01892 807 001

- May 10, 2021

- News and Updates

Depreciation – Why Is It Important For Your Business

As business owners, we often overlook one important aspect in the industry – depreciation. Calculating it looks really complicated but getting it right and knowing its importance has benefits in your business.

DEPRECIATION

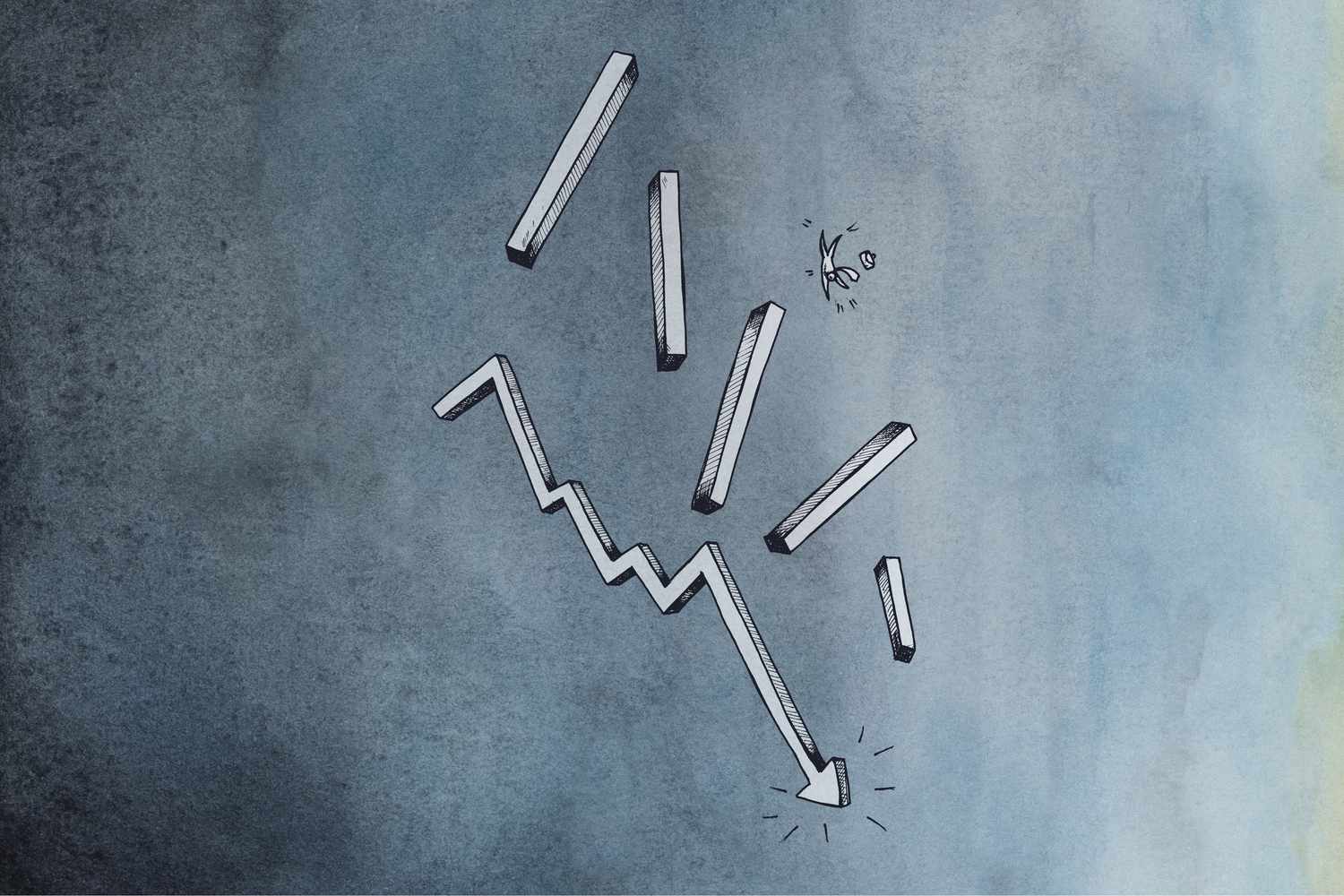

Depreciation is when a business asset loses value over time. Your work computer eventually and gradually depreciates from its original price with time. You might not see it now but doing business means considering the ins and outs of depreciations.

3 REASONS WHY DEPRECIATION IS VERY IMPORTANT IN YOUR BUSINESS

1. It is an expense

- Depreciation accounting entails how much value your business assets lose every year. This value must be recorded in your P&L report and is considered as a loss and must be subtracted from your revenue. By doing this so, you’ll be able to see how much money you really are making and you won’t be underestimating your costs.

2. Recovers the cost of an asset purchased over time

- Depreciation is a business cost so the process allows for companies to cover the total cost of an asset over its lifespan instead of immediately recovering the purchase cost which would see one large cost and lower profits. This could impact credit rating, investment or dividends you can take out.

- Businesses claim the cost of assets using the capital allowance that can be applied when asset purchased (and annually if needed) against the corporation tax. If you don’t list down your business assets’ depreciation, you’ll end up paying too much tax. And we don’t want that.

3. It affects the value of your business

- Over time, your assets lose value, and so can your business. Inaccurate tracking of these assets could lead to overestimating your business value and making it more difficult to secure finance.

METHODS OF CALCULATING DEPRECIATION

Your asset’s value will decline over it’s lifespan. You have to decide how. Will it lose most of its value early or will it lose value at the same rate every year? There are different methods of calculating depreciation. The most common are:

Straight Line Depreciation

- This method, the asset depreciates the same amount every year until it reaches zero value. A business asset projected to last five years would depreciate by one-fifth of its price yearly.

Reducing Balance Depreciation

- Under this method, an asset loses a certain percentage of its value each year.

- The actual amount being depreciated steadily slows down with time.

Units of Production Depreciation

- The lifespan of some business assets is measured by the work they do rather than the time they serve. A good example for this is a vehicle might travel more certain number of kilometers when purchased and slows down over time. You could depreciate business assets like this based on usage rather than age.

As business owners and for small businesses, calculating depreciation can be overwhelming but keep in mind that these can lower your costs reported as it smooths asset purchases over time and help you track your business value so it’s worth to compute your business assets’ depreciation. If you are not sure where to start or how to go about this, get help from us. Contact us today and we’ll help you with this. You may contact us through 01892 807 001 or email us at [email protected].

Similar Posts

Webinar Update of New Government Support for Business

Webinar update on UK Government Support in Lockdown #2

Starting up your small business – How to Benefit from Your Competition

- Previous Post Bookkeeping for small business – How to do it and why is it important --> Thursday, 15 April 2021

- Next Post Building your most valuable asset – your team --> Wednesday, 2 June 2021

- ACMA | ACCA | CGMA | AMCT

- Social Networks:

© 2024 Naylor Accountancy | Company No: 07872310 | All rights reserved | Website by hdcreate.uk

© 2024 Naylor Accountancy. All rights reserved.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

What Is Depreciation? Definition, Types, How to Calculate

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Depreciation gives you a way to correlate the cost of an asset with its usefulness, or ability to produce revenue, year over year.

Distributing an asset’s cost over its lifespan, instead of recognizing the entire cost at once, gives you a more accurate view of the asset’s value and your business’s profit at the end of the year. It can also have tax benefits.

There are four main depreciation methods: straight-line, units of production, double declining balance and sum of the years’ digits.

If you’re not sure which depreciation method to use for each of your assets, your accountant can be a great resource.

Depreciation is an accounting method that spreads the cost of an asset over its expected useful life to give you a more accurate view of its value and your business’s profitability. As opposed to recording the entire cost of an asset as soon as it’s bought, businesses record depreciation as a periodic expense on the income statement. How much value an asset loses year-over-year depends on which depreciation method your business uses: straight-line, units of production, double declining balance or sum of the years' digits.

Businesses have some control over how they depreciate their assets over time. Good small-business accounting software lets you record depreciation, but the process will probably still require manual calculations. You'll need to understand the ins and outs to choose the right depreciation method for your business.

» MORE: 9 accounting basics for small-business owners

advertisement

QuickBooks Online

Types of depreciation

Here are four common methods of calculating annual depreciation expenses, along with when it's best to use them.

1. Straight-line depreciation

This is the most common and simplest depreciation method.

Formula: (Cost of asset – Scrap value of asset) / Useful life of asset = Depreciation expense

Most often used for: Equipment that loses value steadily over time.

Pros: It spreads the expense evenly over each accounting period. It’s also easy to automate the adjusting entry for straight-line depreciation in most accounting software.

Cons: Determining the useful life of the asset requires guesswork. A miscalculation could result in the asset being overvalued for several years.

2. Units of production depreciation

Units of production depreciation is based on how many items a piece of equipment can produce.

Formula: (Number of units produced / Life of asset in units) x (Cost of asset – Scrap value of asset) = Depreciation expense

Most often used for: Manufacturing for equipment that is expected to produce a certain number of items before it's no longer useful.

Pros: Easy to calculate. Because it’s tied to the number of items a piece of equipment produces, it creates a more accurate depreciation calculation.

Cons: You have to keep an accurate record of how many items the equipment has produced. Because production will likely vary from month to month, you’ll need to manually enter this depreciation expense into your accounting software every month. The entry can’t be automated, as it can with straight-line depreciation.

» MORE: Best accounting software for small manufacturing businesses

3. Double declining balance depreciation

Double declining balance depreciation is an accelerated depreciation method. Businesses use accelerated methods when dealing with assets that are more productive in their early years. The double declining balance method is often used for equipment when the units of production method is not used.

Formula: 2 x (1/Life of asset) x Book value = Depreciation expense

Most often used for: Vehicles and other assets that lose value quickly. It writes off an asset’s value the quickest.

Pros: Represents the accelerated loss of certain assets’ value more accurately than straight-line depreciation. You’ll get larger tax write-offs at the beginning of the asset’s life, when it’s most productive. Depreciation expenses continually decline as time goes on and the asset is less productive and/or requires greater maintenance (another write-off).

Cons: The calculations are more complex than the other methods. Usually, business owners using accelerated methods will set up a depreciation schedule — a table that shows the depreciation expense for each year of the asset’s life — so they only have to do the calculations once.

4. Sum of the years’ digits depreciation

Sum of the years’ digits depreciation is another accelerated depreciation method. It doesn’t depreciate an asset quite as quickly as double declining balance depreciation, but it does it quicker than straight-line depreciation.

Formula: (Remaining life of the asset / Sum of the years' digits) x (Cost of asset – Scrap value of asset) = Depreciation expense

Most often used for: Assets that could become obsolete quickly.

Pros: Lets you choose how many years you want to depreciate an asset, based on its useful life. This gives you control over the depreciation expense you record each month. Like other accelerated depreciation methods, it also lets you write off more of the asset’s cost earlier on.

Cons: The most difficult depreciation method to calculate. If you use it with the wrong type of asset, you can easily overstate or understate your net income in a given accounting period.

Depreciation examples

Let’s say you purchase a piece of equipment for $260,000. You anticipate using the equipment for eight years, and you anticipate the scrap value will be $20,000. The annual and monthly depreciation expenses for the vehicle using the straight-line depreciation method would be:

($260,000 – $20,000) / 8 = $30,000

$30,000 / 12 months = $2,500 per month

Find out what your annual and monthly depreciation expenses should be using the simplest straight-line method, as well as the three other methods, in the calculator below.

Understanding depreciation in business and accounting

Depreciation is an expense, which means that it appears as a line item on your income statement and reduces net income. Many small-business owners find depreciation confusing because the depreciation expense on the income statement doesn't match cash flow . Remembering the following points can help simplify the concept.

Depreciation is not a cash expense. That is, a business does not write a check to "depreciation." Instead, the business records or recognizes the cost of the asset over time on the income statement.

Accordingly, depreciation usually doesn’t coincide with when the business buys the asset, even if the purchase is made over time with installment payments.

Depreciation matches expenses to a given time period, but it isn’t strictly an accrual-basis concept. This calculation will appear on both cash-basis and accrual-basis financial statements.

Using depreciation to plan for future business expenses

One often-overlooked benefit of properly recognizing depreciation in your financial statements is that the calculation can help you plan for and manage your business’s cash requirements. This is especially helpful if you want to pay cash for future assets rather than take out a business loan to acquire them.

Because you've taken the time to determine the useful life of your equipment for depreciation purposes, you can make an educated assumption about when the business will need to purchase new equipment. The earlier you can start planning for that purchase — perhaps by setting aside cash each month in a business savings account — the easier it will be to replace the equipment when the time comes.

» MORE: Best business budgeting software

Depreciation and taxes

The four methods described above are for managerial and business valuation purposes. Tax depreciation is different from depreciation for managerial purposes.

Tax depreciation follows a system called MACRS, which stands for modified accelerated cost recovery system. MACRS is a form of accelerated depreciation, and the IRS publishes tables for each type of property. Work with your accountant to be sure you’re recording the correct depreciation for your tax return.

» MORE: Best accounting and bookkeeping apps for small businesses

Instead of recording an asset’s entire expense when it’s first bought, depreciation distributes the expense over multiple years. Depreciation quantifies the declining value of a business asset, based on its useful life, and balances out the revenue it’s helped to produce.

How you calculate depreciation depends on which method you use. Each has its own formula that takes into account some combination of the following figures:

The asset’s useful life in years.

The asset’s cost or book value.

The scrap value of the asset.

How many units the asset will produce over its lifespan.

Assets that don’t lose their value, such as land, do not get depreciated. Alternatively, you wouldn’t depreciate inexpensive items that are only useful in the short term.

On a similar note...

Our Recommendations

- Best Small Business Loans for 2024

- Businessloans.com Review

- Biz2Credit Review

- SBG Funding Review

- Rapid Finance Review

- 26 Great Business Ideas for Entrepreneurs

- Startup Costs: How Much Cash Will You Need?

- How to Get a Bank Loan for Your Small Business

- Articles of Incorporation: What New Business Owners Should Know

- How to Choose the Best Legal Structure for Your Business

Small Business Resources

- Business Ideas

- Business Plans

- Startup Basics

- Startup Funding

- Franchising

- Success Stories

- Entrepreneurs

- The Best Credit Card Processors of 2024

- Clover Credit Card Processing Review

- Merchant One Review

- Stax Review

- How to Conduct a Market Analysis for Your Business

- Local Marketing Strategies for Success

- Tips for Hiring a Marketing Company

- Benefits of CRM Systems

- 10 Employee Recruitment Strategies for Success

- Sales & Marketing

- Social Media

- Best Business Phone Systems of 2024

- The Best PEOs of 2024

- RingCentral Review

- Nextiva Review

- Ooma Review

- Guide to Developing a Training Program for New Employees

- How Does 401(k) Matching Work for Employers?

- Why You Need to Create a Fantastic Workplace Culture

- 16 Cool Job Perks That Keep Employees Happy

- 7 Project Management Styles

- Women in Business

- Personal Growth

- Best Accounting Software and Invoice Generators of 2024

- Best Payroll Services for 2024

- Best POS Systems for 2024

- Best CRM Software of 2024

- Best Call Centers and Answering Services for Busineses for 2024

- Salesforce vs. HubSpot: Which CRM Is Right for Your Business?

- Rippling vs Gusto: An In-Depth Comparison

- RingCentral vs. Ooma Comparison

- Choosing a Business Phone System: A Buyer’s Guide

- Equipment Leasing: A Guide for Business Owners

- HR Solutions

- Financial Solutions

- Marketing Solutions

- Security Solutions

- Retail Solutions

- SMB Solutions

What Is Depreciation in Business?

If you have expensive assets, depreciation is a key accounting and tax calculation.

Table of Contents

- Depreciation is the process of deducting the cost of a business asset over a long period of time, rather than over the course of one year.

- There are four main methods of depreciation: straight line, double declining, sum of the years’ digits and units of production.

- Each method is used for different types of businesses and types of assets.

Depreciation is often misunderstood as a term for something simply losing value, or as a calculation performed for tax purposes. Depreciation is an important part of your business’s tax returns, but it is a complex concept. Keep reading to learn what depreciation is, how it is calculated and how your depreciation calculation can affect your business.

What is depreciation?

Depreciation has two main aspects. The first aspect is the decrease in the value of an asset over time. The second aspect is allocating the price you originally paid for an expensive asset over the period of time you use that asset.

The number of years over which an asset is depreciated is determined by the asset’s estimated useful life, or how long the asset can be used. For example, the estimate useful life of a laptop computer is about five years.

There are multiple classes of assets, including commodities and property. When doing your yearly budget or balance sheet , asset depreciation is considered a fixed cost, unless you are using a method where the depreciable amount changes every year (such as the unit of production method), in which case it would be a variable cost.

[ Related: Business Liabilities And How to Manage Them ]

What assets can be depreciated?

The IRS has specific guidelines about what types of assets can be depreciated for accounting purposes. According to the IRS, to be depreciable, an asset must

- Be owned by you

- Be used in your business or to produce income

- Have a determinable useful life

- Be expected to last for more than one year

Some examples of the most common types of depreciable assets include vehicles; buildings; office equipment or furniture; computers and other electronics; machinery and equipment; and certain intangible items, such as patents, copyrights, and computer software.

What assets cannot be depreciated?

You cannot depreciate an asset that does not meet the IRS’ requirements, so nothing that does not wear out, become obsolete or get used up. You also cannot depreciate

- Collectibles (e.g., art, coins, memorabilia, etc.)

- Investments (e.g., stocks and bonds)

- Personal property

- Any asset used for less than one year

Types of depreciation

There are multiple methods of depreciation used in accounting. The four main types of depreciation are as follows.

1. Straight-line depreciation

This is the simplest and most straightforward method of depreciation. It splits an asset’s value equally over multiple years, meaning you pay the same amount for every year of the asset’s useful life.

Straight-line depreciation is a good option for small businesses with simple accounting systems or businesses where the business owner prepares and files the tax return.

The advantages of straight-line depreciation are that it is easy to use, it renders relatively few errors, and business owners can expense the same amount every accounting period.

However, its simplicity can also be a drawback, because the useful life calculation is largely based on guesswork or estimation. It also does not factor in the accelerated loss of an asset’s value in the short term or the likelihood that maintenance costs will go up as the asset gets older.

- Depreciation formula: Divide the cost of the asset (minus its salvage value) by the estimated number of years of its useful life. The “salvage value” is the estimated amount of money the item will be worth at the end of its useful life. Here’s what the formula looks like: (Cost of asset – Salvage value of asset) / Useful life of asset = Depreciation expense

[ Related Content: What Is EBITDA And How Is It Used? ]

2. Double-declining depreciation

This method, also called declining balance depreciation, allows you to write off more of an asset’s value right after you purchase it and less as time goes by. This is a good option for businesses that want to recover more of the asset’s value upfront rather than waiting a certain number of years, such as small businesses with a lot of initial costs and requiring extra cash.

The double-declining balance method is advantageous because it can help offset increased maintenance costs as an asset ages; it can also maximize tax deductions by allowing higher depreciation expenses in the early years.

However, you won’t benefit from an additional tax deduction if your business already has a tax loss for a given year.

- Depreciation formula: 2 x (Single-line depreciation rate) x (Book value at beginning of the year). The “book value” is the asset’s cost minus the amount of depreciation you have already taken.

3. Sum of the years’ digits depreciation

Sum of the years’ digits (SYD) depreciation is similar to the double-declining method in that it is also an accelerated depreciation calculation. Instead of decreasing the book value, SYD calculates a weighted percentage based on the asset’s remaining useful life.

SYD suits businesses that want to recover more value upfront, but with more even distribution than they would otherwise get using the double-declining method. The SYD method’s main advantage is that the accelerated depreciation reduces taxable income and taxes owed during the early years of the asset’s life. The main drawback of SYD is that it is markedly more complex to calculate than the other methods.

- Depreciation formula: (Remaining lifespan / SYD) x (Asset cost – Salvage value). You must first calculate the SYD by adding together the digits for each depreciation year. For example, the SYD calculation for five years is 5+4+3+2+1=15. You then divide each year by this sum to calculate that year’s depreciation percentage. To find the percentage for the first year’s depreciation, you would divide the digit of the first year (5) by the SYD total (15), which comes out to 33% (5 / 15 = 33%).

[ See: Helpful Accounting Formulas and Ratios ]

4. Units of production depreciation

This is a simple way to depreciate the value of an asset based on how frequently the asset is used. “Units of production” can refer to something the equipment makes — like the number of pizzas that can be made in a pizza oven, or the number of hours that it’s in use. This method is good for businesses that want to write off equipment with a quantifiable and widely accepted (i.e., based on the manufacturer’s specifications) output during its useful life. Make sure you have a method in place for tracking your use of equipment, and expect to write off a different amount every year.

The main advantage of the units of production depreciation method is that it gives you a highly accurate picture of your depreciation cost based on actual numbers, depending on your tracking method. Its main disadvantage is that it is difficult to apply to many real-life situations, as it is not always easy to estimate how many units an asset can produce before it reaches the end of its useful life.

- Depreciation formula: (Asset cost – Salvage value) / Units produced in useful life

How does deprecation affect tax liability?

Depreciation reduces the taxes your business must pay via deductions by tracking the decrease in the value of your assets. Your business’s depreciation expense reduces the earnings on which your taxes are based, reducing the taxes your business owes the IRS. The larger the depreciation expense, the lower your taxable income.

Building Better Businesses

Insights on business strategy and culture, right to your inbox. Part of the business.com network.

- Search Search Please fill out this field.

What Is Depreciation?

Depreciation overview, depreciation and taxes, depreciation in accounting, the bottom line.

- Corporate Finance

Depreciation: Definition and Types, With Calculation Examples

:max_bytes(150000):strip_icc():format(webp)/Office2-EbonyHoward-8b4ada1233ed44aca6ef78c46069435d.jpg)

- Accounting History and Terminology

- Absorption Costing

- Amortization

- Average Collection Period

- Bill of Lading

- Cost of Debt

- Cost of Equity

- Cost-Volume-Profit (CVP) Analysis

- Current Account

- Days Payable Outstanding

- Depreciation CURRENT ARTICLE

- Double Declining Balance Depreciation Method

- Economic Order Quantity

- Factors of Production

- Fiscal Year (FY)

- General Ledger

- Just in Time (JIT)

- Net Operating Loss (NOL)

- Net Realizable Value (NRV)

- Noncurrent Assets

- Operating Cost

- Operating Profit

- Production Costs

- Pro Forma Invoice

- Retained Earnings

- Revenue Recognition

- Triple Bottom Line (TBL)

- Variable Cost

- Work-in-Progress (WIP)

- Year-Over-Year (YOY)

- Zero-Based Budgeting (ZBB)

Depreciation is an accounting practice used to spread the cost of a tangible or physical asset over its useful life. Depreciation represents how much of the asset's value has been used up in any given time period. Companies depreciate assets for both tax and accounting purposes and have several different methods to choose from.

Key Takeaways

- Depreciation allows businesses to spread the cost of physical assets (such as a piece of machinery or a fleet of cars) over a period of years for accounting and tax purposes.

- There are several different depreciation methods, including straight-line and various forms of accelerated depreciation.

- Some methods of accounting for depreciation require that the business estimate the "salvage value" of the asset at the end of its useful life.

Investopedia / Jessica Olah

Assets like machinery and equipment are expensive. Instead of realizing the entire cost of an asset in year one, companies can use depreciation to spread out the cost and match depreciation expenses to related revenues in the same reporting period. This allows the company to write off an asset's value over a period of time, notably its useful life.

Companies take depreciation regularly so they can move their assets' costs from their balance sheets to their income statements . When a company buys an asset, it records the transaction as a debit to increase an asset account on the balance sheet and a credit to reduce cash (or increase accounts payable), which is also on the balance sheet. Neither journal entry affects the income statement, where revenues and expenses are reported.

At the end of an accounting period, an accountant books depreciation for all capitalized assets that are not yet fully depreciated . The journal entry consists of a:

- Debit to depreciation expense, which flows through to the income statement

- Credit to accumulated depreciation, which is reported on the balance sheet

As noted above, businesses use depreciation for both tax and accounting purposes. Under U.S. tax law, they can take a deduction for the cost of the asset, reducing their taxable income. But the Internal Revenue Servicc (IRS) states that when depreciating assets, companies must generally spread the cost out over time. (In some instances they can take it all in the first year, under Section 179 of the tax code. ) The IRS also has requirements for the types of assets that qualify.

Buildings and structures can be depreciated, but land is not eligible for depreciation.

In accounting terms, depreciation is considered a non-cash charge because it doesn't represent an actual cash outflow . The entire cash outlay might be paid initially when an asset is purchased, but the expense is recorded incrementally for financial reporting purposes. That's because assets provide a benefit to the company over an extended period of time. But the depreciation charges still reduce a company's earnings , which is helpful for tax purposes.

The matching principle under generally accepted accounting principles (GAAP) is an accrual accounting concept that dictates that expenses must be matched to the same period in which the related revenue is generated. Depreciation helps to tie the cost of an asset with the benefit of its use over time. In other words, the incremental expense associated with using up the asset is also recorded for the asset that is put to use each year and generates revenue .

The total amount depreciated each year, which is represented as a percentage, is called the depreciation rate. For example, if a company had $100,000 in total depreciation over the asset's expected life, and the annual depreciation was $15,000, the rate would be 15% per year.

Threshold Amounts

Different companies may set their own threshold amounts to determine when to depreciate a fixed asset or property, plant, and equipment (PP&E) and when to simply expense it in its first year of service. For example, a small company might set a $500 threshold, over which it will depreciate an asset. On the other hand, a larger company might set a $10,000 threshold, under which all purchases are expensed immediately.

Accumulated Depreciation, Carrying Value, and Salvage Value

Accumulated depreciation is a contra-asset account , meaning its natural balance is a credit that reduces its overall asset value. Accumulated depreciation on any given asset is its cumulative depreciation up to a single point in its life.

Carrying value is the net of the asset account and the accumulated depreciation, while salvage value is the carrying value that remains on the balance sheet after which all depreciation is accounted for until the asset is disposed of or sold. Salvage value is based on what a company expects to receive in exchange for the asset at the end of its useful life.

The IRS publishes depreciation schedules indicating the number of years over which assets can be depreciated for tax purposes, depending on the type of asset.

Types of Depreciation With Calculation Examples

There are a number of methods that accountants can use to depreciate capital assets. They include straight-line, declining balance, double-declining balance, sum-of-the-years' digits, and unit of production. We've highlighted some of the basic principles of each method below, along with examples to show how they're calculated.

Straight-Line

The straight-line method is the most basic way to record depreciation. It reports an equal depreciation expense each year throughout the entire useful life of the asset until the asset is depreciated down to its salvage value .

Image by Theresa Chiechi © The Balance 2019

Let's assume that a company buys a machine at a cost of $5,000. The company decides that the machine has a useful life of five years and a salvage value of $1,000. Based on these assumptions, the depreciable amount is $4,000 ($5,000 cost - $1,000 salvage value).

The annual depreciation using the straight-line method is calculated by dividing the depreciable amount by the total number of years. In this case, it comes to $800 per year ($4,000 / 5 years). This results in an annual depreciation rate of 20% ($800 / $4,000).

Declining Balance

The declining balance method is an accelerated depreciation method that begins with the asset's book, rather than salvage, value. Because an asset's carrying value is higher in earlier years (before it has begun to be depreciated), the same percentage causes a larger depreciation expense amount in earlier years, then declines each year thereafter. This is the formula:

Declining Balance Depreciation = Book Value x (1/Useful Life)

Using the straight-line example above, the machine costs $5,000 and has a useful life of five years. In year one, depreciation would be $1,000 ($5,000 x 1/5 =$1,000).

In year two it would be ($5,000-$1,000) x 1/5, or $800. In year three, ($5,000-$1,000-$800) x 1/5, or $640, and so forth.

Double-Declining Balance (DDB)

The double-declining balance (DDB) method is an even more accelerated depreciation method. It doubles the (1/Useful Life) multiplier, making it essentially twice as fast as the declining balance method.

DDB = Book Value x (2/Useful Life )

Continuing to use our example of a $5,000 machine, depreciation in year one would be $5,000 x 2/5, or $2,000. In year two it would be ($5,000-$2,000) x 2/5, or $1,200, and so on.

Note that while salvage value is not used in declining balance calculations, once an asset has been depreciated down to its salvage value, it cannot be further depreciated.

Sum-of-the-Years' Digits (SYD)

The sum-of-the-years' digits (SYD) method also allows for accelerated depreciation. You start by combining all the digits of the expected life of the asset.

For example, an asset with a five-year life would have a base of the sum of the digits one through five, or 1 + 2 + 3 + 4 + 5 = 15. In the first year, 5/15 of the depreciable base would be depreciated. In the second year, 4/15 of the depreciable base would be depreciated. This continues until year five when the remaining 1/15 of the base is depreciated. The depreciable base in all of these cases is the purchase price minus the salvage value, or $4,000 in the example we've been using.

For example, year one depreciation would be $1,333 ($4,000 x 5/15 = $1,333). In year two, it would be $1,067 ($4,000 x 4/15 = $1,067).

Units of Production

This method, which is often used in manufacturing, requires an estimate of the total units an asset will produce over its useful life. Depreciation expense is then calculated per year based on the number of units produced that year. This method also calculates depreciation expenses using the depreciable base (purchase price minus salvage value).

Why Are Assets Depreciated Over Time?

New assets are typically more valuable than older ones for a number of reasons. Depreciation measures the value an asset loses over time—directly from ongoing use through wear and tear and indirectly from the introduction of new product models and factors like inflation. Writing off only a portion of the cost each year, rather than all at once, also allows businesses to report higher net income in the year of purchase than they would otherwise.

How Do Businesses Determine Salvage Value?

Salvage value can be based on past history of similar assets, a professional appraisal, or a percentage estimate of the value of the asset at the end of its useful life.

What Is Depreciation Recapture?

Depreciation recapture is a provision of the tax law that requires businesses or individuals that make a profit in selling an asset that they have previously depreciated to report it as income. In effect, the amount of money they claimed in depreciation is subtracted from the cost basis they use to determine their gain in the transaction. Recapture can be common in real estate transactions where a property that has been depreciated for tax purposes, such as an apartment building, has gained in value over time.

How Does Depreciation Differ From Amortization?

Depreciation refers only to physical assets or property. Amortization essentially depreciates intangible assets, such as intellectual property like trademarks or patents, over time.

Depreciation allows businesses to spread the cost of physical assets over a period of time, which can have advantages from both an accounting and tax perspective. Businesses also have a variety of depreciation methods to choose from, allowing them to pick the one that works best for their purposes.

U.S. Securities and Exchange Commission. " Beginners' Guide to Financial Statements ."

Internal Revenue Service. " Depreciation Expense Helps Business Owners Keep More Money ."

Internal Revenue Service " Topic No. 704, Depreciation ."

Internal Revenue Service. " Publication 946 (2022), How to Depreciate Property ."

:max_bytes(150000):strip_icc():format(webp)/investing15-5bfc2b8fc9e77c00519aa65b.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Home » Blog » Finance » Depreciation 101: Essential Knowledge for Business Success

Depreciation 101: Essential Knowledge for Business Success

- June 8, 2023

- By: Lucia Romano, MBA

Depreciation, in its simplest terms, is the gradual decrease in the value of an asset over time. For entrepreneurs, grasping this fundamental concept is paramount to making informed financial decisions, managing resources effectively, and ensuring long-term business success.

In this guide, we will delve into the world of depreciation, exploring its definition, methods, calculations, and, most importantly, its significance for entrepreneurs. By the end, you’ll have the basic knowledge necessary to navigate the complex landscape of depreciation and harness its power for sustainable business success.

What is Depreciation?

The business definition.

Depreciation is a fundamental concept in business accounting that refers to the gradual decrease in the value of tangible assets over time. It recognizes that assets, such as buildings, vehicles, machinery, or equipment, experience wear, and tear or become obsolete as they are used in business operations. Depreciation allows businesses to allocate the cost of these assets over their useful lifespan, reflecting their declining value on the company’s financial statements.

Purpose of Depreciating the Value of an Asset

Asset value depreciation is the reduction in the worth or book value of a company’s tangible assets. When an asset is purchased, it is recorded on the balance sheet at its original cost. However, as time passes, the asset’s value diminishes due to physical deterioration, technological advancements, or changes in market demand. Understanding asset value depreciation is crucial for businesses to assess their net worth and financial health accurately.

Importance of Accounting Depreciation Accurately

Entrepreneurs need to understand depreciation to ensure accurate financial reporting, optimize tax benefits, plan for asset replacement, and make informed business decisions. Accurate depreciation accounting plays a vital role in several aspects of a business:

- Financial Statements: Depreciation affects the balance sheet, income statement, and statement of cash flows. It impacts the reporting of asset values, accumulated depreciation, net income, and cash flows from operating activities. Correctly accounting for depreciation ensures that financial statements provide an accurate and fair representation of the company’s financial position and performance.

- Taxation: Depreciation also has tax implications. Governments often allow businesses to deduct depreciation expenses from their taxable income, reducing the tax burden. Businesses can optimize their tax deductions and comply with tax regulations by accurately tracking and reporting depreciation.

- Asset Replacement Planning: Understanding the rate of asset depreciation helps businesses plan for future capital expenditures. By estimating when an asset will reach the end of its useful life, companies can budget for its replacement or consider alternative investment strategies.

- Decision Making: Accurate depreciation accounting provides insights for strategic decision-making. When evaluating investment opportunities or considering asset disposal, understanding the actual value and remaining useful life of assets is crucial for making informed choices that align with the company’s financial goals.

The Impact on Financial Statements

In summary, depreciation has significant financial implications for entrepreneurs. It affects net income, the balance sheet, and financial statement analysis. Additionally, it plays a crucial role in tax planning and can impact cash flow and overall profitability. Understanding these aspects of depreciation is essential for entrepreneurs to make informed financial decisions and effectively manage their business finances.

Reduction in Net Income

- Net Income: Depreciation is considered a non-cash expense, meaning it doesn’t involve an actual cash outflow. As a result, it reduces net income on the income statement. By recognizing depreciation as an expense, businesses can accurately reflect the cost of asset usage and allocate it over time, which provides a more realistic picture of profitability.

- Balance Sheet: Depreciation affects the balance sheet by reducing the value of assets over time. It is recorded as accumulated depreciation, which offsets the asset’s original cost. This asset value reduction impacts the business’s overall net worth or equity.

Impact on Financial Statements

Depreciation has a direct impact on financial statements, particularly the income statement and balance sheet:

- Income Statement: By reducing net income through depreciation expenses, entrepreneurs can accurately portray the profitability of their business. This allows for more precise evaluation of operational performance and comparison against industry benchmarks.

- Balance Sheet: The balance sheet reflects the value of assets and liabilities. Depreciation reduces the value of assets and is represented as accumulated depreciation, which offsets the original asset cost. This adjustment provides a more accurate representation of the asset’s current value.

Role in Taxes and Profitability

Depreciation plays a crucial role in both tax planning and overall profitability:

- Tax Deductions: Governments often allow businesses to deduct depreciation expenses from their taxable income. By doing so, businesses can reduce their tax liability, effectively lowering their tax burden. Properly accounting for depreciation ensures that entrepreneurs can take advantage of this tax benefit.

- Cash Flow and Profitability: While depreciation is a non-cash expense, it affects cash flow indirectly. By reducing taxable income, depreciation can increase available cash flow, providing more resources for business operations, investments, or debt repayment. Understanding the relationship between depreciation, taxes, and cash flow is essential for maintaining profitability.

Calculating Depreciation

Formula and components.

The basic formula used to calculation depreciation is:

Depreciation Expense = (Cost of Asset – Salvage Value) / Useful Life

- Cost of Asset: The original cost or acquisition cost of the asset.

- Salvage Value: The asset’s estimated value at the end of its useful life.

- Useful Life: The expected duration or period over which the asset is deemed useful before it becomes obsolete or no longer productive.

Methods of Depreciation

When it comes to calculating depreciation, there are several methods that businesses can use. Here are three commonly used methods:

Factors to Consider in Method Selection

Choosing the most appropriate method depends on various factors, including:

- Nature of the Asset : Different assets may warrant different depreciation methods based on their characteristics and patterns of usage.

- Industry Norms: Consider industry standards and common practices to ensure consistency and comparability in financial reporting.

- Regulatory Requirements: Certain industries or jurisdictions may have specific regulations or guidelines regarding depreciation methods that need to be followed.

- Accuracy and relevance: Select a method that accurately reflects the asset’s decline in value over time and provides meaningful information for decision-making and financial analysis.

Entrepreneurs should carefully evaluate these factors and choose the method that best aligns with their business needs, accounting practices, and financial reporting requirements.

Straight-Line Method

The straight-line method is the most straightforward and commonly used depreciation method. It evenly spreads the cost of an asset over its useful life. This method calculates depreciation by dividing the cost of the asset minus its salvage value (if any) by the number of years of useful life.

Example Calculation using the Straight-Line Method:

Let’s consider a piece of machinery purchased for $50,000 with an estimated useful life of 10 years and no salvage value.

Depreciation Expense = ($50,000 – $0) / 10 years = $5,000 per year

Therefore, the annual depreciation expense using the straight-line method is $5,000.

- Simplicity and ease of calculation

- Suitable for assets that have an even usage pattern

- Provides a consistent and predictable depreciation expense over the asset’s useful life.

- May not accurately refelct the actual decline in the asset’s value over time

- Does not account for variations in asset usage.

Declining Balance Method

The declining balance method allows for higher depreciation expenses in the earlier years of an asset’s life and gradually decreases the depreciation amount over time. This method applies a fixed depreciation rate to the asset’s decreasing book value each year.

Units of Production Method

The units of production method tie depreciation to the actual usage or output of the asset. It calculates depreciation based on the asset’s total estimated production or usage over its useful life. This method is beneficial for assets primarily utilized based on production volume, such as manufacturing equipment.

Example Calculation using the Declining Balance Method

Suppose a computer system is acquired for $10,000 with an estimated useful life of 5 years and a depreciation rate of 40% (expressed as 0.40).

Year 1: Depreciation Expense = $10,000 x 0.40 = $4,000 Year 2: Depreciation Expense = ($10,000 – $4,000) x 0.40 = $2,400 Year 3: Depreciation Expense = ($10,000 – $4,000 – $2,400) x 0.40 = $1,440 …and so on until the end of the useful life.

The depreciation expense declines each year based on the declining balance of the asset.

Examples of Depreciation Calculation

Here are a few examples of depreciation calculations for different assets and methods:

Example 1: A company purchases a delivery truck for $30,000 with a useful life of 5 years and an estimated salvage value of $5,000. The company uses the straight-line method.

Depreciation Expense = ($30,000 – $5,000) / 5 years = $5,000 per year

Example 2: An office building is acquired for $500,000 with an estimated useful life of 40 years and no salvage value. The company uses the straight-line method.

Depreciation Expense = ($500,000 – $0) / 40 years = $12,500 per year

Example 3: A manufacturing machine is purchased for $100,000 with an estimated useful life of 10 years and a salvage value of $10,000. The company uses the declining balance method with a depreciation rate of 30%.

Year 1: Depreciation Expense = $100,000 x 0.30 = $30,000 Year 2: Depreciation Expense = ($100,000 – $30,000) x 0.30 = $21,000 Year 3: Depreciation Expense = ($100,000 – $30,000 – $21,000) x 0.30 = $12,600 …and so on until the end of the useful life.

Depreciation & Business Decision-Making

A. depreciation's impact on investment decisions and asset management.

Depreciation plays a crucial role in investment decisions and effective asset management. Here are a few key points to consider:

- Capital Expenditure: When making investment decisions, entrepreneurs need to account for the impact of depreciation on the expected returns of the investment. Depreciation helps determine the actual cost of utilizing the asset over its useful life, providing a more accurate assessment of the investment’s profitability.

- Replacement and Upgrade Decisions: Depreciation considerations help entrepreneurs evaluate when to replace or upgrade existing assets. By comparing the remaining useful life, future depreciation expenses, and potential benefits of new assets, businesses can make informed decisions that optimize operational efficiency and cost-effectiveness.

B. Evaluating Financial Implications of Depreciation in Business Choices

Depreciation has financial implications that should be evaluated when making business choices. Two important aspects to consider are:

1. How Depreciation Affects Return on Investment (ROI)

Depreciation impacts the calculation of return on investment (ROI). By accurately accounting for depreciation expenses, businesses can calculate ROI more effectively. It allows entrepreneurs to determine whether investments are generating satisfactory returns and assess the efficiency of capital utilization.

2. Incorporating Depreciation into Cost-Benefit Analysis

Depreciation is a critical factor in cost-benefit analysis. It helps entrepreneurs assess the long-term financial viability of projects or initiatives. By including depreciation expenses, businesses can compare the present value of costs and benefits over the asset’s useful life, providing a comprehensive evaluation of the project’s profitability.

C. Incorporating Depreciation into Budgeting and Forecasting

Budgeting and forecasting processes should account for the impact of depreciation. Here’s why:

- Accurate Expense Allocation: Including depreciation in budgets ensures that expenses associated with asset usage are appropriately allocated over time. This leads to more accurate financial statements and forecasting models.

- Cash Flow Planning: Depreciation affects cash flow indirectly by reducing taxable income. Entrepreneurs should consider the tax benefits associated with depreciation when planning cash flow, ensuring adequate resources for ongoing operations and future investments.

- Capital Expenditure Planning: Depreciation helps plan future capital expenditures by estimating the replacement or upgrade costs of assets nearing the end of their useful lives. Including these projections in budgets and forecasts ensures businesses are prepared for upcoming expenditures and can allocate resources efficiently.

Incorporating depreciation into business decision-making, financial analysis, and budgeting processes enhances the accuracy of assessments, improves investment choices, and ensures effective asset management. Entrepreneurs who understand the implications of depreciation can make informed decisions that optimize financial outcomes and drive business success.

Throughout this post, we’ve explored the ins and outs of depreciation, uncovering its significance in business operations. We discussed the definition and various methods of depreciation, examined the impact on financial statements and tax implications, and highlighted the role it plays in decision-making and budgeting. By recognizing the true cost of assets over their useful life, entrepreneurs can make strategic choices that optimize profitability, drive growth, and secure a solid foundation for their businesses.

Now armed with a solid understanding of depreciation, it’s time to apply this knowledge to your own business endeavors. Take the opportunity to evaluate your assets, incorporate depreciation into your financial analyses, and refine your budgeting processes. And remember, learning is an ongoing journey, so continue to seek further resources and professional advice to enhance your understanding and mastery of this essential business concept.

COMMENT Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

This site uses Akismet to reduce spam. Learn how your comment data is processed .

RELATED POSTS

The 12 Brand Archetypes (Illustrated with Cats)

Brands, like people (and cats), have underlying personalities that shape who they are. Learn the 12 brand archetypes in this purr-fect guide.

99 Small Business Ideas Vetted by an MBA

Get ready! This is not your average list - discover 100+ realistic, achievable small business ideas & essential startup criteria.

Promotion Pointers: Key Ways to Spread Brand Awareness in 2023

Learn essential promotion strategies to raise awareness about your business and connect with your target audience effectively.

Depreciation

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on March 06, 2023

Fact Checked

Why Trust Finance Strategists?

Table of Contents

Depreciation: definition.

Depreciation is the reduction in the value of a fixed asset due to usage, wear and tear, the passage of time, or obsolescence.

The loss on an asset that arises from depreciation is a direct consequence of the services that the asset gives to its owner.

Therefore, a reasonable assumption is that the loss in the value of a fixed asset in a period is the worth of the service provided by that asset over that period.

From an accounting perspective, depreciation is the process of converting fixed assets into expenses . Also, depreciation is the systematic allocation of the cost of noncurrent , nonmonetary , tangible assets (except for land) over their estimated useful life.

Depreciation: Explanation

Depreciation is a systematic procedure for allocating the acquisition cost of a capital asset over its useful life.

Capital assets such as buildings, machinery, and equipment are useful to a company for a limited number of years. The entire cost of a capital asset is not charged to any one year as an expense; rather the cost is spread over the useful life of the asset.

Thus, the cost of the asset is charged as an expense to the periods that benefit from the use of the asset. The part of the cost that is charged to operation during an accounting period is known as depreciation.

Hence, the objective of depreciation is to achieve the matching principle (i.e., to offset the costs of the goods and services being consumed in an accounting period with the period's revenue , thereby determining the profit or loss made by the business ).

Depreciation Accounting

Depreciation accounting is a system of accounting that aims to distribute the cost (or other basic values) of tangible capital assets less its scrap value over the effective life of the asset. Thus, depreciation is a process of allocation and not valuation.

The expenditure on the purchase of machinery is not regarded as part of the cost of the period; instead, it is shown as an asset in the balance sheet .

The expenditure incurred on the purchase of a fixed asset is known as a capital expense . Capital expenditure is a fixed asset that is charged off as depreciation over a period of years.

The decisions that are made about how much depreciation to charge off are influenced by the accountant's judgment.

Measuring Depreciation

To measure the depreciation of an asset, the following must be known:

- Cost of asset

- Estimated residual value

- Estimated useful life

The purchase price of an asset is its cost plus all other expenses paid to acquire and prepare the asset to ensure it is ready for use.

Estimated residual value is also known as the salvage value or scrap value. This is the expected value of the asset in cash at the end of its useful life.

When calculating depreciation, the estimated residual value is not depreciation because the business can expect to receive this amount from selling off the asset.

The cost of the asset minus its residual value is called the depreciable cost of the asset. The depreciable cost is allocated over the useful life of the asset. However, if the asset is expected not to have residual value, the full cost of the asset is depreciated.

Estimated useful life is the number of years of service the business expects to receive from the asset.

Causes of Depreciation

The causes of depreciation include physical deterioration and obsolescence. An overview of the main causes is given below.

Physical Deterioration

Assets decline in value due to use and wear and tear. All assets have a useful life and every machine eventually reaches a time when it must be decommissioned, irrespective of how effective the organization's maintenance policy is.

Obsolescence

An asset may become obsolete due to better designs, new inventions, or simply changing fashions. This may result in the asset being discarded even though it is still useful and in excellent physical condition.

An asset may be exhausted through work. This is the case for mineral mines, oil wells, and other similar assets. Due to the continuous extraction of minerals or oil, a point comes when the mine or well is completely exhausted—nothing is left.

Therefore, after a certain period, the value of the exhausted asset will be zero.

Efflux of Time

The value of certain assets falls with the passage of time. Leasehold properties, patents , and copyrights are examples of such assets.

Depreciation Is a Process of Cost Allocation

Depreciation is allocated over the useful life of an asset based on the book value of the asset originally entered in the books of accounts.

The market value of the asset may increase or decrease during the useful life of the asset. However, the allocation of depreciation in each accounting period continues on the basis of the book value without regard to such temporary changes.

Also, depreciation expense is merely a book entry and represents a " non-cash" expense . Therefore, depreciation is a process of cost allocation —not of valuation .

Suppose that a company purchases a weighing machine for $1,000. After a year's use, the value of the machine is assessed at $800.

In this example, we can say that the service given by the weighing machine in its first year of life was $200 ($1,000 - $800) to the company.

It is in this sense that depreciation is considered a normal business expense and, consequently, treated in the books of account in more or less the same way as any other expense.

Fixed assets lose value throughout their useful life—every minute, every hour, and every day. It would, however, be impractical (and of no great benefit) to calculate and re-calculate the extent of this loss over short periods (e.g., every month).

As business accounts are usually prepared on an annual basis, it is common to calculate depreciation only once at the end of each financial year.

Methods of Calculating Depreciation

There are three popular ways to calculate depreciation. These are:

- Fixed installment method

- Reducing installment method

- Revaluation method

Depreciation FAQs

Why should depreciation be calculated.

The purpose of Depreciation is to allocate the cost of non-current assets over their useful life. This allocation is reflected in periodic expense entries. These expense entries reduce taxable income each year and hence result in tax savings. (Note: Taxable income = Net profit + Depreciation)

What is a useful life?

The concept of useful life represents the period beyond which it would not be practical to use an asset anymore. Useful life is not equivalent to physical life.

What if the useful life of an asset is short?

If the useful life is short, then calculated Depreciation will also be less in the early accounting periods. This means that there will be a large difference between tax expense and taxable income at the beginning of the accounting period. Because large losses are realized early, the tax benefit will be spread over a longer period.

What is the difference between depreciation and amortization?

Amortization results from a systematic reduction in value of certain assets that have limited useful lives, such as intangible assets. Depreciation occurs when a non-current asset loses value due to use or passage of time. Depreciation does not result from any systematic approach but occurs naturally through the passage of time.

What is an accounting loss?

An accounting loss results from expensing a revenue-generating asset instead of capitalizing it and thus, not creating any future value for the company. In this event, the book value of the asset becomes smaller each year. The accumulated Depreciation account will show a debit balance as a result.

About the Author

True Tamplin, BSc, CEPF®

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide , a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University , where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon , Nasdaq and Forbes .

Our Services

- Financial Advisor

- Estate Planning Lawyer

- Insurance Broker

- Mortgage Broker

- Retirement Planning

- Tax Services

- Wealth Management

Ask a Financial Professional Any Question

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Why You Can Trust Finance Strategists

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

How It Works

Step 1 of 3, ask any financial question.

Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

Step 2 of 3

Our team will connect you with a vetted, trusted professional.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Step 3 of 3

Get your questions answered and book a free call if necessary.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Where Should We Send Your Answer?

Just a Few More Details

We need just a bit more info from you to direct your question to the right person.

Tell Us More About Yourself

Is there any other context you can provide.

Pro tip: Professionals are more likely to answer questions when background and context is given. The more details you provide, the faster and more thorough reply you'll receive.

What is your age?

Are you married, do you own your home.

- Owned outright

- Owned with a mortgage

Do you have any children under 18?

- Yes, 3 or more

What is the approximate value of your cash savings and other investments?

- $50k - $250k

- $250k - $1m

Pro tip: A portfolio often becomes more complicated when it has more investable assets. Please answer this question to help us connect you with the right professional.

Would you prefer to work with a financial professional remotely or in-person?

- I would prefer remote (video call, etc.)

- I would prefer in-person

- I don't mind, either are fine

What's your zip code?

- I'm not in the U.S.

Submit to get your question answered.

A financial professional will be in touch to help you shortly.

Part 1: Tell Us More About Yourself

Do you own a business, which activity is most important to you during retirement.

- Giving back / charity

- Spending time with family and friends

- Pursuing hobbies

Part 2: Your Current Nest Egg

Part 3: confidence going into retirement, how comfortable are you with investing.

- Very comfortable

- Somewhat comfortable

- Not comfortable at all

How confident are you in your long term financial plan?

- Very confident

- Somewhat confident

- Not confident / I don't have a plan

What is your risk tolerance?

How much are you saving for retirement each month.

- None currently

- Minimal: $50 - $200

- Steady Saver: $200 - $500

- Serious Planner: $500 - $1,000

- Aggressive Saver: $1,000+

How much will you need each month during retirement?

- Bare Necessities: $1,500 - $2,500

- Moderate Comfort: $2,500 - $3,500

- Comfortable Lifestyle: $3,500 - $5,500

- Affluent Living: $5,500 - $8,000

- Luxury Lifestyle: $8,000+

Part 4: Getting Your Retirement Ready

What is your current financial priority.

- Getting out of debt

- Growing my wealth

- Protecting my wealth

Do you already work with a financial advisor?

Which of these is most important for your financial advisor to have.

- Tax planning expertise

- Investment management expertise

- Estate planning expertise

- None of the above

Where should we send your answer?

Submit to get your retirement-readiness report., get in touch with, great the financial professional will get back to you soon., where should we send the downloadable file, great hit “submit” and an advisor will send you the guide shortly., create a free account and ask any financial question, learn at your own pace with our free courses.

Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

Get Started

Hey, did we answer your financial question.

We want to make sure that all of our readers get their questions answered.

Great, Want to Test Your Knowledge of This Lesson?

Create an Account to Test Your Knowledge of This Topic and Thousands of Others.

Get Your Question Answered by a Financial Professional

Create a free account and submit your question. We'll make sure a financial professional gets back to you shortly.

To Ensure One Vote Per Person, Please Include the Following Info

Great thank you for voting..

- Aug 19, 2023

Understanding Depreciation: A Key Accounting Concept

Depreciation is a fundamental concept in the world of accounting.

As an accountant, it is crucial to have a deep understanding of this concept and its impact on financial statements and tax deductions.

In this article, we will explore the basics of depreciation, delve into its different types, discuss its importance in accounting, and examine various methods used to calculate it.

Additionally, we will explore practical applications of depreciation in business planning and asset management, and debunk common misconceptions surrounding this critical accounting concept.

What is Depreciation?

At its core, depreciation refers to the systematic allocation of the cost of an asset over its useful life.

In other words, it is an accounting method used to spread the cost of an asset over the period during which it is expected to provide economic benefits.

Depreciation is a fundamental concept in accounting that allows businesses to accurately reflect the value of their assets and the expenses associated with them. By allocating the cost of an asset over its useful life, depreciation ensures that the financial statements provide a true and fair view of the business's financial position.

The Basics of Depreciation

In order to understand depreciation, it is essential to grasp the concept of an asset's useful life.

An asset's useful life refers to the period over which it is expected to be used by a business to generate revenue. This could be a tangible asset like a piece of machinery or even an intangible asset like a patent.

Consider a manufacturing company that purchases a new piece of machinery to increase its production capacity. The useful life of this machinery would be the estimated number of years that it can be used efficiently to contribute to the company's revenue generation.

Depreciation allows businesses to allocate the cost of acquiring an asset and match it with the revenue it generates over its useful life. Doing so provides a more accurate picture of the business's financial performance and ensures that expenses are recognized in the appropriate accounting periods.

For example, if the machinery mentioned earlier has a useful life of 10 years and costs £100,000, the company can allocate £10,000 of depreciation expense each year for 10 years. This way, the cost of the machinery is gradually expensed over its useful life, reflecting its decreasing value as it ages.

Types of Depreciation

There are several types of depreciation methods, each suited to different types of assets and business needs. The most common types of depreciation include:

1. Straight-Line Method

The straight-line method is the simplest and most widely used depreciation method. It evenly allocates the cost of an asset over its useful life. This means that each year, an equal percentage of the asset's cost is expensed.

Using the example of the machinery, if the company decides to use the straight-line method, it would expense £10,000 each year for 10 years, as mentioned earlier.

2. Declining Balance Method

The declining balance method, as the name suggests, allocates a higher percentage of an asset's cost in the early years of its useful life. This method reflects the assumption that many assets tend to lose value more rapidly in their early stages and then stabilize over time.

Continuing with the machinery example, if the company chooses the declining balance method, it might allocate a higher percentage of the cost, let's say 20%, in the first year. In subsequent years, the depreciation expense would decrease as the asset's value stabilizes.

3. Units of Production Method

The units of production method involves allocating the cost of an asset based on the number of units it produces or the hours it operates. This method is particularly useful for assets that are used in production, such as manufacturing equipment.

For instance, if the machinery's value is primarily determined by the number of units it produces, the company could allocate the depreciation expense based on the number of units produced each year. This method ensures that the cost of the machinery is directly linked to its usage and production output.

By offering different depreciation methods, businesses have the flexibility to choose the approach that best suits their assets and financial reporting objectives.

It is important for companies to carefully consider the nature of their assets and their expected patterns of use before deciding on the most appropriate depreciation method.

The Importance of Depreciation in Accounting

Depreciation is a fundamental concept in accounting that impacts financial statements and tax deductions. It is essential for businesses to understand the significance of depreciation and its implications. Let us delve deeper into these two aspects:

Impact on Financial Statements

Depreciation plays a crucial role in financial statements, particularly the income statement and the balance sheet .

On the income statement, depreciation expenses are recognized as a cost and deducted from revenue. This direct subtraction affects the profitability of the business, providing a more accurate representation of its financial performance.

Moreover, on the balance sheet, accumulated depreciation appears as a contra-asset account. This means that it reduces the book value of the asset, reflecting the gradual decrease in its value over time.

By accounting for depreciation, businesses can accurately portray the value of their assets, ensuring transparency in financial reporting.

Furthermore, understanding the impact of depreciation on financial statements is crucial for investors and stakeholders. It allows them to assess the true profitability and asset value of a business, aiding in informed decision-making and financial analysis.

Role in Tax Deductions

In addition to its impact on financial statements, depreciation plays a vital role in tax deductions. It enables businesses to recover the cost of their assets over time, providing tax benefits that can significantly reduce their overall tax liability.

In the United Kingdom, tax laws provide specific depreciation rules and guidelines. These regulations ensure that businesses can fully leverage the tax benefits associated with the gradual wear and tear of their assets.

By depreciating assets over their useful lives, businesses can allocate the cost of the asset proportionately, reducing their taxable income and ultimately lowering their tax burden.

Moreover, understanding the intricacies of depreciation for tax purposes is essential for businesses to optimize their tax planning strategies. By accurately calculating and claiming depreciation expenses, businesses can maximize their tax deductions, freeing up valuable resources for further investment and growth.

In conclusion, depreciation is a crucial aspect of accounting that impacts financial statements and tax deductions.

By recognizing the importance of depreciation, businesses can ensure accurate financial reporting, make informed decisions, and optimize their tax planning strategies. It is imperative for businesses to stay up-to-date with accounting regulations and seek professional advice to navigate the complexities of depreciation effectively.

Methods of Calculating Depreciation

Now that we understand the importance of depreciation, let's dive into the various methods used to calculate it:

By spreading out the cost, businesses can accurately reflect the wear and tear an asset experiences and ensure that its value is properly reflected on the balance sheet.

Straight-Line Method

The straight-line method, as mentioned earlier, distributes the cost of an asset evenly over its useful life. This method is straightforward to calculate and provides a consistent depreciation expense each year.

For example, let's say a company purchases a delivery truck for £50,000 with an estimated useful life of 5 years. Using the straight-line method, the company would divide the cost (£50,000) by the useful life (5 years), resulting in an annual depreciation expense of £10,000.

This method is commonly used for assets with a consistent value decline over time, such as office equipment or furniture.

Declining Balance Method

The declining balance method, on the other hand, applies a higher depreciation rate to the asset's book value.

This results in higher depreciation expenses in the earlier years and gradually decreasing expenses as the asset ages.

Let's continue with the example of the delivery truck. Using the declining balance method, the company might choose a depreciation rate of 20%. In the first year, the depreciation expense would be calculated by multiplying the book value (£50,000) by the depreciation rate (20%), resulting in £10,000. The following year, the depreciation expense would be calculated using the reduced book value (£40,000) and the same depreciation rate, resulting in £8,000.

This method is often used for assets that experience higher levels of wear and tear in the early years, such as vehicles or machinery.

Units of Production Method

The units of production method allocates depreciation based on the actual usage or output of the asset. This method is ideal for businesses where the usage or output of an asset varies significantly from year to year.

For example, let's say a manufacturing company owns a machine that produces widgets. The company estimates that the machine can produce 100,000 widgets over its useful life.

Using the units of production method, the company would allocate depreciation based on the number of widgets produced each year.