Banking Resume - Examples & How-to Guide for 2024

As someone who works in banking, you’re a trusted professional who knows their way around the finance world.

You give financial advice and guidance to your clients.

But when it comes to creating a job-winning resume, you’re the one who needs advice.

What does a good banking resume look like, anyway?

With so many people competing for the top banking jobs, you can’t afford to leave any questions unanswered.

But don’t worry! Our field-tested resume examples and tips will get your feet through the door of employment.

- A job-winning banking resume example

- How to create a banking resume that hiring managers love

- Specific tips and tricks for the banking industry

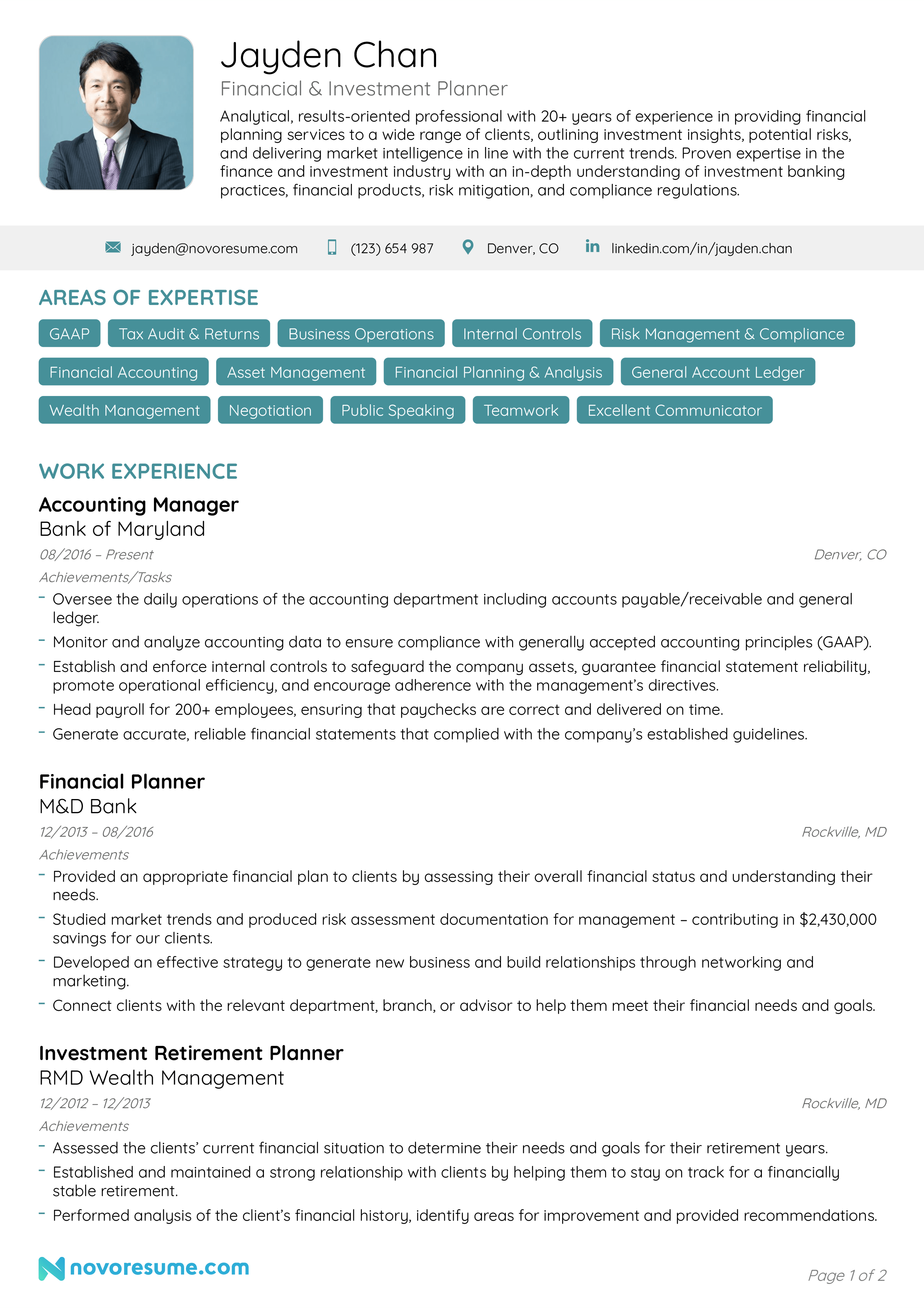

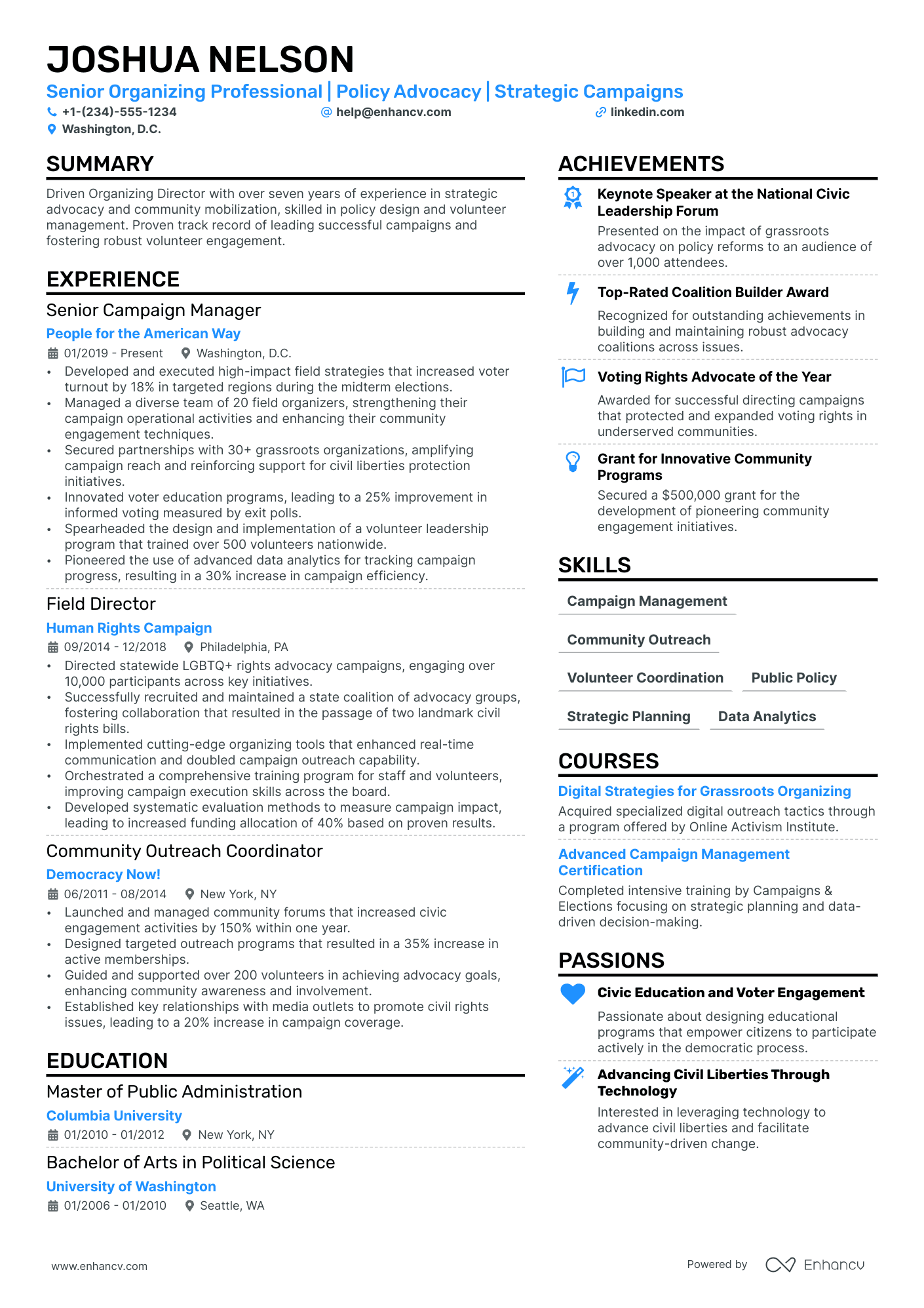

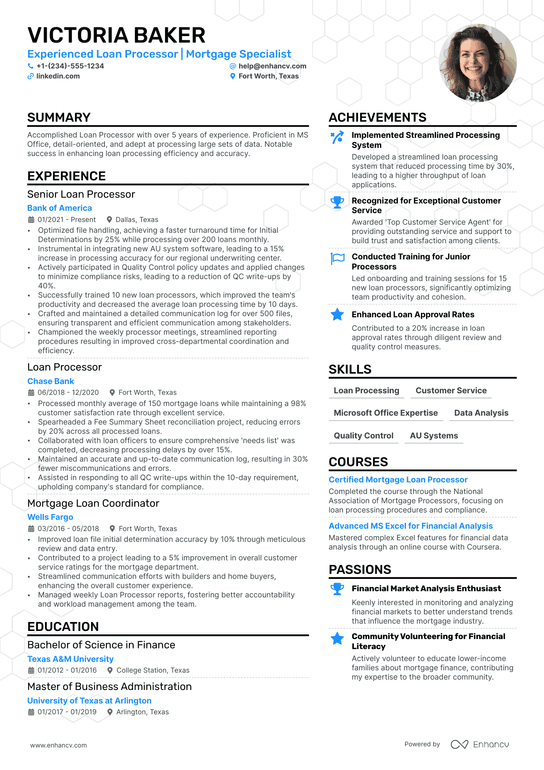

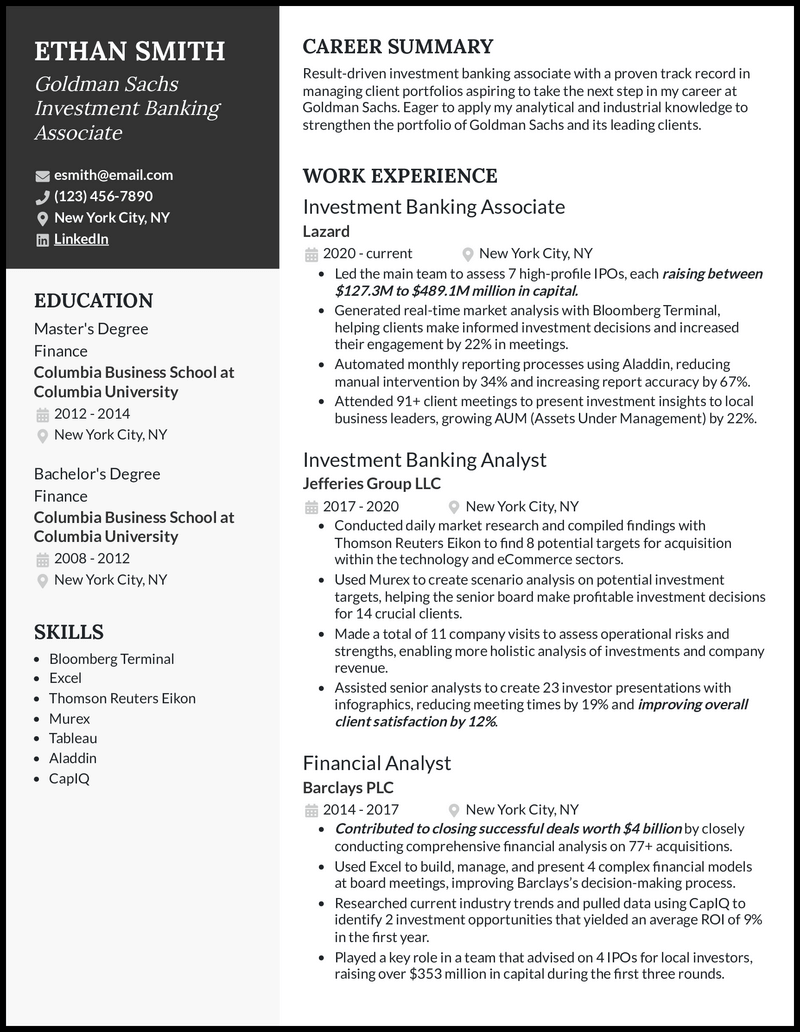

Here’s a banking resume example, built with our own resume builder :

Follow the steps below to create a banking resume of your own.

Are you looking for a resume example for a different job position? Head on over to one of our related resume examples instead:

- Bank Teller Resume

- Accountant Resume

- Bookkeeper Resume

- Business Analyst Resume

- Financial Analyst Resume

- Executive Assistant Resume

- Consultant Resume

- Administrative Assistant Resume

- Office Assistant Resume

- Career Change Resume

How to Format a Banking Resume

Banking is one of the fiercest industries you can enter.

As such, you really need to put your money where your mouth is.

This involves creating a resume that stands out from the competition.

But before you can get writing, you need to choose the correct format.

You see, even the richest of experience won’t impress a hiring manager that is struggling to read the content.

Have relevant banking experience? Then you’ll want to use the most popular format, known as the “ reverse-chronological ” format. It starts with your most recent work experience and then works backward through your banking history and skills.

You may also want to try these two popular formats:

- Functional Resume - This format focuses on your banking skills, which makes it the best format for those who have the relevant skills, but don’t a wealth of experience as a banker.

- Combination Resume - This format mixes both “Functional” and “Reverse-Chronological” formats, making it perfect for those with both the relevant skills AND banking work experience.

- For a professional and precise resume, keep your banking resume to one-page. Feel free to check out our one-page resume templates .

Once the format is sorted, you need to choose the correct resume layout .

We recommend the following layout:

- Margins – Use one-inch margins on all sides

- Font - Pick a professional font that stands out

- Font Size - 11-12pt for normal text and 14-16pt for headers

- Resume Length – Stick to 1-page. Having trouble fitting everything into one page? Check out these one-page resume templates .

- As professional banker, the recruiter expects to see a highly-professional resume. As such, limit how creative you are with the font and layout.

Use a Banking Resume Template

Word is great for a lot of things.

Well, except for building resumes.

You see, you need a banking resume with a professional structure.

Those who have used word to create their own resume will know that one tiny change can ruin the whole structure.

For a professional banking resume, you can use a resume template .

What to Include in a Banking Resume

The main sections in a banking resume are:

- Contact Information

- Work Experience

For a banking resume that rises above the other applications, add these optional sections:

- Awards & Certification

Interests & Hobbies

So that’s a general overview, now it’s time to get specific about each of the sections.

For even more information, check out our guide on What to Put on a Resume .

How to Write Your Contact Information Section

As a banker, you know that accuracy is vital.

And it’s no different than with your contact information section.

In fact, just one digit out of place can render your whole application useless.

For your resume contact information section, include:

- Title – Make this specific to the exact job you’re applying for

- Phone Number - Check this multiple times. You see, one minor error can really mess up your chances

- Email Address - Use a professional email address ([email protected]), NOT that email you created back in school [email protected])

- (Optional) Location - Applying for a job abroad? Mention your location

- Hannah Atkinson - Banker. 101-358-6095. [email protected]

- Hannah Atkinson - Banking Angel. 101-358-6095. [email protected]

How to Write a Banking Resume Summary or Objective

Creating a professional resume that stands out is the #1 goal .

But HOW is this done?

By using an opening paragraph that brings home the bacon!

These opening paragraphs come in two types: resume summary or objective.

Although slightly different, both are introductory paragraphs that sum up the main points of your resume.

The difference between a summary and objective is that:

A resume summary summarizes your most notable banking experiences and achievements. It’s designed for individuals who have multiple years of finance industry experience.

- Experienced banking professional with five years of experience at YZX BANK, where I used analytical and interpersonal skills to maintain a 99.60% customer satisfaction rating. Seeking a chance to leverage my banking skills to maximize the operations and quality of service at BANK XYZ.

A resume objective gives a quick breakdown of your professional goals and aspirations, which makes it perfect for junior bankers. Now, even though you’re talking about your own goals, it’s important to align your message to what the employer wants.

- Enthusiastic finance student looking for a banking role at BANK XYZ. Two years of experience at a local accounting firm. Excellent organization, communication, and analytical skills. Keen to support your banking team, where my interpersonal skills can be leveraged to achieve the best quality of service.

So, which one is best for bankers?

Well, a summary is suited for bankers who have been crunching the numbers for a few years, whereas an objective is suited for individuals who are new to the banking world (student, graduate, or switching careers).

- The hiring manager wants to see the benefits you will bring to the bank, not what it will do for your career. Also, banks want employees who have strong quantitative and communication skills, so use powerful action verbs and be as specific as possible.

How to Make Your Banking Work Experience Stand Out

What’s the best way to impress a recruiter?

Work experience!

Sure, the recruiter wants to hear about your education and skill-set, but nothing proves your talents like a wealth of banking experience.

Use this layout in your experience section:

- Position name

- Company Name

- Responsibilities & Achievements

02/2017 - 01/2020

- Voted “Banker of the Year” in 2018 and 2019

- Followed best practises to process over 1000 loan applications

- Studied market trends and produced risk assessment documentation for management – contributing in $430,000 savings for our clients

- Trained and empowered a team of eight new bank tellers

For a resume that shows your best qualities, make sure to mention your achievements, rather than your daily responsibilities.

Instead of saying:

“Risk assessment”

“Studied market trends and produced risk assessment documentation for management – contributing to $430,000 in savings for our clients”

So, how exactly do the two differ?

Well, the second statement goes into much greater detail. It’s a clear example of how your abilities will have a direct impact on the success of the bank.

What if You Don’t Have Work Experience?

Maybe you’ve got a finance degree but have yet to work in a bank?

Or maybe you’re transitioning from a junior position at a competing bank?

Whatever your personal situation, you have options.

You see, despite a lack of bank experience, you are still able to include relevant skills and experiences from other previous jobs.

For example, if you’ve worked as a junior accountant, you can talk about the crossover experiences. Just like a banker, you would have to pay great attention to detail, work with customers, and enjoy working with numbers.

For the students reading this, you’ll enjoy our guide on how to make a student resume !

Use Action Words to Make Your Banking Resume POP!

- “Responsible for”

- “Worked with”

You’ll find these exact words on nearly all banking resumes.

And since you need your banking resume stand out, we’d recommend using some power words instead:

- Spearheaded

- Conceptualized

How to List Your Education Correctly

Up next in your banker resume comes the education section.

Now, there’s more than one educational path to becoming a bank employee.

The bank manager just wants to know your education to date.

Follow this format:

- Degree Type & Major/Courses

- University/School Name

- Years Studied

- GPA, Honours, Courses, and other relevant achievements

B.A in Banking and Finance

Chicago State University

- Relevant Modules: Principles of Accounting, Consumer Finance and Banking Fundamentals, Financial Management, Risk Analysis, Finance and Economics, Bank Lending and the Legal Environment, Quantitative Methods for Banking, and more]

Still have questions? If so, here are the most frequently asked questions:

What if I’m still studying?

- No matter if you’re still studying or not, you should still mention every year that you have studied to date

Is my high school education important?

- Only list your high school education if that is your highest form of education

What is more important for a banker, education or experience?

- If you’re an experienced banker, your work experience should be listed before your education

If you still have questions, you can check out our guide on how to list education on a resume .

Top 16 Skills for a Banking Resume

Being a successful banker requires a certain set of skills.

And the bank manager needs to know you have what it takes!

Now, you could be the most skilled banker in the world, but they still need to be clearly displayed on your resume – not locked away in a bank vault!

Here are the main skills a hiring manager wants to see from a banker:

Hard Skills for a Banker:

- Balancing Ledgers

- Risk Assessment

- Mortgages and Loans

- Deposits and Withdrawals

- Account Maintenance

- Foreign Currency Exchange

- Investment Management

- Safety Deposit Boxes

- Cash Handling

Soft Skills for a Banker:

- Excellent Communicator

- Problem Solving

- Confident & Professional Manner

- Organization

- Negotiation

- Time Management

- Although bankers need soft skills, we recommend only including the main skills on your resume. It is also wise to only include soft skills that you posses, just in case the interviewer asks.

Looking for a more comprehensive list? Here’s a mega-list of 150+ must-have skills .

Other Resume Sections You Can Include

By now, you should have a resume that’ll get you through the doors of any bank.

Your #1 goal is a resume that stands above the competition.

And this is not the time to leave your future to chance!

The following sections will set you apart from the other candidates.

Awards & Certifications

Have you been awarded at your previous place of work?

Did you win any competitions at university?

Have you completed any certifications to enhance your expertise?

Whatever your case may be, the manager will want to see any relevant awards and certifications.

Awards & Certificates

- Certified Financial Planner (CFP)

- Certified Financial Analyst (CFA)

- “Learning How to Learn” - Coursera Certificate

- “Banker of the Year” 2019 - XYZ Bank

Able to speak other languages?

Whether or not the job description specifically requires it, the ability to speak another language is an impressive skill.

So if you’re able to speak another language, even to a basic standard, feel free to include it inside your resume, but only if there is space.

Order the languages by proficiency:

- Intermediate

Now, you may be wondering, “ why does the bank manager need to know about my love of golf? ”

Well, the manager doesn’t need to know, but it does show them more about who you really are.

And this is great, as banks want an employee who they’ll get along with.

As such, listing your hobbies and interests can be a good idea, especially if it involves social interaction.

If you want some ideas of hobbies & interests to put on your banking resume , we have a guide for that!

Match Your Cover Letter with Your Resume

You don’t need us to tell you how competitive the finance job market is.

And when competing with experienced professionals, you need an edge.

But HOW can you get one?

Well, with a convincing cover letter!

You see, a letter is the perfect tool for communicating with more depth and personality.

Oh, and it shows that you want THIS banking position in THIS bank.

Just like when building the resume, your cover letter also needs the correct structure.

Here’s how to do that:

We recommend writing the following for each section:

Contact Details

All personal contact information, including your full name, profession, email, phone number, location, website.

Hiring Manager’s Contact Information

Their full name, position, location, email

Opening Paragraph

Create a powerful introduction that hooks the reader. Make sure to mention:

- The specific position you’re applying for – Banker

- An impactful summary of your most notable experiences achievements

Once you’ve impressed the hiring manager with your opener, you can delve deeper into the rest of your working history. Some of the points you can mention here are:

- Why you want to work for this specific bank

- What you know about the bank’s culture and vision

- Your most notable experiences and how they relate to this job

- If you’ve worked in similar positions at other banks

Closing Paragraph

This is where you:

- Wrap up the main points of the body paragraph

- Thank the hiring manager for reading

- End with a call to action, such as “It would be great to further discuss how my experience as an X can help the bank with Y”

Formal Salutations

To keep your resume professional, use a formal closing, such as “ Sincerely ” or “ Best regards. ”

Now, if you’re not a professional wordsmith, creating a job-winning cover letter is a difficult task. But don’t worry, you can use our how to write a cover letter article for guidance.

Key Takeaways

You’ve now unlocked the bank vault and discovered how to create a job-winning resume.

Let’s quickly review everything we’ve covered:

- Based on your specific circumstances, choose the correct format. We recommend starting with a reverse-chronological format, and then following the best layout practices

- Use a captivating resume summary or objective

- In the work experience section, highlight your most notable achievements, not your daily duties

- Match your banking resume with a convincing cover letter

Suggested Reading:

- How to Write a Bank Teller Resume in 2024

- How to Ace Interviews with the STAR Method [9+ Examples]

- 26+ Biggest Interview Mistakes (To Avoid in 2024)

To provide a safer experience, the best content and great communication, we use cookies. Learn how we use them for non-authenticated users.

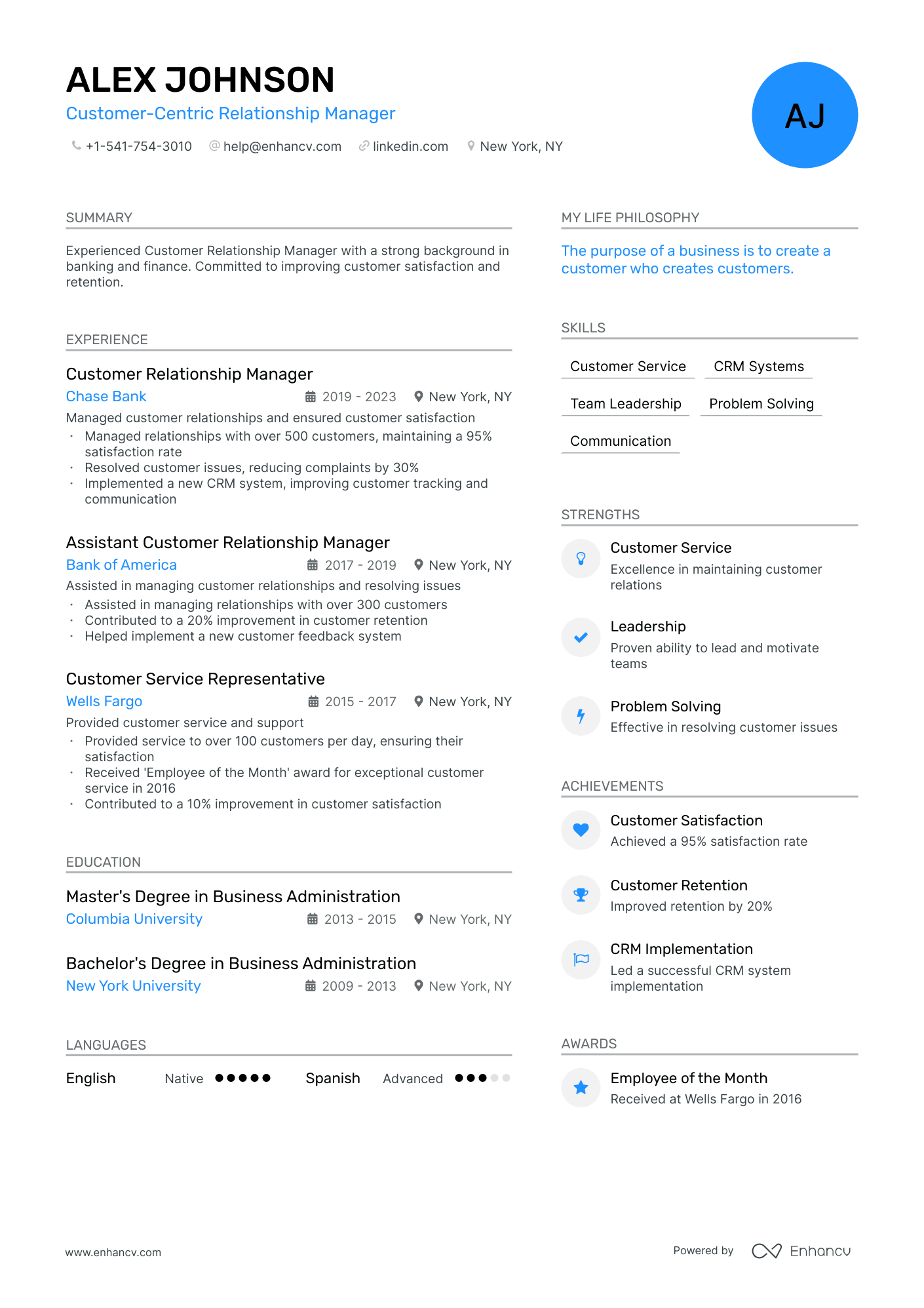

- • Managed relationships with over 500 customers, maintaining a 95% satisfaction rate

- • Resolved customer issues, reducing complaints by 30%

- • Implemented a new CRM system, improving customer tracking and communication

- • Assisted in managing relationships with over 300 customers

- • Contributed to a 20% improvement in customer retention

- • Helped implement a new customer feedback system

- • Provided service to over 100 customers per day, ensuring their satisfaction

- • Received 'Employee of the Month' award for exceptional customer service in 2016

- • Contributed to a 10% improvement in customer satisfaction

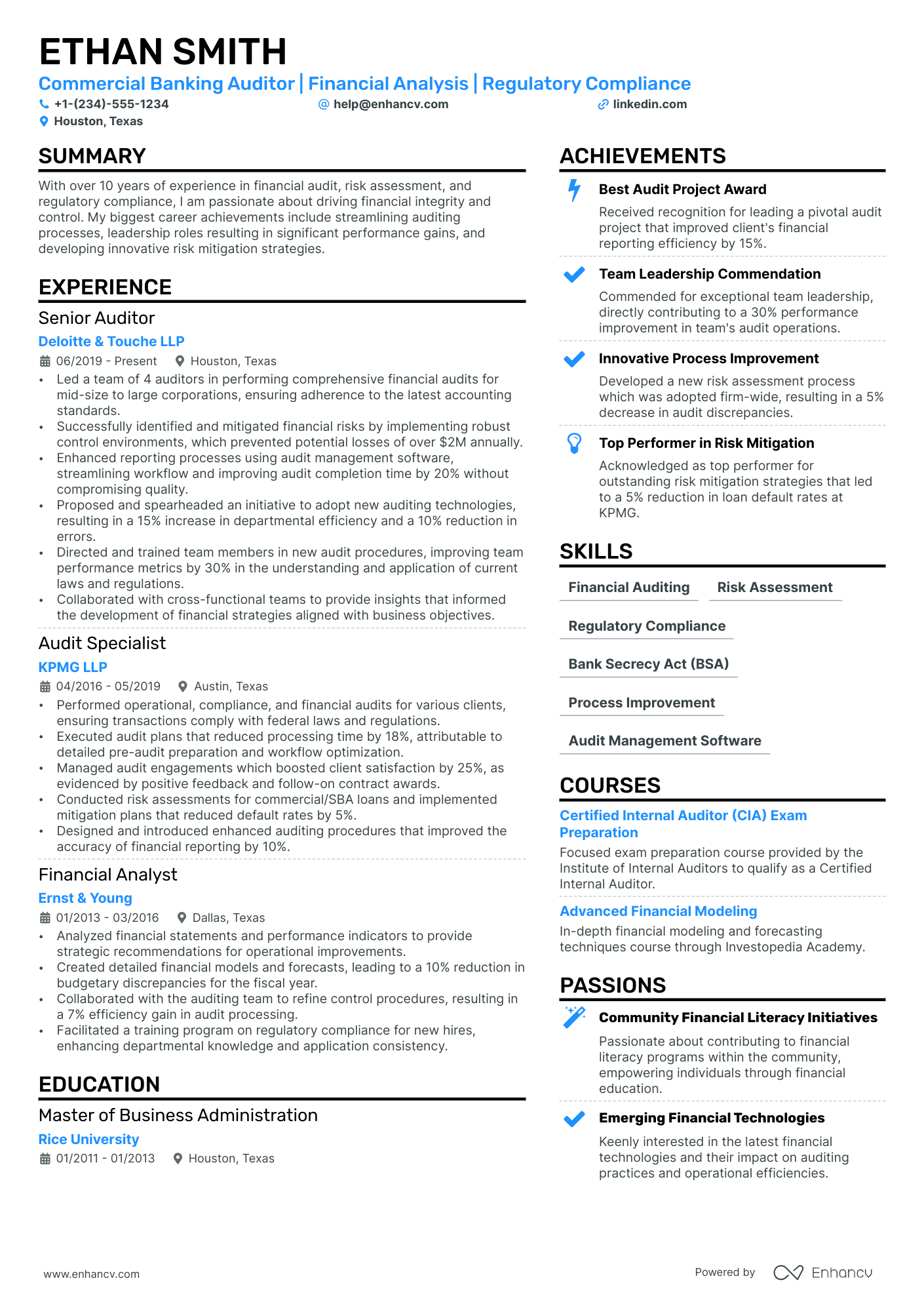

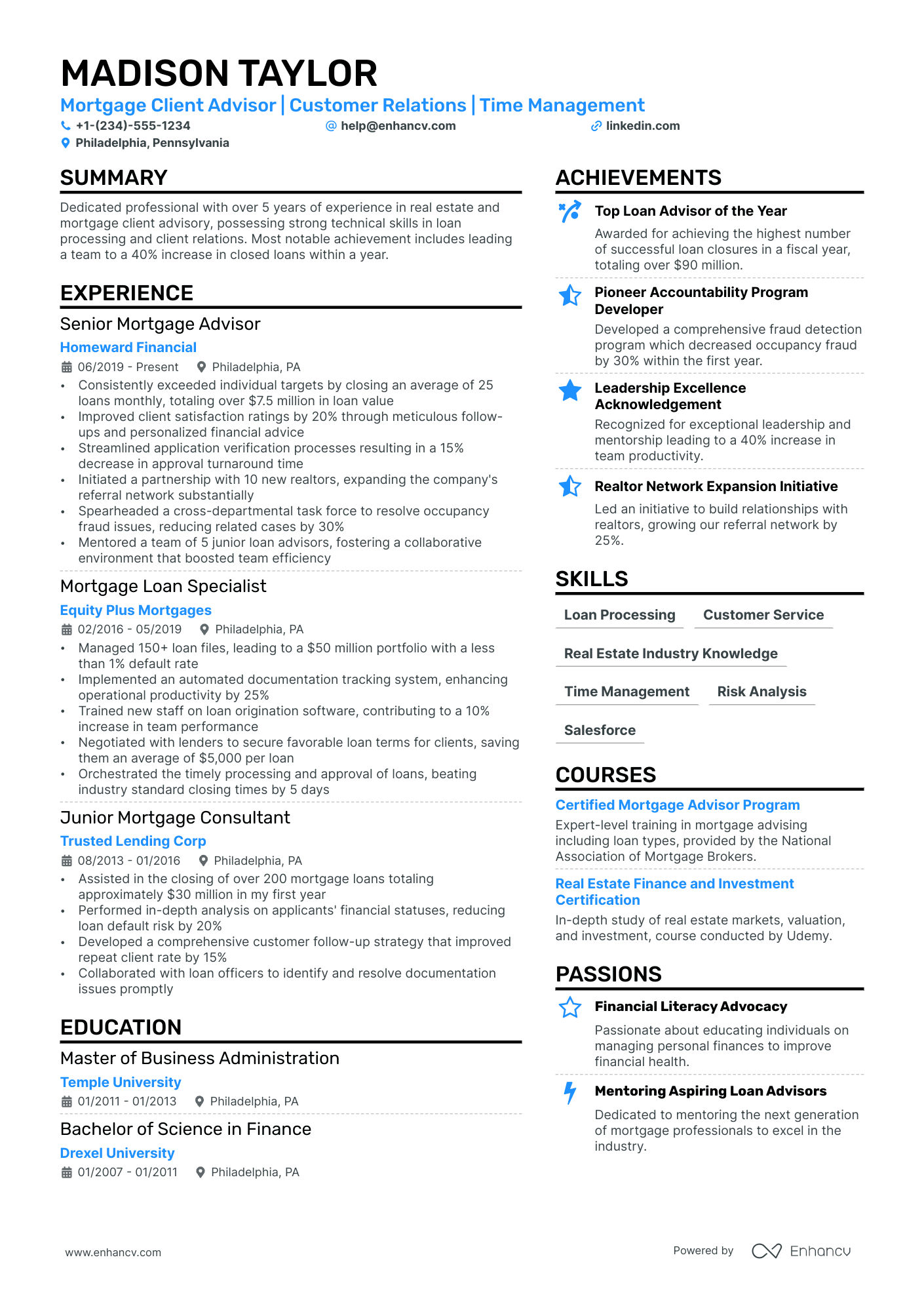

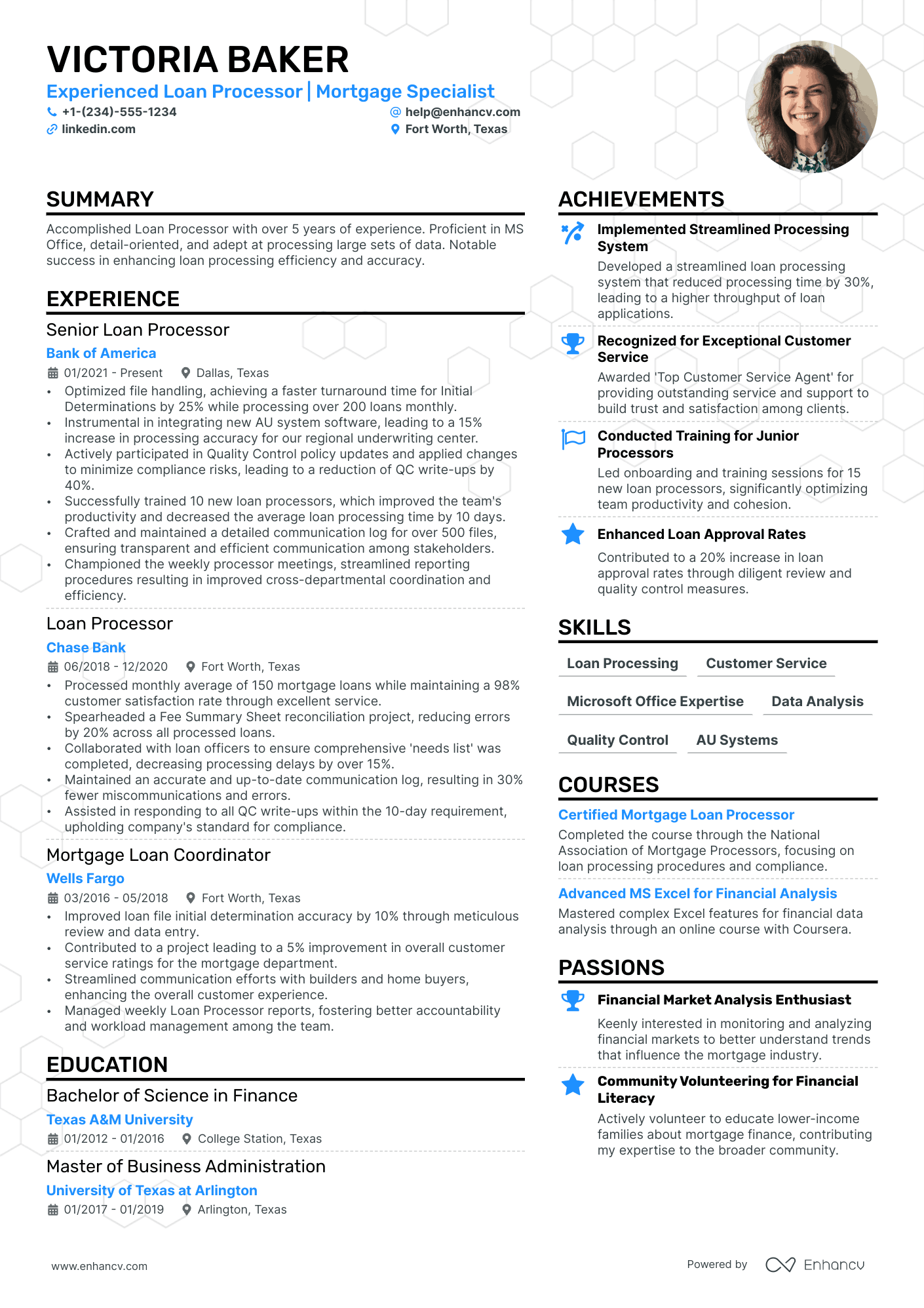

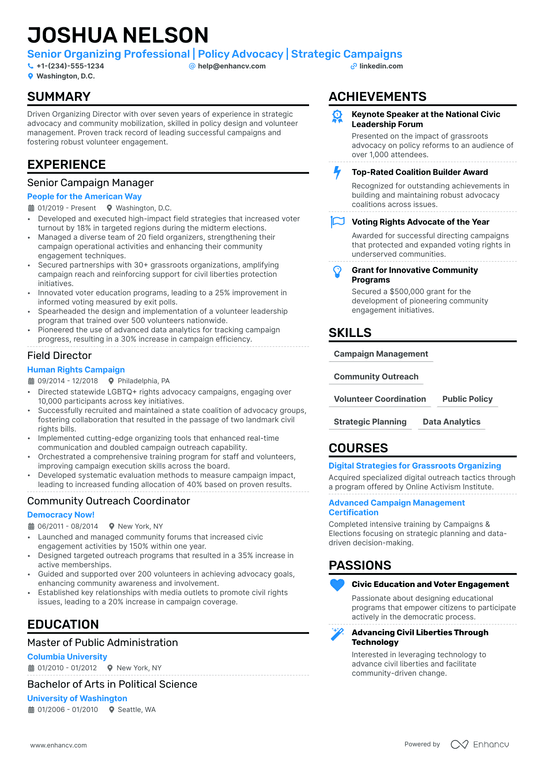

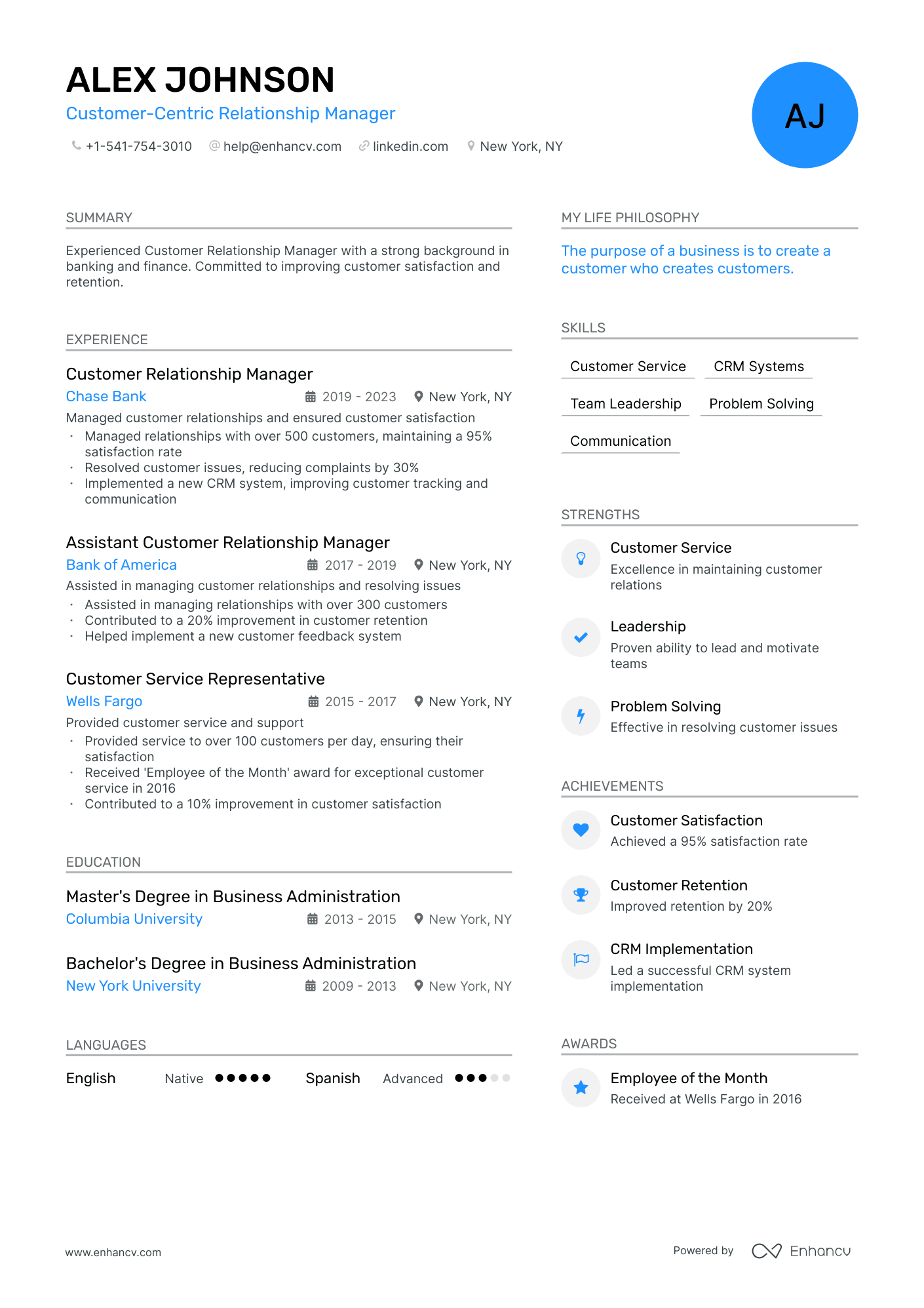

6 Banking Resume Examples & Guide for 2024

Your banking resume must succinctly demonstrate your financial acumen. It should highlight your proficiency in risk management and regulatory compliance. Ensure you include specific examples of successful projects or transactions you've managed. Tailor your experience to showcase your expertise in various banking functions, from personal banking to investment strategies.

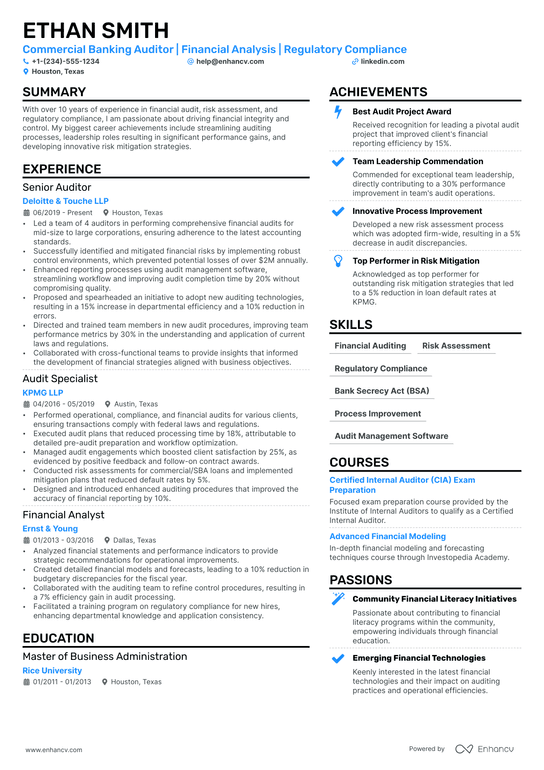

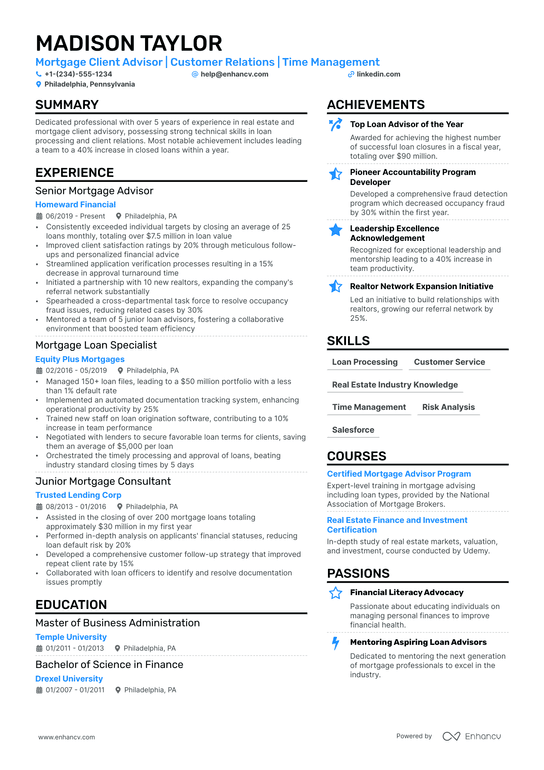

All resume examples in this guide

Commercial Banking

Corporate Banking

Loan Officer

Loan Processor

Phone Banking

Resume guide, what you’ll learn here, looking for related resumes, how to write a banker resume, how to write a complete resume header, how to display your financial expertise in your summary, banker resume experience section: top tips for success, important technical and soft skills for banking jobs, how to present your education on a banker resume, do banking roles require certifications, key takeaways for a banker resume.

Being a banker is one of the most sought after jobs in the world.

It’s prestigious and well paid, even at the entry level. You get to work with notable clients, helping them make enormous amounts of money.

That being said, competition is fierce. Becoming a banker, especially an investment banker, is notoriously difficult.

It all starts with writing a resume that stands-out from the crowd.

No stress – keep reading because this guide will help you write a resume that could land you a dream job.

Let’s get started.

- How to write a resume header that has all the right information

- Our best advice for showing off your banking experience

- The most essential technical and soft skills needed to get hired

- How to format and display information on your banking resume

- Bank Teller resume

- Loan Officer resume

- Personal Banker resume

- Loan Processor resume

- Investment Banking Analyst resume

If you’re an entry level banker fresh out of college, your resume should be formatted differently as a banker with 10+ years of experience.

An entry-level banker should lean towards a functional resume format . This style brings attention to your skills and educational background (rather than your lack of experience).

When you’re just starting out, you will either have minimal or no banking experience at all. Instead of making that glaringly obvious to the recruiter, a functional resume format will draw their eye to your education and skills when they first scan your resume.

On the other hand, if you’re an experienced banker looking for a new position, use the reverse-chronological resume format . This emphasizes your work experience, and puts less of the focus on your education. As you progress in your career, your education becomes less and less important – experience takes precedence.

Once you have your resume format selected, keep these other tips in mind to make your resume clear and concise:

- Use bullet points in your experience, skills, education and certifications sections to make your resume easily scannable.

- Don’t include a photo on your resume if you’re applying in the U.S. – it’s illegal. Check the guidelines for your own country.

- Use a clear and legible font.

- Export your resume as a PDF so the formatting stays intact.

The essential sections in a banker resume

- Resume header

- Resume summary that describes your expertise

- An education & certifications section

- Skills section, with a mix of technical and soft skills

What recruiters want to see in a banker resume

- Experience in banking, private equity or finance

- Knowledge of financial modeling and valuation

- Excellent communication and relationship management skills

- An undergraduate or graduate degree in economics, finance, mathematics, or another related field

A resume header is the very first thing recruiters see when looking at your resume, so it’s important to make a good first impression.

It’s where you’ll list out all of your contact details, your title, and your LinkedIn profile.

Here are a few things to keep in mind when writing your header:

- Include multiple options for contact information like your phone number and email.

- State your seniority level (intern, junior, senior, etc.)

- Add in your LinkedIn profile to give the recruiter an opportunity to validate your information.

Present yourself professionally and you’re off to a great start.

Here are two examples of resume headers – one done wrong, and one done well.

2 investment banker resume header examples

This header gives off an unprofessional impression.

- No links to external sites like a LinkedIn profile

- Only one contact method included

- Non-specific title

Now, let’s take a look at a better resume header.

This header is much better:

- Specified title including the university name and subject area (assuming this is an entry-level position)

- Two options for contact: email and phone number

- LinkedIn profile included

Once you’re done writing your resume header, it’s time to move onto the resume summary where you’ll start to paint a picture of your expertise.

A banking resume summary should instantly present yourself as the ideal candidate for the role, even when a recruiter is doing a quick first scan.

Here’s how to achieve that:

- If you’re a recent graduate, include your university name, area of study and GPA.

- More experienced? Directly state how many years of experience you have, your key areas of expertise, and any notable companies you worked at.

- Highlight any specific quantifiable achievements, using real numbers and figures if possible.

- Showcase some soft skills, especially around client management or presenting.

2 Banking Resume Summary Examples

Let's begin with what to avoid:

A summary like this does not include enough eye catching information.

Anything that isn't detailed information like names, numbers, and specifics is fluff.

Now let’s look at a better example:

At a glance, this entry-level summary delivers valuable information.

- It’s specific about the college name, degree and GPA.

- Includes information about internships, with real data.

- It shows the candidate has leadership skills, as the president of a university club.

The experience section is the one that recruiters care most about.

Pay special attention to making this section of your resume stand out to improve your chances of landing an interview.

This is your spot to describe all of your responsibilities and achievements from previous roles.

The best way to make an impact is to personalize your resume for the job you’re applying to.

While most banking jobs are similar, some will have extra requirements that you’ll want to address in your resume. Make a copy of your original resume and update your experience and skills sections to reflect what the employer is looking for.

For example, do they want someone who knows the mergers and acquisitions process like the back of their hand? If that sounds like you, focus on your past experience and achievements in these areas when writing your experience descriptions.

If you’re applying for a senior role, the employer might be looking for a candidate with leadership experience. If you’ve managed a team in your previous role, talk about the details (how many people, their success rate, etc.)

That’s a sure-fire way to convince the recruiter that you’re the one for the role (just don’t lie – that will catch up with you).

Let’s see these tips in action – here’s a bad resume experience section that needs work, and one that’s ready to be submitted.

Banker resume experience examples

- • Worked side by side with professional Banking Analysts

- • Developed both hard and soft skills and interpersonal skills

- • Helped to build financial statements using Excel

- • Completed market research

This example is okay, but could be improved. It’s not very descriptive, and doesn’t showcase expertise in the banking industry.

Let’s try again.

- • Assisted with acquisition deals ranging in value from $1 million to $300 million

- • Provided financial advice to 50+ clients, completing market research and managing investment portfolios

- • Built financial statements using Excel, and prepared M&A reports

- • Maintained excellent relationships with a 98% client retention rate

Much better!

This description is more detailed, showcasing real figures and achievements. It is specific about the responsibilities of the role, and includes “buzzwords” that will instantly capture a recruiter’s attention.

It also touches on important soft skills, like relationship management, which is essential in banking.

Now that’s done, we can move onto the skills section.

A recruiter’s ideal banker will have both technical and soft skills. They’ll be looking for evidence of this combination in your resume.

Technical skills are the practical knowledge of banking. Do you know how to run a valuation analysis? Can you research and analyze industry and market data? What about executing M&A transactions? Are you a master at creating presentations to deliver to clients or stakeholders?

These are all questions and “buzzwords” that recruiters will be scanning for in your resume.

Our biggest tip for you is to check the job description to see what technical skills they’re looking for in the ideal candidate, and use those same buzzwords in your resume.

Hint: Look at the “responsibilities” or “requirements” section in the job description.

On the other hand, soft skills are the personality traits that will help you excel in such a client-facing role.

Recruiters are looking for candidates who not only know the in’s and out’s of finances, but who can develop and maintain great client relationships, communicate information in an understandable way, and who have excellent analytical skills.

You’re also expected to be able to work well with a team.

How to list technical and soft skills on your banker resume

As far as how to show off those skills, give them their own dedicated section and list them in bullet point format.

Start with ones that are most relevant to the role (and that appear in the job description).

18 technical skills to include on a banker resume

- M&A transactions

- Private placements

- Alternative asset management

- Valuation analysis

- Financial modeling

- Mergers and acquisitions

- Researching businesses and markets

- Deal making and negotiating

- Capital analysis and review

- Internal audit

- Eternal audit

- Credit management

- Risk management

- Expertise with investment products & financial instruments (equity securities, foreign exchange, trading of derivatives, commodity markets)

- Compliance measures

- Data presentation

14 soft skills to include on a banker resume

- Problem solving

- Client relationship management

- Presentation skills

- Works well under pressure

- Ability to meet tight deadlines

- Strong verbal and written communication

- Team collaboration

- Ability to work remotely

- High level of integrity

This section is essential in a banking resume – most roles require a degree, so recruiters will be looking for mention of one.

Here’s what to include:

- List the name of your college, years attended, include your major and your GPA . (The most common majors are finance, math, accounting, economics and statistics)

- List some relevant coursework.

- Include extracurricular clubs and activities, school projects, volunteering or anything else related to finance and/or banking.

If you already have years of banking experience, you can afford to lose some information in your education section in favor of a more detailed experience section. Your resume should be concise and preferably one-page long, so show off what’s most important.

Some jobs might require additional certification. You can check the job description to find out which ones.

In many entry-level banking roles, the employer will set you up to get more training, certifications or licensing. This could include CFA exams, CA designation, a Mutual Funds accreditation, etc. If you already have it, or are currently working on extra certifications, that’s a huge added bonus. Add an extra section on your resume dedicated to certifications, designations and licenses. List them in bullet point format, starting with the most relevant to the role.

CFA certification is most commonly mentioned on job descriptions as an asset for analysts.

Here’s a list of banking-related certifications that would be a great asset to your resume:

Top 7 banking certifications for your resume

- CFP (Certified Financial Planner)

- CAIA (Chartered Alternative Investment Analyst)

- Certified Management Accountant

- Financial Modelling Certification

- Bloomberg Market Concepts

- FINRA Series 7

- CPA (Certified Public Accountant)

- FRM (Financial Risk Manager)

- Personalize every resume for each application you send. Look at the job description before you start writing to see what they’re looking for in their ideal candidate, and use those same “buzzwords” in your resume.

- Showcase a balance of soft and technical skills, listing them in the order of importance (based on what’s listed in the job description)

- Be specific in your summary and experience section about your previous responsibilities and any accomplishments you achieved.

- Include separate sections for education and certifications.

- Triple check your resume for any grammar or spelling mistakes. Attention to detail is important!

Banking resume examples

Explore additional banking resume samples and guides and see what works for your level of experience or role.

When it comes to corporate banking, knowledge of risk management, portfolio management, and a keen understanding of macro-economic factors are vital. Here is what to focus on when applying for a role:

- Feature your knowledge in areas such as portfolio management, analysis of credit risk, or understanding of trade finance. These show your capability to handle the complex nature of corporate banking.

- Experience matters. Highlight your prior roles in tackling large scale deals, managing corporate client portfolios, or risk reduction endeavors. Remember, it's not just about the role you held, it's about the difference you made.

- Similarly, instead of plainly mentioning these skills and experiences, elaborate on metric-based results delivered, such as 'increased portfolio value by...', 'increased client base through...', etc.

- If you have an MBA or any specialized finance certification, don't forget to include this in your application, as it enhances your credibility.

Feature your ability to build and maintain relationships with clients. In fact, throw in some quantifiable results to back this up, such as 'increased customer acquisition rate by…' or 'improved client retention rate by…'.

Showcase your knowledge of various lending products and banking procedures. It could be how you simplified the loan approval process or kept a clean portfolio with a high percentage of performing loans.

Top-notch sales skills are a key part of this job. Highlight any major up-selling or cross-selling successes, signifying your ability to generate revenue for the bank.

Favorable ratings in any past customer service roles will definitely boost your profile.

- Highlight meticulousness and accuracy in the processing of loan applications. Use phrases like ‘managed error-free documentations for…’ to spotlight this skill.

- Demonstrating prioritization and organization abilities is paramount. Show how your top-notch management skills directly contributed to reducing loan approval times or handled a high volume of applications.

- Note down tackling complex mortgage scenarios, situations showcasing your problem-solving skills and adaptation in the changing regulatory landscape.

- Familiarity with loan processing software or tools will stand you in good stead. If you're proficient in specific industry platforms, make sure to mention it.

Highlight your ability to deliver high-quality customer service over the phone. Mention tangible outcomes like ‘improved customer satisfaction scores by…’ or 'reduced average handling time by…'

Knowledge about various banking products and services is crucial. Illustrate how your product advice resulted in an increase in sales or customer retention.

Given the fast-paced nature of this role, attention to detail and the ability to multitask are valued skills. If you can provide examples of managing high call volumes or handling frequent, complex client queries, it will certainly strengthen your application.

Any experience with specific customer relationship management (CRM) tools can be significant. Make sure it's highlighted in your application.

Looking to build your own Banking resume?

- Resume Examples

How to Make Resume Margins the Right Size

Parts of a job-winning resume: how to choose resume elements, how to ask for feedback after an interview, how to let a recruiter down easy when you've got another job offer, marketing director interview questions & answers: a stress-free guide, tech savvy on resume.

- Create Resume

- Terms of Service

- Privacy Policy

- Cookie Preferences

- Resume Templates

- AI Resume Builder

- Resume Summary Generator

- Resume Formats

- Resume Checker

- Resume Skills

- How to Write a Resume

- Modern Resume Templates

- Simple Resume Templates

- Cover Letter Builder

- Cover Letter Examples

- Cover Letter Templates

- Cover Letter Formats

- How to Write a Cover Letter

- Resume Guides

- Cover Letter Guides

- Job Interview Guides

- Job Interview Questions

- Career Resources

- Meet our customers

- Career resources

- English (UK)

- French (FR)

- German (DE)

- Spanish (ES)

- Swedish (SE)

© 2024 . All rights reserved.

Made with love by people who care.

- Resume Writing

- Resume Examples

- Cover Letter

- Remote Work

- Famous Resumes

- Try Kickresume

How Do I Make My Banking Resume Stand Out? (+Real Resume Examples)

- Jakub Kaprál ,

- Updated November 9, 2023 10 min read

Pursuing a career in banking is not for the lazy. It's a fast-paced, demanding and ever-evolving industry that requires you to have the ability to embrace change , accept risks and never cease to work on your skills.

On the other hand, the banking industry is a reliable source of well-paid jobs, which makes it a hot-spot for aspiring young professionals interested in hatching a top career. It's also pretty generous when it comes to opportunities for solid long term career growth.

Last but not least, the career in banking will ready you with a wide range of transferable skills from dealing with people to crunching numbers and solving problems with ease.

That means you can also think of it as your gateway to other types of jobs that you may want to land in the future.

Ready? Let's look at how to write a winning banking resume and score a highly-coveted job that will cover your bills — and perhaps your partner's, too.

Table of Contents

Click on a section to skip

Before job search: Have a clear objective in mind

Resume format: determine your competitive advantage, resume sections: leave nothing to chance, 7 excellent banking resume examples to get you started.

First, it's important to think about the type of work you'd like to do, weighing the pros and cons of each and try to envision what your career's long-term development could look like.

Would you like to become a commercial, investment or mortgage banker? Bank teller, loan officer, financial analyst, internal auditor or branch manager?

Be sure to take your personality traits into account , too. Do you want to interact with customers and their money? Or would you prefer having a more analytical back-office role that allows you to dive deep into numbers and raw data?

The banking sector offers something for everyone . Salaries and formal job requirements differ, though.

According to the US Bureau of Labor Statistics , bank tellers earn less than $30k per year on average but the job doesn't require a university level of education.

On the other hand, the job of a loan officer and financial analyst requires a bachelor's degree and offers a median annual pay of $63k and $85k, respectively. A financial analyst, in particular, may also benefit greatly from conquering the CFA Level 1 exam .

The highly competitive world of banking also enables you to earn promotions and work your way up through various positions. Remember — it's all up for grabs.

So even if you start out as a bank teller, there's no reason to despair. Just gain enough experience and knowledge and the role of a loan officer or even a financial manager can be yours.

Invest in your future.

Score a well-paid job with an outstanding resume.

There are no restrictions when it comes to resume composition. But with a suitable resume format , you can make the reader's attention rivet on the aspects of your career that deserve to be in the spotlight and make less attractive parts a bit more inconspicuous.

If you’ve got years of work experience to showcase, choose a chronological resume format . It's a true classic that records your career progression and makes each of your steps count.

But if you want to highlight a diverse range of technical, transferable and soft skills that you possess, choose a functional resume format .

This one comes in handy especially when you need to downplay a gap in your employment history or a lack of relevant work experience.

There's naturally a third option, too: to come up with a hybrid resume that gives priority to literally anything that you deem important.

This can include your education history, references or awards you've earned — just about anything that you think will convince them to hire you.

When it comes to resume writing, perfection lies in the details .

Mess the formatting up and you'll end up with low readability. Use cheesy words or worn-out phrases and nobody will listen. Include less relevant keywords and your resume might not beat the bots.

Let's now explore the potential of individual resume sections and address their specifics head-on:

1. Profile summary

Many people start their resumes with individual sections such as Work Experience or Skills. But when it comes to marketing yourself to the recruiter, nothing compares to a well-written resume summary sitting on the top of your resume.

Just to make it clear: profile summary is your resume — only extremely condensed . It's a tiny resume for those who don't yet know if they want to read the rest of it and get more details.

That's why you need to make it sound fresh and juicy . Remember that the reader's attention is a very elusive thing that needs to be pampered. Use your summary to say three basic things: who you are, what you do and what makes you stand out.

Here's an example of an excellent profile summary that's hard to beat:

Over 7 years of Business Analyst and IT Consultant experience with extensive international experience. Possess a Master’s Degree in Information Systems from the University of Economics in Prague. Other qualifications include:

- Working knowledge of banking and insurance products, marketing and business processes

- Excellent communication (verbal and written) and interperson al skills; able to communicate effectively to management, users, developers, and cross-functional team members.

- Well-developed analytical and problem-solving skills.

- Expertise in gathering, analyzing and documenting user stories, business and functional requirements and process flow.

- Highly motivated self-starter, capable of a team and individual work.

2. Work experience

You surely have a lot to say about your former jobs. And that's when formatting comes in handy — to help the reader navigate the text with ease.

Make sure your work experience has a neat structure and follows a reverse chronological format . Include dates (months and years) to help recruiters see your career trajectory with the most recent — and the most relevant — items on the top.

Use bullet points together with action verbs to list your job responsibilities. Quantify your achievements. Include numbers to specify anything from revenue growth and number of clients to annual savings.

3. Education

Especially if you're fresh out of college or it wasn't so long ago when you graduated, you shouldn't just skim the surface but include specific details about your studies.

Make your academic achievements speak of your dedication and hard work and you're halfway there. What was your GPA? Did you get any notable award? Did you do any coursework that's relevant to the job you're now applying for?

These details will help you compensate for the scarcity of hands-on experience and let recruiters know you're perfectly equipped for a demanding banking job. Learn more about how to exactly put GPA on your resume .

Bachelor of Science in Business Administration (01/2008 – 10/2012), The University of Milan, Milan, Italy

- Graduated with Honors

- Cumulative GPA (4.00)

4. Skills

Banking jobs demand a pivotal combination of hard and soft skills. These should reflect specific keywords that are included in each job description.

Tailoring your resume to every position you're applying for is an essential part of your job search and failing to do so can result in very poor response — or none at all.

Here's a list of the top soft skills in banking:

Top soft skills in banking

- Strong analytical skills — identify trends, patterns and definitive conclusions from the reams of data you’ll have access to.

- Complex commercial awareness — anticipate financial trends and future business developments

- Excellent oral and written communication skills — convey and receive instructions, describe and explain complex financial concepts or procedures, write in-depth reports and communicate in a professional manner

- Problem-solving skills — tackle complex problems as they arise, which may involve addressing financial implications or coming up with personalised solutions

- Capacity for innovation — push the limits and come up with creative solutions

- Attention to detail — spot anomalies and simple mistakes that would have grave consequences

- Determination and resilience — this includes having a relentless work ethic and willingness to make sacrifices in your personal life and work overtime to achieve goals and meet deadlines

- Working under pressure – meeting deadlines and delivering results

And here's a list of the top hard skills in banking:

Top hard skills in banking

- Microsoft Office — Excel (VBA, formulas, functions), Word, PowerPoint, Outlook

- Data query/data management tools — Access, SQL, Business Objects

- Database management systems (DBMS) — Oracle

- Accounts payable automation

- Predictive analytics

5. Certifications

If you're a seasoned professional, include certifications that you've earned throughout your career:

- Accredited Tax Preparer (ATP) Certification 02/2008, Accounting Institute of Milan

- ArchiMate 3.0 L1 Foundation 08/2019, OpenGroup

If you feel there are still gaps in your knowledge, though, turn your attention to online certificates. With the arrival of quality online education , obtaining a solid finance degree can be a matter of just a few months and a bit of free time.

Make sure to choose one of the credible online education platforms acknowledged by hiring managers and industry professionals — Google’s Digital Garage, Coursera, Udacity, Khan Academy, Udemy, Shaw Academy or Hubspot:

- Machine Learning 12/2018, Stanford University on Coursera

- Banking Credit Analysis Process 04/2019, Udemy

Completing an online degree a great way to fill any gaps in your knowledge or compensate for any voluntary or involuntary employment gaps or parental leaves on your resume. It's also the easiest way to get high-quality education for just a fraction of the fees you’d pay for an ordinary college course.

6. References

Being able to make it in the banking industry requires high levels of confidentiality and trust. That's why you need to provide trusted references to make the next step in your career.

Ask your former employers, ex-colleagues and other trusted industry professionals if they're willing to put in a good word for you with your prospective employer.

Include their names and contact information in a designated section of your resume or, if you can't do so for any reason, make it clear that you’ll provide them upon request .

- Mr. Bryan Simpson – Tax Supervisor, KPMG, Contact Number: 555-555-5555, Email: [email protected]

7. Hobbies

Include hobbies on your resume only if you consider them instrumental in supporting your job-related skills and qualifications. Regular chess players, for example, usually come out strong on logical thinking and reasoning skills. Similarly, you're likely to believe triathlon or marathon runners will show great perseverance in the face of difficulty.

On the other hand, watching movies or having a sweet tooth are hobbies that will hardly help you improve your job prospects.

If you want your hobbies to act as effective icebreakers and good conversation starters, make sure to be really specific. After all, "fervent golf player" or "contemporary American documentary novel lover" sounds much more engaging than vague statements "playing every kind of sport" or "getting lost in a good book."

We all are visual beings. We need examples.

That's why we've put together 7 exceptionally well-written banking resume examples to help you get an idea of how other banking professionals landed their dream jobs and see how you can score yours, too.

1. The World Bank Technology Researcher Resume Example

Hey, recent graduates and young aspiring professionals. It's definitely not a bad idea to figure out your career objective right at the start — and make it the first thing recruiters will see on your resume.

This well-structured resume with the most important sections on top highlights promising academic achievements and job seeker's ambitions.

To convince the hiring managers that you'll be a great hire despite the absence of work experience , you need to use all your weapons. Include any projects, achievements, extracurricular activities or positions of responsibility that are relevant to the position you're applying for.

Technology Researcher at the the World Bank

This resume sample was contributed by a real person who got hired with Kickresume’s help.

2. Prudential Financial Services Associate Resume Example

This one is a great example of a functional, skill-based resume written by a seasoned professional with 20+ years of experience in the field.

If you have a lot to say, do so. But always think about ways to make your resume easy to read .

Of course, bulky paragraphs may save some space and allow you to include even more details. But their readability — compared to bulleted lists — is very low and may even discourage some recruiters to read them in full.

Financial Services Associate at Prudential

3. software asset manager resume sample.

Pack your profile summary with powerful adjectives. Phrases like stellar results, agile global strategic leader, particularly adept will help you promote your personal brand and enable you to hint at your soft skills while talking about your work experience.

Volunteering activities are also a great addition to your resume, especially when they shaped your personality and personal ethics. Job seeker's involvement in Scouts, voluntary work for RAF or British Armed Forces represents strong evidence for the recruiters that they've just come across a reliable and high-performing employee .

Software Asset Manager at Spartan Investments

4. commercial director resume example.

If you want to stay ahead of the game, you need to be always learning and expanding your skillset for the next opportunity that comes your way.

And one of the most convenient ways to do so is to sign up for an online course . This will enable you to obtain a certificate from renowned online platforms (Shaw Academy, Coursera, Udemy, Code Academy) that offer quality education at a reasonable price.

Commercial Director

This resume was written by our experienced resume writers specifically for this profession.

5. Senior Trader Resume Example

What you see is a slick one-pager that effectively uses two columns to save space and accommodate the F-shaped reading pattern .

Another great way to grab the reader's attention is to use numbers. Make your achievements palpable by quantifying everything that can be expressed numerically:

- Ranked 1 out of over 50 traders within two years

- Managed $4 million long portfolios with 70% focus on entertainment-related firms

- Graduated with Distinction (Grade 1 - A/excellent equivalent in all 4 subjects).

Senior Trader

6. scotiabank business analyst resume example.

Multi-page resumes are particularly suitable for seasoned professionals with a prolific career. The neat structure of the work experience section is paired with excellent use of action verbs .

The resume stands out thanks to a substantial profile summary that highlights job seeker's soft skills and reflect the job requirements.

Business Analyst at Scotiabank

7. tax accountant resume example.

If you're thinking about using a functional or hybrid resume , there are a number of ways how to play with the order of sections and list your skills in different places on your resume.

One of them is to relabel your skills as areas of excellence and place them on the top to your profile summary. This way you'll be able to say much more about your transferrable skills and situations where you typically use them.

Tax Accountant

Empowered with new insights on how to make your banking resume distinctive? Now, let's put that knowledge into action. Transform your LinkedIn profile into an aspirational resume that's sure to make recruiters sit up and take notice.

Still not enough? If you want to see more examples from real professionals, check out our resume examples library!

Jakub Kapral is a former professional linguist and a career writer at Kickresume. He has written almost 100 diligently researched resume advice articles and his texts are visited by thousands of people every month. Jakub is a natural teacher who looks to help those who want to enhance their career prospects. He's also an avid drummer and a proud father of two.

Related Posts

Resume analysis: account executive hired by google, the only cover letter guide you’ll need in 2024 (+examples).

- 13 min read

Share this article

Join our newsletter.

Every month, we’ll send you resume advice, job search tips, career hacks and more in pithy, bite-sized chunks. Sounds good?

Banking Resume Examples | Full Guide For 2024

- November 30, 2023

In the current competitive job market, having a well-crafted resume is necessary to stand out from other applicants.

This is particularly true in the banking industry, where employers are looking for candidates with a strong combination of financial expertise, analytical skills, and excellent communication abilities.

Your banking resume needs to showcase your qualifications and make a memorable first impression effectively. By highlighting your relevant experience, skills, and achievements, you can demonstrate your suitability for the position.

What To Include In A Banking Resume?

When crafting your banking resume, it is crucial to include various sections that highlight your qualifications, skills, and experiences. Here’s a more detailed explanation of what to include in a banking resume:

- Contact Information

Provide your full name, phone number, email address, and LinkedIn profile (if applicable). Ensure this information is up to date and easily accessible for potential employers to contact you promptly.

- Summary/Objective

Begin your resume with a concise yet impactful statement that captures your career goals and showcases your relevant skills. Tailor this section specifically to the job you are applying for, highlighting your strengths and how you can contribute to the company’s success.

List your educational qualifications, including degrees, certifications, and any noteworthy coursework. Include the name of the institution, graduation dates, and any honors or awards received.

- Work Experience

Detail your work history, starting with your most recent position. Provide the job title, company name, employment dates, and a comprehensive description of your responsibilities and accomplishments. Focus on quantifiable achievements and specific results to effectively demonstrate your impact.

Showcase your diverse range of banking skills, encompassing both technical and soft skills. Technical skills may include financial analysis, risk assessment, proficiency in banking software, and regulatory compliance.

Emphasize soft skills such as communication, customer service, and problem-solving, which hold significant importance in the banking industry.

Learn more: Unveiling The 10 Best Skills To Put On A Resume .

- Certifications and Licenses

Highlight any relevant certifications or licenses you have acquired. This could include certifications like Certified Financial Planner (CFP) and Chartered Financial Analyst (CFA) or licenses such as Series 7 or Series 63.

- Additional Sections

Consider including extra sections that directly relate to the banking industry. This might encompass awards and accolades, volunteer experience, professional memberships, or language proficiency. B

e selective and include only information that strengthens your qualifications and aligns with the job requirements.

While it is unnecessary to include references on your resume, you can mention that they are available upon request. Always be prepared to provide references if requested during the application process.

It is crucial to tailor your resume by highlighting relevant skills and using concise language to describe responsibilities and achievements with action verbs.

Banking Resume Summary Or Objective

When writing a banking resume summary or objective, it’s essential to craft a compelling statement that quickly grabs the attention of hiring managers and highlights your suitability for the role.

Here’s how to write a banking resume summary or objective :

- Keep it concise: Summarize your skills and career goals in a few sentences. Be direct and specific, focusing on what sets you apart from other candidates.

- Highlight relevant experience: Mention your years of experience in the banking industry, emphasizing key roles and responsibilities that align with the desired position.

- Showcase achievements: Include notable accomplishments that demonstrate your impact and success in previous roles. Quantify results whenever possible to provide a clear sense of your contributions.

- Tailor it to the job: Research the job description and company culture to understand what they value most. Customize your summary or objective to match their requirements and show how you can meet their needs.

Banking Skills To Win That Bank Job

When applying for a bank job, it is important to showcase the skills that make you an ideal candidate. Here is a banking skills list for a resume:

- Financial Analysis: Demonstrating proficiency in financial analysis is crucial for roles such as financial analyst or credit risk analyst. This includes analyzing financial statements, assessing risk, and making informed decisions based on data.

- Customer Service: Customer service skills are necessary for roles such as bank teller or customer service representative. Being able to handle customer inquiries, resolve issues efficiently, and provide a positive experience is vital in the banking industry.

- Attention to Detail: Accuracy is crucial in banking operations, such as processing transactions or reconciling accounts. Having a keen attention to detail minimizes errors and ensures compliance.

- Communication: Effective communication is vital for building relationships, collaborating with colleagues, and presenting information to stakeholders. Clear and concise communication is critical in the banking industry.

- Problem Solving: The skill to recognize and resolve issues is greatly appreciated in the banking industry. Whether it’s resolving customer complaints, addressing operational challenges, or developing innovative solutions, problem-solving skills are essential.

- Analytical Thinking: Strong analytical skills enable professionals in banking to evaluate complex financial data, identify trends, and make informed decisions. Employers highly value candidates who can think critically and analyze situations from various perspectives.

- Technology Proficiency: Banking is becoming increasingly digital, so proficiency in banking software, data analysis tools, and financial technology (fintech) platforms is crucial.

- Regulatory Compliance: A strong understanding of banking regulations and compliance requirements is vital to ensure adherence to legal and ethical standards.

The Best Format For Your Banking Resume

When it comes to creating an investment banking resume, using the right format is crucial in presenting your qualifications effectively. Here’s an overview of the best format for your banking resume:

- Reverse Chronological Format: It presents your work experience in reverse chronological order, starting with your most recent position. This allows employers to see your career progression and relevant experience quickly.

- Clear and Consistent Layout: Use a clean and organized layout that is easy to read. Use headings and subheadings to clearly separate different sections, such as work experience, education, and skills. Maintain consistent formatting throughout the resume.

- Professional Summary/Objective: Begin your resume with a concise summary or objective statement that highlights your critical skills, experiences, and career goals. Tailor this section to match the specific job you are applying for.

- Quantify Results and Achievements: When describing your work experience, provide specific examples of your accomplishments and quantify them when possible. For example, mention how you increased revenue, reduced costs, or improved customer satisfaction.

- Relevant Keywords: Incorporate relevant industry-specific keywords throughout your resume. Many employers use ATS to scan resumes for specific keywords. Research the job description and include keywords related to the desired skills and qualifications.

- Education and Certifications: Include your educational background, including degrees, certifications, and any relevant coursework. List the institution, graduation dates, and any academic honors or awards.

- Skills Section: Create a dedicated section to highlight your banking skills, both technical and soft, and showcase your expertise in areas like financial analysis, risk management, regulatory compliance, customer service, and communication.

- Proofread and Edit: Ensure your resume is error-free by carefully proofreading it. Check for spelling and grammar mistakes and make sure consistency in formatting and punctuation.

By tailoring your resume to specific job requirements, you can create an impactful banking sales resume that increases your chances of landing an interview.

Here is a banking resume example:

Learn The 5 Best Resume Formats to Use in 2024 (top Templates ).

Role Of Resume Builders

Top resume builders like Resume Forrest, the best resume builder , play a crucial role in simplifying the resume creation process for job seekers.

These platforms offer intuitive interfaces and professionally designed templates to help individuals craft polished and effective resumes. With user-friendly features and prompts, Resume Forrest guides users through each section of their resume, ensuring that all relevant information is included.

Additionally, Resume Forrest provides formatting options, allowing users to create visually appealing resumes that stand out to potential employers.

By using a resume builder like Resume Forrest, job seekers can save time and effort while creating professional resumes that showcase their skills and qualifications.

Click to learn Best Resume Builder Services in 2024 [Free & Paid]

Frequently Asked Questions

- How To Make Your Banking Resume Experience?

Focus on showcasing your technical skills such as financial systems knowledge, risk management, and regulatory compliance. Also, emphasize soft skills like communication and problem-solving.

- How Long Is A Banking Resume?

Generally, it is recommended to keep your banking resume to one or two pages to ensure conciseness and relevance to the job requirements.

Learn how long should a CV be .

- What Is Resume Banking?

“Resume banking” refers to the process of submitting your resume to banks or financial institutions for potential job opportunities.

- Writing Recommendations For Your Banking Resume

Tailor your resume to the specific job requirements, quantify your achievements, and include relevant keywords. Additionally, proofread carefully and ask for recommendations from previous employers or colleagues.

- How To Pick The Best Banking Resume Template?

Look for templates that are clean, professional, and easy to read. Choose a layout that highlights your key qualifications and experiences effectively.

Wrapping Up

Crafting a strong banking resume in 2024 requires paying careful attention to detail and taking a strategic approach.

To make your resume stand out from the competition, it is recommended that you follow a specific format, which includes a compelling summary or objective statement, and showcase your relevant banking skills.

You can also save time if you use a banking resume template and ensure a professional appearance. Remember to include essential information such as personal details, work experience, education, skills, and achievements.

Tailor your resume to match specific job descriptions, quantify your accomplishments, and proofread for errors.

With these tips and resources, you’ll be well-equipped to create an outstanding banking resume and increase your chances of landing that dream job.

Top 3 android developer resume for fresher

Craft an impressive android developer resume for fresher that showcases your potential. We will explore the key components that should be included in your resume, providing you with valuable insights to help you stand out among other applicants.

Top 9 steps for ios developer fresher resume with examples

Use our comprehensive guide to create an impressive ios developer fresher resume that highlights your potential for the position to land your dream job.

Best software engineer resume builder 2024

your resume needs to make a great first impression which can be done by the best software engineer resume builder ResumeForrest website.

Top 6 steps for a front end developer resume with experience

Crafting a front end developer resume with experience that effectively showcases your experience and get you hired.

Send Us A Message

© 2023 resumeforrest, inc. all rights reserved..

Build my resume

- Build a better resume in minutes

- Resume examples

- 2,000+ examples that work in 2024

- Resume templates

- 184 free templates for all levels

- Cover letters

- Cover letter generator

- It's like magic, we promise

- Cover letter examples

- Free downloads in Word & Docs

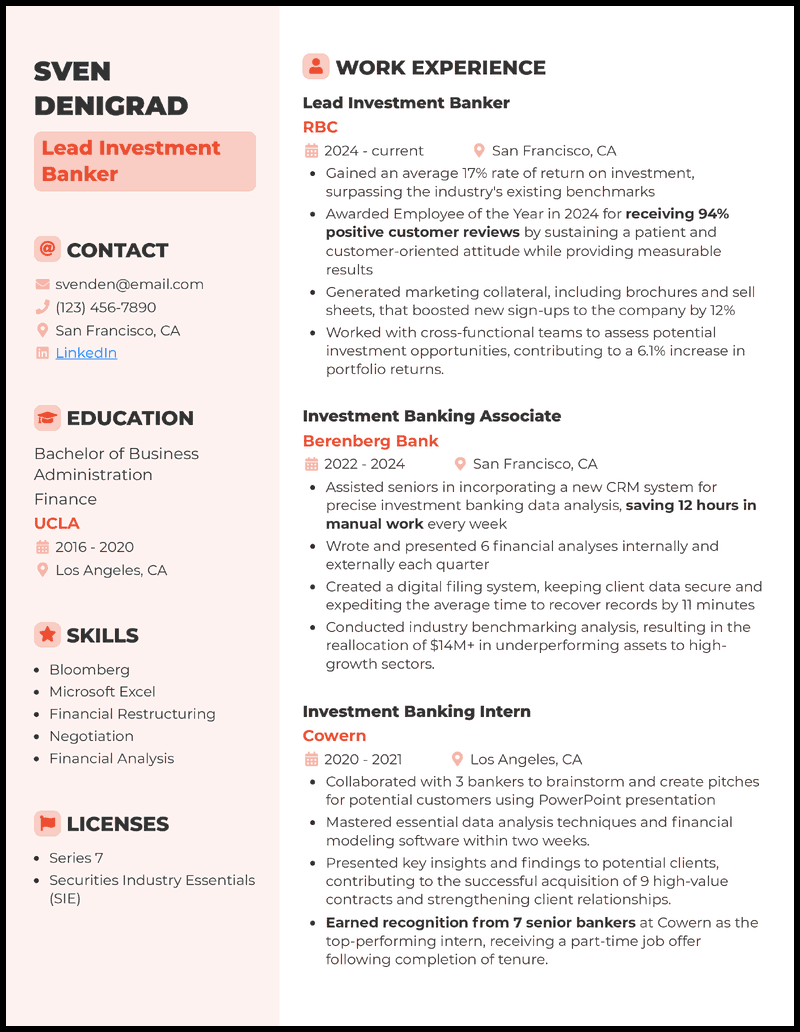

7 Investment Banking Resume Examples & Guide for 2024

Investment Banking Resume

- Investment Banking Resumes by Experience

- Investment Banking Resumes by Role

Investment banking is a challenging profession. Typical work weeks demand far more hours than most jobs, and high-stress and tight deadlines are the norms, not the exception.

Despite this, investment banking jobs can be very lucrative and rewarding. If you’re looking to take your career to the next level, writing a cover letter for a job and building your resume are necessary steps you gotta take.

Your time is precious, which is why we’ve researched the best resumes and what employers are looking for in 2024 . We’ve created seven investment banking resume samples, plus a guide to making this as painless as possible. Check out our tips and see what skills you’ll need to land that high-paying position

or download as PDF

Why this resume works

- A good investment banking resume starts with a professional resume format .

- The reverse-chronological format is an excellent way to go, as it lists your most relevant and current experience toward the top of the page; if your information’s buried, there’s little chance a busy hiring manager will have the time or desire to dig for it.

- Sometimes, there’s a tendency for people to want to include every internship or job they’ve held since they were 10. But, the lemonade stand you operated with your neighbor isn’t really relevant here. Limit your work experience to the most relevant and recent two to four jobs you’ve held, and make sure you keep your resume at exactly one page.

Investment Banking Intern Resume

- What would make this experience go from simple to great are the results you discuss in your investment banking cover letter and resume. Show the employer why you’re above the average with any past relevant project highlighting your knowledge on how to spot market trends and analyze a firm’s potential.

Entry-Level Investment Banking Resume

- When you don’t have much job experience in the field, make sure to include relevant internships, school projects, hobbies, or even volunteer work .

- If you lack internships or volunteer work, don’t worry! Any experience can be written to highlight skills on your resume that are especially relevant to investment banking.

- For example, restaurant jobs also require high-pressure, high-stress work where you must work quickly with a team.

- However, career objectives need to be made highly specific to each job you apply to!

- You’ll make an impact when you include the name of the company you’re applying to while also briefly discussing transferrable skills you can bring to the job.

Goldman Sachs Investment Banking Resume

- Qualifications such as a master’s degree and various financial roles that show your expertise with tools like Bloomberg Terminal and Aladdin are an added advantage for your Goldman Sachs investment banking resume.

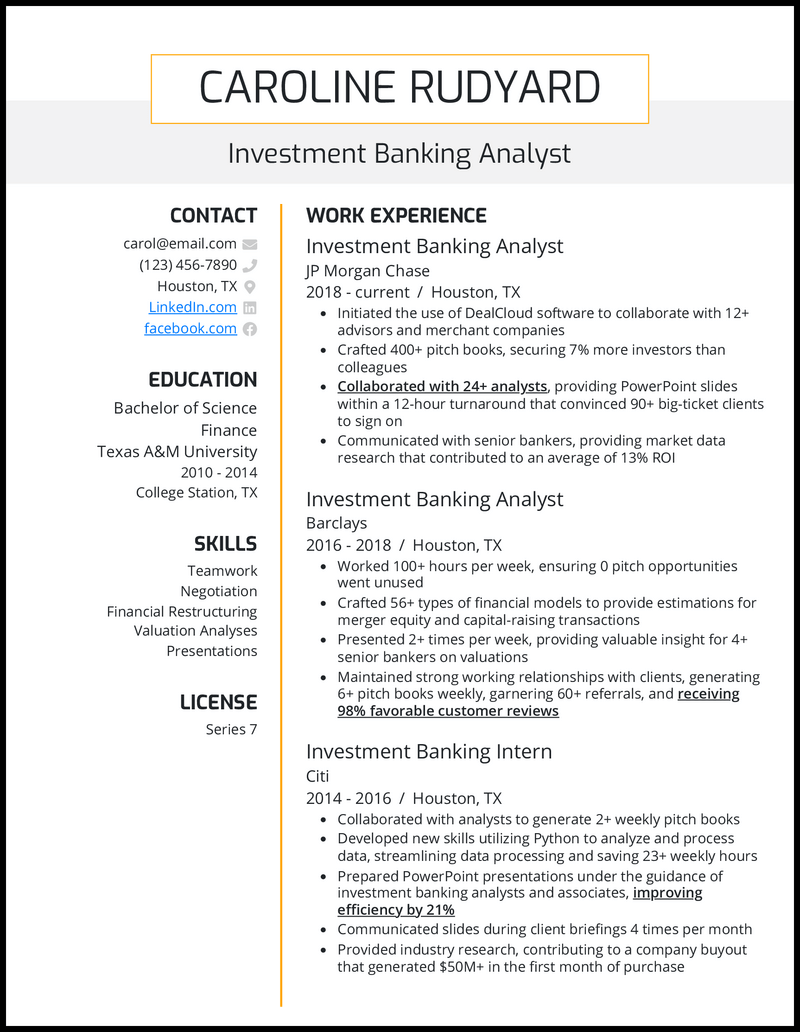

Investment Banking Analyst Resume

- Aside from earning stellar grades and gaining applicable experience, you need a resume that will reflect those details while visually attracting the eye.

- If, say, you apply to Barclays with impressive work experience, it’s a great start; but how you demonstrate your impressive work history will determine whether your resume makes the cut …or ends up in the garbage.

- Metrics are an efficient way to demonstrate your abilities, as numbers show (rather than tell) employers the results you’ve achieved.

- Examples of quantifiable metrics relevant for investment bankers include the number of clients you’ve worked with, client satisfaction ratings, your average rate of returns, how data you’ve compiled and analyzed financially benefited the company, etc.

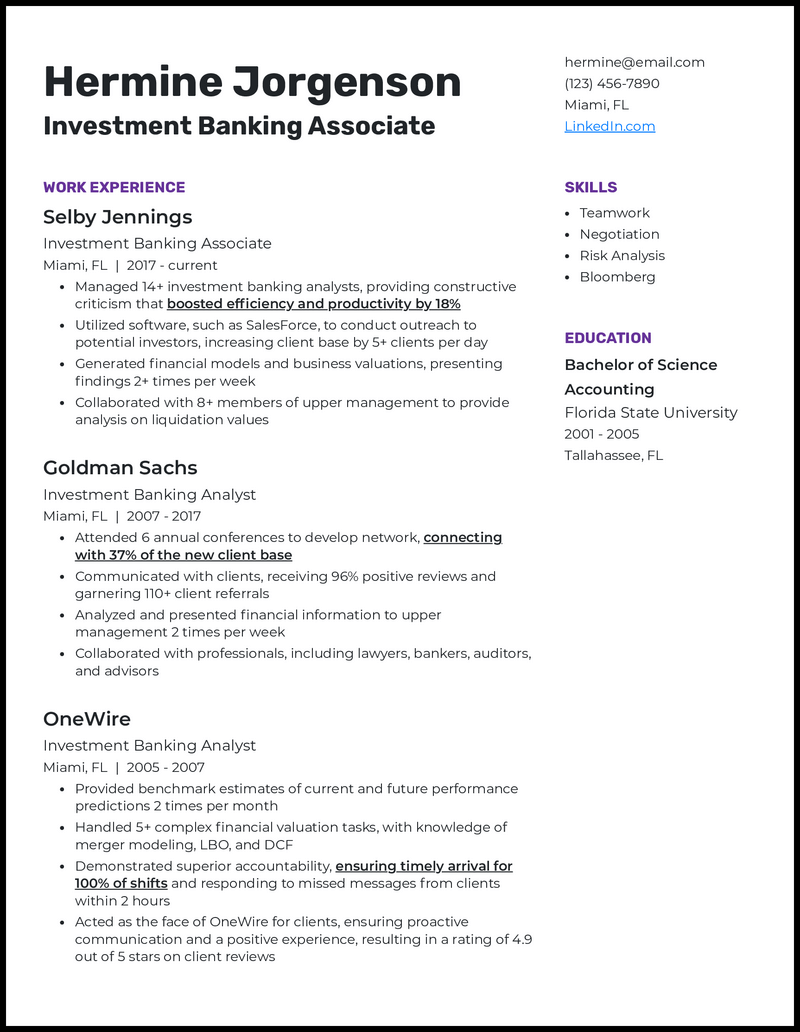

Investment Banking Associate Resume

- It’s a small part; nonetheless, a skills section is a critical part of your resume.

- That’s because investment banking jobs are incredibly competitive. It’s common for 300-400 applicants to apply to a single job posting! So, hiring managers use Applicant Tracking Systems (ATS), which filters and discards resumes that are lacking or light on keywords, to quickly eliminate applicants who may not be a good fit.

- While content is king, employers are likely to miss your content if the resume itself is dull and underwhelming.

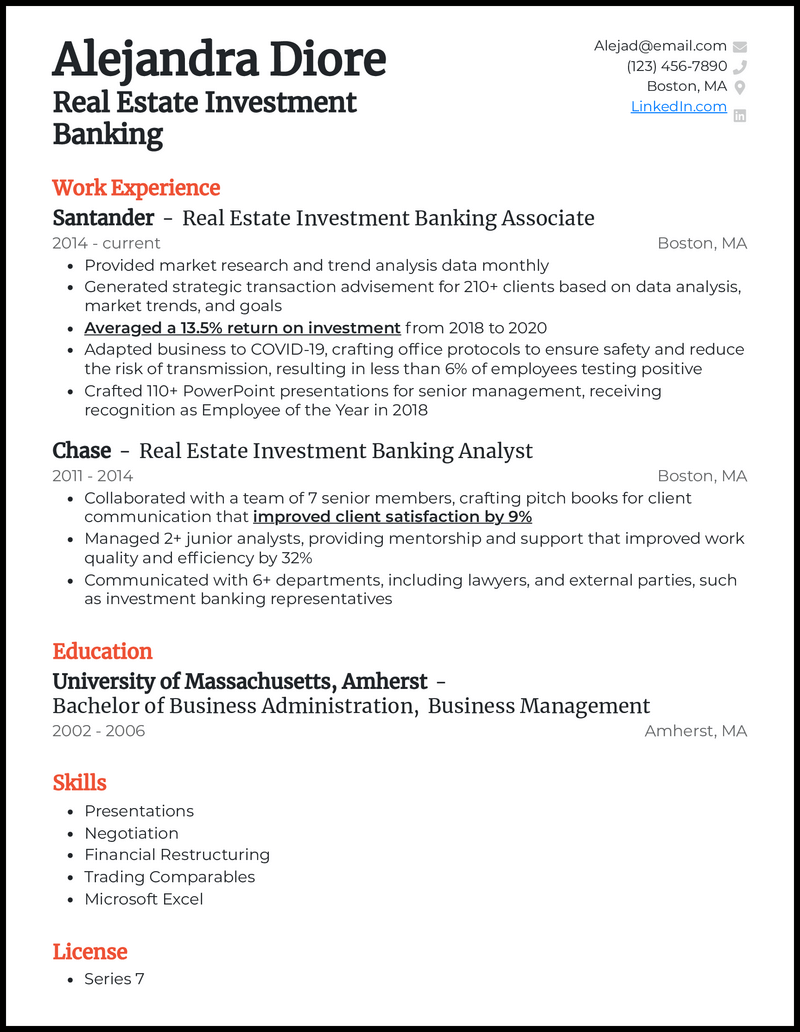

Real Estate Investment Banking Resume

- When you’re writing your real estate investment banking resume , make sure it’s flawless by double-checking your resume for thoughtful word choices, sentence structure, and formatting.

- Avoid diminishing or devaluing language when writing about your experience.

- A great place to start “owning it” is your resume summary .

- Hey, if you’ve got 10 or more years under your belt in the same industry, say so! And take the time to dazzle employers with any specializations you’ve honed in two to three power-packed summary sentences while you’re at it.

- Unlike the resume objective , a summary is exclusive to candidates with extensive experience.

- Did you know that 80 percent of investment banking hiring managers surveyed said they wouldn’t hire a candidate who didn’t present themselves confidently?

- Use action words to start each sentence and active voice to strengthen the flow.

Related resume guides

- Financial analyst

- Data analyst

How to write an MBA resume and make sure it stands out in the stack

Applying to business school, or an MBA program, can be nerve-racking. You’ll need to lasso together transcripts and test scores, fill out an application, and likely ace an interview—but perhaps the most critical piece of it all is an MBA resume. This important document will list out many of the same elements as a traditional resume, such as your educational background and work experience.

But an MBA resume also has a different primary function than the typical resume you might submit to try and land a job: It’s designed to land you a spot in an MBA program. If writing an MBA resume feels intimidating, knowing what to put on it, and some other framing tactics, may help calm your nerves.

UNC Kenan-Flagler’s top-ranked online MBA

Mba resume vs. a job resume .

As noted, an MBA resume should feel familiar to many prospective business school students.

“An MBA resume is very similar to a job resume,” says Kaneisha Grayson, the founder and CEO of The Art of Applying , an MBA admissions consultancy. She adds that both types of resumes will, or should, comprise a single page, incorporate clear, professional formatting, and lay out an applicant’s educational and career accomplishments.

“I’d say one difference between the two is that I advise our clients to put their education at the top—whereas with a job resume, you’d see education at the bottom,” Grayson says. She recommends this variation because an MBA resume’s specific aim of landing an applicant at an educational institution.

So, in that sense, there may not be a whole lot of differences between an MBA resume and a job resume, but there will be some additional focus on specific aspects of your background, all in an effort to win over an MBA program’s selection or admissions committee.

How to write an MBA resume

Again, writing an MBA resume shouldn’t differ a whole lot from writing a traditional resume, but you’ll want to try and keep your end goal in mind, which is landing a spot in an MBA program. As you write your MBA resume, keeping that goal in mind should prove helpful, because it can help you parse out the information you’ll want to include, and the things you won’t.

“An MBA resume is very specialized toward the application cycle,” says Ellin Lolis, President and Founder of Ellin Lolis MBA Consulting . So, again, keep the end goal in mind. “Your education section is going to be important,” Lolis says, “but we mostly want to see your career focus.”

As for the nuts and bolts of writing an MBA resume? Keep it simple by deciding what to rope in, what to leave out, and how to structure it all so that it’s easy to read.

What to include in your MBA resume

The main elements that your MBA resume should include are an education section, a job experience or professional experience section, and a portion that details a bit more about you, personally, such as your hobbies and interests.

You can leave out photographs, information related to your high school, and even most of your contact information—that’ll be included on your program application, the experts say.

Again, do your best to keep what you include to one page. The only time you could probably get a pass for using more than one page is if you have extensive professional experience, and are applying to an executive MBA program. A good rule of thumb? “When you have more than seven years of full-time, post-college work experience,” says Grayson.

How to structure an MBA resume

As for structuring an MBA resume, do your best to contain most elements to the aforementioned sections: Education, professional background and experience, and a section dedicated to your personal hobbies, interests, skills and certifications, and community service work.

List the schools you attended and the degrees you earned, perhaps with any relevant coursework and GPAs in the education section. Your professional section may differ depending on your specific experiences and industries you’ve worked in, but try to frame it as a sort of professional “story,” which can showcase how an MBA can help you take the next step.

Professional background

“Generally speaking, the MBA is not a purely academic degree, as a majority of people are going to earn one to get a better job,” says Lolis. “They’re doing it to boost their career—and at that point, the most relevant thing is your recent job and your professional track record,” she says.

Get into the weeds, too, about your accomplishments. “Don’t just reiterate your job responsibilities,” says Grayson. “Communicate the results of your efforts. Quantifying the results is much more significant and meaningful—describe the impact,” she says.

Hobbies, interests, and more

As for the more personal portion? “One of the main things that’s different from a job resume is that they want you to share some of your hobbies and interests,” Lolis says. “Be very specific,” adds Grayson, “because 90% of people will list ‘travel’ as a hobby. “But that’s not interesting—maybe something like ‘slow traveling to find the best street food.’ That’s interesting.” This, she says, can help spark a conversation, or help your resume stand out from the pile.

In addition to specific hobbies or interests, you might include, add volunteer or community work as well, and perhaps relevant technical or language skills. Again, this may help tip the scales in your favor by showing you have specific know-how related to a given industry or task. Any applicable awards you’ve earned may be good to include, too, as they showcase that you’re capable of excelling in a given area.

Should you customize your resume for each business school?

Experts generally don’t recommend changing up your MBA resume when applying to different schools. Instead, look for specific instructions relayed by the school, if there are any, and make any needed changes accordingly. So, unless you have a really compelling reason, you can probably use the same resume for a number of applications.

Also, don’t go overboard in terms of design to make your resume stand out. “Just stick to traditional formatting,” says Lolis, since that’s what most admissions teams are used to seeing, and are generally looking for. Let the contents of the resume speak for you—not the design.

Where to go if you need help

For many prospective MBA students, piecing together a resume shouldn’t be terribly difficult, given that it’s mostly the same process as writing a traditional resume. However, if you need help, you can reach out to consultants, or even check out some of the resources schools make available to help you along the process.

- Consultants : There are many MBA consultancies out there, including the firms that Lolis and Grayson founded. They can help create, review, and critique an MBA resume and get it into shape.

- Examples and templates : Some schools even make templates available , and example resumes to help students create their own.

The takeaway

In all, you should write an MBA resume in the same way you’d write a traditional resume, with some slight variations. The resume should focus on your professional background and previous education, while also detailing some of your personal interests, too. Stick to classic resume formatting as well, and keep it to one page, if possible.