Learn / Guides / Product research basics

Back to guides

A step-by-step guide to the product research process

A strong product research process ensures product teams maximize resources, meet key business goals, and make confident decisions that will deliver successful products and features to create customer delight.

But, how do you conduct effective product research?

Just as there’s no single way to develop a product, no single research process fits all product teams. But there are key steps that will help you balance business goals and user needs for actionable product research .

This article takes you through the factors you should consider to tailor product research to your desired outcomes and provides a step-by-by-step guide to doing research right.

Use Hotjar to streamline your product research process

Hotjar offers product teams a rich stream of quantitative and qualitative data that keeps you connected to user needs at every stage of research.

What to consider before starting product research

Before jumping into the research process , product managers prepare their team. Take time to consider the why and determine how you can design the process to meet your unique product requirements.

Reflect on:

Why you’re doing the research

Get connected with the deep purpose of your research: what you need to understand to create a profitable and effective product .

Determine specific outcomes of the research process.

During the early product discovery stages, generating new product ideas for innovation and getting to know your users better will serve as a solid foundation throughout the research process. At later stages, look for concrete feedback on a new product, or possible upgrades and feature updates for an existing product. The why behind the research should guide your process.

Categorizing your users

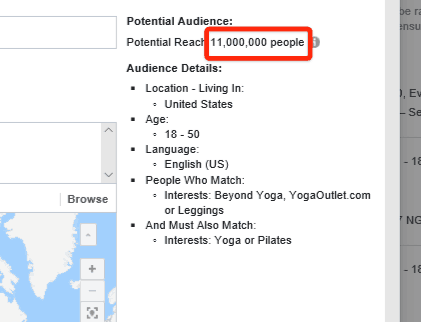

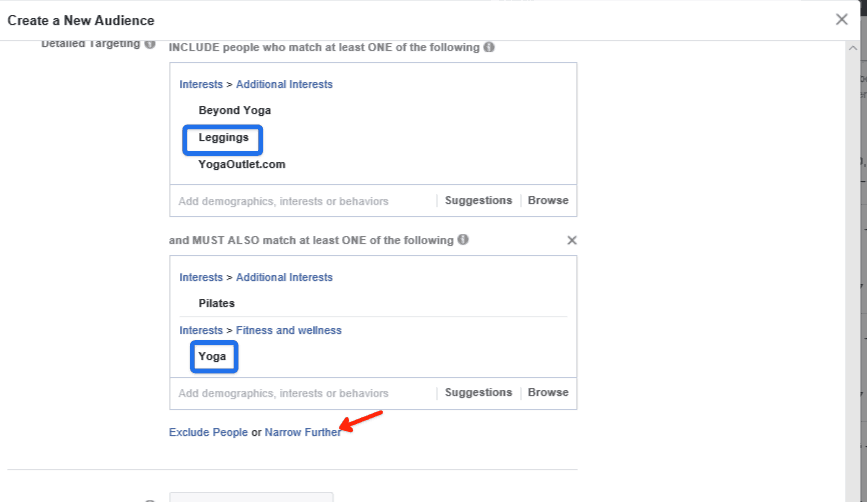

Determining customer needs and segmenting users are crucial steps that impact the success of any product research strategy.

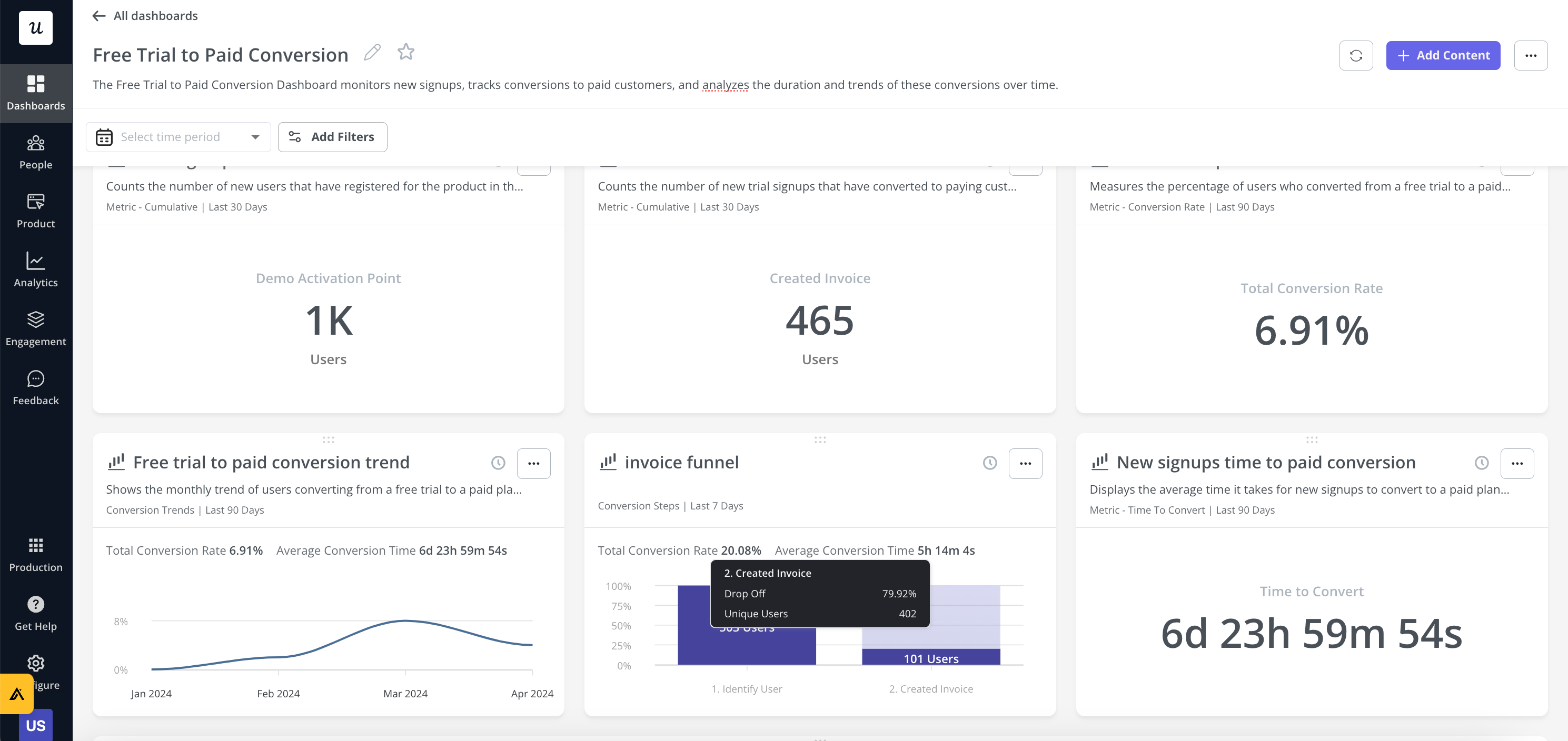

You might use a random sample of potential or existing customers; or segment users according to region, industry, or other criteria to spot patterns across different demographics.

Trial users can give immediate product feedback, which is usually incredibly easy to implement (a new theme, for example) or incredibly difficult, like an entirely new functionality or platform for your product. Your long-time users can give nuanced feedback, but they overlook what doesn't work due to their expertise.

Finding that middle ground of users who like what you offer but aren't stuck to your brand is essential. These users appreciate being treated like their insights matter most—because they do.

Finding impartial user insights can be tricky since many tools track users who’ve been paid or incentivized to click through to your website or product. Product experience insights software like Hotjar can help by providing organic, unbiased user data that gives you a clear picture of your customer experience (CX) .

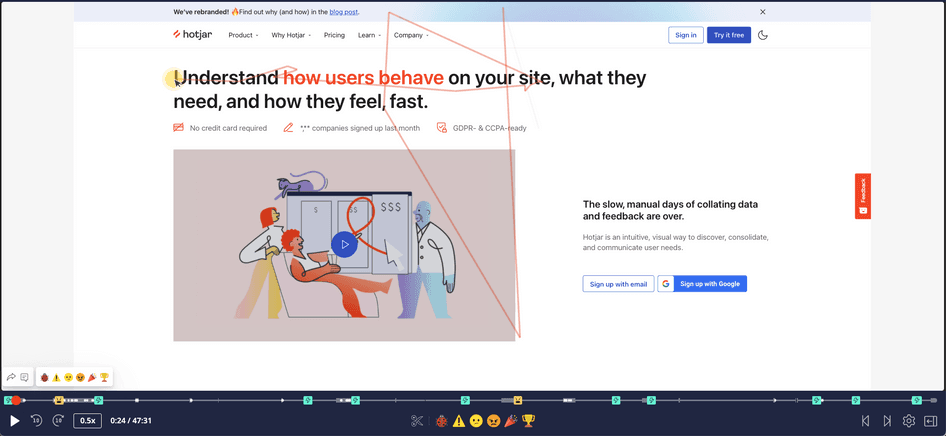

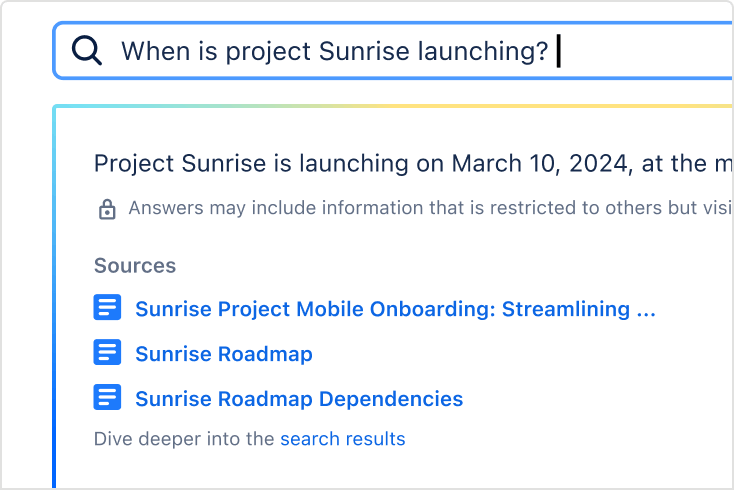

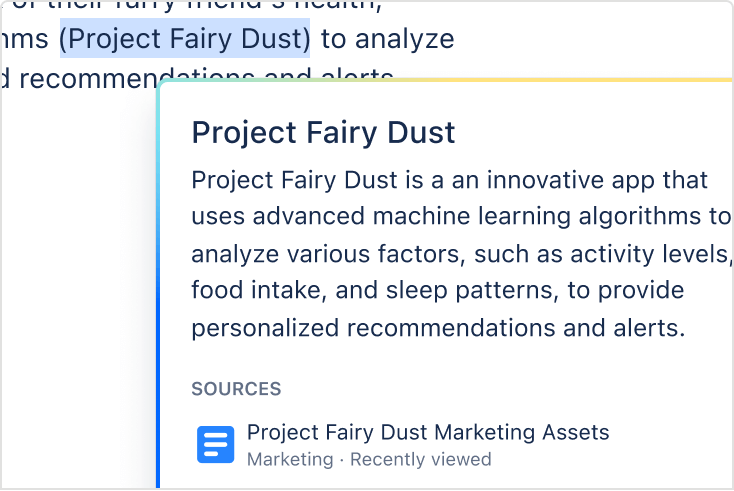

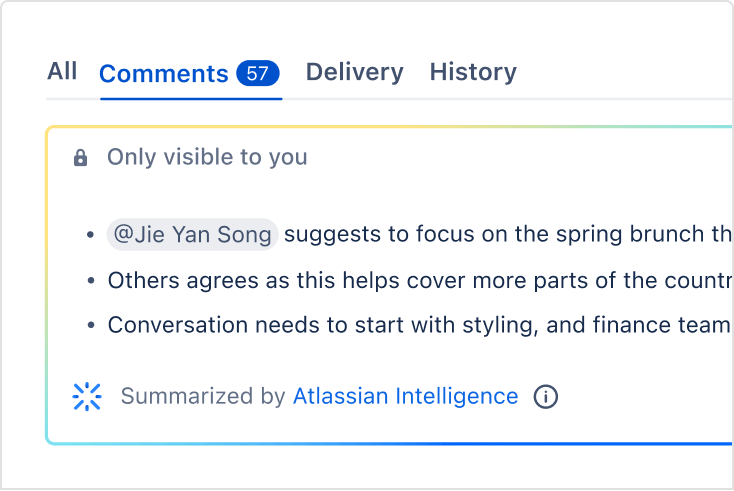

Pro tip: Hotjar Highlights lets you sort and curate user insights and attributes, and share them with your product team. You can also watch Session Recordings of users from specific countries or industries—or filter recordings to see only satisfied or dissatisfied user experiences, which can provide valuable information on what’s working (and what’s not).

A Hotjar Session Recording

Your core business goals

The best product research processes overlap with the overall organizational vision, so update your research goals in line with company goals to ensure alignment.

Designing your research process with cross-functional collaboration in mind is a great way to eliminate any communication issues, ensure all departments collect data that tests product profitability, business goals, and user satisfaction.

Your team’s methodology

Different product methodologies emphasize different aspects of product research throughout its lifecycle, so it’s important to consider techniques that will fit your team’s working stages.

Teams who use waterfall methodologies usually rely on bursts of intense research before development and again during pre-launch. They also make a clear distinction between the product’s research and development phases.

Teams who use agile, lean, or DevOps methods usually integrate research with the broader product development process, engaging in continuous discovery methods.

Whatever your methodology, infuse research into every stage of the product lifecycle to achieve business goals like increased revenue, acquisitions, and user adoption.

Choosing which research tools to use

When you’re deciding how to do product research, you’ll need to consider your budget and company size to pick out your tool stack.

Manual research techniques like user interviews can be time-consuming and cost-intensive, but useful to forge a personal connection with users and ask improvised questions based on their responses.

Automated research tools (like Hotjar 👋) increase speed, efficiency, and cost-effectiveness, and reduce human error. They allow you to reach a larger target audience and ensure you’re getting clean, unbiased product feedback —in person, users are more likely to feel pressure to compliment your product or underplay their concerns, but with tools like Hotjar, you’ll get genuine, in-the-moment feedback from users as they engage with your product.

Which team members will contribute

Involve different team members at each stage of the product workflow. For example, when you’re validating product ideas, you may want to include marketing and technical departments; and when you’re testing product usability , you may want to rely on the expertise of your engineers.

It’s also important to consider what research other departments have done before launching your own process, so you don’t waste resources duplicating generic market research.

8 steps for amazing product research

Amazing product research is all about doing smart research to unearth effective insights without getting lost in an information overload that derails your product workflow .

Follow these eight steps to guide your product research strategies to achieve valuable, actionable product insights that will inform your product’s entire lifecycle, from ideation to execution.

1. Define your research goals

First, set your high-level goals, which should test business objectives as well as customer-centric product discovery. These are often drawn directly from the product vision and strategy.

Then, create attainable, specific goals or questions for your team to focus on during each stage of their research. This might include:

Conducting market research for the product’s adoption before its launch

Identifying areas where key features can be improved after the product launch

Evaluating the product’s performance throughout the product lifecycle

2. Understand your users

User needs are at the center of effective product research processes.

Engage in user discovery—identify and understand your customer—as early as possible , even before you have definite product or feature ideas. Open-ended user research is a key source of product inspiration and innovation, and an essential step in determining product-market fit .

Then, when you have product proposals, prototypes, or a minimum viable product ( MVP) , you can start seeking more specific feedback.

User research is all about interacting with your current or potential users and learning what they want and need . Developing a user-centric culture of ongoing research will help you gauge the market demand, position your product against the competition, and generate customer delight .

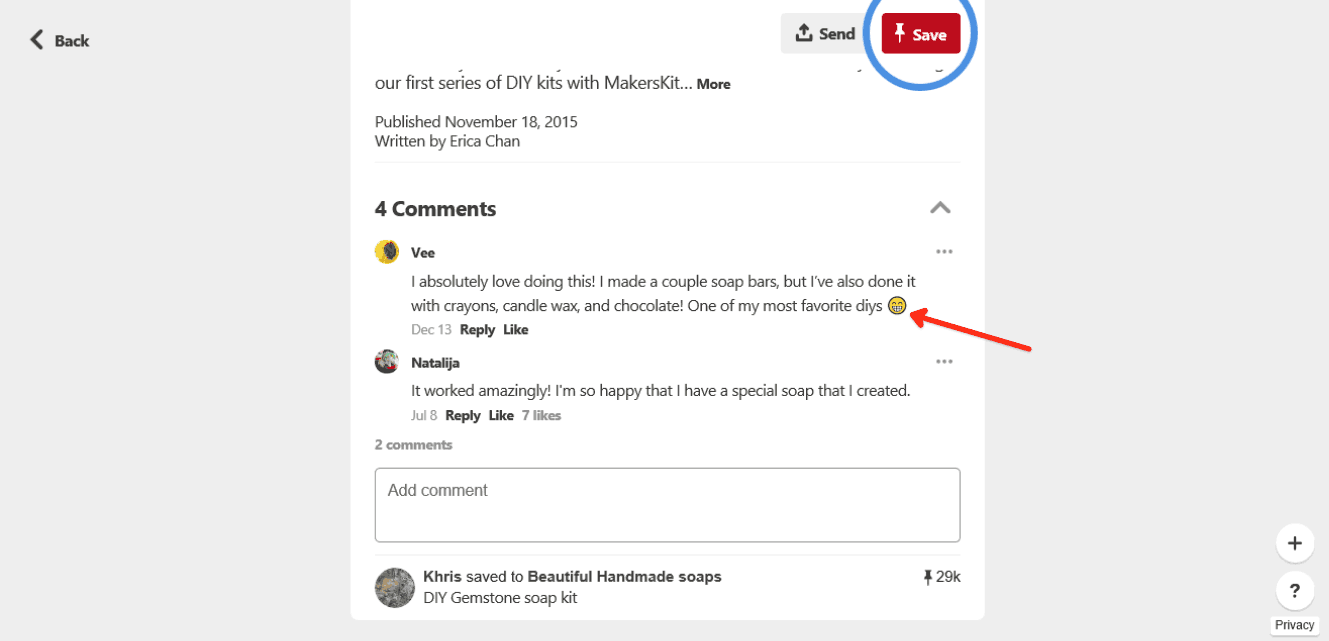

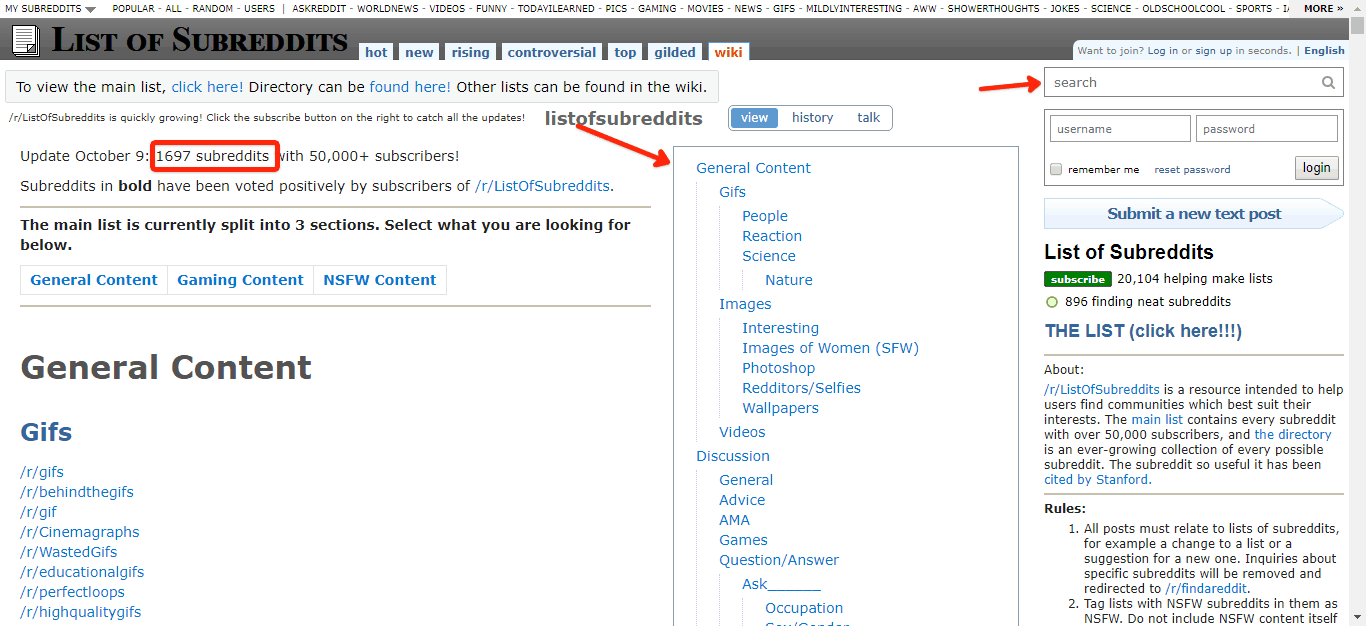

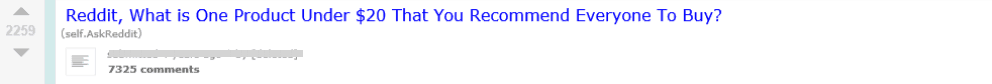

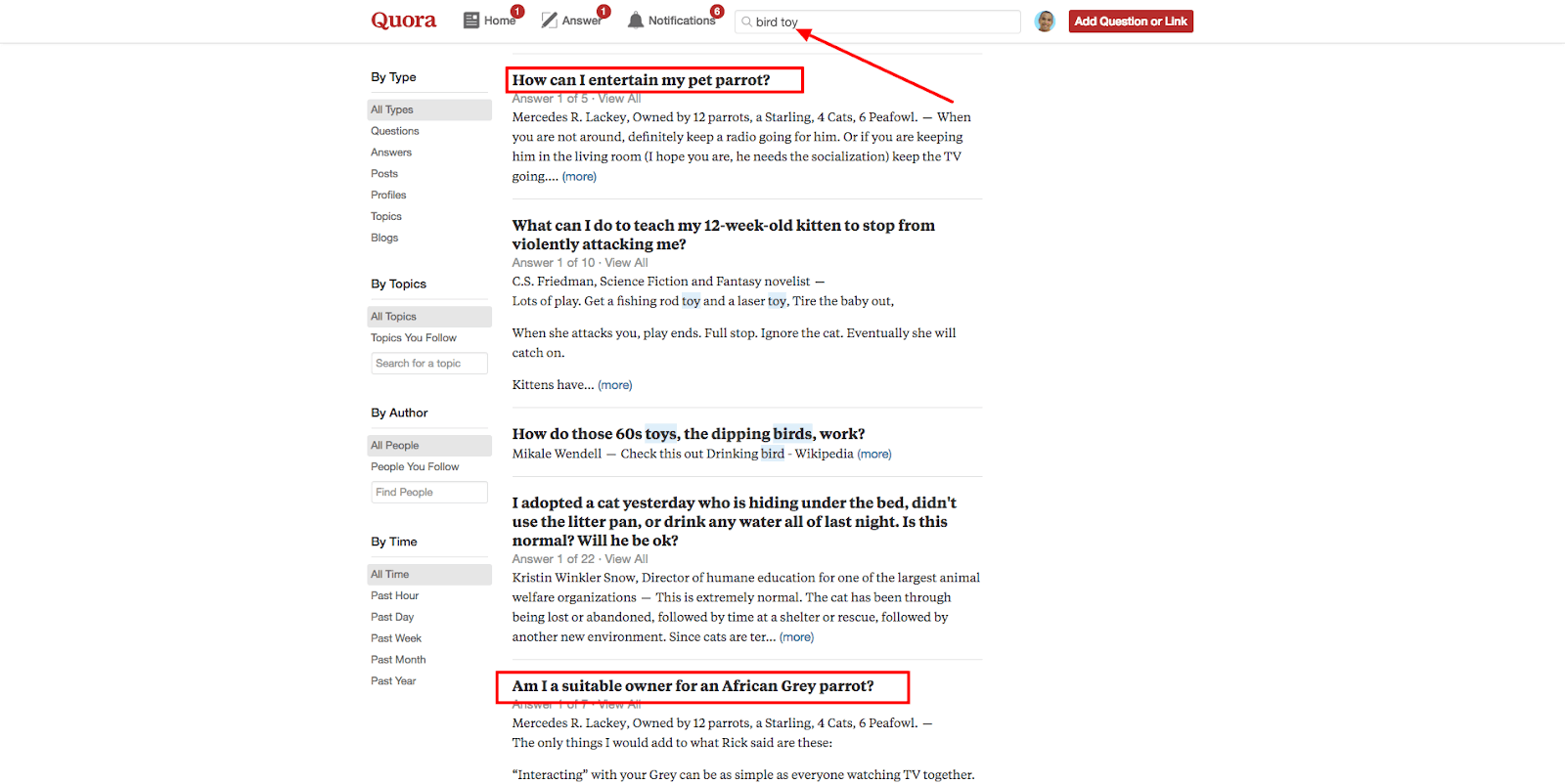

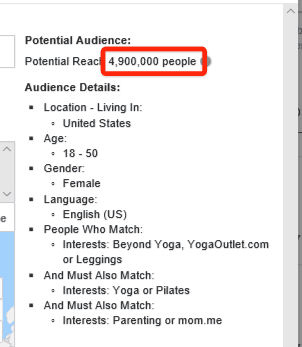

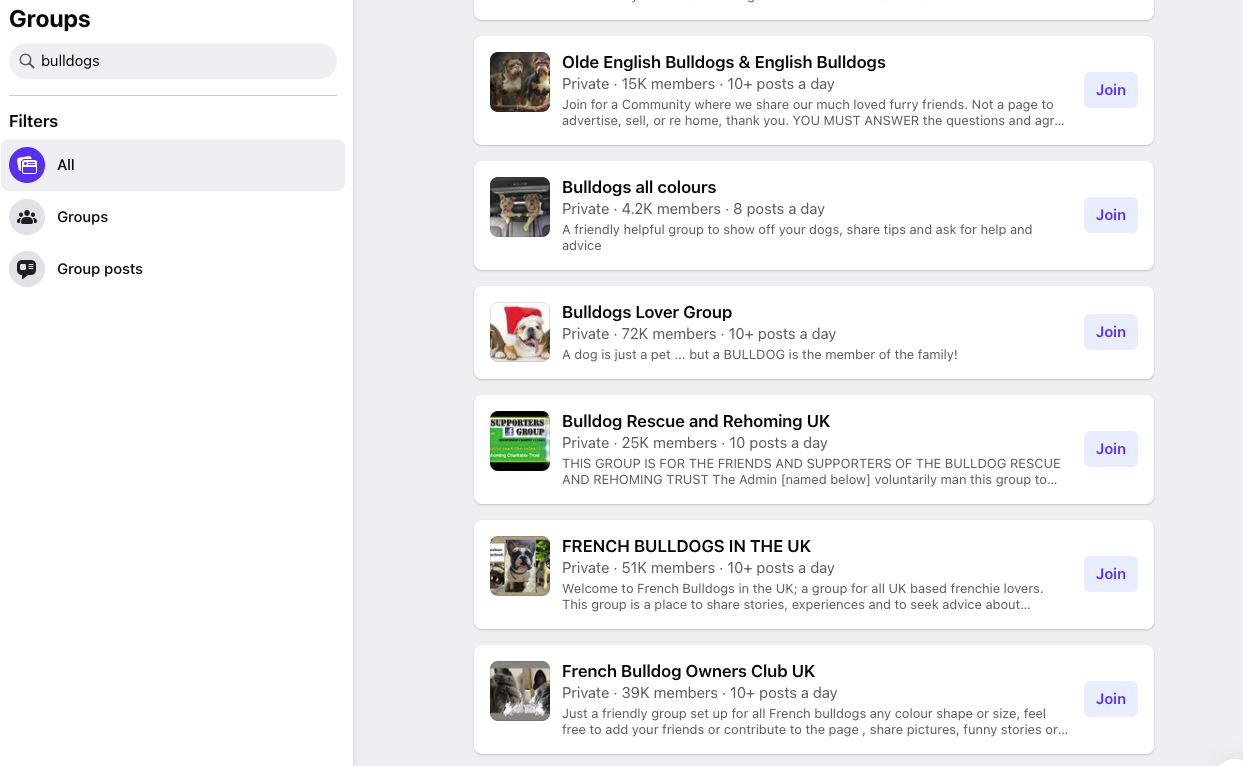

To create a user-centric research culture, conduct user interviews and create user personas. You can also connect more passively with your user demographic by looking at forums, Facebook groups, or sites like Reddit that are used by your customer niche.

The more organic the research process, the better. It’s ideal to catch users in situations where they answer by instinct instead of having carefully crafted answers. It's what they say instinctively that leads to better product solutions.

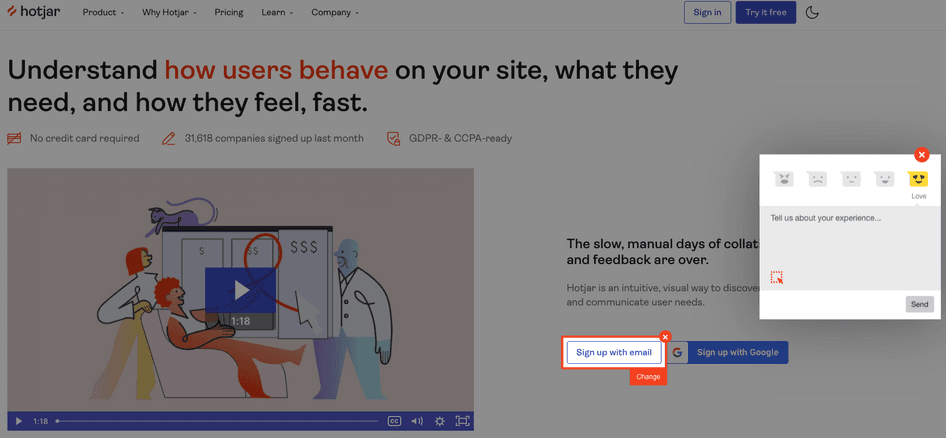

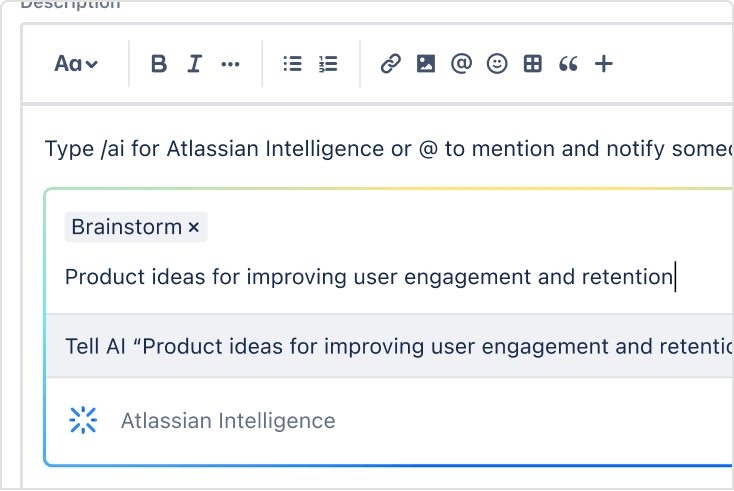

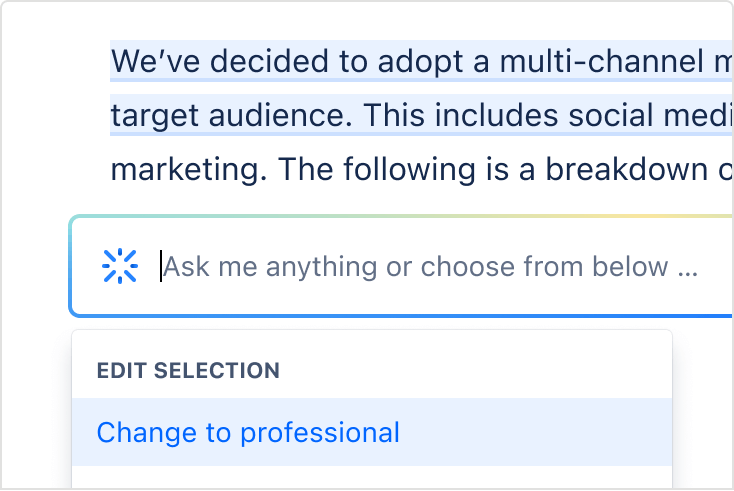

Pro tip: use Feedback widgets to gather user feedback in a non-invasive way.

Hotjar’s Feedback widgets are integrated into the product interface , so users can give quick feedback and then carry on with their tasks. This means you can survey your users and gain valuable insights by learning what they’re thinking and feeling as they interact with the product.

A Hotjar feedback widget

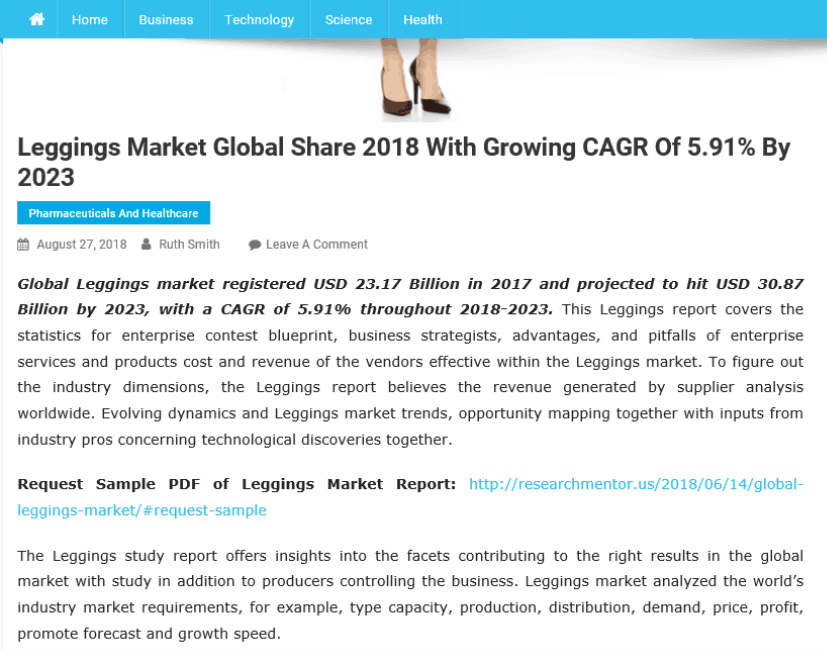

3. Do market research for your product

Run thorough competitive and comparative analyses to test the business potential of your product against other solutions on the market , and engage in opportunity mapping to get stakeholder buy-in.

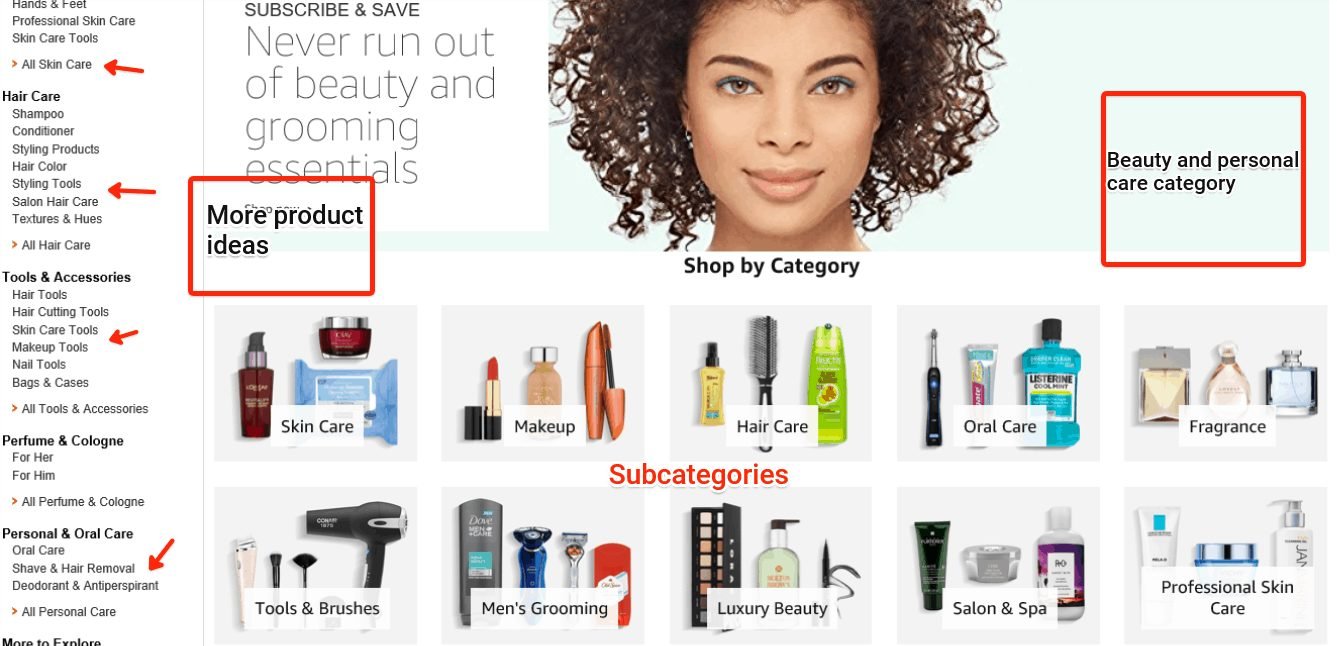

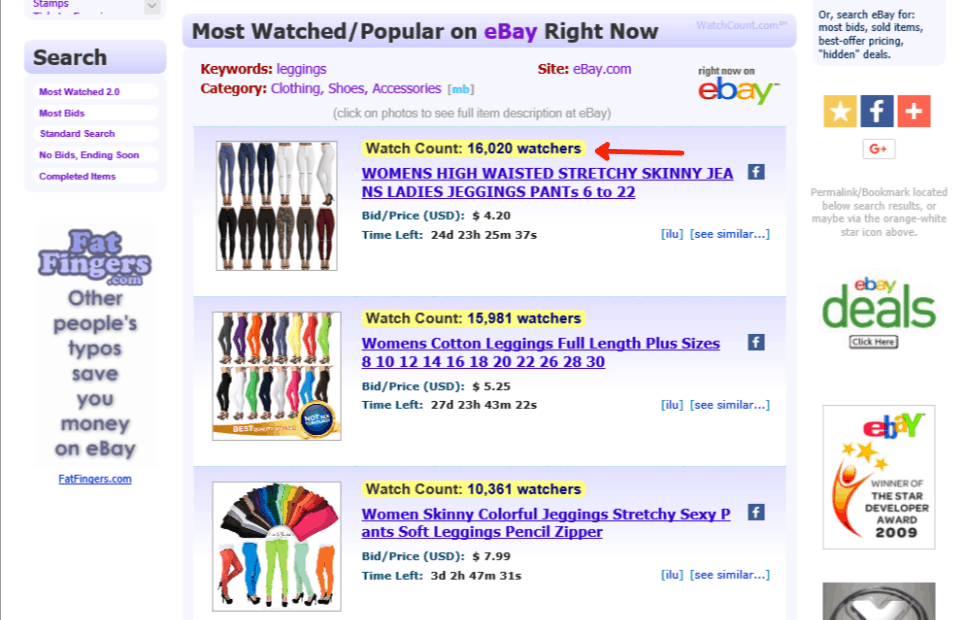

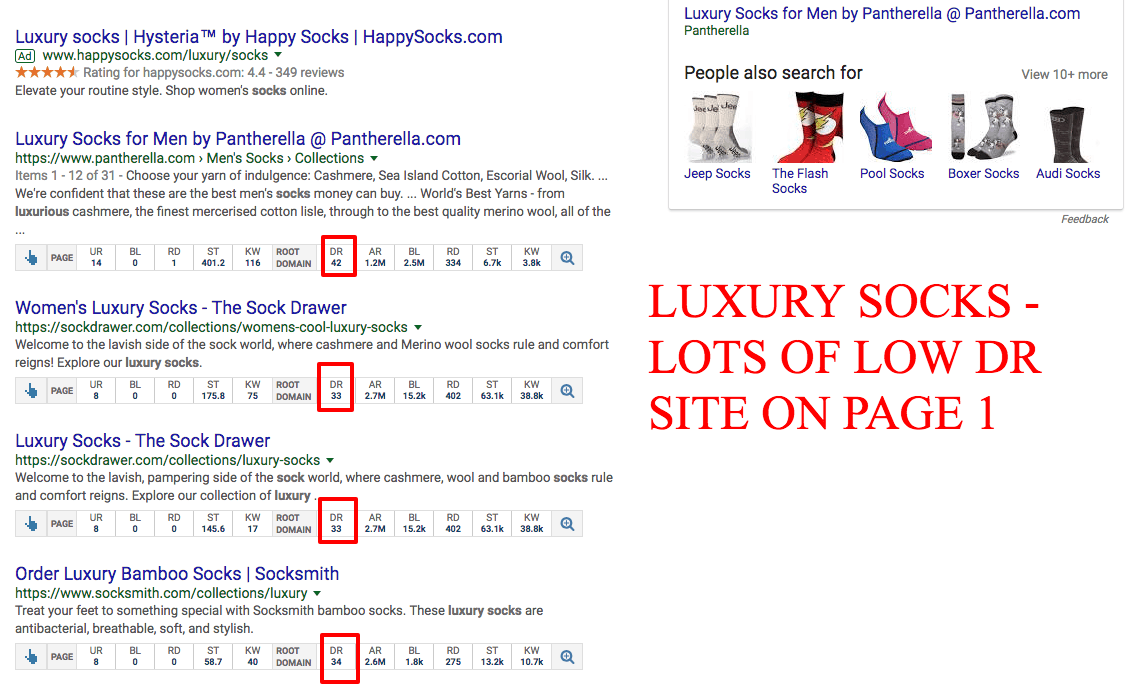

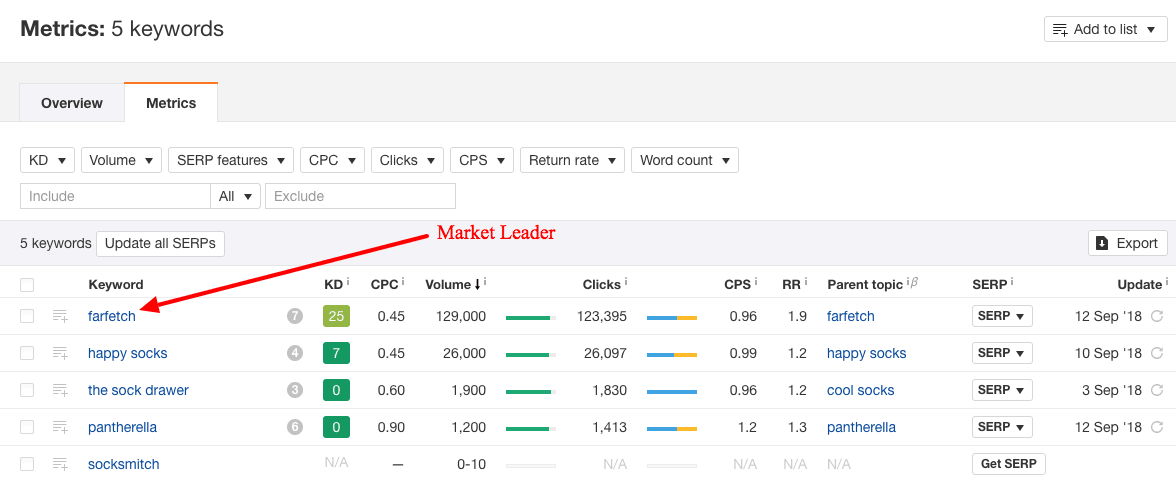

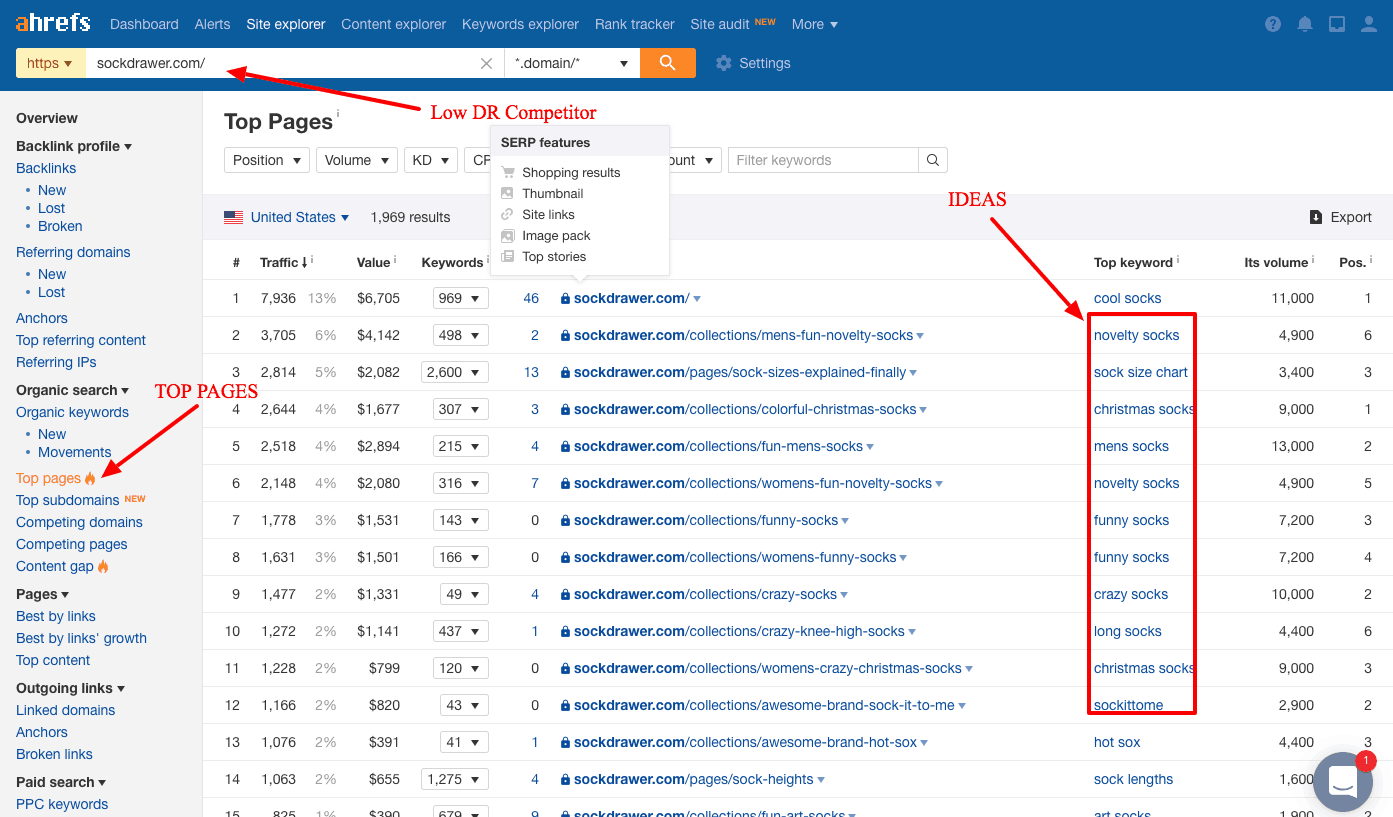

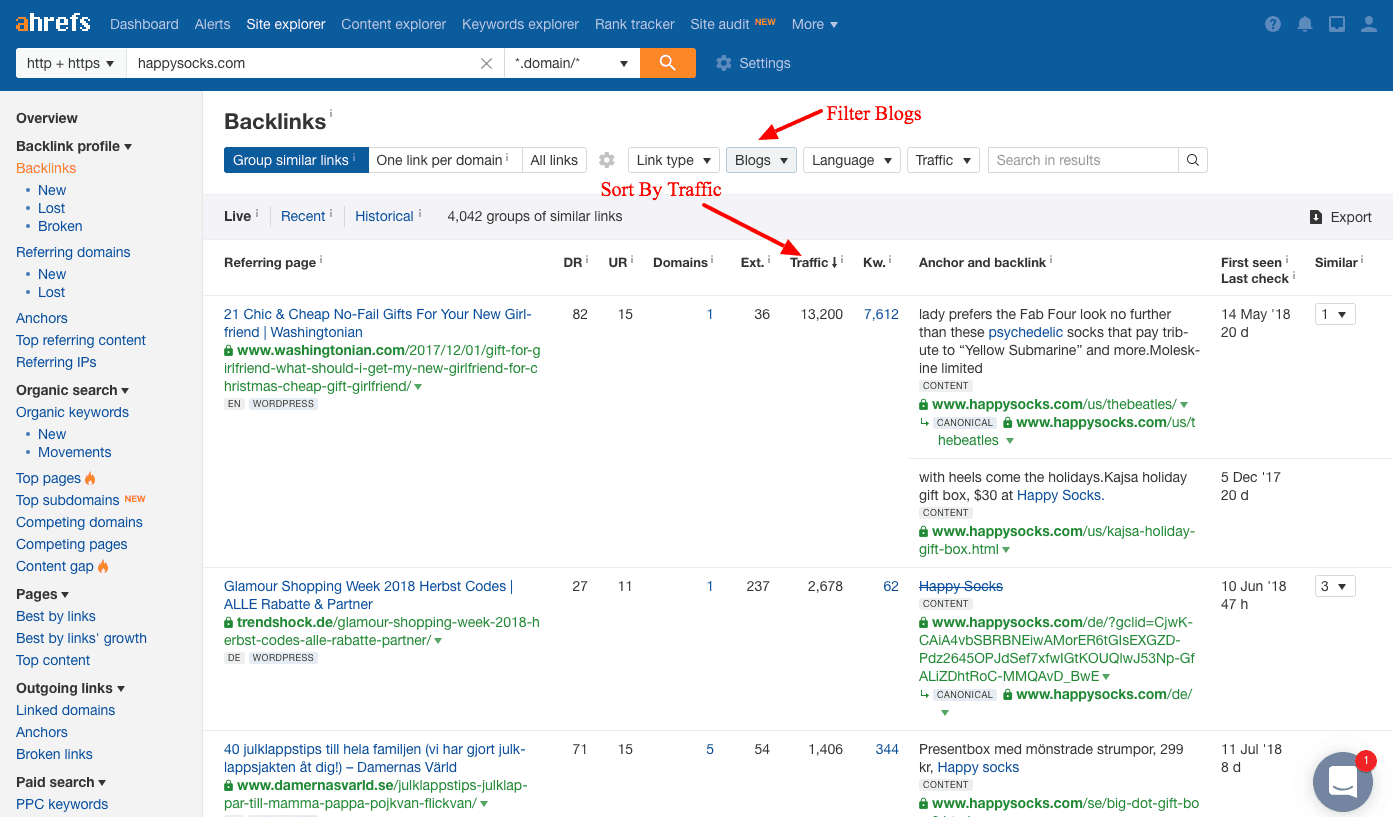

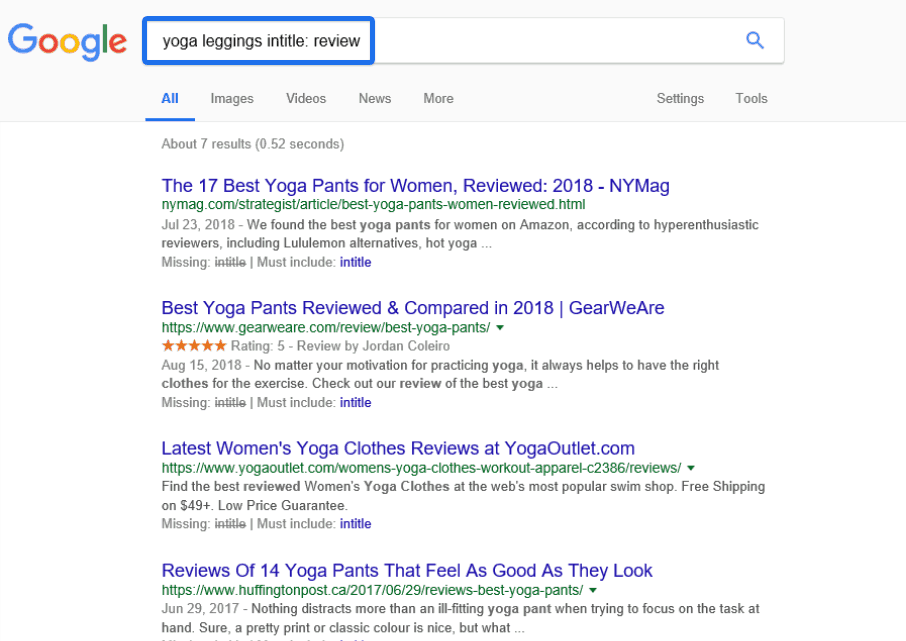

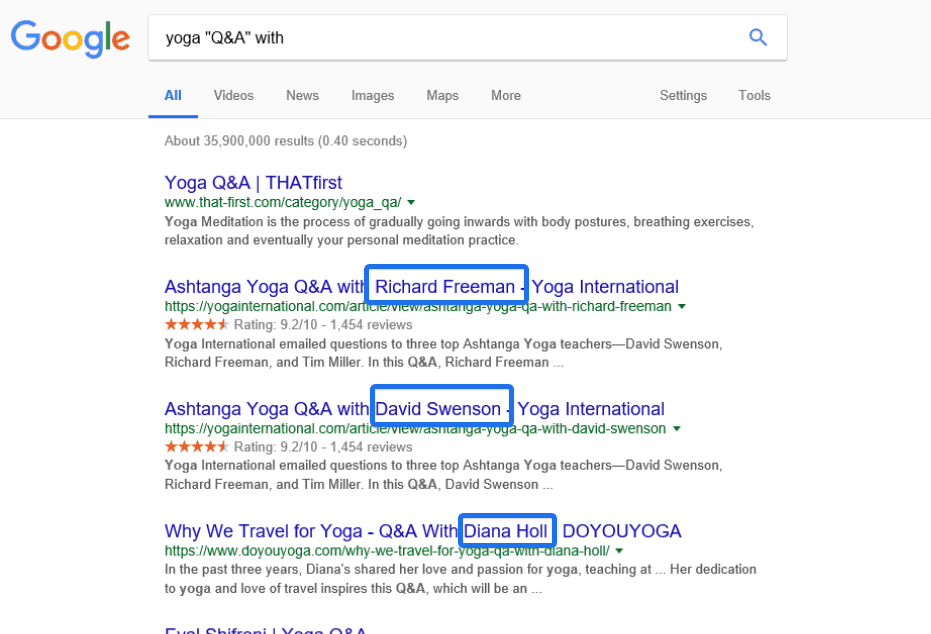

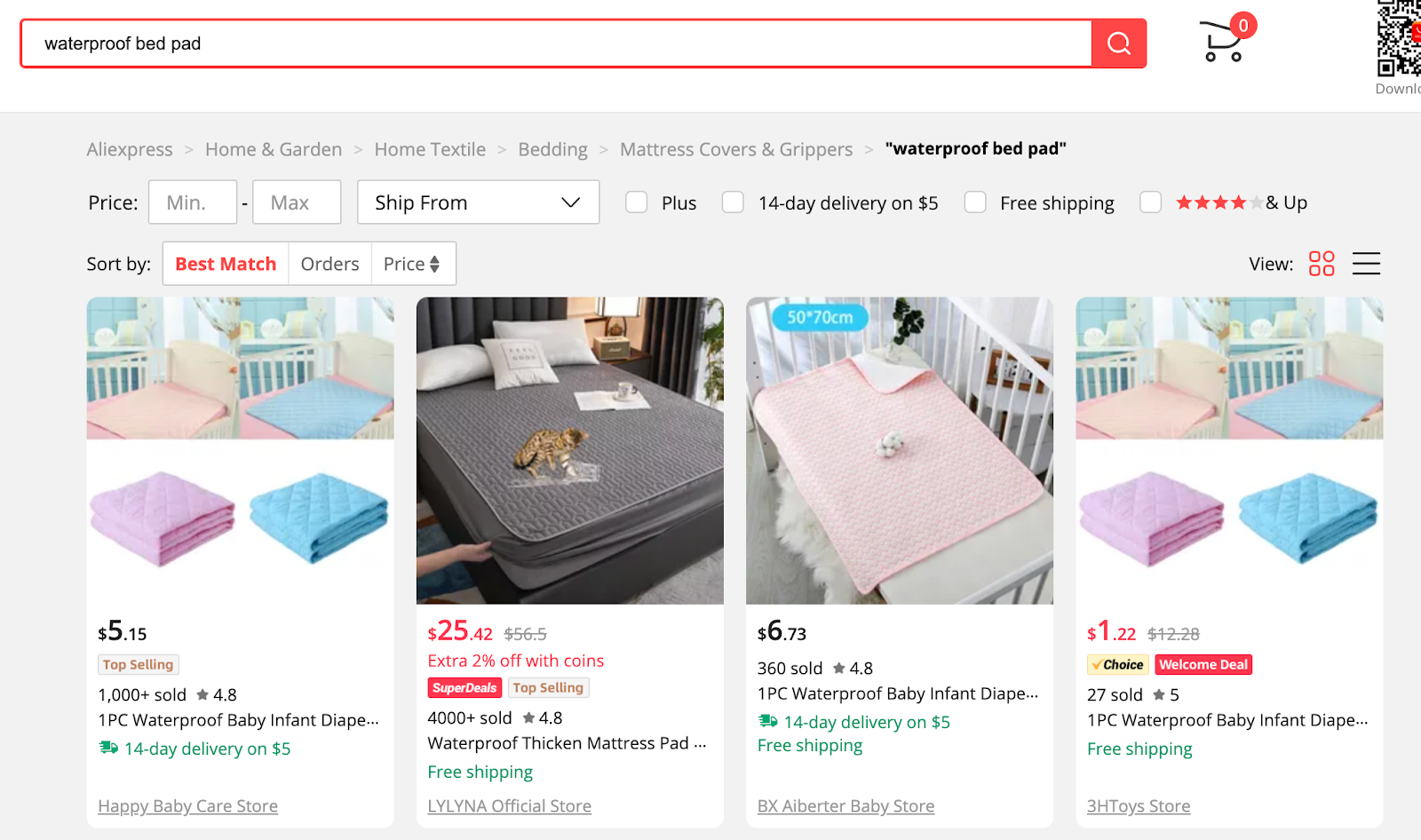

You can also use historical market data and trade reports to predict potential profitability and run keyword research to understand users and what potential customers are searching for to generate product ideas.

Once you’ve validated whether there’s a viable market for your product and determined how saturated that target market is, focus on your product’s unique selling points.

Pro tip: even if you already have a product established in a specific market, make sure to assess the market periodically. Markets and competitors change, and making assumptions because of your initial research processes can be a costly mistake. Work with your marketing team here to validate your ideas and avoid guesswork.

Evaluate your product regularly against the industry by creating a value curve. The value curve plots the product offerings currently available in the market on one axis, and the factors the industry is competing on and investing in heavily on the other. This can help you spot market opportunities, ensure product relevance, and get ideas for features you could add to increase user demand and open up new user bases.

Check out how Gavin increased conversions for his lead generation agency by 42% with Hotjar.

4. Get to know industry trends

Next, combine your understanding of your users and market with research on technology trends that may affect user expectations of your product or its long-term viability.

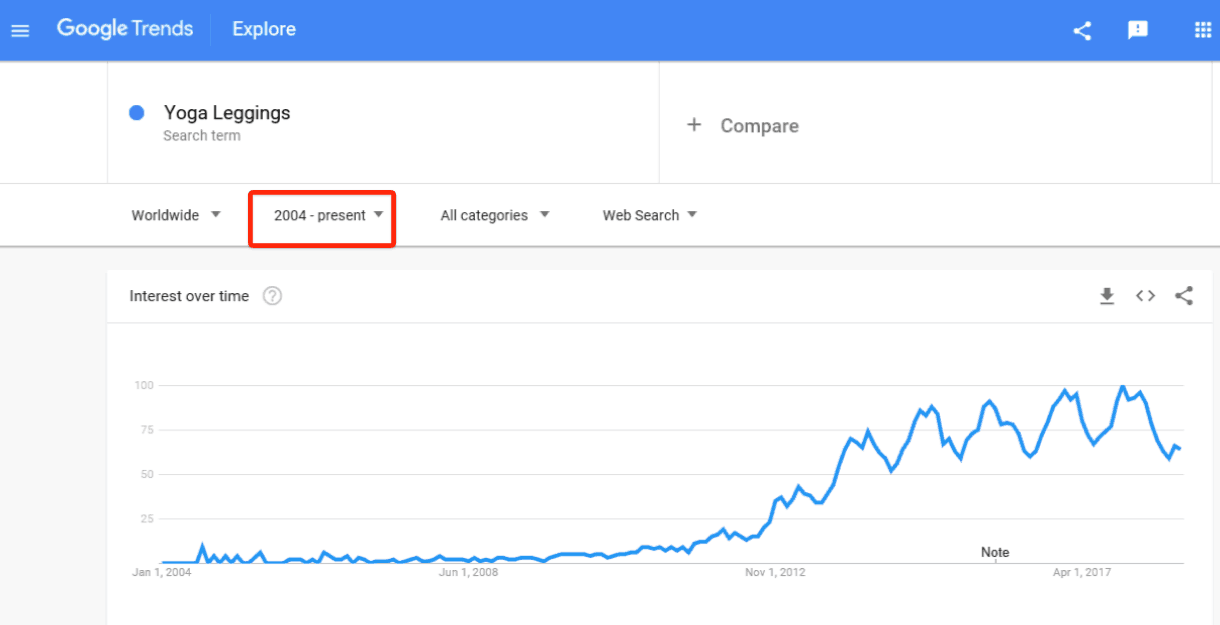

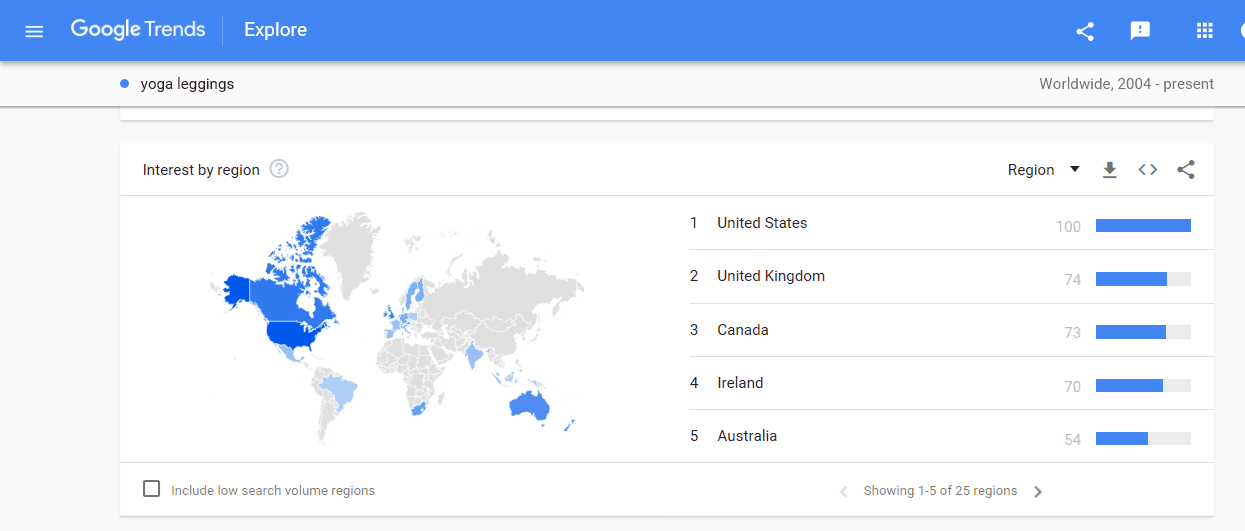

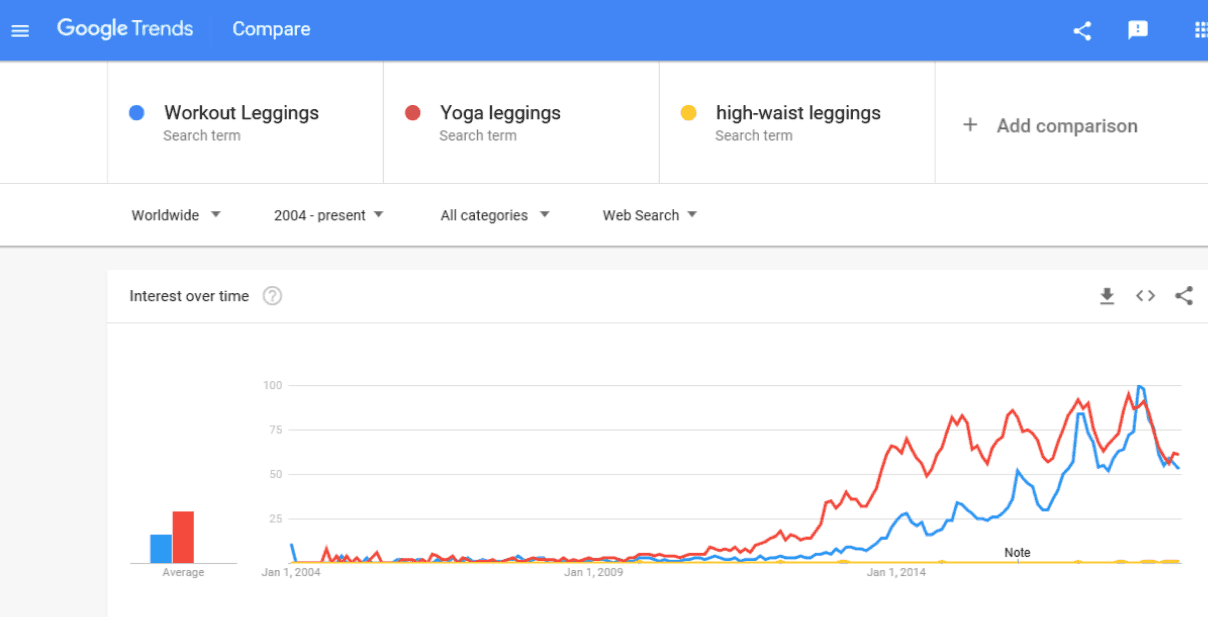

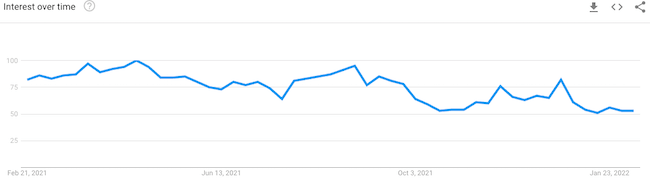

Stay on top of trends by regularly engaging with tech cultures —read trade magazines and news sites, listen to tech news podcasts, and follow key trendspotters on social media and specialist forums. You can also use tools like Google Trends , Trend Hunter , and PSFK .

Another key source of tech trend information is your engineering team . Chances are, you have plenty of techies on your team who are up to speed on different aspects of technology and what’s forecasted to change.

Pro tip: rigorously analyze trends and put them into context to understand what has staying power, as you avoid jumping on every passing fad. Create a learning culture that embraces experimentation and gives team members the opportunity to share their knowledge.

Analyze the latest trending topics and projects in mainstream open-source communities across the Internet such as GitHub. These communities are an incredible resource for identifying tech trends that are sustainable, disruptive, and have immense staying power.

It's also important to subscribe to prominent tech publications and leading technology platforms such as Azure and AWS to get the latest tech news and new feature announcements delivered directly to your inbox. This way, your product team is always in the know about the most important tech trends that are shaping product development and product markets.

5. Validate ideas with current or potential users

Once you’ve developed a strong sense of your users, market, and technology, it’s time to start testing concrete ideas and solutions.

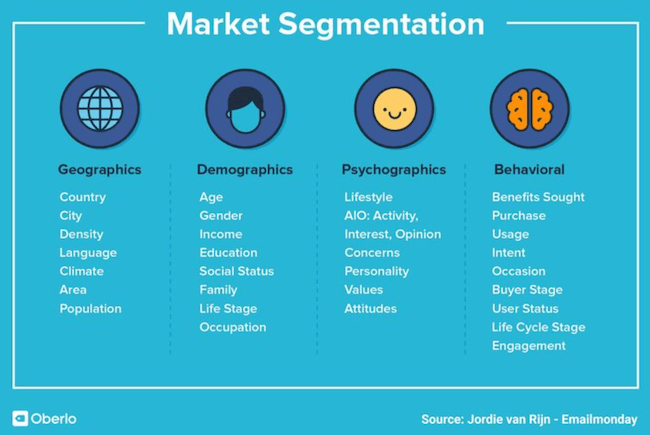

Based on your early research, identify possible products, features, or upgrades that could meet user needs as well as business goals. Then, run concept testing to evaluate the user experience.

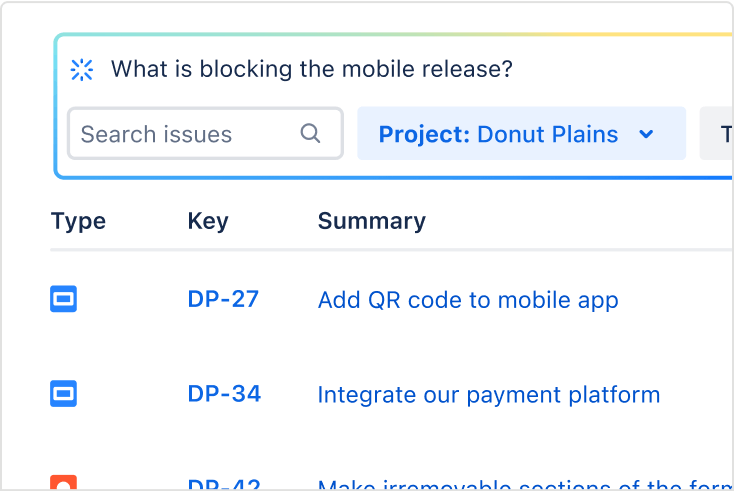

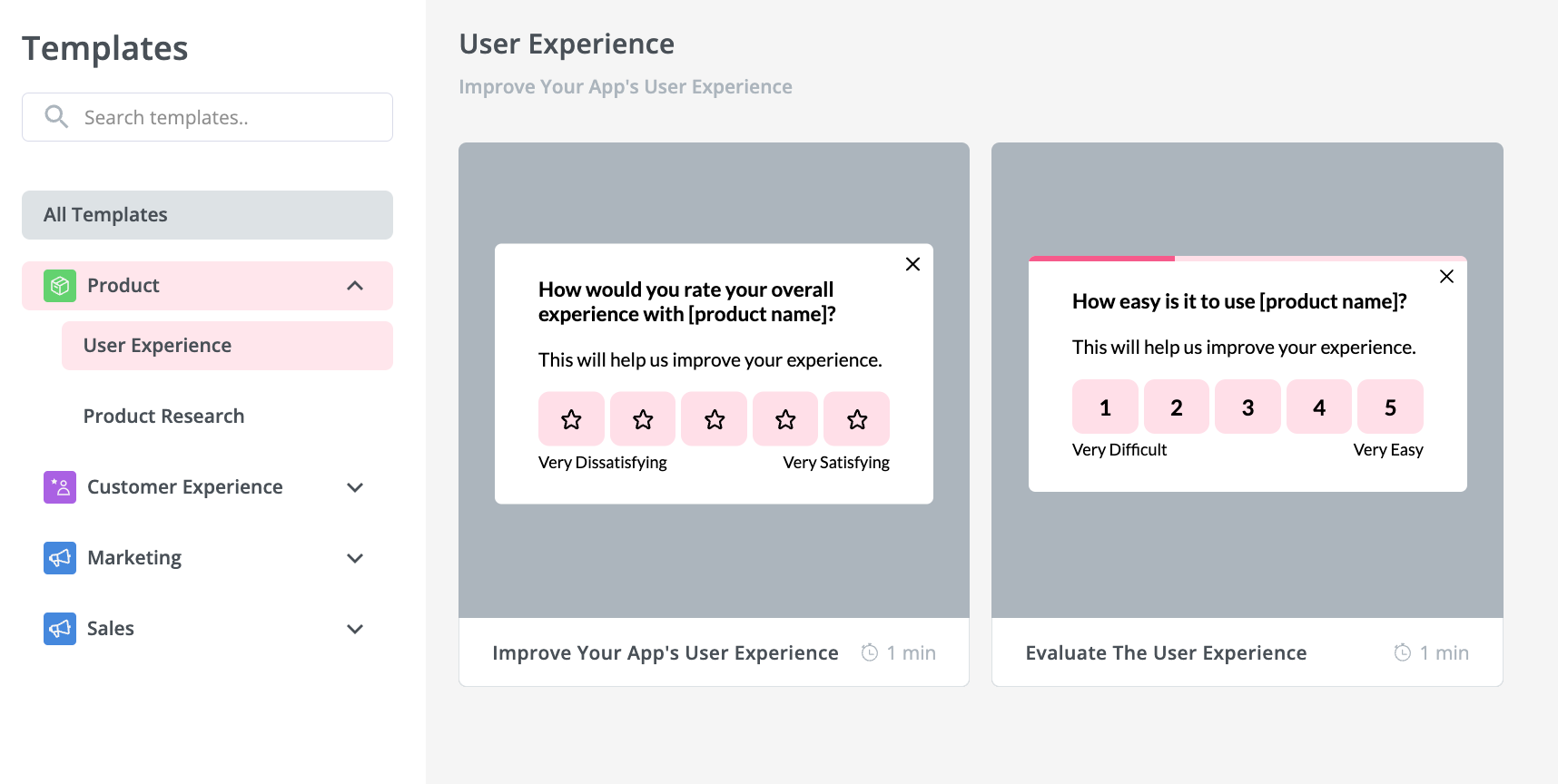

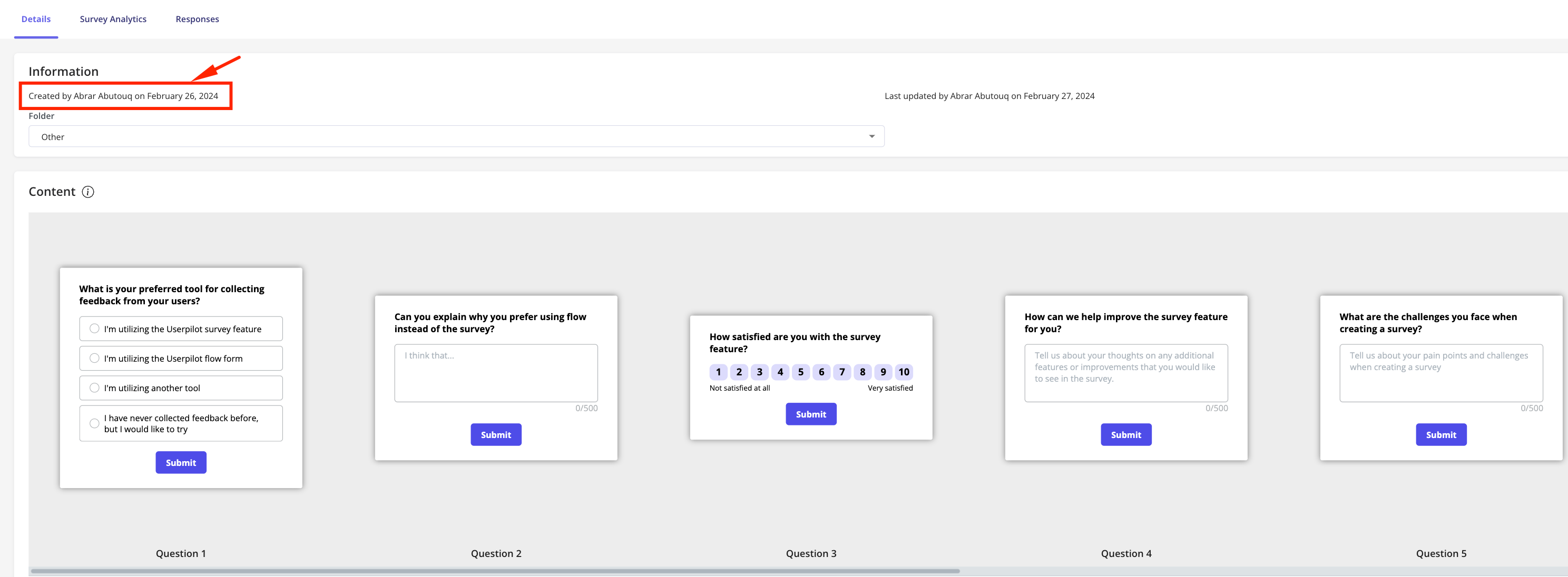

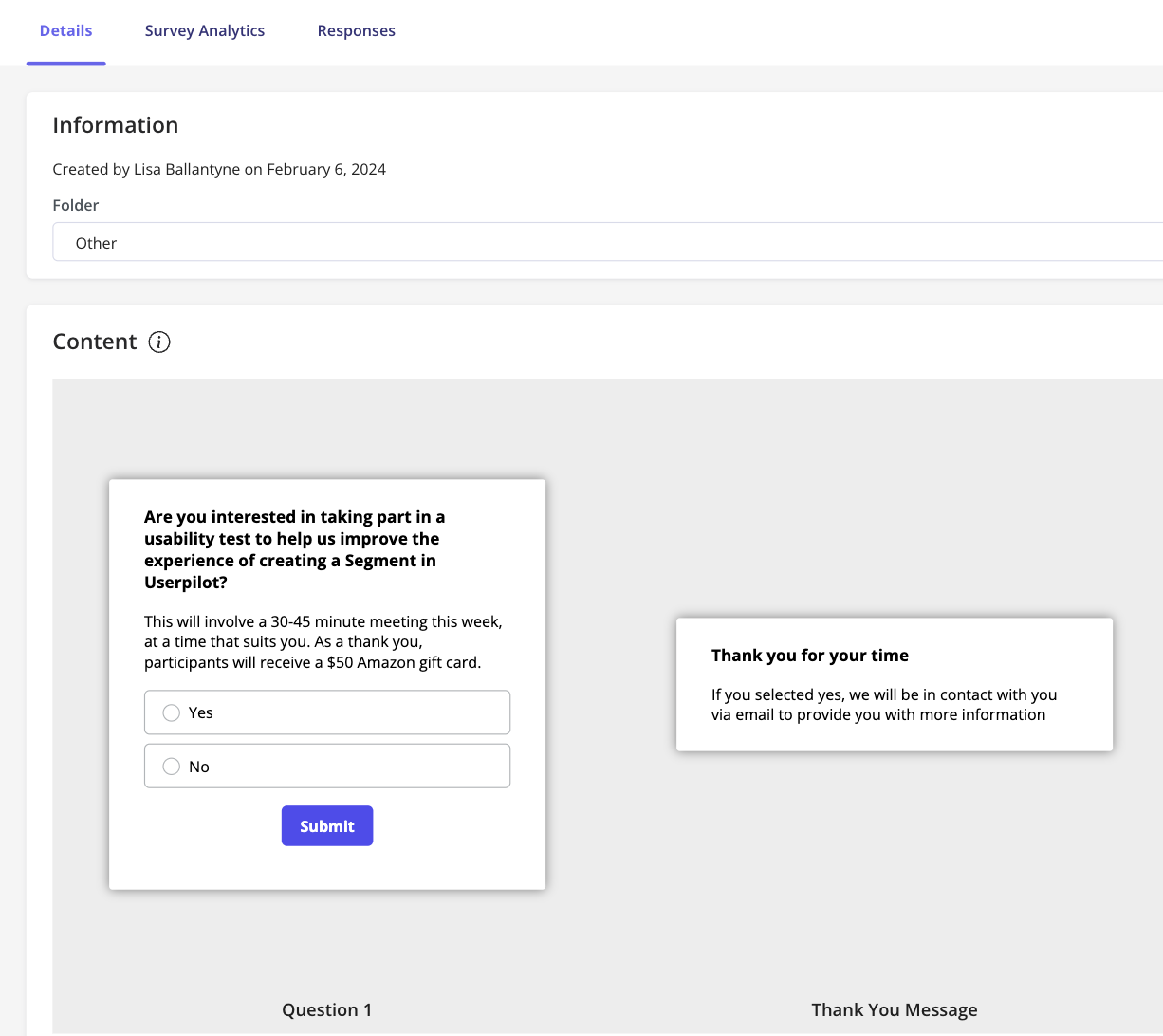

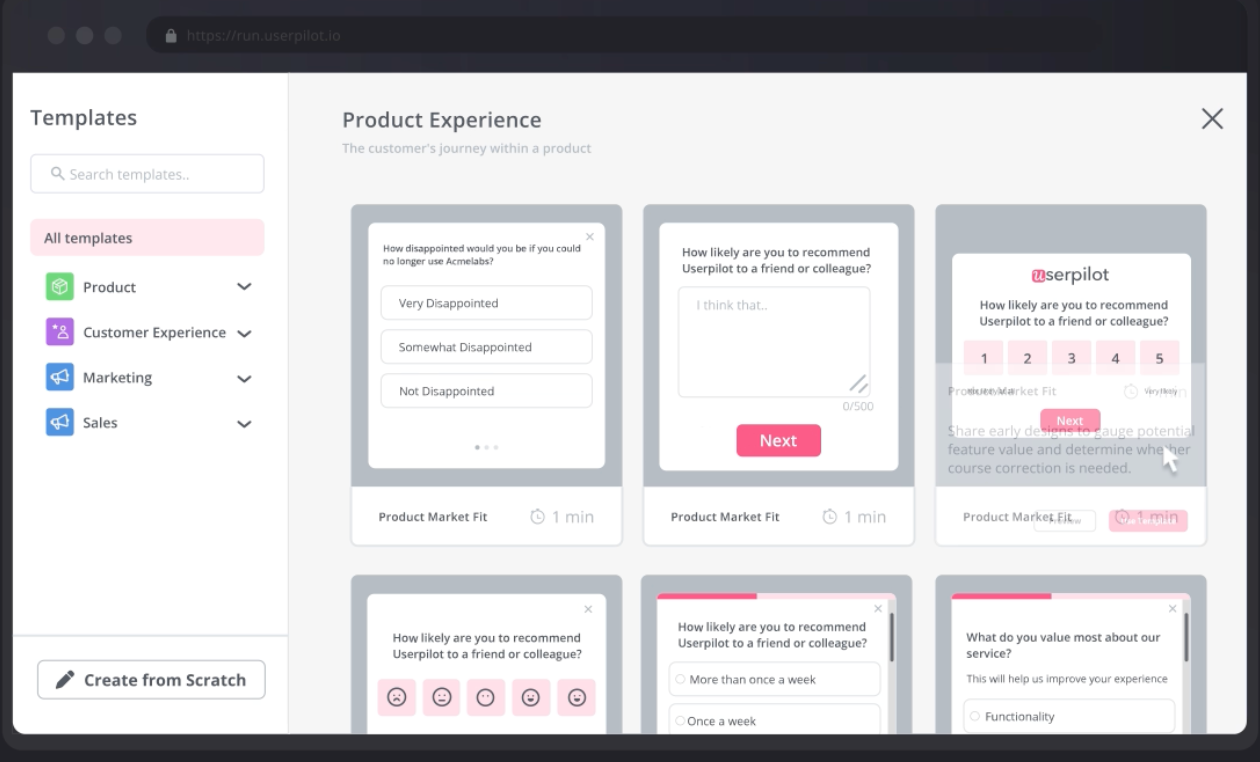

First, identify key users or user types to test. Recruit participants for customer interviews or focus groups, or deploy Hotjar Surveys , Incoming Feedback tools, and Session Recordings to test ideas with existing users.

Then, ask questions or set tasks and observe user responses. You may just want to explain concepts to users at this stage—or you can use wireframes or mockups; or, at later stages, prototypes or MVPs.

Make sure you account for confirmation bias and false-positive responses from users when designing the validation process. Include open- and closed-ended questions and use measures like purchase intent to determine customer adoption.

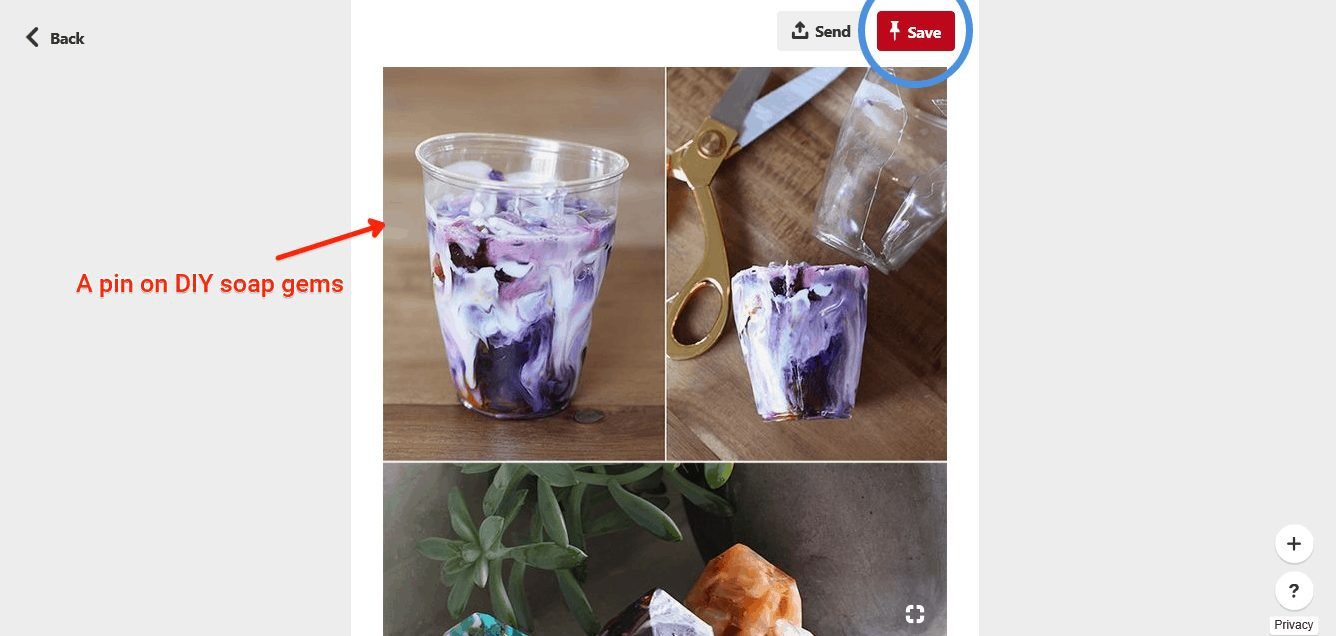

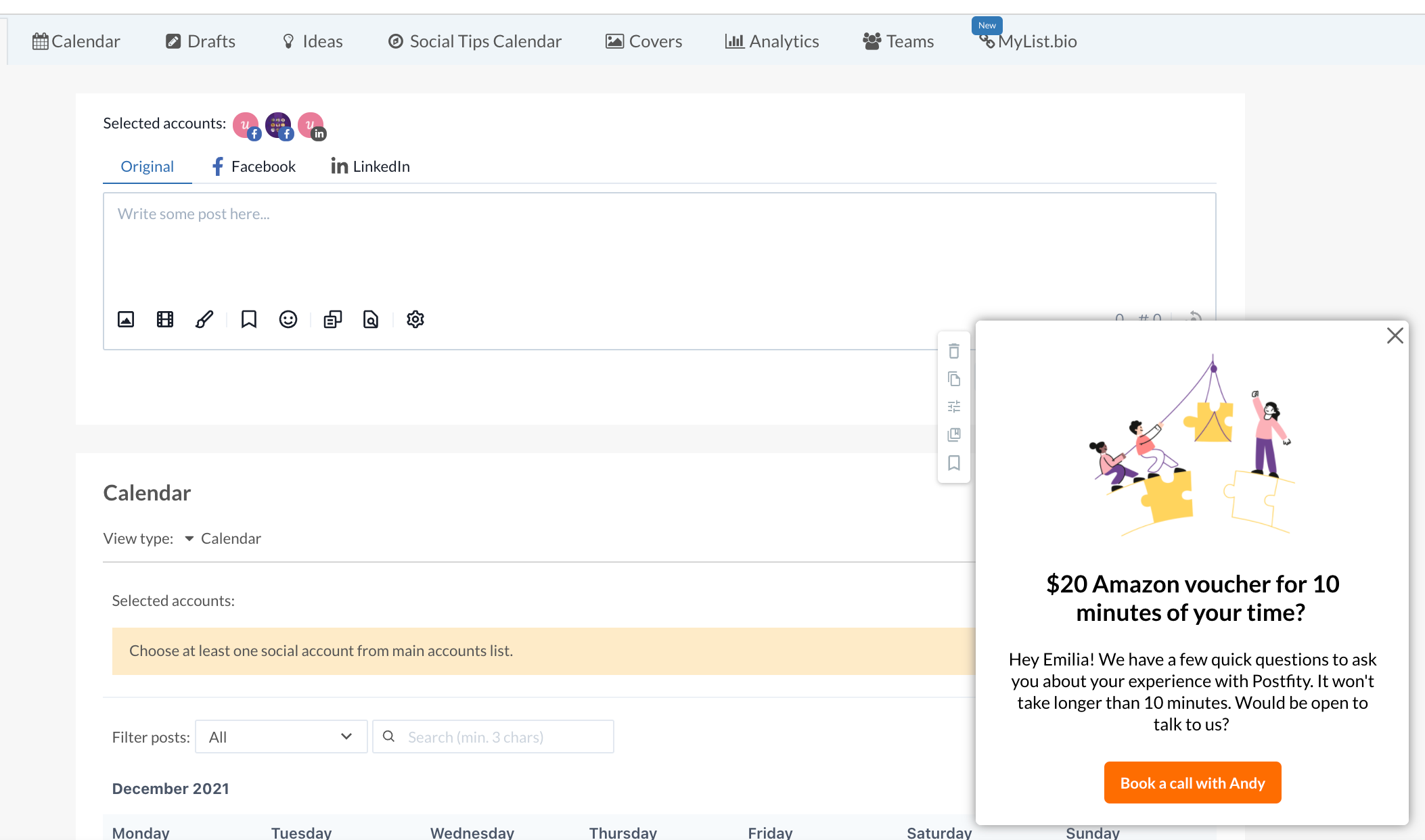

Pro tip: use fake door testing to gauge interest in new features across your existing user base.

In fake door tests, you show users a call-to-action for a product action that doesn’t exist yet. Once they click to perform the action, they’ll be taken to a page that explains this feature isn’t available yet—you may also choose to include a short survey on this page to learn more about their interest. By reviewing answers to survey questions and the click-through rate , product teams can quickly validate ideas for new features or improvements with users.

6. Test your MVP

The next step in your product research process is to develop a Minimum Viable Product based on validated ideas and run tests to improve subsequent iterations.

This is a critical stage in product research that you shouldn’t skip. Waiting for the fully developed product before running tests makes it harder to fix software and prioritize bug issues, causing major delays.

Quality assurance (QA) testing, regression testing, and performance testing check the MVP’s functionality and show developers where they need to make product changes .

User tests are also key at this stage. Different types of product testing , like tree testing and card sorting, can confirm whether users can easily navigate your product to find the functionality they need.

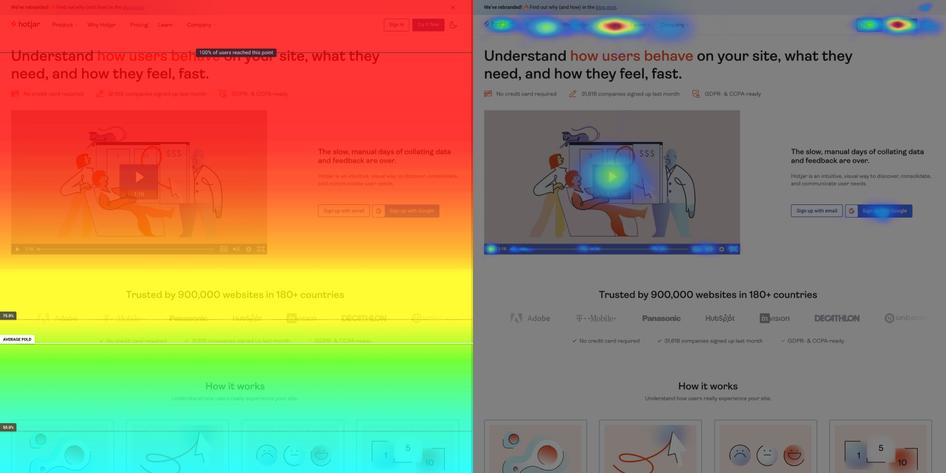

A/B tests and multivariate tests , where you split your user base into groups and give them different versions of a product or feature, can help you decide which iteration to run with. Hotjar Heatmaps allow you to easily compare where users click and scroll on different versions of the product.

7. Continue research after the product launch

Consider doing a soft launch—or even canary deployment—where you release new products or features to a small group of users

Gather data to weed out bugs

Finally, adapt the product based on user responses

Then you can roll it out to all users.

But even once you’ve launched the final product, your research isn’t over. The best product teams stay connected with their users and regularly analyze market trends and tech changes.

After the product is released, either through a soft launch or a regular launch, implementing a data-driven approach to the go-to-market strategy is crucial in parsing consumer reports and validating trends and customer opinions.

Continuous research ensures that your product stays relevant and successfully meets customer needs, which will boost user metrics and business metrics alike.

So how can you continue your research throughout the product lifecycle?

Watch session recordings to spot blockers and bugs where users are rage clicking or dropping off the product journey

Use heatmaps to understand which product elements are most popular—and unpopular—with users

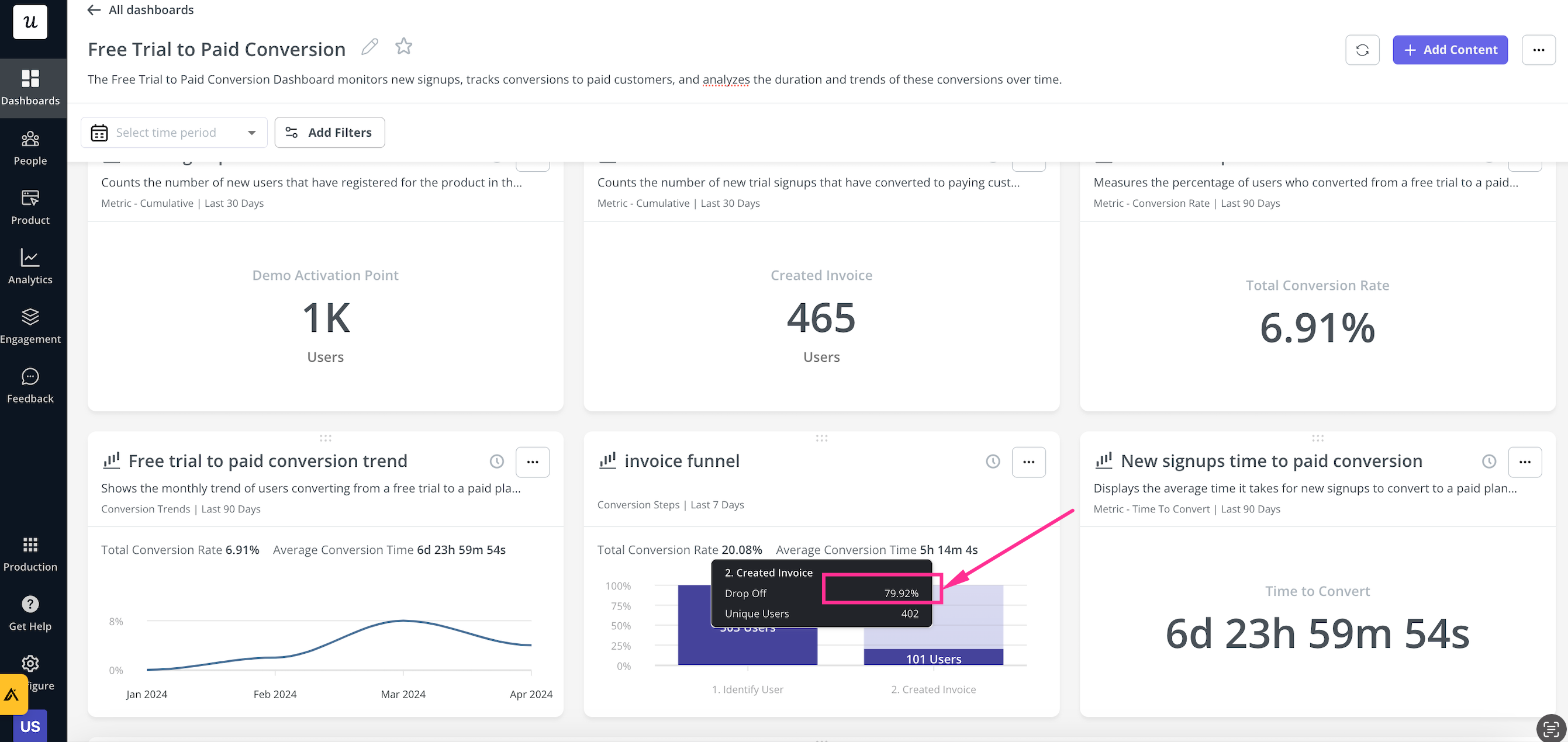

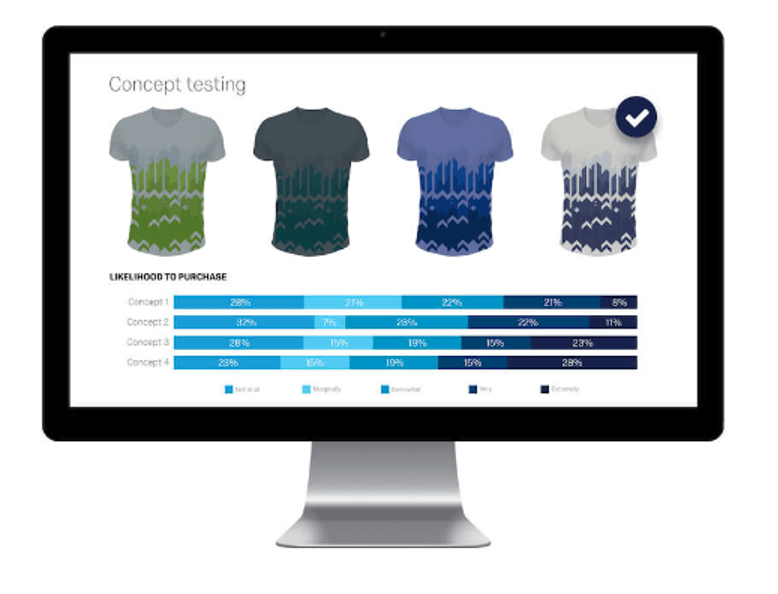

Measure product analytics like click-through rate (CTR) and product conversion rate

Stay up to date on industry and market trends

Incorporate regular opportunities for cross-team discussions to get different research perspectives

Schedule regular user and customer interviews

Use product experience insights tools like Hotjar to give you a steady stream of user feedback through Surveys and Feedback widgets

8. Turn research into action

The final step in any product research process is to organize your research and turn insights into action.

Curate your research into specific, actionable themes to cut through the noise and gather valuable, user-centric insights.

Then, use your research to establish a strong product strategy and roadmap to guide your product development process. Make sure you compare the strategy and roadmap with new research at regular intervals and update where needed, though it’s important to strike a balance: these documents should be dynamic but relatively stable touchpoints.

Your product research should also drive your day-to-day decisions and product backlog management , and form the basis of your product storytelling to help get stakeholder buy-in.

Why creating a user-centric research culture is essential

Remember: at heart, all product research is user research.

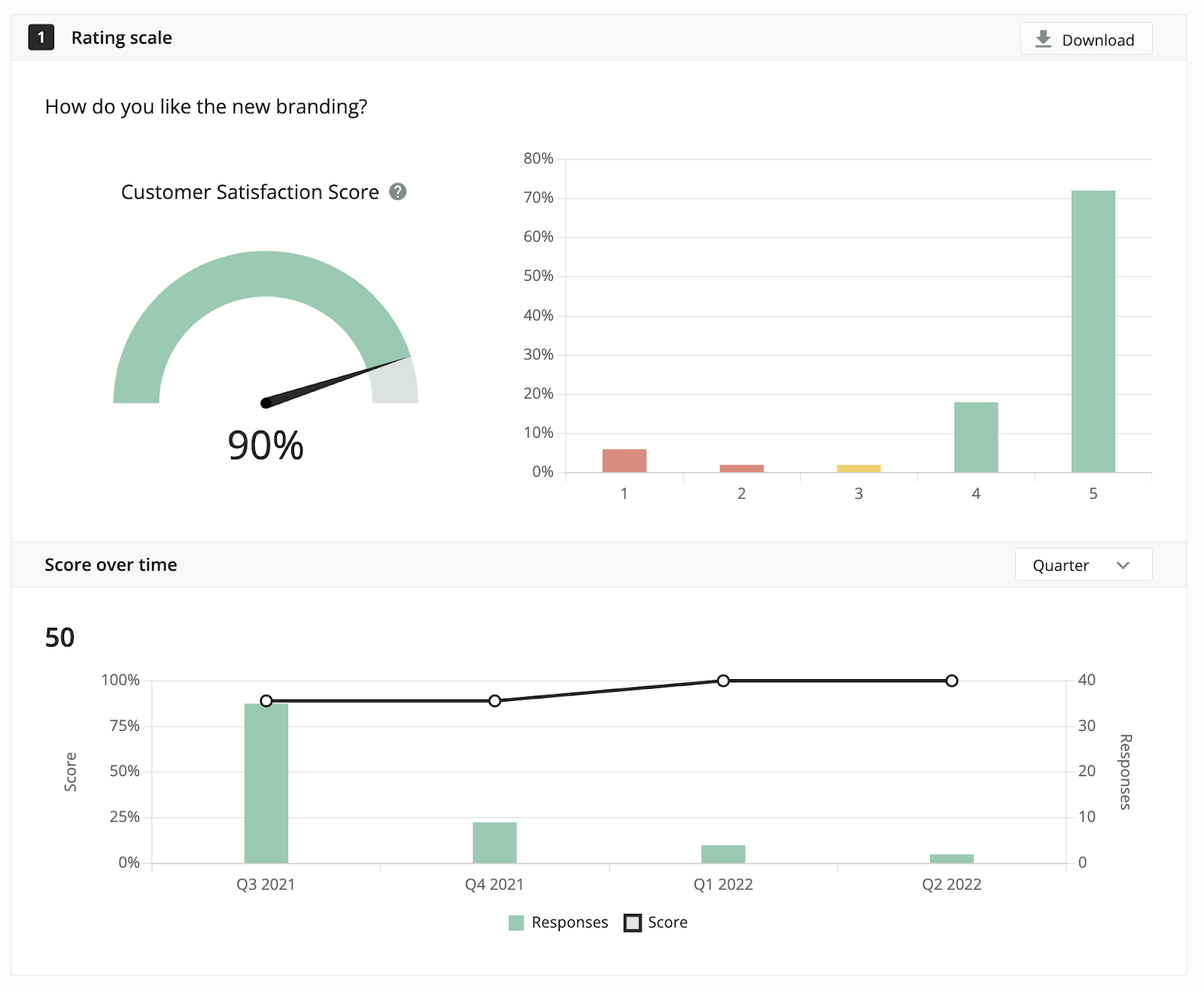

Product teams who are endlessly curious about their users—who they are, what they need, how they experience your product—can better meet the demands of an ever-evolving market, inspire customer loyalty, and increase their Net Promoter Score (NPS) . With a learning mindset and a commitment to customer-centric product discovery, you can transform research into innovation and sustainable business growth .

FAQs on the product research process

What is product research.

Product research is the process of gathering data about your product’s purpose, intended users, and market to meet user needs and achieve business goals.

What are the steps in the product research process?

The 8 steps in an effective product research process are:

1) Define your research goals

2) Understand your users

3) Do market research for your product

4) Get to know industry trends

5) Validate ideas with current or potential users

6) Test your MVP

7) Continue research after the product launch

8) Turn research into action

Why is product research important?

Strong product research is critical to product management because:

It ensures the product will meet customer needs and hit business targets

It helps product managers (PMs) develop a data-informed product vision, strategy, and roadmap

It helps PMs make confident decisions on the product backlog and day-to-day tasks

It keeps the product team motivated and connected with the purpose of their work

It helps the product team communicate product value to stakeholders to get buy-in and secure resources

Prioritize product features

Previous chapter

Guide index

Integrations

What's new?

Prototype Testing

Live Website Testing

Feedback Surveys

Interview Studies

Card Sorting

Tree Testing

In-Product Prompts

Participant Management

Automated Reports

Templates Gallery

Choose from our library of pre-built mazes to copy, customize, and share with your own users

Browse all templates

Financial Services

Tech & Software

Product Designers

Product Managers

User Researchers

By use case

Concept & Idea Validation

Wireframe & Usability Test

Content & Copy Testing

Feedback & Satisfaction

Content Hub

Educational resources for product, research and design teams

Explore all resources

Question Bank

Research Maturity Model

Guides & Reports

Help Center

Future of User Research Report

The Optimal Path Podcast

Maze Guides | Resources Hub

Product Research: The Building Blocks of a User-Centered Solution

0% complete

Product research is a foundational step in building user-centric products. It allows you to understand customer needs, preferences, and market trends, informing the development of successful solutions to user problems. Read on for the ultimate guide to product research, including methods, processes, and best practices—plus our favorite tips from the industry’s leading experts.

Product research 101: Definition, methods, and best practices

You may only build new products once, but you iterate on them continuously. The ongoing evolution of a product’s user experience (UX), informed by user insights, is pivotal to staying ahead of competitors and giving your users exactly what they need. In chapter one of this guide, we’ll explore what product research is, give an overview of key methods (and when to use them), plus best practices to follow.

What is product research?

Product research is any research you conduct to better inform your product and understand your user and market. Unlike user research , product research goes beyond evaluating the user experience and includes market analysis, pricing, feature prioritization, and assessing business viability.

Product research is a broader term than UX research—you can conduct research on the user, the interaction, the market, or your business strategy.

Matthieu Dixte , Product Researcher at Maze

It helps you understand the world you are bringing your product into, and what your users expect to do with a product like yours—so you can use their insights to influence development and design decisions.

Product research can be conducted in multiple ways, such as talking directly to users in focus groups or user interviews , or through product experimentation, usability tests and competitive analysis.

Other research terms you might come across

Ultimately, all research falls under the 'product research' banner if it influences the final product. For some product teams, ‘user research’ and ‘product research’ may be interchangeable. But there are some subtle differences between various research terms that it can be helpful to know. Here are the distinctions between key terms you might hear, explained by Maze's Product Researcher, Matthieu Dixte:

- Market research: Discover who is leading the market, who your direct and indirect competitors are, and what similar products are available to your users at what price

- User research: Understand the user, including their needs, pain points, likes and dislikes, and characteristics—both as a consumer and user of your product

- User experience (UX) research : Learn how your user perceives and interacts with your product—where they click, which paths they follow, and where they search for information on-page

- Product discovery : Uncover what your users’ needs and problems are, validate ideas for potential solutions before development, and apply user insights to your product strategy

- Continuous product discovery : Adapt the mindset of an ever-evolving product and user; conduct research continuously throughout the product lifecycle and ensure all decisions are informed by user insights

For example, let’s say you’re thinking of developing and launching a note-taking app for teenagers. You’d need to conduct market research to see if there are any similar products in high demand to gauge if your tool is something customers want. In parallel, you should run user research to discover who your user persona would be and what their pain points are.

You also have to do product discovery to identify the best way to build and design your potential product to make it appealing for teens. And, if you want to know how your users will feel about your product compared to other options, you need product research .

Lastly, run UX research tests on your mobile and web app to gather feedback, and improve the experience. You should continue to talk with users regularly after launch by adopting a continuous product discovery mindset (and ensure you’re always updating and offering the right product).

Talk to more users without needing to grow your product team

Recruit and test users from Maze’s high-quality panel to get more eyes on your product, without increasing payroll.

Why is product research important?

Are we making the right assumptions? Is this product what users really need? Can they use it effectively?

Research answers all those questions. But product research goes a step further by placing those answers in the context of your niche and the market. It empowers your team—not only to create unbiased, user-centric products—but also to create best-selling products that are based on a robust business strategy and deep understanding of the market.

Product research will also help you:

Head in the right direction

Conducting types of product research like competitive analysis gives you inside information on what your users value in a similar product—and what they’re missing. It ensures you’re heading in the right direction by only working on aspects of your product you know will succeed. This helps you speed time-to-market, reduce the cost of fixing future mistakes, and achieve higher goals.

Product research allows you to “define the total addressable market and north star metric, based on the customer segments that found your idea and product valuable. We would fail at achieving product-market fit without doing customer research,” explains Prerna Kaul , Product Lead for Alexa AI at Amazon.

Make the right decisions at the right time

User data can inform your decisions and help you prioritize them according to the goals of the business. “Make choices regarding the evolution of your product and find the right balance between what you want to deliver to improve the user experience, and the benefits it’ll bring to your company,” advises Matthieu. Without product research, you’re building products in the dark with no idea whether your target audience will like or buy them—which could mean wasted resources and sinking revenue.

Get stakeholder buy-in

You’ve probably found yourself explaining multiple times to stakeholders why you need to prioritize one feature over another. Conducting product research enables you to “clearly articulate the customer value proposition to leadership, tech, and science counterparts,” says Prerna. Having quantitative and qualitative user insights provides reassurance to stakeholders and speeds up sign-off—while ensuring the wider organization is aligned on your product ideas.

In short, product research provides you evidence you need to start evangelizing research among your organization, and get the whole team on board.

Understand the position your users hold in the market

User research is about getting to know your target audience and building ideal customer profiles, but product research is about discovering where your potential customers are located in the market and which trending products to take note of. If your audience is already using a similar product, this means finding out: Which one? Why? Are they willing to switch to a different product? What would it take for you to get them to switch?

“Analyzing the market lets you determine which areas could be ripe for disruption or creation. By analyzing existing products and doing conceptual thinking you can build a picture of how you can get your product to gain traction in the market and offer something new, nuanced, or better than the current options,” says Nick Simpson , Head of UX at Airteam.

Challenge your assumptions and anticipate problems

When Prerna worked at Walmart Labs, her team introduced a feature for users to scan products in the Scan and Go app. “We initially believed that all of our inventory was available in a common database and accessible through the app. However, during research and user testing, we identified that some rare products were not in the online database,” she explains.

This caused test users to drop off the app, so her team had to take a step back and prioritize fixing inventory issues before launching the product. Without conducting product research, you can be left guessing at the cause of user problems, or wondering why they prefer a particular product. Research offers your team a chance to challenge what you think you know, and pre-empt what you don’t.

Product tip 💡

You can use Maze to conduct multiple tests on your product through development, such as Five-Second Tests or Content and Copy Testing , or get insights on your live product through Live Website Testing .

Product research methods

There are many different product research and UX research methods , all of which offer different kinds of data and insight, depending on your objectives. If you’re looking to conduct product research to better understand your users, market, or competitors, here are eight product research methods you should consider to help you build winning products.

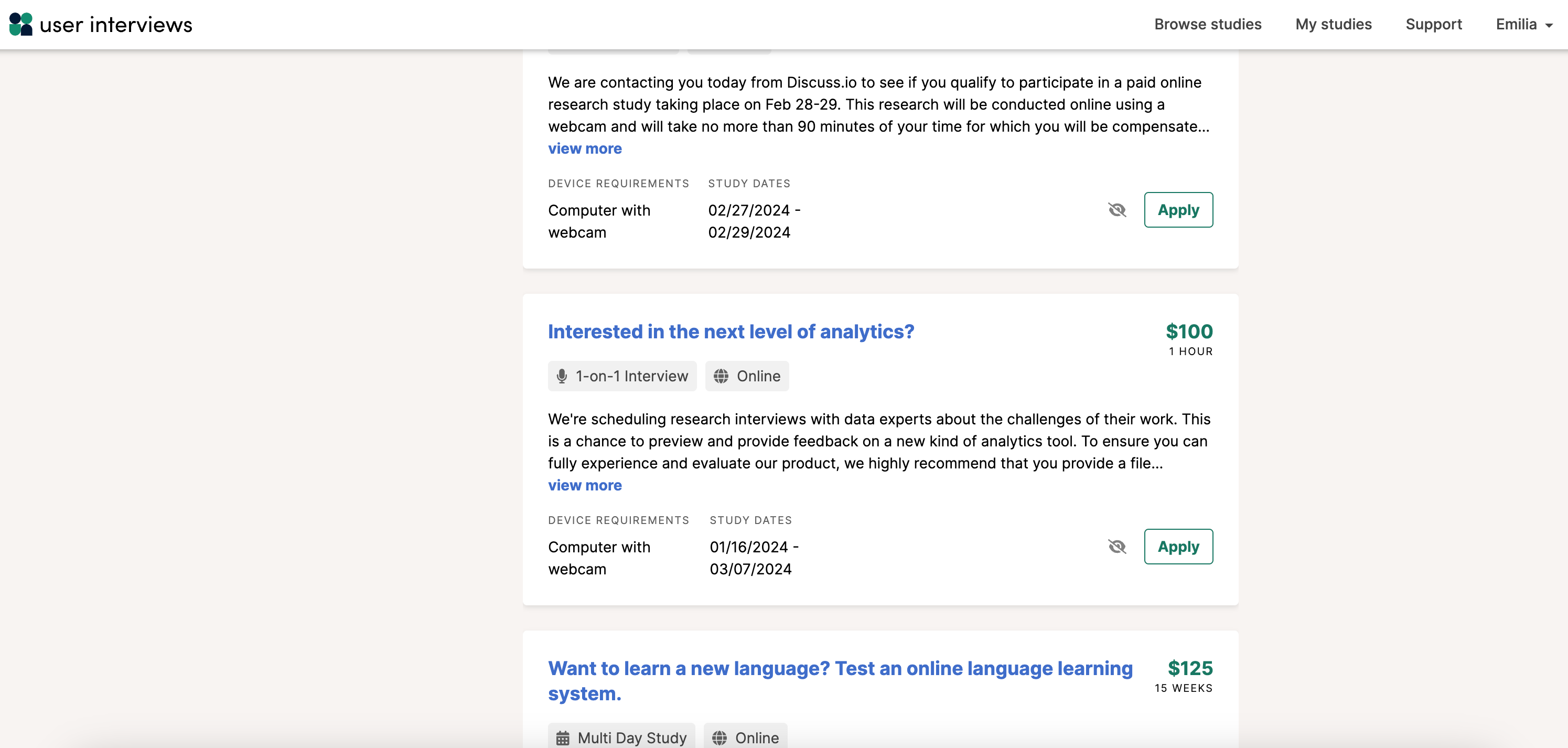

1. Customer interviews

Interviews can take place at any take of the product development process and consist of direct conversations with current or potential customers. You may choose to conduct interviews with a market panel during concept testing and idea screening to validate your ideas, or you may want to speak to current users after the product goes live to gather post-launch feedback. Interviews are a varied and flexible product research method.

During customer interviews, you should ask open and unbiased research questions to gather insights about customer needs, preferences, and experiences regarding their pain points, your product, and competitors.

2. Voice of customer (VoC) analysis

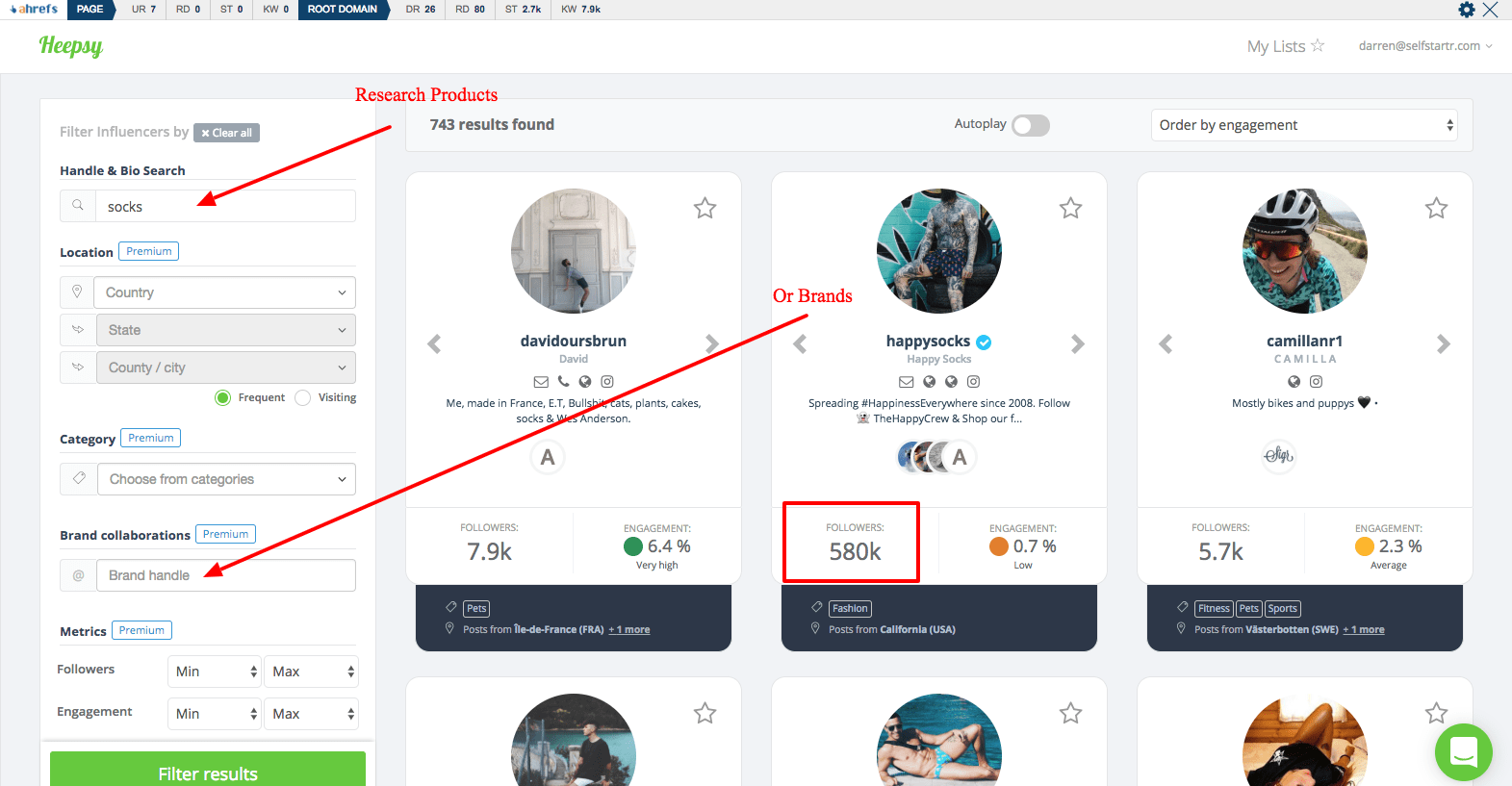

Gauge what current and potential customers are saying about your products or competitor products online. You can do this using VoC tools , by reviewing what people post on social media, looking at Google Trends, or reading reviews on websites like G2.

You should conduct customer voice analysis continuously throughout the lifecycle as it can help you gain a competitive advantage. “Review what’s publicly published, check feature requests, and ask sales, customer success, or support teams for feedback coming from the user,” adds Matthieu.

For example, if a competitor gets acquired by a bigger firm and users start to complain about them removing a feature, you can use the opportunity to develop a similar functionality or improve the one you have. You can also make it more visible on-page and get the sales and marketing teams to use the information to advertise your product.

3. Diary studies

Diary studies involve users self-reporting behaviors, habits, and experiences over a period of time. This is often used during the discovery phase with a competitor product, or later down the line with a prototype. By observing how users feel prior to, during, and after using your (or a competitor) product—and their experience throughout—you can gather valuable, in-the-moment insights within a real life context.

You can conduct diary studies on paper, video, or online on a mobile app or a dedicated platform.

Data from diary research can turn into new product ideas, new features, or inform your current project. For instance, if you have a social media scheduling tool and you identify that users open a time zone calculator when they’re scheduling posts, you instantly have a new feature idea, to add a widget with different time zones.

Learn more about the types of diary study and how to conduct diary research here.

4. Competitive analysis

Analyze competitors' products and strategies to identify what works for them and identify any gaps in the market. The idea behind competitive product analysis is to explore your competitor’s products in-depth, sign up for an account, use them for a while, and take notes of top features, UX, and price points. You can run competitive analysis during the discovery, concept validation , or prototyping stages with direct and indirect competitors, or aspirational businesses.

Matthieu Dixte, Product Researcher at Maze, notes the value of competitive analysis is in understanding your users perspective: “We conduct a lot of competitive analysis at Maze because it's really important for us to understand if the market is mature regarding a particular topic—and to identify the current ground covered. This helps us understand the pros and cons our customers perceive when they choose between our product or another tool.”

Surveys can be a great way to get feedback or gather user sentiment relating to existing products or future concepts. You can also use them to dig deeper into the data gathered during other tests, and understand user issues and preferences in context.

For example, if you ran an A/B test and discovered that certain copy was causing potential users to churn, you could follow-up with a survey with targeted questions around their demographics, preferences, and personal views. This would help add qualitative insights to your quantitative data, and help understand what your users are looking for from your product.

Remember, you can create surveys at any stage of the product development to collect data from users in small or large volumes. You can use different types of surveys and survey principles to validate or debunk hypotheses, prioritize features, and identify your target market. For example, you could ask questions about your product, competitors, and prices or even your customer’s preferences and market trends.

Surveys can have a high drop-out rate, harming the validity of your data. Check out our survey design guide to discover the industry’s top secrets to an engaging survey which keeps users hooked.

6. Usability testing

Since conducting product research is also about understanding how well your customers navigate through your product and if they find it usable, you can run usability or prototype tests . Usability testing evaluates the usability of your product by asking test participants to complete tasks on your tool and seeing how they interact with it.

While typically conducted as a pre-launch check, usability testing is now widely understood as a building block of continuous research. Conducting regular usability tests is crucial to staying familiar with users, taking the pulse of your product, and ensuring every new product decision is informed with real data.

Conduct usability tests on a product research tool like Maze and record your participant’s audio, video, and screen with Clips . This offers you a mix of quantitative and qualitative data to learn why participants take certain actions to complete test tasks.

7. Fake door testing

The fake door testing method, also called the ‘painted door method’, is a way to validate whether your customers would be interested in a particular feature. “It works by faking a feature that is not actually available and implementing a tracker to know how many people click on it,” explains Matthieu.

When people click on the feature, they see a message explaining it’s not available at the moment. If the click-rate is high, you can assume there’s interest in the feature and conduct further research to identify how to design and develop it.

While it’s a quick way to gauge interest, fake door testing runs the risk of frustrating users, so if you’re using this method on a live product, you should be cautious and set a short testing period to avoid creating false expectations in your users.

8. Focus groups

Focus groups are when you gather a group of users to try your product and discuss their thoughts on the design, UX, usability, or price. You’ll offer them prompts or ask a series of user research questions to spark conversation, then observe and take notes.

This can be an expensive or admin-heavy method, as you need to rent a space, find participants who are willing to attend, and compensate them for their time. However, you can also conduct focus groups remotely through video conferencing tools. These groups are a good way of generating new product ideas or gaining deep insight in a short space of time, as you can hear directly from your users and adjust your questioning to follow up on important topics or opinions which participants mention.

When to perform product research

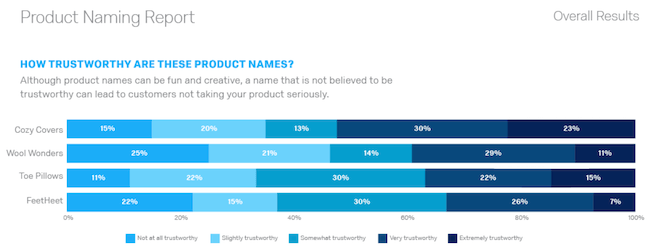

Source: 2023 Continuous Product Discovery Report

According to our 2023 Continuous Product Discovery Report , most teams conduct research at problem discovery (59%) and problem validation (57%), with only 36% researching post-launch.

The consensus is that product teams don’t think that’s enough—78% think they could research more often: which means there’s a big opportunity for you to implement regular research at all stages of the product research process .

Here’s when to conduct research on your product:

- At problem discovery stage to outline a hypothesis based on user insights

- During problem validation to prove your hypothesis

- During solution generation and concept development to see if you’re moving in the right direction

- As you’re screening different ideas for prioritization to identify the ones your users value most

- At solution definition and once you have your initial design to test early wireframes

- After developing a prototype to see assess usability and direction

- During validation and testing to review changes made to previous prototypes

- After development, and post-launch to get feedback and plan your future steps

- Before launching a new feature or doing product optimization to gauge users’ perceptions

Best practices for effective product research

If you only have time to consider one best practice for product research, we’ll keep it short. Just start.

Any research is better than none, and there’s a wealth of knowledge out there waiting to be discovered. If you don’t use it, your competitors will.

Now, here are six other best practices to help you improve your results and get the best insights possible:

1. Conduct research continuously

Your product is never done, at least not while the market, your customers, and technology are evolving. So, for your users to keep choosing you, you need to grow with them, adapt to trends, and keep iterating on your product. The right way to make product iterations is by conducting continuous product research, having frequent communication with your users, and actively listening to the market.

Did you know that user-centric organizations achieve 2.3x better business outcomes? 📊

By putting customers' needs front and center, research-mature organizations are driving better customer satisfaction (1.9x), customer retention (2.4), and increased revenue (4.2x). Learn more in our Research Maturity Report .

2. Focus on the business problem when presenting to stakeholders

It’s easy to get so involved in the product that you forget to mention how it helps the business when presenting research findings. To get stakeholders on board and to build great products that are profitable, always keep the business needs in mind. There’s no product without business success, so always align with your stakeholders and bring it back to team KPIs and business metrics. To convey your story, it’s a good rule of thumb to start each cross-team meeting by presenting the business problem, then sharing how adding a certain feature decision will help you solve it, before getting into the data that backs this up.

3. Embrace your curiosity

One of the biggest mistakes you can make in product research is letting cognitive biases take over the process. Work in teams and ask questions out of curiosity—consider research a way to disprove your hypothesis or challenge your assumptions, rather than a way to prove them right. As Prerna Kaul, Product Lead for Alexa AI at Amazon explains, you often gain more insight from an answer you don’t want to hear. “A huge trust-buster is when researchers sell an idea to customers and reinforce their pre-existing beliefs.” Doing so makes the user tell you what you want to hear but not what you need to know. It’s better to know that you have the wrong assumptions early on and build products that solve the right problem.

It’s non-negotiable to ensure that you are solving the right problem for the customer. Your solution is a painkiller, not a vitamin.

Prerna Kaul , Product Lead for Alexa AI at Amazon

4. Focus on the end goal rather than specific features

When you work closely with a product you’re passionate about, it’s only natural to think of all the possibilities, and minute details and features of the product. However, it’s crucial to understand that, while you might be the one making the internal decisions, the user will have the final call. Getting hung up on specific features will get you frustrated if users disagree, or lead you to make biased choices. To overcome this, you can write a research statement explaining the big problem you’re trying to achieve with the product. Come back to this before and after each decision, to keep your choices grounded in what’s best for the user.

“We always ask: Are we solving the right problem by creating this product? Is it going to have a measurable benefit to people?” says Nick Simpson, Head of UX at Airteam. “Then, we try to answer those questions through research methods to determine whether this investment will be worth it, to both business and users.” By thinking of the overall end goal at all stages, you get to build profitable products and features that really respond to that intention.

5. Take notes of everything

This one might go without saying, but it’s crucial to keep track of everything. Not just to inform future research and remind yourself where decisions came from, but to democratize research and bring the entire organization into your research process .

Set up a centralized research repository that anyone can access, and share it with your wider organization. Within the product team, keep a record of all user insights, even if they sound impossible to achieve at first. “These ‘futuristic’ thoughts or ideas are the ones that can either inform future iterations of the product or that you can creatively turn into something more feasible to design and build,” explains Nick. Keeping an organized information bank enables everyone on the team to get to know the user, the market, and why you’ve made certain decisions in the past.

6. Combine user feedback with data

While your users should be at the center of your business, don’t rely solely on their comments without checking other data. In reality, not everything people say is exactly what they do . Research participants can be influenced by any number of factors, mostly unconscious, so it’s important to use qualitative and quantitative data to reinforce each other.

For example, the users you interviewed might tell you they love a certain feature, but when you contrast those comments with heatmap data and time on page, you see that only a small percentage of your customers actually use it. Consider what research can be conducted to ascertain why this is, how you can improve those metrics, or whether it’s more helpful to refocus efforts on a different feature with a higher profit margin.

Keep learning about product research

In this chapter, we’ve covered a lot about product research:

- What product research is (and what it’s not)

- How researching your product is beneficial to your business

- The different methods you can use to conduct product research

- When to conduct product research

- Best practices for your research

Now, it’s time to kickstart your product research process in the next chapter. We’ll also talk about how to conduct product experiments and competitive analysis, so stay tuned.

Product research process

Product Management

How to do Product Research [Step-by-Step Guide]

Associate Product Marketer at Zeda.io.

Mahima Arora

Created on:

January 11, 2024

Updated on:

August 7, 2023

14 mins read

![how to do a product research How to do Product Research [Step-by-Step Guide]](https://assets-global.website-files.com/62c41df069f3e62476a3ccbe/62d93a37cae828cd769d38c1_christina-wocintechchat-com-rg1y72eKw6o-unsplash.jpg)

Transform Insights into Impact

Build Products That Drive Revenue and Delight Customers!

An effective and robust product research process increases the chances of product success.

Seth W. Godin, an American author, once said – ‘Don’t find customers for your products, find products for your customers.’

The quote subtly hints at the necessity of product research. By performing product research beforehand, product managers can create the ideal product for customers.

Did you know that 90% of new product research focuses on ‘modifications’ and ‘additions’ rather than new concepts?

But even improving or adding new features to an existing product requires a proper product research process.

Product research enables managers to understand the current and future needs of the users. Thus, based on users’ pain points and what they are looking for, product managers can innovate products of a higher value.

Furthermore, organizations with a strong product research process understand the market better. They stay one step ahead of the competition and survive better in the long run.

Now that you know how important product research is, you must dive into how to do product research right away!

So, let’s begin!

10 Steps to Product Research

There’s no single product research process that fits all the product development teams. But there are certain key steps in the process that product managers must know about.

Here are the 10 essential steps to perform a successful product research process. Follow these steps to derive valuable product insights that will guide your product development decisions.

1. Define your research goals

Why are you performing the research?

Once product managers find an answer to the why, they can set the goals of the research.

Set the high-level goals first. You can set these goals considering the product strategy and vision, ensuring their alignment with business objectives.

Next, create SMART (Specific, Measurable, Attainable, Reliable, and Time-bound) goals for the product development team to focus on during each research stage. This may include;

- Performing market research for product adoption before its release

- Finding out the key areas or features of the product to be improved after the launch

- Assessing the product performance through the product’s lifecycle.

Setting clear, measurable, and time-bound goals for the product research process guides the product team’s actions. It helps them to understand what they need to do. Also, the goals help product managers to measure outcomes and make improvements where necessary.

2. Understand your customer's needs and pain points

An effective product research process is always customer-centric. So, start engaging in user discovery.

Understand user pain points. Start your user research even before planning the product features. Interact with your existing and potential users to identify their needs and wants.

Performing open-ended user research will help product managers to;

- Measure the market demand,

- Get inspiration for the new product

- Determine the product-market fit

- Product positioning against competitors, and

- Increase customer satisfaction.

Since user research is a vital part of the product research process, you can check out the best product discovery questions list .

After the user research, when product teams develop prototypes, they can start trials and ask for user feedback. Next, the insights from feedback can be used to improve the product.

3. Perform competitor and comparative analysis

The next step in the product research process is to know the competition.

- Start with competitive analysis . It involves reviewing the products that are directly similar to yours. For example, if a company sells smartphones, it is directly competing with other companies selling smartphones (like Samsung and Xiaomi).

- Next, perform a comparative analysis . It involves evaluating the alternative options for a product. For instance, an automobile manufacturer can compare the safety features of multiple car models to measure the sales of each and identify the features that require improvement.

Performing the analyses will provide insights that product teams can use to make the product better.

4. Study the market

Besides performing competitive and comparative analyses, product managers must run thorough market research to map the available opportunities.

Here are a few ways to study the market thoroughly;

- Use the historical market records, and research reports by academic institutions, government agencies, and trade associations.

- Observe and analyze the competitors’ strategies like advertising, pricing, and distribution of products.

- Read up on blogs, magazines, social media posts, and other specific content related to your space.

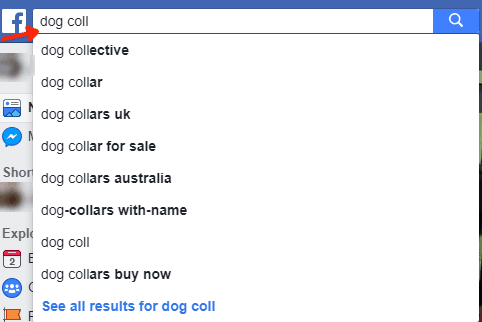

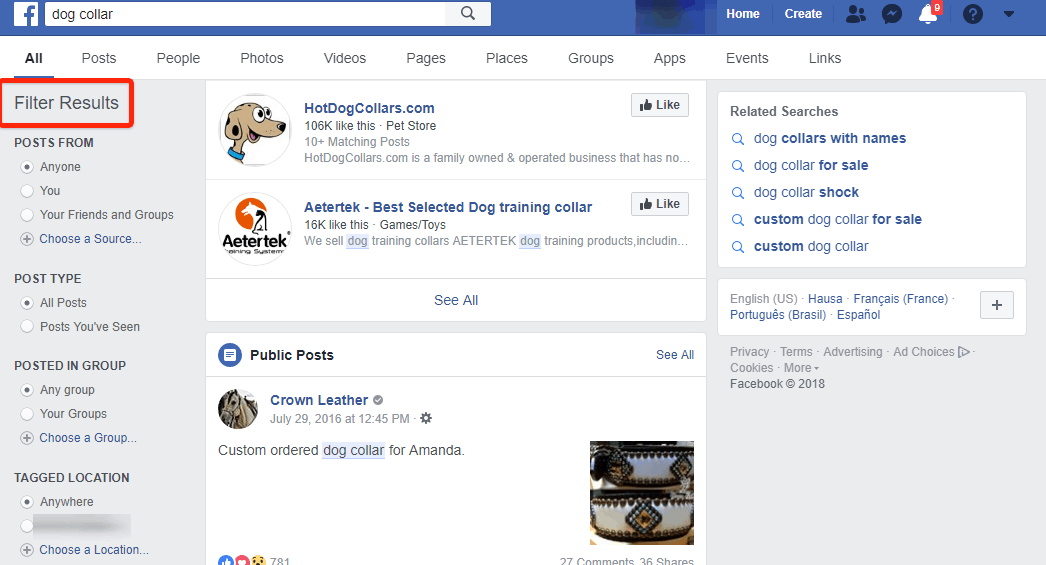

- Run keyword research to understand what your users are looking for. This can help you generate product ideas too.

Once product managers validate a viable market for the product and determine the market saturation, the development teams can focus on the product's USP (Unique Selling Points).

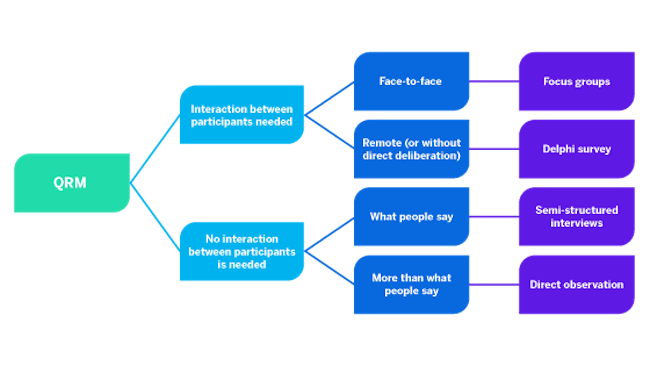

5. Conduct research using qualitative and quantitative methods

Further, product managers can use both qualitative and quantitative methods of market research.

Qualitative methods – The qualitative methods of market research aren’t statistically significant. These methods help product teams to understand the potential customers at a deeper level. Individual interviews, focus groups, observations or follow-me-homes, and interviews with professionals or field experts are a few qualitative methods you can utilize for market research.

Quantitative methods – Quantitative methods include conducting surveys, polls, or sending out questionnaires. Through quantitative methods, product managers study a large enough pool of respondents in their target market to have reasonable confidence in the collected data. For organizations with a limited budget, you can rely on the survey reports of other organizations in the relevant field.

6. Know the industry trends

Stay on top of the industry trends by updating your knowledge regularly. Observe the tech trends that may impact users’ expectations of your product or its viability in the long run.

Engage with the tech cultures – read blogs, news, and magazines, listen to tech podcasts, follow the latest tech updates on social media platforms, forums, etc. Product managers can also use tools like Google Trends, Trend Hunter, etc.

The IT teams in organizations also serve as a key source of tech information. Product managers can interact and take regular updates from them.

The industry trend updates can also help product managers to research future projections, disruptive technologies, and the chances of product category obsolescence. Thus, with these insights, the product teams can create products that are likely to be in demand in the future.

7. Validate product ideas

After thorough research, product teams can test ideas and solutions.

Based on the extensive research data, you can identify the possible products, their key features, or improvisations that can meet the user's needs. Further, you can perform concept testing to examine user experiences with concrete product ideas.

To start testing, identify the key users to test. Get participants for interviews, focus groups, or implement surveys, feedback tools, etc., to test the ideas with the existing users.

Product managers can also ask questions and assess user responses. Or, they may simply explain to the users the product concept using wireframes and mock-ups.

8. Build your product and test the MVP

A crucial step in the product research process and the most conclusive market research that product managers can perform to ensure product success. It is only after a lot of effort that product teams get to the point of testing MVP (Minimal Viable Product).

Testing MVP is all about creating the MVP and trying to sell the product or the product idea to the target audience. Several types of product testing, like card sorting, tree testing, etc., tell whether or not users can navigate your product easily, to find the different functionalities they are looking for.

Further, product managers can run a regression analysis, quality assurance, and performance testing to check the MVP functionalities. Running these tests helps the team to identify the areas where changes are needed.

Multivariate tests and A/B tests are helpful when the user base is split into different groups and each group has different products or product features. These tests help product managers to choose the perfect iteration.

9. Derive findings and insights from the market research data

The market research data is of no use unless you convert them into findings and insights.

Products managers and the product team must analyze the data to find out conclusive outcomes that can support their product decisions.

The team can then start building the final product or improvise the MVP based on the research insights.

10. Use the analysis to guide your product strategy

The final step in the product research process is to convert the research insights into action. Cut through the noise and gather valuable customer-centric insights .

Then, you can use the research to create a strong product roadmap and strategy to guide the entire product development process. When you perform new research, ensure to compare the strategy and roadmap to keep them updated.

Further, the research should also be used to make regular decisions, drive product backlog management , and create the basis for your product storytelling.

7 Tips to Conduct an Effective Product Research

A strategic approach to performing the product research process is essential. But alongside the planned strategy, product managers must consider a few tips or best practices to conduct the product research successfully.

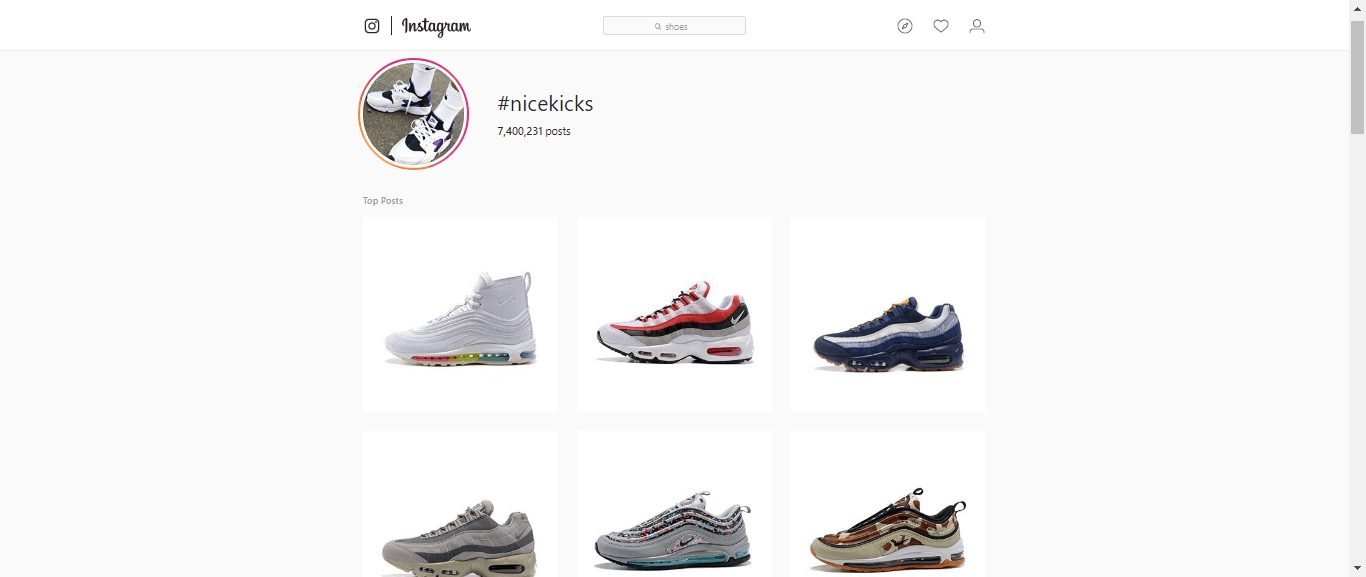

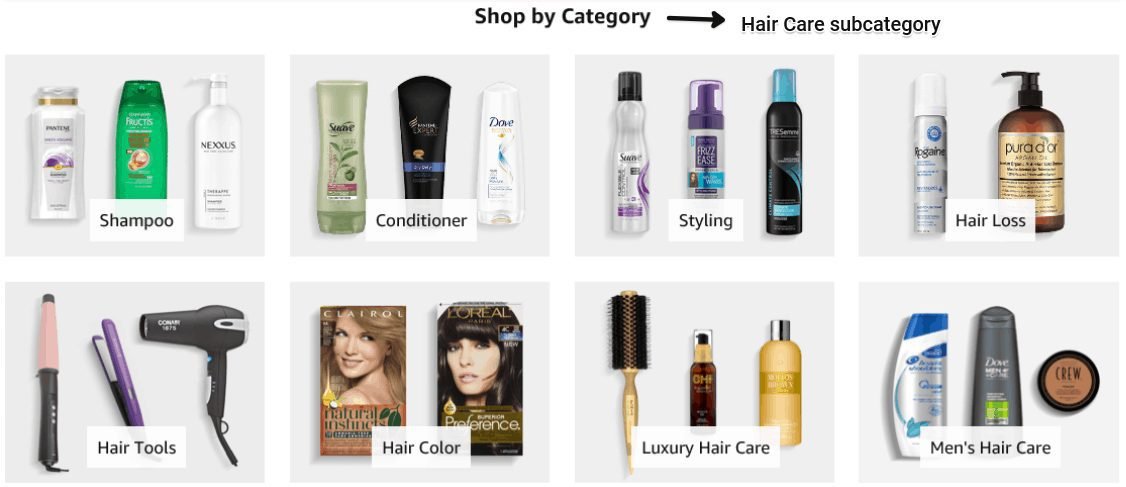

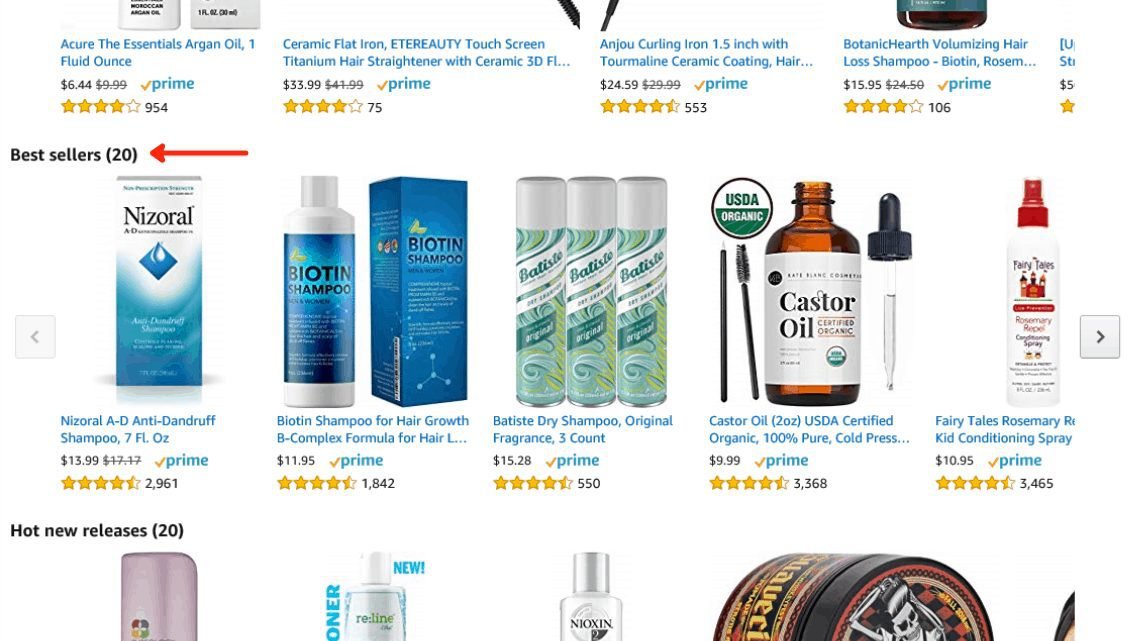

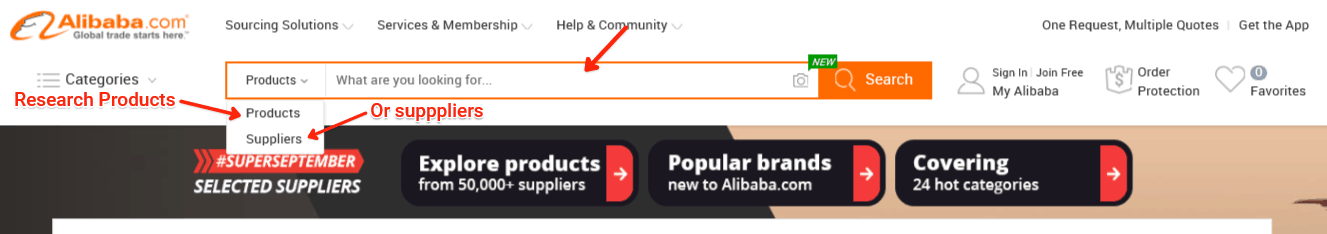

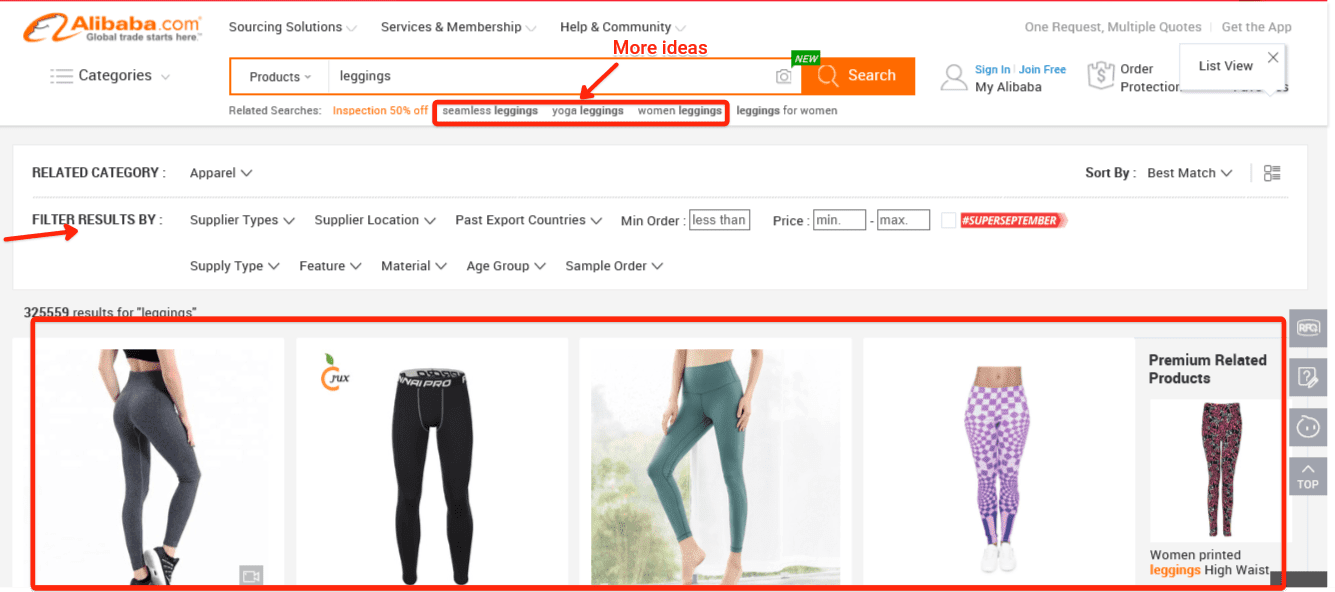

1. Research highly-demanded products

At the initial stage, when you do not have a product concept, get inspired by the products high in demand.

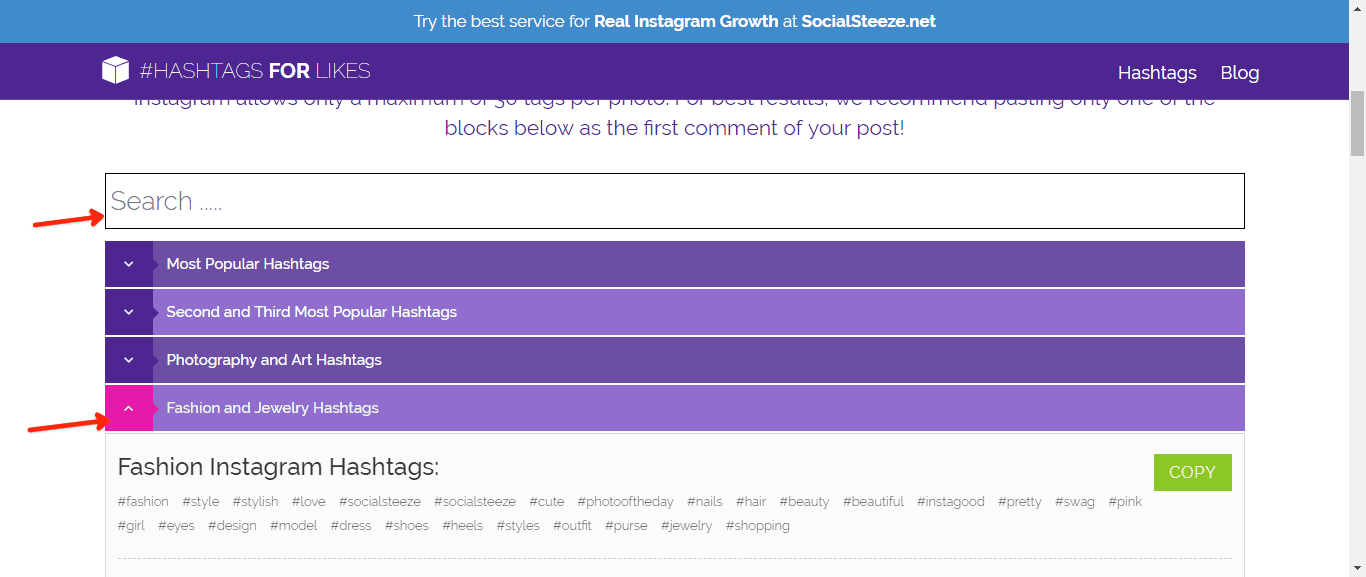

Check out trending hashtags, reviews, comments on review sites, and bestsellers list to find out the most popular products in your space.

Here, the goal is not to imitate the product in demand. It is to keep an open mind, ascertain the demand level, and evaluate if the product idea is awesome or not. The product manager’s goal is to perform an honest evaluation and get back to brainstorming with the collected inspirations.

2. Read about similar products

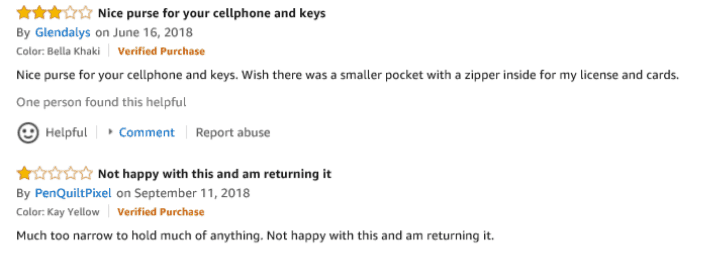

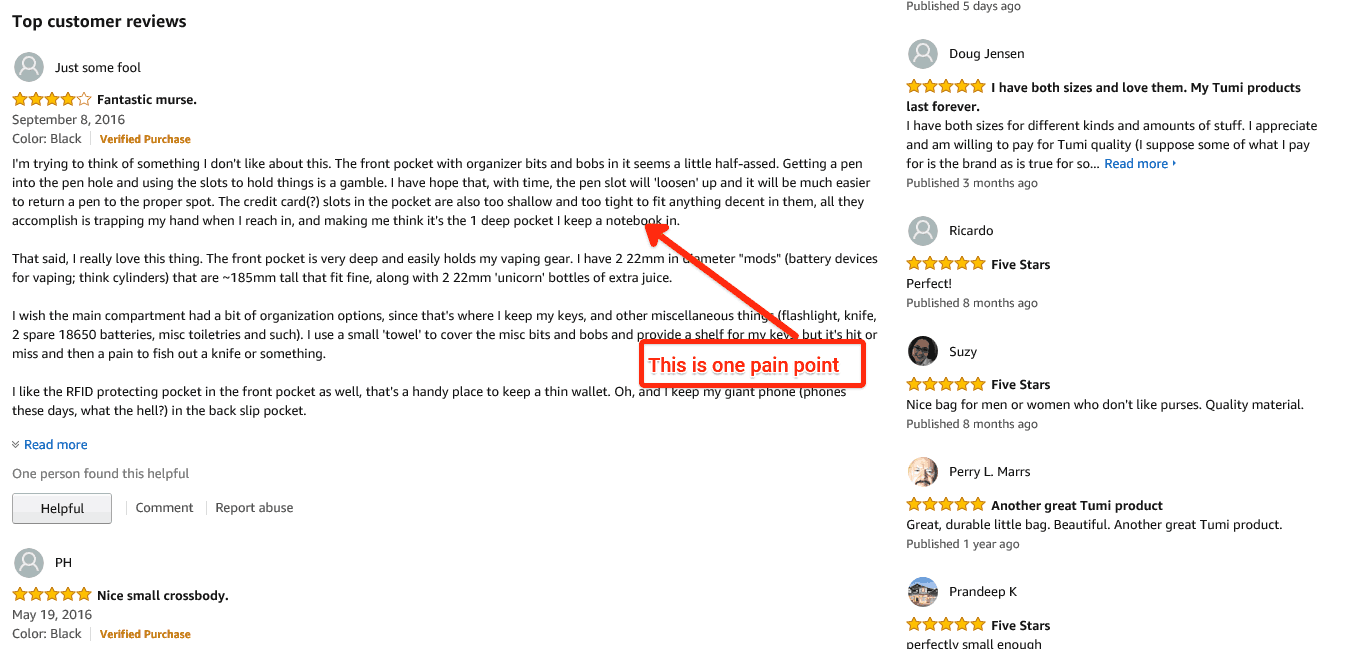

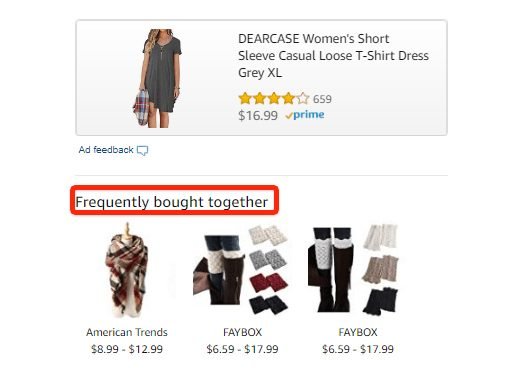

When performing a competitive analysis, read reviews and case studies on the products.

Product reviews are gold mines. You can find out what users like about the product and what they do not. Reading the reviews carefully can give you a list of the customer pain points.

Similarly, product managers must download or buy case studies from companies that sell similar products. The case studies generally include the product-related challenges and how the company solved them.

Evaluating reviews and case studies allows product managers to think through the potential issues and keep the solutions handy. Also, they can identify the product features that can be made better than that of the competitors.

3. Host a focus group

Evaluate your product by bringing in people who fit your target market. Give them a product profile – what the product will look like, its features, and benefits. Then, ask relevant questions concerning what they like and dislike about the product.

Though focus groups aren’t effective all the time, they can help product managers to get an idea of what people would say about the product.

Providing the focus group with an MVP or prototype works better. The feedback received is more valid and meaningful.

4. Get expert product engineers

Product managers can hire product engineers to get unbiased opinions on the product prototypes.

The experts work on a contractual basis. They evaluate the product design, and features, test prototypes, and ensure quality and usability.

If required, product engineers can also assess the market research, build design ideas, and supervise production.

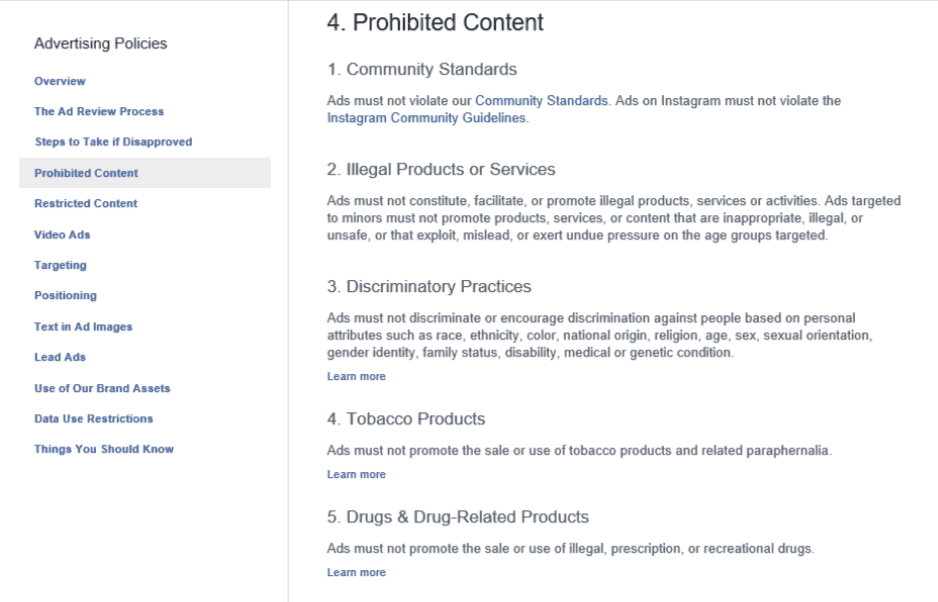

5. Consider product marketing

Building the product is not the end of the product research process. Not overlooking product marketing is one of the best practices to follow.

Product managers must give equal importance to product positioning and marketing strategy. They can check out the competitors to understand;

- How they promote their products

- Whether or not their marketing strategy is successful

- How to make improvements in the strategy

Further, considering the target market is a must. Try answering questions like;

- Where do they mostly shop?

- What are their interests?

- What are the social media platforms and communication channels mostly used by the target market?

- Where do they discover the products from?

Considering these aspects, the marketing strategies, campaigns, and distribution channels must be planned.

6. Go for a soft launch

A trial or soft launch allows product managers to estimate sales. If the trial results aren’t satisfactory, they can modify the product before spending more on its marketing.

Soft launches need not be expensive. You can create a simple landing page for the product and then run a PPC or Pay per Click campaign to assess the demand.

You can also provide a form that interested users could fill up. Explain the product to those who inquire, maintain communication, and notify them when the product is available.

7. Continue product research

Continue your research even after the product launch . Ask for customer feedback, measure the outcomes of your marketing campaign, and track metrics like repeat purchases, new customers, etc.

Further, track competitors too. Observe their strategies and emerging trends. Also, test new strategies like referral programs or loyalty programs.

Product Research Tools

Building a user-centric product isn’t easy. Product managers must be equipped with the most effective tools. They must take every bit of help available to them.

A product research tool is something that can help the product teams a great deal. It helps in making product management a more organized and structured process. Further, using these tools, product managers can get data-backed user insights and accurate research findings.

Check out the best 5 product research tools you can invest in.

Zeda.io is one of the best product management tools that you must invest in. It is a platform where you can;

- Collect feedback, ideas, and feature requests from customers,

- Analyze the data from a single dashboard, convert them to actionable insights, identify trends

- Plan product roadmaps , create live roadmaps, and share them with teams and customers

- Prioritize product tasks with prioritization frameworks like RICE

- Execute the product development process in collaboration with teams

In a nutshell, Zeda.io is the all-in-one product management software that allows you to build a product seamlessly and in an organized way.

Also Read: Top AI Tools for Product Managers and Product Teams

Zendesk is a tool that helps you maintain interactions with your customers. It is a platform that allows collecting, understanding, and responding to user feedback .

Using Zendesk, product teams can listen to customer issues, develop a response plan, and deliver solutions to address their concerns.

Simply said, Zendesk ensures carrying out regular customer conversations as they are an integral part of the product research process. These customer conversations provide direct insights into customers' thoughts opinions, suggestions, and challenges.

Thus, you can learn from customer feedback and incorporate changes, and better features in the product to ensure an incredible user experience.

3. ProductPlan

In the product research process, the product research eventually converts to a product roadmap. It is the product roadmap that highlights the present and future priorities, workflows, product vision, and product progress.

Once you have come across the research stage, the focus is on building the product roadmap. ProductPlan is the platform you can use to build visual roadmaps. The tool helps in maintaining flexibility, team collaboration, and efficient addressing of issues.

Here’s why you should get ProductPlan in your product research tool stack.

- It is easy to use

- It allows customizing roadmaps with lists, layouts, and timelines

- The drag-and-drop interface helps in tailoring the roadmaps according to one’s needs

- You can collaborate with teams, tag the members, and also comment within the roadmap

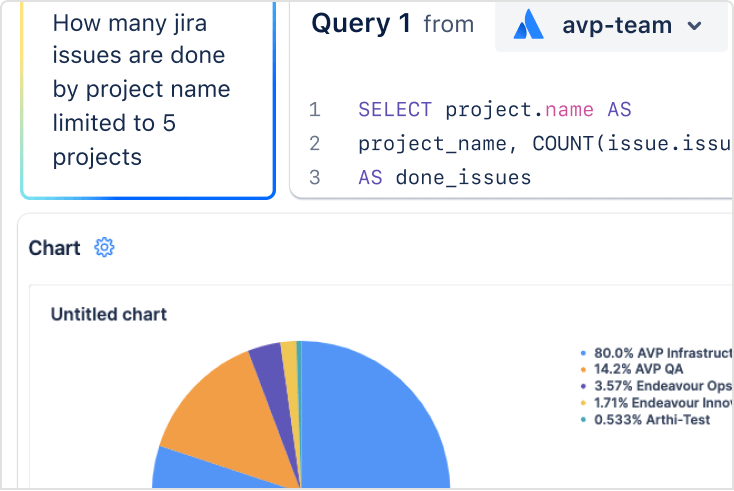

Another must-have product management tool, Jira ensures a hassle-free product journey from prototyping to product launch.

Jira is a project management tool that primarily helps with;

- Organizing project tasks

- Managing scrum and agile teams

- Capturing and recording software bugs

With Jira, agile product teams can manage their workflow seamlessly. The tool offers 300+ integrations, is highly customizable, great for managing product issues, and overall effective product management.

5. Proto.io

After you have built a product, you cannot release it directly to the market. User feedback and validation are required. So, instead of building a full-fledged product, you create an MVP or prototype with the basic features for testing the waters first.

This is where Proto.io comes in. Proto.io is one of the leading prototyping tools that help you build a prototype quickly and easily.

- Proto.io has a great interactive drag-and-drop interface that lets you create the prototype to test each product feature or idea based on your research.

- It is user-friendly with integrated icons and easy image management

Thus, Proto.io increases your research efficiency. It helps you to offer customers an amazing product experience resulting in better customer satisfaction.

Also Read: Choosing the Best Product Discovery Tool: Top 5 Picks

Final Thoughts

How to do product research is a common but complex question. Not all organizations use the same way to perform product research. But the product research process does have a few key steps that are crucial for its success.

Throughout the process, just remember that product research is all about user research. The main goal is to understand the users, their needs, and their pain points.

Once product managers implement the user-centric approach, they can build better products – the products that would meet the ever-changing demands of the market. Further, it will increase customer satisfaction and inspire loyalty.

With platforms like Zeda.io , your product research process can get easier. You can seamlessly perform user research using Zeda.io ’s product features like the central dashboard, prioritization framework, building live product roadmap, easy tracking, sharing roadmaps with teams and customers, etc.

Suggested Read: The Product Management Process: 6 Essential Steps

Join Product Café Newsletter!

Sip on the freshest insights in Product Management, UX, and AI — straight to your inbox.

By subscribing, I agree to receive communications by Zeda.

IN THIS ARTICLE:

Latest articles

Top blogs to read for product folks.

Are you also looking to learn and understand from experiences? Well, here is a list of top blogs to read for Product folks. You can check out great blogs to learn from.

A Product Manager's Key to Master Feature Planning with Zeda.io

As a product manager, a feature frenzy leaves you exhausted, and frankly, unable to build the amazing products your users deserve. Zeda.io's revamped Features dashboard is more than just an intuitive interface; it's a strategic command center transforming feature chaos into feature harmony. Learn how!

Product Management Conferences for 2023

Product management conferences are a great place to learn, share, network, and enjoy. Here are the best ones to look forward to in 2023.

Decide what to build next with AI-powered Insights

- What are product discovery techniques?

- 8 key product discovery techniques link

Top AI Product Management Courses for 2024

Take a deep dive into the Top AI Product Management courses that you can learn from and devise how AI can help you in different ways to enhance your product manager journey.

Market Opportunity Analysis: A Complete Guide (With Examples)

Find out how to perform a market opportunity analysis to make sure your business idea will bring you the results you're looking for.

Product Validation Process & Testing: a Step-by-step Guide (+examples)

Everything you need to know about product validation process and testing: your personal roadmap for creating market-ready products.

Download a resourse

Non tincidunt amet justo ante imperdiet massa adipiscing.

App Sign Up

Subscribe to newsletter, book a demo, ai-powered product discovery for customer-focused teams.

- How to conduct effective product research

Last updated

27 March 2023

Reviewed by

Product research is a continuous process from the early stages of product development through testing a beta product to follow-up once a product is released. It evolves throughout, ensuring the product meets customers' needs and how it can be improved moving forward.

- What is product research?

Product research begins with a concept of the product and helps determine if that product is viable and has a place in the market.

There are certain stages to product research; how many you need depends on whether you are developing a brand-new product or refining an existing one.

Stage 1: Is there a market?

The first step in developing a new product is to determine if there is a market. You must determine who your customer will be and what pain point your product solves. You also need to establish who your competitors are and how their products meet or don't meet your customers' pain points .

What differentiates your product? If there’s an opportunity, how large is the potential customer base ? Can it do a better job?

Stage 2: Does your prototype/beta meet the needs of customers?

Once you know you have a market, you need to test the concept of your product to determine if it meets the needs of potential customers. This may take several rounds of testing, tweaks, and iterations before people can use the solution without help or prompt. Then it is ready for development.

Stage 3: Soft release

Once you have a workable product, you release it to a targeted group of potential customers to determine how it works in the real world. At this point, you are looking for bugs, feedback, and suggested improvements, so you can make necessary changes before the release of the final product.

Stage 4: Post-release follow-up

After releasing your product, you can't just drop product research. You need to determine how much customers like the product, what improvements they would like to see in future versions, and how their needs might change in the future. In other words, as long as you’re trying to sell your product in a dynamic, fast-paced market, you need to continue doing project research to keep up with changing minds and markets.

What are the main elements of product research?

The key elements of good product research are:

Historical research about your industry

Establishing competitors and their products

Reviewing your concept to determine its validity

Testing your product prelaunch

Surveying following the release of your product to target improvements

- Why is product research necessary?

Developing a product or trying to improve one without product research is like target shooting in the dark—you might hit the target eventually, but your chances are much greater if you have a bright spotlight shining on the bullseye. In the product space, missing the target will cost you more than just bullets. You will spend incredible amounts of time and money while your competitors are getting ahead of you.

Product research creates that bright spotlight by allowing you to:

Learn about your customers

Understand their pain points

Develop a product to best resolve those pain points

Know how to market your product to address those pain points

Without research on those issues, you're making uneducated guesses about what your customers need . You can never satisfy a customer if you don't understand their requirements.

- Types of product research

Product research is conducted through many channels. The more thorough the research, the better your chances of developing a product that will appeal to your potential customers. Types of product research are varied, including:

Sourcing historical data from trade associations and research groups

Running customer surveys , interviews, focus groups , etc.

Having beta and soft releases where customers use your product and provide feedback

Gauging how satisfied customers are with the final product

Looking ahead to improvements that will keep the product fresh in the future

We’ll look at these in more depth later in the article.

What’s the difference between market research and product research?

Let's say you have the idea to develop a calendar app for small service businesses, such as hair stylists or nail salons, that allows customers to schedule their own appointments. Market research will help you determine such aspects as:

What competitors are in the market

How their calendars are serving small businesses

Whether their price point is an issue

Whether glitches allow calendars to double-book appointments

Whether existing calendars work for multi-seat businesses

Once you have a handle on the market you’re stepping into, you can start product research by testing your solution with your potential users. Again, it’s a good idea at this point to also research and brainstorm with your users about what they’d ideally like to see. This way, your concept isn’t just your idea, but one already validated by the very customers you’re hoping to target.

Next, you can test your prototype with users, make the tweaks and eventually release your product to the world, keeping tabs on its validity.

By including product research at every step in the designing and releasing process, you can ensure the user interface is easy to understand and use, and ultimately solves the problem users need it to again and again.

- Benefits of good product research

Good product research guides every step of product development. It gives everyone in your company the necessary tools to develop a product that meets customers' pain points and achieves your business goals.

The benefits of good product research include:

Allowing you to identify potential customers and their pain points

Guiding the development of a product that meets those pain points

Preventing you from wasting time and money on activities that don't meet those pain points

Testing your product in real-world situations to determine if it meets its goals

Saving you from developing unwanted products

Keeping you ahead of your competition by knowing what customers need, direct from the source

The exact method for conducting effective product research will vary by product and market, but following these four methods will lead you to the best results:

Use accurate, unbiased data collection methods

You're starting your product research with the hypothesis that the product you envision will solve your customer's pain point in the best way. But that's just your hypothesis. To test your theory, you must conduct accurate, unbiased research.

Sometimes this means letting a third party handle your customer surveys and focus groups. Survey recipients or focus-group respondents are more likely to give honest feedback to a third party.

A third party can help you craft survey questions that will give you honest answers, not the answers you are hoping or expecting to hear about your product.

Developing a product with inaccurate information is as bad, if not worse, than developing a product with no product research.

Conduct a thorough competitive and comparative analysis

As you enter a market niche, you need a thorough understanding of where your competitors stand and how they are serving and not serving your potential clients. This is a competitive analysis .

Your potential customers may have other options for addressing the same need but not in your niche market. Understanding how those options could affect your product is a comparative analysis .

For example, if you think you can build a better tennis racket to serve players who only play occasionally, you'll need to compare your product with others at a fairly low price point to develop a competitive analysis .

But maybe your potential customers feel their exercise needs can be equally filled by playing pickleball or badminton. Determining how your product would fare against those products would be a comparative analysis.

Leverage existing research material

You don't have to reinvent the wheel to conduct quality product research. Trade associations, academics, research groups, and government agencies may have already done much of the heavy lifting. These groups often conduct thorough research on marketplace analysis, trends, and projected changes.

Studying social media and influencers in your field can help you stay current with product development and gain foresight on when a product might be going obsolete.

Base your research on your business goals

At this point, we hope it’s apparent how critical product research is, but you shouldn’t do research without knowing why you’re doing it. To make research as effective as possible, it must be structured against business goals. These should be measurable metrics with associated dates and timelines, with clear processes or tools with which to check them.

A basic example is increasing the number of visitors to your marketing site. To set a proper goal metric, you should be explicit. For example, “By April 25, new visitors to our marketing site should increase by 10% from the 5,000 we’re currently receiving every month.” If this is announced to your marketing team in January, they can request research be carried out that will determine exactly what would give them this result. Knowing the goal, researchers will know what research methods would work best and the timeline and scope they’re dealing with.

As a bonus, working with metrics can virtually eliminate unnecessary heavy management and ultimately give your team the autonomy they need to succeed. They will know without guidance if they’re off target and will be empowered to determine what steps are needed to realize the goals you want your team to achieve.

- Methods of product research

Many methods of product research are available. Use a range of these to get the full picture of how your product should be developed and/or improved to meet your potential customers' pain points.

Concept testing

Often, before even designing a product, you might want to test the concept before spending money and time developing a non-starter. Once you have identified potential customers or people using a competitor's project, you can pitch the concept of your product to them to determine if they feel it could fill their needs.

Concept testing can be done through surveys or interviews. Bear in mind that interviews could give you more back-and-forth feedback that would be beneficial to growing your product beyond its initial concept.

Price testing

Price testing should be conducted at an early stage to determine where your product might fit in your industry, but it should remain open to further testing down the line as the product becomes more concrete. As you make improvements to your product over time, the market might bear a greater price than your initial research suggests.

Finally, there are several testing methods you could use to encourage purchases, for example, using anchoring to list prices next to more costly packages or products to make them seem more affordable.

Product tests

Once you have developed a beta version of your product, you'll want to begin product testing with some potential customers you discovered in your early research. These customers must test the product in real-world situations to determine if it works as designed, contains any glitches, and meets their pain points.

Their input will guide improvements that need to be made before you launch your final product, with continual validation and checking of analytics post-launch. Your product should stay fluid and your product process iterative.

Focus groups

Focus groups can be used at various stages of product development to give direct feedback about your product.

They can be composed of potential customers or other experts in your field, such as academics, researchers, or retired executives who could give a more defined analysis of your product than potential users. They can also be a mix of users who have or have not had experience with your product to offer new insights and perspectives.

Product surveys

Product surveys provide useful feedback after the release of your product, as real-world users can give more detailed information about the product’s pros and cons. You can better address how your product performs in comparison to your competitors’ and identify improvements in the next version of your product.

What are product research questions?

Product research questions are the questions you ask potential customers through interviews, surveys, or focus groups, to determine their pain points and how a product can meet those pain points.

Having a third party help you develop these research questions will take the bias out of the equation to ensure you are getting accurate data.

- How to measure the success of your product research