Risk Management 101: Process, Examples, Strategies

Emily Villanueva

August 16, 2023

Effective risk management takes a proactive and preventative stance to risk, aiming to identify and then determine the appropriate response to the business and facilitate better decision-making. Many approaches to risk management focus on risk reduction, but it’s important to remember that risk management practices can also be applied to opportunities, assisting the organization with determining if that possibility is right for it.

Risk management as a discipline has evolved to the point that there are now common subsets and branches of risk management programs, from enterprise risk management (ERM) , to cybersecurity risk management, to operational risk management (ORM) , to supply chain risk management (SCRM) . With this evolution, standards organizations around the world, like the US’s National Institute of Standards and Technology (NIST) and the International Standards Organization (ISO) have developed and released their own best practice frameworks and guidance for businesses to apply to their risk management plan.

Companies that adopt and continuously improve their risk management programs can reap the benefits of improved decision-making, a higher probability of reaching goals and business objectives, and an augmented security posture. But, with risks proliferating and the many types of risks that face businesses today, how can an organization establish and optimize its risk management processes? This article will walk you through the fundamentals of risk management and offer some thoughts on how you can apply it to your organization.

What Are Risks?

We’ve been talking about risk management and how it has evolved, but it’s important to clearly define the concept of risk. Simply put, risks are the things that could go wrong with a given initiative, function, process, project, and so on. There are potential risks everywhere — when you get out of bed, there’s a risk that you’ll stub your toe and fall over, potentially injuring yourself (and your pride). Traveling often involves taking on some risks, like the chance that your plane will be delayed or your car runs out of gas and leave you stranded. Nevertheless, we choose to take on those risks, and may benefit from doing so.

Companies should think about risk in a similar way, not seeking simply to avoid risks, but to integrate risk considerations into day-to-day decision-making.

- What are the opportunities available to us?

- What could be gained from those opportunities?

- What is the business’s risk tolerance or risk appetite – that is, how much risk is the company willing to take on?

- How will this relate to or affect the organization’s goals and objectives?

- Are these opportunities aligned with business goals and objectives?

With that in mind, conversations about risks can progress by asking, “What could go wrong?” or “What if?” Within the business environment, identifying risks starts with key stakeholders and management, who first define the organization’s objectives. Then, with a risk management program in place, those objectives can be scrutinized for the risks associated with achieving them. Although many organizations focus their risk analysis around financial risks and risks that can affect a business’s bottom line, there are many types of risks that can affect an organization’s operations, reputation, or other areas.

Remember that risks are hypotheticals — they haven’t occurred or been “realized” yet. When we talk about the impact of risks, we’re always discussing the potential impact. Once a risk has been realized, it usually turns into an incident, problem, or issue that the company must address through their contingency plans and policies. Therefore, many risk management activities focus on risk avoidance, risk mitigation, or risk prevention.

What Different Types of Risks Are There?

There’s a vast landscape of potential risks that face modern organizations. Targeted risk management practices like ORM and SCRM have risen to address emerging areas of risk, with those disciplines focused on mitigating risks associated with operations and the supply chain. Specific risk management strategies designed to address new risks and existing risks have emerged from these facets of risk management, providing organizations and risk professionals with action plans and contingency plans tailored to unique problems and issues.

Common types of risks include: strategic, compliance, financial, operational, reputational, security, and quality risks.

Strategic Risk

Strategic risks are those risks that could have a potential impact on a company’s strategic objectives, business plan, and/or strategy. Adjustments to business objectives and strategy have a trickle-down effect to almost every function in the organization. Some events that could cause strategic risks to be realized are: major technological changes in the company, like switching to a new tech stack; large layoffs or reductions-in-force (RIFs); changes in leadership; competitive pressure; and legal changes.

Compliance Risk

Compliance risks materialize from regulatory and compliance requirements that businesses are subject to, like Sarbanes-Oxley for publicly-traded US companies, or GDPR for companies that handle personal information from the EU. The consequence or impact of noncompliance is generally a fine from the governing body of that regulation. These types of risks are realized when the organization does not maintain compliance with regulatory requirements, whether those requirements are environmental, financial, security-specific, or related to labor and civil laws.

Financial Risk

Financial risks are fairly self-explanatory — they have the possibility of affecting an organization’s profits. These types of risks often receive significant attention due to the potential impact on a company’s bottom line. Financial risks can be realized in many circumstances, like performing a financial transaction, compiling financial statements, developing new partnerships, or making new deals.

Operational Risk

Risks to operations, or operational risks, have the potential to disrupt daily operations involved with running a business. Needless to say, this can be a problematic scenario for organizations with employees unable to do their jobs, and with product delivery possibly delayed. Operational risks can materialize from internal or external sources — employee conduct, retention, technology failures, natural disasters, supply chain breakdowns — and many more.

Reputational Risk

Reputational risks are an interesting category. These risks look at a company’s standing in the public and in the media and identify what could impact its reputation. The advent of social media changed the reputation game quite a bit, giving consumers direct access to brands and businesses. Consumers and investors too are becoming more conscious about the companies they do business with and their impact on the environment, society, and civil rights. Reputational risks are realized when a company receives bad press or experiences a successful cyber attack or security breach; or any situation that causes the public to lose trust in an organization.

Security Risk

Security risks have to do with possible threats to your organization’s physical premises, as well as information systems security. Security breaches, data leaks, and other successful types of cyber attacks threaten the majority of businesses operating today. Security risks have become an area of risk that companies can’t ignore, and must safeguard against.

Quality Risk

Quality risks are specifically associated with the products or services that a company provides. Producing low-quality goods or services can cause an organization to lose customers, ultimately affecting revenue. These risks are realized when product quality drops for any reason — whether that’s technology changes, outages, employee errors, or supply chain disruptions.

Steps in the Risk Management Process

The six risk management process steps that we’ve outlined below will give you and your organization a starting point to implement or improve your risk management practices. In order, the risk management steps are:

- Risk identification

- Risk analysis or assessment

- Controls implementation

- Resource and budget allocation

- Risk mitigation

- Risk monitoring, reviewing, and reporting

If this is your organization’s first time setting up a risk management program, consider having a formal risk assessment completed by an experienced third party, with the goal of producing a risk register and prioritized recommendations on what activities to focus on first. Annual (or more frequent) risk assessments are usually required when pursuing compliance and security certifications, making them a valuable investment.

Step 1: Risk Identification

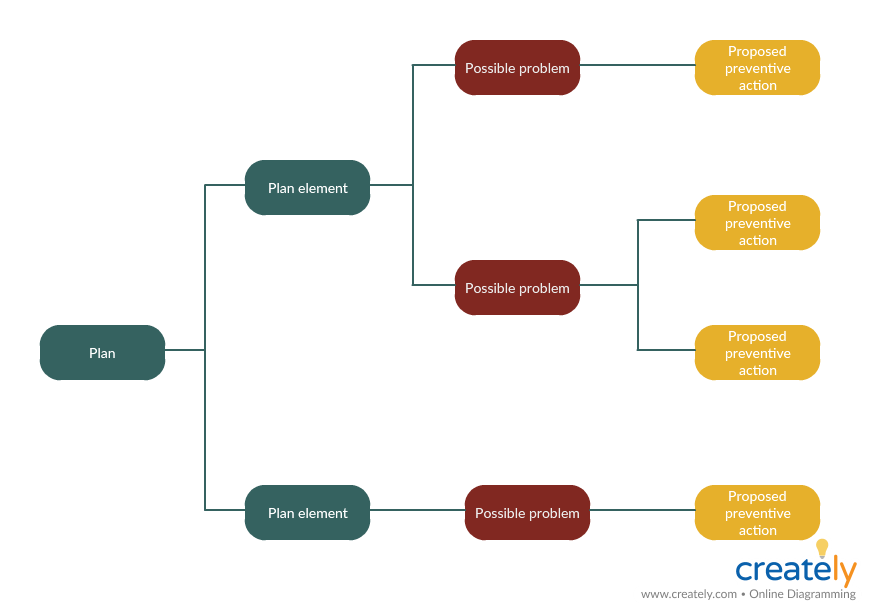

The first step in the risk management process is risk identification. This step takes into account the organization’s overarching goals and objectives, ideally through conversations with management and leadership. Identifying risks to company goals involves asking, “What could go wrong?” with the plans and activities aimed at meeting those goals. As an organization moves from macro-level risks to more specific function and process-related risks, risk teams should collaborate with critical stakeholders and process owners, gaining their insight into the risks that they foresee.

As risks are identified, they should be captured in formal documentation — most organizations do this through a risk register, which is a database of risks, risk owners, mitigation plans, and risk scores.

Step 2: Risk Analysis or Assessment

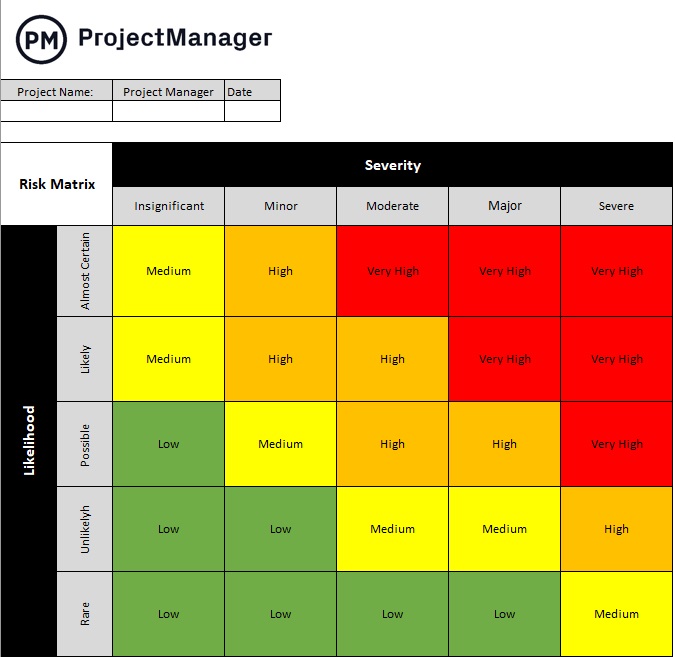

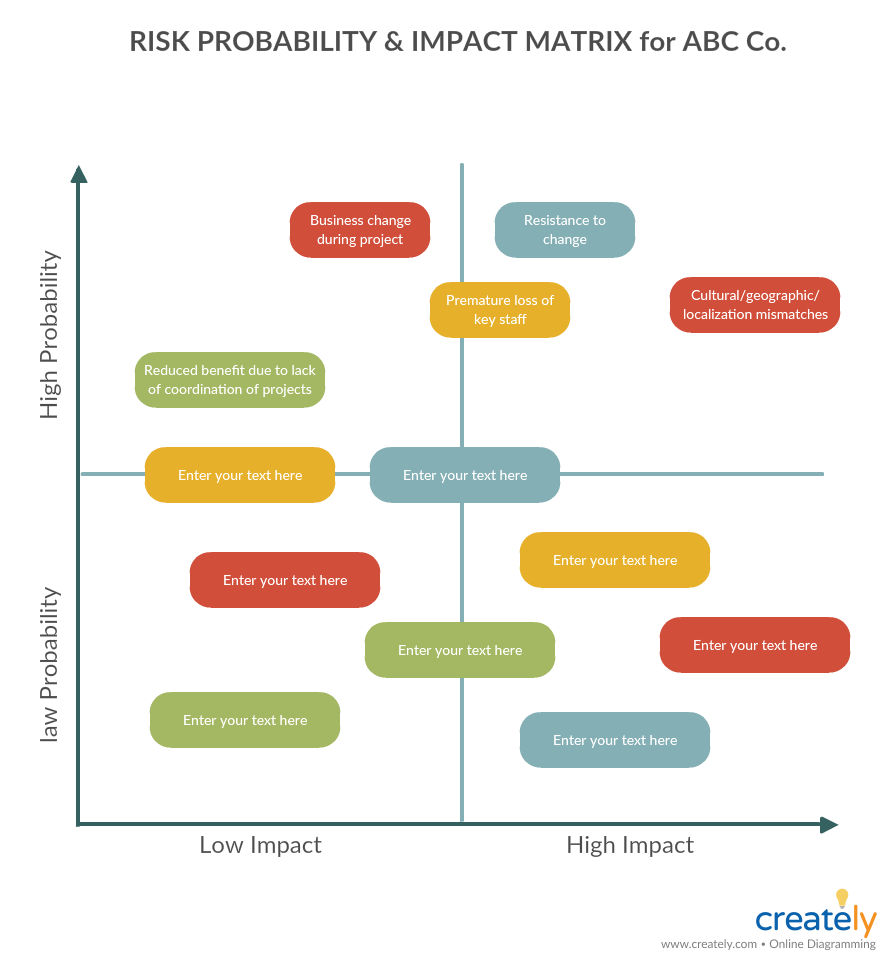

Analyzing risks, or assessing risks, involves looking at the likelihood that a risk will be realized, and the potential impact that risk would have on the organization if that risk were realized. By quantifying these on a three- or five-point scale, risk prioritization becomes simpler. Multiplying the risk’s likelihood score with the risk’s impact score generates the risk’s overall risk score. This value can then be compared to other risks for prioritization purposes.

The likelihood that a risk will be realized asks the risk assessor to consider how probable it would be for a risk to actually occur. Lower scores indicate less chances that the risk will materialize. Higher scores indicate more chances that the risk will occur.

Likelihood, on a 5×5 risk matrix, is broken out into:

- Highly Unlikely

- Highly Likely

The potential impact of a risk, should it be realized, asks the risk assessor to consider how the business would be affected if that risk occurred. Lower scores signal less impact to the organization, while higher scores indicate more significant impacts to the company.

Impact, on a 5×5 risk matrix, is broken out into:

- Negligible Impact

- Moderate Impact

- High Impact

- Catastrophic Impact

Risk assessment matrices help visualize the relationship between likelihood and impact, serving as a valuable tool in risk professionals’ arsenals.

Organizations can choose whether to employ a 5×5 risk matrix, as shown above, or a 3×3 risk matrix, which breaks likelihood, impact, and aggregate risk scores into low, moderate, and high categories.

Step 3: Controls Assessment and Implementation

Once risks have been identified and analyzed, controls that address or partially address those risks should be mapped. Any risks that don’t have associated controls, or that have controls that are inadequate to mitigate the risk, should have controls designed and implemented to do so.

Step 4: Resource and Budget Allocation

This step, the resource and budget allocation step, doesn’t get included in a lot of content about risk management. However, many businesses find themselves in a position where they have limited resources and funds to dedicate to risk management and remediation. Developing and implementing new controls and control processes is timely and costly; there’s usually a learning curve for employees to get used to changes in their workflow.

Using the risk register and corresponding risk scores, management can more easily allocate resources and budget to priority areas, with cost-effectiveness in mind. Each year, leadership should re-evaluate their resource allocation as part of annual risk lifecycle practices.

Step 5: Risk Mitigation

The risk mitigation step of risk management involves both coming up with the action plan for handling open risks, and then executing on that action plan. Mitigating risks successfully takes buy-in from various stakeholders. Due to the various types of risks that exist, each action plan may look vastly different between risks.

For example, vulnerabilities present in information systems pose a risk to data security and could result in a data breach. The action plan for mitigating this risk might involve automatically installing security patches for IT systems as soon as they are released and approved by the IT infrastructure manager. Another identified risk could be the possibility of cyber attacks resulting in data exfiltration or a security breach. The organization might decide that establishing security controls is not enough to mitigate that threat, and thus contract with an insurance company to cover off on cyber incidents. Two related security risks; two very different mitigation strategies.

One more note on risk mitigation — there are four generally accepted “treatment” strategies for risks. These four treatments are:

- Risk Acceptance: Risk thresholds are within acceptable tolerance, and the organization chooses to accept this risk.

- Risk Transfer : The organization chooses to transfer the risk or part of the risk to a third party provider or insurance company.

- Risk Avoidance : The organization chooses not to move forward with that risk and avoids incurring it.

- Risk Mitigation : The organization establishes an action plan for reducing or limiting risk to acceptable levels.

If an organization is not opting to mitigate a risk, and instead chooses to accept, transfer, or avoid the risk, these details should still be captured in the risk register, as they may need to be revisited in future risk management cycles.

Step 6: Risk Monitoring, Reviewing, and Reporting

The last step in the risk management lifecycle is monitoring risks, reviewing the organization’s risk posture, and reporting on risk management activities. Risks should be monitored on a regular basis to detect any changes to risk scoring, mitigation plans, or owners. Regular risk assessments can help organizations continue to monitor their risk posture. Having a risk committee or similar committee meet on a regular basis, such as quarterly, integrates risk management activities into scheduled operations, and ensures that risks undergo continuous monitoring. These committee meetings also provide a mechanism for reporting risk management matters to senior management and the board, as well as affected stakeholders.

As an organization reviews and monitors its risks and mitigation efforts, it should apply any lessons learned and use past experiences to improve future risk management plans.

Examples of Risk Management Strategies

Depending on your company’s industry, the types of risks it faces, and its objectives, you may need to employ many different risk management strategies to adequately handle the possibilities that your organization encounters.

Some examples of risk management strategies include leveraging existing frameworks and best practices, minimum viable product (MVP) development, contingency planning, root cause analysis and lessons learned, built-in buffers, risk-reward analysis, and third-party risk assessments.

Leverage Existing Frameworks and Best Practices

Risk management professionals need not go it alone. There are several standards organizations and committees that have developed risk management frameworks, guidance, and approaches that business teams can leverage and adapt for their own company.

Some of the more popular risk management frameworks out there include:

- ISO 31000 Family : The International Standards Organization’s guidance on risk management.

- NIST Risk Management Framework (RMF) : The National Institute of Standards and Technology has released risk management guidance compatible with their Cybersecurity Framework (CSF).

- COSO Enterprise Risk Management (ERM) : The Committee of Sponsoring Organizations’ enterprise risk management guidance.

Minimum Viable Product (MVP) Development

This approach to product development involves developing core features and delivering those to the customer, then assessing response and adjusting development accordingly. Taking an MVP path reduces the likelihood of financial and project risks, like excessive spend or project delays by simplifying the product and decreasing development time.

Contingency Planning

Developing contingency plans for significant incidents and disaster events are a great way for businesses to prepare for worst-case scenarios. These plans should account for response and recovery. Contingency plans specific to physical sites or systems help mitigate the risk of employee injury and outages.

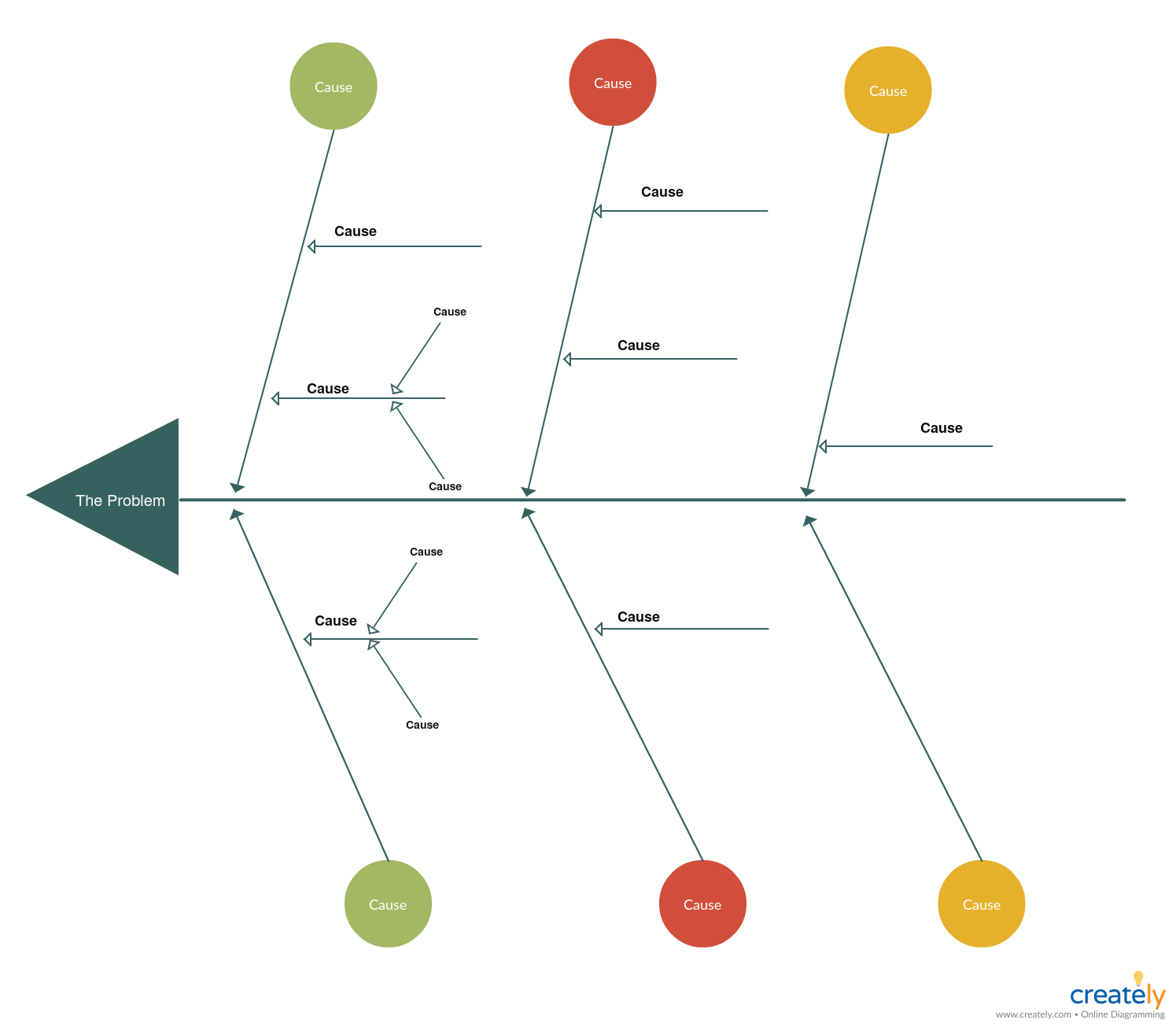

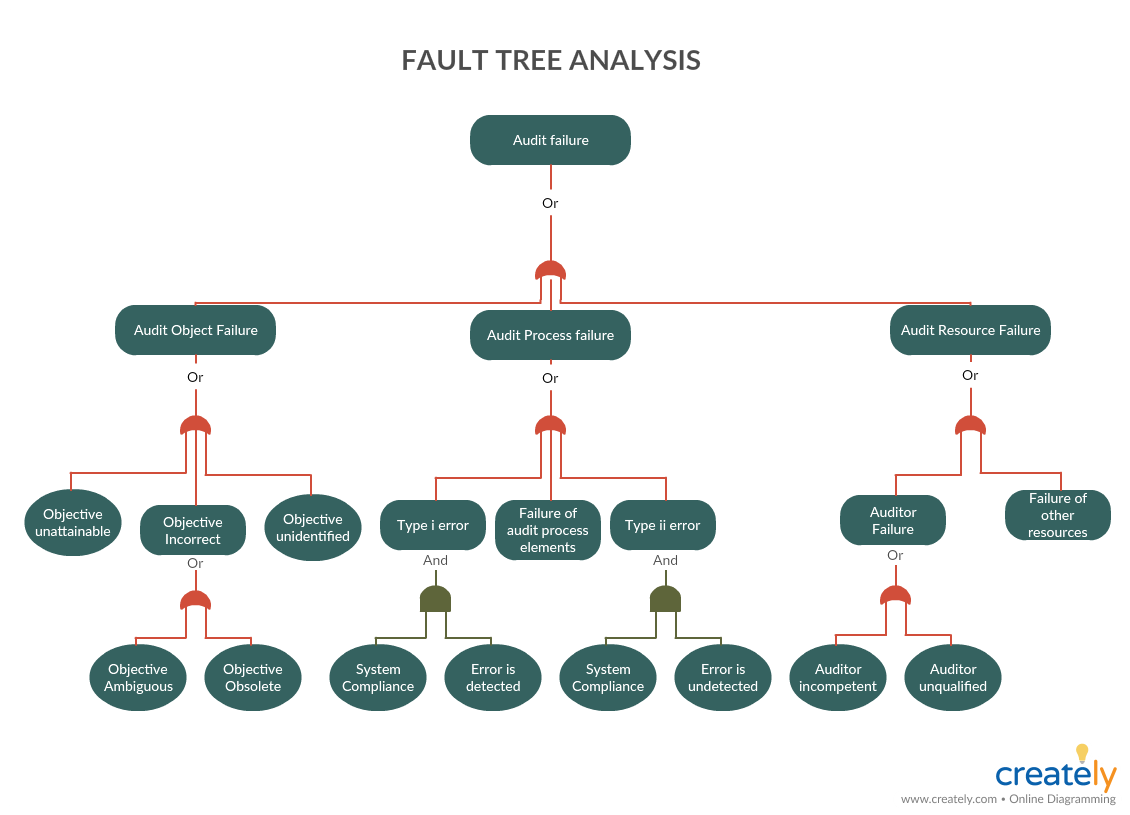

Root Cause Analysis and Lessons Learned

Sometimes, experience is the best teacher. When an incident occurs or a risk is realized, risk management processes should include some kind of root cause analysis that provides insights into what can be done better next time. These lessons learned, integrated with risk management practices, can streamline and optimize response to similar risks or incidents.

Built-In Buffers

Applicable to discrete projects, building in buffers in the form of time, resources, and funds can be another viable strategy to mitigate risks. As you may know, projects can get derailed very easily, going out of scope, over budget, or past the timeline. Whether a project team can successfully navigate project risks spells the success or failure of the project. By building in some buffers, project teams can set expectations appropriately and account for the possibility that project risks may come to fruition.

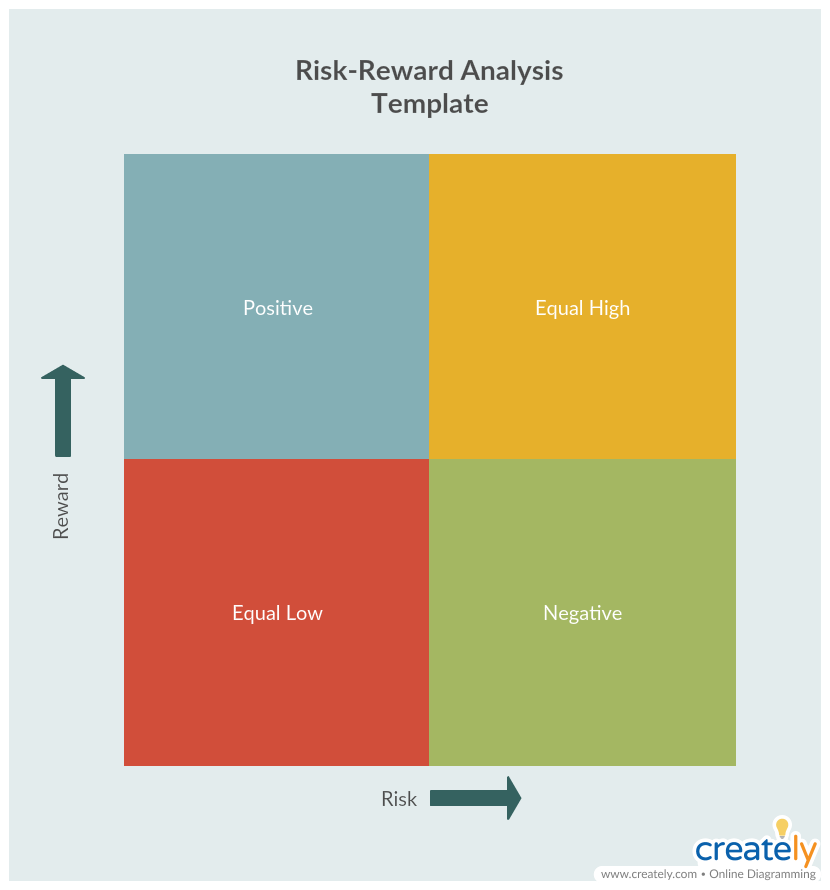

Risk-Reward Analysis

In a risk-reward analysis, companies and project teams weigh the possibility of something going wrong with the potential benefits of an opportunity or initiative. This analysis can be done by looking at historical data, doing research about the opportunity, and drawing on lessons learned. Sometimes the risk of an initiative outweighs the reward; sometimes the potential reward outweighs the risk. At other times, it’s unclear whether the risk is worth the potential reward or not. Still, a simple risk-reward analysis can keep organizations from bad investments and bad deals.

Third-Party Risk Assessments

Another strategy teams can employ as part of their risk management plan is to conduct periodic third-party risk assessments. In this method, a company would contract with a third party experienced in conducting risk assessments, and have them perform one (or more) for the organization. Third-party risk assessments can be immensely helpful for the new risk management team or for a mature risk management team that wants a new perspective on their program.

Generally, third-party risk assessments result in a report of risks, findings, and recommendations. In some cases, a third-party provider may also be able to help draft or provide input into your risk register. As external resources, third-party risk assessors can bring their experience and opinions to your organization, leading to insights and discoveries that may not have been found without an independent set of eyes.

Components of an Effective Risk Management Plan

An effective risk management plan has buy-in from leadership and key stakeholders; applies the risk management steps; has good documentation; and is actionable. Buy-in from management often determines whether a risk management function is successful or not, since risk management requires resources to conduct risk assessments, risk identification, risk mitigation, and so on. Without leadership buy-in, risk management teams may end up just going through the motions without the ability to make an impact. Risk management plans should be integrated into organizational strategy, and without stakeholder buy-in, that typically does not happen.

Applying the risk management methodology is another key component of an effective plan. That means following the six steps outlined above should be incorporated into a company’s risk management lifecycle. Identifying and analyzing risks, establishing controls, allocating resources, conducting mitigation, and monitoring and reporting on findings form the foundations of good risk management.

Good documentation is another cornerstone of effective risk management. Without a risk register recording all of a company’s identified risks and accompanying scores and mitigation strategies, there would be little for a risk team to act on. Maintaining and updating the risk register should be a priority for the risk team — risk management software can help here, providing users with a dashboard and collaboration mechanism.

Last but not least, an effective risk management plan needs to be actionable. Any activities that need to be completed for mitigating risks or establishing controls, should be feasible for the organization and allocated resources. An organization can come up with the best possible, best practice risk management plan, but find it completely unactionable because they don’t have the capabilities, technology, funds, and/or personnel to do so. It’s all well and good to recommend that cybersecurity risks be mitigated by setting up a 24/7 continuous monitoring Security Operations Center (SOC), but if your company only has one IT person on staff, that may not be a feasible action plan.

Executing on an effective risk management plan necessitates having the right people, processes, and technology in place. Sometimes the challenges involved with running a good risk management program are mundane — such as disconnects in communication, poor version control, and multiple risk registers floating around. Risk management software can provide your organization with a unified view of the company’s risks, a repository for storing and updating key documentation like a risk register, and a space to collaborate virtually with colleagues to check on risk mitigation efforts or coordinate on risk assessments. Get started building your ideal risk management plan today!

Emily Villanueva, MBA, is a Senior Manager of Product Solutions at AuditBoard. Emily joined AuditBoard from Grant Thornton, where she provided consulting services specializing in SOX compliance, internal audit, and risk management. She also spent 5 years in the insurance industry specializing in SOX/ICFR, internal audits, and operational compliance. Connect with Emily on LinkedIn .

Related Articles

- Twitter icon

- Facebook icon

- LinkedIn icon

7 Steps to Write a Risk Management Plan For Your Next Project (With Free Template!)

🎁 Bonus Material: Free Risk Management Template

5 Steps to Find Your Definition of Done (With Examples and Workflows)

3 Steps to Minimize Workplace Distraction And Take Back Control of your Focus

The Essential Guide to Writing a Project Communication Plan: What It Is and Why You (Actually) Need One

Working with planio, see how our customers use planio.

Introduction to Risk Assessment in Project Management

Project Management Institute’s (PMI) inclusion of risk management skills in multiple PMI certifications indicates the importance of risk across industries and in all projects. The risk management process includes risk identification and risk assessment. During an assessment, the project manager uses standard risk tools and quality data to help the team better avert later problems, manage the project cost, and keep project work on schedule. Risk assessment is the process by which the identified risks are systematically analyzed to determine their probability of occurrence and the potential impact of that occurrence.

On this page:

What is a risk assessment?

What are risk assessment pmp and risk reassessment pmp, when is a risk assessment needed, why is a risk assessment important, example use of risk assessment: hurricane impacting town, what inputs are needed for a risk assessment, what is a risk data quality assessment pmp, what outputs does a risk assessment generate, how to create a risk assessment, risk assessment matrix, risk assessment best practices, risk assessment pmp and risk reassessment pmp.

Get Your Comprehensive Guide to Risk Management

Learn how to manage risk in every project.

Project teams use risk assessment, a qualitative measure using risk data and the parameters of probability and impact, to identify, categorize, prioritize, and manage risks before they happen.

A “risk reassessment” is the work done to update the original risk assessment due to changes in the project or overall risk management efforts.

For the original and subsequent assessments, the quality of data used to determine the impact directly correlates to the accuracy of the risk assessment and resulting decisions.

Project Management Professional (PMP)® credential holders have shown their knowledge of a risk assessment and their understanding of the high cost of a failure to do a risk assessment. For the PMP certification exam, students need to know the importance of a risk assessment and how to use a probability and impact scoring matrix to help inform the priority of the risk.

Within the PMP exam context, “risk assessment PMP” and “risk reassessment PMP” are informal terms referring to taking identified risks and assessing them using qualitative data, such as the probability of occurrence, to determine the potential impact. From that, project managers determine the risk score, which is an input to subsequent risk response activities.

Risk identification should happen early in the project , closely followed by the risk assessment. Project teams should conduct risk reassessment throughout the life of a project. Updating the risk register is a good reminder to update the corresponding risk assessment. The project’s scope and risk management plan will inform how frequently the reassessment should be conducted (projects of bigger scope should have more reassessments; similarly, smaller scope requires fewer reassessments).

Performing a risk assessment is critical to ensuring the success of a project because it puts the project team in a state of preparedness. When done with verified tools and quality inputs, risk assessment may take time but can prevent problems from negative risks and enable opportunities from positive risks. As shared in the PMI conference paper Risk Assessments—developing the right assessment for your organization , “The best project organizations are those who realize that a risk assessment template is a valuable asset in managing the organization’s bottom line.” Risk assessment connects to managing cost, timelines, and quality.

For an example of how a risk assessment can be used, we use the example of a small municipality located on the east coast of North Carolina. The coastal town has been impacted by natural disasters in the form of hurricanes several times in the past fifty years. A hurricane is a storm that starts in the ocean and moves inland, causing all levels of flooding, electrical storms, and damaging winds. The National Weather Service provides annual forecasts of which geographic regions are predicted to have hurricanes, as well as the number of occurrences and strength of hurricanes.

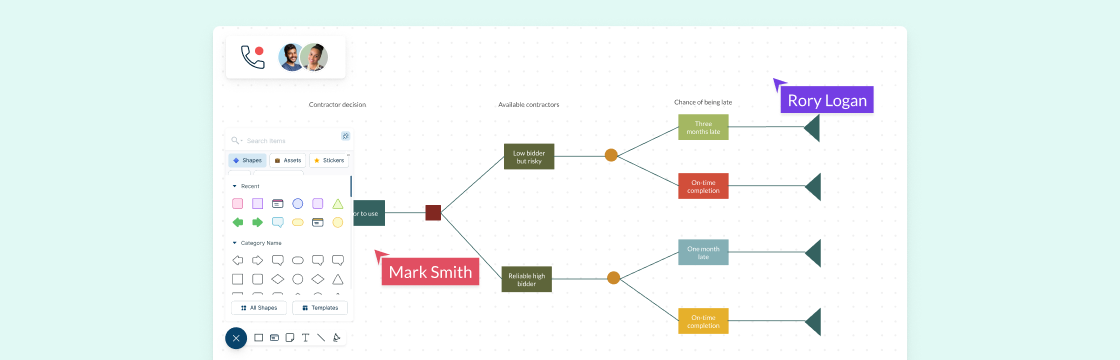

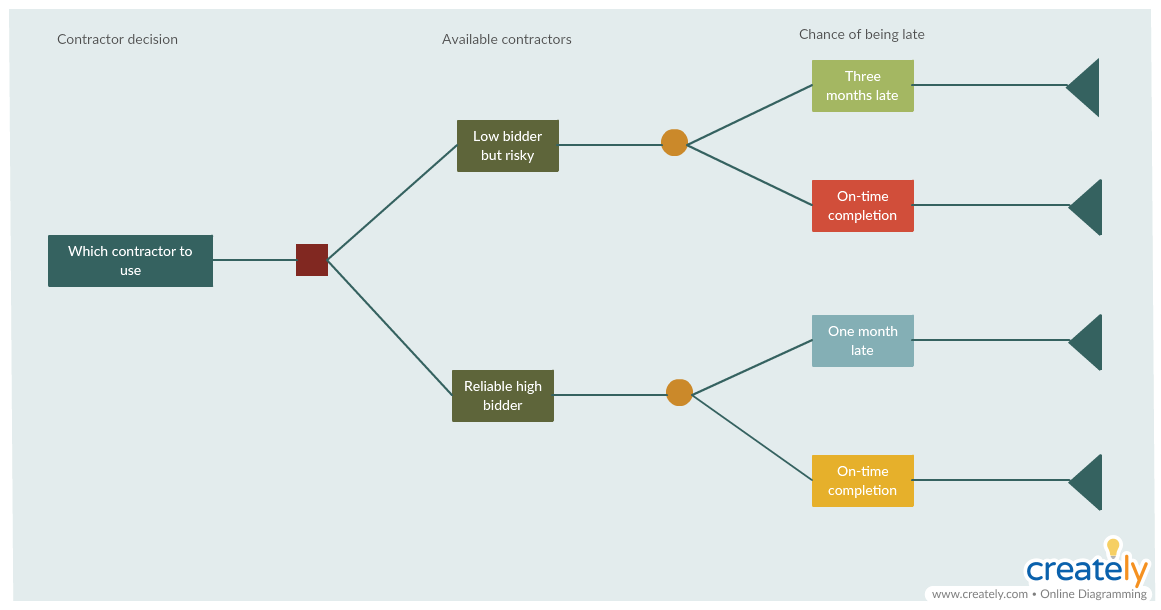

The town manager (“project manager”) and the town administration (“project team”) know a hurricane will happen but not when or how strong it may be. In the risk category of weather events, the project manager and project team identify the risk type of hurricane storm. Then the project team identifies specific potential risks, such as flooding that may cause building damage. The team assesses each risk in terms of probability (or how likely it is to occur), the impact if it occurs, and the probability-impact score (weighing the significance of the risk on the project). The information is captured in a risk assessment matrix as part of the project management and risk management documentation.

For example, they do a risk assessment after the project manager and team identify the risk of water damage to downtown buildings due to hurricane-induced flooding. The team uses standard tools to determine the probability of that specific risk (flooding) and the impact if it occurs (water damage to buildings). The project team uses verified data, like National Weather Service hurricane projections, for probability estimates. For the potential impact, the project team uses cost and quality data like town records to determine what could happen to town property. The data and risk scoring are organized in the project risk assessment matrix and communicated to stakeholders.

Continuing our example of the identified risk of water damage to ground floors, if the assessment indicates the risk is highly likely to occur with a high impact of damage, it will have a higher risk score. That can mean more time invested in risk response planning (such as securing funding to buy and store sandbag materials during flooding to reduce the impact of water damage on buildings). The risk response plan would likely include purchasing sandbag materials before a hurricane, storing them in an accessible space, and training the town staff to set up the sandbags to protect critical buildings when a hurricane is imminent. The cost of buying and storing sandbag materials to protect the buildings is much lower than the cost of fully repairing water-damaged buildings.

In this risk example, the project team:

- determined the appropriate risk categories (natural disasters)

- determined the types within the category (hurricane storms)

- identified a risk event (hurricane bringing flooding to downtown buildings),

- assessed the impact of that risk (flooding damages ground floors),

- assessed the probability of the impact (flooding may be higher or lower but always occurs with hurricanes),

- documented the risk information, including risk scores in the risk assessment matrix,

- communicated the risk assessment results to the team and stakeholders, and then

- used the risk assessment matrix as an input for risk response planning (making sandbag materials available when needed and training people to set them up).

With this example, you should see the risk assessment allows the project team to identify, categorize, prioritize, and mitigate/avoid/exploit risks prior to their occurrence. A risk assessment is a proactive approach in which the risk is identified and assessed to manage cost, reduce negative impact, and protect the project (in this example, town buildings).

A risk assessment should be customized to fit the project context. Standard risk assessment inputs include:

- Project management plan

- Risk management plan

- Risk assessment methodology

- Risk parameter definitions

- Risk tolerance levels

- Risk probability and impact matrix template

- Risk assessment scale (what criteria are used to determine if the risk score is high, mid, or low)

- Risk assessment matrix template

Project managers and project management students use what is informally referred to as the “assessment of other risk parameters PMP” to tailor their risk assessment to a specific project. While probability and impact values are used in all risk assessments, additional parameters, like cost or schedule, can be standalone matrices.

Risk assessment is a qualitative assessment. Therefore, risk data quality (sometimes referred to as “risk data quality assessment PMP”) always impacts the risk assessment quality. A risk data audit helps ensure the quality of data used in the risk assessment. Project managers may use experts or previous project documentation as part of the risk data quality assessment to ensure the accuracy of the overall risk assessment.

The risk assessment outputs are part of the overall project and risk management documentation. A risk assessment can generate the following:

- Project Management Plan updates

- Project document updates

- Risk Management Plan updates

- Risk Register updates

- Risk Response Plan updates

Risk assessment should occur throughout the project. With each iteration, known as a risk reassessment, the risk documentation should be updated accordingly.

For the PMP exam, students need to know the importance of a risk assessment and how to use a probability and impact scoring matrix to help inform the priority of the risk. Project Managers and PMP credential holders should know the seven steps to risk assessment.

1. Identify applicable risk types and organize them

You cannot assess risk if you have not identified it. Begin your risk assessment with risk identification. With your project team, identify potential scenarios that could harm your project. Risks can be of any size and with internal or external triggers. Your team may identify risks that include computer viruses, manufacturing defects, natural disasters, or shipping delays. Each risk is identified and documented in the risk register. The risk may be organized by different factors (internal or external triggers, for example) or by categories (environmental, regulatory, technology, or staffing, for example).

2. Determine how these risks will be qualified and quantified

With risks identified and organized, the project manager should conduct a risk assessment. Each risk must be qualified and quantified. The project manager will use a probability and impact matrix to document the probability of each risk and the impact if it does happen. Remember, the quality of the data used in the assessment impacts its accuracy.

3. Determine your organization’s risk tolerance

Every organization has a risk tolerance level, with variances due to the type of risk, the specific stakeholders of a project, and the scope of the project. Additionally, there are industries with negligible risk tolerance (such as health care) and others with an acceptance of some level of risk (like software development). While every organization has a risk tolerance level, so the project manager should get stakeholder input to determine risk tolerance for each project.

4. Determine the final output format of the risk assessment

Within the risk management activities, determine during the risk planning process how the risk assessment output should be documented and communicated. Spreadsheet programs are often used for the ease of organizing large data sets. However, a company may have risk assessment output requirements, such as storing it on a secure server or capturing it in a shareable file, determining the output format. How the risk assessment output is documented is important because it determines how the information is made available to the project team and stakeholders.

5. Create a plan to maximize the risk assessments applicability to every project

Within a risk assessment and the resulting risk response plan, project managers have a wealth of knowledge that can protect the active project and future projects.

Project managers should have a plan to document the risk assessment, the result of risk responses applied to risks that occur, and the risk assessment matrices with the appropriate risk parameters. Maintaining a consistent and detailed project documentation archive helps ensure a project’s lessons learned are available to other project managers with similar projects, which can reduce the impact of negative risks. The plan should include documentation format requirements, how assessment documentation will be accessed, and how the assessment (and reassessments) will be communicated to the project team and stakeholders.

6. Create a final risk assessment that is flexible and scalable

Knowing the project manager and team will be doing reassessments throughout the project as part of risk reassessment, the process must be flexible and scalable. You may have to add risks throughout the project or incorporate other criteria to ensure the accuracy of the probability and impact scores. Additionally, the risk assessment should work for projects of different scopes. The risk assessment should be flexible enough to remain aligned with project changes and scalable enough to be used in multiple projects.

7. Determine the process to update the risk assessment

PMP credential holders know the importance of risk assessment and reassessment in managing the project cost. Without a process to update risk assessments, the project is vulnerable when risks occur. Changes are inevitable, and a risk assessment that is not current is not effective. Project managers should have a consistent risk assessment update process within their overall risk management activities.

Risk management documentation, such as the risk assessment matrix, is part of the overall project management documentation. The risk matrix documents at least four core areas for each identified risk: (1) risk name, (2) probability, (3) impact, and (4) risk level/ranking. The risk assessment also includes the calculated overall Project Risk score (the project’s probability-impact, or PI, score). The risk assessment matrix is an output of the Risk Assessment process and an input to the Risk Response process.

In a risk assessment matrix, each identified risk is listed along with its corresponding information.:

RISK CATEGORY

- Risk category : from a standardized list of risk categories (e.g., technology, natural disaster, regulations, transportation, etc.), the ones that most closely align with the project are used; not all projects have risks in all categories; therefore, each project will have a different combination of risk categories in its matrix

PROBABILITY

- Probability criteria : used to assign the probability values for a risk category; criteria should come from a standardized list but customized for each project

- Probability (“P”) score : a value given to each risk driven by the probability criteria; the matrix’s score scale will state the parameters for the minimum and maximum value of a P score; the project manager and project team use data and criteria to assign the P score to each risk

- Impact criteria : used to assign the impact values for a risk category; criteria should come from a standardized list but customized for each project

- Impact (“I”) score : a value given to each risk driven by the impact criteria; the matrix’s score scale will state the parameters for the minimum and maximum value of an I score; the project manager and project team use data and criteria to assign the I score to each risk

PROBABILITY AND IMPACT VALUES

- Probability-to-Impact (“PI”) score : the Probability score multiplied by the Impact score results in the PI score; the PI score is the overall risk assessment score; the PI score is used to rank all project risks by lowest probability and impact to highest, so resources are assigned accordingly

- Total Project Risk : all PI scores are added, and then that sum is divided by the quantity (total number of risks) of risks to determine the average; the project’s PI average value of PI scores is the Total Project Risk value.

Probability and impact are integral data points for risk assessment. Project risk tailoring occurs within the specifics of the risk categories, probability criteria, and impact criteria.

Risk Assessment Matrix Example

Project Manager Kestel’s PMI conference paper “ Risk assessments—developing the risk assessment for your organization ” includes an example risk assessment matrix:

From the completed risk assessment matrix, the project manager communicates the total Project Risk score to the team and stakeholders. Communication is part of risk assessment and helps ensure commonly understood terms are used for standardized risk assessment processes.

The risk matrix template ensures key data is consistently defined and included in the project documentation. For a risk matrix , project managers work with the project team and stakeholders to determine the specific risk criteria and refine the criteria for probability and impact. The format of the risk matrix should be determined early in the project and use company standards for project tools when available. The risk matrix should be stored with other project documentation, along with all risk reassessments for a project.

Project managers should complete the risk assessment as part of their risk management activities for all projects. Best practices for risk assessment include:

- Risk assessments should use quality data.

- Risk assessments incorporate expertise and knowledge from the project team and stakeholders.

- Risk data should undergo an audit to determine quality.

- Risk reassessment is conducted frequently throughout the life of a project.

- Risk assessments should use tailored and scalable tools.

- Risk assessment results, including the overall project risk score, are communicated to the team and stakeholders.

Project Managers should:

- lead the risk assessment efforts using standard tools

- customize the risk assessment matrix to the specific needs of the project,

- document the probability and impact of each risk,

- use standard data and terms for risk audit efforts, and

- communicate risk assessment progress and results to the project team and stakeholders.

Project managers should customize the risk assessment criteria to the project type. For example, you would not assess the risk of a particular weather event occurring using the criteria for the probability of manufacturing defects.

Additionally, project managers should use organizational templates and project management office (PMO) standards when available in their company. Customization of a project’s risk assessment should be balanced against the need for standards to contribute to knowledge sharing. No single tool will ensure quality assessment for all projects, but there are standards shared by all projects.

To prepare for the PMP exam, students need to know the importance of risk assessment and how to use a probability and impact scoring matrix to help inform the priority of the risk. Students should understand that a risk assessment is a tool to help manage the project’s cost by closely monitoring highly probable and high (negative or positive) impact risks.

American billionaire fund manager and philanthropist Bruce Kovner is credited with saying, “Risk management is the most important thing to be well understood.” A project manager with the PMP credential has demonstrated knowledge of risk assessment and the role it serves within risk management. Remember these components of creating a risk assessment:

- identify applicable risk types and organize them

- determine how risks will be qualified and quantified

- determine your organization’s risk tolerance

- determine the final output format of the risk assessment

- create a plan to maximize the risk assessment’s applicability to every project

- create a final risk assessment that is flexible and scalable

- determine a process to update the risk assessment

Project Managers managing risk using a scalable risk assessment template and standard processes consistently have successful projects. In addition to earning PMI’s Project Management Professional (PMP) certification, you may continue your certification journey by pursuing the PMI Risk Management Professional (PMP-RMP)® certification to advance your risk project management skills further.

- Megan Bell #molongui-disabled-link What is a Project Schedule Network Diagram?

- Megan Bell #molongui-disabled-link Scheduling Methodology: Build & Control Your Project Schedule

- Megan Bell #molongui-disabled-link Schedule Baseline: How to Create, Use, and Optimize

- Megan Bell #molongui-disabled-link How to Use Agile in Project Management as a PMP® Credential Holder

Popular Courses

PMP Exam Preparation

PMI-ACP Exam Preparation

Lean Six Sigma Green Belt Training

CBAP Exam Preparation

Corporate Training

Project Management Training

Agile Training

Read Our Blog

Press Release

Connect With Us

PMI, PMBOK, PMP, CAPM, PMI-ACP, PMI-RMP, PMI-SP, PMI-PBA, The PMI TALENT TRIANGLE and the PMI Talent Triangle logo, and the PMI Authorized Training Partner logo are registered marks of the Project Management Institute, Inc. | PMI ATP Provider ID #3348 | ITIL ® is a registered trademark of AXELOS Limited. The Swirl logo™ is a trademark of AXELOS Limited | IIBA ® , BABOK ® Guide and Business Analysis Body of Knowledge ® are registered trademarks owned by International Institute of Business Analysis. CBAP ® , CCBA ® , IIBA ® -AAC, IIBA ® -CBDA, and ECBA™ are registered certification marks owned by International Institute of Business Analysis. | BRMP ® is a registered trademark of Business Relationship Management Institute.

- Contact sales

Start free trial

The Risk Management Process in Project Management

When you start the planning process for a project, one of the first things you need to think about is: what can go wrong? It sounds negative, but pragmatic project managers know this type of thinking is preventative. Issues will inevitably come up, and you need a mitigation strategy in place to know how to manage risks when project planning .

But how do you work towards resolving the unknown? It sounds like a philosophical paradox, but don’t worry—there are practical steps you can take. In this article, we’ll discuss strategies that let you get a glimpse at potential risks, so you can identify and track risks on your project.

What Is Risk Management on Projects?

Project risk management is the process of identifying, analyzing and responding to any risk that arises over the life cycle of a project to help the project remain on track and meet its goal. Risk management isn’t reactive only; it should be part of the planning process to figure out the risk that might happen in the project and how to control that risk if it in fact occurs.

A risk is anything that could potentially impact your project’s timeline, performance or budget. Risks are potentialities, and in a project management context, if they become realities, they then become classified as “issues” that must be addressed with a risk response plan . So risk management, then, is the process of identifying, categorizing, prioritizing and planning for risks before they become issues.

Risk management can mean different things on different types of projects. On large-scale projects, risk management strategies might include extensive detailed planning for each risk to ensure mitigation strategies are in place if project issues arise. For smaller projects, risk management might mean a simple, prioritized list of high, medium and low-priority risks.

Get your free

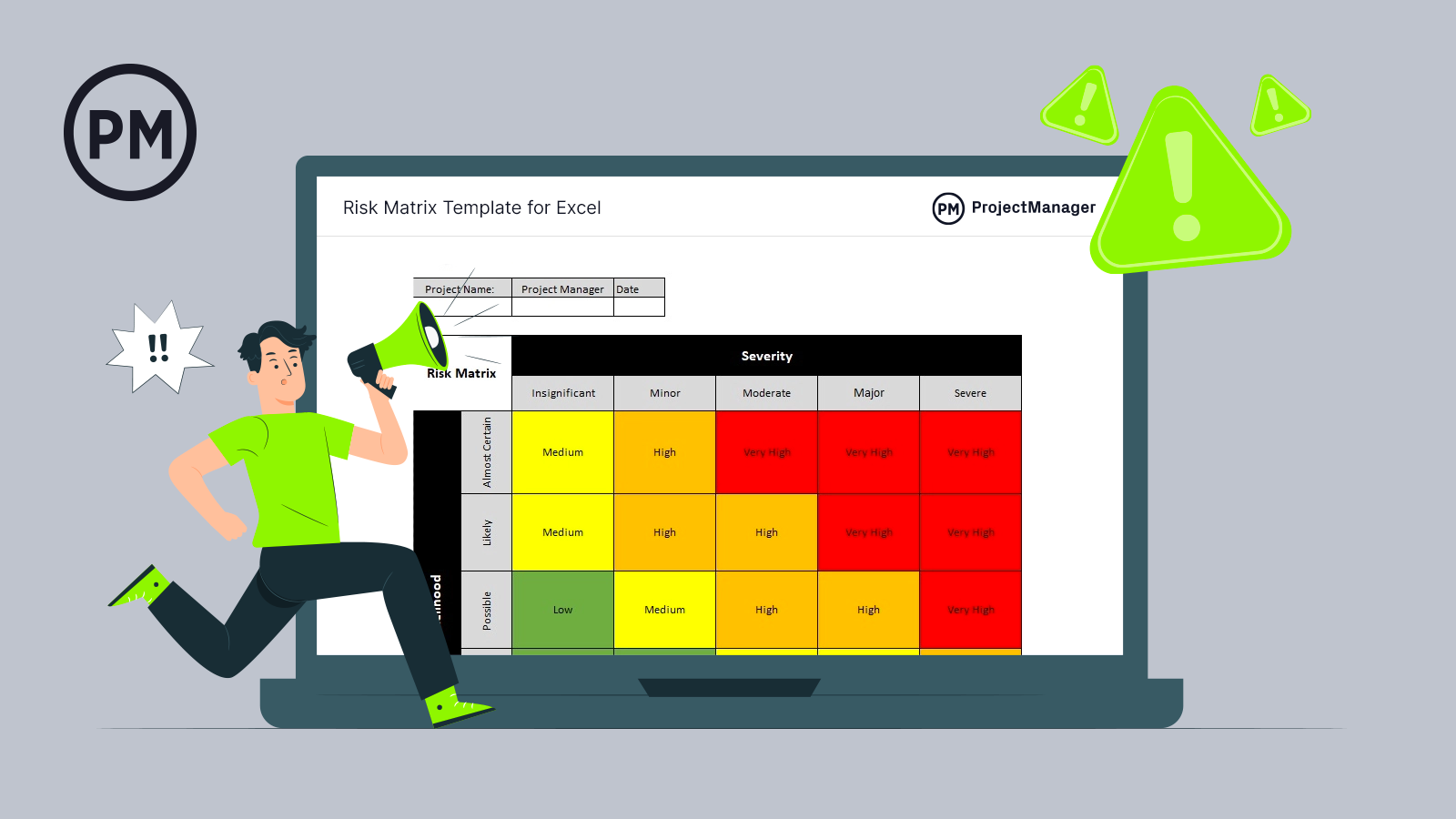

Risk Matrix Template

Use this free Risk Matrix Template for Excel to manage your projects better.

How to Manage Project Risk

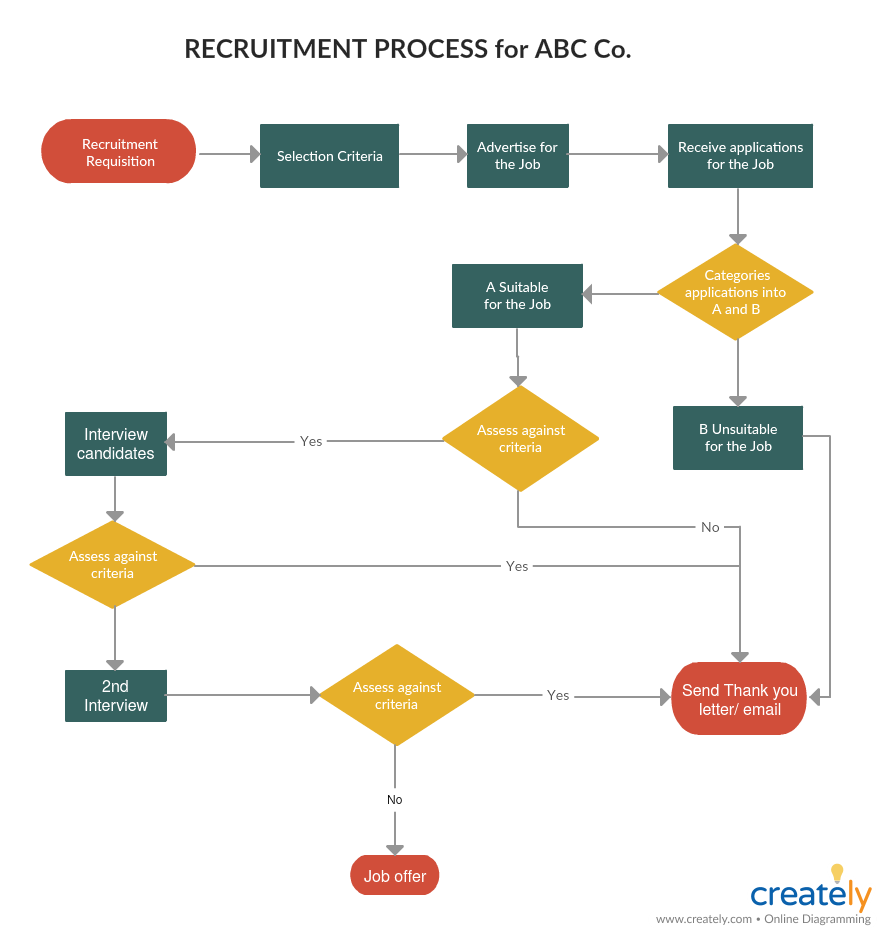

To begin managing risk, it’s crucial to start with a clear and precise definition of what your project has been tasked to deliver. In other words, write a very detailed project charter , with your project vision, objectives, scope and deliverables. This way risks can be identified at every stage of the project. Then you’ll want to engage your team early in identifying any and all risks.

Don’t be afraid to get more than just your team involved to identify and prioritize risks, too. Many project managers simply email their project team and ask to send them things they think might go wrong on the project. But to better plot project risk, you should get the entire project team, your client’s representatives, and vendors into a room together and do a risk identification session.

With every risk you define, you’ll want to log it somewhere—using a risk tracking template helps you prioritize the level of risk. Then, create a risk management plan to capture the negative and positive impacts of the project and what actions you will take to deal with them. You’ll want to set up regular meetings to monitor risk while your project is ongoing. Transparency is critical.

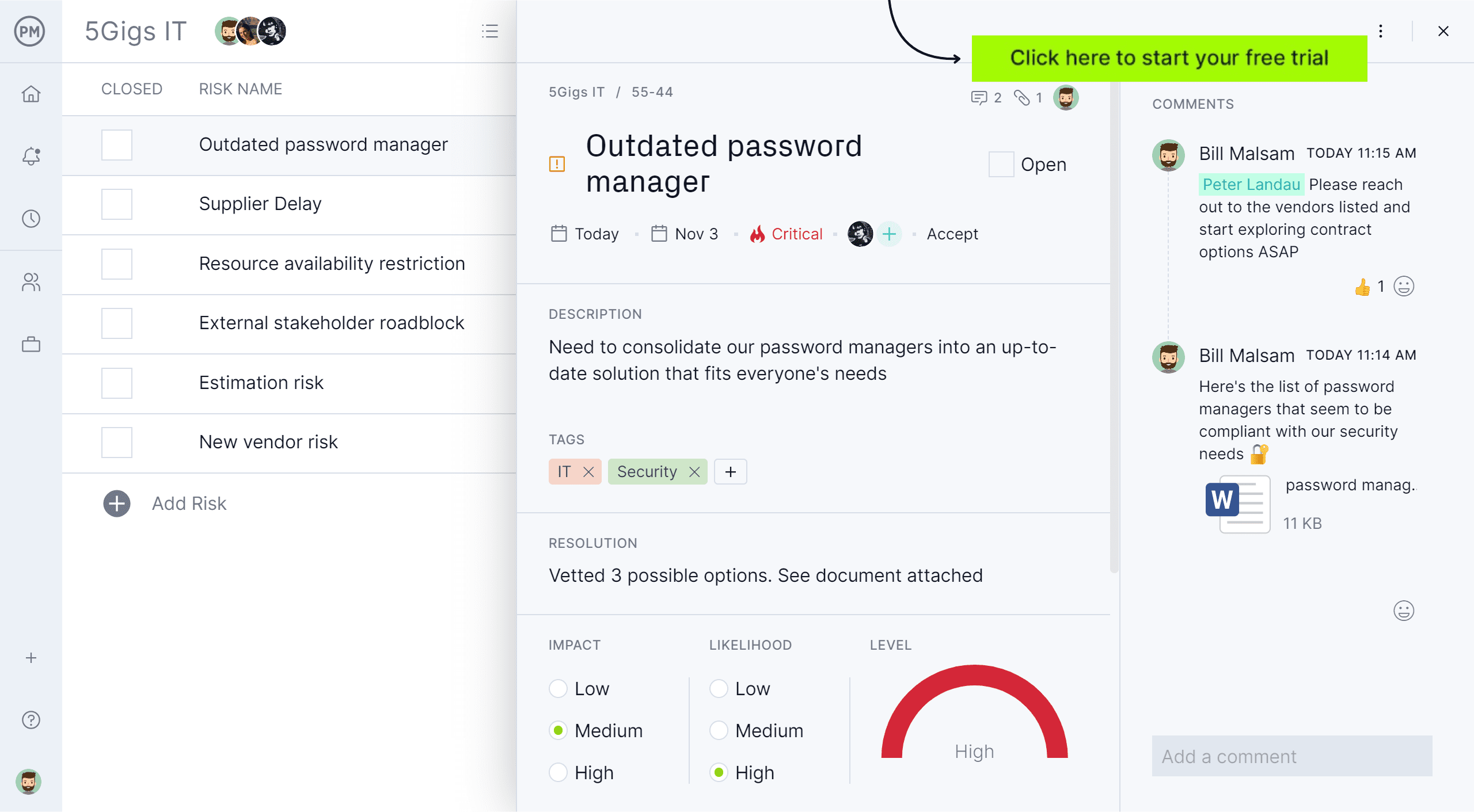

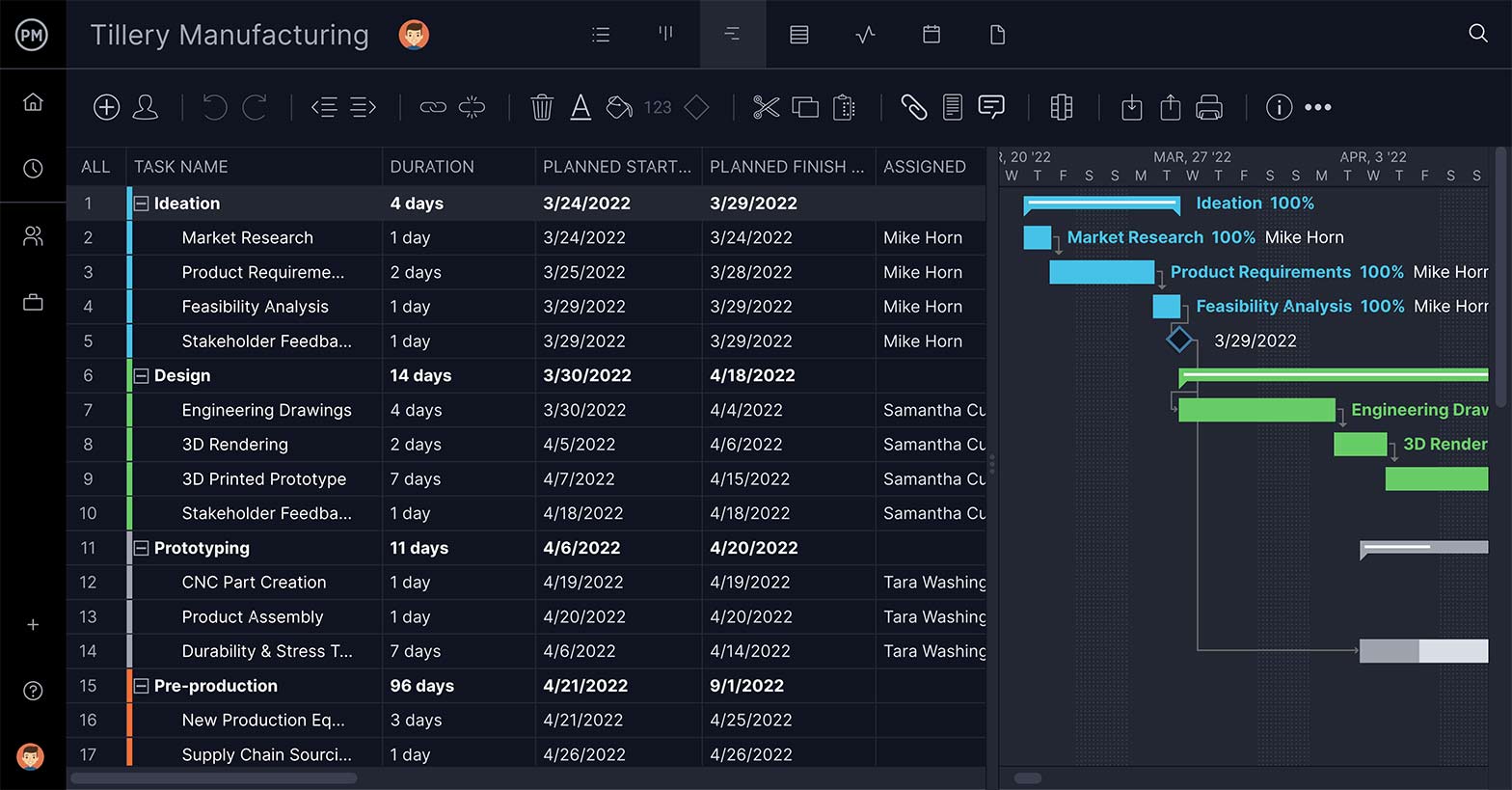

Project management software can help you keep track of risk. ProjectManager is online software that helps you identify risks, track them and calculate their impact. With our Risk view, you can make a risk list with your team and stay on top of all the risks within your project. Write a description, add tags, identify a resolution, mark impact and likelihood, even see a risk matrix—all in one place. Get started today with a free trial.

What Is Positive Risk In Project Management?

Not all risk is created equally. Risk can be either positive or negative, though most people assume risks are inherently the latter. Where negative risk implies something unwanted that has the potential to irreparably damage a project, positive risks are opportunities that can affect the project in beneficial ways.

Negative risks are part of your risk management plan, just as positive risks should be, but the difference is in approach. You manage and account for known negative risks to neuter their impact, but positive risks can also be managed to take full advantage of them.

There are many examples of positive risks in projects: you could complete the project early; you could acquire more customers than you accounted for; you could imagine how a delay in shipping might open up a potential window for better marketing opportunities, etc. It’s important to note, though, that these definitions are not etched in stone. Positive risk can quickly turn to negative risk and vice versa, so you must be sure to plan for all eventualities with your team.

Managing Risk Throughout the Organization

Can your organization also improve by adopting risk management into its daily routine? Yes! Building a risk management protocol into your organization’s culture by creating a consistent set of risk management tools and templates, with training, can reduce overhead over time. That way, each time you start a new project, it won’t be like having to reinvent the wheel.

Things such as your organization’s records and history are an archive of knowledge that can help you learn from that experience when approaching risk in a new project. Also, by adopting the attitudes and values of your organization to become more aware of risk, your organization can develop a risk culture . With improved governance comes better planning, strategy, policy and decisions.

Free Risk Matrix Template

To manage project risks throughout your organization, it’s important to create a risk matrix. A risk matrix is going to help you organize your risks by severity and likelihood, so you can stay on top of potential issues that threaten the greatest impact. Try this free risk matrix template for Excel so you and your team can organize project risks.

6 Steps in the Risk Management Process

So, how do you handle something as seemingly elusive as project risk management? You make a risk management plan. It’s all about the process. Turn disadvantages into an advantage by following these six steps.

Identify the Risk

You can’t resolve a risk if you don’t know what it is. There are many ways to identify risk. As you do go through this step, you’ll want to collect the data in a risk register .

One way is brainstorming with your team, colleagues or stakeholders. Find the individuals with relevant experience and set up interviews so you can gather the information you’ll need to both identify and resolve the risks. Think of the many things that can go wrong. Note them. Do the same with historical data on past projects. Now your list of potential risks has grown.

Make sure the risks are rooted in the cause of a problem. Basically, drill down to the root cause to see if the risk is one that will have the kind of impact on your project that needs identifying. When trying to minimize risk, it’s good to trust your intuition. This can point you to unlikely scenarios that you just assume couldn’t happen. Use a risk breakdown structure process to weed out risks from non-risks.

Analyze the Risk

Analyzing risk is hard. There is never enough information you can gather. Of course, a lot of that data is complex, but most industries have best practices, which can help you with your risk analysis . You might be surprised to discover that your company already has a framework for this process.

When you assess project risk you can ultimately and proactively address many impacts, such as avoiding potential litigation, addressing regulatory issues, complying with new legislation, reducing your exposure and minimizing impact.

So, how do you analyze risk in your project? Through qualitative and quantitative risk analysis, you can determine how the risk is going to impact your schedule and budget.

Project management software helps you analyze risk by monitoring your project. ProjectManager takes that one step further with real-time dashboards that display live data. Unlike other software tools, you don’t have to set up our dashboard. It’s ready to give you a high-level view of your project from the get-go. We calculate the live date and then display it for you in easy-to-read graphs and charts. Catch issues faster as you monitor time, costs and more.

Prioritize Risks & Issues

Not all risks are created equally. You need to evaluate the risk to know what resources you’re going to assemble towards resolving it when and if it occurs.

Having a large list of risks can be daunting. But you can manage this by simply categorizing risks as high, medium or low. Now there’s a horizon line and you can see the risk in context. With this perspective, you can begin to plan for how and when you’ll address these risks. Then, if risks become issues, it’s advisable to keep an issue log so you can keep track of each of them and implement corrective actions.

Some risks are going to require immediate attention. These are the risks that can derail your project. Failure isn’t an option. Other risks are important, but perhaps do not threaten the success of your project. You can act accordingly. Then there are those risks that have little to no impact on the overall project’s schedule and budget . Some of these low-priority risks might be important, but not enough to waste time on.

Assign an Owner to the Risk

All your hard work identifying and evaluating risk is for naught if you don’t assign someone to oversee the risk. In fact, this is something that you should do when listing the risks. Who is the person who is responsible for that risk, identifying it when and if it should occur and then leading the work toward resolving it?

That determination is up to you. There might be a team member who is more skilled or experienced in the risk. Then that person should lead the charge to resolve it. Or it might just be an arbitrary choice. Of course, it’s better to assign the task to the right person, but equally important in making sure that every risk has a person responsible for it.

Think about it. If you don’t give each risk a person tasked with watching out for it, and then dealing with resolving it when and if it should arise, you’re opening yourself up to more risk. It’s one thing to identify risk, but if you don’t manage it then you’re not protecting the project.

Respond to the Risk

Now the rubber hits the road. You’ve found a risk. All that planning you’ve done is going to be put to use. First, you need to know if this is a positive or negative risk. Is it something you could exploit for the betterment of the project? If not you need to deploy a risk mitigation strategy .

A risk mitigation strategy is simply a contingency plan to minimize the impact of a project risk. You then act on the risk by how you prioritize it. You have communications with the risk owner and, together, decide on which of the plans you created to implement to resolve the risk.

Monitor the Risk

You can’t just set forces against risk without tracking the progress of that initiative. That’s where the monitoring comes in. Whoever owns the risk will be responsible for tracking its progress towards resolution. However, you’ll need to stay updated to have an accurate picture of the project’s overall progress to identify and monitor new risks.

You’ll want to set up a series of project meetings to manage the risks. Make sure you’ve already decided on the means of communication to do this. It’s best to have various channels dedicated to communication.

Whatever you choose to do, remember to always be transparent. It’s best if everyone in the project knows what is going on, so they know what to be on the lookout for and help manage the process.

In the video below, Jennifer Bridges, professional project manager (PMP) dives deeper into the steps in the risk management process.

Risk Management Templates

We’ve created dozens of free project management templates for Excel and Word to help you manage projects. Here are some of our risk management templates to help you as you go through the process of identifying, analyzing, prioritizing and responding to risks.

Risk Register Template

A risk register is a risk management document that allows project managers to identify and keep track of potential project risks. Using a risk register to list down project risks is one of the first steps in the risk management process and one of the most important because it sets the stage for future risk management activities.

A risk matrix is a project management tool that allows project managers to analyze the likelihood and potential impact of project risks. This helps them prioritize project risks and build a risk mitigation plan to respond to those risks if they were to occur.

Managing Risk With ProjectManager

Using a risk-tracking template is a start, but to gain even more control over your project risks you’ll want to use project management software. ProjectManager has a number of tools including risk management that let you address risks at every phase of a project.

Make an Online Risk Register

Identify and track all the risks for your project in one place. Unlike other project management software, you can manage risks alongside your project rather than in a separate tool. Set due dates, mark priority, identify resolutions and more.

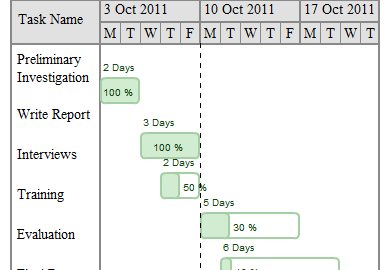

Gantt Charts for Risk Management Plans

Use our award-winning Gantt charts to create detailed risk management plans to prevent risks from becoming issues. Schedule, assign and monitor project tasks with full visibility. Gantt charts allow team members add comments and files to their assigned tasks, so all the communication happens on the project level—in real time.

Risk management is complicated. A risk register or template is a good start, but you’re going to want robust project management software to facilitate the process of risk management. ProjectManager is an online tool that fosters the collaborative environment you need to get risks resolved, as well as provides real-time information, so you’re always acting on accurate data. Try it yourself and see, take this free 30-day trial.

Deliver your projects on time and on budget

Start planning your projects.

Risk management is the process of identifying, assessing and controlling financial, legal, strategic and security risks to an organization’s capital and earnings. These threats , or risks, could stem from a wide variety of sources, including financial uncertainty, legal liabilities, strategic management errors, accidents and natural disasters.

If an unforeseen event catches your organization unaware, the impact could be minor, such as a small impact on your overhead costs. In a worst-case scenario, though, it could be catastrophic and have serious ramifications, such as a significant financial burden or even the closure of your business.

To reduce risk, an organization needs to apply resources to minimize, monitor and control the impact of negative events while maximizing positive events. A consistent, systemic and integrated approach to risk management can help determine how best to identify, manage and mitigate significant risks.

Get insights to better manage the risk of a data breach with the latest Cost of a Data Breach report.

Register for the X-Force Threat Intelligence Index

At the broadest level, risk management is a system of people, processes and technology that enables an organization to establish objectives in line with values and risks.

A successful risk assessment program must meet legal, contractual, internal, social and ethical goals, as well as monitor new technology-related regulations. By focusing attention on risk and committing the necessary resources to control and mitigate risk, a business protects itself from uncertainty, reduce costs and increase the likelihood of business continuity and success.

Three important steps of the risk management process are risk identification, risk analysis and assessment, and risk mitigation and monitoring.

Risk identification is the process of identifying and assessing threats to an organization, its operations and its workforce. For example, risk identification can include assessing IT security threats such as malware and ransomware, accidents, natural disasters and other potentially harmful events that could disrupt business operations.

Risk analysis involves establishing the probability that a risk event might occur and the potential outcome of each event. Risk evaluation compares the magnitude of each risk and ranks them according to prominence and consequence.

Risk mitigation refers to the process of planning and developing methods and options to reduce threats to project objectives. A project team might implement risk mitigation strategies to identify, monitor and evaluate risks and consequences inherent to completing a specific project, such as new product creation. Risk mitigation also includes the actions put into place to deal with issues and effects of those issues regarding a project.

Risk management is a nonstop process that adapts and changes over time. Repeating and continually monitoring the processes can help assure maximum coverage of known and unknown risks.

There are five commonly accepted strategies for addressing risk. The process begins with an initial consideration of risk avoidance then proceeds to 3 additional avenues of addressing risk (transfer, spreading and reduction). Ideally, these three avenues are employed in concert with one another as part of a comprehensive strategy. Some residual risk may remain.

Avoidance is a method for mitigating risk by not participating in activities that may negatively affect the organization. Not making an investment or starting a product line are examples of such activities as they avoid the risk of loss.

This method of risk management attempts to minimize the loss, rather than completely eliminate it. While accepting the risk, it stays focused on keeping the loss contained and preventing it from spreading. An example of this in health insurance is preventive care.

When risks are shared, the possibility of loss is transferred from the individual to the group. A corporation is a good example of risk sharing—several investors pool their capital and each only bears a portion of the risk that the enterprise may fail.

Contractually transferring a risk to a third-party, such as, insurance to cover possible property damage or injury shifts the risks associated with the property from the owner to the insurance company.

After all risk sharing, risk transfer and risk reduction measures have been implemented, some risk will remain since it is virtually impossible to eliminate all risk (except through risk avoidance). This is called residual risk.

Risk management standards set out a specific set of strategic processes that start with the objectives of an organization and intend to identify risks and promote the mitigation of risks through best practice.

Standards are often designed by agencies who are working together to promote common goals, to help to ensure high-quality risk management processes. For example, the ISO 31 000 standard on risk management is an international standard that provides principles and guidelines for effective risk management.

While adopting a risk management standard has its advantages, it is not without challenges. The new standard might not easily fit into what you are doing already, so you could have to introduce new ways of working. And the standards might need customizing to your industry or business.

Manage risk from changing market conditions, evolving regulations or encumbered operations while increasing effectiveness and efficiency.

Speed insights, cut infrastructure costs and increase efficiency for risk-aware decisions with IBM RegTech.

Simplify how you manage risk and regulatory compliance with a unified GRC platform fueled by AI and all your data.

Better manage your risks, compliance and governance by teaming with our security consultants.

Identify IT security vulnerabilities to help mitigate business risks.

Create a smarter security framework to manage the full threat lifecycle.

Understand your cybersecurity landscape and prioritize initiatives together with senior IBM security architects and consultants in a no-cost, virtual or in-person, 3-hour design thinking session.

Understand your cyberattack risks with a global view of the threat landscape.

Discover how a governance, risk, and compliance (GRC) framework helps an organization align its information technology with business objectives, while managing risk and meeting regulatory compliance requirements.

Find out how threat management is used by cybersecurity professionals to prevent cyber attacks, detect cyber threats and respond to security incidents.

Explore financial impacts and security measures that can help your organization avoid a data breach, or in the event of a breach, mitigate costs.

Keep up to date with the latest strategies from our expert writers.

Protect your business from potential risks and strive towards compliance with regulations as you explore the world of proper governance.

Cybersecurity threats are becoming more advanced, more persistent and are demanding more effort by security analysts to sift through countless alerts and incidents. IBM Security QRadar SIEM helps you remediate threats faster while maintaining your bottom line. QRadar SIEM prioritizes high-fidelity alerts to help you catch threats that others miss.

- Product overview

- All features

- App integrations

CAPABILITIES

- project icon Project management

- Project views

- Custom fields

- Status updates

- goal icon Goals and reporting

- Reporting dashboards

- workflow icon Workflows and automation

- portfolio icon Resource management

- Time tracking

- my-task icon Admin and security

- Admin console

- asana-intelligence icon Asana Intelligence

- list icon Personal

- premium icon Starter

- briefcase icon Advanced

- Goal management

- Organizational planning

- Campaign management

- Creative production

- Marketing strategic planning

- Request tracking

- Resource planning

- Project intake

- View all uses arrow-right icon

- Project plans

- Team goals & objectives

- Team continuity

- Meeting agenda

- View all templates arrow-right icon

- Work management resources Discover best practices, watch webinars, get insights

- What's new Learn about the latest and greatest from Asana

- Customer stories See how the world's best organizations drive work innovation with Asana

- Help Center Get lots of tips, tricks, and advice to get the most from Asana

- Asana Academy Sign up for interactive courses and webinars to learn Asana

- Developers Learn more about building apps on the Asana platform

- Community programs Connect with and learn from Asana customers around the world

- Events Find out about upcoming events near you

- Partners Learn more about our partner programs

- Support Need help? Contact the Asana support team

- Asana for nonprofits Get more information on our nonprofit discount program, and apply.

Featured Reads

- Project planning |

- Risk matrix template: How to assess ris ...

Risk matrix template: How to assess risk for project success (with examples)

A risk matrix analyzes project risks based on likelihood and severity. Once you map your risks, you can calculate overall impact and prioritize risks accordingly. In this piece, you’ll learn how to create a risk matrix template and how to use the information from this analysis tool to develop a comprehensive risk management plan.

Risks are a part of any project, and there’s no surefire way to know which ones will occur and when. Sometimes, you'll get through an entire project without experiencing a single hiccup. Other times, you’ll feel like all the odds are against you. Without the help of a crystal ball, the only way to prevent project risks is to proactively prepare for them.

A risk matrix helps you analyze risk by assigning each event as high, medium, or low impact on a scale of one through 25. Once you assess the severity and likelihood of each risk, you’ll prioritize your risks and prepare for them accordingly. In this article, we’ll explain how to create a risk matrix template and offer helpful tools for turning your results into action.

What is a risk matrix in project management?

Types of risks.

As part of the process, you’ll need to brainstorm a list of risks to chart in your risk matrix. The risks you may face will likely fall into these categories:

Strategic risk : Strategic risks involve performance or decision errors, such as choosing the wrong vendor or software for a project.

Operational risk : Operational risks are process errors or procedural mistakes, like poor planning or a lack of communication among teams.

Financial risk : Financial risk can involve various events that cause a loss of company profit, including market changes, lawsuits, or competitors.

Technical risk: Technical risk may include anything related to company technology, such as a security breach, power outage, loss of internet, or damage to property.

External risk: External risks are out of your control, like floods, fires, natural disasters, or pandemics.

There are other risk categories to consider depending on your work industry. For example, if you have government clients, then you also want to brainstorm legal risks. If your company sells a physical product, you may have to think about manufacturing risks.

How to create a risk matrix template

When creating your risk matrix template, you’ll first identify your scale of severity, which you’ll place in the columns of your matrix. The scale of severity measures how severe the consequences will be for each risk. In a five-by-five matrix, there are five levels in your scale of severity.

Negligible (1): The risk will have little consequences if it occurs.

Minor (2): The consequences of the risk will be easy to manage.

Moderate (3): The consequences of the risk will take time to mitigate.

Major (4): The consequences of this risk will be significant and may cause long-term damage.

Catastrophic (5): The consequences of this risk will be detrimental and may be hard to recover from.

You’ll then identify your scale of likelihood, which you’ll place in the rows of your risk matrix template. The scale of likelihood identifies the probability of each risk occurring.

Very likely (5): You can be pretty sure this risk will occur at some point in time.

Probable (4): There’s a good chance this risk will occur.

Possible (3): This risk could happen, but it might not. This risk has split odds.

Not likely (2): There’s a good chance this risk won’t occur.

Very unlikely (1): It’s a long shot that this risk will occur.

When you place a risk in your matrix based on its likelihood and severity, you’ll find the level of risk impact. The risk impact is both color-coded from green to red and rated on a one through 25 scale.

Low (1-6): Low-risk events likely won’t happen, and if they do, they won’t cause significant consequences for your project or company. You can label these as low priority in your risk management plan .

Medium (7-12): Medium-risk events are a nuisance and can cause project hiccups, but if you take action during project planning to prevent and mitigate these risks, you’ll set yourself up for project success. You shouldn’t ignore these risks, but they also don’t need to be a top priority.

High (13-25): High-risk events can derail your project if you don’t keep them top of mind during project planning. Because these risks are likely to happen and have serious consequences, these are most important in your risk management plan.

![risk management in assignment [inline illustration] risk matrix criteria (infographic)](https://assets.asana.biz/transform/6e112071-56ef-4646-ad85-b474220851f0/inline-project-planning-risk-matrix-template-2-2x?io=transform:fill,width:2560&format=webp)

You don’t have to stick to the labels above for your risk matrix template if they don’t feel right for your company or project. You can customize the size and terminology of your matrix to your needs.

How to use a risk matrix

Once you’ve created a risk matrix, you can use it as a comprehensive analysis tool. The best part about a risk matrix template is that you don’t need to change it for every project. Once you have one, you can reuse it and share it with others.

![risk management in assignment [inline illustration] 5 steps to use a risk matrix (infographic)](https://assets.asana.biz/transform/9bc214f5-661e-4696-854a-f6f9ec87502f/inline-project-planning-risk-matrix-template-3-2x?io=transform:fill,width:2560&format=webp)

1. Identify project risks

You’ll need a list of potential risks to make use of your risk matrix. In this step, you’ll determine what risks may affect the specific project you’re working on.

To come up with relevant risks for your project, you’ll need to understand your project scope and objectives. This includes the project’s:

Constraints

Using your project scope as a guide, think of risky situations that might affect your project. If you’re not sure where to start, try brainstorming techniques like mind mapping or starbursting to list as many risks as you can under each risk type.

2. Determine severity of risks

When you created your risk matrix, you defined the criteria for your risk severity and likelihood. Now that you have a list of project risks, categorize them using the matrix criteria. Start with the scale of severity and go through each risk you’ve listed. Consider the following questions:

What is the most negative outcome that could come from this risk?

What are the worst damages that could occur from this risk?

How hard will it be to recover from this risk?

Which of the five severity levels most closely matches this risk?

You may not always have the perspective you need to know how severe the consequences of a risk are. In that case, work with other project stakeholders to determine the potential risk impact.

3. Identify likelihood of risks

Once you’ve defined the severity of each risk, you’ve completed half of the risk analysis equation. Next, identify the likelihood of each risk. To do this, consider the following questions:

Has this risk occurred before and, if so, how often?

Are there risks similar to this one that have occurred?

Can this risk occur, and if so, how likely is it to occur?

Team collaboration is also crucial in this step because you may not have a good idea of similar risks that have occurred in past projects. Make sure to reference past projects and analyze the probability of each risk with your team in order to create a more accurate mitigation plan.

4. Calculate risk impact

The last part of your risk analysis equation is to calculate risk impact. The equation you’ll use is:

Likelihood x severity = risk impact

Place each risk in your matrix based on its likelihood and severity, then multiply the numbers in the row and column where it lands to find the level of risk impact. For example, if you think the risk of a data breach is of major severity (4) and probable likelihood (4), you’d multiply four by four to get a risk impact of 16. This is considered a high-risk impact.

5. Prioritize risks and take action

You should now have a risk impact level on a scale of 1–25 for each risk you’ve identified. With these number values, it’s easier to determine which risks are of top priority. When you have risks with the same risk impact score, it will be up to you and your team to determine which risk to prioritize. Risks with equal risk impact may require equal attention as you create your action plan.

Your risk response plan should include steps to prevent risk and ways to mitigate risk if unfortunate events occur. Because so much goes into project planning, the best strategy when tackling risks may be to divide and conquer.

Risk assessment matrix template

The size of your risk matrix template determines how closely you can analyze your project risks. A larger risk matrix template offers more room on the risk impact spectrum, while a smaller risk matrix template keeps your risk impact rating simpler and less subjective.

Each square in your matrix represents a risk level of likelihood and severity, so you shouldn’t make your risk matrix smaller than three squares in length and width.