- Privacy Policy

Home » Survey Research – Types, Methods, Examples

Survey Research – Types, Methods, Examples

Table of Contents

Survey Research

Definition:

Survey Research is a quantitative research method that involves collecting standardized data from a sample of individuals or groups through the use of structured questionnaires or interviews. The data collected is then analyzed statistically to identify patterns and relationships between variables, and to draw conclusions about the population being studied.

Survey research can be used to answer a variety of questions, including:

- What are people’s opinions about a certain topic?

- What are people’s experiences with a certain product or service?

- What are people’s beliefs about a certain issue?

Survey Research Methods

Survey Research Methods are as follows:

- Telephone surveys: A survey research method where questions are administered to respondents over the phone, often used in market research or political polling.

- Face-to-face surveys: A survey research method where questions are administered to respondents in person, often used in social or health research.

- Mail surveys: A survey research method where questionnaires are sent to respondents through mail, often used in customer satisfaction or opinion surveys.

- Online surveys: A survey research method where questions are administered to respondents through online platforms, often used in market research or customer feedback.

- Email surveys: A survey research method where questionnaires are sent to respondents through email, often used in customer satisfaction or opinion surveys.

- Mixed-mode surveys: A survey research method that combines two or more survey modes, often used to increase response rates or reach diverse populations.

- Computer-assisted surveys: A survey research method that uses computer technology to administer or collect survey data, often used in large-scale surveys or data collection.

- Interactive voice response surveys: A survey research method where respondents answer questions through a touch-tone telephone system, often used in automated customer satisfaction or opinion surveys.

- Mobile surveys: A survey research method where questions are administered to respondents through mobile devices, often used in market research or customer feedback.

- Group-administered surveys: A survey research method where questions are administered to a group of respondents simultaneously, often used in education or training evaluation.

- Web-intercept surveys: A survey research method where questions are administered to website visitors, often used in website or user experience research.

- In-app surveys: A survey research method where questions are administered to users of a mobile application, often used in mobile app or user experience research.

- Social media surveys: A survey research method where questions are administered to respondents through social media platforms, often used in social media or brand awareness research.

- SMS surveys: A survey research method where questions are administered to respondents through text messaging, often used in customer feedback or opinion surveys.

- IVR surveys: A survey research method where questions are administered to respondents through an interactive voice response system, often used in automated customer feedback or opinion surveys.

- Mixed-method surveys: A survey research method that combines both qualitative and quantitative data collection methods, often used in exploratory or mixed-method research.

- Drop-off surveys: A survey research method where respondents are provided with a survey questionnaire and asked to return it at a later time or through a designated drop-off location.

- Intercept surveys: A survey research method where respondents are approached in public places and asked to participate in a survey, often used in market research or customer feedback.

- Hybrid surveys: A survey research method that combines two or more survey modes, data sources, or research methods, often used in complex or multi-dimensional research questions.

Types of Survey Research

There are several types of survey research that can be used to collect data from a sample of individuals or groups. following are Types of Survey Research:

- Cross-sectional survey: A type of survey research that gathers data from a sample of individuals at a specific point in time, providing a snapshot of the population being studied.

- Longitudinal survey: A type of survey research that gathers data from the same sample of individuals over an extended period of time, allowing researchers to track changes or trends in the population being studied.

- Panel survey: A type of longitudinal survey research that tracks the same sample of individuals over time, typically collecting data at multiple points in time.

- Epidemiological survey: A type of survey research that studies the distribution and determinants of health and disease in a population, often used to identify risk factors and inform public health interventions.

- Observational survey: A type of survey research that collects data through direct observation of individuals or groups, often used in behavioral or social research.

- Correlational survey: A type of survey research that measures the degree of association or relationship between two or more variables, often used to identify patterns or trends in data.

- Experimental survey: A type of survey research that involves manipulating one or more variables to observe the effect on an outcome, often used to test causal hypotheses.

- Descriptive survey: A type of survey research that describes the characteristics or attributes of a population or phenomenon, often used in exploratory research or to summarize existing data.

- Diagnostic survey: A type of survey research that assesses the current state or condition of an individual or system, often used in health or organizational research.

- Explanatory survey: A type of survey research that seeks to explain or understand the causes or mechanisms behind a phenomenon, often used in social or psychological research.

- Process evaluation survey: A type of survey research that measures the implementation and outcomes of a program or intervention, often used in program evaluation or quality improvement.

- Impact evaluation survey: A type of survey research that assesses the effectiveness or impact of a program or intervention, often used to inform policy or decision-making.

- Customer satisfaction survey: A type of survey research that measures the satisfaction or dissatisfaction of customers with a product, service, or experience, often used in marketing or customer service research.

- Market research survey: A type of survey research that collects data on consumer preferences, behaviors, or attitudes, often used in market research or product development.

- Public opinion survey: A type of survey research that measures the attitudes, beliefs, or opinions of a population on a specific issue or topic, often used in political or social research.

- Behavioral survey: A type of survey research that measures actual behavior or actions of individuals, often used in health or social research.

- Attitude survey: A type of survey research that measures the attitudes, beliefs, or opinions of individuals, often used in social or psychological research.

- Opinion poll: A type of survey research that measures the opinions or preferences of a population on a specific issue or topic, often used in political or media research.

- Ad hoc survey: A type of survey research that is conducted for a specific purpose or research question, often used in exploratory research or to answer a specific research question.

Types Based on Methodology

Based on Methodology Survey are divided into two Types:

Quantitative Survey Research

Qualitative survey research.

Quantitative survey research is a method of collecting numerical data from a sample of participants through the use of standardized surveys or questionnaires. The purpose of quantitative survey research is to gather empirical evidence that can be analyzed statistically to draw conclusions about a particular population or phenomenon.

In quantitative survey research, the questions are structured and pre-determined, often utilizing closed-ended questions, where participants are given a limited set of response options to choose from. This approach allows for efficient data collection and analysis, as well as the ability to generalize the findings to a larger population.

Quantitative survey research is often used in market research, social sciences, public health, and other fields where numerical data is needed to make informed decisions and recommendations.

Qualitative survey research is a method of collecting non-numerical data from a sample of participants through the use of open-ended questions or semi-structured interviews. The purpose of qualitative survey research is to gain a deeper understanding of the experiences, perceptions, and attitudes of participants towards a particular phenomenon or topic.

In qualitative survey research, the questions are open-ended, allowing participants to share their thoughts and experiences in their own words. This approach allows for a rich and nuanced understanding of the topic being studied, and can provide insights that are difficult to capture through quantitative methods alone.

Qualitative survey research is often used in social sciences, education, psychology, and other fields where a deeper understanding of human experiences and perceptions is needed to inform policy, practice, or theory.

Data Analysis Methods

There are several Survey Research Data Analysis Methods that researchers may use, including:

- Descriptive statistics: This method is used to summarize and describe the basic features of the survey data, such as the mean, median, mode, and standard deviation. These statistics can help researchers understand the distribution of responses and identify any trends or patterns.

- Inferential statistics: This method is used to make inferences about the larger population based on the data collected in the survey. Common inferential statistical methods include hypothesis testing, regression analysis, and correlation analysis.

- Factor analysis: This method is used to identify underlying factors or dimensions in the survey data. This can help researchers simplify the data and identify patterns and relationships that may not be immediately apparent.

- Cluster analysis: This method is used to group similar respondents together based on their survey responses. This can help researchers identify subgroups within the larger population and understand how different groups may differ in their attitudes, behaviors, or preferences.

- Structural equation modeling: This method is used to test complex relationships between variables in the survey data. It can help researchers understand how different variables may be related to one another and how they may influence one another.

- Content analysis: This method is used to analyze open-ended responses in the survey data. Researchers may use software to identify themes or categories in the responses, or they may manually review and code the responses.

- Text mining: This method is used to analyze text-based survey data, such as responses to open-ended questions. Researchers may use software to identify patterns and themes in the text, or they may manually review and code the text.

Applications of Survey Research

Here are some common applications of survey research:

- Market Research: Companies use survey research to gather insights about customer needs, preferences, and behavior. These insights are used to create marketing strategies and develop new products.

- Public Opinion Research: Governments and political parties use survey research to understand public opinion on various issues. This information is used to develop policies and make decisions.

- Social Research: Survey research is used in social research to study social trends, attitudes, and behavior. Researchers use survey data to explore topics such as education, health, and social inequality.

- Academic Research: Survey research is used in academic research to study various phenomena. Researchers use survey data to test theories, explore relationships between variables, and draw conclusions.

- Customer Satisfaction Research: Companies use survey research to gather information about customer satisfaction with their products and services. This information is used to improve customer experience and retention.

- Employee Surveys: Employers use survey research to gather feedback from employees about their job satisfaction, working conditions, and organizational culture. This information is used to improve employee retention and productivity.

- Health Research: Survey research is used in health research to study topics such as disease prevalence, health behaviors, and healthcare access. Researchers use survey data to develop interventions and improve healthcare outcomes.

Examples of Survey Research

Here are some real-time examples of survey research:

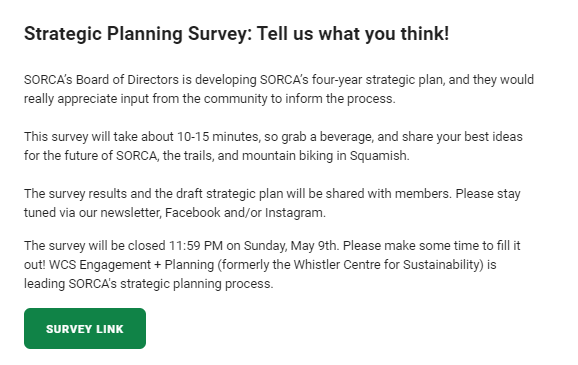

- COVID-19 Pandemic Surveys: Since the outbreak of the COVID-19 pandemic, surveys have been conducted to gather information about public attitudes, behaviors, and perceptions related to the pandemic. Governments and healthcare organizations have used this data to develop public health strategies and messaging.

- Political Polls During Elections: During election seasons, surveys are used to measure public opinion on political candidates, policies, and issues in real-time. This information is used by political parties to develop campaign strategies and make decisions.

- Customer Feedback Surveys: Companies often use real-time customer feedback surveys to gather insights about customer experience and satisfaction. This information is used to improve products and services quickly.

- Event Surveys: Organizers of events such as conferences and trade shows often use surveys to gather feedback from attendees in real-time. This information can be used to improve future events and make adjustments during the current event.

- Website and App Surveys: Website and app owners use surveys to gather real-time feedback from users about the functionality, user experience, and overall satisfaction with their platforms. This feedback can be used to improve the user experience and retain customers.

- Employee Pulse Surveys: Employers use real-time pulse surveys to gather feedback from employees about their work experience and overall job satisfaction. This feedback is used to make changes in real-time to improve employee retention and productivity.

Survey Sample

Purpose of survey research.

The purpose of survey research is to gather data and insights from a representative sample of individuals. Survey research allows researchers to collect data quickly and efficiently from a large number of people, making it a valuable tool for understanding attitudes, behaviors, and preferences.

Here are some common purposes of survey research:

- Descriptive Research: Survey research is often used to describe characteristics of a population or a phenomenon. For example, a survey could be used to describe the characteristics of a particular demographic group, such as age, gender, or income.

- Exploratory Research: Survey research can be used to explore new topics or areas of research. Exploratory surveys are often used to generate hypotheses or identify potential relationships between variables.

- Explanatory Research: Survey research can be used to explain relationships between variables. For example, a survey could be used to determine whether there is a relationship between educational attainment and income.

- Evaluation Research: Survey research can be used to evaluate the effectiveness of a program or intervention. For example, a survey could be used to evaluate the impact of a health education program on behavior change.

- Monitoring Research: Survey research can be used to monitor trends or changes over time. For example, a survey could be used to monitor changes in attitudes towards climate change or political candidates over time.

When to use Survey Research

there are certain circumstances where survey research is particularly appropriate. Here are some situations where survey research may be useful:

- When the research question involves attitudes, beliefs, or opinions: Survey research is particularly useful for understanding attitudes, beliefs, and opinions on a particular topic. For example, a survey could be used to understand public opinion on a political issue.

- When the research question involves behaviors or experiences: Survey research can also be useful for understanding behaviors and experiences. For example, a survey could be used to understand the prevalence of a particular health behavior.

- When a large sample size is needed: Survey research allows researchers to collect data from a large number of people quickly and efficiently. This makes it a useful method when a large sample size is needed to ensure statistical validity.

- When the research question is time-sensitive: Survey research can be conducted quickly, which makes it a useful method when the research question is time-sensitive. For example, a survey could be used to understand public opinion on a breaking news story.

- When the research question involves a geographically dispersed population: Survey research can be conducted online, which makes it a useful method when the population of interest is geographically dispersed.

How to Conduct Survey Research

Conducting survey research involves several steps that need to be carefully planned and executed. Here is a general overview of the process:

- Define the research question: The first step in conducting survey research is to clearly define the research question. The research question should be specific, measurable, and relevant to the population of interest.

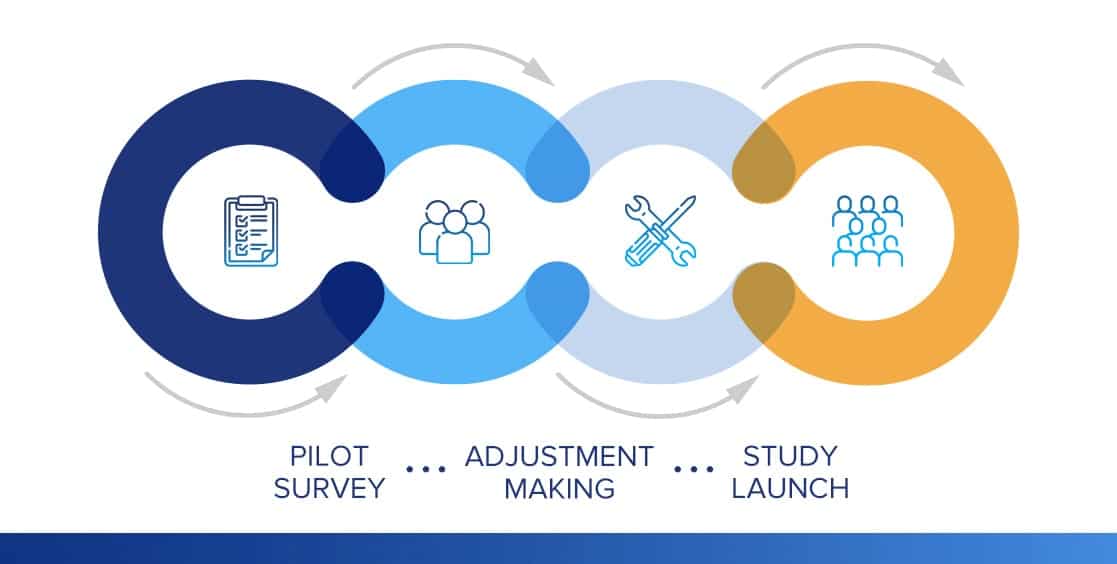

- Develop a survey instrument : The next step is to develop a survey instrument. This can be done using various methods, such as online survey tools or paper surveys. The survey instrument should be designed to elicit the information needed to answer the research question, and should be pre-tested with a small sample of individuals.

- Select a sample : The sample is the group of individuals who will be invited to participate in the survey. The sample should be representative of the population of interest, and the size of the sample should be sufficient to ensure statistical validity.

- Administer the survey: The survey can be administered in various ways, such as online, by mail, or in person. The method of administration should be chosen based on the population of interest and the research question.

- Analyze the data: Once the survey data is collected, it needs to be analyzed. This involves summarizing the data using statistical methods, such as frequency distributions or regression analysis.

- Draw conclusions: The final step is to draw conclusions based on the data analysis. This involves interpreting the results and answering the research question.

Advantages of Survey Research

There are several advantages to using survey research, including:

- Efficient data collection: Survey research allows researchers to collect data quickly and efficiently from a large number of people. This makes it a useful method for gathering information on a wide range of topics.

- Standardized data collection: Surveys are typically standardized, which means that all participants receive the same questions in the same order. This ensures that the data collected is consistent and reliable.

- Cost-effective: Surveys can be conducted online, by mail, or in person, which makes them a cost-effective method of data collection.

- Anonymity: Participants can remain anonymous when responding to a survey. This can encourage participants to be more honest and open in their responses.

- Easy comparison: Surveys allow for easy comparison of data between different groups or over time. This makes it possible to identify trends and patterns in the data.

- Versatility: Surveys can be used to collect data on a wide range of topics, including attitudes, beliefs, behaviors, and preferences.

Limitations of Survey Research

Here are some of the main limitations of survey research:

- Limited depth: Surveys are typically designed to collect quantitative data, which means that they do not provide much depth or detail about people’s experiences or opinions. This can limit the insights that can be gained from the data.

- Potential for bias: Surveys can be affected by various biases, including selection bias, response bias, and social desirability bias. These biases can distort the results and make them less accurate.

- L imited validity: Surveys are only as valid as the questions they ask. If the questions are poorly designed or ambiguous, the results may not accurately reflect the respondents’ attitudes or behaviors.

- Limited generalizability : Survey results are only generalizable to the population from which the sample was drawn. If the sample is not representative of the population, the results may not be generalizable to the larger population.

- Limited ability to capture context: Surveys typically do not capture the context in which attitudes or behaviors occur. This can make it difficult to understand the reasons behind the responses.

- Limited ability to capture complex phenomena: Surveys are not well-suited to capture complex phenomena, such as emotions or the dynamics of interpersonal relationships.

Following is an example of a Survey Sample:

Welcome to our Survey Research Page! We value your opinions and appreciate your participation in this survey. Please answer the questions below as honestly and thoroughly as possible.

1. What is your age?

- A) Under 18

- G) 65 or older

2. What is your highest level of education completed?

- A) Less than high school

- B) High school or equivalent

- C) Some college or technical school

- D) Bachelor’s degree

- E) Graduate or professional degree

3. What is your current employment status?

- A) Employed full-time

- B) Employed part-time

- C) Self-employed

- D) Unemployed

4. How often do you use the internet per day?

- A) Less than 1 hour

- B) 1-3 hours

- C) 3-5 hours

- D) 5-7 hours

- E) More than 7 hours

5. How often do you engage in social media per day?

6. Have you ever participated in a survey research study before?

7. If you have participated in a survey research study before, how was your experience?

- A) Excellent

- E) Very poor

8. What are some of the topics that you would be interested in participating in a survey research study about?

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

9. How often would you be willing to participate in survey research studies?

- A) Once a week

- B) Once a month

- C) Once every 6 months

- D) Once a year

10. Any additional comments or suggestions?

Thank you for taking the time to complete this survey. Your feedback is important to us and will help us improve our survey research efforts.

About the author

Muhammad Hassan

Researcher, Academic Writer, Web developer

You may also like

Questionnaire – Definition, Types, and Examples

Case Study – Methods, Examples and Guide

Observational Research – Methods and Guide

Quantitative Research – Methods, Types and...

Qualitative Research Methods

Explanatory Research – Types, Methods, Guide

Have a language expert improve your writing

Run a free plagiarism check in 10 minutes, automatically generate references for free.

- Knowledge Base

- Methodology

- Doing Survey Research | A Step-by-Step Guide & Examples

Doing Survey Research | A Step-by-Step Guide & Examples

Published on 6 May 2022 by Shona McCombes . Revised on 10 October 2022.

Survey research means collecting information about a group of people by asking them questions and analysing the results. To conduct an effective survey, follow these six steps:

- Determine who will participate in the survey

- Decide the type of survey (mail, online, or in-person)

- Design the survey questions and layout

- Distribute the survey

- Analyse the responses

- Write up the results

Surveys are a flexible method of data collection that can be used in many different types of research .

Table of contents

What are surveys used for, step 1: define the population and sample, step 2: decide on the type of survey, step 3: design the survey questions, step 4: distribute the survey and collect responses, step 5: analyse the survey results, step 6: write up the survey results, frequently asked questions about surveys.

Surveys are used as a method of gathering data in many different fields. They are a good choice when you want to find out about the characteristics, preferences, opinions, or beliefs of a group of people.

Common uses of survey research include:

- Social research: Investigating the experiences and characteristics of different social groups

- Market research: Finding out what customers think about products, services, and companies

- Health research: Collecting data from patients about symptoms and treatments

- Politics: Measuring public opinion about parties and policies

- Psychology: Researching personality traits, preferences, and behaviours

Surveys can be used in both cross-sectional studies , where you collect data just once, and longitudinal studies , where you survey the same sample several times over an extended period.

Prevent plagiarism, run a free check.

Before you start conducting survey research, you should already have a clear research question that defines what you want to find out. Based on this question, you need to determine exactly who you will target to participate in the survey.

Populations

The target population is the specific group of people that you want to find out about. This group can be very broad or relatively narrow. For example:

- The population of Brazil

- University students in the UK

- Second-generation immigrants in the Netherlands

- Customers of a specific company aged 18 to 24

- British transgender women over the age of 50

Your survey should aim to produce results that can be generalised to the whole population. That means you need to carefully define exactly who you want to draw conclusions about.

It’s rarely possible to survey the entire population of your research – it would be very difficult to get a response from every person in Brazil or every university student in the UK. Instead, you will usually survey a sample from the population.

The sample size depends on how big the population is. You can use an online sample calculator to work out how many responses you need.

There are many sampling methods that allow you to generalise to broad populations. In general, though, the sample should aim to be representative of the population as a whole. The larger and more representative your sample, the more valid your conclusions.

There are two main types of survey:

- A questionnaire , where a list of questions is distributed by post, online, or in person, and respondents fill it out themselves

- An interview , where the researcher asks a set of questions by phone or in person and records the responses

Which type you choose depends on the sample size and location, as well as the focus of the research.

Questionnaires

Sending out a paper survey by post is a common method of gathering demographic information (for example, in a government census of the population).

- You can easily access a large sample.

- You have some control over who is included in the sample (e.g., residents of a specific region).

- The response rate is often low.

Online surveys are a popular choice for students doing dissertation research , due to the low cost and flexibility of this method. There are many online tools available for constructing surveys, such as SurveyMonkey and Google Forms .

- You can quickly access a large sample without constraints on time or location.

- The data is easy to process and analyse.

- The anonymity and accessibility of online surveys mean you have less control over who responds.

If your research focuses on a specific location, you can distribute a written questionnaire to be completed by respondents on the spot. For example, you could approach the customers of a shopping centre or ask all students to complete a questionnaire at the end of a class.

- You can screen respondents to make sure only people in the target population are included in the sample.

- You can collect time- and location-specific data (e.g., the opinions of a shop’s weekday customers).

- The sample size will be smaller, so this method is less suitable for collecting data on broad populations.

Oral interviews are a useful method for smaller sample sizes. They allow you to gather more in-depth information on people’s opinions and preferences. You can conduct interviews by phone or in person.

- You have personal contact with respondents, so you know exactly who will be included in the sample in advance.

- You can clarify questions and ask for follow-up information when necessary.

- The lack of anonymity may cause respondents to answer less honestly, and there is more risk of researcher bias.

Like questionnaires, interviews can be used to collect quantitative data : the researcher records each response as a category or rating and statistically analyses the results. But they are more commonly used to collect qualitative data : the interviewees’ full responses are transcribed and analysed individually to gain a richer understanding of their opinions and feelings.

Next, you need to decide which questions you will ask and how you will ask them. It’s important to consider:

- The type of questions

- The content of the questions

- The phrasing of the questions

- The ordering and layout of the survey

Open-ended vs closed-ended questions

There are two main forms of survey questions: open-ended and closed-ended. Many surveys use a combination of both.

Closed-ended questions give the respondent a predetermined set of answers to choose from. A closed-ended question can include:

- A binary answer (e.g., yes/no or agree/disagree )

- A scale (e.g., a Likert scale with five points ranging from strongly agree to strongly disagree )

- A list of options with a single answer possible (e.g., age categories)

- A list of options with multiple answers possible (e.g., leisure interests)

Closed-ended questions are best for quantitative research . They provide you with numerical data that can be statistically analysed to find patterns, trends, and correlations .

Open-ended questions are best for qualitative research. This type of question has no predetermined answers to choose from. Instead, the respondent answers in their own words.

Open questions are most common in interviews, but you can also use them in questionnaires. They are often useful as follow-up questions to ask for more detailed explanations of responses to the closed questions.

The content of the survey questions

To ensure the validity and reliability of your results, you need to carefully consider each question in the survey. All questions should be narrowly focused with enough context for the respondent to answer accurately. Avoid questions that are not directly relevant to the survey’s purpose.

When constructing closed-ended questions, ensure that the options cover all possibilities. If you include a list of options that isn’t exhaustive, you can add an ‘other’ field.

Phrasing the survey questions

In terms of language, the survey questions should be as clear and precise as possible. Tailor the questions to your target population, keeping in mind their level of knowledge of the topic.

Use language that respondents will easily understand, and avoid words with vague or ambiguous meanings. Make sure your questions are phrased neutrally, with no bias towards one answer or another.

Ordering the survey questions

The questions should be arranged in a logical order. Start with easy, non-sensitive, closed-ended questions that will encourage the respondent to continue.

If the survey covers several different topics or themes, group together related questions. You can divide a questionnaire into sections to help respondents understand what is being asked in each part.

If a question refers back to or depends on the answer to a previous question, they should be placed directly next to one another.

Before you start, create a clear plan for where, when, how, and with whom you will conduct the survey. Determine in advance how many responses you require and how you will gain access to the sample.

When you are satisfied that you have created a strong research design suitable for answering your research questions, you can conduct the survey through your method of choice – by post, online, or in person.

There are many methods of analysing the results of your survey. First you have to process the data, usually with the help of a computer program to sort all the responses. You should also cleanse the data by removing incomplete or incorrectly completed responses.

If you asked open-ended questions, you will have to code the responses by assigning labels to each response and organising them into categories or themes. You can also use more qualitative methods, such as thematic analysis , which is especially suitable for analysing interviews.

Statistical analysis is usually conducted using programs like SPSS or Stata. The same set of survey data can be subject to many analyses.

Finally, when you have collected and analysed all the necessary data, you will write it up as part of your thesis, dissertation , or research paper .

In the methodology section, you describe exactly how you conducted the survey. You should explain the types of questions you used, the sampling method, when and where the survey took place, and the response rate. You can include the full questionnaire as an appendix and refer to it in the text if relevant.

Then introduce the analysis by describing how you prepared the data and the statistical methods you used to analyse it. In the results section, you summarise the key results from your analysis.

A Likert scale is a rating scale that quantitatively assesses opinions, attitudes, or behaviours. It is made up of four or more questions that measure a single attitude or trait when response scores are combined.

To use a Likert scale in a survey , you present participants with Likert-type questions or statements, and a continuum of items, usually with five or seven possible responses, to capture their degree of agreement.

Individual Likert-type questions are generally considered ordinal data , because the items have clear rank order, but don’t have an even distribution.

Overall Likert scale scores are sometimes treated as interval data. These scores are considered to have directionality and even spacing between them.

The type of data determines what statistical tests you should use to analyse your data.

A questionnaire is a data collection tool or instrument, while a survey is an overarching research method that involves collecting and analysing data from people using questionnaires.

Cite this Scribbr article

If you want to cite this source, you can copy and paste the citation or click the ‘Cite this Scribbr article’ button to automatically add the citation to our free Reference Generator.

McCombes, S. (2022, October 10). Doing Survey Research | A Step-by-Step Guide & Examples. Scribbr. Retrieved 29 April 2024, from https://www.scribbr.co.uk/research-methods/surveys/

Is this article helpful?

Shona McCombes

Other students also liked, qualitative vs quantitative research | examples & methods, construct validity | definition, types, & examples, what is a likert scale | guide & examples.

Table of Contents

Ai, ethics & human agency, collaboration, information literacy, writing process, survey research, develop knowledge that is otherwise unavailable by developing an effective survey..

Surveys are a series of questions, which are usually presented in questionnaire format. Surveys can be distributed face-to-face, over the phone, or over the Internet.

Developing, Designing, and Distributing Surveys

Surveys are usually developed to obtain information that is otherwise unavailable. For example, suppose you feel that nationwide statistics on college-age drinking or cheating fail to adequately represent life on your campus. You could then develop a survey to demonstrate (or not demonstrate) your point of view.

Note: This section presents detailed instructions for developing, designing, and distributing surveys. Because English teachers are primarily concerned with how your survey is written, they may encourage you not to worry about some of the design issues addressed below, such as census, random, and stratified census sampling procedures

Determine your survey design by creating questions with your purpose and audience in mind.

To develop a credible survey, you must first organize a systematic approach to your study. This involves insuring your study sample actually represents the population of interest. For example, if you were conducting a survey of whether or not college students ever plagiarized or cheated on a test, you would not want to submit your survey to teachers or parents; you would want to hear from college students. A well-designed survey will reduce the chances of this type of misuse of the data.

Ask the Right Questions

Surveys most commonly take the form of a questionnaire. However, a questionnaire is not just a collection of questions, it is a set of questions focused on a particular objective or set of objectives. Defining objectives simply demonstrates you know what you are doing before you do it. If you have selected a topic like “The education of the 20-year-old,” you would most likely need to narrow the topic before designing your survey. One way to narrow the topic is to consider the when question. When does the education of the 20-year-old interest us? It could be cave people, residents of Europe during the plagues, or some time in the 20th century. Take your choice, but the application of a single survey to cover all the periods of time is highly unlikely.

Limit the Survey

Limit your focus by restricting a geographical region. You may want to survey 20-year-olds who live within 1,000 miles of the North Pole, or only those who live in Palaski County, Missouri. By establishing a geographical target population you can expect reasonable closure. If you wanted to interview all the subjects in your original category (the education of 20-year-olds), you may never get around to writing your report. Another factor that influences your survey is the extent to which you want to examine your population. Do you want to look at all the 20-year-old-students or can you focus on a specific subgroup (such as 20-year-old-students in trade schools or 2-year vs. 4-year colleges or, perhaps, the 20-year-old-students who are self-directed learners attending no formal institution)? What do you want to know about these people anyway? Are you interested in how they learn, why they learn, what they learn or perhaps, how much they spend?

Define Objectives

Ask yourself: What am I going to do with the information once it is revealed? You may plan to simply report your findings, make comparisons with other information or take the results of your survey to support or reject a whole new social theory. All these considerations should be met before beginning your survey research. A well-defined set of objectives eases the burden on the researcher.

Create a Survey Instrument

Learn to write effective survey questions..

After defining the population, surveyors need to create an instrument if a proven survey instrument does not exist. As discussed in more detail below, survey creation parallels the computer axiom “GIGO”–Garbage In—Garbage Out. A well-designed, accurate survey is an excellent way for researchers to gather information or data about a particular subject of interest. When prepared in an unprofessional manner, surveys can also become an inaccurate, misused, misunderstood conveyer of misinformation. If a researcher has developed an idea or hypothesis and seeks information only to prove that the idea is correct, the process, the ethics, the motivation, and the very essence of the researcher are worthy of rigorous challenge and should, most likely, be rejected.

Writing Survey Questions

A survey is more than a list of questions. Not only should each question relate to a specific part of your objectives, but each question should be written in a concise and precise manner, and the survey population must be able to understand what is being asked.

There are four common question formats, as discussed in detail below.

Demographic Questions

Demographic questions attempt to identify the characteristics of the population or sample completing the survey.

Your English instructors do not expect you to generalize from a small sample to a larger population, so your sample does not need to reflect characteristics in the overall population. However, you will need to talk meaningfully about your sample, so you will want to describe the characteristics of your respondents as specifically as possible. The kinds of characteristics you should identify are determined largely by the purpose of your research. Gender, income, age, and level of education are examples of the sort of demographic characteristics that you may want to account for in your survey.

Demographic Example:

Circle One : Male or Female?

Closed Questions

With the closed question, the survey provides responses and the subject selects the one that is most appropriate. When constructing closed questions, you need to provide choices that will allow you to make meaningful interpretations.

Closed questions allow the researcher to deal with the responses in a more efficient manner than open ended questions. Both forms of questions can produce similar information.

Closed Question Example:

How often do you study?

a. less than 6 hours a week

b. 6-10 hours a week

b. 11-15 hours a week

c. more than 15 hours a week

The closed question allows for greater uniformity of response, and the categories can be easily matched to the areas of interest by the researcher. Whether you select one type or a combination of questions for your survey, each question must be clear, unambiguous, and relate to a specific item in your objectives.

A common error is to create a double-barreled question such as, “Do you walk to school or carry your lunch?” Clearly, this question is attempting to ask two different things and a simple yes or no response won’t really answer the question. The original question should be rewritten as two questions: “Do you walk to school?” “Do you carry your lunch?” Now the respondent can provide you useful data.

Rank-Ordered Questions

When your library research has informed you that your audience is likely to be concerned about several issues, you can determine which concern is most troubling by asking a rank-ordered question. Essentially, as illustrated by the following example, the rank-order question presents respondents with several alternatives and requests that they rank them according to priority:

Rank-Ordered Question:

Please rank your five most important reasons for not contributing to our company’s blood drives. Put a #1 by your most important concern, a #2 by your second most important concern, and so forth.

_____ Lack of time _____ Lack of awareness of former blood drives _____ Perception that the blood bank has plenty of blood _____ Concern about possible pain _____ Concern about infection _____ Concern about fainting _____ Concern about vomiting _____ Concern about bruising _____ Concern about being infected with AIDS _____ Belief company should provide some compensation

Open Questions

An open question requires respondents to answer in their own words, like a short-answer or essay type response. Open questions allow for free-flowing responses and are less restrictive than the closed questions. If you are going to use an open-ended question format for mailed surveys, don’t expect a high response rate. People seem more inclined to circle or mark a response than to write a lengthy response.

Open Question Example:

(Ans)_________________________________

Because open-ended commentaries can enrich your interpretation of the statistics, you would be wise to include a few such questions in all surveys that you conduct. One generic question that you might find useful is “What important item(s) has/have been left out of this survey?” However, because they are difficult to tabulate and because they require time on the part of your respondents, be sure to limit the number of open-ended questions you ask.

How Many Questions?

Of course, when you are freewriting possible questions, you should attempt to generate as many questions as possible. You might also ask friends and colleagues what questions they would ask if pursuing your topic. Consider using questions that other researchers have asked, and base additional questions on the sources you have consulted to develop an informed survey. Ultimately, however, you will need to limit the questions so that you have a better chance of getting the surveys back. Before submitting your survey to your targeted sample, ask a few people to take it and time how long it takes them to complete it. Many people are willing to give 15 minutes to a survey, yet find a survey that takes more than 30 minutes intolerable.

Formatting Guidelines

Your questionnaire should be prepared so that someone will read it and respond. Try to make this process as easy as possible for the respondent. Make the questionnaire look like a questionnaire. Have it neatly organized, with questions in a logical sequence, numbering each question and page. If you mix open-and closed-ended questions, put the open-ended questions at the end of the questionnaire. An open-ended response is more threatening than a “select a, b, c, or d” response. Keep your questionnaire focused and as short as possible. Each page added reduces the number of potential respondents who will complete the survey.

Sample the Population

Understand the basics of census and random sampling techniques..

A critical step in survey research involves sampling the population. Now that you have narrowed your objectives to something achievable, who are you going to sample? For many, this is a rather simple step: Ask the people who are able to answer your questions! If you want to learn about the educational perceptions of 20-year-olds, ask them. If you want to learn about the parental perceptions of the education of 20-year-olds, ask the parents.

Since data collection involving humans can raise legal, ethical, and moral issues, if you chose to survey the 20-year-olds on a particular college campus, find out what procedures are required before distributing your questionnaire or conducting interviews (see Informed Consent).

- Surveys and questionnaires may be presented:

- In paper format.

- Over the phone.

- Face to face.

- Online, perhaps with results viewable in real time.

Census Sample

A researcher may elect to include all the subjects within the population of interest, otherwise known as a census sample. If one is investigating a particular group of people, such as students enrolled in Composition 1 at 8:00 on Monday morning at a particular university, one would survey all the members of the class. The investigation of all the class members is referred to as a census sample.

Random Sample

If you are seeking information about a statewide issue, you would not attempt to interview everyone in the state. Information is still available if you use a technique that allows a sample from the population of interest to represent the population as a whole. A common technique is to employ the random sample. Random sampling implies that each member of the population has an equal chance of being selected in the sample from the population. As a general rule, the higher the sample size the higher the representativeness. The more representativeness you have in the sample, the more it tends to “look like” the population you are studying. Further study in sampling techniques will show how sample size can be determined to afford the researcher a particular level of confidence in the research outcomes.

Random Sample Techniques

Simple random samples may be made using a variety of techniques. One of the most common techniques is the use of a random number table (see Table 1). If you wanted to select 15 people from a classroom of 60 students, begin by obtaining a class roster of all the students. Assign each student a number from 1 – 60. Now we can use the table. Select a row and column. Any row/ column can serve as a starting point. For instance, if you select row 5, column 7 as your starting point, look at the first two digits (34). This number falls within your population range (1 – 60) and therefore can be used as the first of your required 15 people to be selected. Continue down the column. The next number is 68, but that is outside your range, so you should simply skip it and go to the next number, which is 47. When column 7 is exhausted, go to columns 8, 9, and 10 and if you haven’t accomplished your sample of 15, go to column 1 and continue. Note that column 9, rows 2 and 4 repeat the number 60. Since you have selected 60 the first time, simply skip the second and subsequent times. Using this technique, the 15 people from your class size of 60 are represented by numbers 34, 47, 32, 29, 33, 08, 25, 05, 41, 60, 03, 38, 16, 15, and 28. You have just accomplished a simple random sample. As with many things, once you become familiar with the technique, it is often easier to accomplish than to explain.

Table 1—TABLE OF RANDOM NUMBERS

Stratified-Random Sample

Another method of random sampling is called a stratified-random sample . For instance, one may look at the national census for a particular city or state. By applying percentages of age, ethnicity, or gender within the survey design, the researcher is able to gain representativeness within the survey. If the population of a city under study has a population that is 10% Afro-American, 10% Hispanic, 70% Caucasian, and 10% of other ethnic origins, then the researcher would insure the sample of the population contained 10% Afro-American, 10% Hispanic, and so on. The key to random-stratified sampling is to place the population into various categories, called strata, such as age, gender, ethnicity, income, etc. Then select individuals at random from each category. This technique can be used to identify a highly representative sample using a smaller sample size than a purely random sample.

Transmit the Survey

For the mailed survey there are several tactics you can employ to increase the response rate. Write a letter of transmittal stating the purpose and importance of the study, the reason why the individual was selected to participate, insurance of confidentiality, and an offer of thanks for the individual’s participation. If a separate letter is not appropriate, then consider a survey coversheet that contains similar information. Another technique is to send out a mailing informing intended participants that a questionnaire is forthcoming. Advance notification informing individuals they have been selected for your survey may also spark supportive interest.

Sending the Survey and Following Up

Always pick a date for respondents to reply, and be sure that date is at least a few weeks after the survey is mailed. Otherwise you’ll spend most of your time waiting for a response that will never come. About two weeks after your initial mailing, send a follow-up letter. In the letter thank those who have responded and indicate the necessity of obtaining outstanding surveys. Sometimes a statement like “If you have lost the original survey, please contact (researcher’s name, address, phone/fax number) and a new survey will be sent immediately” may also be helpful.

How many follow-ups are required?

That number is up to the researcher. If you can complete your research with a 20% response rate and your sample represents the population from which it is drawn, then don’t follow up. Do be prepared to explain in your report why you stopped. Some researchers will attempt as many as three times to gain subject participation. Given that you have had a particular number of responses now, ask yourself, “Would my results be different if everyone responded?” If you had a 90% initial response, it is unlikely that the remaining 10% would disrupt your findings. If the initial response was only 10%, then you have a considerable amount of work ahead of you.

Brevity - Say More with Less

Clarity (in Speech and Writing)

Coherence - How to Achieve Coherence in Writing

Flow - How to Create Flow in Writing

Inclusivity - Inclusive Language

The Elements of Style - The DNA of Powerful Writing

Suggested Edits

- Please select the purpose of your message. * - Corrections, Typos, or Edits Technical Support/Problems using the site Advertising with Writing Commons Copyright Issues I am contacting you about something else

- Your full name

- Your email address *

- Page URL needing edits *

- Name This field is for validation purposes and should be left unchanged.

Other Topics:

Citation - Definition - Introduction to Citation in Academic & Professional Writing

- Joseph M. Moxley

Explore the different ways to cite sources in academic and professional writing, including in-text (Parenthetical), numerical, and note citations.

Collaboration - What is the Role of Collaboration in Academic & Professional Writing?

Collaboration refers to the act of working with others or AI to solve problems, coauthor texts, and develop products and services. Collaboration is a highly prized workplace competency in academic...

Genre may reference a type of writing, art, or musical composition; socially-agreed upon expectations about how writers and speakers should respond to particular rhetorical situations; the cultural values; the epistemological assumptions...

Grammar refers to the rules that inform how people and discourse communities use language (e.g., written or spoken English, body language, or visual language) to communicate. Learn about the rhetorical...

Information Literacy - Discerning Quality Information from Noise

Information Literacy refers to the competencies associated with locating, evaluating, using, and archiving information. In order to thrive, much less survive in a global information economy — an economy where information functions as a...

Mindset refers to a person or community’s way of feeling, thinking, and acting about a topic. The mindsets you hold, consciously or subconsciously, shape how you feel, think, and act–and...

Rhetoric: Exploring Its Definition and Impact on Modern Communication

Learn about rhetoric and rhetorical practices (e.g., rhetorical analysis, rhetorical reasoning, rhetorical situation, and rhetorical stance) so that you can strategically manage how you compose and subsequently produce a text...

Style, most simply, refers to how you say something as opposed to what you say. The style of your writing matters because audiences are unlikely to read your work or...

The Writing Process - Research on Composing

The writing process refers to everything you do in order to complete a writing project. Over the last six decades, researchers have studied and theorized about how writers go about...

Writing Studies

Writing studies refers to an interdisciplinary community of scholars and researchers who study writing. Writing studies also refers to an academic, interdisciplinary discipline – a subject of study. Students in...

Featured Articles

Academic Writing – How to Write for the Academic Community

Professional Writing – How to Write for the Professional World

Credibility & Authority – How to Be Credible & Authoritative in Speech & Writing

Conducting Survey Research

Surveys represent one of the most common types of quantitative, social science research. In survey research, the researcher selects a sample of respondents from a population and administers a standardized questionnaire to them. The questionnaire, or survey, can be a written document that is completed by the person being surveyed, an online questionnaire, a face-to-face interview, or a telephone interview. Using surveys, it is possible to collect data from large or small populations (sometimes referred to as the universe of a study).

Different types of surveys are actually composed of several research techniques, developed by a variety of disciplines. For instance, interview began as a tool primarily for psychologists and anthropologists, while sampling got its start in the field of agricultural economics (Angus and Katona, 1953, p. 15).

Survey research does not belong to any one field and it can be employed by almost any discipline. According to Angus and Katona, "It is this capacity for wide application and broad coverage which gives the survey technique its great usefulness..." (p. 16).

Types of Surveys

Surveys come in a wide range of forms and can be distributed using a variety of media.

Mail Surveys

Group administered questionnaires, drop-off surveys, oral surveys, electronic surveys.

- An Example Survey

Example Survey

General Instructions: We are interested in your writing and computing experiences and attitudes. Please take a few minutes to complete this survey. In general, when you are presented with a scale next to a question, please put an X over the number that best corresponds to your answer. For example, if you strongly agreed with the following question, you might put an X through the number 5. If you agreed moderately, you might put an X through number 4, if you neither agreed nor disagreed, you might put an X through number 3.

Example Question:

As is the case with all of the information we are collecting for our study, we will keep all the information you provide to us completely confidential. Your teacher will not be made aware of any of your responses. Thanks for your help.

Your Name: ___________________________________________________________

Your Instructor's Name: __________________________________________________

Written Surveys

Imagine that you are interested in exploring the attitudes college students have about writing. Since it would be impossible to interview every student on campus, choosing the mail-out survey as your method would enable you to choose a large sample of college students. You might choose to limit your research to your own college or university, or you might extend your survey to several different institutions. If your research question demands it, the mail survey allows you to sample a very broad group of subjects at small cost.

Strengths and Weaknesses of Mail Surveys

Cost: Mail surveys are low in cost compared to other methods of surveying. This type of survey can cost up to 50% less than the self-administered survey, and almost 75% less than a face-to-face survey (Bourque and Fielder 9). Mail surveys are also substantially less expensive than drop-off and group-administered surveys.

Convenience: Since many of these types of surveys are conducted through a mail-in process, the participants are able to work on the surveys at their leisure.

Bias: Because the mail survey does not allow for personal contact between the researcher and the respondent, there is little chance for personal bias based on first impressions to alter the responses to the survey. This is an advantage because if the interviewer is not likeable, the survey results will be unfavorably affected. However, this could be a disadvantage as well.

Sampling--internal link: It is possible to reach a greater population and have a larger universe (sample of respondents) with this type of survey because it does not require personal contact between the researcher and the respondents.

Low Response Rate: One of the biggest drawbacks to written survey, especially as it relates to the mail-in, self-administered method, is the low response rate. Compared to a telephone survey or a face-to-face survey, the mail-in written survey has a response rate of just over 20%.

Ability of Respondent to Answer Survey: Another problem with self-administered surveys is three-fold: assumptions about the physical ability, literacy level and language ability of the respondents. Because most surveys pull the participants from a random sampling, it is impossible to control for such variables. Many of those who belong to a survey group have a different primary language than that of the survey. They may also be illiterate or have a low reading level and therefore might not be able to accurately answer the questions. Along those same lines, persons with conditions that cause them to have trouble reading, such as dyslexia, visual impairment or old age, may not have the capabilities necessary to complete the survey.

Imagine that you are interested in finding out how instructors who teach composition in computer classrooms at your university feel about the advantages of teaching in a computer classroom over a traditional classroom. You have a very specific population in mind, and so a mail-out survey would probably not be your best option. You might try an oral survey, but if you are doing this research alone this might be too time consuming. The group administered questionnaire would allow you to get your survey results in one space of time and would ensure a very high response rate (higher than if you stuck a survey into each instructor's mailbox). Your challenge would be to get everyone together. Perhaps your department holds monthly technology support meetings that most of your chosen sample would attend. Your challenge at this point would be to get permission to use part of the weekly meeting time to administer the survey, or to convince the instructors to stay to fill it out after the meeting. Despite the challenges, this type of survey might be the most efficient for your specific purposes.

Strengths and Weaknesses of Group Administered Questionnaires

Rate of Response: This second type of written survey is generally administered to a sample of respondents in a group setting, guaranteeing a high response rate.

Specificity: This type of written survey can be very versatile, allowing for a spectrum of open and closed ended types of questions and can serve a variety of specific purposes, particularly if you are trying to survey a very specific group of people.

Weaknesses of Group Administered Questionnaires

Sampling: This method requires a small sample, and as a result is not the best method for surveys that would benefit from a large sample. This method is only useful in cases that call for very specific information from specific groups.

Scheduling: Since this method requires a group of respondents to answer the survey together, this method requires a slot of time that is convenient for all respondents.

Imagine that you would like to find out about how the dorm dwellers at your university feel about the lack of availability of vegetarian cuisine in their dorm dining halls. You have prepared a questionnaire that requires quite a few long answers, and since you suspect that the students in the dorms may not have the motivation to take the time to respond, you might want a chance to tell them about your research, the benefits that might come from their responses, and to answer their questions about your survey. To ensure the highest response rate, you would probably pick a time of the day when you are sure that the majority of the dorm residents are home, and then work your way from door to door. If you don't have time to interview the number of students you need in your sample, but you don't trust the response rate of mail surveys, the drop-off survey might be the best option for you.

Strengths and Weaknesses of Drop-off Surveys

Convenience: Like the mail survey, the drop-off survey allows the respondents to answer the survey at their own convenience.

Response Rates: The response rates for the drop-off survey are better than the mail survey because it allows the interviewer to make personal contact with the respondent, to explain the importance of the survey, and to answer any questions or concerns the respondent might have.

Time: Because of the personal contact this method requires, this method takes considerably more time than the mail survey.

Sampling: Because of the time it takes to make personal contact with the respondents, the universe of this kind of survey will be considerably smaller than the mail survey pool of respondents.

Response: The response rate for this type of survey, although considerably better than the mail survey, is still not as high as the response rate you will achieve with an oral survey.

Oral surveys are considered more personal forms of survey than the written or electronic methods. Oral surveys are generally used to get thorough opinions and impressions from the respondents.

Oral surveys can be administered in several different ways. For instance, in a group interview, as opposed to a group administered written survey, each respondent is not given an instrument (an individual questionnaire). Instead, the respondents work in groups to answer the questions together while one person takes notes for the whole group. Another more familiar form of oral survey is the phone survey. Phone surveys can be used to get short one word answers (yes/no), as well as longer answers.

Strengths and Weaknesses of Oral Surveys

Personal Contact: Oral surveys conducted either on the telephone or in person give the interviewer the ability to answer questions from the participant. If the participant, for example, does not understand a question or needs further explanation on a particular issue, it is possible to converse with the participant. According to Glastonbury and MacKean, "interviewing offers the flexibility to react to the respondent's situation, probe for more detail, seek more reflective replies and ask questions which are complex or personally intrusive" (p. 228).

Response Rate: Although obtaining a certain number of respondents who are willing to take the time to do an interview is difficult, the researcher has more control over the response rate in oral survey research than with other types of survey research. As opposed to mail surveys where the researcher must wait to see how many respondents actually answer and send back the survey, a researcher using oral surveys can, if the time and money are available, interview respondents until the required sample has been achieved.

Cost: The most obvious disadvantage of face-to-face and telephone survey is the cost. It takes time to collect enough data for a complete survey, and time translates into payroll costs and sometimes payment for the participants.

Bias: Using face-to-face interview for your survey may also introduce bias, from either the interviewer or the interviewee.

Types of Questions Possible: Certain types of questions are not convenient for this type of survey, particularly for phone surveys where the respondent does not have a chance to look at the questionnaire. For instance, if you want to offer the respondent a choice of 5 different answers, it will be very difficult for respondents to remember all of the choices, as well as the question, without a visual reminder. This problem requires the researcher to take special care in constructing questions to be read aloud.

Attitude: Anyone who has ever been interrupted during dinner by a phone interviewer is aware of the negative feelings many people have about answering a phone survey. Upon receiving these calls, many potential respondents will simply hang up.

With the growth of the Internet (and in particular the World Wide Web) and the expanded use of electronic mail for business communication, the electronic survey is becoming a more widely used survey method. Electronic surveys can take many forms. They can be distributed as electronic mail messages sent to potential respondents. They can be posted as World Wide Web forms on the Internet. And they can be distributed via publicly available computers in high-traffic areas such as libraries and shopping malls. In many cases, electronic surveys are placed on laptops and respondents fill out a survey on a laptop computer rather than on paper.

Strengths and Weaknesses of Electronic Surveys

Cost-savings: It is less expensive to send questionnaires online than to pay for postage or for interviewers.

Ease of Editing/Analysis: It is easier to make changes to questionnaire, and to copy and sort data.

Faster Transmission Time: Questionnaires can be delivered to recipients in seconds, rather than in days as with traditional mail.

Easy Use of Preletters: You may send invitations and receive responses in a very short time and thus receive participation level estimates.

Higher Response Rate: Research shows that response rates on private networks are higher with electronic surveys than with paper surveys or interviews.

More Candid Responses: Research shows that respondents may answer more honestly with electronic surveys than with paper surveys or interviews.

Potentially Quicker Response Time with Wider Magnitude of Coverage: Due to the speed of online networks, participants can answer in minutes or hours, and coverage can be global.

Sample Demographic Limitations: Population and sample limited to those with access to computer and online network.

Lower Levels of Confidentiality: Due to the open nature of most online networks, it is difficult to guarantee anonymity and confidentiality.

Layout and Presentation issues: Constructing the format of a computer questionnaire can be more difficult the first few times, due to a researcher's lack of experience.

Additional Orientation/Instructions: More instruction and orientation to the computer online systems may be necessary for respondents to complete the questionnaire.

Potential Technical Problems with Hardware and Software: As most of us (perhaps all of us) know all too well, computers have a much greater likelihood of "glitches" than oral or written forms of communication.

Response Rate: Even though research shows that e-mail response rates are higher, Opermann (1995) warns that most of these studies found response rates higher only during the first few days; thereafter, the rates were not significantly higher.

Designing Surveys

Initial planning of the survey design and survey questions is extremely important in conducting survey research. Once surveying has begun, it is difficult or impossible to adjust the basic research questions under consideration or the tool used to address them since the instrument must remain stable in order to standardize the data set. This section provides information needed to construct an instrument that will satisfy basic validity and reliability issues. It also offers information about the important decisions you need to make concerning the types of questions you are going to use, as well as the content, wording, order and format of your survey questionnaire.

Overall Design Issues

Four key issues should be considered when designing a survey or questionnaire: respondent attitude, the nature of the items (or questions) on the survey, the cost of conducting the survey, and the suitability of the survey to your research questions.

Respondent attitude: When developing your survey instrument, it is important to try to put yourself into your target population's shoes. Think about how you might react when approached by a pollster while out shopping or when receiving a phone call from a pollster while you are sitting down to dinner. Think about how easy it is to throw away a response survey that you've received in the mail. When developing your instrument, it is important to choose the method you think will work for your research, but also one in which you have confidence. Ask yourself what kind of survey you, as a respondent, would be most apt to answer.

Nature of questions: It is important to consider the relationship between the medium that you use and the questions that you ask. For instance, certain types of questions are difficult to answer over the telephone. Think of the problems you would have in attempting to record Likert scale responses, as in closed-ended questions, over the telephone--especially if a scale of more than five points is used. Responses to open-ended questions would also be difficult to record and report in telephone interviews.

Cost: Along with decisions about the nature of the questions you ask, expense issues also enter into your decision making when planning a survey. The population under consideration, the geographic distribution of this sample population, and the type of questionnaire used all affect costs.

Ability of instrument to meet needs of research question: Finally, there needs to be a logical link between your survey instrument and your research questions. If it is important to get a large number of responses from a broad sample of the population, you obviously will not choose to do a drop-off written survey or an in-person oral survey. Because of the size of the needed sample, you will need to choose a survey instrument that meets this need, such as a phone or mail survey. If you are interested in getting thorough information that might need a large amount of interaction between the interviewer and respondent, you will probably pick in-person oral survey with a smaller sample of respondents. Your questions, then, will need to reflect both your research goals and your choice of medium.

Creating Questionnaire Questions

Developing well-crafted questionnaires is more difficult than it might seem. Researchers should carefully consider the type, content, wording, and order of the questions that they include. In this section, we discuss the steps involved in questionnaire development and the advantages and disadvantages of various techniques.

Open-ended vs. Closed-ended Questions

All researchers must make two basic decisions when designing a survey--they must decide: 1) whether they are going to employ an oral, written, or electronic method, and 2) whether they are going to choose questions that are open or close-ended.

Closed-Ended Questions: Closed-ended questions limit respondents' answers to the survey. The participants are allowed to choose from either a pre-existing set of dichotomous answers, such as yes/no, true/false, or multiple choice with an option for "other" to be filled in, or ranking scale response options. The most common of the ranking scale questions is called the Likert scale question. This kind of question asks the respondents to look at a statement (such as "The most important education issue facing our nation in the year 2000 is that all third graders should be able to read") and then "rank" this statement according to the degree to which they agree ("I strongly agree, I somewhat agree, I have no opinion, I somewhat disagree, I strongly disagree").

Open-Ended Questions: Open-ended questions do not give respondents answers to choose from, but rather are phrased so that the respondents are encouraged to explain their answers and reactions to the question with a sentence, a paragraph, or even a page or more, depending on the survey. If you wish to find information on the same topic as asked above (the future of elementary education), but would like to find out what respondents would come up with on their own, you might choose an open-ended question like "What do you think is the most important educational issue facing our nation in the year 2000?" rather than the Likert scale question. Or, if you would like to focus on reading as the topic, but would still not like to limit the participants' responses, you might pose the question this way: "Do you think that the most important issue facing education is literacy? Explain your answer below."

Note: Keep in mind that you do not have to use close-ended or open-ended questions exclusively. Many researchers use a combination of closed and open questions; often researchers use close-ended questions in the beginning of their survey, then allow for more expansive answers once the respondent has some background on the issue and is "warmed-up."

Rating scales: ask respondents to rate something like an idea, concept, individual, program, product, etc. based on a closed ended scale format, usually on a five-point scale. For example, a Likert scale presents respondents with a series of statements rather than questions, and the respondents are asked to which degree they disagree or agree.

Ranking scales: ask respondents to rank a set of ideas or things, etc. For example, a researcher can provide respondents with a list of ice cream flavors, and then ask them to rank these flavors in order of which they like best, with the rank of "one" representing their favorite. These are more difficult to use than rating scales. They will take more time, and they cannot easily be used for phone surveys since they often require visual aids. However, since ranking scales are more difficult, they may actually increase appropriate effort from respondents.