What Are Business Expenses? Examples, Tips and FAQs

Any company will have business expenses. Meticulously tracking them ensures you know where your funds are going, and it helps you reduce your tax liability. It’s also crucial to understand what business expenses are and what you can deduct so you're not paying more taxes than necessary.

What Are Business Expenses?

According to the Internal Revenue Service (IRS), business expenses are ordinary and necessary costs incurred to operate your business. Examples include inventory, payroll and rent. Fixed expenses are regular and don’t change much — things like rent and insurance. Variable expenses are expected, but they can change. Some examples include sales commissions, gas for business vehicles and shipping costs. You expect variable expenses each month, but the actual amount will vary. Tracking your business expenses helps you keep an eye on whether you’ll see profits or losses.

Key Takeaways

- Business expenses need to be considered ordinary and necessary for them to be tax-deductible.

- Business expenses are recorded on an income (profit and loss) statement.

Business Expenses Explained

Also referred to as deductions, business expenses are the costs of operating a business. They’re recorded on the income statement. These expenses will be subtracted from business revenue to show a company's net profit or loss and taxable income.

Guidelines for business expenses can be found in Section 162 of the Internal Revenue Code (IRC). As long as an expense is considered ordinary and necessary, it can be reported to the IRS to help reduce tax liability.

According to the IRS, ordinary refers to expenses common to most business owners in the industry or trade. Necessary means your expenses help with your business operations, and they're appropriate to your organization.

How Do Business Expenses Impact or Reduce Taxes?

Any expense that meets the IRS definition of ordinary and necessary can be deducted. To be written off, an expense needs to be incurred by a business intending to make a profit. Some expenses may be fully deductible, whereas others are partially deductible or won’t be fully deducted the year they’re incurred.

What Are Examples of Deductible Business Expenses?

The following business expenses may be fully or partially deductible:

- Advertising and marketing

- Bank fees and interest

- Business mileage

- Commissions

- Educational expenses for employees

- Employee benefits

- Equipment maintenance and repair

- Home office (you’ll need to meet certain requirements such as that it is your main place of business)

- Membership dues (business-related expenses only)

- Office supplies and equipment

- Payroll (employees and contractors)

- Rent or office lease

- Mortgage payments

- Some costs of business travel

What Are Examples of Non-Deductible Business Expenses?

Not all business expenses are tax-deductible.

Here are some examples:

- Demolition expenses or losses

- Educational expenses incurred to meet requirements to conduct business

- Government fines and penalties

- Illegal activities

- Lobbying expenses

- Political contributions

Also note that capital expenditures, while deductible, are typically written off over several years through an accounting process known as depreciation.

Income Statement Reporting

Your income statement is the main financial statement used when recording business expenses and determining your taxable income. The income statement shows a picture of your company’s expenses and revenues over a given period of time. The statements are typically broken into different categories.

Costs of Goods Sold (COGS): Also known as cost of sales, COGS refer to the cost of manufactured or purchased goods sold. COGS are a business expense and affect how much profit a company makes on its products. It's deducted from a business's total revenue to determine gross profit and can include factory overhead, storage, cost of raw materials and parts used to make a product, direct labor costs, shipping or freight in costs and indirect costs, such as distribution or sales force costs.

Operating Costs: Operating costs are any expenses associated with the day-to-day maintenance and administration of a business. Operating costs include fixed, variable and semi-variable costs. These expenses are subtracted from gross profit to find operating profit and typically include marketing costs and executive compensation. Gifts and meals would also fall under this category.

Depreciation: Depreciation is the process of deducting the cost of a business asset over a long period of time, rather than over one year. Depreciation has two main components: one is the decrease in the value of an asset over time and when you allocate the price you originally paid for an asset over the period of time you use that asset. Generally Accepted Accounting Principles (GAAP) requires that companies use standard depreciation methods with specific depreciation schedules for various asset categories. Amortization is similar to depreciation, but is a method of spreading the cost of an intangible asset over a specific period of time.

Interest expenses: Interest paid on loans is subtracted from taxable income.

Personal vs. Business Expenses

Business expenses can be deducted to lower your company’s overall taxable income. Personal expenses cannot. So, what are some of the differences and is there ever a gray area?

Personal expenses: It’s vital that you keep your personal expenses separate from business. For example, if you go to the hardware store to buy some lumber for a personal project and throw in some industrial cleaner to scrub the floors of your store, be sure to run two transactions. That way you can keep separate receipts and if you have a business credit or debit card, you can use that for the business purchase.

Business expenses: Are you making a purchase to try and drive more revenue to your business? Is it something that would be considered a normal purchase in your industry? It’s likely a business expense. Record the purchase, store the receipt and record the reason for the purchase. The amount can be deducted from your income and lower your tax liability. Large expenses that increase the long-term value of your business like buying new equipment or investing in a new building are considered capital expenditures and are handled differently than other expenses .

Key differences: Business purchases are things you buy in the normal operations of your business. Personal expenses are items that do not pertain to your business. But what about things like home offices? If you use an office out of your home primarily for business purposes, you may be able to write off that expense. But you won’t be able to deduct the entire price of your home mortgage. There are occasions when you can itemize certain aspects of expenses like utilities, real estate taxes or phones. It’s especially important for you to keep meticulous records that detail why you’re expensing these items, in case you are ever audited.

Top 6 Business Expense Tips

Staying on top of your business expenses can be overwhelming. But it is also one of the easiest ways to reduce your overall tax liability. Here are some tips to make expense management a little easier.

Keep meticulous records.

When in doubt, keep it. Not only will receipts and other documentation of your business expenses come in handy if you’re ever audited, the IRS requires some records be kept for up to 7 years. Things like receipts, tax returns and employment records need to be kept for 3-4 years. And documentation of writing off bad debt should be kept for 7 years. Consider using business accounting software to track your expenses and go paperless for record keeping.

Separate personal and business expenses.

Business expenses can be written off and reduce your overall tax liability. Start separating your business and personal expenses right away. Open a separate business checking account. Get a business credit or debit card. And make sure your business partners know which expenses can be written off, and which can’t.

Brush up on what expenses are considered tax deductible.

Not all expenses are tax deductible. But most expenses you incur while trying to drive revenue to your business can be written off. Some major purchases like large equipment are considered capital expenditures. The initial purchase may not be written off all in one tax year, but the depreciation of value, along with the costs of running it would be.

Save receipts for business travel.

Many business travel expenses are tax deductible. Keep records of costs like transportation, lodging and some of the meals (usually 50% of the cost.) Keep your receipts for these expenses for at least three years, as long as the IRS can audit you.

Record expenses as soon as possible.

Whether you store your records yourself or use a business accounting software program, get in the habit of recording expenses right away. Formalize the process for how you track and store the receipts and record expenses.

Monitor and review expenses regularly.

Business accounting software can display your expense information with charts and dashboards. And if you track your expenses manually, be sure to build regular review into the expense management policies and procedures. Consider double-entry bookkeeping to catch errors and prevent fraud.

How to Track Business Expenses?

Tracking your business expenses should become a habit. By making it part of your regular workflow , you’re less likely to miss expenses that can reduce your overall tax burden. And by keeping an eye on your expenses and revenue through your income statement, you’re able to better monitor the financial health of your company.

Open a business bank account. Make sure this is separate from your personal checking account and only use it for business expenses. This will make it easier to track your business charges. And you may be eligible for business credit or debit cards that come with perks like cash back or no-interest financing for three months.

Formalize how you store receipts. Consider scanning receipts and keeping digital copies. Try and make it part of your regular workflow. If not daily, try to set aside the same time each week to scan and organize receipts. Write the business purpose on the receipt so you can remind yourself later, if needed.

Review and categorize your expenses regularly. Examine each transaction and track your spending by category. By comparing your expenses to revenue, you can see how much it costs to produce an amount of revenue in a given time.

Consider buying business accounting software. Save time and ensure you have the most up-to-date information with an accounting platform. Store and track receipts and easily categorize expenses. You can see charts and dashboards of your financial information, as well as generate important reports, like the income statement.

Tracking Business Expenses With Software

By tracking your expenses, you can reduce your tax liability. But it’s also important to keep detailed records of these expenses in case you’re audited or need to reconcile accounts. Going paperless and using business accounting software can help save time, automate processes and keep more accurate financial records, even if you have a small business or startup. As your business grows, the software will scale with your growth. And top-tier cloud solutions like NetSuite integrate with other business software, such as your CRM, inventory management and ecommerce functions.

#1 Expense Management Software

Business Expense FAQs

Can business expenses be carried forward.

Your business may be able to take a carryforward if you have a net operating loss (NOL), you're over the amount of deductions allowed and a nonrefundable credit you qualify for is more than the tax you owe in a year.

Business expenses that can be deducted are not taxed. There are a few business expenses like demolition that cannot be written off.

Can I deduct personal expenses for business?

You cannot deduct personal expenses for your business. However, if the expense is for both business and personal use, you may deduct the business portion. For example, let’s say you have a vehicle and drive to consult with on-site clients 25% of the time. You can deduct 25% of your business expenses. You’ll need to keep records such as mileage incurred, maintenance costs and the purpose of each trip.

What are the three types of business expenses?

The three major types are:

- Fixed: These expenses tend not to change and remain the same. Examples include rent or equipment lease payments.

- Variable: These expenses change from month to month. Examples include employee commissions and utilities.

- Periodic: These expenses happen occasionally. Examples include emergency equipment repairs and annual bonuses.

Financial Management

6 Expense Management Best Practices: The Complete Guide for CFOs and Experts

After employee payroll and benefits, travel and entertainment (T&E) is the second-largest controllable expense for companies. That makes following expense management best practices — the process and technologies…

Trending Articles

Learn How NetSuite Can Streamline Your Business

NetSuite has packaged the experience gained from tens of thousands of worldwide deployments over two decades into a set of leading practices that pave a clear path to success and are proven to deliver rapid business value. With NetSuite, you go live in a predictable timeframe — smart, stepped implementations begin with sales and span the entire customer lifecycle, so there’s continuity from sales to services to support.

Before you go...

Discover the products that 37,000+ customers depend on to fuel their growth.

Before you go. Talk with our team or check out these resources.

Want to set up a chat later? Let us do the lifting.

NetSuite ERP

Explore what NetSuite ERP can do for you.

Business Guide

Complete Guide to Cloud ERP Implementation

SMALL BUSINESS MONTH. 50% Off for 6 Months. BUY NOW & SAVE

50% Off for 6 Months Buy Now & Save

Wow clients with professional invoices that take seconds to create

Quick and easy online, recurring, and invoice-free payment options

Automated, to accurately track time and easily log billable hours

Reports and tools to track money in and out, so you know where you stand

Easily log expenses and receipts to ensure your books are always tax-time ready

Tax time and business health reports keep you informed and tax-time ready

Automatically track your mileage and never miss a mileage deduction again

Time-saving all-in-one bookkeeping that your business can count on

Track project status and collaborate with clients and team members

Organized and professional, helping you stand out and win new clients

Set clear expectations with clients and organize your plans for each project

Client management made easy, with client info all in one place

Pay your employees and keep accurate books with Payroll software integrations

- Team Management

FreshBooks integrates with over 100 partners to help you simplify your workflows

Send invoices, track time, manage payments, and more…from anywhere.

- Freelancers

- Self-Employed Professionals

- Businesses With Employees

- Businesses With Contractors

- Marketing & Agencies

- Construction & Trades

- IT & Technology

- Business & Prof. Services

- Accounting Partner Program

- Collaborative Accounting™

- Accountant Hub

- Reports Library

- FreshBooks vs QuickBooks

- FreshBooks vs HoneyBook

- FreshBooks vs Harvest

- FreshBooks vs Wave

- FreshBooks vs Xero

- Free Invoice Generator

- Invoice Templates

- Accounting Templates

- Business Name Generator

- Estimate Templates

- Help Center

- Business Loan Calculator

- Mark Up Calculator

Call Toll Free: 1.866.303.6061

1-888-674-3175

- All Articles

- Productivity

- Project Management

- Bookkeeping

Resources for Your Growing Business

Business expenses: definition with examples.

Business expenses are ordinary and necessary costs a business incurs in order for it to operate. Businesses need to track and categorize their expenditures because some business expenses can count as tax deductions. Deductible expenses reduce a business’s taxable income, which can result in significant cost savings.

Here’s What We’ll Cover:

What Can You Write off as Business Expenses?

Business expenses examples, can business expenses be carried forward, can i deduct personal expenses for business, types of business expenses, tips for tracking business expenses.

NOTE: FreshBooks Support team members are not certified income tax or accounting professionals and cannot provide advice in these areas, outside of supporting questions about FreshBooks. If you need income tax advice please contact an accountant in your area.

Tax deductible business expenses are ones that are considered by the Internal Revenue Service (IRS) to be both “ordinary and necessary.”

Ordinary is defined by the IRS as “one that is common and accepted in your trade or business. A necessary expense is “one that is helpful and appropriate for your trade or business.”

Not all expenses a company incurs are tax deductible. Those that are may only qualify for a partial reduction. Some companies will need to ‘ capitalize ’ a business expense.

Capitalizing an expense refers to business assets that a business invests in to generate revenue, but is also one that will depreciate over a number of years (like a building or piece of equipment).

Capitalizing large business expenses means only the depreciation amount of those items for that year will show up on a company’s income statement, unlike regular business expenses which show the full amounts. This will allow a company to accurately assess its profits.

Here are some common business expense examples that may be partially or fully tax deductible:

- Payroll (employees and freelance help)

- Bank fees and interest

- Insurance expenses

- Business vehicles

- Equipment or equipment rental

- Office supplies

- Membership dues (including union or other professional affiliations)

- Commissions & fees

- Business meals

- Business travel expenses

- Employee retirement plans

- Employee education plans

- Employee benefit programs

- Subscriptions

- Equipment rentals

- Advertising and marketing costs

- Office equipment

- Repair and maintenance costs

- Executive compensation

- Employee salaries and wages

- Interest expenses

- Shipping costs

If you operate a small business out of your home, some of your housing costs may be partially deductible:

- Home office space (as long as this is your main place of business)

- Mortgage interest

- Security system

- Property taxes

- Maintenance, repairs or upkeep

- Business phone line (separate from home line)

For example, say your home is 1,000 square feet, and you use 100 square feet (10% of the total square footage) exclusively for your home office. In that case, you can deduct 10% of the above expenses as part of the home office deduction. The remaining 90% are considered personal expenses.

Typically, a company’s business expenses are fully deductible the tax year the purchases were made. If the business expenses missed were considerable and affected a company’s taxes, the company could then choose to file an amended tax return . You have three years from the tax return due date to file an amended return and claim business expenses and get a tax refund.

In addition, business expenses that are considered to be capitalized costs (see above) will be carried forward, but the depreciation amounts will change every year. Capitalizing business expenses is standard for a new company with a lot of expensive start up costs.

No, you cannot claim personal expenses as tax-deductible business expenses. The only exception is if the costs incurred are both personal and business expenses. In that case, you can only deduct the portion of the expense that relates to business purposes.

Let’s give an example. Take John, he’s self-employed and runs his own tax consulting business. He uses his vehicle 50% of the time to visit clients in their homes or at their place of business, and 50% of the time the vehicle is used for family or pleasure. The costs of maintaining and operating the vehicle include both personal and business expenses.

The rules allow John to deduct the business portion of gas, insurance, maintenance, and repairs as deductible expenses. But to back up these business expenses on his taxes he needs to track mileage and the purpose of each trip.

There are three types of business expenses:

Fixed Expenses

A fixed cost is one that does not change or changes only slightly. An example of fixed business expenses would be the monthly rent a business pays on its headquarters.

Variable expenses vary from month to month and are typically a company’s largest expense. Examples of variable business expenses would be payroll for a company with a large amount of freelance personnel, or overtime expenditures.

Periodic expenses are ones that happen infrequently. Periodic business expenses can be hard to plan for, such as money needed for an unexpected machine replacement or repair.

Keeping track of business expenses can be a time-consuming burden for a small business owner. However, there are several ways to make this task easier and more efficient.

The following tips can help you ensure you track business expenses efficiently and effectively:

- Set up a separate business bank account. Open a business checking account and ensure all of your business-related income and expenses run through that account.

- Use business accounting software . Most business owners use accounting software to track business costs. Most modern accounting software can connect to your business bank account to automatically record expenses.

- Keep good records. Document all business spending with receipts and invoices to establish a clear paper trail in case the IRS decides to audit your taxable income.

- Review expenses regularly. It’s important for business owners to review their expenses regularly in order to stay on top of their finances. This allows them to identify areas where they can reduce operating costs to save money, spot tax deductions to lower the company’s tax liability, and make more informed decisions about how to grow their business.

By following these simple steps, business owners will always know where their business money is going, helping them make better decisions in their business and reduce their tax liability.

Janet Berry-Johnson

About the author

Janet Berry-Johnson, CPA, is a freelance writer with over a decade of experience working on both the tax and audit sides of an accounting firm. She’s passionate about helping people make sense of complicated tax and accounting topics. Her work has appeared in Business Insider, Forbes, and The New York Times, and on LendingTree, Credit Karma, and Discover, among others. You can learn more about her work at jberryjohnson.com .

RELATED ARTICLES

Save Time Billing and Get Paid 2x Faster With FreshBooks

Want More Helpful Articles About Running a Business?

Get more great content in your Inbox.

By subscribing, you agree to receive communications from FreshBooks and acknowledge and agree to FreshBook’s Privacy Policy . You can unsubscribe at any time by contacting us at [email protected].

👋 Welcome to FreshBooks

To see our product designed specifically for your country, please visit the United States site.

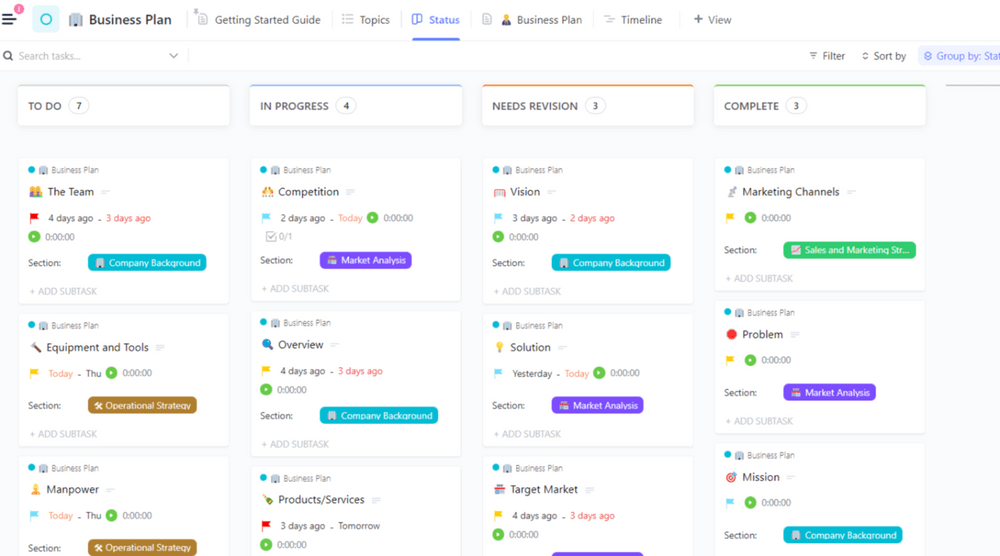

How To Write A Business Plan (2024 Guide)

Updated: Apr 17, 2024, 11:59am

Table of Contents

Brainstorm an executive summary, create a company description, brainstorm your business goals, describe your services or products, conduct market research, create financial plans, bottom line, frequently asked questions.

Every business starts with a vision, which is distilled and communicated through a business plan. In addition to your high-level hopes and dreams, a strong business plan outlines short-term and long-term goals, budget and whatever else you might need to get started. In this guide, we’ll walk you through how to write a business plan that you can stick to and help guide your operations as you get started.

Featured Partners

ZenBusiness

$0 + State Fees

Varies By State & Package

On ZenBusiness' Website

On LegalZoom's Website

Northwest Registered Agent

$39 + State Fees

On Northwest Registered Agent's Website

Drafting the Summary

An executive summary is an extremely important first step in your business. You have to be able to put the basic facts of your business in an elevator pitch-style sentence to grab investors’ attention and keep their interest. This should communicate your business’s name, what the products or services you’re selling are and what marketplace you’re entering.

Ask for Help

When drafting the executive summary, you should have a few different options. Enlist a few thought partners to review your executive summary possibilities to determine which one is best.

After you have the executive summary in place, you can work on the company description, which contains more specific information. In the description, you’ll need to include your business’s registered name , your business address and any key employees involved in the business.

The business description should also include the structure of your business, such as sole proprietorship , limited liability company (LLC) , partnership or corporation. This is the time to specify how much of an ownership stake everyone has in the company. Finally, include a section that outlines the history of the company and how it has evolved over time.

Wherever you are on the business journey, you return to your goals and assess where you are in meeting your in-progress targets and setting new goals to work toward.

Numbers-based Goals

Goals can cover a variety of sections of your business. Financial and profit goals are a given for when you’re establishing your business, but there are other goals to take into account as well with regard to brand awareness and growth. For example, you might want to hit a certain number of followers across social channels or raise your engagement rates.

Another goal could be to attract new investors or find grants if you’re a nonprofit business. If you’re looking to grow, you’ll want to set revenue targets to make that happen as well.

Intangible Goals

Goals unrelated to traceable numbers are important as well. These can include seeing your business’s advertisement reach the general public or receiving a terrific client review. These goals are important for the direction you take your business and the direction you want it to go in the future.

The business plan should have a section that explains the services or products that you’re offering. This is the part where you can also describe how they fit in the current market or are providing something necessary or entirely new. If you have any patents or trademarks, this is where you can include those too.

If you have any visual aids, they should be included here as well. This would also be a good place to include pricing strategy and explain your materials.

This is the part of the business plan where you can explain your expertise and different approach in greater depth. Show how what you’re offering is vital to the market and fills an important gap.

You can also situate your business in your industry and compare it to other ones and how you have a competitive advantage in the marketplace.

Other than financial goals, you want to have a budget and set your planned weekly, monthly and annual spending. There are several different costs to consider, such as operational costs.

Business Operations Costs

Rent for your business is the first big cost to factor into your budget. If your business is remote, the cost that replaces rent will be the software that maintains your virtual operations.

Marketing and sales costs should be next on your list. Devoting money to making sure people know about your business is as important as making sure it functions.

Other Costs

Although you can’t anticipate disasters, there are likely to be unanticipated costs that come up at some point in your business’s existence. It’s important to factor these possible costs into your financial plans so you’re not caught totally unaware.

Business plans are important for businesses of all sizes so that you can define where your business is and where you want it to go. Growing your business requires a vision, and giving yourself a roadmap in the form of a business plan will set you up for success.

How do I write a simple business plan?

When you’re working on a business plan, make sure you have as much information as possible so that you can simplify it to the most relevant information. A simple business plan still needs all of the parts included in this article, but you can be very clear and direct.

What are some common mistakes in a business plan?

The most common mistakes in a business plan are common writing issues like grammar errors or misspellings. It’s important to be clear in your sentence structure and proofread your business plan before sending it to any investors or partners.

What basic items should be included in a business plan?

When writing out a business plan, you want to make sure that you cover everything related to your concept for the business, an analysis of the industry―including potential customers and an overview of the market for your goods or services―how you plan to execute your vision for the business, how you plan to grow the business if it becomes successful and all financial data around the business, including current cash on hand, potential investors and budget plans for the next few years.

- Best VPN Services

- Best Project Management Software

- Best Web Hosting Services

- Best Antivirus Software

- Best LLC Services

- Best POS Systems

- Best Business VOIP Services

- Best Credit Card Processing Companies

- Best CRM Software for Small Business

- Best Fleet Management Software

- Best Business Credit Cards

- Best Business Loans

- Best Business Software

- Best Business Apps

- Best Free Software For Business

- How to Start a Business

- How To Make A Small Business Website

- How To Trademark A Name

- What Is An LLC?

- How To Set Up An LLC In 7 Steps

- What is Project Management?

How To Make Money On Social Media in 2024

15 Ways to Advertise Your Business in 2024

What Is a Proxy Server?

How To Get A Business License In North Dakota (2024)

How To Write An Effective Business Proposal

Best New Hampshire Registered Agent Services Of 2024

Julia is a writer in New York and started covering tech and business during the pandemic. She also covers books and the publishing industry.

Kelly Main is a Marketing Editor and Writer specializing in digital marketing, online advertising and web design and development. Before joining the team, she was a Content Producer at Fit Small Business where she served as an editor and strategist covering small business marketing content. She is a former Google Tech Entrepreneur and she holds an MSc in International Marketing from Edinburgh Napier University. Additionally, she is a Columnist at Inc. Magazine.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Create a Business Budget for Your Small Business

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

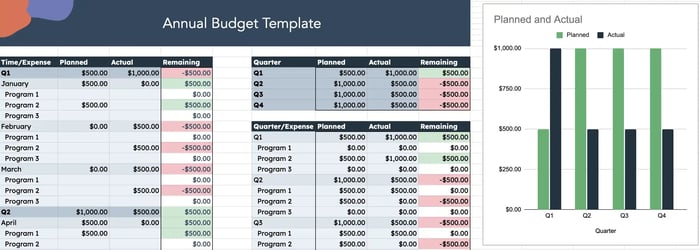

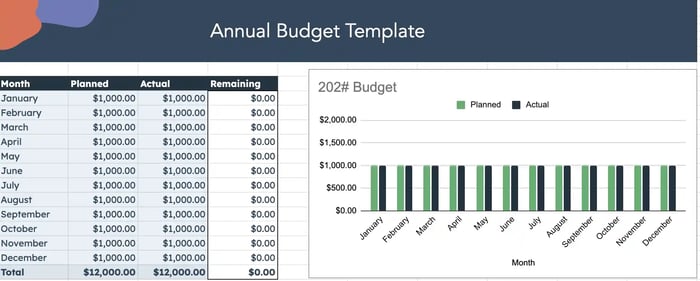

A business budget estimates future revenue and expenses in detail, so that you can see whether you’re on track to meet financial expectations for the month, quarter or year. Think of your budget as a point of comparison — you run your actual numbers against it to determine if you’re over or under budget.

From there, you can make informed business decisions and pivot accordingly. For example, maybe you find that your expenses are over budget for the quarter, so you may hold off on a large equipment purchase.

Here’s a step-by-step guide for creating a business budget, along with why budgets are crucial to running a successful business.

» MORE: What is accounting? Definition and basics, explained

advertisement

QuickBooks Online

How does a business budget work?

Budgeting uses past months’ numbers to help you make financially conservative projections for the future and wiser business decisions for the present. If you’ve had a few bad months and predict another slow one, you can prepare to minimize expenses where possible. If business has been booming and you’re bringing in new customers, maybe you invest in buying more inventory to satisfy increased demand.

Creating a business budget from scratch can feel tedious, but you might already have access to tools that can help simplify the process. Your small-business accounting software is a good place to start, since it houses your business’s financial data and may offer basic budgeting reports.

To create a budget in QuickBooks Online , for example, you break down your estimated income and expenses across each area of your business. Then, the software calculates figures like gross profit, net operating income and net income for you.

You can then compare actual versus projected figures side by side by running a Budget vs. Actuals report. Businesses that need more in-depth features, like cash flow forecasting or the ability to use different projection methods, might subscribe to business budgeting software in addition to accounting software.

If your small business doesn’t have access to these features or has simple financials, you can download free small-business budget templates to manually create and track your budget. Regardless of which option you choose, your business will likely benefit from hiring an accountant to help manage your budget, course-correct when the business gets off track, and make sure taxes are being paid correctly.

Why is a business budget important?

A business budget encourages you to look beyond next week and next month to next year, or even the next five years.

Creating a budget can help your business do the following:

Maximize efficiency.

Establish a financial plan that helps your business reach its goals.

Point out leftover funds that you can reinvest.

Predict slow months and keep you out of debt.

Estimate what it will take to become profitable.

Provide a window into the future so you can prepare accordingly.

Creating a business budget will make operating your business easier and more efficient. A business budget can also help ensure you’re spending money in the right places and at the right time to stay out of debt.

How to create a business budget in 6 steps

The longer you’ve been in business, the more data you’ll have to inform your forward-looking budget. If you run a startup, however, you’ll want to do extensive research into typical costs for businesses in your industry, so that you have working estimates for revenue and expenses.

From there, here’s how to put together your business budget:

1. Examine your revenue

One of the first steps in any budgeting exercise is to look at your existing business and find all of your revenue sources. Add all those income sources together to determine how much money comes into your business monthly. It’s important to do this for multiple months and preferably for at least the previous 12 months, provided you have that much data available.

Notice how your business’s monthly income changes over time and try to look for seasonal patterns. Your business might experience a slump after the holidays, for example, or during the summer months. Understanding these seasonal changes will help you prepare for the leaner months and give you time to build a financial cushion.

Then, you can use those historic numbers and trends to make revenue projections for future months. Make sure to calculate for revenue, not profit. Your revenue is the money generated by sales before expenses are deducted. Profit is what remains after expenses are deducted.

2. Subtract fixed costs

The second step for creating a business budget involves adding up all of your historic fixed costs and using them to reliably predict future ones. Fixed costs are those that stay the same no matter how much income your business is generating. They might occur daily, weekly, monthly or yearly, so make sure to get as much data as you can.

Examples of fixed costs within your business might include:

Debt repayment.

Employee salaries.

Depreciation of assets.

Property taxes.

Insurance .

Once you’ve identified your business’s fixed costs, you’ll subtract those from your income and move to the next step.

3. Subtract variable expenses

As you compile your fixed costs, you might notice other expenses that aren’t as consistent. Unlike fixed costs, variable expenses change alongside your business’s output or production. Look at how they’ve fluctuated over time in your business, and use that information to estimate future variable costs. These expenses get subtracted from your income, too.

Some examples of variable expenses are:

Hourly employee wages.

Owner’s salary (if it fluctuates with profit).

Raw materials.

Utility costs that change depending on business activity.

During lean months, you’ll probably want to lower your business’s variable expenses. During profitable months when there’s extra income, however, you may increase your spending on variable expenses for the long-term benefit of your business.

4. Set aside a contingency fund for unexpected costs

When you’re creating a business budget, make sure you put aside extra cash and plan for contingencies.

Although you might be tempted to spend surplus income on variable expenses, it’s smart to establish an emergency fund instead, if possible. That way, you’ll be ready when equipment breaks down and needs replacing, or if you have to quickly replace inventory that's damaged unexpectedly.

5. Determine your profit

Add up all of your projected revenue and expenses for each month. Then, subtract expenses from revenue. You may also see the resulting number referred to as net income . If you end up with a positive number, you can expect to make a profit. If not, that’s a loss — and that can be OK, too. Small businesses aren’t necessarily profitable every month, let alone every year. This is especially true when your business is just starting out. Compare your projected profits to past profits to confirm whether they’re realistic.

Looking for accounting software?

See our overall favorites, or choose a specific type of software to find the best options for you.

on NerdWallet's secure site

6. Finalize your business budget

Are the resulting profits enough to work with, or is your business overspending? This is your opportunity to set spending and earning goals for each month, quarter and year. These goals should be realistic and achievable. If they don’t line up with your projections, make sure to establish a strategy for making up the difference.

As time goes on, regularly compare your actual numbers to your budget to determine whether your business is meeting those goals, and course correct if necessary.

» MORE: Ways your small business can spend smarter

A business budget projects future revenue and expenses so you can create a smart, realistic spending plan. As the year progresses, comparing your actual numbers against your budget can help you hold your business accountable and make sure it reaches its financial goals.

A business budget includes projected revenue, fixed costs, variable costs and the resulting profits. You can also factor in contingency funds for unforeseen circumstances like equipment failure.

On a similar note...

How to Create an Expense Budget

4 min. read

Updated October 27, 2023

One of the fundamentals of your financial plan and the start of good business management is managing expenses. That starts with an expense budget. Set your budget as a goal, then review and revise often to stay on track. Being right on budget is usually good, but good management takes the regular review to check on the timing, efficiency, and results of what your business spends.

For the record, we could call it an expense forecast, or projected expenses. Those are the same thing. Regardless of what you call it when you combine it with projected sales and costs, you have what you need to project your profit or loss.

- The key types of expenses in business spending

Expenses make up just one of the three common types of spending in a normal business.

Expenses mostly include operating expenses, like rent, utilities, advertising, and payroll. That’s what I’m talking about in this article.

Direct costs are another type of spending—another way to say it is the costs of goods sold (COGS), or what you spend on what you sell. For example, the COGS for a bookstore are the costs of buying the books it resells to its customers. Those go in your sales forecast .

Repaying debts and purchasing assets is the third type of spending. These affect your cash flow (the amount of real cash you have on hand to pay bills) and your balance sheet, but not your profits—which are left over after you pay your bills.

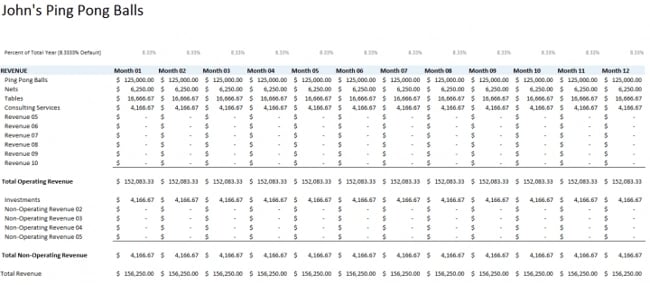

- Your expense budget

It’s all about educated guessing.

Don’t expect to accurately guess the future. Do use your experience, educated guessing, a bit of research, and common sense to estimate expenses in line with sales and costs and your planned activities.

The math is simple

The illustration here shows a sample expense budget from a soup delivery subscription plan we use as an example.

The math and the logic is simple. Make the rows match your accounting as much as possible. Set timeframes and estimate what expenses will be for each of the next 12 months, and then for the following two years as estimated annual totals.

In the example, the two owners know their business. As they develop their budget, they have a good idea of what they pay for kitchen time, Facebook ads, commissions, office equipment, and so on.

And if you don’t know these numbers for your business, find out. If you don’t know rents, talk to a broker, see some locations, and estimate what you’ll end up paying.

Do the same for utilities, insurance, and leased equipment: Make a good list, call people, and take a good educated guess.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

Payroll and payroll taxes are operating expenses

Expenses also include payroll, wages and salaries, or compensation. They are worth a list of their own. In the case of the soup business in the example above, for payroll, they do a separate list so they can keep track. Payroll is a serious fixed cost and an obligation. Here is the payroll budget associated with the sample plan above.

Notice that the totals from the personnel plan show up in the expense budget. And you can see the estimated expense for benefits over and above the gross salary. Employee-related expenses include payroll taxes along with what they budget for health insurance and other benefits.

Don’t worry too much about depreciation

Depreciation is a special case. Traditionally, it counts as an operating expense, but a lot of businesses budget for it separately because it doesn’t actually cost money.

It’s a concept the tax code allows us to deduct as a business expense, in theory, to allow for the gradual decline in the value of an asset, or—depending on which expert you follow—to allow money to buy new assets when existing assets become obsolete.

The argument for including it in the expenses is that it gives a more accurate picture of profits. And many people separate depreciation from the other expenses so they can calculate EBITDA, which is earnings before interest, taxes, depreciation, and amortization (which is like depreciation, but for intangible assets).

Bottom line: Include it or not; it’s your choice.

Yes, interest expense is an expense

Because interest is also excluded from EBITDA, many people also exclude it from operating expenses. They list it separately, along with depreciation, to make the EBITDA calculation easier. I say you can do that either way, it doesn’t matter, as long as you include the interest expense in your budget. Because, unlike depreciation, interest does cost money.

- Remember the underlying goal

The purpose of the budget is to help you make good decisions.

Set expenses to align with your strategy and tactics, so you do what works best for your long-term progress. Match your accounting categories as much as possible, so you can track later. Keep track of assumptions so when things come out different from the plan —and they always do—you can adjust quickly.

Tim Berry is the founder and chairman of Palo Alto Software , a co-founder of Borland International, and a recognized expert in business planning. He has an MBA from Stanford and degrees with honors from the University of Oregon and the University of Notre Dame. Today, Tim dedicates most of his time to blogging, teaching and evangelizing for business planning.

Table of Contents

Related Articles

1 Min. Read

How to Calculate Return on Investment (ROI)

7 Min. Read

7 Financial Terms Small Business Owners Need to Know

5 Min. Read

How to Improve the Accuracy of Financial Forecasts

8 Min. Read

How to Plan Your Exit Strategy

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

The Best Free Business Budget Templates

Published: October 12, 2023

Business budgets are a source of truth for your income and expenses. That includes all the money you spend — from A/B testing your marketing campaigns to your monthly office rent.

While organizing the numbers may sound difficult, using a business budget template makes the process simple. Plus, there are thousands of business budget templates for you to choose from.

We’ll share seven budget templates that can help organize your finances. But first, you’ll learn about different types of business budgets and how to create one.

What is a Business Budget?

A business budget is a spending plan that estimates the revenue and expenses of a business for a period of time, typically monthly, quarterly, or yearly.

The business budget follows a set template, which you can fill in with estimated revenues, plus any recurring or expected business expenses.

For example, say your business is planning a website redesign. You'd need to break down the costs by category: software, content and design, testing, and more.

Having a clear breakdown will help you estimate how much each category will cost and compare it with the actual costs.

Image Source

Types of Budgets for a Business

Master budget, operating budget, cash budget, static budget, departmental budget, capital budget, labor budget, project budget.

Business budgets aren’t one size fits all. In fact, there are many different types of budgets that serve various purposes. Let’s dive into some commonly used budgets:

Think of a master budget as the superhero of budgets — it brings together all the individual budgets from different parts of your company into one big, consolidated plan. It covers everything from sales and production to marketing and finances.

It includes details like projected revenues, expenses, and profitability for each department or business unit. It also considers important financial aspects like cash flow, capital expenditures, and even creates a budgeted balance sheet to show the organization's financial position.

The master budget acts as a guide for decision-making, helps with strategic planning, and gives a clear picture of the overall financial health and performance of your company. It's like the master plan that ties everything together and helps the organization move in the right direction.

Your operating budget helps your company figure out how much money it expects to make and spend during a specific period, usually a year. It not only predicts the revenue your business will bring in, but also outlines expenses it will need to cover, like salaries, rent, bills, and other operational costs.

By comparing your actual expenses and revenue to the budgeted amounts, your company can see how it's performing and make adjustments if needed. It helps keep things in check, allowing your business to make wise financial decisions and stay on track with its goals.

.png)

Free Business Budget Templates

Manage your business, personal, and program spend on an annual, quarterly, and monthly basis.

- Personal Budget Template

- Annual Budget Template

- Program Budget Template

You're all set!

Click this link to access this resource at any time.

A cash budget estimates the cash inflows and outflows of your business over a specific period, typically a month, quarter, or year. It provides a detailed projection of cash sources and uses, including revenue, expenses, and financing activities.

The cash budget helps you effectively manage your cash flow, plan for cash shortages or surpluses, evaluate the need for external financing, and make informed decisions about resource allocation.

By utilizing a cash budget, your business can ensure it has enough cash on hand to meet its financial obligations, navigate fluctuations, and seize growth opportunities.

A static budget is a financial plan that remains unchanged, regardless of actual sales or production volumes.

It’s typically created at the beginning of a budget period and doesn’t account for any fluctuations or changes in business conditions. It also assumes that all variables, such as sales, expenses, and production levels, will remain the same throughout the budget period.

While a static budget provides a baseline for comparison, it may not be realistic for businesses with fluctuating sales volumes or variable expenses.

A departmental budget focuses on the financial aspects of a specific department within your company, such as sales, marketing or human resources.

When creating a departmental budget, you may look at revenue sources like departmental sales, grants, and other sources of income. On the expense side, you consider costs such as salaries, supplies, equipment, and any other expenses unique to that department.

The goal of a departmental budget is to help the department manage its finances wisely. It acts as a guide for making decisions and allocating resources effectively. By comparing the actual numbers to the budgeted amounts, department heads can see if they're on track or if adjustments need to be made.

A capital budget is all about planning for big investments in the long term. It focuses on deciding where to spend money on things like upgrading equipment, maintaining facilities, developing new products, and hiring new employees.

The budget looks at the costs of buying new stuff, upgrading existing things, and even considers depreciation, which is when something loses value over time. It also considers the return on investment, like how much money these investments might bring in or how they could save costs in the future.

The budget also looks at different ways to finance these investments, whether it's through loans, leases, or other options. It's all about making smart decisions for the future, evaluating cash flow, and choosing investments that will help the company grow and succeed.

A labor budget helps you plan and manage the costs related to your employees. It involves figuring out how much your business will spend on wages, salaries, benefits, and other labor-related expenses.

To create a labor budget, you'll need to consider factors like how much work needs to be done, how many folks you'll need to get it done, and how much it'll all cost. This can help your business forecast and control labor-related expenses and ensure adequate staffing levels.

By having a labor budget in place, your business can monitor and analyze your labor costs to make informed decisions and optimize your resources effectively.

A project budget is the financial plan for a specific project.

Let's say you have an exciting new project you want to tackle. A project budget helps you figure out how much money you'll need and how it will be allocated. It covers everything from personnel to equipment and materials — basically, anything you'll need to make the project happen.

By creating a project budget, you can make sure the project is doable from a financial standpoint. It helps you keep track of how much you planned to spend versus how much you actually spend as you go along. That way, you have a clear idea of whether you're staying on track or if there are any financial challenges that need attention.

How to Create a Business Budget

While creating a business budget can be straightforward, the process may be more complex for larger companies with multiple revenue streams and expenses.

No matter the size of your business, here are the basic steps to creating a business budget.

1. Gather financial data.

Before you create a business budget, it’s important to gather insights from your past financial data. By looking at things like income statements, expense reports, and sales data, you can spot trends, learn from past experiences, and see where you can make improvements.

Going through your financial history helps you paint a true picture of your income and expenses. So, when you start creating your budget, you can set achievable targets and make sure your estimates match what's actually been happening in your business.

2. Find a template, or make a spreadsheet.

There are many free or paid budget templates online. You can start with an already existing budget template. We list a few helpful templates below.

You may also opt to make a spreadsheet with custom rows and columns based on your business.

3. Fill in revenues.

Once you have your template, start by listing all the sources of your business’ income. With a budget, you’re planning for the future, so you’ll also need to forecast revenue streams based on previous months or years. For a new small business budget, you’ll rely on your market research to estimate early revenue for your company.

When you estimate your revenue , you're essentially figuring out how much money you have to work with. This helps you decide where to allocate your resources and which expenses you can fund.

4. Subtract fixed costs for the time period.

Fixed costs are the recurring costs you have during each month, quarter, or year. Examples include insurance, rent for office space, website hosting, and internet.

The key thing to remember about fixed costs is that they stay relatively stable, regardless of changes in business activity. Even if your sales decrease or production slows down, these costs remain the same.

However, it's important to note that fixed costs can still change over the long term, such as when renegotiating lease agreements or adjusting employee salaries.

5. Consider variable costs.

Variable costs will change from time to time. Unlike fixed costs, variable costs increase or decrease as the level of production or sales changes.

Examples include raw materials needed to manufacture your products, packaging and shipping costs, utility bills, advertising costs, office supplies, and new software or technology.

You may always need to pay some variable costs, like utility bills. However, you can shift how much you spend toward other expenses, like advertising costs, when you have a lower-than-average estimated income.

6. Set aside time for business budget planning.

Unexpected expenses might come up, or you might want to save to expand your business. Either way, review your budget after including all expenses, fixed costs, and variable costs. Once completed, you can determine how much money you can save. It’s wise to create multiple savings accounts. One should be used for emergencies. The other holds money that can be spent on the business to drive growth.

Fill out the form to get the free templates.

How to manage a business budget.

There are a few key components to managing a healthy business budget.

Budget Preparation

The process all starts with properly preparing and planning the budget at the beginning of each month, quarter, or year. You can also create multiple budgets, some short-term and some long-term. During this stage, you will also set spending limits and create a system to regularly monitor the budget.

Budget Monitoring

In larger businesses, you might delegate budget tracking to multiple supervisors. But even if you’re a one-person show, keep a close eye on your budget. That means setting a time in your schedule each day or week to review the budget and track actual income and expenses. Be sure to compare the actual numbers to the estimates.

Budget Forecasting

With regular budget tracking, you always know how your business is doing. Check in regularly to determine how you are doing in terms of revenue and where you have losses. Find where you can minimize expenses and how you can move more money into savings.

Why is a Budget Important for a Business?

A budget is crucial for businesses. Without one, you could easily be drowning in expenses or unexpected costs.

The business budget helps with several operations. You can use a business budget to keep track of your finances, save money to help you grow the business or pay bonuses in the future, and prepare for unexpected expenses or emergencies.

You can also review your budget to determine when to take the next leap for your business. For example, you might be dreaming of a larger office building or the latest software, but you want to make sure you have a healthy net revenue before you make the purchase.

Best Free Business Budget Templates

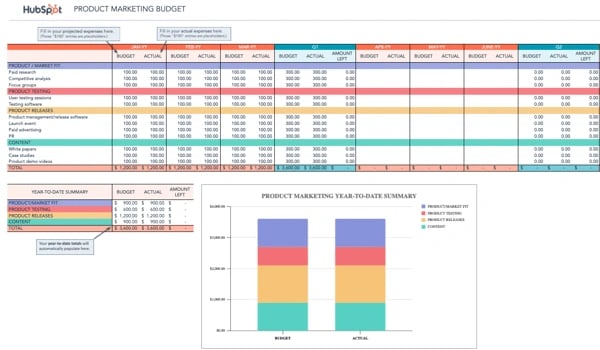

1. marketing budget template.

Knowing how to manage a marketing budget can be a challenge, but with helpful free templates like this marketing budget template bundle , you can track everything from advertising expenses to events and more.

This free bundle includes eight different templates, so you can create multiple budgets to help you determine how much money to put toward marketing, plus the return on your investment.

2. Small Business Budget Template

For small businesses, it can be hard to find the time to draw up a budget, but it’s crucial to help keep the business in good health.

Capterra offers a budget template specifically for small businesses. Plus, this template works with Excel. Start by inputting projections for the year. Then, the spreadsheet will project the month-to-month budget. You can input your actual revenue and expenses to compare, making profits and losses easy to spot.

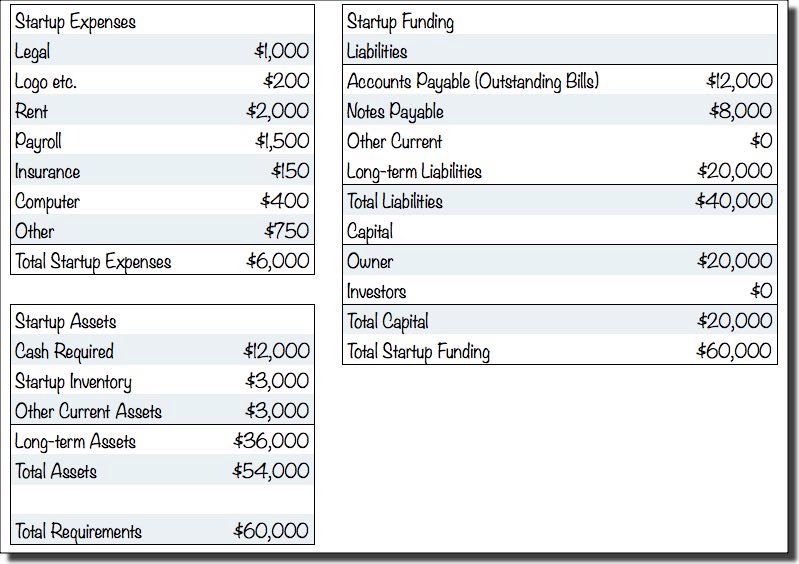

3. Startup Budget Template

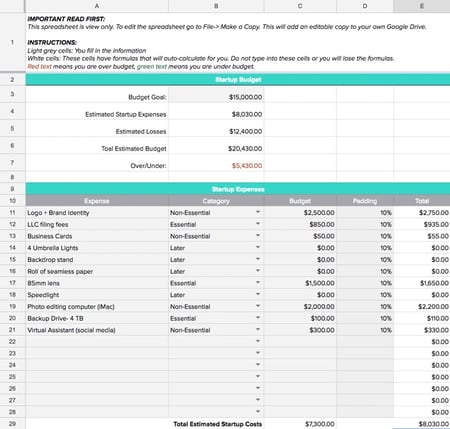

What if you don’t have any previous numbers to rely on to create profit and expense estimates? If you are a startup, this Gusto budget template will help you draw up a budget before your business is officially in the market. This will help you track all the expenses you need to get your business up and running, estimate your first revenues, and determine where to pinch pennies.

4. Free Business Budget Template

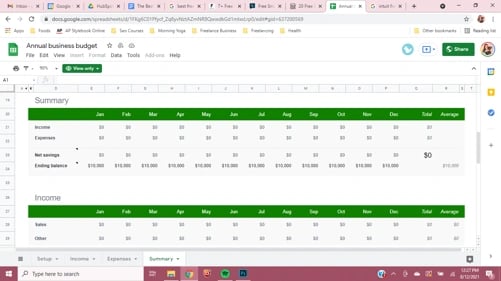

You might be familiar with Intuit. Many companies, big and small, rely on Intuit’s services like Quickbooks and TurboTax. Even if you don’t use the company’s paid financial services, you can take advantage of Intuit’s free budget template , which works in Google Sheets or Excel.

It features multiple spreadsheet tabs and simple instructions. You enter your revenue in one specific tab and expenses in another. You can also add additional tabs as needed. Then, like magic, the spreadsheet uses the data in the income and expense tabs to summarize the information. This template can even determine net savings and the ending balance.

5. Department Budget Sheet

A mid- to large-size company will have multiple departments, all with different budgetary needs. These budgets will all be consolidated into a massive, company-wide budget sheet. Having a specific template for each department can help teams keep track of spending and plan for growth.

This free template from Template.net works in either document or spreadsheet formats. This budget template can help different departments keep track of their income and spending.

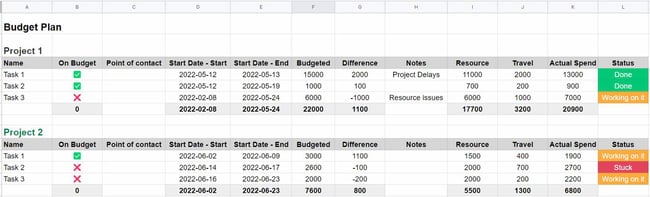

6. Project Budget Template

Every new project comes with expenses. This free budget template from Monday will help your team estimate costs before undertaking a project. You can easily spot if you're going over budget midway through a project so you can adjust.

This template is especially useful for small companies that are reporting budgets to clients and for in-house teams getting buy-in for complex projects.

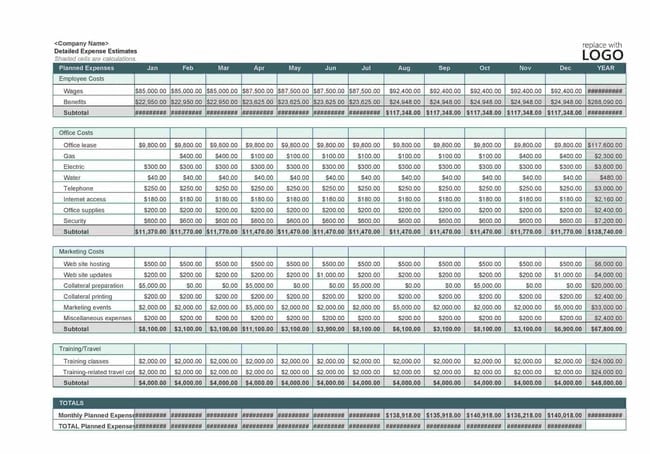

7. Company Budget Template

Want to keep track of every penny? Use this template from TemplateLab to draw up a detailed budget. The list of expenses includes fixed costs, employee costs, and variable costs. This business template can be especially useful for small businesses that want to keep track of expenses in one, comprehensive document.

Create a Business Budget to Help Your Company Grow

Making your first business budget can be daunting, especially if you have several revenue streams and expenses. Using a budget template can make getting started easy. And, once you get it set up, these templates are simple to replicate.

With little planning and regular monitoring, you can plan for the future of your business.

Editor's note: This post was originally published in September 2021 and has been updated for comprehensiveness.

Don't forget to share this post!

Related articles.

![business expenses for business plan Marketing Budget: How Much Should Your Team Spend in 2024? [By Industry]](https://blog.hubspot.com/hubfs/how%20to%20spend%20your%20marketing%20budget_featured.webp)

Marketing Budget: How Much Should Your Team Spend in 2024? [By Industry]

![business expenses for business plan How Marketing Leaders are Navigating Recession [New Data]](https://blog.hubspot.com/hubfs/how%20marketing%20leaders%20are%20navigating%20recession.webp)

How Marketing Leaders are Navigating Recession [New Data]

![business expenses for business plan 3 Ways Marketers are Already Navigating Potential Recession [Data]](https://blog.hubspot.com/hubfs/how-marketers-are-navigating-recession.jpg)

3 Ways Marketers are Already Navigating Potential Recession [Data]

![business expenses for business plan Marketing Without a Budget? Use These 10 Tactics [Expert Tips]](https://blog.hubspot.com/hubfs/marketing%20without%20budget.jpg)

Marketing Without a Budget? Use These 10 Tactics [Expert Tips]

24 Ways to Spend Your Marketing Budget Next Quarter

Startup Marketing Budget: How to Write an Incredible Budget for 2023

![business expenses for business plan How to Manage Your Entire Marketing Budget [Free Budget Planner Templates]](https://blog.hubspot.com/hubfs/free-marketing-budget-templates_5.webp)

How to Manage Your Entire Marketing Budget [Free Budget Planner Templates]

10 Best Free Project Management Budget Templates for Marketers

What Marketing Leaders Are Investing in This Year

The Best Free Business Budget Worksheets

6 templates to manage your business, personal, and program spend on an annual, quarterly, and monthly basis.

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

- Search Search Please fill out this field.

Business Plan: What It Is, What's Included, and How to Write One

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

What Is a Business Plan?

A business plan is a document that details a company's goals and how it intends to achieve them. Business plans can be of benefit to both startups and well-established companies. For startups, a business plan can be essential for winning over potential lenders and investors. Established businesses can find one useful for staying on track and not losing sight of their goals. This article explains what an effective business plan needs to include and how to write one.

Key Takeaways

- A business plan is a document describing a company's business activities and how it plans to achieve its goals.

- Startup companies use business plans to get off the ground and attract outside investors.

- For established companies, a business plan can help keep the executive team focused on and working toward the company's short- and long-term objectives.

- There is no single format that a business plan must follow, but there are certain key elements that most companies will want to include.

Investopedia / Ryan Oakley

Understanding Business Plans

Any new business should have a business plan in place prior to beginning operations. In fact, banks and venture capital firms often want to see a business plan before they'll consider making a loan or providing capital to new businesses.

Even if a business isn't looking to raise additional money, a business plan can help it focus on its goals. A 2017 Harvard Business Review article reported that, "Entrepreneurs who write formal plans are 16% more likely to achieve viability than the otherwise identical nonplanning entrepreneurs."

Ideally, a business plan should be reviewed and updated periodically to reflect any goals that have been achieved or that may have changed. An established business that has decided to move in a new direction might create an entirely new business plan for itself.

There are numerous benefits to creating (and sticking to) a well-conceived business plan. These include being able to think through ideas before investing too much money in them and highlighting any potential obstacles to success. A company might also share its business plan with trusted outsiders to get their objective feedback. In addition, a business plan can help keep a company's executive team on the same page about strategic action items and priorities.

Business plans, even among competitors in the same industry, are rarely identical. However, they often have some of the same basic elements, as we describe below.

While it's a good idea to provide as much detail as necessary, it's also important that a business plan be concise enough to hold a reader's attention to the end.

How to Write a Business Plan

While there are any number of templates that you can use to write a business plan, it's best to try to avoid producing a generic-looking one. Let your plan reflect the unique personality of your business.

Many business plans use some combination of the sections below, with varying levels of detail, depending on the company.

Common Elements of a Business Plan

The length of a business plan can vary greatly from business to business. Regardless, it's best to fit the basic information into a 15- to 25-page document. Other crucial elements that take up a lot of space—such as applications for patents—can be referenced in the main document and attached as appendices.

These are some of the most common elements in many business plans:

- Executive summary: This section introduces the company and includes its mission statement along with relevant information about the company's leadership, employees, operations, and locations.

- Products and services: Here, the company should describe the products and services it offers or plans to introduce. That might include details on pricing, product lifespan, and unique benefits to the consumer. Other factors that could go into this section include production and manufacturing processes, any relevant patents the company may have, as well as proprietary technology . Information about research and development (R&D) can also be included here.

- Market analysis: A company needs to have a good handle on the current state of its industry and the existing competition. This section should explain where the company fits in, what types of customers it plans to target, and how easy or difficult it may be to take market share from incumbents.

- Marketing strategy: This section can describe how the company plans to attract and keep customers, including any anticipated advertising and marketing campaigns. It should also describe the distribution channel or channels it will use to get its products or services to consumers.

- Financial plans and projections: Established businesses can include financial statements, balance sheets, and other relevant financial information. New businesses can provide financial targets and estimates for the first few years. Your plan might also include any funding requests you're making.

The best business plans aren't generic ones created from easily accessed templates. A company should aim to entice readers with a plan that demonstrates its uniqueness and potential for success.

2 Types of Business Plans

Business plans can take many forms, but they are sometimes divided into two basic categories: traditional and lean startup. According to the U.S. Small Business Administration (SBA) , the traditional business plan is the more common of the two.

- Traditional business plans : These plans tend to be much longer than lean startup plans and contain considerably more detail. As a result they require more work on the part of the business, but they can also be more persuasive (and reassuring) to potential investors.

- Lean startup business plans : These use an abbreviated structure that highlights key elements. These business plans are short—as short as one page—and provide only the most basic detail. If a company wants to use this kind of plan, it should be prepared to provide more detail if an investor or a lender requests it.

Why Do Business Plans Fail?

A business plan is not a surefire recipe for success. The plan may have been unrealistic in its assumptions and projections to begin with. Markets and the overall economy might change in ways that couldn't have been foreseen. A competitor might introduce a revolutionary new product or service. All of this calls for building some flexibility into your plan, so you can pivot to a new course if needed.

How Often Should a Business Plan Be Updated?

How frequently a business plan needs to be revised will depend on the nature of the business. A well-established business might want to review its plan once a year and make changes if necessary. A new or fast-growing business in a fiercely competitive market might want to revise it more often, such as quarterly.

What Does a Lean Startup Business Plan Include?

The lean startup business plan is an option when a company prefers to give a quick explanation of its business. For example, a brand-new company may feel that it doesn't have a lot of information to provide yet.

Sections can include: a value proposition ; the company's major activities and advantages; resources such as staff, intellectual property, and capital; a list of partnerships; customer segments; and revenue sources.

The Bottom Line

A business plan can be useful to companies of all kinds. But as a company grows and the world around it changes, so too should its business plan. So don't think of your business plan as carved in granite but as a living document designed to evolve with your business.

Harvard Business Review. " Research: Writing a Business Plan Makes Your Startup More Likely to Succeed ."

U.S. Small Business Administration. " Write Your Business Plan ."

- How to Start a Business: A Comprehensive Guide and Essential Steps 1 of 25

- How to Do Market Research, Types, and Example 2 of 25

- Marketing Strategy: What It Is, How It Works, and How to Create One 3 of 25

- Marketing in Business: Strategies and Types Explained 4 of 25

- What Is a Marketing Plan? Types and How to Write One 5 of 25

- Business Development: Definition, Strategies, Steps & Skills 6 of 25

- Business Plan: What It Is, What's Included, and How to Write One 7 of 25

- Small Business Development Center (SBDC): Meaning, Types, Impact 8 of 25

- How to Write a Business Plan for a Loan 9 of 25

- Business Startup Costs: It’s in the Details 10 of 25

- Startup Capital Definition, Types, and Risks 11 of 25

- Bootstrapping Definition, Strategies, and Pros/Cons 12 of 25

- Crowdfunding: What It Is, How It Works, and Popular Websites 13 of 25

- Starting a Business with No Money: How to Begin 14 of 25

- A Comprehensive Guide to Establishing Business Credit 15 of 25

- Equity Financing: What It Is, How It Works, Pros and Cons 16 of 25

- Best Startup Business Loans for May 2024 17 of 25

- Sole Proprietorship: What It Is, Pros and Cons, and Differences From an LLC 18 of 25

- Partnership: Definition, How It Works, Taxation, and Types 19 of 25

- What Is an LLC? Limited Liability Company Structure and Benefits Defined 20 of 25

- Corporation: What It Is and How To Form One 21 of 25

- Starting a Small Business: Your Complete How-to Guide 22 of 25

- Starting an Online Business: A Step-by-Step Guide 23 of 25

- How to Start Your Own Bookkeeping Business: Essential Tips 24 of 25

- How to Start a Successful Dropshipping Business: A Comprehensive Guide 25 of 25

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1456193345-2cc8ef3d583f42d8a80c8e631c0b0556.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Ready to simplify your receipt and expense management process?

Enter your email to sign up for Expensify today!

All the business expense categories you need to know

Tackling tax season without a well-organized record of your business expenses is like trying to assemble a puzzle in the dark — frustrating, time-consuming, and you might turn the light on just to realize you didn’t do any of it right in the first place.

For many small businesses and startups , categorizing business expenses to prep for tax season might not seem like the highest priority task. But putting your business expenses on the back burner can lead to significant financial issues and missed tax savings that directly impact your bottom line.

Read on to uncover the essential business expense categories every business should be familiar with, ensuring you’re set up for success during tax season and beyond.

What are business expenses?

Business expenses are the costs incurred during the day-to-day operations of a company. These can range from tangible assets such as inventory or office equipment to intangibles like fees for legal services or advertising.

Because these expenses are so broad, knowing what does and doesn’t qualify as a business expense is key. That’s where business expense categories come into play. Knowing and utilizing these categories helps business owners plan their finances, save money during tax time, and improve how they run their business.

Business expense categories, defined