Home » Pros and Cons » 14 Pros and Cons of a Business Plan

14 Pros and Cons of a Business Plan

Should you create a business plan? Most people will say that you should have at least some sort of outline that helps you guide your business. Yet sometimes an opportunity is so great that you’ve just got to jump right in and grab it before it disappears. If you want funding or growth to be sustainable, however, there is a good chance that you’ll need to create a business plan of some sort in order to find success. Here are some of the pros and cons of a business plan to consider as you go about the process of creating and then running your business.

What Are the Pros of a Business Plan?

A business plan is a guide that you can use to make money. By understanding what your business is about and how it is likely to perform, you’ll be able to see how each result receive can impact your bottom line. With comprehensive plans in place, you’ll be prepared to take action no matter what happens over the course of any given day. Here are some more benefits to think about.

1. It gives you a glimpse of the future. A business plan helps you to forecast an idea to see if it has the potential to be successful. There’s no reason to proceed with the implementation of an idea if it is just going to cost you money, but that’s what you do if you go all-in without thinking about things. Even if the future seems uncertain, you’ll still get a glimpse of where your business should be.

2. You’ll know how to allocate your resources. How much inventory should you be holding right now? What kind of budget should you have? Some resources that your business needs to have are going to be scare. When you can see what your potential financial future is going to be, you can make adjustments to your journey so that you can avoid the obstacles that get in your way on the path toward success.

3. It is necessary to have a business plan for credit. In order for a financial institution to give you a line of credit, you’ll need to present them with your business plan. This plan gives the financial institution a chance to see how organized you happen to be so they can more accurately gauge their lending risks. Most institutions won’t even give you an appointment to discuss financing unless you have a formal business plan created and operational.

4. A business plan puts everyone onto the same page. When you’re working with multiple people, then you’re going to have multiple viewpoints as to what will bring about the most success. That’s not to say that the opinions of others are unimportant. If there isn’t any structure involved with a business, then people with a differing opinion tend to go rogue and just do their own thing. By making sure that everyone is on the same page with a business plan, you can funnel those creative energies into ideas that bring your company a greater chance of success.

5. It allows others to know that you’re taking this business seriously. It’s one thing to float an idea out to the internet to see if there is the potential of a business being formed from it. Creating a business plan for that idea means you’re taking the idea more seriously. It shows others that you have confidence in its value and that you’re willing to back it up. You are able to communicate your intentions more effectively, explain the value of your idea, and show how its growth can help others.

6. It’s an easy way to identify core demographics. No matter what business idea you have, you’re going to need customers in order for it to succeed. Whether you’re in the service industry or you’re selling products online, you’ll need to identify who your core prospects are going to be. Once that identification takes place, you can then clone those prospects in other demographics to continue a growth curve. Without plans in place that allow you to identify these people, you’re just guessing at who will want to do business with you and that’s about as reliable as throwing darts at a dartboard while blindfolded.

7. There is a marketing element included with a good business plan. This allows you to know how you’ll be able to reach future markets with your current products or services. You’ll also be able to hone your value proposition, giving your brand a more effective presence in each demographic.

What Are the Cons of a Business Plan?

A business plan takes time to create. Depending on the size of your business, it could be a time investment that takes away from your initial profits. Short-term losses might happen when you’re working on a plan, but the goal is to great long-term gains. For businesses operating on a shoestring budget, one short-term loss may be enough to cause that business to shut their doors. Here are some of the other disadvantages that should be considered.

1. A business plan can turn out to be inaccurate. It is important to involve the “right” people in the business planning process. These are the people who are going to be influencing the long-term vision of your business. Many small business owners feel like they can avoid this negative by just creating the business plan on their own, but that requires expertise in multiple fields for it to be successful. A broad range of opinions and input is usually necessary for the best possible business plan because otherwise the blind spots of inaccuracy can lead to many unintended consequences.

2. Too much time can be spent on analysis. Maybe you’ve heard the expression “paralysis by analysis.” It cute and catchy, but it also accurately describes the struggle that many have in the creation of a business plan. Focus on the essentials of your business and how it will grow. Sure – you’ll need to buy toilet paper for the bathroom and you’ll want a cleaning service twice per week, but is that more important than knowing how you can reach potential customers? Of course not.

3. There is often a lack of accountability. Because one person is generally responsible for the creation of a business plan, it is difficult to hold that person accountable to the process. The plans become their view of the company and the success they’d like to see. It also means the business plan gets created on their timetable instead of what is best for the business and since there isn’t anyone else involved, it can be difficult to hold their feet to the fire to get the job done.

4. A great business plan requires great implementation practices. Many businesses create a plan that just sits somewhere on a shelf or on a drive somewhere because it was made for one specific purpose: funding. When a solid business plan has assigned specific responsibilities to specific job positions and creates the foundation for information gathering and metric creation, it should become an integral part of the company. Unfortunately poor implementation has ruined many great business plans over the years.

5. It restricts the freedom you once had. Business plans dictate what you should do and how you should do it. A vibrant business sometimes needs its most creative people to have the freedom to develop innovative new ideas. Instead the average plan tends to create an environment where the executives of the company dictate the goals and the mission of everyone. The people who are on the front lines are often not given the chance to influence the implementation of the business plan, which ultimately puts a company at a disadvantage.

6. It creates an environment of false certainty. It is important to remember that a business plan is nothing more than a forecast based on plans and facts that are present today. We live in a changing world where nothing is 100% certain. If there is too much certainty in the business plan that has been created, then it can make a business be unable to adapt to the changes that the world is placing on it. Or worse – it can cause a business to miss an exciting new opportunity because they are so tunnel-visioned on what must be done to meet one specific goal.

7. There are no guarantees. Even with all of the best research, the best workers, and a comprehensive business plan all working on your behalf, failure is more likely to happen than success. In the next 5 years, 95 out of 100 companies that start-up today will be out of business and many of them will have created comprehensive business plans.

The pros and cons of a business plan show that it may be an essential component of good business, but a comprehensive plan may not be necessary in all circumstances. The goal of a business plan should be clear: to analyze the present so a best guess at future results can be obtained. You’re plotting out a journey for that company. If you can also plan for detours, then you’ll be able to increase your chances to experience success.

Related Posts:

- 25 Best Ways to Overcome the Fear of Failure

- 30 Best Student Action Plan Examples

- 100 Most Profitable Food Business Ideas

- 10 Amazon Pricing Strategies with Examples

- Privacy Policy

Advantages and Disadvantages of Business Plan

Every business starts with a business plan because starting a business without a plan is like going on a chilled winter night without warm clothes and since starting a business involves money and where there is money one cannot take chances of going ahead without a plan. In order to understand it better let’s look at some of the advantages and disadvantages of business plan –

Advantages of Business Plan

- The first and foremost advantage of business plans is that once the company has business plan ready then only it can take it forward and present it to prospective investors who in turn if they like the plan will finance the business plan and we all know how important capital is for starting a business because without capital no business can start.

- Another benefit of business plans is that it helps the promoter in getting things right because if plans are in mind only then it can lead to confusion as mind has dozen of ideas but once the plan in mind is put into paper in the form of business plan than it gets more clarity and the owner can concentrate on one plan only rather than thinking about dozen of plans.

- Another advantage of the business plans is that it helps in prioritizing the work and also putting the right people for right job which in turn increases the possibility of the business plan being a success as the owner can keep track of milestones of business as envisaged in the business plan.

Disadvantages of Business Plan

- The biggest disadvantage of the business plans is that it involves time and expenses and as far as small businesses are concerned they neither have money and expertise to make a proper business plan which in turn can lead to business suffering more rather than gaining from the business plan.

- Another drawback of it is that due to the presence of business plans the owners may lose flexibility and become rigid also they will keep sticking to the business plan even if it detrimental to the interests of the business. So for example, if business plan has envisaged 10000 units of production but due to change in consumer taste sales of only 5000 units can be done and if the owner sticks to the business plan then it will be a loss making the decision. Hence a good business plan is one which has the scope of flexibility in it.

- Another disadvantage of business plans is that though plans are good to see and hear but execution of those plans has many problems and uncertainties right from procurement of finance, production related uncertainty, marketing and selling challenges and many other problems and it is next to impossible that plans are carried out in exact fashion as set out by the top management or the owner of the company.

- Company Profiles and Job Related

- Finance Abbreviations and Management

- Finance Questions and Answers

- Finance Words and Examples

- Financial Markets

- Financial Products and Marketing

- Multiple Choice Questions and Offbeat

Lets Learn Finance

Try for free

Business Plan

Who should write a business plan, pros and cons of a business plan, the anatomy of a business plan, .css-uphcpb{position:absolute;left:0;top:-87px;} what is a business plan, definition of a business plan.

A business plan is a strategic document which details the strategic objectives for a growing business or startup, and how it plans to achieve them.

In a nutshell, a business plan is a written expression of a business idea and will describe your business model, your product or service, how it will be priced, who will be your target market, and which tactics you plan to use to reach commercial success.

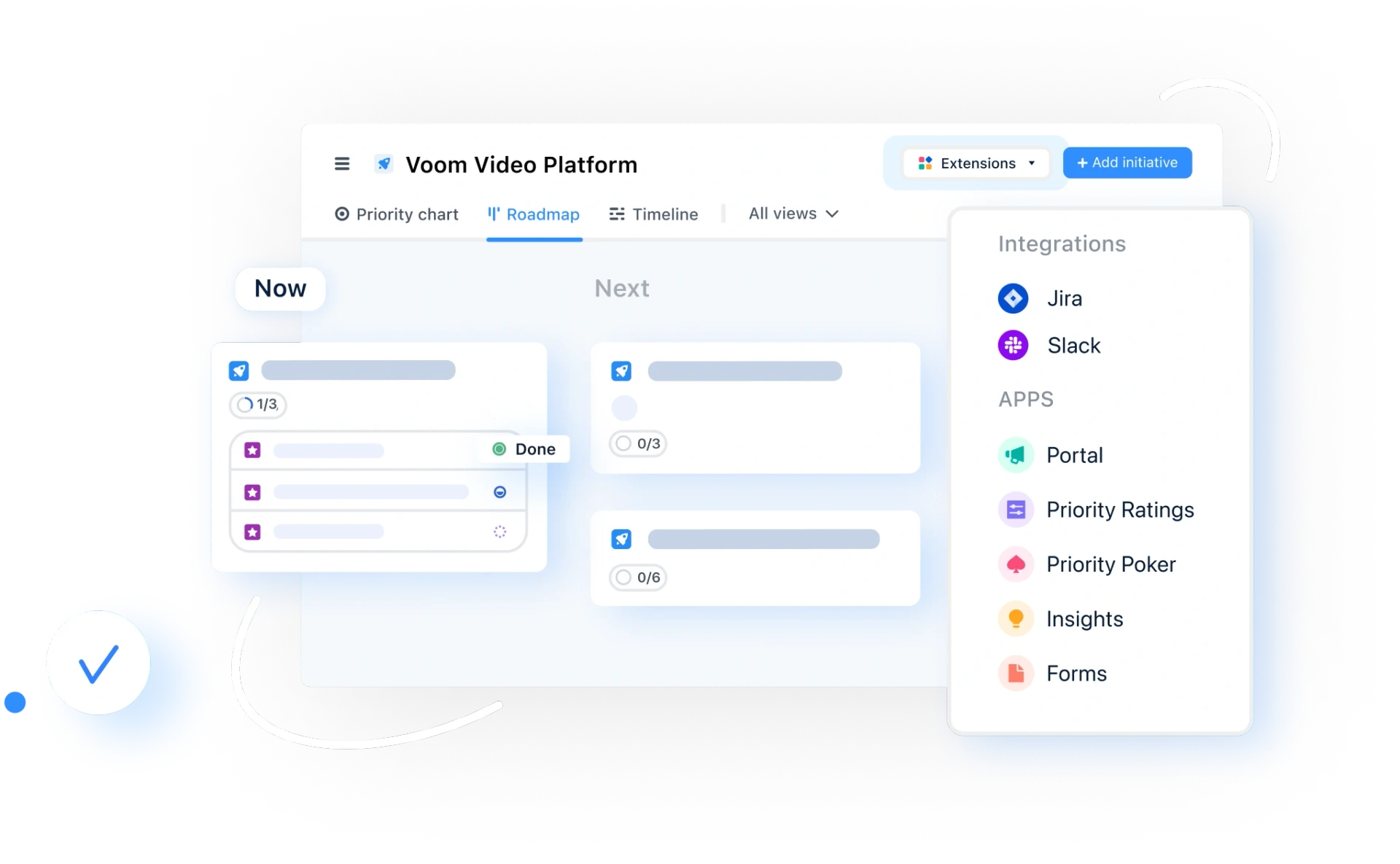

Whilst every enterprise should have a plan of some sort, a business plan is of particular importance during the investment process. Banks, venture capitalists, and angel investors alike will need to see a detailed plan in order to make sound investment decisions — think of your plan as a way of convincing them your idea is worth their resources.

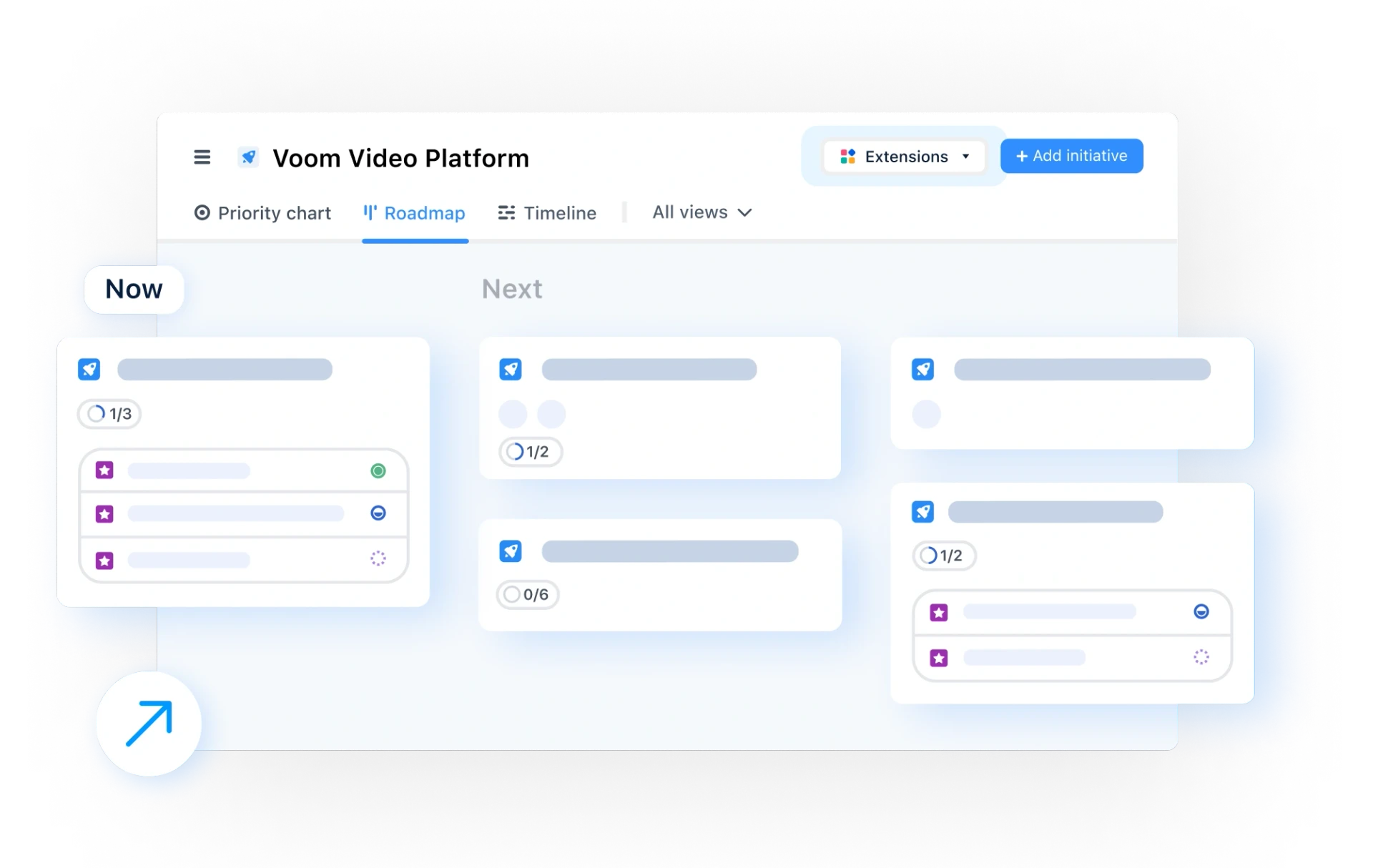

Roadmapping From A to Z

Business plans can also be useful as a guide to keeping a new business on track, especially in the first few months or years when the road ahead isn’t too clear.

Starting a business isn’t an exact science. Some companies organically develop out of trial and error, while others are plotted out from start to finish.

So if you’re asking whether your company needs a lengthy business plan, the answer would be ‘no’. That said, there are definitely a few situations in which writing a plan makes sense and can help increase the chances of a business becoming successful:

In situations when the market is new and untested — or simply volatile — it can be very helpful to have a business plan to refer back to when the road ahead isn’t clear.

For those who have an exciting business idea but haven’t necessarily distilled it down into black-and-white. Writing a business plan is a great way to look at a concept from all angles and spot any potential pitfalls.

How to write a business plan?

The most important step in writing a business plan is to identify its purpose.

Who are you trying to attract with it, and why?

Here are a few key pointers for writing a business plan:

Are you looking to secure a bank loan, get funding from private investors, or to lure skilled professionals to join you?

Include a brief history of your business, the concept, and the products or services. Keep it professional and transparent.

Don’t exaggerate your experience or skills, and definitely don’t leave out information investors need to know. They’ll find out at some point, and if they discover you lied, they could break off their involvement. Trust is crucial.

Explain what the product or service your business offers in simplistic terms.

Watch out for complex language and do whatever you can to prevent readers from becoming confused.

Focus on the benefits the business offers, how it solves the core audience’s problem(s), and what evidence you have to prove that there is a space in the market for your idea. It’s important to touch on the market your business will operate in, and who your main competitors are.

Another essential aspect of writing an effective business plan is to keep it short and sweet. Just focus on delivering the crucial information the reader has to know in order to make a decision. They can always ask you to elaborate on certain points later.

Still, deciding whether or not a business plan will benefit you at this stage of your venture?

Let’s look at a few reasons why you might (or might not) want to write a business plan.

A business plan will help you to secure funding even when you have no trading history. At the seed stage, funding is all-important — especially for tech and SaaS companies. It’s here that a business plan can become an absolute lifesaver.

Your business plan will maintain a strategic focus as time goes on. If you’ve ever heard of “mission creep”, you’ll know how important an agreed can be — and your business plan serves exactly that purpose.

Having a plan down in black and white will help you get other people on board . Again, with no trading history, it can be hard to convince new partners that you know what you’re doing. A business plan elegantly solves this problem.

Your business plan can cause you to stop looking outward. Sometimes, especially in business, you need to be reactive to market conditions. If you focus too much on your original business plan, you might make mistakes that can be costly or miss golden opportunities because they weren’t in the plan.

A lot of time can be wasted analyzing performance. It’s easy to become too focused on the goals and objectives in your business plan — especially when you’re not achieving them. By spending too much time analyzing past performance and looking back, you may miss out on other ways to push the business forward.

A business plan is out of date as soon as it’s written. We all know how quickly market conditions change. And, unfortunately, certain elements in your business plan may have lost relevance by the time you’re ready to launch. But there is another way ��— by transferring your strategic plan into an actionable roadmap , you can get the best of both worlds. The business plan contains important detail that is less likely to change, such as your mission statement and target audience, and the roadmap clarifies a flexible, adaptable, route forward.

So, you’ve decided to write a business plan — a great choice!

But now comes the tricky task of actually writing it.

This part can be a little frustrating because there is no one-size-fits-all template appropriate for all business plans. The best approach, in fact, is to look at common ingredients of a business plan and pick out the ones that make sense for your venture.

The key elements of a great business plan include:

An overview of the business concept . This is sometimes referred to as an executive summary and it’s essentially the elevator pitch for your business.

A detailed description of the product or service. It’s here that you’ll describe exactly what your core offering will be — what’s your USP , and what value do you deliver?

An explanation of the target audience. You need a good understanding of who you’ll be selling your product or service to, backed up by recent market research.

Your sales and marketing strategy. Now that you know who you’re targeting, how do you plan to reach them? Here you can list primary tactics for finding and maintaining an engaged client base.

Your core team . This section is all about people: do you have a team behind you already? If not, how will you build this team and what will the timeline be? Why are you the right group of people to bring this idea to the market? This section is incredibly important when seeking external investment — in most cases, passion can get you much further than professional experience.

Financial forecasts . Some investors will skim the executive summary and skip straight to the finances — so expect your forecasts to be scrutinized in a lot of detail. Writing a business plan for your eyes only? That’s fine, but you should still take time to map out your financial requirements: how much money do you need to start? How do you plan to keep money coming in? How long will it take to break even ? Remember, cash is king. So you need a cash flow forecast that is realistic, achievable and keeps your business afloat, especially in the tricky first few years.

General FAQ

Glossary categories.

Feedback Management

Prioritization

Product Management

Product Strategy

Roadmapping

Build great roadmaps

Book a demo

Experience the new way of doing product management

- Search Search Please fill out this field.

What Is a Business Plan?

Understanding business plans, how to write a business plan, common elements of a business plan, how often should a business plan be updated, the bottom line, business plan: what it is, what's included, and how to write one.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

- How to Start a Business: A Comprehensive Guide and Essential Steps

- How to Do Market Research, Types, and Example

- Marketing Strategy: What It Is, How It Works, How To Create One

- Marketing in Business: Strategies and Types Explained

- What Is a Marketing Plan? Types and How to Write One

- Business Development: Definition, Strategies, Steps & Skills

- Business Plan: What It Is, What's Included, and How to Write One CURRENT ARTICLE

- Small Business Development Center (SBDC): Meaning, Types, Impact

- How to Write a Business Plan for a Loan

- Business Startup Costs: It’s in the Details

- Startup Capital Definition, Types, and Risks

- Bootstrapping Definition, Strategies, and Pros/Cons

- Crowdfunding: What It Is, How It Works, and Popular Websites

- Starting a Business with No Money: How to Begin

- A Comprehensive Guide to Establishing Business Credit

- Equity Financing: What It Is, How It Works, Pros and Cons

- Best Startup Business Loans

- Sole Proprietorship: What It Is, Pros & Cons, and Differences From an LLC

- Partnership: Definition, How It Works, Taxation, and Types

- What is an LLC? Limited Liability Company Structure and Benefits Defined

- Corporation: What It Is and How to Form One

- Starting a Small Business: Your Complete How-to Guide

- Starting an Online Business: A Step-by-Step Guide

- How to Start Your Own Bookkeeping Business: Essential Tips

- How to Start a Successful Dropshipping Business: A Comprehensive Guide

A business plan is a document that details a company's goals and how it intends to achieve them. Business plans can be of benefit to both startups and well-established companies. For startups, a business plan can be essential for winning over potential lenders and investors. Established businesses can find one useful for staying on track and not losing sight of their goals. This article explains what an effective business plan needs to include and how to write one.

Key Takeaways

- A business plan is a document describing a company's business activities and how it plans to achieve its goals.

- Startup companies use business plans to get off the ground and attract outside investors.

- For established companies, a business plan can help keep the executive team focused on and working toward the company's short- and long-term objectives.

- There is no single format that a business plan must follow, but there are certain key elements that most companies will want to include.

Investopedia / Ryan Oakley

Any new business should have a business plan in place prior to beginning operations. In fact, banks and venture capital firms often want to see a business plan before they'll consider making a loan or providing capital to new businesses.

Even if a business isn't looking to raise additional money, a business plan can help it focus on its goals. A 2017 Harvard Business Review article reported that, "Entrepreneurs who write formal plans are 16% more likely to achieve viability than the otherwise identical nonplanning entrepreneurs."

Ideally, a business plan should be reviewed and updated periodically to reflect any goals that have been achieved or that may have changed. An established business that has decided to move in a new direction might create an entirely new business plan for itself.

There are numerous benefits to creating (and sticking to) a well-conceived business plan. These include being able to think through ideas before investing too much money in them and highlighting any potential obstacles to success. A company might also share its business plan with trusted outsiders to get their objective feedback. In addition, a business plan can help keep a company's executive team on the same page about strategic action items and priorities.

Business plans, even among competitors in the same industry, are rarely identical. However, they often have some of the same basic elements, as we describe below.

While it's a good idea to provide as much detail as necessary, it's also important that a business plan be concise enough to hold a reader's attention to the end.

While there are any number of templates that you can use to write a business plan, it's best to try to avoid producing a generic-looking one. Let your plan reflect the unique personality of your business.

Many business plans use some combination of the sections below, with varying levels of detail, depending on the company.

The length of a business plan can vary greatly from business to business. Regardless, it's best to fit the basic information into a 15- to 25-page document. Other crucial elements that take up a lot of space—such as applications for patents—can be referenced in the main document and attached as appendices.

These are some of the most common elements in many business plans:

- Executive summary: This section introduces the company and includes its mission statement along with relevant information about the company's leadership, employees, operations, and locations.

- Products and services: Here, the company should describe the products and services it offers or plans to introduce. That might include details on pricing, product lifespan, and unique benefits to the consumer. Other factors that could go into this section include production and manufacturing processes, any relevant patents the company may have, as well as proprietary technology . Information about research and development (R&D) can also be included here.

- Market analysis: A company needs to have a good handle on the current state of its industry and the existing competition. This section should explain where the company fits in, what types of customers it plans to target, and how easy or difficult it may be to take market share from incumbents.

- Marketing strategy: This section can describe how the company plans to attract and keep customers, including any anticipated advertising and marketing campaigns. It should also describe the distribution channel or channels it will use to get its products or services to consumers.

- Financial plans and projections: Established businesses can include financial statements, balance sheets, and other relevant financial information. New businesses can provide financial targets and estimates for the first few years. Your plan might also include any funding requests you're making.

The best business plans aren't generic ones created from easily accessed templates. A company should aim to entice readers with a plan that demonstrates its uniqueness and potential for success.

2 Types of Business Plans

Business plans can take many forms, but they are sometimes divided into two basic categories: traditional and lean startup. According to the U.S. Small Business Administration (SBA) , the traditional business plan is the more common of the two.

- Traditional business plans : These plans tend to be much longer than lean startup plans and contain considerably more detail. As a result they require more work on the part of the business, but they can also be more persuasive (and reassuring) to potential investors.

- Lean startup business plans : These use an abbreviated structure that highlights key elements. These business plans are short—as short as one page—and provide only the most basic detail. If a company wants to use this kind of plan, it should be prepared to provide more detail if an investor or a lender requests it.

Why Do Business Plans Fail?

A business plan is not a surefire recipe for success. The plan may have been unrealistic in its assumptions and projections to begin with. Markets and the overall economy might change in ways that couldn't have been foreseen. A competitor might introduce a revolutionary new product or service. All of this calls for building some flexibility into your plan, so you can pivot to a new course if needed.

How frequently a business plan needs to be revised will depend on the nature of the business. A well-established business might want to review its plan once a year and make changes if necessary. A new or fast-growing business in a fiercely competitive market might want to revise it more often, such as quarterly.

What Does a Lean Startup Business Plan Include?

The lean startup business plan is an option when a company prefers to give a quick explanation of its business. For example, a brand-new company may feel that it doesn't have a lot of information to provide yet.

Sections can include: a value proposition ; the company's major activities and advantages; resources such as staff, intellectual property, and capital; a list of partnerships; customer segments; and revenue sources.

A business plan can be useful to companies of all kinds. But as a company grows and the world around it changes, so too should its business plan. So don't think of your business plan as carved in granite but as a living document designed to evolve with your business.

Harvard Business Review. " Research: Writing a Business Plan Makes Your Startup More Likely to Succeed ."

U.S. Small Business Administration. " Write Your Business Plan ."

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1456193345-2cc8ef3d583f42d8a80c8e631c0b0556.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

Do you REALLY need a business plan?

The top three questions that I get asked most frequently as a professional business plan writer will probably not surprise you:

- What is the purpose of a business plan – why is it really required?

- How is it going to benefit my business if I write a business plan?

- Is a business plan really that important – how can I actually use it?

Keep reading to get my take on what the most essential advantages of preparing a business plan are—and why you may (not) need to prepare one.

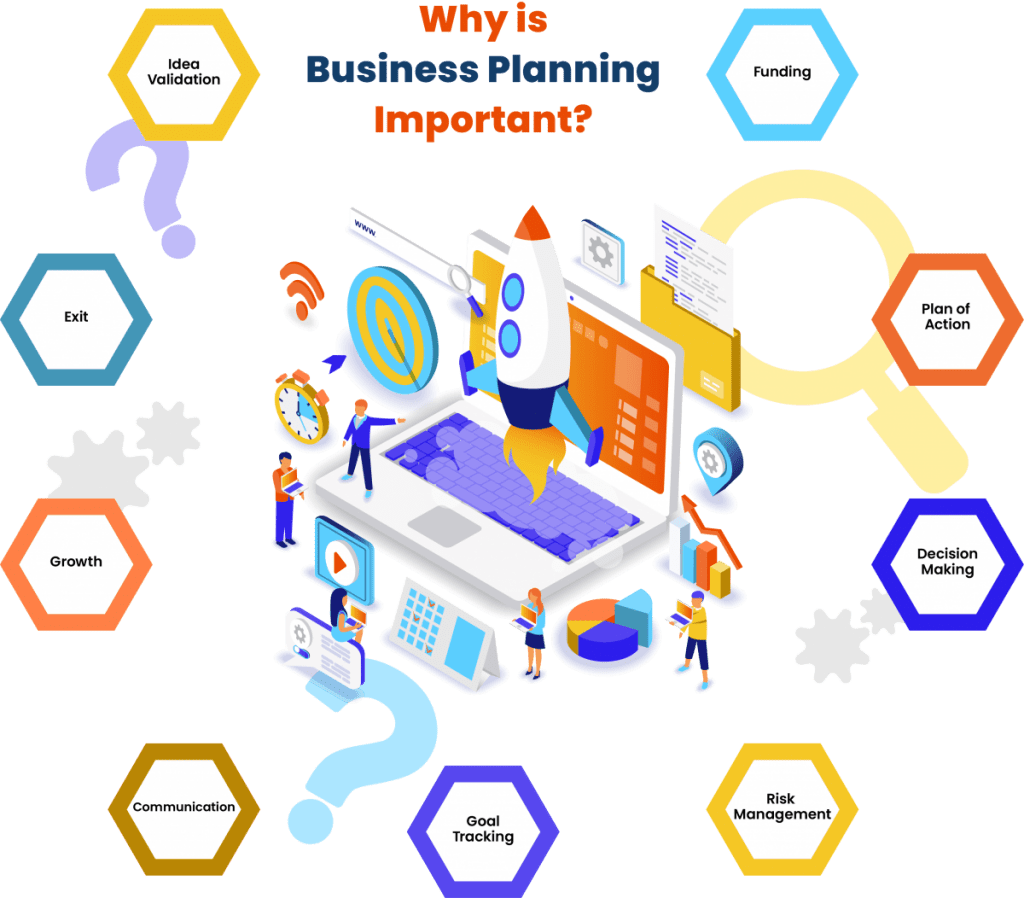

The importance, purpose and benefit of a business plan is in that it enables you to validate a business idea, secure funding, set strategic goals – and then take organized action on those goals by making decisions, managing resources, risk and change, while effectively communicating with stakeholders.

Let’s take a closer look at how each of the important business planning benefits can catapult your business forward:

1. Validate Your Business Idea

The process of writing your business plan will force you to ask the difficult questions about the major components of your business, including:

- External: industry, target market of prospective customers, competitive landscape

- Internal: business model, unique selling proposition, operations, marketing, finance

Business planning connects the dots to draw a big picture of the entire business.

And imagine how much time and money you would save if working through a business plan revealed that your business idea is untenable. You would be surprised how often that happens – an idea that once sounded so very promising may easily fall apart after you actually write down all the facts, details and numbers.

While you may be tempted to jump directly into start-up mode, writing a business plan is an essential first step to check the feasibility of a business before investing too much time and money into it. Business plans help to confirm that the idea you are so passionate and convinced about is solid from business point of view.

Take the time to do the necessary research and work through a proper business plan. The more you know, the higher the likelihood that your business will succeed.

2. Set and Track Goals

Successful businesses are dynamic and continuously evolve. And so are good business plans that allow you to:

- Priorities: Regularly set goals, targets (e.g., sales revenues reached), milestones (e.g. number of employees hired), performance indicators and metrics for short, mid and long term

- Accountability: Track your progress toward goals and benchmarks

- Course-correction: make changes to your business as you learn more about your market and what works and what does not

- Mission: Refer to a clear set of values to help steer your business through any times of trouble

Essentially, business plan is a blueprint and an important strategic tool that keeps you focused, motivated and accountable to keep your business on track. When used properly and consulted regularly, it can help you measure and manage what you are working so hard to create – your long-term vision.

As humans, we work better when we have clear goals we can work towards. The everyday business hustle makes it challenging to keep an eye on the strategic priorities. The business planning process serves as a useful reminder.

3. Take Action

A business plan is also a plan of action . At its core, your plan identifies where you are now, where you want your business to go, and how you will get there.

Planning out exactly how you are going to turn your vision into a successful business is perhaps the most important step between an idea and reality. Success comes not only from having a vision but working towards that vision in a systematic and organized way.

A good business plan clearly outlines specific steps necessary to turn the business objectives into reality. Think of it as a roadmap to success. The strategy and tactics need to be in alignment to make sure that your day-to-day activities lead to the achievement of your business goals.

4. Manage Resources

A business plan also provides insight on how resources required for achieving your business goals will be structured and allocated according to their strategic priority. For example:

Large Spending Decisions

- Assets: When and in what amount will the business commit resources to buy/lease new assets, such as computers or vehicles.

- Human Resources: Objectives for hiring new employees, including not only their pay but how they will help the business grow and flourish.

- Business Space: Information on costs of renting/buying space for offices, retail, manufacturing or other operations, for example when expanding to a new location.

Cash Flow It is essential that a business carefully plans and manages cash flows to ensure that there are optimal levels of cash in the bank at all times and avoid situations where the business could run out of cash and could not afford to pay its bills.

Revenues v. Expenses In addition, your business plan will compare your revenue forecasts to the budgeted costs to make sure that your financials are healthy and the business is set up for success.

5. Make Decisions

Whether you are starting a small business or expanding an existing one, a business plan is an important tool to help guide your decisions:

Sound decisions Gathering information for the business plan boosts your knowledge across many important areas of the business:

- Industry, market, customers and competitors

- Financial projections (e.g., revenue, expenses, assets, cash flow)

- Operations, technology and logistics

- Human resources (management and staff)

- Creating value for your customer through products and services

Decision-making skills The business planning process involves thorough research and critical thinking about many intertwined and complex business issues. As a result, it solidifies the decision-making skills of the business owner and builds a solid foundation for strategic planning , prioritization and sound decision making in your business. The more you understand, the better your decisions will be.

Planning Thorough planning allows you to determine the answer to some of the most critical business decisions ahead of time , prepare for anticipate problems before they arise, and ensure that any tactical solutions are in line with the overall strategy and goals.

If you do not take time to plan, you risk becoming overwhelmed by countless options and conflicting directions because you are not unclear about the mission , vision and strategy for your business.

6. Manage Risk

Some level of uncertainty is inherent in every business, but there is a lot you can do to reduce and manage the risk, starting with a business plan to uncover your weak spots.

You will need to take a realistic and pragmatic look at the hard facts and identify:

- Major risks , challenges and obstacles that you can expect on the way – so you can prepare to deal with them.

- Weaknesses in your business idea, business model and strategy – so you can fix them.

- Critical mistakes before they arise – so you can avoid them.

Essentially, the business plan is your safety net . Naturally, business plan cannot entirely eliminate risk, but it can significantly reduce it and prepare you for any challenges you may encounter.

7. Communicate Internally

Attract talent For a business to succeed, attracting talented workers and partners is of vital importance.

A business plan can be used as a communication tool to attract the right talent at all levels, from skilled staff to executive management, to work for your business by explaining the direction and growth potential of the business in a presentable format.

Align performance Sharing your business plan with all team members helps to ensure that everyone is on the same page when it comes to the long-term vision and strategy.

You need their buy-in from the beginning, because aligning your team with your priorities will increase the efficiency of your business as everyone is working towards a common goal .

If everyone on your team understands that their piece of work matters and how it fits into the big picture, they are more invested in achieving the objectives of the business.

It also makes it easier to track and communicate on your progress.

Share and explain business objectives with your management team, employees and new hires. Make selected portions of your business plan part of your new employee training.

8. Communicate Externally

Alliances If you are interested in partnerships or joint ventures, you may share selected sections of your plan with the potential business partners in order to develop new alliances.

Suppliers A business plan can play a part in attracting reliable suppliers and getting approved for business credit from suppliers. Suppliers who feel confident that your business will succeed (e.g., sales projections) will be much more likely to extend credit.

In addition, suppliers may want to ensure their products are being represented in the right way .

Professional Services Having a business plan in place allows you to easily share relevant sections with those you rely on to support the organization, including attorneys, accountants, and other professional consultants as needed, to make sure that everyone is on the same page.

Advisors Share the plan with experts and professionals who are in a position to give you valuable advice.

Landlord Some landlords and property managers require businesses to submit a business plan to be considered for a lease to prove that your business will have sufficient cash flows to pay the rent.

Customers The business plan may also function as a prospectus for potential customers, especially when it comes to large corporate accounts and exclusive customer relationships.

9. Secure Funding

If you intend to seek outside financing for your business, you are likely going to need a business plan.

Whether you are seeking debt financing (e.g. loan or credit line) from a lender (e.g., bank or financial institution) or equity capital financing from investors (e.g., venture or angel capital), a business plan can make the difference between whether or not – and how much – someone decides to invest.

Investors and financiers are always looking at the risk of default and the earning potential based on facts and figures. Understandably, anyone who is interested in supporting your business will want to check that you know what you are doing, that their money is in good hands, and that the venture is viable in the long run.

Business plans tend to be the most effective ways of proving that. A presentation may pique their interest , but they will most probably request a well-written document they can study in detail before they will be prepared to make any financial commitment.

That is why a business plan can often be the single most important document you can present to potential investors/financiers that will provide the structure and confidence that they need to make decisions about funding and supporting your company.

Be prepared to have your business plan scrutinized . Investors and financiers will conduct extensive checks and analyses to be certain that what is written in your business plan faithful representation of the truth.

10. Grow and Change

It is a very common misconception that a business plan is a static document that a new business prepares once in the start-up phase and then happily forgets about.

But businesses are not static. And neither are business plans. The business plan for any business will change over time as the company evolves and expands .

In the growth phase, an updated business plan is particularly useful for:

Raising additional capital for expansion

- Seeking financing for new assets , such as equipment or property

- Securing financing to support steady cash flows (e.g., seasonality, market downturns, timing of sale/purchase invoices)

- Forecasting to allocate resources according to strategic priority and operational needs

- Valuation (e.g., mergers & acquisitions, tax issues, transactions related to divorce, inheritance, estate planning)

Keeping the business plan updated gives established businesses better chance of getting the money they need to grow or even keep operating.

Business plan is also an excellent tool for planning an exit as it would include the strategy and timelines for a transfer to new ownership or dissolution of the company.

Also, if you ever make the decision to sell your business or position yourself for a merger or an acquisition , a strong business plan in hand is going to help you to maximize the business valuation.

Valuation is the process of establishing the worth of a business by a valuation expert who will draw on professional experience as well as a business plan that will outline what you have, what it’s worth now and how much will it likely produce in the future.

Your business is likely to be worth more to a buyer if they clearly understand your business model, your market, your assets and your overall potential to grow and scale .

Related Questions

Business plan purpose: what is the purpose of a business plan.

The purpose of a business plan is to articulate a strategy for starting a new business or growing an existing one by identifying where the business is going and how it will get there to test the viability of a business idea and maximize the chances of securing funding and achieving business goals and success.

Business Plan Benefits: What are the benefits of a business plan?

A business plan benefits businesses by serving as a strategic tool outlining the steps and resources required to achieve goals and make business ideas succeed, as well as a communication tool allowing businesses to articulate their strategy to stakeholders that support the business.

Business Plan Importance: Why is business plan important?

The importance of a business plan lies in it being a roadmap that guides the decisions of a business on the road to success, providing clarity on all aspects of its operations. This blueprint outlines the goals of the business and what exactly is needed to achieve them through effective management.

Sign up for our Newsletter

Get more articles just like this straight into your mailbox.

Related Posts

Recent Posts

14 Reasons Why You Need a Business Plan

10 min. read

Updated May 10, 2024

There’s no question that starting and running a business is hard work. But it’s also incredibly rewarding. And, one of the most important things you can do to increase your chances of success is to have a business plan.

A business plan is a foundational document that is essential for any company, no matter the size or age. From attracting potential investors to keeping your business on track—a business plan helps you achieve important milestones and grow in the right direction.

A business plan isn’t just a document you put together once when starting your business. It’s a living, breathing guide for existing businesses – one that business owners should revisit and update regularly.

Unfortunately, writing a business plan is often a daunting task for potential entrepreneurs. So, do you really need a business plan? Is it really worth the investment of time and resources? Can’t you just wing it and skip the whole planning process?

Good questions. Here’s every reason why you need a business plan.

- 1. Business planning is proven to help you grow 30 percent faster

Writing a business plan isn’t about producing a document that accurately predicts the future of your company. The process of writing your plan is what’s important. Writing your plan and reviewing it regularly gives you a better window into what you need to do to achieve your goals and succeed.

You don’t have to just take our word for it. Studies have proven that companies that plan and review their results regularly grow 30 percent faster. Beyond faster growth, research also shows that companies that plan actually perform better. They’re less likely to become one of those woeful failure statistics, or experience cash flow crises that threaten to close them down.

- 2. Planning is a necessary part of the fundraising process

One of the top reasons to have a business plan is to make it easier to raise money for your business. Without a business plan, it’s difficult to know how much money you need to raise, how you will spend the money once you raise it, and what your budget should be.

Investors want to know that you have a solid plan in place – that your business is headed in the right direction and that there is long-term potential in your venture.

A business plan shows that your business is serious and that there are clearly defined steps on how it aims to become successful. It also demonstrates that you have the necessary competence to make that vision a reality.

Investors, partners, and creditors will want to see detailed financial forecasts for your business that shows how you plan to grow and how you plan on spending their money.

- 3. Having a business plan minimizes your risk

When you’re just starting out, there’s so much you don’t know—about your customers, your competition, and even about operations.

As a business owner, you signed up for some of that uncertainty when you started your business, but there’s a lot you can do to reduce your risk . Creating and reviewing your business plan regularly is a great way to uncover your weak spots—the flaws, gaps, and assumptions you’ve made—and develop contingency plans.

Your business plan will also help you define budgets and revenue goals. And, if you’re not meeting your goals, you can quickly adjust spending plans and create more realistic budgets to keep your business healthy.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- 4. Crafts a roadmap to achieve important milestones

A business plan is like a roadmap for your business. It helps you set, track and reach business milestones.

For your plan to function in this way, your business plan should first outline your company’s short- and long-term goals. You can then fill in the specific steps necessary to reach those goals. This ensures that you measure your progress (or lack thereof) and make necessary adjustments along the way to stay on track while avoiding costly detours.

In fact, one of the top reasons why new businesses fail is due to bad business planning. Combine this with inflexibility and you have a recipe for disaster.

And planning is not just for startups. Established businesses benefit greatly from revisiting their business plan. It keeps them on track, even when the global market rapidly shifts as we’ve seen in recent years.

- 5. A plan helps you figure out if your idea can become a business

To turn your idea into reality, you need to accurately assess the feasibility of your business idea.

You need to verify:

- If there is a market for your product or service

- Who your target audience is

- How you will gain an edge over the current competition

- If your business can run profitably

A business plan forces you to take a step back and look at your business objectively, which makes it far easier to make tough decisions down the road. Additionally, a business plan helps you to identify risks and opportunities early on, providing you with the necessary time to come up with strategies to address them properly.

Finally, a business plan helps you work through the nuts and bolts of how your business will work financially and if it can become sustainable over time.

6. You’ll make big spending decisions with confidence

As your business grows, you’ll have to figure out when to hire new employees, when to expand to a new location, or whether you can afford a major purchase.

These are always major spending decisions, and if you’re regularly reviewing the forecasts you mapped out in your business plan, you’re going to have better information to use to make your decisions.

7. You’re more likely to catch critical cash flow challenges early

The other side of those major spending decisions is understanding and monitoring your business’s cash flow. Your cash flow statement is one of the three key financial statements you’ll put together for your business plan. (The other two are your balance sheet and your income statement (P&L).

Reviewing your cash flow statement regularly as part of your regular business plan review will help you see potential cash flow challenges earlier so you can take action to avoid a cash crisis where you can’t pay your bills.

- 8. Position your brand against the competition

Competitors are one of the factors that you need to take into account when starting a business. Luckily, competitive research is an integral part of writing a business plan. It encourages you to ask questions like:

- What is your competition doing well? What are they doing poorly?

- What can you do to set yourself apart?

- What can you learn from them?

- How can you make your business stand out?

- What key business areas can you outcompete?

- How can you identify your target market?

Finding answers to these questions helps you solidify a strategic market position and identify ways to differentiate yourself. It also proves to potential investors that you’ve done your homework and understand how to compete.

- 9. Determines financial needs and revenue models

A vital part of starting a business is understanding what your expenses will be and how you will generate revenue to cover those expenses. Creating a business plan helps you do just that while also defining ongoing financial needs to keep in mind.

Without a business model, it’s difficult to know whether your business idea will generate revenue. By detailing how you plan to make money, you can effectively assess the viability and scalability of your business.

Understanding this early on can help you avoid unnecessary risks and start with the confidence that your business is set up to succeed.

- 10. Helps you think through your marketing strategy

A business plan is a great way to document your marketing plan. This will ensure that all of your marketing activities are aligned with your overall goals. After all, a business can’t grow without customers and you’ll need a strategy for acquiring those customers.

Your business plan should include information about your target market, your marketing strategy, and your marketing budget. Detail things like how you plan to attract and retain customers, acquire new leads, how the digital marketing funnel will work, etc.

Having a documented marketing plan will help you to automate business operations, stay on track and ensure that you’re making the most of your marketing dollars.

- 11. Clarifies your vision and ensures everyone is on the same page

In order to create a successful business, you need a clear vision and a plan for how you’re going to achieve it. This is all detailed with your mission statement, which defines the purpose of your business, and your personnel plan, which outlines the roles and responsibilities of current and future employees. Together, they establish the long-term vision you have in mind and who will need to be involved to get there.

Additionally, your business plan is a great tool for getting your team in sync. Through consistent plan reviews, you can easily get everyone in your company on the same page and direct your workforce toward tasks that truly move the needle.

- 12. Future-proof your business

A business plan helps you to evaluate your current situation and make realistic projections for the future.

This is an essential step in growing your business, and it’s one that’s often overlooked. When you have a business plan in place, it’s easier to identify opportunities and make informed decisions based on data.

Therefore, it requires you to outline goals, strategies, and tactics to help the organization stay focused on what’s important.

By regularly revisiting your business plan, especially when the global market changes, you’ll be better equipped to handle whatever challenges come your way, and pivot faster.

You’ll also be in a better position to seize opportunities as they arise.

Further Reading: 5 fundamental principles of business planning

- 13. Tracks your progress and measures success

An often overlooked purpose of a business plan is as a tool to define success metrics. A key part of writing your plan involves pulling together a viable financial plan. This includes financial statements such as your profit and loss, cash flow, balance sheet, and sales forecast.

By housing these financial metrics within your business plan, you suddenly have an easy way to relate your strategy to actual performance. You can track progress, measure results, and follow up on how the company is progressing. Without a plan, it’s almost impossible to gauge whether you’re on track or not.

Additionally, by evaluating your successes and failures, you learn what works and what doesn’t and you can make necessary changes to your plan. In short, having a business plan gives you a framework for measuring your success. It also helps with building up a “lessons learned” knowledge database to avoid costly mistakes in the future.

- 14. Your business plan is an asset if you ever want to sell

Down the road, you might decide that you want to sell your business or position yourself for acquisition. Having a solid business plan is going to help you make the case for a higher valuation. Your business is likely to be worth more to a buyer if it’s easy for them to understand your business model, your target market, and your overall potential to grow and scale.

Free business plan template

Join over 1-million businesses and make planning easy with our simple, modern, investor-approved business plan template.

Download Template

- Writing your business plan

By taking the time to create a business plan, you ensure that your business is heading in the right direction and that you have a roadmap to get there. We hope that this post has shown you just how important and valuable a business plan can be. While it may still seem daunting, the benefits far outweigh the time investment and learning curve for writing one.

Luckily, you can write a plan in as little as 30 minutes. And there are plenty of excellent planning tools and business plan templates out there if you’re looking for more step-by-step guidance. Whatever it takes, write your plan and you’ll quickly see how useful it can be.

Tim Berry is the founder and chairman of Palo Alto Software , a co-founder of Borland International, and a recognized expert in business planning. He has an MBA from Stanford and degrees with honors from the University of Oregon and the University of Notre Dame. Today, Tim dedicates most of his time to blogging, teaching and evangelizing for business planning.

Table of Contents

- 6. You’ll make big spending decisions with confidence

- 7. You’re more likely to catch critical cash flow challenges early

Related Articles

7 Min. Read

8 Business Plan Templates You Can Get for Free

10 Min. Read

Use This Simple Business Plan Outline to Organize Your Plan

5 Min. Read

How to Run a Productive Monthly Business Plan Review Meeting

5 Consequences of Skipping a Business Plan

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

The Advantages and Disadvantages of Different Business Plan Strategies

Related blogs.

- Unlocking the Benefits of Outsourcing

- A Step-by-Step Guide to the Business Registration Process

- Uncover The Benefits & Power of Customer Segmentation

- Exploring the Benefits of Strategic Partnerships

- Strategies for Building Customer Loyalty

Introduction

A business plan strategy is a document that outlines and outlines the goals and objectives of a business. It also contains information about the company's objectives, strategies, and resources. As business owners or entrepreneurs, it is important to develop strategies that will allow the business to reach its goals in the long-term.

There are two primary strategies when it comes to business planning: complete and incomplete. A complete business plan strategy covers all aspects of the business, including management, marketing, finance, operations, and more. An incomplete business plan strategy typically focuses on one or two aspects of the business, such as finance or marketing.

Advantages and Disadvantages of Complete Strategies

Creating a business plan that takes a complete approach involves including all information wherein all factors are considered. When a business plan is created with a complete strategy, the goals and objectives of the organization are stated clearly and in detail. Furthermore, when taking a more detailed approach, every aspect of the business strategies is taken into account and can account for facets such as business environment, competitive market positioning, and supportive channels. These strategies are designed to enhance visibility, credibility, and reliability within the markets in which the organization looks to compete.

Disadvantages

The major disadvantage of developing a complete approach business plan is the high cost and time involved. Generally, a complete plan comprises of a complex set of components and intensive research. This includes research on technology, people, and competitive landscape, that can be quite expensive. Additionally, a complete business plan could take a few months and possibly even more than a year for completion. Furthermore, although a complete plan provides clear direction, since it focuses on more elements, it becomes very difficult and challenging to track progress. A complete approach can be too overwhelming at times, especially for smaller businesses.

Advantages and Disadvantages of Incomplete Strategies

Businesses that prefer an incomplete business plan strategy often find it less time consuming and more cost effective to implement. They do not invest more time into creating complex goals or analysis, which helps to save time, energy, and money. In addition, they allow businesses to easily adjust to changes in their markets or to develop in different directions without having to invest too much in planning.

A disadvantage of incomplete strategies is that they may not account for the true state of the business's operations due to their simpler set of objectives. This type of strategy could also fail to consider external influences, such as changes in the competitive environment, or the interests of stakeholders. Ultimately, developing an incomplete strategy can lead to inadequate or misdirected goals, and may prevent a successful outcome.

In addition, due to their simplified nature, incomplete strategies may not be able to thoroughly recognize potential risks and exploits that could ensue. This could lead to volatile decision making and a chaotic business environment. Furthermore, the strategies may lack the structure, focus, and vision that are necessary for any long-term business success.

Considerations for Choosing Between Complete and Incomplete Strategies

Choosing between complete and incomplete business plan strategies ultimately comes down to two major considerations: size and scale of business, and type and scope of planning.

Size and Scale of Business

The size and scale of your business is a key factor when deciding between complete and incomplete strategies. For smaller and more agile operations, an incomplete strategy may be preferable, as it requires less start-up cost and can be implemented quickly. And while larger operations are typically better-suited to a comprehensive approach, incomplete strategies may still be applicable depending on the nature of the business.

Type and Scope of Planning

The type and scope of planning is also a major factor when choosing between a complete and incomplete strategy. For example, companies that require detailed and elaborate plans may find that a complete strategy is more effective and efficient. Alternatively, less complex companies may find that an incomplete strategy is more suitable to their needs.

In addition to size and scope of business and type and scope of planning, there are a number of other considerations to take into account when selecting between complete and incomplete strategies. Such considerations may include budget, resources, timeline, and overall objectives. Ultimately, the strategy chosen should be tailored to the unique needs of the organization.

Examples of Suitable Industries for Complete Strategies

When it comes to creating a business plan, there is no one-size-fits-all approach. For some industries, a more complete strategy may be best while a more incomplete one may be better suited for others. Two industries that may require a more complete approach include the financial sector and the manufacturing industry.

Financial Sector

The financial sector is one of the most highly regulated industries in the world. When it comes to creating a business plan, it is critical to take a comprehensive approach that understands the legal and regulatory frameworks that govern this industry. A financial business plan should include an in-depth analysis of the competitive landscape as well as a detailed roadmap for how the business plans to achieve its financial goals. The business plan should also outline the risks associated with entering the industry and how the business will mitigate them.

Manufacturing Industry

The manufacturing industry is all about efficiency and cost savings. A successful manufacturing business plan must take a holistic view of the whole manufacturing process and include a detailed cost-benefit analysis. It should outline the costs associated with manufacturing, including capital costs, labor costs, raw materials, and other overhead expenses. The plan should also provide a clear timeline for when the business expects to achieve certain production goals and be able to generate revenue.

The manufacturing business plan should also include strategies for ensuring quality across the production process and meeting safety standards. A good plan should also include contingency plans for dealing with unexpected challenges and unexpected markets.

Examples of Suitable Industries for Incomplete Strategies

Incomplete business strategies can be a great fit for certain industries depending on the specific type of services or products they provide. The following is a list of two industries that are particularly suited for an incomplete business plan strategy.

Food & Beverage Service

Food and beverage service industries such as restaurants, catering, and cafes can benefit from an incomplete business plan strategy. As customers' tastes change drastically and the market shifts, businesses in these industries often face an ever-evolving landscape. By not having a rigid business plan to adhere to, these businesses can quickly adapt their approach and reevaluate their goals.

Likewise, retail businesses can also use an incomplete strategy as the market rapidly changes due to customer demands as well as technological advancements. With a plan that is not set in stone, such businesses can easily introduce new products or services to their customers as the need arises and keep up with the competition.

Choosing a business plan strategy is essential for companies that wish to achieve their business goals. There are several options available, including complete and incomplete strategies. Each strategy is beneficial in different scenarios, but both should be thoroughly considered in order to determine which is the best fit for a company.

Summary of Complete and Incomplete Strategies

A complete strategy involves strategizing enterprise-wide goals and implementing the necessary tactics to achieve them. This kind of strategy is best suited to businesses that have well-defined goals, the right resources, and the capacity to implement a long-term plan. An incomplete strategy, on the other hand, emphasizes flexibility and adapting to changing business needs. It is best suited to companies that need to adjust their plans quickly, as the market shifts.

Final Considerations for Choosing a Strategy

When choosing between a complete and incomplete business plan strategy, business owners should take into account their goals, resources, and needs. It is essential to evaluate each option carefully in order to determine which strategy is best suited for the company's specific needs. Additionally, business owners should also consider any outside factors, such as the current market and competitors, that could influence their decision.

By understanding the differences between complete and incomplete business plan strategies, companies can make an informed and effective decision for their business. With the right strategy in place, businesses can develop and grow on their own terms.

Fundrising Ready

MAC & PC Compatible

Immediate Download

Related Articles

The surprising truth about profitability in the appliance store industry: a deep dive into the numbers, why investing in an alcohol treatment center is more profitable than you think, counting the profits: a closer look at the profitability of accounting agencies, the art of boosting profits in your a la carte restaurant: a comprehensive guide, airbnb: unpacking the profitability of one of the world's most successful companies., the untold story of how car washes are making a fortune: discover the profit potential today, pedaling to profit: unveiling the lucrative world of bicycle couriers, thirsty for success discover the untapped profit potential of running a beer bar, the beauty within profits: discovering the lucrative world of beauty salons, unlocking the profit potential: how to make your beach hotel more profitable, leave a comment.

Your email address will not be published. Required fields are marked *

Please note, comments must be approved before they are published

What Are the Benefits of a Business Plan?

- Small Business

- Running a Business

- Benefits of a Business

- ')" data-event="social share" data-info="Pinterest" aria-label="Share on Pinterest">

- ')" data-event="social share" data-info="Reddit" aria-label="Share on Reddit">

- ')" data-event="social share" data-info="Flipboard" aria-label="Share on Flipboard">

Checklist for a Business Plan

Why is an effective business plan introduction important, what does "abridged" mean on a business plan.

- What Does a Business Plan Consist Of?

- Importance of Following a Business Plan

What is a business plan, and what’s the point of a business plan? To understand the benefits of a business plan, it is important to first understand why it's useful and how to create one.

In essence, a business plan describes a business in detail, including its goals and how it intends to achieve them. Business plans are typically written for new businesses, though they can be written for existing ones as well. The plan includes the operational, financial and marketing aspects of the venture.

The business plan is a fundamental tool and is necessary for a startup that needs a sense of direction. One of the reasons a business plan is so important is that it is one of the main requirements of venture capital firms and banks interested in investing funds in businesses. The business plan usually starts with an executive summary, followed by a description of the business in detail, including its products and services, and a section on how the business is going to achieve its goals from operational, financial and marketing standpoints. The business plan also typically includes a brief look at the industry within which the business will operate and how the business will differentiate itself from the competition.

What Are the Various Types of Business Plans?

There are many types of business plans. These include: feasibility plans, annual plans, internal plans, operations plans, growth plans and more. These different types of plans are drafted to match the different business situations. For example, if you’re preparing a business plan for internal reasons and not to seek funding from a financial institution, there is absolutely no need to include background information in your business plan. When you’re preparing a business plan for external investors, you should describe the management team; if you’re preparing the business plan for a bank, you should include the financial history and background of the company. With different circumstances, different pieces of information are included in the business plan.

Business Plans for Start-Ups

The business plan you prepare for a startup is about as standard as it gets when it comes to explaining all the steps that need to be taken by a new business to achieve its goals. These plans typically include information on the financial analysis of the business, the milestones for implementation, the management team, the strategy of the business, various forecasts, the marketplace and the product or service offering of the organization.

Notable among the plan's forecasts are predictions for the sales, profit, loss, cash flow and balance sheet of the company. There will also likely be additional tables included in the section on financial analysis, as well as the monthly projections for the first year. The plan for a startup usually begins with an abstract and contains an appendix at the end.

Internal Business Plans

Any business plan you do not prepare with the intent to show a financial institution, an external investor or any other third party is known as an internal business plan. In such plans, you don’t really need to describe in detail the organization or the management team. You may also choose whether or not to include financial projections like forecasts and budget. Usually, in internal business plans, the whole plan is written as a report using paragraph form. The main points will either be depicted as bullet points or as slides, in the case of a PowerPoint presentation.

Operational Business Plans

Operational business plans are typically prepared for use by the business itself, so they are strictly a type of internal business plan. They are also known as annual plans and include detailed information on deadlines, implementation milestones, specific dates, and the responsibilities of teams and their managers.

The operational business plan doesn’t go into much detail about who needs to do what and when. It looks at the responsibilities and dates from the perspective of what is a top priority and what is high level. It typically arranges data in the form of bullet points on slides in a presentation. There's no need for descriptions of the management teams or the organization. You also won’t find detailed explanations of all financial projections in these business plans. They are typically not regarded at all when the business plan is being used to formulate strategies going forward.

Growth Business Plans

Some business plans do not concern themselves with the entirety of the business. They are only interested in a part of the business or a specific area of interest. These are called growth plans, new product plans or expansion plans, depending on what they are looking to achieve. They may or may not be internal plans, depending whether they are meant to attract outside investment or meet the loan requirements of a bank. For example, you could prepare a startup plan to attract new investment when the business is just starting out. When you need to attract new funding or some kind of debt finance, you would prepare an expansion plan. Both plans should include a detailed description of the organization as well as extensive background data on each member of the management team. If, however, the expansion plan is for the business’s own internal consumption, it will be categorized as an internal business plan and won’t contain details about the organizations or the management team. Internal expansion and growth plans are used to strategize on the steps the business needs to take to expand and grow. Such internal plans also involve internal funding provided by the business itself. There may or may not be detailed financial projections. However, the projections of the sales and costs of any expansion plans are typically laid out in detail.

The bigger picture: This is one of the key advantages of a business plan. When you plan your business right, you can get a clearer picture of the business as a whole. You can easily comnect the dots between strategy and tactics, and everything is easier to work out.

Strategic focus: As a startup, you need to create an identity and focus on building that identity. It is usually defined by your target market, and the products and services you are tailoring to match their needs.

Set priorities: It’s impossible to do everything at once in a business. When you plan your business, you can order things in terms of their importance and allocate your effort, resources and time in an efficient and strategic manner.

Manage change: When you plan your business effectively, you can check your assumptions, track your progress and see new developments right from the beginning, allowing you to adjust accordingly.

Forces you to be accountable: When you plan effectively, you set expectations for yourself and a means by which you will be able to track your results. You can constantly review your business plan in terms of what you expect and what eventually happens.

- Score: What is the purpose of a business plan?

- Investment Bank: Types of Business Plans

- Reference for Business: BUSINESS PLAN

- U.S. Small Business Administration: Handle Legal Concerns--Legal FAQ's

- My Own Business: Business Licenses, Permits, and Business Names

Nicky is a business writer with nearly two decades of hands-on and publishing experience. She's been published in several business publications, including The Employment Times, Web Hosting Sun and WOW! Women on Writing. She also studied business in college.

Related Articles

6 types of business plans, how to conclude a business plan, why is planning an important step in starting a business, what are the main purposes of a business plan, four types of information in a business plan, what is the difference between a marketing & business plan, how to simply write a business plan for a loan, what is the overall purpose of a business plan, what is a business plan template, most popular.

- 1 6 Types of Business Plans

- 2 How to Conclude a Business Plan

- 3 Why Is Planning an Important Step in Starting a Business?

- 4 What Are the Main Purposes of a Business Plan?

The Disadvantages of a Business Plan

by Kenneth Black

Published on 26 Sep 2017

The advantages of a business plan are very clear: it provides direction and strategy for your business, is often necessary to get financing and is a way to keep employees on track. While these advantages are all valuable, there also are some disadvantages to a business plan. Understanding these and how to avoid or correct them is key in determining the overall success of any plan. Doing this takes time and energy, but not doing it can be risky in the long run.

Discouragement