What is Subscription Billing?

Automated invoice processing, what is recurring billing, what is automation in billing.

- Subscription Billing Management Software

What is an Automated Payment System?

Subscription billing management, invoice payment methods explained, subscription business model: overview, gains, types, how it works and metrics to track, top free online invoicing and payment processing tools.

- Business Finance

What is Auto-Financing? How to Start an Auto Finance Business

- - Business Finance

- - January 30, 2024

- - No Comments

Speaking of the perfect auto finance business you could have, here is a guide to a comprehensive business plan that can significantly contribute to the success of your venture.

Let’s dive into the key elements of an effective auto finance business plan, the meaning of auto-financing, and the success u could have through an auto finance business loan.

Meaning of Auto Financing Business

Auto financing refers to the process of obtaining a loan to purchase a vehicle, typically a car, truck, or motorcycle. Instead of paying the full purchase price upfront, individuals can use auto financing to spread the cost of the vehicle over some time.

The most common type of auto financing is through a car loan , where a lender provides the borrower with a specific amount of money to buy a vehicle. In turn, the borrower agrees to repay the loan amount, along with interest, in regular installments over an agreed-upon term.

Here are some key elements of auto financing:

- Down Payment: Many auto financing agreements require a down payment, which is an upfront payment made by the buyer. The down payment is usually a percentage of the vehicle’s total cost and can affect the loan terms.

- Loan Term: The loan term is the duration over which the borrower agrees to repay the loan. Auto loans typically have terms ranging from 24 to 72 months, although longer terms are becoming more common.

- Interest Rate: Lenders charge interest on the loan amount as compensation for providing the funds. The interest rate can vary based on factors such as the borrower’s credit score, the loan term, and the economic environment.

- Monthly Payments: Borrowers make regular monthly payments to repay the loan. These payments include both the principal amount (the original loan amount) and the interest.

- Secured Loan: Auto loans are usually secured loans, meaning that the vehicle itself serves as collateral. If the borrower fails to repay the loan, the lender has the right to repossess the vehicle.

- Credit Score: A borrower’s credit score plays a crucial role in determining the interest rate and loan terms. Higher credit scores often result in lower interest rates and better loan terms.

- Dealership Financing vs. Direct Lending: Auto financing can be obtained through the dealership or direct lending institutions such as banks, credit unions, or online lenders. Dealership financing is convenient, but it’s essential to compare rates and terms with other lenders to ensure the best deal.

The Three Sources of Finance

- Short-term financing – This involves taking out a loan for a purchase, usually with a loan term of less than one year. Examples of short-term financing include “Buy Now, Pay Later,” “Unsecured Personal Loans,” and “Payday Loans.”

- Medium-term financing – In this case, a business may take out a bank loan.

- Long-term financing – Longer-term funding offers the most favorable borrowing terms for businesses.

How to Start an Auto Finance Business

Starting an auto finance business involves several key steps, and it requires careful planning, compliance with regulations, and financial acumen. Now that you have an understanding of what an auto financing business is, let’s look at how to start an auto finance business.

Here’s a general guide on how to start an auto finance business:

Research and Industry Knowledge

Gain a deep understanding of the auto finance industry, including market trends, regulations, and competition. Familiarize yourself with the various types of auto financing, such as direct lending, dealership financing, and subprime lending.

Create a Business Plan

Develop a comprehensive business plan that outlines your business goals, target market, competitive analysis, marketing strategy, financial projections, and operational plan. A well-thought-out business plan will serve as a roadmap for your venture and may be required if you seek financing.

Legal Structure and Registration

Choose a legal structure for your auto finance business, such as a sole proprietorship, partnership, corporation, or limited liability company (LLC). Register your business with the appropriate authorities and obtain any necessary licenses or permits.

Compliance with Regulations

Auto financing is heavily regulated to protect consumers. Familiarize yourself with federal and state regulations governing auto loans and consumer lending. Ensure that your business operations comply with these regulations to avoid legal issues.

Secure Funding

Determine the capital needed to start and operate your auto finance business. This may include funds for lending, technology infrastructure, marketing, and operating expenses. Explore financing options such as personal savings, loans, investors, or partnerships.

Build Relationships with Lenders

If your business model involves partnering with banks or financial institutions to secure funds for lending, establish relationships with these lenders. Negotiate terms and conditions that are favorable for both parties.

Develop Technology Infrastructure

Invest in a robust technology infrastructure for loan processing, customer management, and compliance tracking. This may include software for credit scoring, loan origination, and document management.

Create Underwriting Criteria

Establish clear underwriting criteria to evaluate the creditworthiness of borrowers. Define factors such as credit scores, income levels, and debt-to-income ratios that will influence lending decisions.

Marketing and Branding

Develop an eCommerce marketing strategy to attract borrowers. Create a strong brand presence through online and offline channels. Consider advertising, digital marketing, and partnerships with dealerships to increase your visibility in the market.

Employee Hiring and Training

Hire experienced professionals with knowledge of the auto finance industry and compliance requirements. Provide ongoing training to keep your team informed about changes in regulations and best practices.

Implement Risk Management Strategies

Develop risk management strategies to minimize potential losses. This includes monitoring and addressing delinquencies, default rates, and economic factors that may impact the auto finance industry.

Launch and Monitor Performance

Launch your auto finance business and closely monitor its performance. Analyze key performance indicators (KPIs) such as loan portfolio quality, customer satisfaction, and financial metrics. Make adjustments to your strategies based on performance data.

Customer Service and Relationship Management

Provide excellent customer service and establish strong relationships with borrowers. A positive customer experience can lead to repeat business and referrals.

How Does Auto Financing Work?

Auto financing works by allowing individuals to borrow money to purchase a vehicle and repay the loan over a specified period.

Here’s a step-by-step overview of how auto financing typically works:

Offering Financing Options

Businesses offering auto financing provide customers with various financing options to purchase vehicles. This may include loans, leases, or other financing arrangements. The goal is to make it easier for customers to afford vehicles by spreading out the cost over time.

Credit Evaluation

When a customer applies for auto financing, the business evaluates their creditworthiness. This involves reviewing the customer’s credit history, income, employment status, and other relevant financial information. The credit evaluation helps the business determine the customer’s ability to repay the loan and assess the level of risk involved.

Loan Approval

Based on the credit evaluation, the business decides whether to approve the customer’s loan application. If approved, the business determines the loan terms, including the loan amount, interest rate, down payment requirement, and repayment schedule. These terms may vary depending on factors such as the customer’s credit score, the vehicle’s price, and market conditions.

Closing the Deal

Once the loan terms are finalized and agreed upon by the customer, the business completes the financing arrangement. This may involve signing a loan agreement or lease contract outlining the terms and conditions of the financing arrangement. The customer may also need to provide documentation such as proof of insurance and identification.

Disbursement of Funds

After the financing arrangement is finalized, the business disburses the funds to complete the vehicle purchase. This may involve paying the dealership for a new or used vehicle or transferring funds to the customer to purchase a vehicle from a private seller.

Loan Servicing

Throughout the loan term, the business manages the loan account, including collecting payments from the customer, maintaining records, and providing customer service. This may involve sending monthly statements, processing payments, and addressing any customer inquiries or concerns.

Risk Management

Businesses offering auto financing also engage in risk management to mitigate the potential for loan defaults or losses. This may involve monitoring loan performance, implementing collection strategies for delinquent accounts, and repossessing vehicles in cases of default.

Top 5 Auto Finance Business Examples

Auto finance businesses, also known as car finance companies, offer financial products allowing people to acquire cars through arrangements other than full-cash payments.

Here are the top 5 auto finance businesses:

- Toyota Financial Services

- Ally Financial

- GM Financial

- Capital One Auto Finance

Auto Finance Business Loan

Auto finance business loans are an excellent option for companies to finance a new or used vehicle . Also, auto finance business loans let you finance a vehicle for company use and these loans are available through banks, credit unions, and online lenders.

If you are determined to enter into the car loan business, you should know what a car equity loan is. Car equity is a loan where a paid-off vehicle is used as the collateral for a loan.

The value of the car is what you use to calculate the maximum amount the borrowers can get. Auto finance business loans can get you profit owing to the attractiveness brought because there is no requirement borrowers need to comply with.

How to Start a Car Loan Business

- Arrange for a perfect credit line

This is the most important thing you need when starting a car loan business. You should first have your personal budget before deciding to make the loans yourself.

If you have enough starting capital you can partner with different banks between the bank and your business. Make sure you have a good relationship with them on the credit line so that they can give you capital to run your business through its initial stage.

- Obtain business license

Obtaining a license from the country and the state where your business is established is very important to operate as an auto finance lender . Check the regulations put in the price for banking and insurance that you need to operate.

Also, take some time to research to know the documentation you need to pursue before launching business operations.

- Install computer software to operate your business

Installing computers to track different aspects of your business including the payment method and application used.

This can be overwhelming for using automated systems that can group data well with a good software system, tracking of payments and balances, and print out the report of the growth of the business.

- Marketing your car loan business

Marketing your business is a good authority that will help you reach your target audience. You can launch a marketing campaign directly to consumers while targeting a small area and a large segment.

As the business expands, you can move the business to digital marketing and media outlets. You can also talk to leadership to refer potential customers to your auto loan business.

Starting an auto finance business is not as challenging as one might think. One of the challenges people might face is access to capital to operate smoothly.

It is important to ensure your business is licensed and registered both with the local and state authorities. Also, make sure you invest in digital marketing strategies that will help your auto finance business attract the right customers.

Hey there! This website is sponsored by affiliate partners.

We are proud affiliates for some of these tools. Affiliate links are used for each tool that we are an affiliate of, which means that if you click that link and subsequently make a purchase, we will earn a commission. You pay nothing extra – any commission we earn comes at no additional cost to you.

Raphael Ojo

Writer & blogger.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

- Budget Tips

- Business Funding

- Investments & Savings

- Making Money Online

Payment Solutions

Personal Finance

The 7 Best Budgeting Apps: Pros & Cons

What is Biometric Payment? Biometric Payments Online

Best Online Stock Broker in 2024

What is NFC Contactless Payments?

What is Online Investing?

PayCape is your go-to destination for all things financial technology! Dive into the future with trending topics, expert tips, and exclusive hacks for fintech enthusiasts and businesses.

Sponsored Content

Do you have a product or service you want us to promote or review? We are here for you. Shoot our advertising team a message. We’ll get back to you within 2 days. The PayCape team can’t wait to partner with you!

Explore Topics

- Blog (11)

- Budget Tips (8)

- Business Finance (3)

- Business Funding (1)

- Guides (3)

- How-To (3)

- Investments & Savings (9)

- Making Money Online (2)

- Payment Solutions (23)

- Personal Finance (7)

Join 70,000 subscribers!

By signing up, you agree to our Privacy Policy

- 50-30-20 Rule

- 50/30/20 Rule

- Best Budgeting App

- best budgeting method

- Best Expense Tracker

- biometric payments

- Budget Template

- Budgeting App

- budgeting apps

- Capital Budgeting

- contactless payments

- Expense Tracker

- Facebook ads

- free expense tracker

- Google Sheets

- how to create a budget

- how to create a personal budget

- how to invest online

- How to Save

- Investment in Cryptocurrency

- Mutual Funds Online for Beginners

- Passive Income

- Payment methods

- Payment systems

- paypal in nigeria

- personal budget

- personal finance

- Recurring Billing

- Recurring Billing Software

- Recurring payments

- Stock broker

- Subscription

- Subscription Billing

- Subscription Billing Software

- Subscription Billing Tools

- Subscription Business Model

- Subscription Management

- Subscription payment business model

- Subscription payment methods

- Subscription Payments

- Subscription-Based Business

- the best way to create a budget

- what is a budget

How to Pay Online

Investments & Savings

Write For PayCape

Our Gift Store

Advertise With Us

Internship Program

Privacy Policy

Terms & Conditions

© 2024 Powered By Tech Della Solutions LTD

Press ESC to close

End of Content.

Business auto loans: What they are & how to get one

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

- • Personal finance

- • Mortgages

- Connect with Allison Martin on LinkedIn Linkedin

- • Personal loans

- • Auto loans

- Connect with Pippin Wilbers on LinkedIn Linkedin

- Get in contact with Pippin Wilbers via Email Email

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money .

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most — the different types of lending options, the best rates, the best lenders, how to pay off debt and more — so you can feel confident when investing your money.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Key retirement financial advisor takeaways

- Business auto loans let you finance a vehicle for company use.

- These loans are available through banks, credit unions and online lenders.

- Like standard auto loans, they are secured and use the vehicle as collateral.

- If you can’t get approved for a business auto loan or prefer to explore alternatives, try leasing a car or taking out a small business loan to fund the purchase.

If you can’t pay cash for your company car, it’s worth exploring business auto loans. These loans and the application process share many similarities with personal auto loans. As with standard auto loans, your vehicle secures the loan — the lender can repossess it if you fail to make loan payments.

Lenders will want reassurance that you’re using the vehicle for business purposes, but the upside is you could qualify for a few tax breaks. Here’s what to know about business auto loans, how to get one and if you should consider alternative funding sources.

What is a business auto loan?

A business auto loan is a secured loan . It can finance purchasing a new or used vehicle for business purposes. Banks, credit unions and online lenders offer these loans. The cost of borrowing varies by lender and your financial profile.

Lenders set their approval guidelines for these loans. They may require your business credit score, personal credit score or both to meet certain thresholds. They may also set a minimum time in business and annual revenue.

Some will allow you to take out the loan in your company’s name, but you may need to provide a personal guarantee , which means your assets could be at risk if you default on the payments. Depending on the lender, you may be required to use the vehicle solely for your business.

This restriction has an upside. You can deduct more of your interest on a vehicle you use only for a business than one used partially for personal needs. Plus, you may be eligible for the standard mileage deduction to get a break at tax time. Consult with a reputable tax professional to learn more and determine your eligibility.

Should I lease or buy a business vehicle?

Instead of buying, you can also lease a vehicle for your business. Leasing could be better if you don’t plan to keep the vehicle long-term and qualify for a lower monthly payment. Leasing still allows you to access certain tax benefits .

But if you know you’ll need to make significant alterations to the vehicle or plan to drive it a ton, a lease likely isn’t a good fit. This is also the case if you prefer to own the vehicle for an extended period and may want to explore the possibility of an extended loan term to make the monthly auto loan payments more affordable. Consider if the mileage and usage restrictions work for your situation.

How to get a business auto loan

- Set a budget: Whether you’re buying a new or used vehicle, calculate how large of a monthly payment your company can afford. It’s equally important to factor in the overall cost of the vehicle so you’ll know what to expect. Use the business loan and interest rate calculator to simplify the process.

- Review your credit: Check your personal and business credit scores and reports to identify errors. File disputes with the respective credit reporting agencies to ensure your score accurately reflects your credit history when you apply for financing. It can take up to 30 days for a creditor to respond, so review your credit well before you want to buy. Higher scores and a clean credit history can help you qualify for a lower interest rate.

- Choose a vehicle: Look at available options and decide on the type of company vehicle that best suits your needs. Remember that some lenders may only finance new vehicles, while others may have tight restrictions on the used vehicles they finance. It’s best to know exactly what you’re looking for before exploring lenders.

- Get preapproved: Shop around with at least three different lenders . If the lenders offer preapproval, apply to view potential loan offers. Doing so helps you compare offers to find the best deal on commercial vehicle financing. Some lenders may require that you provide documentation proving you own the company before issuing loan preapproval.

- Provide documentation: You may need to provide your employer identification number , Social Security number, business license and financial information. The lender will also likely request personal documents proving your personal income and creditworthiness.

Where to get a business auto loan

If you’re ready to research business lenders, you have two primary options: brick-and-mortar lenders and online lenders.

Brick-and-mortar lenders

Traditional banks, like Bank of America , offer loans with competitive rates and repayment terms between 48 and 72 months. These loans typically come with mileage and vehicle age restrictions.

Credit unions also feature commercial vehicle loans, and the rates are often more competitive than those of a traditional bank. The process can be lengthy with either option, and you’ll typically need to provide a lot of paperwork.

Online lenders

While not as strict as bank lenders, online lenders generally still require that you have a reasonable credit score and meet the minimum time in business guidelines. Some also impose restrictions on vehicles that can be financed. Still, you may find it easier to qualify, and the interest rate ranges are often comparable to a bank or credit union.

One such lender is National Funding — it offers loans for commercial vehicle purchases and leases to business owners with a credit score over 600 who’ve been in business for at least six months.

Alternatives to business auto loans

Going with a business auto loan isn’t your only option, though. Here are three alternatives that could help you secure the car your business needs.

- Small business loan: You can finance a vehicle with a small business loan or business line of credit .

- Consumer auto loan: A consumer auto loan could be better if you use the vehicle for personal and business purposes. These can be easier to secure, but you put your personal credit on the line rather than your company’s.

- Leasing: The car won’t be an asset your business can claim, but there are ways to incorporate the cost into your taxes to save money when you file. It may also be less expensive on a month-to-month basis, depending on the financing terms you qualify for.

The bottom line

When you’re ready to finance a vehicle for your business, take time to compare your options and get rate quotes from at least three lenders. Interest rates have significantly increased in the past years, but by doing your homework, you give yourself the best chance at finding a business auto loan with terms that work for your company’s financial situation.

Related Articles

How to get a car loan with bad credit: 10 tips for finding the best

Vroom auto loan alternatives: Try these online shopping platforms

How to get the best auto loan rates: Your 6-step guide

What is an auto loan? Where do you find them? And how do they work?

How to Start a Car Finance Company

You, your car, and the wide-open road. Owning a quality vehicle may be a luxury, but for many, driving is a necessity—albeit a pleasurable one. That’s why, it comes as little surprise to learn that the US car industry—both used and new—is steadily growing, and this presents an opportunity for those interested in getting into the car finance field.

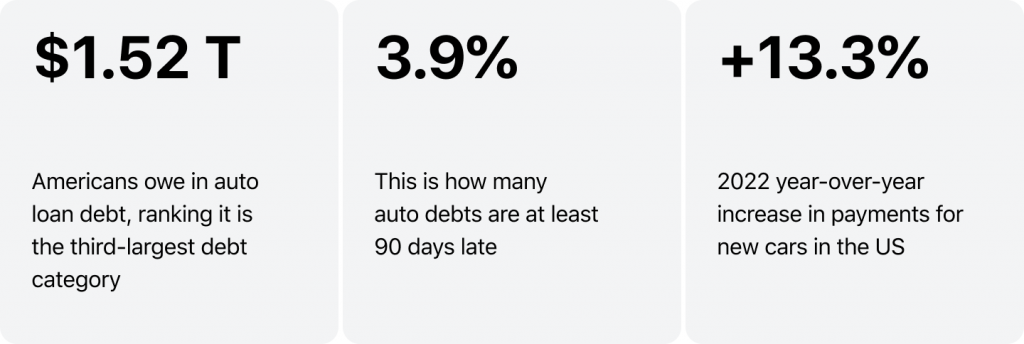

Lending Platforms in Automobile Finance Industry: Auto Lending Trends 2022 In 2021, the value of automotive loan origination grew to $738 billion , up from $616 billion the previous year, and the market is showing no signs of stopping. So, whether you’re considering upgrading your business offerings to include vehicle finance or wondering how to start a car finance company, let’s dive right in and find out why this market is prime for fintech innovators.

How to start an auto lending company: where to start?

As of 2021, banks hold the greatest share of the car financing market at 33%. They are closely followed by captives at 26% , credit unions at 20%, and specialty finance at 11%, with other lenders making up the final 10% of the market.

In all these divisions, lending is growing year-on-year. Banks have the highest growth rate at 32% CAGR with credit unions at 25% CAGR. Surprisingly both speciality finance and other are growing too at 18% and 12% respectively, marking an interesting market shift. What this means is that no matter where you are on the how to start a car loan business scale—opportunity is there. The challenge? Identifying market gaps and finding out how to make your company stand out.

Understanding the market and how to start an auto loan company that leads

Before you kick the wheels in gear on your car loan business, there are a few questions you’ll need to ask yourself.

What type of lender are you?

McKinsey identified four auto financing archetypes. These can help you understand which area your business best fits into. They include:

- Formulaic —based on cost and margin impact comes from extra factors, such as inflation, increases, etc., which are then passed onto consumers.

- Competition-based —balances increasing margins and being competitive on the market.

- Value centric —seeks to maximize value for the end customer, and delays price rises to deliver value.

- Premium —targets the premium sector of the market.

Understanding this can help you establish your market positioning so you kick your business off with the value-positioning you want.

What segment do your intent to target?

9 Must-Have Features for Auto Loan Origination Software How to start an auto finance company rule one—know which segment of the market you’re targeting, as how you offer your lending services will differ whether you’re targeting budget vehicles, new cars, or premium rides.

At the same time, look out for new opportunities, such as electric cars, which continue to grow in popularity, and other evolving technologies.

Who are your competitors?

Once you know more about your own offering or potential offering, it’s time to take a look at your competitors. Analyze the market to find companies that are similar to yours in size, offerings, and market segment. However, don’t just limit yourself to competing with this grouping, draw inspiration from the wider auto loan market as well.

What is your unique selling point or market niche?

Whether you have 1 competitor, 100, or 1,000, there will be something that makes your business proposition unique. This may be anything from the specific types of loans you offer to address a market need (for example, ex-pats) to simply a new approach to customer service or even an innovative usage of technology. It is this USP that is likely to help your business succeed in a competitive market.

How to start an auto finance company: next steps

Now that you have a grasp of how to start an auto finance company your way, it’s time to take the next step and that’s to put your research into action. Based on our research, these are the steps you should consider taking:

- Developing a business plan —just like any business or part of your business, starting an auto loan segment requires a business plan. Be sure to include the essentials, including an executive summary, description of services, market analysis, competitor analysis, products and services, risk management, financial projections, and growth plans.

- Secure funding —this is a crucial element of any venture. To ensure you have sufficient funds to cover operational costs and risks, make sure you are able to secure funding. Consider the different types of funding available, including equity financing, debt financing, asset-backed securities, and government support programs.

- Regulations —lending is a regulated industry, that’s why before beginning your operations, you’ll need to ensure you have the valid licences and permits in hand to avoid any issues.

- Build your team —having the right people on board is critical to your business’s success. Look for an experienced team or consider outsourcing some of the more specific tasks to the experts to get the best results.

- Developing criteria and infrastructure —now that you have the basics, it’s time to get down to specifics, for example, what type of loan management tools you will use and how they will serve your clients.

How to start an auto loan company: technology

Speaking of infrastructure, it’s time we talked about technology. Although the automobile industry has been around for a couple of generations now, the way loans are issued has changed substantially. For companies to be successful in the modern market, they need to take note of the past—personalized, in-house services, tailored loans (typical mom-and-pop shops)—and look towards the future. And that future is fintech.

Auto Dealership Financing Software: Guide For Smooth Digital Transformation Now, there are any number of financial technology solutions out there, from fully custom software, out-of-the-box tech, and hybrid versions that offer the best of both worlds. However, when it comes to starting your auto loan company, you need to find the one that’s right for you to be able to implement it successfully and take the market lead.

Before you begin, it’s important to understand how you want your new product to work and how it will look for your client. For example:

- Will it integrate into a current product?

- Are you planning to a standalone lending module?

- Or do you plan to develop a business from scratch?

Starting from this point, you’ll have some idea of the technology you’ll need or, at least, the challenges you’ll need it to solve. At this stage, you’ll be able to start sourcing an in-house team or seek out dedicated fintech development partners for your project.

Ready to launch? Here’s how to kick-start a car finance company into hyperspeed

At HES, we have over 10 years of experience in developing solutions for the automotive industry. So, whether you’re a dedicated car loan company, a startup, or a lending business branching out into a new avenue, the first step we recommend is getting in touch with our dedicated team, who’ll walk you through the process of how to get the right start for your car lending business.

Looking for unique software for auto lending?

500+ business plans and financial models

Car Dealership Business Plan: Complete Guide

- January 11, 2023

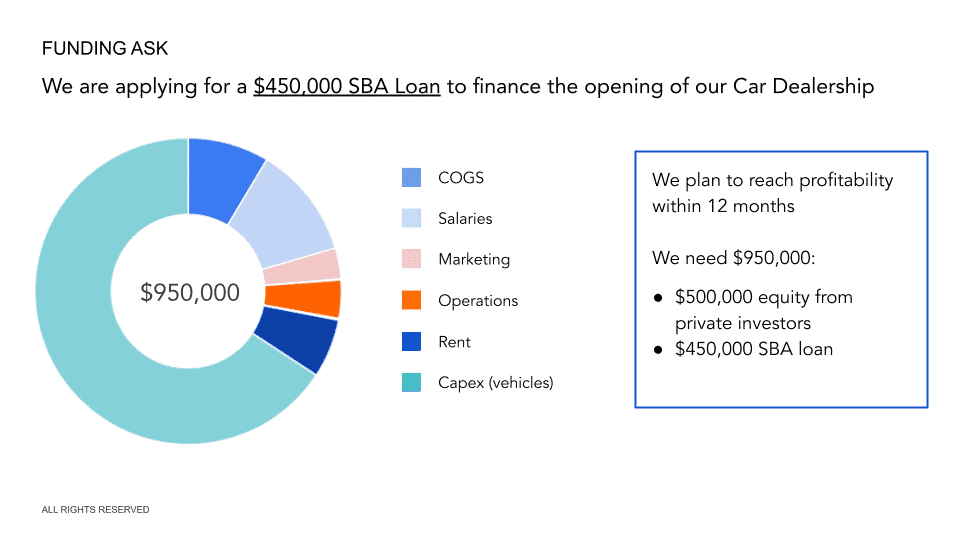

Whether you’re looking to raise funding from private investors or to get a loan from a bank (like a SBA loan) for your car dealership, you will need to prepare a solid business plan.

In this article we go through, step-by-step, all the different sections you need in your car dealership business plan. Use this template to create a complete, clear and solid business plan that get you funded.

1. Executive Summary

The executive summary of a business plan gives a sneak peek of the information about your business plan to lenders and/or investors.

If the information you provide here is not concise, informative, and scannable, potential lenders and investors may lose interest.

Though the executive summary is the first and the most important section, it should normally be the last section you write because it will have the summary of different sections included in the entire business plan below.

Why do you need a business plan for your car dealership?

The purpose of a business plan is to secure funding through one of the following channels:

- Obtain bank financing or secure a loan from other lenders (such as a SBA loan )

- Obtain private investments from investment funds, angel investors, etc.

- Obtain a public or a private grant

How to write an executive summary for your car dealership?

Provide a precise and high-level summary of every section that you have included in the business plan. The information and the data you include in this segment should grab the attention of potential investors and lenders immediately. Also make sure that the executive summary doesn’t exceed 2 pages.

The executive summary usually consists of the 5 main paragraphs:

- Business overview : introduce your car dealership: what is your business model (franchise vs. independent business ; new vs. used car dealership), how many cars will you have in inventory? Are you partnering with any car manufacturer(s)? Where would your store be located? Etc.

- Market overview : briefly analyze the car dealership industry in your area ( market size and growth), your competitors and target customers: average income of your target audience , demographic distribution, customer preferences etc.

- Management & people : introduce the management team and their industry experience. Mention your business partner(s), if any. Also give here an overview of the different teams, roles and their reporting lines

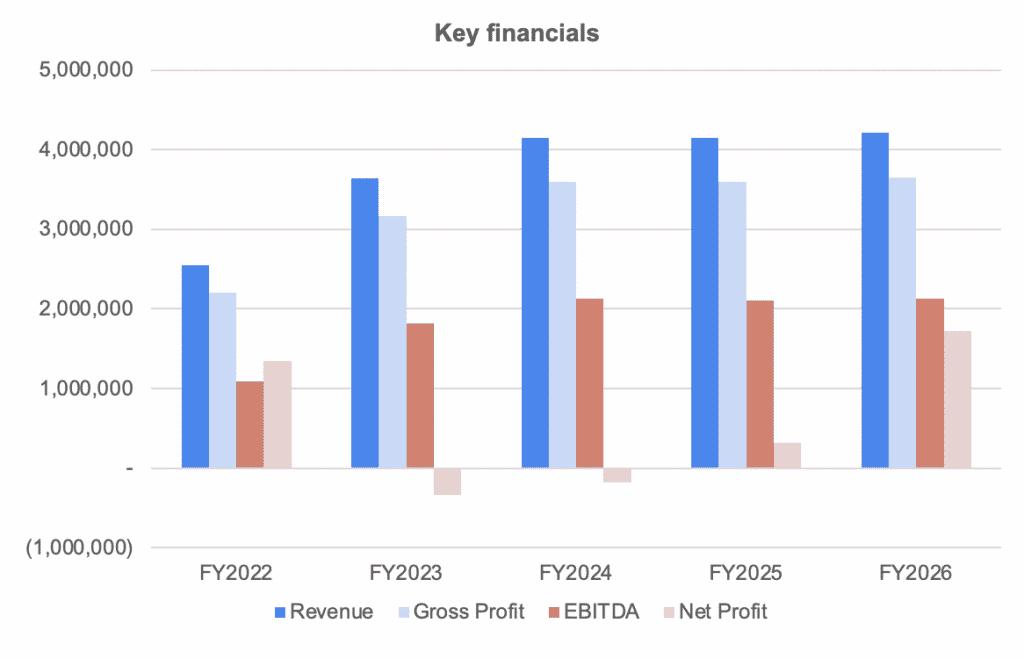

- Financial plan : how much profit and revenue do you expect in the next 5 years? When will you reach the break-even point and start making profits? Also include here a small chart with your key financials (revenue, net profit )

- Funding ask : what loan/investment/grant are you seeking? How much do you need? How long will this last? How will you spend the money?

Car Dealership Financial Model

Download an expert-built 5-year Excel financial model for your business plan

2. Business Overview

In the business overview section of your car dealership business plan, you should expand on what your company sells, to whom, and how it is structured. A few examples of questions you must answer here are:

- The history behind the project: why did you choose to open a car dealership today?

- Your business model : Are you franchising or is this an independent store? Are you selling new or used vehicles?

- Products & services : What vehicles / brands do you plan to sell? Are you planning to add any additional services (e.g. car repair & checkups, etc.)

- What is the legal structure of your company? Who are the directors / shareholders?

a) History of the Project

Briefly explain how did you come up with the plan to start a car dealership business. What motivated you to get into this business venture?

Also try to demonstrate to investors your interest and passion for the car industry and car dealership in general.

For example, you might have worked in a car dealership and/or at a car manufacturer sales department in the past, and found immense growth potential for this type of business in your area.

b) Business Model

Explain in this section what business model you chose for your car dealership. Here are a few questions you must answer:

- Will you start an independent dealership, franchise model, chain store, etc.?

- Will you open a brand-specific dealership?

- Would your car dealership deal in new cars, used cars, or both?

- Do you plan to open an online dealership?

- Would you offer service and repairs in your car dealership?

c) Products & Services

Now that we have briefly introduced what your business model is, you must explain in detail what exactly you intend to sell. There are 2 things here:

- Products (cars): what vehicles and brands do you intend to sell? Why did you choose these vehicles / brands?

- Services : if you offer additional services (e.g. car repairs, checkups), explain what they are

In addition to the products and services , you should also include a list of prices for each. Of course, this doesn’t need to be exact. Car prices fluctuate based on various factors. Yet, you must be able to provide a range of prices for each category (e.g. sedan, luxury cars, vans, etc.).

If you specialize in a specific brand, you can provide a list of prices per model in appendix as well.

The prices are important as they will allow investors to tie your product offering with your financial projections later on.

d) Legal Structure

Explain the legal structure of your nursing home in this section. Are you starting a corporation, a limited liability company, or a partnership? Who are the investors? How much equity do they actually own? Is there a board of directors? Do they have prior industry experience?

3. Car Dealership Market Overview

A complete understanding of the car dealership industry is important for the success of your business.

Therefore, you must cover here 3 important areas:

- Status quo : how big is the car dealership industry in your area? How fast is the market growing? What are the trends fuelling this growth (or decline)?

- Competition overview : how many car dealership competitors are there? How do they compare vs. your business? How can you differentiate yourself from them?

- Customer analysis : what are your target customers? What are their customer preferences?

a) Status quo

When looking at the car dealership industry, try to start at the national level (US) and narrow it down to your service area (a city for example). You should answer 2 important questions here:

How big is the car dealership industry in your area?

How fast is the car dealership industry growing in your area, how big is the car dealership industry in the us.

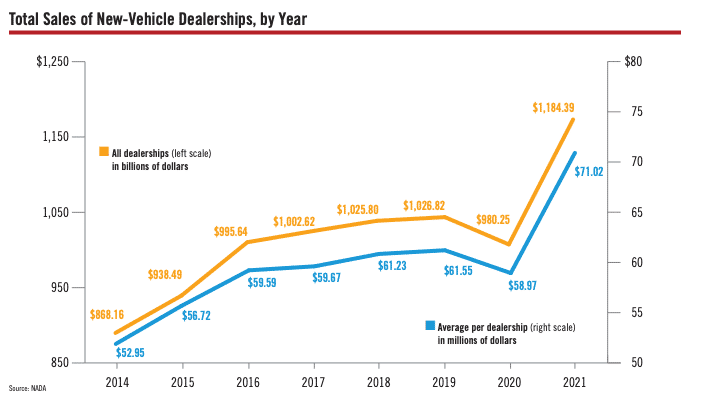

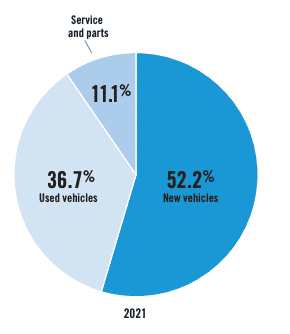

The auto parts and car dealership industry in the US is huge: it was worth $1.18 trillion in 2021 as per the National Automobile Dealers Association . As per the same report, there were 16,676 light vehicles car dealerships in the US in 2021 which generate an average revenue of $71 million.

Sales are divided between new (52%) and used vehicles (37%) as well as services and parts (11%).

After the US, assess the size of the car wash industry in your city or area. Focus on the zone where you plan to offer your services.

Naturally, you might not be able to get the data for your specific city or region. Instead, you can estimate the size of your market, for more information on how to do it, read our article on how to estimate TAM, SAM and SOM for your startup .

Luckily, NADA publishes statistics per state so you can narrow it down easily. For your city instead, you will need to do work out some estimates. To give you an example, let’s assume you plan to operate in an area where there are already 30 car dealership businesses (in a 25 miles radius for example).

Assuming our business is based in Connecticut, we can use the state’s average annual turnover of $49,661 : we can reasonably assume that the car dealership industry is worth $1.5 million in your area . In other words, there are over 35,100 light vehicles (new and used) being sold in your area each year (assuming the average retail price of $43,000).

Now that we know your area’s market size, let’s look at growth instead.

Fortunately, you can use NADA’s number again as they publish annual reports. Just use your state’s market size growth, and explain the growth (or decline). This can be due to average car prices, or volume.

b) Competition overview

You should discuss both your direct and indirect competition in your business plan. Other car dealerships in the region will be your immediate competitors. Internet auctions, individual dealers, etc., will be your indirect competitors.

In this section, you should also discuss the essential components of the business models of your main competitors. Your research should be focused on their clientele, the kinds of cars they offer, and their strengths and weaknesses .

A thorough competitive analysis is crucial as it may allow you to discover and address a customer need or preference that none of your rivals is addressing today.

Here are some of the questions that you must answer in this section:

- How many competitors are there in the area where you want to open your car dealership?

- Are they franchises or independent stores?

- Do they partner with specific car manufacturers?

- What type of cars do they offer (luxury, economy, used, new, etc.)?

- What is the average price range of the cars they sell?

- How many employees do they have?

- Do they offer services and repairs?

- Do your competitors offer buyback on the cars sold by them previously to the client?

- What type of offers and discounts do they offer to attract customers?

- How many cars / vehicles do they sell on average per month?

c) Customer analysis

Now that we have a good idea of the car dealership industry in your area as well as competition, now is time to focus on your target audience: customers.

Knowing your customer is extremely important before you get into any business. This is all the more relevant for car dealership where customer preferences and tastes are very different.

For example, if you are planning to get into a luxury car dealership business, you should look into:

- The estimated population of high-income people in your area

- Types of luxury cars that are in demand (hatchback, sedan, SUV, etc.)

- Shopping preference of your target customers (online or offline)

- How frequently do they buy (or exchange) new cars?

- Is their buying decision influenced by offers or discounts?

- What features do your target customers want in their new luxury cars?

- What type of additional services do they expect from their dealers?

4. Sales & Marketing Strategy

This is the section of your business plan where you outline your customer acquisition strategy. Try to answer the following questions:

- What are the different marketing strategies you will use?

- What are your Unique Selling Points (USPs)? In other words, how do you differentiate from your competitors?

- How do you intend to track the success of your marketing strategy ?

- What is your CAC or customer acquisition cost?

- What is your marketing budget?

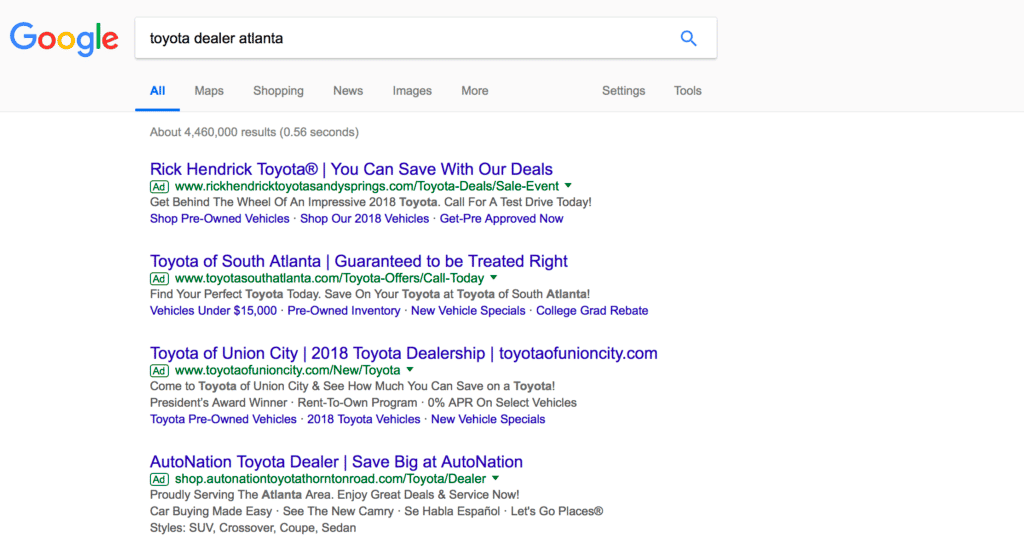

What marketing channels do car dealerships use?

A few marketing channels that car dealership businesses typically use are:

- Signage, billboards

- PPC ads, Facebook ads, etc.

- Print media

- Loyalty programs

- Online local listing (Google Business)

- Content marketing (share content like vehicle maintenance tips, safe driving tips, etc.) on platforms like blogs, social media, etc.

- Word of mouth, recommendations

You must have a fair and nearly accurate estimate of your marketing budget. Therefore, make sure to budget for marketing accordingly in your financial projections.

What are your Unique Selling Propositions (USPs)?

In other words, how do you differentiate yourself vs. competitors? This is very important as you might need to win customers from competitors.

A few examples of USPs are:

- Products: you may be the exclusive distributor or a car make in your area for example

- Services : you may offer repairs and regular checkups for your customers

- Location : you store is closer to a busy road and/or to where your customers live

Your USPs will depend on your business model, competitor analysis, and target audience. Whatever your USPs are, it should appeal to your potential customers and attract them.

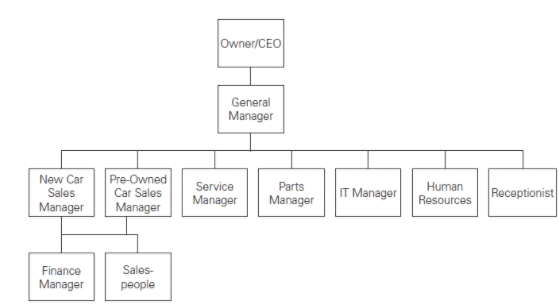

5. Management & People

You must address 2 things here:

- The management team and their experience/track record

- The organizational structure: the different team members and who reports to whom

Small businesses often fail because of managerial weaknesses. Thus, having a strong management team is vital. Highlight the experience and education of senior managers that you intend to hire to oversee your car dealership.

Describe their duties, responsibilities, and roles. Also, highlight their previous experience and explain how they succeeded in their previous roles.

Organization Structure

Even if you haven’t already hired a VP of sales, sales managers, support staff and any other relevant staff members, you must provide a chart of the organizational structure outlining the different teams, roles and their reporting lines.

6. Financial Plan

The financial plan is perhaps, with the executive summary, the most important section of any business plan.

Indeed, a solid financial plan tells lenders that your business is viable and can repay the loan you need from them. If you’re looking to raise equity from private investors, a solid financial plan will prove them your car dealership is an attractive investment.

There should be 3 sections to your financial plan section:

- Your historical financials (only if you already operate the business and have financial accounts to show)

- The startup costs of your project (if you plan to start a new car dealership, or purchase new inventory, expand your store, etc.)

- The 5-year financial projections

a) Historical Financials (if any)

In the scenario where you already have some historical financials (a few quarters or a few years), include them. A summary of your financial statements in the form of charts e.g. revenue, gross profit and net profit is enough, save the rest for the appendix.

If you don’t have any, don’t worry, most new businesses don’t have any historical financials and that’s ok. If so, jump to Startup Costs instead.

b) Startup Costs

Before we expand on 5-year financial projections in the following section, it’s always best practice to start with listing the startup costs of your project. For a car dealership, startup costs are all the expenses you incur before you open your shop and starting making sales. These expenses typically are:

- The lease deposit for the commercial space you rent (if you don’t buy it)

- The design and renovation of the existing facilities

- The inventory costs (the initial stock of vehicles you must buy to sell them at opening)

For example, let’s assume you want to buy 30 light vehicles as a start for inventory, and you take on a loan where you need to put down 15% upfront. Now, assuming these vehicles each cost $50,000 on average, this means you must put down $300,000 yourself. This comes in addition with any other startup cost mentioned above (lease deposit, renovation costs, etc.).

c) 5-Year Financial Projections

In addition to startup costs, you will now need to build a solid 5-year financial model as part of your business plan for your car dealership .

Your financial projections should be built using a spreadsheet (e.g. Excel or Google Sheets) and presented in the form of tables and charts in your business plan.

As usual, keep it concise here and save details (for example detailed financial statements, financial metrics, key assumptions used for the projections) for the appendix instead.

Your financial projections should answer at least the following questions:

- How much revenue do you expect to generate over the next 5 years?

- When do you expect to break even?

- How much cash will you burn until you get there?

- What’s the impact of a change in pricing (say 20%) on your margins?

- What is your average customer acquisition cost?

You should include here your 3 financial statements (income statement, balance sheet and cash flow statement). This means you must forecast:

- The number of vehicles you sell over time ;

- Your expected revenue ;

- Operating costs to run the business ;

- Any other cash flow items (e.g. capex, debt repayment, etc.).

When projecting your revenue, make sure to sensitize pricing and the number of customers as a small change in these assumptions will have a big impact on your revenues.

7. Funding Ask

This is the last section of the business plan of your car dealership. Now that we have explained what type of vehicles your company sells to whom and at what price, but also what’s your marketing strategy, where you go and how you get there, this section must answer the following questions:

- How much funding do you need?

- What financial instrument(s) do you need: is this equity or debt, or even a free-money public grant?

- How long will this funding last?

- Where else does the money come from? If you apply for a SBA loan for example, where does the other part of the investment come from (your own capital, private investors?)

If you raise debt:

- What percentage of the total funding the loan represents?

- What is the corresponding Debt Service Coverage Ratio ?

If you raise equity

- What percentage ownership are you selling as part of this funding round?

- What is the corresponding valuation of your business?

Use of Funds

Any business plan should include a clear use of funds section. This is where you explain how the money will be spent.

Will you spend most of the loan / investment to acquire the cost for the inventory (the vehicles)? Or will it cover mostly the cost of buying the land and building the store?

Those are very important questions you should be able to answer in the blink of an eye. Don’t worry, this should come straight from your financial projections. If you’ve built solid projections like in our car dealership financial model template , you won’t have any issues answering these questions.

For the use of funds, we recommend using a pie chart like the one we have in our financial model template where we outline the main expenses categories as shown below.

Privacy Overview

BizFundingResource.com

Auto Loan Company Business Plan and SWOT Analysis

Auto Loan Company Business Plan, Marketing Plan, How To Guide, and Funding Directory

The Auto Loan Company Business Plan and Business Development toolkit features 18 different documents that you can use for capital raising or general business planning purposes. Our product line also features comprehensive information regarding to how to start an Auto Loan Company business. All business planning packages come with easy-to-use instructions so that you can reduce the time needed to create a professional business plan and presentation.

Your Business Planning Package will be immediately emailed to you after you make your purchase.

- Bank/Investor Ready!

- Complete Industry Research

- 3 Year Excel Financial Model

- Business Plan (26 to 30 pages)

- Loan Amortization and ROI Tools

- Three SWOT Analysis Templates

- Easy to Use Instructions

- All Documents Delivered in Word, Excel, and PDF Format

- Meets SBA Requirements

Cars are expensive purchases and as such auto loan companies exist in order to provide the necessary capital in order to purchase cars. As such, these businesses are relatively immune from negative changes in the economy. These businesses generate extremely high gross margins from the ongoing interest that is paid for vehicle loan as well as closing fees that can be acquired at the time the vehicle is purchased. Typically, most auto loan companies usually start their operations with the capital base ranging anywhere from $2 million to $10 million depending on the number of loans that will be immediately issued at the onset of operations. Of course, this number may be substantially higher if there are third-party institutional buyers standing by to purchase the close automotive loans. This is one of the additional ways that these companies generate significant revenues via the sale of seasoned auto loans. The barriers to entry for this type of business are very high. This is due to the fact that there must be a number of regulations that must be dealt with in addition to having the appropriate amount of capital on hand in order to issue automotive loans.

Most investors are happy to provide a significant amount of capital to automotive loan companies given the high gross margins generated on a monthly basis. The economically secure nature of these revenues also ensures that there is a strong return on investment coupled with having a significant collateral base. As with any business that is looking to raise capital a business plan that contains a three-year to profit and loss statement, cash flow analysis, balance sheet, breakeven analysis, and business ratios page should be developed. Additionally, within the business plan – the automotive loan company credit procedures, protocols, and disbursement manual should be included as well. Most funding sources are going to want to see what collateral and credit standards will be used during the automotive lending process. Beyond this information, a full analysis regarding graphics, median household income, median family income, population density, population size, and competitive information should also be included. As many people now use the Internet to acquire auto loans it is imperative that this demographic analysis is extremely broad so that a very large number of potential borrowers can be targeted via the company’s operations.

After the business plan is developed is time to establish the auto loan company marketing plan. This is one of the most complex aspects of the business planning process given that there are thousands of specialty finance companies, banks, and private funding sources that provide auto loans to borrowers. Again, the high gross margins and strong collateral of these debt instruments has driven a significant amount of competition into the industry. One of the foremost aspects of the marketing plan should focus on online marketing. This includes having a proprietary website that allows users to fill out a lending application very quickly. It is important that this website have the proper functionality in place so that the credit check can be immediately completed once a borrower submit their application for an auto loan. One of the other ways that these businesses draw borrowers is through the use of social media. These days it is very important to have an expansive presence on social media platforms such as FaceBook, Twitter, Google+, and others in order to increase the visibility of the auto loan company brand name. This is going to be one of the primary ways that these companies need to continue to do their operations moving forward.

Frequently developed is the auto loan company SWOT analysis. This analysis focuses on the strengths, weaknesses, opportunities, and threats that are commonly found among these companies. As it relates the strengths, and auto loan company is able to put juice highly recurring streams of revenue from interest. Additionally, these companies can produce secondary income from close closing fees as well as the sale of seasoned loans to institutional buyers. For weaknesses, auto loan companies have a significant number of regulations as it relates to lending that they need to adhere to on a day-to-day basis. Also, there is a significant amount of competition within this industry. For opportunities, most auto loan companies expand their operations by acquiring additional rounds of capital that allow them to increase the number of loans that go through their pipeline. Pertaining to threats, there are no pieces of legislation that would impact the way that an auto loan company conducts business at this time. However, there may be changes in regulations as political shifts in the United States occur. It is important that appropriate legal counsel is retained in order to ensure that the auto loan company complies with the law at all times.

How to Start a Profitable Car Title Loan Business

Car title loans provide fast cash for customers in need of emergency funds by leveraging their vehicle’s value while still retaining ownership and use of their car. This growing lending niche offers lucrative potential for entrepreneurs interested in starting a car title loan business. This comprehensive guide covers how to start a car title loan company, state licensing, marketing strategies, maximizing profits, common challenges and future outlook.

Table of Contents

What is a Car Title Loan Business?

A car title loan business provides short-term secured loans to borrowers who use their vehicle’s title as collateral. The lender offers 25% to 50% of the car’s value in cash and holds the title until the quickly repaid loan plus fees are paid off. The borrower retains use of their vehicle during repayment. Interest rates are usually charged monthly.

Why Start a Car Title Loan Company?

Reasons entrepreneurs are attracted to the car title loan model include:

- Requires little startup capital

- Fast application and approval processes

- Secured by valuable asset (vehicle)

- Higher interest and fee income potential

- Additional revenue from renewals

- Recession resistant demand

- Minimal overhead expenses

- Scalable with multiple locations

Car title lending can generate very high ROI for owners when run efficiently.

Steps to Start a Car Title Loan Business

To launch a car title loan company, follow these key steps:

- Choose a business entity and establish licensing

- Understand your state’s car title loan laws and regulations

- Obtain required lending licenses and bonding

- Find affordable office space, ideally with parking

- Design workflow process and loan management systems

- Stock office supplies and documentation forms

- Hire and train loan officers/processors

- Partner with repossession and towing services

- Install security systems and surveillance

- Market loans and build community awareness

- Start approving and funding loans!

Take time upfront to build an organized and compliant foundation.

Licensing Requirements for Car Title Lenders

Car title loan companies must adhere to federal Truth in Lending Act (TILA) disclosure rules and interested rate caps under state law. Specific licensing often includes:

- State lending or consumer loan license

- Vehicle title lender registration

- City/county business licenses

- Sales permits and reseller certificate

- Zoning approvals and sign permits

- Sales tax ID number

- EIN from IRS

- FDIC certificate if offering checking accounts

Research requirements thoroughly before operating to avoid violations.

Writing a Car Title Loan Business Plan

A key startup step is creating a detailed business plan covering:

- Executive summary and company overview

- Startup costs – licenses, office, systems, marketing

- Revenue model and fee/rate structure

- Loan volume projections

- Staffing and operations model – workflow, volumes

- Target market – demographics, geography

- Competitor analysis

- Marketing plan with lead generation and sales strategies

- Funding sources – investment, loans, grants, investors

- Financial projections – profit and loss, cash flow , balance sheet

- Contingencies and risks

The plan provides a blueprint to guide the business launch and strategy.

How Much Does it Cost to Start a Car Title Loan Company?

You can start a small car title lending operation with around $25,000 to $50,000 in startup capital including:

- Licensing fees $2,000 – $5,000

- Lease deposit & first month $3,000 – $5,000

- Office furniture & computers $5,000 – $10,000

- Security system $2,000 – $3,000

- Signage $1,000 – $2,000

- Initial advertising and marketing $5,000 – $10,000

- Legal and professional fees $3,000 – $5,000

- Insurance $2,000 – $4,000

- Working capital $10,000 – $25,000

Exact budget will depend on state requirements, location, scale, and systems needed.

Car Title Loan Business Model

Car title loan companies generate revenue through:

- High interest rates charged – average 25% monthly

- Origination fees – average $100 per new loan

- Late/collection fees – if payments are late

- Renewal fees – for loan extensions

- Repossession and sale of vehicle if defaulted

Gross revenue on a typical 1-month $1,000 car title loan would be approximately $250.

Using proper underwriting, the business can earn substantial income while providing an essential service to those in need.

How Much Can You Profit in the Car Title Loan Business?

A well-run car title lending operation can produce an average of $5,000 to $15,000 in monthly net profit . Profits are dependent on loan volume, interest rates charged, and the ability to keep defaults and overhead low. Larger companies with multiple locations can earn over $50,000 per month.

Marketing a Car Title Loan Company

Promoting your lending services is critical to generating new customers. Effective marketing activities include:

- Digital advertising – Google, Facebook and banner ads focused locally. Target people searching for fast cash solutions.

- SEO optimization – Ensure your website ranks well for related keyword searches like “car title loans near me”.

- Signage and vehicle wraps – Place eye-catching and directional signs around town and on company cars.

- Direct mail – Send loan offer postcards and flyers to nearby households.

- Networking – Join and sponsor local chambers, charities and business associations.

- Referrals – Encourage refer-a-friend programs through loyal customers.

- Reputation building – Gain positive online reviews and testimonials. Be involved in the community.

- Press releases – Promote new location openings, unique loan products, awards.

Car Title Loan Underwriting Process

The underwriting process involves:

- Verifying borrower identity, income, and residence

- Confirming vehicle free-and-clear title and ownership

- Inspecting car condition, mileage, value

- Checking loan status through clearance companies

- Reviewing borrower’s credit report and finances

- Assessing repayment ability with monthly budget

- Approving suitable loan amounts in line with policy

- Completing all required legal loan documentation

- Disbursing funds to customer

Applying sound underwriting protects the business from defaults.

Tips for Optimizing Car Title Loan Profits

Best practices for maximizing profits include:

- Maintain lean overhead structure and efficient operations

- Employ strong underwriting but expedite funding

- Develop referral rewards program to increase retention

- Extend renewal grace periods to encourage on-time payments

- Increase rates and fees judiciously based on competitive research

- Institute collection call and late payment reminder procedures

- Boost customer lifetime value with additional financial products

- Explore expansion into payday loans and check cashing

- Offer bi-weekly or semi-monthly payments to ease borrower cash flow

- Start loyalty program for continuous customers

- Sell repossessed asset quickly to minimize losses

Finding the optimal balance between growth, defaults, and expenses takes experience and analysis.

Common Challenges Facing Car Title Loan Companies

Top issues to be aware of include:

- High default rates if underwriting is not rigorous

- Industry perception and bad public image

- Regulatory compliance burden and legal threats

- Security risks and potential robberies

- Short term loans require constant new customer acquisition

- Limited scalability due to state by state legislation

- Intense competition from payday lenders and banks

- Technology integration for analytics and efficiency

- Seasonal loan demand fluctuations throughout year

Proactive planning and processes can help mitigate these risks.

Insurance and Regulations for Car Title Lenders

Proper insurance policies include:

- General liability – protect against customer injuries

- Commercial property – covers office assets & equipment

- Surety bonds – required in some states

- Business interruption – compensates for lost income

- Workers comp – for employees

- Auto insurance – for company vehicle fleet

- E&O insurance – protects against underwriting errors

Adhere to all federal and state lending rules, disclosures, rates caps and licensing requirements.

Should You Start a Car Title Loan Company?

Before diving in, consider:

- Your risk tolerance and aptitude for lending

- Required licensing timeframes and costs in your state

- Competitor saturation in target locations

- Compliance demands and regulatory shifts

- Interest rates justified relative to risk

- Abilities to minimize defaults through underwriting

- Comfort with collateral seizure if necessary

- Ongoing funding for marketing and growth

- Access to quality referral partners

- Infrastructure for security and recordkeeping

The business can be extremely lucrative but does carry unique challenges.

Trends and Future of the Car Title Loan Industry

- Increased digital application and servicing

- Greater consumer demand for fast financing options

- Trying new customer acquisition strategies like radio/TV

- Regulatory crackdowns in some states

- Partnering with dealers on auto loans

- Offering longer 2-3 month loan terms

- New fintech entrants and payoff consolidation apps

- Lower default rates attributed to economic stability

Convenience and responsible service will be differentiators going forward.

A car title loan business provides an appealing avenue to profit by helping customers leverage their vehicle asset for quick cash loans. However, new entrants must carefully adhere to regulations, implement strong underwriting, maximize marketing ROI and streamline operations to succeed long-term. Used appropriately, car title loans fill an important niche effectively serving customers through temporary financial challenges or emergencies. By following the guidance in this article, your new lending business can generate substantial wealth while making a positive community impact .

Frequently Asked Questions

How much money do you need to start a car title loan business.

Around $25,000 to $50,000 is recommended to sufficiently cover startup costs like licensing, office space, legal, marketing, supplies and adequate operating capital.

Do you need a lot of money to start in the car title loan business?

The relative startup costs are low compared to many other finance business models, like banks or auto dealers. Initial investment can often earn ROI in under a year.

What are the profit margins on car title loans?

Typical net profit margins range from 30% to 60%+ on car title loans after costs. Profitability relies heavily on keeping defaults and overhead expenses low.

How much interest can you charge on car title loans?

Maximum interest rates and fees vary by state but average around 25% monthly. Some states have caps as low as 30% APR. Research state statutes.

How do car title loans work?

Borrowers receive 25% to 50% of their car’s value in cash. They keep driving the car while repaying the loan plus fees over a short term, usually 30 days. The title is collateral if defaulted.

Is a car title loan a good idea?

For borrowers, the high interest rates mean car title loans should only be used as a last resort for quick funds. Shop rates and examine alternatives before borrowing.

Do you need good credit for a car title loan?

No, credit checks are rarely part of the application since the vehicle title is the collateral. All that is typically required is proof of income, residence, and a lien-free car title.

Are car title loans legal?

Car title loans are legal in about half of U.S. states but are restricted or banned in others. Regulations and interest rate caps vary widely.

How do car title loans affect your credit?

Car title lenders usually don’t report activity to credit bureaus. However, severe late payments or repossession can negatively impact your score.

What is the default rate on car title loans?

Industry average default rates are estimated to range from 10% to 20%+. Effective underwriting and collections help minimize defaults.

I do not provide any financial advice or recommendations. The article is intended for educational and informational purposes only. Readers should conduct their own due diligence and consult qualified professionals before making business or investment decisions.

Sarah Teague brings 5 years of professional writing experience to her role as content writer for Walletminded. In this position, Sarah creates compelling articles, blog posts, and other digital content that engage readers and promote the Walletminded brand. Before joining Walletminded, Sarah honed her writing skills as a freelance writer and ghostwriter. Her work included crafting blog posts and web content for financial services, technology, and healthcare clients. Sarah holds a bachelor's degree in English from Emory University, where she also served as editor of the campus literary journal. She continues to volunteer her time as a writing mentor for youth in her community. When she's not meticulously crafting content, you can find Sarah attempting new baking recipes and enjoying hikes with her dog. She also loves curling up with a good memoir.

View all posts

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

RELATED STORIES

Can You Superscript and Subscript in Canva?

How to Demonstrate Your Fit for an Upwork Project

What is SSO and How Does it Work on GoDaddy?

Easy To Start Online Business Ideas That Make Money

How to Start a Concrete Driveway Resurfacing Business

How to Start a Boat Storage Business

Starting a Coinless Laundry Business: An In-Depth Guide for Entrepreneurs

How to Start a Carpet Cleaning Business: An In-Depth Guide for Entrepreneurs

Renting Out ADUs: An In-Depth Guide for Entrepreneurs

Renting Out Garage Space

Car Dealership Business Plan Template

Written by Dave Lavinsky

Car Dealership Business Plan

Over the past 20+ years, we have helped over 4,000 entrepreneurs create business plans to start and grow their car dealerships. On this page, we will first give you some background information with regards to the importance of business planning. We will then go through a car dealership business plan template step-by-step so you can create your plan today.

Download our Ultimate Car Dealership Business Plan Template here >

What Is a Car Dealership Business Plan?

A business plan provides a snapshot of your car dealership as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategy for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for Your Car Dealership

If you’re looking to start a car dealership or grow your existing car dealership you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your car dealership in order to improve your chances of success. Your car dealership business plan is a living document that should be updated annually as your company grows and changes.

Source of Funding for Car Dealership Businesses

With regards to funding, the main sources of funding for a car dealership are personal savings, bank loans and angel investors. With regards to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to confirm that your financials are reasonable. But they will want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business.

The second most common form of funding for a car dealership is angel investors. Angel investors are wealthy individuals who will write you a check. They will either take equity in return for their funding, or, like a bank, they will give you a loan.

Finish Your Business Plan Today!

Your business plan should include 10 sections as follows:

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.