What Is Medicare Assignment?

Written by: Rachael Zimlich, RN, BSN

Reviewed by: Eboni Onayo, Licensed Insurance Agent

Key Takeaways

Medicare assignment describes the fee structure that your doctor and Medicare have agreed to use.

If your doctor agrees to accept Medicare assignment, they agree to be paid whatever amount Medicare has approved for a service.

You may still see doctors who don’t accept Medicare assignment, but you may have to pay for your visit up front and submit a claim to Medicare for reimbursement.

You may have to pay more to see doctors who don’t accept Medicare assignment.

How Does Medicare Assignment Work?

What is Medicare assignment ?

Medicare assignment simply means that your provider has agreed to stick to a Medicare fee schedule when it comes to what they charge for tests and services. Medicare regularly updates fee schedules, setting specific limits for what it will cover for things like office visits and lab testing.

When a provider agrees to accept Medicare assignment, they cannot charge more than the Medicare-approved amount. For you, this means your out-of-pocket costs may be lower than if you saw a provider who did not accept Medicare assignment. The provider acknowledges that the amount Medicare set for a particular service is the maximum amount that will be paid.

You may still have to pay a Medicare deductible and coinsurance, but your provider will have to submit a claim to Medicare directly and wait for payment before passing any share of the costs onto you. Doctors who accept Medicare assignment cannot charge you to submit these claims.

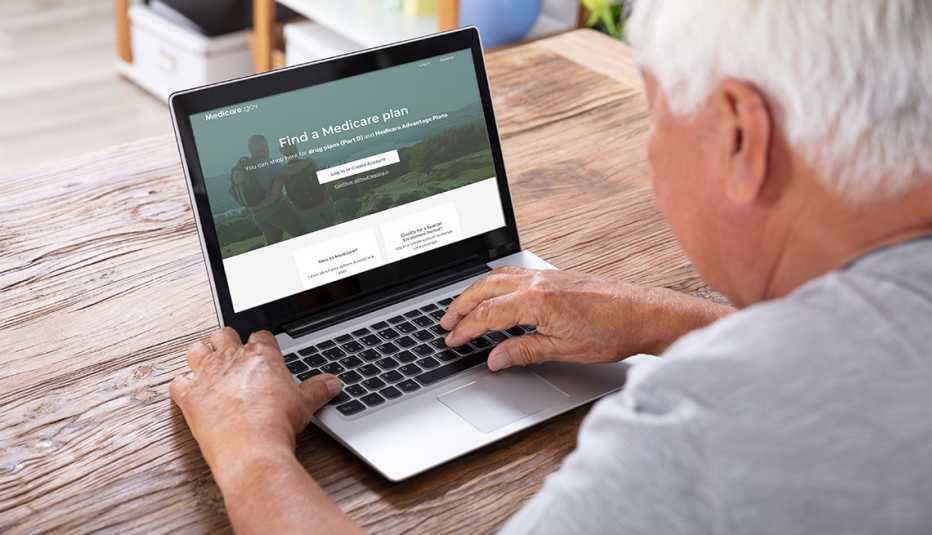

Ready for a new Medicare Advantage plan?

How Do I Know if a Provider Accepts Medicare Assignment?

There are a few levels of commitment when it comes to Medicare assignment.

- Providers who have agreed to accept Medicare assignment sign a contract with Medicare.

- Those who have not signed a contract with Medicare can still accept assignment amounts for services of their choice. They do not have to accept assignment for every service provided. These are called non-participating providers.

- Some providers opt out of Medicare altogether. Doctors who have opted out of Medicare completely or who use private contracts will not be paid anything by Medicare, even if it’s for a covered service within the fee limits. You will have to pay the full cost of any services provided by these doctors yourself.

You can check to see if your provider accepts Medicare assignment on Medicare’s website .

Billing Arrangement Options for Providers Who Accept Medicare

Doctors that take Medicare can sign a contract to accept assignment for all Medicare services, or be a non-participating provider that accepts assignment for some services but not all.

A medical provider that accepts Medicare assignment must submit claims directly to Medicare on your behalf. They will be paid the agreed upon amount by Medicare, and you will pay any copayments or deductibles dictated by your plan.

If your doctor is non-participating, they may accept Medicare assignment for some services but not others. Even if they do agree to accept Medicare’s fee for some services, Medicare will only pay then 95% of the set assignment cost for a particular service.

If your provider does plan to work with Medicare, either the provider or you can submit a claim to Medicare, but you may have to pay the entire cost of the visit up front and wait for reimbursement. They can’t charge you for more than the amount approved by Medicare, but they can charge you above the Medicare-approved amount. This is called the limiting charge, and can be up to 15% more than Medicare-approved amount for non-participating providers.

What Does It Mean When a Provider Does Not Accept Medicare Assignment?

Providers who refuse Medicare assignment can still choose to accept Medicare’s set fees for certain services. These are called non-participating providers.

There are a number of providers who opt out of participating in Medicare altogether; they are referred to as “opt-out doctors”. This means they have signed an opt-out agreement with Medicare and can’t be paid by Medicare at all — even for services normally covered by Medicare. Opt-out contracts last for at least two years. Some of these providers may only offer services to patients who sign contracts.

You do not need to sign a contract with a private provider or use an opt-out provider. There are many options for alternative providers who accept Medicare. If you do choose an opt-out or private contract provider, you will have to pay the full cost of services on your own.

My Medicare coverage doesn’t address all of my needs.

Do providers have to accept Medicare assignment?

No. Providers can choose to accept a full Medicare assignment, or accept assignment rates for some services as a non-participating provider. Doctors can also opt out of participating in Medicare altogether.

How much will I have to pay if my provider doesn't accept Medicare assignment?

Some providers that don’t accept assignment as a whole will accept assignment for some services. These are called non-participating providers. For these providers and providers who have completely opted out of Medicare, you will pay the majority of or the full amount for your care.

How do I submit a claim?

If you need to submit your own claim to Medicare, you can call 1-800-MEDICARE or use Form CMS-1490S .

Can my provider charge to submit a claim?

No. Providers are not allowed to charge to submit a claim to Medicare on your behalf.

Lower Costs with Assignment. Medicare.gov.

Fee Schedules . CMS.gov.

This website is operated by GoHealth, LLC., a licensed health insurance company. The website and its contents are for informational and educational purposes; helping people understand Medicare in a simple way. The purpose of this website is the solicitation of insurance. Contact will be made by a licensed insurance agent/producer or insurance company. Medicare Supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. Our mission is to help every American get better health insurance and save money. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

Let's see if you're missing out on Medicare savings.

We just need a few details.

Related Articles

What Is Medicare IRMAA?

What Is an IRMAA in Medicare?

Do All Doctors Accept Medicare?

What Does It Mean for a Doctor to Accept Medicare Assignment?

How to Report Medicare Fraud

Medicare Fraud Examples & How to Report Abuse

How to Change Your Address with Medicare

Reporting a Change of Address to Medicare

Can I Get Medicare if I’ve Never Worked?

Can You Get Medicare if You've Never Worked?

Why Are Some Medicare Advantage Plans Free?

Why Are Some Medicare Advantage Plans Free? $0 Premium Plans Explained

Am I Enrolled in Medicare?

When and How Do I Enroll?

When and How Do I Enroll in Medicare?

Medicare Frequently Asked Questions

Let’s see if you qualify for Medicare savings today!

Take control of your money! Save, budget and navigate your finances easier with AARP Money Map.

AARP daily Crossword Puzzle

Hotels with AARP discounts

Life Insurance

AARP Dental Insurance Plans

AARP MEMBERSHIP — Limited Time Offer-Memorial Day Sale

Join AARP for just $9 per year with a 5-year membership. Join now and get a FREE Gift! Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

- right_container

Work & Jobs

Social Security

AARP en Español

- Membership & Benefits

AARP Rewards

- AARP Rewards %{points}%

Conditions & Treatments

Drugs & Supplements

Health Care & Coverage

Health Benefits

Staying Fit

Your Personalized Guide to Fitness

Get Happier

Creating Social Connections

Brain Health Resources

Tools and Explainers on Brain Health

Your Health

8 Major Health Risks for People 50+

Scams & Fraud

Personal Finance

Money Benefits

View and Report Scams in Your Area

AARP Foundation Tax-Aide

Free Tax Preparation Assistance

AARP Money Map

Get Your Finances Back on Track

How to Protect What You Collect

Small Business

Age Discrimination

Flexible Work

Freelance Jobs You Can Do From Home

AARP Skills Builder

Online Courses to Boost Your Career

31 Great Ways to Boost Your Career

ON-DEMAND WEBINARS

Tips to Enhance Your Job Search

Get More out of Your Benefits

When to Start Taking Social Security

10 Top Social Security FAQs

Social Security Benefits Calculator

Medicare Made Easy

Original vs. Medicare Advantage

Enrollment Guide

Step-by-Step Tool for First-Timers

Prescription Drugs

9 Biggest Changes Under New Rx Law

Medicare FAQs

Quick Answers to Your Top Questions

Care at Home

Financial & Legal

Life Balance

LONG-TERM CARE

Understanding Basics of LTC Insurance

State Guides

Assistance and Services in Your Area

Prepare to Care Guides

How to Develop a Caregiving Plan

End of Life

How to Cope With Grief, Loss

Recently Played

Word & Trivia

Atari® & Retro

Members Only

Staying Sharp

Mobile Apps

More About Games

Right Again! Trivia

Right Again! Trivia – Sports

Atari® Video Games

Throwback Thursday Crossword

Travel Tips

Vacation Ideas

Destinations

Travel Benefits

Outdoor Vacation Ideas

Camping Vacations

Plan Ahead for Summer Travel

AARP National Park Guide

Discover Canyonlands National Park

History & Culture

8 Amazing American Pilgrimages

Entertainment & Style

Family & Relationships

Personal Tech

Home & Living

Celebrities

Beauty & Style

Movies for Grownups

Summer Movie Preview

Jon Bon Jovi’s Long Journey Back

Looking Back

50 World Changers Turning 50

Sex & Dating

Spice Up Your Love Life

Friends & Family

How to Host a Fabulous Dessert Party

Home Technology

Caregiver’s Guide to Smart Home Tech

Virtual Community Center

Join Free Tech Help Events

Create a Hygge Haven

Soups to Comfort Your Soul

AARP Solves 25 of Your Problems

Driver Safety

Maintenance & Safety

Trends & Technology

AARP Smart Guide

How to Clean Your Car

We Need To Talk

Assess Your Loved One's Driving Skills

AARP Smart Driver Course

Building Resilience in Difficult Times

Tips for Finding Your Calm

Weight Loss After 50 Challenge

Cautionary Tales of Today's Biggest Scams

7 Top Podcasts for Armchair Travelers

Jean Chatzky: ‘Closing the Savings Gap’

Quick Digest of Today's Top News

AARP Top Tips for Navigating Life

Get Moving With Our Workout Series

You are now leaving AARP.org and going to a website that is not operated by AARP. A different privacy policy and terms of service will apply.

Go to Series Main Page

What is Medicare assignment and how does it work?

Kimberly Lankford,

Because Medicare decides how much to pay providers for covered services, if the provider agrees to the Medicare-approved amount, even if it is less than they usually charge, they’re accepting assignment.

A doctor who accepts assignment agrees to charge you no more than the amount Medicare has approved for that service. By comparison, a doctor who participates in Medicare but doesn’t accept assignment can potentially charge you up to 15 percent more than the Medicare-approved amount.

That’s why it’s important to ask if a provider accepts assignment before you receive care, even if they accept Medicare patients. If a doctor doesn’t accept assignment, you will pay more for that physician’s services compared with one who does.

AARP Membership — $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

How much do I pay if my doctor accepts assignment?

If your doctor accepts assignment, you will usually pay 20 percent of the Medicare-approved amount for the service, called coinsurance, after you’ve paid the annual deductible. Because Medicare Part B covers doctor and outpatient services, your $240 deductible for Part B in 2024 applies before most coverage begins.

All providers who accept assignment must submit claims directly to Medicare, which pays 80 percent of the approved cost for the service and will bill you the remaining 20 percent. You can get some preventive services and screenings, such as mammograms and colonoscopies , without paying a deductible or coinsurance if the provider accepts assignment.

What if my doctor doesn’t accept assignment?

A doctor who takes Medicare but doesn’t accept assignment can still treat Medicare patients but won’t always accept the Medicare-approved amount as payment in full.

This means they can charge you up to a maximum of 15 percent more than Medicare pays for the service you receive, called “balance billing.” In this case, you’re responsible for the additional charge, plus the regular 20 percent coinsurance, as your share of the cost.

How to cover the extra cost? If you have a Medicare supplement policy , better known as Medigap, it may cover the extra 15 percent, called Medicare Part B excess charges.

All Medigap policies cover Part B’s 20 percent coinsurance in full or in part. The F and G policies cover the 15 percent excess charges from doctors who don’t accept assignment, but Plan F is no longer available to new enrollees, only those eligible for Medicare before Jan. 1, 2020, even if they haven’t enrolled in Medicare yet. However, anyone who is enrolled in original Medicare can apply for Plan G.

Remember that Medigap policies only cover excess charges for doctors who accept Medicare but don’t accept assignment, and they won’t cover costs for doctors who opt out of Medicare entirely.

Good to know. A few states limit the amount of excess fees a doctor can charge Medicare patients. For example, Massachusetts and Ohio prohibit balance billing, requiring doctors who accept Medicare to take the Medicare-approved amount. New York limits excess charges to 5 percent over the Medicare-approved amount for most services, rather than 15 percent.

AARP NEWSLETTERS

%{ newsLetterPromoText }%

%{ description }%

Privacy Policy

ARTICLE CONTINUES AFTER ADVERTISEMENT

How do I find doctors who accept assignment?

Before you start working with a new doctor, ask whether he or she accepts assignment. About 98 percent of providers billing Medicare are participating providers, which means they accept assignment on all Medicare claims, according to KFF.

You can get help finding doctors and other providers in your area who accept assignment by zip code using Medicare’s Physician Compare tool .

Those who accept assignment have this note under the name: “Charges the Medicare-approved amount (so you pay less out of pocket).” However, not all doctors who accept assignment are accepting new Medicare patients.

AARP® Vision Plans from VSP™

Exclusive vision insurance plans designed for members and their families

What does it mean if a doctor opts out of Medicare?

Doctors who opt out of Medicare can’t bill Medicare for services you receive. They also aren’t bound by Medicare’s limitations on charges.

In this case, you enter into a private contract with the provider and agree to pay the full bill. Be aware that neither Medicare nor your Medigap plan will reimburse you for these charges.

In 2023, only 1 percent of physicians who aren’t pediatricians opted out of the Medicare program, according to KFF. The percentage is larger for some specialties — 7.7 percent of psychiatrists and 4.2 percent of plastic and reconstructive surgeons have opted out of Medicare.

Keep in mind

These rules apply to original Medicare. Other factors determine costs if you choose to get coverage through a private Medicare Advantage plan . Most Medicare Advantage plans have provider networks, and they may charge more or not cover services from out-of-network providers.

Before choosing a Medicare Advantage plan, find out whether your chosen doctor or provider is covered and identify how much you’ll pay. You can use the Medicare Plan Finder to compare the Medicare Advantage plans and their out-of-pocket costs in your area.

Return to Medicare Q&A main page

Kimberly Lankford is a contributing writer who covers Medicare and personal finance. She wrote about insurance, Medicare, retirement and taxes for more than 20 years at Kiplinger’s Personal Finance and has written for The Washington Post and Boston Globe . She received the personal finance Best in Business award from the Society of American Business Editors and Writers and the New York State Society of CPAs’ excellence in financial journalism award for her guide to Medicare.

Discover AARP Members Only Access

Already a Member? Login

More on Medicare

How Do I Create a Personal Online Medicare Account?

You can do a lot when you decide to look electronically

I Got a Medicare Summary Notice in the Mail. What Is It?

This statement shows what was billed, paid in past 3 months

Understanding Medicare’s Options: Parts A, B, C and D

Making sense of the alphabet soup of health care choices

Recommended for You

AARP Value & Member Benefits

Learn, earn and redeem points for rewards with our free loyalty program

AARP® Dental Insurance Plan administered by Delta Dental Insurance Company

Dental insurance plans for members and their families

The National Hearing Test

Members can take a free hearing test by phone

AARP® Staying Sharp®

Activities, recipes, challenges and more with full access to AARP Staying Sharp®

SAVE MONEY WITH THESE LIMITED-TIME OFFERS

- Individuals myGov is a simple and secure way to access online government services.

- PRODA Log in to access HPOS, Business Hub, Aged Care Provider Portal and a range of other government online services.

- Centrelink Business Online

- Child Support Business Online

Assignment of benefit

Signature requirements when a patient assigns their Medicare benefit to the servicing provider as full payment for health services.

on this page

Responsible person, patient unable to sign - sensitive issue, patient unable to sign - deceased, email agreement.

If a patient is unable to sign an assignment of benefit form , you can get a signature from any of the following:

- the patient’s parent

- the patient’s guardian

- another responsible person.

In the absence of a parent, guardian or responsible person, leave the ‘patient signature’ section blank.

Where the signature space is either left blank or another person signs on the patient’s behalf, the assignment of benefit form must include the following:

- the notation ‘Patient unable to sign’

- in the ‘Practitioner’s Use’ section, the reason why the patient was unable to sign. For example, use ‘unconscious’, ‘injured hand’ or ‘verbal consent obtained’.

For Medicare Easyclaim , consent from the patient, the patient’s parent, guardian or other responsible person is acceptable. Press the OK or YES button on the EFTPOS terminal.

‘Responsible person’ refers to an adult person accompanying the patient or in whose care the patient has been placed.

A responsible person can include someone who is any of the following:

- the parent or guardian

- holds power of attorney

- holds a guardianship order

- the next of kin.

This does not include the:

- health professional who rendered the service

- health professional’s staff

- hospital proprietor or staff

- aged care home proprietor or staff.

If you assess the reason a patient is unable to sign is of a highly sensitive nature, write in the ‘Practitioner’s Use’ section either:

- ‘due to medical condition’

- ‘due to sensitive condition’.

Only do this if revealing the reason would:

- mean an unacceptable breach of patient confidentiality

- unduly embarrass or distress the recipient of the patient’s copy of the assignment of benefit form.

This should not be routine practice. You can’t use ‘extenuating circumstances’ as a reason for no patient signature.

You and the patient must have entered into a bulk bill agreement at the time of service. This must include having the patient sign the assignment of benefit form.

If the patient has not signed the form, a signature from a responsible person is acceptable.

A responsible person can be either:

- the executor of the will

- an appointed administrator.

You must not write ‘patient deceased’ as a reason for not getting a signature on the assignment of benefit form.

Follow the steps in the table below when a patient assigns their right to a Medicare benefit to you by email.

For privacy reasons, don’t include the Medicare card number and provider number in the email.

This process complies with section 10 of the Electronic Transactions Act 1999 . This act outlines the steps to be taken for an electronic signature to be recognised.

It also meets the legal requirement of needing a patient signature to assign a Medicare benefit.

Example email

Dear Mr Jones (patient)

Details of the telehealth consultation to be claimed with Medicare:

Item number: 91822

Benefit amount: $78.05

Date and time of consultation: 01.07.2022 10:30 am

Patient name: Peter Jones

Health professional name: Jane Smith

If you (the patient) agree to the assignment of the Medicare benefit directly to the health professional (bulk bill), reply to this email including the following wording:

- ‘Yes, I agree to the assignment of the Medicare benefit directly to the health professional.’

- your (the patient’s) name or the name of parent or guardian (where a child is the patient and unable to sign).

Regards Dr Jane Smith

Privacy note: Your personal information is protected by law, including the Privacy Act 1988, and is collected by Services Australia for the assessment and administration of payments and services. This information is required to process your application or claim. Your information may be used by the agency, or given to other parties where you have agreed to that, or where it is required or authorised by law (including for the purpose of research or conducting investigations). You can get more information about the way in which the agency will manage your personal information, including our privacy policy .

Read more about Assignment of benefit and signature requirements for telehealth services .

This information was printed 3 June 2024 from https://www.servicesaustralia.gov.au/assignment-benefit-signature-requirements-and-exemptions . It may not include all of the relevant information on this topic. Please consider any relevant site notices at https://www.servicesaustralia.gov.au/site-notices when using this material.

Printed link references

The independent source for health policy research, polling, and news.

Medicare 101

Published: May 28, 2024

KFF Authors:

Juliette Cubanski

Meredith Freed

Nancy Ochieng

Alex Cottrill

Jeannie Fuglesten Biniek

Tricia Neuman

Juliette Cubanski , Meredith Freed , Nancy Ochieng , Alex Cottrill , Jeannie Fuglesten Biniek and Tricia Neuman

Table of Contents

What is medicare.

Medicare is the federal health insurance program established in 1965 under Title XVIII of the Social Security Act for people age 65 or older, regardless of income or medical history, and later expanded to cover people under age 65 with long-term disabilities. Today, Medicare provides health insurance coverage to 66 million people , including 58 million people age 65 or older and 8 million people under age 65. Medicare covers a comprehensive set of health care services, including hospitalizations, physician visits, and prescription drugs, along with post-acute care, skilled nursing facility care, home health care, hospice, and preventive services. People can choose to get coverage of Medicare benefits under traditional Medicare or Medicare Advantage private plans.

Medicare spending comprised 12% of the federal budget in 2022 and 21% of national health care spending in 2021 . Funding for Medicare comes primarily from general revenues, payroll tax revenues, and premiums paid by beneficiaries. Over the longer term, the Medicare program faces financial pressures associated with higher health care costs, growing enrollment, and an aging population.

Who Is Covered by Medicare?

Most people become eligible for Medicare when they reach age 65, regardless of income, health status, or medical conditions. Residents of the U.S., including citizens and permanent residents, are eligible for premium-free Medicare Part A if they have worked at least 40 quarters (10 years) in jobs where they or their spouses paid Medicare payroll taxes and are at least 65 years old. People under age 65 who receive Social Security Disability Insurance (SSDI) payments generally become eligible for Medicare after a two-year waiting period. People diagnosed with end-stage renal disease (ESRD) and amyotrophic lateral sclerosis (ALS) become eligible for Medicare with no waiting period.

Medicare covers a diverse population in terms of demographics and health status, and this population is expected to grow larger and more diverse in the future as the U.S. population ages. Currently, most people with Medicare are White, female, and between the ages of 65 and 84 (Figure 1). The share of U.S. adults who are age 65 or older is projected to grow from 17% in 2020 to nearly a quarter of the nation’s total population in 2060, while people ages 80 and older will account for more than one-third of people 65 and older in 2060, up from one-quarter in 2020. As the U.S. population ages, the number of Medicare beneficiaries is projected to grow from around 63 million people in 2020 to just over 93 million people in 2060. The Medicare population will also grow more racially and ethnically diverse. By 2060, people of color will comprise close to half (47%) of the U.S. population ages 65 and older, nearly double the share in 2020 (25%).

While many Medicare beneficiaries enjoy good health, others live with health problems that affect their quality of life, including multiple chronic conditions, limitations in their activities of daily living, and cognitive impairments. In 2021, one-third (33%) of Medicare beneficiaries had four or more chronic conditions, more than a quarter (27%) had a functional impairment, and 17% had a cognitive impairment (Figure 2).

Most Medicare beneficiaries have limited financial resources, including income and assets. In 2023, half of all Medicare beneficiaries had incomes below $36,000 and savings below $103,800 per person. Median incomes for Medicare beneficiaries are lower among women than men, among people of color than White beneficiaries, and among beneficiaries under age 65 with disabilities than older beneficiaries (Figure 3).

What Does Medicare Cover and How Much Do People Pay for Medicare Benefits?

Benefits . Medicare covers a comprehensive set of medical care services, including hospital stays, physician visits, and prescription drugs. Medicare benefits are divided into four parts:

- Part A, also known as the Hospital Insurance (HI) program, covers inpatient care provided in hospitals and short-term stays in skilled nursing facilities, hospice care, post-acute home health care, and pints of blood received at a hospital or skilled nursing facility. An estimated 63.5 million people were enrolled in Part A in 2021. In 2021, 14% of beneficiaries in traditional Medicare had an inpatient hospital stay, while 8% used home health care services, and 4% had a skilled nursing facility stay (Figure 4). (Comparable utilization data for beneficiaries in Medicare Advantage is not available.)

- Part B, the Supplementary Medical Insurance (SMI) program, covers outpatient services such as physician visits, outpatient hospital care, and preventive services (e.g. mammography and colorectal cancer screening), among other medical benefits. An estimated 58 million people were enrolled in Part B in 2021. A larger share of beneficiaries use Part B services compared to Part A services. For example, in 2021, nearly 9 in 10 (88%) traditional Medicare beneficiaries used physician and other medical services covered under Part B and 66% used outpatient hospital services.

- Part C, more commonly referred to as the Medicare Advantage program, allows beneficiaries to enroll in a private plan, such as a health maintenance organization (HMO) or preferred provider organization (PPO), as an alternative to traditional Medicare. Medicare Advantage plans cover all benefits under Medicare Part A, Part B, and, in most cases, Part D (Medicare’s outpatient prescription drug benefit), and typically offer extra benefits, such as dental services, eyeglasses, and hearing exams. In 2023, 31 million beneficiaries were enrolled in Medicare Advantage , which is 51% of Medicare beneficiaries who are eligible to enroll in Medicare Advantage plans. (See “ What Is Medicare Advantage and How Is It Different From Traditional Medicare? ” for additional information.)

- Part D is a voluntary outpatient prescription drug benefit delivered through private plans that contract with Medicare, either stand-alone prescription drug plans (PDPs) or Medicare Advantage prescription drug (MA-PD) plans. In 2023, an estimated 50 million beneficiaries are enrolled in Part D . In 2021, nearly all Medicare beneficiaries enrolled in Part D (98%) used prescription drugs. (See “ What Is the Medicare Part D Prescription Drug Benefit? " for additional information.)

Although Medicare covers a comprehensive set of medical benefits, Medicare does not cover long-term care services. Additionally, coverage of vision services, dental care, and hearing aids is not part of the standard benefit, though most Medicare Advantage plans offer some coverage of these services .

Premiums and cost sharing . Medicare has varying premiums, deductibles, and coinsurance amounts that typically change yearly to reflect program cost changes.

- Part A: Most beneficiaries do not pay a monthly premium for Part A services, but are required to pay a deductible for inpatient hospitalizations ($1,632 in 2024). (People who are working contribute payroll taxes to Medicare and qualify for premium-free Part A at age 65 based on having paid 1.45% of their earnings over at least 40 quarters). Beneficiaries are generally subject to cost sharing for Part A benefits, including extended inpatient stays in a hospital ($408 per day for days 61-90 and $816 per day for days 91-150 in 2024) or skilled nursing facility ($204 per day for days 21-100 in 2024). There is no cost sharing for home health visits.

- Part B: Beneficiaries enrolled in Part B, including those in traditional Medicare and Medicare Advantage plans, are generally required to pay a monthly premium ($174.70 in 2024). Beneficiaries with annual incomes greater than $103,000 for a single person or $206,000 for a married couple in 2024 pay a higher, income-related monthly Part B premium, ranging from $244.60 to $594. Approximately 8% of all Medicare beneficiaries are expected to pay income-related Part B premiums in 2024. Part B benefits are subject to an annual deductible ($240 in 2024), and most Part B services are subject to coinsurance of 20 percent.

- Part C: In addition to paying the Part B premium, Medicare Advantage enrollees may be charged a separate monthly premium for their Medicare Advantage plan, although 7 in 10 enrollees were in plans that charged no additional premium in 2023 . Medicare Advantage plans are generally prohibited from charging more than traditional Medicare, but vary in the deductibles and cost-sharing amounts they charge. Medicare Advantage plans may establish provider networks and require higher cost sharing for services received from non-network providers.

- Part D: Part D plans vary in terms of premiums, deductibles, and cost sharing. People in traditional Medicare who are enrolled in a separate stand-alone Part D plan generally pay a monthly Part D premium unless they qualify for full benefits through the Part D Low-Income Subsidy (LIS) program and are enrolled in a premium-free (benchmark) plan. In 2023, the average enrollment-weighted premium for stand-alone Part D plans was $40 per month , substantially higher than the enrollment-weighted average monthly portion of the premium for drug coverage in MA-PDs ($10 in 2023).

Sources of coverage . Most people with Medicare have some type of coverage that may protect them from unlimited out-of-pocket costs and may offer additional benefits, whether it’s coverage in addition to traditional Medicare or coverage from Medicare Advantage plans, which are required to have an out-of-pocket cap and typically offer supplemental benefits (Figure 5). However, based on KFF analysis of data from the 2021 Medicare Current Beneficiary Survey, 3 million people with Medicare have no additional coverage, which places them at risk of facing high out-of-pocket spending or going without needed medical care due to costs.

- Medicare Advantage plans now cover more than half of all Medicare beneficiaries enrolled in both Part A and Part B, or 31 million people (in 2021, Medicare Advantage enrollment was just under half of beneficiaries, or around 27 million people). (See “What Is Medicare Advantage and How Is It Different From Traditional Medicare? ” for additional information.)

- Employer and union-sponsored plans provided some form of coverage to 15.2 million Medicare beneficiaries – one-quarter (26%) of Medicare beneficiaries overall in 2021. Of the total number of beneficiaries with employer coverage, 9.7 million beneficiaries had this coverage in addition to traditional Medicare (32% of beneficiaries in traditional Medicare), while 5.6 million beneficiaries were enrolled in Medicare Advantage employer group plans. (These estimates exclude 5.2 million Medicare beneficiaries with Part A only in 2021, primarily because they or their spouse were active workers and had primary coverage from an employer plan.)

- Medicare supplement insurance, also known as Medigap, covered 2 in 10 (21%) Medicare beneficiaries overall, or 41% of those in traditional Medicare (12.5 million beneficiaries) in 2021. Medigap policies , sold by private insurance companies, fully or partially cover Medicare Part A and Part B cost-sharing requirements, including deductibles, copayments, and coinsurance.

- Medicaid, the federal-state program that provides health and long-term services and supports coverage to low-income people, was a source of coverage for 11 million Medicare beneficiaries with low incomes and modest assets in 2021 (19% of all Medicare beneficiaries), including 6.1 million enrolled in Medicare Advantage and 5.0 million in traditional Medicare. (This estimate is somewhat lower than KFF estimates published elsewhere due to different data sources and methods used.) For these beneficiaries, referred to as dual-eligible individuals, Medicaid typically pays the Medicare Part B premium and may also pay a portion of Medicare deductibles and other cost-sharing requirements. Most dual-eligible individuals are eligible for full Medicaid benefits, including long-term services and supports.

What Is Medicare Advantage and How Is It Different From Traditional Medicare?

Medicare Advantage, also known as Medicare Part C, allows beneficiaries to receive their Medicare benefits from a private health plan, such as an HMO or PPO. Medicare pays private insurers to provide Medicare-covered benefits (Part A and B, and often Part D) to enrollees. Virtually all Medicare Advantage plans include an out-of-pocket limit for benefits covered under Parts A and B, and most offer additional benefits not covered by traditional Medicare, such as vision, hearing, and dental. The average Medicare beneficiary can choose from 43 Medicare Advantage plans offered by eight insurance companies in 2024. These plans vary across many dimensions, including premiums, cost-sharing requirements, out-of-pocket limits, extra benefits, provider networks, prior authorization and referral requirements, denial rates, and prescription drug coverage.

More than half of all eligible Medicare beneficiaries (51% ), are currently enrolled in a Medicare Advantage plan, up from 25% in 2010 (Figure 6). The share of eligible Medicare beneficiaries in Medicare Advantage plans varies across states, ranging from 2% in Alaska to 60% in Alabama, Hawaii, and Michigan. Growth in Medicare Advantage enrollment is due to a number of factors. Medicare beneficiaries are attracted to Medicare Advantage due to the multitude of extra benefits, the simplicity of one-stop shopping (in contrast to traditional Medicare where beneficiaries might purchase a Part D plan and a Medigap plan), and the availability of plans with no premiums beyond the Part B premium, driven in part by the current payment system that generates high gross margins in this market (see “ How Does Medicare Pay Private Plans in Medicare Advantage and Medicare Part D? ” for additional information) . Insurers market these plans aggressively, airing thousands of TV ads for Medicare Advantage during the Medicare open enrollment period. In some cases, Medicare beneficiaries have no choice but to be enrolled in a Medicare Advantage plan for their retiree health benefits as some employers are shifting their retirees into these plans ; if they are dissatisfied with this option, they may have to give up retiree benefits altogether, although they would retain Medicare and have the option to choose traditional Medicare (potentially with a Medigap supplement).

There are several differences between Medicare Advantage and traditional Medicare. Medicare Advantage plans can establish provider networks, the size of which can vary considerably for both physicians and hospitals , depending on the plan and the county where it is offered. These provider networks may also change over the course of the year. Medicare Advantage enrollees who seek care from an out-of-network provider may pay higher cost sharing or pay completely out of-pocket for their care. In contrast, traditional Medicare beneficiaries may see any provider that accepts Medicare and is accepting new patients. In 2019, 89% of non-pediatric office-based physicians accepted new Medicare patients , with little change over time. Only 1% of all non-pediatric physicians formally opted out of the Medicare program in 2023.

Medicare Advantage plans also often use tools to manage utilization and costs, such as requiring enrollees to receive prior authorization before a service will be covered and requiring enrollees to obtain a referral for specialists or mental health providers. In 2023, virtually all Medicare Advantage enrollees were in plans that required prior authorization for some services, most often higher-cost services. Over 35 million prior authorization requests were submitted to Medicare Advantage plans in 2021 (Figure 7). Prior authorization and referrals to specialists are applied less frequently in traditional Medicare, with prior authorization generally applying to a limited set of services .

Medicare Advantage plans are required to use payments from the federal government that exceed their costs of covering Part A and B services ( known as rebates ) to provide supplemental benefits to enrollees, such as lower cost sharing, extra benefits not covered by traditional Medicare, or rebates toward Part B and/or Part D premiums. Examples of extra benefits include eyeglasses , hearing exams , preventive dental care , and gym memberships (Figure 8). ( See “ How Does Medicare Pay Private Plans in Medicare Advantage and Medicare Part D? ” for a discussion of how Medicare pays Medicare Advantage plans ). [Additionally], Medicare Advantage plans must include a cap on out-of-pocket spending, providing protection from catastrophic medical expenses. Traditional Medicare does not have an out-of-pocket limit, though some have protection from catastrophic costs if they purchase a Medigap policy. (See “What Does Medicare Cover and How Much Do People Pay for Medicare Benefits?” for a brief discussion of Medigap .)

What Is the Medicare Part D Prescription Drug Benefit?

Medicare Part D , Medicare’s voluntary outpatient prescription drug benefit, was established by the Medicare Modernization Act of 2003 (MMA) and launched in 2006. Before the addition of the Part D benefit, Medicare did not cover the cost of outpatient prescription drugs. Under Part D, Medicare helps cover prescription drug costs through private plans that contract with Medicare to offer the Part D benefit to enrollees, which is unlike coverage of Part A and Part B benefits under traditional Medicare, and beneficiaries must enroll in a Part D plan if they want this benefit.

A total of 50.5 million people with Medicare are currently enrolled in plans that provide the Medicare Part D drug benefit, including plans open to everyone with Medicare (stand-alone prescription drug plans, or PDPs, and Medicare Advantage drug plans, or MA-PDs) and plans for specific populations (including retirees of a former employer or union and Medicare Advantage Special Needs Plans, or SNPs). More than 13 million low-income beneficiaries receive extra help with their Part D plan premiums and cost sharing through the Part D Low-Income Subsidy Program (LIS).

For 2024, the average Medicare beneficiary has a choice of 21 stand-alone Part D plans and 36 Medicare Advantage drug plans . These plans vary in terms of premiums, deductibles and cost sharing, the drugs that are covered, any utilization management restrictions that apply, and pharmacy networks. People in traditional Medicare who are enrolled in a separate stand-alone Part D plan generally pay a monthly Part D premium unless they qualify for full benefits through the Part D LIS program and are enrolled in a premium-free (benchmark) plan. In 2023, the average enrollment-weighted premium for stand-alone Part D plans was $40 per month . In 2023, most stand-alone Part D plans included a deductible, averaging $411 . Plans generally impose a tiered structure to define cost-sharing requirements and cost-sharing amounts charged for covered drugs, typically charging lower cost-sharing amounts for generic drugs and preferred brands and higher amounts for non-preferred and specialty drugs, and a mix of flat dollar copayments and coinsurance (based on a percentage of a drug’s list price) for covered drugs.

The standard design of the Medicare Part D benefit currently has four distinct phases, where the share of drug costs paid by Part D enrollees, Part D plans, drug manufacturers, and Medicare varies. Based on changes in the Inflation Reduction Act, these shares will change in 2024 and 2025 (Figure 9). Most notably, the benefit includes catastrophic coverage for enrollees with high drug costs, a phase where Part D enrollees not receiving low-income subsidies have been responsible for paying 5% of their total drug costs. In 2024, costs in the catastrophic phase will change: the 5% coinsurance requirement for Part D enrollees will be eliminated and Part D plans will pay 20% of total drug costs in this phase instead of 15%. In 2025, out-of-pocket drug costs for Part D enrollees will be capped at $2,000. These changes are expected to help well over 1 million Part D enrollees with high drug costs each year.

The Inflation Reduction Act of 2022 , signed into law by President Biden on August 16, 2022, includes several provisions to lower prescription drug costs for people with Medicare and reduce drug spending by the federal government, including several changes related to the Part D benefit. These provisions include (but are not limited to) (Figure 10):

- Requiring the Secretary of the Department of Health and Human Services to negotiate the price of some drugs covered under Medicare, with negotiated prices first available for 10 Part D drugs in 2026 (and first available for Part B drugs in 2028). The law that established the Part D benefit included a provision known as the “ noninterference ” clause, which, to date, has prevented the HHS Secretary from being involved in price negotiations between drug manufacturers and pharmacies and Part D plan sponsors. In addition, the Secretary of HHS does not currently negotiate prices for drugs covered under Medicare Part B (administered by physicians).

- Adding a hard cap on out-of-pocket drug spending under Part D, which will phase in beginning in 2024, with a $2,000 cap on out-of-pocket spending in 2025. As noted above, under the original design of the Part D benefit, enrollees have had catastrophic coverage for high out-of-pocket drug costs, but there has been no limit on the total amount that beneficiaries pay out of pocket each year.

- Limiting the price of insulin products to no more than $35 per month in all Part D plans and in Part B and making adult vaccines covered under Part D available for free as of 2023. Until these provisions took effect, beneficiary costs for insulin and adult vaccines were subject to varying cost-sharing amounts.

- Expanding eligibility for full benefits under the Part D Low-Income Subsidy program in 2024, eliminating the partial LIS benefit for individuals with incomes between 135% and 150% of poverty. Beneficiaries who receive full LIS benefits pay no Part D premium or deductible and only modest copayments for prescription drugs until they reach the catastrophic threshold, at which point they face no additional cost sharing.

- Requiring drug manufacturers to pay a rebate to the federal government if prices for drugs covered under Part D and Part B increase faster than the inflation rate, with the initial period for measuring Part D drug price increases running from October 2022-September 2023. Previously, Medicare had no authority to limit annual price increases for drugs covered under Part B or Part D. Year-to-year drug price increases exceeding inflation are not uncommon and affect people with both Medicare and private insurance.

How Does Medicare Pay Hospitals, Physicians, and Other Providers in Traditional Medicare?

In 2023, Medicare is estimated to spend $436 billion on benefits covered under Part A and Part B for beneficiaries in traditional Medicare. Medicare pays providers in traditional Medicare using various payment systems depending on the setting of care (Figure 11).

Medicare relies on a number of different approaches when determining payments to providers for Part A and Part B services delivered to beneficiaries in traditional Medicare. These providers include hospitals (for both inpatient and outpatient services), physicians, skilled nursing facilities, home health agencies, and several other types of providers. Of the $436 billion in estimated spending on Medicare benefits covered under Part A and Part B in traditional Medicare in 2023, $144 billion (33%) is for hospital inpatient services and $62 billion (14%) is for hospital outpatient services, $72 billion (17%) is for services covered under the physician fee schedule, and $158 billion (36%) is for all other Part A or Part B services for beneficiaries in traditional Medicare.

Medicare uses prospective payment systems for most providers in traditional Medicare. These systems generally require that Medicare pre-determine a base payment rate for a given unit of service (e.g. a hospital stay, an episode of care, a particular service). Then, based on certain variables, such as the provider’s geographic location and the complexity of the patient receiving the service, Medicare adjusts its payment for each unit of service provided . Medicare updates payment rates annually for most payment systems to account for inflation adjustments.

The main features of hospital, physician, outpatient, and skilled nursing facility payment systems (altogether accounting for 70% of spending on Part A and Part B benefits in traditional Medicare) are described below:

- Inpatient hospitals (acute care) : Medicare pays hospitals per beneficiary discharge using the Inpatient Prospective Payment System . The rate for each discharge corresponds to one of over 750 different categories of diagnoses – called Medicare Severity Diagnosis Related Groups (MS-DRGs), which reflect the principal diagnosis, secondary diagnoses, procedures performed, and other patient characteristics. DRGs that are likely to incur more intense levels of care and/or longer lengths of stay are assigned higher payments. Medicare’s payments to hospitals also account for a portion of hospitals’ capital and operating expenses.

- Medicare also makes additional payments to hospitals in particular situations. These include additional payments for rural or isolated hospitals that meet certain criteria. Further, Medicare makes additional payments to help offset costs incurred by hospitals that are not otherwise accounted for in the inpatient prospective payment system. These include add-on payments for treating a disproportionate share (DSH) of low-income patients, as well as for covering costs associated with care provided by medical residents, known as indirect medical education (IME). While not part of the Inpatient Prospective Payment System, Medicare also pays hospitals directly for the costs of operating residency programs, known as Graduate Medical Education (GME) payments.

- While not part of the Physician Fee Schedule, Medicare also pays for a limited number of drugs that physicians and other health care providers administer. For drugs administered by physicians, which are covered under Part B, Medicare reimburses providers based on a formula set at 106% of the Average Sales Price (ASP), which is the average price to all non-federal purchasers in the U.S, inclusive of rebates (other than rebates paid under the Medicaid program).

- Hospital outpatient departments : Medicare pays hospitals for ambulatory services provided in outpatient departments, using the Hospital Outpatient Prospective Payment System , based on the classification of individual services into Ambulatory Payment Classifications (APC) with similar characteristics and expected costs. Final determination of Medicare payments for outpatient department services is complex. It incorporates both individual service payments and payments “packaged” with other services, partial hospitalization payments, as well as numerous exceptions, such as payments for new technologies. Medicare payment rates for services provided in hospital outpatient departments are typically higher than for similar services provided in physicians’ offices, and evidence indicates that providers have shifted the billing of services to higher-cost settings . There is bipartisan interest in proposals to expand so-called “site-neutral” payments, meaning that Medicare would align payment rates for the same service across settings.

- Skilled Nursing Facilities (SNFs) : SNFs are freestanding or hospital-based facilities that provide post-acute inpatient nursing or rehabilitation services. Medicare pays SNFs based on the Skilled Nursing Facility Prospective Payment System , and payments to SNFs are determined using a base payment rate, adjusted for geographic differences in labor costs, case mix, and, in some cases, length of stay. Daily rates consider six care components – nursing, physical therapy, occupational therapy, speech–language pathology services, nontherapy ancillary services and supplies, and non–case mix (room and board services).

How Does Medicare Pay Private Plans in Medicare Advantage and Medicare Part D?

Medicare Advantage . Medicare pays insurers offering Medicare Advantage plans a set monthly amount per enrollee. The payment is determined through an annual process in which plans submit “bids” for how much they estimate it will cost to provide benefits covered under Medicare Parts A and B for an average beneficiary. The bid is compared to a county “benchmark”, which is the maximum amount the federal government will pay for a Medicare Advantage enrollee and is a percentage of estimated spending in traditional Medicare in the same county, ranging from 95 percent in high-cost counties to 115 percent in low-cost counties. When the bid is below the benchmark in a given county, plans receive a portion of the difference (“the rebate”), which they must use to lower cost sharing, pay for extra benefits, or reduce enrollees’ Part B or Part D premiums. Payments to plans are risk adjusted, based on the health status and other characteristics of enrollees, including age, sex, and Medicaid enrollment. In addition, Medicare adopted a quality bonus program that increases the benchmark for plans that receive at least four out of five stars under the quality rating system, which increases plan payments.

Generally, Medicare pays more to private Medicare Advantage plans for enrollees than their costs would be in traditional Medicare. The Medicare Payment Advisory Commission (MedPAC) reports that while it costs Medicare Advantage insurers 82% of what it costs traditional Medicare to pay for Medicare-covered services, plans receive payments from CMS that are 122% of spending for similar beneficiaries in traditional Medicare, on average. The higher spending stems from features of the formula used to determine payments to Medicare Advantage plans, including setting benchmarks above traditional Medicare spending in half of counties and higher benchmarks due to the quality bonus program, resulting in bonus payments of nearly $13 billion in 2023 . This amount is more than four times greater than spending on bonus payments in 2015 (Figure 12).

The higher spending in Medicare Advantage is also related to the impact of coding intensity, where Medicare Advantage enrollees look sicker than they would if they were in traditional Medicare, resulting in plans receiving higher risk adjustments to their monthly per person payments, translating to an estimated $83 billion in excess payments to plans in 2024 .

Higher payments to Medicare Advantage allow plans to offer extra benefits attractive to enrollees. However, these benefits come at a cost to all beneficiaries through higher premiums and contribute to the strain on the Medicare Part A Hospital Insurance Trust Fund . (See “How Much Does Medicare Spend and How Is the Program Financed? ” for additional information . )

Medicare Part D . Medicare pays Part D plans, both stand-alone prescription drug plans and Medicare Advantage plans that offer drug coverage, based on an annual competitive bidding process. Plans submit bids yearly to Medicare for their expected costs of providing the drug benefit plus administrative expenses. Plans receive a direct subsidy per enrollee, which is risk-adjusted based on the health status of their enrollees, plus reinsurance payments from Medicare for the highest-cost enrollees and adjustments for the low-income subsidy (LIS) status of their enrollees. (Unlike Medicare Advantage, there is no quality bonus program that provides higher payments to Part D plans with higher Part D quality ratings.) Risk-sharing arrangements with the federal government (“risk corridors”) limit plans' potential total losses or gains.

Under reinsurance, Medicare currently subsidizes 80% of total drug spending incurred by Part D enrollees with relatively high drug spending above the catastrophic coverage threshold and plans pay 20% in 2024 (up from 15% in prior years). In the aggregate, Medicare’s reinsurance payments to Part D plans accounted for close to half of total Part D spending (48%) in 2022, up from 14% in 2006 (increasing from $6 billion in 2006 to $57 billion in 2022 ) (Figure 13).

Beginning in 2025, under a provision of the Inflation Reduction Act, Medicare’s share of costs for brand-name drugs above the catastrophic threshold will decrease from 80% to 20% , shifting more of the responsibility for these costs to Part D plans and drug manufacturers. (See “What Is the Medicare Part D Prescription Drug Benefit?” for more detail on plan liability under various phases of the Part D benefit and more information on changes to Part D included in the Inflation Reduction Act .)

For 2024, Medicare’s actuaries estimate that Part D plans will receive direct subsidy payments averaging $383 per enrollee overall, $2,588 for enrollees receiving the LIS, and $1,153 in reinsurance payments for very high-cost enrollees.

What Is Medicare Doing to Promote Alternative Payment Models?

While Medicare has traditionally paid providers on a fee-for-service basis, the program is implementing various alternative payment models designed to tie payments under traditional Medicare to provider performance on quality and spending. Although the overarching goals of these various models are similar— improving the quality and affordability of patient care , advancing health equity, and reducing health care costs—the specific aims vary by model.

A notable example of an alternative payment model within Medicare is the Medicare Shared Savings Program (MSSP) , a permanent accountable care organization (ACO) program in traditional Medicare established by the Affordable Care Act (ACA) that offers financial incentives to providers for meeting or exceeding savings targets and quality goals. ACOs are groups of doctors, hospitals, and other health care providers who voluntarily form partnerships to collaborate and share accountability for the quality and cost of care delivered to their patients. The MSSP currently offers different participation options to ACOs, allowing these organizations to share in savings only or both savings and losses, depending on their level of experience and other factors.

ACOs have a defined patient population for the purpose of calculating annual savings or losses. Beneficiaries in traditional Medicare may choose to align themselves to an ACO ( voluntary alignment ) or may be assigned to a particular ACO based on where they received a plurality of their primary care services. In either case, beneficiaries are free to seek treatment from any provider who accepts Medicare and are not limited to ACO-affiliated providers. This contrasts with enrollment in Medicare Advantage, where beneficiaries are generally limited to seeing providers in their plan’s network or face higher out-of-pocket costs for seeing out-of-network providers.

In 2022, the Medicare Shared Savings Program saved Medicare an estimated $1.8 billion relative to annual spending targets. As of 2023, there are 456 MSSP ACOs nationwide , with over 573,000 participating clinicians and 10.9 million beneficiaries aligned to MSSP ACOs (Figure 14).

The ACA also established the Center for Medicare and Medicaid Innovation (CMMI, also known as the Innovation Center) , an operating center within the Centers for Medicare & Medicaid Services tasked with designing and testing alternative payment models to address concerns about rising health care costs, quality of care, and inefficient spending within the Medicare, Medicaid, and CHIP programs. Since its start in 2010, CMMI has launched more than 70 models across six different categories, including accountable care models, disease-specific models, health plan models, and others (Figure 15). CMMI models are designed to be tested over a limited number of years, but Congress gave CMMI the authority to expand models nationwide permanently if they meet certain quality and savings criteria . As of 2023, six models have shown statistically significant savings, and four have met the requirements for permanent expansion into the wider Medicare program, including the Medicare Diabetes Prevention Program and the Home Health Value-Based Purchasing Model .

According to the Congressional Budget Office (CBO), the activities of CMMI increased federal spending by $5.4 billion from 2011 to 2020, which CBO attributes in part to the mixed success of many models at generating sufficient savings to offset their high upfront costs. (CBO had initially projected that CMMI would reduce federal spending by $2.8 billion in its first decade of operation.) However, a review of select CMMI models provides evidence of improvements in care coordination, team-based care, and other care delivery changes, even in the absence of savings. CBO projects that CMMI’s activities will come closer to the breakeven point regarding federal spending over the next decade (2024-2033).

How Much Does Medicare Spend and How Is the Program Financed?

Spending . Medicare plays a significant role in the health care system, accounting for 21% of total national health spending in 2021, 26% of spending on both hospital care and physician and clinical services, and 32% of spending on retail prescription drug sales (Figure 16).

In 2022, Medicare spending, net of income from premiums and other offsetting receipts, totaled $747 billion and accounted for 12% of the federal budget —a similar share as spending on Medicaid, the ACA, and the Children’s Health Insurance Program combined, and defense spending (Figure 17).

In 2023, Medicare benefit payments are estimated to total $1 trillion , up from $583 billion in 2013 (including spending for Part A, Part B, and Part D benefits in both traditional Medicare and Medicare Advantage). Medicare spending per person has also grown, increasing from $5,800 to $15,700 between 2000 and 2022 – or 4.6% average annual growth over the 22-year period. In recent years, however, growth in Medicare spending per person has been lower in Medicare than in private health insurance .

Spending on Medicare Part A benefits (mainly hospital inpatient services) has decreased as a share of total Medicare spending over time as care has shifted from inpatient to outpatient settings, leading to an increase in spending on Part B benefits (including physician services, outpatient services, and physician-administered drugs). Spending on Part B services now accounts for the largest share of Medicare benefit spending (49% in 2023) (Figure 18). Moving forward, Medicare spending on physician services and other services covered under Part B is expected to grow to more than half of total Medicare spending by 2033, while spending on hospital care and other services covered under Part A is projected to decrease further as a share of the total.

Payments to Medicare Advantage plans for Part A and Part B benefits tripled as a share of total Medicare spending between 2013 and 2023, from $145 billion to $454 billion , partly due to steady enrollment growth in Medicare Advantage plans. Growth in spending on Medicare Advantage also reflects that Medicare pays more to private Medicare Advantage plans for enrollees than their costs in traditional Medicare, on average. (See “ How Does Medicare Pay Private Plans in Medicare Advantage and Medicare Part D? ” for additional information.) These higher payments have contributed to growth in spending on Medicare Advantage and overall Medicare spending. In 2023, just over half of all Medicare program spending for Part A and Part B benefits was for Medicare Advantage plans, up from just under 30% in 2013 . Between 2023 and 2033, Medicare Advantage payments are projected to total nearly $8 trillion, $2 trillion more than spending under traditional Medicare (Figure 19).

Financing . Medicare funding, which totaled $989 billion in 2022, comes primarily from general revenues (43%), payroll tax revenues (36%), and premiums paid by beneficiaries (16%). Other sources include taxes on Social Security benefits, payments from states, and interest.

The different parts of Medicare are funded in varying ways, and revenue sources dedicated to one part of the program cannot be used to pay for another part (Figure 20).

- Part A, which covers inpatient hospital stays, skilled nursing facility (SNF) stays, some home health visits, and hospice care, is financed primarily through a 2.9% tax on earnings paid by employers and employees (1.45% each). Higher-income taxpayers (more than $200,000 per individual and $250,000 per couple) pay a higher payroll tax on earnings (2.35%). Payroll taxes accounted for 89% of Part A revenue in 2022.

- Part B, which covers physician visits, outpatient services, preventive services, and some home health visits, is financed primarily through a combination of general revenues (71% in 2022) and beneficiary premiums (28%) (and 1% from interest and other sources). The standard Part B premium that most Medicare beneficiaries pay is calculated as 25% of annual Part B spending, while beneficiaries with annual incomes over $103,000 per individual or $206,000 per couple pay a higher, income-related Part B premium reflecting a larger share of total Part B spending, ranging from 35% to 85%.

- Part D, which covers outpatient prescription drugs, is financed primarily by general revenues (74%) and beneficiary premiums (14%), with an additional 11% of revenues coming from state payments for beneficiaries enrolled in both Medicare and Medicaid. Higher-income enrollees pay a larger share of the cost of Part D coverage, as they do for Part B.

- The Medicare Advantage program (sometimes referred to as Part C) does not have its own separate revenue sources. Funds for Part A benefits provided by Medicare Advantage plans are drawn from the Medicare HI trust fund. Funds for Part B and Part D benefits are drawn from the Supplementary Medical Insurance (SMI) trust fund. Beneficiaries enrolled in Medicare Advantage plans pay the Part B premium and may pay an additional premium if required by their plan. In 2023, 73% of Medicare Advantage enrollees pay no additional premium.

Measuring the level of reserves in the Medicare Hospital Insurance trust fund, out of which Part A benefits are paid, is a common way of measuring Medicare's financial status. Each year, Medicare’s actuaries provide an estimate of the year when the reserves are projected to be fully depleted. In 2024, the Medicare Trustees projected sufficient funds would be available to pay for Part A benefits in full until 2036, 12 years from now. At that point, in the absence of Congressional action, Medicare will be able to pay 89% of costs covered under Part A using payroll tax revenues. Since 2010, the projected year of trust fund reserve depletion has ranged from 5 years out (in 2021) to 19 years out (in 2010) (Figure 21).

The level of reserves in the Part A Trust Fund is affected by growth in the economy, which affects revenue from payroll tax contributions, health care spending and utilization trends, and demographic trends: an increasing number of beneficiaries as the population ages, especially between 2010 and 2030 when the baby boom generation reaches Medicare eligibility age, and a declining ratio of workers per beneficiary making payroll tax contributions.

Part B and Part D do not have financing challenges similar to Part A, because both are funded by beneficiary premiums and general revenues that are set annually to match expected outlays. However, future increases in spending under Part B and Part D will require increases in general revenue funding and higher premiums paid by beneficiaries.

Future Outlook

Looking to the future, Medicare faces a number of challenges from the perspective of beneficiaries, health care providers and private plans, and the federal budget. These include:

- How best to address the fiscal challenges arising from an aging population and increasing health care costs through spending reductions and/or revenue increases.

- Whether and how to improve coverage for Medicare beneficiaries, including an out-of-pocket limit in traditional Medicare, enhanced financial support for lower-income beneficiaries, and additional benefits, such as dental and vision.

- How to control spending while ensuring fair and adequate payments to hospitals, physicians and other providers, and Medicare Advantage plans, including whether and how to reduce overpayments to Medicare Advantage plans.

- How to address the implications for traditional Medicare of rapid growth in Medicare Advantage enrollment.

Consideration of possible changes to Medicare will involve careful deliberation about the potential implications for federal spending and taxpayers, the solvency of the Medicare Hospital Insurance trust fund, total health care spending, the affordability of health care for Medicare’s growing number of beneficiaries, many of whom have limited incomes, and access to high-quality medical care.

- What to Know about Medicare Spending and Financing

- An Overview of the Medicare Part D Prescription Drug Benefit

- Medicare Advantage in 2023: Enrollment Update and Key Trends

- Key Facts About Medicare Part D Enrollment and Costs in 2023

- What to Know about the Medicare Open Enrollment Period and Medicare Coverage Options

- Explaining the Prescription Drug Provisions in the Inflation Reduction Act

- A Snapshot of Sources of Coverage Among Medicare Beneficiaries

- Spending on Medicare Advantage Quality Bonus Payments Will Reach at Least $12.8 Billion in 2023

- FAQs about the Inflation Reduction Act’s Medicare Drug Price Negotiation Program

- How Many Physicians Have Opted Out of the Medicare Program?

- The Facts About Medicare Spending

- Medicare Part D in 2024: A First Look at Prescription Drug Plan Availability, Premiums, and Cost Sharing

- Medicare Advantage 2024 Spotlight: First Look

- Income and Assets of Medicare Beneficiaries in 2023

Cubanski, Juliette, Freed, Meredith, Ochieng, Nancy, Cottrill, Alex, Fuglesten Biniek, Jeannie, & Neuman, Tricia, Medicare 101. In Altman, Drew (Editor), Health Policy 101, (KFF, May 28, 2024) https://www.kff.org/health-policy-101-medicare/ (date accessed).

More From Forbes

Many layers of rules lead to medicare confusion.

- Share to Facebook

- Share to Twitter

- Share to Linkedin

Multiple layers of Medicare rules can lead to confusion and frustration.

I recently did a webinar on Medicare basics for over 600 consumers. During the Q&A session, I realized why Medicare is so confusing. The first question I was asked, “When are the seven months I have to enroll in Medicare?” highlights the reason.

You would think there should be one enrollment period for everyone, right? There was back when Medicare started. By 1966, one year after Medicare became official, 19 million people had enrolled . (Just a comment about that. Even with all the computers and automation, could you imagine the scene in today’s world if Social Security had to process 19 million applications in 12 months or 52,000 a day?)

Life was no doubt simpler in the 1960s. Those turning 65 were either retiring or already retired and qualified for full Social Security benefits. There was one Medicare for everyone. But then life started getting complicated. People were living longer and retiring later. Medicare started interacting with all kinds of different situations – COBRA, retiree plans, SSDI, Medicare Advantage, Part D drug plans – with all kinds of different rules and policies, each one layered upon those that came before.

The IEP and Layers of Confusion

Back to the question. The Initial Enrollment Period is a seven-month period during which those turning 65 can decide what to do about Medicare. When this period starts and ends depends on one’s date of birth. Consider the example of two twins. One is born at 11:55 PM on October 1 and the second at 12:05 AM on October 2. Only ten minutes separate their births but they will have two different IEPs.

NSA Warns iPhone And Android Users To Turn It Off And On Again

‘godzilla minus one’ is coming to netflix this weekend, but there’s a catch, sudden u s dollar collapse fear predicted to trigger a 15 7 trillion etf bitcoin price gold flip as countries go dual currency.

For the second twin and everyone born on any day of the month, except the first, the IEP begins three months before and ends three months after the birth month. Enroll during the first three months and Medicare begins the first day of the birth month. Enroll during the last four months and coverage starts the first day of the next month.

Medicare treats those born on the first day of the month as if they were born the last day of the previous month. The IEP starts four months before and ends two months after the birth month. Enroll during the first three months and Medicare takes effect the month before the birth month. Sign up during the last four months and Medicare begins the next month.

In my example, the IEP for the first-born twin would be June 1-December 30 and, for the second twin, July 1-January 31. These twins may be identical in every respect, except for Medicare.

More Enrollment Period Layers

Now, if these twins decide to continue working and delay Medicare enrollment, they will confront another layer, with different rules: the Part B Special Enrollment Period . This SEP gives those retiring past age 65 an opportunity to enroll in Medicare without delay or penalty. It is an eight-month period that begins with the end of coverage or employment, whichever comes first.

If, for whatever reason, the twins miss their IEP or Part B SEP, they would face another layer, the General Enrollment Period . This is a three-month period from January 1-March 31 every year. Medicare takes effect the first of the month after enrolling and there can be late enrollment penalties.

Besides these three periods for signing up for Medicare Part A and/or Part B, there are dozens of other enrollment periods. There are three open enrollment periods: Open Enrollment (October 15-December 7), Medicare Advantage Open Enrollment (January 1-March 31), and Medigap Open Enrollment (six months beginning when a person is 65 or older and enrolled in Part B). Then, Medicare.gov addresses over 30 special enrollment situations , along with more enrollment periods for all kinds of situations.

I could go on but you get the idea. Medicare involves layer upon layer of rules, policies and procedures, leading to confusion. If you are trying to figure out what to do in a particular situation, remember to cut through the layers to get to the one that works for you. Then, you can take a break and enjoy a slice of seven-layer cake.

- Editorial Standards

- Reprints & Permissions

Join The Conversation

One Community. Many Voices. Create a free account to share your thoughts.

Forbes Community Guidelines

Our community is about connecting people through open and thoughtful conversations. We want our readers to share their views and exchange ideas and facts in a safe space.

In order to do so, please follow the posting rules in our site's Terms of Service. We've summarized some of those key rules below. Simply put, keep it civil.

Your post will be rejected if we notice that it seems to contain:

- False or intentionally out-of-context or misleading information

- Insults, profanity, incoherent, obscene or inflammatory language or threats of any kind

- Attacks on the identity of other commenters or the article's author

- Content that otherwise violates our site's terms.

User accounts will be blocked if we notice or believe that users are engaged in:

- Continuous attempts to re-post comments that have been previously moderated/rejected

- Racist, sexist, homophobic or other discriminatory comments

- Attempts or tactics that put the site security at risk

- Actions that otherwise violate our site's terms.

So, how can you be a power user?

- Stay on topic and share your insights

- Feel free to be clear and thoughtful to get your point across

- ‘Like’ or ‘Dislike’ to show your point of view.

- Protect your community.

- Use the report tool to alert us when someone breaks the rules.

Thanks for reading our community guidelines. Please read the full list of posting rules found in our site's Terms of Service.

An official website of the United States government

Here's how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

What should I do if I get a call claiming there is a problem with my Social Security number or account?

Plan for retirement

Apply for your monthly retirement benefit any time between age 62 and 70. We calculate your payment by looking at how much you've earned throughout your life. The amount will be higher the longer you wait to apply, up until age 70. The timing is up to you and should be based on your own personal needs.

Get an estimate Get an estimate

Check your Social Security account to see how much you'll get when you apply at different times between age 62 and 70.

- View estimate

- Create account

Other factors that can affect your amount

Paying for healthcare.

You're eligible to get Medicare at age 65 and the sign-up process for Part A (hospital insurance) and Part B (medical insurance) is completed through us. If you decide to sign up for Part B, the cost will be taken out of your monthly benefit amount. Be sure to plan ahead for that reduction.

Determine when to sign up for Medicare

Withholding taxes from benefit payments

You may pay federal income taxes on your benefits if your combined income (50% of your benefit amount plus any other earned income) exceeds $25,000/year filing individually or $32,000/year filing jointly. You can pay the IRS directly or have taxes withheld from your payment.

Request to withhold taxes

Continuing to work