps prioritize operational activities and expenses, effectively allocate resources, and increase the viability and sustainability of a business in the long run.

Having learned to determine financial needs, let’s head straight to setting financial goals.

2. Define Your Financial Goals

Setting realistic financial goals is fundamental in preparing an effective financial plan. So, it would help to outline your long-term strategies and goals at the beginning of your financial planning process.

Let’s understand it this way—if you are a SaaS startup pursuing VC financing rounds, you may ask investors about what matters to them the most and prepare your financial plan accordingly.

However, a coffee shop owner seeking a business loan may need to create a plan that appeals to banks, not investors. At the same time, an internal financial plan designed to offer financial direction and resource allocation may not be the same as previous examples, seeing its different use case.

Feeling overwhelmed? Just define your financial goals—you’ll be fine.

You can start by identifying your business KPIs (key performance indicators); it would be an ideal starting point.

3. Choose the Right Financial Planning Tool

Let’s face it—preparing a financial plan using Excel is no joke. One would only use this method if they had all the time in the world.

Having the right financial planning software will simplify and speed up the process and guide you through creating accurate financial forecasts.

Many financial planning software and tools claim to be the ideal solution, but it’s you who will identify and choose a tool that is best for your financial planning needs.

Create a Financial Plan with Upmetrics in no time

Enter your Financial Assumptions, and we’ll calculate your monthly/quarterly and yearly financial projections.

Start Forecasting

4. Make Assumptions Before Projecting Financials

Once you have a financial planning tool, you can move forward to the next step— making financial assumptions for your plan based on your company’s current performance and past financial records.

You’re just making predictions about your company’s financial future, so there’s no need to overthink or complicate the process.

You can gather your business’ historical financial data, market trends, and other relevant documents to help create a base for accurate financial projections.

After you have developed rough assumptions and a good understanding of your business finances, you can move forward to the next step—projecting financials.

5. Prepare Realistic Financial Projections

It’s a no-brainer—financial forecasting is the most critical yet challenging aspect of financial planning. However, it’s effortless if you’re using a financial planning software.

Upmetrics’ forecasting feature can help you project financials for up to 7 years. However, new startups usually consider planning for the next five years. Although it can be contradictory considering your financial goals and investor specifications.

Following are the two key aspects of your financial projections:

Revenue Projections

In simple terms, revenue projections help investors determine how much revenue your business plans to generate in years to come.

It generally involves conducting market research, determining pricing strategy , and cash flow analysis—which we’ve already discussed in the previous steps.

The following are the key components of an accurate revenue projection report:

- Market analysis

- Sales forecast

- Pricing strategy

- Growth assumptions

- Seasonal variations

This is a critical section for pre-revenue startups, so ensure your projections accurately align with your startup’s financial model and revenue goals.

Expense Projections

Both revenue and expense projections are correlated to each other. As revenue forecasts projected revenue assumptions, expense projections will estimate expenses associated with operating your business.

Accurately estimating your expenses will help in effective cash flow analysis and proper resource allocation.

These are the most common costs to consider while projecting expenses:

- Fixed costs

- Variable costs

- Employee costs or payroll expenses

- Operational expenses

- Marketing and advertising expenses

- Emergency fund

Remember, realistic assumptions, thorough research, and a clear understanding of your market are the key to reliable financial projections.

6. Consider “What if” Scenarios

After you project your financials, it’s time to test your assumptions with what-if analysis, also known as sensitivity analysis.

Using what-if analysis with different scenarios while projecting your financials will increase transparency and help investors better understand your startup’s future with its best, expected, and worst-case scenarios.

Exploring “what-if” scenarios is the best way to better understand the potential risks and opportunities involved in business operations. This proactive exercise will help you make strategic decisions and necessary adjustments to your financial plan.

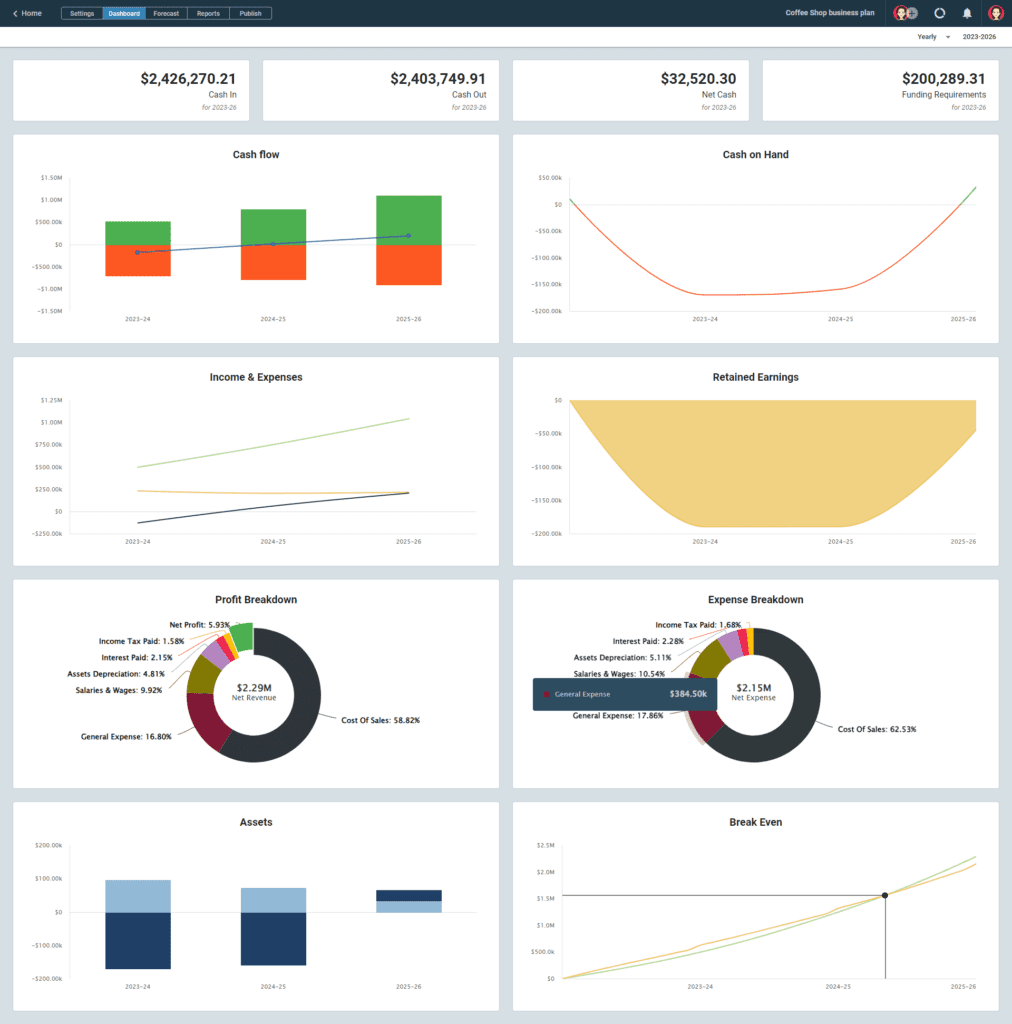

7. Build a Visual Report

If you’ve closely followed the steps leading to this, you know how to research for financial projections, create a financial plan, and test assumptions using “what-if” scenarios.

Now, we’ll prepare visual reports to present your numbers in a visually appealing and easily digestible format.

Don’t worry—it’s no extra effort. You’ve already made a visual report while creating your financial plan and forecasting financials.

Check the dashboard to see the visual presentation of your projections and reports, and use the necessary financial data, diagrams, and graphs in the final draft of your financial plan.

Here’s what Upmetrics’ dashboard looks like:

8. Monitor and Adjust Your Financial Plan

Even though it’s not a primary step in creating a good financial plan, it’s quite essential to regularly monitor and adjust your financial plan to ensure the assumptions you made are still relevant, and you are heading in the right direction.

There are multiple ways to monitor your financial plan.

For instance, you can compare your assumptions with actual results to ensure accurate projections based on metrics like new customers acquired and acquisition costs, net profit, and gross margin.

Consider making necessary adjustments if your assumptions are not resonating with actual numbers.

Also, keep an eye on whether the changes you’ve identified are having the desired effect by monitoring their implementation.

And that was the last step in our financial planning guide. However, it’s not the end. Have a look at this financial plan example.

Startup Financial Plan Example

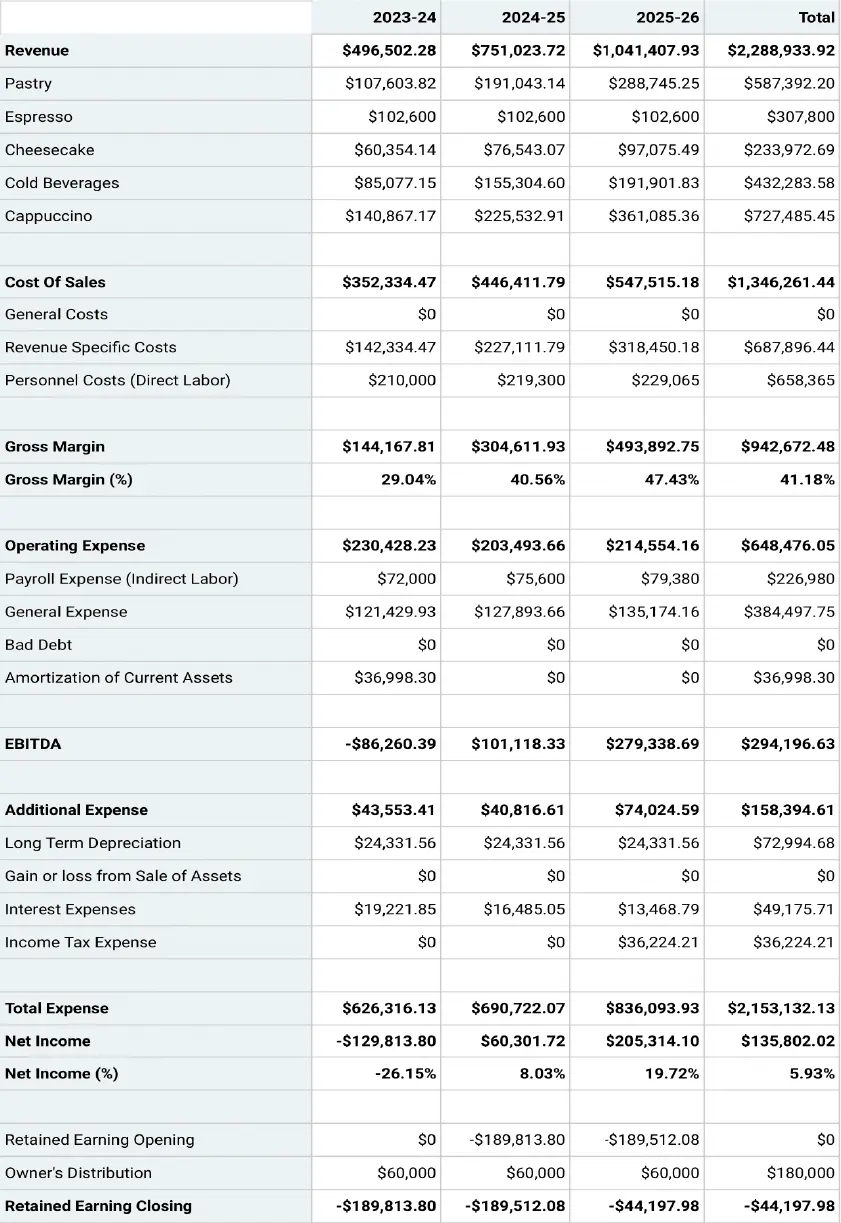

Having learned about financial planning, let’s quickly discuss a coffee shop startup financial plan example prepared using Upmetrics.

Important Assumptions

- The sales forecast is conservative and assumes a 5% increase in Year 2 and a 10% in Year 3.

- The analysis accounts for economic seasonality – wherein some months revenues peak (such as holidays ) and wanes in slower months.

- The analysis assumes the owner will not withdraw any salary till the 3rd year; at any time it is assumed that the owner’s withdrawal is available at his discretion.

- Sales are cash basis – nonaccrual accounting

- Moderate ramp- up in staff over the 5 years forecast

- Barista salary in the forecast is $36,000 in 2023.

- In general, most cafes have an 85% gross profit margin

- In general, most cafes have a 3% net profit margin

Projected Balance Sheet

Projected Cash-Flow Statement

Projected Profit & Loss Statement

Break Even Analysis

Start Preparing Your Financial Plan

We covered everything about financial planning in this guide, didn’t we? Although it doesn’t fulfill our objective to the fullest—we want you to finish your financial plan.

Sounds like a tough job? We have an easy way out for you—Upmetrics’ financial forecasting feature. Simply enter your financial assumptions, and let it do the rest.

So what are you waiting for? Try Upmetrics and create your financial plan in a snap.

Build your Business Plan Faster

with step-by-step Guidance & AI Assistance.

Frequently Asked Questions

How often should i update my financial projections.

Well, there is no particular rule about it. However, reviewing and updating your financial plan once a year is considered an ideal practice as it ensures that the financial aspirations you started and the projections you made are still relevant.

How do I estimate startup costs accurately?

You can estimate your startup costs by identifying and factoring various one-time, recurring, and hidden expenses. However, using a financial forecasting tool like Upmetrics will ensure accurate costs while speeding up the process.

What financial ratios should startups pay attention to?

Here’s a list of financial ratios every startup owner should keep an eye on:

- Net profit margin

- Current ratio

- Quick ratio

- Working capital

- Return on equity

- Debt-to-equity ratio

- Return on assets

- Debt-to-asset ratio

What are the 3 different scenarios in scenario analysis?

As discussed earlier, Scenario analysis is the process of ascertaining and analyzing possible events that can occur in the future. Startups or businesses often consider analyzing these three scenarios:

- base-case (expected) scenario

- Worst-case scenario

- best case scenario.

About the Author

Ajay is a SaaS writer and personal finance blogger who has been active in the space for over three years, writing about startups, business planning, budgeting, credit cards, and other topics related to personal finance. If not writing, he’s probably having a power nap. Read more

Reach Your Goals with Accurate Planning

- Search Search Please fill out this field.

- Building Your Business

- Becoming an Owner

- Business Plans

Writing a Business Plan—Financial Projections

Spell out your financial forecast in dollars and sense

Creating financial projections for your startup is both an art and a science. Although investors want to see cold, hard numbers, it can be difficult to predict your financial performance three years down the road, especially if you are still raising seed money. Regardless, short- and medium-term financial projections are a required part of your business plan if you want serious attention from investors.

The financial section of your business plan should include a sales forecast , expenses budget , cash flow statement , balance sheet , and a profit and loss statement . Be sure to follow the generally accepted accounting principles (GAAP) set forth by the Financial Accounting Standards Board , a private-sector organization responsible for setting financial accounting and reporting standards in the U.S. If financial reporting is new territory for you, have an accountant review your projections.

Sales Forecast

As a startup business, you do not have past results to review, which can make forecasting sales difficult. It can be done, though, if you have a good understanding of the market you are entering and industry trends as a whole. In fact, sales forecasts based on a solid understanding of industry and market trends will show potential investors that you've done your homework and your forecast is more than just guesswork.

In practical terms, your forecast should be broken down by monthly sales with entries showing which units are being sold, their price points, and how many you expect to sell. When getting into the second year of your business plan and beyond, it's acceptable to reduce the forecast to quarterly sales. In fact, that's the case for most items in your business plan.

Expenses Budget

What you're selling has to cost something, and this budget is where you need to show your expenses. These include the cost to your business of the units being sold in addition to overhead. It's a good idea to break down your expenses by fixed costs and variable costs. For example, certain expenses will be the same or close to the same every month, including rent, insurance, and others. Some costs likely will vary month by month such as advertising or seasonal sales help.

Cash Flow Statement

As with your sales forecast, cash flow statements for a startup require doing some homework since you do not have historical data to use as a reference. This statement, in short, breaks down how much cash is coming into your business on a monthly basis vs. how much is going out. By using your sales forecasts and your expenses budget, you can estimate your cash flow intelligently.

Keep in mind that revenue often will trail sales, depending on the type of business you are operating. For example, if you have contracts with clients, they may not be paying for items they purchase until the month following delivery. Some clients may carry balances 60 or 90 days beyond delivery. You need to account for this lag when calculating exactly when you expect to see your revenue.

Profit and Loss Statement

Your P&L statement should take the information from your sales projections, expenses budget, and cash flow statement to project how much you expect in profits or losses through the three years included in your business plan. You should have a figure for each individual year as well as a figure for the full three-year period.

Balance Sheet

You provide a breakdown of all of your assets and liabilities in the balances sheet. Many of these assets and liabilities are items that go beyond monthly sales and expenses. For example, any property, equipment, or unsold inventory you own is an asset with a value that can be assigned to it. The same goes for outstanding invoices owed to you that have not been paid. Even though you don't have the cash in hand, you can count those invoices as assets. The amount you owe on a business loan or the amount you owe others on invoices you've not paid would count as liabilities. The balance is the difference between the value of everything you own vs. the value of everything you owe.

Break-Even Projection

If you've done a good job projecting your sales and expenses and inputting the numbers into a spreadsheet, you should be able to identify a date when your business breaks even—in other words, the date when you become profitable, with more money coming in than going out. As a startup business, this is not expected to happen overnight, but potential investors want to see that you have a date in mind and that you can support that projection with the numbers you've supplied in the financial section of your business plan.

Additional Tips

When putting together your financial projections, keep some general tips in mind:

- Get comfortable with spreadsheet software if you aren't already. It is the starting point for all financial projections and offers flexibility, allowing you to quickly change assumptions or weigh alternative scenarios. Microsoft Excel is the most common, and chances are you already have it on your computer. You can also buy special software packages to help with financial projections.

- Prepare a five-year projection . Don’t include this one in the business plan, since the further into the future you project, the harder it is to predict. However, have the projection available in case an investor asks for it.

- Offer two scenarios only . Investors will want to see a best-case and worst-case scenario, but don’t inundate your business plan with myriad medium-case scenarios. They likely will just cause confusion.

- Be reasonable and clear . As mentioned before, financial forecasting is as much art as science. You’ll have to assume certain things, such as your revenue growth, how your raw material and administrative costs will grow, and how effective you’ll be at collecting on accounts receivable. It’s best to be realistic in your projections as you try to recruit investors. If your industry is going through a contraction period and you’re projecting revenue growth of 20 percent a month, expect investors to see red flags.

How to Create a Sales Forecast

11 min. read

Updated October 27, 2023

Business owners are often afraid to forecast sales. But, you shouldn’t be. Because you can successfully forecast your own business’s sales.

You don’t have to be an MBA or CPA. It’s not about some magic right answer that you don’t know. It’s not about training you don’t have. It doesn’t take spreadsheet modeling (much less econometric modeling) to estimate units and price per unit for future sales. You just have to know your own business.

Forecasting isn’t about seeing into the future

Sales forecasting is much easier than you think and much more useful than you imagine.

I was a vice president of a market research firm for several years, doing expensive forecasts, and I saw many times that there’s nothing better than the educated guess of somebody who knows the business well. All those sophisticated techniques depend on data from the past — and the past, by itself, isn’t the best predictor of the future. You are.

It’s not about guessing the future correctly. We’re human; we don’t do that well. Instead, it’s about setting down assumptions, expectations, drivers, tracking, and management. It’s about doing your job, not having precognitive powers.

- Successful forecasting is driven by regular reviews

What really matters is that you review and revise your forecast regularly. Spending should be tied to sales, so the forecast helps you budget and manage. You measure the value of a sales forecast like you do anything in business, by its measurable business results.

That also means you should not back off from forecasting because you have a new product, or new business, without past data. Lay out the sales drivers and interdependencies, to connect the dots, so that as you review plan-versus-actual results every month, you can easily make course corrections.

If you think sales forecasting is hard, try running a business without a forecast. That’s much harder.

Your sales forecast is also the backbone of your business plan . People measure a business and its growth by sales, and your sales forecast sets the standard for expenses , profits, and growth. The sales forecast is almost always going to be the first set of numbers you’ll track for plan versus actual use, even if you do no other numbers.

If nothing else, just forecast your sales, track plan-versus-actual results, and make corrections — that process alone, just the sales forecast and tracking is in itself already business planning. To get started on building your forecast follow these steps.

And if you run a subscription-based business, we have a guide dedicated to building a sales forecast for that business model.

- Step 1: Set up your lines of sales

Most forecasts show several distinct lines of sales. Ideally, your sales lines match your accounting, but not necessarily in the same level of detail.

For example, a restaurant ought not to forecast sales for each item on the menu. Instead, it forecasts breakfasts, lunches, dinners, and drinks, summarized. And a bookstore ought not to forecast sales by book, and not even by topic or author, but rather by lines of sales such as hardcover, softcover, magazines, and maybe categories (such as fiction, non-fiction, travel, etc.) if that works.

Always try to set your streams to match your accounting, so you can look at the difference between the forecast and actual sales later. This is excellent for real business planning. It makes the heart of the process, the regular review, and revision, much easier. The point is better management.

For instance, in a bicycle retail store business plan, the owner works with five lines of sales, as shown in the illustration here.

In this sample case, the revenue includes new bikes, repair, clothing, accessories, and a service contract. The bookkeeping for this retail store tracks sales in those same five categories.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- Step 2: Forecast line by line

There are many ways to forecast a line of sales.

The method for each row depends on the business model

Among the main methods are:.

- Unit sales : My personal favorite. Sales = units times price. You set an average price and forecast the units. And of course, you can change projected pricing over time. This is my favorite for most businesses because it gives you two factors to act on with course corrections: unit sales, or price.

- Service units : Even though services don’t sell physical units, most sell billable units, such as billable hours for lawyers and accountants, or trips for transportations services, engagements for consultants, and so forth.

- Recurring charges : Subscriptions. For each month or year, it has to forecast new signups, existing monthly charges, and cancellations. Estimates depend on both new signups and cancellations, which is often called “churn.”

- Revenue only : For those who prefer to forecast revenue by the stream as just the money, without the extra information of breaking it into units and prices.

Most sales forecast rows are simple math

For a business plan, I recommend you make your sales forecast a detailed look at the next 12 months and then broadly cover two years after that. Here’s how to approach each method of line-by-line forecasting.

Start with units if you can

For unit sales, start by forecasting units month by month, as shown here below for the new bike’s line of sales in the bicycle shop plan:

I recommend looking at the visual as you forecast the units because most of us can see trends easier when we look at the line, as shown in the illustration, rather than just the numbers. You can also see the numbers in the forecast near the bottom. The first year, fiscal 2021 in this forecast, is the sum of those months.

Estimate price assumptions

With a simple revenue-only assumption, you do one row of units as shown in the above illustration, and you are done. The units are dollars, or whatever other currency you are using in your forecast. In this example, the new bicycle product will be sold for an average of $550.00.

That’s a simplifying assumption, taking the average price, not the detailed price for each brand or line. Garrett, the shop owner, uses his past results to determine his actual average price for the most recent year. Then he rounds that estimate and adds his own judgment and educated guess on how that will change.

Multiply price times units

Multiplying units times the revenue per unit generates the sales forecast for this row. So for example the $18,150 shown for October of 2020 is the product of 33 units times $550 each. And the $21,450 shown for the next month is the product of 39 units times $550 each.

Subscription models are more complicated

Lately, a lot of businesses offer their buyers subscriptions, such as monthly packages, traditional or online newspapers, software, and even streaming services. All of these give a business recurring revenues, which is a big advantage.

For subscriptions, you normally estimate new subscriptions per month and canceled subscriptions per month, and leave a calculation for the actual subscriptions charged. That’s a more complicated method, which demands more details.

For that, you can refer to detailed discussions on subscription forecasting in How to Forecast Sales for a Subscription Business .

- But how do you know what numbers to put into your sales forecast?

The math may be simple, yes, but this is predicting the future, and humans don’t do that well. So, don’t try to guess the future accurately for months in advance.

Instead, aim for making clear assumptions and understanding what drives your sales, such as web traffic and conversions, in one example, or the direct sales pipeline and leads, in another. Review results every month, and revise your forecast. Your educated guesses become more accurate over time.

Experience in the field is a huge advantage

In a normal ongoing business, the business owner has ample experience with past sales. They may not know accounting or technical forecasting, but they know their business. They are aware of changes in the market, their own business’s promotions, and other factors that business owners should know. They are comfortable making educated guesses.

If you don’t personally have the experience, try to find information and make guesses based on the experience of an employee, your mentor , or others you’ve spoken within your field.

Use past results as a guide

Use results from the recent past if your business has them. Start a forecast by putting last year’s numbers into next year’s forecast, and then focus on what might be different this year from next.

Do you have new opportunities that will make sales grow? New marketing activities, promotions? Then increase the forecast. New competition, and new problems? Nobody wants to forecast decreasing sales, but if that’s likely, you need to deal with it by cutting costs or changing your focus.

Look for drivers

To forecast sales for a new restaurant, first, draw a map of tables and chairs and then estimate how many meals per mealtime at capacity, and in the beginning. It’s not a random number; it’s a matter of how many people come in.

To forecast sales for a new mobile app, you might get data from the Apple and Android mobile app stores about average downloads for different apps. A good web search might also reveal some anecdotal evidence, blog posts, and news stories, about the ramp-up of existing apps that were successful.

Get those numbers and think about how your case might be different. Maybe you drive downloads with a website, so you can predict traffic from past experience and then assume a percentage of web visitors who will download the app.

- Estimate direct costs

Direct costs are also called the cost of goods sold (COGS) and per-unit costs. Direct costs are important because they help calculate gross margin, which is used as a basis for comparison in financial benchmarks, and are an instant measure (sales less direct costs) of your underlying profitability.

For example, I know from benchmarks that an average sporting goods store makes a 34 percent gross margin. That means that they spend $66 on average to buy the goods they sell for $100.

Not all businesses have direct costs. Service businesses supposedly don’t have direct costs, so they have a gross margin of 100 percent. That may be true for some professionals like accountants and lawyers, but a lot of services do have direct costs. For example, taxis have gasoline and maintenance. So do airlines.

A normal sales forecast includes units, price per unit, sales, direct cost per unit, and direct costs. The math is simple, with the direct costs per unit related to total direct costs the same way price per unit relates to total sales.

Multiply the units projected for any time period by the unit direct costs, and that gives you total direct costs. And here too, assume this view is just a cut-out, it flows to the right. In this example, Garrett the shop owner projected the direct costs of new bikes based on the assumption of 49 percent of sales.

Given the unit forecast estimate, the calculation of units times direct costs produces the forecast shown in the illustration below for direct costs for that product. So therefore the projected direct costs for new bikes in October is $8,894, which is 49% of the projected sales for that month, $18,150.

- Never forecast in a vacuum

Never think of your sales forecast in a vacuum. It flows from the strategic action plans with their assumptions, milestones , and metrics. Your marketing milestones affect your sales. Your business offering milestones affect your sales.

When you change milestones—and you will, because all business plans change—you should change your sales forecast to match.

- Timing matters

Your sales are supposed to refer to when the ownership changes hands (for products) or when the service is performed (for services). It isn’t a sale when it’s ordered, or promised, or even when it’s contracted.

With proper accrual accounting , it is a sale even if it hasn’t been paid for. With so-called cash-based accounting, by the way, it isn’t a sale until it’s paid for. Accrual is better because it gives you a more accurate picture, unless you’re very small and do all your business, both buying and selling, with cash only.

I know that seems simple, but it’s surprising how many people decide to do something different. The penalty for doing things differently is that then you don’t match the standard, and the bankers, analysts, and investors can’t tell what you meant.

This goes for direct costs, too. The direct costs in your monthly profit and loss statement are supposed to be just the costs associated with that month’s sales. Please notice how, in the examples above, the direct costs for the sample bicycle store are linked to the actual unit sales.

- Live with your assumptions

Sales forecasting is not about accurately guessing the future. It’s about laying out your assumptions so you can manage changes effectively as sales and direct costs come out different from what you expected. Use this to adjust your sales forecast and improve your business by making course corrections to deal with what is working and what isn’t.

I believe that even if you do nothing else, by the time you use a sales forecast and review plan versus actual results every month, you are already managing with a business plan . You can’t review actual results without looking at what happened, why, and what to do next.

Tim Berry is the founder and chairman of Palo Alto Software , a co-founder of Borland International, and a recognized expert in business planning. He has an MBA from Stanford and degrees with honors from the University of Oregon and the University of Notre Dame. Today, Tim dedicates most of his time to blogging, teaching and evangelizing for business planning.

Table of Contents

- Forecasting isn’t about seeing into the future

Related Articles

7 Min. Read

7 Financial Terms Small Business Owners Need to Know

6 Min. Read

How to Create a Profit and Loss Forecast

3 Min. Read

What Is a Break-Even Analysis?

10 Min. Read

What Is a Balance Sheet? Definition, Formulas, and Example

The LivePlan Newsletter

Become a smarter, more strategic entrepreneur.

Your first monthly newsetter will be delivered soon..

Unsubscribe anytime. Privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Financial Forecasting: How to Do It with Different Methods, Models, & Software

Published: June 07, 2023

Planning for your company's future is significantly easier and more effective when you have a picture of what that future might look like. That's why any business interested in sound financial planning needs to have a grip on financial forecasting — the process of making accurate projections that can frame thoughtful, productive financial decisions in real time.

Here, we'll explore the concept of financial forecasting in depth, review some popular financial forecasting models, go over some prominent financial forecasting methods, and see some of the best financial forecasting software solutions on the market.

1. What is financial forecasting?

Forecasting vs. Budgeting

2. Financial Forecasting Models

- Top-Down Financial Forecasting

- Delphi Financial Forecasting

- Statistical Forecasting

- Bottom-Up Financial Forecasting

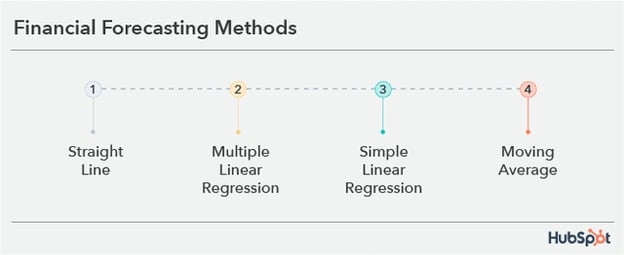

3. Financial Forecasting Methods

- Straight Line

- Simple Linear Regression

- Multiple Linear Regression

- Moving Average

4. How to do Financial Forecasting

5. Financial Forecasting Software

What is financial forecasting?