The benefits of a cashless society

We're shifting toward a cashless society, with potential for enormous socio-economic benefits for both developed and developing countries. Image: Jonas Leupe/Unsplash

.chakra .wef-1c7l3mo{-webkit-transition:all 0.15s ease-out;transition:all 0.15s ease-out;cursor:pointer;-webkit-text-decoration:none;text-decoration:none;outline:none;color:inherit;}.chakra .wef-1c7l3mo:hover,.chakra .wef-1c7l3mo[data-hover]{-webkit-text-decoration:underline;text-decoration:underline;}.chakra .wef-1c7l3mo:focus,.chakra .wef-1c7l3mo[data-focus]{box-shadow:0 0 0 3px rgba(168,203,251,0.5);} Mehul Desai

.chakra .wef-9dduvl{margin-top:16px;margin-bottom:16px;line-height:1.388;font-size:1.25rem;}@media screen and (min-width:56.5rem){.chakra .wef-9dduvl{font-size:1.125rem;}} Explore and monitor how .chakra .wef-15eoq1r{margin-top:16px;margin-bottom:16px;line-height:1.388;font-size:1.25rem;color:#F7DB5E;}@media screen and (min-width:56.5rem){.chakra .wef-15eoq1r{font-size:1.125rem;}} Fourth Industrial Revolution is affecting economies, industries and global issues

.chakra .wef-1nk5u5d{margin-top:16px;margin-bottom:16px;line-height:1.388;color:#2846F8;font-size:1.25rem;}@media screen and (min-width:56.5rem){.chakra .wef-1nk5u5d{font-size:1.125rem;}} Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:, davos agenda.

The first recognisable coins were produced in China more than 3,000 years ago.

If you visit China today, however, there’s a strong chance you’ll see people paying for things using facial recognition on their phones.

This is a radical shift, but it’s just the beginning of the cash revolution.

Have you read?

Africa should follow in india's footsteps towards a cashless economy. this is why, these are the countries that would benefit most from a cashless world.

The new global payments ecosystem, including both physical cash as well as mobile wallets, is the result of the convergence of three large and powerful industries: telecommunications, banking and retail.

And if the private and public sector can work together to harness the latest technology and realise the full potential of a cashless society, there will be enormous benefits.

It’s important to first reflect upon where we are on the journey toward a cashless society.

Thus far, the shift is basically a move from physical cash to cash-replacements. With private companies involved in processing those transactions, there is inevitably a cost. And that means there is a loss of value when the transfer occurs.

This is my vision of a true cashless society. There is an exchange of value in its entirety – just like cash. And it requires a national government – rather than banks or the like – to act as the payment provider, effectively becoming a state-backed utility.

The savings from avoiding the processing costs could then be used to benefit those in need, such as by being transferred to a fund to rejuvenate economically depressed areas, as one example.

This might sound counterintuitive, but I would argue just about everyone has access to capital. However, for the poorer members of society, there’s often a prohibitively high cost to accessing it. If you have a great business idea but can’t afford start-up capital, then your venture is unlikely to get off the ground.

A cashless society – along with the transformation of the last mile of money transfers, payments and banking services – will help to close the financial inclusion gap.

Cashless technologies could be some of our greatest assets in the fight against corruption and organised crime, too.

And, once again, the people who stand to benefit most are those who are most in need.

There are 1.4 billion people in the world who have to make do with less than $1.25 a day. At the same time, around $1.26 trillion is effectively stolen from developing countries , due to corruption, bribery, theft and tax evasion. If we could reclaim that money for those countries, we could lift those 1.4 billion people above the poverty threshold and keep them there for at least six years.

If everyone were connected to an end-to-end e-payment infrastructure – a cashless environment – there would be transparency in money flows. Whether it’s international aid or private investment, if everyone in the chain were connected digitally, you could see where the money went and how it was spent.

Any sums appearing outside of that framework could immediately be flagged and investigated. This would narrow the focus for law enforcement and forensic accountants, making it easier to target and recoup hidden money.

There are, of course, many challenges to overcome as we embrace this level of disruption. And governments will need to take preemptive and proactive action in areas such as identity management and the protection of security and privacy.

However, the underlying support structures to make it all possible – the building blocks, or e-plumbing – are already in place. We already have secure, enabled ecosystems and the next generation of infrastructure.

At Finablr, we have four decades of experience in regulatory alignment and cross-border compliance, with a network spanning 170 countries. We also have proprietary technology, which enabled 150 million transactions at a total value of $115 billion in 2018 alone.

There’s no going back – which means we need to face the risks and deal with some of the difficulties of going cashless in order to unlock the benefits.

In developed countries, a cashless society will deliver transactions that are seamless, frictionless and low-cost. And in developing nations, it could deliver life-changing socio-economic benefits.

This easily accessible exchange of value will create a more equal world, and strengthen the bond between people, regardless of where they live.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The agenda .chakra .wef-n7bacu{margin-top:16px;margin-bottom:16px;line-height:1.388;font-weight:400;} weekly.

A weekly update of the most important issues driving the global agenda

.chakra .wef-1dtnjt5{display:-webkit-box;display:-webkit-flex;display:-ms-flexbox;display:flex;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;-webkit-flex-wrap:wrap;-ms-flex-wrap:wrap;flex-wrap:wrap;} More on Davos Agenda .chakra .wef-17xejub{-webkit-flex:1;-ms-flex:1;flex:1;justify-self:stretch;-webkit-align-self:stretch;-ms-flex-item-align:stretch;align-self:stretch;} .chakra .wef-nr1rr4{display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;white-space:normal;vertical-align:middle;text-transform:uppercase;font-size:0.75rem;border-radius:0.25rem;font-weight:700;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;line-height:1.2;-webkit-letter-spacing:1.25px;-moz-letter-spacing:1.25px;-ms-letter-spacing:1.25px;letter-spacing:1.25px;background:none;padding:0px;color:#B3B3B3;-webkit-box-decoration-break:clone;box-decoration-break:clone;-webkit-box-decoration-break:clone;}@media screen and (min-width:37.5rem){.chakra .wef-nr1rr4{font-size:0.875rem;}}@media screen and (min-width:56.5rem){.chakra .wef-nr1rr4{font-size:1rem;}} See all

Davos 2024 Opening Film

Building trust amid uncertainty – 3 risk experts on the state of the world in 2024

Andrea Willige

March 27, 2024

Why obesity is rising and how we can live healthy lives

Shyam Bishen

March 20, 2024

Global cooperation is stalling – but new trade pacts show collaboration is still possible. Here are 6 to know about

Simon Torkington

March 15, 2024

How messages of hope, diversity and representation are being used to inspire changemakers to act

Miranda Barker

March 7, 2024

AI, leadership, and the art of persuasion – Forum podcasts you should hear this month

Robin Pomeroy

March 1, 2024

- Search Search Please fill out this field.

- Banking Basics

The Pros and Cons of a Cashless Society

What do we gain and lose when cash is no longer king?

:max_bytes(150000):strip_icc():format(webp)/KhadijaKhartit-4f144e2b63ee4dd4af60ac8a02233c50.jpg)

What Is a Cashless Society?

Benefits of a cashless society.

- Disadvantages of a Cashless Society

- What Does Cashless Look Like?

Examples of Cashless Societies

The bottom line, frequently asked questions (faqs).

The Balance / Caitlin Rogers

A cashless society might sound like something out of science fiction, but it's on its way. Many present-day financial practices and transactions already happen without cash, and many financial institutions, service companies, and even governments are proponents of the shift.

Key Takeaways

- Many countries are moving towards a cashless society, in which all financial transactions are electronic.

- In addition to simply eliminating the costs and hassles of managing currency, going cashless may also reduce certain types of crime.

- The downsides of going cashless include less privacy, greater exposure to hacking, technological dependency, magnifying economic inequality, and more.

- Credit and debit cards, electronic payment apps, mobile payment services, and virtual currencies in use today could pave the way to a full cashless society.

A cashless society is one where cash—paper and coin currency—isn't used for financial transactions. Instead, all transactions are electronic, using debit or credit cards or payment services like PayPal, Zelle, Venmo, and Apple Pay . Many countries are moving in this direction, but it's difficult to tell which ones will eliminate cash altogether.

In addition to logistical challenges, several social issues need to be addressed before a society can give up on cash entirely.

The benefits and disadvantages below can give you an idea of the myriad of effects going cashless can have on money and banking as you know it.

Reduced crime rates without tangible money to steal

Digital paper trail, and less money laundering

Less time and cost associated with handling, storing, and depositing paper money

Easier currency exchange while traveling internationally

Exposes your personal information to a possible data breach

No alternative source of money in the case of technical issues or hacker activity

Technological learning curve

Lack of control over spending without a physical reminder

Those with the technological ability to take advantage of a cashless society will likely find that it's more convenient. As long as you have your card or phone, you have instantaneous access to all your cash holdings. Convenience isn't the only benefit. Here are some other benefits.

Lower Crime Rates

Carrying cash makes you an easy target for criminals. Once the money is taken from your wallet and put into a criminal's wallet, it'll be difficult to track that cash or prove that it's yours. One study by American and German researchers found that crime in Missouri dropped by 9.8% as the state replaced cash welfare benefits with Electronic Benefit Transfer (EBT) cards.

Automatic Paper Trails

Similarly, financial crime should also dry up in a cashless society. Illegal transactions, such as illegal gambling or drug operations, typically use cash so that there isn't a record of the transaction and the money is easier to launder. Money laundering becomes much harder if the source of funds is always clearly identifiable. It is harder to hide income and evade taxes when there's a record of every payment you receive.

Cash Management Costs Money

Going cashless isn't just convenient. It costs money to print bills and mint coins. Businesses need to store the money, get more when they run out, deposit cash when they have too much on hand, and in some cases, hire companies to transport cash safely. Banks hire large security teams to protect branches against physical bank robberies. Spending time and resources moving money around and protecting large sums of cash could become a thing of the past in a cashless future.

International Payments Become Much Easier

When you travel, you may need to exchange your dollars for local currency. However, if you're traveling in a country that accepts cashless transactions, you don't need to worry about how much of the local currency you'll need to withdraw. Instead, your mobile device handles everything for you.

Disadvantages of a Cash-Free World

Depending on your perspective, going cashless might be more problematic than beneficial. Here are some of the major downsides associated with a cashless financial system.

Digital Transactions Sacrifice Privacy

Electronic payments aren't as private as cash payments. You might trust the organizations that handle your data, and you might have nothing to hide. However, the more information you have floating around online, the more likely it is to wind up in malicious hands. Cash allows you to spend money and receive funds anonymously .

Cashless Transactions Are Exposed to Hacking Risks

Hackers are the bank robbers and muggers of the electronic world. In a cashless society, you're more exposed to hackers. If you are targeted and somebody drains your account, you may not have any alternative ways to spend money. Even if you're protected under federal law, it will still be inconvenient to restore your financial standing after a breach.

Technology Problems Could Impact Your Access to Funds

Glitches, outages, and innocent mistakes can also cause problems, leaving you unable to buy things when you need to. Likewise, merchants have no way to accept payments when systems malfunction. Even something as simple as a dead phone battery could leave you "penniless," in a sense.

Economic Inequality Could Become Exacerbated

Unless special outreach efforts are made, the poor and unbanked will likely have an even harder time in a cashless society. If smartphone purchases become the standard way to transact, for example, those who can't afford smartphones will be left behind. The UK is experimenting with contactless ways to donate to charities and homeless individuals, but these efforts may not be developed enough yet to substitute cash donations.

Payment Providers Could Charge Fees

If society is forced to choose from just a few payment methods, or if one app becomes the standard payment app, the companies who develop these services might not offer them for free. Payment processors may cash in on the high volumes by imposing fees, which would eliminate the savings that should come from less cash handling.

The Temptation To Overspend May Increase

When you spend with cash, you recognize the financial impact by physically taking the cash out of your pocket and giving it to someone else. With electronic payments, on the other hand, it's easy to swipe, tap, or click without noticing how much you spend. Consumers may have to rethink the ways they manage their spending.

Negative Interest Rates Could Be Passed Onto Customers

When all money is electronic, negative interest rates could have a more direct effect on consumers. Countries like Denmark, Japan, and Switzerland have already experimented with negative interest rates.

Dropping the interest rate is typically a move to stimulate an economy, but the result is that money loses purchasing power.

According to the International Monetary Fund, negative interest rates reduce bank profitability, and banks could be tempted to hike fees on customers to make up that deficit. Banks are limited in their ability to pass on those costs because customers can simply withdraw their cash from the bank if they don't like the fees. In the future, if customers can't withdraw cash from the bank, they may have to accept any additional fees.

What Does a Cashless Society Look Like?

Without cash, payments happen electronically. Instead of using paper and coins to exchange value, you authorize a transfer of funds from a bank account to another person or business. The logistics are still developing, but there are some hints as to how a cashless society might evolve.

- Credit and debit cards : Cards are among the most popular cash alternatives in use today, but cards alone might not be enough to support a 100% cashless society. Mobile devices could become a primary tool for payments instead.

- Electronic payment apps : Apps like Zelle , PayPal, and Venmo are helpful for person-to-person payments ( P2P payments ). In addition, bill-splitting apps allow friends to split their bills easily and fairly. Fintech companies like Stripe, Adyen, and Fiserv support business-to-consumer (B2C), business-to-business (B2B), or what they now merge into account-to-account (A2A) online payments in a reliable and speedy fashion.

- Mobile payment services : These services, along with mobile wallets like Apple Pay, provide secure, cash-free payments. Many nations that use cash sparingly have already seen mobile devices become common tools for payments.

- Virtual currencies : Cryptocurrency is already part of the discussion. Crypto is used for money transfers, and it introduces competition and innovation that may help keep costs low. However, there are risks and regulatory hurdles that make cryptocurrencies impractical for most consumers, so they might not yet be ready for widespread use.

Several nations are already making moves to eliminate cash, with the push coming from both consumers and government bodies. Sweden and India are two notable examples with two different outcomes.

It's not uncommon to see signs that say, "No Cash Accepted" in Swedish shops. According to the European Payments Council, cash transactions accounted for just 1% of Sweden's GDP in 2019, and cash withdrawals have been steadily declining by about 10% per year. Consumers are mostly happy with this situation, but those who struggle to keep up with technological developments continue to rely on cash.

Sweden is gearing up to become the first cashless nation in the world, with an economy 100% digital by 2023.

The Indian government banned 500 and 1,000 rupee notes in November 2016 in an effort to catch criminals and those working in the informal economy. The implementation was controversial, in part, because these notes made up 86% of currency in circulation. However, criminals weren't punished for hoarding untraceable cash, which had been the intent of the move.

The Economic Times cited the Reserve Bank of India as it reported that electronic transactions had increased temporarily, but cash returned to pre-demonetization levels by the end of 2017.

While these two examples had varying levels of success, both countries struggled to address how the marginalized would fare in a 100% cashless society.

With the many technological and societal moves towards digital and virtual financial transactions, cash currency is becoming less and less common. However, the shift to a fully cashless society has many potential drawbacks, and only time will tell whether cash holds a special niche.

What happens to the cash in circulation if a society goes cashless?

Most countries have a department within their governing body that regulates the printing and distribution of currency, as well as its destruction. In the U.S., the Federal Reserve has the power to issue money, but the actual printing (and yes, shredding, too), is handled by the Bureau of Engraving and Printing within the Treasury Department.

Who wants a cashless society?

A cashless society would primarily benefit certain businesses. While some individuals prefer using debit and credit to cash for convenience, businesses benefit from processing fees when consumers use their apps and services to send and receive payments. Handling cash is also expensive, so moving to cashless payments will also save businesses money and make transactions easier to track.

U.S. House Financial Services Committee. " Touchless Transactions Act of 2020 ."

European Payments Council. " Sweden: Cashless Society and Digital Transformation ."

Institute for the Study of Labor. " Less Cash, Less Crime: Evidence From the Electronic Benefit Transfer Program ," Page 2.

United States Mint. " 2020 Biennial Report to the Congress ," Page 3.

Board of Governors of the Federal Reserve System. " How Much Does It Cost To Produce Currency and Coin? "

The White House. " Executive Order on Ensuring Responsible Development of Digital Assets ."

Federal Trade Commission. " Data Breach Response: A Guide for Business ."

TAP London. " What is TAP London? "

Greater Change. " Fund a Person's Path Out of Homelessness ."

Consumer Financial Protection Bureau. " Helpful Tips for Using Mobile Payment Services and Avoiding Risky Mistakes ."

S&P Dow Jones Indices. " Where Inflation and Interest Rates Intersect ," Page 2.

International Monetary Fund. " Back to Basics: How Can Interest Rates Be Negative? "

Internal Revenue Service. " Virtual Currencies ."

Knowledge at Wharton. " Going Cashless: What Can We Learn from Sweden's Experience? "

U.S. Department of State. " 2017 Investment Climate Statements: India ."

The Economic Times. " A Year After Note Ban, Cashless Economy Is Still a Distant Dream ."

Bureau of Engraving and Printing. " About the BEP ."

- International edition

- Australia edition

- Europe edition

The big idea: should we embrace a cashless society?

For those who can’t or won’t get banked or go digital, what happens in a cashless future?

How do you like to pay? Do you prefer to tap, wave, insert, single-click or double-click – or are you a hold out for hard cash? If it’s the latter, you’re fast becoming the exception.

Between our growing enthusiasm for online shopping, the ease and speed with which we can now make electronic bank transfers, and the inexorable rise of cards and the advent of digital wallets, more and more of us are shunning physical money. This is still a relatively recent trend. Cards only overtook cash as the consumers’ preferred mode of payment in the UK in 2017 – with contactless accounting for 40% of transactions. The shift has been dizzyingly rapid.

The big advantages of non-cash payments are that they are seamless, efficient, convenient. This clearly matters a lot to us. But has it been our decision to adopt these new habits, or have we sleepwalked into them, with a little help from those who stand to profit?

The truth is, it’s a bit of both. Merchants are keen to reduce cost and increase spend: the less friction we experience at the till, the less chance there is for second thoughts. Payment providers sell their equipment and services to merchants, so the merchants’ appetites are their primary consideration. On the other hand, we are the ones who have chosen to use cards and engage in e-commerce. If you can remember struggling with the limitations of eBay in the days of “Cash on Collection”, you’ll know that what you really wanted was PayPal. If you are old enough to remember queueing at the bank or the cheque guarantee card, you’ll know that you would have killed for instant bank transfers, debit cards and online banking.

But are there downsides to this level of convenience? What if our choice to abandon cash is chasing it over a cliff, and what would that mean? The Bank of England has committed to making physical cash available “as long as there is demand for it”. Presumably if demand ceases the Bank will stop. Handling cash presents high fixed costs; it doesn’t matter whether you are delivering £500 in £20 notes to an ATM or £50,000, the costs of driver, security and fuel are the same. Similarly, if a shop takes just £5 of cash in a day, the owner still has to run a till, maintain a float, account for cash payments and deposit that cash in a bank. The less we use cash, the higher the cost of handling it, which means fewer merchants will accept it and fewer ATMs will distribute it. Before you know it, the demand that the Bank is monitoring may have simply evaporated.

Should we care? Well, cancelling cash has more than a few ramifications. Many of our young learn about money by handling it, many of our old only feel comfortable using it, while those on a tight budget find it helps in managing their outgoings. Having to pat pockets or rummage in purses makes us more conscious of what we’re spending than swiping or clicking.

Then there’s inclusion. True, cash is insecure; cash holders miss out on interest and are unable to build up financial histories, which are essential for getting access to a wider array of financial services. That’s why “financial inclusion” usually means bringing people out of a cash-based existence and into the formal sector. But cash alone offers a universally attainable means of paying and being paid. For those who can’t or won’t get banked or go digital, what happens in a cashless future? There are an estimated 1.3 million “unbanked” adults in the UK and many more who lack either digital confidence or access. Not everyone is happy or able to wave a card, much less to buy now and pay later. Cash may be dirty, expensive and unsafe. It may aid and abet the criminal and the corrupt, but it’s also freely accessible to everyone.

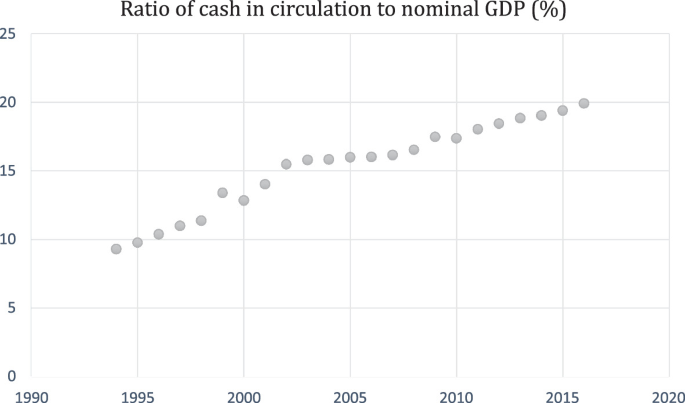

This accessibility is cash’s upside and its downside. It’s available to the bad guys as well as the good guys. Physical money may be playing an ever-shrinking role in the legitimate economy but it still plays a large one in the underground economy; while the number of legal transactions involving cash is declining, the volume and value of banknotes in circulation is actually increasing . So alongside the merchants and payment providers hoping for reduced costs, increased spending and rich seams of data about customers, law enforcers and tax collectors might also be forgiven for cheering on the cashless revolution.

The economic and enforcement arguments against cash may stack up nicely, but a payment isn’t just an economic or administrative act; it is a social one that depends on the two parties’ common acceptance of a currency and the mode of delivering it. With cash this social act is limited to two parties – the payor and the payee – and it’s private between them. Conversely, digital payments leave myriad traces – traces that accumulate into vast stores of information about us.

Depending on how you pay, this record may be more or less extensive and may be visible to a few or several organisations. It may comprise information that shows who you are, where you were, how much you spent, what you bought and from whom. Your smartphone might reveal just as much information, if not more, but it’s still possible to leave your device at home, or even go without one. The equivalent choice won’t be available if cash goes.

Abandoning the freedoms of cash may not be of any great concern if you’re as pure as the driven snow and not too worried about being tracked and ad-targeted, but are you ready to settle for a world in which every transaction is recorded and, by definition, controllable? Think about that the next time you choose how to pay, because each time you go cashless, your decision is helping to shape our collective future. There may come a time when we all, to paraphrase Lord Byron, have cause to lament: “Alas! how deeply public is all payment!”

Natasha de Terán and Gottfried Leibbrandt are the authors of The Pay Off .

Further reading

The Betrayal: The True Story of My Brush with Death in the World of Narcos and Launderers by Robert Mazur (Icon Books, £14.99)

Paid: Tales of Dongles, Checks, and Other Money Stuff edited by Bill Maurer and Lana Swartz (MIT, £17.99)

This Is How They Tell Me the World Ends by Nicole Perlroth (Bloomsbury, £14.99)

Money by Felix Martin (Vintage, £10.99)

- The big idea

- Society books

Comments (…)

Most viewed.

Protesters gather in London in July 2023 against digital currencies, among other causes. Photo by Martin Pope/SOPA/Getty

Going cashless

It’s not in the interests of the ordinary person but it’s not a conspiracy either. a cashless society is a system run amok.

by Brett Scott + BIO

Four centuries ago, a woman named Else Knutsdatter was executed in Vardø, a small coastal town in Norway. She was accused of having used witchcraft to raise an ocean storm that claimed the lives of 40 men. She wasn’t the only one to fall victim to 17th-century folk who – in the absence of other explanations – could be convinced that disasters were conjured by malevolent sorcerers. Ninety others were executed for conspiring to produce the same storm.

Today, we know that physics and atmospheric pressures produced those storms. So, in the realm of weather, we’ve moved to systemic thinking , where bad things don’t need to be explained with reference to bad actors. When it comes to descriptions of politics and economics, the progress is not so unequivocal. Do bad things like climate change, conflict and corporate greed happen because powerful politicians and CEOs construct it like that, or do they emerge in the vacuum of human agency, in the fact that nobody’s actually in control? This is a question that confronts me in the campaign to protect the physical cash system against the digital takeover by Big Finance and Big Tech.

Photo supplied by the author

For more than eight years, I’ve advocated for the protection and promotion of physical notes and coins. I wrote a book called Cloudmoney: Why the War on Cash Endangers Our Freedom (2023). In that book, I point out that the public has swallowed a false just-so story that says we are pining for a cashless society. All over the world, public and private sector leaders claim that ‘our’ desire for speed, convenience, scale and interconnection drives an inevitable digital transition. This is supposed to bring a ‘frictionless’ world of digital payment-fuelled commerce, done at the click of a button or scan of the iris. The message is: keep up or else face being left behind .

The fact that so many leaders recite this script triggers some folks into thinking ulterior motives are guiding them, and it is true that the finance and tech sectors, for example, gain massively from the digitisation hype. Over the past few decades, they’ve launched various top-down attacks against the cash system, something I chronicle in my book. Physical cash is issued by governments (via central banks), whereas the units in your bank account are basically ‘digital casino chips’ issued by the likes of Barclays, HSBC and Santander. ‘Cashless society’ is a privatisation , in which power over payments is transferred to the banking sector. Every tap of a contactless card or Apple Pay triggers banks into moving these digital casino chips around for you. It gives them enormous power, revenue and data. They can share that data with governments but, more often than not, they’re using it for their own purposes (such as passing it through AI models to decide whether you get access to things or not).

By rejecting the story that cashless society is driven primarily from the bottom up, I sometimes get accused of being a conspiracy theorist. It’s not hard to imagine the outlines of a ‘conspiracy’ when you look at who benefits most from payments privatisation. Not only are Visa, Mastercard and the banking sector big beneficiaries, the fixation on digitisation also extends the power of Amazon and other corporate behemoths that are moving beyond the internet into the physical world via smart devices and automated stores that plug into digital finance systems. It’s a small jump to imagine how governments can piggyback on this digital enclosure to spy on us, or manipulate us.

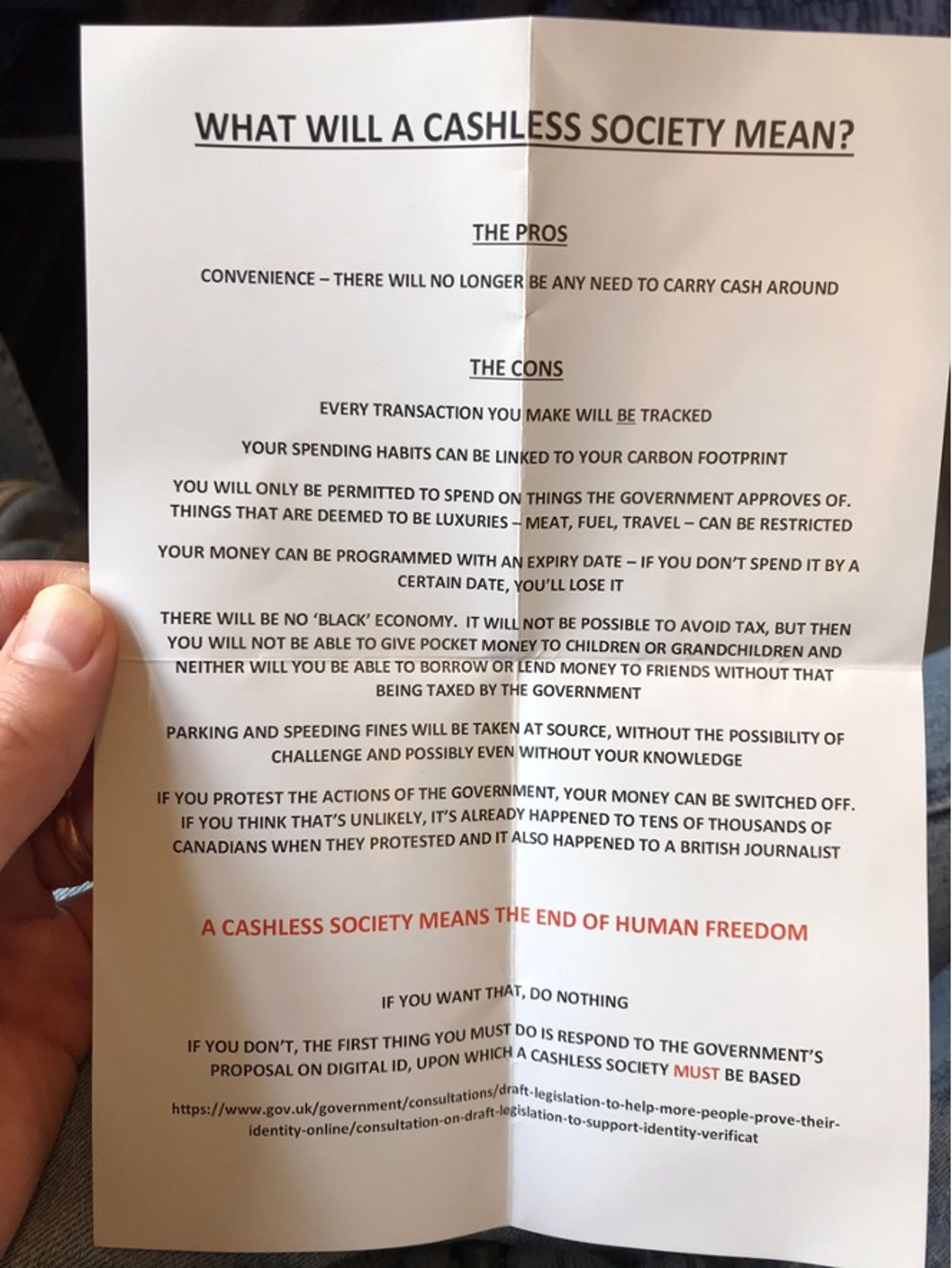

A ngst about this creeping enclosure finds widespread expression on social media. In London, and other places where the use of cash has plummeted, it’s turning up in the form of warning posters and pamphlets handed out by conscientious objectors against ‘cashless’ establishments. They warn against a looming digital takeover, but what they don’t realise is that the powerful corporations leading this takeover are themselves led by a larger puppetmaster, and this ‘puppetmaster of puppetmasters’ is no conspiring group of elites. It’s a system , and the dominant stories about digital progress are its ideology .

Systemic thinking requires stretching out the mind to picture powerful but invisible forces. So, let’s ease in through a simple thought experiment: imagine a million blindfolded people tied together, trying to find a direction to walk. They collectively form a system , but its interdependence is so complex that it’s almost impossible for people to coordinate. This means they default to some lowest common denominator, vaguely stumbling in a direction without knowing why. This resembles how our global economic system works. We’re all tied into complex webs of interdependency, and the system generates pressures that require it to expand and accelerate. Its logic demonstrates almost evolutionary properties, such that anyone who goes against its default tendencies hits a wall, while anyone who stumbles in the direction of its prevailing current doesn’t. This may sound abstract, but we can see it clearly at work in the world with physical cash.

For centuries, the capitalist system has been underpinned by nation-states that have fostered the growth of large firms. For a long time, cash helped that system to expand and accelerate. In the 1950s, corporates were more than happy to have adverts featuring people using cash to buy their products, but in the contemporary moment firms are turning against it. Cash is hard to automate. It cannot be plugged into globe-spanning digital infrastructures. It operates at human scale and speed within a system that increasingly demands inhuman scale and speed. It’s creating ‘friction’ at a systemic level , so even if you like cash at a local level, you’ll gradually find yourself coerced away from it.

Amazon lacks infrastructure to process cash, and street-level shops are drawn into this systemic recalibration

‘Coercion’ in this situation doesn’t mean a consortium of CEOs or politicians will force you to stop using cash. If you are tied into a system that contains processes beyond your control, then the system itself can just pull you along. Capitalism often operates on autopilot, with the players following a set formula to boost profits, and one part of that formula is to automate stuff. In 1759, Adam Smith introduced the metaphor of the ‘invisible hand’ to illustrate how all these movements, and these chains of interdependency, can be mapped. For example, Lloyds Bank, guided by shareholder demands for profits, shuts down physical branches to cut costs by pushing you on to automated apps. Having no branches makes it harder for small businesses to deposit cash, so they are nudged toward putting up signs saying ‘We’re cashless.’ That then sends a message to customers that there’s something newly unacceptable about cash. At the same time, people will notice that banks have shut down many ATMs, with the banks justifying this by saying their customers are ‘going digital’, but this creates a self-fulfilling prophesy because removing ATMs lowers public access to cash, making it harder to use. Lloyds and other banks then see the resulting up-tick in digital finance as implicit permission to close down further branches.

What we have here are a series of feedback loops, all serving the prevailing systemic logic of expansion and acceleration. Cashless society, then, is not just a privatisation process, but also an automation process. Automated giants like Amazon in fact lack any infrastructure to process physical cash, and street-level shops are being drawn into this systemic recalibration. Hipster cafés in London have signs saying ‘We’ve gone cashless’; what they are actually saying is ‘We’ve joined an automation alliance with Big Finance, Big Tech, Visa and Mastercard. To interact with us you must interact with them.’

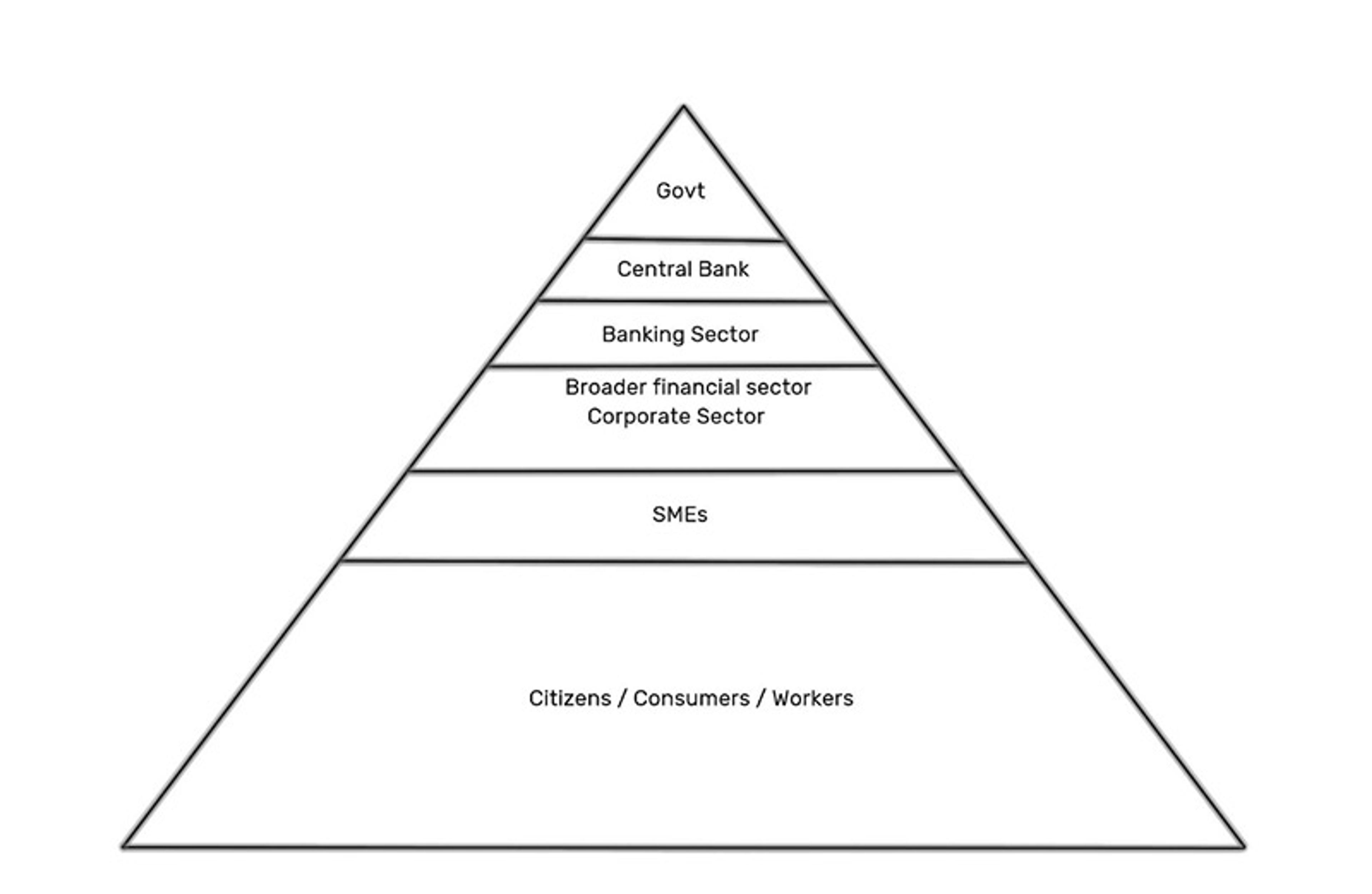

The politics of the ‘invisible hand’ can be visualised with a pyramid:

Where does power lie in this pyramid? Anyone who wishes to divert attention away from the top will likely claim that it resides in numbers, at the bottom. Appealing to legitimacy-from-below is a major tactic used by politicians, who present their governments as reflecting the will of the people, with industry following suit. Rather than admitting to their own interests, banks and fintech companies present the decline of cash as a bottom-up phenomenon driven by popular support. In this view, HSBC’s decision to close ATMs must simply reflect the fact that ordinary people no longer care for cash. In this view, industry simply responds to our demands.

Big firms turn to freemarket doctrine in these situations, which maintains that businesses survive only if they mould themselves to our needs. So the presence of thriving corporations can indicate only that they’re serving us well. Left-wing thinkers reject this freemarket dogma, pointing out that some industries are powerful enough to effectively legislate the conditions of our lives. We all know that firms invest heavily in warping our perceptions via marketing, and often secure our consent only through tricks and misrepresentation. Left-wing calls for government regulation in turn compel freemarketeers to accuse them of stifling both popular will and business. Market conservatives paint a picture of consumers, workers and small entrepreneurs battling the clumsy state, while Lefties present workers, citizens and mom-and-pop shops fighting the corporate behemoths. Economic politics is all about painting these contrasting David-and-Goliath options.

When it comes to money, though, the battle lines get more confusing, because the monetary system is a public-private hybrid . Physical cash is government money, but it has properties – like anonymity – that appeal to some anti-government libertarians. Privacy-invading card-payment systems, by contrast, have historically been run by the private sector, so those pro-business libertarians who are concerned by surveillance are forced to accuse banks of being phoney ‘crony capitalists’ collaborating with controlling governments.

This collaboration can be seen in the case of the 2022 anti-vax ‘Freedom Convoy’ truckers, whose bank accounts were frozen by a Canadian government order. Libertarians rallied in support of the truckers, but there’s many variations of these alliances between states and payments firms. For example, the US government agency USAID has funded programmes like Catalyst: Inclusive Cashless Payment Partnership, pushing Visa as a tool of empowerment in India. In its 2017 annual report , Visa talks about doubling its market penetration into India after it ‘worked closely’ with Narendra Modi’s government in its ‘demonetisation’ efforts in 2016, during which time certain banknotes were outlawed. The Indian prime minister’s open attacks on the public cash system also drew fawning praise from Indian digital-payments firms.

I t’s easy to get stuck in a binary of explaining cashless society as either a bottom-up phenomenon demanded by us, or a top-down enclosure pushed by power players. The reality is a more complex mix. Because at scale it’s cheaper to push billions of people through a handful of centralised players, almost every industry in the world is dominated by oligopolies of large firms. Those firms will inevitably build political connections, while smaller firms get relegated to the periphery. Oligopolistic firms fluctuate between collaboration and competition, but the evolutionary logic of our economic system is always towards greater automation. Corporate executives benefit if they nudge everyone in this direction, and they have a niggling insecurity that, if they don’t, competitors will leave them behind. The problem is that many people don’t love digital acceleration, and it takes a considerable effort over time to erode their resistance. This is why big retailers like Tesco start by tentatively testing cashless stores in certain locations to set a precedent. It took years for the airline industry to make it feel ‘normal’ to refuse cash, but that norm is still not universal. Even last year, I found myself seated next to a man on a flight who was humiliated and flustered when the attendants refused his banknote.

The man wasn’t a frequent flyer and came from a working-class background, pointing toward an important fact: when a capitalist system is resetting to a state of higher speed and automation, it often does so first through social elites. In London, a hipster barber targeting yuppies may very well refuse cash, but a hair salon targeting working-class immigrants will almost certainly ‘still’ take it. Words like ‘still’ are loaded, because they imply that whoever is still doing the thing has yet to go through some evolutionary upgrade.

Digital payments giants like Visa invest heavily in presenting ‘going cashless’ as a grassroots triumph for the small entrepreneur who wants to cut costs. In reality, this alliance between Big Finance/Big Tech and small and medium-sized enterprises applies only to businesses with middle-class customers. A decade ago, many of those customers didn’t even perceive cash as particularly inconvenient. Even now, they would prefer choice (the fact that I sometimes use my card doesn’t mean I asked a shop to remove its cash till). It’s businesses that remove our payments choice, but they rely on the fact that most middle-class people simply adapt their expectations and edit their memories to forget those old days when cash felt totally normal. Once new cultural norms are established, it compels compliance. Eventually, you get discriminated against if you insist on being that guy who complains that the London bar won’t accept your coins.

The fact that people fall into line and begin displaying a preference for card payments is read by politicians as a signal to support the transition. They too are worried about being ‘left behind’. This pressure to go along with the transnational automation drive means that the average UK Labour Party politician doesn’t challenge cashless society. Rather, they call for a slight slowdown in the imagined ‘race’ towards it, to give cash-dependent communities a chance to ‘catch up’.

Cashless pubs allow hundreds of unmasked people in while refusing cash to protect their employees

So, capitalism has inherent trends, but it also has inherent contradictions. Here’s one of them. Our cashless card payments rely upon ‘digital casino chips’ issued to us by banks, but – as anyone who has been to a casino knows – such chips have power only because you believe they can be redeemed for cash. In the total absence of cash, there could be a collapse in the public’s belief in bank-issued digital money. Banks and corporates make private decisions that erode our cash infrastructure, but in doing so they are undermining the public basis of confidence in their private systems.

This was accelerated by the outbreak of COVID-19, which gave companies a convenient cover to fast-track their automation plans. It’s easier for a retailer to announce they don’t accept cash because of COVID-19 than to admit that they’re trying to shave a percent off their costs. For example, Visa entered a deal with the US National Football League to promote cashless Super Bowls. Signed in 2019 and piloted in 2020, it went public in 2021 during the pandemic, with attendant media coverage presenting it as a measure of public hygiene. Cashless pubs in London allow hundreds of unmasked people in their establishments while claiming to refuse cash to protect their employees from any coronavirus that may be stuck to the notes (a contention that is scientifically inaccurate ).

In 2020, such scaremongering, along with the fact that so many of us were forced into online shopping during the pandemic, caused a precipitous drop in transactional cash use. This raised the possibility of a financial stability problem, because cash psychologically (and legally) backs our cashless digital casino chips. This puts central banks in a bind. They know that the trajectory leads to a crisis-prone bank-dominated version of cashless society. So they think about how to maintain public access to government money without upsetting the transnational automation agenda. One way they are trying to resolve this is with a new form of ‘digital cash’ – central bank digital currency (CBDC).

To understand CBDC, imagine being able to download a payments app on the iPhone App Store from your nation’s central bank (like the US Federal Reserve or the Bank of England). Various countries have appointed teams to experiment with this hypothetical government payment system, but it creates a new problem. In a country like the UK, a state-issued digital pound would upset banking giants like Barclays, Lloyds and HSBC. They would rightly perceive it as competition to their own digital money empires. Given that central banks are supposed to maintain the stability of private banks, rather than directly compete with them, the Bank of England (and all other central banks) will have to make concessions: any future CBDC will be watered down to prevent disruption to the banking sector, and its operation will be outsourced to private partners… like the banks themselves.

I n 2015, I was one of the few people raising awareness of the dangers of cashless society from a Left-wing perspective. Then the pandemic hit, and a new generation of pro-cash activism emerged in the so-called populist Right. Libertarians seized upon early COVID-19 controls as evidence of a new era in totalitarianism. Social conservatives had already cast Big Tech firms as hives of ‘wokeness’. Conservative commentators began to weave these perspectives together. They presented themselves as rebellious champions protecting the everyman from an alliance of liberal corporate elites and authoritarian socialist governments.

In May 2020, my mother was sent a video by her friend on Facebook. It claimed that Bill Gates had orchestrated COVID-19 to microchip us via vaccines and to usher in a cashless society where our every economic move could be monitored. Her friend was very excited to announce that ‘Your son is in this! You must be so proud.’ Sure enough, there was a clip of me (used without my permission), in which I was describing how financial institutions engage in a war on cash. It was followed by a clip of an evangelical pastor warning that ‘the Bible clearly links the mark of the beast with the emergence of a cashless society’.

How is it that I end up in a video like this? Conspiracy theorists happily take my work out of context in order to push their version of events. Rather than analysing the logic of capitalism, many of them have decided that behind digital innovation-speak lie satanic overlords, paedophiles, Marxists, Jews or caricatured banksters smoking cigars.

Ironically, it’s central banks’ response to the corporate attack on cash that has really spurred the new wave of pro-cash activism. The possibility of a state-controlled digital pound or digital euro replacing the battered cash system has galvanised the imagination of libertarian activists. Libertarians have always faced a tension when complaining about the surveillance that accompanies cashless society. This is because digital payment systems are pushed by private sector fintech entrepreneurs, and libertarians are supposed to be pro-entrepreneurialism. CBDC has enabled them to escape this bind. It allows them to rework the story of cashless society as being driven by an oppressive digital state.

These systems limit choice, and can be used to push people’s business to big retailers, rather than small ones

This mutated version of the cashless society story is now spreading virally. My dad recently forwarded me a video, which he received on WhatsApp, about the looming spectre of CBDC. The anonymous producers stitched together clips from libertarian activists, self-help gurus and even the populist UK politician Nigel Farage, all of whom cast CBDC as a new form of digital totalitarianism. They argued that this centralised digital money will be sold to us under the banner of convenience, but that the true agenda is to enable governments to micromanage us by controlling our payments. The conclusion? Say no to CBDC. Say yes to physical cash.

They’re not wrong to point out the dangers of digital control, but their selective curation of the form and examples misrepresents why it is happening and how to oppose it. The cashless system is run by transnational corporations, and the actually existing examples of payments control often concern welfare recipients: for instance, the Australian ‘cashless welfare card’ was a Visa card system that blocked Indigenous Australians on benefits from buying non-approved goods in non-approved stores. These systems not only limit choice, but can be used to push people’s business to big retailers, rather than small ones.

Farage and his contemporaries don’t focus on the payments censorship of Indigenous welfare recipients. They fixate on conservative fears, like the hypothetical blocking of transactions for guns and meat. This is causing me problems, because moderate progressives – who previously would have expressed some concern about corporate power – have started associating a pro-cash stance with reactionaries, and to a broader suite of ideas that they espouse. In Germany, I’ve even been accused of being aligned with the neo-Nazi Reichsbürger movement, purely on the basis that they too are pro-cash. I’ve seen digital payments promoters use this disorientation to their advantage. They can suggest that critiques of their industry are the realm of crackpot antisemites. If conspiracy theorists are the ones leading the charge against digitisation, surely it must show the concern is built from the wild fantasies of paranoid flat-Earthers. Rather than fight cashless society, then, they suggest we should promote corporate financial inclusion : give a helping hand to all those people who have yet to be absorbed into Big Finance. Get them accounts. Help them become corporate consumers.

Moderate progressives are often taken in by this story and in backing away from the cashless society battle they cede territory to the far Right. It’s an example of a trend in our post-pandemic moment, where the meeting of two sides of the political horseshoe has led to the spread of Right-wing ideas among people who previously considered themselves Leftists. The new Right has appropriated the rebellious language of Left-wing hacker culture, which pushed digital privacy for decades (for a pop-culture version of this, watch the TV series Mr. Robot , in which anti-capitalist hackers target the corporate giant ‘Evil Corp’). Top-down power has been re-ascribed to a generic blob of ‘globalists’, acting via institutions like the World Economic Forum (WEF), but anti-WEF campaigning was a standard part of Left-wing culture in the 1990s and ’00s. To Left-wingers, the WEF represented venal corporate capitalists, which is why the ‘alter-globalisation’ movement championed the World Social Forum as an alternative. In the midst of lockdowns, however, it was anti-mask and anti-vax campaigners who took on the aesthetics of Occupy Wall Street, holding street protests with placards warning about cashless society and digital ID.

A surreal twilight zone has formed between the language of the old Left and that of the populist Right, and into it has stepped a character like Russell Brand. In 2013, he came out as an anti-corporate socialist and, back then, every Lefty activist I knew was clamouring to find his email address in the hope that he’d platform their cause. Fast-forward several years, and he renamed his podcast to Stay Free, peppering it with libertarian language and topics that appeal to the Right. He presents himself as being on an open-minded search for the truth that the mainstream media won’t tell us, and it increasingly involves him having discussions with conservative edge-lords. In November 2022, he released an obligatory video about CBDCs, entitled ‘Oh Sh*t, It’s REALLY Happening’.

Notably, no cashless establishments use CBDC, because it doesn’t exist yet. They all use the private sector digital payments system but, in choosing to focus on the fantasy version of cashless society, rather than the actual one, Brand signals that his allegiance lies with the Right wing.

I n the martial arts classic Kill Bill: Vol 2 (2004), the five-point palm exploding-heart technique is a precise sequence of five hits that cause an opponent’s heart to stop. In the conspiracy world, the five-point punch of the globalists involves them hitting us with digital IDs, 5G technology, vaccines, COVID-19 passports and now CBDCs. This is supposed to trigger a global cardiac arrest called the ‘Great Reset’. The Great Reset is actually the name of a real programme convened by the WEF, in which they talk about the need for a post-pandemic digital and green transition. Those goals emerge from different sources because, while capitalism generates a digitisation agenda to speed things up, it doesn’t generate a conservation impulse to slow things down. Green transition rhetoric doesn’t emerge from market processes: it’s the result of decades of relentless campaigning from civil society groups, who pushed past the lobbying of the fossil fuel industry to showcase the economic risks of climate change. Big business and politicians now pay lip service to that.

Nevertheless, they attempt to subordinate it to their automation fixation by proposing digital techno-fixes for climate change. This is a gift to our conspiracy theorists. They can now present CBDCs as being a future tool to force us to buy only low-carbon vegan sausages, under the control of Greta Thunberg and the Bank for International Settlements (a BIS v ideo about CBDC is a favourite among them).

An anti-cashless society propaganda leaflet. Supplied by the author

Cashless society authentically sucks. It’s a world where your kid cannot sell lemonade on the side of the road without paying Mastercard executives in New York. It’s an attack on privacy, autonomy, local independence and casual informal interactions in favour of surveillance, dependence and centralisation of power in large institutions. I frequently interact with people who have very real concerns about it, but who – like our 17th-century folk who lost loved ones to a storm – have been steered into reactionary ideas about it. Our struggle to see large-scale systemic processes gives oxygen to conspiracy theorists. I frequently get asked to go on Right-wing media channels, such as GB News, to be interviewed by anti-woke libertarians or Christian evangelists. Many of them imagine capitalism to be the realm of the small individual, and present elites as being malevolent actors who attack the system from above. It’s an easy story to tell. But the reality is that elites are a by-product of our system. The invisible hand likes tapping the contactless card, regardless of whether you as an individual do, and the role of the elites in the war on cash is to simply unblock resistance to that. More often than not, they’re examples of Hannah Arendt’s banality of evil . They’re just people ‘doing their job’, serving a system that wants to commodify any aspect of our lives that remains un-commodified and un-automated.

The dominant tendencies in capitalism pull upon all of us but it’s possible to demand space for other values. It’s been done before. There was a time when the automobile industry seemed ascendant, and bikes were pushed off the roads, but we built a cultural movement to demand bicycle lanes. That’s why we should see cash as being like the public bicycle of payments, and support efforts across the political spectrum to protect and promote it. Digital bank systems are the private Uber of payments: they may appear convenient, but total Uberisation unleashes demons that cash historically kept in check – surveillance, censorship, digital exclusion, and serious resilience and financial stability problems. The point isn’t to argue that everyone must always use the ‘bicycle’. It’s to ensure that we don’t get totally ‘Uberised’ in private and public life. We need to promote a healthy balance of power between different forms of money in the system, and that’s within our collective political abilities.

Conscientious unbelievers

How, a century ago, radical freethinkers quietly and persistently subverted Scotland’s Christian establishment

Felicity Loughlin

History of technology

Why America fell for guns

The US today has extraordinary levels of gun ownership. But to see this as a venerable tradition is to misread history

The scourge of lookism

It is time to take seriously the painful consequences of appearance discrimination in the workplace

Andrew Mason

Economic history

The southern gap

In the American South, an oligarchy of planters enriched itself through slavery. Pervasive underdevelopment is their legacy

Keri Leigh Merritt

Thinkers and theories

Our tools shape our selves

For Bernard Stiegler, a visionary philosopher of our digital age, technics is the defining feature of human experience

Bryan Norton

Family life

A patchwork family

After my marriage failed, I strove to create a new family – one made beautiful by the loving way it’s stitched together

The Consequences of Moving to a Cashless Society Essay

Introduction, literature review.

In a world where we can instantly transfer money with the tap of a button, it’s hard to imagine a future without cash. But what would a cashless society look like? A cashless society is one where people no longer use physical currency but instead use electronic methods of payment such as credit cards, debit cards, and mobile payments. This shift has been slowly occurring for several decades now, as technology has made non-cash payments more convenient and widespread. For instance, in Sweden, cash is used in only 3% of all transactions (Hasan, et al., 2020). A cashless society is more efficient because it reduces the need to print and distribute paper money. It lowers crime by making it more difficult to commit fraud or theft when there is no cash involved. Additionally, it can reduce corruption because it is more challenging to bribe someone when all transactions are electronic and traceable.

On the other hand, there are some drawbacks associated with a cashless society. One, it is difficult for unbanked or underbanked people to participate in such an economy. Additionally, it can be harder to anonymously donate to charities or to engage in other types of transactions that one might not want a paper trail for. The decision of whether or not to move to a cashless society is a complex one, with several pros and cons to consider. Ultimately, the decision will come down to weighing the advantages and disadvantages of such a move. This essay explores the positive and negative implications of a cashless economy for society.

The consequences of moving to a cashless society are still being debated by experts. Some argue that it could lead to negative effects, such as turning citizens into criminals, while others believe that the benefits outweigh the risks. However, there is still a lack of consensus on the issue. Taskinsoy (2020) argues that the move towards a cashless society is being accelerated by the global lockdown caused by the novel coronavirus. This is because people are now relying more on online transactions and digital payments. Rivera (2019); Engert (2018) warned of the potential negative effects of a cashless society, such as making it easier for the government to track citizens and turning them into criminals if they are unable to pay their debts.

A cashless economy is more efficient and transparent but can contribute to more crime. It is easier to launder money through cashless means, as opposed to physical cash (Rivera, 2019). However, Alaeddin (2019) disagrees with the views of other studies, claiming that society could be less corrupt if the cashless means are fully installed, as it would be more difficult to hide or launder money.

One of the main benefits of a cashless economy is increased efficiency. This is because cashless transactions are often faster and more convenient than traditional methods. For example, when you use a credit or debit card to pay for something, you don’t have to count out the exact change or wait for the other person to count it (Jain & Jain, 2017). This can save a lot of time, especially in busy situations. In addition, cashless transactions can be done online or over the phone, which is very convenient for both businesses and customers.

There is the assurance of more security with a cashless economy compared to physical cash. With electronic payments, there is no risk of theft or loss of cash (Jain & Jain, 2017). In addition, electronic payments are more difficult to forge than paper money. With electronic payments, there is a transparent record of all transactions which can be easily traced. This makes it more difficult for corrupt officials to pocket public funds.

Another advantage of a cashless economy is increased efficiency. Electronic payments are faster than cash payments, and they can be made online or in person, making them more flexible. In addition, electronic payments can be made 24 hours a day, 7 days a week (Hasan et al, 2020) This allows businesses to accept payments at any time, and it also allows consumers to make payments when it is convenient for them.

The increased transparency that comes with electronic payments can help to prevent corruption and fraud. By being able to track and trace all transactions, businesses, and government agencies can see where money is going and how it is being used. This makes it more difficult for corrupt officials to pocket funds or funnel money into illicit activities (Fujiki, 2020). Additionally, it becomes easier to identify and investigate fraudulent activities when all transactions are recorded and available for review. Electronic payments can therefore help to create a more accountable and transparent system, making it more difficult for corruption and fraud to go undetected.

There are also some disadvantages to a cashless society. One of the biggest disadvantages is that a cashless economy can be exclusionary. This is because not everyone has access to electronic payment methods and the Internet, which is central to the use of cashless techniques (Liu, 2021). This can exclude certain groups of people, such as the elderly, the poor, and rural populations. In addition, a cashless economy can be vulnerable to cyberattacks. Hackers can target electronic payment systems and steal people’s money (Seshan, 2019). A cashless economy can lead to higher prices. This is because businesses can charge higher prices for goods and services when they don’t have to accept cash.

Fujiki (2020) examines the use of noncash payment methods in Japan. He finds that the use of noncash payment methods has increased in recent years, but that cash is still widely used for regular payments. He argues that the demand for cash is likely to decline in the future as more people use electronic payment methods (Maurya, 2019). Most people are willing to use digital payment systems, but there are some concerns about security and privacy. Liu (2021), argued that governments should take steps to address these concerns to promote the use of digital payment systems. A cash-free society would be more convenient, but the government and organizations providing such services should ensure its security and access to all.

The first-hand survey I conducted through questionnaires, established that more people believe in a future dominated by non-cash payment techniques. More than 80% of the participants in the questionnaires reported finding it safer to use cashless means to make business transactions. Moreover, more people claimed to better manage and trace their use of finances with cashless techniques, as they can refer to their transactions whenever needed. This is difficult to achieve with cash payments. However, some people reported encounters with fraudsters, who managed to steal from them. Despite this, they claimed to have physical cash was more unsafe than electronic money.

A cashless economy can have several benefits, such as increased efficiency and transparency. However, some drawbacks should be considered, such as the exclusion of those without access to electronic payment methods or the internet, and vulnerability to cyberattacks. Additionally, prices for goods and services could potentially increase in a cashless economy. Further research could explore the potential impacts of a cashless society on different groups of people. For instance, the researchers could examine how a cashless economy would impact the elderly, the poor, and rural populations. Additionally, the research could explore how a cashless economy would impact businesses, and whether or not prices would increase for goods and services. Ultimately, the decision of whether or not to move to a cashless society is a complex one, with several pros and cons to consider.

Alaeddin, O., Altounjy, R., Abdullah, N., Zainudin, Z., & Hallak Kantakji, M. (2019). The future of corruption in the era of a cashless society. Humanities & Social Sciences Reviews , 7 (2), 454–458.

Engert, W., Fung, B. S. C., & Hendry, S. (2018). Is a cashless society problematic? [PDF document].

Fujiki, H. (2020). The use of noncash payment methods for regular payments and the household demand for cash: Evidence from Japan. The Japanese Economic Review , 71 (4), 719–765.

Hasan, A., Atif Aman, M., & Ashraf Ali, M. (2020). Cashless economy in India: Challenges ahead. Shanlax International Journal of Commerce , 8 (1), 21–30.

Jain, V., & Jain, P. (2017). A journey towards a cashless society. Banking Sector in Oman: Strategic Issues, Challenges and Future Scenarios , 17 (5), 61-73. Web.

Liu, W. (2021). Digital payments. Singapore University of Social Sciences – World Scientific Future Economy Series , 105–119.

Maurya, P. (2019). Cashless economy and digitalization . Proceedings of 10th International Conference on Digital Strategies for Organizational Success .

Rivera, J. W. (2019). Potential negative effects of a cashless society. Journal of Money Laundering Control , 22 (2), 350–358.

Seshan, R. (2019). Cashless economy or value for money. In Deyell, J. & Mukherjee, R. (eds.) From Mountain Fastness to Coastal Kingdoms (pp. 127–138). Routledge.

Taskinsoy, J. (2020). A move towards a cashless society accelerates with the novel coronavirus-induced global lockdown [PDF document].

- Chicago (A-D)

- Chicago (N-B)

IvyPanda. (2023, August 14). The Consequences of Moving to a Cashless Society. https://ivypanda.com/essays/the-consequences-of-moving-to-a-cashless-society/

"The Consequences of Moving to a Cashless Society." IvyPanda , 14 Aug. 2023, ivypanda.com/essays/the-consequences-of-moving-to-a-cashless-society/.

IvyPanda . (2023) 'The Consequences of Moving to a Cashless Society'. 14 August.

IvyPanda . 2023. "The Consequences of Moving to a Cashless Society." August 14, 2023. https://ivypanda.com/essays/the-consequences-of-moving-to-a-cashless-society/.

1. IvyPanda . "The Consequences of Moving to a Cashless Society." August 14, 2023. https://ivypanda.com/essays/the-consequences-of-moving-to-a-cashless-society/.

Bibliography

IvyPanda . "The Consequences of Moving to a Cashless Society." August 14, 2023. https://ivypanda.com/essays/the-consequences-of-moving-to-a-cashless-society/.

- Cashless Technology Trend in China

- Should America Keep Paper Money

- Starbucks Marketing Analysis

- Improving Taxi Businesses With Information Technology

- Online Bill Pay vs. Paying via Postal Mail

- “The 2010 Federal Reserve Payments Study”

- Compensation, Methods, Inventories and Controls: Searching for an Optimum Solution

- Cash Flow Statement

- Commonwealth Bank and the Bank Technologies

- Physical Security: Islamabad Hotel Bombing

- Impact of Financial Speculation on Commodity Markets

- Financial Stability in Old Age

- The City of Acme Departmental Financial Plan

- Bitcoin Technology: Ethical Considerations and Summing Up

- Financial Leverage and South African Sustainability

- Skip to main content

- Keyboard shortcuts for audio player

The Pros And Cons Of Moving Toward A Cashless Society

NPR's Mary Louise Kelly speaks with economist Kenneth Rogoff about what would happen if the U.S. were to get rid of a lot of its paper currency, particularly larger bills, as he advocates.

MARY LOUISE KELLY, HOST:

More and more of us are finding more and more ways to buy, sell and store our money, but about 70 percent of Americans still use paper money on a weekly basis. Harvard economist Ken Rogoff does not want to get rid of cash, but he does see problems with it. So we called him to ask why and ask what getting rid of cash would mean to our society.

Professor Rogoff, hey there.

KEN ROGOFF: Greetings.

KELLY: Greetings to you. So as we just heard from that 70 percent figure, a lot of us still like cash. You can touch it. It's easy. You don't like cash. Why not?

ROGOFF: Well, what I object to is people buying apartments in Trump Tower with suitcases of cash, buying $50,000 cars, engaged, of course, in drug transactions, human trafficking, whatever. A lot of people have perfectly healthy, good uses for cash. I have no moral objections to it. And I think for small transactions, it's still a big deal.

KELLY: Yeah. You can't tip your housekeeper at a hotel if you don't have, you know, five bucks on hand or 20 bucks or whatever. You can't do it with a debit card.

ROGOFF: Not in our country, anyway - in Sweden, maybe you can. But yes. But the question is, most of our cash is in $100 bills. And I don't know about you and your friends, but most of mine do not have $1,000 worth of $100 bills in their family of four. And that's really, I think, where a rethinking is needed.

KELLY: How much should we be worried about some Americans being left behind in a cashless society?

ROGOFF: If we literally go cashless, then obviously, it would be a problem. But I don't think anyone, even the Swedes, are talking about that. It's really reducing the amount of cash. By the way, something a number of countries have already done - and we should do - is give people free debit accounts. You could save a lot of money because most of the low-income people who'd be getting free debit accounts, the government's transferring money to anyway. And it's kind of expensive to process the checks.

KELLY: You mentioned Sweden. They are way farther along this path towards a cashless society than the U.S. is. We had a story out of Sweden recently on ALL THINGS CONSIDERED, where there were mixed views - some Swedes feeling like this is maybe going too far, too fast; others feeling like, what's the problem? - especially the younger generation. Do you think Sweden is where the U.S. is headed? Is that our future?

ROGOFF: We are already where Sweden was, say, five or seven years ago. And in another five or seven years, we will be where Sweden is today.

KELLY: Meaning what? How will our daily lives look different, do you think?

ROGOFF: Well, I already stand in line at Starbucks in Harvard Square. And when I get to the front of the line, I'm the only one using cash. I'm old. I still use it.

KELLY: (Laughter).

ROGOFF: I think it'll look more and more like that in many places.

KELLY: What should we be doing, as a society, to get ready for this other than - I don't know - charging up our Apple apps and our debit cards?

ROGOFF: Most people will be able to adjust at the pace that they want to. There are these new technologies that I can't even keep up with even though I work on the topic.

KELLY: Do you have a Venmo account, may I ask?

ROGOFF: My children do. I don't. Otherwise, they'd want me to Venmo them money all the time.

ROGOFF: I think we have to, say, coordinate state regulation.

ROGOFF: There has to be views about how big cash transactions should be. The U.S. is really trailing a lot of the rest of the world in getting around to this.

KELLY: Yeah.

ROGOFF: But by and large, technology will play out and will adjust. It won't be as fast as people think. And by the way, I don't believe it'll be cryptocurrencies. I think it'll be simpler digital mechanisms. There are some vulnerabilities we need to cover - like cybersecurity. We're there already on having to worry about that. But I think we are headed to a less-cash society whether people want to recognize it or not.

KELLY: Ken Rogoff is an economics professor at Harvard and author of "The Curse Of Cash."

Professor Rogoff, thank you.

ROGOFF: Thank you for having me.

Copyright © 2019 NPR. All rights reserved. Visit our website terms of use and permissions pages at www.npr.org for further information.

NPR transcripts are created on a rush deadline by an NPR contractor. This text may not be in its final form and may be updated or revised in the future. Accuracy and availability may vary. The authoritative record of NPR’s programming is the audio record.

A Cashless Society: Facts and Issues

- Open Access

- First Online: 03 November 2022

Cite this chapter

You have full access to this open access chapter

- Yukinobu Kitamura 3

Part of the book series: Hitotsubashi University IER Economic Research Series ((HUIERS,volume 48))

6985 Accesses

3 Altmetric

In this chapter, I would like to describe my views on the development of a cashless society. We will first examine statistics related to cashless payments. When calculated to include bank transfers/account transfers, the cashless payment ratio reaches as high as 92% in Japan, which is not a low figure even among developed countries.

With regard to the choice of payment method, empirical studies and observed facts indicate that the cost structure is much more complex than the cost function considered by economic theorists, and that there are differences among retailers in their attitudes toward pricing and discounts.

You have full access to this open access chapter, Download chapter PDF

7.1 Introduction

In this chapter, I would like to describe my views on the development of a cashless society. We will first examine statistics related to cashless payments. The cashless payment ratio presented by the Japanese government represents the ratio of the amount paid with credit cards, electronic money, and debit cards to the amount of private final consumption expenditure, and it has been pointed out that the value of this ratio in Japan was 18.2% in 2015, which was quite low among developed countries. However, this statistic does not include bank transfers/account transfers and other electronic payments that households and businesses use on a daily basis, and is not considered to be a useful statistic when considering a cashless society. When recalculated to include bank transfers/account transfers, the cashless payment ratio reaches as high as 92% in Japan, which is not a low figure even among developed countries.

With regard to the choice of payment method, empirical studies and observed facts indicate that the cost structure is much more complex than the cost function considered by economic theorists, and that there are differences among retailers in their attitudes toward pricing and discounts. It is also clear that retailers have different attitudes toward pricing and discounting, and that the fact that cash payments are still used to some extent may reflect the preferences of retailers as well as consumers.

With regard to the merits of going cashless, most of the issues discussed are based on the assumption that cash will be abolished, and do not identify the advantages of going cashless while maintaining cash. At the same time, the disadvantages also relate to special cases where cash payments are rejected and the scale and immediacy of crime in cyberspace compared to cash, and do not discuss the disadvantages created by cashlessness itself.

As for policy issues, we discuss measures that will lead to the realization of a cashless society, including the creation of a system and the fostering of a competitive environment for businesses to increase the quality and diversity of their payment methods, and the promotion of digitization, with the government taking the lead. The interpretation here is that a cashless society will emerge as a by-product of the industrial revolution that has been underway since the end of the twentieth century, centered on the development of information and communications.

7.2 Statistics Related to the Cashless System

Among some statistics that capture the reality of cashless payments, we discuss two indicators that we felt needed to be explained.

7.2.1 Cashless Payment Ratio

The Ministry of Economy, Trade and Industry's “Fin Tech Vision” defines the cashless payment ratio as the amount of cashless payments (payments made with credit cards, debit cards, and electronic money) as a percentage of private final consumption expenditure. In Japan, the ratio was 18.2% as of 2015, which is quite low, and the government set a numerical target (Key Performance Indicator: KPI) in its Future Investment Strategy 2017 to raise the ratio to around 40% over the next 10 years.