Online banking services: a meta-analytic review and assessment of the impact of antecedents and consequents on satisfaction

- Original Article

- Published: 31 October 2018

- Volume 23 , pages 168–178, ( 2018 )

Cite this article

- Fernando de Oliveira Santini 1 ,

- Wagner Junior Ladeira 1 ,

- Claudio Hoffmann Sampaio 2 &

- Marcelo Gattermann Perin 2

512 Accesses

7 Citations

Explore all metrics

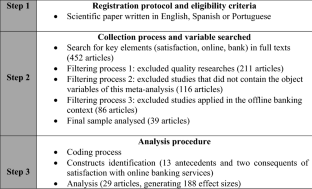

This paper provides a meta-analysis of the generalizations in the relationships between the antecedents and consequents of satisfaction with online banking services. In total, 118 observations were analysed, with a sample of 49,607 respondents in 39 published articles from studies indexed in ten databases (Jstor, Emerald, PsycINFO, Taylor & Francis, Elsevier Science Direct, Scopus, ProQuest, SciELO, Google Scholar and EBSCO). Specifically, for the data analysis, we used the correlation coefficient r (plus χ 2 , f test, t test, z test and β values). The results showed that constructs related to uncertainty, as evoked by online devices, system performance, quality of device content and online banking device structures, are significant and positive antecedents of consumer satisfaction. We also found that satisfaction with online banking services promotes trust and loyalty. Finally, we also detected that the relationship between reliability, satisfaction and service quality is stronger among Western banking consumers.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Similar content being viewed by others

Customer experience: fundamental premises and implications for research

Larissa Becker & Elina Jaakkola

Customer engagement in social media: a framework and meta-analysis

Fernando de Oliveira Santini, Wagner Junior Ladeira, … Barry J. Babin

The influence of social media eWOM information on purchase intention

Choi-Meng Leong, Alexa Min-Wei Loi & Steve Woon

Ahmad, A.M.K., and H.A. Al-Zúbi. 2011. E-banking functionality and outcomes of customer satisfaction: An empirical investigation. International Journal of Marketing Studies 3(1): 50–65.

Google Scholar

Aldas-Manzano, J., C. Ruiz-Mafe, S. Sanz-Blas, and C. Lassala-Navarré. 2011. Internet banking loyalty: Evaluating the role of trust, satisfaction, perceived risk and frequency of use. The Service Industries Journal 31(7): 1165–1190.

Article Google Scholar

Ahmad Al-Hawari, M. 2014. Does customer sociability matter? Differences in e-quality, e-satisfaction, and e-loyalty between introvert and extravert online banking users. Journal of Services Marketing 28(7): 538–546.

Ariff, M.S.M., L.O. Yun, N. Zakuan, and K. Ismail. 2013. The impacts of service quality and customer satisfaction on customer loyalty in internet banking. Procedia-Social and Behavioral Sciences 81: 469–473.

Asfour, H.K., and S.I. Haddad. 2014. The impact of mobile banking on enhancing customers’ E-satisfaction: An empirical study on commercial banks in Jordan. International Business Research 7(10): 145–168.

Butt, M.M., and M. Aftab. 2013. Incorporating attitude towards IT banking in an integrated service quality, satisfaction, trust and loyalty model in online Islamic banking context. International Journal of Bank Marketing 31(1): 6–23.

Casaló, L.V., C. Flavián, and M. Guinalíu. 2008. The role of satisfaction and website usability in developing customer loyalty and positive word-of-mouth in the e-banking services. International Journal of Bank Marketing 26(6): 399–417.

Cockrill, A., M.M. Goode, and A. Beetles. 2009. The critical role of perceived risk and trust in determining customer satisfaction with automated banking channels. Services Marketing Quarterly 30(2): 174–193.

Cooil, B., T.L. Keiningham, L. Aksoy, and M. Hsu. 2007. A longitudinal analysis of customer satisfaction and share of wallet: Investigating the moderating effect of customer characteristics. Journal of Marketing 71(1): 67–83.

Culiberg, B., and I. Rojek. 2011. Identifying service quality dimensions as antecedents to customer satisfaction in retail banking. Economic and Business Review 12(3): 151–166.

DeLone, W.H., and E.R. McLean. 1992. Information systems success: The quest for the dependent variable. Information Systems Research 3(1): 60–95.

De Matos, C.A., and C.A.V. Rossi. 2008. Word-of-mouth communications in marketing: A meta-analytic review of the antecedents and moderators. Journal of the Academy of Marketing Science 36(4): 578–596.

Dickersin, K. 2002. Systematic reviews in epidemiology: Why are we so far behind? International Journal of Epidemiology 31(1): 6–12.

Fern, E.F., and K.B. Moroe. 1996. Effect-size estimates: Issues and problems in interpretation. Journal of Consumer Research 23(2): 89–105.

Fiebig, É.A., and E.C. de Freitas. 2011. Canais de atendimento, satisfação e lucratividade de clientes em serviços: um caso bancário. Revista eletrônica de Administração, Porto Alegre 70: 742–775.

Hedges, L.V., and I. Olkin. 1985. Statistical methods for meta-analysis . Orlando, FL: Academic Press.

Herington, C., and S. Weaven. 2009. E-retailing by banks: e-service quality and its importance to customer satisfaction. European Journal of Marketing 43(9/10): 1220–1231.

Hofstede, G. 1994. The business of international business is culture. International Business Review 3(1): 1–14.

Hunter, J.E., and F.L. Schmidt. 2004. Methods of meta-analysis: Correcting error and bias in research findings . Thousand Oaks: Sage.

Book Google Scholar

Jamal, A. 2004. Retail banking and customer behaviour: a study of self concept, satisfaction and technology usage. The International Review of Retail, Distribution and Consumer Research 14(3): 357–379.

Kaura, V. 2013. Antecedents of customer satisfaction: A study of Indian public and private sector banks. International Journal of Bank Marketing 31(3): 167–186.

Kirca, A.H., S. Jayachandran, and W.O. Bearden. 2005. Market orientation: A meta-analytic review and assessment of its antecedents and impact on performance. Journal of marketing 69(2): 24–41.

Ladeira, W.J., F.D.O. Santini, C.F. Araujo, and C.H. Sampaio. 2016. A meta-analysis of the antecedents and consequences of satisfaction in tourism and hospitality. Journal of Hospitality Marketing & Management 25(8): 975–1009.

Lai, S.F., Y.C. Hsiao, Y.F. Yang, Y.C. Huang, and I.C. Lee. 2009. The mediating influence of service quality satisfaction and information trust on the e-CRM process model: An empirical bank marketing research. The Journal of American Academy of Business 15(1): 243–253.

Liao, Z., and M.T. Cheung. 2002. Internet-based e-banking and consumer attitudes: An empirical study. Information & Management 39(4): 283–295.

Liébana-Cabanillas, F., F. Muñoz-Leiva, and F. Rejón-Guardia. 2013. The determinants of satisfaction with e-banking. Industrial Management & Data Systems 113(5): 750–767.

Mano, H., and R.L. Oliver. 1993. Assessing the dimensionality and structure of the consumption experience: Evaluation, feeling, and satisfaction. Journal of Consumer research 20(3): 451–466.

Mansori, S., G.G. Tyng, and Z.M.M. Ismail. 2014. Service recovery, Satisfaction and customers’ post service behavior in the Malaysian Banking Sector. Management Dynamics in the knowledge economy 2(1): 5–20.

Marakarkandy, B., and N. Yajnik. 2013. Re-examining and empirically validating the End User Computing Satisfaction models for satisfaction measurement in the internet banking context. International Journal of Bank Marketing 31(6): 440–455.

Masrek, M.N., I.S. Mohamed, N.M. Daud, and N. Omar. 2014. Technology trust and mobile banking satisfaction: A case of Malaysian consumers. Procedia-Social and Behavioral Sciences 129: 53–58.

McCullough, J., L.S. Heng, and G.S. Khem. 1986. Measuring the marketing orientation of retail operations of international banks. International Journal of Bank Marketing 4(3): 9–18.

Methlie, L.B., and H. Nysveen. 1999. Loyalty of on-line bank customers. Journal of Information Technology 14(4): 375–386.

Moher, D., A. Liberati, J. Tetzlaff, and D.G. Altman. 2009. Preferred reporting items for systematic reviews and meta-analyses: The PRISMA statement. Annals of Internal Medicine 151(4): 264–269.

Momeni, M., B. Kheiry, and M. Dashtipour. 2013. Analysis the effects of electronic banking on customer satisfaction and loyalty (Case study: Selected branches of Melli Bank in Tehran). Interdisciplinary Journal of Contemporary Research Business 4(12): 230–241.

Morgan, R.M., and S.D. Hunt. 1994. The commitment–trust theory of relationship marketing. The Journal of Marketing 58(3): 20–38.

Narteh, B. 2013. Determinants of students’ loyalty in the Ghanaian banking industry. The TQM Journal 25(2): 153–169.

Nguyen, N.T., T.T. Tran, and C.N. Wang. 2014. An empirical study of customer satisfaction towards bank payment card service quality in Ho Chi Minh banking branches. International Journal of Economics and Finance 6(5): 170–181.

Oliver, R.L. 1981. Measurement and evaluation of satisfaction processes in retail settings. Journal of Retailing 57(3): 25–48.

Oliver, R.L. 1997. Satisfaction: A behavioral perspective on the consumer . New York, NY: Irwin-McGraw-Hill.

Oliver, R. L. 2010. Customer satisfaction. Wiley International Encyclopedia of Marketing.

Oliver, R.L., and W.S. DeSarbo. 1988. Response determinants in satisfaction judgments. Journal of Consumer Research 14: 495–507.

Pan, Y., and G.M. Zinkhan. 2006. Determinants of retail patronage: A meta-analytical perspective. Journal of Retailing 82(3): 229–243.

Pikkarainen, K., T. Pikkarainen, H. Karjaluoto, and S. Pahnila. 2006. The measurement of end-user computing satisfaction of online banking services: Empirical evidence from Finland. International Journal of Bank Marketing 24(3): 158–172.

Ping, C.T.Y., N.M. Suki, and N.M. Suki. 2012. Service quality dimension effects on customer satisfaction towards e-banking. Interdisciplinary Journal of Contemporary Research In Business 4(4): 741.

Ramseook-Munhurrun, P., and P. Naidoo. 2011. Customers’ perspectives of service quality in internet banking. Services Marketing Quarterly 32(4): 247–264.

Roche I.D. 2014. An empirical investigation of internet banking service quality, corporate image and the impact on customer satisfaction; with special reference to Sri Lankan banking sector. Journal of Internet Banking and Commerce 19(2).

Rod, M., N.J. Ashill, J. Shao, and J. Carruthers. 2009. An examination of the relationship between service quality dimensions, overall internet banking service quality and customer satisfaction: A New Zealand study. Marketing Intelligence & Planning 27(1): 103–126.

Rosa, F., and Kamakura, W. 2002. Electronic service channels and customer satisfaction, retention and profitability in banks: a study at the individual level. Annual Meeting of the National Association of Graduate Programs in Administration.

Rostami, A., C. Valmohammadi, and J. Yousefpoor. 2014. The relationship between customer satisfaction and customer relationship management system; a case study of Ghavamin Bank. Industrial and Commercial Training 46(4): 220–227.

Rosenthal, R., and D.B. Rubin. 1991. A simple general purpose display of magnitude and experimental effect. Journal of Educational Psychology 74(2): 166–169.

Sadeghi, T., and K.H. Hanzaee. 2010. Customer satisfaction factors (CSFs) with online banking services in an Islamic country: IR Iran. Journal of Islamic Marketing 1(3): 249–267.

Sampaio, C.H., W.J. Ladeira, and F.D.O. Santini. 2017. Apps for mobile banking and customer satisfaction: a cross-cultural study. International Journal of Bank Marketing 35(7): 1133–1153.

Sanayei, A., and H. Jamshidi. 2011. An analysis of the factors affecting customers satisfaction and trust in mobile banking (Case study: Branches of Bank Mellat in Isfahan. Interdisciplinary Journal of Contemporary Research Business 3(7): 440–452.

Sanayei, A., B. Ranjbarian, A. Shaemi, and A. Ansari. 2011. Determinants of customer loyalty using mobile payment services in Iran. Interdisciplinary Journal of Contemporary Research in Business 3(6): 22–34.

Sanchez-Franco, M.J. 2009. The moderating effects of involvement on the relationships between satisfaction, trust and commitment in e-banking. Journal of Interactive Marketing 23(3): 247–258.

Santouridis, I., and M. Kyritsi. 2014. Investigating the determinants of internet banking adoption in Greece. Procedia Economics and Finance 9: 501–510.

Seiler, V., M. Rudolf, and T. Krume. 2013. The influence of socio-demographic variables on customer satisfaction and loyalty in the private banking industry. International Journal of Bank Marketing 31(4): 235–258.

Shergill, G.S., and B. Li. 2005. Internet banking-an empirical investigation of a trust and loyalty model for New Zealand banks. Journal of Internet commerce 4(4): 101–118.

Shirzad, E., and J. Beikzad. 2014. E-banking service quality and its relationship with customer satisfaction at Mehr-Eqtesad Bank in Khuzestan. Arabian Journal of Business and Management Review 3(11).

Singh, J., and P. Kaur. 2013. Customers’ attitude towards technology based services provided by select Indian banks: Empirical analysis. International Journal of Commerce and Management 23(1): 56–68.

Thakur, R. 2014. What keeps mobile banking customers loyal? International Journal of Bank Marketing 32(7): 628–646.

Tong, C., S.K.S. Wong, and K.P.H. Lui. 2012. The influences of service personalization, customer satisfaction and switching costs on E-Loyalty. International Journal of Economics and Finance 4(3): 105–114.

Tsai, H.T., J.L. Chien, and M.T. Tsai. 2014. The influences of system usability and user satisfaction on continued Internet banking services usage intention: Empirical evidence from Taiwan. Electronic Commerce Research 14: 1–33.

Unyathanakorn, K., P.C.L. Kasikornbank, and N. Rompho. 2014. Factors affecting customer satisfaction in online banking service. Journal of Marketing Development and Competitiveness 8(2): 50.

Yoon, C. 2010. Antecedents of customer satisfaction with online banking in China: The effects of experience. Computers in Human Behavior 26(6): 1296–1304.

Zeithaml, V.A., A. Parasuraman, and A. Malhotra. 2002. Service quality delivery through web sites: A critical review of extant knowledge. Journal of the Academy of Marketing Science 30(4): 362–375.

Zhu, Y.Q., and H.G. Chen. 2012. Service fairness and customer satisfaction in Internet banking: Exploring the mediating effects of trust and customer value. Internet Research 22(4): 482–498.

Download references

Author information

Authors and affiliations.

University of the Vale do Rio dos Sinos, Av. Unisinos, 950, São Leopoldo, RS, Zip Code: 93022-000, Brazil

Fernando de Oliveira Santini & Wagner Junior Ladeira

Pontifical Catholic University of Rio Grande do Sul, Av. Ipiranga, 6681, Porto Alegre, RS, Zip Code: 90619-900, Brazil

Claudio Hoffmann Sampaio & Marcelo Gattermann Perin

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Fernando de Oliveira Santini .

Rights and permissions

Reprints and permissions

About this article

de Oliveira Santini, F., Ladeira, W.J., Sampaio, C.H. et al. Online banking services: a meta-analytic review and assessment of the impact of antecedents and consequents on satisfaction. J Financ Serv Mark 23 , 168–178 (2018). https://doi.org/10.1057/s41264-018-0059-4

Download citation

Revised : 14 October 2018

Published : 31 October 2018

Issue Date : December 2018

DOI : https://doi.org/10.1057/s41264-018-0059-4

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Satisfaction

- Online services

- Meta-analysis

- Find a journal

- Publish with us

- Track your research

- Bibliography

- More Referencing guides Blog Automated transliteration Relevant bibliographies by topics

- Automated transliteration

- Relevant bibliographies by topics

- Referencing guides

Exploring older people's challenges on online banking/finance systems: Early findings

Proceedings of the 2023 Conference on Human Information Interaction and Retrieval

Related Papers

Bernardo Figueiredo

Sustainability

Christine Garzia

The pandemic increased working from home (WFH) across the world. The implications of such practice for both organisations and employees are not sufficiently clear. This study examines the work-related experiences and attitudes of trade union members WFH in Malta during the first two years of the pandemic and compares them to those of workers not WFH. Data was collected through a mixed-method approach comprising focus groups (11 participants), a survey (340 participants) and interviews (15 participants). The pandemic appears to have affected less the careers of participants WFH than those of their peers. Participants were generally satisfied with their preparedness and productivity when WFH and experienced better work-related attitudes than those not WFH. But since the pandemic started, significant minorities of participants WFH felt lower levels of happiness and higher stress levels and experienced a deterioration in their physical and/or mental health. Participants experienced diff...

International Journal of Case Studies in Business, IT, and Education

Ashlin DSouza

Objective: Digital marketing in the growing world has paved the way for many small-scale businesses to reach every corner of the geographic locations that they could not reach physically. The study focuses on the digital marketing usefulness based on past trends, in forecasting the near future trends in emerging markets when it comes to evolution of digital marketing, the effect of COVID-19 on digital marketing, comparison of past, present and scope for future businessmen to analyse the market to launch digital platform. SWOT analysis is also an integral part of this study as an attempt to dive in depth of positive and negative sides of digital marketing. Methodology: The study on the systematic Evolution of digital marketing is studied depending on the secondary sources with an intention to dive in depth of emergence and evolution of digital marketing. The semi-systematic review is done by studying different reports and articles published from Google Scholar, ResearchGate, SSRN and...

International Journal of Research in Business and Social Science (2147- 4478)

Jacob Mofokeng

Today use of Credit Card even in developing countries has become a common scenario. People use it to shop, pay bills and for online transactions. This study explored the challenges of forensic technology in responding to credit card fraud as an approach used by the South African Police Service (SAPS) in Sedibeng region. This study was carried out utilising a qualitative approach and thirty nine interviews were carried out among officials deployed in the SAPS, community leaders, members of the community and bank managers. The key findings indicated that the challenges in responding to this scourge is that the perpetrators utilise advanced technologies resources (computer hacking software) as opposed to SAPS which does not have systems nor capacity to effectively respond to this crime. The limited resources to respond to this crime adequately. For recommendations; significant emphases should be directed on the promotion of public awareness through public education. The intensive train...

Fiona Maingi

Science, Education and Innovations in the Context of Modern Problems (2790-0169)

Dr. Nasir Mammadov

Governments frequently sanction approaches to boost shoppers from practices with negative externalities to the detriment of purchaser comfort. Understanding the nonmonetary costs, shoppers face suggestions for social welfare assessment and strategy structure; nevertheless, measuring these costs is not possible. The objective of this investigation is to analyse the customer's expectation and social changes towards no plastic bag policy. In this research, the researcher has taken an approach to the disappointment level among the consumers because of no plastics sack policy. A quantitative methodology being utilises to get the information through review from 400 retail customers who visit the retail outlets. The outcome uncovered that all the factors in this investigation show a tremendous relationship towards the client disappointment towards no plastic pack policy. These expands the estimation of the findings and is exceptionally applicable to overcoming any barrier in the process of developing Malaysian retail business.

OLUFUNMILOLA OMOTAYO

Globalization involves interaction, collaboration and integration among individuals, organizations, societies, and governments of different nations. Globalization has enhanced progress in various parts of the world in different ways. Over the years, it has promoted access to education, transportation, communication, health facilities, importation and exportation, employment opportunities, revenue for the government and good standard of living for the people. Other aspects of the society that have been greatly influenced by globalization include trade and technology. Advancement in information technology presents new strategies for engaging in globalized economic activities as it facilitates easy transfer of properties, resources, money and collaboration with distant partners. A major negative impact on the society associated with the use of technology in the contemporary time however, is cybercrime. The paper investigates the various forms of cybercrimes, the effects and prevention ...

International scientific conference "New Challenges in Economic and Business Development – 2021: Post-Crisis Economy" : Proceedings

Andzela Veselova

Global pandemic COVID-19 has increased the level of digitalization which allows public and private sector organizations in the world to employ people remotely outside office premises and crossing borders of the world. Remote work is one of the new employment forms caused by the impact of digitalization, which keeps conquering and strengthening the positions on our daily professional lives. It means extended use of different new employment forms, including the digital transition of administration processes and business management, improvement of digital skills and competences, contributing to development of areas of services and products with higher benefit (Breaugh, Farabee, 2012). Research aims to study basic principles and tendencies of remote work organization based on theoretical aspects, draw conclusions and elaborate proposals for improvement of remote work. In order to achieve the goal, the tasks are as follows: 1) provide the explanation of remote work organization; 2) descr...

ugochukwu onwunyi

The cyberspace and the Nigerian youths have always brought up a lot of debate and controversies coupled with the use of cyber technology which has been remarkably accentuated by many scholars but lately, it has turned out to be a tool of eminent danger which if not properly addressed would cost the entire country its integrity and image. Cybercrime has taken a whole lot of dimensions and would snowboard to catastrophe. This paper shrewdly highlighted the major causations of cybercrime among our youths, like peer influence, bad leadership style among others. The national lockdown due to the Corona Virus pandemic which affected schools and most jobs was high point for engagement in cybercrime among the gullible youths. The study was qualitative in nature as the pool of our literature was drawn from the secondary sources like the newspaper, internet, textbooks, journals etc. The Marxist theory of crime was judiciously utilized in this paper to decipher the cybercrime, its implications ...

Ageing and Society

Amanda Phelan

Financial abuse is a significant form of elder maltreatment and is frequently ranked in the top two most common forms of abuse perpetration. Despite this, it is under-identified, under-reported and under-prosecuted. Financial institutions, such as banks, are important environments for identifying and responding to the financial abuse of older people. Traditionally, banks have not always been part of inter-sectorial responses to financial abuse, yet are important stakeholders. The aim of this study is to explore perceptions and experiences of financial abuse in five national banks. Data were collected from 20 bank managers and five members of the National Safeguarding Committee in the Republic of Ireland. Using thematic analysis, four themes were identified: defining a vulnerable adult; cases of financial abuse of vulnerable adults; case responses to financial abuse of vulnerable adults; and contextual issues. The data demonstrate the multiplicity of manifestations and the complexity...

RELATED PAPERS

Annual Meeting of the Association for Information Science & Technology

Jessica Vitak

Abdulganiyu Onigbanjo

Darius Nassiry

Professor Dimitrios Buhalis

International Journal of Environmental Research and Public Health

International Journal of Geriatric Psychiatry

Anomita Karim

Leolin Anthony

Murphy Smith

Lecture notes in networks and systems

HABEEBULLAH ZAKARIYAH

Proceedings of the International Conference on Business Excellence

Claudia Antal-Vaida

IEEE Access

Dr Gulzar Alam

Management and Accounting Review

Eley Suzana

Book Printing UK Remus House

Dr. Hedda Martina Šola

The Impact of the Fourth Industrial Revolution on Employees in the Banking Sector.

Kacper Gradon

Olena Uvarova

Journal of The Knowledge Economy

erman aminullah

THE ICT SECTOR AS A STRATEGIC PILLAR FOR DIGITAL TRANSFORMATION IN NAMIBIA

Ronel le Grange

International Journal of Research in Community Services

Rini Tresnasari

darina saxunova

Transport Reviews

Toon Zijlstra

ramnath raja

7th International Conference on Banking, Insurance & Business Management

International Conference on Banking, Insurance & Business Management

Information Systems Frontiers

Nnamdi Madichie

Prof. Shreya Oza

Oxford TMCD

Dr. Emre Eren Korkmaz , Turkay Nefes

Bhanu Bhakta Acharya

Muyanja Ssenyonga

Journal of Pure & Applied Sciences

Alhadi Klaib

Zenodo (CERN European Organization for Nuclear Research)

geetika jha

Przegląd Nauk o Obronności

Elena Doval

JPAIR Institutional Research

Alexander Franco Delantar

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

Diane M. Omalley

How Our Essay Service Works

Customer Reviews

IMAGES

VIDEO

COMMENTS

Online banking , also known as internet banking, e-banking or virtual banking, is. an electronic payment system that enables customers of a bank or other financial institution to. conduct a range ...

The term 'electronic banking' is commonly associated with digital banking, mobile banking, online banking, and incumbent banking. In accordance with. Angelakopoulos, G., & Mihiotis, A. (2011), and Chowdhury et al, (2015), one of. the e-banking technology is automated teller machine (ATM), because of it.

This paper provides a meta-analysis of the generalizations in the relationships between the antecedents and consequents of satisfaction with online banking services. In total, 118 observations were analysed, with a sample of 49,607 respondents in 39 published articles from studies indexed in ten databases (Jstor, Emerald, PsycINFO, Taylor & Francis, Elsevier Science Direct, Scopus, ProQuest ...

to mobile banking technology, online service, and payment technology (Korn, Miller, Polsky, 2016). The push for these technologies is driven by the customer's desire to access banking services remotely from anywhere. While it may sound like FinTech and traditional banks are a perfect match, there are some pitfalls and risks involved with

Online banking is a major depart from how traditional banks used to do business thus senior management support is essential for successful delivery of this large-scale change initiative. Daniel (1999) reported a similar finding when she mentioned that lack of senior management support is a major restriction to online banking. Moreover ...

The aim of this thesis is to contribute to this growing area of research by developing a theoretical model based on the Elaboration Likelihood Model for trust in mobile banking, which could significantly extend the reliability and validity of the previous research. The result of the current research is important for mobile banking managers.

for adoption of online banking generally would come after two or three years. In the literature review we will present the studies that provide theoretical and empirical analysis relating our study. After the third decade of the first online banking users in the USA, major studies followed policy implications, rules, laws and banks types.

For the purpose of simplicity and in-depth analysis, the interaction between customers and OB Service Providers (OBSPs) was divided into three phases—Creating, Accessing, and Performing (CAP)—as shown in Fig. 2.Phase 1, the creating phase, is the first step in which customers create their online banking username and password in order to begin accessing their bank account online.

Madu and Madu argued that the online banking must ensure that their employees are knowledgeable about their operation, and courteous in their responses to the customers. Schneider and Perry suggested some web features that help promote the assurance to consumers. For instances, providing detailed banks information (e.g. background, mission ...

Consult the top 50 dissertations / theses for your research on the topic 'Internet banking.'. Next to every source in the list of references, there is an 'Add to bibliography' button. Press on it, and we will generate automatically the bibliographic reference to the chosen work in the citation style you need: APA, MLA, Harvard, Chicago ...

banking is secure enough for E-banking customers as well as the risks encountered by customers when using e-banking in Tanzania. The study involved (52.8%) males and (47.2%) female. data collection methods were questionnaires. The study revealed different impacts affecting the bank customers using e-banking services and products,

Essays in Banking and Corporate Finance Citation Passalacqua, Andrea. 2020. Essays in Banking and Corporate Finance. Doctoral dissertation, ... This dissertation studies the role of different types of frictions in preventing optimal resource allocation in the economy. In chapter 1, I focus on financial frictions and consider

Page | ii CERTIFICATE This is to certify that the dissertation report titled "An Analysis on E-Banking Services" is a bonafide work carried out by Mr. Rohan Tanwar & Mr. Lakshya Singh of Master of Business Administration (Business Analytics) 2018-20 and submitted to University School of Management and Entrepreneurship, Delhi Technological University, Bawana

These services were Internet banking, online shopping, buying or renewing existing insurance policies, 1 https://www.glasgowgg.org.uk Exploring older people's challenges on online banking/finance systems: Early findings Figure 1: Themes and Codes buying transport tickets and tickets for events. Questions2 regarding these services were asked ...

research. This chapter contains the concept of e-banking the types of online banking along with an analysis of the contrast between traditional and online banking. The review further explores how online banking has an impact on traditional banking. The banking sector of any country is considered to be one of the crucial industries for an economy.

OATD.org aims to be the best possible resource for finding open access graduate theses and dissertations published around the world. Metadata (information about the theses) comes from over 1100 colleges, universities, and research institutions. OATD currently indexes 7,434,212 theses and dissertations. About OATD (our FAQ). Visual OATD.org

Dissertations on Banking. Banking can be defined as the business of a bank or someone employed in the banking industry. Used in a non-business sense, banking generally means carrying out activities related to the management of one's bank accounts or finances. View All Dissertation Examples.

Ongoing 24/7 support. Real-time alerts. Free revisions. Free quality check. Free title page. Free bibliography. Any citation style. REVIEWS HIRE. Your Price: .40 per page.