Resume Worded | Proven Resume Examples

- Resume Examples

- Finance Resumes

5 Risk Management Resume Examples - Here's What Works In 2024

Risk managers are the bodyguards of a company. it is their job to investigate, identify and analyze potential risks to a company and offer solutions to safeguard against any negative outcomes. like bodyguards, they must be perceptive, resourceful, and trustworthy. in this guide, we will show you 4 resume samples for 4 risk management positions, and give you some tips to help you create an effective resume of your own..

Risk managers research and assess potential company risks and liabilities. It is their job to see potential problems before they arise. This job requires a wholesome cocktail of both hard and soft skills to be successful. A good risk manager will have strong analytical, research, and problem-solving skills, and will be very knowledgeable about the industry they are working in. At the same time, they must have excellent communication skills as one of the main sources of the information that they will use to assess for risk will come from fellow employees and/or external stakeholders.

This guide will specify the expected requirements and job descriptions of 4 risk manager positions, as well as provide relevant tips to help your resume stand out.

Risk Management Resume Templates

Jump to a template:

- Risk Manager

- Risk Analyst

- Health Care Risk Manager

- Financial Risk Manager

Jump to a resource:

- Keywords for Risk Management Resumes

Risk Management Resume Tips

- Action Verbs to Use

- Related Finance Resumes

Get advice on each section of your resume:

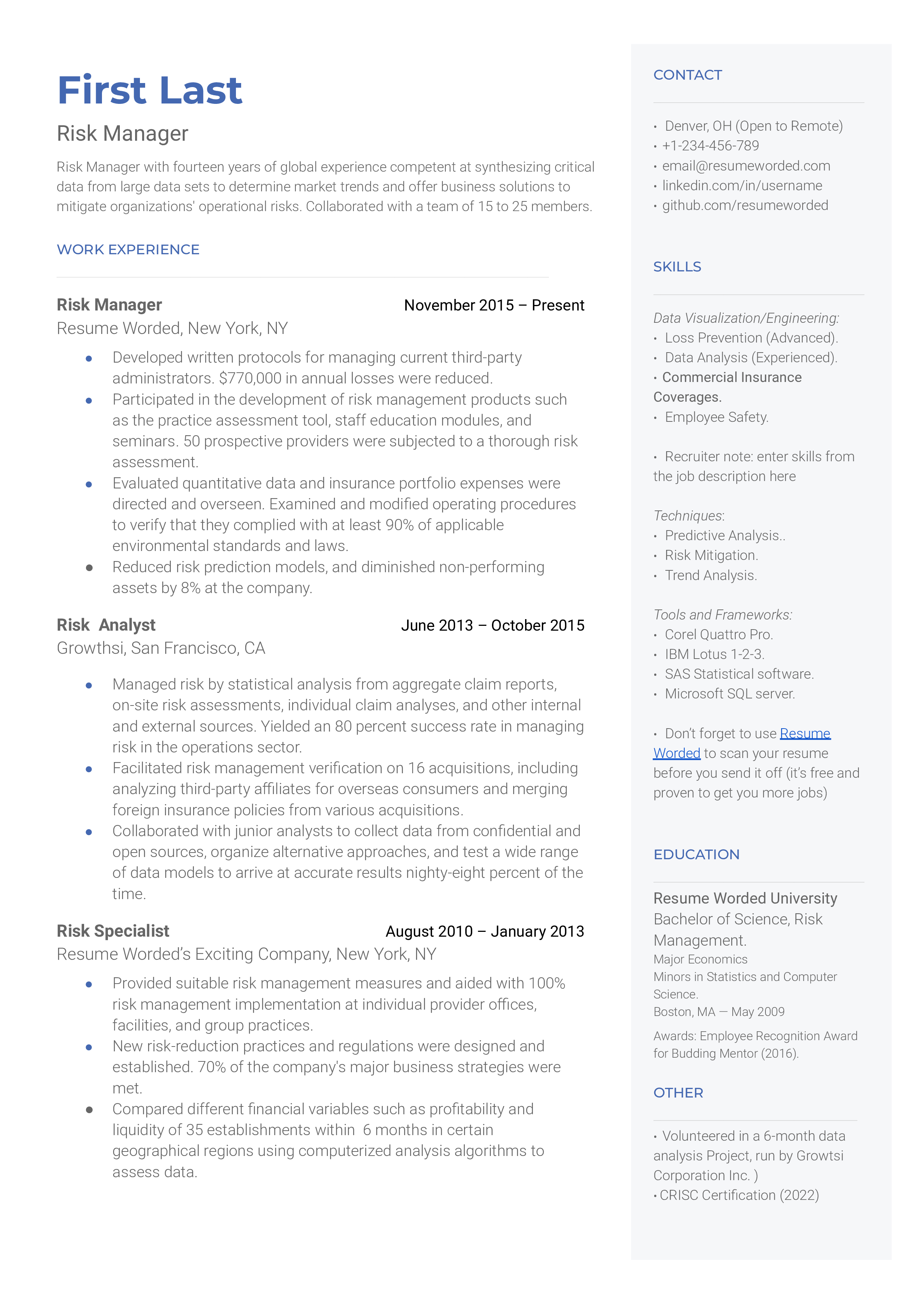

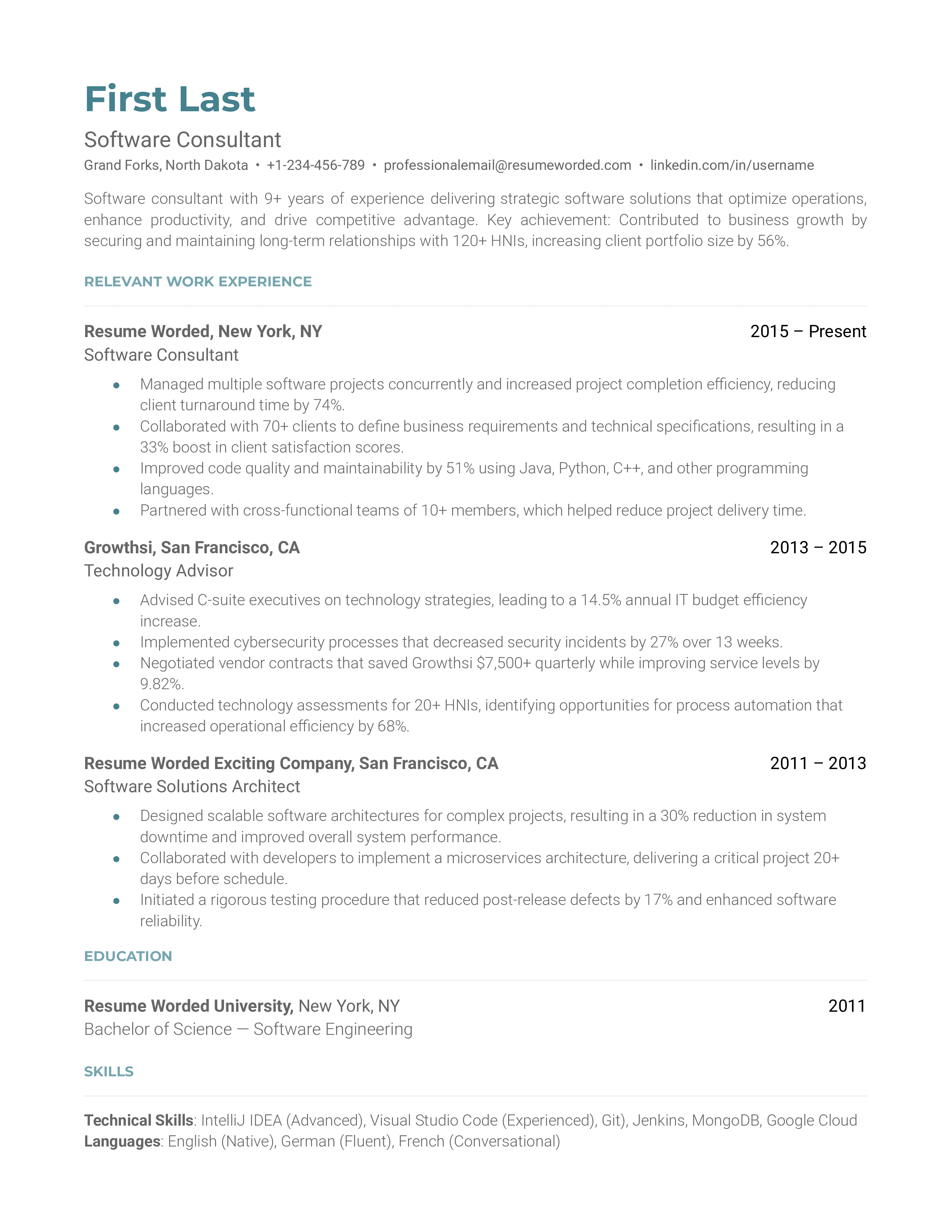

Template 1 of 5: Risk Manager Resume Example

A risk manager identifies and assesses risk for a company, and handles all risk management issues within the company. As a risk manager, your responsibilities will include, conducting risk assessments, presenting risk assessment reports to relevant superiors, offering and implementing measures and policies aimed at managing risk, and reviewing current risk management policies, amongst others. Some skills you will be expected to have include, problem-solving skills, communication skills, and strong attention to detail. Be sure to highlight any successes you have had in the past where you used these skills. Educationally, recruiters will expect you to at least have a bachelor’s degree in risk management, finance, or a similar field. Extensive experience and further education in the field will only bolster your resume and put you above your competition. Take a look at this strong risk manager resume.

We're just getting the template ready for you, just a second left.

Tips to help you write your Risk Manager resume in 2024

mention the size of the teams you have managed..

As a risk manager, you may be working with a team of risk analysts who will be doing a lot of the data analyst work that you will be basing recommendations on. Show recruiters that you can effectively manage a sizeable team by quantifying the size of previous teams you have managed.

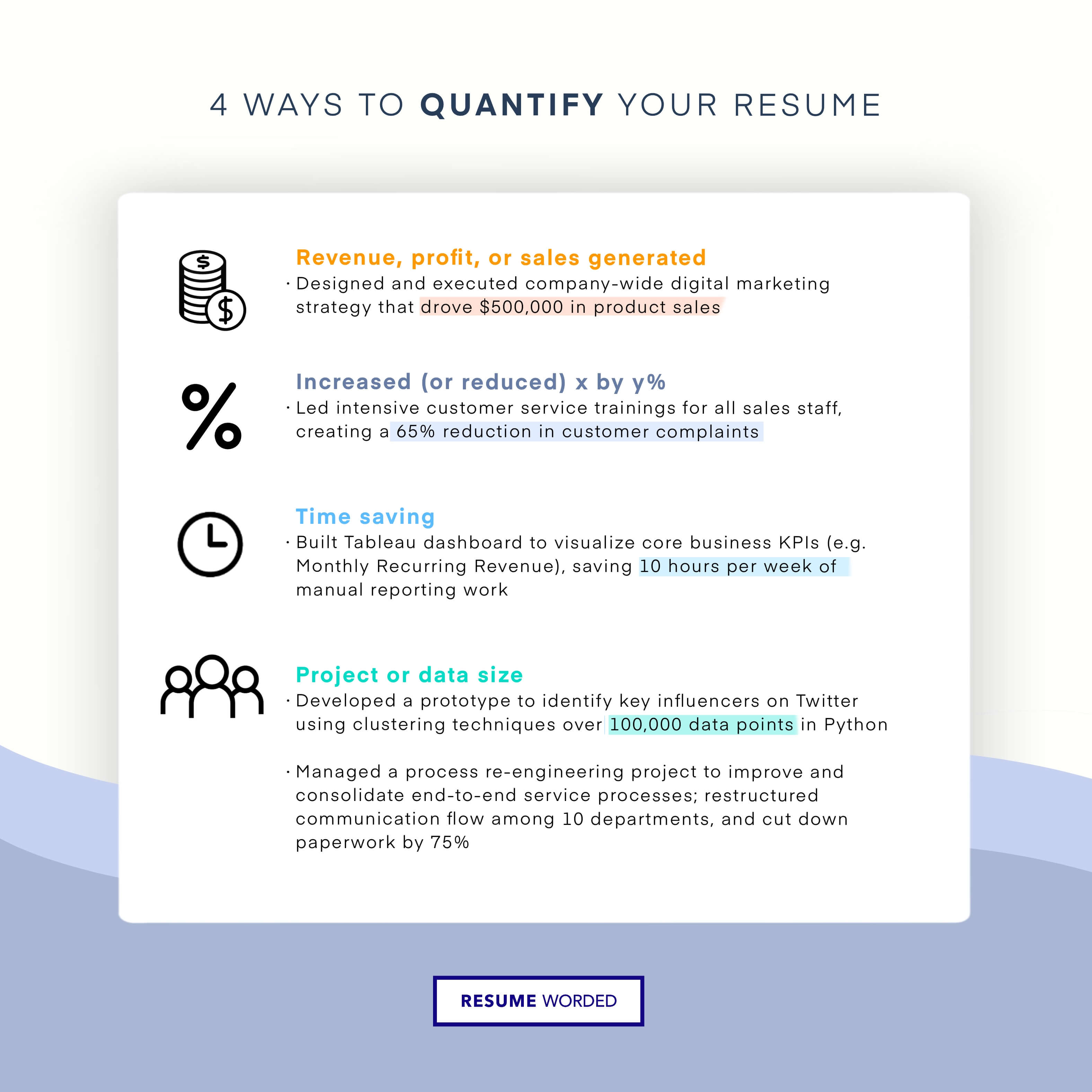

Use numbers and metrics to show how your work reduced or mitigated risk.

The core function of your job is to reduce or limit risk for a company. To stand out to recruiters, include metrics that show how much money you saved your company or your success rate in managing risk.

Skills you can include on your Risk Manager resume

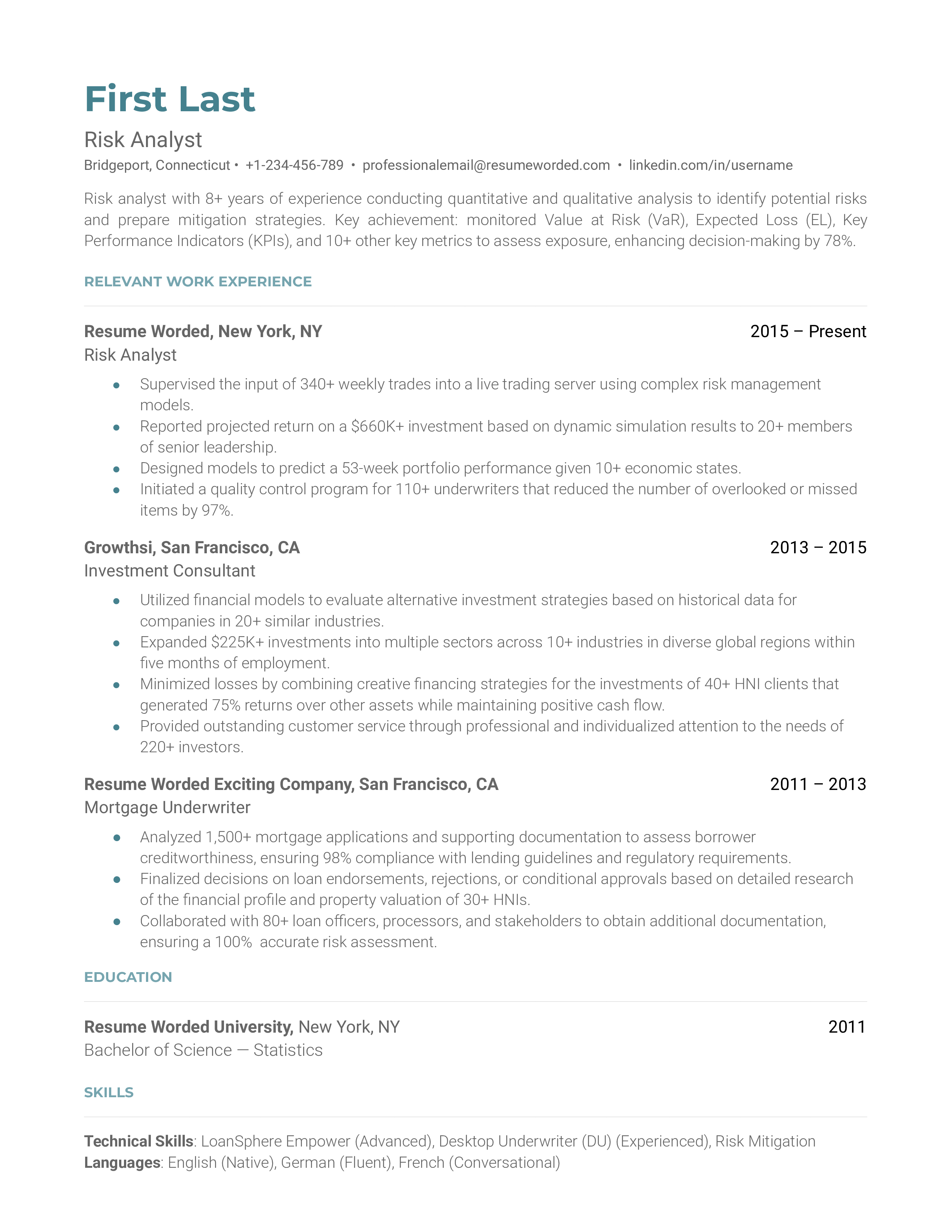

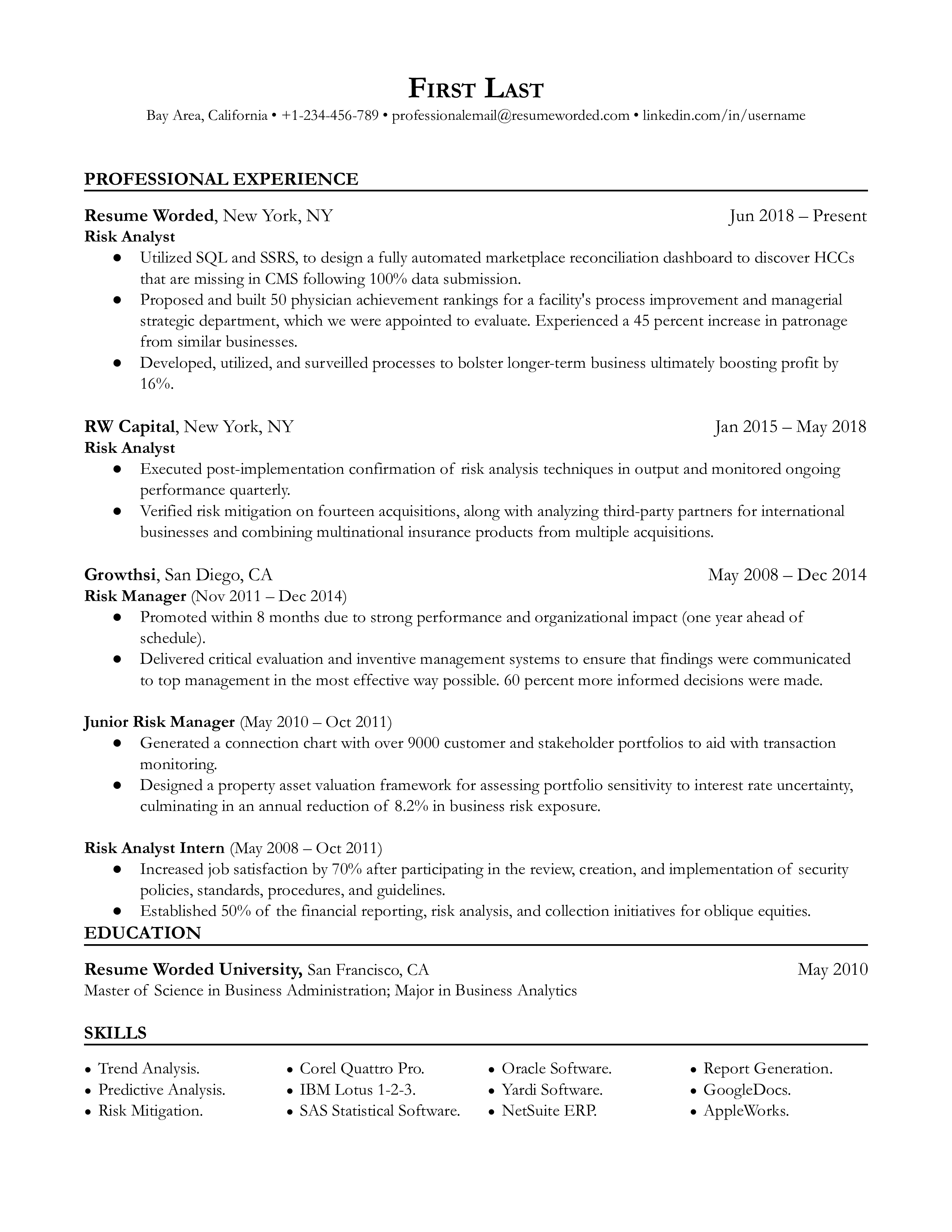

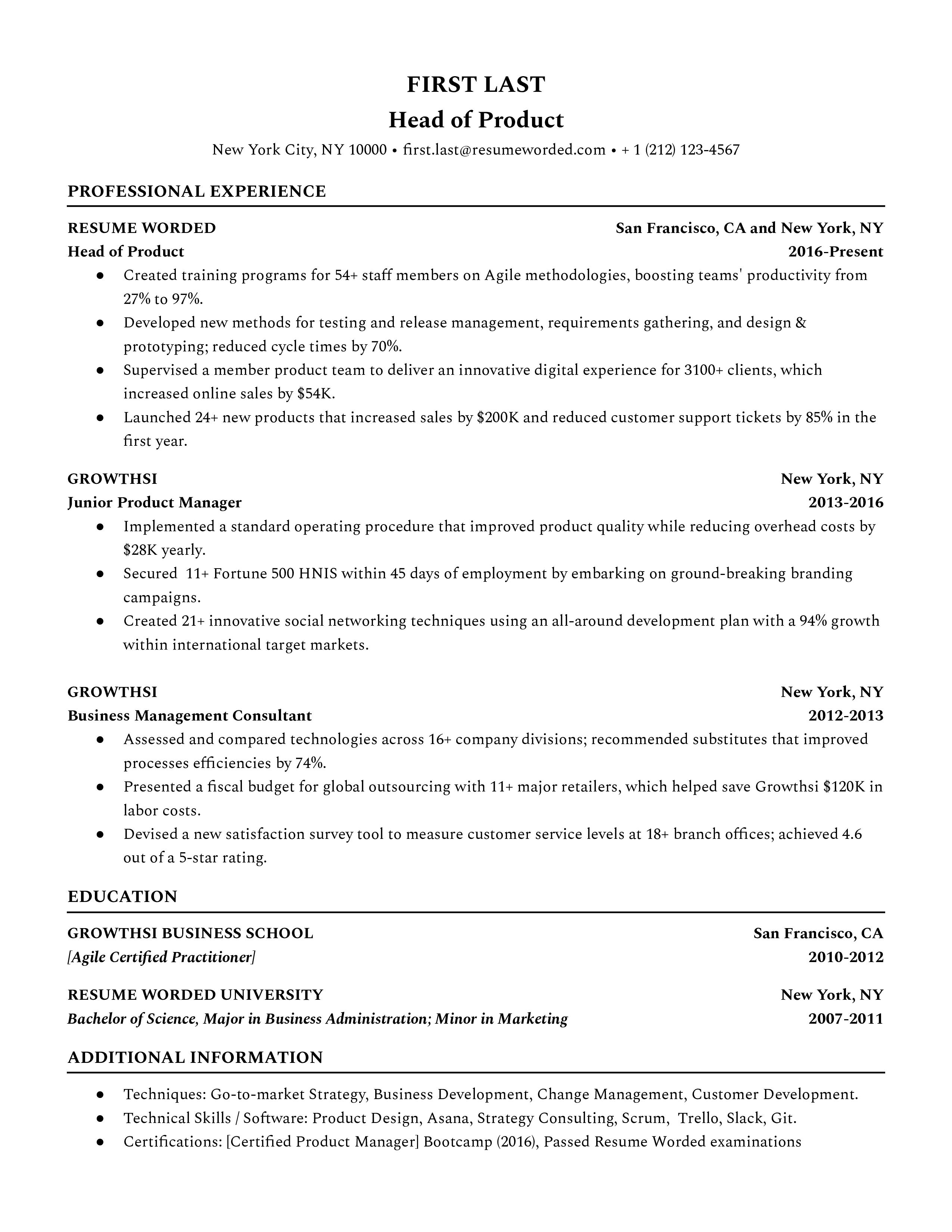

Template 2 of 5: risk analyst resume example.

Hey, let's discuss the Risk Analyst role and how you can craft a compelling resume for this position. One thing about risk analysis is that it’s a dynamic field closely tied to the financial sector, so staying up-to-date with trends in finance and risk management is absolutely vital. It's not just about data anymore; it's also about understanding regulatory changes and new financial products. Your resume should reflect that you're not just a number cruncher, but also a strategic thinker who can anticipate and mitigate financial risks. This is an industry where precision matters a lot, so your resume should be super detailed and error-free. Remember, your potential employer will see your resume as a reflection of your work – sloppy equals risky in their eyes.

Tips to help you write your Risk Analyst resume in 2024

highlight regulatory knowledge.

Since regulations change frequently in the risk analyst field, it's important that you address your knowledge of regulatory requirements. Include any certifications or training you have that demonstrate your understanding of current financial regulations and guidelines.

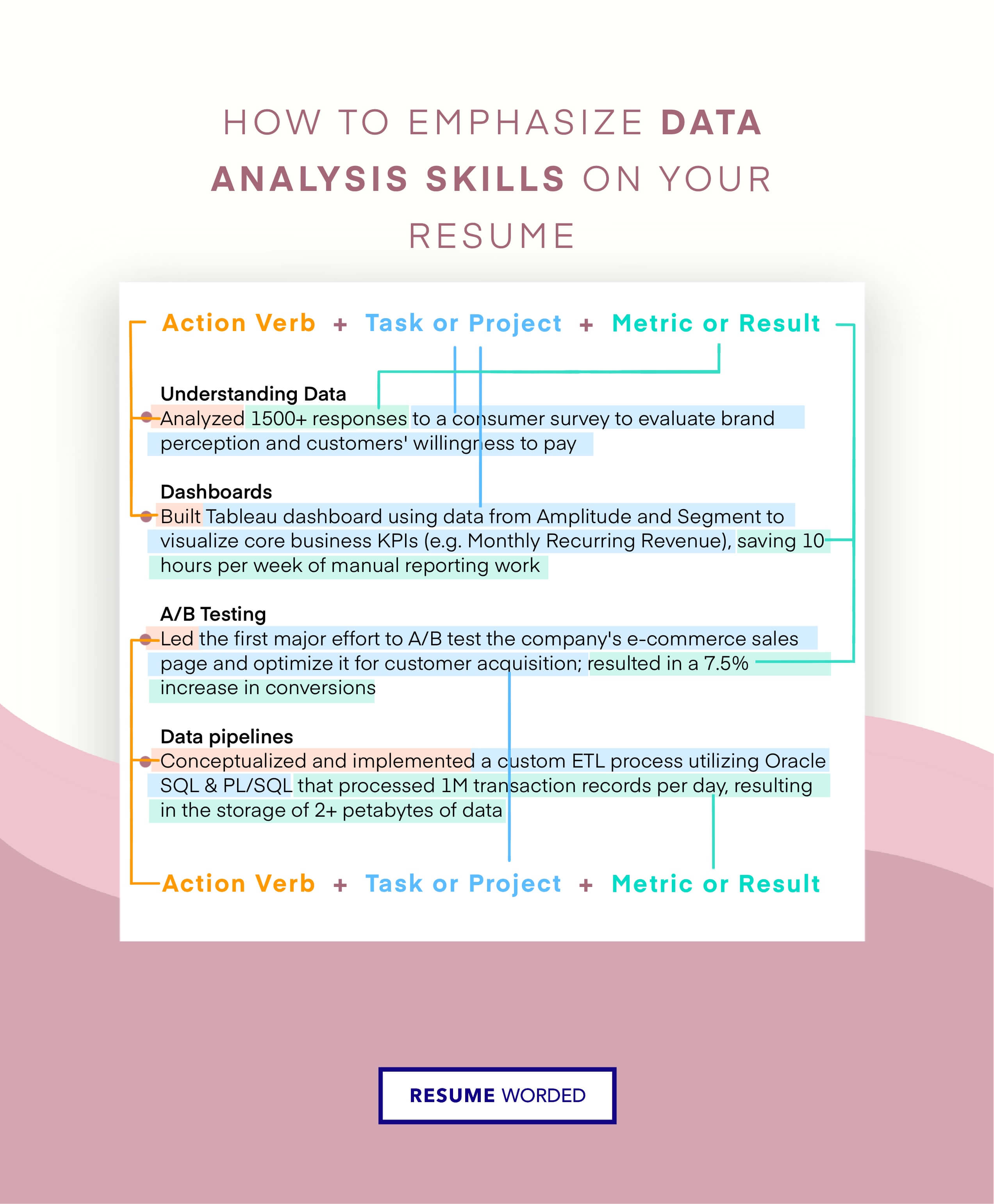

Showcase Data Analysis Skills

Risk analysis is data-intensive. Thus, your resume should highlight your abilities in data collection, statistical analysis, and predictive modeling. If you have any proficiency in risk analysis software or experience with data visualization tools, definitely mention that - it can be a game-changer.

Skills you can include on your Risk Analyst resume

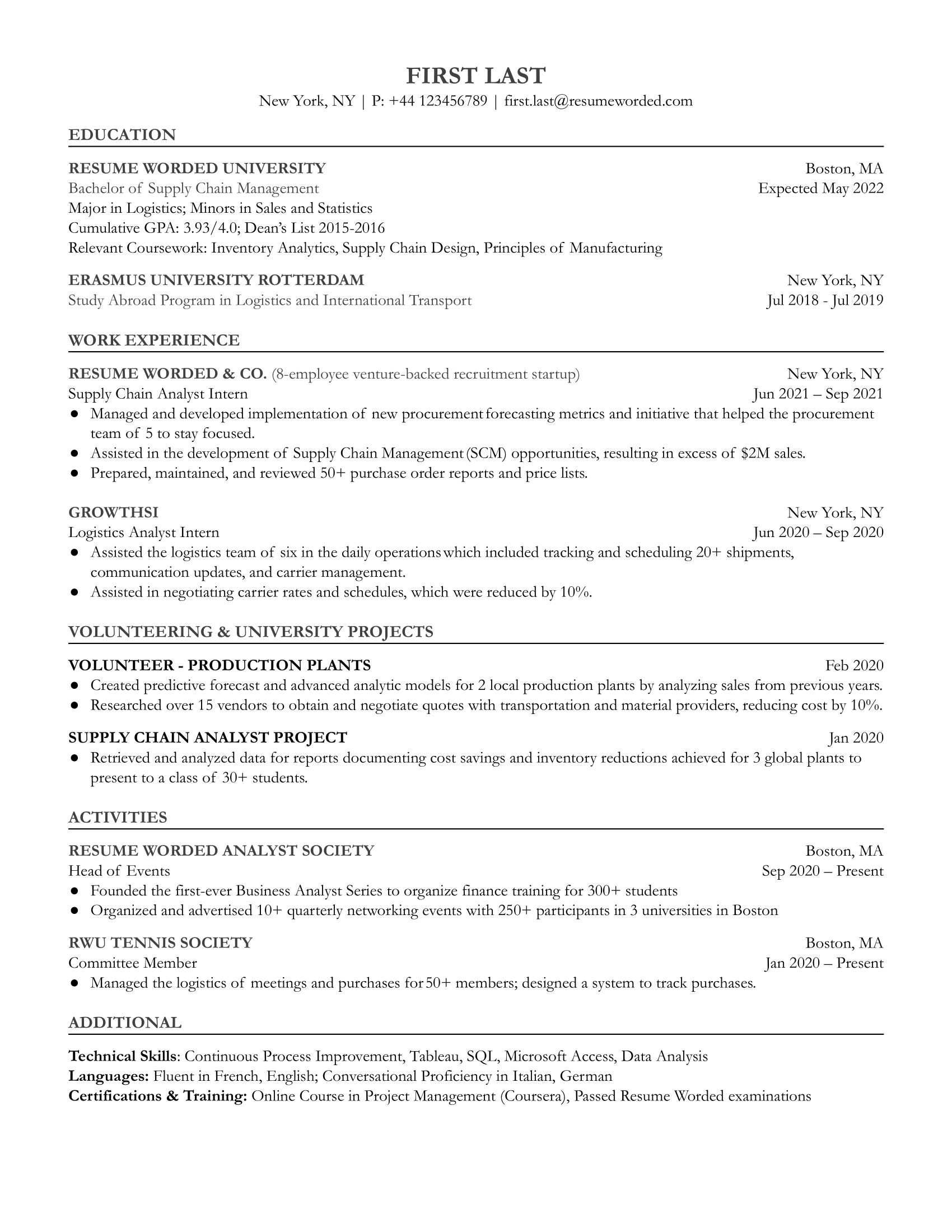

Template 3 of 5: risk analyst resume example.

A risk analyst is the part of the risk management team that handles a lot of the data analysis and interrogation. Risk analysts will collect all relevant data and try to determine the risk associated. They will then take their findings to a risk manager who will use their results to help create a more holistic risk assessment presentation. Because this position is very technical, your experience with risk information management software (RIMS) and other relevant technology is highly important, so ensure the skills section of your resume is updated. Take a look at this successful risk analyst resume.

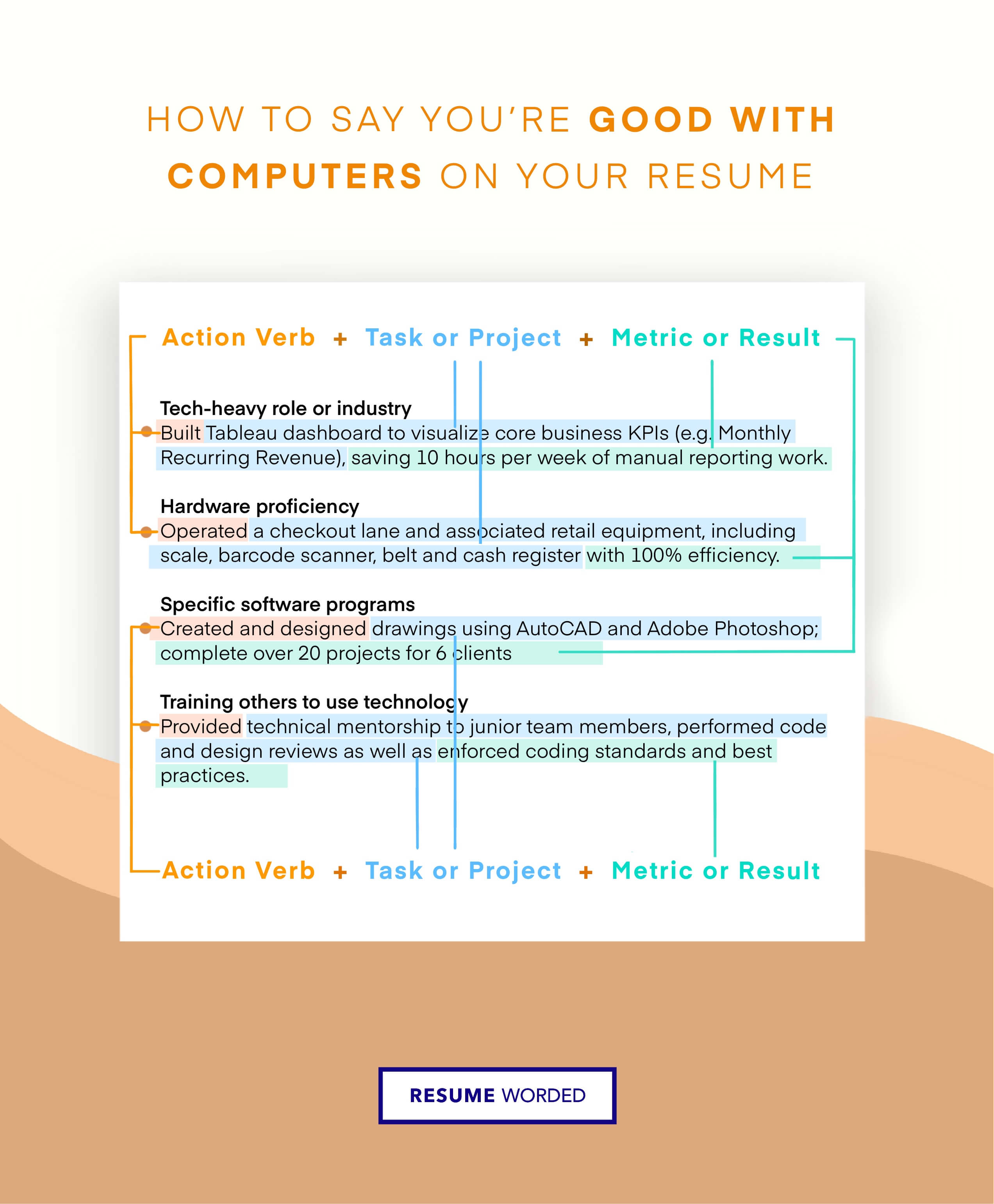

Ensure that you are experienced with the latest data analysis technology.

A big part of your job is doing data analysis. Thankfully, technology has made that analysis a lot simpler. As we continue to get new data analysis technology it is important that you stay current with the newest technologies and that the skill section on your resume is equally current. So keep an eye out for these new technologies and become experienced with them as soon as possible.

Use risk analyst language in your resume.

An easy way to show recruiters that you are experienced as a risk analyst is to use the industry-standard language. So feel free to use industry abbreviations and other keywords used in your work.

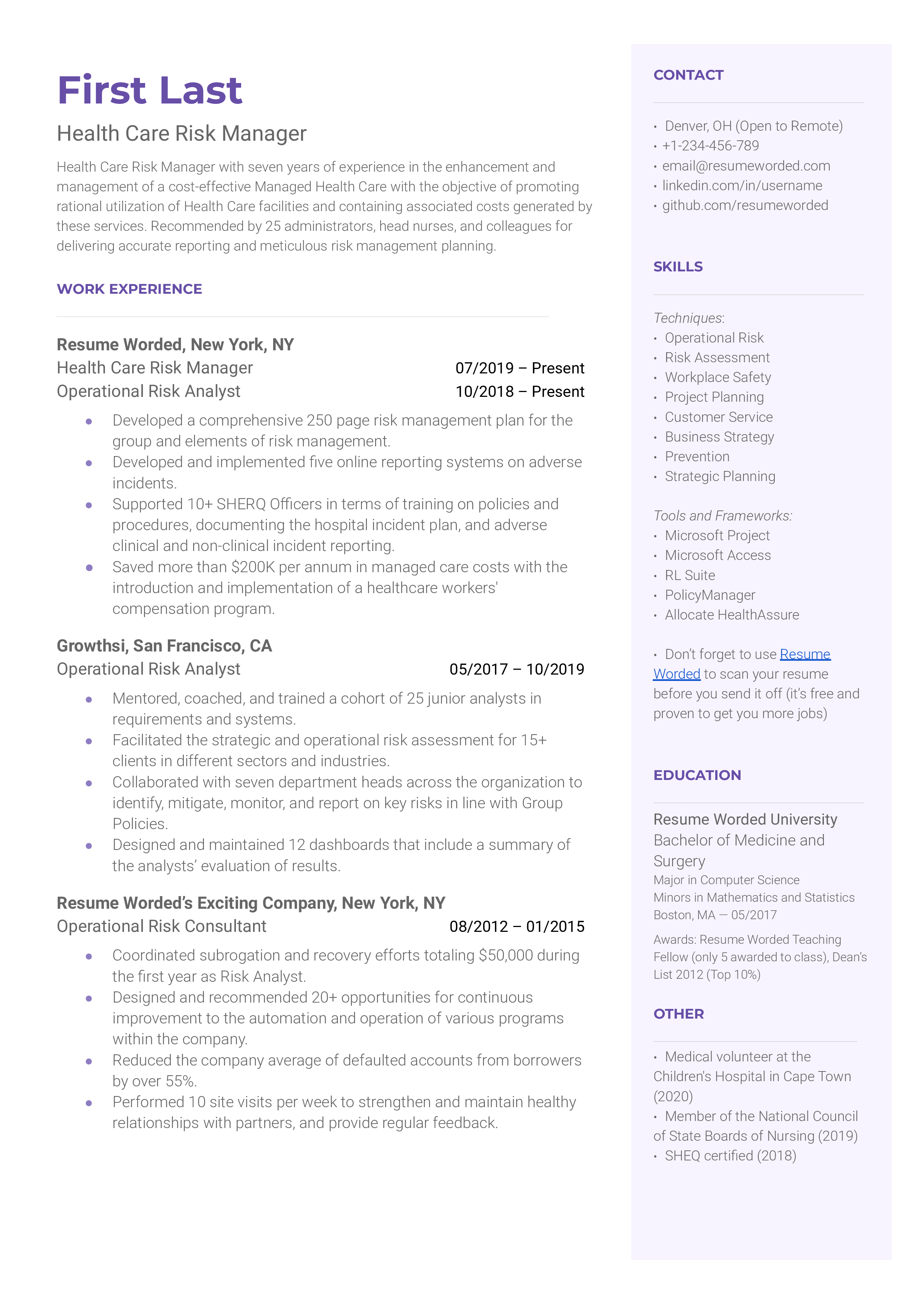

Template 4 of 5: Health Care Risk Manager Resume Example

A healthcare risk manager works for a healthcare company and is tasked with identifying, analyzing, and offering solutions to minimize risks to patients, staff, and the general public. While these professionals traditionally focussed on patient safety, the increased risks associated with advancements in healthcare technology have seen healthcare risk managers expanding their scope of risk to protect the healthcare facility, its staff, and the public as well. When looking for applicants for this position, recruiters will be looking for a bachelor’s degree in health administration or a related field. Beyond that, you will need to have an in-depth knowledge of the healthcare sector, as well as analytical, communication, and problem-solving skills, etc. Here is a strong healthcare risk manager resume.

Tips to help you write your Health Care Risk Manager resume in 2024

highlight your education in the health industry..

It is essential for healthcare risk managers to have an in-depth knowledge of the health industry to do their job effectively. So if you have gone to medical school or have a degree in a health-related field, make sure it is well highlighted in your resume.

Use metrics and numbers to show your workload capabilities.

Recruiters want to know that your output will be worth your salary. To prove that to them, highlight how many projects or reports you have completed. E.g. this applicant mentions that they have ‘developed and implemented five online reporting systems on adverse incidents.’

Skills you can include on your Health Care Risk Manager resume

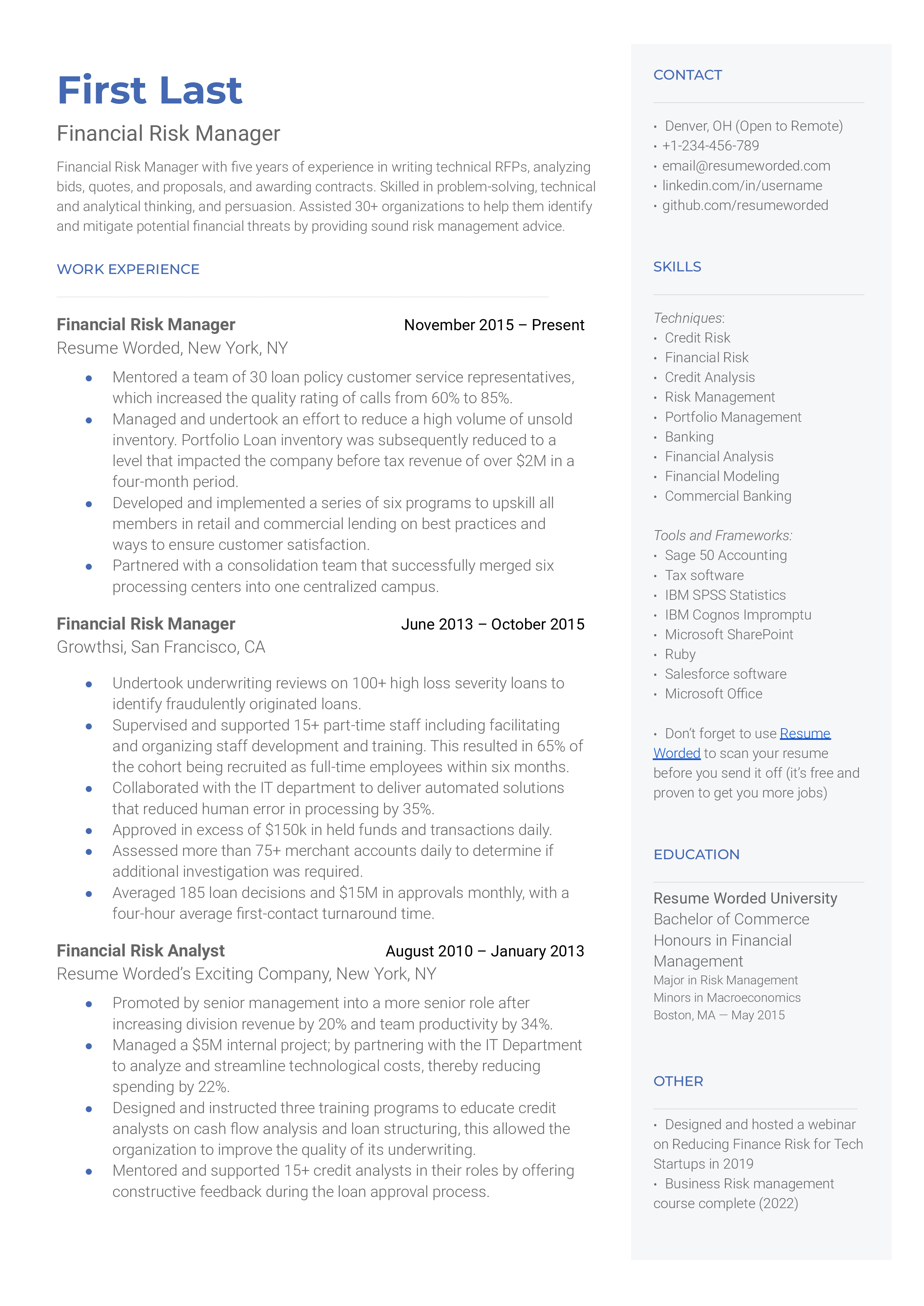

Template 5 of 5: financial risk manager resume example.

Much like all other risk managers, financial risk managers identify, analyze and attempt to mitigate risks to a company. However, these risk managers specialize in the financial industry. You may therefore find them in banks, trading and investment companies, etc. To be globally and professionally designated as a financial risk manager (FRM), you must gain GARP (Global Association of Risk Professionals) certification through a tough and thorough testing process. Beyond the certification, recruiters will also be paying specific attention to your knowledge of the financial industry, and your success within it. In addition, you will be expected to have very strong analytical, and problem-solving skills. Take a look at this strong financial risk manager resume.

Tips to help you write your Financial Risk Manager resume in 2024

list finance-specific tools..

There is specific software and technology that you may use when dealing with financial institutions like banks. You will want to show recruiters that you are experienced using these industry-specific tools by making sure they are all listed in your tools section. For all tools you are not experienced in, take a crash course or gain experience using them before adding them to your resume.

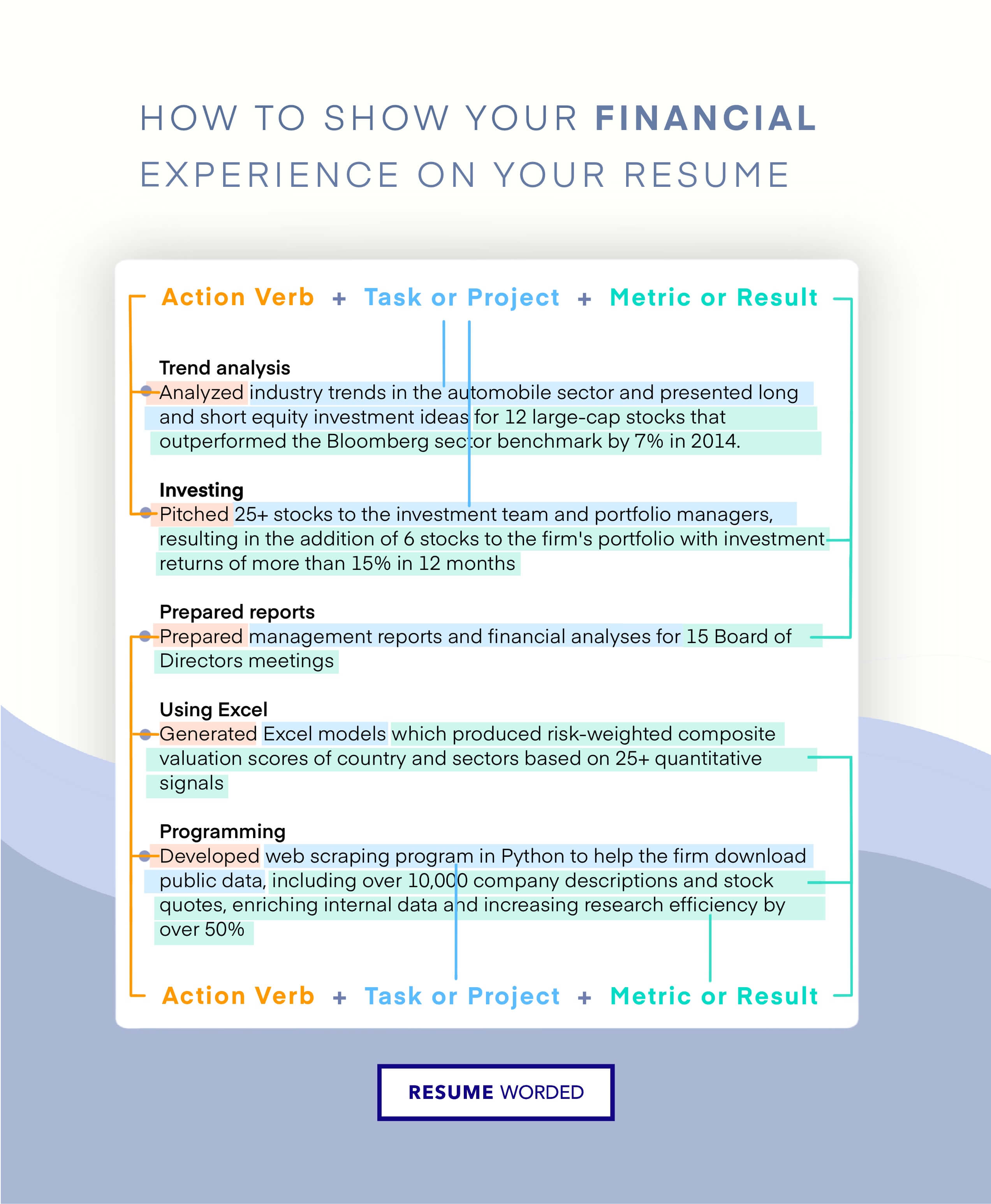

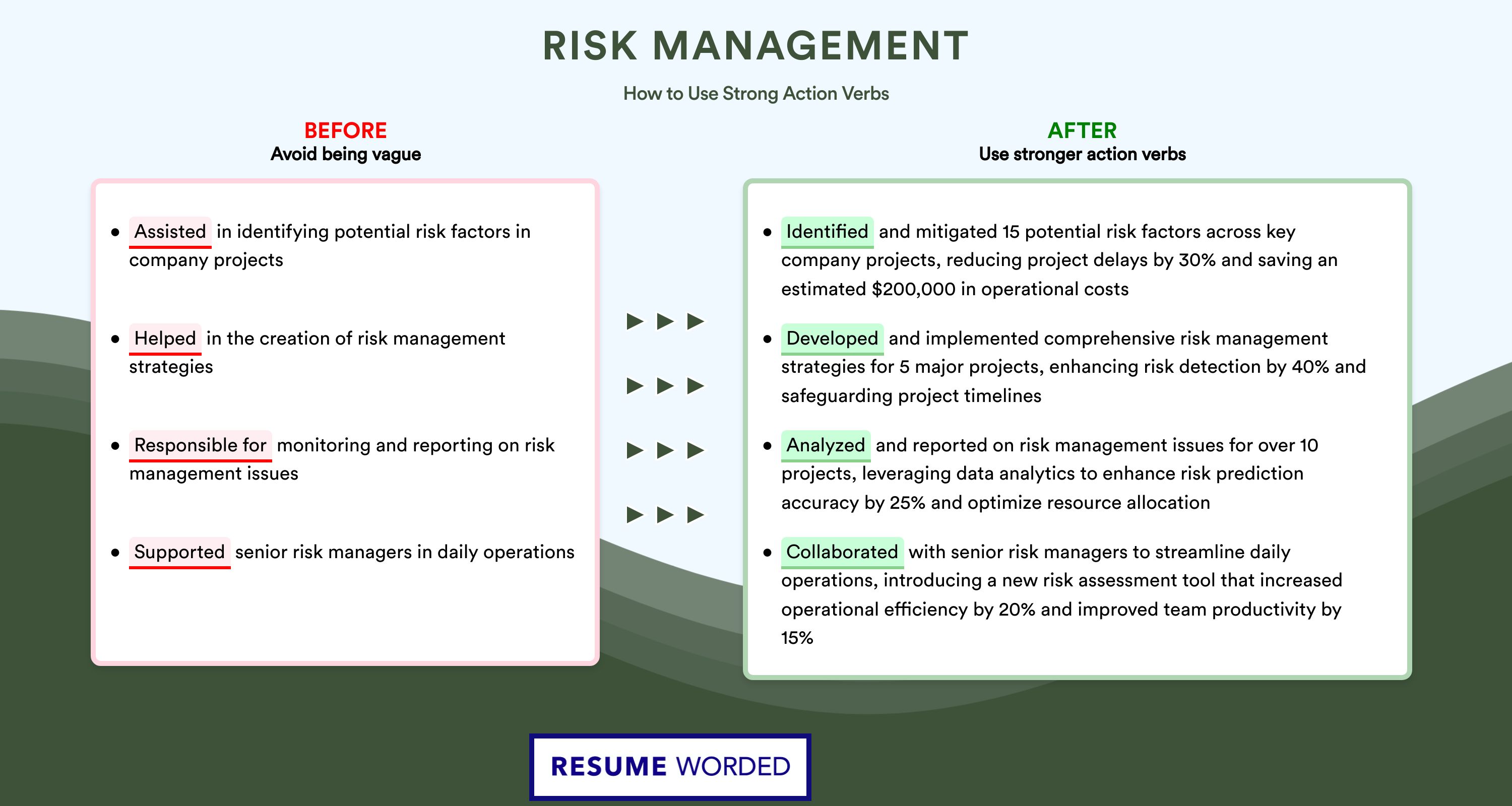

Use strong action verbs which stress risk manager skills in finance.

Strong action verbs that highlight your managerial and analytical skills will make you attractive to recruiters. Using verbs such as “approved”, “supervised”, and “analyzed” helps show your ability to lead a team and perform your risk analysis functions.

Skills you can include on your Financial Risk Manager resume

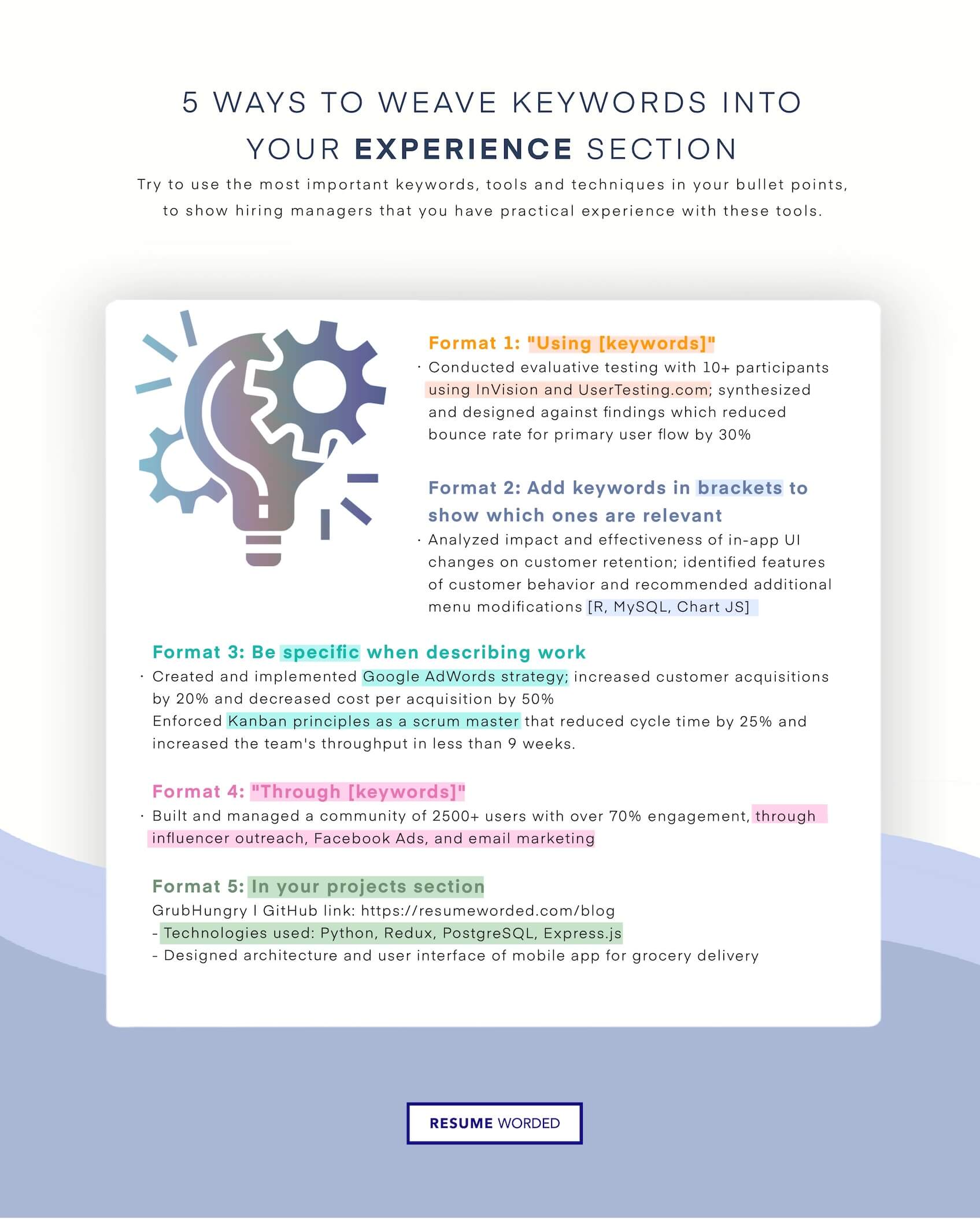

We spoke with hiring managers at top companies like Aon, Deloitte, and KPMG to get their insights on what makes a strong risk management resume. They emphasized the importance of showcasing your ability to identify, assess, and mitigate risks across various industries and business functions. The following tips will help you craft a compelling resume that catches the attention of employers looking for top risk management talent.

Highlight your risk assessment experience

Employers want to see that you have hands-on experience conducting risk assessments. Be specific about the types of risks you have evaluated, such as:

- Conducted a comprehensive operational risk assessment for a $500M manufacturing company, identifying and prioritizing top risks across supply chain, production, and distribution

- Performed a financial risk assessment for a global banking client, analyzing credit, market, and liquidity risks and recommending risk mitigation strategies

Avoid being too general or vague in describing your experience, like:

- Conducted various risk assessments for clients

- Experienced in risk assessment

Demonstrate your industry expertise

Risk management roles often require deep knowledge of specific industries. Showcase your expertise by highlighting relevant industry experience, certifications, or education. For example:

- 5+ years of experience managing risks in the healthcare industry, with a focus on regulatory compliance and data privacy

- Certified Risk Management Professional (CRMP) with a specialization in financial services risk

Avoid simply listing industries without providing context:

- Experience in healthcare, finance, and technology

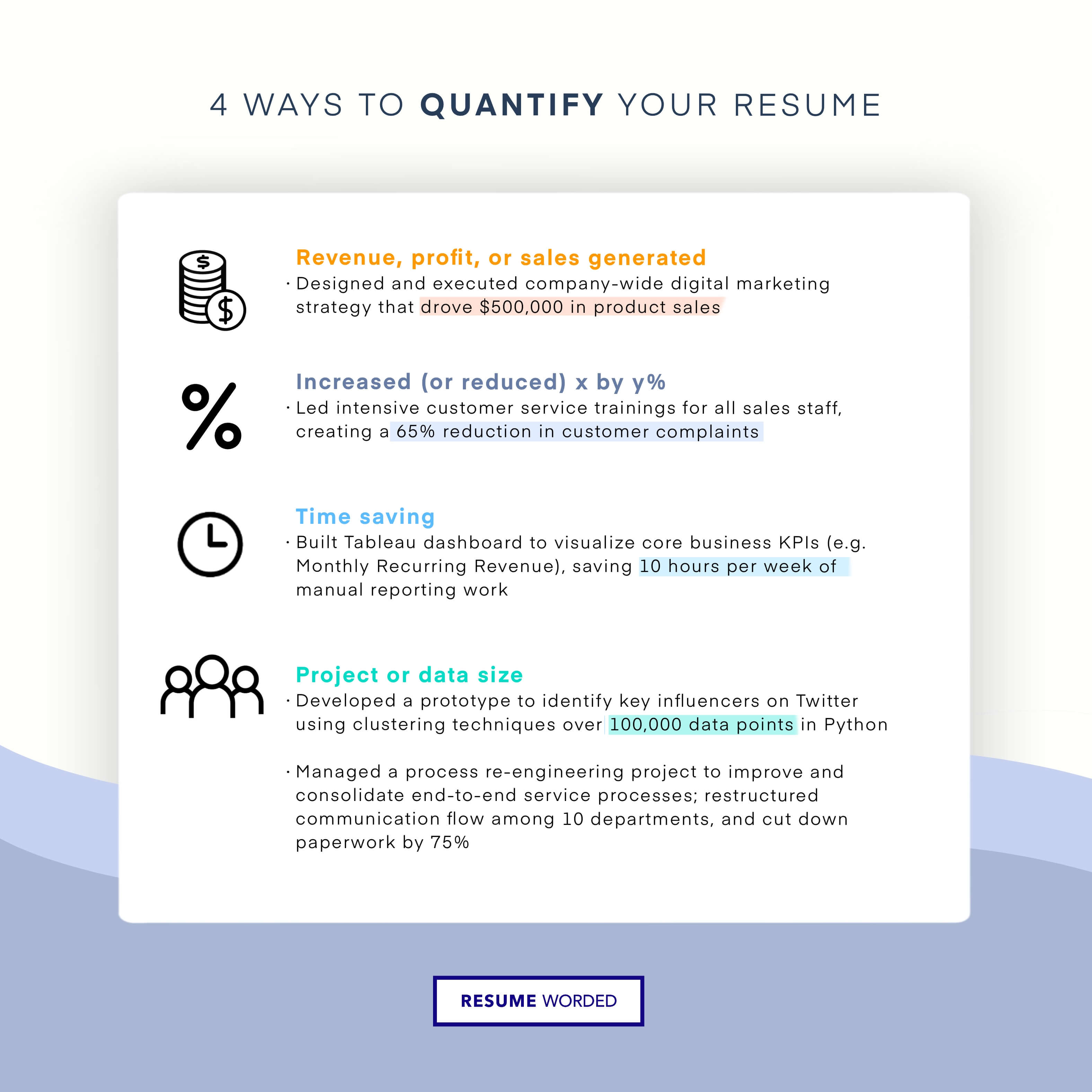

Quantify your impact

Wherever possible, use numbers and metrics to quantify the impact of your risk management efforts. This helps employers understand the scale and significance of your contributions. For example:

- Implemented a risk monitoring dashboard that reduced the time to identify and respond to critical risks by 50%

- Developed a risk assessment framework that was adopted across 10 business units, covering $2B in annual revenue

Avoid using vague or unquantified statements:

- Improved risk identification and response times

- Created a risk assessment framework that was widely adopted

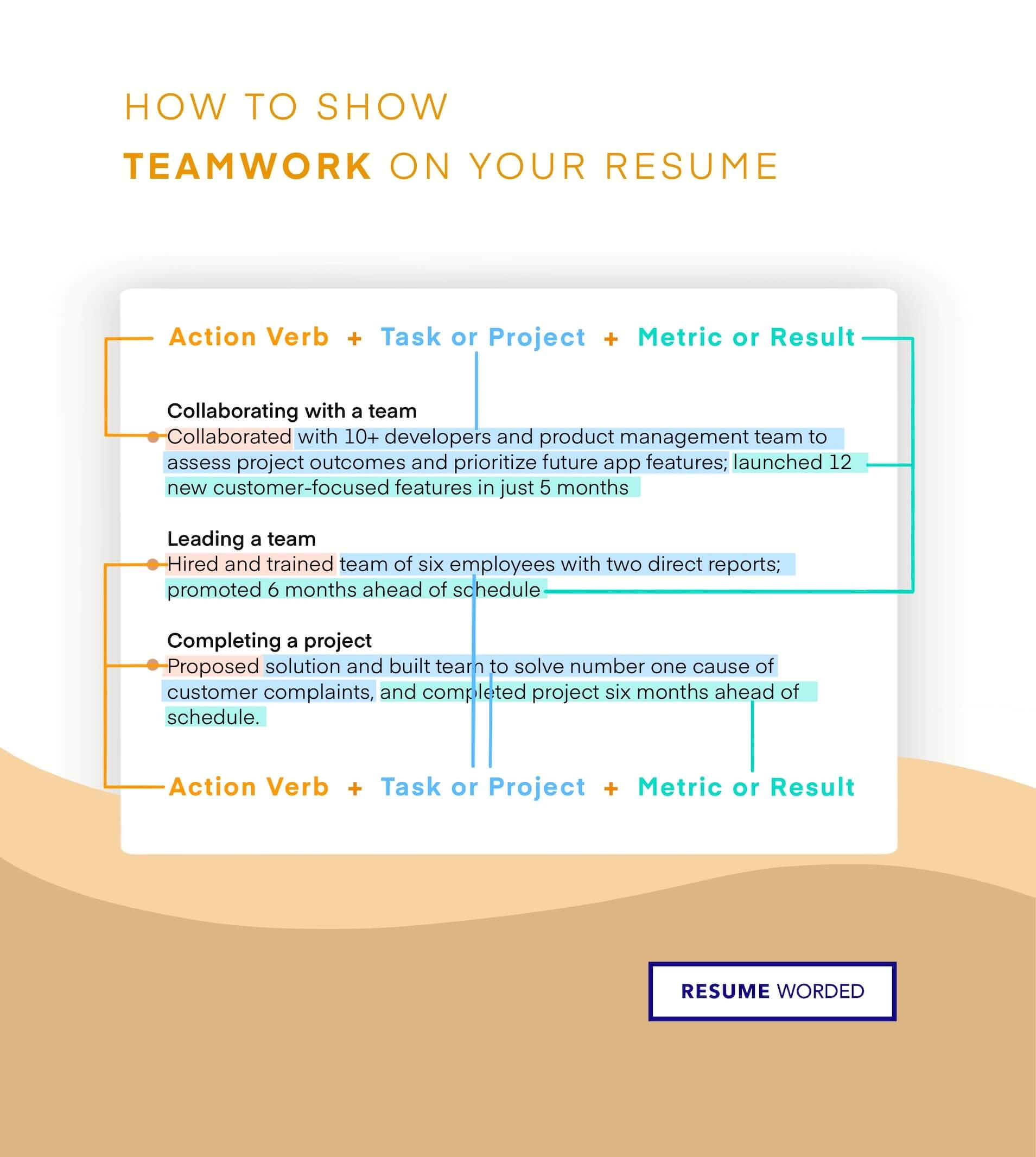

Showcase your communication and collaboration skills

Risk management professionals need to be able to effectively communicate risks and mitigation strategies to stakeholders at all levels of an organization. Highlight examples of how you have collaborated with cross-functional teams and communicated complex risk concepts to non-technical audiences. For example:

- Presented quarterly risk reports to the executive leadership team and board of directors, translating technical findings into actionable business recommendations

- Collaborated with IT, legal, and compliance teams to develop and implement a company-wide risk management policy

Avoid generic statements that don't provide specific examples:

- Strong communication and collaboration skills

- Experienced in presenting to executive audiences

Tailor your resume to the job description

Risk management roles can vary significantly depending on the company and industry. Carefully review the job description and tailor your resume to highlight the specific skills and experiences that the employer is seeking. For example, if the job description emphasizes experience with a particular risk management framework or tool, make sure to call that out in your resume.

Consider including a brief summary statement at the top of your resume that directly addresses the key requirements of the role, like:

Certified Risk Management Professional with 7+ years of experience in the financial services industry. Expertise in conducting enterprise-wide risk assessments, developing risk mitigation strategies, and implementing risk monitoring programs. Proven track record of collaborating with cross-functional teams to embed risk management into business processes and decision-making.

Highlight your problem-solving skills

Risk management is all about proactively identifying potential problems and developing solutions to mitigate those risks. Use your resume to showcase specific examples of how you have used your problem-solving skills to navigate complex risk scenarios. For example:

- Led a cross-functional team to investigate and resolve a critical security breach, minimizing customer data loss and reputational damage

- Developed a comprehensive business continuity plan that enabled the company to quickly recover from a major natural disaster with minimal financial impact

Avoid generic statements that don't demonstrate your impact:

- Strong problem-solving skills

- Experienced in risk mitigation

Writing Your Risk Management Resume: Section By Section

header, 1. decide on the best resume header format.

There are a few different ways to format your resume header, depending on your experience level and personal brand:

- For a clean, modern look, consider a simple header with your name in a slightly larger font than the rest of your contact details.

- If you have a lot of certifications or want to highlight your LinkedIn profile, you might opt for a more detailed header format.

- For a traditional industry like finance or insurance, a classic header format with your name, phone number, and email address is a safe bet.

Remember, the goal is to make it easy for hiring managers to find your contact information at a glance.

2. Use a professional email address

When it comes to your email address, stick to a professional format that incorporates your name, like [email protected] . Avoid using outdated email providers or unprofessional handles, such as:

- [email protected]

Instead, opt for a modern, professional email provider and a straightforward format, like:

Remember, your email address is often the first point of contact with potential employers, so make sure it reflects your professionalism and attention to detail.

3. Highlight your risk management credentials

If you have relevant risk management certifications or designations, such as Certified Risk Manager (CRM) or Professional Risk Manager (PRM), consider including them after your name in your resume header. For example:

John Smith, CRM, PRM New York, NY | [email protected] | 555-123-4567 | linkedin.com/in/johnsmith

Including your credentials in your header is a great way to immediately convey your expertise and commitment to the risk management field. However, be selective and only include the most relevant and impressive credentials to avoid cluttering your header.

Summary

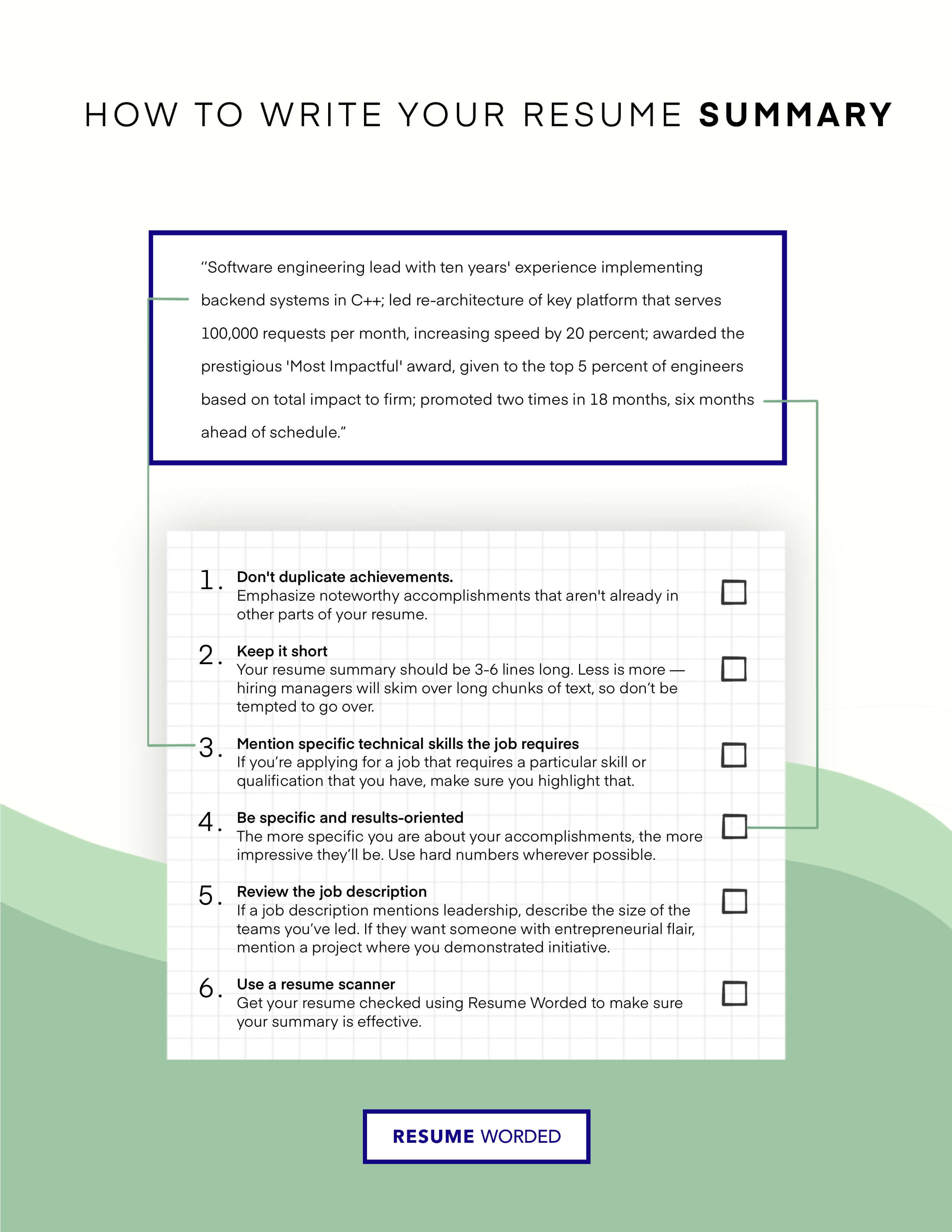

A resume summary for a risk management position is optional, but it can be a valuable addition if you have extensive experience or are making a career change. It allows you to provide context and highlight key qualifications that may not be immediately apparent from the rest of your resume. However, avoid using an objective statement, as it is outdated and focuses on what you want rather than what you can offer the employer.

When crafting your summary, tailor it to the specific risk management role you are targeting. Emphasize your most relevant skills, experience, and achievements without repeating information that is already covered in other sections of your resume. Keep it concise, ideally no more than a short paragraph.

To learn how to write an effective resume summary for your Risk Management resume, or figure out if you need one, please read Risk Management Resume Summary Examples , or Risk Management Resume Objective Examples .

1. Highlight your risk management expertise

When writing your resume summary, focus on showcasing your risk management expertise and the value you can bring to the organization. Consider the following examples:

- Experienced risk management professional with a proven track record of identifying and mitigating potential risks across various industries

- Certified Risk Manager (CRM) with 10+ years of experience developing and implementing effective risk management strategies

Avoid generic or vague statements that do not specifically relate to risk management, such as:

- Hardworking individual with a passion for success

- Results-driven professional seeking a challenging opportunity

Instead, emphasize your risk management qualifications, relevant certifications, and specific achievements that demonstrate your expertise in the field.

Quantify your achievements whenever possible to make your summary more impactful. For example, mention the percentage by which you reduced potential losses or the number of successful risk management initiatives you led.

2. Tailor your summary to the job description

To create a compelling resume summary, align your qualifications with the requirements outlined in the job description. Identify the key skills and experience the employer is looking for and incorporate them into your summary.

For example, if the job description emphasizes experience with enterprise risk management (ERM) frameworks, you could write:

Skilled risk management professional with extensive experience implementing and managing ERM frameworks for large organizations. Adept at identifying, assessing, and mitigating risks across various business functions to protect company assets and ensure regulatory compliance.

By tailoring your summary to the specific job requirements, you demonstrate your relevance and increase the likelihood of capturing the hiring manager's attention.

To ensure your resume summary is well-aligned with the job description, try using our Targeted Resume tool. It checks your resume against the job posting and provides feedback on how well your skills and keywords match the employer's requirements.

Experience

The work experience section is the most important part of your risk management resume. It's where you show hiring managers how you've applied your skills to real-world situations and made an impact in previous roles. Here are some key tips to make your work experience section stand out:

1. Highlight your risk management achievements

Instead of simply listing your responsibilities, focus on your achievements and the impact you made in each role. Use specific examples and metrics to quantify your success.

For example, instead of saying:

- Conducted risk assessments and created risk management plans

Say something like:

- Conducted 25+ risk assessments across multiple business units, identifying and mitigating risks that saved the company $500K in potential losses

- Created and implemented a comprehensive risk management plan that reduced the company's overall risk exposure by 30%

Use our Score My Resume tool to get instant feedback on your resume and ensure you're highlighting your achievements effectively.

2. Showcase your industry expertise

Demonstrate your deep understanding of the risk management industry by using relevant terminology and highlighting your experience with industry-specific tools and methodologies.

For example:

- Expertise in risk identification techniques such as HAZOP, FMEA, and bowtie analysis

- Proficient in risk management software tools including IBM OpenPages, RSA Archer, and ServiceNow GRC

- Certified in ISO 31000 Risk Management and COSO Enterprise Risk Management Framework

Tailor your resume to the specific job description using our Targeted Resume tool, which checks if your resume has the right skills and keywords for the role.

3. Demonstrate your collaboration and leadership skills

Risk management professionals often work cross-functionally with various stakeholders across the organization. Showcase your ability to collaborate effectively and lead risk management initiatives.

Led a cross-functional team of 15 members from finance, legal, and operations to develop and implement a business continuity plan that ensured the company's resilience during the COVID-19 pandemic

- Collaborated with executive leadership to align risk management strategies with overall business objectives, resulting in a 20% reduction in risk-related incidents

Highlight your leadership roles and promotions to demonstrate your career progression and ability to take on increasing responsibility.

Education

The education section of your risk management resume is an important part of your application. It shows employers that you have the necessary knowledge and training to succeed in the role. Here are some tips to help you write a strong education section that will impress hiring managers.

1. List your degrees in reverse chronological order

Start with your most recent degree and work backwards. This format helps employers quickly see your highest level of education and your most recent academic achievements.

Master of Business Administration (MBA), XYZ University, 2018-2020 Bachelor of Science in Finance, ABC College, 2014-2018

Avoid listing your degrees in a random or unclear order, such as:

Bachelor of Science in Finance, ABC College Master of Business Administration (MBA), XYZ University

2. Include relevant coursework and academic projects

If you are a recent graduate or have limited work experience, highlighting relevant coursework and academic projects can help demonstrate your knowledge and skills to employers.

Examples of relevant coursework for risk management might include:

- Risk assessment and management

- Financial risk modeling

- Insurance and risk finance

- Business continuity planning

However, avoid listing generic or irrelevant courses, such as:

- Introduction to psychology

- Art history

- Basic writing

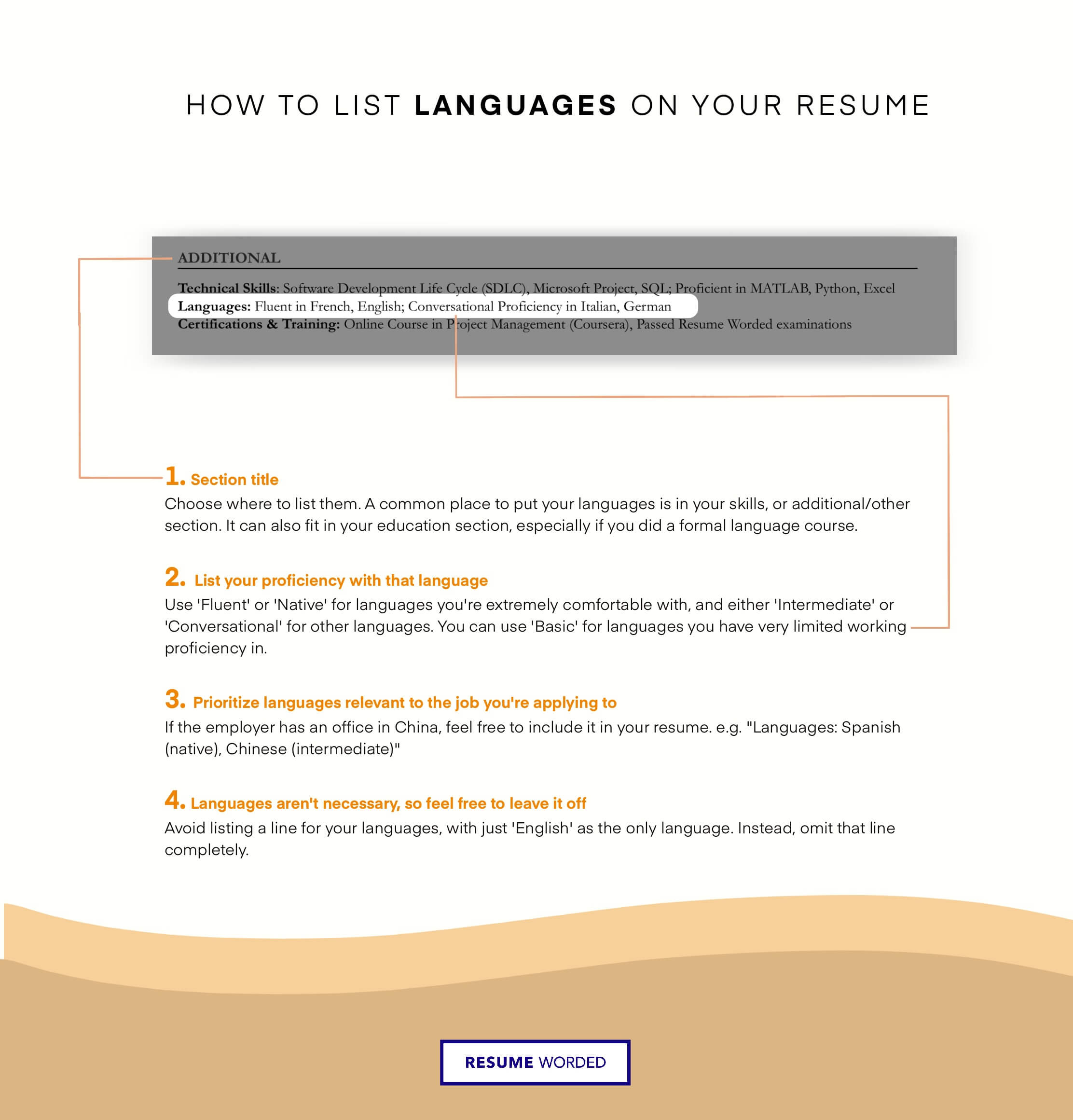

3. Highlight your certifications and professional development

In addition to your formal education, include any relevant certifications or professional development courses you have completed. These show employers that you are committed to staying up-to-date with industry trends and best practices.

Some examples of relevant certifications for risk management professionals include:

- Certified Risk Manager (CRM)

- Financial Risk Manager (FRM)

- Chartered Property Casualty Underwriter (CPCU)

- Certified Business Continuity Professional (CBCP)

However, avoid listing non-substantial or irrelevant certifications, such as:

- First aid certification

- Diversity and inclusion training

- Workplace safety course

4. Keep it concise if you are a senior-level professional

If you have extensive work experience, your education section should be brief and to the point. Employers will be more interested in your professional achievements than your academic background.

MBA, Finance, XYZ University BS, Accounting, ABC College

Avoid providing unnecessary details or listing irrelevant degrees, such as:

Master of Business Administration, XYZ University, 2005-2007 Relevant coursework: Financial accounting, marketing, organizational behavior GPA: 3.8 Bachelor of Science in Accounting, ABC College, 2001-2005 Relevant coursework: Auditing, tax accounting, business law GPA: 3.6 Associate of Arts, Liberal Studies, DEF Community College, 1999-2001

Action Verbs For Risk Management Resumes

A risk manager position is a technical position requiring expert analytical skills. Using action verbs that emphasize the analytical and technical aspects of the job is a direct way to indicate your capabilities in this field.

This list of action verbs is focused on the technical tasks of the position as well as the communication tasks that you can expect of a risk manager. Using the right action verbs is an easy way to spotlight yourself and help showcase your most relevant skills in a few words.

- Investigated

- Facilitated

- Coordinated

- Collaborated

For a full list of effective resume action verbs, visit Resume Action Verbs .

Action Verbs for Risk Management Resumes

Skills for risk management resumes.

When looking at the skills section of a risk manager’s resume, recruiters are looking to see the technical skills needed in identifying and analyzing risk. Communicating and collaborating with other stakeholders is also an important part of a risk manager’s job, so including relevant skills in these areas is also important.

Here is a list of recruiter-approved skills you would expect to see in a risk manager’s resume. Add those that you are experienced with to your resume to impress recruiters and secure an interview.

- Risk Management

- Financial Risk

- Operational Risk

- Operational Risk Management

- Enterprise Risk Management

- Financial Services

- Stakeholder Management

- Credit Risk

- Risk Assessment

- Risk Analysis

- Portfolio Management

- Change Management

- Retail Banking

- Financial Analysis

- Business Analysis

- Internal Controls

- Internal Audit

- Business Strategy

- Operations Management

- Business Process Improvement

- Wind Tunnel

How To Write Your Skills Section On a Risk Management Resumes

You can include the above skills in a dedicated Skills section on your resume, or weave them in your experience. Here's how you might create your dedicated skills section:

Skills Word Cloud For Risk Management Resumes

This word cloud highlights the important keywords that appear on Risk Management job descriptions and resumes. The bigger the word, the more frequently it appears on job postings, and the more 'important' it is.

How to use these skills?

Other finance resumes.

Director of Product Management

Supply Chain

- Bookkeeper Resume Guide

- Investment Banking Resume Guide

- Financial Analyst Resume Guide

- Accountant Resume Guide

- Equity Research Resume Guide

- C-Level and Executive Resume Guide

- Financial Advisor Resume Guide

- Procurement Resume Guide

- Auditor Resume Guide

- Financial Controller Resume Guide

Risk Management Resume Guide

- Accounts Payable Resume Guide

- Internal Audit Resume Guide

- Purchasing Manager Resume Guide

- Loan Processor Resume Guide

- Finance Director Resume Guide

- Credit Analyst Resume Guide

- Collections Specialist Resume Guide

- Finance Executive Resume Guide

- VP of Finance Resume Guide

- Claims Adjuster Resume Guide

- Payroll Specialist Resume Guide

- Cost Analyst Resume Guide

- M&A Resume Guide

- Risk Manager Resume Example

- Risk Analyst Resume Example

- Health Care Risk Manager Resume Example

- Financial Risk Manager Resume Example

- Tips for Risk Management Resumes

- Skills and Keywords to Add

- All Resume Examples

- Risk Management CV Examples

- Risk Management Cover Letter

- Risk Management Interview Guide

- Explore Alternative and Similar Careers

Download this PDF template.

Creating an account is free and takes five seconds. you'll get access to the pdf version of this resume template., choose an option..

- Have an account? Sign in

E-mail Please enter a valid email address This email address hasn't been signed up yet, or it has already been signed up with Facebook or Google login.

Password Show Your password needs to be between 6 and 50 characters long, and must contain at least 1 letter and 1 number. It looks like your password is incorrect.

Remember me

Forgot your password?

Sign up to get access to Resume Worded's Career Coaching platform in less than 2 minutes

Name Please enter your name correctly

E-mail Remember to use a real email address that you have access to. You will need to confirm your email address before you get access to our features, so please enter it correctly. Please enter a valid email address, or another email address to sign up. We unfortunately can't accept that email domain right now. This email address has already been taken, or you've already signed up via Google or Facebook login. We currently are experiencing a very high server load so Email signup is currently disabled for the next 24 hours. Please sign up with Google or Facebook to continue! We apologize for the inconvenience!

Password Show Your password needs to be between 6 and 50 characters long, and must contain at least 1 letter and 1 number.

Receive resume templates, real resume samples, and updates monthly via email

By continuing, you agree to our Terms and Conditions and Privacy Policy .

Lost your password? Please enter the email address you used when you signed up. We'll send you a link to create a new password.

E-mail This email address either hasn't been signed up yet, or you signed up with Facebook or Google. This email address doesn't look valid.

Back to log-in

These professional templates are optimized to beat resume screeners (i.e. the Applicant Tracking System). You can download the templates in Word, Google Docs, or PDF. For free (limited time).

access samples from top resumes, get inspired by real bullet points that helped candidates get into top companies., get a resume score., find out how effective your resume really is. you'll get access to our confidential resume review tool which will tell you how recruiters see your resume..

Writing an effective resume has never been easier .

Upgrade to resume worded pro to unlock your full resume review., get this resume template (+ 4 others), plus proven bullet points., for a small one-time fee, you'll get everything you need to write a winning resume in your industry., here's what you'll get:.

- 📄 Get the editable resume template in Google Docs + Word . Plus, you'll also get all 4 other templates .

- ✍️ Get sample bullet points that worked for others in your industry . Copy proven lines and tailor them to your resume.

- 🎯 Optimized to pass all resume screeners (i.e. ATS) . All templates have been professionally designed by recruiters and 100% readable by ATS.

Buy now. Instant delivery via email.

instant access. one-time only., what's your email address.

I had a clear uptick in responses after using your template. I got many compliments on it from senior hiring staff, and my resume scored way higher when I ran it through ATS resume scanners because it was more readable. Thank you!

Thank you for the checklist! I realized I was making so many mistakes on my resume that I've now fixed. I'm much more confident in my resume now.

- Applying to Uni

- Apprenticeships

- Health & Relationships

- Money & Finance

Personal Statements

- Postgraduate

- U.S Universities

University Interviews

- Vocational Qualifications

- Accommodation

- Budgeting, Money & Finance

- Health & Relationships

- Jobs & Careers

- Socialising

Studying Abroad

- Studying & Revision

- Technology

- University & College Admissions

Guide to GCSE Results Day

Finding a job after school or college

Retaking GCSEs

In this section

Choosing GCSE Subjects

Post-GCSE Options

GCSE Work Experience

GCSE Revision Tips

Why take an Apprenticeship?

Applying for an Apprenticeship

Apprenticeships Interviews

Apprenticeship Wage

Engineering Apprenticeships

What is an Apprenticeship?

Choosing an Apprenticeship

Real Life Apprentices

Degree Apprenticeships

Higher Apprenticeships

A Level Results Day 2024

AS Levels 2024

Clearing Guide 2024

Applying to University

SQA Results Day Guide 2024

BTEC Results Day Guide

Vocational Qualifications Guide

Sixth Form or College

International Baccalaureate

Post 18 options

Finding a Job

Should I take a Gap Year?

Travel Planning

Volunteering

Gap Year Guide

Gap Year Blogs

Applying to Oxbridge

Applying to US Universities

Choosing a Degree

Choosing a University or College

Personal Statement Editing and Review Service

Guide to Freshers' Week

Student Guides

Student Cooking

Student Blogs

- Top Rated Personal Statements

Personal Statement Examples

Writing Your Personal Statement

- Postgraduate Personal Statements

- International Student Personal Statements

- Gap Year Personal Statements

Personal Statement Length Checker

Personal Statement Examples By University

Personal Statement Changes 2025

- Personal Statement Template

Job Interviews

Types of Postgraduate Course

Writing a Postgraduate Personal Statement

Postgraduate Funding

Postgraduate Study

Internships

Choosing A College

Ivy League Universities

Common App Essay Examples

Universal College Application Guide

How To Write A College Admissions Essay

College Rankings

Admissions Tests

Fees & Funding

Scholarships

Budgeting For College

Online Degree

Platinum Express Editing and Review Service

Gold Editing and Review Service

Silver Express Editing and Review Service

UCAS Personal Statement Editing and Review Service

Oxbridge Personal Statement Editing and Review Service

Postgraduate Personal Statement Editing and Review Service

You are here

- Mature Student Personal Statements

- Personal Statements By University

- Accountancy and Finance Personal Statements

- Actuarial Science Personal Statements

- American Studies Personal Statements

- Anthropology Personal Statements

- Archaeology Personal Statements

- Architecture Personal Statements

- Art and Design Personal Statements

- Biochemistry Personal Statements

- Bioengineering Personal Statements

- Biology Personal Statements

- Biomedical Science Personal Statements

- Biotechnology Personal Statements

Business Management Personal Statement Examples

- Business Personal Statements

- Catering and Food Personal Statements

- Chemistry Personal Statements

- Classics Personal Statements

- Computer Science Personal Statements

- Computing and IT Personal Statements

- Criminology Personal Statements

- Dance Personal Statements

- Dentistry Personal Statements

- Design Personal Statements

- Dietetics Personal Statements

- Drama Personal Statements

- Economics Personal Statement Examples

- Education Personal Statements

- Engineering Personal Statement Examples

- English Personal Statements

- Environment Personal Statements

- Environmental Science Personal Statements

- Event Management Personal Statements

- Fashion Personal Statements

- Film Personal Statements

- Finance Personal Statements

- Forensic Science Personal Statements

- Geography Personal Statements

- Geology Personal Statements

- Health Sciences Personal Statements

- History Personal Statements

- History of Art Personal Statements

- Hotel Management Personal Statements

- International Relations Personal Statements

- International Studies Personal Statements

- Islamic Studies Personal Statements

- Japanese Studies Personal Statements

- Journalism Personal Statements

- Land Economy Personal Statements

- Languages Personal Statements

- Law Personal Statement Examples

- Linguistics Personal Statements

- Management Personal Statements

- Marketing Personal Statements

- Mathematics Personal Statements

- Media Personal Statements

- Medicine Personal Statement Examples

- Midwifery Personal Statements

- Music Personal Statements

- Music Technology Personal Statements

- Natural Sciences Personal Statements

- Neuroscience Personal Statements

- Nursing Personal Statements

- Occupational Therapy Personal Statements

- Osteopathy Personal Statements

- Oxbridge Personal Statements

- Pharmacy Personal Statements

- Philosophy Personal Statements

- Photography Personal Statements

- Physics Personal Statements

- Physiology Personal Statements

- Physiotherapy Personal Statements

- Politics Personal Statements

- Psychology Personal Statement Examples

- Radiography Personal Statements

- Religious Studies Personal Statements

- Social Work Personal Statements

- Sociology Personal Statements

- Sports & Leisure Personal Statements

- Sports Science Personal Statements

- Surveying Personal Statements

- Teacher Training Personal Statements

- Theology Personal Statements

- Travel and Tourism Personal Statements

- Urban Planning Personal Statements

- Veterinary Science Personal Statements

- Zoology Personal Statements

- Personal Statement Editing Service

- Personal Statement Writing Guide

- Submit Your Personal Statement

- Personal Statement Questions 2025

- Personal Statement Changes 2024

What is a business management personal statement?

You are required to write a business and management personal statement to showcase your main strengths, skills, experience and career goals to your chosen universities.

Admissions tutors want to see candidates with business and/or management experience that they can apply to their course.

It should also convey your passion for the subject, as well as why you want to pursue a degree in this area.

How do I write a business management personal statement?

It’s a good idea to start your statement with why you want to study business and and management at university (rather than just business ). For example, you may want to focus on the management part and why this interests you.

Make sure you back up everything with examples, which means having a good list of notes about your experience.

A good business and management personal statement should be written concisely, with a clear structure, including a memorable conclusion.

For inspiration on how to write your own unique statement, take a look at some of our business and management personal statement examples above (please don't copy them!), which will help you decide what to include.

What should I include in my business management personal statement?

It’s important you talk about skills and experience from all areas of your life and try to relate them to hobbies or extracurricular activities, especially if they are relevant to your course.

Think about how any work experience has helped you, what you have learned from it, and how it might be useful in your degree.

University admissions tutors want students on their course that are going to work hard and be of benefit to their department.

For more help and advice on what to include in your business and management personal statement, please see:

- Personal Statement Editing Services

- Personal Statement Tips From A Teacher

- Analysis Of A Personal Statement

- The 15th January UCAS Deadline: 4 Ways To Avoid Missing It

- Personal Statement FAQs

- Personal Statement Timeline

- 10 Top Personal Statement Writing Tips

- What To Do If You Miss The 15th January UCAS Deadline.

Further resources

For more information about business management degrees and careers, please visit the following:

- Business & Finance - National Careers Service

- What jobs can you get with a busines degree in the UK?

- 18 Career Paths in Business

- Business careers advice for school leavers

- What can you do with a business degree?

Related resources

Business personal statement examples.

Find out more

Business Management Jobs

Business Management Careers

Business & Management UCAS Guide

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

How to Write a Strong Personal Statement

- Ruth Gotian

- Ushma S. Neill

A few adjustments can get your application noticed.

Whether applying for a summer internship, a professional development opportunity, such as a Fulbright, an executive MBA program, or a senior leadership development course, a personal statement threads the ideas of your CV, and is longer and has a different tone and purpose than a traditional cover letter. A few adjustments to your personal statement can get your application noticed by the reviewer.

- Make sure you’re writing what they want to hear. Most organizations that offer a fellowship or internship are using the experience as a pipeline: It’s smart to spend 10 weeks and $15,000 on someone before committing five years and $300,000. Rarely are the organizations being charitable or altruistic, so align your stated goals with theirs

- Know when to bury the lead, and when to get to the point. It’s hard to paint a picture and explain your motivations in 200 words, but if you have two pages, give the reader a story arc or ease into your point by setting the scene.

- Recognize that the reviewer will be reading your statement subjectively, meaning you’re being assessed on unknowable criteria. Most people on evaluation committees are reading for whether or not you’re interesting. Stated differently, do they want to go out to dinner with you to hear more? Write it so that the person reading it wants to hear more.

- Address the elephant in the room (if there is one). Maybe your grades weren’t great in core courses, or perhaps you’ve never worked in the field you’re applying to. Make sure to address the deficiency rather than hoping the reader ignores it because they won’t. A few sentences suffice. Deficiencies do not need to be the cornerstone of the application.

At multiple points in your life, you will need to take action to transition from where you are to where you want to be. This process is layered and time-consuming, and getting yourself to stand out among the masses is an arduous but not impossible task. Having a polished resume that explains what you’ve done is the common first step. But, when an application asks for it, a personal statement can add color and depth to your list of accomplishments. It moves you from a one-dimensional indistinguishable candidate to someone with drive, interest, and nuance.

- Ruth Gotian is the chief learning officer and associate professor of education in anesthesiology at Weill Cornell Medicine in New York City, and the author of The Success Factor and Financial Times Guide to Mentoring . She was named the #1 emerging management thinker by Thinkers50. You can access her free list of conversation starters and test your mentoring impact . RuthGotian

- Ushma S. Neill is the Vice President, Scientific Education & Training at Memorial Sloan Kettering Cancer Center in New York City. She runs several summer internships and is involved with the NYC Marshall Scholar Selection Committee. ushmaneill

Partner Center

Risk Management 101: Process, Examples, Strategies

Emily Villanueva

August 16, 2023

Effective risk management takes a proactive and preventative stance to risk, aiming to identify and then determine the appropriate response to the business and facilitate better decision-making. Many approaches to risk management focus on risk reduction, but it’s important to remember that risk management practices can also be applied to opportunities, assisting the organization with determining if that possibility is right for it.

Risk management as a discipline has evolved to the point that there are now common subsets and branches of risk management programs, from enterprise risk management (ERM) , to cybersecurity risk management, to operational risk management (ORM) , to supply chain risk management (SCRM) . With this evolution, standards organizations around the world, like the US’s National Institute of Standards and Technology (NIST) and the International Standards Organization (ISO) have developed and released their own best practice frameworks and guidance for businesses to apply to their risk management plan.

Companies that adopt and continuously improve their risk management programs can reap the benefits of improved decision-making, a higher probability of reaching goals and business objectives, and an augmented security posture. But, with risks proliferating and the many types of risks that face businesses today, how can an organization establish and optimize its risk management processes? This article will walk you through the fundamentals of risk management and offer some thoughts on how you can apply it to your organization.

What Are Risks?

We’ve been talking about risk management and how it has evolved, but it’s important to clearly define the concept of risk. Simply put, risks are the things that could go wrong with a given initiative, function, process, project, and so on. There are potential risks everywhere — when you get out of bed, there’s a risk that you’ll stub your toe and fall over, potentially injuring yourself (and your pride). Traveling often involves taking on some risks, like the chance that your plane will be delayed or your car runs out of gas and leave you stranded. Nevertheless, we choose to take on those risks, and may benefit from doing so.

Companies should think about risk in a similar way, not seeking simply to avoid risks, but to integrate risk considerations into day-to-day decision-making.

- What are the opportunities available to us?

- What could be gained from those opportunities?

- What is the business’s risk tolerance or risk appetite – that is, how much risk is the company willing to take on?

- How will this relate to or affect the organization’s goals and objectives?

- Are these opportunities aligned with business goals and objectives?

With that in mind, conversations about risks can progress by asking, “What could go wrong?” or “What if?” Within the business environment, identifying risks starts with key stakeholders and management, who first define the organization’s objectives. Then, with a risk management program in place, those objectives can be scrutinized for the risks associated with achieving them. Although many organizations focus their risk analysis around financial risks and risks that can affect a business’s bottom line, there are many types of risks that can affect an organization’s operations, reputation, or other areas.

Remember that risks are hypotheticals — they haven’t occurred or been “realized” yet. When we talk about the impact of risks, we’re always discussing the potential impact. Once a risk has been realized, it usually turns into an incident, problem, or issue that the company must address through their contingency plans and policies. Therefore, many risk management activities focus on risk avoidance, risk mitigation, or risk prevention.

What Different Types of Risks Are There?

There’s a vast landscape of potential risks that face modern organizations. Targeted risk management practices like ORM and SCRM have risen to address emerging areas of risk, with those disciplines focused on mitigating risks associated with operations and the supply chain. Specific risk management strategies designed to address new risks and existing risks have emerged from these facets of risk management, providing organizations and risk professionals with action plans and contingency plans tailored to unique problems and issues.

Common types of risks include: strategic, compliance, financial, operational, reputational, security, and quality risks.

Strategic Risk

Strategic risks are those risks that could have a potential impact on a company’s strategic objectives, business plan, and/or strategy. Adjustments to business objectives and strategy have a trickle-down effect to almost every function in the organization. Some events that could cause strategic risks to be realized are: major technological changes in the company, like switching to a new tech stack; large layoffs or reductions-in-force (RIFs); changes in leadership; competitive pressure; and legal changes.

Compliance Risk

Compliance risks materialize from regulatory and compliance requirements that businesses are subject to, like Sarbanes-Oxley for publicly-traded US companies, or GDPR for companies that handle personal information from the EU. The consequence or impact of noncompliance is generally a fine from the governing body of that regulation. These types of risks are realized when the organization does not maintain compliance with regulatory requirements, whether those requirements are environmental, financial, security-specific, or related to labor and civil laws.

Financial Risk

Financial risks are fairly self-explanatory — they have the possibility of affecting an organization’s profits. These types of risks often receive significant attention due to the potential impact on a company’s bottom line. Financial risks can be realized in many circumstances, like performing a financial transaction, compiling financial statements, developing new partnerships, or making new deals.

Operational Risk

Risks to operations, or operational risks, have the potential to disrupt daily operations involved with running a business. Needless to say, this can be a problematic scenario for organizations with employees unable to do their jobs, and with product delivery possibly delayed. Operational risks can materialize from internal or external sources — employee conduct, retention, technology failures, natural disasters, supply chain breakdowns — and many more.

Reputational Risk

Reputational risks are an interesting category. These risks look at a company’s standing in the public and in the media and identify what could impact its reputation. The advent of social media changed the reputation game quite a bit, giving consumers direct access to brands and businesses. Consumers and investors too are becoming more conscious about the companies they do business with and their impact on the environment, society, and civil rights. Reputational risks are realized when a company receives bad press or experiences a successful cyber attack or security breach; or any situation that causes the public to lose trust in an organization.

Security Risk

Security risks have to do with possible threats to your organization’s physical premises, as well as information systems security. Security breaches, data leaks, and other successful types of cyber attacks threaten the majority of businesses operating today. Security risks have become an area of risk that companies can’t ignore, and must safeguard against.

Quality Risk

Quality risks are specifically associated with the products or services that a company provides. Producing low-quality goods or services can cause an organization to lose customers, ultimately affecting revenue. These risks are realized when product quality drops for any reason — whether that’s technology changes, outages, employee errors, or supply chain disruptions.

Steps in the Risk Management Process

The six risk management process steps that we’ve outlined below will give you and your organization a starting point to implement or improve your risk management practices. In order, the risk management steps are:

- Risk identification

- Risk analysis or assessment

- Controls implementation

- Resource and budget allocation

- Risk mitigation

- Risk monitoring, reviewing, and reporting

If this is your organization’s first time setting up a risk management program, consider having a formal risk assessment completed by an experienced third party, with the goal of producing a risk register and prioritized recommendations on what activities to focus on first. Annual (or more frequent) risk assessments are usually required when pursuing compliance and security certifications, making them a valuable investment.

Step 1: Risk Identification

The first step in the risk management process is risk identification. This step takes into account the organization’s overarching goals and objectives, ideally through conversations with management and leadership. Identifying risks to company goals involves asking, “What could go wrong?” with the plans and activities aimed at meeting those goals. As an organization moves from macro-level risks to more specific function and process-related risks, risk teams should collaborate with critical stakeholders and process owners, gaining their insight into the risks that they foresee.

As risks are identified, they should be captured in formal documentation — most organizations do this through a risk register, which is a database of risks, risk owners, mitigation plans, and risk scores.

Step 2: Risk Analysis or Assessment

Analyzing risks, or assessing risks, involves looking at the likelihood that a risk will be realized, and the potential impact that risk would have on the organization if that risk were realized. By quantifying these on a three- or five-point scale, risk prioritization becomes simpler. Multiplying the risk’s likelihood score with the risk’s impact score generates the risk’s overall risk score. This value can then be compared to other risks for prioritization purposes.

The likelihood that a risk will be realized asks the risk assessor to consider how probable it would be for a risk to actually occur. Lower scores indicate less chances that the risk will materialize. Higher scores indicate more chances that the risk will occur.

Likelihood, on a 5×5 risk matrix, is broken out into:

- Highly Unlikely

- Highly Likely

The potential impact of a risk, should it be realized, asks the risk assessor to consider how the business would be affected if that risk occurred. Lower scores signal less impact to the organization, while higher scores indicate more significant impacts to the company.

Impact, on a 5×5 risk matrix, is broken out into:

- Negligible Impact

- Moderate Impact

- High Impact

- Catastrophic Impact

Risk assessment matrices help visualize the relationship between likelihood and impact, serving as a valuable tool in risk professionals’ arsenals.

Organizations can choose whether to employ a 5×5 risk matrix, as shown above, or a 3×3 risk matrix, which breaks likelihood, impact, and aggregate risk scores into low, moderate, and high categories.

Step 3: Controls Assessment and Implementation

Once risks have been identified and analyzed, controls that address or partially address those risks should be mapped. Any risks that don’t have associated controls, or that have controls that are inadequate to mitigate the risk, should have controls designed and implemented to do so.

Step 4: Resource and Budget Allocation

This step, the resource and budget allocation step, doesn’t get included in a lot of content about risk management. However, many businesses find themselves in a position where they have limited resources and funds to dedicate to risk management and remediation. Developing and implementing new controls and control processes is timely and costly; there’s usually a learning curve for employees to get used to changes in their workflow.

Using the risk register and corresponding risk scores, management can more easily allocate resources and budget to priority areas, with cost-effectiveness in mind. Each year, leadership should re-evaluate their resource allocation as part of annual risk lifecycle practices.

Step 5: Risk Mitigation

The risk mitigation step of risk management involves both coming up with the action plan for handling open risks, and then executing on that action plan. Mitigating risks successfully takes buy-in from various stakeholders. Due to the various types of risks that exist, each action plan may look vastly different between risks.

For example, vulnerabilities present in information systems pose a risk to data security and could result in a data breach. The action plan for mitigating this risk might involve automatically installing security patches for IT systems as soon as they are released and approved by the IT infrastructure manager. Another identified risk could be the possibility of cyber attacks resulting in data exfiltration or a security breach. The organization might decide that establishing security controls is not enough to mitigate that threat, and thus contract with an insurance company to cover off on cyber incidents. Two related security risks; two very different mitigation strategies.

One more note on risk mitigation — there are four generally accepted “treatment” strategies for risks. These four treatments are:

- Risk Acceptance: Risk thresholds are within acceptable tolerance, and the organization chooses to accept this risk.

- Risk Transfer : The organization chooses to transfer the risk or part of the risk to a third party provider or insurance company.

- Risk Avoidance : The organization chooses not to move forward with that risk and avoids incurring it.

- Risk Mitigation : The organization establishes an action plan for reducing or limiting risk to acceptable levels.

If an organization is not opting to mitigate a risk, and instead chooses to accept, transfer, or avoid the risk, these details should still be captured in the risk register, as they may need to be revisited in future risk management cycles.

Step 6: Risk Monitoring, Reviewing, and Reporting

The last step in the risk management lifecycle is monitoring risks, reviewing the organization’s risk posture, and reporting on risk management activities. Risks should be monitored on a regular basis to detect any changes to risk scoring, mitigation plans, or owners. Regular risk assessments can help organizations continue to monitor their risk posture. Having a risk committee or similar committee meet on a regular basis, such as quarterly, integrates risk management activities into scheduled operations, and ensures that risks undergo continuous monitoring. These committee meetings also provide a mechanism for reporting risk management matters to senior management and the board, as well as affected stakeholders.

As an organization reviews and monitors its risks and mitigation efforts, it should apply any lessons learned and use past experiences to improve future risk management plans.

Examples of Risk Management Strategies

Depending on your company’s industry, the types of risks it faces, and its objectives, you may need to employ many different risk management strategies to adequately handle the possibilities that your organization encounters.

Some examples of risk management strategies include leveraging existing frameworks and best practices, minimum viable product (MVP) development, contingency planning, root cause analysis and lessons learned, built-in buffers, risk-reward analysis, and third-party risk assessments.

Leverage Existing Frameworks and Best Practices

Risk management professionals need not go it alone. There are several standards organizations and committees that have developed risk management frameworks, guidance, and approaches that business teams can leverage and adapt for their own company.

Some of the more popular risk management frameworks out there include:

- ISO 31000 Family : The International Standards Organization’s guidance on risk management.

- NIST Risk Management Framework (RMF) : The National Institute of Standards and Technology has released risk management guidance compatible with their Cybersecurity Framework (CSF).

- COSO Enterprise Risk Management (ERM) : The Committee of Sponsoring Organizations’ enterprise risk management guidance.

Minimum Viable Product (MVP) Development

This approach to product development involves developing core features and delivering those to the customer, then assessing response and adjusting development accordingly. Taking an MVP path reduces the likelihood of financial and project risks, like excessive spend or project delays by simplifying the product and decreasing development time.

Contingency Planning

Developing contingency plans for significant incidents and disaster events are a great way for businesses to prepare for worst-case scenarios. These plans should account for response and recovery. Contingency plans specific to physical sites or systems help mitigate the risk of employee injury and outages.

Root Cause Analysis and Lessons Learned

Sometimes, experience is the best teacher. When an incident occurs or a risk is realized, risk management processes should include some kind of root cause analysis that provides insights into what can be done better next time. These lessons learned, integrated with risk management practices, can streamline and optimize response to similar risks or incidents.

Built-In Buffers

Applicable to discrete projects, building in buffers in the form of time, resources, and funds can be another viable strategy to mitigate risks. As you may know, projects can get derailed very easily, going out of scope, over budget, or past the timeline. Whether a project team can successfully navigate project risks spells the success or failure of the project. By building in some buffers, project teams can set expectations appropriately and account for the possibility that project risks may come to fruition.

Risk-Reward Analysis

In a risk-reward analysis, companies and project teams weigh the possibility of something going wrong with the potential benefits of an opportunity or initiative. This analysis can be done by looking at historical data, doing research about the opportunity, and drawing on lessons learned. Sometimes the risk of an initiative outweighs the reward; sometimes the potential reward outweighs the risk. At other times, it’s unclear whether the risk is worth the potential reward or not. Still, a simple risk-reward analysis can keep organizations from bad investments and bad deals.

Third-Party Risk Assessments

Another strategy teams can employ as part of their risk management plan is to conduct periodic third-party risk assessments. In this method, a company would contract with a third party experienced in conducting risk assessments, and have them perform one (or more) for the organization. Third-party risk assessments can be immensely helpful for the new risk management team or for a mature risk management team that wants a new perspective on their program.

Generally, third-party risk assessments result in a report of risks, findings, and recommendations. In some cases, a third-party provider may also be able to help draft or provide input into your risk register. As external resources, third-party risk assessors can bring their experience and opinions to your organization, leading to insights and discoveries that may not have been found without an independent set of eyes.

Components of an Effective Risk Management Plan

An effective risk management plan has buy-in from leadership and key stakeholders; applies the risk management steps; has good documentation; and is actionable. Buy-in from management often determines whether a risk management function is successful or not, since risk management requires resources to conduct risk assessments, risk identification, risk mitigation, and so on. Without leadership buy-in, risk management teams may end up just going through the motions without the ability to make an impact. Risk management plans should be integrated into organizational strategy, and without stakeholder buy-in, that typically does not happen.

Applying the risk management methodology is another key component of an effective plan. That means following the six steps outlined above should be incorporated into a company’s risk management lifecycle. Identifying and analyzing risks, establishing controls, allocating resources, conducting mitigation, and monitoring and reporting on findings form the foundations of good risk management.

Good documentation is another cornerstone of effective risk management. Without a risk register recording all of a company’s identified risks and accompanying scores and mitigation strategies, there would be little for a risk team to act on. Maintaining and updating the risk register should be a priority for the risk team — risk management software can help here, providing users with a dashboard and collaboration mechanism.

Last but not least, an effective risk management plan needs to be actionable. Any activities that need to be completed for mitigating risks or establishing controls, should be feasible for the organization and allocated resources. An organization can come up with the best possible, best practice risk management plan, but find it completely unactionable because they don’t have the capabilities, technology, funds, and/or personnel to do so. It’s all well and good to recommend that cybersecurity risks be mitigated by setting up a 24/7 continuous monitoring Security Operations Center (SOC), but if your company only has one IT person on staff, that may not be a feasible action plan.

Executing on an effective risk management plan necessitates having the right people, processes, and technology in place. Sometimes the challenges involved with running a good risk management program are mundane — such as disconnects in communication, poor version control, and multiple risk registers floating around. Risk management software can provide your organization with a unified view of the company’s risks, a repository for storing and updating key documentation like a risk register, and a space to collaborate virtually with colleagues to check on risk mitigation efforts or coordinate on risk assessments. Get started building your ideal risk management plan today!

Emily Villanueva, MBA, is a Senior Manager of Product Solutions at AuditBoard. Emily joined AuditBoard from Grant Thornton, where she provided consulting services specializing in SOX compliance, internal audit, and risk management. She also spent 5 years in the insurance industry specializing in SOX/ICFR, internal audits, and operational compliance. Connect with Emily on LinkedIn .

Related Articles

How To Write A Good Risk Statement

April 22, 2024

A risk statement is fundamental for proactive risk management . It support effective risk management in clearly identifying, evaluating, and planning strategies to mitigate potential threats effectively.

It enhances stakeholder understanding and supports decision-making processes by outlining potential risks and their impacts. The stakeholders will be able to develop risk statements that will ensure risk effectively scored.

Crafting a well-defined statement involves elements like the triggering event, impact evaluation, response strategies , root cause analysis , and anticipated consequences .

A quality risk statement is concise, thorough, and tailored to the audience and context. Its importance lies in fostering clear communication, risk mitigation , and alignment with business objectives.

Understanding statements is essential for effective risk management and organizational resilience.

Key Takeaways

- Clear statements aid in identifying, assessing, and responding to potential risks effectively.

- Effective statements enable stakeholders to understand the impact of risks on organizational objectives.

- Crafting tailored statements is crucial for proactive risk mitigation planning and decision-making.

- Root cause analysis and consequence outlining are essential components of quality risk statements.

- Statements are vital in enhancing organizational resilience and driving strategic decision-making.

Importance of Clear Risk Statements

Clear risk statements are pivotal in helping stakeholders comprehend program risks and facilitating system engineering planning .

They foster a shared comprehension across organizational boundaries and focus on identifying events, consequences, and causes with simplicity.

Effective statements are key in pinpointing impacts on program objectives and known risk causes, providing actionable insights for informed decision-making.

Risk statement

Crafting precise risk statements is crucial for organizations to identify and manage potential uncertainties and vulnerabilities effectively.

A good statement clearly outlines the risk event, its consequences , and the cause , enabling stakeholders to grasp program risks easily.

Structured statements facilitate system engineering planning and enhance communication between different organizational units.

The primary aim of a statement is to succinctly identify the event, consequences, and cause without unnecessary complexity.

Accepted formats for writing statements include if-then, condition-consequence, and because-event-consequence structures.

Examples of Risk Statements

Examples of well-structured risk statements are valuable tools for organizations to enhance their risk management practices and decision-making processes .

These statements articulate potential events, consequences, and causes in a clear and structured manner, aiding effective communication and understanding among stakeholders.

Organizations can improve their decision-making processes and overall risk management practices by presenting risks concisely and organized.

Whether related to business processes, capital infrastructure, communications, conflict of interest, or financial management, the importance of clarity in risk statements cannot be overstated.

Crafting precise and impactful statements is essential for proactively addressing risks and opportunities, ultimately contributing to the success and resilience of an organization.

The risk management process

An essential aspect of the risk management process is articulating concise and structured risk statements that effectively outline potential events, consequences, and causes for proactive mitigation and strategic planning.

Good statements play an important role in effective risk management by providing clarity on the risks identified, ensuring a common understanding among stakeholders, and supporting system engineering planning.

By presenting risks clearly, these statements help identify and address potential threats and opportunities without complexity.

The key objective of a well-crafted statement is to identify the event, consequences, and cause without ambiguity, contributing to improved risk management practices.

Elements of a Quality Risk Statement

When constructing a quality risk statement, it is essential to identify key components. These include the event triggering the risk, impact assessment techniques , and potential risk response strategies .

These elements help in understanding the nature of the risk, evaluating its potential consequences, and devising effective plans to address it.

Key Components Identified

In crafting a quality risk statement, essential components such as the event trigger , root cause analysis , and anticipated consequences must be clearly articulated to enable effective risk management.

The statement format typically follows an if/then structure , outlining the identified risks and their potential impacts.

Root cause analysis involves delving into the underlying reasons for the risk occurrence by asking ‘why.’

Anticipated consequences detail the potential outcomes the organization may face if the risk materializes.

Alternative approaches like the 4Cs and CASE models offer different frameworks for constructing clear statements.

Clear and concise risk statements are vital for stakeholders to grasp the risks’ implications on program objectives and known causes.

Iterative refinement ensures that statements are actionable and support robust risk management practices.

Impact Assessment Techniques

Impact assessment techniques play a pivotal role in crafting a quality statement by elucidating the event triggers and evaluating the relevant, quantifiable, and thorough consequences to gauge the potential impact accurately.

- Identification of Event Triggering the Risk: Pinpointing the specific event or series of events that initiate the risk scenario.

- Assessment of Consequences: Ensuring that consequences outlined in the statement are relevant, quantifiable, and thorough for effective impact evaluation.

- Estimating Likelihood of Events: Evaluating the probability of events and their consequences to gauge the risk exposure accurately.

- Consideration of Multiple Causes: Recognizing and incorporating various factors contributing to the identified risk event for a detailed risk assessment.

- Importance of Clear Articulation: Clearly expressing the events, causes, and consequences within the statement to enhance understanding and decision-making.

Risk Response Strategies

A quality risk statement involves meticulous identification and clear articulation of event triggers, root causes, and consequences to inform effective risk response strategies.

The if/then format enhances the statement’s actionability by outlining potential scenarios and corresponding responses.

In a quality statement, the 4Cs approach (clear, concise, consistent, and all-encompassing) and the CASE approach (context, actors, story, and events) offer structured methods to articulate risk response strategies effectively.

Identifying the root cause or causes that lead to the risk event is vital in developing targeted responses.

Additionally, outlining the consequences of the risk event provides a basis for effective risk management decisions . By utilizing these approaches and ensuring a detailed analysis of events, causes, and consequences, organizations can enhance their ability to respond proactively to risks.

Crafting Effective Risk Statements

Crafting effective risk statements involves ensuring clarity in communication, evaluating the potential impact of identified risks on organizational objectives , and devising strategies for risk mitigation .

By clearly articulating what events could occur, why they might happen, and why they are important, organizations can lay the groundwork for informed decision-making and proactive risk management .

Tailoring these statements to the audience and context while aligning them with business goals is vital for enhancing risk awareness and fostering a culture of preparedness within the organization.

Importance of Clarity

Effective risk statements are essential in guiding organizational decision-making and risk response strategies by clearly and concisely describing potential uncertainties and vulnerabilities.

- Clarity in statements supports effective risk management.

- Good statements help identify risks effectively.

- Protecting confidential customer information is vital in risk assessments.

- Clearly defined risk scenarios aid in preparing for potential risk events.

- Well-crafted risk responses are essential for safeguarding sensitive customer data.

Impact Assessment Strategies

To progress from the discussion on the importance of clarity in risk statements to the current focus on Impact Assessment Strategies, it is imperative to emphasize the necessity of precisely outlining potential uncertainties and vulnerabilities within organizational objectives.

Impact assessment strategies involve identifying the risks, causes, and consequences in a detailed manner to aid decision-making.

Crafting effective statements entails quantifying the likelihood and impact of risks and using if-then statements to articulate potential scenarios clearly.

This clarity enhances understanding of risks and their implications, enabling proactive risk response planning.

By incorporating structured formats and quantifying risks, organizations can develop thorough risk statements that facilitate informed decision-making and proactive management of potential threats and opportunities.

Risk Mitigation Planning

Risk Mitigation Planning involves meticulously formulating risk statements to identify, assess, and address potential events, consequences, and causes within an organization or project.