Economics Essay Topics: 162 Practical Ideas & Useful Tips

Essay writing is an inherent part of the economics studying process. Nevertheless, it is quite a challenging task. Are you a high school or college student who is struggling with an economic essay topic choice? Or maybe you are unsure about your writing skills?

We know how to help you .

The following article will guide you in choosing the best topic for your essay on economics. Here, you can find a variety of ideas for high school or college. The economic essay topics are divided into several categories that will help you with your research. And a pleasant bonus from our team! We have created a great guide on how to write an economics essay.

So, don’t miss your chance to write an outstanding economic paper! Check out our essay ideas, read our tips carefully, and be ready to receive your grade A!

- ⭐ Best Economic Topics

- 🤝 Socio-Economic

- 🗺️ International Economics

- 🛠️ Labor Economics

- 🌆 Urban Economics

- ⚽ Sports Economics

- 💉 Health Economics

- 💼 Business Economics

- 🏤 Globalization

- 🧮 Economic History

- 💫 How to Write?

⭐ 15 Best Economic Essay Topics

- 2008 Economic Crisis.

- Socio-economic policy.

- Economic systems – Singapore.

- Racial pay gap.

- Economic globalization.

- History of online trading.

- Child labor policies.

- The Economic Naturalist.

- Foundations of economic theory.

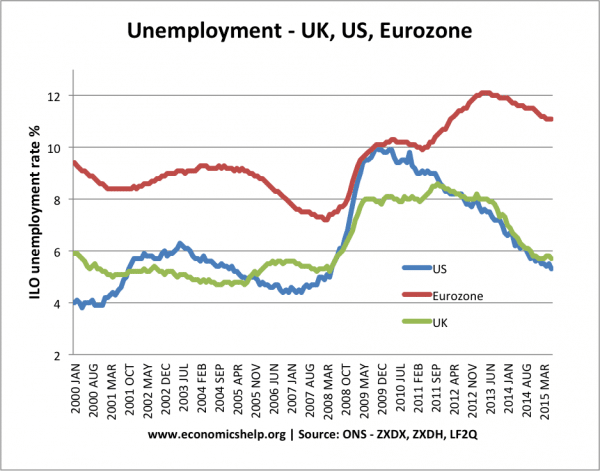

- Impact of unemployment.

- Universal Basic Income.

- The role of consumerism.

- Healthcare economics – Canada’s Medicare.

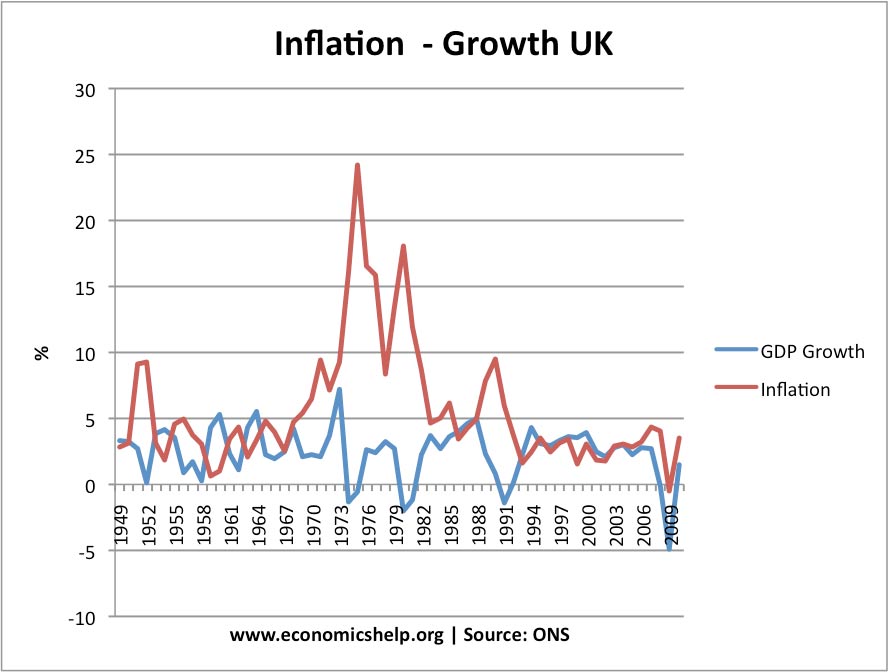

- Reasons for recession.

- Cryptocurrency & environmental issues.

✨ Excellent Economic Essay Topics

Has economics always been a subject of meticulous research? The question is quite controversial, right? There is no specific time when economics started its rapid progress. Generally, economics remains the topic of interest since the establishment of capitalism in the Western world.

Nowadays, the economy is the main engine that moves our world forward. The way we do business determines the geopolitical situation in the world. Moreover, it influences many other parts of our lives.

Economics studying is of utmost importance nowadays. It helps to gain a better understanding of processes that put everything in motion.

Economics is quite broad, so it has a great variety of subfields. And this is a fantastic opportunity for us to generate as many essay ideas as possible. Here, you will find great economic topics for your paper. As mentioned before, we have divided them into several sections to ease your selection process. There’s a wide selection of free college essays samples on economics in our database, too. So be sure to check that out.

🤝 Socio-Economic Essay Topics

- The economic impact of racial segregation in America in the 1950s.

- Designing a just socio-economic system.

- Socio-economic status of Hong Kong in modern-day China. Explain how the city of Hong Kong gained a special status in China. Why did it emerge as one of the most important cities in its economy? Comment on the significance of Hong Kong in the international economic arena.

- Economic growth in the United States in the post-World War 2 period.

- Mobile banking in Saudi Arabia: towards understanding the factors that affect the sector.

- The importance of Dior’s bar suit to the women’s fashion industry.

- Economic problems in the 1980’s Soviet Union. Talk about the significant problems with the economy the USSR had in the 1980s. What role did they play in its collapse?

- What socio-economic problems did segregation in South Africa cause?

- History of economic development in the UAE. Discuss the economic miracle in the UAE and Dubai. Explain how the government could turn the city of Dubai into one of the most famous tourist destinations. What strategies were applied?

- Gender inequality and socio-economic development .

- The problem of poverty in Venezuela.

- How the socio-economic and political position of women changed between 1880 and 1940.

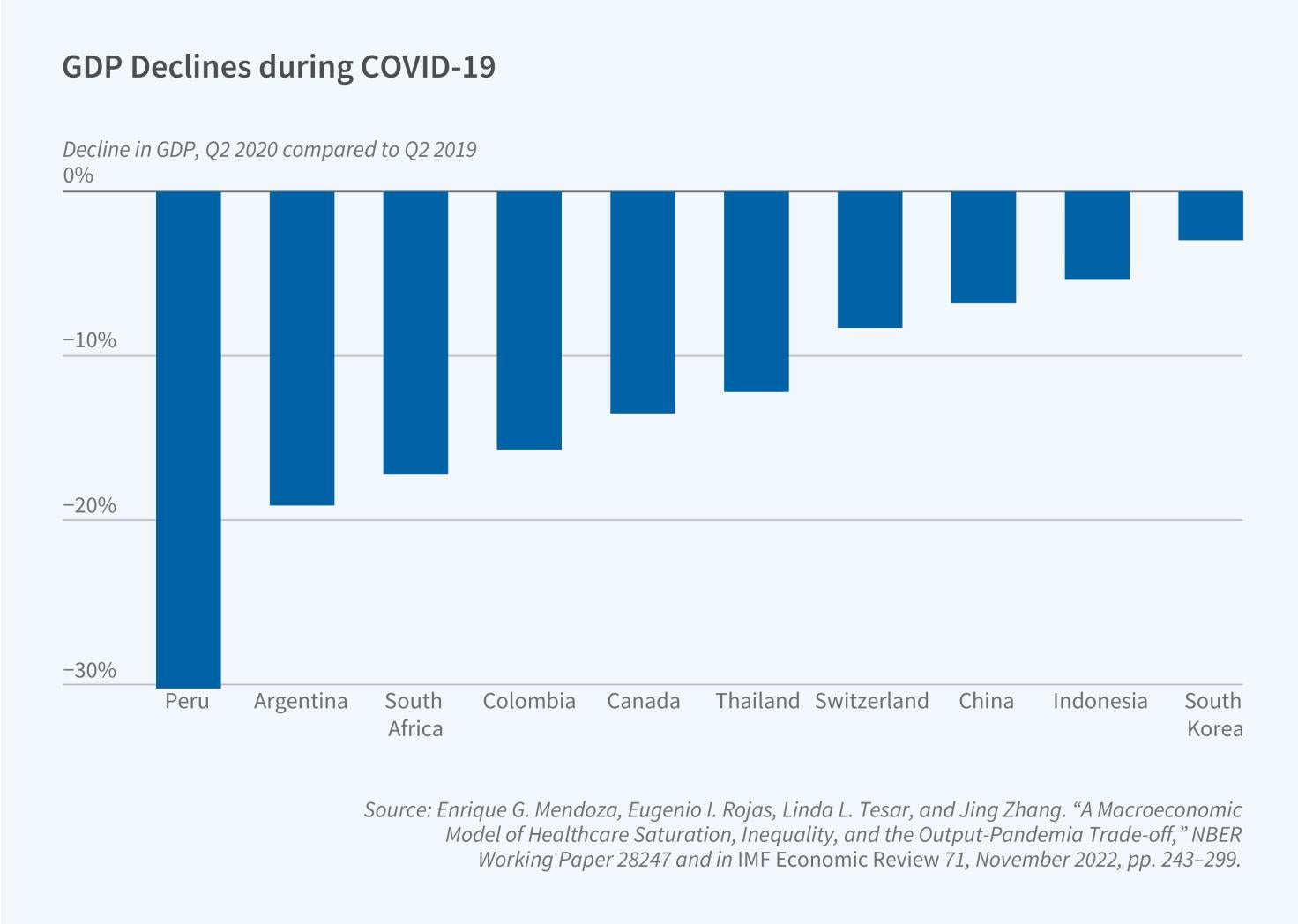

- The economic impact of COVID-19 on global trade.

- How do the three main economic groups interact with each other? There are three critical economic groups: – Consumers – Producers – Government Analyze the interaction of these groups with each other.

- Extended essay: how the study of economic data helped our society to advance?

- Western industrialization socio-economic impacts.

- Inequality at the top: not all billionaires have the same powers. Analyze billionaires’ net worth, liquidity, political power, and wealth security. Explain why they have unequal social status. What factors determine the influence of billionaires?

- An analysis of systems that help us measure agricultural development in a country.

- Is social media a useful tool for brand promotion?

- The phenomenon of dualism in economic development.

🗺️ International Economics Essay Topics

- Globalization and its impact on international economic relations. Define the term globalization. What role does globalization play in international economic relations? Provide specific examples of globalization’s impact on the global political economy.

- The lack of justice for the cheap international labor market. Discuss the issue of cheap labor in various countries. Why do some workers often lack fundamental human rights while others abuse moral norms? Analyze the causes and effects of inequality in the workplace.

- Japan macroeconomics: problems and possible solutions.

- The issue of mercantilism in the history of Great Britain. Analyze the rise and development of mercantilism in the history of Great Britain. To solidify your ideas, provide persuasive arguments, and appropriate examples of mercantilism.

- Why does the problem of environmental protection remain unresolved among global economies?

- Nissan Motor company’s international business.

- International environmental concerns in economics: the case of China .

- The issue of international criminal justice in industry. Explain why international businesses often avoid criminal justice after wrongdoings. Select one case of unethical behavior of a company’s CEO or regular employee. Briefly introduce the problem. What were the causes and effects? How was the issue resolved? Express your own opinion regarding the lack of criminal justice in business.

- The economy of Singapore and its role in international trade.

- International microeconomics trade dispute case study: US-China dispute on the exportation of raw materials.

- The phenomenon of the “gig economy” and its impact on the global economy.

- The effect of population growth in the international economy.

- International economics in the context of globalization.

- How does Brexit affect the economy of the European Union? Analyze the immediate impact of Brexit on the EU’s economy. Predict future advantages and disadvantages of Brexit for both: Great Britain and the EU.

- South Africa: international agribusiness, trade, and financing.

- Historical essay: the economy of the Dutch East India company.

- The issue of Mozambique’s economy and possible solutions. Investigate the issue of extreme poverty in Mozambique. What are some possible solutions to the problem of poverty? Base your suggestions on the country’s cultural, historical, and geographical aspects.

- Imbalances in the global economy. Discuss the imbalances between trading countries on the scale of the global economy. What solutions would you suggest to deal with this issue?

- How will global economies adapt to China’s growing power?

- Etihad Airways company managerial economics.

🛠️ Labor Economics Essay Topics

- Ford Motor company’s labor economics.

- Labor economics: child labor.

- The UPS firm perspective: the labor market.

- Gender inequality of wage rate in modern business. Research how and why gender inequality is still an issue in the modern world of economics. What are some ways to deal with the problem? Present your ideas accurately and effectively. Provide solid arguments and appropriate examples to prove your position.

- What are the best ways to increase labor productivity in business?

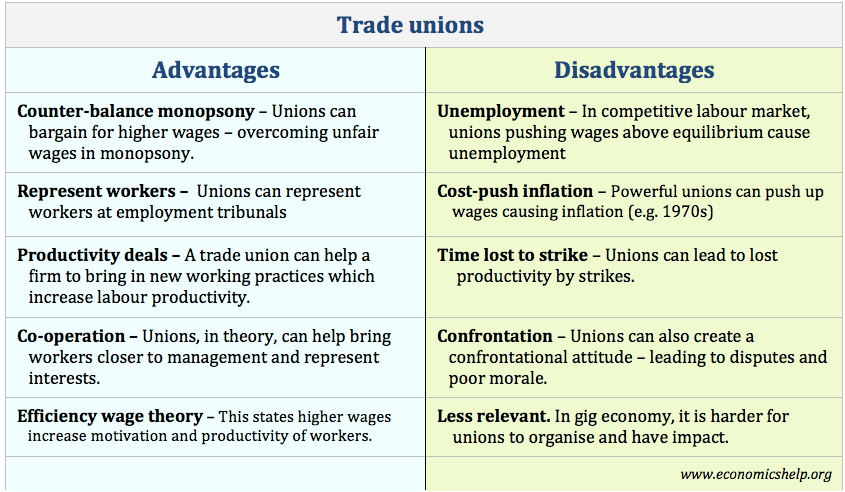

- Labor unions adverse effects on economics.

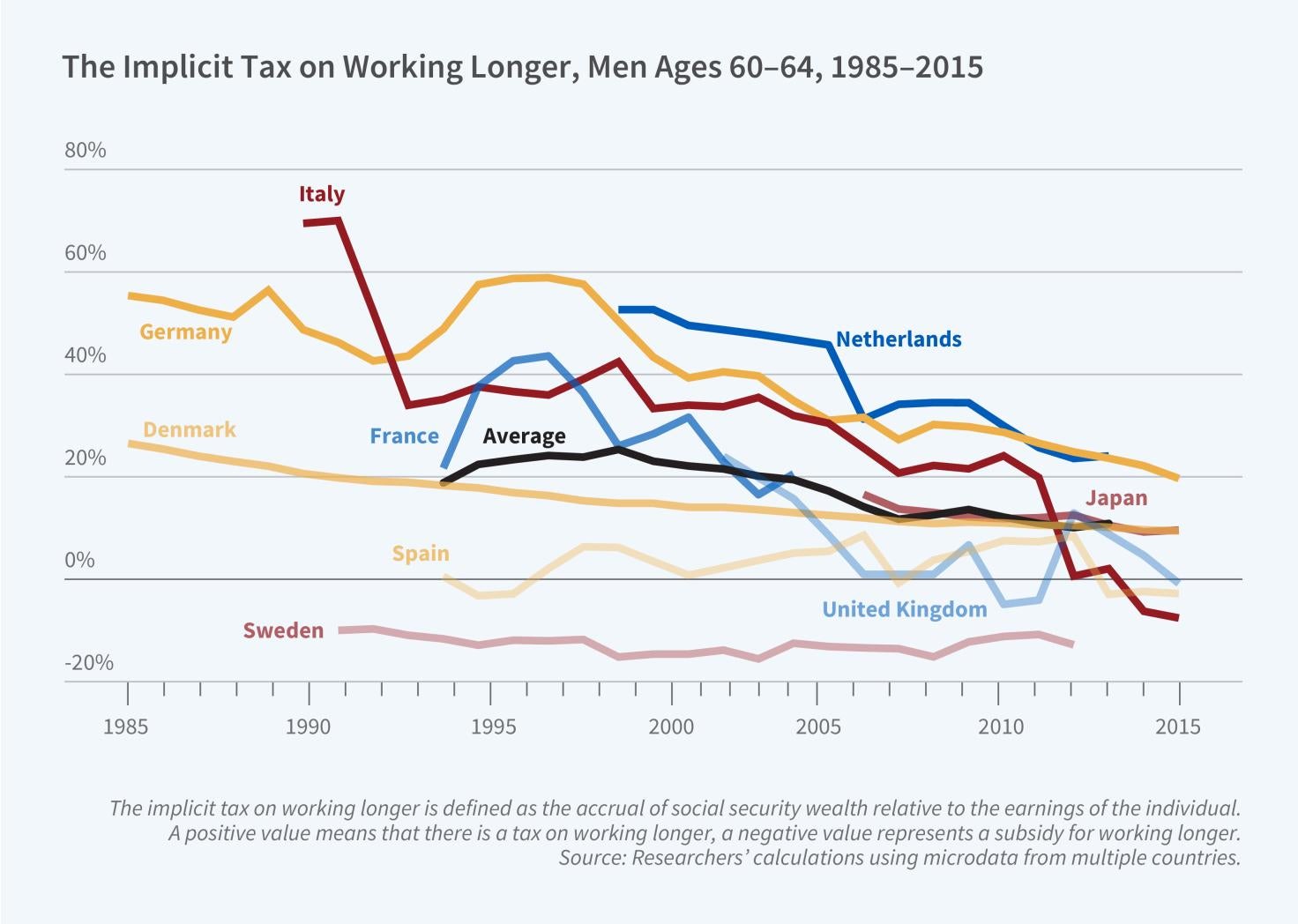

- The decrease of the labor force in modern industries. Talk about the rising rates of robotization in the majority of industries. How will it affect the traditional labor force? Comment on the problem of unemployment caused by labor automatization.

- Violations of labor rights of workers.

- Modern labor essay: how can an entrepreneur guarantee the minimum wage to their workers?

- How can labor geography help develop a special economic zone? Talk about labor geography and its effects on developing an exclusive economic zone. How does the geopolitical location of a particular country influence its level of economic development?

- Entrepreneurship in the organic cosmetics sphere.

- Gender-oriented labor trade unions. A case study. Discuss the gender-oriented trade unions and analyze their impact on our society.

- Child labor in the Turkish cotton industry.

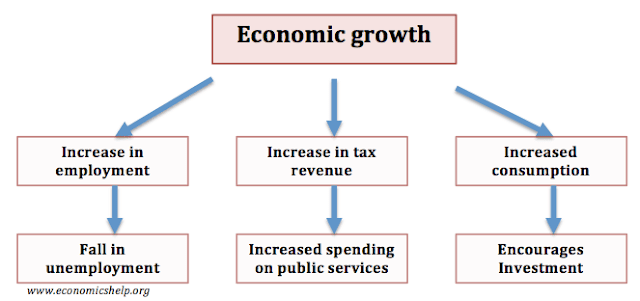

- The connection between economic growth and demography. Analyze the connection between economic growth and its demographic context. Investigate both sides: – The issue of overpopulation – The problem of low birth rate. From an economic perspective, what problem is more dangerous?

- The issue of sex discrimination in the workplace.

- The effects of Landrum-Griffin Labor Act. Explore the labor Act of Landrum-Griffin that was passed in the US Congress in 1959. Discuss its implications and consequences. Discuss its implications and consequences.

🌆 Urban Economics Essay Topics

- Cities and their role in aggregate economics.

- Urbanization in Hong Kong and its effects on citizens.

- The urban planning of the city of New York: a critical analysis. Analyze the urban history of NY. How has the city been developing? Discuss revolutionary solutions to the past and problems of modern times.

- The impact of a city’s design on the local traffic.

- Dubai’s spatial planning: creative solutions for building a city in the desert.

- Globalization, urban political economy, and economic restructuring.

- How do urban areas affect local wildlife? Comment on how modern production technologies in urban areas impact the natural diversity of wildlife. What impact does the rapid economic progress have on the environment? Suggest possible solutions.

- Urban sociology: does the city make us better people?

- Why should people be more careful about investing in real estate? Discuss the issues of overinvestment into real estate. Consider the economic crisis of 2008 as an example.

- How can regional authorities help improve a city?

- Urban life and its effects on education.

- The economic development of a city’s metropolitan area: challenges and solutions.

- Main factors for the emergence of cities in the Middle Ages.

- The ethics of relocation: is it justified? Talk about the case of relocating locals when building projects of great magnitude. To what extent can it be justified? Mention its economic and ethical side.

- The difficulties behind the construction of “green” buildings. Discuss the relatively new phenomenon of environmentally friendly buildings. Analyze both sides: the pros and cons. What obstacles lie behind the “green” building? What opportunities do the “green” buildings offer? Elaborate on your ideas by providing clear arguments or counterarguments.

- What factors play a critical role in the success of retail productivity in cities?

⚽ Sports Economics Essay Topics

- Do teams with higher budgets perform better on the field?

- Corruption in European football leagues: a critical analysis. Investigate the corruption issue in the European football leagues. State reasons and solutions for the problem.

- The managerial catastrophe of Arsenal F.C.

- The NextG sports company’s communication planning.

- Roger D. Blair’s Sports Economics literary review. Write a literary analysis of Sports Economics by Roger D. Blair. Discuss his opinion on the economy of sports. Do you agree or disagree with his position? Provide compelling supportive arguments or strong counterarguments.

- How significant is the impact factor of a local team on a city’s economy?

- Kinsmen Sports Centre: marketing metrics innovation.

- What role does statistical data play in sports? Analyze the part of economic statistical data in different sports organizations. How can statistics help to develop an effective financing plan? Comment on the impact of financing on the performance of a sports club.

- Sports and energy drinks marketing analysis.

- Is there a connection between the lack of money and any contemporary issues in a sports team?

- Performance-enhancing drugs in sports.

- The business of FIFA: a financial analysis. Investigate the finances of FIFA. What economic factors make them so influential in the modern world of football?

- The global sports retail industry.

- The Olympics: logistics and economy. Discuss the logistics behind the Olympics Games event. How the Olympic Games impact the economy of the host country?

💉 Health Economics Essay Topics

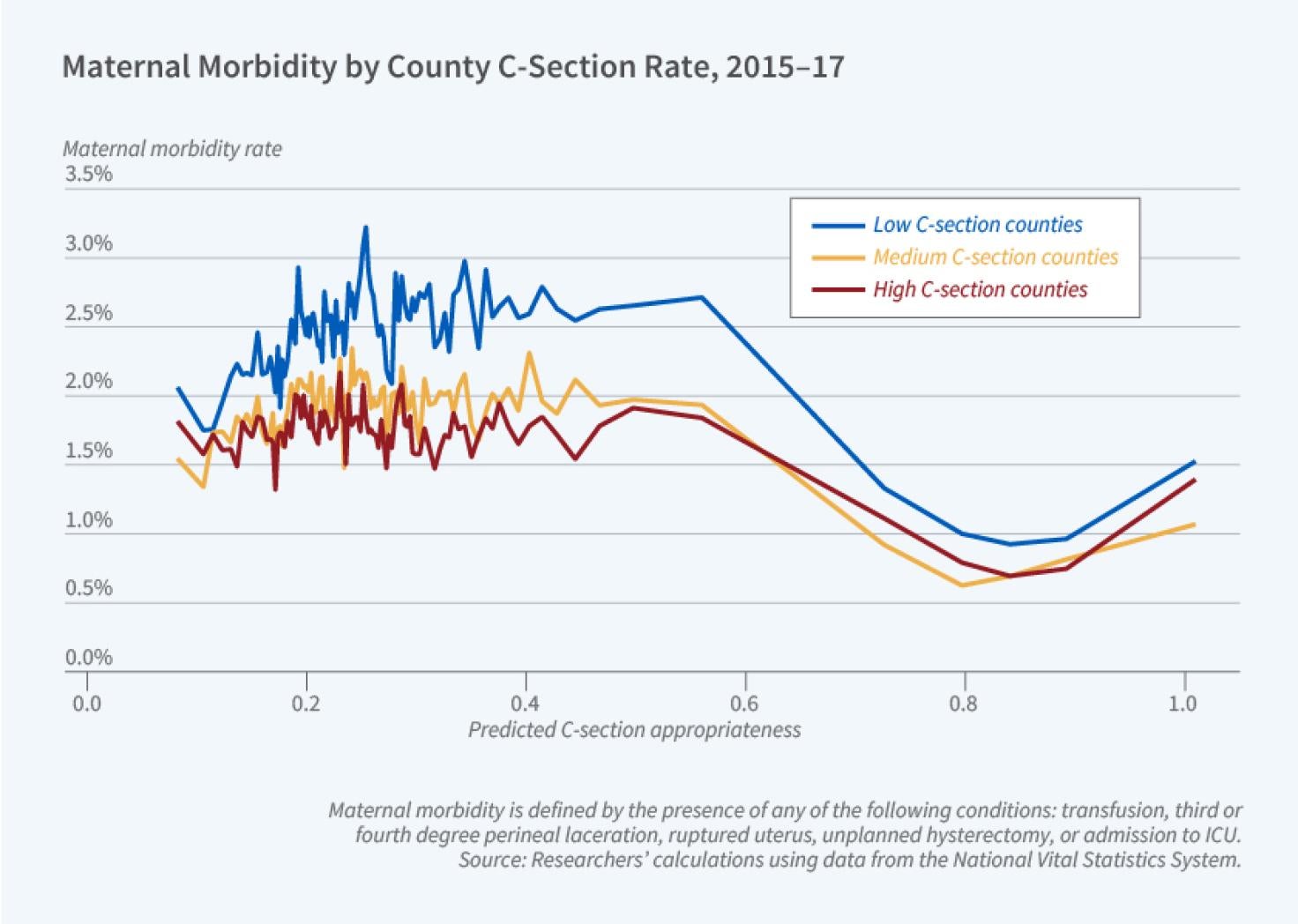

- Is bioprinting the new future of medicine? Analyze the new market of organ printing and discuss its challenges. Investigate bioprinting from an economic perspective. Will the outputs cover the inputs? How will bioprinting impact the financial aspect of the health care sector?

- Cost-effectiveness of pharmaceutical products in the United States. Comment on the immense cost-effectiveness of pharmaceuticals. What do you think is the price of pharmaceutical products reasonable? Is it ethical to set extremely high prices on the medicals?

- An economic evaluation of the antibiotics market.

- Health economics-SIC and NAICS.

- The financial side of cancer treatment: is it too expensive? Analyze the market for cancer treatment programs in various countries. Explore its costs and complications. What are some possible ways to reduce the price of cancer treatment and make it more affordable?

- The issue of fast food consumption: a multibillion-dollar market . Fast food has always been one of the notable causes of obesity, diabetes, and other illnesses. Investigate the economic aspect of the issue. Are high profits from fast food production worth peoples’ health conditions?

- History and evolution of healthcare economics.

- The financial management of a hospital: a case study.

- The issue of public healthcare in the USA. Write about the long-standing issue of medical sector operation in the USA. Analyze its history, financial, and social aspects.

- Demand in healthcare economics.

- What are the economic outcomes of a global pandemic? Taking the COVID-19 outbreak as an example, conduct research on the effects of a pandemic on the economy. How does it affect local economies? What impact does the quarantine have on the international economy? Provide appropriate examples to support your ideas.

💼 Business Economics Essay Topics

- When does an advertising campaign become unnecessary?

- Sustainable development of a nation’s economic stability. Discuss how a country can create a sustainable economy. Provide bright examples to solidify your position.

- How can a small business compete with monopolies?

- What are the limitations of the Lewis Model?

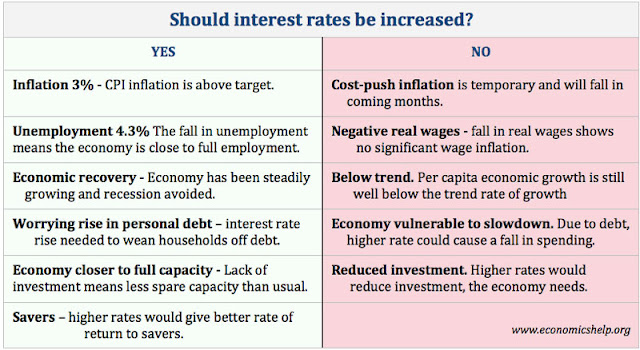

- The phenomenon of inflation: inevitable liability or a land of opportunity for our economies? Explore the process of inflation in modern economies. Does it only have adverse effects on the countries’ economies? Are there any advantages of inflation? Analyze it from a positive perspective.

- Economics, business, and sugar in the UK.

- The shadow economy of the finance sector. Dive into the backstage of the finance sector and research various “grey” areas where business can be done.

- Chinese and Japanese business systems comparison.

- Oil demand and its changes in the XXI century: a critical analysis. Analyze the oil sector and write about its fluctuation in the XXI century. How did the changes in oil demand affect the global economy?

- The social and economic impact of mass emigration.

🌠 40 More Good Economic Essay Topics

Scrolled through our ideas, but can’t find a suitable topic for yourself? No worries! We have more issues to share with you.

So, don’t stress out. Take a look at our list of economical essay topics. Here are 40 more ideas focusing on globalization and the history of economics.

🏤 Economic Globalization Essay Topics

- The impact of globalization on the tourist industry in the Caribbean . Analyze both: the positive and negative effects of globalization on the Caribbean. To make your paper well-structured, explore two advantages and two disadvantages. Don’t forget to improve your essay with strong evidence and appropriate examples!

- Toyota Motor Corporation: impacts of globalization.

- What are the effects of globalization on developing countries? To what extent do developing countries profit from globalization? Research the subject by comparing various examples.

- Defining globalization and its effects on current trade.

- Economic growth as a result of globalization: proper financial strategies. How can a country successfully achieve prosperity with globalization? Discuss proper economic strategies.

- The socio-political significance of the IT industry’s globalization.

- Human trafficking in developing nations as a result of globalization.

- Globalization and criminal justice policy.

- What are the advantages and disadvantages of globalization?

- Globalization challenges and countermeasures.

- The effect of globalization on worldwide trade and employment rates.

- Economic integration within the European Union: a critical analysis. Talk about the history of economic integration within the EU. What are the negative and positive outcomes of economic integration?

- Globalization and food in Japan.

- Does globalization bring negative effects to cultural heritage and identity?

- The Industrial Revolution as the first step towards globalization. Focus on the Industrial Revolution in Europe. Discuss its precursors and consequences. Why is the revolution considered to be a starting point of globalization? Provide specific examples of globalization processes that occurred in the economic sector after the Industrial revolution.

- Globalization 2.0 an analysis of a book by David Rieff.

- Globalization effects on fundamentalism growth.

- Does direct investment by foreign businesses come with strings attached? Dive into the shady area of globalization and discuss how to direct foreign investment can bring problems of geopolitical scale.

- Effects of globalization on sexuality.

- Alibaba’s globalization strategy: an economic analysis.

🧮 Economic History Essay Topics

- The rapid economic growth of Europe during the Age of Discovery. Analyze the factors that brought economic growth to Europe during the Age of Discovery. What factors contributed to the dynamic economic progress of that time?

- Brazil’s economic history.

- History of capitalism: from the Renaissance to the United States of America. Discuss the origins of capitalism and its centuries-long path towards XXth century America. How the establishment of capitalism impacted the economy of the USA?

- Max Weber: economic history, the theory of bureaucracy, and politics as a vocation.

- 2008 Economic Crisis: origins and fallout. Talk about the 2008 Financial Crisis. Discuss its causes and outcomes. What should have been done differently to avoid the global crisis? Comment on the economic strategies countries used to recover from it.

- The economic marvel of Communist China: from rags to riches.

- What made world economic growth of the Renaissance possible?

- The economic history of Canada: how did the settlers facilitate economic growth?

- What did the major powers of the XIXth century base their economies on?

- The Rothschilds: political and financial role in the Industrial Revolution. Research the dynasty of Rothschilds and how they came to power. What was their role in Europe’s Industrial Revolution?

- The link between the “oil curse” and the economic history of Latin America.

- Roman Empire’s monetary policy: a socio-economic analysis.

- How did the demand for different goods change their value in the 2000s years? Analyze the demand for goods in the 2000s years and their change in value. Why do these fluctuations in demand for products and services occur?

- The history of economic thought.

- Soviet Union’s economic timeline: from the new Economic Policy to Reformation. Discuss the economic issues of the Soviet Union from the historical perspective. Why did the Soviet Union collapse? What improvements in the financial sector should have been done?

- History of France economics over the past 20 years.

- The history of economic analysis.

- The concept of serfdom and slavery as the main economic engine of the past. Dive into the idea of feudalism and serfdom. Discuss its social and economic aspects.

- The World Bank’s structure, history, activities.

- The history of Islamic banking: concepts and ideas.

💫 How to Write an Economics Essay?

Generally, essay writing on economics has the same structure as any other essay. However, there are some distinctive features of economic papers. Thus, it is essential to figure them out from the very beginning of your work.

You might be wondering what those aspects of the economic paper are. Well, we have an answer.

Below, you will find a detailed plan that explains the fundamental concepts of the essay writing process. So, don’t hesitate to use our tips! They are indeed helpful.

Pick a topic and dissect it. Picking the right topic is the very basis of writing a successful essay. Think of something that you will be interested in and make sure you understand the issue clearly. Also, don’t forget to check our ultimate economics essay topics and samples list!

Research it. After selecting the right idea from our economical essay topics, research your subject thoroughly. Try to find every fascinating and intriguing detail about it. Remember that you can always ask your fellow students, friends, or a teacher for help.

Come up with a thesis statement. A thesis statement is an essential element of your essay. It will determine your focus and guide the readers throughout your paper. Make your thesis secure and try to catch the reader’s attention using context and word choice.

Outline your essay. Never underestimate the power of a well-structured outline! Creating an essay outline can significantly help you to determine your general plan. Evaluate which economic framework you will be using to address the issue. State the main points of your thesis and antithesis. Make sure that they answer the central question of your work.

Write your introduction. First and foremost, a practical introduction should capture the readers’ attention and state the essay’s key topic. So, put enough effort to develop an outstanding introduction. It will create the first impression of your paper.

Moreover, an introduction should include a thesis statement. As we have mentioned above, a thesis plays a crucial role. Thus, make sure it is clearly stated.

Another significant feature of the introduction is its coherence with the body of your essay. Consequently, the introductory paragraph’s last statement has to present the subject of the next section, generically. Also, keep in mind that no more than three key points can be discussed in a paper, even if it is an extended essay.

Thoroughly work on the body paragraphs. Usually, the body of the essay contains several paragraphs. The number of these paragraphs will depend on the nature of your question. Be sure to create one section for every critical point that you make. This will make your paper properly-structured, and the reader will quickly get your ideas. For your convenience, we created a plan to develop your ideas in each paragraph, So, use it and make your writing process easier!

- Argument. Present your argument in the topic sentence of the paragraph in a way that directly answers the question. A hint: the most effective way to introduce the critical point is to place the topic sentence at the beginning of the paragraph. This will help the readers to concentrate their attention on a specific idea.

- Comment and discussion. Explain the meaning of your argument and provide an economic analysis. Present clear evidence and persuasive arguments to solidify your position.

- Connection. Link your comments with the vital point of the paragraph. Demonstrate the coherence of your evidence with the point.

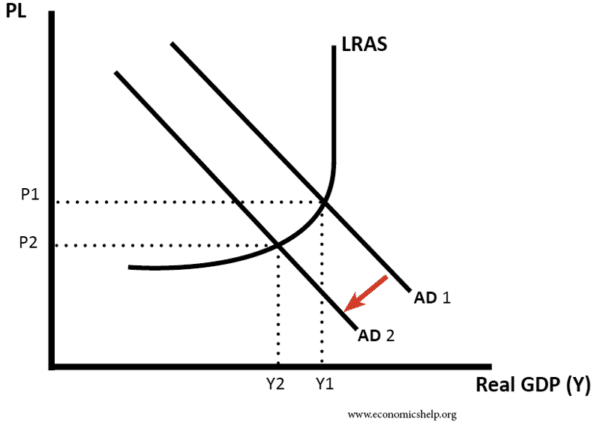

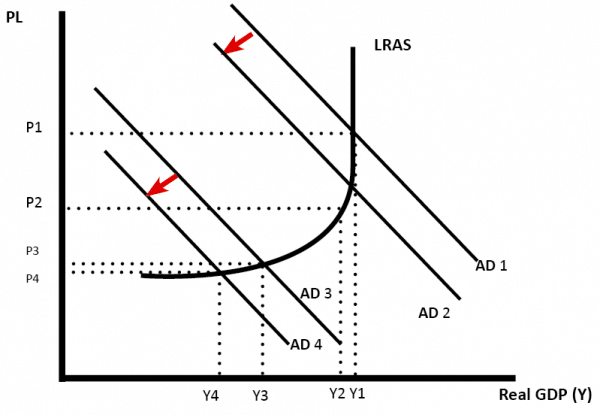

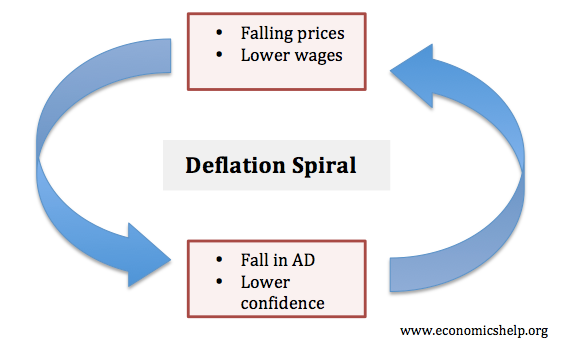

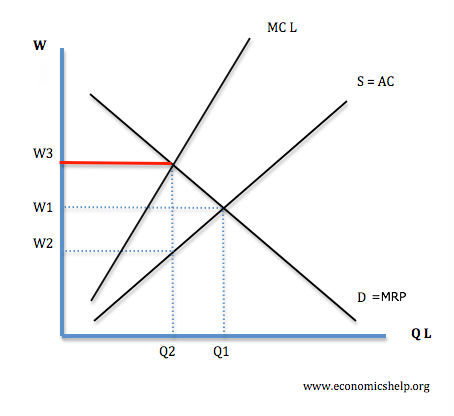

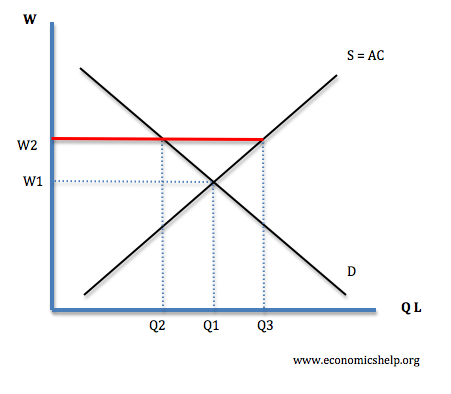

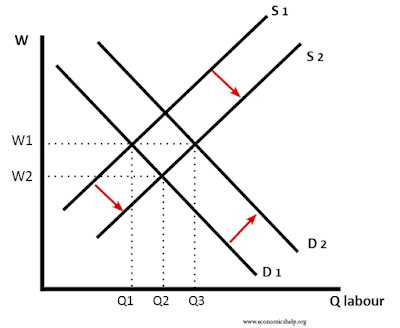

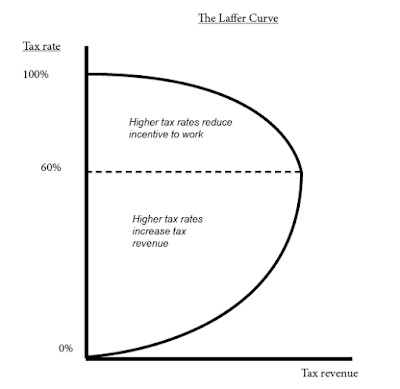

- Diagrams, tables, charts. If necessary, provide the reader with visual aids. Sometimes, an appropriate diagram or a suitable chart can say more than words. Besides, your paper will look more professional if you use any kind of visual aids.

Conclude your essay. In your conclusion, summarize and synthesize your work by restating your thesis. Also, it is crucial to strengthen it by mentioning the practical value of your findings. Remember to make your essay readable by choosing appropriate wording and avoiding too complex grammar constructions.

Thank you for visiting our page! Did you enjoy our article and learned something new? We are glad to help you. Don’t forget to leave a comment and share the article with others!

🔗 References

- High School Economics Topics: Econlib, The Library of Economics and Liberty

- Guide to Writing an Economics Essay: The Economics Tutor

- How to Write the Introduction of Your Development Economics Paper: David Evans, Center For Global Development

- Senior Essay: Department of Economics, Yale University

- Developing A Thesis: Maxine Rodburg and The Tutors of the Writing Center at Harvard University

- Academic Essay Writing, Some Guidelines: Department of Economics, Carleton University

- The Writing Process: Writing Centre Resource Guide, LibGuides at Dalhousie University

- Research Papers: KU Writing Center, the University of Kansas

- Unpacking the Topic: University of Southern Queensland

- Economic Issues: PIIE, Peterson Institute for International Economics

- Areas of Research: EPI, Economic Policy Institute

- Top 100 Economics Blogs Of 2023: Prateek Agarwal, Intelligent Economist

- Current Environmental Economic Topics, Environmental Economics: US EPA, United States Environmental Protection Agency

- Hot Topics in the U.S. Economy: The Balance

- Share via Facebook

- Share via Twitter

- Share via LinkedIn

- Share via email

- Economic Essays Grade 12

Grade 12 Economic Essays for the Next Three-Year Cycle (2021-2023)

- Discuss in detail the markets within the FOUR-SECTOR model (Circular Flow)

Discuss in detail 'The new economic paradigm'/Explain the 'smoothing of cycles (Business Cycles)

Discuss in detail the features underpinning forecasting (Business Cycles)

Discuss in detail the main objectives of the public sector in the economy (Public Sector)

Discuss in detail the reason(s) for public sector failure (link them to typical problems experienced through public sector provisioning) (Public Sector)

Discuss in detail the reasons for international trade (Foreign Exchange Markets)

- Discuss in detail export promotion (Protectionism and FreeTrade)

Discuss in detail the arguments in favour of protectionism (Protectionism and Free Trade)

Discuss in detail the demand-side approach in promoting growth and development in South Africa (Growth and development)

Discuss in detail the following South African growth and development policies and strategic initiatives (Growth and development)

Discuss in detail South Africa's initiaties (endeavours) in regional development (Industrial Development Policies)

Discuss in detail the following economic indicators (Economic and Social Performance Indicators

Discuss in detail the following social indicators (Economic and Social Performance Indicators)

Discuss in detail the various equilibrium positions with the aid of graphs-PERFECT MARKET (Perfect Market)

- Discuss the monopoly in detail (with/without the aid of graphs) (Imperfect Market)

Examine the oligopoly in detail (Imperfect Market)

- Compare and contrast any TWO types of market structures

Discuss in detail how the following factors lead to the misallocation of resources in the market (Market Failures)

Discuss in detail state intervention as a consequence of market failures, with the aid of relevant graphs (Market Failures)

Discuss in detail the consequences of inflation (Inflation)

Discuss in detail the measures to combat demand-pull and/or cost-push inflation (Inflation)

Examine in detail the effects of tourism (Tourism)

Examine in detail the benefits of tourism (Tourism)

Discuss in detail how the government can ensure sustainable development (Environmental Sustainability)

- Discuss in detail the following problems and the international measures taken to ensure sustainable development (Environmental Sustainability)

ESSAYS FOR THE NEXT THREE-YEAR CYCLE (2021-2023)

Macroeconomics- paper1.

Discuss in detail the markets within the FOUR-SECTOR model (Circular Flow) INTRODUCTION The economy of a country is regarded as an open economy because of the presence of households, producers, government, foreign sector and financial sector as active participants in the economy. Markets link the participants in the economy 🗸🗸 [Max 2]

BODY: MAIN PART PRODUCT / GOODS/ OUTPUT MARKET🗸

- These are the markets for consumer goods and services🗸🗸

- Goods are defined as tangible items, like food, clothes, cars, etc. that satisfies some human wants or needs🗸🗸

- Buying and selling of goods that are produced in markets e.g. 🗸🗸

- Capital Goods market for trading of buildings and machinery🗸🗸

- Consumer goods market for trading of durable consumer goods, semi-durable consumer goods and non-durable consumer goods. 🗸🗸

- Services are defined as non-tangible actions and include wholesale and retail, transport and financial markets. 🗸🗸

FACTOR / RESOURCE/ INPUT MARKETS🗸

- Households sell factors of production on the markets: rent for natural resources, wages for labour interest for capital and profit for entrepreneurship🗸🗸

- The factor market includes the labour, property and financial markets. 🗸🗸

- The market where services of factors of production are traded e.g. labour is hired and capital is borrowed – these services earn wages, interest, rent and profits🗸🗸

FINANCIAL MARKETS🗸

- They are not directly involved in the production of good and services, but act as a link between households , the business sector and other participants with surplus finds🗸🗸

- E.g. banks, insurance companies and pension funds🗸

MONEY MARKETS🗸

- In the money markets short term loans, and very short term funds are saved and borrowed by consumers and business enterprises 🗸🗸

- Products sold in the market are bank debentures, treasury bills and government bonds 🗸🗸

- The simplest form exists when parties make demand and short-term deposits and borrow on short term 🗸🗸

- The SARB is the key institution in the money market🗸🗸

CAPITAL MARKETS🗸

- In the capital markets long term funds are borrowed and saved by consumers and the business sector🗸🗸

- The Johannesburg Security Exchange (JSE) is a key institution in the capital 🗸🗸

- Products sold in this market are mortgage bonds and shares🗸🗸

FOREIGN EXCHANGE MARKETS🗸

- On the foreign exchange markets businesses buy/ sell foreign currency to pay for imported goods and services🗸🗸

- These transactions occur in banks and consists of electronic money transfers from one account to another🗸🗸

- The leading centres/ most important foreign exchange markets are in London, New York and Tokyo 🗸🗸

- e.g. traveller’s cheques to travel abroad🗸

- Flows of private and public goods and services are real flows and they are accompanied by counter flows of expenditure and taxes on the product market🗸🗸

- Factor services are real flows and they are accompanied by counter flows of income on the factor market🗸🗸

- Imports and exports are real flows and are accompanied by counter flows of expenditure and revenue on the foreign exchange market🗸🗸[Max 26]

- A change in investment of R 10m will result in a change in income of R 20m🗸🗸

- An increase in investment causes the expenditure function to shift upwards from C1 to C2 so that C1 is parallel to C2🗸🗸

- The effect of the increase in investment is that the total expenditure will increase from R 20m to R 30m🗸🗸

- The increase in the value of output (Y) is greater than the increase in the expenditure (E) 🗸🗸 (Explanation must comply with the figures supplied in the graphical presentation) [Max 4] [Max 10]

CONCLUSION The circular flow ensures continued interdependence and coordination of the economic activities in the economy / markets are critically important institutions in our economic system, because they regulate the supply and demand and safeguard price stability and general business confidence. 🗸🗸 [Any other relevant conclusion] [Max 2]

INTRODUCTION The new economic paradigm in terms of the smoothing of business cycles discourages monetary policy makers from using monetary and fiscal policies to fine tune the economy but rather encourages achieving stability through sound long term decisions relating to demand and supply in the economy/smoothing out the painful part of economic down-fall that is part of the market economy🗸🗸 (Accept other relevant definition/description of smoothing/new economic paradigm). [Max 2]

BODY: MAIN PART The new economic paradigm is embedded in the demand and supply side policies. 🗸🗸

Demand-side policies

- It focuses on aggregate demand in the economy🗸🗸

- When households, firms and the government spend more, demand in the economy increases. 🗸🗸

- This makes the economy grow but lead to inflation.🗸🗸

- Aggregate demand increases more quickly than aggregate supply and this causes price increases. 🗸🗸

- If the supply does not react to the increase in demand, prices will increase. 🗸🗸

- This will lead to inflation (a sustained and considerable in the general price level) 🗸🗸

Unemployment:

- Demand-side policies are effective in stimulating economic growth. 🗸🗸

- Economic growth can lead to an increase in demand for labour. 🗸🗸

- As a result more people will be employed and unemployment will increase. 🗸🗸

- As unemployment decreases inflation is likely to increase. 🗸🗸

- This relationship between unemployment and inflation is illustrated in the Phillips curve. 🗸🗸

- The PC curve shows the initial situation. A is the point of intersection of the PC curve with the x- axis. It shows the natural rate of unemployment, for instance 14%🗸🗸

- At point A inflation rate is zero. 🗸🗸

- If unemployment falls to C for instance, 8%, inflation caused by wage increases is at 6%.🗸🗸

- If unemployment increases from C to B to A, inflation falls from 6% to 2% to 0%.🗸🗸

Supply-side policies Reduction of costs 🗸

- Infrastructural services: reasonable charge and efficient transport, communication, water

- services and energy supply. 🗸🗸

- Administrative costs: these costs include inspection, reports on applications

- of various laws, regulations and by-laws, tax returns and returns providing statistical

- information.

- It adds to costs and businesses carry a heavy burden 🗸🗸

- Cash incentives: it includes subsidies for businesses to locate in neglected areas where unemployment is high and compensation to exporters for certain costs they

- incurred in development of export markets. 🗸🗸

Improving the efficiency of inputs 🗸

- Tax rates: low tax rates can serve as an incentive to workers. It will improve the productivity and output. 🗸🗸

- Capital consumption: replacing capital goods regularly creates opportunities for businesses to keep up with technological development and better outputs🗸🗸

- Human resource development: to improve the quality of manpower by improving health care, education and training. 🗸🗸

- Free advisory service: these promote opportunities to export. 🗸🗸

Improving the efficiency of markets 🗸

- Deregulation: removal of laws, regulations and by-laws and other forms of government controls makes the market free. 🗸🗸

- Competition: encourages the establishment of new businesses 🗸🗸

- Levelling the play field: private businesses cannot compete with public enterprises 🗸🗸 Answers must be in full sentences and well described with examples to be able to obtain 2 marks per fact. Learners should be awarded 1 mark per heading or sub-heading to a maximum of 8 marks. (8 x 1) (8) [Max 26]

Explanation: The above graph shows:

- Aggregate demand (AD) and aggregate supply (AS) are in equilibrium at point C. 🗸🗸

- If aggregate demand is stimulated so that it moves to AD1 and aggregate supply responds promptly and relocates at AS1; a larger real output becomes available without any price increases. 🗸🗸

- Supply is often sticky and fixed in the short term. 🗸🗸

- Therefore, if aggregate demand increases to AD1 and aggregate supply does not respond, intersection is at point F. Real production increases but so does the price, in other words, with more inflation. 🗸🗸

- The aggregate demand locates at any position to the left of AS1 inflation prevails. 🗸🗸

- The solution is to create conditions that ensure supply is more flexible. 🗸🗸

- If the cost of increasing production is completely flexible, a great real output can be supplied at any given price level. 🗸🗸 [Max 10]

CONCLUSION It is clear from the discussion above that it is critically important to manage the aggregate supply and demand to ensure stability in the economy. 🗸🗸 [Accept any relevant higher order conclusion] [Max 2]

INTRODUCTION Accurate prediction is not possible in Economics. The best the economists can do is to try and forecast what might happen. There are a number of techniques available to help economists to forecast business cycles, e.g. economic indicators 🗸🗸 OR Successive periods of contraction and expansion of economic activities 🗸🗸 [Accept any other relevant introduction] [Max 2]

BODY: MAIN PART Business cycle indicators Leading economic indicators 🗸

- These are indicators that change before the economy changes / coincide with the reference turning point 🗸🗸

- They give consumers, business leaders and policy makers a glimpse (advance warnings) of where the economy might be heading. 🗸🗸

- Peak before a peak in aggregate economic activity is reached.

- Most important type of indicator in helping economists to predict what the economy will be like in the future 🗸🗸

- When these indicators rise, the level of economic activities will also rise in a few months' time/an upswing 🗸🗸

- E.g. job advertising space/inventory/sales ratio🗸

Coincident economic indicators🗸

- They move at the same time as the economy / if the turning point of a specific time series variable coincides with the reference turning point🗸🗸

- It indicates the actual state of the economy🗸🗸

- E.g. value of retail sales. 🗸

- If the business cycle reaches a peak and then begins to decline, the value of retail sales will reach a peak and then begin to decline at same time🗸🗸

Lagging economic indicators🗸

- They do not change direction until after the business cycle has changed its direction🗸🗸

- They serve to confirm the behaviour of co-incident indicators🗸🗸

- E.g. the value of wholesalers' sales of machinery🗸

- If the business cycle reaches a peak and begins to decline, we are able to predict the value of new machinery sold🗸🗸

Composite indicator🗸

- It is a summary of the various indicators of the same type into a single value🗸🗸

- Their values are consolidated into a single value , if this is done we find a value of a composite leading , coincident and lagging indicator🗸🗸 Accept ONE example from the table below:

- This is the time that it takes for a business cycle to move through one complete cycle (measured from peak to peak) 🗸🗸

- It is useful to know the length because the length tends to remain relatively constant over time.🗸🗸

- If a business cycle has the length of 10 years it can be predicted that 10 years will pass between successive peaks or troughs in the economy. 🗸🗸

- Longer cycles show strength. 🗸🗸

- Cycles can overshoot. 🗸🗸

Ways to measure lengths:

- Crisis to crisis 🗸🗸

- Historical records 🗸🗸

- Consensus on businesses experience 🗸🗸

Amplitude 🗸

- It is the difference between the total output between a peak and a trough. 🗸🗸

- It measures the distance of the oscillation of a variable from the trend line / It is the intensity (height) of the upswing and downswing (contraction and expansion) in economic activity 🗸🗸

- A large amplitude during an upswing indicates strong underlying forces – which result in longer cycles 🗸🗸

- The larger the amplitude the more extreme the changes that may occur / extent of change 🗸🗸

- E.g. During the upswing inflation may increase from 5% to 10%. (100% increase) 🗸🗸

- A trend is the movement of the economy in a general direction. 🗸🗸

- It usually has a positive slope because the production capacity of the economy increases over time 🗸🗸

- Also known as the long term growth potential of the economy. 🗸🗸

- The diagram above illustrates an economy which is growing – thus an upward trend (positive slope) 🗸🗸

- Trends are useful because they indicate the general direction in which the economy is moving – it indicates the rate of increase or decrease in the level of output🗸🗸

Extrapolation 🗸

- Forecasters use past data e.g. trends and by assuming that this trend will continue, they make predictions about the future🗸🗸

- Means to estimate something unknown from facts or information that are known 🗸🗸

- if it becomes clear that the business cycle has passed through a trough and has entered a boom phase, forecasters might predict that the economy will grow in the months that follow 🗸🗸

- It is also used to make economic predictions in other settings e.g. prediction of future share prices🗸🗸

Moving average 🗸

- It is a statistical analytical tool that is used to analyse the changes that occur in a series of data over a certain period of time / repeatedly calculating a series of different average values along a time series to produce a smooth curve 🗸🗸

- The moving average could be calculated for the past three months in order to smooth out any minor fluctuations 🗸🗸

- It is calculated to iron out (minimize) small fluctuations and reveal long-term trends in the business cycle🗸🗸 Answers must be in full sentences and well described with examples to be able to obtain 2 marks per fact. Learners should be awarded 1 mark per 8 headings and examples. [8 x 1=8] [Max 26]

BODY: ADDITIONAL PART

- An expansionary monetary policy is implemented when the economy is in recession in order to stimulate economic activities. 🗸🗸

- Interest rates can be reduced to encourage spending. 🗸🗸

- Households and firms can borrow more and spend more. 🗸🗸

- The increased spending increases the level of economic activity. 🗸🗸

- Investment will increase and more factors of production will be employed. 🗸🗸

- Higher levels of production, income and expenditure will be achieved. 🗸🗸

- If the supply of goods and services does not increase in line with an increase in demand, inflation will increase. 🗸🗸

- Inflation can be curbed by reducing money supply and availability of credit. 🗸🗸

- To dampen demand at the peak the government will be able to reduce the money supply by increasing interest rates. 🗸🗸

- Selling government bonds and securities (open market transactions) and reduce the supply of money in circulation. 🗸🗸

- Increase the cash reserve requirements to manipulate money creation activities of banks. 🗸🗸

- Persuade banks to decrease lending (moral suasion) 🗸🗸

- To devaluate the exchange rate (exchange rate policy) 🗸🗸 [Max 10]

CONCLUSION It remain clear that business cycles must be clearly monitored through the indicators available, policy makers must act quickly by using monetary and fiscal instruments in order to prevent instability in the economy. 🗸🗸 [Accept any other relevant conclusion] [Max 2]

INTRODUCTION: The government provides goods and services that are under supplied by the market and therefore plays a major role in regulating economic activity and guiding and shaping the economy. 🗸🗸 [Max 2]

BODY: MAIN PART Objectives:

Economic growth 🗸

- Refer to an increase in the production of goods and services 🗸🗸

- Measured in terms of Real GDP 🗸🗸

- For economic growth to occur, the economic growth rate must be higher than Population growth 🗸🗸

- Growth and development in a country benefit its citizens because it often leads to a higher standard of living 🗸🗸

Full employment 🗸

- It is when all the people who want to work, who are looking for a job must be able to get a job 🗸🗸

- High levels of employment is the most important economic objective of the government 🗸🗸

- The unemployment rate increased over the past few years 🗸🗸

- Informal sector activities must be promoted because it is an area where employment increase 🗸🗸

Exchange rate stability 🗸

- The economy must be manage effectively and effective Fiscal and monetary policy must be used to keep the exchange rate relatively stable 🗸🗸

- Depreciation and Appreciation of the currency create uncertainties for producers and traders and should be limited. These uncertainties must be limited 🗸🗸

- The SARB changed the Exchange rate from a Managed floating to a free floating exchange rate 🗸🗸

Price stability 🗸

- Stable price causes better results in terms of job creation and economic growth 🗸🗸

- The SARB inflation target is 3% - 6% and they are successful in keeping inflation within this target 🗸🗸

- Interest Rates, based on the Repo Rate are the main instruments used in the stabilisation policy 🗸🗸

- The stable budget deficit also has a stabilizing effect on the inflation rate 🗸🗸

Economic equity 🗸

- Redistribution of income and wealth is essential 🗸🗸

- South Africa uses a progressive income tax system – taxation on profits, taxation on wealth, capital gains tax and taxation on spending, are used to finance free services 🗸🗸

- Free social services are basic education; primary health and to finance basic economic services 🗸🗸

- E.g. Cash Grant to the poor, e.g. child grants and cash grants to vulnerable people, e.g. disability grants 🗸

- Progressive taxation means that the higher income earners pay higher/more taxation 🗸🗸 [Max 26]

- Learner responses can be positive or negative.

- Follow the argument and see if the learner can produce enough evidence to support his/her answer.

Economic Growth:

- SA targets 4–5% economic growth. Previously SA had a 5% growth rate 🗸🗸

- In recent years the growth rate decreased steadily (presently below 3%) 🗸🗸

Full Employment:

- Compared to foreign countries unemployment is very high. (Expanded – over 30%) 🗸🗸

- Efforts by SA government to reduce these figures includes the GEAR strategy, focus on small business enterprises, Public Works Programme 🗸🗸

Exchange rate stability:

- SA now operates on a free floating exchange rate system in line with international benchmarks 🗸🗸

- Unfortunately our currency has lost its value, with a general trend of depreciation over the last few years 🗸🗸

Price stability:

- For the past few years South Africa has managed to remain within the 3–6% target 🗸🗸

- The current increase in the repo rate has put constraints on the inflation rate 🗸🗸

Economic equity:

- Economic equity has improved (BEE, affirmative action, gender equity) and led to an improvement in economic equity 🗸🗸 [Any 5 x 2] [Max 10]

CONCLUSION: While some successes have been achieved by government, the fulfilling of some of the objectives are compromised by factors like lack of accountability, corruption, budgeting, nepotism and incompetence. 🗸🗸 [Any relevant conclusion] [Max 2]

INTRODUCTION The government responds to market failures by establishing and maintaining state owned enterprises to provide public goods and services 🗸🗸 [Any other relevant introduction] [Max 2]

BODY: MAIN PART

- It is required to give an explanation of one's decisions, actions and expenditures over a period of time 🗸🗸

- There are mechanisms for evaluating government's economic and financial performance 🗸🗸

- That the desired quantities and quality of goods and services for which taxes are raised are delivered 🗸🗸

- That monopolies, corruption, nepotism, incompetence and apathy does not occur 🗸🗸

- Two important elements of accountability is participation and transparency🗸🗸

- Ministerial responsibilities, i.e. the ministers of government departments are responsible for decisions and actions and expenditures 🗸🗸

- Parliamentary questioning arises and members of the government departments have to respond 🗸🗸

- The national treasury is responsible for treasury control 🗸🗸

- The auditor-general reports annually in writing on each government department🗸🗸

- Public goods are efficiently provided if Pareto efficiency is achieved 🗸🗸

- That is if resources are allocated in such a way that no one can be made better off without making someone else worse off 🗸🗸

- Bureaucracy the official rules and procedures. 🗸🗸/insensitivity to the needs of their clients 🗸🗸

- Incompetence- the lack of skill or ability to do a task successfully🗸🗸/May have improper qualifications/or an attitude of apathy 🗸🗸

- Corruption- the exploitation of a person's position for private gain /taking bribes, committing fraud, nepotism 🗸🗸

- State-owned enterprises do not operate according to the forces of supply and demand 🗸🗸

- It becomes thus very difficult for state-owned enterprises to assess needs and they are thus prone to under- or over-supplying public goods and services 🗸🗸

- The census and other household surveys as well as local government structures provide this type of information 🗸🗸

- Since resources are scarce, government must then decide which needs and whose needs are to be satisfied 🗸🗸

- In the private sector houses are built according to the price that people are able and willing to pay 🗸🗸

- In the public sector housing is regarded as a social responsibility and authorities supply them according to the needs of people 🗸🗸

- In a market economy prices are determined by supply and demand 🗸🗸

- The objectives of firms are to maximise their profits and they usually set prices to achieve this objective 🗸🗸

- Government does not pursue the profit maximisation objective 🗸🗸

- Government takes into account certain social, economic, political and environmental conditions as well as public opinion 🗸🗸

- Free-of-charge services- this is met from taxes 🗸🗸 and applies to most community goods and collective goods 🗸🗸 (e.g.) defence, police whereby charges and toll fees are levied 🗸

- User-charges 🗸 option to charge depends on technical reasons 🗸🗸 (e.g.) cost of providing a double lane road could be recovered by toll charges 🗸 Economic reasons 🗸 such as services like water and electricity 🗸 that have a zero price 🗸 political reasons 🗸 where income distribution is significantly unequal, administrative rationing according to need takes place 🗸🗸 (e.g.) public health and education 🗸

- Direct and indirect subsidies direct subsidies are used to cover part of the costs 🗸🗸 (e.g.) urban bus service 🗸 and an indirect subsidy is used to write off accumulated losses or deficits 🗸🗸

- Standing charges -called availability charges 🗸🗸 (e.g.) water and electricity 🗸 standing charges goes to meet fixed costs and the price per unit consumed covers variable costs 🗸🗸

- Price discrimination - different users have different elastic ties of demand for a good 🗸🗸 (e.g.) commercial and manufacturing businesses pay higher rates than households and they pay on a sliding scale🗸🗸

- State-owned enterprises that either render a service or when an existing enterprise is nationalised 🗸🗸

- They focus on making a profit and maximizing cost at the expense of the needs of some groups 🗸🗸 (e.g.) Iscor 🗸 SABC, 🗸SAA, Spoornet 🗸

- refers to the process whereby state-owned enterprises and state-owned assets are handed over or sold to private individuals 🗸🗸

- cost of maintaining and managing state-owned enterprises are high which can lead to higher taxes and larger public debt 🗸🗸

- State-owned enterprises are not run as efficiently as private enterprises 🗸🗸

- Nationalisation is the process whereby the state takes control and ownership of privately owned assets and private enterprises 🗸🗸

- It includes contracting of services, public-private partnerships, increasing competitiveness🗸🗸 [Max 26]

ADDITIONAL PART Possible problems in your community or elsewhere

- Lack of drinking water due to burst pipes 🗸🗸

- Lack of electricity due to lack of infrastructure (load shedding) 🗸🗸

- Lack of schooling – no buildings available – lack of maintenance 🗸🗸

- Lack of health services due to lack of staff, infrastructure, strikes 🗸🗸

- Lack of adequate housing (RDP) 🗸🗸 [Max 10 marks - List of examples max 5 marks] [Accept any other relevant answer]

CONCLUSION If the above problems are not dealt with timeously by government, government will continue to fail its people in terms of service delivery, seeing many protests occurring regularly 🗸🗸 [Any other relevant higher order conclusion] [Max 2]

INTRODUCTION International trade can be defined as the exchange of goods and services between countries globally. 🗸🗸 These trade agreements are negotiated by protocols and agreement due to the uneven distribution of natural resources globally. 🗸🗸

BODY-MAIN PART The main reasons for international trade.

Demand reasons The size of the population impacts demand.

- If there is an increase in population growth, it causes an increase in demand, as more people’s needs must be satisfied. 🗸🗸

- Local suppliers may not be able to satisfy this demand. 🗸🗸

The population’s income levels effect demand.

- Changes in income cause a change in the demand for goods and services. 🗸🗸 • An increase in the per capita income of people in more disposable income that can be spent on local goods and services, some of which may then have to be imported. 🗸🗸

An increase in the wealth of the population leads to greater demand for goods.

- People have access to loans and can spend more on luxury goods, many of which are produced in other countries. 🗸🗸

Preferences and tastes can play a part in the determining of prices,

- E.g. customers in Australia have a preference for a specific product which they do not produce and need to import and it will have a higher value than in other countries. 🗸🗸

The difference in consumption patterns is determined

- By the level of economic development in the country, e.g. a poorly developed country will have a high demand for basic goods and services but a lower demand for luxury goods. 🗸🗸

Supply reasons Natural resources are not evenly distributed

- Across all countries of the world. 🗸🗸

- They vary from country to country and can only be exploited in places where these resources exist. 🗸🗸

Climatic conditions

- Make it possible for some countries to produce certain goods at a lower price than other countries, e.g. Brazil is the biggest producer of coffee. 🗸🗸

Labour resources

- Differ in quantity, quality and cost between countries. 🗸🗸

- Some countries have highly skilled, well-paid workers with high productivity levels, e.g. Switzerland. 🗸🗸

Technological resources

- Are available in some countries that enable them to produce certain goods and services at a low unit cost, e.g. Japan. 🗸🗸

Specialisation in the production

- Certain goods and services allows some countries to produce them at a lower cost than others, e.g. Japan produces electronic goods and sells these at a lower price. 🗸🗸

Capital allows developed countries

- Enjoy an advantage over underdeveloped countries. 🗸🗸

- Due to a lack of capital, some countries cannot produce all the goods they require themselves. 🗸🗸

ADDITIONAL PART

- Buying and selling goods and services from other countries: 🗸🗸

- The purchase of goods and services from abroad that leads to an outflow of currency from SA- Imports (M). 🗸🗸

- The of goods and services to buyers from other countries leading to an inflow of currency to SA – Exports (X) 🗸🗸

- Different factor endowments mean some countries can produce goods and services more efficiently than others- specialisation is therefore possible: 🗸🗸

Absolute Advantage:

- Where one country can produce goods with fewer resources than other. 🗸🗸

Comparative Advantage:

- Where one country can produce goods at a lower opportunity cost it sacrifices less resources in production. 🗸🗸

CONCLUSION International trade is important of countries to survive economically, as barriers to trade would disadvantage all countries, due to their interdependency globally. 🗸🗸 [Any other relevant higher order conclusion] [Max 2]

ECONOMIC PURSUITS-PAPER 1

Discuss in detail export promotion (Protectionism and Free Trade)

INTRODUCTION Export promotion refers to measures taken by governments increase production of goods and services that can be exported. The government provides incentives to encourage production 🗸🗸 [Max 2]

BODY: MAIN PART REASONS:

- Export promotion measures lower cost of production which makes it easier to compete on the international market 🗸🗸

- Achieve significant export-led economic growth🗸🗸

- Export enlarges production capacity of country because more and larger manufacturing industries are established. 🗸🗸

- The first step to export-led economic growth is to implement policies that encourage the establishment of industries to produce goods and services for export markets🗸🗸

METHODS: Exports are promoted through: Incentives🗸

- Export incentives include information on export markets, research with regard to new markets, concessions on transport charges, export credit and export credit guarantees and publicity commending successful exporters🗸🗸

- This will encourage manufacturers to export an increased volume of their production🗸🗸

- Trade missions help to market SA products abroad🗸🗸and supply SA companies with information about potential markets 🗸🗸

Direct Subsidies🗸

- Described as direct because it involves government expenditure. 🗸🗸

- Include cash payments to exporters, refunds on import tariffs and employment subsidies.

- The aim is to increase the competitiveness of exporting company🗸🗸 reduce cost of production🗸🗸and explore and establish overseas markets🗸🗸

Indirect subsidies

- Regarded as indirect because it results in the government receiving less revenue🗸🗸 e.g. general tax rebates,

- Tax concessions on profits earned from exports or on capital invested to produce export goods, refunding

- Of certain taxes e.g. custom duties on imported goods used in the manufacturing process🗸🗸

- Allows companies to lower their prices and enables them to compete in international markets🗸🗸

- Challenge for governments to design incentives and subsidies in such a way that prices of export goods can't be viewed as dumping prices🗸🗸

Trade neutrality 🗸

- Can be achieved if incentives in favour of export production are introduced

- Up to point that neutralises the impact of protectionist measures in place🗸🗸

- E.g. subsidies equal to magnitude of import duties can be paid🗸

Export processing zones (EPZs) 🗸

- Is free-trade enclave within a protected area –

- Is fenced and controlled industrial park that falls outside

- Domestic customs area, and usually located near harbour or airport 🗸🗸 NOTE : For the response with regard to the effectiveness of export promotion methods, a maximum of 5 marks can be allocated.

- No limitations on size and scale since world market is very large🗸🗸

- Cost and efficiency of production based on this and organised along lines of comparative advantage🗸🗸

- Increased domestic production will expand exports to permit more imports and may result in backward linkage effects that stimulate domestic production in related industries🗸🗸

- Exchange rates are realistic and there is no need for exchange control and quantitative restrictions🗸🗸

- Value can be added to natural resources of the country 🗸🗸

- Creates employment opportunities 🗸🗸

- Increase in exports has positive effect on balance of payments 🗸🗸

- Increase in production leads to lower domestic prices, which benefit local consumers🗸🗸

DISADVANTAGES

- Real cost of production 🗸 subsidies and incentives reduce total cost of production which must be met from sales🗸🗸 real cost is thus concealed by subsidies🗸🗸products cannot compete in open market 🗸🗸

- Lack of competition 🗸 businesses charge prices that are so low that they force competitors out of the market 🗸🗸

- Increased tariffs and quotas 🗸can be against spirit of provisions of WTO🗸🗸overseas competitors retaliate with tariffs and quotas🗸🗸 goods are sold domestically below their real cost of production (export subsidies and dumping) 🗸🗸

- Protection of labour-intensive industries 🗸 developed countries maintain high levels of effective protection for their industries that produce labour-intensive goods in which developing countries already have or can achieve comparative advantage 🗸🗸

- Withdrawal of incentives often leads to closure of effected companies. 🗸🗸

- Incentives often lead to inefficiencies in the production process, since companies don't have to do their best to compete🗸🗸

- Can be seen as dumping 🗸🗸 [Max 26]

BODY: ADDITIONAL PART How successful is South Africa in protecting the local textile industry against foreign competition?

- Not successful: 🗸 Many domestic textile manufacturers closed down due to unfair international competition 🗸🗸 Many wholesalers make use of suppliers from abroad 🗸🗸 e.g. Woolworths/Walmart🗸

- Dumping still occurs – European manufacturers still dump clothing in Africa out of season at prices below cost 🗸🗸 Job losses due to a lack of protection in this industry 🗸🗸 [Accept any motivation relating to success indicators] [Max 10]

CONCLUSION South Africa's international trade policy facilitates globalisation thereby impacting positively on the balance of payment. 🗸🗸 [Accept any other relevant conclusion] [Max 2]

INTRODUCTION Protectionism refers to a deliberate policy on the part of the government to erect trade barriers, such as tariffs and quotas, in order to protect domestic industries against international competition. 🗸🗸 [Accept any other relevant definition] [Max 2]

BODY-MAIN PART Raising revenue for the government

- Import tariffs raise revenue for the government. 🗸🗸

- In smaller countries the tax base is often small due to low incomes of individuals and businesses. 🗸🗸

- Low incomes do not provide much in the form of income taxes and therefore custom duties on imports is a significant source of income or revenue. 🗸🗸

Protecting the whole industrial base

- Maintaining domestic employment. 🗸🗸

- Countries with high unemployment are continuously pressured to stimulate employment creation and therefore resort to protectionism in order to stimulate industrialisation. 🗸🗸

- It is thought that using protectionism the country’s citizens would purchase more domestic products and raise domestic employment. 🗸🗸

- These measures on domestic employment creation at the expense of other countries, led to such measures as “beggar-my-neighbour” policies. 🗸🗸

- Applying import policies is likely to reduce other countries ability to buy country’s exports and may provoke retaliation. 🗸🗸

Protecting workers

- It is argued that imports from other countries with relatively low wages represent unfair competition and threaten the standard of living of the more highly paid workers of the local industries. 🗸🗸

- Local industries would therefore be unable to compete because of higher wages pushing up the price levels of goods. 🗸🗸

- Protection is thus necessary to prevent local wage levels from falling or even to prevent local businesses from closing down due to becoming unprofitable. 🗸🗸

- Competition from low-wage countries may also reflect the fact that those countries have a comparative advantage in low-skilled labour-intensive industries. 🗸🗸

Diversifying the industrial base

- Overtime countries need to develop diversified industries to prevent overspecialisation. 🗸🗸

- A country relying too heavily on the export of one or a few products is very vulnerable. 🗸🗸

- If a developing country’s employment and income is dependent on only one or two industries, there is the risk that world fluctuations in prices and demand and supply-side problems could results in significant fluctuations in domestic economic activity. 🗸🗸

- Import restrictions may be imposed on a range of products in order to ensure that a number of domestic industries develop. 🗸🗸

Develop strategic industries

- Some industries such as the iron-ore and steel, agriculture, (basic foodstuffs, such as maize), energy (fuels) and electronics (communication) among others, are regarded as strategic industries. 🗸🗸

- Developing countries may feel that they need to develop these industries in order to become self-sufficient . 🗸🗸

Protecting specific industries Dumping

- Foreign industries may engage in dumping because government subsidies permit them to sell at very low prices or because they are seeking to raise profits through price discrimination. 🗸🗸

- The reason for selling products at lower prices may be to dispose of accumulate stocks Of the goods and as a result consumers in the importing country stand to benefit however,

- Their long term objective may be to drive out domestic producers and gain control of the market and consumers

- Are likely to lose out in the reduction in choice and higher prices that the exporters will be able to charge. 🗸🗸

Infant industries

- Usually newly established and find it difficult to survive due to their average costs being higher than that of their well-established foreign competitors. 🗸🗸

- However, if they are given protection in their early years they may be able to grow and Thereby take advantage lower their average costs and become competitive and at this point protection can be removed. 🗸🗸

Declining industries/sunset industries

- Structural changes in the demand and supply of a good may severely hit an industry such industries should be permitted to go out of business gradually declining industries

- Are likely to be industries that no longer have a comparative advantage and however, if they go out of business quickly there may be a sudden and large increase in unemployment. 🗸🗸

- Protection may enable an industry to decline gradually thereby allowing time for resources including labour to move to other industries. 🗸🗸

- Protecting domestic standards domestic regulations of food safety human rights and environmental standards have been increasingly acting as trade restrictions. 🗸🗸 [Accept any other relevant fact] [Max 26]

ADDITIONAL PART South Africa promotes exports through subsidies

Direct Subsidies

- Strict screening measures should be put in place when companies apply for financial assistance. Government expenditure can provide direct financial support to domestic producers for their exports e.g. 🗸🗸

- Cash grants offered to South African exhibitors to exhibit their products at exhibitions overseas. To explore new markets. 🗸🗸

- Foreign trade missions to explore new markets imposition of tariffs on imports. 🗸🗸

- Funds for the formation of formal export councils. 🗸🗸

- Subsidies for training or employing personnel. 🗸🗸

- Funds for the export market research. 🗸🗸

- Product registration and foreign patent registrations. 🗸🗸

- Government can refund companies certain taxes to promote exports.

- These types of indirect subsidies are:

- General tax rebates (Part of the cost of production can be subtracted from the tax that has been paid) 🗸🗸

- Tax concessions on profits earned from exports or on capital invested to produce export goods. 🗸🗸

- Refunds on import tariffs in the manufacturing process of exported goods companies often use custom duties are paid on these goods and the government refunds them. 🗸🗸 [Max 10]

CONCLUSION Most countries agree that protectionism is harmful to the economy if not well managed. Protectionism is needed especially where industries are young and need expansion or development. 🗸🗸 [Any other relevant higher order conclusion] [Max 2]

INTRODUCTION Economic growth is responsible for the overall growth of the economy, in order to enhance the well being of the economy as a whole. Whereas economic development would focus on the individual well being of the citizens of a country. [Any other relevant higher order conclusion] [Max 2]

BODY-MAIN PART Growth and Development A demand-side approach includes discretionary changes in monetary and fiscal policies with the aim of changing the level of aggregate demand. 🗸🗸

Monetary policy

- Is driven by the South African Reserve Bank (SARB). 🗸🗸

- It aims to stabilise prices by managing inflation. 🗸🗸

Fiscal policy

- Is driven by the Department of Finance. 🗸🗸

- It aims to facilitate government, political and economic objectives. 🗸🗸

- A demand-side approach to economic growth and development does not only depend on fiscal and monetary policy. 🗸🗸

- It is dependent on all components of aggregate demand, that is, C, I, X and G. 🗸🗸

South African approach

- The South African approach uses both monetary and fiscal measures to influence aggregate demand in the economy. 🗸🗸

- The South African Reserve Bank (SARB) as the central bank in South Africa formulates the monetary policy. 🗸🗸

- They use the following instruments:

Interest rate changes

- It is used to influence credit creation by making credit more expensive or cheaper. 🗸🗸

- The exchange rate is stabilised by encouraging inflow or outflows. 🗸🗸

Open market transactions

- To restrict credit the SARB sells securities. When banks buy these securities money flows from banks to the SARB. 🗸🗸

- The banks have less money to lend and cannot extend as much credit as before. 🗸🗸

- To encourage credit creation the SARB buys securities. Money flows into the banking system.🗸🗸

Moral suasion

- The SARB consults with banks to act in a responsible manner based on the prevailing economic conditions. 🗸🗸

Cash Reserve Requirements

- Banks are required to hold a certain minimum cash reserve in the central bank. 🗸🗸

- Banks have a limited amount to give out as credit. 🗸🗸

- South Africa’s fiscal policy is put into practice through the budgetary process. 🗸🗸

- The main purpose of fiscal policy is to stimulate macroeconomic growth and employment, and ensure redistribution of wealth. 🗸🗸

- The following instruments are used:

Progressive personal income tax

- Higher income earners are taxed at higher tax rates. 🗸🗸

- These taxes are used to finance social development. 🗸🗸

- The poor benefit more than those with higher incomes. 🗸🗸

Wealth taxes

- Properties are levied (taxed) according to their market values. 🗸🗸

- Transfer duties are paid when properties are bought. 🗸🗸

- Securities (shares and bonds) are taxed when traded. 🗸🗸

- Capital gains tax is levied on gains on the sale of capital goods (e.g. properties, shares). 🗸🗸

- Estate duties are paid on the estates of the deceased. 🗸🗸

- These taxes are used to finance development expenditures which benefit the poor more often. 🗸🗸

Cash benefits

- Old age pensions, disability grants, child support and unemployment insurance are cash grants. These are also known as social security payments. 🗸🗸

- Benefits in kind (natura benefits) 🗸🗸

- These include the provision of healthcare, education, school meals, protection etc. 🗸🗸

- When user fees are charged, poor or low income earners pay less or nothing. 🗸🗸

- Limited quantities of free electricity and water are provided. 🗸🗸

Other redistribution

- Public works programmes, e.g. the Strategic Integrated Projects (SIP) provides employment subsidies and other cash and financial benefits such as training, financing and export incentives.🗸🗸

Land restitution and land redistribution

- Land restitution is the return of land to those that have lost it due to discriminatory laws in the past. 🗸🗸

- Land redistribution focuses on land for residential (town) and production (farm) for previously disadvantaged groups. 🗸🗸

- The money for these programmes is provided in the main budget. 🗸🗸

Subsidies on properties

- It helps people to acquire ownership of fixed residential properties. 🗸🗸

- E.g. government’s housing subsidy scheme provides funding to all people earning less than R3 500 per month🗸🗸

CONCLUSION The demand-side approach focuses on the expansion of the demand for goods and services produced in the economy. 🗸🗸 OR To ensure economic growth, there should be an adequate and growing demand for goods and services produced in the economy. 🗸🗸

[Any other relevant higher order conclusion] [Max 2]

INTRODUCTION Different growth and development strategies have been implemented in South Africa since 1994, each aimed at addressing particular needs at the time of introduction. 🗸🗸 [Any other relevant introduction] [Max 2]

BODY-MAIN PART The Reconstruction and Development Programme (RDP)

- The RDP was an integrated, coherent socio-economic policy framework that was implemented directly after our first democratic elections in 1994. 🗸🗸

- It seeked to mobilise all our people and our country’s resources toward the final eradication of apartheid and the building of a democratic, non-racial and non-sexist future. 🗸🗸

The RDP was based on six principles.

- an integrated and sustainable programme. 🗸🗸

- a people-driven process focusing on the needs of the population. 🗸🗸

- peace and security for all, aimed at a non-violent society that respects all human rights. 🗸🗸

- nation-building, focusing on the needs of all members of society. 🗸🗸

- linking reconstruction and development. 🗸🗸

- The RDP consisted of many proposals, strategies and policy programmes.

- All of these could, however be grouped into five major policy programmes that were linked to each other.

The five key programmes were:

- meeting basic needs. 🗸🗸

- developing our human resources. 🗸🗸

- building the economy. 🗸🗸

- democratising the state and society. 🗸🗸

- implementing the RDP. 🗸🗸

The Growth, Employment and Redistribution Programme (GEAR)

- The GEAR built upon the strategic vision set out in the RDP, i.e. 🗸🗸

- The importance of all the objectives of the RDP was reaffirmed but it recognized the implementation and macroeconomic problems that the government had been experiencing in implementing the RDP. 🗸🗸

- The RDP placed much more emphasis on disciplined economic policy. 🗸🗸

- While still recognizing that there were very serious needs that had to be addressed. 🗸🗸

The Accelerated and Shared Growth Initiative for South Africa Programme (AsgiSA).

- AsgiSA resulted from government’s commitment to halve unemployment and poverty by 2014. 🗸🗸

- The Joint Initiative on Priority Skills Acquisition (Jipsa) was established to address the scarce and critical skills needed to meet AsgiSA’s objectives. 🗸🗸

AsgiSA identified six important factors that prevented growth:

- the relative volatility of the currency. 🗸🗸

- the cost, efficiency and capacity of the national logistics system. 🗸🗸

- shortages of suitably skilled labour, and the spatial distortions of apartheid affecting low-skilled labour costs. 🗸🗸

- barriers to entry, limits to competition and limited new investment opportunities. 🗸🗸

- the regulatory environment and the burden on small and medium enterprises (SME’s). 🗸🗸

- AsgiSA was not intended to be a government programme. 🗸🗸

- But rather a national initiative supported by all the key groups in the economy. 🗸🗸

- Namely business, labour, entrepreneurs and government and semi-government departments and institutions. 🗸🗸

Joint Initiative on Priority Skills Acquisitions (JIPSA)

- It is the skills development arm of ASGISA. Focus is on skills development, especially through the SETAS. 🗸🗸

Expanded Public Works Programme (EPWP)

- It is a nationwide government intervention to create employment using labour-intensive methods, and to give people skills they can use to find jobs when their work in the EPWP is done. 🗸🗸

The New Growth Path (NGP)

- The New Growth Path (NGP) was released in November 2011. 🗸🗸

- This plan is designed to serve as a framework for economic policy, and to be the driver of the country’s job strategy. 🗸🗸