- Sample Business Plans

Investment Company Business Plan

The possibility for substantial financial gains is one of the main advantages of an investment company. As the company expands and gains customers, it has the potential to generate large fees and commissions based on investment portfolios.

Are you looking for the same rewards? Then go on with planning everything first.

Need help writing a business plan for your investment company? You’re at the right place. Our investment company business plan template will help you get started.

Free Business Plan Template

Download our free business plan template now and pave the way to success. Let’s turn your vision into an actionable strategy!

- Fill in the blanks – Outline

- Financial Tables

How to Write An Investment Company Business Plan?

Writing an investment company business plan is a crucial step toward the success of your business. Here are the key steps to consider when writing a business plan:

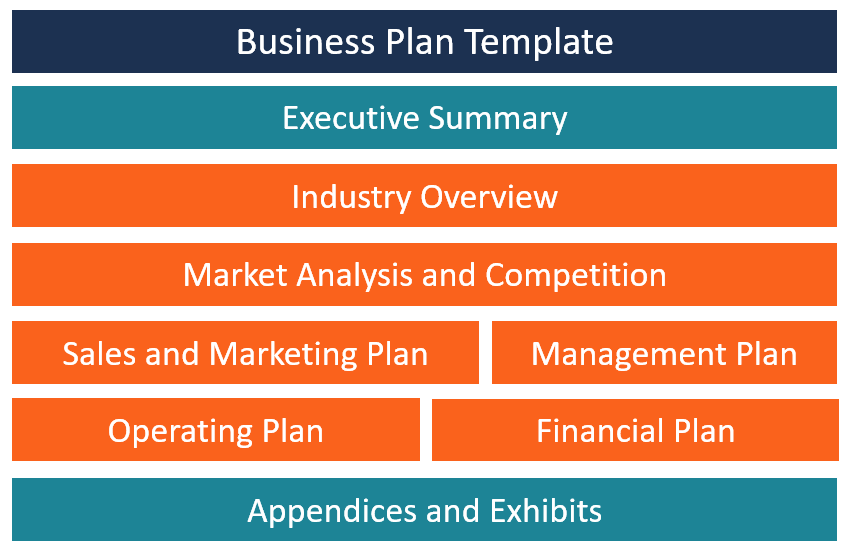

1. Executive Summary

An executive summary is the first section planned to offer an overview of the entire business plan. However, it is written after the entire business plan is ready and summarizes each section of your plan.

Here are a few key components to include in your executive summary:

Introduce your Business:

Start your executive summary by briefly introducing your business to your readers.

Market Opportunity:

Products and services:.

Highlight the investment company services you offer your clients. The USPs and differentiators you offer are always a plus.

Marketing & Sales Strategies:

Financial highlights:, call to action:.

Ensure your executive summary is clear, concise, easy to understand, and jargon-free.

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $7/month

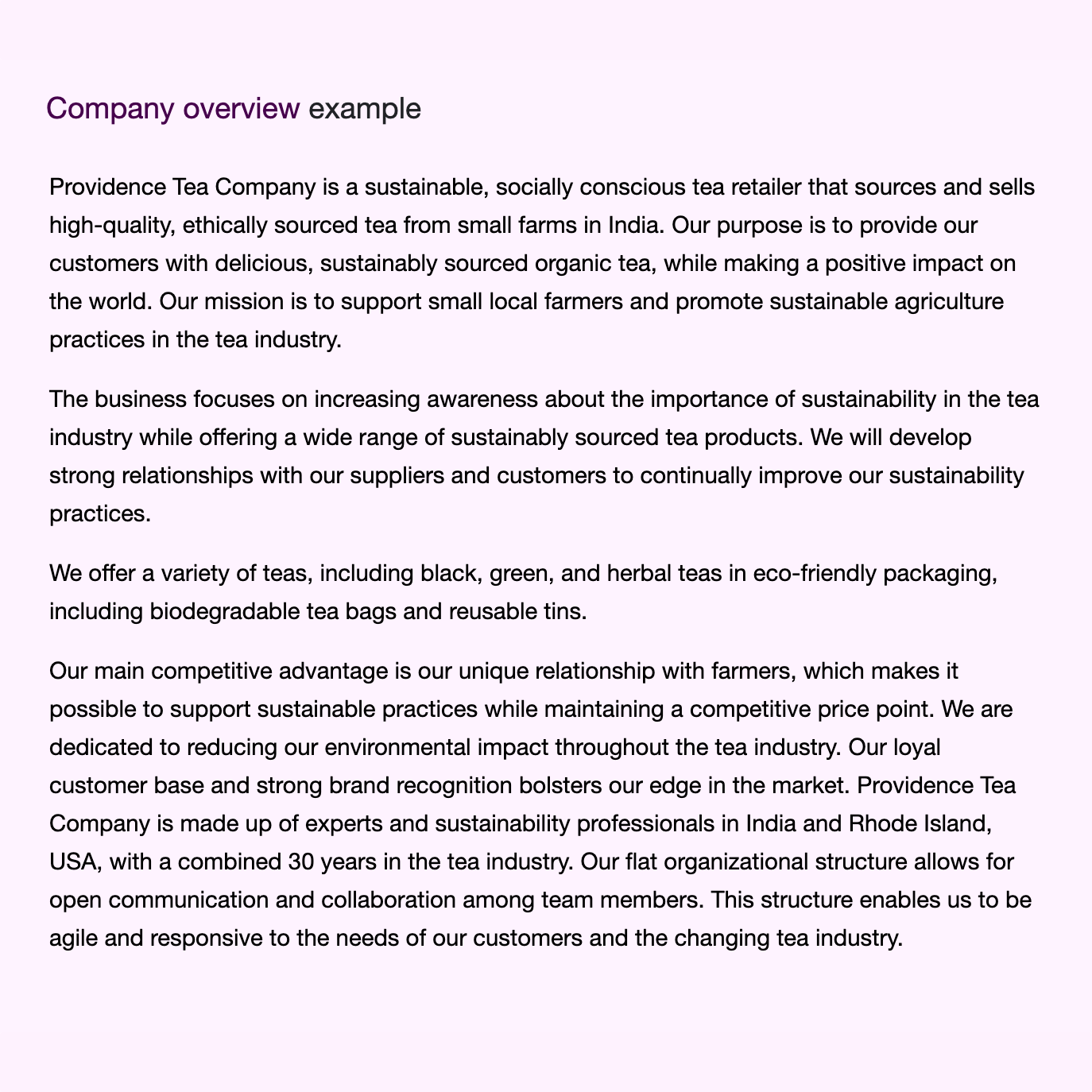

2. Business Overview

The business overview section of your business plan offers detailed information about your company. The details you add will depend on how important they are to your business. Yet, business name, location, business history, and future goals are some of the foundational elements you must consider adding to this section:

Business Description:

Describe your business in this section by providing all the basic information:

Describe what kind of investment company you run and the name of it. You may specialize in one of the following investment businesses:

- Mutual fund companies

- Venture capital funds

- Private equity funds

- Asset management companies

- Pension fund managers

- Describe the legal structure of your investment company, whether it is a sole proprietorship, LLC, partnership, or others.

- Explain where your business is located and why you selected the place.

Mission Statement:

Business history:.

If you’re an established investment company, briefly describe your business history, like—when it was founded, how it evolved over time, etc.

Future Goals:

This section should provide a thorough understanding of your business, its history, and its future plans. Keep this section engaging, precise, and to the point.

3. Market Analysis

The market analysis section of your business plan should offer a thorough understanding of the industry with the target market, competitors, and growth opportunities. You should include the following components in this section.

Target market:

Start this section by describing your target market. Define your ideal customer and explain what types of services they prefer. Creating a buyer persona will help you easily define your target market to your readers.

Market size and growth potential:

Describe your market size and growth potential and whether you will target a niche or a much broader market.

Competitive Analysis:

Market trends:.

Analyze emerging trends in the industry, such as technology disruptions, changes in customer behavior or preferences, etc. Explain how your business will cope with all the trends.

Regulatory Environment:

Here are a few tips for writing the market analysis section of your investment company business plan:

- Conduct market research, industry reports, and surveys to gather data.

- Provide specific and detailed information whenever possible.

- Illustrate your points with charts and graphs.

- Write your business plan keeping your target audience in mind.

4. Products And Services

The product and services section should describe the specific services and products that will be offered to customers. To write this section should include the following:

Describe your services:

Mention the investment company services your business will offer. This list may include services like,

- Portfolio management

- Financial planning

- Investment research and analysis

- Wealth management

- Mutual funds and exchange-traded funds

Investment advisory services:

Additional services:.

In short, this section of your investment business plan must be informative, precise, and client-focused. By providing a clear and compelling description of your offerings, you can help potential investors and readers understand the value of your business.

5. Sales And Marketing Strategies

Writing the sales and marketing strategies section means a list of strategies you will use to attract and retain your clients. Here are some key elements to include in your sales & marketing plan:

Unique Selling Proposition (USP):

Define your business’s USPs depending on the market you serve, the equipment you use, and the unique services you provide. Identifying USPs will help you plan your marketing strategies.

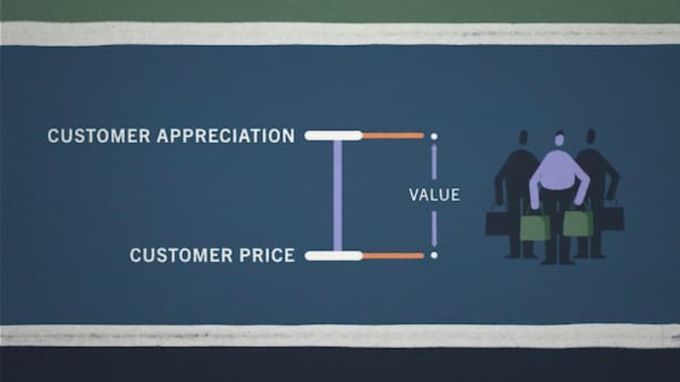

Pricing Strategy:

Marketing strategies:, sales strategies:, customer retention:.

Overall, this section of your investment company business plan should focus on customer acquisition and retention.

Have a specific, realistic, and data-driven approach while planning sales and marketing strategies for your investment business, and be prepared to adapt or make strategic changes in your strategies based on feedback and results.

6. Operations Plan

The operations plan section of your business plan should outline the processes and procedures involved in your business operations, such as staffing requirements and operational processes. Here are a few components to add to your operations plan:

Staffing & Training:

Operational process:, equipment & software:.

Include the list of equipment and software required for investment business, such as servers & data storage, network equipment, trading platforms, customer relationship management software, portfolio management software, etc.

Adding these components to your operations plan will help you lay out your business operations, which will eventually help you manage your business effectively.

7. Management Team

The management team section provides an overview of your investment business’s management team. This section should provide a detailed description of each manager’s experience and qualifications, as well as their responsibilities and roles.

Founders/CEO:

Key managers:.

Introduce your management and key members of your team, and explain their roles and responsibilities.

Organizational structure:

Compensation plan:, advisors/consultants:.

Mentioning advisors or consultants in your business plans adds credibility to your business idea.

This section should describe the key personnel for your investment company, highlighting how you have the perfect team to succeed.

8. Financial Plan

Your financial plan section should provide a summary of your business’s financial projections for the first few years. Here are some key elements to include in your financial plan:

Profit & loss statement:

Cash flow statement:, balance sheet:, break-even point:.

Determine and mention your business’s break-even point—the point at which your business costs and revenue will be equal.

Financing Needs:

Be realistic with your financial projections, and make sure you offer relevant information and evidence to support your estimates.

9. Appendix

The appendix section of your plan should include any additional information supporting your business plan’s main content, such as market research, legal documentation, financial statements, and other relevant information.

- Add a table of contents for the appendix section to help readers easily find specific information or sections.

- In addition to your financial statements, provide additional financial documents like tax returns, a list of assets within the business, credit history, and more. These statements must be the latest and offer financial projections for at least the first three or five years of business operations

- Provide data derived from market research, including stats about the industry, user demographics, and industry trends.

- Include any legal documents such as permits, licenses, and contracts.

- Include any additional documentation related to your business plan, such as product brochures, marketing materials, operational procedures, etc.

Use clear headings and labels for each section of the appendix so that readers can easily find the necessary information.

Remember, the appendix section of your investment firm business plan should only include relevant and important information supporting your plan’s main content.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

This sample investment company business plan will provide an idea for writing a successful investment company plan, including all the essential components of your business.

After this, if you still need clarification about writing an investment-ready business plan to impress your audience, download our investment company business plan pdf .

Related Posts

Bookkeeping Business Plan

Concierge Services Business Plan

How to make Perfect Business Outline

Simple Business Plan Template Example

What are Business Plan Components

How to Write Business Plan Appendix

Frequently asked questions, why do you need an investment company business plan.

A business plan is an essential tool for anyone looking to start or run a successful investment business. It helps to get clarity in your business, secures funding, and identifies potential challenges while starting and growing your business.

Overall, a well-written plan can help you make informed decisions, which can contribute to the long-term success of your investment company.

How to get funding for your investment company?

There are several ways to get funding for your investment company, but self-funding is one of the most efficient and speedy funding options. Other options for funding are:

Small Business Administration (SBA) loan

Crowdfunding, angel investors.

Apart from all these options, there are small business grants available, check for the same in your location and you can apply for it.

Where to find business plan writers for your investment company?

There are many business plan writers available, but no one knows your business and ideas better than you, so we recommend you write your investment company business plan and outline your vision as you have in your mind.

What is the easiest way to write your investment company business plan?

A lot of research is necessary for writing a business plan, but you can write your plan most efficiently with the help of any investment company business plan example and edit it as per your need. You can also quickly finish your plan in just a few hours or less with the help of our business plan software .

About the Author

Upmetrics Team

Upmetrics is the #1 business planning software that helps entrepreneurs and business owners create investment-ready business plans using AI. We regularly share business planning insights on our blog. Check out the Upmetrics blog for such interesting reads. Read more

Plan your business in the shortest time possible

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Create a great Business Plan with great price.

- 400+ Business plan templates & examples

- AI Assistance & step by step guidance

- 4.8 Star rating on Trustpilot

Streamline your business planning process with Upmetrics .

Investment Company Business Plan Template

Written by Dave Lavinsky

Investment Company Business Plan

You’ve come to the right place to create your Investment Company business plan.

We have helped over 1,000 entrepreneurs and business owners create business plans and many have used them to start or grow their Investment Companies.

Below is a template to help you create each section of your Investment Company business plan.

Executive Summary

Business overview.

NovaGrowth Investments is a startup investment company located in Aurora, Colorado. The company is founded by Thom Anderson, an investment broker from Colorado Springs, Colorado, who has amassed millions of dollars for his clients over ten years while working at Clear River Investments. Because Thom has gained an extensive following of clients who have already indicated they will follow him to his new investment company, he has made the initial steps into forming NovaGrowth Investments. Thom plans on recruiting a team of highly-qualified professionals to help manage the day-to-day operations of a premier investment company in every aspect of marketing and advising in the land acquisition investment company.

NovaGrowth Investments will provide a wide array of services for investors, in particular those related to the optimal attention and time needed to secure valuable investments on their behalf. Investors can feel confident and secure, knowing that Thom and his team are looking out for their interests in every aspect of the land acquisition process. What’s more, NovaGrowth offers customized guarantees of investment performance that are singular within the investment company industry.

Product Offering

The following are the services that NovaGrowth Investments will provide:

- Analysis and expansive vetting of land acquisition opportunities up to 5M acres

- Extensive market research that secures in-depth findings

- Consistent and competitive returns while managing risk effectively

- Full spectrum wealth management

- Comprehensive array of software tools/programs to capture critical intelligence

- Unique strategies tailored for each individual client

- “New investor” welcome package with goal-setting seminar included

- “Boots on the Ground” team of investment analysts who visit each location under consideration and offer a full report plus video capture of the land

- Oversight and management of each portfolio and customized suggestions

Customer Focus

NovaGrowth Investments will target individual investors. They will also target corporate investors who are seeking land acquisitions. They will target fast-growing companies known to be seeking additional tracts of land. NovaGrowth Investments will target industry partners (cattle ranchers, horse breeders, etc) that could benefit from land acquisition as an investment.

Management Team

NovaGrowth Investments will be owned and operated by Thom Anderson. He recruited Jackson Byers and Kylie Carlson to manage the day-to-day operations of the investment company and oversee human resources.

Thom Anderson is a graduate of Cambridge University in the U.K., where he graduated with an International Business bachelor’s degree. He spent five years in the U.K. sourcing land for a large investment firm as an entry-level investment advisor.

Upon his return to the U.S.,Thom obtained his investment broker’s license and was employed by Clear River Investments in Colorado Springs, Colorado. Within one year, Thom secured over 5M in investments for his clients and, within five years, he amassed over 25M in land acquisition investments on behalf of his clients.

Jackson Byers is a graduate of the University of Illinois, where he graduated with a master’s degree in Accounting. His former role at Clear River Investments was as the Associate Accountant, where he managed the normal business accounting processes for the firm. He will serve as the Staff Accountant in the startup company and will assist in overseeing the day-to-day operations of the firm.

Kylie Carlson was hired by Thom Anderson as his Assistant and worked for him at Clear River Investments for over ten years. Her new role will be the Human Resources Manager, overseeing personnel and the processes that are regulated and required by Colorado.

Success Factors

NovaGrowth Investments will be able to achieve success by offering the following competitive advantages:

- Friendly, knowledgeable, and highly-qualified team of NovaGrowth Investments

- “Boots on the Ground” team of investment analysts who visit each location under consideration and offer a full report plus video capture of the land.

- NovaGrowth Investments offers outstanding value for each client in both their management fees and land acquisition percentages. Their pricing denotes quality and value and their results continually substantiate it.

Financial Highlights

NovaGrowth Investments is seeking $200,000 in debt financing to launch its NovaGrowth Investments. The funding will be dedicated toward securing the office space and purchasing office equipment and supplies. Funding will also be dedicated toward three months of overhead costs to include payroll of the staff, rent, and marketing costs for the marketing costs. The breakout of the funding is below:

- Office space build-out: $20,000

- Office equipment, supplies, and materials: $10,000

- Three months of overhead expenses (payroll, rent, utilities): $150,000

- Marketing costs: $10,000

- Working capital: $10,000

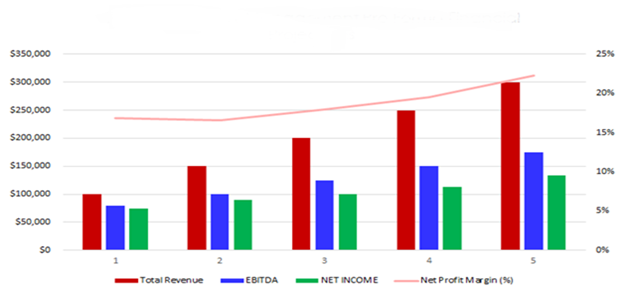

The following graph outlines the financial projections for NovaGrowth Investments.

Company Overview

Who is novagrowth investments.

NovaGrowth Investments is a newly established, full-service investment company in Aurora, Colorado. NovaGrowth Investments will be the most reliable, effective and value-driven choice for private and commercial investors in Aurora and the surrounding communities. NovaGrowth Investments will provide a comprehensive menu of portfolio and land acquisition services for any potential investor to utilize. Their full-service approach includes a comprehensive seminar and helpful introductory information for first-time investors.

NovaGrowth Investments will be able to manage the investments and acquire new investments for their clients. The team of professionals are highly qualified and experienced in investment brokerage and land acquisitions. NovaGrowth Investments removes all headaches and issues of trying to locate safe and secure investments and ensures all issues are taken care of expeditiously while delivering the best customer service.

NovaGrowth Investments History

Thom Anderson is a graduate of Cambridge University in the U.K., where he graduated with an International Business bachelor’s degree. He spent five years in the U.K. sourcing land for a large investment firm as an entry-level investment advisor. Upon his return to the U.S.,Thom obtained his investment broker’s license and was employed by Clear River Investments in Colorado Springs, Colorado. Within one year, Thom secured over 5M in investments for his clients and, within five years, he amassed over 25M in land acquisition investments on behalf of his clients.

Since incorporation, NovaGrowth Investments has achieved the following milestones:

- Registered NovaGrowth Investments, LLC to transact business in the state of Colorado.

- Has a contract in place for a 10,000 square foot office at one of the midtown buildings

- Reached out to numerous contacts to sign on with NovaGrowth Investments.

- Began recruiting a staff of seven and four office personnel to work at NovaGrowth Investments

NovaGrowth Investments Services

The following will be the services NovaGrowth Investments will provide:

Industry Analysis

The investment company industry is expected to grow over the next five years to over $1.3 trillion. The growth will be driven by ongoing vast opportunities for individuals and organizations seeking to grow their wealth The growth will be driven by new technology that navigating the complexities of the financial markets The growth will be driven by an increase in the interest of individuals in “making their own way” in the world The growth will be driven by the stability of land ownership as an on-going and important element in investment portfolios.

Costs will likely be reduced as technology continues to advance, allowing better-informed acquisition interest and supplemental risk mitigation Costs will likely be reduced as younger investors, such as Gen Z and millennials, continue to express an interest and desire for land acquisition investments, which indicates an increased number of sellers will enter the market due to favorable conditions.

Customer Analysis

Demographic profile of target market.

NovaGrowth Investments will target those potential individual investors in Aurora, Colorado. They will target businesses with a track record of land investments or a need for land due to company growth. NovaGrowth Investments will target industry partners (cattle ranchers, horse breeders, etc) that could benefit from land acquisition as an investment.

| Total | Percent | |

|---|---|---|

| Total population | 1,680,988 | 100% |

| Male | 838,675 | 49.9% |

| Female | 842,313 | 50.1% |

| 20 to 24 years | 114,872 | 6.8% |

| 25 to 34 years | 273,588 | 16.3% |

| 35 to 44 years | 235,946 | 14.0% |

| 45 to 54 years | 210,256 | 12.5% |

| 55 to 59 years | 105,057 | 6.2% |

| 60 to 64 years | 87,484 | 5.2% |

| 65 to 74 years | 116,878 | 7.0% |

| 75 to 84 years | 52,524 | 3.1% |

Customer Segmentation

NovaGrowth Investments will primarily target the following customer profiles:

- Individual investors

- Businesses with a record of land investments or those seeking land due to internal growth

- Industry partners seeking additional land for livestock or farming purposes

Competitive Analysis

Direct and indirect competitors.

NovaGrowth Investments will face competition from other companies with similar business profiles. A description of each competitor company is below.

CapitalMax Advisors

CapitalMax Advisors is a startup investment company in Colorado Springs, Colorado. The owner, Barry Jackson, is a graduate of Purdue University and has been an investment advisor for over ten years. He recently launched Capital Max Advisors to meet what he coined, “The Great Asset Allocation” investment opportunities within the city of Colorado Springs. Barry has hired ten associates from his former employer’s company to seek investors who are primarily interested in asset allocation investments and the company is promising reduced portfolio management rates for the first six months of business.

CapitalMax Advisors is a full-service investment company with a strong following of investors who were delighted by Barry’s performance on their behalf at his former employer. The expectation is that CapitalMax Advisors will live up to their primary purpose, which is to oversee and direct asset allocation to maximize returns in substantial numbers.

WealthWise Investments

Owned by Tamara and Loren Downs, WealthWise Investments is known for it’s assertive actions on behalf of clients. The company was founded in 2010 and currently offers a diverse range of investment products and services. They specialize in ETFs, mutual funds, and alternative investments. WealthWise Investments is known for its expertise in risk management, technology-driven investment strategies, and statewide reach beyond it’s home city of Colorado Springs.

WealthWise Investments offers excellent services to clients; however, clients have noted publicly that the fees and service charges are high in tandem with the asset allocation gains. There have been two complaints noted with the state regulatory agencies. Meanwhile, Tamara and Loren Downs continue to employ efforts to bring technology-driven tools into the investment company that will trim staff and distribute higher rates on behalf of investors.

FinTech Capital Management

FinTech Capital Management is a five-year-old company located in Denver, Colorado. The focus of the company is on financial technology investments on behalf of their client investors. Currently, the company has recorded stable and growing levels of profitability and has been tagged as an investment management firm known for its expertise in mutual funds and retirement planning They offer a sizable range of investment strategies, including equity, fixed income, and asset allocation funds. They are tech-driven and focus on research-driven investment decisions to fulfill the goals of their clients in long-term wealth creation.

In addition to tech acquisitions, FinTech Capital Management is also directed toward senior investors, with brokerage, retirement planning, wealth management, and mutual funds in their services offered. They provide a range of investment options, from individual stocks and bonds to managed portfolios and retirement accounts, many of which are perfect for those investors who have amassed a sizable portfolio, but are becoming risk-averse as they age. FinTech Capital Management is owned by The Thurgood Family Trust with the Thurgood brothers, Jonathan and Regis, responsible for day-to-day management. It has been recently suggested that the firm may be sold if the right buyers were to approach.

Competitive Advantage

NovaGrowth Investments will be able to offer the following advantages over their competition:

Marketing Plan

Brand & value proposition.

NovaGrowth Investments will offer the unique value proposition to its clientele:

- Unique investment strategies tailored for each individual client

Promotions Strategy

The promotions strategy for NovaGrowth Investments is as follows:

Word of Mouth/Referrals

Thom Anderson has built up an extensive list of contacts over the years by providing exceptional service and expertise to former clients and potential investors. The contacts and clients will follow him to his new company and help spread the word of NovaGrowth Investments.

Professional Associations and Networking

The executives within NovaGrowth Investments will begin networking in professional associations and at events within the city-wide industry groups. This will bring the new startup into focus for other companies, providing a path to increased clients and strategic partnerships within the city.

Social Media Marketing

NovaGrowth Investments will target their primary and secondary audiences with a series of text announcements via social media. The announcements will be invitations to the opening of the company, with a champagne reception and information regarding the services available at NovaGrowth Investments. The social media announcements will continue for the three weeks prior to the launch of the company.

Website/SEO Marketing

NovaGrowth Investments will fully utilize their website. The website will be well organized, informative, and list the services that NovaGrowth Investments provides. The website will also list their contact information and biographies of the executive group. The website will engage in SEO marketing tactics so that anytime someone types in the Google or Bing search engine “Investment company” or “Investment opportunities near me,” NovaGrowth Investments will be listed at the top of the search results.

The pricing of NovaGrowth Investments will be moderate and on par with competitors so customers feel they receive excellent value when purchasing their services.

Operations Plan

The following will be the operations plan for NovaGrowth Investments. Operation Functions:

- Thom Anderson will be the owner and President of the company. He will oversee all staff and manage client relations. Thom has spent the past year recruiting the following staff:

- Jackson Byers will provide all client accounting, tax payments and monthly financial reporting. His title will be Staff Accountant.

- Kylie Carlson will provide all employee onboarding and oversight as she assumes the role of Human Resources Manager.

Milestones:

NovaGrowth Investments will have the following milestones completed in the next six months.

- 5/1/202X – Finalize contract to lease office space

- 5/15/202X – Finalize personnel and staff employment contracts for NovaGrowth Investments

- 6/1/202X – Finalize contracts for NovaGrowth Investments clients

- 6/15/202X – Begin networking at industry events

- 6/22/202X – Begin moving into NovaGrowth Investments office

- 7/1/202X – NovaGrowth Investments opens its doors for business

Financial Plan

Key revenue & costs.

The revenue drivers for NovaGrowth Investments are the fees they will charge to clients for their investment acquisition and portfolio management services.

The cost drivers will be the overhead costs required in order to staff NovaGrowth Investments. The expenses will be the payroll cost, rent, utilities, office supplies, and marketing materials.

Funding Requirements and Use of Funds

NovaGrowth Investments is seeking $200,000 in debt financing to launch its investment company. The funding will be dedicated toward securing the office space and purchasing office equipment and supplies. Funding will also be dedicated toward three months of overhead costs to include payroll of the staff, rent, and marketing costs for the print ads and association memberships. The breakout of the funding is below:

Key Assumptions

The following outlines the key assumptions required in order to achieve the revenue and cost numbers in the financials and in order to pay off the startup business loan.

- Number of Clients Per Month: 175

- Average Revenue per Month: $437,500

- Office Lease per Year: $100,000

Financial Projections

Income statement.

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| Revenues | ||||||

| Total Revenues | $360,000 | $793,728 | $875,006 | $964,606 | $1,063,382 | |

| Expenses & Costs | ||||||

| Cost of goods sold | $64,800 | $142,871 | $157,501 | $173,629 | $191,409 | |

| Lease | $50,000 | $51,250 | $52,531 | $53,845 | $55,191 | |

| Marketing | $10,000 | $8,000 | $8,000 | $8,000 | $8,000 | |

| Salaries | $157,015 | $214,030 | $235,968 | $247,766 | $260,155 | |

| Initial expenditure | $10,000 | $0 | $0 | $0 | $0 | |

| Total Expenses & Costs | $291,815 | $416,151 | $454,000 | $483,240 | $514,754 | |

| EBITDA | $68,185 | $377,577 | $421,005 | $481,366 | $548,628 | |

| Depreciation | $27,160 | $27,160 | $27,160 | $27,160 | $27,160 | |

| EBIT | $41,025 | $350,417 | $393,845 | $454,206 | $521,468 | |

| Interest | $23,462 | $20,529 | $17,596 | $14,664 | $11,731 | |

| PRETAX INCOME | $17,563 | $329,888 | $376,249 | $439,543 | $509,737 | |

| Net Operating Loss | $0 | $0 | $0 | $0 | $0 | |

| Use of Net Operating Loss | $0 | $0 | $0 | $0 | $0 | |

| Taxable Income | $17,563 | $329,888 | $376,249 | $439,543 | $509,737 | |

| Income Tax Expense | $6,147 | $115,461 | $131,687 | $153,840 | $178,408 | |

| NET INCOME | $11,416 | $214,427 | $244,562 | $285,703 | $331,329 |

Balance Sheet

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| ASSETS | ||||||

| Cash | $154,257 | $348,760 | $573,195 | $838,550 | $1,149,286 | |

| Accounts receivable | $0 | $0 | $0 | $0 | $0 | |

| Inventory | $30,000 | $33,072 | $36,459 | $40,192 | $44,308 | |

| Total Current Assets | $184,257 | $381,832 | $609,654 | $878,742 | $1,193,594 | |

| Fixed assets | $180,950 | $180,950 | $180,950 | $180,950 | $180,950 | |

| Depreciation | $27,160 | $54,320 | $81,480 | $108,640 | $135,800 | |

| Net fixed assets | $153,790 | $126,630 | $99,470 | $72,310 | $45,150 | |

| TOTAL ASSETS | $338,047 | $508,462 | $709,124 | $951,052 | $1,238,744 | |

| LIABILITIES & EQUITY | ||||||

| Debt | $315,831 | $270,713 | $225,594 | $180,475 | $135,356 | |

| Accounts payable | $10,800 | $11,906 | $13,125 | $14,469 | $15,951 | |

| Total Liability | $326,631 | $282,618 | $238,719 | $194,944 | $151,307 | |

| Share Capital | $0 | $0 | $0 | $0 | $0 | |

| Retained earnings | $11,416 | $225,843 | $470,405 | $756,108 | $1,087,437 | |

| Total Equity | $11,416 | $225,843 | $470,405 | $756,108 | $1,087,437 | |

| TOTAL LIABILITIES & EQUITY | $338,047 | $508,462 | $709,124 | $951,052 | $1,238,744 |

Cash Flow Statement

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| CASH FLOW FROM OPERATIONS | ||||||

| Net Income (Loss) | $11,416 | $214,427 | $244,562 | $285,703 | $331,329 | |

| Change in working capital | ($19,200) | ($1,966) | ($2,167) | ($2,389) | ($2,634) | |

| Depreciation | $27,160 | $27,160 | $27,160 | $27,160 | $27,160 | |

| Net Cash Flow from Operations | $19,376 | $239,621 | $269,554 | $310,473 | $355,855 | |

| CASH FLOW FROM INVESTMENTS | ||||||

| Investment | ($180,950) | $0 | $0 | $0 | $0 | |

| Net Cash Flow from Investments | ($180,950) | $0 | $0 | $0 | $0 | |

| CASH FLOW FROM FINANCING | ||||||

| Cash from equity | $0 | $0 | $0 | $0 | $0 | |

| Cash from debt | $315,831 | ($45,119) | ($45,119) | ($45,119) | ($45,119) | |

| Net Cash Flow from Financing | $315,831 | ($45,119) | ($45,119) | ($45,119) | ($45,119) | |

| Net Cash Flow | $154,257 | $194,502 | $224,436 | $265,355 | $310,736 | |

| Cash at Beginning of Period | $0 | $154,257 | $348,760 | $573,195 | $838,550 | |

| Cash at End of Period | $154,257 | $348,760 | $573,195 | $838,550 | $1,149,286 |

Investment Company Business Plan FAQs

What is an investment company business plan.

An investment company business plan is a plan to start and/or grow your investment company business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your Investment Company business plan using our Investment Company Business Plan Template here .

What are the Main Types of Investment Company Businesses?

There are a number of different kinds of investment company businesses , some examples include: Closed-End Funds Investment Company, Mutual Funds (Open-End Funds) Investment Company, and Unit Investment Trusts (UITs) Investment Company.

How Do You Get Funding for Your Investment Company Business Plan?

Investment Company businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding.

What are the Steps To Start an Investment Company Business?

Starting an investment company business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop An Investment Company Business Plan - The first step in starting a business is to create a detailed investment company business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your investment company business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your investment company business is in compliance with local laws.

3. Register Your Investment Company Business - Once you have chosen a legal structure, the next step is to register your investment company business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your investment company business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Investment Company Equipment & Supplies - In order to start your investment company business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your investment company business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Learn more about how to start a successful investment company business:

- How to Start an Investment Company

How to Write a Successful Investment Company Business Plan + Template

Creating a business plan is essential for any business, but it can be especially helpful for investment businesses who want to improve their strategy and/or raise funding.

A well-crafted business plan not only outlines the vision for your company, but also documents a step-by-step roadmap of how you are going to accomplish it. In order to create an effective business plan, you must first understand the components that are essential to its success.

This article provides an overview of the key elements that every investment company business owner should include in their business plan.

Download the Ultimate Business Plan Template

What is an Investment Company Business Plan?

An investment business plan is a formal written document that describes your company’s business strategy and its feasibility. It documents the reasons you will be successful, your areas of competitive advantage, and it includes information about your team members. Your business plan is a key document that will convince investors and lenders (if needed) that you are positioned to become a successful venture.

Why Write an Investment Company Business Plan?

An investment business plan is required for banks and investors. The document is a clear and concise guide of your business idea and the steps you will take to make it profitable.

Entrepreneurs can also use this as a roadmap when starting their new company or venture, especially if they are inexperienced in starting a business.

Writing an Effective Investment Company Business Plan

The following are the key components of a successful investment company business plan:

Executive Summary

The executive summary of an investment company business plan is a one to two page overview of your entire business plan. It should summarize the main points, which will be presented in full in the rest of your business plan.

- Start with a one-line description of your investment company

- Provide a short summary of the key points in each section of your business plan, which includes information about your company’s management team, industry analysis, competitive analysis, and financial forecast among others.

Company Description

This section should include a brief history of your company. Include a short description of how your company started, and provide a timeline of milestones your company has achieved.

If you are just starting your investment business, you may not have a long company history. Instead, you can include information about your professional experience in this industry and how and why you conceived your new venture. If you have worked for a similar company before or have been involved in an entrepreneurial venture before starting your investment firm, mention this.

You will also include information about your chosen investment company business model and how, if applicable, it is different from other companies in your industry.

Industry Analysis

The industry or market analysis is an important component of an investment company business plan. Conduct thorough market research to determine industry trends and document the size of your market.

Questions to answer include:

- What part of the investment industry are you targeting?

- How big is the market?

- What trends are happening in the industry right now (and if applicable, how do these trends support the success of your company)?

You should also include sources for the information you provide, such as published research reports and expert opinions.

Customer Analysis

This section should include a list of your target audience(s) with demographic and psychographic profiles (e.g., age, gender, income level, profession, job titles, interests). You will need to provide a profile of each customer segment separately, including their needs and wants.

For example, the customers of an investment business may include:

- Individuals

- small businesses

- other investment firms

You can include information about how your customers make the decision to buy from you as well as what keeps them buying from you.

Develop a strategy for targeting those customers who are most likely to buy from you, as well as those that might be influenced to buy your products or investment services with the right marketing .

Competitive Analysis

The competitive analysis helps you determine how your product or service will be different from competitors, and what your unique selling proposition (USP) might be that will set you apart in this industry.

For each competitor, list their strengths and weaknesses. Next, determine your areas of competitive differentiation and/or advantage; that is, in what ways are you different from and ideally better than your competitors.

Below are sample competitive advantages your investment business may have:

- You have a team of experienced investment professionals.

- You offer a wide range of investment products and services.

- You have a proven track record of successful investments.

- You use cutting-edge technology to support your investment decisions.

Marketing Plan

This part of the business plan is where you determine and document your marketing plan. . Your plan should be clearly laid out, including the following 4 Ps.

- Product/Service: Detail your product/service offerings here. Document their features and benefits.

- Price: Document your pricing strategy here. In addition to stating the prices for your products/services, mention how your pricing compares to your competition.

- Place: Where will your customers find you? What channels of distribution (e.g., partnerships) will you use to reach them if applicable?

- Promotion: How will you reach your target customers? For example, you may use social media, write blog posts, create an email marketing campaign, use pay-per-click advertising, launch a direct mail campaign. Or, you may promote your investment business via speaking engagements, trade shows, or networking events.

Operations Plan

This part of your investment company business plan should include the following information:

- How will you deliver your product/service to customers? For example, will you do it in person or over the phone only?

- What infrastructure, equipment, and resources are needed to operate successfully? How can you meet those requirements within budget constraints?

The operations plan is where you also need to include your company’s business policies. You will want to establish policies related to everything from customer service to pricing, to the overall brand image you are trying to present.

Finally, and most importantly, in your Operations Plan, you will lay out the milestones your company hopes to achieve within the next five years. Create a chart that shows the key milestone(s) you hope to achieve each quarter for the next four quarters, and then each year for the following four years. Examples of milestones for an investment business include reaching $X in sales. Other examples include adding X number of new clients or launching a new investment product line.

Management Team

List your team members here including their names and titles, as well as their expertise and experience relevant to your specific investment industry. Include brief biography sketches for each team member.

Particularly if you are seeking funding, the goal of this section is to convince investors and lenders that your team has the expertise and experience to execute on your plan. If you are missing key team members, document the roles and responsibilities you plan to hire for in the future.

Financial Plan

Here you will include a summary of your complete and detailed financial plan (your full financial projections go in the Appendix).

This includes the following three financial statements:

Income Statement

Your income statement should include:

- Revenue: how much revenue you generate.

- Cost of Goods Sold: These are your direct costs associated with generating revenue. This includes labor costs, as well as the cost of any equipment and supplies used to deliver the product/service offering.

- Net Income (or loss): Once expenses and revenue are totaled and deducted from each other, this is the net income or loss.

Sample Income Statement for a Startup Investment Company

| Revenues | $ 336,090 | $ 450,940 | $ 605,000 | $ 811,730 | $ 1,089,100 |

| $ 336,090 | $ 450,940 | $ 605,000 | $ 811,730 | $ 1,089,100 | |

| Direct Cost | |||||

| Direct Costs | $ 67,210 | $ 90,190 | $ 121,000 | $ 162,340 | $ 217,820 |

| $ 67,210 | $ 90,190 | $ 121,000 | $ 162,340 | $ 217,820 | |

| $ 268,880 | $ 360,750 | $ 484,000 | $ 649,390 | $ 871,280 | |

| Salaries | $ 96,000 | $ 99,840 | $ 105,371 | $ 110,639 | $ 116,171 |

| Marketing Expenses | $ 61,200 | $ 64,400 | $ 67,600 | $ 71,000 | $ 74,600 |

| Rent/Utility Expenses | $ 36,400 | $ 37,500 | $ 38,700 | $ 39,800 | $ 41,000 |

| Other Expenses | $ 9,200 | $ 9,200 | $ 9,200 | $ 9,400 | $ 9,500 |

| $ 202,800 | $ 210,940 | $ 220,871 | $ 230,839 | $ 241,271 | |

| EBITDA | $ 66,080 | $ 149,810 | $ 263,129 | $ 418,551 | $ 630,009 |

| Depreciation | $ 5,200 | $ 5,200 | $ 5,200 | $ 5,200 | $ 4,200 |

| EBIT | $ 60,880 | $ 144,610 | $ 257,929 | $ 413,351 | $ 625,809 |

| Interest Expense | $ 7,600 | $ 7,600 | $ 7,600 | $ 7,600 | $ 7,600 |

| $ 53,280 | $ 137,010 | $ 250,329 | $ 405,751 | $ 618,209 | |

| Taxable Income | $ 53,280 | $ 137,010 | $ 250,329 | $ 405,751 | $ 618,209 |

| Income Tax Expense | $ 18,700 | $ 47,900 | $ 87,600 | $ 142,000 | $ 216,400 |

| $ 34,580 | $ 89,110 | $ 162,729 | $ 263,751 | $ 401,809 | |

| 10% | 20% | 27% | 32% | 37% | |

Balance Sheet

Include a balance sheet that shows your assets, liabilities, and equity. Your balance sheet should include:

- Assets : All of the things you own (including cash).

- Liabilities : This is what you owe against your company’s assets, such as accounts payable or loans.

- Equity : The worth of your business after all liabilities and assets are totaled and deducted from each other.

Sample Balance Sheet for a Startup Investment Company

| Cash | $ 105,342 | $ 188,252 | $ 340,881 | $ 597,431 | $ 869,278 |

| Other Current Assets | $ 41,600 | $ 55,800 | $ 74,800 | $ 90,200 | $ 121,000 |

| Total Current Assets | $ 146,942 | $ 244,052 | $ 415,681 | $ 687,631 | $ 990,278 |

| Fixed Assets | $ 25,000 | $ 25,000 | $ 25,000 | $ 25,000 | $ 25,000 |

| Accum Depreciation | $ 5,200 | $ 10,400 | $ 15,600 | $ 20,800 | $ 25,000 |

| Net fixed assets | $ 19,800 | $ 14,600 | $ 9,400 | $ 4,200 | $ 0 |

| $ 166,742 | $ 258,652 | $ 425,081 | $ 691,831 | $ 990,278 | |

| Current Liabilities | $ 23,300 | $ 26,100 | $ 29,800 | $ 32,800 | $ 38,300 |

| Debt outstanding | $ 108,862 | $ 108,862 | $ 108,862 | $ 108,862 | $ 0 |

| $ 132,162 | $ 134,962 | $ 138,662 | $ 141,662 | $ 38,300 | |

| Share Capital | $ 0 | $ 0 | $ 0 | $ 0 | $ 0 |

| Retained earnings | $ 34,580 | $ 123,690 | $ 286,419 | $ 550,170 | $ 951,978 |

| $ 34,580 | $ 123,690 | $ 286,419 | $ 550,170 | $ 951,978 | |

| $ 166,742 | $ 258,652 | $ 425,081 | $ 691,831 | $ 990,278 | |

Cash Flow Statement

Include a cash flow statement showing how much cash comes in, how much cash goes out and a net cash flow for each year. The cash flow statement should include:

- Cash Flow From Operations

- Cash Flow From Investments

- Cash Flow From Financing

Below is a sample of a projected cash flow statement for a startup investment business.

Sample Cash Flow Statement for a Startup Investment Company

| Net Income (Loss) | $ 34,580 | $ 89,110 | $ 162,729 | $ 263,751 | $ 401,809 |

| Change in Working Capital | $ (18,300) | $ (11,400) | $ (15,300) | $ (12,400) | $ (25,300) |

| Plus Depreciation | $ 5,200 | $ 5,200 | $ 5,200 | $ 5,200 | $ 4,200 |

| Net Cash Flow from Operations | $ 21,480 | $ 82,910 | $ 152,629 | $ 256,551 | $ 380,709 |

| Fixed Assets | $ (25,000) | $ 0 | $ 0 | $ 0 | $ 0 |

| Net Cash Flow from Investments | $ (25,000) | $ 0 | $ 0 | $ 0 | $ 0 |

| Cash from Equity | $ 0 | $ 0 | $ 0 | $ 0 | $ 0 |

| Cash from Debt financing | $ 108,862 | $ 0 | $ 0 | $ 0 | $ (108,862) |

| Net Cash Flow from Financing | $ 108,862 | $ 0 | $ 0 | $ 0 | $ (108,862) |

| Net Cash Flow | $ 105,342 | $ 82,910 | $ 152,629 | $ 256,551 | $ 271,847 |

| Cash at Beginning of Period | $ 0 | $ 105,342 | $ 188,252 | $ 340,881 | $ 597,431 |

| Cash at End of Period | $ 105,342 | $ 188,252 | $ 340,881 | $ 597,431 | $ 869,278 |

You will also want to include an appendix section which will include:

- Your complete financial projections

- A complete list of your company’s business policies and procedures related to the rest of the business plan (marketing, operations, etc.)

- Any other documentation which supports what you included in the body of your business plan.

Writing a good business plan gives you the advantage of being fully prepared to launch and/or grow your investment company. It not only outlines your business vision but also provides a step-by-step process of how you are going to accomplish it.

In addition, a well-crafted business plan can help you secure funding from investors and lenders.

Despite all the advantages that come with writing a business plan, it doesn’t have to be a daunting task. You can start by using a template (like the one included in this article) and then customize it to fit your specific investment company.

Finish Your Investment Company Business Plan in 1 Day!

Other helpful articles.

How to Start an Investment Company

Business Plan Template for Investment Managers

- Great for beginners

- Ready-to-use, fully customizable Subcategory

- Get started in seconds

Securing funding for your investment portfolio can be a challenging task, especially when you need to convince potential investors about your strategies and growth projections. That's where ClickUp's Business Plan Template for Investment Managers comes in handy!

This comprehensive template is specifically designed for investment managers and financial institutions, helping you outline your investment strategies, target markets, growth projections, and risk management practices. With this template, you'll be able to:

- Clearly communicate your investment strategies and goals to potential investors

- Showcase your market research and analysis to demonstrate your expertise

- Provide a detailed financial plan that highlights projected returns and risk management strategies

Don't miss out on securing funding for your investment portfolio. Get started with ClickUp's Business Plan Template for Investment Managers and take your investment strategies to the next level!

Business Plan Template for Investment Managers Benefits

A business plan template for investment managers offers a range of benefits for financial institutions and investment managers, including:

- Clearly defining investment strategies, target markets, and growth projections to attract potential investors

- Outlining risk management practices to instill confidence in investors and mitigate potential risks

- Providing a structured framework to organize and communicate business goals and objectives

- Streamlining the process of securing funding for investment portfolios

- Ensuring compliance with regulatory requirements and industry best practices

- Facilitating strategic decision-making and resource allocation for optimal portfolio management

Main Elements of Investment Managers Business Plan Template

When it comes to creating a comprehensive business plan for investment managers, ClickUp has you covered with its Business Plan Template. This template includes:

- Custom Statuses: Keep track of the progress of each section of your business plan with statuses like Complete, In Progress, Needs Revision, and To Do.

- Custom Fields: Utilize custom fields such as Reference, Approved, and Section to add specific information and categorize your business plan effectively.

- Custom Views: Access 5 different views to gain different perspectives on your business plan, including Topics, Status, Timeline, Business Plan, and Getting Started Guide.

- Collaboration Features: Collaborate with your team seamlessly using features like comments, notifications, and task assignments to ensure everyone is on the same page.

- Document Management: Easily attach relevant documents to your business plan using ClickUp's Docs feature, ensuring all your resources are stored in one place.

With ClickUp's Business Plan Template, investment managers can create a comprehensive and well-structured business plan that showcases their investment strategies and attracts potential investors.

How To Use Business Plan Template for Investment Managers

Creating a business plan for investment managers can be a crucial step in outlining your goals and strategies. Follow these 6 steps to effectively use the Business Plan Template for Investment Managers in ClickUp:

1. Define your investment strategy

Start by clearly defining your investment strategy and the types of investments you plan to focus on. Are you specializing in stocks, bonds, real estate, or a combination? Determine your target market and investment approach to establish a strong foundation for your business plan.

Use custom fields in ClickUp to specify your investment strategy and track important details.

2. Conduct market research

Thorough market research is essential to understand the competitive landscape and identify potential opportunities. Analyze industry trends, target customer profiles, and competitor strategies. This information will help you make informed decisions and set realistic expectations for your business.

Create tasks in ClickUp to conduct research and track key findings.

3. Develop your marketing and sales plan

Outline your marketing and sales strategies to attract clients and grow your investment business. Identify your target audience, determine the most effective marketing channels, and establish a clear value proposition. Additionally, create a sales plan that outlines your approach to acquiring and retaining clients.

Use the Board view in ClickUp to visualize your marketing and sales strategies and track progress.

4. Set financial goals and projections

Define your financial goals and projections to assess the viability and profitability of your investment management business. Determine the amount of assets under management (AUM) you aim to achieve and project your revenue and expenses. This will help you gauge your performance and make necessary adjustments along the way.

Utilize the Goals feature in ClickUp to set financial targets and track progress towards achieving them.

5. Create an operational plan

Develop an operational plan that outlines how you will manage your investment portfolios and execute your investment strategies. Define your investment process, risk management protocols, and compliance procedures. Additionally, establish a framework for evaluating investment opportunities and monitoring portfolio performance.

Use the Gantt chart view in ClickUp to create a timeline for implementing your operational plan and track progress.

6. Regularly review and update your business plan

A business plan is a living document that should be reviewed and updated regularly. Monitor your progress, assess the effectiveness of your strategies, and make necessary adjustments. Stay adaptable to market changes and continuously refine your business plan to ensure long-term success.

Set recurring tasks in ClickUp to regularly review and update your business plan and keep it aligned with your evolving investment management business.

Get Started with ClickUp’s Business Plan Template for Investment Managers

Investment managers and financial institutions can use the Business Plan Template for Investment Managers in ClickUp to create a comprehensive and professional business plan that showcases their investment strategies and attracts potential investors.

First, hit “Add Template” to sign up for ClickUp and add the template to your Workspace. Make sure you designate which Space or location in your Workspace you’d like this template applied.

Next, invite relevant members or guests to your Workspace to start collaborating.

Now you can take advantage of the full potential of this template to create a compelling business plan:

- Use the Topics View to organize your business plan into different sections such as investment strategies, target markets, growth projections, and risk management practices

- The Status View will help you track the progress of each section in your business plan, including Complete, In Progress, Needs Revision, and To Do

- The Timeline View will provide a visual representation of your business plan's timeline and key milestones

- The Business Plan View will allow you to view and edit the entire business plan in one place, making it easy to make updates and revisions

- The Getting Started Guide View will provide step-by-step instructions on how to use the template and customize it to fit your specific needs

- Use the custom fields Reference, Approved, and Section to add additional information and categorize different sections of your business plan

- Update statuses and custom fields as you progress through each section to keep stakeholders informed and ensure a smooth workflow

- Monitor and analyze your business plan to ensure it is comprehensive, professional, and aligned with your investment objectives

- Business Plan Template for Acupuncture Practitioners

- Business Plan Template for Personal Goals

- Business Plan Template for Video Game

- Business Plan Template for Equipment Operators

- Business Plan Template for Doordash

Template details

Free forever with 100mb storage.

Free training & 24-hours support

Serious about security & privacy

Highest levels of uptime the last 12 months

- Product Roadmap

- Affiliate & Referrals

- On-Demand Demo

- Integrations

- Consultants

- Gantt Chart

- Native Time Tracking

- Automations

- Kanban Board

- vs Airtable

- vs Basecamp

- vs MS Project

- vs Smartsheet

- Software Team Hub

- PM Software Guide

Need a business plan? Call now:

Talk to our experts:

- Business Plan for Investors

- Bank/SBA Business Plan

- Operational/Strategic Planning

- L1 Visa Business Plan

- E1 Treaty Trader Visa Business Plan

- E2 Treaty Investor Visa Business Plan

- EB1 Business Plan

- EB2 Visa Business Plan

EB5 Business Plan

- Innovator Founder Visa Business Plan

- UK Start-Up Visa Business Plan

- UK Expansion Worker Visa Business Plan

- Manitoba MPNP Visa Business Plan

- Start-Up Visa Business Plan

- Nova Scotia NSNP Visa Business Plan

- British Columbia BC PNP Visa Business Plan

- Self-Employed Visa Business Plan

- OINP Entrepreneur Stream Business Plan

- LMIA Owner Operator Business Plan

- ICT Work Permit Business Plan

- LMIA Mobility Program – C11 Entrepreneur Business Plan

- USMCA (ex-NAFTA) Business Plan

- Franchise Business Planning

- Landlord Business Plan

- Nonprofit Start-Up Business Plan

- USDA Business Plan

- Cannabis business plan

- eCommerce business plan

- Online Boutique Business Plan

- Mobile Application Business Plan

- Daycare business plan

- Restaurant business plan

- Food Delivery Business Plan

- Real Estate Business Plan

- Business Continuity Plan

- Buy Side Due Diligence Services

- ICO whitepaper

- ICO consulting services

- Confidential Information Memorandum

- Private Placement Memorandum

- Feasibility study

- Fractional CFO

- How it works

- Business Plan Examples

Business Plan for an Investment Company

Published Dec.20, 2022

Updated Apr.19, 2024

By: Jakub Babkins

Average rating 5 / 5. Vote count: 5

No votes so far! Be the first to rate this post.

Table of Content

1. Investment company Business Plan For Starting Your Own Business

The sample business plan for an investment company outlines the creation of an investment company. The company’s mission is to provide clients with access to a wide range of investment opportunities, including stocks, bonds, mutual funds, and alternative investments. The company will also provide financial planning and wealth management services, including portfolio design, asset allocation, and risk management strategies.

The Investment Company’s business plan includes strategies for marketing and advertising, financial projections, and a detailed description of the company’s services and fees. This is the business Plan for Investors who want to invest in a company with a significant probability of success.

2. Sources Of Financing For Investment Firms

In writing a business plan for an investment company, the sources of financing for investment firms typically include private investors, venture capital firms, angel investors, crowdfunding, and debt capital. Private investors are individuals or groups who invest in the company in exchange for equity or a portion of the profits. Venture capital firms provide financing and advice to companies in exchange for equity. Angel investors are wealthy individuals or groups who invest in companies in exchange for equity. Crowdfunding involves the collection of small amounts of money from a large group of people. Debt capital is a loan secured by the company’s assets and must be repaid with interest.

The most common sources of financing for investment firms are debt financing, equity financing, and derivatives. Debt financing involves loans from banks, other lending institutions, or private investors. Equity financing involves the issuance of stock to raise capital. Derivatives are contracts between two parties that derive their value from an underlying asset or benchmark.

The most important source of financing for an investment company in the business plan investment company is the capital that the company brings in from its own operations.

3. Executive Summary Of Investment Company Business Plan

The business.

The new investment company business plan for an Investment Company is designed to provide an overview of our company’s mission and objectives. We are a full-service investment firm that specializes in providing comprehensive financial advice and services to individuals, families, and business owners. We aim to maximize investment returns and increase our clients’ net worth.

We plan to provide a wide range of services, including portfolio management, asset allocation, retirement planning, estate planning, tax planning, and general financial planning.

Management Of Investment Company

The investment company business plan outlines the management team of experienced financial and legal professionals committed to providing the highest quality of investment management services. Our goal is to create a fully integrated, world-class investment company that provides our clients with a range of innovative and tailored investment solutions.

Customers Of Investment Company

In the investment company business plan template, the customers of our investment company will be individuals, small businesses, and institutions that are looking for a trusted financial partner to help them manage and grow their wealth. We will offer our clients a wide range of services, including portfolio management, retirement planning, estate planning, tax planning, and philanthropic planning. Our goal is to provide our clients with the best advice, products, and services to help them meet their financial goals.

Business Target

The business target for our investment company is to create long-term capital appreciation and wealth for our investors by making prudent investments in start-up and established businesses. Our goal is to be a reliable and trusted partner for our investors and maximize their investment return.

4. Investment Company Summary

Company owner.

Our investment company, JS Investment Group, is owned and operated by John Smith. John Smith is a highly experienced investor and entrepreneur who has successfully founded and managed several small investment company business plans. He deeply understands the investment industry and is passionate about helping others achieve success through strategic investments.

Why The Investment Company Is Being Started

The primary reason for starting an investment company in an investment company business plan sample is to provide clients with a safe and secure place to invest their money. With a wide range of investment options available, our team of experienced financial professionals can help clients make informed decisions about their investments. We also plan to provide clients with up-to-date market analysis and research.

How The Investment Company Will Be Started

The company will seek to raise capital through debt and equity financing. Equity financing will come from the founders and outside investors. The company will also seek to raise capital through debt financing, which will be used to fund the startup costs and ongoing operations of the company. In the business plan for the investment holding company, the company will focus on providing quality investment advice and services to its clients.

The Investment company owner John Smith estimates startup costs based on assets, investments, loans, and expenses in collaboration with financial experts.

JS Investment Group’s start-up requirements include total startup expenses, total assets, total start-up funding, total funding requirements, total assets, total liabilities, total planned investment, total capital, total liabilities, and total funding.

| Legal | $122,300 |

| Consultants | $0 |

| Insurance | $15,300 |

| Rent | $34,400 |

| Research and Development | $14,300 |

| Expensed Equipment | $31,800 |

| Signs | $3,230 |

| Start-up Assets | $244,000 |

| Cash Required | $173,000 |

| Start-up Inventory | $31,100 |

| Other Current Assets | $225,000 |

| Long-term Assets | $252,600 |

| Start-up Expenses to Fund | $221,330 |

| Start-up Assets to Fund | $925,700 |

| Assets | |

| Non-cash Assets from Start-up | $1,200,800 |

| Cash Requirements from Start-up | $280,500 |

| Additional Cash Raised | $43,530 |

| Cash Balance on Starting Date | $36,700 |

| Liabilities and Capital | |

| Liabilities | $20,000 |

| Current Borrowing | $0 |

| Long-term Liabilities | $0 |

| Accounts Payable (Outstanding Bills) | $52,000 |

| Other Current Liabilities (interest-free) | $0 |

| Capital | |

| Planned Investment | $1,147,030 |

| Investor 1 | $0 |

| Investor 2 | $0 |

| Other | $0 |

| Additional Investment Requirement | $0 |

| Loss at Start-up (Start-up Expenses) | $342,500 |

5. Services of Investment Company

The product description section in a business plan for an investment banking company includes services. However, below are the all services offered by our investment company include:

- Investment Advisory: Providing tailored advice and strategies to meet individual, business, and corporate clients’ investment goals.

- Investment Management: The business plan for an investment banking company provides services of designing, constructing, and managing bespoke portfolios for clients, as well as providing ongoing monitoring and rebalancing services.

- Mutual Fund Management: The business plan for an investment management company offers selecting and monitoring mutual funds for clients, as well as providing risk management and portfolio diversification services.

- Estate Planning: Developing strategies for both tax and non-tax-related estate planning objectives.

- Retirement Planning: Assisting clients with the creation of retirement plans and investments to meet their retirement income needs.

- Financial Planning: Helping clients to prepare for their financial future by creating strategies that integrate their investment, tax, insurance, and estate planning goals.

- Risk Management: Identifying and managing investment risks to help clients reach their financial goals.

- Portfolio Analysis: Examining and evaluating portfolios to ensure they are in line with the client’s investment objectives.

- Tax Planning: Developing strategies to minimize the client’s tax liability and maximize after-tax returns.

- Asset Allocation: Designing and implementing asset allocation strategies to help clients meet their long-term financial goals.

6. Marketing Analysis

A marketing analysis is an important part of a sample business plan for an investment company. This analysis provides information on the market in which the company operates, including the size and growth of the market, the competition, and potential growth opportunities.

The investment company market is highly competitive, as investors have a wide range of options when it comes to deciding where to invest their money.

The company will face competition from both traditional and online investment companies. Traditional investment companies offer services such as portfolio management and financial planning. Online investment companies offer services such as stock trading and portfolio management.

In addition to traditional investment companies, investors can choose from online brokers, mutual funds, and other alternative investments. As a result, it is important for an investment company to differentiate itself from the competition and to create a strong value proposition for its customers.

The investment industry is expected to continue to grow as people become more aware of the need for financial planning and the importance of investing.

Market Trends

Excellent work.

excellent work, competent advice. Alex is very friendly, great communication. 100% I recommend CGS capital. Thank you so much for your hard work!

In order to compete effectively in the investment company market, it is important to understand the current market trends and identify areas of opportunity.

In the investment company business plan example, one of the most important trends to consider is the shift towards more technology-driven investment strategies. This trend is driven by advancements in technology and increased access to data, which has enabled more sophisticated portfolio management techniques.

Additionally, many investors are increasingly looking to alternative investments such as cryptocurrency, venture capital, and private equity as a way of diversifying their portfolios. Furthermore, an increasing number of investors are turning to online trading platforms as a way of managing their investments. Finally, it is important to consider the potential impact of environmental, social, and governance (ESG) investing on the industry, as ESG-focused investments are gaining traction in the financial markets.

Marketing Segmentation

In the private investment company business plan, the company will target a wide range of potential customers, including individual investors, high-net-worth individuals, family offices, and institutional investors. Each of these customer segments will require different strategies and services, so the company will tailor its marketing and services accordingly.

For individual investors, the company will focus on providing personalized services that are tailored to the specific needs and investment goals of each client. The company will also provide educational resources and tools to help clients make informed decisions about their investments.

For high-net-worth individuals, the company will focus on providing personalized portfolio construction and asset management services.

We plan to target high-net-worth, individuals and institutional clients who are looking for a more personalized approach to investing. We will use a combination of traditional and alternative investment strategies to provide our clients with the best return on their investments. We plan to use our extensive network of banks and other financial institutions to secure the most attractive terms for our clients.

We have identified three key areas of focus when it comes to our business plan. First, we plan to build a strong customer base by offering superior customer service and customer education. Second, we plan to develop our own proprietary financial products and services to offer our clients. Finally, we plan to focus on developing relationships with banks and other financial institutions to ensure that we can offer the best terms for our clients.

Product Pricing

JS Investment Group will use a combination of fixed fees and performance-based fees for our services. For our portfolio management and asset allocation services, we will charge a flat fee of 1% of the total assets under management. For our investment research and risk management services, we will charge a fixed fee of $250 per hour.

For our performance-based fees, we will charge a 20% fee on any profits earned by our clients. This fee will be applied on a quarterly basis and will be calculated based on the performance of the portfolio during that period.

7. Marketing Strategy Of Investment Company

Competitive analysis.

The business plan for an investment company covers the company analysis in which the company’s competitive landscape is large and diverse. There are a number of large and well-established firms that have been in the industry for many years. Additionally, there is a large number of small, independent firms that have emerged in recent years.

Sales Strategy

Our sales strategy is to target potential customers through a variety of outlets, including direct mail, email marketing, social media campaigns, and online advertising. We will focus our efforts on targeting potential customers who are likely to be interested in our services, such as high-net-worth individuals, small business owners, and those with an interest in investing. We will also work to build relationships with local financial advisors and other industry professionals in order to develop a strong referral network.

Sales Monthly

The company’s primary source of revenue will be from the sales of investment products, with a focus on monthly sales. The company will also offer financial advice and portfolio management services, for which it will charge a fee. Experts predict the following sales each month for our company.

Sales Yearly

The JS Investment Group will generate revenue by selling various services. Experts predict the following sales yearly for our company.

Sales Forecast

Our sales forecast for the next three years predicts a steady increase in revenue. Below is a forecast of sales for our company:

| Unit Sales | |||

| 3,267 | 3,463 | 3,671 | |

| 1,654 | 1,753 | 1,858 | |

| 1,843 | 1,954 | 2,071 | |

| 3,313 | 3,512 | 3,722 | |

| Unit Prices | Year 1 | Year 2 | Year 3 |

| $422.00 | $489.52 | $567.84 | |

| $1,654.00 | $1,918.64 | $2,225.62 | |

| $492.00 | $570.72 | $662.04 | |

| $987.00 | $1,144.92 | $1,328.11 | |

| Sales | |||

| Direct Unit Costs | Year 1 | Year 2 | Year 3 |

| $400.00 | $440.00 | $462.00 | |

| $1,567.00 | $1,723.70 | $1,809.89 | |

| $459.00 | $504.90 | $530.15 | |

| $897.00 | $986.70 | $1,036.04 | |

| Direct Cost of Sales | |||