- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Write a Successful Business Plan for a Loan

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What does a loan business plan include?

What lenders look for in a business plan, business plan for loan examples, resources for writing a business plan.

A comprehensive and well-written business plan can be used to persuade lenders that your business is worth investing in and hopefully, improve your chances of getting approved for a small-business loan . Many lenders will ask that you include a business plan along with other documents as part of your loan application.

When writing a business plan for a loan, you’ll want to highlight your abilities, justify your need for capital and prove your ability to repay the debt.

Here’s everything you need to know to get started.

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

A successful business plan for a loan describes your financial goals and how you’ll achieve them. Although business plan components can vary from company to company, there are a few sections that are typically included in most plans.

These sections will help provide lenders with an overview of your business and explain why they should approve you for a loan.

Executive summary

The executive summary is used to spark interest in your business. It may include high-level information about you, your products and services, your management team, employees, business location and financial details. Your mission statement can be added here as well.

To help build a lender’s confidence in your business, you can also include a concise overview of your growth plans in this section.

Company overview

The company overview is an area to describe the strengths of your business. If you didn’t explain what problems your business will solve in the executive summary, do it here.

Highlight any experts on your team and what gives you a competitive advantage. You can also include specific details about your business such as when it was founded, your business entity type and history.

Products and services

Use this section to demonstrate the need for what you’re offering. Describe your products and services and explain how customers will benefit from having them.

Detail any equipment or materials that you need to provide your goods and services — this may be particularly helpful if you’re looking for equipment or inventory financing . You’ll also want to disclose any patents or copyrights in this section.

Market analysis

Here you can demonstrate that you’ve done your homework and showcase your understanding of your industry, current outlook, trends, target market and competitors.

You can add details about your target market that include where you’ll find customers, ways you plan to market to them and how your products and services will be delivered to them.

» MORE: How to write a market analysis for a business plan

Marketing and sales plan

Your marketing and sales plan provides details on how you intend to attract your customers and build a client base. You can also explain the steps involved in the sale and delivery of your product or service.

At a high level, this section should identify your sales goals and how you plan to achieve them — showing a lender how you’re going to make money to repay potential debt.

Operational plan

The operational plan section covers the physical requirements of operating your business on a day-to-day basis. Depending on your type of business, this may include location, facility requirements, equipment, vehicles, inventory needs and supplies. Production goals, timelines, quality control and customer service details may also be included.

Management team

This section illustrates how your business will be organized. You can list the management team, owners, board of directors and consultants with details about their experience and the role they will play at your company. This is also a good place to include an organizational chart .

From this section, a lender should understand why you and your team are qualified to run a business and why they should feel confident lending you money — even if you’re a startup.

Funding request

In this section, you’ll explain the amount of money you’re requesting from the lender and why you need it. You’ll describe how the funds will be used and how you intend to repay the loan.

You may also discuss any funding requirements you anticipate over the next five years and your strategic financial plans for the future.

» Need help writing? Learn about the best business plan software .

Financial statements

When you’re writing a business plan for a loan, this is one of the most important sections. The goal is to use your financial statements to prove to a lender that your business is stable and will be able to repay any potential debt.

In this section, you’ll want to include three to five years of income statements, cash flow statements and balance sheets. It can also be helpful to include an expense analysis, break-even analysis, capital expenditure budgets, projected income statements and projected cash flow statements. If you have collateral that you could put up to secure a loan, you should list it in this section as well.

If you’re a startup that doesn’t have much historical data to provide, you’ll want to include estimated costs, revenue and any other future projections you may have. Graphs and charts can be useful visual aids here.

In general, the more data you can use to show a lender your financial security, the better.

Finally, if necessary, supporting information and documents can be added in an appendix section. This may include credit histories, resumes, letters of reference, product pictures, licenses, permits, contracts and other legal documents.

Lenders will typically evaluate your loan application based on the five C’s — or characteristics — of credit : character, capacity, capital, conditions and collateral. Although your business plan won't contain everything a lender needs to complete its assessment, the document can highlight your strengths in each of these areas.

A lender will assess your character by reviewing your education, business experience and credit history. This assessment may also be extended to board members and your management team. Highlights of your strengths can be worked into the following sections of your business plan:

Executive summary.

Company overview.

Management team.

Capacity centers on your ability to repay the loan. Lenders will be looking at the revenue you plan to generate, your expenses, cash flow and your loan payment plan. This information can be included in the following sections:

Funding request.

Financial statements.

Capital is the amount of money you have invested in your business. Lenders can use it to judge your financial commitment to the business. You can use any of the following sections to highlight your financial commitment:

Operational plan.

Conditions refers to the purpose and market for your products and services. Lenders will be looking for information such as product demand, competition and industry trends. Information for this can be included in the following sections:

Market analysis.

Products and services.

Marketing and sales plan.

Collateral is an asset pledged to a lender to guarantee the repayment of a loan. This can be equipment, inventory, vehicles or something else of value. Use the following sections to include information on assets:

» MORE: How to get a business loan

Writing a business plan for a loan application can be intimidating, especially when you’re just getting started. It may be helpful to use a business plan template or refer to an existing sample as you’re going through the draft process.

Here are a few examples that you may find useful:

Business Plan Outline — Colorado Small Business Development Center

Business Plan Template — Iowa Small Business Development Center

Writing a Business Plan — Maine Small Business Development Center

Business Plan Workbook — Capital One

Looking for a business loan?

See our overall favorites, or narrow it down by category to find the best options for you.

on NerdWallet's secure site

U.S. Small Business Administration. The SBA offers a free self-paced course on writing a business plan. The course includes several videos, objectives for you to accomplish, as well as worksheets you can complete.

SCORE. SCORE, a nonprofit organization and resource partner of the SBA, offers free assistance that includes a step-by-step downloadable template to help startups create a business plan, and mentors who can review and refine your plan virtually or in person.

Small Business Development Centers. Similarly, your local SBDC can provide assistance with business planning and finding access to capital. These organizations also have virtual and in-person training courses, as well as opportunities to consult with business experts.

Business plan software. Although many business plan software platforms require a subscription, these tools can be useful if you want a templated approach that can break the process down for you step-by-step. Many of these services include a range of examples and templates, instruction videos and guides, and financial dashboards, among other features. You may also be able to use a free trial before committing to one of these software options.

A loan business plan outlines your business’s objectives, products or services, funding needs and finances. The goal of this document is to convince lenders that they should approve you for a business loan.

Not all lenders will require a business plan, but you’ll likely need one for bank and SBA loans. Even if it isn’t required, however, a lean business plan can be used to bolster your loan application.

Lenders ask for a business plan because they want to know that your business is and will continue to be financially stable. They want to know how you make money, spend money and plan to achieve your financial goals. All of this information allows them to assess whether you’ll be able to repay a loan and decide if they should approve your application.

On a similar note...

Mortgage Broker Business Plan Template

Written by Dave Lavinsky

Mortgage Broker Business Plan

You’ve come to the right place to create your Mortgage Broker business plan.

We have helped over 10,000 entrepreneurs and business owners create business plans and many have used them to start or grow their Mortgage Broker companies.

Below is a template to help you create each section of your Mortgage Broker business plan.

Executive Summary

Business overview.

Davidson Mortgage, located in Tucson, Arizona, is a new mortgage brokerage specializing in residential mortgages. The company will operate in a professional setting, conveniently located next to several banks in the center of the shopping district. We offer a wide range of services to help our clients get a mortgage, including finding loan options, applying for the loans on the clients’ behalf, and completing all the paperwork. We strive to serve our clients with the utmost empathy to ensure they get the best mortgage for their situation.

Davidson Mortgage is headed by Harold Davidson. He is an MBA graduate from Arizona State University with 20 years of experience working in the finance industry. His passion is to help his clients qualify for their dream homes and provide them with a smooth process from start to finish.

Davidson Mortgage will focus on providing superior service to all of its clients to ensure they get the best mortgage possible. Our services include finding loan options, applying for loans on behalf of customers, and completing closing paperwork. Since customer service is our top priority, we will keep in touch with our clients after they have closed on the mortgage. Furthermore, Harold will create webinars, online courses, and other content to educate his clients and the local community on the mortgage lending process.

Customer Focus

Davidson Mortgage will primarily serve homebuyers interested in properties located in the Tucson, Arizona area. Tucson is a growing city with thousands of residents eager to purchase a new home. We expect our clientele to be equal parts first-time home buyers and existing homeowners.

Management Team

Davidson Mortgage is run by Harold Davidson. Harold has been a licensed mortgage broker for the past 20 years, working for several large firms. However, throughout his career, he desired to have a closer connection with his clients as well as have more flexibility to help them get their dream homes. He started this company in order to achieve those goals. In addition to his valuable experience, Harold also holds an MBA from Arizona State University.

Harold is joined by Bethany Peterson. She will serve as the company’s full-time assistant, who, among other things, will manage the company website, coordinate scheduling, and answer basic client questions. Bethany has experience working with C-level executives and has spent significant time as an administrator.

Success Factors

Davidson Mortgage is uniquely qualified to succeed due to the following reasons:

- Davidson Mortgage will fill a specific market niche in the growing community we are entering. In addition, we have surveyed local realtors and homebuyers and received extremely positive feedback saying that they would consider making use of our services when launched.

- Our location is in an economically vibrant area where new home sales are on the rise, and turnover in homes and rentals occurs often due to the upward mobility of residents.

- The management team has a track record of success in the mortgage brokerage business.

- The local area is currently underserved and has few independent mortgage brokers offering high customer service to homebuyers.

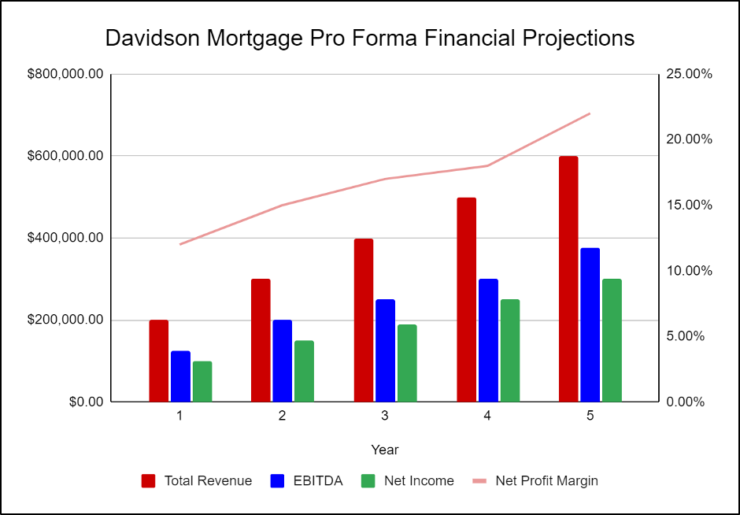

Financial Highlights

Davidson Mortgage is seeking a total funding of $250,000 of debt capital to open its office. The capital will be used for funding capital expenditures and location build-out, hiring initial employees, marketing expenses, and working capital.

Specifically, these funds will be used as follows:

- Office design/build: $50,000

- Three months of overhead expenses (payroll, rent, utilities): $100,00

- Marketing expenses: $50,000

- Working capital: $50,000

Company Overview

Who is davidson mortgage, davidson mortgage history.

After surveying the local customer base and finding a potential office, Harold Davidson incorporated Davidson Mortgage as an S-Corporation on 1/1/2023.

The business is currently being run out of Harold’s home office, but once the lease on Davidson Mortgage’s office location is finalized, all operations will be run from there.

Since incorporation, Davidson Mortgage has achieved the following milestones:

- Found office space and signed Letter of Intent to lease it

- Developed the company’s name, logo, and website

- Hired an interior designer for the decor and furniture layout

- Determined equipment and fixture requirements

Davidson Mortgage Services

Industry analysis.

Despite the pandemic hurting several industries, the mortgage brokers industry still performed strong and is projected to continue to do so. Last year, U.S. mortgage brokerages brought in revenues of $11.7 billion and employed 47,000 people. There were just over 12,000 businesses in this market.

However, the mortgage broker industry is highly fragmented, with the top two companies accounting for just over 11% of industry revenue. Furthermore, mortgage interest rates are on the rise, as well as housing prices, preventing many people from buying houses and applying for mortgages. These two factors significantly stunt the industry at present.

Despite these challenges, the industry is still projected to increase moderately throughout the rest of the decade. Though larger firms may dominate revenue and clientele, studies and surveys show that clients don’t necessarily favor working with large firms. Providing excellent service and personal touches throughout the process can help small firms succeed in the industry.

Customer Analysis

Demographic profile of target market.

Davidson Mortgage will primarily serve the residents of Tucson, Arizona. The area we serve has a significant population of people who are searching for their first home, as well as families and individuals who need a new home.

The precise demographics for Tucson, Arizona are:

Customer Segmentation

Davidson Mortgage will primarily target the following customer segments:

- Existing homeowners

- First-time home buyers

Competitive Analysis

Direct and indirect competitors.

Davidson Mortgage will face competition from other companies with similar business profiles. A description of each competitor company is below.

The Loan Store

Established in 2010, The Loan Store originates, finances, and sells mortgage and non-mortgage lending products throughout the United States. It offers a range of consumer credit products, such as home loan products, home equity loans, and unsecured personal loans, as well as home and personal loan servicing. The company claims to be one of the largest private, independent retail mortgage lenders in the U.S. Its current business channels include direct lending, affinity, branch retail, and servicing.

However, agents working with The Loan Store experience high turnover, resulting in little concern for maintaining ongoing relationships with clients. Also, the agents themselves are mixed in quality, ranging from part-time brokers with little experience or sales records to full-time brokers with long-term experience. There is no systematic company method for passing on knowledge from experienced to inexperienced brokers as all are competing with each other, to a certain extent, for commissions.

Direct Loan Connection

Founded in 2006, Direct Loan Connection (DLC) employs licensed mortgage professionals who have access to multiple lending institutions, including banks, credit unions, and trust companies. This access enables the company to offer a vast array of available mortgage products – ranging from first-time homebuyer programs to financing for the self-employed to financing for those with credit blemishes. In addition, to help homebuyers and homeowners, DLC offers commercial mortgages.

Though they are a local leader in the premium end of the market, they refuse to negotiate their broker’s fees and sometimes lose potential clients because of this. Davidson Mortgage’s fees will be far more reasonable.

Supreme Mortgage

Supreme Mortgage specializes in mortgage brokering and is committed to helping homebuyers, and homeowners get the best mortgage with the lowest interest rate. The brokerage works with more than 40 lenders who compete to provide mortgages and who pay Supreme Mortgage’s fee so that clients receive the service free of charge.

Some reviews of Supreme Mortgage point out the low-quality service offered by brokers, who have little training in customer service. Furthermore, Supreme Mortgage does not attempt to maintain long-term relationships with customers who will eventually purchase another home.

Competitive Advantage

Davidson Mortgage enjoys several advantages over its competitors. These advantages include:

- Location: Davidson Mortgage’s location is near the center of town, in the shopping district of the city. It is visible from the street, where many residents shop for both day-to-day and luxury items.

- Client-oriented service: Davidson Mortgage will have a full-time assistant to keep in contact with clients and answer their everyday questions. Harold Davidson realizes the importance of accessibility to his clients and will further keep in touch with his clients through monthly seminars on topics of interest.

- Management: Harold Davidson has been extremely successful working in the mortgage brokerage sector and will be able to use his previous experience to grant his clients detailed insight into the world of home loans. His unique qualifications will serve customers in a much more sophisticated manner than many of Davidson Mortgage’s competitors.

- Relationships: Having lived in the community for 25 years, Harold Davidson knows many of the local leaders, newspapers, and other influencers.

Marketing Plan

Davidson Mortgage will use several strategies to promote its name and develop its brand. By using an integrated marketing strategy, Davidson Mortgage will win clients and develop consistent revenue streams.

Brand & Value Proposition

The Davidson Mortgage brand will focus on the company’s unique value proposition:

- Client-focused residential mortgage brokerage services, where the company’s interests are aligned with the customer

- Service built on long-term relationships and personal attention

- Big-firm expertise in a small-firm environment

Promotions Strategy

The promotions strategy for Davidson Mortgage is as follows:

Website/SEO

Davidson Mortgage will invest heavily in developing a professional website that displays all of the features and benefits of working with the mortgage broker. It will also invest heavily in SEO so the brand’s website will appear at the top of search engine results.

Social Media

Davidson Mortgage will invest heavily in a social media advertising campaign. Harold and Bethany will create the company’s social media accounts and invest in ads on all social media platforms. It will use targeted marketing to appeal to the target demographics.

Davidson Mortgage understands that the best promotion comes from satisfied customers. The company will work to partner with local realtors by providing economic or financial incentives for every new client produced. This strategy will increase in effectiveness after the business has already been established.

By offering webinars and courses on topics of interest in the office or other locations, Harold Davidson will encourage residents in the community to become comfortable with the expertise and character of Davidson Mortgage. These webinars will generally be offered free of charge as general promotion and for direct networking.

Davidson Mortgage’s pricing will rely on the standard industry rates in order to be perceived as neither a luxury nor a discount broker. The standard rate for brokering a mortgage is 1-2% of the loan amount. By seeking quality clients and maintaining long-term relationships with them, Davidson Mortgage will fend off pressure to discount their rates, even in down markets.

Operations Plan

The following will be the operations plan for Davidson Mortgage.

Operation Functions:

- Harold Davidson is the founder and will operate as the President of the company. He will be in charge of all the general operations and executive functions within the company. Furthermore, until he hires additional staff, he will personally help all clients who agree to utilize the company’s services.

- Harold is assisted by his long-term assistant Bethany Peterson. She will serve as the company’s full-time assistant and will manage the company website, coordinate scheduling, and answer basic client questions. Bethany has experience working with C-level executives and has spent significant time as an administrator.

- As the business grows and Harold takes on more clients, he will hire other mortgage brokers to assist him.

Milestones:

The following are a series of steps that will lead to the company’s long-term success. Davidson Mortgage expects to achieve the following milestones in the next six months:

3/202X Finalize lease agreement

4/202X Design and build out Davidson Mortgage office

5/202X Hire and train initial staff

6/202X Kickoff of promotional campaign

7/202X Reach break-even

8/202X Reach 25 ongoing clients

Financial Plan

Key revenue & costs.

Davidson Mortgage’s revenues will come primarily from the commissions earned from residential mortgage sales.

The major cost drivers for the company will include employee salaries, lease payments, and marketing expenses.

Funding Requirements and Use of Funds

Key assumptions.

The following outlines the key assumptions required to achieve the revenue and cost numbers in the financials and to pay off the startup business loan.

- Annual lease: $30,000

Financial Projections

Income statement, balance sheet, cash flow statement, mortgage broker business plan faqs, what is a mortgage broker business plan.

A mortgage broker business plan is a plan to start and/or grow your mortgage broker business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your Mortgage Broker business plan using our Mortgage Broker Business Plan Template here .

What are the Main Types of Mortgage Broker Businesses?

There are a number of different kinds of mortgage broker businesses , some examples include: Retail Mortgage Broker, Business/Corporate Mortgage Broker, or Private Mortgage Brokers.

How Do You Get Funding for Your Mortgage Broker Business Plan?

Mortgage Broker businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding.

What are the Steps To Start a Mortgage Broker Business?

Starting a mortgage broker business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop A Mortgage Broker Business Plan - The first step in starting a business is to create a detailed mortgage broker business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your mortgage broker business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your mortgage broker business is in compliance with local laws.

3. Register Your Mortgage Broker Business - Once you have chosen a legal structure, the next step is to register your mortgage broker business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your mortgage broker business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Mortgage Broker Equipment & Supplies - In order to start your mortgage broker business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your mortgage broker business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Learn more about how to start a successful mortgage broker business:

- How to Start a Mortgage Broker Business

Advertiser Disclosure

Your Guide To Commercial Mortgages

Marc Guberti is a Certified Personal Finance Counselor who has been a finance freelance writer for five years. He has covered personal finance, investing, banking, credit cards, business financing, and other topics. Marc’s work has appeared in US News & World Report, USA Today, Investor Place, and other publications. He graduated from Fordham University with a finance degree and resides in Scarsdale, New York. When he’s not writing, Marc enjoys spending time with the family and watching movies with them (mostly from the 1930s and 40s). Marc is an avid runner who aims to run over 100 marathons in his lifetime.

Updated October 19, 2023

4 min. read

What Is a Commercial Mortgage and How Does It Work?

Is a commercial mortgage right for your business, business growth, business expenses, business opportunities, what are the benefits of getting a commercial mortgage, loan large amounts, own a commercial real estate asset, build equity, flexible terms, how to get a commercial mortgage, 1. do your research, 2. know your credit score, 3. gather required documents, 4. devise a business plan, 5. prepare your down payment (just in case).

A commercial property establishes your business in the local community. You’ll have a location for prospects and can expand if your initial property gains momentum. While price can present a steep barrier to entry, commercial mortgages help business owners finance these assets. We’ll explain how commercial mortgages can help your company and how to get one.

A commercial mortgage is a financial product that business owners use to secure a commercial or multifamily property with five or more units. These loans help business owners obtain property without making a cash offer. Some business owners take out a new loan with a lower interest rate to refinance their existing commercial mortgage, but you can also use this financial product for other endeavors, such as renovating properties you own.

Many businesses rely on commercial mortgages to finance commercial properties. These loans can help your business, but they’re not for everyone. Consider these factors before getting a loan:

A business property gives your company a physical footprint, which helps your company grow within the local community. Businesses with solid margins can grow sustainably, and a commercial mortgage puts these companies in a position to gain market share. Leverage is a useful resource for business growth. You can finance new equipment , hire new people, and spend money on ads. Commercial mortgages turn leverage into new locations for businesses.

A commercial mortgage adds an expense to your budget and turns the property into collateral. You should assess your finances and determine if you can comfortably afford the monthly mortgage payments. Buying a commercial property and losing it in a few years is a significant setback. Not only will you have to acquire another commercial property, but customers may habitually visit your old location and not know about your new address. Some companies overextend and end up losing everything, so you should assess your financial situation before taking on more debt.

A commercial mortgage isn’t only an investment in the building but an investment in the neighborhood and residents of the area. You should analyze a community before buying a piece of land. The average income, unemployment rate, and crime rate serve as starting points for assessing a community. Location is one of the most important parts of real estate, and it influences how many opportunities will come your way.

Business owners use commercial mortgages to obtain financing, but they’re not the only choice. We’ll explore the competitive advantages commercial mortgages have over other financial products:

More opportunities open up when you retain more funding. While you can borrow money with many financial products, few provide as much as commercial mortgages. Most mortgage lending companies provide loan amounts of up to $5 million for a commercial mortgage. Since lenders require a down payment, you could use one of these loans to buy a property with over $5 million.

A commercial real estate asset puts your company on the map. You get a physical location people to interact with your customers and provide services. Additionally, owning real estate will benefit your company during tax season. Real estate owners can access depreciation, 1031 exchanges, and other tax-saving measures to protect more of their profits.

Real estate investors flock to the asset for equity and appreciation . You may have business aspirations with this property, but you also need to expand your real estate portfolio. Each monthly mortgage payment increases your equity in the commercial property, and building equity will help if you sell the property, use a cash-out refinance, or tap into a line of credit. As you make monthly payments and gain equity, your property may appreciate. The location can become more desirable, and annual inflation props up real estate.

If you own a multifamily investment property, appreciation rates are under your control. Investors look at a multifamily property’s net operating income to assess the valuation. Working hard to increase net operating income will raise your property’s value and build more equity in the process.

Low rates reduce the monthly payments for any loan, but they carry extra significance for commercial mortgages. Some business owners borrow over $1 million for commercial real estate financing. However, a higher interest rate can sting business owners. Depending on how much you borrow, an additional percentage point can add over $1,000 to your monthly payment. Comparing commercial real estate loans from multiple banks and lenders will lead to the most competitive rates. Such due diligence can help you secure a lower interest rate and save thousands of dollars over the loan’s lifetime.

Business owners can select from several financing choices with shorter terms than residential mortgages. You can choose a 3-year loan term if you want to pay it back quickly or a 25-year mortgage for lower monthly payments. Most commercial loans have 3, 5, or 10-year terms.

Getting financing for a commercial property is exciting. This property can help your business grow, and you may expand operations in the future. A commercial mortgage loan is the starting point of new opportunities, and we’ll share how to get one.

Investing in an office building, apartment complex, or any commercial property is a significant expenditure, so you should do as much research as possible to feel confident about the location and find the right lender. Reaching out to several lenders gives you more financing choices. Then, once you have the proper financing, you can swoop in and secure a high-quality property you feel confident about after doing your research.

Lenders will ask about your credit score before giving you a loan. Most lenders have post-credit approval requirements for aspiring commercial property owners. A credit score indicates your ability to manage debt; Lenders feel more confident giving money to people with higher scores, and strong credit can lower your interest rate. Check your credit score before approaching a lender, and improve it as much as possible. Paying off credit cards and other debt on time is one of the best ways to raise your score.

Lenders will ask for several documents in your application. Each lender has different requirements, but you can expect to provide the following documents:

- Personal and business tax returns

- Financial statements

- Business operating statements for the year

- Profit and loss statement

- Business projections (i.e., cash flow and other metrics)

- Basic personal information (i.e., social security number)

- Business Plan

Assemble these files now, so you have them when it’s time to approach lenders.

Some lenders will review your business plan before letting you borrow money. A business plan will help you utilize the commercial property, identify the available opportunities, and position yourself to gain market share. You should already have a business plan, as it’s a valuable resource. However, it would help to adapt your strategy to accommodate your new asset.

Not all lenders will let you escape from making a down payment. Saving up for a down payment is a good insurance measure, as you don’t want to get rejected from a desirable property because you didn’t save enough money for the initial payment. Start saving money and put the down payment proceeds into a separate bank account. A separate account lowers the chances of those funds getting mixed up with other costs.

You may also like

Small Business Loan Requirements

Read this guide to learn what the requirements are for a small business loan plus a convenient way to get fast access to business funding.

How Business Equipment Financing Works

LLC Business Loans: A Comprehensive Guide

How to Get a Small Business Loan from the Government

How a Startup Loan Can Kickstart Your Small Business

The Definitive Guide to Small Business Loan Interest Rates

Advertisement Disclosure

- Apply for Online Mortgage

- Tel: 289-800-4840

Commercial Mortgage Business Plans

A detailed business plan is a key requirement for your commercial mortgage application. Your plan will outline what your business does, how it operates, and how it plans to grow.

Every mortgage is a risk for lenders. The most effective commercial mortgage business plans illustrate why that risk is worth taking.

As you plan your real estate investment, take the time to understand how to write a business plan for commercial mortgage approval.

7 Essentials for a Business Plan for Commercial Mortgage Approval

It’s important to look at your business at a high level and detail each element so that a lender can understand your model and your aspirations. A solid business plan can make the difference between an offer and a rejection.

All business plans should include the following information:

1. Your Executive Summary: All successful commercial mortgage business plans feature killer executive summaries. The summary needs to describe your business, its goals, its points of differentiation, and why you need a commercial mortgage. Keep it simple and impactful.

2. A Description of What Your Company Does: In this section, you will elaborate on how your business was formed, what it does, and where you want to take it next. This can be detailed, but, avoid repeating information that can be better presented in the following sections.

3. Details of Your Management Team: Lenders want to know that you have the leadership to succeed in your business goals. An overview of your management, including previous experience, must be included in commercial mortgage business plans.

4. Essential Financials: Financial data will provide context for your current and future strategy. Details matter. Important financials include earnings and outgoings dating back at least three years.

5. Your Growth and Marketing Plans: A successful business plan for commercial mortgage approval needs to do more than just indicate where you want to take your company. You need to illustrate how you will achieve goals. Marketing and growth strategies should be outlined.

6. Production / Execution Plan: Do you have the resources to achieve your targets? If you will be an owner-operator of industrial property, do you have equipment and supply chains set up? If you are seeking to buy property to manage and rent, do you have existing tools in place to manage tenants?

7. HR Strategy: Depending on the size of your business, you may need to explain how you plan to hire and retain the talent that will help you achieve your goals.

Supporting Documentation for Commercial Mortgage Business Plans

It’s not enough to simply state your intentions. You will need verified documentation to provide as evidence. This can include contracts with suppliers and staff, bank-issued transaction records, contracts with third parties, market research reports, etc.

Documentation needs can be extensive. Knowing what to include can be challenging. This is why commercial real estate clients prefer to work with licensed Ontario mortgage brokers.

Build the Most Compelling Business Plan with a Mortgage Broker

Developing a business plan for commercial mortgage approval can be time-consuming and at points confusing. If you are making a commercial investment for the first time, a mortgage broker will become an invaluable asset.

We can help you to prepare your business plan with all the supporting documentation that gives your application an edge. With experience and a deep understanding of the mortgage industry, we know exactly what lenders want to see.

Talk to us today if you want expert support throughout the mortgage application process, the lowest possible rates, and the best terms. Commercial property investment can help you to achieve your personal and business goals. We provide the expertise to bring it all together.

To book an appointment to discuss your needs and learn more about how Mortgage Capital Investment can help you, call 416-877-7438 today, or contact us.

Lowest Residential Mortgage Rates in Canada*

Updated: May07 , 2024

* Current promotion rates may provide an additional 0.05% discount or may be anytime discontinued at the Lender discretion.Some condition may apply.Rates may vary between geographic regions and the posted rates on this website may not be available in your area.TD Bank rate used for comparable are the rate listed in the Broker Chanel Portal by TD Canada Bank at the date above. Please contact our MCI office for more details and current promotions.

LOWEST REGULAR RATES IN CANADA* * Current promotion rates may provide an additional 0.10% discount. Rates may vary between geographic regions and the posted rates on this website may not be available in your area. Please contact our MCI office for more details and current promotions.

Fields with (*) are required

Accept the terms and conditions.

Don't bother with copy and paste.

Get this complete sample business plan as a free text document.

Mortgage Broker Business Plan

Start your own mortgage broker business plan

Claremont Funding

Executive summary executive summary is a brief introduction to your business plan. it describes your business, the problem that it solves, your target market, and financial highlights.">.

Claremont Funding is an outstanding mortgage brokerage firm serving the lending needs of real estate professionals, builders and individual home buyers. We have access to a full range of mortgage sources and are dedicated to finding the right loan–with the best rates, terms and costs–to meet our clients’ unique needs.

This firm is capitalized by two principal investors, Joan Billings and Maureen Shoe. Both are licensed brokers with a combined experience of over 30 years in the industry.

1.1 Objectives

Claremont Funding aims to offer comprehensive mortgage broker services. Claremont Funding will focus on providing personal and specialized services to meet each client’s specific needs. The primary objectives of our firm are:

- Become profitable serving the real estate investment opportunities becoming available in the rapidly growing old town section of the city.

- Develop a solid, corporate identity in our specified target market area.

- Become one of the top brokerage firms in the area by our third year of operation, or before.

- Realize a positive return on investment within the first 12 months.

1.2 Mission

Claremont Funding offers high-quality mortgage brokerage services to residential and business customers. Our aim is to provide our customers with fair mortgage rates at reasonable prices, while keeping our clients informed and educated throughout the process. We will become friends and mentors to our customers as well as quality service providers. Claremont is an excellent place to work, a professional environment that is challenging, rewarding, creative, and respectful of ideas and individuals. Claremont ultimately provides excellent value to its customers and fair reward to its owners and employees.

Company Summary company overview ) is an overview of the most important points about your company—your history, management team, location, mission statement and legal structure.">

Claremont Funding is a new company that provides a high level of expertise. We will provide superior personal service to buyers. We take pride in knowing that 70% of our business comes from repeat clients and their referrals.

Our responsibility as mortgage professionals is to determine what a customer’s financial goals are, not just quote a rate. We have access to hundreds of loan programs, allowing us to arrange the most beneficial solution… whatever the buyer’s needs may be.

2.1 Company Ownership

The owners and brokers of Claremont Funding are Joan Billings and Maureen Shoe.

2.2 Start-up Summary

Our start-up costs are outlined in the following table. Start-up costs derive from website design, office equipment, main computer station complete with all mortgage information for broker usage, stationery, legal costs, furnishings, office advertising and services, and expenses associated with opening our office. The start-up costs are to be financed by direct owner investment and credit. Lease office space averages $1.10 – 1.60 per square foot to an approximate of $1,500 per month, plus utilities, for efficient leased office space. Commercial lease will be for a three to five year agreement with the first month and a security deposit equal to the monthly lease rate payable at the time of lease start date.

Our personal goal is to break through the barriers that impede homeownership for those who wish to realize the American Dream. We provide potential and current homeowners the opportunity to find the best mortgage loan for their needs.

We match buyers to loan programs. We have an extensive questionnaire for our buyers to list their wants and needs. We then take this questionnaire and put the supplied information to match buyers to the loan packages matching their criteria.

Market Analysis Summary how to do a market analysis for your business plan.">

Due to the strengthening of the area’s economy and lower interest rates, more home buyers today are looking to purchase homes. These changes in attitudes of home buyers are a tremendous boost to real estate firms. Residential construction is booming in the city’s Old Town section. We are poised to take advantage of these changes, and expect to become a recognized name and profitable entity in the city’s real estate market. We chose to locate our office in the area of most revenue potential and where we have close connection to dominant real estate firms. Our targeted market area, the Old Town area, shows stability and growth. We have a beautiful office, centered in the Old Town area.

The first quarter home values were up 12.5 percent from the same period in 2001, the Office of Federal Housing Enterprise Oversight reported. The gain reflects an increase from the previous quarter, when residential real estate values saw growth of 12.1 percent.

4.1 Market Segmentation

The home buyers that Claremont Funding will be serving can be divided into two groups:

- First-time homeowners: A bulk of the new construction in the Old Town section of the city is directed toward first-time homeowners.

- Residential refinancing: Whether it is for purchasing, construction, remodeling, debt consolidation, investment properties or refinancing–we have programs available to service those with good and bad credit.

4.2 Target Market Segment Strategy

We cannot survive waiting for the customer to come to us. Instead, we must get better at focusing on the specific market segments whose needs match our offerings. Focusing on targeted segments is the key to our future. Therefore, we need to focus our marketing message and our services offered. We need to develop our message, communicate it, and make good on it.

Strategy and Implementation Summary

Claremont Funding will focus on the mortgage broker needs in the Old Town section of the city and the surrounding areas. Our target customer will be first-time home buyers and existing homeowners who are interested in refinancing.

5.1 Sales Forecast

The following table and chart give a run-down on forecasted sales. We expect sales to build between January through March with the most growth during the months of March through August. We expect sales to drop off from September till the end of the year.

5.2 Milestones

The accompanying table lists important program milestones, with dates and managers in charge, and budgets for each. The milestone schedule indicates our emphasis on planning for implementation.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

5.3 Competitive Edge

Claremont Funding’s competitive edge is that both Joan and Maureen are the most visible lecturers to new home owners in the city. Joan has a weekly column in the city’s daily newspaper and Maureen lectures weekly to the city’s numerous neighborhood councils and civic groups. Together, they represent the most recognizable faces in the city on the subject of home ownership and refinancing a home.

Between them, they have a base of 6,000 satisfied customers who continue to make referrals to the brokers.

The city has been growing by 15% annually for the past 10 years. With the population now at 1.3 million, the new construction in the Old Town section of the city is valued at two billion dollars in home sales next year alone. Claremont Funding is positioned well to grab a large share of the mortgage services demanded by the city’s growth in Old Town.

Management Summary management summary will include information about who's on your team and why they're the right people for the job, as well as your future hiring plans.">

Claremont Funding is a two member mortgage brokerage firm. Both brokers are equal partners in the firm.

6.1 Personnel Plan

The following table shows the personnel plan for Claremont Funding.

Financial Plan investor-ready personnel plan .">

- We want to finance growth mainly through cash flow.

- The most important factor for Claremont Funding is the closing sales days. These dates will be determined ultimately by the Seller and the Buyer and a move out/move in schedule will be complied with.

7.1 Important Assumptions

The financial plan depends on important assumptions, most of which are shown in the following table as annual assumptions. The monthly assumptions are included in the appendix. From the beginning, we recognize that collection days are critical, but not a factor we can influence easily. At least we are planning on the problem, and dealing with it. Interest rates, tax rates, and personnel burden are based on conservative assumptions. Some of the more important underlying assumptions are:

- We assume a strong economy, without major recession.

- We assume, of course, that there are no unforeseen changes in the economy that would change our estimations.

7.2 Break-even Analysis

The following table and chart will summarize our break-even analysis.

7.3 Projected Profit and Loss

Our projected profit and loss is shown on the following table.

7.4 Projected Cash Flow

Cash flow projections are critical to our success. The annual cash flow figures are included here and the more important detailed monthly numbers are included in the appendix.

7.5 Projected Balance Sheet

The balance sheet in the following table shows managed but sufficient growth of net worth, and a sufficiently healthy financial position. The monthly estimates are included in the appendix.

7.6 Business Ratios

The following table provides important ratios for the industry, as determined by the Standard Industry Classification (SIC) Index, 7389, Business Services.

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Your Commercial Loan Amortization Schedule

The following table shows your regular amortizatizing payments with annual summaries.

Current Mortgage Rates

Refinancing tools, mortgage tools.

- Payment Amount

- PMI vs 2nd Mortgage

- Remaining Principal

- Cost Per Thousand

Loan Qualification

- Home Affordability

- Income Requirements

- FHA Qualification

Loan Comparison Tools

- Best Home Loan

- Mortgage Length

- Calculate Points

- Rent vs Buy

Money Saving Tools

- Fixed Annuity

- Variable Annuity

- Extra Payment

- Tax Benefits

Interest Only Loans

- Interest Only

- Interest + Pay Extra

- Reverse Mortgages

Credit Cards

- Minimum Credit Card Payments

- Pay Off Credit Cards

- Canadian Mortgages

- Desktop Mortgage Calculator

Commercial Property Loan Calculator

This tool figures payments on a commercial property, offering payment amounts for P & I, Interest-Only and Balloon repayments — along with providing a monthly amortization schedule. This calculator automatically figures the balloon payment based on the entered loan amortization period. If you instead want to calculate for a known ending balloon payment, please use our balloon loan calculator .

Current Commercial Mortgage Rates

Note: The range of commercial mortgage rates should be considered typical. However, there are outliers on the high and low end of the range. Thus, these figures do not guarantee actual rates on a specific commercial mortgage deal. To see which options you qualify for & get the best deal you can we recommend contacting a commercial mortgage broker who can help you see what you qualify for.

The Complete Guide to Understanding Commercial Mortgages

Running a new or old business? Coming up with strategic plans to achieve your goals is a must. But besides all the careful planning, you need enough working capital to jumpstart your operations. This is important whether you’re a establishing a new company or getting ready for expansion.

As your business grows, it’s crucial to find the appropriate commercial property that can accommodate your needs. This is where securing commercial mortgage can help. It saves money on rising rental expenses and reduces your overall cost structure. In the long run, this provides financial leeway for your business, especially during unfavorable economic periods.

In this guide, we’ll detail how commercial real estate loans work and how to qualify for this type of mortgage. You’ll learn about commercial loan terms, its payment structure, and rates. We’ll also discuss various sources of commercial real estate loans, as well as different options available in the market.

What is a Commercial Mortgage?

A loan secured by business property is called a commercial mortgage. It is used to purchase commercial property, develop land, or a building. This type of mortgage is also used to renovate offices and refinance existing commercial loans. Examples of property that use commercial mortgages include apartment complexes, restaurants, office buildings, industrial facilities, and shopping centers.

Commercial mortgages are commonly offered by banks and credit unions. They are also provided by insurance companies and independent investors. As for government-backed commercial loans, you may obtain Small Business Administration (SBA) loans to finance a business venture.

Commercial real estate financing is similar to traditional home loans. Lenders provide borrowers with money which is secured to your property. But instead of acquiring a primary residence or vacation home, commercial loans are designed to help you own business property. Commercial loan funds are also used as capital to start a business or expand its operations.

In summary, companies use commercial mortgages to accomplish the following goals:

- Develop or renovate an owner-occupied business

- Buy their own commercial property

- Obtain land development investments

- Acquire buy-to-let premises and lease them out

Commercial loans take a smaller fraction of the real estate market. Despite this fact, they remain significant financing tools for economic development. Commercial mortgages help companies acquire business property, improve its service, and implement expansion. In contrast, residential mortgages receive further government backing, making them more liquid than commercial loans. Meanwhile, commercial properties remain essential income-producing assets for economic growth.

Personal Guarantee on Commercial Loans

Business owners must personally guarantee a commercial mortgage if they don’t have enough credit to secure financing. Credit requirements are based on the risk assessment conducted by a lender.

Once you sign a personal guarantee, you tie your private assets to a commercial loan. And because it is an unsecured contract, a lender can take any of your assets as debt repayment . This allows them to seek monetary compensation in case you default on your loan. It’s a risky move, especially if you’re operating on thin margins. As a rule, try to secure enough credit before taking a commercial loan.

Commercial Loan Terms and Payment Structure

Commercial mortgages come in short terms of 3, 5, and 10 years. Others stretch as long as 25 years. But in general, commercial mortgage terms are not as long as most residential loans, which is usually 30 years.

When it comes to the payment structure, expect commercial loans to vary from the traditional amortizing schedule. A lender asks a borrower to pay the full loan after several years with a lump sum payment. This is called a balloon payment , where you pay the total remaining balance by the end of the agreed term.

For instance, a commercial loan has a balloon payment due in 10 years. The payment is based on a traditional amortization schedule such as a 30-year loan. Basically, you pay the first 10 years of principal and interest payments based on the full amortization table. Once the term ends, you make the balloon payment, which pays off the remaining balance in the mortgage.

Furthermore, you have the option make interest-only payments in a commercial loan. This means you do not have to worry about making principal payments for the entire term. Likewise, once the loan term is through, you must settle any remaining balance with a balloon payment.

In some cases, commercial lenders offer fully amortized loans as long as 20 or 25 years. This is how certain Small Business Administration loans are structured. And depending on the commercial loan and lender, some large commercial mortgages may be given a term of 40 years.

Commercial Loan Repayment Example

To understand how commercial payments work, let’s review this example. Let’s presume your commercial real estate loan is $2.5 million with 9 percent APR, with a loan term of 10 years. Let’s use the calculator on top of this page to estimate your monthly payment, interest-only payment, and total balloon payment.

- Commercial loan amount: $2,500,000

- Interest rate: 9% APR

- Term: 10 years

According to the results, your monthly commercial mortgage payment will be $20,155.80 for 10 years. If you choose to make interest-only payments, it will only be $18,787.00 per month. Once the 10 years is up, you must make a balloon payment of $2,240,215.07 to pay off your remaining balance.

What If You Can’t Make the Balloon Payment?

Sometimes, you might not be able to make a balloon payment on your commercial mortgage. If you’re worried about lack of funds, refinance before the end of the term. Start asking about refinancing at least a year before the term ends. This will save you from foreclosure and losing your lender’s trust. If you default on your loan, it spells bad news for your credit history, making it difficult to get approved for future commercial loans.

Commercial refinancing is basically taking out a new mortgage. It will help you restructure your payment into an amount you can afford. It also allows you to lower your interest rate and take a workable payment term. To refinance, you must also meet lender qualifications. Lenders conduct background checks on your personal and business credit history. They will also ask how long you’ve had the property.

Commercial Real Estate Interest Rates

Commercial loan rates are often slightly higher than residential mortgages. It is usually around 0.25 percent to 0.75 percent higher. If the property needs more active management such as a motel, the rate can increase. Depending on the establishment and type of financing, commercial mortgage rates typically range between 1.176 percent up to 12 percent.

Commercial real estate loans are fairly considered illiquid assets. Unlike residential mortgages, there are no organized secondary markets for commercial loans. This makes them much harder to sell. Thus, higher rates are assigned for purchasing commercial property.

Indexes Used for Commercial Loans

Lenders tie their commercial loans to several different types of indexes. An index is an indicator or statistical measure of change in market securities. Some of the most popular indexes used for commercial mortgages and adjustable rate loans are the prime rate and LIBOR. Commercial loans rates are also determined by U.S. Treasury Bonds and swap spreads.

This is the average of the prime rates offered by banks to other banks. The prime rate is also offered to the most creditworthy borrowers. Lenders adjust prime rates depending on market conditions. If your commercial loan is indexed to a prime rate, it generally means the rate is based on your lender’s individual prime rate.

LIBOR stands for the London Inter-Bank Offered Rate. It is one of the most widely used benchmarks for indexing interest rates all over the world. LIBOR is the rate used by London banks to lend funds to one another. It is also the rate used by banks that lend in the inter-bank market for short-term loans. LIBOR is based on estimates submitted by leading global banks. The calculation is headed by the ICE Benchmark Administration, which estimates 35 LIBOR rates for various financing products daily.

U.S. Treasury Bonds

Bonds are an important component of the commercial mortgage market. They establish the limit on how much lenders and banks can charge for real estate loans. In particular, the 10-year Treasury note is a type of bond that impacts mortgage rates. It’s auctioned and backed by the U.S. Government, which means it’s more secured compared to high-risk corporate bonds. Moreover, the 10-year Treasury bond is one of the benchmarks for commercial mortgages and residential loans. How the real estate market performs is dependent on 10-Year Treasury yields, which sets the standard for loan prices.

Swap Spreads

A common type of spread used in commercial real estate loans are swap spreads. A swap spread shows the difference between the swap rate (fixed interest rate) and the corresponding government bond yield (sovereign debt yield) of similar maturity. For the U.S., the sovereign debt yield would be the U.S. Treasury security. Swap spreads measure the likelihood of how interest rates will rise.

The tables below show commercial mortgages indices with corresponding yield and swap rates (July 27, 2020):

SOFR – Secured Overnight Financing Rate

The next table indicates commercial mortgage rates from different lending sources in 2020 & 2022:

Note: The range of commercial mortgage rates should be considered typical. However, there are outliers on the high and low end of the range. Thus, these figures do not guarantee actual rates on a specific commercial mortgage deal. The above chart shows data from the middle of 2020 and early August 2022 so you can see how changing credit conditions can impact various options.

Common Sources of Commercial Mortgage Financing

There are many sources of commercial financing in the market. Commercial loans are offered by banks, credit unions, insurance companies, and government-backed lenders. Private investors also lend commercial mortgages but at much higher rates.

The right kind of commercial loan for your business depends on the loan features you need. You must also factor in your business strategy, the type of commercial property, and your credit availability.

Below are several common types of commercial loans and where you can obtain them:

Conventional Commercial Mortgages

Business loans provided by FDIC-backed enterprises such as banks and credit unions are called conventional commercial mortgages. These are used for owner-occupied premises and investment properties. Conventional commercial loans are the kind that require a personal guarantee. During the underwriting process, they also need to check your global cash flow and your personal and business income tax returns.

A commercial mortgage is referred to as a “permanent loan” when you secure your first mortgage on a commercial property. Personal loans are typically amortized for 25 years. But for buildings with significant wear and tear, or properties over 30 years old, they may only grant a commercial loan for 20 years.

Permanent loans are known for their low rates compared to other types of commercial financing. The rates are low because they typically guarantee property that’s already developed and almost fully rented.

Owner-occupied Business vs. Investment Property

For developing an owner-occupied business, you are required to use 51 percent of the property. If you cannot meet this requirement, you should secure an investment property loan. Investment property loans are more appropriate for business owners who want to purchase property and lease them for extra profits. You can also use this to flip and sell old houses.

Conduit or CMBS Loans

A conduit loan , also called a commercial mortgage backed security (CMBS) loan, is a kind of commercial real estate loan backed by a first-position mortgage. Conduit loans are pooled together with a diverse set of other mortgages. Then, they are placed into a Real Estate Mortgage Investment Conduit (REMIC) trust and sold to investors. Each sold loan carries a risk equivalent to its rate of return. This type of loan is also used for properties such as retail buildings, shopping malls, warehouses, offices, and hotels.

Conduit loans can provide liquidity to real estate investors and commercial lenders. They are package by conduit lenders, commercial banks, and investment banks. These loans usually come with a fixed interest rate and a balloon payment by the end of the term. Some lenders also allow interest-only payments. Conduit loans are amortized with 5, 7, and 10-year terms, as well as 25 and 30-year terms.

The Small Business Administration (SBA) offers guaranteed commercial loans to qualified applicants. The SBA is a federal agency dedicated to aid businesses in securing loans. They help reduce default risk for lenders and make it easy for business owners to access capital. The SBA does not lend directly to borrowers, but offer financing through partner lenders, micro-lending institutions, and community development organizations.

There are two common types of SBA loans, the SBA 7(a) loan and the SBA 504 loan.

SBA 7(a) Loans

SBA 7(a) financing is used for developing owner-occupied business property. If you’re looking to build a new commercial establishment or renovate an old office, this can work for you. Likewise, a business is eligible for an SBA 7(a) loan if they occupy more than 50 percent of the property. An SBA 7(a) loan may guarantee up to 85 percent of the loan amount if the mortgage is $150,000. If you need a higher loan amount, the SBA can guarantee up to 75 percent.

This loan can be taken as fixed-rate mortgage, a variable-rate mortgage, or as a combination of the tow. SBA 7(a) loans fully amortize and typically paid up to 25 years. Moreover, the maximum rate for this type of financing is dependent on the current prime rate.

Qualified borrowers can secure up to $5 million from an SBA-backed lender. SBA 7(a) loans are available in fully amortized loans of up to 20 or 25 years.

Business owners can use SBA 7(a) loans to:

- Expand a business

- Establish or acquire a business

- Fund inventory

- Purchasing equipment and machinery

- Renovate or construct buildings

- Refinance existing business debt unrelated to the property

SBA 504 Loans

Another popular SBA commercial mortgage is the SBA 504 loan . It’s geared toward borrowers who utilize over 50 percent of their existing commercial property. This type of mortgage is structured with 2 loans: One part of the loan must be financed with a Certified Development Company (CDC) which accounts for 40 percent of the loan amount. The other part should be financed by a bank that will provide 50 percent of the loan amount.

With an SBA 504 loan, you can obtain up to f $5.5 million from your CDC lender. On the other hand, you can secure up to $5 million from the bank lender. You can use this type of loan to secure larger financing compared to an SBA 7(a) program. SBA 504 loans come with a fully amortized payment structure with a term of up to 20 years.

Borrowers can make use of SBA 504 loans to fund the following business goals:

- Invest in equipment

- Build or upgrade existing facilities

- Purchase existing land or buildings

- Develop land – parking, landscapes, streets

- Refinance debt associated with business expansion, including new or old property and equipment

Hard Money Loans

Borrowers who are unable to secure commercial loans usually have a history of foreclosure or a short sale on a loan. When this happens, they can turn to private investors for hard money loans .

Hard money loans are granted by private lenders as long as you have sufficient equity signed as a collateral for the loan. This type of financing comes in short terms, such as 12 months up to 2 years. If you’re looking for short-term financing to move your business or reconstruct your establishment, you can take advantage of this type of loan.

However, take caution. Private investors can be critical when it comes to repayment. They may also perform background checks on your credit. They base loan approval on property value without heavy reference to creditworthiness. Furthermore, hard money loans usually demand a higher interest rate of 10 percent or more compared to traditional commercial mortgages.

Hard Money Loan Risks

If your lender notices you’re not producing the agreed income, they might cut your financing. Some private lenders may even seize assets signed as collateral till they see proof of return of investment. Keep these risks in mind before you sign up for a hard money loan. If you really must take it, make sure you have enough funds to cover all your bases.

Bridge Loans

Bridge loans are similar to hard money loans though they can last up to 3 years and the interest rate tends to be slightly lower - in the 6% to 10% range. Both bridge and hard money loans are typically interest-only loans.

How to Qualify for Commercial Real Estate Loans

Commercial loan approval depends on your creditworthiness as a business owner. When a lender grants a loan, they trust that your company will produce enough profits to pay back the mortgage. That said, a commercial lender can only approve your loan after carefully reviewing your financial status.

Main Qualifications for Commercial Lending

Lenders refer to three main types of requirements before approving a commercial mortgage. These qualifications include your business finances, personal finances, and the property’s characteristics. They also check your personal and business credit score. Commercial lenders review your accounting books to verify if you have enough cash flow to repay the mortgage.

Apart from your finances, commercial underwriters also evaluate your company profile and your business associates. They will even assess your business plan and check the company’s projected earnings based on your goals. Due to this strict underwriting process, many new companies have a hard time getting their loan approved.

Make sure to meet the following requirements when you apply for a commercial loan:

Business Credit Score

Lenders assess your business credit score to gauge the appropriate interest rate, payment term, and down payment required for your loan. A higher credit score gives you greater chances of securing a commercial loan approval.

Who Scores Business Credit Profiles?

There are three primary credit agencies that assess business credit scores. The following are three main types of business credit scores classifications used by lenders:

- FICO LiquidCredit Small Business Scoring Service ( FICO SBSS score ) – This credit system ranges from 0 to 300, with 300 being the highest. The minimum required FICO SBSS score is 140 for a Small Business Administration loan pre-screen. But generally, 160 is more preferred by lenders.

- Dun & Bradstreet PAYDEX Score – This business credit system has a scale between 1 to 100, with 100 being the best possible score. Scores between 80 and 100 are considered low risk, increasing your company’s credibility to lenders. So aim for a high credit score of 80.

- Experian Business Credit Score – This scoring system ranges from 0 to 100. Zero represents the highest risk, while 100 indicates the lowest risk. For Experian, a credit score between 60 to 100 is classified with medium to low risk. A score of 80 and above is well preferred by lenders.

Personal Credit Score

When it comes to your personal credit score, get ready with a high credit rating. Most commercial lenders prefer borrowers with a FICO score not lower than 680. But to increase your chances of securing a commercial loan, aim for a score of 700.

Down Payment

Make sure you’ve saved up a large down payment. Commercial lenders typically require 20 to 30 percent down payment to secure a loan. Other lenders may even request for a 50 percent down payment.

Your Company’s Age

Lenders prefer businesses that have been running for at least 2 years . This is possible if you have an excellent credit history, both for your business and personal finances. But in many cases, you have higher chances of getting approved if your business is older.

Occupying More Than Half of the Property

A small business is required to occupy 51 percent of the property or more than half of the premises. If you are unable to meet this criteria, you cannot qualify for a commercial mortgage. You should consider applying for an investment property loan instead.

Investment Property Loans

Investment property loans are appropriate for rental properties. Borrowers use them to buy commercial property and rent them out for extra profit. Investment property loans are also used by house flippers who renovate and sell houses in the market.

Lending Ratio Qualifications

Commercial lenders evaluate three major ratios before approving a mortgage. This helps them further assess the risk profile of your loan. The three types of ratios are as follows:

1. Loan-to-Value (LTV) Ratio

LTV ratio is the percentage between the loan value and the market value of the commercial property securing the loan. A mortgage is considered a high-risk loan if the LTV ratio is high. Lenders typically accept 60 to 80 percent LTV for commercial loan borrowers. If you have a high risk loan, your lender usually assigns a higher interest rate.