How to Do Market Research: The Complete Guide

Learn how to do market research with this step-by-step guide, complete with templates, tools and real-world examples.

Access best-in-class company data

Get trusted first-party funding data, revenue data and firmographics

What are your customers’ needs? How does your product compare to the competition? What are the emerging trends and opportunities in your industry? If these questions keep you up at night, it’s time to conduct market research.

Market research plays a pivotal role in your ability to stay competitive and relevant, helping you anticipate shifts in consumer behavior and industry dynamics. It involves gathering these insights using a wide range of techniques, from surveys and interviews to data analysis and observational studies.

In this guide, we’ll explore why market research is crucial, the various types of market research, the methods used in data collection, and how to effectively conduct market research to drive informed decision-making and success.

What is market research?

Market research is the systematic process of gathering, analyzing and interpreting information about a specific market or industry. The purpose of market research is to offer valuable insight into the preferences and behaviors of your target audience, and anticipate shifts in market trends and the competitive landscape. This information helps you make data-driven decisions, develop effective strategies for your business, and maximize your chances of long-term growth.

Why is market research important?

By understanding the significance of market research, you can make sure you’re asking the right questions and using the process to your advantage. Some of the benefits of market research include:

- Informed decision-making: Market research provides you with the data and insights you need to make smart decisions for your business. It helps you identify opportunities, assess risks and tailor your strategies to meet the demands of the market. Without market research, decisions are often based on assumptions or guesswork, leading to costly mistakes.

- Customer-centric approach: A cornerstone of market research involves developing a deep understanding of customer needs and preferences. This gives you valuable insights into your target audience, helping you develop products, services and marketing campaigns that resonate with your customers.

- Competitive advantage: By conducting market research, you’ll gain a competitive edge. You’ll be able to identify gaps in the market, analyze competitor strengths and weaknesses, and position your business strategically. This enables you to create unique value propositions, differentiate yourself from competitors, and seize opportunities that others may overlook.

- Risk mitigation: Market research helps you anticipate market shifts and potential challenges. By identifying threats early, you can proactively adjust their strategies to mitigate risks and respond effectively to changing circumstances. This proactive approach is particularly valuable in volatile industries.

- Resource optimization: Conducting market research allows organizations to allocate their time, money and resources more efficiently. It ensures that investments are made in areas with the highest potential return on investment, reducing wasted resources and improving overall business performance.

- Adaptation to market trends: Markets evolve rapidly, driven by technological advancements, cultural shifts and changing consumer attitudes. Market research ensures that you stay ahead of these trends and adapt your offerings accordingly so you can avoid becoming obsolete.

As you can see, market research empowers businesses to make data-driven decisions, cater to customer needs, outperform competitors, mitigate risks, optimize resources and stay agile in a dynamic marketplace. These benefits make it a huge industry; the global market research services market is expected to grow from $76.37 billion in 2021 to $108.57 billion in 2026 . Now, let’s dig into the different types of market research that can help you achieve these benefits.

Types of market research

- Qualitative research

- Quantitative research

- Exploratory research

- Descriptive research

- Causal research

- Cross-sectional research

- Longitudinal research

Despite its advantages, 23% of organizations don’t have a clear market research strategy. Part of developing a strategy involves choosing the right type of market research for your business goals. The most commonly used approaches include:

1. Qualitative research

Qualitative research focuses on understanding the underlying motivations, attitudes and perceptions of individuals or groups. It is typically conducted through techniques like in-depth interviews, focus groups and content analysis — methods we’ll discuss further in the sections below. Qualitative research provides rich, nuanced insights that can inform product development, marketing strategies and brand positioning.

2. Quantitative research

Quantitative research, in contrast to qualitative research, involves the collection and analysis of numerical data, often through surveys, experiments and structured questionnaires. This approach allows for statistical analysis and the measurement of trends, making it suitable for large-scale market studies and hypothesis testing. While it’s worthwhile using a mix of qualitative and quantitative research, most businesses prioritize the latter because it is scientific, measurable and easily replicated across different experiments.

3. Exploratory research

Whether you’re conducting qualitative or quantitative research or a mix of both, exploratory research is often the first step. Its primary goal is to help you understand a market or problem so you can gain insights and identify potential issues or opportunities. This type of market research is less structured and is typically conducted through open-ended interviews, focus groups or secondary data analysis. Exploratory research is valuable when entering new markets or exploring new product ideas.

4. Descriptive research

As its name implies, descriptive research seeks to describe a market, population or phenomenon in detail. It involves collecting and summarizing data to answer questions about audience demographics and behaviors, market size, and current trends. Surveys, observational studies and content analysis are common methods used in descriptive research.

5. Causal research

Causal research aims to establish cause-and-effect relationships between variables. It investigates whether changes in one variable result in changes in another. Experimental designs, A/B testing and regression analysis are common causal research methods. This sheds light on how specific marketing strategies or product changes impact consumer behavior.

6. Cross-sectional research

Cross-sectional market research involves collecting data from a sample of the population at a single point in time. It is used to analyze differences, relationships or trends among various groups within a population. Cross-sectional studies are helpful for market segmentation, identifying target audiences and assessing market trends at a specific moment.

7. Longitudinal research

Longitudinal research, in contrast to cross-sectional research, collects data from the same subjects over an extended period. This allows for the analysis of trends, changes and developments over time. Longitudinal studies are useful for tracking long-term developments in consumer preferences, brand loyalty and market dynamics.

Each type of market research has its strengths and weaknesses, and the method you choose depends on your specific research goals and the depth of understanding you’re aiming to achieve. In the following sections, we’ll delve into primary and secondary research approaches and specific research methods.

Primary vs. secondary market research

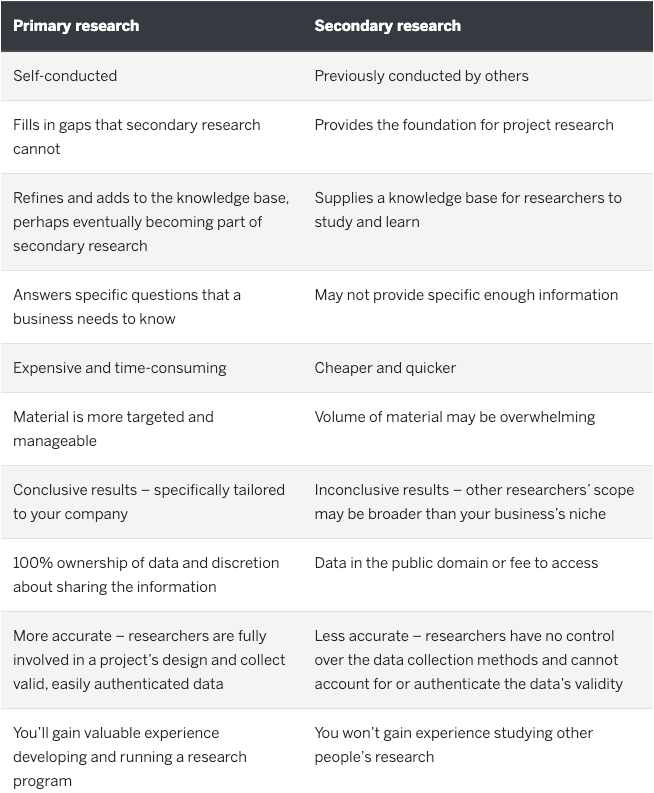

Market research of all types can be broadly categorized into two main approaches: primary research and secondary research. By understanding the differences between these approaches, you can better determine the most appropriate research method for your specific goals.

Primary market research

Primary research involves the collection of original data straight from the source. Typically, this involves communicating directly with your target audience — through surveys, interviews, focus groups and more — to gather information. Here are some key attributes of primary market research:

- Customized data: Primary research provides data that is tailored to your research needs. You design a custom research study and gather information specific to your goals.

- Up-to-date insights: Because primary research involves communicating with customers, the data you collect reflects the most current market conditions and consumer behaviors.

- Time-consuming and resource-intensive: Despite its advantages, primary research can be labor-intensive and costly, especially when dealing with large sample sizes or complex study designs. Whether you hire a market research consultant, agency or use an in-house team, primary research studies consume a large amount of resources and time.

Secondary market research

Secondary research, on the other hand, involves analyzing data that has already been compiled by third-party sources, such as online research tools, databases, news sites, industry reports and academic studies.

Here are the main characteristics of secondary market research:

- Cost-effective: Secondary research is generally more cost-effective than primary research since it doesn’t require building a research plan from scratch. You and your team can look at databases, websites and publications on an ongoing basis, without needing to design a custom experiment or hire a consultant.

- Leverages multiple sources: Data tools and software extract data from multiple places across the web, and then consolidate that information within a single platform. This means you’ll get a greater amount of data and a wider scope from secondary research.

- Quick to access: You can access a wide range of information rapidly — often in seconds — if you’re using online research tools and databases. Because of this, you can act on insights sooner, rather than taking the time to develop an experiment.

So, when should you use primary vs. secondary research? In practice, many market research projects incorporate both primary and secondary research to take advantage of the strengths of each approach.

One rule of thumb is to focus on secondary research to obtain background information, market trends or industry benchmarks. It is especially valuable for conducting preliminary research, competitor analysis, or when time and budget constraints are tight. Then, if you still have knowledge gaps or need to answer specific questions unique to your business model, use primary research to create a custom experiment.

Market research methods

- Surveys and questionnaires

- Focus groups

- Observational research

- Online research tools

- Experiments

- Content analysis

- Ethnographic research

How do primary and secondary research approaches translate into specific research methods? Let’s take a look at the different ways you can gather data:

1. Surveys and questionnaires

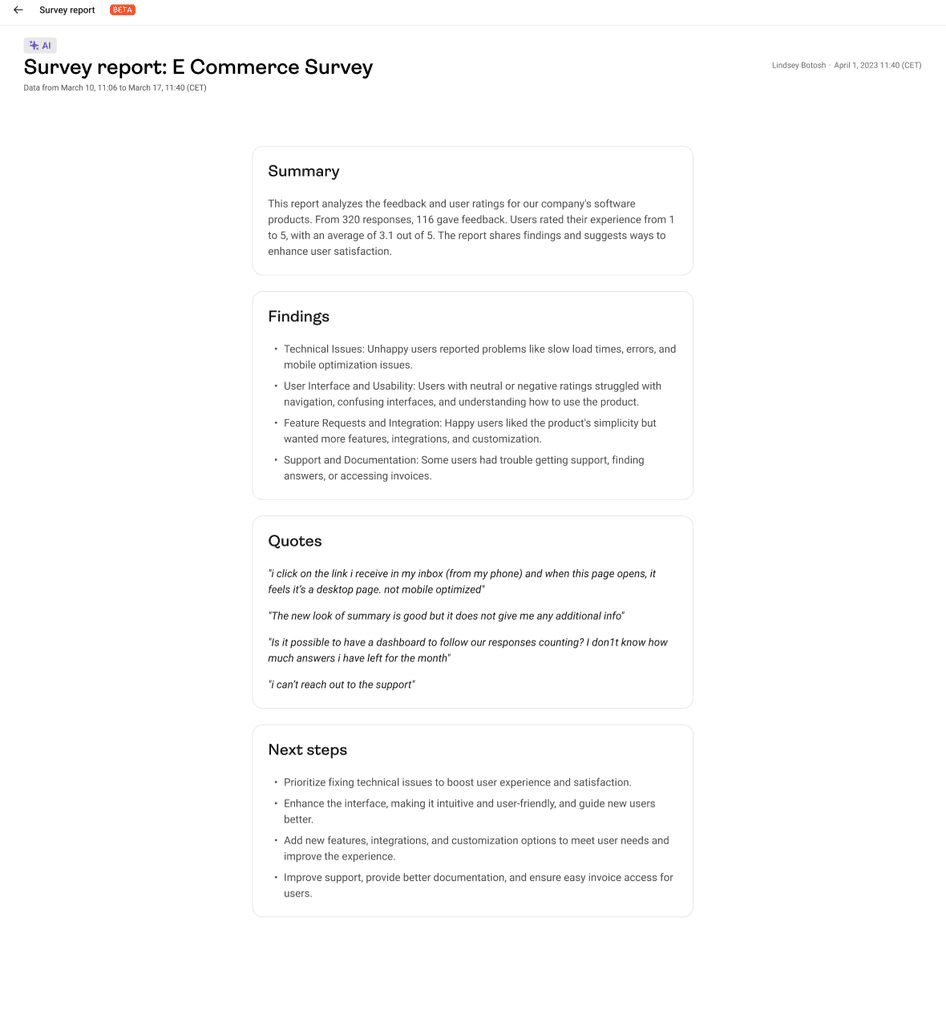

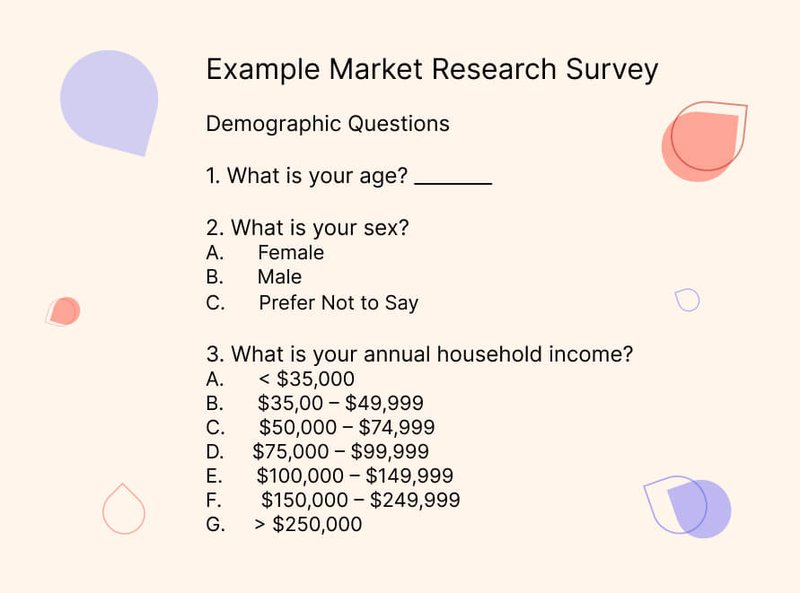

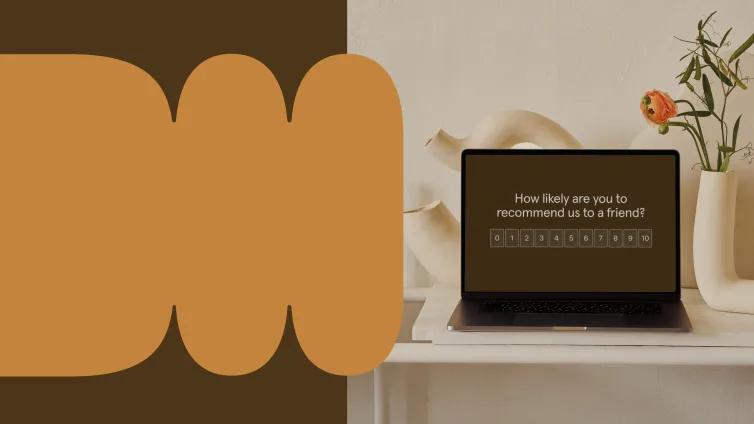

Surveys and questionnaires are popular methods for collecting structured data from a large number of respondents. They involve a set of predetermined questions that participants answer. Surveys can be conducted through various channels, including online tools, telephone interviews and in-person or online questionnaires. They are useful for gathering quantitative data and assessing customer demographics, opinions, preferences and needs. On average, customer surveys have a 33% response rate , so keep that in mind as you consider your sample size.

2. Interviews

Interviews are in-depth conversations with individuals or groups to gather qualitative insights. They can be structured (with predefined questions) or unstructured (with open-ended discussions). Interviews are valuable for exploring complex topics, uncovering motivations and obtaining detailed feedback.

3. Focus groups

The most common primary research methods are in-depth webcam interviews and focus groups. Focus groups are a small gathering of participants who discuss a specific topic or product under the guidance of a moderator. These discussions are valuable for primary market research because they reveal insights into consumer attitudes, perceptions and emotions. Focus groups are especially useful for idea generation, concept testing and understanding group dynamics within your target audience.

4. Observational research

Observational research involves observing and recording participant behavior in a natural setting. This method is particularly valuable when studying consumer behavior in physical spaces, such as retail stores or public places. In some types of observational research, participants are aware you’re watching them; in other cases, you discreetly watch consumers without their knowledge, as they use your product. Either way, observational research provides firsthand insights into how people interact with products or environments.

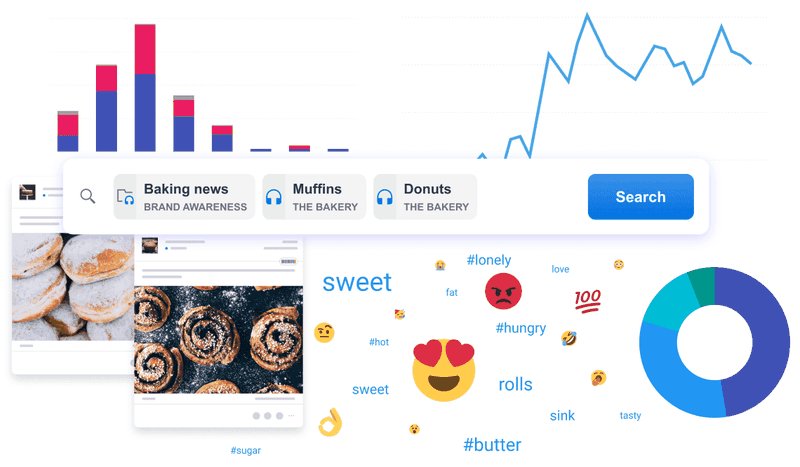

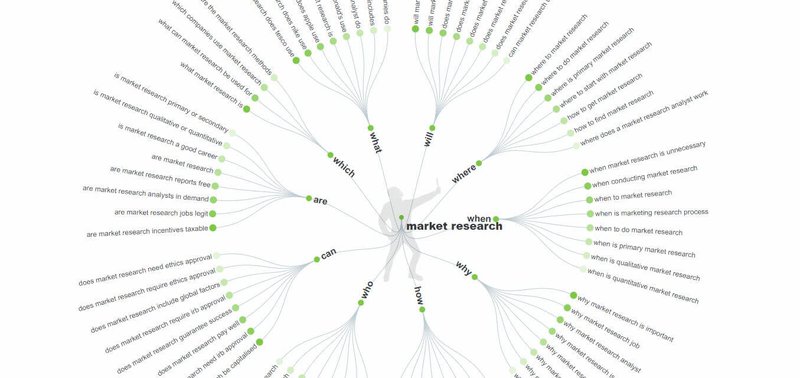

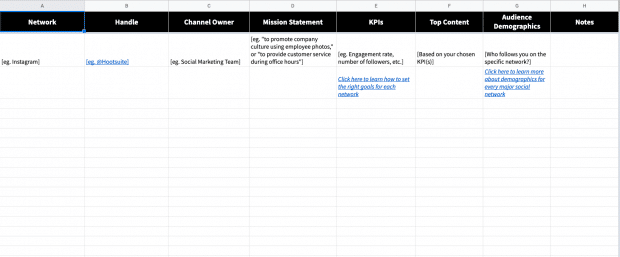

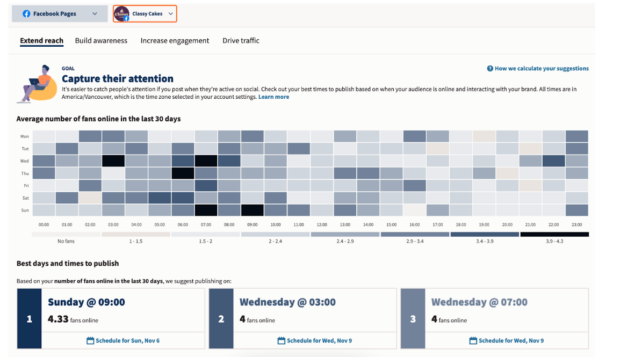

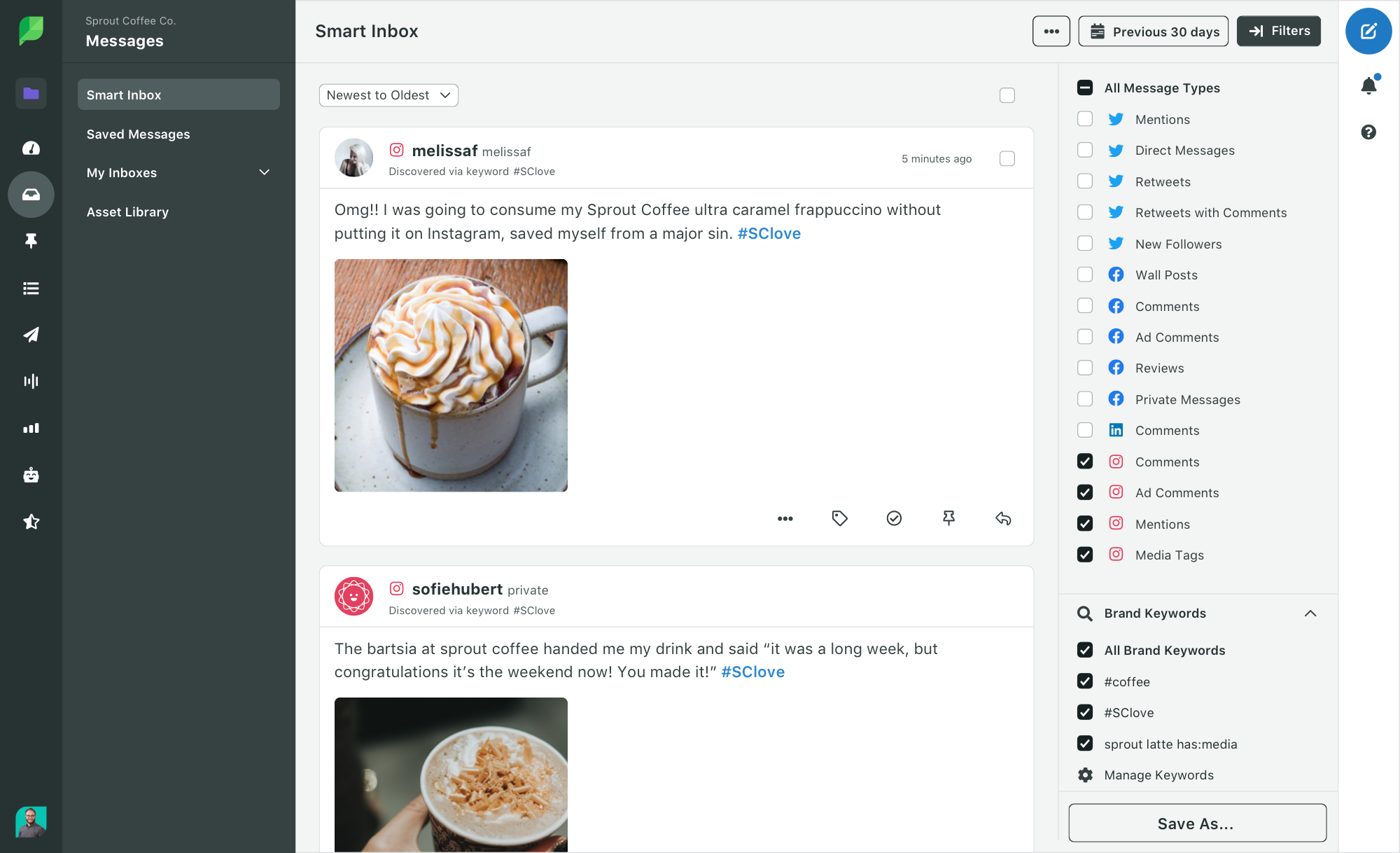

5. Online research tools

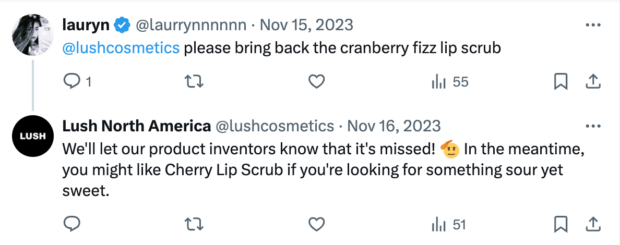

You and your team can do your own secondary market research using online tools. These tools include data prospecting platforms and databases, as well as online surveys, social media listening, web analytics and sentiment analysis platforms. They help you gather data from online sources, monitor industry trends, track competitors, understand consumer preferences and keep tabs on online behavior. We’ll talk more about choosing the right market research tools in the sections that follow.

6. Experiments

Market research experiments are controlled tests of variables to determine causal relationships. While experiments are often associated with scientific research, they are also used in market research to assess the impact of specific marketing strategies, product features, or pricing and packaging changes.

7. Content analysis

Content analysis involves the systematic examination of textual, visual or audio content to identify patterns, themes and trends. It’s commonly applied to customer reviews, social media posts and other forms of online content to analyze consumer opinions and sentiments.

8. Ethnographic research

Ethnographic research immerses researchers into the daily lives of consumers to understand their behavior and culture. This method is particularly valuable when studying niche markets or exploring the cultural context of consumer choices.

How to do market research

- Set clear objectives

- Identify your target audience

- Choose your research methods

- Use the right market research tools

- Collect data

- Analyze data

- Interpret your findings

- Identify opportunities and challenges

- Make informed business decisions

- Monitor and adapt

Now that you have gained insights into the various market research methods at your disposal, let’s delve into the practical aspects of how to conduct market research effectively. Here’s a quick step-by-step overview, from defining objectives to monitoring market shifts.

1. Set clear objectives

When you set clear and specific goals, you’re essentially creating a compass to guide your research questions and methodology. Start by precisely defining what you want to achieve. Are you launching a new product and want to understand its viability in the market? Are you evaluating customer satisfaction with a product redesign?

Start by creating SMART goals — objectives that are specific, measurable, achievable, relevant and time-bound. Not only will this clarify your research focus from the outset, but it will also help you track progress and benchmark your success throughout the process.

You should also consult with key stakeholders and team members to ensure alignment on your research objectives before diving into data collecting. This will help you gain diverse perspectives and insights that will shape your research approach.

2. Identify your target audience

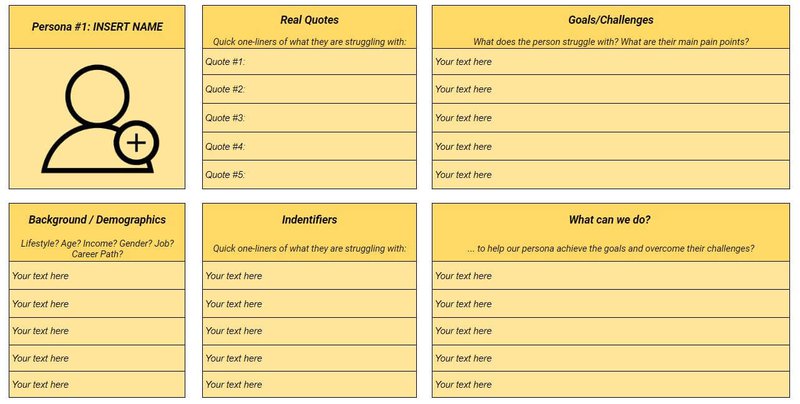

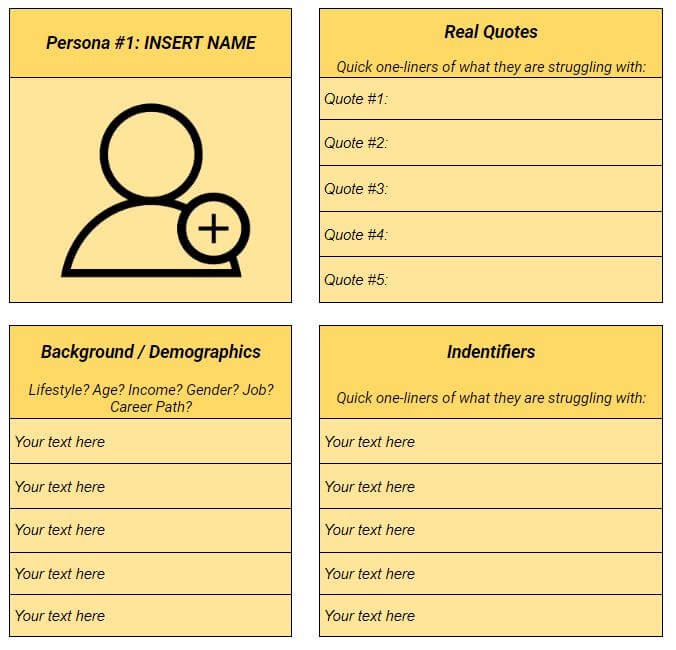

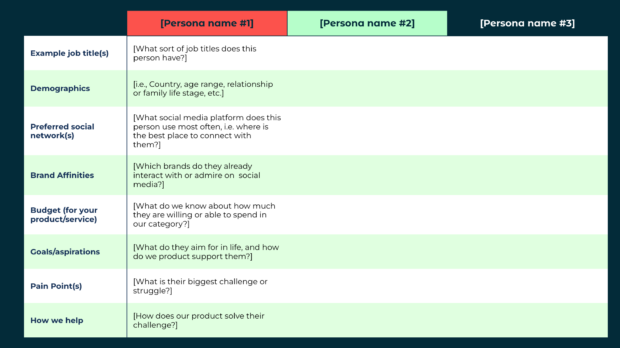

Next, you’ll need to pinpoint your target audience to determine who should be included in your research. Begin by creating detailed buyer personas or stakeholder profiles. Consider demographic factors like age, gender, income and location, but also delve into psychographics, such as interests, values and pain points.

The more specific your target audience, the more accurate and actionable your research will be. Additionally, segment your audience if your research objectives involve studying different groups, such as current customers and potential leads.

If you already have existing customers, you can also hold conversations with them to better understand your target market. From there, you can refine your buyer personas and tailor your research methods accordingly.

3. Choose your research methods

Selecting the right research methods is crucial for gathering high-quality data. Start by considering the nature of your research objectives. If you’re exploring consumer preferences, surveys and interviews can provide valuable insights. For in-depth understanding, focus groups or observational research might be suitable. Consider using a mix of quantitative and qualitative methods to gain a well-rounded perspective.

You’ll also need to consider your budget. Think about what you can realistically achieve using the time and resources available to you. If you have a fairly generous budget, you may want to try a mix of primary and secondary research approaches. If you’re doing market research for a startup , on the other hand, chances are your budget is somewhat limited. If that’s the case, try addressing your goals with secondary research tools before investing time and effort in a primary research study.

4. Use the right market research tools

Whether you’re conducting primary or secondary research, you’ll need to choose the right tools. These can help you do anything from sending surveys to customers to monitoring trends and analyzing data. Here are some examples of popular market research tools:

- Market research software: Crunchbase is a platform that provides best-in-class company data, making it valuable for market research on growing companies and industries. You can use Crunchbase to access trusted, first-party funding data, revenue data, news and firmographics, enabling you to monitor industry trends and understand customer needs.

- Survey and questionnaire tools: SurveyMonkey is a widely used online survey platform that allows you to create, distribute and analyze surveys. Google Forms is a free tool that lets you create surveys and collect responses through Google Drive.

- Data analysis software: Microsoft Excel and Google Sheets are useful for conducting statistical analyses. SPSS is a powerful statistical analysis software used for data processing, analysis and reporting.

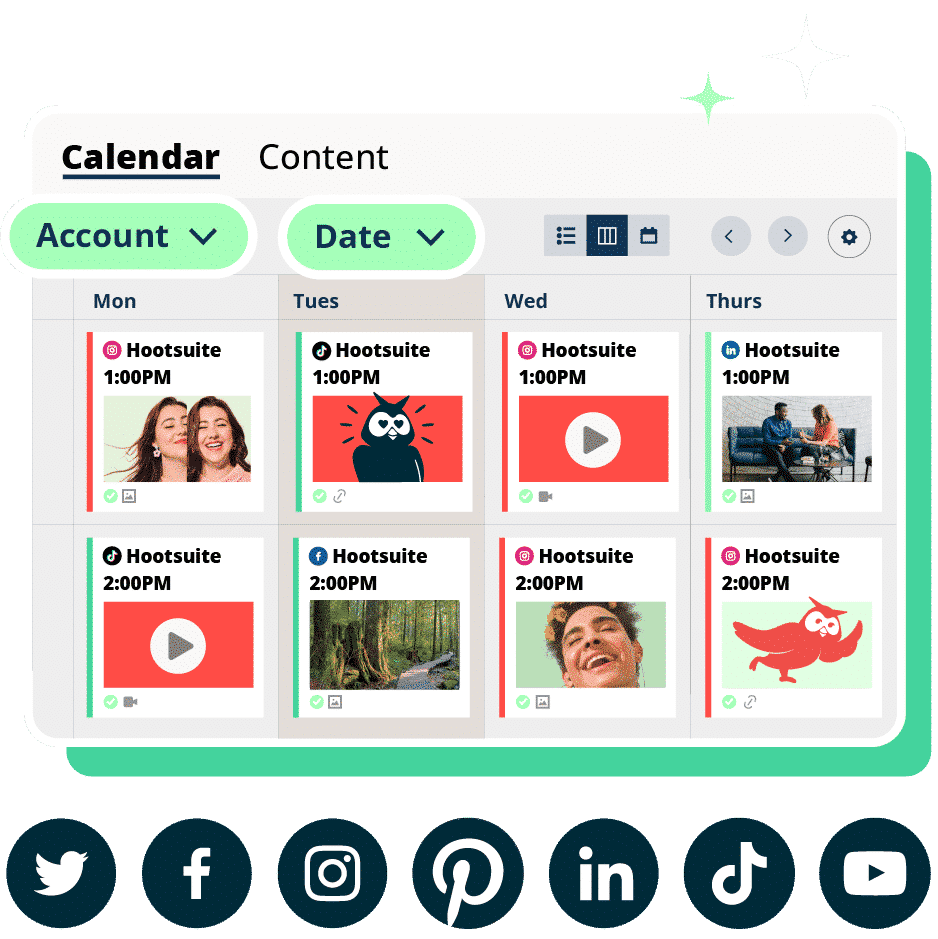

- Social listening tools: Brandwatch is a social listening and analytics platform that helps you monitor social media conversations, track sentiment and analyze trends. Mention is a media monitoring tool that allows you to track mentions of your brand, competitors and keywords across various online sources.

- Data visualization platforms: Tableau is a data visualization tool that helps you create interactive and shareable dashboards and reports. Power BI by Microsoft is a business analytics tool for creating interactive visualizations and reports.

5. Collect data

There’s an infinite amount of data you could be collecting using these tools, so you’ll need to be intentional about going after the data that aligns with your research goals. Implement your chosen research methods, whether it’s distributing surveys, conducting interviews or pulling from secondary research platforms. Pay close attention to data quality and accuracy, and stick to a standardized process to streamline data capture and reduce errors.

6. Analyze data

Once data is collected, you’ll need to analyze it systematically. Use statistical software or analysis tools to identify patterns, trends and correlations. For qualitative data, employ thematic analysis to extract common themes and insights. Visualize your findings with charts, graphs and tables to make complex data more understandable.

If you’re not proficient in data analysis, consider outsourcing or collaborating with a data analyst who can assist in processing and interpreting your data accurately.

7. Interpret your findings

Interpreting your market research findings involves understanding what the data means in the context of your objectives. Are there significant trends that uncover the answers to your initial research questions? Consider the implications of your findings on your business strategy. It’s essential to move beyond raw data and extract actionable insights that inform decision-making.

Hold a cross-functional meeting or workshop with relevant team members to collectively interpret the findings. Different perspectives can lead to more comprehensive insights and innovative solutions.

8. Identify opportunities and challenges

Use your research findings to identify potential growth opportunities and challenges within your market. What segments of your audience are underserved or overlooked? Are there emerging trends you can capitalize on? Conversely, what obstacles or competitors could hinder your progress?

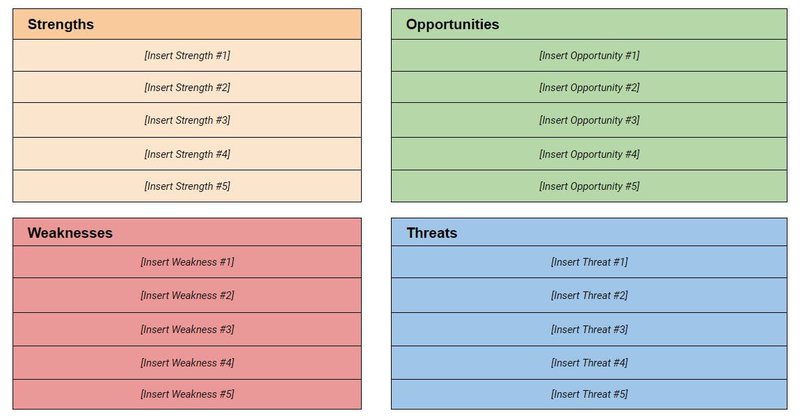

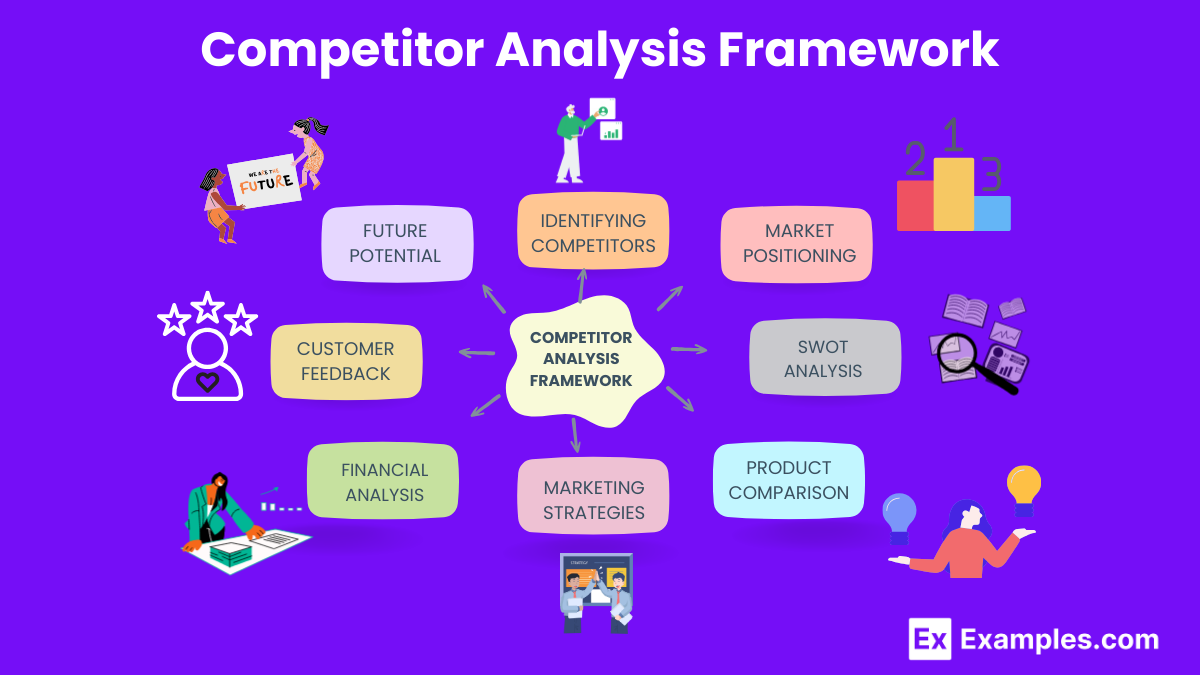

Lay out this information in a clear and organized way by conducting a SWOT analysis, which stands for strengths, weaknesses, opportunities and threats. Jot down notes for each of these areas to provide a structured overview of gaps and hurdles in the market.

9. Make informed business decisions

Market research is only valuable if it leads to informed decisions for your company. Based on your insights, devise actionable strategies and initiatives that align with your research objectives. Whether it’s refining your product, targeting new customer segments or adjusting pricing, ensure your decisions are rooted in the data.

At this point, it’s also crucial to keep your team aligned and accountable. Create an action plan that outlines specific steps, responsibilities and timelines for implementing the recommendations derived from your research.

10. Monitor and adapt

Market research isn’t a one-time activity; it’s an ongoing process. Continuously monitor market conditions, customer behaviors and industry trends. Set up mechanisms to collect real-time data and feedback. As you gather new information, be prepared to adapt your strategies and tactics accordingly. Regularly revisiting your research ensures your business remains agile and reflects changing market dynamics and consumer preferences.

Online market research sources

As you go through the steps above, you’ll want to turn to trusted, reputable sources to gather your data. Here’s a list to get you started:

- Crunchbase: As mentioned above, Crunchbase is an online platform with an extensive dataset, allowing you to access in-depth insights on market trends, consumer behavior and competitive analysis. You can also customize your search options to tailor your research to specific industries, geographic regions or customer personas.

- Academic databases: Academic databases, such as ProQuest and JSTOR , are treasure troves of scholarly research papers, studies and academic journals. They offer in-depth analyses of various subjects, including market trends, consumer preferences and industry-specific insights. Researchers can access a wealth of peer-reviewed publications to gain a deeper understanding of their research topics.

- Government and NGO databases: Government agencies, nongovernmental organizations and other institutions frequently maintain databases containing valuable economic, demographic and industry-related data. These sources offer credible statistics and reports on a wide range of topics, making them essential for market researchers. Examples include the U.S. Census Bureau , the Bureau of Labor Statistics and the Pew Research Center .

- Industry reports: Industry reports and market studies are comprehensive documents prepared by research firms, industry associations and consulting companies. They provide in-depth insights into specific markets, including market size, trends, competitive analysis and consumer behavior. You can find this information by looking at relevant industry association databases; examples include the American Marketing Association and the National Retail Federation .

- Social media and online communities: Social media platforms like LinkedIn or Twitter (X) , forums such as Reddit and Quora , and review platforms such as G2 can provide real-time insights into consumer sentiment, opinions and trends.

Market research examples

At this point, you have market research tools and data sources — but how do you act on the data you gather? Let’s go over some real-world examples that illustrate the practical application of market research across various industries. These examples showcase how market research can lead to smart decision-making and successful business decisions.

Example 1: Apple’s iPhone launch

Apple ’s iconic iPhone launch in 2007 serves as a prime example of market research driving product innovation in tech. Before the iPhone’s release, Apple conducted extensive market research to understand consumer preferences, pain points and unmet needs in the mobile phone industry. This research led to the development of a touchscreen smartphone with a user-friendly interface, addressing consumer demands for a more intuitive and versatile device. The result was a revolutionary product that disrupted the market and redefined the smartphone industry.

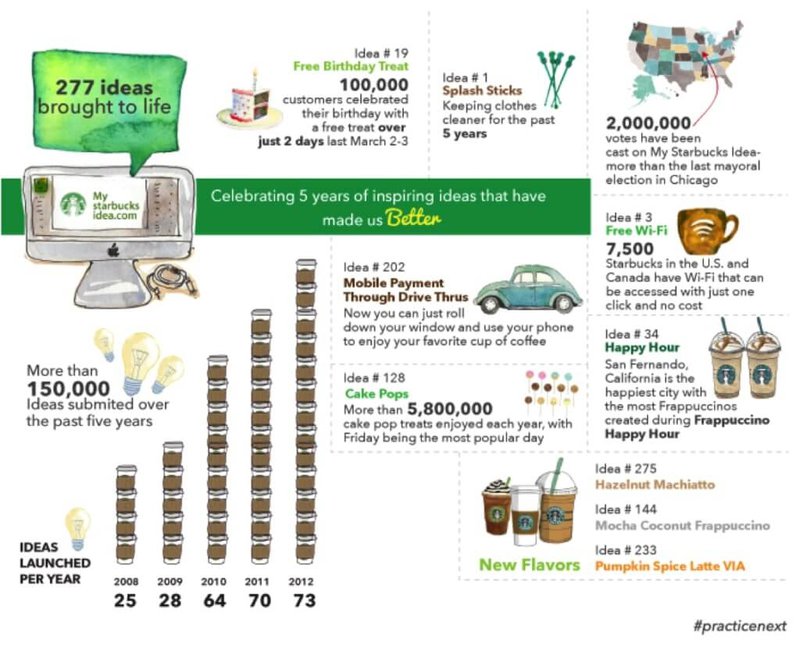

Example 2: McDonald’s global expansion

McDonald’s successful global expansion strategy demonstrates the importance of market research when expanding into new territories. Before entering a new market, McDonald’s conducts thorough research to understand local tastes, preferences and cultural nuances. This research informs menu customization, marketing strategies and store design. For instance, in India, McDonald’s offers a menu tailored to local preferences, including vegetarian options. This market-specific approach has enabled McDonald’s to adapt and thrive in diverse global markets.

Example 3: Organic and sustainable farming

The shift toward organic and sustainable farming practices in the food industry is driven by market research that indicates increased consumer demand for healthier and environmentally friendly food options. As a result, food producers and retailers invest in sustainable sourcing and organic product lines — such as with these sustainable seafood startups — to align with this shift in consumer values.

The bottom line? Market research has multiple use cases and is a critical practice for any industry. Whether it’s launching groundbreaking products, entering new markets or responding to changing consumer preferences, you can use market research to shape successful strategies and outcomes.

Market research templates

You finally have a strong understanding of how to do market research and apply it in the real world. Before we wrap up, here are some market research templates that you can use as a starting point for your projects:

- Smartsheet competitive analysis templates : These spreadsheets can serve as a framework for gathering information about the competitive landscape and obtaining valuable lessons to apply to your business strategy.

- SurveyMonkey product survey template : Customize the questions on this survey based on what you want to learn from your target customers.

- HubSpot templates : HubSpot offers a wide range of free templates you can use for market research, business planning and more.

- SCORE templates : SCORE is a nonprofit organization that provides templates for business plans, market analysis and financial projections.

- SBA.gov : The U.S. Small Business Administration offers templates for every aspect of your business, including market research, and is particularly valuable for new startups.

Strengthen your business with market research

When conducted effectively, market research is like a guiding star. Equipped with the right tools and techniques, you can uncover valuable insights, stay competitive, foster innovation and navigate the complexities of your industry.

Throughout this guide, we’ve discussed the definition of market research, different research methods, and how to conduct it effectively. We’ve also explored various types of market research and shared practical insights and templates for getting started.

Now, it’s time to start the research process. Trust in data, listen to the market and make informed decisions that guide your company toward lasting success.

Related Articles

- Entrepreneurs

- 15 min read

What Is Competitive Analysis and How to Do It Effectively

Rebecca Strehlow, Copywriter at Crunchbase

17 Best Sales Intelligence Tools for 2024

- Market research

- 10 min read

How to Do Market Research for a Startup: Tips for Success

Jaclyn Robinson, Senior Manager of Content Marketing at Crunchbase

Search less. Close more.

Grow your revenue with Crunchbase, the all-in-one prospecting solution. Start your free trial.

Market Research: A How-To Guide and Template

Discover the different types of market research, how to conduct your own market research, and use a free template to help you along the way.

MARKET RESEARCH KIT

5 Research and Planning Templates + a Free Guide on How to Use Them in Your Market Research

Updated: 02/21/24

Published: 02/21/24

Today's consumers have a lot of power. As a business, you must have a deep understanding of who your buyers are and what influences their purchase decisions.

Enter: Market Research.

![example of a market research strategy → Download Now: Market Research Templates [Free Kit]](https://no-cache.hubspot.com/cta/default/53/6ba52ce7-bb69-4b63-965b-4ea21ba905da.png)

Whether you're new to market research or not, I created this guide to help you conduct a thorough study of your market, target audience, competition, and more. Let’s dive in.

Table of Contents

What is market research?

Primary vs. secondary research, types of market research, how to do market research, market research report template, market research examples.

Market research is the process of gathering information about your target market and customers to verify the success of a new product, help your team iterate on an existing product, or understand brand perception to ensure your team is effectively communicating your company's value effectively.

Market research can answer various questions about the state of an industry. But if you ask me, it's hardly a crystal ball that marketers can rely on for insights on their customers.

Market researchers investigate several areas of the market, and it can take weeks or even months to paint an accurate picture of the business landscape.

However, researching just one of those areas can make you more intuitive to who your buyers are and how to deliver value that no other business is offering them right now.

How? Consider these two things:

- Your competitors also have experienced individuals in the industry and a customer base. It‘s very possible that your immediate resources are, in many ways, equal to those of your competition’s immediate resources. Seeking a larger sample size for answers can provide a better edge.

- Your customers don't represent the attitudes of an entire market. They represent the attitudes of the part of the market that is already drawn to your brand.

The market research services market is growing rapidly, which signifies a strong interest in market research as we enter 2024. The market is expected to grow from roughly $75 billion in 2021 to $90.79 billion in 2025 .

.png)

Free Market Research Kit

- SWOT Analysis Template

- Survey Template

- Focus Group Template

Download Free

All fields are required.

You're all set!

Click this link to access this resource at any time.

Why do market research?

Market research allows you to meet your buyer where they are.

As our world becomes louder and demands more of our attention, this proves invaluable.

By understanding your buyer's problems, pain points, and desired solutions, you can aptly craft your product or service to naturally appeal to them.

Market research also provides insight into the following:

- Where your target audience and current customers conduct their product or service research

- Which of your competitors your target audience looks to for information, options, or purchases

- What's trending in your industry and in the eyes of your buyer

- Who makes up your market and what their challenges are

- What influences purchases and conversions among your target audience

- Consumer attitudes about a particular topic, pain, product, or brand

- Whether there‘s demand for the business initiatives you’re investing in

- Unaddressed or underserved customer needs that can be flipped into selling opportunity

- Attitudes about pricing for a particular product or service

Ultimately, market research allows you to get information from a larger sample size of your target audience, eliminating bias and assumptions so that you can get to the heart of consumer attitudes.

As a result, you can make better business decisions.

To give you an idea of how extensive market research can get , consider that it can either be qualitative or quantitative in nature — depending on the studies you conduct and what you're trying to learn about your industry.

Qualitative research is concerned with public opinion, and explores how the market feels about the products currently available in that market.

Quantitative research is concerned with data, and looks for relevant trends in the information that's gathered from public records.

That said, there are two main types of market research that your business can conduct to collect actionable information on your products: primary research and secondary research.

Primary Research

Primary research is the pursuit of first-hand information about your market and the customers within your market.

It's useful when segmenting your market and establishing your buyer personas.

Primary market research tends to fall into one of two buckets:

- Exploratory Primary Research: This kind of primary market research normally takes place as a first step — before any specific research has been performed — and may involve open-ended interviews or surveys with small numbers of people.

- Specific Primary Research: This type of research often follows exploratory research. In specific research, you take a smaller or more precise segment of your audience and ask questions aimed at solving a suspected problem.

Secondary Research

Secondary research is all the data and public records you have at your disposal to draw conclusions from (e.g. trend reports, market statistics, industry content, and sales data you already have on your business).

Secondary research is particularly useful for analyzing your competitors . The main buckets your secondary market research will fall into include:

- Public Sources: These sources are your first and most-accessible layer of material when conducting secondary market research. They're often free to find and review — like government statistics (e.g., from the U.S. Census Bureau ).

- Commercial Sources: These sources often come in the form of pay-to-access market reports, consisting of industry insight compiled by a research agency like Pew , Gartner , or Forrester .

- Internal Sources: This is the market data your organization already has like average revenue per sale, customer retention rates, and other historical data that can help you draw conclusions on buyer needs.

- Focus Groups

- Product/ Service Use Research

- Observation-Based Research

- Buyer Persona Research

- Market Segmentation Research

- Pricing Research

- Competitive Analysis Research

- Customer Satisfaction and Loyalty Research

- Brand Awareness Research

- Campaign Research

1. Interviews

Interviews allow for face-to-face discussions so you can allow for a natural flow of conversation. Your interviewees can answer questions about themselves to help you design your buyer personas and shape your entire marketing strategy.

2. Focus Groups

Focus groups provide you with a handful of carefully-selected people that can test out your product and provide feedback. This type of market research can give you ideas for product differentiation.

3. Product/Service Use Research

Product or service use research offers insight into how and why your audience uses your product or service. This type of market research also gives you an idea of the product or service's usability for your target audience.

4. Observation-Based Research

Observation-based research allows you to sit back and watch the ways in which your target audience members go about using your product or service, what works well in terms of UX , and which aspects of it could be improved.

5. Buyer Persona Research

Buyer persona research gives you a realistic look at who makes up your target audience, what their challenges are, why they want your product or service, and what they need from your business or brand.

6. Market Segmentation Research

Market segmentation research allows you to categorize your target audience into different groups (or segments) based on specific and defining characteristics. This way, you can determine effective ways to meet their needs.

7. Pricing Research

Pricing research helps you define your pricing strategy . It gives you an idea of what similar products or services in your market sell for and what your target audience is willing to pay.

8. Competitive Analysis

Competitive analyses give you a deep understanding of the competition in your market and industry. You can learn about what's doing well in your industry and how you can separate yourself from the competition .

9. Customer Satisfaction and Loyalty Research

Customer satisfaction and loyalty research gives you a look into how you can get current customers to return for more business and what will motivate them to do so (e.g., loyalty programs , rewards, remarkable customer service).

10. Brand Awareness Research

Brand awareness research tells you what your target audience knows about and recognizes from your brand. It tells you about the associations people make when they think about your business.

11. Campaign Research

Campaign research entails looking into your past campaigns and analyzing their success among your target audience and current customers. The goal is to use these learnings to inform future campaigns.

- Define your buyer persona.

- Identify a persona group to engage.

- Prepare research questions for your market research participants.

- List your primary competitors.

- Summarize your findings.

1. Define your buyer persona.

You have to understand who your customers are and how customers in your industry make buying decisions.

This is where your buyer personas come in handy. Buyer personas — sometimes referred to as marketing personas — are fictional, generalized representations of your ideal customers.

Use a free tool to create a buyer persona that your entire company can use to market, sell, and serve better.

Don't forget to share this post!

Related articles.

26 Tools & Resources for Conducting Market Research

What is a Competitive Analysis — and How Do You Conduct One?

![example of a market research strategy SWOT Analysis: How To Do One [With Template & Examples]](https://blog.hubspot.com/hubfs/marketingplan_20.webp)

SWOT Analysis: How To Do One [With Template & Examples]

TAM SAM SOM: What Do They Mean & How Do You Calculate Them?

![example of a market research strategy How to Run a Competitor Analysis [Free Guide]](https://blog.hubspot.com/hubfs/Google%20Drive%20Integration/how%20to%20do%20a%20competitor%20analysis_122022.jpeg)

How to Run a Competitor Analysis [Free Guide]

![example of a market research strategy 5 Challenges Marketers Face in Understanding Audiences [New Data + Market Researcher Tips]](https://blog.hubspot.com/hubfs/challenges%20marketers%20face%20in%20understanding%20the%20customer%20.png)

5 Challenges Marketers Face in Understanding Audiences [New Data + Market Researcher Tips]

Causal Research: The Complete Guide

Total Addressable Market (TAM): What It Is & How You Can Calculate It

What Is Market Share & How Do You Calculate It?

![example of a market research strategy 3 Ways Data Privacy Changes Benefit Marketers [New Data]](https://blog.hubspot.com/hubfs/how-data-privacy-benefits-marketers_1.webp)

3 Ways Data Privacy Changes Benefit Marketers [New Data]

Free Guide & Templates to Help Your Market Research

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

The Ultimate Guide to Market Research: Types, Benefits, and Real-World Examples

Team Fratzke

Today's consumers hold a lot of power when making purchase decisions. With a quick inquiry in a search engine or search bar within a social media platform, they can access genuine reviews from their peers without relying on sales reps.

Considering this shift in consumer behavior, adjusting your marketing strategy so it caters to the modern-day buying process is essential . To achieve this, you must thoroughly understand your target audience, the market you operate in, and the factors influencing their decision-making.

This is where market research can be leveraged so you stay current with your audience and industry.

Article Overview

In this article, we’ll walk you through everything you need to know about how to conduct market research, including:

- Why market research is essential for understanding your target audience, the market you operate in, and factors influencing decision-making

- What are the different types of market research, such as primary and secondary market research

- How to collect information about your customers and target market to determine the success of a new or existing product, improve your brand, and communicate your company's value

- Real-world examples of companies leveraging market research

What is market research?

Market research is a necessary process that involves collecting and documenting information about your target market and customers. This helps you determine the success of a new product, improve an existing one, or understand how your brand is perceived. You can then turn this research into profits by developing marketing strategies and campaigns to effectively communicate your company's value .

While market research can provide insights into various aspects of an industry, it is not a crystal ball that can predict everything about your customers. Market researchers typically explore multiple areas of the market, which can take several weeks or even months to get a complete picture of the business landscape.

Even by researching just one of those areas, you can gain better insights into who your buyers are and what unique value proposition you can offer them that no other business currently provides.

Of course, you can simply use your industry experience and existing customer insights to make sound judgment calls. However, it's important to note that market research provides additional benefits beyond these strategies. There are two things to consider:

- Your competitors also have experienced individuals in the industry and a customer base. Your immediate resources may equal those of your competition's immediate resources. Seeking a larger sample size for answers can provide a better edge.

- Your brand's customers do not represent the entire market's attitudes, only those who are attracted to your brand.

The market research services industry is experiencing rapid growth , indicating a strong interest in market research as we enter 2024. The market is expected to grow from approximately $75 billion in 2021 to $90.79 billion in 2025, with a compound annual growth rate of 5%.

Your competitors have highly skilled individuals within the industry, meaning your available personnel resources are likely similar to those of your competitors. So what are you going to do to get ahead?

You’re going to do thorough market research, which is why seeking answers from a larger sample size is essential. Remember that your customers represent only a portion of the market already attracted to your brand, and their attitudes may not necessarily reflect those of the entire market. You could be leaving money on the table by leaving out untapped customers .

Why do market research?

Market research helps you meet your buyers where they are. Understanding your buyer's problems, pain points, and desired outcomes is invaluable as our world becomes increasingly noisy and demanding. This knowledge will help you tailor your product or service to appeal to them naturally.

What’s even better is when you're ready to grow your business, market research can also guide you in developing an effective market expansion strategy.

Market research provides valuable insights into factors that impact your profits and can help you to :

- Identify where your target audience and current customers are conducting their product or service research

- Determine which competitors your target audience looks to for information, options, or purchases

- Keep up with the latest trends in your industry and understand what your buyers are interested in

- Understand who makes up your market and what challenges they are facing

- Determine what influences purchases and conversions among your target audience

- Analyze consumer attitudes about a particular topic, pain, product, or brand

- Assess the demand for the business initiatives you're investing in

- Identify unaddressed or underserved customer needs that can be turned into selling opportunities

- Understand consumer attitudes about pricing for your product or service.

Market research provides valuable information from a larger sample size of your target audience, enabling you to obtain accurate consumer attitudes. By eliminating any bias or assumptions you have about your target audience, you can make better business decisions based on the bigger picture.

As you delve deeper into your market research, you will come across two types of research: primary and secondary market research . Simply put, think of two umbrellas beneath market research - one for primary and one for secondary research. In the next section, we will discuss the difference between these two types of research. That way, if you work with a market who wants to use them, you’ll be ready with an understanding of how they can each benefit your business.

Primary vs. Secondary Research

Both primary and secondary research are conducted to collect actionable information on your product. That information can then be divided into two types: qualitative and quantitative research. Qualitative research focuses on public opinion and aims to determine how the market feels about the products currently available. On the other hand, quantitative research seeks to identify relevant trends in the data gathered from public records.

Let's take a closer look at these two types.

Primary Research

Primary research involves gathering first-hand information about your market and its customers. It can be leveraged to segment your market and create focused buyer personas . Generally, primary market research can be categorized into exploratory and specific studies.

Exploratory Primary Research

This type of primary market research is not focused on measuring customer trends; instead, it is focused on identifying potential problems worth addressing as a team. It is usually conducted as an initial step before any specific research is done and may involve conducting open-ended interviews or surveys with a small group of people.

Specific Primary Research

After conducting exploratory research, businesses may conduct specific primary research to explore issues or opportunities they have identified as necessary. Specific research involves targeting a smaller or more precise audience segment and asking questions aimed at solving a suspected problem. Specific primary research reveals problems that are unique to your audience so you can then offer a unique (and valuable) solution.

Secondary Research

Secondary research refers to collecting and analyzing data that has already been published or made available in public records. This may include market statistics, trend reports, sales data, and industry content you already can access. Secondary research really shines when you go to your competitors . The most commonly used sources of secondary market research include:

- Public sources

- Commercial sources

- Internal sources

Public Sources

When conducting secondary market research, the first and most accessible sources of information are usually free . That’s right–these public sources are free and at your fingertips so there’s no reason for you to not be checking them out and leveraging them for your own gain.

One of the most common types of public sources is government statistics. According to Entrepreneur, two examples of public market data in the United States are the U.S. Census Bureau and the Bureau of Labor & Statistics. These sources offer helpful information about the state of various industries nationwide including:

Commercial Sources

Research agencies such as Pew, Fratzke, Gartner, or Forrester often provide market reports containing industry insights from their own in-depth studies . These reports usually come at a cost if you want to download and obtain the information, but these agencies are experts at what they do, so the research is most likely valuable.

Internal Sources

Internal sources of market data can include average revenue per sale, customer retention rates, and other data on the health of old and new accounts. They are often overlooked when it comes to conducting market research because of how specific the data is; however, these sources can be valuable as they provide information on the organization's historical data.

By analyzing this information, you can gain insights into what your customers want now . In addition to these broad categories, there are various ways to conduct market research. Let’s talk about them.

Types of Market Research

- Interviews (in-person or remote)

Focus Groups

- Product/ Service Use Research

Observation-Based Research

Buyer persona research, market segmentation research, pricing research.

- Competitive Analysis Research

Customer Satisfaction and Loyalty Research

Brand awareness research, campaign research.

Interviews can be conducted face-to-face or virtually, allowing for a natural conversation flow while observing the interviewee's body language. By asking questions about themselves, the interviewee can help you create buyer personas , which are made by using information about the ideal customer, such as:

- Family size

- Challenges faced at work or in life

And other aspects of their lifestyle. This buyer profile can shape your entire marketing strategy , from the features you add to your product to the content you publish on your website. Your target audience will feel that the marketing was made just for them and will be drawn to your product or service.

Focus groups are market research involving a few carefully selected individuals who can test your product, watch a demonstration, offer feedback, and answer specific questions. This research can inspire ideas for product differentiation or highlight the unique features of your product or brand that set it apart from others in the market. This is a great market research option to gain specific feedback, which you can use to improve your services .

Product/Service Use Research

Product or service usage research provides valuable insights into how and why your target audience uses your product or service. This research can help in various ways including:

- Identifying specific features of your offering that appeal to your audience.

- Allowing you to assess the usability of your product or service for your target audience.

According to a report published in 2020, usability testing was rated the most effective method for discovering user insights, with a score of 8.7 out of 10. In comparison, digital analytics scored 7.7, and user surveys scored 6.4.

Observation-based research is a process that involves observing how your target audience members use your product or service. The way that you intended your product or service to be used may not be the actual way that it is used. Observation-based research helps you understand what works well in terms of customer experience (CX) and user experience (UX), what problems they face, and which aspects of your product or service can be improved to make it easier for them to use.

To better understand how your potential customers make purchasing decisions in your industry, it is essential to know who they are. This is where buyer persona research comes in handy. Buyer or marketing personas are fictional yet generalized representations of your ideal customers. They give you someone to whom you want your marketing efforts to empathize and move, even though they don’t really exist.

Gathering survey data and additional research to correctly identify your buyer personas will help you to visualize your audience so you can streamline your communications and inform marketing strategy . Key characteristics to include in a buyer persona are:

- Job title(s)

- Family size

- Major challenges

Market segmentation research enables you to classify your target audience into various groups or segments based on specific and defining characteristics. This method allows you to understand their needs, pain points, expectations, and goals more effectively.

Pricing research can provide valuable insights about the prices of similar products or services in your market. It can help you understand what your target audience expects to pay for your offerings and what would be a reasonable price for you to set. Correct pricing is important because if you set it too high, consumers will go to your cheaper competitor; but if you set it too low, your consumers may become suspicious of your product or service and still end up with your competitor. This information allows you to develop a solid pricing strategy aligning with your business goals and objectives.

Competitive Analysis

Competitive analyses are incredibly valuable as they provide a deep understanding of your market and industry competition. Through these analyses, you can gain insights like:

- What works well in your industry

- What your target audience is already interested in regarding products like yours

- Which competitors you should work to keep up with and surpass

- How you can differentiate yourself from the competition

Understanding customer satisfaction and loyalty is crucial to encouraging repeat business and identifying what drives customers to return (such as loyalty programs, rewards, and exceptional customer service). Researching this area will help you determine the most effective methods to keep your customers coming back again and again. If you have a CRM system, consider further utilizing automated customer feedback surveys to improve your understanding of their needs and preferences.

Brand awareness research helps you understand the level of familiarity your target audience has with your brand. It provides insights into your audience members' perceptions and associations when they think about your business.This type of research reveals what they believe your brand represents. This information is valuable for developing effective marketing strategies, improving your brand's reputation, and increasing customer loyalty .

To improve your marketing campaigns, you need to research by analyzing the success of your past campaigns among your target audience and current customers. This requires experimentation and thoroughly examining the elements that resonate with your audience. By doing so, you can identify the aspects of your campaigns that matter most to your audience and use them as a guide for future campaigns.

Now that you understand the different market research categories and types let's look at how to conduct your market research. Using our expertise and experience, we’ve created a step-by-step guide to conducting market research.

How to Do Market Research (Detailed Roadmap)

- Define the problem or objective of the research.

- Determine the type of data needed.

- Identify the sources of data.

- Collect the data.

- Analyze the data.

- Interpret the results.

- Report the findings.

- Take action based on the findings.

1. Define the problem or objective of the research

Defining the problem or objective of the research is the first step in conducting market research. This involves identifying the specific issue that the research is trying to address. It is essential to be clear and specific about the research problem or objective, as it will guide the entire research process.

2. Determine the type of data needed

After defining the research problem or objective, the next step is determining the data type needed to address the issue. This involves deciding whether to collect primary or secondary data. Primary data is collected directly from the source, while secondary data is collected from existing sources such as government reports or market research studies.

3. Identify the sources of data

Once the data type has been determined, the next step is identifying the data sources. This involves identifying potential sources of primary and secondary data that can be used to address the research problem or objective. Primary data sources can include surveys, focus groups, and interviews, while secondary data sources can include government reports, industry publications, and academic journals.

4. Collect the data

After identifying the data sources, the next step is to collect the data. This involves designing and implementing a data collection plan consistent with the research problem or objective. The data collection plan should specify the methods and procedures for collecting data, sample size, and sampling method.

5. Analyze the data

Once the data has been collected, the next step is to analyze the data. This involves organizing, summarizing, and interpreting the data to identify patterns, relationships, and trends. The research problem or objective should guide the data analysis process and be conducted using appropriate statistical methods and software.

6. Interpret the results

After analyzing the data, the next step is to interpret the results. This involves drawing conclusions from the data analysis and using the results to address the research problem or objective. It is essential to analyze the results objectively and to avoid making assumptions or drawing conclusions that are not supported by the data.

7. Report the findings

Try identifying common themes to create a story and action items.To make the process easier, use your favorite presentation software to create a report, as it will make it easy to add quotes, diagrams, or call clips.

Feel free to add your flair, but the following outline should help you craft a clear summary:

- Background: What are your goals, and why did you conduct this study?

- Participants: Who you talked to? A table works well to break groups down by persona and customer/prospect.

- Executive Summary: What were the most exciting things you learned? What do you plan to do about it?

- Key Findings: Identify the key findings using data visualizations and emphasize key points.

- Recommendations + Action Plan: Your analysis will uncover actionable insights to fuel strategies and campaigns you can run to get your brand in front of buyers earlier and more effectively. Provide your list of priorities, action items , a timeline, and its impact on your business.

8. Take action based on the findings

The final step in conducting market research is to take action based on the findings. This involves using the results to make informed decisions about the marketing strategy, product development, or other business decisions. It is important to use the findings to drive action and to monitor and evaluate the effectiveness of the action taken continuously.

How to Prepare for Market Research Projects

Identify a persona group to engage, prepare research questions for your market research participants, list your primary competitors.

The idea is to use your persona as a reference point for understanding and reaching out to your industry's audience members. Your business might cater to more than one persona, and that's completely acceptable! However, you must be mindful of each persona while strategizing and planning your content and campaigns.

How to Identify the Right People to Engage for Market Research

When selecting a group on which to conduct market research , it is essential to consider individuals with the same characteristics as your target audience.

If you need to research multiple target audiences, recruit separate groups for each one. Select people who have recently interacted with you by looking through social media for post interactions or seeing if they’ve made recent purchases from you.

If you are planning to conduct an evaluation, it is recommended that you focus on people who have completed it within the last six months. However, if you have a longer sales cycle or a specific market, you can extend the period up to a year. It is crucial to ask detailed questions during the evaluation, so the participants' experience must be fresh.

Gather a mix of participants

If you want to expand your customer base, you’re going to want to get viewpoints of your product or service from every angle. Consider getting this mix by recruiting individuals who have already purchased your product, those who have bought a competitor's product, and those who haven't purchased anything. While targeting your existing customers may be the easiest option, gathering information from non-customers can help you gain a more balanced market perspective .

We recommend taking the following steps to select a mix of participants:

- Create a list of customers who made a recent purchase . This is usually the most accessible group to recruit. If you have a CRM system with list segmentation capabilities, run a report of deals that closed within the past six months and filter it for the characteristics you're looking for. Otherwise, work with your sales team to get them a list of appropriate accounts.

- Create a list of customers who were in an active evaluation but didn't make a purchase. You should get a mix of buyers who either purchased from a competitor or decided not to purchase. Again, you can obtain this list from your CRM or your Sales team's system to track deals.

- Use social media to call for participants. Try reaching out to people who follow you on social media but decided not to buy from you. Some may be willing to talk to you and explain why they did not purchase your product.

- Leverage your network . Spread the word that you're conducting a study to your coworkers, former colleagues, and LinkedIn connections. Even if your direct connections don't qualify, some will likely have a coworker, friend, or family member who does.

- Choose an incentive to motivate participants to spend time on your study. If you're on a tight budget , you can reward participants for free by giving them exclusive access to content.

Related Resources:

- Digital Marketing Strategy: Keep It Simple

- 5 Marketing Predictions for the Looming Recession

- Recession Proof Marketing Strategies for Your Business

- Marketing Operations Framework - The Five Ps

- Biggest Marketing Challenges Leaders Face

- Digital Marketing Benchmarks & KPIs - How To Compare Your Performance

Preparation is key when conducting research in hopes of gaining productive and informative conversations. This involves creating a discussion guide, whether it is for a focus group, an online survey, or a phone interview. The guide should help you cover all the relevant topics and manage your time efficiently.

The discussion guide should be in an outline format, with an allocated time and open-ended questions for each section. All the questions must be open-ended, as asking closed questions may lead the interviewee to respond with a simple "yes" or "no" answer. You may need more detailed answers to make informed decisions, so be sure to ask follow-up questions as necessary. Also leave out any leading questions as they may unintentionally influence the interviewee's response, skewing your research results.

It's essential to identify your competitors accurately and you may even have some hidden in plain sight. There are some instances where your company's business division might compete with your main product or service, even though that company's brand might have a different focus. Take a look at Apple: the company is known primarily for its laptops and mobile devices, but Apple Music competes with Spotify over its music streaming service.

From a content perspective, you might compete with a blog, YouTube channel, or similar publication for inbound website visitors — even though their products don't overlap with yours. An example of this is when a toothpaste company might compete with publications like Health.com or Prevention on specific blog topics related to health and hygiene, even though the magazines don't sell oral care products.

Here are a few ways to build your competitor list:

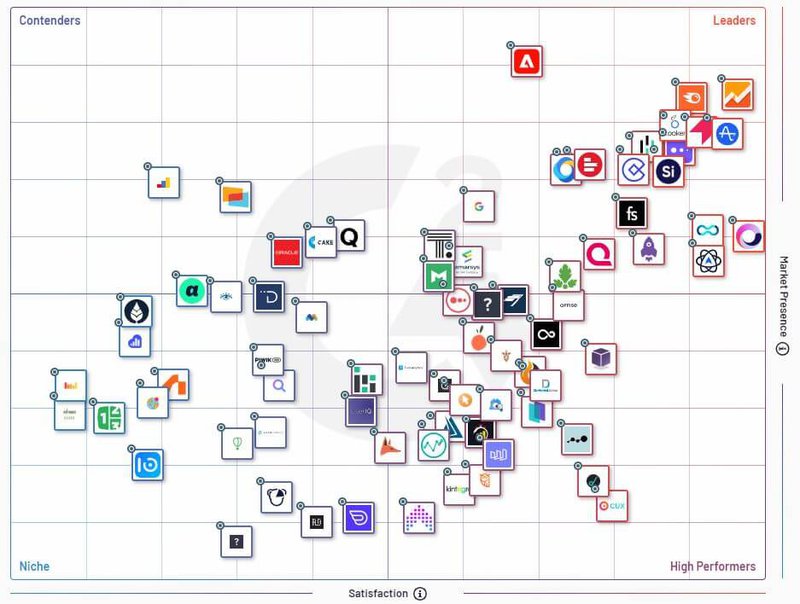

- Check your industry quadrant on G2 Crowd: This is a significant first step for secondary market research in some industries. G2 Crowd aggregates user ratings and social data to create "quadrants" that show companies as contenders, leaders, niche players, or high performers in their respective industries. G2 Crowd specializes in digital content, IT services, HR, e-commerce, and related business services.

- Download a market report: Companies like Forrester and Gartner offer free and gated market forecasts yearly on the vendors leading their industry. On Forrester's website, for example, you can select "Latest Research" from the navigation bar and browse Forrester's latest material using a variety of criteria to narrow your search. These reports are good assets to save on your computer.

- Use social media : Social networks can be excellent company directories if you use the search bar correctly. On LinkedIn, for example, select the search bar and enter the name of the industry you're pursuing. Then, under "More," select "Companies" to narrow your results to the businesses that include this or a similar industry term on their LinkedIn profile.

Identifying Content Competitors

Search engines can be beneficial when it comes to secondary market research . To identify the online publications competing with your business, start with the overarching industry term you identified earlier, and then come up with more specific industry terms that are related to your company . For example, if you run a catering business, you might consider yourself a "food service" company, as well as a vendor in "event catering," "cake catering," "baked goods," and so on.

Once you have this list, follow these steps:

- Google it: Running a search on Google for the industry terms that describe your company can be very beneficial. You may come across a mix of product developers, blogs, magazines, and other websites.

- Compare your search results against your buyer persona: Remember the persona you created during the primary research stage? You can use it to evaluate whether a publication you found through Google could steal website traffic from you. If the website's content aligns with what your buyer persona would want to see, it is a potential competitor and should be added to your list of competitors.

After a series of similar Google searches for the industry terms you identify with, look for repetition in the website domains that have come up.

When searching, examine the first two or three pages of results. These websites are considered reputable sources of content in your industry and should be monitored closely as you create your collection of videos, reports, web pages, and blog posts.

Market Research Examples

Mcdonald's focus on customer feedback and profiling.

McDonald's invests in developing a detailed consumer profile to attract and retain customers, including parents of young children who appreciate the family-friendly atmosphere and menus. The brand seeks feedback from customers through surveys and questionnaires in stores, social media, and its mobile app. It also monitors customer feedback on digital channels.

Nike's Extensive Research and Collaboration for Running Shoes Development

Nike invests heavily in creating running shoes that cater to the needs of its customers, which it determines through extensive market research and customer surveys. The brand goes to great lengths to understand its customers' preferences, such as the type of running surface, the distance they run, and their running style, to develop shoes that meet their specific needs.

In addition to customer surveys, Nike also collaborates with athletes to develop shoes that cater to their specific requirements. This research helps Nike improve its existing running shoe models and innovate new ones, ensuring that the brand stays ahead of the competition.

Disney employs focus groups that specifically cater to children to test out their new characters and ideas.

The Walt Disney Company invests millions of dollars in creating captivating stories tested for their effectiveness with children, the intended audience. Disney executives hold focus groups with preschoolers and kindergartners several times a year to gather their opinions and feedback on TV episodes, Disney characters, and more.

This market research strategy is effective because children are the ultimate audience that Disney aims to please. The collected feedback helps the company improve existing content to meet the preferences of its audience and ensure continued success as a multi-billion dollar enterprise.

KFC tested its meatless product in specific markets before launching it nationwide.

In 2019, KFC began developing and testing a meatless version of its famous chicken. However, instead of immediately launching the product nationwide, they decided to test it in select stores in the Atlanta, Georgia area.

This is an innovative and practical approach to market research, as it allows the company to determine the product's sales performance on a smaller scale before committing too many resources to it. If the meatless chicken fails to gain popularity in Georgia, KFC can make the necessary changes to the product before introducing it to the broader market.

Yamaha conducted a survey to determine whether to use knobs or sliding faders on the Montage keyboard.

Yamaha is a Japanese corporation that produces various products, from motorcycles to golf cars to musical instruments. When it began developing its new Montage keyboard, the team was unsure whether to use knobs or sliding faders on the product.

To address this dilemma, Yamaha used Qualtrics to send a survey to their customers. Within just a few hours , they received 400 responses. By using survey feedback, Yamaha ensured that it was designing a product that would perfectly meet the preferences of its audiences.

The Body Shop used social listening to determine how to reposition brand campaigns based on customer feedback.

The Body Shop is a well-known brand that offers ethically sourced and natural products. They take pride in their core value of sustainability. The Body Shop team tracked conversations to understand the sustainability subtopics that were most important to their audiences.

They found that their customers cared a lot about refills. Based on this information, the Body Shop team confidently relaunched their Refill Program across 400 stores globally in 2021, with plans to add another 400 in 2022. Market research confirmed that their refill concept was on the right track and also highlighted the need for increased efforts to demonstrate how much the Body Shop cares about its customers' values .

VideoTranscript

The takeaway.

Fratzke Consulting offers a comprehensive suite of market research services to help brands gain valuable insights into their target market, competitors, and industry trends. Our expert team utilizes various primary and secondary research methods to gather accurate and unbiased data, including surveys, competitive research, and industry reports. With Fratzke Consulting, you'll have the tools to succeed in today's rapidly evolving business landscape.

Interested in learning more? Book a free audit consultation today.

Stay in the know

Get the latest insights sent directly to your inbox.

Related Posts

What is Web Governance? 7 Key Principles To Set Your Team Up For Success.

In today’s digital age, a company’s website serves as the primary and most reliable source of information for its audiences. To ensure quality on a website, organizations need to have a sound web governance system in place. Web governance outlines the activities and resources required to manage a website, defines governance principles, and ensures quality, consistency, accessibility, and compliance.

Fractional CMO: What is it and Why Your Brand May Need One

Learn about fractional CMOs, their responsibilities, and why your business might benefit from hiring one. With a fractional CMO, you can get expert marketing strategy and leadership without the cost of a full-time CMO.

100 of the Best Website Designs to Inspire You in 2024 (A-Z)

100 inspiring website designs that can fuel your next web project in 2024. From visually stunning e-commerce sites to user-friendly SaaS platforms, Fratzke Consulting showcases our favorite designs.

201 Harbor Blvd. Suite 203 Fullerton, CA, 92832 Phone: (714) 614-2881 Hours: Monday - Friday 8AM-6PM

Stay in the loop

© 2024 by Fratzke

Learn / Blog / Article

Back to blog

How to do market research in 4 steps: a lean approach to marketing research

From pinpointing your target audience and assessing your competitive advantage, to ongoing product development and customer satisfaction efforts, market research is a practice your business can only benefit from.

Learn how to conduct quick and effective market research using a lean approach in this article full of strategies and practical examples.

Last updated

Reading time.

A comprehensive (and successful) business strategy is not complete without some form of market research—you can’t make informed and profitable business decisions without truly understanding your customer base and the current market trends that drive your business.

In this article, you’ll learn how to conduct quick, effective market research using an approach called 'lean market research'. It’s easier than you might think, and it can be done at any stage in a product’s lifecycle.

How to conduct lean market research in 4 steps

What is market research, why is market research so valuable, advantages of lean market research, 4 common market research methods, 5 common market research questions, market research faqs.

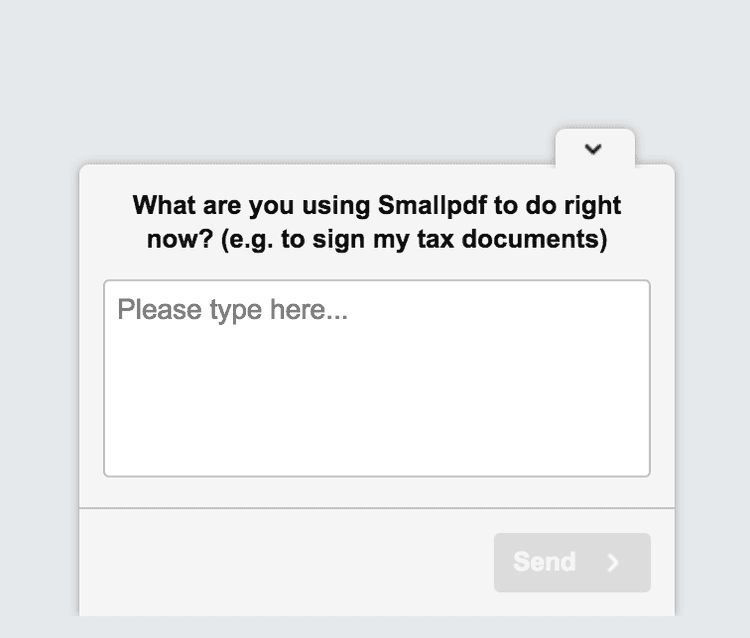

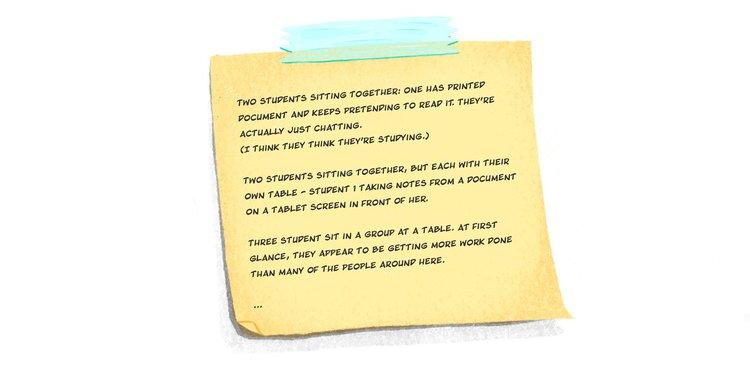

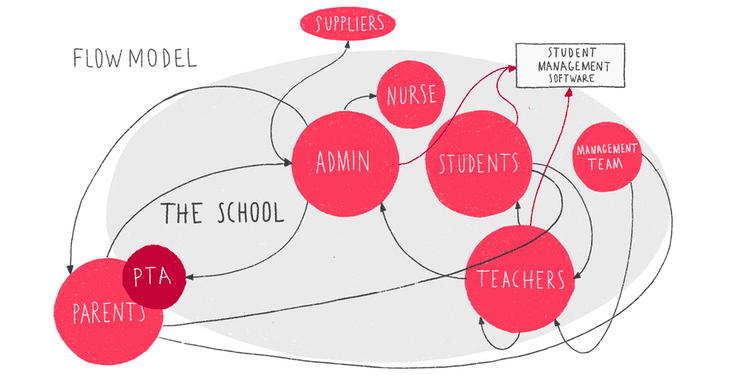

We’ll jump right into our 4-step approach to lean market research. To show you how it’s done in the real world, each step includes a practical example from Smallpdf , a Swiss company that used lean market research to reduce their tool’s error rate by 75% and boost their Net Promoter Score® (NPS) by 1%.

Research your market the lean way...

From on-page surveys to user interviews, Hotjar has the tools to help you scope out your market and get to know your customers—without breaking the bank.

The following four steps and practical examples will give you a solid market research plan for understanding who your users are and what they want from a company like yours.

1. Create simple user personas

A user persona is a semi-fictional character based on psychographic and demographic data from people who use websites and products similar to your own. Start by defining broad user categories, then elaborate on them later to further segment your customer base and determine your ideal customer profile .

How to get the data: use on-page or emailed surveys and interviews to understand your users and what drives them to your business.

How to do it right: whatever survey or interview questions you ask, they should answer the following questions about the customer:

Who are they?

What is their main goal?

What is their main barrier to achieving this goal?

Pitfalls to avoid:

Don’t ask too many questions! Keep it to five or less, otherwise you’ll inundate them and they’ll stop answering thoughtfully.

Don’t worry too much about typical demographic questions like age or background. Instead, focus on the role these people play (as it relates to your product) and their goals.