7 Different Types of Business Plans Explained

11 min. read

Updated April 10, 2024

Business plans go by many names: Strategic plans, traditional plans , operational plans, feasibility plans, internal plans, growth plans, and more.

Different situations call for different types of plans.

But what makes each type of plan unique? And why should you consider one type over another?

In this article, we’ll uncover a quick process to find the right type of business plan, along with an overview of each option.

Let’s help you find the right planning format.

- What type of business plan do you need?

The short answer is… it depends.

Your current business stage, intended audience, and how you’ll use the plan will all impact what format works best.

Remember, just the act of planning will improve your chances of success . It’s important to land on an option that will support your needs. Don’t get too hung up on making the right choice and delay writing your plan.

So, how do you choose?

1. Know why you need a business plan

What are you creating a business plan for ? Are you pitching to potential investors? Applying for a loan? Trying to understand if your business idea is feasible?

You may need a business plan for one or multiple reasons. What you intend to do with it will inform what type of plan you need.

For example: A more robust and detailed plan may be necessary if you seek investment . But a shorter format could be more useful and less time-consuming if you’re just testing an idea.

2. Become familiar with your options

You don’t need to become a planning expert and understand every detail about every type of plan. You just need to know the basics:

- What makes this type of plan unique?

- What are its benefits?

- What are its drawbacks?

- Which types of businesses typically use it?

By taking the time to review, you’ll understand what you’re getting into and be more likely to complete your plan. Plus, you’ll come away with a document built with your use case(s) in mind—meaning you won’t have to restart to make it a valuable tool.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

3. Start small and grow

When choosing a business plan format, a good tactic is to opt for a shorter option and build from there. You’ll save time and effort and still come away with a working business plan.

Plus, you’ll better understand what further planning you may need to do. And you won’t be starting from scratch.

Read More: How to identify the right type of plan for your business

Again, the type of business plan you need fully depends on your situation and use case. But running through this quick exercise will help you narrow down your options.

Now let’s look at the common business plan types you can choose from.

- Traditional business plan

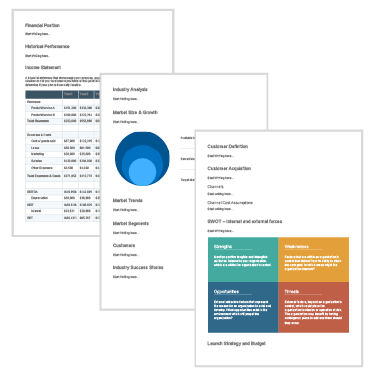

The traditional (or standard) business plan is an in-depth document covering every aspect of your business. It’s the most common plan type you’ll come across.

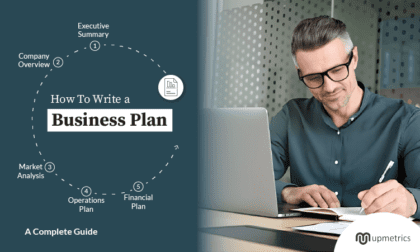

A traditional business plan is broken up into 10 sections:

- Executive summary

- Description of products and services

- Market analysis

- Competitive analysis

- Marketing and sales plan

- Business operations

- Key milestones and metrics

- Organization and management team

- Financial plan

- Appendix

Why use this type of plan?

A traditional business plan is best for anyone approaching specific business planning events—such as presenting a business plan to a bank or investor for funding.

A traditional plan can also be useful if you need to add more details around specific business areas.

For example: You start as a solopreneur and don’t immediately need to define your team structure. But eventually you hit a threshold where you need more staff in order to keep growing. A great way to explore which roles you need and how they will function is by fleshing out the organization and management section .

That’s the unseen value of a more detailed plan like this. While you can follow the structure outlined above and create an in-depth plan ready for funding, you can also choose which sections to prioritize.

Read More: How to write a traditional business plan

- One-page plan

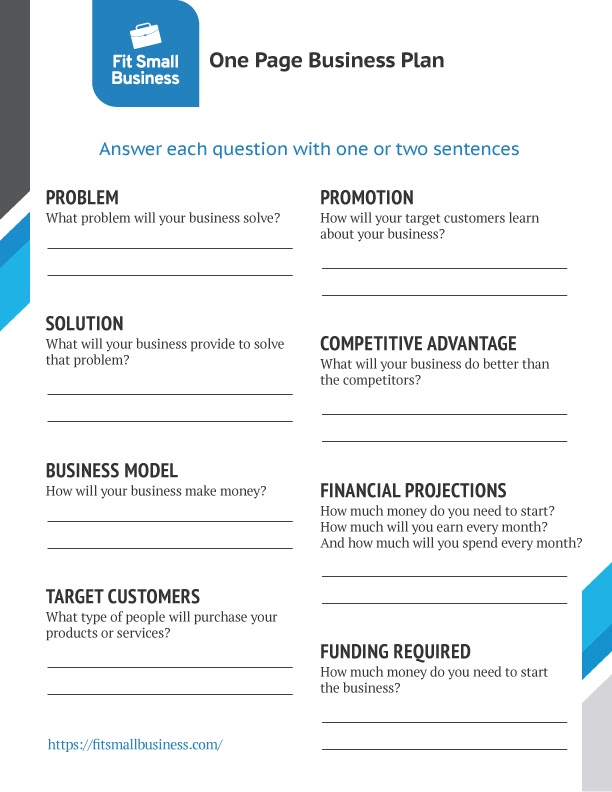

The one-page business plan is a simplified (but just as useful) version of a traditional business plan. It follows the same structure, but is far easier to create. It can even be used as a pitch document.

Here’s how you’ll organize information when using a one-page plan:

- Value proposition

- Market need

- Your solution

- Competition

- Target market

- Sales and marketing

- Budget and sales goals

- Team summary

- Key partners

- Funding needs

A one-page plan is faster and easier to assemble than a traditional plan. You can write a one-page plan in as little as 30 minutes .

You’ll still cover the crucial details found in a traditional plan, but in a more manageable format.

So, if you’re exploring a business idea for the first time or updating your strategy—a one-page plan is ideal. You can review and update your entire plan in just a few minutes.

Applying for a loan with this type of plan probably wouldn’t make sense. Lenders typically want to see a more detailed plan to accurately assess potential risk.

However, it is a great option to send to investors.

“Investors these days are much less likely to look at a detailed plan,” says Palo Alto Software COO Noah Parsons. “An executive summary or one-page plan, pitch presentation, and financials are all a VC is likely to look at.”

Creating a more detailed plan is as much about being prepared as anything else. If you don’t dig into everything a traditional plan covers, you’ll struggle to land your pitch .

If you don’t intend to seek funding, a one-page plan is often all you need. The key is regularly revisiting it to stay on top of your business.

Let’s explore two unique processes to help you do that:

Read More: How to write a one-page business plan

Lean planning process

Lean planning is a process that uses your one-page plan as a testing tool. The goal is to create a plan and immediately put it into action to see if your ideas actually work. You’ll typically be focusing on one (or all) of the following areas:

- Strategy – What you will do

- Tactics – How you will do it

- Business Model – How you make money

- Schedule – Who is responsible and when will it happen

Why use this process?

Lean planning is best for businesses that need to move fast, test assumptions, revise, and get moving again. It’s short and simple, and meant to get everyone on the same page as quickly as possible.

That’s why it’s so popular for startups. They don’t necessarily need a detailed plan, since they’re mostly focused on determining whether or not they have a viable business idea .

The only drawback is that this planning process is built primarily around early-stage businesses. It can be a useful tool for established businesses looking to test a strategy, but it may not be as helpful for ongoing management.

Read More: The fundamentals of lean planning

Growth planning

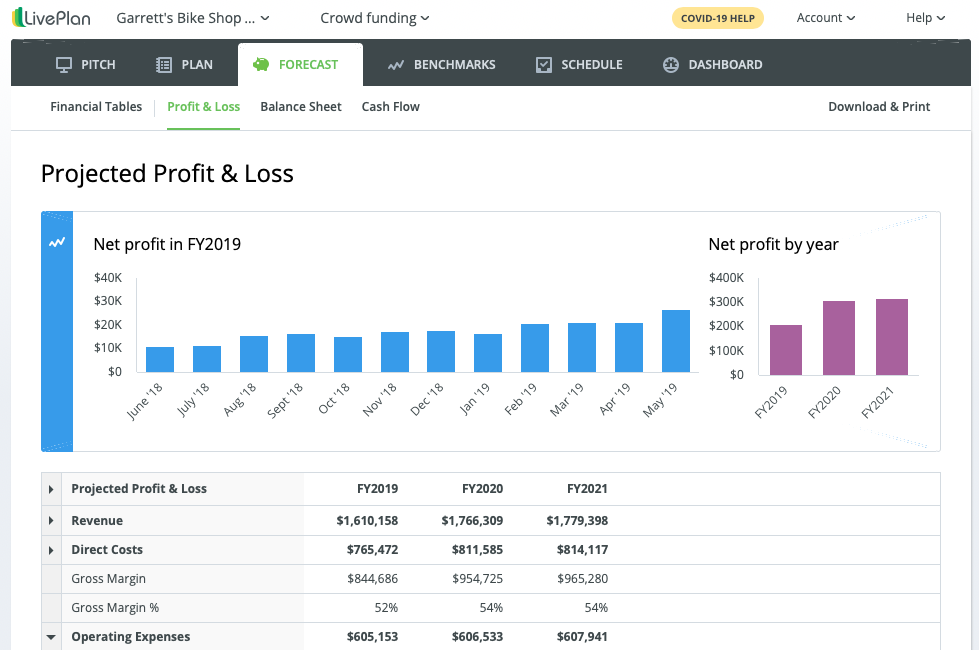

Growth planning is a financials-focused planning process designed to help you make quick and strategic decisions.

Again, it starts with a one-page plan outlining your strategy, tactics, business model, and schedule. The next step is to create a working financial forecast that includes projected sales, expenses, and cash flows.

From there, you run your business.

As you go, track your actual financial performance and carve out time to compare it to your forecasts . If you spot any differences, these discrepancies may indicate problems or opportunities that call for adjusting your current strategy.

Growth planning combines the simplicity of the one-page plan and the speed of lean planning, with the power of financial forecasting.

This makes the process useful for every business stage and even allows you to skip to the forecasting step if you already have a plan.

With growth planning, you’ll:

- Regularly revisit your financials

- Better understand how your business operates

- Make quick and confident decisions

This process focuses on growing your business. If diving into your financials isn’t a priority right now, that’s okay. Start with a one-page plan instead, and revisit growth planning when you’re ready.

Read More: How to write a growth-oriented business plan

- Internal plan

Sometimes you just need a business plan that works as an internal management tool.

Something to help you:

- Set business goals

- Provide a high-level overview of operations

- Prepare to create budgets and financial projections

You don’t need an overly long and detailed business plan for this. Just a document that is easy to create, useful for developing or revisiting your strategy, and able to get everyone up to speed.

The internal plan is a great option if you’re not planning to present your plan to anyone outside your business. Especially if you’re an up-and-running business that may have created a plan previously. You might just need something simple for day-to-day use.

Read More: 8 steps to write a useful internal business plan

- 5-year business plan

Some investors or stakeholders may request a long-term plan stretching up to five years. They typically want to understand your vision for the future and see your long-term goals or milestones.

To be honest, creating a detailed long-term business plan is typically a waste of time. There are a few exceptions:

- A long-term plan is specifically asked for

- You want to outline your long-term vision

- Real estate development

- Medical product manufacturing

- Transportation, automotive, aviation, or aerospace development

The reality is, you can’t predict what will happen in the next month, let alone the next one, three, or five years.

So, when creating a long-term plan, don’t dig too deep into the details. Focus on establishing long-term goals , annual growth targets, and aspirational milestones you’d like to hit.

Then supplement these with a more focused one-page plan that actually describes your current business, which you can use in your business right now.

Read More: How to write a five-year business plan

- Nonprofit business plan

A nonprofit business plan is not too different from a traditional plan. You should still cover all of the sections I listed above to help you build a sustainable business.

The main differences in a nonprofit plan are tied to funding and awareness. You need to account for:

- Fundraising sources and activities.

- Alliances and partnerships.

- Promotion and outreach strategies.

You also need to set goals, track performance, and demonstrate that you have the right team to run a fiscally healthy organization. You’re just not pursuing profits, you’re trying to fulfill a mission. But you cannot serve your community if your organization isn’t financially stable.

If you can use your business plan to show that you’re a well-organized nonprofit organization, you are more likely to attract donors and convince investors to provide funding.

Read More: How to write a nonprofit business plan

Resources to help write your business plan

Don’t get too hung up on the type of business plan you choose. Remember, you can always start small and expand if you need to.

To help you do that, I recommend downloading our free one-page business plan template . It’s especially useful if you’re exploring an idea and need a quick way to document how your business will operate.

If you know you’ll pursue funding, download our free traditional business plan template . It’s already in an SBA-lender-approved format and provides detailed instructions for each section. And if you want to explore other options, check out our roundup of the 8 best business plan templates you can download for free.

Lastly, check out our library of over 550 sample business plans if you need inspiration. These can provide specific insight into what you should focus on in a given industry.

Remember, just by deciding to write a business plan, you are increasing your likelihood of success. Pick a format and start writing!

Types of business plans FAQ

Which type of planning should be done for a business?

The type of planning fully depends on your business stage and how you intend to use the plan. Generally, whatever format you choose should help you outline your strategy, business model, tactics, and timeline.

How many types of business plans are there?

There are seven common types of business plans, including: traditional, one-page, lean, growth, internal, 5-year, and nonprofit plans.

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Tim Berry is the founder and chairman of Palo Alto Software , a co-founder of Borland International, and a recognized expert in business planning. He has an MBA from Stanford and degrees with honors from the University of Oregon and the University of Notre Dame. Today, Tim dedicates most of his time to blogging, teaching and evangelizing for business planning.

.png?format=auto)

Table of Contents

- Plan writing resources

Related Articles

1 Min. Read

Free Clothing Retail Sample Business Plan

9 Min. Read

What Is a Balance Sheet? Definition, Formulas, and Example

2 Min. Read

Why You Should Care about Intellectual Property

6 Min. Read

How to Write a Nail Salon Business Plan + Free Sample Plan PDF

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

What is a Business Plan? Definition, Tips, and Templates

Published: June 07, 2023

In an era where more than 20% of small enterprises fail in their first year, having a clear, defined, and well-thought-out business plan is a crucial first step for setting up a business for long-term success.

Business plans are a required tool for all entrepreneurs, business owners, business acquirers, and even business school students. But … what exactly is a business plan?

In this post, we'll explain what a business plan is, the reasons why you'd need one, identify different types of business plans, and what you should include in yours.

What is a business plan?

A business plan is a documented strategy for a business that highlights its goals and its plans for achieving them. It outlines a company's go-to-market plan, financial projections, market research, business purpose, and mission statement. Key staff who are responsible for achieving the goals may also be included in the business plan along with a timeline.

The business plan is an undeniably critical component to getting any company off the ground. It's key to securing financing, documenting your business model, outlining your financial projections, and turning that nugget of a business idea into a reality.

What is a business plan used for?

The purpose of a business plan is three-fold: It summarizes the organization’s strategy in order to execute it long term, secures financing from investors, and helps forecast future business demands.

Business Plan Template [ Download Now ]

Working on your business plan? Try using our Business Plan Template . Pre-filled with the sections a great business plan needs, the template will give aspiring entrepreneurs a feel for what a business plan is, what should be in it, and how it can be used to establish and grow a business from the ground up.

Purposes of a Business Plan

Chances are, someone drafting a business plan will be doing so for one or more of the following reasons:

1. Securing financing from investors.

Since its contents revolve around how businesses succeed, break even, and turn a profit, a business plan is used as a tool for sourcing capital. This document is an entrepreneur's way of showing potential investors or lenders how their capital will be put to work and how it will help the business thrive.

All banks, investors, and venture capital firms will want to see a business plan before handing over their money, and investors typically expect a 10% ROI or more from the capital they invest in a business.

Therefore, these investors need to know if — and when — they'll be making their money back (and then some). Additionally, they'll want to read about the process and strategy for how the business will reach those financial goals, which is where the context provided by sales, marketing, and operations plans come into play.

2. Documenting a company's strategy and goals.

A business plan should leave no stone unturned.

Business plans can span dozens or even hundreds of pages, affording their drafters the opportunity to explain what a business' goals are and how the business will achieve them.

To show potential investors that they've addressed every question and thought through every possible scenario, entrepreneurs should thoroughly explain their marketing, sales, and operations strategies — from acquiring a physical location for the business to explaining a tactical approach for marketing penetration.

These explanations should ultimately lead to a business' break-even point supported by a sales forecast and financial projections, with the business plan writer being able to speak to the why behind anything outlined in the plan.

.webp)

Free Business Plan Template

The essential document for starting a business -- custom built for your needs.

- Outline your idea.

- Pitch to investors.

- Secure funding.

- Get to work!

You're all set!

Click this link to access this resource at any time.

Free Business Plan [Template]

Fill out the form to access your free business plan., 3. legitimizing a business idea..

Everyone's got a great idea for a company — until they put pen to paper and realize that it's not exactly feasible.

A business plan is an aspiring entrepreneur's way to prove that a business idea is actually worth pursuing.

As entrepreneurs document their go-to-market process, capital needs, and expected return on investment, entrepreneurs likely come across a few hiccups that will make them second guess their strategies and metrics — and that's exactly what the business plan is for.

It ensures an entrepreneur's ducks are in a row before bringing their business idea to the world and reassures the readers that whoever wrote the plan is serious about the idea, having put hours into thinking of the business idea, fleshing out growth tactics, and calculating financial projections.

4. Getting an A in your business class.

Speaking from personal experience, there's a chance you're here to get business plan ideas for your Business 101 class project.

If that's the case, might we suggest checking out this post on How to Write a Business Plan — providing a section-by-section guide on creating your plan?

What does a business plan need to include?

- Business Plan Subtitle

- Executive Summary

- Company Description

- The Business Opportunity

- Competitive Analysis

- Target Market

- Marketing Plan

- Financial Summary

- Funding Requirements

1. Business Plan Subtitle

Every great business plan starts with a captivating title and subtitle. You’ll want to make it clear that the document is, in fact, a business plan, but the subtitle can help tell the story of your business in just a short sentence.

2. Executive Summary

Although this is the last part of the business plan that you’ll write, it’s the first section (and maybe the only section) that stakeholders will read. The executive summary of a business plan sets the stage for the rest of the document. It includes your company’s mission or vision statement, value proposition, and long-term goals.

3. Company Description

This brief part of your business plan will detail your business name, years in operation, key offerings, and positioning statement. You might even add core values or a short history of the company. The company description’s role in a business plan is to introduce your business to the reader in a compelling and concise way.

4. The Business Opportunity

The business opportunity should convince investors that your organization meets the needs of the market in a way that no other company can. This section explains the specific problem your business solves within the marketplace and how it solves them. It will include your value proposition as well as some high-level information about your target market.

5. Competitive Analysis

Just about every industry has more than one player in the market. Even if your business owns the majority of the market share in your industry or your business concept is the first of its kind, you still have competition. In the competitive analysis section, you’ll take an objective look at the industry landscape to determine where your business fits. A SWOT analysis is an organized way to format this section.

6. Target Market

Who are the core customers of your business and why? The target market portion of your business plan outlines this in detail. The target market should explain the demographics, psychographics, behavioristics, and geographics of the ideal customer.

7. Marketing Plan

Marketing is expansive, and it’ll be tempting to cover every type of marketing possible, but a brief overview of how you’ll market your unique value proposition to your target audience, followed by a tactical plan will suffice.

Think broadly and narrow down from there: Will you focus on a slow-and-steady play where you make an upfront investment in organic customer acquisition? Or will you generate lots of quick customers using a pay-to-play advertising strategy? This kind of information should guide the marketing plan section of your business plan.

8. Financial Summary

Money doesn’t grow on trees and even the most digital, sustainable businesses have expenses. Outlining a financial summary of where your business is currently and where you’d like it to be in the future will substantiate this section. Consider including any monetary information that will give potential investors a glimpse into the financial health of your business. Assets, liabilities, expenses, debt, investments, revenue, and more are all useful adds here.

So, you’ve outlined some great goals, the business opportunity is valid, and the industry is ready for what you have to offer. Who’s responsible for turning all this high-level talk into results? The "team" section of your business plan answers that question by providing an overview of the roles responsible for each goal. Don’t worry if you don’t have every team member on board yet, knowing what roles to hire for is helpful as you seek funding from investors.

10. Funding Requirements

Remember that one of the goals of a business plan is to secure funding from investors, so you’ll need to include funding requirements you’d like them to fulfill. The amount your business needs, for what reasons, and for how long will meet the requirement for this section.

Types of Business Plans

- Startup Business Plan

- Feasibility Business Plan

- Internal Business Plan

- Strategic Business Plan

- Business Acquisition Plan

- Business Repositioning Plan

- Expansion or Growth Business Plan

There’s no one size fits all business plan as there are several types of businesses in the market today. From startups with just one founder to historic household names that need to stay competitive, every type of business needs a business plan that’s tailored to its needs. Below are a few of the most common types of business plans.

For even more examples, check out these sample business plans to help you write your own .

1. Startup Business Plan

As one of the most common types of business plans, a startup business plan is for new business ideas. This plan lays the foundation for the eventual success of a business.

The biggest challenge with the startup business plan is that it’s written completely from scratch. Startup business plans often reference existing industry data. They also explain unique business strategies and go-to-market plans.

Because startup business plans expand on an original idea, the contents will vary by the top priority goals.

For example, say a startup is looking for funding. If capital is a priority, this business plan might focus more on financial projections than marketing or company culture.

2. Feasibility Business Plan

This type of business plan focuses on a single essential aspect of the business — the product or service. It may be part of a startup business plan or a standalone plan for an existing organization. This comprehensive plan may include:

- A detailed product description

- Market analysis

- Technology needs

- Production needs

- Financial sources

- Production operations

According to CBInsights research, 35% of startups fail because of a lack of market need. Another 10% fail because of mistimed products.

Some businesses will complete a feasibility study to explore ideas and narrow product plans to the best choice. They conduct these studies before completing the feasibility business plan. Then the feasibility plan centers on that one product or service.

3. Internal Business Plan

Internal business plans help leaders communicate company goals, strategy, and performance. This helps the business align and work toward objectives more effectively.

Besides the typical elements in a startup business plan, an internal business plan may also include:

- Department-specific budgets

- Target demographic analysis

- Market size and share of voice analysis

- Action plans

- Sustainability plans

Most external-facing business plans focus on raising capital and support for a business. But an internal business plan helps keep the business mission consistent in the face of change.

4. Strategic Business Plan

Strategic business plans focus on long-term objectives for your business. They usually cover the first three to five years of operations. This is different from the typical startup business plan which focuses on the first one to three years. The audience for this plan is also primarily internal stakeholders.

These types of business plans may include:

- Relevant data and analysis

- Assessments of company resources

- Vision and mission statements

It's important to remember that, while many businesses create a strategic plan before launching, some business owners just jump in. So, this business plan can add value by outlining how your business plans to reach specific goals. This type of planning can also help a business anticipate future challenges.

5. Business Acquisition Plan

Investors use business plans to acquire existing businesses, too — not just new businesses.

A business acquisition plan may include costs, schedules, or management requirements. This data will come from an acquisition strategy.

A business plan for an existing company will explain:

- How an acquisition will change its operating model

- What will stay the same under new ownership

- Why things will change or stay the same

- Acquisition planning documentation

- Timelines for acquisition

Additionally, the business plan should speak to the current state of the business and why it's up for sale.

For example, if someone is purchasing a failing business, the business plan should explain why the business is being purchased. It should also include:

- What the new owner will do to turn the business around

- Historic business metrics

- Sales projections after the acquisition

- Justification for those projections

6. Business Repositioning Plan

.webp?width=650&height=450&name=businessplan_6%20(1).webp)

When a business wants to avoid acquisition, reposition its brand, or try something new, CEOs or owners will develop a business repositioning plan.

This plan will:

- Acknowledge the current state of the company.

- State a vision for the future of the company.

- Explain why the business needs to reposition itself.

- Outline a process for how the company will adjust.

Companies planning for a business reposition often do so — proactively or retroactively — due to a shift in market trends and customer needs.

For example, shoe brand AllBirds plans to refocus its brand on core customers and shift its go-to-market strategy. These decisions are a reaction to lackluster sales following product changes and other missteps.

7. Expansion or Growth Business Plan

When your business is ready to expand, a growth business plan creates a useful structure for reaching specific targets.

For example, a successful business expanding into another location can use a growth business plan. This is because it may also mean the business needs to focus on a new target market or generate more capital.

This type of plan usually covers the next year or two of growth. It often references current sales, revenue, and successes. It may also include:

- SWOT analysis

- Growth opportunity studies

- Financial goals and plans

- Marketing plans

- Capability planning

These types of business plans will vary by business, but they can help businesses quickly rally around new priorities to drive growth.

Getting Started With Your Business Plan

At the end of the day, a business plan is simply an explanation of a business idea and why it will be successful. The more detail and thought you put into it, the more successful your plan — and the business it outlines — will be.

When writing your business plan, you’ll benefit from extensive research, feedback from your team or board of directors, and a solid template to organize your thoughts. If you need one of these, download HubSpot's Free Business Plan Template below to get started.

Editor's note: This post was originally published in August 2020 and has been updated for comprehensiveness.

Don't forget to share this post!

Related articles.

24 of My Favorite Sample Business Plans & Examples For Your Inspiration

![what are the 2 types of business plans How to Write a Powerful Executive Summary [+4 Top Examples]](https://blog.hubspot.com/hubfs/executive-summary-example_5.webp)

How to Write a Powerful Executive Summary [+4 Top Examples]

Maximizing Your Social Media Strategy: The Top Aggregator Tools to Use

The Content Aggregator Guide for 2023

![what are the 2 types of business plans 7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]](https://blog.hubspot.com/hubfs/gantt-chart-example.jpg)

7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]

![what are the 2 types of business plans The 8 Best Free Flowchart Templates [+ Examples]](https://blog.hubspot.com/hubfs/flowchart%20templates.jpg)

The 8 Best Free Flowchart Templates [+ Examples]

16 Best Screen Recorders to Use for Collaboration

The 25 Best Google Chrome Extensions for SEO

Professional Invoice Design: 28 Samples & Templates to Inspire You

Customers’ Top HubSpot Integrations to Streamline Your Business in 2022

2 Essential Templates For Starting Your Business

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

- Search Search Please fill out this field.

What Is a Business Plan?

Understanding business plans, how to write a business plan, common elements of a business plan, how often should a business plan be updated, the bottom line, business plan: what it is, what's included, and how to write one.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

A business plan is a document that details a company's goals and how it intends to achieve them. Business plans can be of benefit to both startups and well-established companies. For startups, a business plan can be essential for winning over potential lenders and investors. Established businesses can find one useful for staying on track and not losing sight of their goals. This article explains what an effective business plan needs to include and how to write one.

Key Takeaways

- A business plan is a document describing a company's business activities and how it plans to achieve its goals.

- Startup companies use business plans to get off the ground and attract outside investors.

- For established companies, a business plan can help keep the executive team focused on and working toward the company's short- and long-term objectives.

- There is no single format that a business plan must follow, but there are certain key elements that most companies will want to include.

Investopedia / Ryan Oakley

Any new business should have a business plan in place prior to beginning operations. In fact, banks and venture capital firms often want to see a business plan before they'll consider making a loan or providing capital to new businesses.

Even if a business isn't looking to raise additional money, a business plan can help it focus on its goals. A 2017 Harvard Business Review article reported that, "Entrepreneurs who write formal plans are 16% more likely to achieve viability than the otherwise identical nonplanning entrepreneurs."

Ideally, a business plan should be reviewed and updated periodically to reflect any goals that have been achieved or that may have changed. An established business that has decided to move in a new direction might create an entirely new business plan for itself.

There are numerous benefits to creating (and sticking to) a well-conceived business plan. These include being able to think through ideas before investing too much money in them and highlighting any potential obstacles to success. A company might also share its business plan with trusted outsiders to get their objective feedback. In addition, a business plan can help keep a company's executive team on the same page about strategic action items and priorities.

Business plans, even among competitors in the same industry, are rarely identical. However, they often have some of the same basic elements, as we describe below.

While it's a good idea to provide as much detail as necessary, it's also important that a business plan be concise enough to hold a reader's attention to the end.

While there are any number of templates that you can use to write a business plan, it's best to try to avoid producing a generic-looking one. Let your plan reflect the unique personality of your business.

Many business plans use some combination of the sections below, with varying levels of detail, depending on the company.

The length of a business plan can vary greatly from business to business. Regardless, it's best to fit the basic information into a 15- to 25-page document. Other crucial elements that take up a lot of space—such as applications for patents—can be referenced in the main document and attached as appendices.

These are some of the most common elements in many business plans:

- Executive summary: This section introduces the company and includes its mission statement along with relevant information about the company's leadership, employees, operations, and locations.

- Products and services: Here, the company should describe the products and services it offers or plans to introduce. That might include details on pricing, product lifespan, and unique benefits to the consumer. Other factors that could go into this section include production and manufacturing processes, any relevant patents the company may have, as well as proprietary technology . Information about research and development (R&D) can also be included here.

- Market analysis: A company needs to have a good handle on the current state of its industry and the existing competition. This section should explain where the company fits in, what types of customers it plans to target, and how easy or difficult it may be to take market share from incumbents.

- Marketing strategy: This section can describe how the company plans to attract and keep customers, including any anticipated advertising and marketing campaigns. It should also describe the distribution channel or channels it will use to get its products or services to consumers.

- Financial plans and projections: Established businesses can include financial statements, balance sheets, and other relevant financial information. New businesses can provide financial targets and estimates for the first few years. Your plan might also include any funding requests you're making.

The best business plans aren't generic ones created from easily accessed templates. A company should aim to entice readers with a plan that demonstrates its uniqueness and potential for success.

2 Types of Business Plans

Business plans can take many forms, but they are sometimes divided into two basic categories: traditional and lean startup. According to the U.S. Small Business Administration (SBA) , the traditional business plan is the more common of the two.

- Traditional business plans : These plans tend to be much longer than lean startup plans and contain considerably more detail. As a result they require more work on the part of the business, but they can also be more persuasive (and reassuring) to potential investors.

- Lean startup business plans : These use an abbreviated structure that highlights key elements. These business plans are short—as short as one page—and provide only the most basic detail. If a company wants to use this kind of plan, it should be prepared to provide more detail if an investor or a lender requests it.

Why Do Business Plans Fail?

A business plan is not a surefire recipe for success. The plan may have been unrealistic in its assumptions and projections to begin with. Markets and the overall economy might change in ways that couldn't have been foreseen. A competitor might introduce a revolutionary new product or service. All of this calls for building some flexibility into your plan, so you can pivot to a new course if needed.

How frequently a business plan needs to be revised will depend on the nature of the business. A well-established business might want to review its plan once a year and make changes if necessary. A new or fast-growing business in a fiercely competitive market might want to revise it more often, such as quarterly.

What Does a Lean Startup Business Plan Include?

The lean startup business plan is an option when a company prefers to give a quick explanation of its business. For example, a brand-new company may feel that it doesn't have a lot of information to provide yet.

Sections can include: a value proposition ; the company's major activities and advantages; resources such as staff, intellectual property, and capital; a list of partnerships; customer segments; and revenue sources.

A business plan can be useful to companies of all kinds. But as a company grows and the world around it changes, so too should its business plan. So don't think of your business plan as carved in granite but as a living document designed to evolve with your business.

Harvard Business Review. " Research: Writing a Business Plan Makes Your Startup More Likely to Succeed ."

U.S. Small Business Administration. " Write Your Business Plan ."

- How to Start a Business: A Comprehensive Guide and Essential Steps 1 of 25

- How to Do Market Research, Types, and Example 2 of 25

- Marketing Strategy: What It Is, How It Works, and How to Create One 3 of 25

- Marketing in Business: Strategies and Types Explained 4 of 25

- What Is a Marketing Plan? Types and How to Write One 5 of 25

- Business Development: Definition, Strategies, Steps & Skills 6 of 25

- Business Plan: What It Is, What's Included, and How to Write One 7 of 25

- Small Business Development Center (SBDC): Meaning, Types, Impact 8 of 25

- How to Write a Business Plan for a Loan 9 of 25

- Business Startup Costs: It’s in the Details 10 of 25

- Startup Capital Definition, Types, and Risks 11 of 25

- Bootstrapping Definition, Strategies, and Pros/Cons 12 of 25

- Crowdfunding: What It Is, How It Works, and Popular Websites 13 of 25

- Starting a Business with No Money: How to Begin 14 of 25

- A Comprehensive Guide to Establishing Business Credit 15 of 25

- Equity Financing: What It Is, How It Works, Pros and Cons 16 of 25

- Best Startup Business Loans for April 2024 17 of 25

- Sole Proprietorship: What It Is, Pros and Cons, and Differences From an LLC 18 of 25

- Partnership: Definition, How It Works, Taxation, and Types 19 of 25

- What Is an LLC? Limited Liability Company Structure and Benefits Defined 20 of 25

- Corporation: What It Is and How To Form One 21 of 25

- Starting a Small Business: Your Complete How-to Guide 22 of 25

- Starting an Online Business: A Step-by-Step Guide 23 of 25

- How to Start Your Own Bookkeeping Business: Essential Tips 24 of 25

- How to Start a Successful Dropshipping Business: A Comprehensive Guide 25 of 25

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1456193345-2cc8ef3d583f42d8a80c8e631c0b0556.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- Customer Reviews

- Net 30 Account

- Wise Services

- Steps & Timeline

- Work at a Glance

- Market Research at a Glance

- Business Plan Writing Services

- Bank Business Plan

- Investor Business Plan

- Franchise Business Plan

- Cannabis Business Plan

- Strategic Business Plan

- Corporate Business Plan

- Merge and Acquisition Business Plan (M&A)

- Private Placement Memorandums (PPM)

- Sample Business Plans

- Professional Feasibility Study

- PowerPoint Presentations

- Pitch Deck Presentation Services

- Business Plan Printing

- Market Research

- L-1 Business Plan

- E-2 Business Plan

- EB-5 Business Plan

- EB-5 Regional Centers

- Immigration Attorneys

- Nonprofit Business Plan

- Exit Business Planning

- Business Planning

- Business Formation

- Business License

- Business Website

- Business Branding

- Business Bank Account

- Digital Marketing

- Business Funding Resources

- Small Business Loans

- Venture Capital

- Net 30 Apply

- Frequently Asked Questions

- Business Credit Cards

- Talk to Us 1-800-496-1056

What is a business plan? Definition, Purpose, and Types

In the world of business, a well-thought-out plan is often the key to success. This plan, known as a business plan, is a comprehensive document that outlines a company’s goals, strategies , and financial projections. Whether you’re starting a new business or looking to expand an existing one, a business plan is an essential tool.

As a business plan writer and consultant , I’ve crafted over 15,000 plans for a diverse range of businesses. In this article, I’ll be sharing my wealth of experience about what a business plan is, its purpose, and the step-by-step process of creating one. By the end, you’ll have a thorough understanding of how to develop a robust business plan that can drive your business to success.

What is a business plan?

Purposes of a business plan, what are the essential components of a business plan, executive summary, business description or overview, product and price, competitive analysis, target market, marketing plan, financial plan, funding requirements, types of business plan, lean startup business plans, traditional business plans, how often should a business plan be reviewed and revised, what are the key elements of a lean startup business plan.

- What are some of the reasons why business plans don't succeed?

A business plan is a roadmap for your business. It outlines your goals, strategies, and how you plan to achieve them. It’s a living document that you can update as your business grows and changes.

Looking for someone to write a business plan?

Find professional business plan writers for your business success.

These are the following purpose of business plan:

- Attract investors and lenders: If you’re seeking funding for your business , a business plan is a must-have. Investors and lenders want to see that you have a clear plan for how you’ll use their money to grow your business and generate revenue.

- Get organized and stay on track: Writing a business plan forces you to think through all aspects of your business, from your target market to your marketing strategy. This can help you identify any potential challenges and opportunities early on, so you can develop a plan to address them.

- Make better decisions: A business plan can help you make better decisions about your business by providing you with a framework to evaluate different options. For example, if you’re considering launching a new product, your business plan can help you assess the potential market demand, costs, and profitability.

The executive summary is the most important part of your business plan, even though it’s the last one you’ll write. It’s the first section that potential investors or lenders will read, and it may be the only one they read. The executive summary sets the stage for the rest of the document by introducing your company’s mission or vision statement, value proposition, and long-term goals.

The business description section of your business plan should introduce your business to the reader in a compelling and concise way. It should include your business name, years in operation, key offerings, positioning statement, and core values (if applicable). You may also want to include a short history of your company.

In this section, the company should describe its products or services , including pricing, product lifespan, and unique benefits to the consumer. Other relevant information could include production and manufacturing processes, patents, and proprietary technology.

Every industry has competitors, even if your business is the first of its kind or has the majority of the market share. In the competitive analysis section of your business plan, you’ll objectively assess the industry landscape to understand your business’s competitive position. A SWOT analysis is a structured way to organize this section.

Your target market section explains the core customers of your business and why they are your ideal customers. It should include demographic, psychographic, behavioral, and geographic information about your target market.

Marketing plan describes how the company will attract and retain customers, including any planned advertising and marketing campaigns . It also describes how the company will distribute its products or services to consumers.

After outlining your goals, validating your business opportunity, and assessing the industry landscape, the team section of your business plan identifies who will be responsible for achieving your goals. Even if you don’t have your full team in place yet, investors will be impressed by your clear understanding of the roles that need to be filled.

In the financial plan section,established businesses should provide financial statements , balance sheets , and other financial data. New businesses should provide financial targets and estimates for the first few years, and may also request funding.

Since one goal of a business plan is to secure funding from investors , you should include the amount of funding you need, why you need it, and how long you need it for.

- Tip: Use bullet points and numbered lists to make your plan easy to read and scannable.

Access specialized business plan writing service now!

Business plans can come in many different formats, but they are often divided into two main types: traditional and lean startup. The U.S. Small Business Administration (SBA) says that the traditional business plan is the more common of the two.

Lean startup business plans are short (as short as one page) and focus on the most important elements. They are easy to create, but companies may need to provide more information if requested by investors or lenders.

Traditional business plans are longer and more detailed than lean startup business plans, which makes them more time-consuming to create but more persuasive to potential investors. Lean startup business plans are shorter and less detailed, but companies should be prepared to provide more information if requested.

Need Guidance with Your Business Plan?

Access 14 free business plan samples!

A business plan should be reviewed and revised at least annually, or more often if the business is experiencing significant changes. This is because the business landscape is constantly changing, and your business plan needs to reflect those changes in order to remain relevant and effective.

Here are some specific situations in which you should review and revise your business plan:

- You have launched a new product or service line.

- You have entered a new market.

- You have experienced significant changes in your customer base or competitive landscape.

- You have made changes to your management team or organizational structure.

- You have raised new funding.

A lean startup business plan is a short and simple way for a company to explain its business, especially if it is new and does not have a lot of information yet. It can include sections on the company’s value proposition, major activities and advantages, resources, partnerships, customer segments, and revenue sources.

What are some of the reasons why business plans don't succeed?

- Unrealistic assumptions: Business plans are often based on assumptions about the market, the competition, and the company’s own capabilities. If these assumptions are unrealistic, the plan is doomed to fail.

- Lack of focus: A good business plan should be focused on a specific goal and how the company will achieve it. If the plan is too broad or tries to do too much, it is unlikely to be successful.

- Poor execution: Even the best business plan is useless if it is not executed properly. This means having the right team in place, the necessary resources, and the ability to adapt to changing circumstances.

- Unforeseen challenges: Every business faces challenges that could not be predicted or planned for. These challenges can be anything from a natural disaster to a new competitor to a change in government regulations.

What are the benefits of having a business plan?

- It helps you to clarify your business goals and strategies.

- It can help you to attract investors and lenders.

- It can serve as a roadmap for your business as it grows and changes.

- It can help you to make better business decisions.

How to write a business plan?

There are many different ways to write a business plan, but most follow the same basic structure. Here is a step-by-step guide:

- Executive summary.

- Company description.

- Management and organization description.

- Financial projections.

How to write a business plan step by step?

Start with an executive summary, then describe your business, analyze the market, outline your products or services, detail your marketing and sales strategies, introduce your team, and provide financial projections.

Why do I need a business plan for my startup?

A business plan helps define your startup’s direction, attract investors, secure funding, and make informed decisions crucial for success.

What are the key components of a business plan?

Key components include an executive summary, business description, market analysis, products or services, marketing and sales strategy, management and team, financial projections, and funding requirements.

Can a business plan help secure funding for my business?

Yes, a well-crafted business plan demonstrates your business’s viability, the use of investment, and potential returns, making it a valuable tool for attracting investors and lenders.

Quick Links

- Investor Business Plans

- M&A Business Plan

- Private Placement

- Feasibility Study

- Hire a Business Plan Writer

- Business Valuation Calculator

- Business Plan Examples

- Real Estate Business Plan

- Business Plan Template

- Business Plan Pricing Guide

- Business Plan Makeover

- SBA Loans, Bank Funding & Business Credit

- Finding & Qualifying for Business Grants

- Leadership for the New Manager

- Content Marketing for Beginners

- All About Crowdfunding

- EB-5 Regional Centers, A Step-By-Step Guide

- Logo Designer

- Landing Page

- PPC Advertising

- Business Entity

- Business Licensing

- Virtual Assistant

- Business Phone

- Business Address

- E-1 Visa Business Plan

- EB1-A Visa Business Plan

- EB1-C Visa Business Plan

- EB2-NIW Business Plan

- H1B Visa Business Plan

- O1 Visa Business Plan

- Business Brokers

- Merger & Acquisition Advisors

- Franchisors

Proud Sponsor of

- 1-800-496-1056

- (613) 800-0227

- +44 (1549) 409190

- +61 (2) 72510077

BUSINESS STRATEGIES

7 types of business plans every entrepreneur should know

- Amanda Bellucco Chatham

- Aug 3, 2023

What’s the difference between a small business that achieves breakthrough growth and one that fizzles quickly after launch? Oftentimes, it’s having a solid business plan.

Business plans provide you with a roadmap that will take you from wantrepreneur to entrepreneur. It will guide nearly every decision you make, from the people you hire and the products or services you offer, to the look and feel of the business website you create.

But did you know that there are many different types of business plans? Some types are best for new businesses looking to attract funding. Others help to define the way your company will operate day-to-day. You can even create a plan that prepares your business for the unexpected.

Read on to learn the seven most common types of business plans and determine which one fits your immediate needs.

What is a business plan?

A business plan is a written document that defines your company’s goals and explains how you will achieve them. Putting this information down on paper brings valuable benefits. It gives you insight into your competitors, helps you develop a unique value proposition and lets you set metrics that will guide you to profitability. It’s also a necessity to obtain funding through banks or investors.

Keep in mind that a business plan isn’t a one-and-done exercise. It’s a living document that you should update regularly as your company evolves. But which type of plan is right for your business?

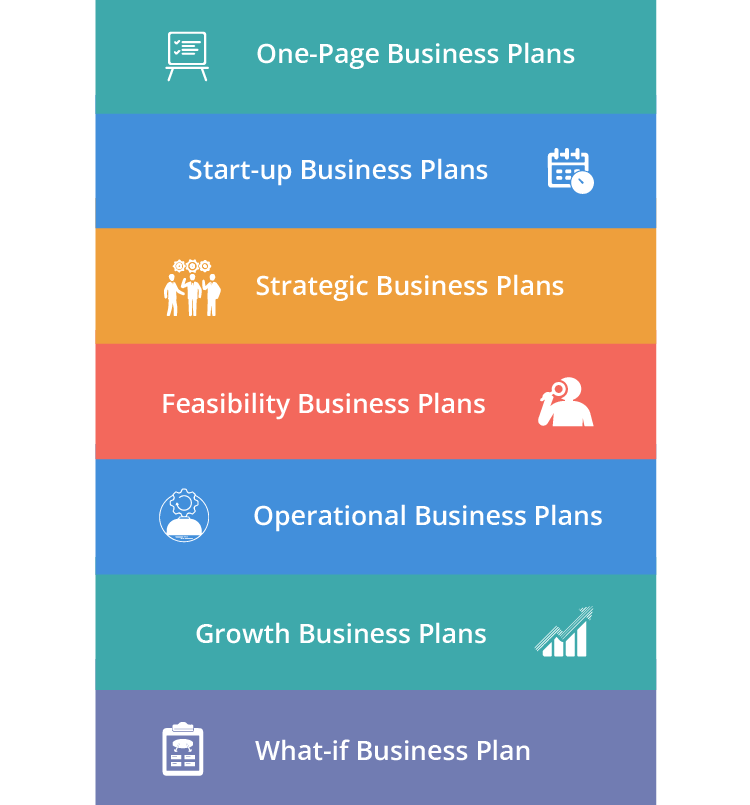

7 common types of business plans

Startup business plan

Feasibility business plan

One-page business plan

What-if business plan

Growth business plan

Operations business plan

Strategic business plan

01. Startup business plan

The startup business plan is a comprehensive document that will set the foundation for your company’s success. It covers all aspects of a business, including a situation analysis, detailed financial information and a strategic marketing plan.

Startup plans serve two purposes: internally, they provide a step-by-step guide that you and your team can use to start a business and generate results on day one. Externally, they prove the validity of your business concept to banks and investors, whose capital you’ll likely need to make your entrepreneurial dreams a reality.

Elements of a startup business plan should include the following steps:

Executive summary : Write a brief synopsis of your company’s concept, potential audience, product or services, and the amount of funding required.

Company overview: Go into detail about your company’s location and its business goals. Be sure to include your company’s mission statement , which explains the “why” behind your business idea.

Products or services: Explain exactly what your business will offer to its customers. Include detailed descriptions and pricing.

Situation analysis: Use market research to explain the competitive landscape, key demographics and the current status of your industry.

Marketing plan: Discuss the strategies you’ll use to build awareness for your business and attract new customers or clients.

Management bios: Introduce the people who will lead your company. Include bios that detail their industry-specific background.

Financial projections: Be transparent about startup costs, cash flow projections and profit expectations.

Don’t be afraid to go into too much detail—a startup business plan can often run multiple pages long. Investors will expect and appreciate your thoroughness. However, if you have a hot new product idea and need to move fast, you can consider a lean business plan. It’s a popular type of business plan in the tech industry that focuses on creating a minimum viable product first, then scaling the business from there.

02. Feasibility business plan

Let’s say you started a boat rental company five years ago. You’ve steadily grown your business. Now, you want to explore expanding your inventory by renting out jet skis, kayaks and other water sports equipment. Will it be profitable? A feasibility business plan will let you know.

Often called a decision-making plan, a feasibility business plan will help you understand the viability of offering a new product or launching into a new market. These business plans are typically internal and focus on answering two questions: Does the market exist, and will you make a profit from it? You might use a feasibility plan externally, too, if you need funding to support your new product or service.

Because you don’t need to include high-level, strategic information about your company, your feasibility business plan will be much shorter and more focused than a startup business plan. Feasibility plans typically include:

A description of the new product or service you wish to launch

A market analysis using third-party data

The target market , or your ideal customer profile

Any additional technology or personnel needs required

Required capital or funding sources

Predicted return on investment

Standards to objectively measure feasibility

A conclusion that includes recommendations on whether or not to move forward

03. One-page business plan

Imagine you’re a software developer looking to launch a tech startup around an app that you created from scratch. You’ve already written a detailed business plan, but you’re not sure if your strategy is 100% right. How can you get feedback from potential partners, customers or friends without making them slog through all 32 pages of the complete plan?

That’s where a one-page business plan comes in handy. It compresses your full business plan into a brief summary. Think of it as a cross between a business plan and an elevator pitch—an ideal format if you’re still fine-tuning your business plan. It’s also a great way to test whether investors will embrace your company, its mission or its goals.

Ideally, a one-page business plan should give someone a snapshot of your company in just a few minutes. But while brevity is important, your plan should still hit all the high points from your startup business plan. To accomplish this, structure a one-page plan similar to an outline. Consider including:

A short situation analysis that shows the need for your product or service

Your unique value proposition

Your mission statement and vision statement

Your target market

Your management team

The funding you’ll need

Financial projections

Expected results

Because a one-page plan is primarily used to gather feedback, make sure the format you choose is easy to update. That way, you can keep it fresh for new audiences.

04. What-if business plan

Pretend that you’re an accountant who started their own financial consulting business. You’re rapidly signing clients and growing your business when, 18 months into your new venture, you’re given the opportunity to buy another established firm in a nearby town. Is it a risk worth taking?

The what-if business plan will help you find an answer. It’s perfect for entrepreneurs who are looking to take big risks, such as acquiring or merging with another company, testing a new pricing model or adding an influx of new staff.

A what-if plan is additionally a great way to test out a worst-case scenario. For example, if you’re in the restaurant business, you can create a plan that explores the potential business repercussions of a public health emergency (like the COVID-19 pandemic), and then develop strategies to mitigate its effects.

You can share your what-if plan internally to prepare your leadership team and staff. You can also share it externally with bankers and partners so that they know your business is built to withstand any hard times. Include in your plan:

A detailed description of the business risk or other scenario

The impact it will have on your business

Specific actions you’ll take in a worst-case scenario

Risk management strategies you’ll employ

05. Growth business plan

Let’s say you’re operating a hair salon (see how to create a hair salon business plan ). You see an opportunity to expand your business and make it a full-fledged beauty bar by adding skin care, massage and other sought-after services. By creating a growth business plan, you’ll have a blueprint that will take you from your current state to your future state.

Sometimes called an expansion plan, a growth business plan is something like a crystal ball. It will help you see one to two years into the future. Creating a growth plan lets you see how far—and how fast—you can scale your business. It lets you know what you’ll need to get there, whether it’s funding, materials, people or property.

The audience for your growth plan will depend on your expected sources of capital. If you’re funding your expansion from within, then the audience is internal. If you need to attract the attention of outside investors, then the audience is external.

Much like a startup plan, your growth business plan should be rather comprehensive, especially if the people reviewing it aren’t familiar with your company. Include items specific to your potential new venture, including:

A brief assessment of your business’s current state

Information about your management team

A thorough analysis of the growth opportunity you’re seeking

The target audience for your new venture

The current competitive landscape

Resources you’ll need to achieve growth

Detailed financial forecasts

A funding request

Specific action steps your company will take

A timeline for completing those action steps

Another helpful thing to include in a growth business plan is a SWOT analysis . SWOT stands for strengths, weaknesses, opportunities and threats. A SWOT analysis will help you evaluate your performance, and that of your competitors. Including this type of in-depth review will show your investors that you’re making an objective, data-driven decision to expand your business, helping to build confidence and trust.

06. Operations business plan

You’ve always had a knack for accessories and have chosen to start your own online jewelry store. Even better, you already have your eCommerce business plan written. Now, it’s time to create a plan for how your company will implement its business model on a day-to-day basis.

An operations business plan will help you do just that. This internal-focused document will explain how your leadership team and your employees will propel your company forward. It should include specific responsibilities for each department, such as human resources, finance and marketing.

When you sit down to write an operations plan, you should use your company’s overall goals as your guide. Then, consider how each area of your business will contribute to those goals. Be sure to include:

A high-level overview of your business and its goals

A clear layout of key employees, departments and reporting lines

Processes you’ll use (i.e., how you’ll source products and fulfill orders)

Facilities and equipment you’ll need to conduct business effectively

Departmental budgets required

Risk management strategies that will ensure business continuity

Compliance and legal considerations

Clear metrics for each department to achieve

Timelines to help you reach those metrics

A measurement process to keep your teams on track

07. Strategic business plan

Say you open a coffee shop, but you know that one store is just the start. Eventually, you want to open multiple locations throughout your region. A strategic business plan will serve as your guide, helping define your company’s direction and decision-making over the next three to five years.

You should use a strategic business plan to align all of your internal stakeholders and employees around your company’s mission, vision and future goals. Your strategic plan should be high-level enough to create a clear vision of future success, yet also detailed enough to ensure you reach your eventual destination.

Be sure to include:

An executive summary

A company overview

Your mission and vision statements

Market research

A SWOT analysis

Specific, measurable goals you wish to achieve

Strategies to meet those goals

Financial projections based on those goals

Timelines for goal attainment

Related Posts

What is a target market and how to define yours

21 powerful mission statement examples that stand out

Free business plan template for small businesses

Was this article helpful?

- HR & Payroll

Business Plan: A Beginner’s Guide with Types and Templates

Setting up your own company, business, or startup could be an overwhelming process. It involves a variety of operations that need to be carried out in areas such as legal, financial, sales, among others. All these operations are a part of the Business Plan. The question here is what is a business plan and how do you go about writing it?

This article takes you on a detailed journey of writing a business plan apart from the following points:

- Understanding a business plan

- Elements of a business plan

- Types of business plans

- We also see why making a business plan is important

- How to write a step-by-step business plan?

- We also look into why some business plans fail.

- Business plans FAQ

What Is a Business Plan?

The startup of a company requires knowing and addressing many problems — legal issues, finance, sales and commercialization, protection of intellectual property, protection of liability, and more.

A business plan is defined as a written document that comprises business details, the company’s goals, and methods to achieve these goals. A business plan contains a comprehensive framework for the company in terms of marketing, finance, and operations.

Business plans serve a significant purpose. They are documents that can assist in inviting potential investment before a substantiated record of success has been ascertained. It helps create a good platform for businesses to continue to pursue targets.

Drafting a business plan is specifically useful for a startup or new enterprise. Optimally, the plan will be periodically restructured to see if objectives have been achieved or changed throughout the years. The companies may also decide after some time to redraw and upgrade the business plan to give a new direction after establishment.

Understanding Business Plans

Fundamentally, a business plan is a key document that must be put in place before start-up activities. Therefore, before new companies can provide their capital, banks and risk-capital companies often make a viable business plan a necessary precondition.

It is highly advisable to define a business plan before commencing any operations of the business. There have been examples of companies not lasting long without a competent business plan. It helps the businesses take decisions on matters of investments, learn about potential risks and adapt to new trends.

A strong business plan defines a company's identity, what it does, how it does it, and where it's headed. It is easier to grasp a company plan if you keep this history in mind. The core team or the people in a company's internal dynamics shapes its policies and objectives, or participates in the capital budgeting process must be able to comprehend a business plan.

Here’s a step-by-step guide to understanding the complicated and detailed document.

Executive Summary

Being the first section in a business plan, it comprises the summary of the entire strategy of the company. This 2 to 3-page summary presents the vision statement and brings into perspective the rest of the strategy.

Table of Contents

This comes after the executive summary. This should be looked into carefully to know if there are any particular aspects you would want to know the details about.

The next few sections can tell you a lot about who the adversaries are and what sort of products and services does the company offer. Any kind of issues that the company faces or even its capabilities are mentioned in this section.

Look for Management Capabilities

Within these sections, there would be information about the people playing key roles in the company. You can know about their qualifications and expertise from the document. These spaces will also consist of the description of the location of the company. It would be good to know about it to assess if it is strategically situated.

Operations Section

This section comprehensively describes the manufacturing, marketing, selling of products carried out by the business. Its customer support and other services can be assessed from this section.

Finances and Forecast Section

This could be helpful in understanding the revenue, expenditure, and other critical financial aspects of the organization. A complete chart of costs, risk analyses, and earnings estimates can be accessed through this section. This space also provides details about how these important digits were arrived at.

Final Section

This helps you understand the company’s targets and projections and the measures they wish to take for accomplishing the same. This will also share a glimpse of the ways in which the resources or funds from the investors will be used.

Elements of a Business Plan

Typically, a 20-25 page document, business plan varies hugely based on the type and size of the business. The details or the depth of the plan could be diverse and entail different kinds of elements. However, there are some crucial elements that come under the main plan and are also a part of the appendices.

Although, business plans are different, here are some common critical elements that are included in all the plans. Let’s look at them one by one:

This is the point that elaborately explains the mission of the company. Besides, it also includes information about the company’s management leaders, employees, functions.

Products and Services

This point includes all the products or services that the company is offering. Apart from the names of these products, services, it also comprises the details pertaining to the product such as the pricing, longevity, and benefits that the customers can avail of from its services.

Other information that could be a part of this point, includes production and manufacturing processes. It may also showcase any patents or proprietary technology that the company has acquired. A research and development report is also a part of this element.

Market Analysis

A company must have a thorough understanding of its sector as well as its intended audience. A market analysis will show you the expected demand for the products that the company sells. It will also help you know what difficulties you could face from the competitors. This will also assist you with an insight into the expertise of the contemporaries along with their strengths and drawbacks.

Marketing Strategy

This section explains how the organization plans to recruit and retain customers, as well as how it plans to reach out to them. This necessitates the creation of a distinct distribution channel. It will also detail branding, brand awareness and email marketing campaign plans , as well as the forms of media via which such efforts will be carried out.

Financial Planning

The organization should incorporate its financial planning and future estimates in order to persuade the other parties to review its business plan. The established companies may include income statements , balance sheets, and so on; On the other hand, new enterprises will include objectives and projections for the initial years of operation, as well as venture capitalists.

Every good business should have a budget in place. This comprises expenses such as employment, innovation, production, advertising, and any other business-related expenditure.

Types of Business Plans

The company management and investors can use business plans to help them start and grow their company. A company prepares a business plan to describe the objectives that will forecast and organize for expansion and to understand each area of the firm. A business plan is written by competent entrepreneurs to direct management and attract investment funds.

Business plans are drawn based on the requirements of the company. With this in mind, there are the following types of business plans:

Business Plans for Startups

A start-up business plan should outline the actions necessary to launch a new firm. It also includes a financial study with spreadsheets that describe financial concepts such as income, profit, and cash flow estimates. This may also be used by potential investors to gain an insight into the financial status of the startup. The startup business plans give clarity on market analysis, the product or service that the startup will provide besides the set goals.

Internal Business Plans

Internal plans detail project marketing, staffing, and technology costs. This document will summarise the company's present situation, including administrative performance and profitability, before determining whether and how the company would repay any project-related cash. These are written for a limited audience within the company, such as the marketing team evaluating a proposed initiative. They usually comprise a market study that shows the intended audience, competitive landscape, and the market's beneficial impact on corporate profits.

Business Plans for Strategic Business Development

A strategic business plan lays out a structural plan by providing a high-level picture of the company's objectives and how it moves to achieve them. While the framework of a strategic business plan varies per firm, typically contain five elements:

- The vision statement

- The mission statement

- Defining the key performance factors

- tactics for accomplishing objectives

- Timeframe for implementation

A strategic business plan engages personnel at all levels of the organization in the big picture, motivating them to collaborate to achieve the company's objectives

Business Plans for Scalability

A feasibility or scalability business plan considers two key issues regarding a planned business endeavor:

- If there will be buyers for the products or services that the company intends to sell.

- Whether or not the enterprise will be profitable.

This plan highlights the details of the demand of the product or service and the associated target audience for the said product. A feasibility study typically concludes by providing recommendations for the future.

Business Plans for Operations

These include features regarding the operations of the company and hence, the name. The plan specifies the deployment benchmarks and timelines for the future year. It also entails employee responsibilities.

Business Plans for Growth

These are also known as the plans for expansion and are created for both, internal as well as external use. This plan features the details around the following points:

- Detailed and specific highlights about the company

- Details of officials as the company