How to Highlight Risks in Your Business Plan

Tallat Mahmood

5 min. read

Updated October 25, 2023

One of the areas constantly dismissed by business owners in their business plan is an articulation of the risks in the business.

This either suggests you don’t believe there to be any risks in your business (not true), or are intentionally avoiding disclosing them.

Either way, it is not the best start to have with a potential funding partner. In fact, by dismissing the risks in your business, you actually make the job of a lender or investor that much more difficult.

Why a funder needs to understand your business’s risks:

Funding businesses is all about risk and reward.

Whether it’s a lender or an investor, their key concern will be trying to balance the risks inherent in your business, versus the likelihood of a reward, typically increasing business value. An imbalance occurs when entrepreneurs talk extensively about the opportunities inherent in their business, but ignore the risks.

The fact is, all funders understand that risks exist in every business. This is just a fact of running a business. There are risks that exist with your products, customers, suppliers, and your team. From a funder’s perspective, it is important to understand the nature and size of risks that exist.

- There are two main reasons why funders want to understand business risks:

Firstly, they want to understand whether or not the key risks in your business are so fundamental to the investment proposition that it would prevent them from funding you.

Some businesses are not at the right stage to receive external funding and placate funder concerns. These businesses are best off dealing with key risk factors prior to seeking funding.

The second reason why lenders and investors want to understand the risk in your business is so that they can structure a funding package that works best overall, despite the risk.

In my experience, this is an opportunity that many business owners are wasting, as they are not giving funders an opportunity to structure deals suitable for them.

Here’s an example:

Assume your business is seeking equity funding, but has a key management role that needs to be filled. This could be a key business risk for a funder.

Highlighting this risk shows that you are aware of the appointment need, and are putting plans in place to help with this key recruit. An investor may reasonably decide to proceed with funding, but the funding will be released in stages. Some will be released immediately and the remainder will be after the key position has been filled.

The benefit of highlighting your risks is that it demonstrates to investors that you understand the danger the risks pose to your company, and are aware that it needs to be dealt with. This allows for a frank discussion to take place, which is more difficult to do if you don’t acknowledge this as a problem in the first place.

Ultimately, the starting point for most funders is that they want to invest in you, and want to validate their initial interest in you.

Highlighting your business risks will allow the funder to get to the nub of the problem, and give them a better idea of how they may structure their investment in order to make it work for both parties. If they are unsure of the risks or cannot get clear explanations from the team, it is unlikely they will be forthcoming when it comes to finding ways to make a potential deal work.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- The right way to address business risks:

The main reason many business owners don’t talk about business risks with potential funders is because they don’t want to highlight the weaknesses in their business.

This is a fair concern to have. However, there is a right way to address business risk with funders, without turning lenders and investors off.

The solution is to focus on how you mitigate the risks.

In other words, what are the steps you are taking in your business as a direct reaction to the risks that you have identified? This is very powerful in easing funder fears, and in positioning you as someone who has a handle on their business.

For example, if a business risk you had identified was a high level of customer concentration, then a suitable mitigation plan would be to market your products or services targeting new clients, as opposed to focusing all efforts on one client.

Having net profit margins that are lower than average for your market would raise eyebrows and be considered a risk. In this instance, you could demonstrate to funders the steps you are putting in place over a period of time to help increase those margins to at least market norms for your niche.

The process of highlighting risks—and, more importantly, outlining key mitigating actions—not only demonstrates honesty, but also a leadership quality in solving the problems in your business. Lenders and investors want to see both traits.

- The impact on your credibility:

Any lender or investor backs the leadership team of a business first, and the business itself second.

This is because they realize that it is you, the management team, who will ultimately deliver value and grow the business for the benefit for all. As such, it is imperative that they have the right impression about you.

The consequence of highlighting business risks in your business plan with mitigations is that it provides funders a real insight into you as a business leader. It demonstrates that not only do you have an understanding of their need to understand risk in your business, but you also appreciate that minimizing that risk is your job.

This will have a massive impact on your credibility as a business owner and management team. This impact is more acute when compared to the hundreds of businesses they will meet that omit discussing the risks in their business.

The fact is, funders have seen enough businesses and business plans in all sectors to instinctively know what risks to expect. It’s just more telling if they hear it from you first.

- What does this mean for you going forward?

Funders rely on you to deliver on your inherent promise to add value to your business for all stakeholders. The weight of this promise becomes much stronger if they can believe in the character of the team, and that comes from your credibility.

A business plan that discusses business risks and mitigations is a much more complete plan, and will increase your chances of securing funding.

Not only that, but highlighting the risks your business faces also has a long-term impact on your character and credibility as a business leader.

Tallat Mahmood is founder of The Smart Business Plan Academy, his flagship online course on building powerful business plans for small and medium-sized businesses to help them grow and raise capital. Tallat has worked for over 10 years as a small and medium-sized business advisor and investor, and in this period has helped dozens of businesses raise hundreds of millions of dollars for growth. He has also worked as an investor and sat on boards of companies.

Table of Contents

- Why a funder needs to understand your business’s risks:

Related Articles

4 Min. Read

How to Create an Expense Budget

2 Min. Read

How to Use These Common Business Ratios

1 Min. Read

How to Calculate Return on Investment (ROI)

7 Min. Read

7 Financial Terms Small Business Owners Need to Know

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Find Study Materials for

- Explanations

- Business Studies

- Combined Science

- Computer Science

- Engineering

- English literature

- Environmental Science

- Human Geography

- Macroeconomics

- Microeconomics

- Social Studies

- Browse all subjects

- Textbook Solutions

- Read our Magazine

Create Study Materials

- Flashcards Create and find the best flashcards.

- Notes Create notes faster than ever before.

- Study Sets Everything you need for your studies in one place.

- Study Plans Stop procrastinating with our smart planner features.

- Risks and Rewards of Running a Business

The terms risk and rewards are often used together to emphasise the risk-taking approach. To gain more rewards, calculated risks must be taken. As Mark Zuckerberg, the founder of Facebook, said:

Create learning materials about Risks and Rewards of Running a Business with our free learning app!

- Instand access to millions of learning materials

- Flashcards, notes, mock-exams and more

- Everything you need to ace your exams

- Business Case Studies

- Business Development

- Business Operations

- Change Management

- Corporate Finance

- Financial Performance

- Human Resources

- Influences On Business

- Intermediate Accounting

- Introduction to Business

- Basic Financial Terms

- Business Enterprise

- Business Location

- Business Ownership

- Business Planning

- Classification of Businesses

- Evaluating Business Success Based On Objectives

- Measuring Success in Business

- Motivation in Entrepreneurship

- Reasons for Business Failure

- Managerial Economics

- Nature of Business

- Operational Management

- Organizational Behavior

- Organizational Communication

- Strategic Analysis

- Strategic Direction

The biggest risk is not taking any risk. In a world that's changing really quickly, the only strategy that is guaranteed to fail is not taking risks."

Understanding a business enterprise

Employees in an enterprise are happy to contribute to its growth by fulfilling the roles that are required of them. They have no stake in the company as far as investment is concerned. They receive their salary at the end of the month. On the other hand, people who follow the route of setting up business enterprises, often face greater risks. Potentially, their rewards can be greater.

A business enterprise is an operation through which factors of production are utilised to produce goods or services with the goal of making profits.

The scale of an enterprise can be different. A company with more than 500 employees, or a small grocery store with only two employees, are both examples of an enterprise.

Risk and rewards of starting a business enterprise

The level of risk associated with starting a business enterprise depends on its scale. If it is a small enterprise, its operations are likely to be less complicated. The level of decision-making required for its operations is also potentially simpler. Hence, the level of risk is often at a low level. On the other hand, if it’s a big enterprise, with many operations proceeding at the same time, the decision-making could be complex, and the risks are often high.

One of the most famous investment principles is 'the risk-return tradeoff', which states that when there is a higher risk, there is a higher potential reward.

A lot of factors need to be assessed when turning a business idea into reality. When the market is uncertain, the one who shows courage and makes the first move could get a head start in the race. In marketing, this is known as the first-mover advantage . In such a scenario, the one who makes the first move could get big rewards.

Types of risks in business

There are a few risks that impact the future of a business.

Risks and Rewards of Running a Business: Market u ncertainty

It is a common practice to conduct market research before devising strategies and visions for the business. It helps in reducing market risks to an extent. However, examining every possible scenario is one thing; experiencing market reactions to your business offering is another thing altogether. In a market, there are lots of unpredictable factors. For example, a change in government policy on the import of raw materials could entirely change the situation for business owners.

Risks and Rewards of Running a Business: Financial r isk

Starting a business requires capital, be it through investment by the owner themselves, or other investors. In either situation, it presents a financial risk. Therefore, it requires comprehensive financial management to reduce this risk. An owner should have multiple financial plans in store in case of unpredictable situations. Financial inflows and outflows must be managed effectively to ensure the business is on track to meet financial objectives . However, even with more than one emergency financial plan, the risk can only be reduced to a certain extent.

Risks and Rewards of Running a Business: Health r isk

Setting up a business enterprise can often come with lots of health risks too. Business owners have the ultimate responsibility in making decisions. They are the ones who lead the enterprise, and this could affect their physical as well as mental health. Starting a business means putting in more effort and time to plan everything and to execute the ideas. It means working extra hours and managing all the business aspects yourself. All of this adds pressure on business owners, and it could lead to mental and physical burnout.

Risks and Rewards of Running a Business: No guaranteed returns

As mentioned before, a business enterprise has financial risks. Even if everything is planned and executed effectively, there are no guarantees on returns. It all depends on how consumers react to the business offering. If it works then huge returns can be expected; but if it does not work, then huge losses are incurred.

However, there are people who still want to take this path. The reason is simple: greater risks often give greater rewards.

Types of rewards in business

Let's look at some reasons why people will take the risk of setting up a business enterprise.

Risks and Rewards of Running a Business: Autonomy

Having your own business enterprise ensures more freedom. It gives owners a sense of ownership. They make key decisions and are viewed as leaders. This freedom allows owners to take up responsibility, ensuring more flexibility in decision making .

Risks and Rewards of Running a Business: G rowth opportunities

It is often said that business ownership gives far more freedom and responsibility than a paid job. A business owner can assess the market opportunities and can decide to benefit from them, without having to take permission from any supervisor. These opportunities would also enable him to constantly learn and grow as an owner and a leader.

Risks and Rewards of Running a Business: Greater financial rewards

Since starting a business enterprise comes with many risks, it also grants more financial rewards in most cases. The owners put so much at stake for business enterprises to grow, it is only fair that they get greater financial rewards for their efforts.

Risks and Rewards of Running a Business: More satisfaction

The motivation to work hard depends on the level of satisfaction you get during the whole process. A job that gives you satisfaction will always drive you to push for more, and achieve bigger goals. Freedom, a sense of ownership, and the ultimate responsibility that comes with running a business will keep you motivated.

Examples of risk and reward in business

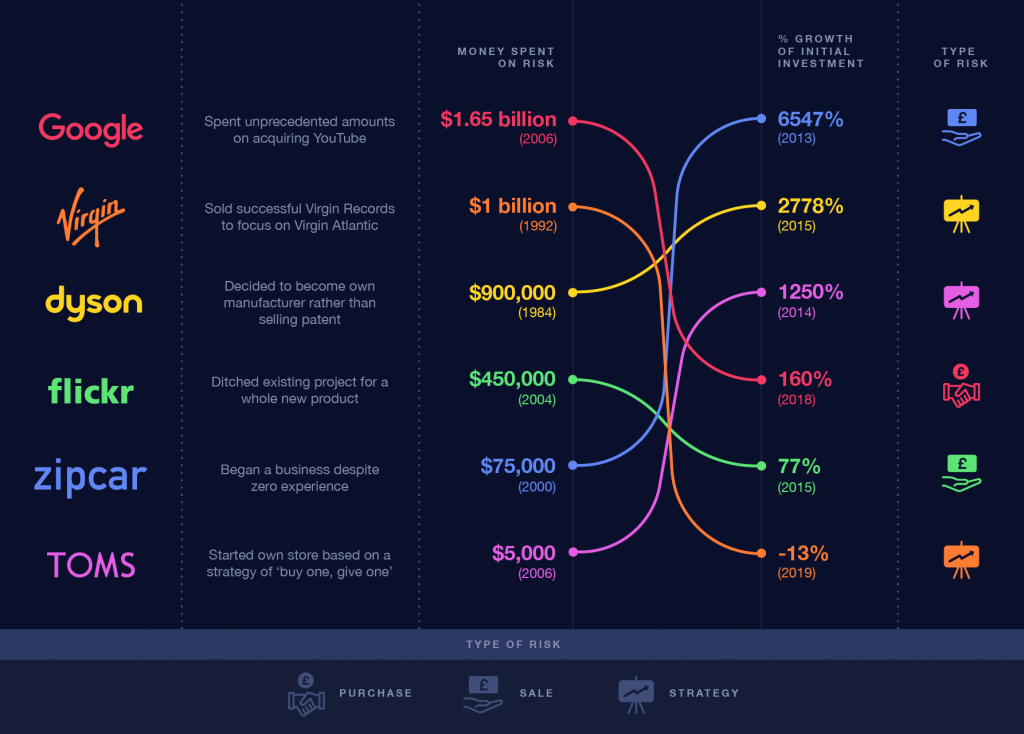

In 2006, Google acquired YouTube for $1.65 billion. At the time YouTube had been around for less than two years. The video hosting platform was already well-known, but nobody had expected it to reach such heights. It was a bold move from Google to spend that amount of money on a relatively fresh company. Many business analysts thought Google had overpaid for this acquisition. The financial risks associated with this acquisition were enormous.

Google took the risk and now it is safe to say that it was a smart investment. They have got huge rewards. Now, YouTube has an estimated worth of $170 billion.

Different people have different aspirations in life. People who do not want to take risks, tend to prefer conventional job roles. To start a business enterprise is certainly risky, because of a lot of uncertainty in the external environment . However, people who assess the situations and take risks, are often rewarded.

Risks and Rewards of Running a Business - Key takeaways

- People who start business enterprises often face greater risks; they can potentially get proportionally rewarded.

To gain more rewards, calculated risks should be taken.

- The risk-return tradeoff states that when there is a higher risk, there is a higher potential reward.

- Market uncertainty, financial risk, health risk, and no guaranteed returns are the risks associated with starting a business enterprise.

- There are many rewards of running a business; these include freedom, job satisfaction, and financial gains.

Flashcards in Risks and Rewards of Running a Business 15

What did Mark Zuckerberg say about risk and reward?

"The biggest risk is not taking any risk,". And also: "In a world that's changing really quickly, the only strategy that is guaranteed to fail is not taking risks."

What is one of the things required for more rewards?

What is the difference between risk-takers and non-risk takers?

Risk-takers prefer roles that are non-conventional, whereas non-risk takers prefer conventional job roles.

What is the definition of a business enterprise?

What is the risk-return tradeoff principle?

When there is a higher risk, there is a higher potential reward.

What does first-mover advantage mean?

It means the one who makes the first move in the market could get big rewards, such as a competitive advantage.

Learn with 15 Risks and Rewards of Running a Business flashcards in the free Vaia app

We have 14,000 flashcards about Dynamic Landscapes.

Already have an account? Log in

Frequently Asked Questions about Risks and Rewards of Running a Business

What are the risks of running a business?

Market uncertainty, financial risk, health risk, and no guaranteed returns are the types of risks in running a business.

What are the 3 risks of running a business?

What are the rewards of running your own business?

Autonomy, growth opportunities, greater financial rewards, and more satisfaction are the rewards of running your own business.

What are the risks and rewards of starting a business?

Market uncertainty, financial risk, health risk, and no guaranteed returns are the types of risks i8nvolved with starting a business.

Autonomy, growth opportunities, greater financial rewards, and more satisfaction are the rewards of starting a business.

What are the ways that risk and reward can impact on business activity?

Knowing and understanding the existing or potential risks will help businesses prepare better and take necessary action. It will help businesses in understanding their strengths and weaknesses, as analysing and preparing for risks involves an in-depth analysis of both internal and external factors of the business, thereby improving the business.

Knowing the rewards that come with undertaking the risks motivate entrepreneurs in running the business. It gives them a sense of ownership, freedom, and satisfaction. These motivating factors help entrepreneurs run the businesses better.

Discover learning materials with the free Vaia app

Vaia is a globally recognized educational technology company, offering a holistic learning platform designed for students of all ages and educational levels. Our platform provides learning support for a wide range of subjects, including STEM, Social Sciences, and Languages and also helps students to successfully master various tests and exams worldwide, such as GCSE, A Level, SAT, ACT, Abitur, and more. We offer an extensive library of learning materials, including interactive flashcards, comprehensive textbook solutions, and detailed explanations. The cutting-edge technology and tools we provide help students create their own learning materials. StudySmarter’s content is not only expert-verified but also regularly updated to ensure accuracy and relevance.

Vaia Editorial Team

Team Business Studies Teachers

- 7 minutes reading time

- Checked by Vaia Editorial Team

Study anywhere. Anytime.Across all devices.

Create a free account to save this explanation..

Save explanations to your personalised space and access them anytime, anywhere!

By signing up, you agree to the Terms and Conditions and the Privacy Policy of Vaia.

Sign up to highlight and take notes. It’s 100% free.

Join over 22 million students in learning with our Vaia App

The first learning app that truly has everything you need to ace your exams in one place

- Flashcards & Quizzes

- AI Study Assistant

- Study Planner

- Smart Note-Taking

Privacy Overview

Get unlimited access with a free vaia account..

- Instant access to millions of learning materials.

- Flashcards, notes, mock-exams, AI tools and more.

- Everything you need to ace your exams.

More From Forbes

How to mitigate risk and maximize rewards as a startup entrepreneur.

- Share to Facebook

- Share to Twitter

- Share to Linkedin

Stephen Scoggins is the founder and CEO of Scoggins International Inc.

As an entrepreneur, I know that the core difference between successful and unsuccessful businesses lies in the ability to risk and reward equally.

According to data from the U.S. Bureau of Labor Statistics , "approximately 20% of new businesses fail during the first two years of being open, 45% during the first five years, and 65% during the first 10 years." With this in mind, entrepreneurs need to understand how to mitigate risks and maximize rewards to increase their chances of success.

Removing And Reducing Risk: Three Core Areas

The scales must be balanced with equal risk and reward at any given moment. To achieve this balance, I believe it is crucial for entrepreneurs to understand how to evaluate risks effectively. This requires thinking like an investor rather than a traditional entrepreneur or banker. As an investor, I evaluate risks and expect a four-to-one return on every dollar I put to work.

Entrepreneurs must have a risk removal (mitigation) plan to evaluate risks effectively. This plan should cover three core areas, often the root cause of catastrophic business failure: personal, business and acquisitional assets.

Personal risks include risking assets and resources, while business risks include finance, reputation and team management. Acquisitional asset risks, on the other hand, relate to assets acquired over time from business operations.

Best Travel Insurance Companies

Best covid-19 travel insurance plans, the four phases of risk evaluation.

To evaluate risks effectively, I recommend entrepreneurs consider four key phases. Within each phase, there are several considerations that entrepreneurs must keep in mind. These phases are:

1. Professional impact. Under the professional impact, entrepreneurs should consider their leadership, mentorship, communication, legacy and ability to identify bottlenecks.

2. Reputational impact. Under the reputational impact, entrepreneurs must consider honesty, integrity, relationships and the impact of their decisions on their reputation.

3. Operational impact. This form of impact involves considering flow, fulfillment, cycle times and capital investments.

4. Financial impact. Lastly, entrepreneurs must consider revenue, profit, margin, cash flow, taxes and capital investments under financial impact.

Risk Mitigation Considerations

It is easy to think that one decision can solve a problem. However, when entrepreneurs filter that decision through the four lenses, they can ensure that the solution does not cause exponential problems in other areas.

Some examples of considerations that entrepreneurs should keep in mind include:

• Verifying that their idea or brand is not already taken.

• Claiming key domain names, trademarks and business visual identity.

• Obtaining a corporate veil.

• Understanding their tax bracket and expectations.

• Finalizing an operating agreement, especially when it comes to partners.

Other important considerations include market conditions, the competitive landscape, organizational structure, cash flow management, non-disclosures, competitors, personal leadership, data-driven decisions, overall layers of risk mitigation and those representing their interests, such as legal, financial and operational professionals. Process, systems, and organizational flow are also essential.

Becoming Unstoppable

As entrepreneurs, we have two ways to learn: By making mistakes ourselves or by learning from others who have already made those mistakes and found solutions before us.

In conclusion, entrepreneurs must understand the importance of mitigating risks and maximizing rewards to ensure the success of their businesses. By evaluating risks effectively and considering key considerations, entrepreneurs can increase their chances of success and avoid becoming a statistic.

Forbes Business Council is the foremost growth and networking organization for business owners and leaders. Do I qualify?

- Editorial Standards

- Reprints & Permissions

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

How to Build Risk into Your Business Model

- Karan Girotra

- Serguei Netessine

Smart companies design their innovations around managing risk.

Reprint: R1105G

To create value, companies typically focus on revenue, cost structure, and resource velocity. Improving those factors is the main focus of management literature. But all of them are vulnerable to sharp changes in demand and supply.

Companies can innovate their business models to reduce the impact of such swings. But they can also create value by adding some risk. For instance, more than 30 years ago Rolls-Royce identified a major pain point in the aircraft industry: maintenance of airplane engines. An engine breakdown grounds the plane while the airline pays for repair time and materials. So Rolls-Royce offered a service contract whereby the airline would pay for an engine’s flight hours rather than for time and materials. The new contract triggered a completely new value creation dynamic, because Rolls-Royce was motivated to improve its own products and maintenance processes.

Business model innovations are much cheaper than product and technology innovations, and they can be approached in a systematic way. Furthermore, nearly all the big ones have already been done—so you can simply adapt them to suit your own situation.

The Idea in Brief

Many managers find it harder to tell if changes in their business models will work out than to guess whether a new product or technology will catch on.

The secret to systematic business model innovation is to focus on identifying where the risks are in your value chain. Then determine whether you can reduce them, shift them to other people, or even assume them yourself.

If you take this approach, you won’t need extensive experimentation and prototyping to identify very powerful innovations, because many tools for managing risk are available.

In early 2008 four entrepreneurs in Paris started MyFab, an internet-based furniture retailer that is doing more to change the industry than any other company since IKEA. Instead of building large stocks of furniture, as its competitors do, MyFab provides a catalog of potential designs. Customers vote on them, and the most popular ones are put into production and shipped to buyers directly from the manufacturing sites—with no retail outlets, inventories, complicated distribution, or logistics networks.

- KG Karan Girotra is the Charles H. Dyson Family Professor of Management at Cornell Tech and the Johnson College of Business at Cornell University, and a coauthor, with Serguei Netessine, of The Risk-Driven Business Model: Four Questions That Will Define Your Company (HBR Press, 2014). Follow him on Twitter: @Girotrak

- Serguei Netessine is the vice dean for global initiatives and the Dhirubhai Ambani Professor of Innovation and Entrepreneurship at the University of Pennsylvania’s Wharton School and a coauthor, with Karan Girotra, of The Risk-Driven Business Model: Four Questions That Will Define Your Company (HBR Press, 2014). Follow him on Twitter: @snetesin

Partner Center

The Risks and Rewards of Business

Starting a new business is a brave move for even the most qualified of entrepreneurs. The rewards can be life-changing if the concept has legs, and the potential for success is enormously inspiring. But in the temperamental world of business, no success is achieved without taking risks and overcoming obstacles.

With the constant development of emerging and evolving technology, and new start-ups cropping up every day, opportunity for innovation is as rife as competition is fierce.

So, are the risks worth taking in order to reap the rewards? We investigated further.

The biggest risks are taken in the first year of business

Looking at some of the biggest risk and reward stories across the business realm, we have identified six of the most common chances that entrepreneurs take when launching or growing their company.

The most significant and highest stake risks that a business will take usually occur in their first year of operation. It takes funding, a sound USP and a strong business model to get the start-up off the ground, followed by manpower and profit to excel growth. If one area fails, then it can have crucial implications for the future of the business.

Read on to find out more about the risks the world’s largest organisations took in their early phases, in order to get the where they are today.

Risk 1: Growth

Some of the world’s most recognised business success stories can be held accountable to the potentially crippling financial risks that they took to build the business and boost growth.

Firstly, without sufficient financial backing, a company’s prospect for profitability is small. While a lot of entrepreneurs turn to crowd-funding platforms (acquiring funding for a project by appealing for public donations – usually via the internet) to get money in the bank, a large portion of start-ups rely on bank loans and investments from external stakeholders.

Of course, if things go to plan, the business should generate enough income to cover the initial investments and beyond, however, if the gamble doesn’t pay off, the financial consequences can be hampering.

The same can be said for acquiring new assets. Whether done to drive growth, monopolise the market or expand the company’s offerings, mergers are good for business, but they can also come with unforeseen side effects and the ROI may prove uneconomical.

FinTech company, Ebury (external link) , discovered that despite the challenges they faced in order to grow the business, it was the growth itself that proved the biggest risk. Hiscox have put together a case study documenting their rise to global success .

Example: Google

The risk: Acquiring YouTube for $1.65 billion in 2006 The reward: Google is now worth $132.1 billion – including a 160% growth on the initial YouTube investment

Google ranks third in the most valuable companies in the world of 2018 [1] , but it could have been an entirely different story if the astronomical £1.65 billion purchase of YouTube hadn’t proven to be the profitable investment they hoped for.

YouTube had only been around for a year or so at the time of the acquisition, but its videos were already being viewed by as many as a million people a day. While it hasn’t been quite as lucrative as Google may have hoped, YouTube continues to dominate the market and it could be argued that the purchase is worthwhile, even if purely to beat rivals such as Facebook to the acquisition.

Google make a point of not releasing the revenue and income of YouTube as a separate entity, however, it’s been estimated that it brings in over $10 billion annually and could be worth as much as $100 billion [2] .

Risk 2: Cutting costs

In a similar vein to acquiring new business assets, sometimes selling on existing assets can be the most economic option – possibly because it’s costing the business too much to run or even if a desirable offer comes in, that simply can’t be turned down.

While this is a risky move, sometimes selling costly assets to focus money and resources on more profitable areas of the business can be a positive move for the progression of the company.

Example: Virgin Group

The risk: Selling Virgin Records for $1 billion to focus on Virgin Atlantic The loss: Air France-KLM bought a 31% stake in Virgin Atlantic business leaving Virgin Group with a minority stake of just 20% [3] .

Having founded Virgin Records in 1972, Branson successfully turned the label from a small successful record shop into a ground-breaker of the music industry, with some of the world’s hugest artists on the bill.

Entrepreneurialism simply runs through Branson’s veins, however, and by 1992 he struck a deal to sell the label for $1 billion to part-fund his new venture – Virgin Airlines. This was a mammoth sum at the time, and it helped to propel the Virgin Atlantic business into success.

In 2018, however, it was reported that Virgin Atlantic has made a loss of £28.4 million for 2017 [4] and Air France KLM bought a 31% stake in the business worth £220 million, leaving Virgin Group with the minority stake (20%), while Delta retain 49%. Based on the price paid for the shares, you could estimate that the Virgin Atlantic business is worth approximately £709 million. This is significantly less than what Virgin Records sold for in 1992, and that’s not even accounting for inflation.

Risk 3: Strategy

It would be wrong to presume the risks taken by businesses are simply optimistic gambles. With so much on the line, realistically, every move is a calculated and very deliberate action. If a business isn’t meeting expectations in those early days, it’s critical that the reason(s) for the short-coming is identified and actioned strategically.

Sometimes a change of strategy is essential for the progression of the business, and in other cases altering the direction of the company altogether to suit market demand, or to navigate obstacles could be what it takes to achieve long-term success.

Perkbox (external link) changed their business model three times before finding success. Read what CEO, Saurav Copra, has to say about the challenges they overcame in a case study .

Example: Dyson

The risk: Borrowing $900,000 to start a manufacturing line instead of selling blueprint The reward: The company is now worth $5.3 billion

Making the decision to start his own manufacturing company – rather than selling on the blueprint for the Dyson vacuum cleaner to an existing retailer – was the best career choice James Dyson ever made.

Having purchased what was allegedly the “most powerful vacuum cleaner on the market” (and subsequently finding that the product was far from efficient), Dyson resolved that he would create a new model that would blow the competing design out of the water. After five years of experimenting with prototypes, the vacuum cleaner was ready, but the anticipated demand from domestic appliance retailers simply wasn’t there.

At this point, he formulated a plan to open a manufacturing line himself – a business that required a $900,000 bank loan [5] . With hard work, determination and a strong sales pitch, he managed to get the Dyson vacuum cleaner into stores across the UK, and by 1996 it was the bestselling vacuum cleaner in Britain. Not long after, it went global.

Today, Dyson is worth an extraordinary $5.3 billion dollars and that $900,000 loan is old news.

Risk 4: Market demand

The starting point for any new business is identifying a gap in the market – because without a strong USP, the company is likely to get swallowed up among competition. For your own assurance, as well as stakeholders, every business leader should thoroughly assess the market demand (or how you could drive this demand) and build a full understanding of how your business could fit into the current landscape.

Introducing a fresh product to an existing market or creating a brand-new market altogether, gives the advantage of lesser market rivalry, however, the customers will need convincing that this innovation will benefit them in some way.

Smart energy company, geo (external link) , took the plunge into launching a new piece of technology, into a basically untouched market. Hiscox has documented how they went on to become a market leader in a case study .

Example: TOMS

The risk: Creating a business model on the premise of giving away free stock The reward: Sold 50% stake to Bain Capital Private Equity in 2014, valuing the company at $625 million [6] .

When TOMS founder Blake Mycoskie hatched the concept for the “one for one” (for every pair of shoes purchased a pair is donated to a child in need) business model that the brand runs on, he didn’t have an easy time finding a shoemaker who would work with him. They all thought he was crazy, and the business would never have legs. Fortunately, he managed to convince a local shoemaker called Jose and the rest is history.

Upon launch of the brand, the press loved the TOMS story and within the first summer 10,000 pairs of shoes had been sold. The company went on to become more and more profitable and in 2014 private equity firm, Bain, took a 50% stake in the then valued $625 million business.

Unfortunately, four years on, TOMS’ earnings are down by a half as sales struggle and the company is facing approximately $350 million of debt, which analysts put down to the company not expanding their product-range enough [7] .

Risk 5: Product demand

For a product to be profitable, it must provide the solution to an existing problem – if not, you’re opening yourself up for a tough ride convincing investors that it’s worth their money and customers that they want to buy it.

Example: flickr

The risk: Investing $450,000 into ditching their existing project for a new product The reward: A 77% growth on initial investment

When Flickr founders Steward Butterfield and Caterina Fake founded the company, they originally intended for it to be a kind of a multiplayer online game, which eventually was turned into a chat system with live photo-sharing options. They later discovered that as the internet is ever changing, their product had to be too. Their users wanted to share photographs, not chat, so that’s the direction they took it in.

In 2005, Yahoo bought flickr for $25 million [8] , from which the site rose in popularity among professional and amateur photographers. Unfortunately, it was still early in the growth of tech start-ups at the time and flickr likely missed out on what could have been a much larger buyout if they had held out for just a few more months, when the market took off – Myspace was sold to News Corp. for $580 million in July 2005 and YouTube was acquired by Google in October 2006 for $1.65 billion.

In 2018, after Yahoo’s acquisition by Verizon, flickr was sold on again to the independent image-hosting firm SmugMug.

Risk 6: Team

The beating heart of every successful business is a strong workforce, who share the same values and goals for the future and progression of the company. A lack of cooperation, or disagreements about key business activities can create roadblocks for maintaining successful growth.

Unfortunately, it’s not uncommon for a business to suffer as a result of personal fall-outs and breakdowns of relationships within the team. On top of this, every company with employees has to consider that they are responsible for their staff’s wellbeing. Employers’ liability insurance is a legal requirement, and can cover the business in the case an employee falls ill or is injured as a result of their work.

Unforeseen circumstances can’t be avoided, but it’s only sensible to take the time to confirm that everyone on board wants the same results before launching the business and you have the right cover in place to protect the business from costly legal fees.

Example: Zipcar

The risk: Starting a business with an unfamiliar partner, with just $68 in the bank The reward: Zipcar was sold to Avis for $491 million, [9] 6547% the initial investment

For Zipcar founders, Antje Danielson and Robin Chase, the biggest risk of starting the company from nothing wasn’t purely the financial gamble, but also going into business with somebody they didn’t know all so well.

Launching Zipcar in 2000 with just $68 in the bank, a few short months after meeting, it wasn’t long before a rift grew between the pair. This led to Chase firing Danielson in 2001 over a dispute in a board meeting, before Chase was also fired after a fruitless round of funding in 2003.

Ironically, Zipcar went on to become a phenomenal success – it was sold to Avis in 2013 for a colossal $491 million, [10] 6547% the initial investment – but neither benefitted from the riches.

What’s evident from looking at each of the above companies’ stories, is that risk is an inevitable part of every business – nobody said success is easy! While chances still need to be taken to maintain growth and profitability after the business is fully established, it’s the high-stake risks in the early phases of a business that can present the most impactful rewards or obstacles.

Unsurprisingly, financial ventures carry the highest risk and reward potential. After all, money is a central factor in the motivation and operation of business. Other lesser considered risks, such as the humans behind the company’s running and changing market demands can also have a significant impact though.

Having a comprehensive business insurance policy in place can protect your business from many of the common risks faced in the day to day running, so you can have peace of mind and focus your attention on the positive sides of the business.

[1] https://www.forbes.com/sites/kurtbadenhausen/2018/05/23/the-worlds-most-valuable-brands-2018-by-the-numbers/#61276e3b2eed (external link) [2] https://www.thestreet.com/investing/youtube-might-be-worth-over-100-billion-14586599 (external link) [3] https://www.bbc.co.uk/news/business-40745277 (external link) [4] https://www.ft.com/content/a81e071a-2847-11e8-b27e-cc62a39d57a0 (external link) [5] https://www.inc.com/magazine/201203/burt-helm/how-i-did-it-james-dyson.html (external link) [6] https://www.forbes.com/sites/clareoconnor/2014/08/20/bain-deal-makes-toms-shoes-founder-blake-mycoskie-a-300-million-man/#b69dd0556680 (external link) [7] https://thehustle.co/toms-shoes-struggling/ (external link) [8] https://www.theguardian.com/technology/2018/apr/23/flickr-bought-by-smugmug-yahoo-breakup (external link) [9] https://www.theverge.com/2014/4/1/5553910/driven-how-zipcars-founders-built-and-lost-a-car-sharing-empire (external link) [10] https://www.theverge.com/2014/4/1/5553910/driven-how-zipcars-founders-built-and-lost-a-car-sharing-empire (external link)

Disclaimer: At Hiscox, we want to help your small business thrive. Our blog has many articles you may find relevant and useful as your business grows. But these articles aren’t professional advice. So, to find out more on a subject we cover here, please seek professional assistance.

Related articles

What the Brexit trade deal really means for small businesses

The School of Hard Knocks: when should you grow your small business?

Businesses emerging from the pandemic: how can you begin to recover?

DNA of an Entrepreneur 2014: Innovation key to growth

The 10 biggest challenges businesses face today (and need consultants for)

8 key risks all businesses should manage (but often don’t) / Bernard Marr

The Hiscox Experts are leaders valued for their experience within the insurance industry. Their specialisms include areas such as professional indemnity and public liability, across industries including media, technology, and broader professional services. All content authored by the Hiscox Experts is in line with our editorial guidelines .

Your session will end in 60 seconds!

- Solutions Company creation Business account Certified accounting Invoicing Expense management

- Resources Contact Sales (WhatsApp) Help Center Blog

You are reading...

Home > Start a Business > 5 Tips for Balancing Entrepreneurial Risk and Reward

5 Tips for Balancing Entrepreneurial Risk and Reward

By Bernardo Barbosa

Published on 9 January 2024

5 mins read

In the world of entrepreneurship, uncertainty is a constant companion. Nevertheless, one must embrace this uncertainty and view it as an opportunity for growth and innovation. Taking risks is an essential part of the entrepreneurial journey, and it requires a mindset that is open to new possibilities and willing to step outside of your comfort zone. But how does one even begin with balancing entrepreneurial risk and reward?

To get you started, here are a few key points to keep in mind:

- **Be adaptable:** The ability to adapt to changing circumstances is crucial for success in the entrepreneurial world. Being open to new ideas and willing to pivot when necessary can help navigate uncertain situations.

- **Stay informed:** Stay up-to-date with industry trends, market conditions, and customer needs. This knowledge will enable you to make informed decisions and anticipate potential challenges.

- **Seek support:** Surround yourself with a network of mentors, advisors, and fellow entrepreneurs who can provide guidance and support during uncertain times.

Embracing uncertainty is not about blindly taking risks, but rather about being strategic in your approach. Below, we have listed five important tips that can help you grow your business while taking calculated risks.

Begin your Business Adventure in Portugal Today!

1. Taking Calculated Risks

When it comes to entrepreneurship, taking risks is inevitable. However, successful entrepreneurs understand the importance of taking calculated risks. These risks should be carefully evaluated and analyzed, considering all potential outcomes and consequences. To do so, entrepreneurs should:

- Conduct thorough market research to identify opportunities and assess market demand.

- Evaluate the potential return on investment and weigh it against the potential risks.

- Seek advice and guidance from experienced mentors or industry experts .

- Develop contingency plans to mitigate potential losses.

Taking calculated risks is about finding the right balance between ambition and caution and making informed decisions that have the potential to yield significant rewards.

2. Identifying and Evaluating Opportunities

To identify and evaluate opportunities, start by looking for gaps in the market that your business can fill, and consider the potential profitability of each one. Analyzing the feasibility of different options is equally crucial, as it helps you determine the risks and rewards associated with each opportunity.

To summarize:

- Look for gaps in the market

- Analyze the feasibility of different options

- Evaluate factors such as market size and competitive landscape

- Assess the viability of each opportunity

3. Developing a Solid Business Plan

Here are some key points to consider when developing your business plan:

- Clearly define your business objectives and target market.

- Identify your unique selling proposition and how you will differentiate yourself from competitors.

- Outline your marketing and sales strategies to reach your target audience.

- Develop a detailed financial plan, including revenue projections, expenses, and funding requirements.

A well-crafted business plan helps you secure funding and provides a clear direction for your entrepreneurial journey.

4. Diversifying Your Investments

Here are some key benefits of diversification:

- **Risk reduction:** Diversification helps to minimize the impact of a single investment's poor performance on your entire portfolio. If one investment underperforms, others may offset the losses.

- **Opportunity for growth:** By investing in a variety of assets, you increase your chances of benefiting from the growth of different sectors or regions.

- **Stability:** Diversification can provide stability to your portfolio by balancing out the ups and downs of individual investments.

Diversification is not just about spreading your investments randomly. It requires careful consideration of your risk tolerance, investment goals, and time horizon. Consulting with a financial advisor can help you develop a well-diversified investment strategy that aligns with your specific needs and objectives.

5. Implementing Risk Management Strategies

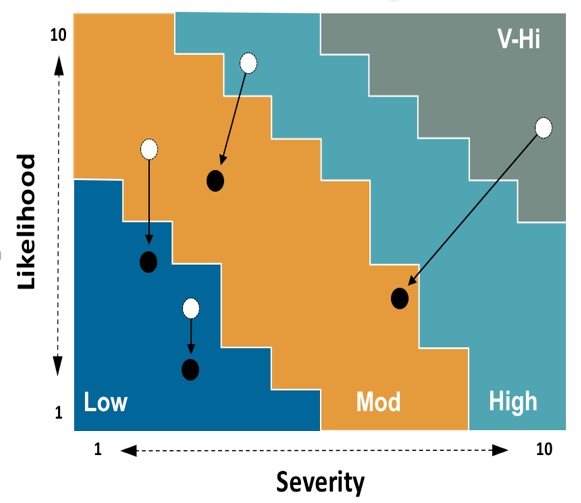

- **Identify potential risks:** Conduct a thorough analysis of your business operations and identify any potential risks that could impact your business.

- **Assess the likelihood and impact:** Evaluate the likelihood and potential impact of each identified risk to prioritize your risk management efforts.

- **Develop risk mitigation plans:** Create a plan to mitigate each identified risk, outlining specific actions and strategies to minimize their impact.

- **Monitor and review:** Regularly monitor and review your risk management strategies to ensure their effectiveness and make necessary adjustments.

Implementing effective risk management strategies is an ongoing process that requires continuous evaluation and adaptation. By proactively managing risks, entrepreneurs can safeguard their businesses and increase their chances of long-term success.

Was this helpful?

Written by bernardo barbosa.

Our specialised team focuses on bringing relevant and useful content everyday for our community of entrepeneurs. We love to stay updated and we thrive on sharing the best news with you.

Subscribe to our newsletter

Receive the latests insights and trends to help you start and run your business.

Start your 30-day free trial

Full flexibility. cancel anytime. no hidden fees., available on.

4.8 on Trustpilot

4.6 on App Store

4.4 on Play Store

Want to stay updated with our latest news.

No spam, ever. Your email address will only be used for the company news.

Shopping Cart

No products in the cart.

Balancing Risk and Reward in Business Ventures

Embarking on a business venture is like navigating uncharted waters. It’s an exciting journey filled with opportunities, but it also comes with its fair share of challenges. Understanding how to balance risk and reward is crucial for entrepreneurs, and it’s a skill that even high school and homeschooling students can benefit from as they prepare for the future. In this comprehensive guide, we’ll delve into the definitions of risk and reward in the business context, explore the challenges faced by entrepreneurs, discuss the potential rewards, and provide practical strategies for maintaining equilibrium.

Defining Risk and Reward

Before we delve into the intricacies of balancing risk and reward, it’s essential to understand these fundamental concepts. Risk, in the business realm, refers to the possibility of encountering negative outcomes or financial losses. On the other hand, reward encompasses the positive outcomes and financial gains associated with a successful business venture. Both elements are inherently intertwined in the entrepreneurial landscape, creating a delicate balance that requires strategic decision-making.

Entrepreneurial Risks

- Financial Risks: Entrepreneurs often invest personal savings or secure loans to fund their ventures.Fluctuations in the market can lead to financial instability, affecting cash flow and profitability.

- Market Risks: Consumer preferences, competition, and technological advancements can impact the market demand for a product or service.

- Operational Risks: Challenges in supply chain management, production processes, or unforeseen disruptions can pose operational risks.

- Regulatory Risks: Changes in government regulations can impact industries, leading to compliance challenges and potential legal consequences.

Entrepreneurial Rewards

- Financial Gains: Successful business ventures can yield significant profits, providing entrepreneurs with financial independence.

- Personal Fulfillment: Entrepreneurship allows individuals to pursue their passions and bring their innovative ideas to life.

- Professional Growth: Building and managing a business fosters valuable skills, such as leadership, decision-making, and adaptability.

- Job Creation: Successful businesses contribute to the economy by creating job opportunities for others.

Balancing Risk and Reward

- Strategic Planning: Develop a comprehensive business plan that outlines goals, potential challenges, and mitigation strategies.

- Diversification: Spread investments across different sectors or products to minimize the impact of market fluctuations.

- Risk Assessment: Regularly assess potential risks and update strategies to adapt to changing market conditions.

- Financial Management: Maintain a healthy financial structure, including a contingency fund, to navigate unforeseen challenges.

- Continuous Learning: Stay informed about industry trends, market dynamics, and emerging technologies to make informed decisions.

School or Homeschool Learning Ideas

- Business Simulation Games: Utilize business simulation games to teach students about decision-making, risk analysis, and the consequences of their choices.

- Entrepreneurial Case Studies: Explore real-world entrepreneurial case studies, discussing both successful ventures and those that faced challenges.

- Guest Speakers : Invite local entrepreneurs to share their experiences and insights with students, offering firsthand perspectives on risk and reward.

- Budgeting Exercises: Engage students in practical budgeting exercises, helping them understand financial management and the importance of contingency planning.

- Business Plan Development: Guide students in developing a basic business plan for a hypothetical venture, emphasizing risk assessment and strategic planning.

What Our Children Need to Know

- Recognizing Opportunities: Encourage children to identify opportunities in their surroundings, fostering an entrepreneurial mindset from a young age.

- Failure as a Learning Opportunity: Emphasize that failure is a part of the entrepreneurial journey, providing valuable lessons and opportunities for growth.

- Ethical Decision-Making: Teach the importance of ethical decision-making in business, emphasizing the long-term benefits of integrity and responsibility.

- Adaptability and Resilience : Instill the qualities of adaptability and resilience, preparing children for the dynamic nature of the business world.

The Big Questions

- What motivates entrepreneurs to take risks in the business world?

- How can individuals balance the pursuit of passion with the need for financial stability in entrepreneurship?

- Do you believe that failure is an inherent part of the entrepreneurial journey, or can success be achieved without facing significant setbacks?

- In what ways can entrepreneurs contribute positively to their communities while achieving financial success?

- Is there an age limit to starting a business, or can individuals of any age pursue entrepreneurial endeavors?

Balancing risk and reward in business ventures is a skill that transcends age and educational backgrounds. Entrepreneurs must navigate a complex landscape, making strategic decisions to achieve success while minimizing potential pitfalls. By instilling these principles in students and homeschooling learners, we empower the next generation to approach challenges with resilience, creativity, and a strategic mindset.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Cancel reply

Restricted Content

There was a problem reporting this post.

Block Member?

Please confirm you want to block this member.

You will no longer be able to:

- See blocked member's posts

- Mention this member in posts

- Invite this member to groups

- Message this member

- Add this member as a connection

Please note: This action will also remove this member from your connections and send a report to the site admin. Please allow a few minutes for this process to complete.

Upgrade to become a Premium Member and avail 20% discount on all courses.

- Search Search Please fill out this field.

What Is Business Risk?

Understanding business risk, reducing business risk, the bottom line, business risk: definition, factors, and examples.

:max_bytes(150000):strip_icc():format(webp)/wk_headshot_aug_2018_02__william_kenton-5bfc261446e0fb005118afc9.jpg)

Business risk is the exposure a company or organization has to factor(s) that will lower its profits or lead it to fail. Anything that threatens a company’s ability to achieve its financial goals is considered a business risk .

There are many factors that can converge to create business risk. Sometimes it is a company’s top leadership or management that creates situations where a business may be exposed to a greater degree of risk.

However, sometimes the cause of risk is external to a company. Because of this, it is impossible for a company to completely shelter itself from risk. However, there are ways to mitigate the overall risks associated with operating a business ; most companies accomplish this by adopting a risk management strategy.

Key Takeaways

- Business risk is any exposure a company or organization has to factor(s) that may lower its profits or cause it to go bankrupt.

- The sources of business risk are varied but include changes in consumer taste and demand, the state of the overall economy, and government rules and regulations.

- Risk can be created by external factors that the business doesn’t control, as well as by decisions made within the company’s management or executive team.

- While companies may not be able to completely avoid business risk, they can take steps to mitigate its impact, including the development of a strategic risk plan.

Xiaojie Liu / Investopedia

When a company experiences a high degree of business risk, it may impair its ability to provide investors and stakeholders with adequate returns. For example, the chief executive officer (CEO) of a company may make certain decisions that affect its profits, or the CEO may not accurately anticipate certain events in the future, causing the business to incur losses or fail.

Business risk is influenced by a number of different factors, including:

- Consumer preferences, demand, and sales volumes

- Per-unit price and input costs

- Competition

- The overall economic climate

- Government regulations

A company with a higher amount of business risk may decide to adopt a capital structure with a lower debt ratio to ensure that it can meet its financial obligations at all times. With a low debt ratio, when revenues drop, the company may not be able to service its debt (and this may lead to bankruptcy ). On the other hand, when revenues increase, a company with a low debt ratio experiences larger profits and is able to keep up with its obligations.

To calculate risk, analysts use four ratios: contribution margin, operation leverage effect, financial leverage effect, and total leverage effect. For more complex calculations, analysts can incorporate statistical methods.

Business risk usually occurs in one of four ways: strategic risk, compliance risk, operational risk, and reputational risk .

Types of Business Risk

Strategic risk.

Strategic risk arises when a business does not operate according to its business model or plan. When a company does not operate according to its business model, its strategy becomes less effective over time, and the company may struggle to reach its defined goals.

For example, imagine ABC Store is a big box store that strategically positions itself as a low-cost provider for working-class shoppers. Its main competitor is XYZ Store, which is seen as a destination for more middle-class consumers. However, if XYZ decides to undercut ABC’s prices, this becomes a strategic risk for ABC.

Compliance Risk

The second form of business risk is compliance risk, sometimes known as regulatory risk. Compliance risk primarily arises in industries and sectors that are highly regulated. For example, in the wine industry, there is a three-tier system of distribution that requires wholesalers in the United States to sell wine to a retailer, which then sells it to consumers. This system prohibits wineries from selling their products directly to retail stores in some states.

However, many U.S. states do not have this type of distribution system; compliance risk arises when a brand fails to understand the individual requirements of the state in which it is operating. In this situation, a brand risks becoming noncompliant with state-specific distribution laws and may face fines or other legal action.

Operational Risk

The third type of business risk is operational risk . This risk arises from within the corporation, especially when the day-to-day operations of a company fail to perform.

For example, in 2012, the multinational bank HSBC faced a high degree of operational risk and, as a result, incurred a large fine from the U.S. Department of Justice when its internal anti-money laundering (AML) operations team was unable to adequately stop money laundering in Mexico.

Reputational Risk

Anytime a company’s reputation is ruined, either by an event that was the result of a previous business risk or by a different occurrence, it runs the risk of losing customers and its brand loyalty suffering. The reputation of HSBC faltered in the aftermath of the fine it was levied for poor anti-money laundering practices.

Business risk cannot be entirely avoided because it is unpredictable. However, there are many strategies that businesses employ to cut back the impact of all types of business risk, including strategic, compliance, operational, and reputational risk.

The first step that brands typically take is to identify all sources of risk in their business plan . These aren’t just external risks—they may also come from within the business itself. Taking action to cut back the risks as soon as they present themselves is key. Management should come up with a plan to deal with any identifiable risks before they become too great.

Finally, most companies adopt a risk management strategy . This can be done either before the business begins operations or after it experiences a setback. Ideally, a risk management strategy will help the company be better prepared to deal with risks as they present themselves. The plan should have tested ideas and procedures in place in case risk presents itself.

Once the management of a company has come up with a plan to deal with the risk, it’s important that they take the extra step of documenting everything in case the same situation arises again. After all, business risk isn’t static—it tends to repeat itself during the business cycle. By recording what led to risk the first time, as well as the processes used to mitigate it, the business can implement those strategies a second time with greater ease. This reduces the time frame in which unaddressed risk can impact the business, as well as lowering the cost of risk management.

What Are the 4 Main Types of Business Risk?

The four main types of risk that businesses encounter are strategic, compliance (regulatory), operational, and reputational risk. These risks can be caused by factors that are both external and internal to the company.

Why Is Risk Management Important in Business?

Businesses face a great deal of uncertainty in their operations, much of it outside their control. This uncertainty creates risk that can jeopardize a company’s short-term profits and long-term existence. Because risk is unavoidable, risk management is an important part of running a business. When a business has a thorough and carefully created risk management plan in place, and when it is able to iterate on that plan to deal with new and unexpected risks, the business is more likely to survive the impact of both internal and external risk.

What Are Internal Risks That Can Impact a Business?

Internal risks that can impact a business often come from decisions made by the management or executive team in pursuit of growth. These decisions can create physical or tangible risks. For example, on-site risks such as fires, equipment malfunctions, or hazardous materials can jeopardize production, endanger employees, and lead to legal or financial penalties. Policies that guarantee a safe working environment would, in this instance, be an effective strategy for managing internal risks.

In business, risks are factors that an organization encounters that may lower its profits or cause it to fail. Sources of risk can be external, such as changes in what consumers want, changes in competitor behavior, external economic factors, and government rules or regulations. They can also be internal, such as decisions made by management or the executive team.

No company can completely avoid risks, especially because many risk factors are external. However, businesses can put risk management strategies into place. These strategies can be used to reduce risk and to mitigate the impact of risks when they arise. By documenting the sources of risk and creating a strategic plan that can be repeated, businesses can reduce the overall impact of risk and deal with it more efficiently and effectively in the future.

National Alcohol Beverage Control Association. “ Alcohol Regulation 101: Three-Tier System .”

National Alcohol Beverage Control Association. “ Alcohol Regulation 101: Structure of U.S. Alcohol Regulation .”

U.S. Department of Justice, Office of Public Affairs. “ HSBC Holdings Plc and HSBC Bank USA N.A. Admit to Anti-Money Laundering and Sanctions Violations, Forfeit $1.256 Billion in Deferred Prosecution Agreement .”

:max_bytes(150000):strip_icc():format(webp)/operational_risk.asp-Final-4be32b4ee5c74958b22dfddd7262966f.png)

- Terms of Service

- Editorial Policy

- Privacy Policy

Live revision! Join us for our free exam revision livestreams Watch now →

Reference Library

Collections

- See what's new

- All Resources

- Student Resources

- Assessment Resources

- Teaching Resources

- CPD Courses

- Livestreams

Study notes, videos, interactive activities and more!

Business news, insights and enrichment

Currated collections of free resources

Browse resources by topic

- All Business Resources

Resource Selections

Currated lists of resources

- Study Notes

Starting a Business: Risks and Rewards (GCSE)

Last updated 22 Mar 2021

- Share on Facebook

- Share on Twitter

- Share by Email

An entrepreneur cannot avoid risk in a start-up and everyone knows that a large proportion of new businesses eventually fail. The trick is to assess:

- What the main risks are in a new business (e.g. unexpected costs, lower than expected sales, failure to secure distribution)

- The probability of the risks happening (this has to be an estimate)

- What would happen if the risks occur – cost, cash etc

The third part of the assessment above is perhaps the most important. For the small business, often starved of cash, even a relatively small event can prove disastrous. The entrepreneur has to assess the potential impact on the business of a risk, but also assess the upside (where things turn out to be better than expected).

So, a calculated risk can be defined as follows:

"A risk that has been given thoughtful consideration and for which the potential costs and potential benefits have been weighted and considered"

Entrepreneurs take calculated risks everyday, since they take decisions everyday. Each time they take a decision they are weighing up the significance of the options and (often intuitively) working out whether to go ahead.

Rewards from enterprise

That's enough about the negative side of setting a business up. What about the rewards? We looked earlier at the motivations for setting up a business. Many of the intangible rewards that arise from being in business happen because these motives are achieved.

- A sense of satisfaction

- Building something

- Being in control

- Making that first sale

- Opening a new location

- Employing more people

- Getting an industry award or good publicity

- Getting great feedback from customers

These are the kind of non-financial rewards that give entrepreneurs a buzz.

However, ultimately, it is the financial rewards that justify the effort and make taking the risk worthwhile.

You should also remember that there is a strong tradition of entrepreneurs who have built and sold one business for a substantial amount going onto build other successful businesses. They never lose the entrepreneurial buzz. Such people are called " serial entrepreneurs ".

- Risk-taking

- Calculated risk

- Entrepreneur

You might also like

Generating business ideas for a start-up (revision presentation).

Teaching PowerPoints

The Big Bang Theory does Business Studies

15th September 2015

CEO Secrets

28th December 2018

BREXIT and Contingency Planning

22nd February 2016

Brexit: A Failure of Contingency Planning?

29th March 2016

Introducing Topic Plus PowerPoints for Edxcel GCSE Business (9-1) - Theme 1

11th September 2017

The rise of the freelancer

15th August 2018

How to start an airline

1st March 2021

Our subjects

- › Criminology

- › Economics

- › Geography

- › Health & Social Care

- › Psychology

- › Sociology

- › Teaching & learning resources

- › Student revision workshops

- › Online student courses

- › CPD for teachers

- › Livestreams

- › Teaching jobs

Boston House, 214 High Street, Boston Spa, West Yorkshire, LS23 6AD Tel: 01937 848885

- › Contact us

- › Terms of use

- › Privacy & cookies

© 2002-2024 Tutor2u Limited. Company Reg no: 04489574. VAT reg no 816865400.

- Resume & Cover Letters

- HR & Workforce Management

- Finding a Job

- Career Growth

- News & Trends

Risk Versus Reward for Businesses

Find your new job.

Look for your perfect career match with the Jobillico job search!

All businesses find themselves weighing the benefits of risk versus reward when planning for the future. The leaders of organizations must balance the continued welfare of the company and its employees with the opportunity for expansion and increased success.

Companies that take risks are industry leaders. From Netflix recognizing the appeal of streaming over physical media to Apple designing an edge-to-edge screen with the iPhone, they made risky decisions that went against common industry trends at the time. This is not to say that every company is one risky maneuver away from becoming a giant corporation bent on marketplace disruption, but the same principles and theories still apply.

When considering risk versus reward, leaders must weigh important factors. These include the potential business rewards – both tangible and intangible – and the impact on employees, while also using tools such as cost-benefit analysis and risk assessment software as part of a strategic management approach.

Performing a Risk Assessment

Just because a project is seen as a risk, it does not mean that it should be treated as an unknown. Do not mistake taking a risk for being unprepared. As part of a company’s strategic management plan, a full risk assessment will still provide a wealth of information regarding potential scenarios. All available information should be collected and organized in order for company leaders to make an informed decision.

For large corporations, the emerging field of risk assessment software has grabbed a lot of industry attention . Using customizable programs, the risk is quantified and analyzed using a series of statistics and probabilities in order to arrive at a conclusion. While this approach is appealing for conglomerates, medium-sized business will do well to remember the human element in their organizational chart. They have a more limited audience, and therefore consumer trends may also be more limited.

A Cost-Benefits Analysis

While taking a risk is potentially beneficial from the viewpoint of expanding your company, you still need to ensure that the benefits from such a risk align with your company goals . Once you have collected as much data and information as possible regarding a new project it is time for a cost-benefit analysis. This is an important component of good strategic management and will ensure that you remain on track with your large-scale business goals.

Steps of Cost-Benefit Analysis

There is a proper methodology which should be followed when performing a cost-benefit analysis. Important factors to be considered include:

- Determining if the venture aligns with current company goals

- Identifying how much of your current resources (time, budget and employee attention) will be required

- Estimating the financial compensation and deciding if it outweighs new onboarding costs

- Creating a timetable of achievements, milestones and stretch goals

- Setting a date to reanalyze the current strategy and determine if changes are required

Of course, it will be impossible to predict exactly how any new business plan will work out until it has been put into practice. A thorough cost-benefit analysis with proper methodology will provide you with an accurate view of your company’s current state and objectives, on which you can base your decision when deciding risk versus reward.

The Impact of Risk on Employees

Proper risk assessment and risk management must also extend to a company’s most valuable resource: the employees themselves. Many workers would consider stability and certainty to be important factors in the workplace, and undertaking risky ventures will definitely introduce an element of instability into a company.

As a company leader, it should be a top priority to reduce stress and pressure in the workforce. Without doing so, it can lead to serious exhaustion and employee burnout . Employees that experience less stress are more productive, produce better results, feel more loyal and consequently do whatever they can to improve a company’s standing and reach stretch goals. A new business project will entail more uncertainty, in addition to the increase in the daily workload required to achieve success.

It is important for businesses to take employee health into account when considering risk versus reward, as workers who feel burnt out, disgruntled or unappreciated will be less inspired to contribute fully to a new project. A new business project may even entail revising your organizational chart to ensure that the increased workload will be handled without additional strain on workers. By making sure that your employees understand the rewards for themselves and the organization, you will put the company in a better position to succeed.

The Importance of Strategic Meetings

It is important that your company instils a corporate culture among employees which supports risk-taking and its potential awards. Employees should also be involved in processes of considering risk versus reward. After presenting a thorough risk assessment analysis, strategic meetings are a perfect way to foster unity among team members while mapping out company plans, as long as they are organized correctly .

Presenting the positive rewards and negative risks of a new strategy to the entire team will result in a range of opinions. By allowing your team a voice, you are guaranteeing a diversity of viewpoints which may highlight factors and possibilities that have been overlooked. They can point out unseen issues, shape the organizational approach for the better and suggest stretch goals should a new project prove successful.

Ensuring open communication between team members will reinforce a culture of intelligent risk-taking within your company, and let employees know that they are encouraged to think outside the proverbial box.

Tangible and Intangible Business Rewards

The simplest reason for undertaking a risky endeavour is that it will be rewarding to your business. Things become complicated, however, when trying to determine the tangible and intangible business rewards. In terms of strategic management, both can greatly impact your decision, but only one is easy to determine when considering risk versus reward.