Request Letter to Bank Manager for Education Loan (for Higher Studies)

As a student, sometimes you need to write request letters to bank managers for education purpose related things. The reasons are like sanctioning the loan (or) releasing the installments (or) to increase the loan repayment extension time (or) for educational loan subsidies etc.

For all those reasons, here you can find different formats for educational loan request letters which you can submit to the bank manager.

How to Write a Letter to Bank Manager for Education Loan

- Read bank guidelines regarding the education loan, you can find those details on the bank’s website.

- Ready all the required documents such as admission letter by the college/university, educational certificates, and property document copies if you are applying through collateral.

- Mention your name, course details, college/university name, and place of the college.

- Write how much of an education loan you need.

- Enclose all the supporting documents with the letter.

Education Loan Request Letter 1 (Without Collateral)

The Bank Manager,

Bank Address.

Your address.

Sub: Educational loan regarding.

Dear Sir/Madam,

I am writing this letter to request you to sanction me an education loan of amount __________ Rs to pursue my higher studies.

I got an admission to study ___________(course name) at __________(college/university name) at ____________(city name).

So here I would like to request you to kindly provide me with the educational loan for the above mentioned amount without any collateral and please find the attached copies of my rank card and admission letter along with this letter.

Thanking you.

Yours sincerely,

(Mobile no)

Educational Loan Request Letter 2 (With Collateral)

Address of the Bank.

Sub: Application for student loan.

My name is ____________(your name) writing this request letter to apply for an educational of amount _____________ Rs to study _______________(course name) at ______________(college/university name) at ___________________(city name).

I would like to apply for this loan through collateral by keeping our ___________(land/house/flat etc) located at ______(property location).

The __________(property) is in my father’s name, Mr _____________(your father name) who is working as a government employee.

So kindly grant the education loan for the above said amount, and please find the attached copies of my admission letter, and property copies, and bank statement of my father.

Yours faithfully,

Education Loan Request Letter to Study in Abroad (Format 3)

Name of the Bank,

Sub: Regarding educational loan to study abroad.

Dear Sir / Madam,

My name is _________(your name), S/o / D/o ___________(your father’s name) got an opportunity to study abroad. I got an admission to study _______(course name) at ________(college/university name) in ____________ (country name).

I need an educational loan to pursue my higher studies abroad, so here I am requesting you to kindly provide me the education loan of __________Rs. (loan amount).

And kindly find the attached copies of my admission letter and other educational certificates, and I hope you grant me the loan as soon as possible.

Letter to Bank Manager to Disburse Education Loan Amount (Format 4)

Sub: Education loan disbursement regarding.

I __________(your name) have been sanctioned with an educational loan of amount ________Rs to study MBBS at University of Montreal in Canada .

My First semester exams will be held next month, so kindly disburse the loan amount and please find the attached copies of the semester fee payment slip, and disbursement break-up details.

Kindly credit the loan amount to below mentioned bank details:

- Account name:

- Account no:

- IBAN no:

- SWIFT code:

It will take a maximum of 15 days to get an education loan from the date of application.

In most cases banks will directly credit the education loan directly to institutions bank accounts.

Once the education loan is sanctioned to you, then every installment will be paid within 24-48 banking hours from the time of your request.

- SBI home loan closure letter format sample in Word

- Application format for transfer certificate after 10th/12th.

Leave a Comment Cancel reply

- Scholarships

- Edu loans Education loans Study Abroad Education Loan

- University listing

- More Courier transcripts Articles Events

- Education Loan

Demand Letter For Education Loan

https://www.wemakescholars.com/education-loan/demand-letter-for-education-loan

✓ 3 Types of Demand Letters for Education Loan

✓ Format & Samples of Demand letter for Education Loan

Speak with a Financial officer

Due to high number of loan requests from your region, we are not accepting any new applications at the moment. We believe in offering quality service to our customers.

Sorry for the inconvenience caused.

Please confirm

Are you an Indian national?

Please confirm below details

Contact Number:

Email Address:

OTP verification

Please enter the OTP sent to

Table of content

How to write a demand letter for an education loan, letter to bank manager for education loan disbursement, asking for a demand letter from the university about the tuition expenses, demand letter in case of an issue.

- Need Help? Ask Here!

While getting an education loan from banks is one process, the processes after the loan is sanctioned are a whole other thing. To get some things done, students have to write letters to the bank. These letters are called "Demand Letters".

Demand letters are the letters written by students to the bank (or sometimes to their university) to demand some work to be done. It is a formal way of letting the bank know of your concerns and requesting them to get it sorted.

Now, demand letters are written for a few purposes such as:

- Asking the bank to disburse the sanctioned loan amount into the student's account or the university's account.

- Requesting the university to give a detailed list of tuition fees and other expenses.

- Seeking assistance with disbursements etc. when any issues arise.

Demand letters are important as they also act as a means of communication between the borrower and the bank and help build a smooth rapport eliminating communication gaps or no communication at all and taking action on the borrower's demands.

These letters contain essential information about the loan. Some elements of demand letters are:

- The purpose of the letter

- Details of the loan such as rate of interest, repayment, loan amount, etc.

- Disbursement schedule.

Now, let us see what types of demand letters are there and their purposes.

Demand letters can be written for various purposes and in this article, we have mentioned three types of demand letters. By understanding these different types of demand letters for an education loan, students will be able to determine which type best suits their needs and situation.

Letter To Bank Manager For Education Loan Disbursement:

This letter is written to the bank manager by the applicant asking for the sanctioned loan amount to be disbursed into the student’s bank account or the university's account(if the university requests so). This can be for the first installment or any other installment of the loan amount.

Asking For A Demand Letter From The University About The Tuition Expenses:

The purpose of this letter is to request the university to provide a fee structure demand letter to show it to the bank and request to disburse the approved loan amount to the student's designated bank account. This letter acts as proof of the expenses that will need to be borne. It can be written once with all detailed expenses for the whole course or each semester depending on the guidelines of the university. It is through this letter the lenders disburse the amount for the students to use.

Demand Letter In Case Of An Issue:

The letter mentioned is usually written by students to the bank if their loan disbursement has been delayed or denied. This letter is often written in the worst-case scenario when the student has exhausted all other options for resolving the issue. The purpose of the letter of appeal is to inform the bank of the situation and to request that the disbursement of the loan be expedited or reconsidered. The letter should clearly explain the circumstances that led to the delay or denial of the loan disbursement, and provide any relevant documentation to support the student's case.

The above-mentioned types of demand letters are the mostly written ones. And as told above, these letters can be written for any demand that needs quick resolution.

In the next section, we have provided the formats of demand letters for your reference and to remove confusion about their structure. Keep in mind that demand letters can be written in the format of a formal letter with a requesting tone to it.

From, [Name of the applicant], [Address of the applicant],

To, [Name of the principal] [Name of the college / Institution], [Address of the college/ Financial institution], Date: DD/MM/YYYY Subject: Fee structure for processing of education loan Sir/Madam,

I am [Your name], the [Son/Daughter] of [Parent's name], currently enrolled in [Class] at [Name of the college/ Institution]. I am in the [Semester number] of the academic session of [Academic year], and I require a demand letter/fee structure for the fresh/renewal processing of my education loan dated [Date] from [Bank Name & Address of the bank] for the below mention fees

I am grateful that you have considered my request, and I eagerly anticipate a timely response from you regarding this issue.

Yours Sincerely, [Your name].

Demands letters are very helpful in asking for disbursement of the amount and resolving issues that arise in your loan. We believe this article has been helpful to you. For any education loan-related queries, reach out to our team of expert financial officers who will guide you for free.

Education Loan FAQs

Is it possible to disregard or not respond to a demand letter for a education loan?

While it's understandable that some individuals may consider ignoring a demand letter for an education loan, it's important to note that doing so may not be the most advantageous option for them. In the event that legal action is taken, they may be required to explain to a judge why they didn't respond to the sender's attempt to resolve the matter. It's in their best interests to carefully consider and respond to the demand letter to avoid any further legal complications.

How long does it take to reach a settlement after sending a demand letter for an education loan?

It's important to note that there is no fixed timeline for reaching an agreement following the sending of a demand letter. Typically, the sender will provide a deadline by which they hope to receive a response. Once the initial demand letter has been sent, both parties can work together to negotiate and find a mutually agreeable solution to the issue at hand.

What occurs after a demand letter for an education loan is sent?

After sending a demand letter for an education loan, the sender patiently awaits a response from the recipient. The recipient is given the opportunity to carefully review the letter and its contents, as well as verify any details presented. Following this, the recipient can respond by either making a counter-offer, agreeing to a settlement, or providing reasons for their non-compliance. Additionally, the recipient may choose to seek legal assistance in drafting their response to the demand letter for an education loan.

Our Education Loan team will help you with any questions

Kindly login to comment and ask your questions about Demand Letter For Education Loan

Client's Login

Are you a new user? SIGN UP HERE

Forgot Password

Modal header.

- Subscribers

Welcome, Login to your account.

Recover your password.

A password will be e-mailed to you.

How to Write a Letter to a Bank Manager for Education Loan

A letter to bank manager for education loan is a type of request letter that students write to their respective banks. It may be to get the education loan sanctioned or to release the loan installments.

The letter should be written formally. It should mention the course and university to which you intend to take admission, along with all academic records.

Subject line

A letter to a bank manager for an education loan is a formal document that asks the bank to sanction a certain amount of money for higher studies. It is usually written by students who need financial assistance from the bank to pursue their dream course. The subject line of this letter should be clear and concise, and it should include the borrower’s name. It should also mention their educational qualification and professional background.

When writing a letter to a bank manager, it is essential to write professionally. It is a good idea to use block letter format, as this makes it easier to read and understand. Start the letter with a proper salutation, such as “Sincerely” or “Yours Faithfully.” You can also add a brief introduction about yourself and your purpose for writing the letter.

In the body of the letter, explain why you are applying for an education loan. Explain how this loan will help you reach your goals and objectives. Lastly, describe how you will repay the loan. This information should persuade the bank manager to approve your application for an education loan.

If you are seeking an education loan extension, start the letter by reiterating the original terms of the agreement. Then, explain why you need an extension and how you will be able to meet your obligations. Finally, enclose any documents that support your request. In the final paragraph, thank the manager for his or her consideration and express your hope that the loan will be approved.

From address

If you have a student education loan from a bank, you may need to write letters to the manager for various reasons. These could be requests for sanctioning the loan, releasing the installments, or extending your loan repayment period. Here are some tips on writing these types of letters to a bank manager.

A letter to the manager is a formal letter that should be written in proper format. It should include the date and the name of the person in charge of the department. The letter should also state the purpose of the letter and explain how you are able to meet the requirements for the loan. The letter should end by thanking the bank manager for his or her help and support.

You must first read the bank’s guidelines for educational loans and make sure that you have all the necessary documents. The most important thing is to write a compelling letter that describes why you need the loan and how you will repay it. The letter should also include a copy of the admission letter from your university and any property documents you have.

The bank manager will want to see all the relevant documentation before granting you the loan. This will help them determine if you are eligible for the loan and whether it is in your best interest to take out the loan. The letter should also include a request for an appointment with the bank manager to discuss your situation in person. Then, the manager can decide if you need to change the loan agreement or not.

A letter to the bank manager for an education loan is a formal letter that asks the bank to sanction an educational loan. It can be used for a number of reasons, including requesting an extension on the loan repayment schedule or requesting additional funds to cover tuition costs. This letter should be written in a professional tone and should include a subject line, the sender’s address, and the recipient’s name and address. It should also be signed with a date in the format of DD/MM/YYYY.

An educational loan is a great way to finance your higher education and help you achieve your dreams. However, it’s essential to read the bank’s guidelines and know what documents you need to submit to get the best rate. You can find all the information you need by reading this article, which will help you write a good loan letter to your bank manager.

When writing a letter to the bank manager, you should use a formal and professional tone. The letter should be addressed to the bank manager and should begin with the person’s full name and address. It should also include a subject line that explains why the letter is being written. The body of the letter should be a summary of why the person is asking for the loan.

If you are a student applying for a loan, this sample letter to the bank manager is an excellent place to start. It will help you write a persuasive letter that will increase your chances of getting the loan. The letter should mention all of the required information, such as the course and university you are attending, the amount you need to borrow, and any collateral documents that might be necessary if you’re using collateral.

When writing a letter to a bank manager for an education loan, you should write the date on top of the page in the format DD/MM/YYYY. This will help the manager identify and process your request quickly. In addition, it is a good idea to include the address of the sender and the recipient in the subject line.

Educational loan sanction is a significant step towards pursuing higher studies and achieving your career goals. To write an effective letter to a bank manager for an education loan, make sure you have all of the required documentation ready, including an admission letter from the college/university and copies of property documents if you are applying through collateral. You should also be familiar with the bank’s guidelines regarding educational loans, which can usually be found on their website.

In the body of your letter, explain the circumstances that have led to your request for an extension on your education loan. Include a summary of the original terms on your loan and explain why you will be unable to meet the repayment schedule based on your current income. The letter should end by requesting an appointment with the bank manager. This way, the manager can discuss your request in person and make a decision.

A letter to a bank manager is a formal document that must be written for many reasons. For example, it can be used for opening a new account, issuing an ATM card, or even closing an existing account. This letter must be carefully written with the correct format and content. It should also include all relevant details regarding the request. In addition, the writer should be polite and professional throughout the letter.

A sample letter to a bank manager can be used for several purposes, but it is most commonly used in the process of applying for an education loan. It should contain all the necessary information to help the bank manager assess the borrower’s financial situation. It should also include an explanation of the purpose of the loan and why it is needed.

The letter should begin with a salutation and the date. The letter should also mention the name of the borrower, their contact information, and their educational background. The borrower should also explain why they are seeking a loan and how it will help them achieve their goals.

The body of the letter should also state how much money is required and what the borrower plans to do with it. Depending on the type of loan, the letter may also ask for collateral. If a deposit is required, the borrower should make sure that they have all of the proper documents, including an admission letter, proof of identity, and property papers. The borrower should also enclose the loan application form and any additional information requested by the bank. Finally, the borrower should sign and date their letter. The final part of the letter should end with a formal closing, such as “Yours sincerely” or “Yours faithfully.” If you are unsure about how to write a loan application letter, then you can refer to this template for assistance.

Kreditbee Loan Details in Hindi

How to Close a Home Loan Account

Click, Apply, Achieve: The Online Personal Loan Pathway

No Credit Check Federal Allotment Loan Companies

Anonymix Review: Keeping Your Transactions Anonymous and Secure

LIC Policy Loan Application Form

Educational Loan Request Letter: How To Make Yours Stand Out!

As someone who has crafted numerous educational loan request letters over the years, I’ve realized that a well-structured and compelling letter can significantly increase your chances of getting your loan approved.

Here’s a comprehensive guide, based on my experience, to help you write an effective educational loan request letter.

Key Takeaways:

- Understand the Purpose : Recognize the importance of the letter in securing your educational loan.

- Be Clear and Concise : Present your information in a straightforward manner.

- Personalization : Tailor the letter to reflect your unique educational journey and financial needs.

- Documentation : Attach necessary documents to support your request.

- Follow Up : Be prepared to follow up after sending your letter.

Step 1: Start with Personal Introduction

Begin your letter with a personal introduction. Mention your name, current educational status, and the program you wish to enroll in. This sets the context for your request.

Example: “My name is [Your Name], a recent graduate from [Your School], and I am writing to request a loan for my upcoming Master’s program in [Program Name] at [University Name].”

Step 2: State the Purpose of the Loan

Clearly explain why you need the loan. Include details about the course, such as the duration, fees, and how it aligns with your career goals.

Example: “The total cost of the program is [Amount], which covers tuition, books, and living expenses for the two-year duration. This program is a crucial step for my career in [Your Career Goal].”

Step 3: Outline Your Financial Situation

Discuss your financial situation honestly. Mention any scholarships, grants, or existing financial aid you have and explain why they are insufficient.

Example: “Despite receiving a partial scholarship, I am facing a shortfall of [Amount], which I am hoping to cover with this loan.”

Step 4: Detail Your Repayment Plan

Lenders want to know that you can repay the loan. Outline your repayment strategy, including potential earnings and any backup plans.

Example: “Upon graduation, I plan to work in [Industry/Job Role], where the starting salary averages [Amount]. This income will enable me to repay the loan within [Timeframe].”

Step 5: Provide Supporting Documentation

Attach documents like admission letters, fee structures, scholarship details, and your resume. This evidence strengthens your request.

Documentation Checklist:

- Admission Letter

- Fee Structure of the Program

- Scholarship or Grant Details

- Your Resume/CV

- Financial Statements (if applicable)

Step 6: Conclude with a Thank You and Follow-Up

End your letter by thanking the lender for considering your request. Mention that you are willing to provide any additional information if needed.

Example: “Thank you for considering my application. I am happy to provide any further information required and look forward to a positive response.”

Step 7: Proofread and Send

Finally, proofread your letter for any errors. A well-written, error-free letter makes a good impression.

Template for Educational Loan Request Letter

[Your Name] [Your Address] [City, State, Zip Code] [Your Email Address] [Your Phone Number] [Date]

[Loan Officer’s Name or Lender’s Name] [Name of the Bank or Financial Institution] [Bank’s Address] [City, State, Zip Code]

Dear [Loan Officer’s Name or Lender’s Designation],

I am writing this letter to formally request an educational loan to assist in funding my [undergraduate/graduate] studies at [University Name].

My name is [Your Full Name], and I have recently been admitted to the [Name of the Course/Program] beginning [Start Date of the Course].

The comprehensive cost of attending [University Name], including tuition, books, and living expenses, is approximately [Total Cost].

While I have secured [amount in scholarships/grants, if any], there remains a shortfall of [required loan amount] to fully cover the entire cost of the program.

I have chosen [University Name] because [briefly state your reasons – focus on the quality of the program, how it aligns with your career goals, etc.].

This program is crucial for my career development as it provides [mention specific skills, opportunities, or experiences the program offers].

Regarding the repayment of the loan, I have a detailed plan in place. [Discuss your repayment strategy.

For example, talk about your potential earnings after graduation, any part-time job you might take while studying, or other financial resources you will use to repay the loan].

Enclosed with this letter are copies of my admission letter from [University Name], detailed fee structure, my financial aid summary, and other relevant financial documents. These documents further validate my financial situation and the necessity for this loan.

I am committed to my educational goals and equally dedicated to repaying any financial assistance I receive. I would be grateful for the opportunity to discuss this loan request in more detail.

Please feel free to contact me at [Your Phone Number] or [Your Email Address] should you require any additional information or documentation.

Thank you very much for considering my application. I look forward to a favorable response from your esteemed institution.

[Your Signature (if sending a hard copy)] [Your Printed Name]

Enclosures:

- Admission Letter from [University Name]

- Course Fee Structure

- Financial Aid Summary

- [Any other relevant document]

Personal Insights:

In my experience, a personalized letter that resonates with your own journey is more effective. Be honest, clear, and detailed about your needs and repayment plans. Remember, the goal is to build trust with the lender.

Comment Request:

I’d love to hear about your experiences or any additional tips you might have on writing an educational loan request letter. Please share your thoughts and suggestions in the comments below!

Frequently Asked Questions (FAQs)

Q: How Do I Write an Educational Loan Request Letter?

Answer: When I wrote my educational loan request letter, I focused on being clear and concise. I introduced myself, explained my educational background, and the reason I needed the loan.

I detailed the course I wanted to pursue and how it would help my career. I also mentioned my plan to repay the loan. It’s important to be honest and provide all necessary details to make a strong case.

Q: What Should I Include in My Loan Request Letter?

Answer: In my loan request letter, I included my personal information, educational qualifications, admission details of the course, the total cost of education, and other financial aids I was receiving.

I also added a repayment plan, showing how I intended to manage the loan repayment after completing my studies. Including these details can demonstrate responsibility and planning.

Q: How Can I Make My Loan Request Letter Stand Out?

Answer: To make my loan request letter stand out, I added a personal touch by sharing my educational journey and the challenges I faced.

I clearly articulated my career goals and how the specific course would help me achieve them. I also ensured that my letter was well-organized, error-free, and had a tone of respect and professionalism.

Q: Is It Necessary to Mention Academic Achievements in the Loan Request Letter?

Answer: Yes, mentioning academic achievements can strengthen your request. In my letter, I highlighted my academic successes and any extracurricular activities relevant to my chosen field of study.

This showed the lender that I was serious about my education and had a track record of dedication and success.

Q: How Important Is It to Explain the Repayment Plan in the Loan Request Letter?

Answer: It’s very important. In my loan request letter, I detailed my repayment plan, including potential earning opportunities during and after my studies.

This helped the lender understand my commitment to repaying the loan. It’s essential to be realistic and honest about your repayment capabilities.

Related Articles

Personal loan request letter sample: free & effective, request letter for working capital loan: the simple way, personal loan paid in full letter sample: free & effective, sample letter to bank requesting extension of time for loan payment: free & effective, ask someone for money in a letter sample: free & effective, business loan request letter sample: free & customizable, leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

Write An Application To The Bank Manager For Education Loan Installment In English

Bank Manager, SBI Bank, Magadi Road Branch Near Magadi Road metro station, Bengaluru- 454332

Subject : Application to bank manager for education loan installment

Good evening sir, I, Rashid Mohammed Khan, received approval from your bank for a Rs. 10,000 education loan. The loan’s initial installments have already been paid to me, however the second installment is still owed to my college. I sincerely ask you to disburse the second installment of the balance of the education loan for my college expenses. However, I ask that you release the second payment as soon as you can. I’m prepared to go to the bank if necessary. But I do ask that you release the money as soon as possible. You can count on hearing from me. I’ve included all the needed paperwork.

Regards, Rashid Mohammed Khan

Related Posts:

- Essay on Delhi Metro in English

- Random Address Generator [United States]

- Common Conversational Phrases in English [List of 939]

- Write An Application To The Principal For Delay In Fee Payment In English

- Write An Application To The Bank Manager For Disbursement Of Loan In English

- Write An Application To The Bank Manager For Enhancement Of Credit Limit In English

Letter To Bank Manager For Education Loan Repayment [2+ SAMPLES & FORMAT]

Letter To Bank Manager For Education Loan Repayment [2+ SAMPLES & FORMAT].

Sample 1 : format for letter to bank manager for loan repayment..

From, ____________ ____________ Receiver's address To, The Branch manager, ______________________ ______________________ ______________________ Date Date : ___/___/______. Subject : ____________________________ Salutation ____________ Introduction _______________________________________ _______________________________________ Main Body: Reasons of extension . _______________________________________ _______________________________________ Conclusion _______________________________________ _______________________________________ Name & Signature ___________________ ___________________ Enclosure 1. _________________ 2. _________________ 3. _________________.

You'll need• Letter to bank for education loan repayment extension.

SAMPLE 2: Letter to bank manager for education loan repayment.

Your address Here. To The Branch manager Name if the bank Address Branch name. Dated : 20th December, 2021. Subject, Application for education loan repayment extension. Sir, With the above reference to my subject educational loan account, I would like to begin paying my educational loan through EMI beginning the following month 30th December, 2021. Please advise on how, when, and how much I should pay as EMI per month. Should I pay my EMI via ECS? Kindly, provide guidance on how to pay; EMI or ECS. I look forward to hearing from you soon. Yours sincerely, Name : [_____________________] Signature : [__________________] Contact No.: [_________________] Enclosure :- 1. Bank passbook copy 2. Voter ID copy 3. Others documents.

MUST READ| How to write application for educational loan to the principal.

![Letter To Bank Manager For Education Loan Repayment [2+ SAMPLES & FORMAT] Letter To Bank Manager For Education Loan Repayment](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgBGwS4EaQgHPdNKW7m4dz__f1AZbaKugR6GuWFuZlujZrMFcVnVkuE2xLso6Q4Rh2dw0P9gx8VegNvQ6uTgeuUN7AytGI36PdVTjQoDXXOo74vT2dnVJdpn5XpoW5dbMqUH_ColLOGw6p3/s16000/Webp.net-compress-image.jpg)

- Car Loan Request Letter To Bank Manager.

- Education Loan Closure Letter .

- SBI Personal Loan Closure Letter .

- Home Loan Closure Letter Sample.

You may like these posts

Post a comment.

Made with Love by

- Privacy Policy

- Terms and Conditions

Contact form

Second Installment Education Loan Application (with Samples & PDFs)

I have listed sample templates to help you craft an effective and professional second installment education loan application.

Also, I would like to point out that you can also download a PDF containing all the samples at the end of this post.

Request for Disbursement of Second Installment of Education Loan – Application

First, find the sample template for second installment education loan application below.

To, The Branch Manager, [Bank’s Name], [Bank’s Branch], [City], [Pincode]

Subject: Application for the Second Installment of the Education Loan

Dear Sir/Madam,

I, [Your Full Name], am writing this letter to kindly request the release of the second installment of my education loan, which I had previously been granted by your esteemed bank.

As you may recall, the loan account number is [Your Loan Account Number] and it was sanctioned for pursuing my [Course Name] at [College/University Name]. I have successfully completed my first year and now I am moving on to the second year of my course.

I had received the first installment at the beginning of my course, and it greatly assisted me in the payment of my tuition fees, books, and other academic necessities. I am now in need of the second installment to continue my studies without any financial hindrances.

I have attached my first year’s mark sheet and a certificate of admission for the second year as evidence of my academic progress. I kindly request you to process the second installment at the earliest to ensure seamless continuation of my studies.

I am extremely grateful for the support your bank has provided me in pursuing my higher education. I assure you that I will comply with all the terms and conditions of the loan agreement and repay the loan amount in the stipulated time.

Thank you for your consideration and I look forward to your positive response.

Yours sincerely, [Your Full Name] [Your Full Address] [Your Contact Number] [Your Email ID]

Enclosures: 1. First year Mark-sheet 2. Second year Admission Certificate

Below I have listed 5 different sample applications for “second installment education loan application” that you will certainly find useful for specific scenarios:

Application for Second Installment Education Loan Due to Increased Tuition Fees

To, The Branch Manager, [Bank Name], [Bank Branch Address],

Subject: Application for Second Installment Education Loan Due to Increased Tuition Fees

Respected Sir/Madam,

I, [Your Full Name], son/daughter of [Father’s/Mother’s Name], resident of [Your Residential Address], am a current account holder in your esteemed bank with the account number [Your Account Number]. I am writing this letter to bring to your kind attention a matter of immediate concern.

I am pursuing my [Your Course Name] from [Your University/College Name], and had previously received an education loan from your bank to cover the tuition fees for the course. I am grateful for the financial support provided by your bank which has enabled me to pursue my studies.

However, due to unforeseen circumstances, the university has recently increased the tuition fees for the course. The revised fees are higher than the initial amount for which the loan had been sanctioned. As a result, I am facing a financial shortfall to meet the increased fees.

In light of this situation, I humbly request you to sanction the second installment of my education loan to help me cover the increased tuition fees. I assure you that I will adhere to the repayment schedule as earlier agreed upon.

I am enclosing the official notification of fee hike received from the university, along with my latest academic records for your reference. I kindly request you to expedite the process as the university has set a deadline for fee payment.

Thank you for considering my application. I am hopeful for a positive response from your end. Please feel free to contact me for any further details or clarifications.

Yours faithfully, [Your Full Name] [Your Contact Number] [Date]

Application for Second Installment Education Loan for Additional Course Materials

To, The Branch Manager, [Bank Name], [Bank Branch Address], [City], [State], [Pin Code]

Subject: Application for Second Installment of Education Loan for Additional Course Materials

I, [Your Full Name], a [Your Course Name] student at [Your College Name], am writing this letter to kindly request the release of the second installment of my education loan, sanctioned under the account number [Your Account Number].

In accordance with the loan agreement, the first installment was used for paying my tuition fees and hostel charges. Now, I require the second installment to purchase additional course materials which include textbooks, reference books, software, and other equipment necessary for my academic progress. These materials are quintessential for my study, and I find it challenging to continue without them.

I assure you that this fund will be strictly utilized for the said purpose, and I am prepared to provide any receipts or proofs of purchase, if required. I understand the rules and obligations of the loan agreement and commit to abide by them.

I kindly request you to approve my application and disburse the second installment at the earliest convenience. Your support is crucial to my academic journey, and I am grateful for your understanding and assistance.

Thank you for your time and consideration. I look forward to your positive response.

Yours Sincerely,

[Your Full Name], [Your Contact Number], [Your Email Address], [Date]

Application for Second Installment Education Loan for Unforeseen Educational Expenses

To, The Branch Manager, [Bank Name], [Bank Branch Address]

Subject: Application for Second Installment Education Loan for Unforeseen Educational Expenses

I, [Your Full Name], a holder of an education loan account ([Account Number]) in your esteemed bank, am penning down this letter to kindly request the disbursement of the second installment of my education loan.

I am currently pursuing [Name of the Course] from [University/Institution Name], and the second term/semester of my academic year is due to commence shortly. However, due to unforeseen educational expenses, my financial requirements have escalated.

The unforeseen costs comprise mainly [briefly mention the nature of expenses: could be lab equipment, additional books, hostel fees, etc.]. These expenses were not included in the initial cost of education, and hence, I am left with a financial gap to fulfill my academic obligations.

I kindly request you to expedite the process of disbursing the second installment of my education loan to meet these unexpected expenses. I assure you that these funds will be used strictly for my educational purposes, adhering to the terms and conditions of the loan agreement.

I am enclosing herewith the necessary documents including the receipts and cost estimates of the unforeseen expenses for your reference.

I am hopeful for a positive and prompt response from your side. I thank you in advance for your understanding and support in my academic journey.

Yours faithfully, [Your Full Name] [Your Contact Details] [Date]

Application for Second Installment Education Loan for Studying Abroad

To, The Branch Manager, [Name of the Bank], [Branch Address],

Subject: Application for Second Installment Education Loan for Studying Abroad

I, [Your Name], a resident of [Your Address], write this letter to kindly request the sanction of the second installment of my education loan. I had been granted an education loan with account number [Your Account Number], for pursuing higher studies abroad at [Name of the University], [Country Name].

The first installment of the loan has been effectively utilized for the payment of my university tuition fees and initial living expenses. I am now in need of the second installment to pay for my second semester fees and to manage my living expenses for the next period.

The payment for the upcoming semester is due on [Due Date]. Therefore, I kindly request you to process the second installment of my loan at the earliest to avoid any late payment fees or complications.

I am attaching all the necessary documents including the fee structure, due date details, and the receipt of the first installment payment for your reference.

I sincerely thank you for your constant support and understanding. I assure you that I will abide by all terms and conditions laid down by the bank regarding the repayment of the loan.

Thanking you,

Yours faithfully, [Your Name] [Your Contact Number] [Your Email Address] [Date]

Application for Second Installment Education Loan for Residential Accommodation on Campus

To, The Branch Manager, [Bank Name], [Bank Address],

Subject: Application for Second Installment Education Loan for Residential Accommodation on Campus

I, [Your Full Name], a student of [Your Course Name] at [Your Institute Name], have been granted an educational loan by your esteemed bank with the account number [Your Loan Account Number]. I am penning down this letter to formally request the release of the second installment of my education loan to help me secure residential accommodation on campus.

The first installment of the loan has been completely utilized for my tuition fees and other academic expenses. Now, as I am required to shift to the campus for the upcoming academic year, I am in need of funds to facilitate my accommodation expenses. The cost of the residential facility, as per the institute’s guidelines, is [Amount in INR] for the academic year.

I have attached all the necessary documents, including the official letter from the institute requesting to make the payment for the accommodation fees, along with this application. I kindly request you to process my application at the earliest, as the last date to pay the fees is [Due Date].

I am grateful to the bank for the financial support provided for my higher studies, and I assure you that I will abide by all the terms and conditions of the loan agreement. I look forward to your positive response.

Yours sincerely,

[Your Full Name] [Your Address] [Your Contact Number] [Your Email ID] Date: [Current Date]

How to Write Second Installment Education Loan Application

Some writing tips to help you craft a better application:

- Start with your personal information. Include your name, address, and contact details.

- State the purpose of the letter: applying for the second installment of an education loan.

- Provide loan details. Mention the loan account number and the amount of the first installment.

- Say why you need the second installment. Explain how you used the first one and how the second one will be used.

- Attach necessary documents. Include proof of admission, academic progress report, or fee structure as needed.

- End with a request for prompt action. Ask for the bank’s assistance in processing your application quickly.

- Close the letter. Thank them for their time and consideration, and sign off with your name and date.

Related Topics:

- Application for Twenty Days of Leave from Work

- Two Wheeler License Application

- Two Days Sick Leave Application

View all topics →

I am sure you will get some insights from here on how to write “second installment education loan application”. And to help further, you can also download all the above application samples as PDFs by clicking here .

And if you have any related queries, kindly feel free to let me know in the comments below.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Get the Tata Capital App to apply for Loans & manage your account. Download Now

- Personal Loan

- Business Loan

- Vehicle Loan

- Loan Against Securities

- Loan Against Property

- Education Loan New

- Credit Cards

- Microfinance

- Rural Individual Loan New

Personal loan starting @ 10.99% p.a

- Instant approval

- Overdraft Facility

All you need to know

- Rates & Charges

- Documents Required

Personal loan for all your needs

Overdraft Loan

Personal Loan for Travel

Personal Loan for Medical

Personal Loan for Marriage

Personal Loan for Home Renovation

- Personal Loan EMI Calculator

Pre-payment Calculator

Eligibility Calculator

Check Your Credit Score

Higher credit score increases the chances of loan approval. Check your CIBIL score today and get free insights on how to be credit-worthy.

Home Loan with instant approval starting @ 8.70% p.a

- Easy repayment

- Home Loan Online

- Approved Housing Projects

Home Loan for all your needs

- Home Extension Loan

Affordable Housing Loan

Plot & Construction Loan

- Balance Transfer

Home Loan Top Up

- Calculators

- Home Loan EMI Calculator

- PMAY Calculator

Balance Transfer & Top-up Calculator

- Area Conversion Calculator

- Stamp Duty Calculator

Register as a Selling Agent. Join our Loan Mitra Program

Business loan to suit your growth plan

- Collateral-free loans

- Customized EMI options

Business loan for all your needs

- Machinery Loan

Small Business Loan

EMI Calculator

- GST Calculator

- Foreclosure Calculator

Looking for Secured Business Loans?

Get secured business loans with affordable interest rates with Tata Capital. Verify eligibility criteria and apply today

Accelerate your dreams with our Vehicle Loans

- Flexible Tenures

- Competitive interest rates

Explore Used Car Loans

- Used Car Loan

Loan On Used Car

Explore Two Wheeler Loans

- Two Wheeler Loan

Used Car EMI Calculator

Two Wheeler EMI Calculator

Get upto 95% of your car value and book your dream car

A loan upto ₹5,00,000 to own the bike of your choice

Avail Loan Against Securities up to ₹40 crores

- Quick access to finance

- Zero foreclosure charges

Explore Loan Against Securities

Loan against Shares

Loan against mutual funds

- Loan Against Securities Calculator

Avail Loan Against Property up to ₹3 crores

- Loan against property

- Business loan against property

- Mortgage loan against property

- EMI Options

Loans for all your needs

Secured Micro LAP

Empowering Rural India with Microfinance loans

- Quick processing

Want To Know More?

Avail a Rural Individual Loan

- Working Capital Loans

- Cleantech Finance

Structured Products

- Equipment Financing & Leasing

Construction Financing

Commercial Vehicle Loan

- Explore all Business Loans

Digital financial solutions to aid your growth

- Simple standard documentation process

- Quick disbursal

Most Popular products

Channel Financing

Invoice Discounting

Purchase Order Funding

Working Capital Demand Loan

Sub Dealer Loan

Pioneering Climate Finance through innovative solutions

Most popular products

Project & structured design

Debt Syndication

Financial Advisory

Cleantech Advisory

Financing solutions tailored to your business needs

- Quick approvals

- Flexible payment options

Our Bestselling Products

Structured Investment

Letter of Credit

Lease Rental Discounting

Avail Term Loans up to Rs. 1 Crore

- Customise loan tenures as per your needs

- Get your loan processed, sanctioned and funds disbursed digitally

- Equipment Finance

Avail Digital Equipment Loans up to Rs. 1 Crore

- Attractive ROIs

- Customizable Loan tenure

Equipment Leasing

Avail Leasing solutions for all asset classes

- Up to 100% financing

- No additional collateral required

Ensure your business’ operational effeciency with ease

- Wide range of equipments covered

- Minimum paperwork

- Construction Finance

- Construction Equipment Finance

Wealth Services by Tata Capital

Personalised Wealth Services for exclusive customers delivered by a team of experts from a suite of product offerings

- Inhouse research & reports

- Exclusive Privileges & Offers

Financial Goal Calculator

Retirement Calculator

- Download forms

Moneyfy by Tata Capital

A personal finance app, your one-stop shop for comprehensive financial needs - SIP, Mutual Funds, Loans, Insurance, Credit Cards and many more

- 100% digital journey

- Start investing in SIP as low as Rs 500

SIP Calculator

Investment Calculator

- Mutual Funds

Protect your family against unforeseen risks

Avail any of the Insurance policies online in just a few clicks

Bestselling insurance solutions

Motor Insurance

Life Insurance

Health Insurance

Home & Travel Insurance

Wellness Insurance

Protection Plan & other solutions

Retirement Solutions & Child Plan

Quick Links for loans

- Used Car Loans

- Loan against Property

Loan Against securities

Quick Links for insurance

- Car Insurance

- Bike Insurance

Saving & Investments

Medical Insurance

Cardiac Insurance

Cancer care Insurance

Other Insurance

- Wellness solutions

- Retirement Solution Plans

- Child Plans

- Home Insurance

- Travel Insurance

- Mutual Fund

Choose from our list of insurance solutions

Retirement Solutions & Child Plans

Quick Links for Loans

Cancer Care Insurance

Offers & Updates

Download the moneyfy app.

Be investment ready in minutes

Take a Tata Capital Home Loan

Lowest interest rates starting at 8.70%*

Apply for a Tata Card

Get benefits worth Rs. 18,000*

Sign in to unlock special offers!

You are signed in to unlock special offers.

- Retail Customer Login

- Corporate Customer Login

- My Wealth Account

- Dropline Overdraft Loan

- Two wheeler Loan

Quick Links for Insurance

- Term insurance

- Savings & investments

- Medical insurance

- Cardiac care

- Cancer care

Personal loan

- Rate & Charges

Loan Against Shares

Loan Against Mutual Funds

Avail a Rural Individual Loan

Compound Interest Calculator

Home Insurance & Travel Insurance

Menu

- Loan for Home

- Loan for Business

- Loan for Education

- Loan for Vehicle

- Personal Use Loan

- Loan for Travel

- Loan for Wedding

- Capital Goods Loan

- Home Repair Loan

- Medical Loan

- Loan on Property

- Loan on Securities

- Wealth Services

- What’s Trending

- RBI Regulations

- Equipment Lease

- Circulating Capital Loan

- Construction Loan

- Leadership Talks

- Dealer Finance

- Shubh Chintak

- Coronavirus

- Government Updates

- Lockdown News

- Finance Solutions

Tata Capital > Blog > Loan for Education > How to Write a Letter for Education Loan Application in India

How to Write a Letter for Education Loan Application in India

Congratulations on receiving an acceptance letter from your dream university! Now, to finance your tuition fee, living costs, and other expenses, you can consider opting for education finance. It is a ray of hope for students who aspire to study in premier institutes and are looking to manage their educational expenses.

Loans for education come with a pretty simple application process. But, first things first, you must write a loan application letter to the lender requesting them to sanction your loan. Read on to understand how to write an application for education loan.

How to write application for loan

After you have selected a lender, you must write a loan application letter to them explaining your academic and financial situation. Here’s what you should include in your letter.

- Recipient’s address

First, you must mention the Manager’s name you are writing the letter to, the name of the lending institution, branch details, and the branch address.

- Applicant address

Next, include your name and address.

Once you have mentioned the address details, write the date. This doubles up as the date of application when the lender approves your letter.

After the date, write the subject line or the purpose of the letter. So, make sure it is to the point and conveys the intent of writing the letter.

Once you mention the email subject, address the authority directly in the salutation.

Now comes the meat of the application. This section must include all the details required by the lender to grant you a loan. So, introduce yourself, talk about the institute you have been accepted into and the degree you wish to pursue and mention why you need the loan. Make sure to include your academic records, entrance/foreign exam scorecard, acceptance letter, and other relevant documents to make a convincing case for why you deserve the opportunity. Lastly, assure the lender that you will complete your studies and fetch a good job and close the letter.

Here’s a sample letter to make things clear for you.

Sample letter for education finance

The Bank Manager

Date: XX/X/20XX

Subject: Application for the education loan

I am writing this letter to apply for a student loan to pursue higher education in English Literature. I recently completed my Bachelor’s in English Literature from the University of Delhi with a 9.7 CGPA. Besides, I scored 85% marks in the All India Senior School Certificate Examination (AISSCE) with a Science background.

I applied to the University of Pennsylvania for a full-time Master’s degree in English and have been selected for the programme. The total hostel fee, cost of education accessories, tuition fee, and boarding expenses in the United States is approximately Rs. 20 lakhs.

Due to my humble family background, I’m unable to afford the cost and require financial assistance. I request you to grant me a personal loan for higher education at this prestigious university. I will repay the loan amount on time.

I have attached my academic records, credentials, acceptance letter and other relevant documents with the letter. I am looking forward to your response.

Thank you. Yours sincerely, Anita

After formally putting your request forward with aletter for education loan, you must wait for the lender to approve and sanction your loan.

Additional Read: Recent Changes Happening in Higher Educations in The New Normal World

Need help financing your education? We can help!

Getting a solid education is a stepping stone toward a promising career. Therefore, you shouldn’t have to compromise your dreams due to a shortage of funds. At Tata Capital, we offer customisable loans with competitive personal loan interest rates to help you pursue your education in India and abroad. You can avail of an amount depending on your needs and loan eligibility.

What’s more, with Tata Capital, you can apply for a student loan online and get a hassle-free experience with minimal documentation and fast approval. So, without further ado, visit our website and apply for education finance today!

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Most Viewed Blogs

5 Pro Tips To Pay Off Your Education Loan Faster

Can I get Education Loan for Pursuing CFA in India?

Know All About Education Loan – CSIS Subsidy Scheme in India

Things to Look Out for While Signing Education Loan Documents

A Guide To Education Loan Eligibility

Here’s the List of MS in US Scholarships for Indian Students

Education Loan Options for Borrowers with Low Credit Score

5 Last Minute Strategies Helping to Pay For your College Tuition Fees

Tips To Apply For Scholarships

Trending Blogs

- Business Loan EMI Calculator

Used Car Loan EMI Calculator

Two Wheeler Loan EMI Calculator

Loan Against Property Calculator

- Media Center

- Branch Locator

- Tata Capital Housing Finance Limited

- Tata Securities Limited

Tata Mutual Fund

Tata Pension Fund

Important Information

- Tata Code of Conduct

- Master T&Cs’ Tata Capital Limited

- Master T&Cs' Tata Capital Financial Services Limited - Pre 31st December, 2023

- Master T&Cs' Tata Capital Housing Finance Limited - Pre 31st December, 2023

- Master T&Cs' Tata Capital Housing Finance Limited

- Vendor Feedback Form

- Rate History

- Ways to Service

- Our Partners

- Partnership APIs

- SARFAESI – Regulatory Display - Tata Capital Limited

- SARFAESI – Regulatory Display - Tata Capital Housing Finance Limited

Investor Information

- Tata Capital Limited

Our Private Equity Funds

- Tata Capital Healthcare Fund

- Tata Opportunities Fund

- Tata Capital Growth Fund

Amalgamated Companies

- Archived Documents of Tata Capital Financial Services Limited

- Archived Documents of Tata Cleantech Capital Limited

Top Branches

Most important terms & conditions - home loans.

Download in your preferred language

Policies, Codes & Other Documents

- Tata Code Of Conduct

- Audit Committee Charter

- Affirmative Action Policy

- Whistleblower Policy

- Code of Conduct for Non-Executive Directors

- Remuneration Policy

- Board Diversity Policy

- Code of Corporate Disclosure Practices and Policy on determination of legitimate purpose for communication of UPSI

- Anti-Bribery and Anti-Corruption Policy

- Vigil Mechanism

- Composition Of Committees

- Notice Of Hours Of Work, Rest-Interval, Weekly Holiday

- Fit & Proper Policy

- Policy For Appointment Of Statutory Auditor

- Policy On Related Party Transactions

- Policy For Determining Material Subsidiaries

- Policy On Archival Of Documents

- Familiarisation Programme

- Compensation Policy for Key Management Personnel and Senior Management

- Fair Practice Code - Micro Finance

- Fair Practice Code

- Internal Guidelines on Corporate Governance

- Grievance Redressal Policy

- Privacy Policy on protecting personal data of Aadhaar Number holders

- Dividend Distribution Policy

- List of Terminated Vendors

- Policy for determining Interest Rates, Processing and Other Charges

- Policy specifying the process to be followed by the Investors for claiming their Unclaimed Amounts

- NHB registration certificate

- KYC pamphlet

- Fair Practices Code

- Most Important Terms & Conditions - Home Equity

- Most Important Terms & Conditions - Offline Quick Cash

- Most Important Terms & Conditions - Digital Quick Cash

- Most Important Terms & Conditions - GECL

- Most Important Terms & Conditions - Dropline Overdraft

- GST Details

- Customer Grievance Redressal Policy

- Recovery Agents List

- Legal Disclaimer

- Privacy Commitment

- Investor Information And Financials

- Guidelines On Corporate Governance

- Anti-Bribery & Anti-Corruption Policy

- Whistle Blower Policy

- Policy Board Diversity Policy and Director Attributes

- TCHFL audit committee Charter

- Code of Conduct For Non-Executive Directors

- Code of Corporate Disclosure Pracrtices and policy On determination of Legitimate purpose

- List of Terminated Channel Partners

- Policy On Resolution Framework 2.0

- RBI Circular On Provisioning

- Policy for Use of Unparliamentary Language by Customers

- Policy for Determining Interest Rates and Other Charges

- Additional Facility

- Compensation Policy For Key Management Personnel And Senior Management

- Guidelines for release of property documents in the event of demise of Property Owners who is a sole or joint borrower

- Prevention Of Money Laundering Policy

- Policy For Accounting Of Tax In Respect Of The Tax Position Under Litigation

- Cyber Security Policy

- Conflict Of Interest Policy

- Policy For Outsourcing Of Activities

- Surveillance Policy

- Anti-Bribery And Anti-Corruption Policy

- Code Of Conduct For Prevention Of Insider Trading

Tata Capital Solutions & Services

- Loans for You

- Loans for Business

- Overdraft Personal Loan

- Wedding Loan

- Travel Loan

- Home Renovation Loan

- Personal Loan for Govt employee

- Personal Loan for Salaried

- Personal Loan for Women

- Small Personal Loan

- Required Documents

- Application Process

- Affordable Housing

- Business Loan for Women

- MSME/SME Loan

Vehicle Loans

More Products

- Emergency Credit Line Guarantee Scheme (ECLGS)

- Credit Score

- Education Loan

- Rural Individual Loans

- Structured Loans

- Commercial Vehicle Finance

- Personal Loan Pre Payment Calculator

- Personal Loan Eligibility Calculator

- Balance Transfer & Top-Up Calculator

- Home Loan Eligibility Calculator

- Business Loan Pre Payment Calculator

- Loan Against Property EMI Calculator

- Used car Loan EMI Calculator

- Two wheeler Loan EMI Calculator

- APR Calculator

- Personal Loan Rates And Charges

- Home Loan Rates And Charges

- Business Loan Rates And Charges

- Loan Against Property Rates And Charges

- Used Car Loan Rates And Charges

- Two Wheeler Loan Rates and Charges

- Loan Against Securities Rates And Charges

Uh oh, something went wrong

Please try again later.

Search This Blog

Search letters formats here, letter to bank requesting 'extension of time' for loan payment.

submit your comments here

Wow. Well written. I did some edits to the letter format and wrote to my bank. Thank you.

The format works perfect for me. Thanks for making it available to us. Great job.

I referred this format a couple of weeks back and wrote the letter to bank. I wasn't really expecting that they would approve it. Today, I received the letter that they've extended the time. Thanks anyway!

Using this format to night for my Loan extension as a result of Covid-19 Pandemic. Will post the result from the bank. However, i am confident of the positive response after submission.

Post a Comment

Leave your comments and queries here. We will try to get back to you.

Letters in English

Sample Letters, Letter Templates & Formats

Home » Letters » Bank Letters » Request Letter to Bank for Payment of Third Installment

Request Letter to Bank for Payment of Third Installment

To, The Manager, __________ (Bank Name), __________ (Branch Address)

Date: __/__/____ (Date),

Subject: Requesting deduction of the third installment

Dear Sir/ Madam,

This is to most humbly inform you that my name is _________ (Name) and I do hold a loan from your branch ________ (type of loan) bearing loan account number _________ (Account Number).

Respected, the mentioned loan was taken on __/__/____ (Date) and the installment deducts on __ (Date) of every month amounting (Installment Amount). But to the best of my knowledge, only two installments have been deducted from my bank account _________ (account number). The third installment was due on __/__/____ (Date) but has not yet been deducted from my account.

I ensure you that there is a sufficient balance available in my bank account. I request you kindly deduct the third installment from my bank account in order to prevent any possible penalties. I shall be highly thankful.

Thanking you, _________ (Signature) _________ (Your name), _________ (Contact number)

Incoming Search Terms:

- sample letter to bank for deduction of the third installment

- letter of request to bank for deduction of third EMI

- third installment deduction request letter

- Request Letter for Bonafide Certificate from College for Passport

- Request Letter for Refund of Security Deposit for Rented Vehicle – Sample Letter Requesting Security Refund for Rented Vehicle

Privacy Overview

CBSE Library

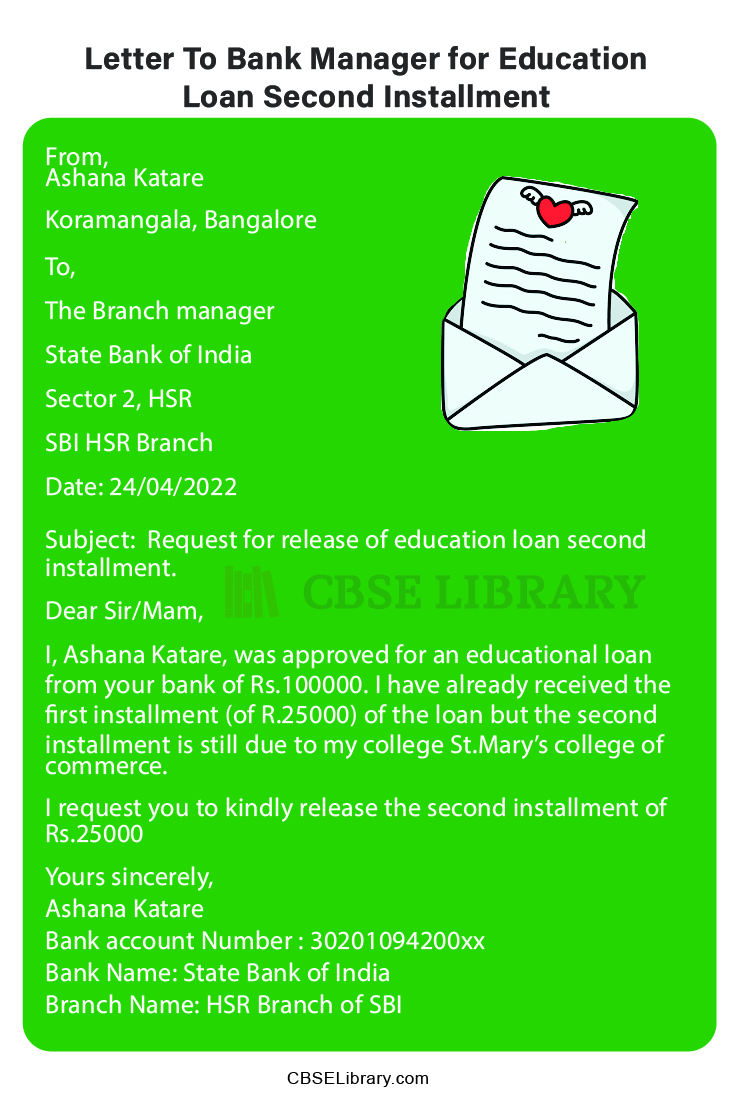

Letter To Bank Manager for Education Loan Second Installment | How to Write a Letter? Format and Samples

Letter To Bank Manager For Education Loan Second Installment: In the event that you don’t have a reasonable thought on the most proficient method to compose a letter to the bank chief for instruction credit the second portion, read this article till the end. Your questions about the letter to the bank administrator for schooling credit second portion are promptly made accessible for you.

These examples can be applied to a letter to the bank supervisor for the home advance second portion, but you’ve to alter them according to the prerequisites. As an understudy, now and again you want to compose demand letters to bank chiefs for training reason-related things. The reasons resemble authorizing the advance (or) delivering the portions (or) to build the credit reimbursement augmentation time (or) for instructive credit endowments and so on.

Get Other Types of Letter Writing like Formal, Informal and Different Types of Letter Writing Samples.

For that large number of reasons, here you can observe various arrangements for instructive credit demand letters which you can submit to the bank supervisor.

Format of Letter for Education Loan

Letter for education loan second installment sample, request for release of education loan second installment, letter for loan second installment, faq’s on letter to bank manager for education loan second installment, how to write letter to bank manager for education loan.

To write the bank manager for an education loan to release the second installment we should know the format of the letter. Since this letter to the bank manager is a formal letter, we should be very precise of the words being used in the letter. The letter should sound polite and formal. Proper salutation should be given to the respected person who is receiving the letter.

- Peruse bank rules with respect to the training credit, you can track down those subtleties on the bank’s site.

- Prepared every one of the necessary reports, for example, confirmation letter by the school/college, instructive testaments, and property record duplicates assuming you are applying through insurance.

- Notice your name, course subtleties, school/college name, and spot of the school.

- Compose the amount of instruction credit you want.

- Encase every one of the supporting reports with the letter.

To compose a letter to the bank manager we need to remember a few significant focuses so they can match the norm of the authority letters kept in touch with the bank. The issue can be everything except the letter ought to be composed courteously and in an aware way, since all the bank letters are addressed to the top of the branch or the Bank Manager. Here are the significant focuses to be recalled while composing the letter.

- Addressing the Branch Manager

- Write the Name and Address of the bank

- Salutation (Sir/Madam)

- Body of the letter

- Attach the required documents

- Account number and Account holder Name

- Name and Signature

Let us see some samples for the letters to the bank manager for education second installment.

Question 1. What amount of time will it require to get a loan for education?

Answer: It will take a limit of 15 days to get instruction in advance from the date of use.

Question 2. To whom banks will credit the education loan?

Answer: As a rule, banks will straightforwardly credit the instruction advance straightforwardly to organizations financial balances.

Question 3. What amount of time will it require to dispense the loan for education?

Leave a Comment Cancel reply

IMAGES

VIDEO

COMMENTS

I am writing this letter to bring your concern that I have applied for education loan on dated _____ (date) which was got sanctioned on _____ (sanction date) and I have completed all the formalities for the loan disbursement for my education loan of amount _____ (Mention the amount) at the branch address _____ (Address of branch).

To, The Branch Manager, _____ (name of the bank), _____ (branch address) Date: __/__/_____ (date) Subject: Request for Next Installment. Respected Sir/Madam, My name is _____ (name), and I am writing this letter with due respect to request the release of the next installment amount for the education loan that I am availing from your bank under the loan account number _____ (loan account number).

Conclude by thanking the bank manager for their consideration and provide your contact information for any further communication. Begin with a formal salutation, followed by a brief introduction of yourself and your loan details. Clearly mention the purpose of your letter and the installment number you are requesting.

To. The Bank Manager, Bank Name, Address of the Bank. Sub: Education loan disbursement regarding. I _____(your name) have been sanctioned with an educational loan of amount _____Rs to study MBBS at University of Montreal in Canada.. My First semester exams will be held next month, so kindly disburse the loan amount and please find the attached copies of the semester fee payment slip, and ...

The education loan disbursement letter is addressed to the manager of the bank or the financial institution concerned. Do not write paragraphs and overcloud your data. You should be mindful of the intent, and clarity is a must. The ideal length of a disbursement letter is 1 page. Be sure to include the following data in the disbursement letter ...

This can be for the first installment or any other installment of the loan amount. Asking For A Demand Letter From The University About The Tuition Expenses: ... Letter To Bank Manager For Education Loan Disbursement: From, [Name of the applicant], [Address of the applicant], To, [The Branch Manager]

A letter to bank manager for education loan is a type of request letter that students write to their respective banks. It may be to get the education loan sanctioned or to release the loan installments.The letter should be written formally. ... You must first read the bank's guidelines for educational loans and make sure that you have all the ...

Step 2: State the Purpose of the Loan. Clearly explain why you need the loan. Include details about the course, such as the duration, fees, and how it aligns with your career goals. Example: "The total cost of the program is [Amount], which covers tuition, books, and living expenses for the two-year duration.

Near Magadi Road metro station, Bengaluru- 454332. Subject: Application to bank manager for education loan installment. Good evening sir, I, Rashid Mohammed Khan, received approval from your bank for a Rs. 10,000 education loan. The loan's initial installments have already been paid to me, however the second installment is still owed to my ...

Letter To Bank Manager For Education Loan Demand Draft. This letter is written to the bank manager by a student asking for the education loan-sanctioned amount to be disbursed into the student's bank account. This can be the first instalment or any other instalment of the loan amount that needs to be transferred to the college or the student ...

How to write a good letter for educational loan? SAMPLE 1: Write a letter to the manager of a bank requesting a loan for higher studies. SAMPLE 2: Application letter to bank manager for education loan. SAMPLE 3: Request letter to bank manager for education loan disbursement.

The branch manager. Name of the bank. Address of the bank. Branch name. Dated : 4th Nov, 2021. Subject, Application for educational loan 2nd installment. Dear Sir, This is to inform you that my name is Sophie Das, and I live in Mumbai's 24/New Hill neighbourhood. I'm writing to voice my dissatisfaction with the fact that I filed for an ...

To. The Branch manager. Name if the bank. Address. Branch name. Dated : 20th December, 2021. Subject, Application for education loan repayment extension. Sir, With the above reference to my subject educational loan account, I would like to begin paying my educational loan through EMI beginning the following month 30th December, 2021.

Start with your personal information. Include your name, address, and contact details. State the purpose of the letter: applying for the second installment of an education loan. Provide loan details. Mention the loan account number and the amount of the first installment. Say why you need the second installment.

Letter to Bank Manager for Education Loan: A Letter to a Bank Manager for an Education Loan is a formal letter that is written by an individual who is in need of financial assistance from the bank to pursue higher studies.It should be written with utmost care and sincerity as it will be the first interaction between the person and the bank.

Address. City. Date: XX/X/20XX. Subject: Application for the education loan. Sir/Madam. I am writing this letter to apply for a student loan to pursue higher education in English Literature. I recently completed my Bachelor's in English Literature from the University of Delhi with a 9.7 CGPA.

I value my relationship with the bank and wish to continue this in the mutually beneficial interests. Thanking you in advance in anticipation for your kind consideration on my request! Yours faithfully, (Signature) (Name of the Account holder) request letter to bank for extension of time, write a letter to bank manager seeking time for payment ...

The third installment was due on __/__/____ (Date) but has not yet been deducted from my account. I ensure you that there is a sufficient balance available in my bank account. I request you kindly deduct the third installment from my bank account in order to prevent any possible penalties. I shall be highly thankful.

Complete Letter To Bank Manager For Education Loan Second Installment online with US Legal Forms. Easily fill out PDF blank, edit, and sign them. Save or instantly send your ready documents.

Letter To Bank Manager For Education Loan Second Installment: In the event that you don't have a reasonable thought on the most proficient method to compose a letter to the bank chief for instruction credit the second portion, read this article till the end. Your questions about the letter to the bank administrator for schooling credit second portion are promptly made accessible for you.

Letter to Bank Manager for Student Loan - Application for Education Loan in Bank.In this video, you will find a sample request letter for Education Loan in B...

Sub: Letter for Installment Payments of Loan Dear manager, I sent this letter to request for Installment Payments of Loan. I took a loan of (Amount of amount) from the bank/ institute/company, few months (date) ago and the due date of pay the amount back is (date).

In this video, we will show you how to Write an Application to bank manager for education loan installment in English_____English Summary🌍 Check ...