Tax Planning 101 for Small Businesses (Plus 9 Year-End Tax Planning Strategies to Consider Now)

- Successful business tax planning can impact your business’s bottom line and long-term growth.

- It’s important to make the most of tax write-offs and credits to lower your business’s tax liability and pay lower taxes.

- Learn the best tax planning strategies for small businesses in this article from Nav’s experts to prepare for this coming tax season.

Compare Business Tax Solutions

Tax software and services can save you time and money by simplifying the tax prep and filing process. Use Nav to find the right tax solution for your business.

Importance of Tax Planning for Small Businesses

Tax planning is essential for small businesses since it serves as a strategic financial tool that can significantly impact their bottom line. By proactively managing tax obligations, small business owners can unlock opportunities for cost savings and make sure that they maximize deductions, credits, and incentives available to them.

This not only results in immediate financial relief but also helps with cash flow management , allowing businesses to allocate resources more efficiently.

Furthermore, year-end tax planning enables small businesses to stay compliant with ever-evolving tax laws, reducing the risk of penalties and legal issues. Choosing the right business entity, optimizing investment strategies, and implementing retirement and succession planning are integral aspects of tax planning that contribute to the long-term financial health and sustainability of small businesses.

Ultimately, effective tax planning empowers small businesses to navigate the complexities of the tax landscape, make informed financial decisions, and position themselves for growth and success in a competitive marketplace.

Overview of Major Tax Changes That Will Impact Small Businesses in 2024

Let’s look at the major changes happening to taxes in 2024 that might affect your business.

Changes to Income Tax Rates

Annual changes to income tax rates typically occur due to various economic, fiscal, and political factors. Governments adjust income tax rates as a way to manage fiscal policy, generate revenue, address economic challenges, and respond to social and political pressures.

Also, inflation erodes the purchasing power of money over time. To account for inflation and maintain the real value of tax revenue, governments may adjust tax brackets and rates periodically.

New tax brackets for 2024

A tax bracket is a range of income levels that determines the rate at which an individual or business is taxed. As someone’s income increases and moves into a higher bracket, the applicable tax rate on that portion of income also goes up.

There are still seven tax brackets, which is the same as last year, but the income levels increased.

Changes to corporate income tax rates

The corporate tax rate is the percentage of a company’s profits that it is required to pay in taxes to the government. This tax is applied to a corporation’s taxable income — or revenue minus allowable business expenses and other deductions. This tax is paid by corporations and not other business entities, like LLCs or sole proprietorships.

The U.S. corporate income tax rate will remain the same — at 21% — in 2024. In early 2023, President Biden had proposed raising the rate to 28% . However, the proposal fell through, so it will stay steady in 2024.

Impact on small business owners’ personal income taxes

Your business’s tax impact on your personal tax returns depends on what kind of entity you run . If you’re a sole proprietor or LLC, your business taxes will automatically pass through to your personal taxes. That means you’ll file one return for both yourself and your business. As an LLC, you can choose to be taxed as a corporation if it makes the most financial sense.

Tax Deductions and Credits

Tax deductions and credits are both used to reduce a taxpayer’s overall tax liability, but they work differently.

- Tax deductions : Reduce taxable income, meaning the amount of income you bring in that can be taxed. Deductions can include eligible business expenses or certain itemized deductions.

- Tax credits : Directly reduce the amount of taxes owed. Credits are typically tied to specific actions, expenses, or circumstances, like education expenses, child care costs, or energy-efficient home improvements.

While deductions provide savings by lowering the taxable income, tax credits offer a dollar-for-dollar reduction in the actual tax liability.

Extension and changes to small business tax deductions

A standard tax deduction is a fixed amount that eligible taxpayers can subtract from their adjusted gross income to reduce their taxable income, simplifying the tax filing process. It serves as a baseline deduction for people who don’t itemize specific expenses like mortgage interest or charitable contributions.

In other words, if your deductions don’t exceed what’s on the list below, you’re better off taking the standard deduction.

Here are the standard deductions for 2024:

- Single : $14,600 (up from $13,850)

- Married filing jointly : $29,200 (up from $27,700)

- Married filing separately : $14,600 (up from $13,850)

- Head of household : $21,900 (up from $20,800)

Section 179 deduction

The Section 179 deduction allows businesses to deduct the full purchase price (with a maximum of $1,160,000 in 2023) of qualifying equipment and software in the year it was purchased, rather than depreciating it over time. This deduction is designed to incentivize small and medium-sized businesses to invest in capital assets, like machinery, vehicles, or office equipment. So this deduction can give you tax relief while helping you maintain your business’s property.

Qualified Business Income deduction

The Qualified Business Income deduction is a U.S. tax benefit that lets certain businesses deduct up to 20% of their qualified business income. If you own a sole proprietorship, partnership, S corporation, or a specific type of trust or estate, you may be able to get the Qualified Business Income deduction. Eligible businesses must generally operate in qualified fields and meet specific income thresholds. The deduction is designed to help small business owners and entrepreneurs by reducing their taxable income, fostering business growth, and promoting investment. According to the IRS , “the deduction is available regardless of whether taxpayers itemize deductions on Schedule A or take the standard deduction.”

New and expanded small business tax credits

It’s always good to keep an eye out for new tax credits, or those that may expand to allow you to qualify for them. Here are two important credits you may not have heard of.

Employee Retention Credit

If your business has employees, you may still qualify for the Employee Retention Credit (ERC). The ERC is a tax credit that encourages businesses, particularly those adversely affected by the COVID-19 pandemic, to hold onto their employees. Employers can claim the credit for a percentage of qualified wages paid to employees during the pandemic. Learn more in this article from Nav’s experts.

Paid Family Leave Credit

The Employer Credit for Paid Family and Medical Leave helps business owners provide paid leave to their employees for qualified family and medical reasons. Employers may be eligible for a tax credit ranging from 12.5% to 25% of the wages paid to qualifying employees during their family or medical leave, depending on the percentage of the employee’s regular wages paid during the leave period. To qualify, employers must have a written policy in place that provides at least two weeks of paid family and medical leave annually to qualifying full-time employees.

Accelerate your path to better funding

Build business credit history, see your business credit-building impact, and secure new funding options — only with Nav Prime.

Retirement Plans

It’s especially important as a small business owner to plan for retirement since you don’t have an employer taking out regular contributions to a retirement account. Here’s a breakdown of the changes to expect in the coming year.

Higher contribution limits for small business retirement plans

- Traditional or Roth IRA : Increasing to $7,000 per year.

- Solo 401(k) : Increasing to $69,000 per year with catch-up contributions remaining at $7,500.

- SEP IRA : Increasing to $69,000 (or up to 25% of compensation or net self-employment earnings, whichever is less).

- SIMPLE IRA : Increasing to $16,000 with catch-up contributions remaining at $3,500.

Tax benefits of setting up a retirement plan

Establishing a retirement plan for your business offers several tax advantages. First off, contributions to qualified retirement plans are typically tax-deductible for your business, which reduces its taxable income and potential overall tax liability.

Additionally, employees contributing to these plans may enjoy tax benefits, including tax-deferred growth. In cases like a Roth IRA, they’ll get tax-free withdrawals in retirement. Employers may also qualify for tax credits, like the Retirement Plan Startup Cost Tax Credit , which can help offset the cost of starting a retirement plan.

A well-designed retirement plan not only helps employees in saving for the future but also can help your business save money.

Estimated Tax Payments

Now let’s explore what small business owners need to know about estimated tax payments.

Updated IRS rules for estimated quarterly tax payments

Self-employed individuals and businesses that make enough revenue pay quarterly taxes to the government.

Here’s a brief overview of the key points:

- Frequency : Quarterly tax payments are due four times a year, typically on April 15, June 15, September 15, and January 15 of the following year.

- Who pays : Might include self-employed individuals, freelancers, sole proprietors, partners in partnerships, and S corporation shareholders, among others.

- Calculating payments : Taxpayers estimate their annual income and deductions and calculate the estimated tax for the year. The IRS provides Form 1040-ES to help business owners do the math for their estimated tax liability.

Although there aren’t any big changes in store for 2024, it’s important to keep an eye out for possible changes in the future.

Strategies to avoid underpayment penalties

If you fail to pay (or don’t pay enough) in quarterly tax payments, you might face an underpayment penalty. Common situations leading to underpayment penalties include insufficient withholding from wages, failure to make required quarterly estimated tax payments, or significant changes in income that were not adequately addressed.

For example, you may have to pay this fine if you hand over less than 90% of the current year’s taxes. Therefore, it’s crucial for small business owners to stay informed about their tax obligations, make accurate estimated payments, and adjust their withholding to avoid potential penalties and interest on the underpaid amount.

Year-End Tax Planning Strategies

It’s important to prepare for the end of the year ahead of time based on your business structure. Working with a professional helps you stay up to date on tax changes, like the 2017 Tax Cuts and Job Act (TCJA). Whether you have a sole proprietorship, a limited liability company (LLC), an S corporation, or a C corporation, using a tax advisor, CPA, or tax software can help make sure your business taxes are accurate.

Planning ahead also provides time to organize and gather necessary documentation, which helps you make sure to file on time. Additionally, some tax-saving strategies and deductions may have specific deadlines or requirements that need to be met before the end of the tax year. Planning in advance allows businesses to take advantage of these opportunities.

Lastly, early planning helps avoid the rush and stress associated with last-minute tax preparations, reducing the risk of errors and ensuring compliance with tax regulations. Overall, strategic planning for year-end business taxes is essential for financial management, tax efficiency, and compliance with legal obligations.

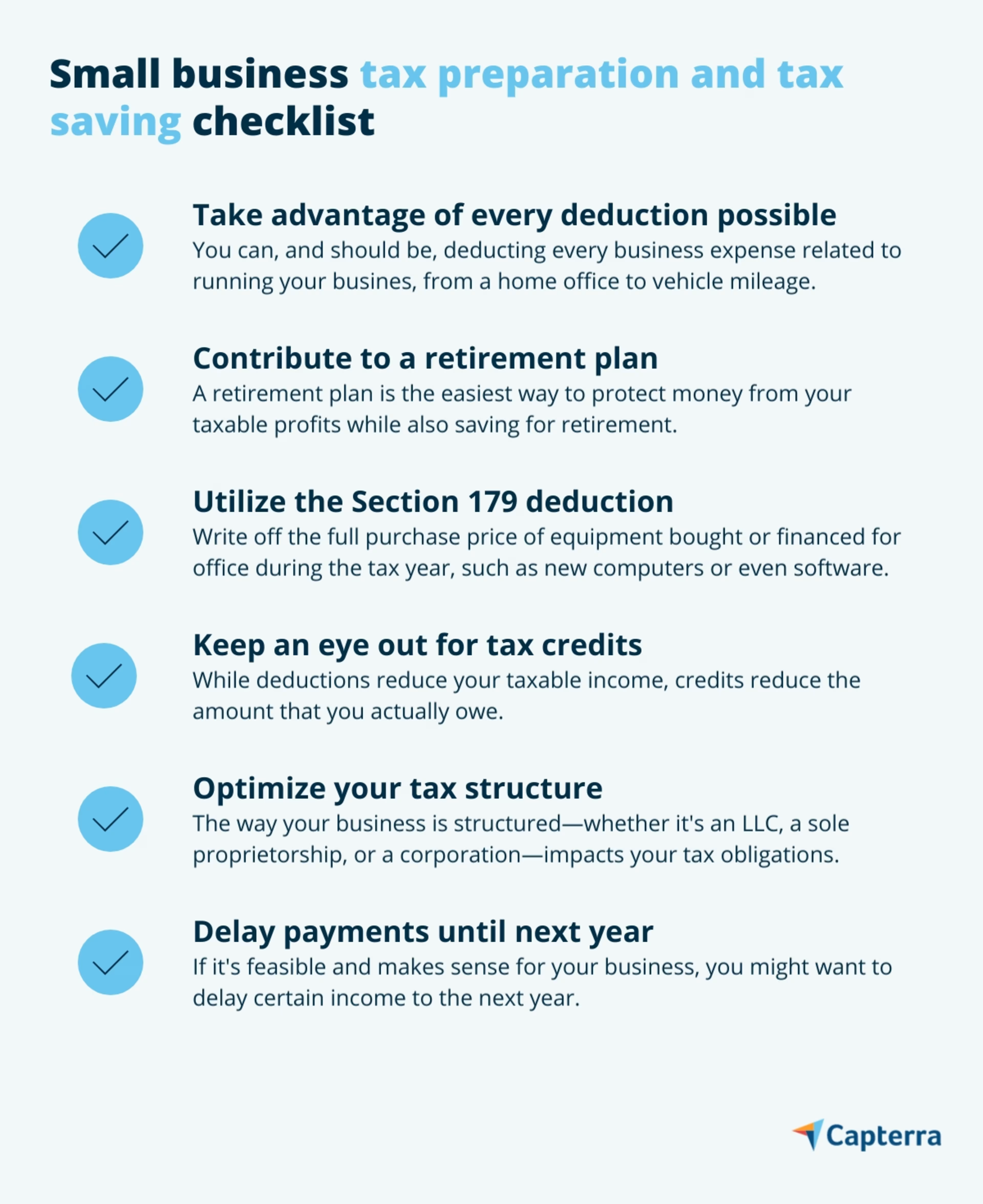

Ways to reduce tax bill as a small business

There are many ways you may be able to help lower your tax bill as a small business owner, including:

- Defer income : Delaying billing clients or customers until next year can lower taxable income for the current year. It’s best to do this only if you know that you’ll stay in the same tax bracket the following year.

- Accelerate deductions : Making expenditures like inventory purchases, business supplies, and equipment upgrades before year-end can provide tax deductions for the current year. This can be a good idea to do one year to beat the standard deduction. The next year, you could skimp on expenses the following year and plan to spend less than the standard deduction (since you would get the same deduction no matter how much you spend).

- Bonus depreciation : You can deduct up to 100% on eligible assets purchased for business purposes by December 31, which can maximize deductions.

- Section 179 deduction : Deducting on qualifying equipment under Section 179 can reduce taxable income.

- Retirement plan contributions : Making deductible 401(k) or SIMPLE IRA contributions by December 31 can lower business income taxed at the owner’s personal rate.

- Business equipment purchases : Buying necessary equipment, property, or vehicles for the business before year-end may entitle you to valuable tax deductions and credits.

- Charitable donations : Businesses can deduct qualified charitable contributions made by December 31. Consider donating inventory or services.

- Tax loss harvesting : Selling investments at a loss to offset capital gains and up to $3,000 of ordinary income can lower your tax burden.

- Tax estimates : If operating as a pass-through entity, carefully calculating your fourth quarter estimated payment to avoid underpayment penalties.

Summary of Major 2024 Tax Changes Impacting Small Businesses

Overall, there are a few changes that may help small business owners pay less in taxes. First, tax brackets are increasing, which means you’ll have to earn more to fall into a higher tax bracket. Also, retirement limits are higher, which means small business owners can contribute larger amounts to their retirement accounts.

These complicated changes can happen each year, which highlights why it’s essential to work with a tax professional or advisor.

How Nav Can Help

Nav is your small business partner. Don’t spend hours searching for what you need. Instead, use Nav to help you find the right software or service for business taxes that can help you maintain compliance and reduce your tax burden. Also, using the Cash Flow Health tool makes it easier to stay on top of your business’s finances and understand your borrowing power.

Tiffany Verbeck

Tiffany Verbeck is a Digital Marketing Copywriter for Nav. She uses the skills she learned from her master’s degree in writing to provide guidance to small businesses trying to navigate the ins-and-outs of financing. Previously, she ran a writing business for three years, and her work has appeared on sites like Business Insider, VaroWorth, and Mission Lane.

Have at it! We'd love to hear from you and encourage a lively discussion among our users. Please help us keep our site clean and protect yourself. Refrain from posting overtly promotional content, and avoid disclosing personal information such as bank account or phone numbers. Reviews Disclosure: The responses below are not provided or commissioned by the credit card, financing and service companies that appear on this site. Responses have not been reviewed, approved or otherwise endorsed by the credit card, financing and service companies and it is not their responsibility to ensure all posts and/or questions are answered.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name and email in this browser for the next time I comment.

- Search Search Please fill out this field.

- Building Your Business

- Business Taxes

8 Year-End Tax Tips for Small Businesses

Tax Credits and Deductions Can Save Your Business Money

Stock Up and Pre-Pay Expenses

Set up a 401(k) plan for employees, write off bad business debts, write off or write down obsolete equipment and inventory, give employees bonuses or gifts.

- Bonus Depreciation & Section 179 Deductions

Purchase Energy-Efficient Vehicles and Property

Time your income and deductions, frequently asked questions (faqs).

Cavan Images / Getty Images

Filing taxes is an unavoidable chore but it’s a necessary part of running a successful small business. The good news is that you have opportunities to save money on business taxes by claiming deductions and credits, and making smart moves at the end of the tax year.

Paying attention to timing is critical for leveraging tax benefits for your small business. Doing some year-end housekeeping can help you make the most of any tax breaks your business qualifies for.

Key Takeaways

- Year-end tax planning can help to maximize opportunities to claim deductions and credits for your small business.

- Using surplus cash to pre-pay expenses or stock up on supplies and inventory can increase your deductible expenses for the year.

- Deferring income could help you to push tax liability into future years, but it's important to consider how that can affect your business financially.

2017 Tax Changes To Remember for Year-End Tax Planning

The 2017 Tax Cuts and Jobs Act (the "Trump Tax Cuts") instituted a number of changes to the way small businesses handle taxes. These tax changes below could impact your business taxes, so it’s important to remember them at the end of the year:

- Eligible businesses can claim a 20% deduction from net business income, subject to restrictions and limits

- Certain deductions for small business have been eliminated, including the deduction for entertainment expenses

- If you have bought or plan to buy large capital items like vehicles, machinery, or equipment, higher first-year depreciation limits could save you money

You may want to consider hiring a tax expert to help you with filing business taxes if it’s your first time doing so.

Claiming a deduction for eligible business expenses can save money, as deductions reduce your taxable income for the year. If you have any cash sitting around, or you can reasonably use your credit line or a business credit card for purchases, stocking up on supplies or pre-paying certain expenses could give you a larger deduction:

- Replenish office supplies or any supplies you use regularly

- Stock up on inventory, especially if you’re able to find it at a discount

- Pre-pay insurance coverage for the next year

- If you use subscription services, switch from a monthly to yearly payment

Setting up a 401(k) for yourself and your employees is another way to save on business taxes. You can claim a tax credit for your business for the cost of setting up and administering a 401(k) plan, up to $500 a year for each of the first three years the plan is in existence. Even if you have a sole proprietorship , you can still use a solo 401(k) to set aside money for your retirement and save on business taxes. The potential tax savings could more than pay for the cost of setting up the plan and funding it. The Department of Labor suggests following these steps:

- Adopt a written 401(k) plan document

- Arrange a trust for the plan’s assets

- Develop a recordkeeping system to keep track of contributions

- Provide plan information to employees who are eligible to participate

A bank or brokerage can help you set up a plan for yourself and your employees. If you’d like to create an individual 401(k), you can start the process online through a brokerage that offers them.

Bad (un-collectible) debts can be written off before the end of the year and the uncollected debts can be deducted from your taxable business income. The IRS also includes unpaid loans and business loan guarantees under the bad debt umbrella. To deduct bad debts, you must use the accrual accounting method:

- Run an accounts receivable aging report to see which receivables are unpaid from customers or clients

- Make note of which debts you may still be able to collect on and which ones have a high certainty of remaining unpaid

- Add up all bad debts you want to write off and review the list with your tax advisor

Just know that if you receive the money from the customer later, you will have to reverse the write-off and declare the payment as income.

Obsolete , damaged, or worthless equipment can be taken off your accounting records to increase your expenses and lower your tax liability. You can write it down, meaning you reduce its value for tax purposes, or write it off, in which case its value drops to zero:

- Review your business inventory and equipment

- Mark items that are obsolete, worthless, damaged beyond repair, or damaged but still usable

- List the full value of the items that are obsolete or worthless for write-off

- List the reduction in value for items that are damaged but still usable for write-down

- Claim the total expense for write-offs and write-downs as a deduction when you file your tax return

For example, if you have a computer that you purchased for $2,000 and it's sitting in a back room because it no longer turns on and you bought a new computer, you can expense the full $2,000 purchase price because the computer is obsolete. If a piece of equipment costs $1,000 new and you feel its value is $300 less because of damage, you can list $300 as an expense, reducing the book value to $700.

In addition to receiving a tax deduction for paying bonuses or gifts to your employees, you may also receive much goodwill from employees, especially around the holidays.

Bonuses to employees of all types of companies are deductible business expenses if they're considered additional pay for services, not gifts. But, bonuses to sole proprietors , partners , and limited liability company (LLCs) members are not deductible, because the owners/partners/members are considered by the IRS to be self-employed.

Holiday gifts and holiday parties may be deductible as long as they are not routinely/frequently given and are for the purpose of promoting goodwill.

Claim Bonus Depreciation and Section 179 Deductions

Changes to the tax code allow for accelerating depreciation on certain types of business equipment. In simpler terms, these provisions allow you to expense more of the value of business equipment purchased this year, for a larger tax deduction.

Bonus Depreciation

Bonus depreciation allows businesses to depreciate up to 100% of the adjusted basis of certain qualified property during the year that the property is placed in service, if that property is placed in service between Sept. 27, 2017, and before Jan. 1, 2023. You should be aware that some states modify or deny bonus depreciation. Check with your state department of revenue to see what the provisions are in your state.

Section 179 Depreciation

Section 179 allows taxpayers to deduct the cost of certain property as an expense when the property is placed into service. That includes machinery, equipment, and qualified real property. The current maximum deduction is $1.08 million, with a phaseout limit of $2.7 million.

If it's in your budget to upgrade vehicles or property, you could see a decent tax break at year’s end.

Energy-Efficient Property

The 179D deduction allows businesses to claim a tax benefit for energy-efficient improvements made to commercial properties. The tax deduction is $1.88 per square foot for owners of new or existing buildings who install energy-efficient lighting, heating, cooling, ventilation, and hot water systems. Building envelopes are also eligible for the deduction.

Alternative Motor Vehicles and Hybrids

Section 30D of the Internal Revenue Code provides a credit for the purchase of alternative motor vehicles and hybrid cars , including plug-in electric vehicles. You must be the original purchaser of this vehicle. The total tax credit is capped at $7,500 per vehicle.

One final year-end tax tip for small businesses revolves around deciding when to time the receipt of income and when to pay expenses. Getting the timing right matters for maximizing tax savings.

Deferring Income

As you get to the end of your business tax year, you may have the option of taking income in this year or next year. If you can take income in the year of the lower profit , you may be able to minimize your taxes.

For example, if this year you will have a loss, but you know you will have a profit next year, you may want to encourage customers to pay you this year when your profits will be lower. If you think your profit will be lower next year, try to move payments from customers into next year. This is tricky, since you don't really know what will happen next year, but it is worth a discussion with your tax advisor.

Timing Deductions

When considering whether to take a deduction for an expense this year or next year, here are three points to take into account:

- Take the deduction in the year when your profit is higher : This will result in lower profits in that year.

- Take the deduction in the year when the deduction amount is higher : Some deductions change from year to year. Learning about these changes can save you money by allowing you to take the deduction when it is higher.

- Take the deduction in the year when the tax rates are higher : If you know that business tax rates will increase next year, take the deductions next year to minimize your taxable income in that year.

The principle of timing income and expense deductions, if done thoughtfully and with the assistance of your tax advisor, could lower your business taxes.

What is the best tax planning software for businesses?

There are a number of tax planning software programs businesses can use to track income and expenses for tax purposes. The best tax software program for your business is the one that you find easiest to use, has the features you need to complete your tax planning, and comes at a price that’s affordable for your budget.

How do you file business taxes for an LLC?

The way you file taxes as an LLC can depend on whether you are the sole owner. If you're the sole owner of an LLC, the IRS considers you to be a sole proprietor. In that case, you'd file a personal income tax return (1040) and file a Schedule C to report business income and expenses. If you opt to file taxes as a partnership or as a corporation, then you'll need to file IRS Form 1065 or Form 1120, respectively.

IRS. " Tax Cuts and Jobs Act: A Comparison for Small Businesses ."

IRS. " Retirement Plans Startup Costs Tax Credit ."

Department of Labor. " 401(k) Plans for Small Business ."

IRS. " Topic No. 453 Bad Debt Deduction ."

U.S. Small Business Administration. " Tax Results for Giving Up on Company Property ."

IRS. " Publication 535, Business Expenses ."

IRS. " New Rules and Limitations for Depreciation and Expensing Under the Tax Cuts and Jobs Act ."

IRS. " Publication 946 (2021), How To Depreciate Property ."

Department of Energy. " 179D Commercial Buildings Energy-Efficiency Tax Deduction ."

IRS. " Plug-In Electric Drive Vehicle Credit (IRC 30D) ."

IRS. " Instructions for Schedule C ."

IRS. " Instructions for Form 1120 ."

IRS. " Instructions for Form 1065 ."

Contributor,

Darin Wickens

Strategic Tax Planning for Business (with Tips and Examples)

“If you fail to plan, you are planning to fail” – Benjamin Franklin. Failing to develop and implement a great strategic tax plan for business is a sure-fire way to overpay taxes. So why do so many business owners and their accountants neglect tax planning?

Here’s everything you need to uncomplicate the strategic tax planning process and the steps you can take to create a tax-optimized business strategy .

Table of Contents

What is strategic tax planning for business?

Importance of tax planning for your business, the current state of tax planning and advisory, save taxes by being proactive—not reactive, is tax planning worth the extra cost, tax minimization, tax evasion, tax avoidance.

- Business entity structure

- Tax filing status

- Asset location

- Tax-loss harvesting

- Income shifting

- Capital gains harvesting

- Charitable giving

- Get organized

- Understand your tax obligations

- Know your deductions and credits

- Choose the best strategic tax and accounting method: cash or accrual

- Use tax planning software

- Stay up-to-date with tax law changes

- Work with a tax planning professional

How Tax Hive can help

Tax planning without the stress.

“If you fail to plan, you are planning to fail” – Benjamin Franklin. Failing to develop and implement a great strategic tax plan for business is a sure-fire way to overpay taxes. So why do so many business owners and their accountants neglect tax planning?

As a business owner, you juggle many priorities. You probably have strategic initiatives to increase sales and reduce costs. But far too many overlook what likely is their most significant expense (and opportunity): Taxes.

If you’re burying your head in the sand and only thinking about taxes when you’re forced to – during “tax time” or when making quarterly payments, you’re almost certainly paying too much in taxes.

We understand taxes can be complicated and overwhelming at times. The tax code is thousands of pages long and isn’t the easiest to understand. Combining this with the reality that many taxpayers are terrified of an audit, we know the anxiety and why you might naturally avoid thinking about taxes.

Here’s everything you need to uncomplicate the strategic tax planning process and the steps you can take to create a tax-optimized business strategy .

Strategic tax planning involves looking forward one, five, 10, or 20 years rather than looking back at the past year (which is tax preparation in a nutshell). When you plan, consider what you can do to pay the lowest tax possible while arranging some of your savings to generate a tax-free income.

Here’s an example: If you had an extra $35,000 in income every year, but that income was taxed at a combined federal and state rate of 30%, you would be left with $24,500. You could turn a loss of $10,500 into a gain through careful tax planning. You could invest that money in a laddered bond portfolio or a well-structured low-cost indexed life policy that offers tax-free distributions, for example.

Tax planning allows you to use different tax exemptions, deductions, credits, and available benefits to minimize how much tax you owe, legally and morally. That’s more money you can put towards other financial goals like advertising campaigns, capital investments, employee bonuses, or even personal financial goals like paying down a house, saving for retirement, or taking a vacation. It also gives you a snapshot of your finances and taxes at the beginning of the fiscal year instead of leaving it to the eleventh hour.

It can be helpful to think of tax planning in terms of your favorite sporting activity. In basketball, for example, you have rules, time restrictions, and referees. You also have a coach, teammates, and plays you’ve drawn up and practiced together. Waiting until the third or fourth quarter usually won’t win you the game – the preparation, planning, practice, and in-game adjustments win the game.

When you own a business, paying taxes is your obligation. However, you should never be surprised by how much you owe. Understanding how business taxes work and calculating how much you have to pay every quarter or year is essential to ensuring you have enough money or a surplus to spend elsewhere in the business.

When you invest in tax planning, you accomplish a few things. First, you lower the risk of making inaccurate tax estimates. Second, you reduce the risk of forgetting to file and pay taxes on time, leading to unnecessary fees and other penalties. And last but not least, tax planning can help you find money in tax deductions, credits, or other areas you otherwise may miss entirely.

Other benefits of tax planning include:

- Lower tax rate: It may be possible to lower your effective tax rate and reduce your tax burden using strategies that aren’t widely known.

- Reduce taxable income: Reduce the amount of income that gets taxed, with or without a change in the tax rate.

- Flexibility in paying taxes: Manage cash flow and minimize unnecessary fees and penalties by scheduling quarterly estimated taxes.

- Tax credits: Take advantage of tax credits that benefit your business and reduce your overall tax bill.

The reality is that business taxes can be complicated. Plus, tax laws often change over time and from one region to another, and many regulations apply selectively to certain scenarios and business types.

If you hire a trusted financial adviser who is well-versed in tax strategies, that person will be able to flag any most relevant updates to your business. The more legal loopholes they can find, the more you’ll be able to save, so it’s important to consider getting help here.

With new U.S. tax legislation, as well as the impact of the pandemic on businesses, tax planning has become an essential tool to boost a business’s bottom line.

However, many tax accountants don’t currently offer tax planning as a service.

A 2021 Tax Planning and Advisory Insights survey by Intuit Accountants showed that only 1 in 3 clients currently receive tax planning and advisory services.

So, why the low numbers? If tax planning is critical to optimizing your tax situation and saving as much money as possible, why aren’t most accountants doing it? For the most part, it’s just basic economics – they have a finite amount of time and other limited resources.

And for the tax professionals who provide tax planning services, they’re billing up to five times the cost of basic tax preparation.

In addition to cost alone, tax planning requires specialized knowledge of the tax code and the ins and outs of the 1,400 plus tax deductions and credits. It’s incredibly time-consuming, with several hours spent preparing a “typical” tax plan.

But as clients become savvier about the needs of their business, the demand for tax planning is growing, and tax professionals are taking note. Many tax professionals are strongly considering adding tax advisory as a service.

Many small business owners are familiar with reactive tax planning. You monitor your sales throughout the year and keep your expenses under control, so you don’t break the bank. And at the end of the year (or quarter), you crunch these numbers to figure out how much you owe in taxes.

While reactive tax planning can help your business reduce its taxes, it isn’t the most effective method for your business. It can lead to a last-minute rush where you miss additional deductions and certain credit benefits. You also risk bringing in an advisor who isn’t familiar with your business’s financial picture over the previous year, putting the onus on you to ask the right questions.

You’ll succeed better if you ditch this method and consider proactive tax planning.

Proactive tax planning is strategic tax planning for business. It gives you more freedom throughout the year and at tax time. It’s also key to making your business more profitable and growing your in the long term. It works by looking at state and federal tax laws ahead of time and working within them, curbing your tax liability at the end of the year.

Enlisting professional advisory services (such as Tax Hive) and communicating with one of our tax pros is key to getting the most out of proactive tax planning. We work closely with you to ensure we don’t miss valuable strategies or other ways to make your business more tax-efficient.

Paying an additional cost when trying to reduce your overall expenses may not be an attractive option at first glance—but it’s important to note that tax planning is an investment .

As mentioned earlier, tax planning and advisory services may cost you more than basic tax preparation. However, the result can far outweigh the initial cost. For instance, an internal study of more than 20,000 business owners by Tax Hive found that business owners are missing over $60,000 in potential business tax deductions.

Tax minimization, tax evasion, and tax avoidance: the differences explained

There are three basic strategies to lower the amount you pay Uncle Sam each year — tax minimization, tax avoidance, and tax evasion. Two are entirely legal, but practicing one of them could land you behind bars.

Tax minimization is 100% legal. You use the most tax-efficient methods to get long-term benefits for you and your business. It involves income shifting, entity structuring, tax deductions and credits, writing off appropriate expenses, or taking advantage of benefits through health insurance and retirement plans. It’s a way to optimize your business—before tax season starts.

If you’ve watched legal dramas or gangster films, there’s a good chance you’ve heard of the term “tax evasion.” Tax evasion is an illegal practice where taxpayers don’t accurately report their total income earned to avoid paying higher taxes. Evasion could include underreporting sales, claiming inflated or unwarranted deductions, forging documents, and transferring illegal assets. A form of tax fraud, tax evasion is a serious crime that can lead to hefty fines and even jail time.

While tax evasion is against the law, tax avoidance is a way to reduce your tax liability legally. Avoidance could include decreasing business expenses, maximizing tax credits, taking advantage of loopholes, or deferring the payment of taxes with a pre-determined plan. It’s important to note any tactics used to avoid taxes must fall within the framework of the law. That said, it’s a good idea to seek the advice of a tax expert or attorney to ensure you haven’t crossed over into tax evasion territory.

Common business tax planning strategies

1. business entity structure.

Each business entity and structure has its tax benefits and drawbacks.

Let’s look at sole proprietorship, for example. It’s the most common type of business in the U.S., representing 73 percent of all businesses . While sole proprietorships are easy to start and inexpensive to operate, they’re generally not the best business structure for many things, like limiting personal liability or reducing taxes.

Sole proprietorships generally aren’t great for reducing taxes because your business and personal income aren’t taxed as separate entities. Instead, they’re considered “pass-through” entities. This means your business income and expenses are passed onto you, the business owner, and recorded on your individual income tax return. So, your business ends up contributing to higher overall income, potentially raising your all-in tax rate for both personal and business, depending on your income bracket.

Incorporating can potentially reduce your tax liability. For one reason, the Tax Cuts and Jobs Act lowered the corporate tax rate to 21% in 2017. You can also save on self-employment taxes with the proper tax filing election (e.g., S-Corporation election). But that doesn’t mean it’s the best move for everyone.

The cost of incorporation can get pricey and comes with strict reporting requirements, which can add a pile of paperwork to your to-do list.

Whether a C corporation , partnership , or limited liability company (LLC) , switching to another entity type can significantly impact how much you might pay (or save) in taxes. Talking through your options with a tax professional—or your in-house Tax Hive advisor—can help you evaluate your choices and what structure might best suit your tax needs. It’s valuable to consider your tax filing status before you set up a formal business entity.

2. Tax filing status

Your filing status determines your filing requirements, standard deduction, eligibility for certain credits, and your correct tax. If more than one filing status applies to you, the IRS has an online questionnaire you can do to help you choose the one that’ll get you the lowest amount of tax.

The type of business and how you structure your business largely determine the tax return you need to file. If your business is a sole proprietorship, you report your business income on the Schedule C (Form 1040) income tax form. For a partnership, report your expenses, losses, and income on Form 1065 .

If you own a single-member LLC, the IRS treats you as a sole proprietor, so you’ll use Form 1040 , Schedule C, E, or F. If the only member of the LLC is a corporation, report the LLC income plus expenses on the corporation’s return on Form 1120 .

Depending on your business structure, you may qualify to file your corporate taxes as an S Corporation (also known as S-Corp or S Corp). An S Corporation is not a business structure. Instead, an S Corp is a tax filing status that allows your business to pass corporate income and expenses to shareholders for tax purposes.

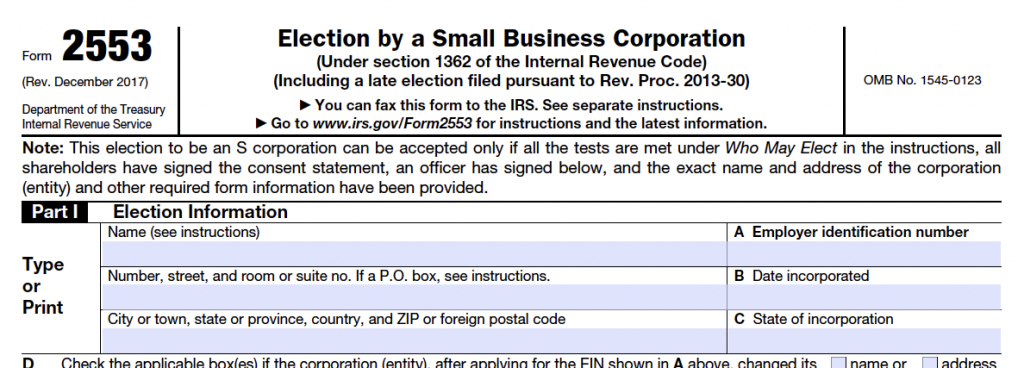

Operating a corporation and LLC but filing taxes as an S Corporation can bypass double taxation and significantly reduce your self-employment taxes. You should work closely with a tax professional, accountant, or attorney to evaluate eligibility, deadlines, and requirements. You can read more about Form 2553 from the IRS. When you file taxes as an S Corporation, you’ll use Form 1120-S .

3. Asset location

Organizing your assets through asset location is key to dramatically reducing taxes in your portfolio and enhancing the tax efficiency of your investments.

Asset location focuses on where to strategically invest your money to maximize your return on investment after-tax rather than how to invest. Don’t confuse it with asset allocation , which is how you mix and distribute your assets within a given account.

Generally, you’ve got three types of accounts for investing and saving, each with different tax treatments: tax-advantaged, tax-free, or taxable accounts.

- A tax-advantaged account is a kind of savings plan or financial account where you get a tax benefit such as tax deferral or tax exemption. This account is famous for retirement savings, education expense savings, and savings for healthcare expenses. Investment examples within a tax-advantaged account include stocks, actively managed funds, mutual funds, high-yield bonds, REITs, and annuities.

- A tax-free account lets you save with after-tax dollars. You don’t escape taxation entirely since you’re using the money you’ve already paid taxes on. But when you make qualified withdrawals, you pay no additional income tax–not even on your investment growth. Some tax-free accounts include Roth IRAs, Roth 401(k)s, and Roth 403(b)s.

- With a taxable account , there’s a downside: You don’t get a tax deduction for the money you put in, unlike a 401(k) or a traditional IRA. And you don’t get to duck paying taxes when you take cash out like you can with a Roth. Instead, you must pay capital gains tax on the earnings from your investments when you sell them. On the upside, a taxable account doesn’t put a ceiling on your contribution amounts like tax-deferred and tax-free accounts do.

When allocating your growth assets (like stocks) across the different account types, you should consider these factors:

- The tax efficiency of assets (What kind of gains do they make? Long-term, short-term, or ordinary?)

- The management style of assets (Do you manage assets passively or actively?)

- Client profile (age, time horizon, tax bracket, taxable income level, liquidity needs, and estate planning needs)

4. Tax-loss harvesting

It’s bad news when you lose money on your investments, right? Watching your portfolio shrink in a bear market can be downright painful. But a reasonably simple tax-loss harvesting strategy can help turn that pain into a tax advantage.

Tax-loss harvesting (also called tax-loss selling) happens when you sell an investment that has dropped in value below what you paid, triggering a capital loss.

You then use the proceeds of the sale to buy a comparable investment (in the same sector, for instance) while the market is still down, hoping it will increase in value over time and deliver a capital gain.

You then apply your capital loss to your capital gain, and presto! Tax savings.

Why not sit on your original investment until the price recovers and even jumps above your purchase price? Because you’d still have a capital gain, but you wouldn’t have a capital loss to offset it.

And if you sold low but didn’t jump back into the market, you’d miss the chance to squeeze some value from your capital loss. Because you don’t pay tax on capital gains inside registered accounts, tax-loss harvesting only works for taxable, non-registered investment accounts.

5. Income shifting

Income shifting is moving unearned income from someone in a higher tax bracket to someone in a lower tax bracket. It aims to save tax by moving investment or business income off your tax bill to a retired parent or child, for example.

You can do this in a few ways. One is to hire, say, your 18-year-old son, to work at your business. You get a business deduction for their wages, and your son pays less tax on that money than you would have. If you have a sole proprietorship or partnership and hire a child under 18 to work for you, your child doesn’t have to pay Social Security or Medicare taxes.

It’s a bonus that you’re already supporting your child, so why not get a tax break? You may not control what your child spends their wages on, but you can agree that a share of it can go towards an investment like their college fund.

The IRS knows people will go to tremendous lengths to outwit them, so they’ve put a lot of rules and limits on income shifting. If you hire your child, it has to be a real job, paid at the going rate, and you should have proof of the work.

There are also rules about what kinds of assets you can transfer, how old a child must be to accept the transfer, and a ceiling on the amount transferred before it triggers the gift tax. Talk to your accountant to ensure you’re doing it by the book.

6. Capital gains harvesting

Capital gains harvesting is strategically selling your winning investments to reduce current and future taxes and create a more balanced portfolio. How does it work? Capital-gain harvesting offers investors the chance to achieve long-term capital gains with little or no impact on their taxes. It can work in three ways:

- If you have a fluctuating income (you’re self-employed, work part-time, or on sabbatical) and know it’s going to be a lean year, it’s an excellent time to sell your high-performing assets, realize your gains and pay lower tax on them than you would in a high-income year.

- If you have losses elsewhere in your portfolio, you can use them to cancel out any tax you might owe on your gains.

- If a particular class of assets is performing very well for you, its value in proportion to your entire portfolio won’t line up with the asset mix you want to maintain. So, selling some high-performing assets and using that money to buy lower-performing assets “on-sale” will let you put your portfolio back into balance.

But we know the IRS doesn’t make it too easy to avoid paying taxes. They’ve created some rules about capital gains harvesting, too. For instance, you must own an asset for at least a year to qualify for the tax rate for long-term capital gains (which is lower than the regular capital gains tax rate).

And selling your assets may put you on the hook for net investment income tax or alternative minimum tax. Again, your accountant or financial advisor can help you avoid these pitfalls.

7. Charitable giving

Whether you’re sponsoring your local Little League team, creating an endowment at your alma mater, or doing something in between, your charitable giving can benefit your small business’s bottom line and your community.

Like all the tax breaks we’ve discussed, there are limits on how much money you can donate during any given tax year. As an individual, you can donate and write off up to 100% of your taxable income, while your business can donate and write off up to 25% of its taxable income.

If you take the standard deduction (as most people do), you may not see an additional tax benefit for your giving. Don’t let this stop you from making a charitable donation.

Here’s one way to give strategically to maximize your deduction: Instead of making donations below the standard deduction for several years, cluster them in one year. That way, the total you give exceeds the standard deduction, and you get a better tax break. Depending on how much you donate, you can do this by giving every other year or even every third year.

Another popular way to make the most of your charitable donations is a donor-advised fund. Donor-advised funds let you make charitable contributions and get your tax deduction immediately. You can put several years’ worth of donations into the fund, take the full deduction for that year, and then decide how, where, and when to hand out your money in the following years.

7 tips to help with successful tax planning

As you get started with tax planning, here are seven things you can do to streamline the process.

1. Get organized

It can be easy to throw away receipts or forget to keep track of smaller expenses, but for tax purposes, it’s best to keep as many records as possible. Any tax-planning advisor will ask you for details and records of all your accounts. But even if you’re not working with one, it’s your responsibility to keep track of all financial aspects of your business. By doing so, you can customize tax strategies to their needs.

2. Understand your tax obligations

A basic understanding of federal, state, and local tax regulations can help you avoid paying too much in taxes and protect you from the risk of paying too little. Also, with some knowledge of tax-related topics, you’ll be able to identify potential tax benefits (and tax traps) in time to do something about them. Even if you believe no taxes are due, you’re still responsible for filing the return.

The IRS provides a list of due dates and directions for filing your taxes. That said, we strongly recommend hiring an accountant to set up your tax filings and payment schedule. Missing a due date, not paying the taxes owed, or not filing at all could raise flags with the IRS. You could face potential IRS scrutiny, fines, tax penalties, and interest.

3. Know your deductions and credits

The answer to having the lowest tax bill is not leaving a single tax credit or deduction on the table. Both reduce your tax bill, but in separate ways. Knowing the difference allows you to work out some very effective tax strategies.

A tax deduction reduces your taxable income and is taxed at a certain percentage based on your bracket. Basically, only a specific rate of every dollar you deduct gets taken off your income tax.

For example, if your tax rate is 10%, one dollar of deductions will give you 10 cents of tax savings. With a 24% tax rate, one dollar will save you 24 cents.

Operating expenses are a good example of tax deductions as they allow you to deduct any reasonable expense you incur to earn income, including any tax paid on that expense. This includes things like bad debts, business insurance, education, marketing costs, work-related travel expenses, and office supplies.

A tax credit , on the other hand, decreases your taxes directly by reducing the income tax you owe dollar for dollar. A few credits are refundable, which means if you owe $250 in taxes but qualify for a $1,000 credit, you’ll get a refund for the remainder of $750. (Most tax credits, though, aren’t refundable.)

There are hundreds of credits and deductions out there. Here’s a list of common ones that will help you get a larger tax return.

Further reading: Self Employed Tax Deduction Cheat Sheet

4. Choose the best strategic tax and accounting method: cash or accrual

Which strategic and accounting method should you use? It depends on the timing of when you reflect sales and purchases in your books.

Cash accounting identifies expenses and revenue only when cash changes hands. It’s used mainly by small businesses and sole proprietors with no inventory.

Accrual accounting reports revenue when a business earns money (e.g., when a project is complete) and expenses when billed (e.g., when you receive an invoice) but not yet paid. According to the IRS, corporations (other than an S corp) with gross receipts averaging over $25 million for the last three years must use the accrual method.

Your choice will make a difference in how your company schedules tax payments.

With the cash method, taxes are not paid on money you haven’t yet received. With the accrual method, taxes are paid on money that you’re still owed.

5. Use tax planning software

With technology continuously evolving, it’s now easier than ever to file your taxes using the software. Tax software allows you to prepare your taxes quickly and efficiently, making tax refunds you deserve easier to get.

As a small business owner, you know how crucial accurate record-keeping is for your company’s success. Platforms like Holistiplan, Tax Planner Pro, and TaxWise can save you time, maintain precise bookkeeping records, reduce errors, and automatically create reports that’ll help you understand your business finances and help you complete your taxes in less time. You can file documents in one place and organize your records year-round with just a few clicks.

You can also plan out how much tax is due, determine what deductions you can claim for your business, and see where you must comply with government regulations and rules. Not being organized could leave you paying far more taxes than you need to.

6. Stay up-to-date with tax law changes

With the U.S. tax law constantly changing (even more so since the pandemic), keeping up with the latest IRS rules and regulations can be a superhuman feat.

Having a tax plan helps you understand what’s changed and lets you reassess your strategy when needed. By understanding current tax laws, you won’t risk noncompliance with new or updated regulations, and your tax return will contain fewer errors. You’re then less likely to face an audit or have to pay more money down the line.

Here are some significant tax changes for the 2022 tax year.

Working with an accountant can ensure you comply with current regulations and pay the right amount.

7. Work with a tax planning professional

There’s nothing fun about paying taxes, so coughing up high fees to handle your taxes can exacerbate an otherwise unpleasant situation. On the other hand, preparing your tax return can be risky. It can cost you thousands of dollars in overpaid taxes, fines, and penalties because of overlooked deductions and simple mistakes.

For that reason, many small business owners hire a CPA, accountant, tax attorney, or a specialized tax professional with a proactive approach to tax planning to take care of their taxes and provide other accounting and business advice. As we discussed above, many CPAs, accountants, and tax preparers don’t provide proactive, comprehensive tax planning.

Tax planning services may cost more initially, but they can help your small business grow by providing advice on short-term and long-term tax-saving opportunities.

If you’re still in the process of hiring an accountant, bookkeeper, and tax advisor for your small business but need help with your tax-saving plan today, Tax Hive will pair you with an experienced accountant to help evaluate your needs and execute an optimized tax plan . Our tax-slashing technology and tax experts look at over 1,400 federal, state, and local deductions as they review your unique situation.

Even after building your plan, Tax Hive professionals are always available to answer questions, address concerns, and make appropriate adjustments. They’ll also ensure you’re ready come tax time with a year-end financial plan, including all the information you need to file—our tax team can even file your taxes for you.

Do you have a CPA, accountant, or tax prep firm you already like? No problem. Simply take our plan to them to implement on your behalf.

A well-implemented strategy allows you to execute a tax plan tailored to your business and its needs. Tax season and financial planning are much more effective and less stressful when you have a solid plan. Doing so is a step in getting ahead of your competitors, allocating more money towards business growth, and ultimately lowering your taxes.

- Learn More: Business Ownership Information (BOI) Reporting

- Meet the Team

- CMP Celebrates 40-Years In Business

- Testimonials

- Our Reviews

- Financial Audits & Reviews

- Outsourced CFO

- Business Valuation

- Estate and Succession Planning

- ERISA / 401K Audits

- Crypto Tax Services

- R&D Tax Credit Services

- Bookkeeping and Payroll

- Accounting Software Solutions

- Retirement Plan Services and TPA

- Quickbooks Consultation

- Cost Segragation Studies

- Problems We Solve

- Farm and Ranch

- Real Estate and Construction

- Retail and Wholesale

- Non Profits

- Manufacturing

- Internet Marketing/YouTube

- Important Documents

- Important Links

Wasatch Front 801-467-4450 | Cache Valley 435-750-5566 | Southern Utah 435-269-4540

19 Small Business Tax Planning Strategies to Slash Your Tax Bill [2023]

This post was originally published on February 24, 2022, and extensively updated on January 4, 2023.

As a business owner, it’s your job to take care of a host of obligations. One moment, you may be managing a human resources issue, and the next, you are coping with a customer complaint. Wearing so many different hats can make it difficult to stay on top of other, less frequent aspects of running a business, such as taxes.

![business planning taxation tips 19 Small Business Tax Planning Strategies to Slash Your Tax Bill [2023]](https://blog.cmp.cpa/hs-fs/hubfs/19%20Small%20Business%20Tax%20Planning%20Strategies%20to%20Slash%20Your%20Tax%20Bill%20%5B2023%5D.jpg?width=800&height=400&name=19%20Small%20Business%20Tax%20Planning%20Strategies%20to%20Slash%20Your%20Tax%20Bill%20%5B2023%5D.jpg)

At CMP , we’re familiar with the tax challenges that businesses face. One of the most frequently asked questions we hear from our business clients is this:

What’s the best tax strategy to use for my business?

Having a tax strategy is essential because it governs everything you do and provides a framework that allows you to fulfill your tax obligations without overpaying. In this post, we will review some business tax basics and reveal 19 of the best tax strategies for business owners.

Reduce Tax Liability with These Tax Planning Strategies for Your Small Business

Now that we’ve covered some of the basics, here are 19 tax strategies to help you minimize your tax burden and save money at tax time.

1. Look for Ways to Reduce Your Adjusted Gross Income

Many of the taxes you pay are tied to your adjusted gross income or AGI. For example, if your AGI doesn’t exceed $200,000 or $250,000 if married and filing a joint return, you won’t be required to pay the additional 0.9% in Medicare taxes. You can lower your AGI by reducing your salary or doing one of the following things:

- Contributing to a tax-deferred retirement plan

- Itemizing deductions if they exceed your standard deduction

- Contributing to a health savings plan

If you think you might want to itemize deductions, consider tracking them on a spreadsheet throughout the year. That way, you won’t need to scramble to calculate them at tax time.

2. Be Strategic with Your Tax Elections

Applying some strategies to your business expenses can help you reduce your taxable income. For example, if you acquire new business equipment or machinery, you can deduct the cost upfront up to $1 million under the 2018 tax law.

However, for new businesses or those that aren’t yet turning a profit, you may want to consider depreciation as an alternative. Depreciation allows you to deduct the value of your purchase in future tax years instead of all at once. That’s beneficial if you expect your profits to increase and push you into a higher tax bracket.

Other tips include:

- Deducting home office expenses based on actual costs or the IRS simplified rate , which is $5 per square foot up to 300 square feet of space.

- If your business has been impacted by a disaster, you can claim the losses on your prior year’s returns instead of the year when the disaster occurred.

- You can choose between deducting vehicle expenses based on the actual cost or the IRS mileage allowance of 58.5 cents per mile from 1/1/22-6/30/2022, then at 62.5 cents per mile from 7/1/22-12/31/2022

- Deduct business insurance expenses, including liability, workers’ compensation, commercial auto, and business interruption services insurance.

The IRS scrutinizes insurance deductions closely, so ask your accountant before taking deductions.

3. Rethink Your Exit Planning Strategy and Wealth Transfer Strategies

As 2022 draws to a close, it’s essential to look at economic conditions and rethink your business exit plan and wealth transfer strategies. According to Bloomberg News , there is a 100% probability of a recession sometime in 2023, which increases the importance of planning.

Here are some things you can do to minimize your tax burden and protect your business going into 2023.

- Review your estimated net income . If your income is lower than expected, you may want to seek out tax credits and other tax benefits that you may not have qualified for at a higher income level. If it’s higher than expected, then you can get aggressive with deductions by making donations and finding other ways to reduce your taxable income .

- Reassess your business entity . As your business income increases, it may become necessary to reconsider your business structure from a tax perspective. If you’re a sole proprietor, you may want to incorporate it as an LLC, and some LLCs may wish to apply to file as an S corporation to save money.

- Optimize Your Retirement Plan . It’s possible to save thousands of dollars by offering your employees a retirement plan and using your contributions to lower your tax burden.

- Evaluate Your Business Succession Plan . If you already have a business succession plan , the end of 2022 is a good time to review and make changes as needed. If you don’t have one, then you’ll need to create one to prepare your heirs for what will happen when you’re preparing to hand over the reins to them.

Working with a tax professional can help you evaluate your strategies and make the most of any opportunities to secure your business succession plan and wealth transfer strategies.

4. Acquire Assets at the End of the Year

In some tax years, it may be beneficial to estimate your business taxes and then acquire new and used assets to reduce your taxes.

The Tax Cuts and Jobs Act of 2018 allows a 100% bonus depreciation. It may be worthwhile to take advantage of it, particularly in years when your profits have been high. It is important to remember that assets you purchase must be placed in service before the end of the year.

5. Help an Employee with Student Loans

The CARES Act, which was signed into law by then-President Trump in 2020, included a provision that allows employers to assist employees with student loans. It used to be that if an employer repaid part of an employee’s student loans, the employee had to pay taxes because the payments were seen as income.

Discover how different types of income are taxed in our blog post: " Breaking Down Income Types: How Each Is Taxed ." Understanding how your income is taxed is crucial for proper financial planning. Our article comprehensively summarizes various income sources, including wages, investments, rental earnings, and more. Gain valuable insights into the tax implications of different income types, helping you confidently navigate the complex world of taxation.

The CARES Act included an exception that allows employers to get a payroll tax exemption for repaying employees’ student loans and excludes the repayments from employees’ income, meaning that they don’t have to pay taxes.

This provision will remain in effect through 2025 and presents an opportunity for employers to earn some goodwill with employees while also saving money on payroll taxes.

6. Establish Fringe Benefit Plans for Employees

When you increase employees’ wages, you also trigger higher employment tax costs. One way to get around that is to offer fringe benefits as part of employees’ compensation.

Some of the tax-exempt benefits you may want to consider include the following:

- Medical and dental insurance

- Long-term care insurance

- Disability insurance

- Group term life insurance

- Childcare assistance

- Tuition reimbursement

- Transportation

- Employee meals

- Student loan payments (see above)

You can find more information about eligible fringe benefits here .

7. Take a Tax-Free Loan from Your Business

A lot of business owners don’t know that they can take out a low- or no-interest loan from their business. If the loan interest is below the Applicable Federal Rates set by the IRS, you may need to report the interest.

You can check out the current IRS set rates here . Of course, you should ask your accountant before implementing this strategy.

8. Don’t Ignore Carryover Deductions

You already know that some deductions have limitations. The same is true of tax credits , which means that you may not be able to use them fully in the current year. However, you may not be aware that some of these deductions allow a carryover to future years.

Examples of carryovers include capital losses, general business credits, home office deductions, net operating losses (up to 80% of taxable income ), and charitable contributions.

9. Use Accountable Plans

Do you reimburse your employees for things like entertainment, travel, and other costs? If you do, you may want to use an accountable plan. Using an accountable plan allows you to deduct the expenses without reporting the reimbursements as employee income. In other words, it can reduce both your employment taxes and your overall taxable income.

As a bonus, using an accountable plan can also save your employees money on taxes. That’s because, under the new tax law, employees can no longer deduct miscellaneous unreimbursed employee expenses .

10. Abandon Property Instead of Reporting it as a Capital Loss

If your business owns property that has no value, you might be tempted to sell it and report it as a capital loss on your taxes. However, there are some benefits to abandoning it instead.

Abandonment of property allows you to take an ordinary loss, which is fully deductible, instead of a capital loss, which is subject to limitations. Keep in mind that a Section 1231 property may be ordinary or capital, depending on other Section 1231 losses for the year and prior losses.

11. Defer Taxable Income

Are you using cash-method accounting for your business? If you are, you can take advantage of that by carefully managing your business taxable income to minimize your taxes. If you anticipate that your business income will be taxed at the same (or lower) rate in 2023, here are a few tips to help you defer some of your income:

- Put recurring expenses on your credit card. You can deduct them in the current year even though you won’t pay the credit card bill until next year.

- Mail checks a few days before the end of the year. You can deduct the expenses in the year you mail the checks. If you’re mailing a big check, use registered mail so you can prove the mailing date.

- Prepay expenses at the end of the year , provided that the benefit does not exceed IRS limitations (the earlier of 12 months before the first date on which your business realizes the benefit or the end of the next tax year). For example, you could prepay your office rent or prepay some of your insurance premiums.

- Delay sending invoices until the last few days of the year. That way, you’ll receive payment in the new year and can report the income in the new year as well.

You’ll need to be cautious with the last strategy. Don’t delay sending invoices to customers who pay slowly.

12. Hire Your Spouse or Children

If your spouse or children can contribute to your business, then put them on the payroll . Kids can work tax-free if their income is below the IRS threshold. The Tax Cuts and Jobs Act of 2018 nearly doubled the exemption amount for dependent minors.

As a bonus, you can take the money you pay your kids and put it into an education savings account or Roth IRA. You also won’t need to withhold payroll taxes.

13. Evaluate Your Business Entity Type

The business entity type you choose significantly impacts your tax liability. As we mentioned earlier, people who are sole proprietors, have Limited Partnerships, or certain Limited Liability Companies are on the hook to pay self-employment taxes. Depending on how much you earn as a sole proprietor or as an employee of any pass-through entity, you may also have to pay the additional 0.9% Medicare tax.

If your estimated business taxes are high, then you may want to consider taking a step back and reorganizing your business as a different type of entity . For example, reorganizing an LLC as a C corporation has some tax benefits. Navigating the ins and outs of different business entity types can be confusing, so it’s beneficial to work with a tax professional to determine the appropriate structure for your business.

14. Write Off Bad Debts

As a business owner, you may sell products or services to customers on credit. For example, many companies invoice clients and give them 15 or 30 days to pay. When you have delivered goods and services, your instinct may be to continually try to collect them, but that’s not always the most advantageous approach for taxes.

As the end of the tax year approaches, you should review your accounts, including past due invoices and loans you may have made to employees or vendors, and consider whether they should be written off as bad debt . Writing these debts off can help you to offset what you owe on your taxes and reduce your overall tax obligation. It is important to note that this applies to accrual basis taxpayers only (see below).

15. Review Your Accounting Method

There are several accounting methods you may use as a business owner, and in some cases, you may have a choice about which method to use. The two most common methods are the cash method and the accrual method.

With the cash method, you must report any money you receive and any business expenses you incur in the year you pay them. This method is available to many small businesses, but businesses that have average receipts of more than $25 million for the past three years are not eligible.

The other option is the accrual method, which allows you to report income in the year it is earned and expenses in the year they are incurred. There are benefits to both methods, and you should consult with your accountant to determine which method best suits your business needs.

16. Check If You’re Eligible for Penalty Relief

Sometimes, despite their best efforts, business owners incur a penalty from the IRS. The penalty could be because they missed a tax filing deadline or underpaid their taxes, and in some cases, the penalties can be significant.

If you incur a penalty, it is worthwhile to see if you are eligible for penalty relief . Some circumstances that may be eligible for penalty relief include:

- Failing to file a tax return

- Failing to pay on time

- Failing to deposit taxes as required

You can check with the IRS or your accountant to find out if you are eligible for penalty relief. Often the IRS will remove the first penalty assessed to you.

17. Pay Down Your Debt

Payments you make for business expenses are not tax-deductible in most cases, but there is one exception: loan interest. If you have an outstanding business loan and cash on hand, you may want to make extra payments or even pay off the loan entirely so that you can deduct the interest when you file your tax return.

Keep in mind that the IRS does not allow an interest deduction for personal expenses paid with a credit card. You can view IRS Publication 334 for information about non-farm business interest deductions and IRS Publication 225 for information about interest deductions for farms.

18. Stay Updated on the Latest Small Business Tax Law Changes

In August of 2022, the Inflation Reduction Act was signed into law by President Joseph Biden. The law included some of the provisions that were originally part of Biden’s Build Back Better bill, which was negotiated and renegotiated throughout 2021 and into 2022.

For businesses, the most important part of that legislation is that there is now a 15% corporate minimum tax. Wall Street experts have evaluated the provision and concluded that the impact of it would be minimal since very few companies were paying less before the act’s passage.

It’s important to note that the 15% minimum tax applies only to the adjusted financial statement income of companies that pay more than $1 billion in profits to shareholders.

The Inflation Reduction Act also included a 1% excise tax to be imposed upon shares repurchased by companies after December 31, 2021. Earlier proposed changes to the Base Erosion and Anti-Abuse Tax (BEAT) and Global Intangible Low-Tax Income (GILTI) were not included in the final bill. We are always watching to see what happens with pending tax legislation, and as a business owner, you should be too.

19. Consult a Tax Advisor

One of the best things you can do as a small business owner to minimize the amount of tax you are required to pay is to consult a tax advisor. Even if you are someone who keeps a close eye on business news and stays up to date on tax law changes, you still need professional advice to help you file your taxes.

Business tax filings can be complex, and the penalties for mistakes or oversights can be high. Ultimately, paying for a tax advisor will be less expensive than trying to clean up the aftermath of a mistake with your taxes .

The AMT credit can help you avoid paying a higher tax rate by offering a dollar-to-dollar reduction on previous years' taxes. Check our blog post, Alternative Minimum Tax Explained to find out how this works.

Small Business Tax Planning FAQ

Here are a couple of questions that we often hear from clients about small business tax planning.

How Much Does a Small Business Pay in Taxes?

This is a frequently asked question because people want to know how much they will need to pay, so they can prepare and be sure to have the money they need to meet their tax obligations.

The short answer is that every small business is unique, but we can still give you some idea of what to expect. The Small Business Administration released figures that showed an average of 19.8% as the effective tax rate for small businesses. The percentages can vary depending on your business structure and other factors.

There are five basic types of taxes that business owners may need to pay. They are as follows:

- Self-employment tax

- Estimated tax

- Employer tax

The Tax Cuts and Jobs Act of 2017 changed the tax code for corporations. As of January 1, 2018, C corporations have a flat corporate income tax rate of 21%. This rate does not apply to other business structures. You should keep in mind that if you have a sole proprietorship or partnership—and in some cases, an LLC—you may need to pay self-employment tax.

Why is Tax Planning Important for Small Businesses?

As a business owner, paying taxes is your obligation, but the amount you owe should never be a surprise. It’s essential to understand how business taxes work and estimate the amount you need to pay each quarter or year to ensure that you have the appropriate amount of money.

Tax planning is something that can help you make accurate tax estimates, make all tax filings and reports on time, and avoid the potential repercussions of not doing so. As business taxes can be complicated, we recommend working with an experienced tax professional to help you with tax planning. You should also know that tax planning is often the best way to find tax savings.

Final Thoughts on Small Business Tax Strategies

Calculating, filing, and paying your business taxes can be a time-consuming and expensive endeavor. The 19 tax strategies we have reviewed here can help you understand your tax obligations and minimize your tax burden as you head into 2023.

Do you need assistance planning your income tax strategy ? CMP can help create an excellent tax plan for you and your business.

About Ashlyn Rodeback