U.S. Department of the Treasury

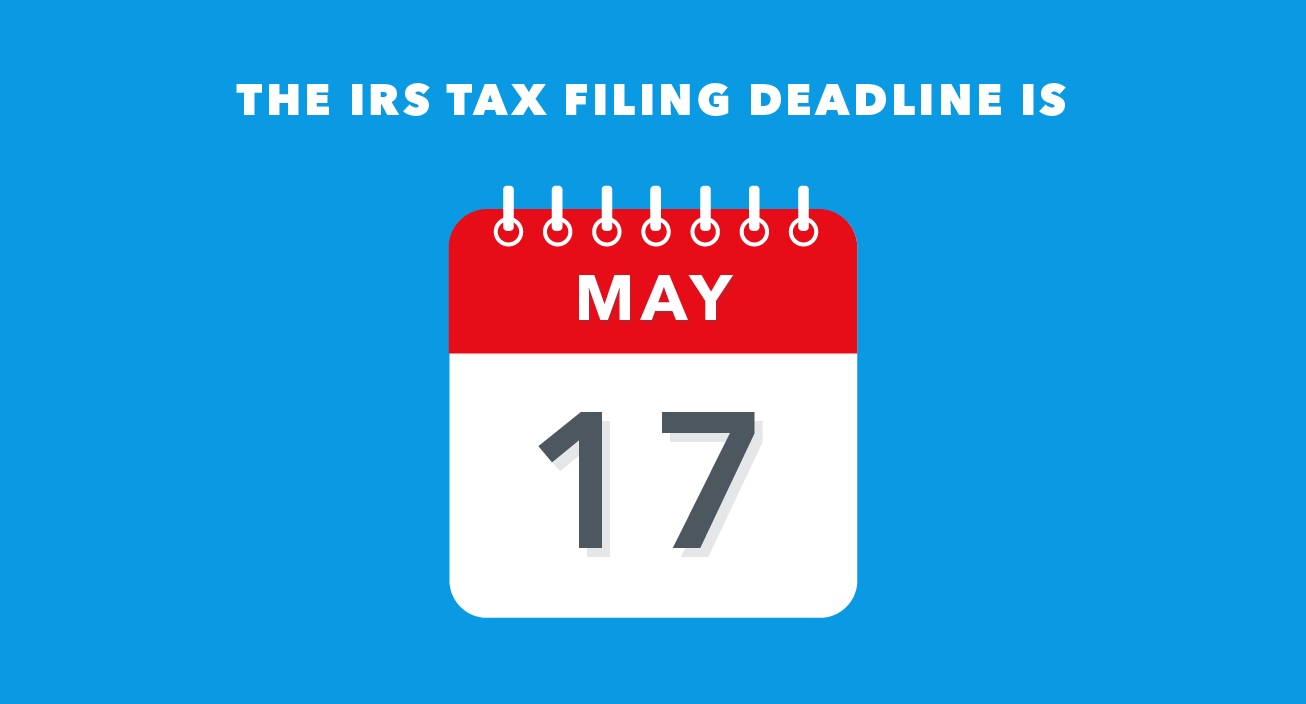

Treasury and irs extend filing and payment deadline to may 17.

WASHINGTON — The U.S. Department of the Treasury and the Internal Revenue Service announced today that the federal income tax filing due date for individuals for the 2020 tax year will be automatically extended from April 15, 2021, to May 17, 2021.

The IRS will be providing formal guidance in the coming days.

Additional details on the taxpayer relief announced today are available on IRS.gov .

KPMG Personalization

- Home ›

- Insights ›

US – UPDATE: Federal Filing and Payment Deadline

United states – update: treasury, irs extend federal filing and payment deadline.

On March 29, 2021, the U.S. Department of the Treasury and IRS issued Notice 2021-21, which formalizes tax filing and payment guidance initially provided on March 17, 2021, and provides details on the additional tax deadlines that have been postponed until May 17, 2021.

As reported in GMS Flash Alert 2021-089 , on March 17, 2021, the United States Department of the Treasury and Internal Revenue Service (IRS) announced that the U.S. individual federal income tax filing and payment due dates for the 2020 tax year was automatically extended from April 15, 2021, to May 17, 2021. 1 On March 29, 2021, the U.S. Treasury Department and IRS issued Notice 2021-21 (“the Notice”), 2 which formalizes the guidance provided on March 17, 2021, and provides details on the additional tax deadlines that have been postponed until May 17, 2021.

WHY THIS MATTERS

Notice 2021-21 expands on the guidance issued on March 17, 2021 by clarifying the scope of the relief that was previously announced and providing details about the additional tax deadlines that have been postponed. The postponement of multiple deadlines provides relief to taxpayers who may require additional time to get their tax affairs in order due to disruptions caused by the COVID-19 pandemic.

Notice 2021-21

Postponement of due dates with respect to certain federal tax returns and federal tax payment.

The Notice formally postpones the due date for filing certain federal income tax returns and making certain federal income tax payments from April 15, 2021, to May 17, 2021, for all individual taxpayers. There is no limitation on the amount of the payment that may be postponed. The extension is automatic, so taxpayers do not need to file Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return , to request the extension.

The relief provided applies to:

- Form 1040 series tax returns (Form 1040, Form 1040-SR, Form 1040-NR, Form 1040-PR, Form 1040-SS, or Form 1040 (SP)) originally due on April 15, 2021, for a taxpayer’s 2020 tax year;

- All schedules, returns, and other forms that are filed as attachments to the Form 1040 series or are required to be filed by the due date of the Form 1040 series, including, for example, Schedule H and Schedule SE, as well as Forms 965-A, 3520, 5329, 5471, 8621, 8858, 8865, 8915-E, and 8938;

- Federal income tax payments reported on Form 1040 series tax return originally due on April 15, 2021, for a taxpayer’s 2020 tax year, including the 10-percent additional tax on amounts includible in gross income from 2020 distributions from IRAs or workplace-based retirement plans.

The period beginning on April 15, 2021, and ending on May 17, 2021, will be disregarded in the calculation of any interest, penalty, or addition to tax for failure to file the federal income tax returns or to pay the federal income taxes postponed under the Notice. Interest, penalties, and additions to tax with respect to such postponed federal income tax filings and payments will begin to accrue on May 18, 2021.

In addition, elections that are made or required to be made on a timely filed Form 1040 series (or attached to the form) will be timely made if filed on or before May 17, 2021.

In extending the deadline to file Form 1040 series returns to May 17, the IRS is automatically postponing to May 17, 2021, the deadline for individuals to make 2020 contributions to their individual retirement arrangements (IRAs and Roth IRAs), health savings accounts (HSAs), Archer medical savings accounts (Archer MSAs), and Coverdell education savings accounts (Coverdell ESAs). The extension also applies to reporting and paying the 10-percent additional tax on amounts includible in gross income from 2020 distributions from IRAs or workplace-based retirement plans. Furthermore, the Notice postpones the due date for Form 5498 series returns 3 related to these accounts to June 30, 2021.

No extension is provided for the payment or deposit of any other type of federal tax, including federal estimated income tax payments, or for the filing of any federal return other than the Form 1040 series and the Form 5498 series for the 2020 taxable year.

Notice 2021-21 does not alter the April 15, 2021 deadline for estimated tax payments; these payments are still due on April 15. Furthermore, it does not appear that an overpayment of 2020 income taxes that is applied to 2021 estimated tax on a return filed after April 15, 2021 would be considered a timely-paid first quarter payment under Notice 2021-21.

Relief with Respect to Certain Claims for Refund

For tax year 2017 federal income tax returns, the normal April 15 deadline to claim a refund is also extended to May 17, 2021. This postponement is limited to claims for credit or refund properly filed on the Form 1040 series or on a Form 1040-X.

1 IR-2021-59, Tax Day for individuals extended to May 17: Treasury, IRS extend filing and payment deadline .

2 IRS Notice 2021-21.

3 Form 5498 series returns include: Form 5498, IRA Contribution Information , Form 5498-ESA, Coverdell ESA Contribution Information, and Form 5498-SA, HSA, Archer MSA, or Medicare Advantage MSA Information .

The above information is not intended to be "written advice concerning one or more federal tax matters" subject to the requirements of section 10.37(a)(2) of Treasury Department Circular 230 as the content of this document is issued for general informational purposes only.

The information contained in this newsletter was submitted by the KPMG International member firm in United States.

FLASH ALERT - ALL

COVID-19 FLASH ALERTS

TAX FLASH ALERTS

UNITED STATES FLASH ALERTS

FLASH ALERTS BY COUNTRY

FLASH ALERTS BY TOPIC

FLASH ALERT HOME

To subscribe to GMS Flash Alert , fill out the subscription form .

© 2024 KPMG LLP, a Delaware limited liability partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved.

For more detail about the structure of the KPMG global organization please visit https://kpmg.com/governance .

GMS Flash Alert is a Global Mobility Services publication of the KPMG LLP Washington National Tax practice. The KPMG name and logo are trademarks used under license by the independent member firms of the KPMG global organization. KPMG International Limited is a private English company limited by guarantee and does not provide services to clients. No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member firm. The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation.

Connect with us

- Find office locations kpmg.findOfficeLocations

- Email us kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia

- Request for proposal

Stay up to date with what matters to you

Gain access to personalized content based on your interests by signing up today

Browse articles, set up your interests , or View your library .

You've been a member since

Still need to file? An expert can help or do taxes for you with 100% accuracy. Get started

- Latest News

IRS Announced Federal Tax Filing and Payment Deadline Extension

Share this:

- Click to share on Facebook (Opens in new window)

- Click to share on Twitter (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- Click to share on Pinterest (Opens in new window)

- Click to print (Opens in new window)

- Written by Katharina Reekmans, EA

- Published Mar 30, 2021 - [Updated May 14, 2021]

- 16 min read

What is the federal tax deadline? ( Click here for state tax deadlines )

The federal tax filing deadline has been extended to may 17, 2 021 for individual returns. .

This only applies to individual 1040 tax returns, not business tax filing deadlines or quarterly estimated tax deadlines. See 2021 quarterly estimated tax deadlines here.

Taxpayers are encouraged to file their taxes now to get their refund ASAP.

While you now have more time to file, the sooner you do it, the sooner you will get your refund ! And we know money in your pocket is more important now than ever.

Most people receive a tax refund each year and last year the average amount was close to $3,000, for many, their largest paycheck of the year. During times like this, a $3,000 refund is much needed money.

Also, if you didn’t get a stimulus payment or only received a partial stimulus payment, claiming the Recovery Rebate Credit by filing a tax return is the only way to get your additional money. For families that haven’t received their first and second stimulus payments this could be up to an additional $1,800 per taxpayer.

The IRS has also extended the federal tax deadline to June 15, 2021 for residents of Texas, Oklahoma and Louisiana due to severe storms. You can learn more about the tax relief available here: Texas Relief , Oklahoma Relief , and Louisiana Relief.

So here is what you need to know about the tax deadline extension announcement:

- Do I need to file an extension to file past April 15? No, you do not need to take any action. T he May 17 e xtension applies to all taxpayers automatically.

- Will the extension of the tax deadline delay my tax refund? No, the IRS expects to continue to process refunds as normal but encourages all taxpayers to file now.

- Will the deadline for my state taxes also be extended? That depends on your state. Many may conform to the ne w May 17 tax d eadline, but it will take some time for states to make that decision. To find out the deadline in your state, see below.

- Does this extension apply to 2021 quarterly estimated tax payments? No, this extension does not apply to first and second quarter 2021 estimated income tax payment deadlines. Those remain April 15, 2021 and June 15, 2021.

Does the extended deadline mean I have more time to pay? Does the extended deadline allow me to pay my balance due before May 17th?

The extension of the federal tax filing deadline also applies to 2020 tax payments.

Taxpayers that owe money can defer federal tax payments for Tax Year 2020, interest free and penalty free until May 17. This deferment applies to all individual taxpayers. These taxpayers can defer tax year 2020 federal tax payments regardless of the amount owed until the new deadline. This only applies to individual 1040 tax returns, not business tax filings.

Deferment of federal tax payments means that if you owe money on your federal taxes, you will get more time to pay what you owe.

- How do I know if I qualify for the extended payment deadline? And do I need to file an extension to get it? Any individual taxpayer with a Federal Tax Payment related to their 2020 taxes can defer their tax payment, free of penalties and interest.

- What do I do if I already filed my taxes and scheduled my payment for April 15? If you have already filed and scheduled your payment for April 15, you will need to cancel your payment and reschedule it. If you filed with TurboTax, you will need to contact the U.S. Treasury Financial Agent at 888-353-4537 to make that change. Changes to payments need to be made no later than 11:59 p.m. ET two business days prior to the scheduled payment date.

- What if I need more time past the May 17 d eadline to pay? If you need additional time, beyond May 17, you will need to file an extension. An extension will give you until October 15, 2021 to file your taxes, but you will still need to pay any taxes owed by May 17. Payments afte r May 17 will be subject to penalties and interest. The IRS also has installment plans available, you can find out more here .

For Filing an Extension to File Past May 17

Are there any additional deadline extensions for individuals.

The IRS recently announced that individuals have until May 17 instead of April 15 to meet certain other deadlines and make an impact on their taxes as follows:

- The deadline to make a 2020 contribution to your IRA , Health Savings Account(HSA), Archer Medical Savings Account, and Coverdell Education Savings Account

- Automatically postpones the time for reporting and payment of the *10% additional tax on amounts includible in gross income from 2020 distributions from IRAs or workplace-based retirement plans

- The deadline to claim 2017 unclaimed refunds

*Note, the 10% additional tax is waived on coronavirus related retirement distributions under CARES Act.

Continue to check back here for the most up to date tax deadline information and related changes as we await final IRS guidance .

State Tax Deadline Updates (Last Update: 04/15/21)

Many state tax deadlines will likely also change to May 17th . Get the latest on tax deadlines and guidance for your state below.

Alabama – May 17

Alabama has announced that the tax filing and payment deadline for individual returns will be May 17, 2021. This extension does not apply to estimated tax payments due on April 15, 2021.

Arizona – May 17

Arizona has moved the deadline for filing and paying state individual income taxes to May 17, 2021. This extended deadline also includes Form 140PTC and Form 140ET. This deadline does not apply to first quarter tax year 2021 estimated payments, the due date for these estimated payments remains April 15, 2021.

Arkansas – May 17

Arkansas will follow the federal deadline for filing and payment for individuals until May 17, 2021. This deadline does not apply to estimated payments or business returns.

California – May 17

California has extended the state filing and payment deadline for individuals to May 17, 2021. This extension does not apply to estimated tax payments due on April 15, 2021 or business tax returns.

Colorado – May 17

Colorado has extended its individual state income tax payment and filing deadline to May 17, 2021. Individuals will have the option to pay any 2020 income tax payments by May 17, 2021 without penalty or interest. This extension does not apply to estimated payments for the 2021 income tax year due for individuals and corporations on April 15, 2021. This extension does not apply to business tax returns.

Connecticut – May 17

Connecticut has extended the filing and payment deadline for Connecticut individual income tax returns to Monday, May 17 th , 2021. This extension does not apply to estimated tax payments or business tax returns.

Delaware – May 17

Delaware has extended the filing and payment deadline for Delaware individual income tax returns to May 17, 2021. This extension does not apply to estimated tax payments or business tax returns.

Georgia – May 17

Georgia has announced that they have extended the individual filing and payment deadline for the tax year 2020. This extension only applies to the 2020 tax year individual state income tax payments and state individual income tax returns. This extension does not apply to state estimated tax payments due on April 15, 2021. These estimated tax payments are still due on April 15th. No extension has been provided for any other type of state tax (including employee withholding, sales tax, and business tax returns).

As of today, there have been no changes to the 2020 HI state tax deadlines. We will continue to keep you updated. Please check back here later for more details.

Idaho – May 17

Idaho has extended the 2020 Idaho income tax filing deadline to May 17, 2021. This extension applies to all individual income tax returns and fiduciary returns (Form 66). Payment deadlines for individual income tax returns and fiduciary 1st quarter estimated payments have also been extended to May 17, 2021. This deadline also applies to property tax relief programs. The state corporate, partnership, and s-corporation filings have not been extended and will remain April 15, 2021.

Illinois – May 17

Illinois has extended the individual income tax filing and payment deadline to may 17, 2021. the filing extension does not apply to estimated tax payments that are due on april 15, 2021. this extension does not apply to business tax returns., indiana – may 17 .

Indiana has extended the deadline for individual income tax filing and payments to May 17, 2021. All other tax return filings and payment due dates remain unchanged.

Iowa – June 1

Iowa has extended its filing and payment deadline for individual tax returns until June 1, 2021. This extension also includes 1st Quarter estimated payments. This extension does not apply to business tax returns.

Kansas – May 17

Kansas has announced that Kansas 2020 individual income tax, fiduciary income tax, and Homestead or Property tax relief refund claim filings are extended to May 17, 2021. This extension does not apply to estimated tax payments or business tax returns.

Kentucky – May 17

Kentucky has extended the deadline for individual income tax filing and payments to May 17, 2021. Penalties, interest and additions to tax will begin to accrue on any remaining unpaid balances as of May 17, 2021. This extension only applies to individual taxpayers and does not apply to estimated tax payments or business returns.

Louisiana – June 15

The Louisiana state tax deadline has been extended to June 15. This extended due date is for individual income, corporation income and franchise, fiduciary income, partnership and partnership composite tax returns and payments with original or extended due dates on or after February 11, 2021 and before June 14, 2021. For excise, sales, severance and withholding tax returns and payments due on or after February 11, 2021 and on or before February 28, 2021 have a due date of March 31, 2021. The IRS has extended the federal tax deadline for Louisiana residents to June 15 due to the severe winter storms.

Maine – May 17

Maine has moved the deadline for Maine individual income tax return and individual tax payments to May 17, 2021. This extension does not apply to corporate tax returns and payments and does not apply to individual and corporate estimated tax payments. These estimated payments will remain due on April 15, 2021.

Maryland – July 15

The new tax deadline for Maryland state residents is now July 15, 2021 . The extension applies to 2020 individual, corporate, pass-through entity, and fiduciary tax returns. It also includes 1st and 2nd quarter estimated payments that are typically due one April 15, 2021 and 2nd quarter estimated payments that are typically due on June 15, 2021 now have a deadline of July 15, 2021.

Massachusetts – May 17

Massachusetts has determined that individual personal income tax returns and payments for the 2020 tax year otherwise due on April 15, 2021 will now be due on May 17, 2021. This extension does not apply to estimated tax payments or business tax returns.

Michigan – May 17

Michigan has announced an extension for individual and composite state income tax returns and payments will be due on May 17, 2021. This extension is limited to the state individual and composite income tax annual return and does not apply to fiduciary return or corporate tax returns. This extension does not apply to first quarter estimated payments and payments due on April 15, 2021 will remain at that due date. This extension also does not apply to city income taxes. City income tax taxpayers should contact their respective tax administrators for information regarding their city income tax.

Minnesota – May 17

Minnesota is allowing additional time for making 2020 state individual tax filings and payments until May 17, 2021 without any penalty and interest being applied. This grace period does not include individual estimated tax payments. This extension does not apply to business tax returns.

Mississippi – May 17

Mississippi will follow the federal extension to file the 2020 individual income tax returns to May 17, 2021. This extension only applies to the filing of individual income tax returns and payment of tax due. There will be no penalty and interest accrued on returns filed and payments made on or before May 17, 2021. This extension does not apply to quarterly estimated payments and payments due on April 15, 2021 will remain at that due date.

Missouri – May 17

Missouri has announced the extension of their state individual tax filing and payment deadline for 2020 tax year to May 17, 2021. This extension applies to individual taxpayers including those who pay self-employment tax. However, the extension does not apply to estimated tax payments due on April 15, 2021 and that deadline has not changed. This extension does not apply to business tax returns.

Montana – May 17

Montana has announced that the deadline to file 2020 Montana individual income tax returns is May 17, 2021. Montana taxpayers who file by May 17 will not have to worry about interest or penalties. This extension does not apply to quarterly estimated payments.

Nebraska – May 17

Nebraska has extended the deadline for individual income tax returns. This extension for filing and postponement of payment does not include estimated payments or business tax returns.

New Hampshire

As of today, there have been no changes to the 2020 NH state tax deadlines. We will continue to keep you updated. Please check back here later for more details

New Jersey – May 17

New Jersey has extended the 2020 income tax filing and due date for individuals to May 17, 2021. This extension includes any tax payments due with a return. This extension does not include first quarter estimated payments, which are still due by April 15, 2021.

New Mexico – May 17

New Mexico has extended the deadline for filing and paying 2020 New Mexico Personal Income taxes to May 17, 2021. This extension does not apply to business tax returns or estimated payments.

New York – May 17

New York State has extended the due date for personal income tax returns and related payments for the 2020 tax year to May 17,2021. This extension is limited to personal income tax returns for individuals only. The deadline for payment or deposit of any other type of state tax or filing of any other state information return remain unchanged. This extension does not apply to estimated tax payments for the 2021 tax year that are due on April 15, 2021 still are due on April 15, 2021. This extension does not apply to business tax returns.

North Carolina – May 17

North Carolina has extended the time for filing North Carolin individual income tax to May 17, 2021. The state will not charge penalties for those filing and paying their taxes by May 17, 2021. However, tax payments received after April 15 will be charged interest accruing from April 15 until the date of payment. This extension does not apply to trust taxes, sales and use, or withholdings taxes or estimated payments due on April 15, 2021. This extension also does not apply to business tax returns.

North Dakota – May 17

The deadline for North Dakota individual tax return filing and payments has been extended to May 17, 2021 without penalty and interest. This extension does not apply to estimated tax payments due on April 15, 2021. This extension also does not apply to business tax returns.

Ohio – May 17

Ohio has extended the filing and payment deadline for Ohio individual income tax returns and school district income taxes for tax year 2020 to May 17, 2021. This extension does not apply to estimated tax payments or business tax returns.

Oklahoma – June 15 (Individual and Business Payments deadline)

The individual and business payments tax deadline for Oklahoma has been extended to June 15 to provide relief to those affected by the severe winter storms. This includes first quarter estimated tax payments.

The IRS has extended the federal tax deadline for Oklahoma residents to June 15 due to the severe winter storms.

Oregon – May 17

Oregon will follow the IRS and extended the tax filing and payment deadline for individuals to May 17. This extension does not apply to estimated tax payments or business returns.

Pennsylvania – May 17

Pennsylvania has extended the deadline for individual income tax return filings and payments to May 17, 2021. This extension does not apply to estimated tax payments due on April 15, 2021. This extension does not apply to business returns.

Rhode Island – May 17

Rhode Island has postponed its deadline for individuals to file their Rhode Island personal income tax returns and make related payments for the 2020 tax year to May 17, 2021. This extension does not apply to estimated payments or business tax returns.

South Carolina – May 17

South Carolina has extended the deadline for individual income tax return filings and payments for the 2020 tax year to May 17, 2021. This extension is only for individual tax returns and does not apply to estimated tax payments due April 15, 2021.

Tennessee – May 17

Tennessee has announced the extension for filing and payment for Hall individual income tax returns to May 17, 2021. This extension applies for all taxpayers that file Hall individual income tax. For franchise and excise tax, the extension only applies to individuals who file a Tennessee franchise and excise tax return using a Schedule J2 – Computation of Net Earnings for a Single Member LLC Filing as an Individual. This extension does not apply to estimated payments due April 15, 2021. These estimated payments are still due on April 15.

Texas – June 15 (franchise tax deadline)

Texas has extended the franchise tax deadline from May 15 to June 15, to provide relief to those affected by the severe winter storms. This is in line with the federal extension for Texas residents .

Texas does not have individual state taxes.

Utah – May 17

The due date for Utah individual income tax for tax year 2020 is May 17th. The extension of the individual filing due date has the effect of also postponing the payment due date to May 17th. Interest and penalties will not accrue if payment requirements are met by this new due date. This extension does not apply to estimated tax payments and business tax returns.

Vermont – May 17

Vermont has extended the deadline for taxpayers to file their 2020 personal income tax return and pay any tax owed to May 17, 2021 without any penalties or interest. This extension also applies to Homestead Declarations and Property Tax Credit Claims allowing taxpayers to file these with their personal income tax return by May 17 without penalty or interest. This extension does not apply to any estimated payments due on April 15, 2021. This extension also does not apply to business tax returns.

Virginia – May 17

Virginia has extended the state filing and payment deadline for individuals to May 17, 2021. THis extension does not apply to estimated tax payments or business tax returns.

Washington D.C. – May 17

The District of Columbia has extended the state filing and payment deadline for individuals to May 17, 2021. Business returns for corporate, unincorporated business tax, fiduciary and partnerships returns and payments are extended to May 17, 2021. This extension does not apply to estimated tax payments and the first quarter payments are due April 15, 2021.

West Virginia – May 17

West Virginia extended the state filing and payment deadline for individuals to May 17, 2021. This extension does not apply to estimated tax payments or business tax returns.

Wisconsin – May 17

Wisconsin has extended the individual income tax return filing and payment deadline to May 17, 2021. This extension does not apply to 2021 estimated tax payments for individuals due April 15, 2021 and does not apply to any other return or tax payments due.

Previous Post

What The Coronavirus Relief and New Tax Deadline Mean for…

Your Top Tax Questions About Coronavirus (COVID-19), Answered

Written by Katharina Reekmans

Katharina Reekmans is an Enrolled Agent and a contributor to the TurboTax Blog team. Katharina has years of experience in tax preparation and representation before the IRS. Her passions surround financial literary and tax law interpretation. She has a strong commitment to using all resources and knowledge to best serve the interest of clients. Katharina has worked as a senior tax accountant, operations manager, and controller. Katharina prides herself on unraveling tax laws so that the average person can understand them. More from Katharina Reekmans

15 responses to “IRS Announced Federal Tax Filing and Payment Deadline Extension”

what about the contribution deadline for 2020 IRAs? Is that also extended to May 17th?

Yes the IRS has extended the same date for individuals to make 2020 contributions to their individual retirement arrangements by May 17, 2021.

Hope this helps! Best, Katharina Reekmans

What about contributions to an IRA for 2020?

What about Indiana?

Does the filing extension to May 17 also apply to contribution deadline for 2020 IRA deposits? Thank you.

Sorry for the delay in response, but the IRS has officially announced that they will be extending the same May 17th deadline to 2020 IRA contributions as well.

Hope this helps. Best, Katharina Reekmans

What about New Jersey deadline

Hi Marc, We have updated the article to include New Jersey. New Jersey will follow the actions of the IRS and has extended 2020 individual tax filing due date to May 17, 2021.

When is Virginia’s filing date?

What about Utah?

I live in Utah. I do not see any State Tax deadline information for Utah. What do you know about the current State filing deadline for Utah?

What is the deadline for filing New Jersey 2020 individual income taxes?

What about Ohio, is it still April 15?

At the moment Ohio has not provided any official updates regarding a filing extension. Please check back with this post as we continue to provide updates.

Missouri???

Leave a Reply Cancel reply

Browse related articles.

What is My State Tax Deadline? What to Know About Coron…

Was the Tax Year 2019 Tax Deadline Delayed? What to Kno…

Oklahoma Tax Deadline Extension and Relief for Winter S…

Does Your State Have a Deadline Extension This Tax Seas…

Louisiana Tax Deadline Extension and Relief for Winter …

IRS Provides Tax Relief for Victims of Hurricane Ida

Your Top Tax Questions About Coronavirus (COVID-19), An…

Extension and Tax Relief for Texas Winter Storm Victims

Tax Year 2023: Does Your State Have an Extended Deadlin…

IRS Announces Tax Relief for Hawaii Wildfire Victims

- Share full article

Advertisement

Supported by

Your Money Adviser

The Tax Filing Deadline Was Delayed, but Read the Fine Print

The federal government and most states pushed back the date to May 17, but others have gone their own way. And if you make estimated tax payments, the deadline remains April 15.

By Ann Carrns

Tax filing is a little more complicated this year.

The deadline to file a 2020 individual federal return and pay any tax owed has been extended to May 17 , about a month later than the typical April deadline. The Treasury Department and the Internal Revenue Service moved the date to give filers, tax preparers and the I.R.S. itself more time to adjust to disruptions from the coronavirus pandemic.

Most states are following the extended federal deadlines, and a few have adopted even more generous extensions.

But the I.R.S. has not postponed the deadline for making first-quarter 2021 estimated tax payments, as it did last year when it delayed Tax Day because of the pandemic. This year, the first estimated tax deadline remains April 15. Some members of Congress are pushing for the I.R.S. to reconcile the deadlines , but it’s unclear whether that will happen, with April 15 less than a week away.

“It just creates confusion,” said Mark A. Stewart Jr., a certified public accountant and president of the National Conference of CPA Practitioners.

Most states have retained their usual deadlines for first-quarter estimated taxes. One exception is Maryland, which moved both its filing deadline and the deadline for first- and second-quarter estimated tax payments to July 15.

So it’s a good idea to double-check deadlines.

The I.R.S. continues to grapple with pandemic challenges. Filers are seeing “more refund delays” than usual this year, according to an online update on March 25 from the Taxpayer Advocate Service , an independent office within the I.R.S. that represents taxpayers.

The number of returns processed by the I.R.S. as of April 2 was down about 10 percent from a year earlier, according to statistics provided by the agency. But the start of this year’s tax season was delayed to allow the agency to update and test its systems to reflect tax changes approved by Congress late last year. The number of returns processed on comparable days of the season is up about 3 percent, the agency reported.

The agency is “on track when you consider that this tax season started late,” an I.R.S. spokesman, Eric Smith, said in an email.

Last year, a shutdown because of the pandemic left the I.R.S. with a backlog of unprocessed paper tax returns. This year, even with the late start to the tax season, the agency is still struggling to deal with the 2019 paper returns, along with a crush of 2020 returns, I.R.S. “resource” issues and technology problems, the advocate service said.

The advocate service said the I.R.S. was also having to “manually verify” large numbers of rebate credits, which taxpayers can claim to obtain the first and second round of federal stimulus payments, if they haven’t already received them.

In addition, the agency has had to recalculate refunds for filers who reported unemployment benefits last year. The latest round of pandemic relief legislation, which became law on March 11, made the first $10,200 of unemployment benefits tax-free for many Americans. But some had already filed returns when the tax break became available, so they will get a refund of any overpayment — probably beginning in May.

On Wednesday, the I.R.S. posted an update on its website, saying it had about 16.5 million unprocessed individual returns “in the pipeline,” including two million received before 2021.

Most people have income taxes withheld from their paychecks. If they overpay, they get money back as a refund when they file their return. But those who don’t have taxes automatically withheld — including self-employed people or workers who have two jobs and don’t have taxes withheld from both checks — generally have to pay taxes to the I.R.S. four times a year. Other income that isn’t subject to withholding includes alimony, interest and dividends, and taxes on the sale of stocks or other investments. Nearly 10 million filers paid estimated taxes in 2018, the I.R.S. said.

The earlier deadline for the estimated tax payment makes the tax return filing extension less helpful than it should be for quarterly payers, tax experts say. The amount of estimated tax to be paid is typically calculated based on the previous year’s tax return, and the first installment is normally paid when the tax return is filed.

So if people haven’t completed their 2020 returns yet, they will have to estimate what they must pay in 2021 — and could face underpayment penalties at tax time next year if they pay too little over the course of the year. (The penalty is based on how much you owe, and how long you have owed it, according to TurboTax .) They may still be charged a penalty if they are late with estimated payments, even if they are due a refund when they file their tax return, the I.R.S. says.

Some people may not realize they have to make the first estimated payment before their 2020 return is due, Mr. Stewart said.

“They hear Tax Day is moved to May 17, so a lot of people will go to their preparer on April 30,” Mr. Stewart said. “Unfortunately, the first-quarter estimated payment is late.”

The conference and other groups representing tax professionals had urged the government to postpone the estimated tax deadline as well. In congressional committee testimony in March, the I.R.S. commissioner, Charles P. Rettig, said the estimated tax deadline hadn’t been changed because it would, in effect, be giving “a break” on interest and penalties to wealthy people, who would invest the money instead of paying the government.

But people who file estimated taxes also include sole proprietors and workers in the gig economy with modest incomes, accountants say. Many people who lost jobs in the pandemic switched to work delivering meals and groceries ordered by mobile apps, said Melanie Lauridsen, senior manager for tax policy and advocacy at the American Institute of Certified Public Accountants.

“That’s where the need is,” Ms. Lauridsen said.

The disconnect between the filing and estimated tax deadlines means tax preparers are pushed to get returns done by the traditional deadline anyway. “It’s putting a tremendous amount of stress on tax preparers,” said Rhonda Collins, director of tax content and government relations with the National Association of Tax Professionals.

In general, filers must estimate what they owe and round up to reduce the risk of underpaying. “It feels like it’s very much a guesstimate,” Ms. Collins said.

Should you incur a penalty when you file your tax return next year, you can request an abatement. Often, the I.R.S. is lenient with first-time errors, she said, especially when there are extenuating circumstances.

It’s also important to keep track of your income in 2021, tax professionals say. Many people had lower incomes than usual during 2020 because of the pandemic, and could see them rise in 2021 if the pandemic wanes as expected and the economy expands. If your income is turning out to be higher than expected, you may need to increase the amounts of your estimated payments later in the year.

Here are some questions and answers about tax deadlines this year:

When is the deadline for making contributions to individual retirement accounts and health savings accounts?

You can make contributions to I.R.A.s and H.S.A.s for the tax year 2020 up until the extended filing deadline on May 17, the I.R.S. says.

When are the deadlines for 2021 estimated tax payments?

The first is April 15, followed by June 15, Sept. 15 and Jan. 18 of 2022.

How can I check the filing and payment deadlines in my state?

It’s wise to check your state’s revenue department website for details. You can look up the link on the Federation of Tax Administrators website .

A Guide to Making Better Financial Moves

Making sense of your finances can be complicated. the tips below can help..

The way advisers handle your retirement money is about to change: More investment professionals will be required to act in their customers’ best interest when providing advice about their retirement money.

The I.R.S. estimates that 940,000 people who didn’t file their tax returns in 2020 are due back money. The deadline for filing to get it is May 17.

Credit card debt is rising, and shopping for a card with a lower interest rate can help you save money. Here are some things to know .

Whether you’re looking to make your home more energy-efficient, install solar panels or buy an electric car, this guide can help you save money and fight climate change .

Starting this year, some of the money in 529 college savings accounts can be used for retirement if it’s not needed for education. Here is how it works .

Are you trying to improve your credit profile? You can now choose to have your on-time rent payments reported to the credit bureaus to enhance your score.

clock This article was published more than 3 years ago

Where’s my tax refund? The Post’s personal finance columnist answers your tax deadline questions.

The federal tax deadline is drawing near. Individual taxpayers have until May 17 to file their federal tax returns. State filings and payment deadlines vary widely but many states have followed the federal extension.

This year, the entire process of filing taxes has been mired in delays brought on by the pandemic and the extraordinary stimulus measures by the federal government.

On Wednesday, The Washington Post’s personal finance columnist Michelle Singletary answered tax-filing questions with Curtis Campbell, the president of TaxAct, one of the leading online tax-preparation services. Here are some of the questions they answered:

- Is there a way to update your mailing address after you file taxes?

- Did I answer the question about the second stimulus payment correctly?

- When will I receive my third stimulus check?

Read the transcript below.

Looking for more? Read some of The Post’s coverage:

- If you call the IRS, there’s only a 1-in-50 chance you’ll reach a human being

- If you’re in line for a stimulus payment, here’s why you shouldn’t wait to file your taxes on May 17

- A new FEMA program offers up to $9,000 to help with covid-19 funerals. Scammers see an opportunity.

Sign up for Singletary’s weekly newsletter to get advice on budgeting and planning for retirement.

Teddy Amenabar , an editor on The Post’s audience team, produced this Q&A.

Ask The Post’s journalists

Our reporters and editors answer your questions. join our live chats or ask a question in advance..

Get advice: Carolyn Hax takes your questions about the strange train we call life.

Find a dining suggestion: Chat with restaurant critic Tom Sietsema.

Ask for cooking help: Aaron Hutcherson and Becky Krystal are your guides to the kitchen.

Chat with a satire columnist: Alexandra Petri offers a lighter take on news and political in(s)anity.

Debate a columnist: Jennifer Rubin discusses politics, policy and more.

Explore all of our chats on our community page .

IRS to extend April 15 tax deadline by a month

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate tax products to write unbiased product reviews.

- The federal tax deadline, when tax returns and payments are due, will move to May 17.

- The IRS and Treasury Department announced the change in a statement on Wednesday.

- An extension gives the IRS more time to implement new laws in the latest stimulus legislation.

- See Personal Finance Insider's picks for the best tax software .

The Internal Revenue Service is pushing the 2020 federal tax deadline to May 17.

Bloomberg first reported the development and Insider confirmed it with a Democratic aide. The IRS and Treasury Department issued a statement later on Wednesday announcing the news. The extension automatically applies to individual federal tax returns and payments for 2020 normally due on April 15. It does not apply to estimated quarterly tax payments for 2021.

In a letter to the IRS and Treasury Department on Tuesday, more than 100 members of Congress asked for the federal deadline to be extended.

"Almost a year [after last year's tax-filing deadline was extended], we are still grappling with the massive economic, logistical and health challenges wrought by this devastating pandemic. Millions of stressed-out taxpayers, businesses and preparers would appreciate an extension of the deadline to file their 2020 tax returns," they wrote.

House Democrats lauded the IRS' decision. "This extension is absolutely necessary to give Americans some needed flexibility in a time of unprecedented crisis," House Ways and Means Committee Chair Richard Neal and Oversight Subcommittee Chair Bill Pascrell said in a joint statement. "Under titanic stress and strain, American taxpayers and tax preparers must have more time to file tax returns."

The IRS moved the tax deadline back in 2020

Last year the IRS moved the tax deadline from April 15 to July 15 to give taxpayers and preparers more time to file and pay during widespread coronavirus shutdowns. Most states that tax income followed suit, postponing their deadlines by 60 to 90 days.

The pandemic is still making it difficult for some people to get the help they need, Neal and Pascrell said in a joint statement on March 8.

"Facing enormous strain and anxiety, taxpayers need flexibility now. We demand that the IRS announce an extension as soon as possible," they wrote.

After winter storms knocked out power in several states in February, the IRS extended the federal tax deadline for residents and business in Texas, Louisiana, and Oklahoma to June 15.

Extending the deadline for 2020 tax returns nationwide will allow for additional time to implement new tax laws authorized by the American Rescue Plan, Neal and Pascrell said, including tax forgiveness on unemployment income up to $10,200.

Tax professionals have also expressed concern about the April deadline. In a March 4 letter , American Institute of Certified Public Accountants Chair Christopher W. Hesse, on behalf of the organization with more than 431,000 members, said it didn't "reflect the real-world hardship and challenges imposed on taxpayers and tax professionals," and requested a June 15 due date for returns and payments.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

- Main content

Some of the content on this website requires JavaScript to be enabled in your web browser to function as intended. This includes, but is not limited to: navigation, video, image galleries, etc. While the website is still usable without JavaScript, it should be enabled to enjoy the full interactive experience.

- Fowler School of Law

» JD Application Instructions

Log in to your online LSAC account and follow these steps:

Step 1 Check the "JD/First Year" box on your application. Step 2 Upload your Personal Statement. The personal statement must be no more than three pages in length, typewritten, 12 point font, and double-spaced. Step 3 Upload your Resume. The resume may include, but is not limited to, work experience, volunteer experience, extracurricular activities, etc. Step 4 Order a Credential Assembly Service report to be sent to Chapman University Fowler School of Law. Step 5 Two letters of recommendation are required. Note: If the application materials do not meet the requirements, there may be a delay in processing your file and a subsequent delay in placing your file into review. If you have any additional information to provide after submitting your application to LSAC, you may email the addendum(s) to [email protected] .

- Admission FAQs & Policies

- Consumer Information (ABA Required Disclosures)

- Check Your Status

- Commitment to Diversity

- Newly Admitted J.D. Students

- Transfer Applicants

- Visiting Applicants

- Student Profile

Application Checklist

Berkeley Law requires that applicants submit their application online through the Law School Admission Council (LSAC) website . There are two basic steps to applying via LSAC:

- Applying online (online application form, c.v., personal statement, and application fee)

- Having your supporting materials sent to LSAC (academic records, English language test scores, and letters of recommendation).

Click on each section below for basic information about the LL.M. application checklist, or go to the Application Forms & Deadlines page to see full, detailed instructions for 2024-25 applications.

Applying Online

Online application form.

Applications for the 2024-25 LL.M. programs have closed.

Application Fee

Pay the $80 application fee by credit card while submitting online application.

Note: if you are applying to more than one track, email us to request an application fee waiver code so that you only have to pay the application fee once. For the LL.M. executive track, you can apply for both options on the same application form with one application fee.

Curriculum Vitae (C.V.) or Resume

The Curriculum Vitae should provide a synopsis of your educational and academic background and skills. This summary should include professional experience, research experience, publications, presentations, awards, honors, and affiliations. There are no format requirements.

Upload your C.V. to the Attachments section of the online application form.

Personal Statement

The Personal Statement can describe your legal interests, the particular area of study you intend to undertake as a law student, the reasons you wish to study at Berkeley Law, and your professional plans or goals following the completion of your degree. Since the admissions committee does not grant interviews, you may also use the statement to describe aspects of yourself that are not apparent from your other application materials. The Personal Statement should be written without assistance from others, including generative AI (e.g., ChatGPT, Bard, etc.), and should be limited to three pages of double-spaced text.

Upload your Personal Statement to the Attachments section of the online application form.

Supporting Materials

Official academic records (transcripts).

It is your responsibility to request an official copy of academic records to be sent directly to LSAC from each institution you attended, using LSAC’s Transcript Request Form which can be printed from the Transcripts page of your LLM CAS account. All academic records must be mailed directly to LSAC from the appropriate issuing institution in a sealed school envelope with a stamp or seal across the sealed flap of the envelope. Documents sent by the applicant or without the Transcript Request Form will not be accepted. Transcripts received by LSAC become their property and cannot be returned to the applicant or the issuing institution.

Academic records issued in a language other than English must be translated into English. The translation may be done by anyone as long as it is a literal, line-by-line, word-for-word translation in the same format as the original, and need not be certified.

Go to LSAC’s website for more information on sending academic records to LSAC’s LLM CAS , and specific document requirements by country .

English Language Test Scores (TOEFL/IELTS) or Waiver Request

Berkeley Law requires Official Score Reports of the Test of English as a Foreign Language (TOEFL) or International English Language Testing System (IELTS) before admitting an applicant whose primary language is not English. We do not accept the Cambridge English Assessment or Duolingo English Test.

Applicants whose primary language is English should submit a waiver request as instructed below; Berkeley Law will not assume English proficiency for any applicant.

The minimum score required is 100 on the internet-based TOEFL (iBT) taken at a test center or through the Home Edition, or 600 on the iBT Paper Edition. There is no subscore requirement. Information about test dates and registration procedures is available at most universities and US consulates and on the TOEFL website .

To have your TOEFL score report sent to LSAC’s LLM CAS, provide ETS with their institution code: 8395

MyBest TOEFL Scores will be accepted, but please note that these scores are not reported to Berkeley Law automatically. To submit your MyBest score for consideration, download a copy of your latest score report from ETS and email it to [email protected] as an attachment with the subject “MyBest TOEFL Score”. Note that all test scores included in the MyBest Score must have been sent to LSAC and verifiable through the LLM CAS report.

The minimum score required is 7 on a 9 point scale (overall score) on the IELTS Academic Test, taken at a test center or through IELTS Online. There is no subscore requirement. Information about test dates and registration procedures is available on the IELTS website .

To have your IELTS score sent to LSAC’s LLM CAS, you must request that your official score report be sent for electronic download using the IELTS system to Law School Admission Council LLM/JD Credential Assembly Svc.

TOEFL and IELTS scores that are more than two years old at the time of application cannot be considered ; applicants must retake the test to submit a more recent score. Applicants should register for the test in time to ensure that the score report will be issued by the application deadline.

Go to LSAC’s website for more information on submitting a TOEFL or IELTS score report to LSAC’s LLM CAS .

English Language Requirement Waiver Requests

You may request an English Language Requirement Waiver if any of the following criteria apply:

- You have attended a US university for full-time study for a minimum of one academic year with a 3.0/B average or higher, OR

- Y ou have attended a foreign university for full-time study as part of a degree program for a minimum of two years in which the sole language of instruction is English , OR

- You are a native English speaker.

To request a waiver via our online application, check the “Yes” button for Question 1 under English Requirement and choose the appropriate reason from the drop down options. If your waiver is based on education in English, you must submit official academic records through LSAC to verify your eligibility. We do not waive the English Language Requirement based on work experience in English. Please do not contact the Advanced Degree Programs Office in advance of applying if you meet the criteria above; requesting the waiver through the application will suffice.

Letters of Recommendation

Berkeley Law requires two letters of recommendation and will accept a third if you feel it will strengthen your application. We prefer that at least one letter comes from one of your law professors.

To send letters of recommendation to LSAC, log in to your LLM CAS account and follow the instructions to add your recommenders’ names and contact information, submit requests for letters to your recommenders, and assign your letters once they are submitted. An email will be sent to each of your recommenders requesting them to complete and upload a letter for you, or you may print the required recommender forms to provide to your recommenders if they prefer to submit a letter by paper. Letters processed by LSAC become their property and cannot be returned or copied.

Go to LSAC’s website for more information on submitting letters of recommendation to LSAC’s LLM CAS .

Video Assessment (executive track applicants only)

Executive track applicants will receive an email invitation after submitting their online application form to complete the video assessment through Kira Talent’s online platform. More information about the video assessment process will be provided in the email invitation.

Watch this video to hear our Senior Director of Admissions & Recruitment help you avoid common application mistakes and see our Application Timeline!

We strongly advise applicants to register for the LLM Credential Assembly Service and submit their supporting materials well in advance of the application deadline. LSAC recommends applicants register at least six weeks before their first application deadline .

Applicants will not be considered for admission until all required application materials are received by Berkeley Law’s Advanced Degree Programs Office. All applications and supporting documents become the property of Berkeley Law and will not be returned. It is the responsibility of the applicant to ensure that all items are submitted before the deadline.

Please note that LSAC will not forward any supporting documents to Berkeley Law until all of your transcripts are received, as well as authenticated and evaluated if you purchased the International Authentication & Evaluation Service.

Steps to Apply

Application forms & deadlines, eligibility & admissions standards.

An official website of the United States Government

- Kreyòl ayisyen

- Search Toggle search Search Include Historical Content - Any - No Include Historical Content - Any - No Search

- Menu Toggle menu

- INFORMATION FOR…

- Individuals

- Business & Self Employed

- Charities and Nonprofits

- International Taxpayers

- Federal State and Local Governments

- Indian Tribal Governments

- Tax Exempt Bonds

- FILING FOR INDIVIDUALS

- How to File

- When to File

- Where to File

- Update Your Information

- Get Your Tax Record

- Apply for an Employer ID Number (EIN)

- Check Your Amended Return Status

- Get an Identity Protection PIN (IP PIN)

- File Your Taxes for Free

- Bank Account (Direct Pay)

- Payment Plan (Installment Agreement)

- Electronic Federal Tax Payment System (EFTPS)

- Your Online Account

- Tax Withholding Estimator

- Estimated Taxes

- Where's My Refund

- What to Expect

- Direct Deposit

- Reduced Refunds

- Amend Return

Credits & Deductions

- INFORMATION FOR...

- Businesses & Self-Employed

- Earned Income Credit (EITC)

- Child Tax Credit

- Clean Energy and Vehicle Credits

- Standard Deduction

- Retirement Plans

Forms & Instructions

- POPULAR FORMS & INSTRUCTIONS

- Form 1040 Instructions

- Form 4506-T

- POPULAR FOR TAX PROS

- Form 1040-X

- Circular 230

IRS reminds taxpayers living and working abroad of June 15 deadline

More in news.

- Topics in the News

- News Releases for Frequently Asked Questions

- Multimedia Center

- Tax Relief in Disaster Situations

- Inflation Reduction Act

- Taxpayer First Act

- Tax Scams/Consumer Alerts

- The Tax Gap

- Fact Sheets

- IRS Tax Tips

- e-News Subscriptions

- IRS Guidance

- Media Contacts

- IRS Statements and Announcements

IR-2021-122, June 2, 2021

WASHINGTON – The Internal Revenue Service today reminded taxpayers living and working outside of the United States that they must file their 2020 federal income tax return by Tuesday, June 15. This deadline applies to both U.S. citizens and resident aliens abroad , including those with dual citizenship.

Just as most taxpayers in the United States are required to timely file their tax returns with the IRS, those living and working in another country are also required to file. An automatic two-month deadline extension is normally granted for those overseas and in 2021 that date is still June 15 even though the normal income tax filing deadline was extended a month from April 15 to May 17 .

Benefits and qualifications

An income tax filing requirement generally applies even if a taxpayer qualifies for tax benefits, such as the Foreign Earned Income Exclusion or the Foreign Tax Credit , which substantially reduce or eliminate U.S. tax liability. These tax benefits are only available if an eligible taxpayer files a U.S. income tax return.

A taxpayer qualifies for the special June 15 filing deadline if both their tax home and abode are outside the United States and Puerto Rico. Those serving in the military outside the U.S. and Puerto Rico on the regular due date of their tax return also qualify for the extension to June 15. IRS recommends attaching a statement if one of these two situations apply.

Reporting required for foreign accounts and assets

Federal law requires U.S. citizens and resident aliens to report any worldwide income, including income from foreign trusts and foreign bank and securities accounts. In most cases, affected taxpayers need to complete and attach Schedule B to their tax return. Part III of Schedule B asks about the existence of foreign accounts, such as bank and securities accounts, and usually requires U.S. citizens to report the country in which each account is located.

In addition, certain taxpayers may also have to complete and attach to their return Form 8938, Statement of Foreign Financial Assets . Generally, U.S. citizens, resident aliens and certain nonresident aliens must report specified foreign financial assets on this form if the aggregate value of those assets exceeds certain thresholds. See the instructions for this form for details.

Foreign accounts reporting deadline

Separate from reporting specified foreign financial assets on their tax return, taxpayers with an interest in, or signature or other authority over foreign financial accounts whose aggregate value exceeded $10,000 at any time during 2020, must file electronically with the Treasury Department a Financial Crimes Enforcement Network (FinCEN) Form 114, Report of Foreign Bank and Financial Accounts (FBAR) . Because of this threshold, the IRS encourages taxpayers with foreign assets, even relatively small ones, to check if this filing requirement applies to them. The form is only available through the BSA E-filing System website .

The deadline for filing the annual Report of Foreign Bank and Financial Accounts (FBAR) was April 15, 2021, but FinCEN is granting filers who missed the original deadline an automatic extension until October 15, 2021, to file the FBAR. There is no need to request this extension.

Report in U.S. dollars

Any income received or deductible expenses paid in foreign currency must be reported on a U.S. tax return in U.S. dollars. Likewise, any tax payments must be made in U.S. dollars.

Both FINCEN Form 114 and IRS Form 8938 require the use of a December 31 exchange rate for all transactions, regardless of the actual exchange rate on the date of the transaction. Generally, the IRS accepts any posted exchange rate that is used consistently. For more information on exchange rates, see Foreign Currency and Currency Exchange Rates .

Expatriate reporting

Taxpayers who relinquished their U.S. citizenship or ceased to be lawful permanent residents of the United States during 2020 must file a dual-status alien tax return, and attach Form 8854, Initial and Annual Expatriation Statement . A copy of Form 8854 must also be filed with Internal Revenue Service, 3651 S IH35 MS 4301AUSC, Austin, TX 78741, by the due date of the tax return (including extensions). See the instructions for this form and Notice 2009-85 PDF , Guidance for Expatriates Under Section 877A, for further details.

More time is available

Extra time is available for those who cannot meet the June 15 date. Individual taxpayers who need additional time to file can request a filing extension to Oct. 15 by printing and mailing Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return . The IRS can't process extension requests filed electronically after May 17, 2021. Find out where to mail the form.

Businesses that need additional time to file income tax returns must file Form 7004, Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns .

Combat zone extension

Members of the military qualify for an additional extension of at least 180 days to file and pay taxes if either of the following situations apply:

- They serve in a combat zone or they have qualifying service outside of a combat zone or

- They serve on deployment outside the United States away from their permanent duty station while participating in a contingency operation. This is a military operation that is designated by the Secretary of Defense or results in calling members of the uniformed services to active duty (or retains them on active duty) during a war or a national emergency declared by the President or Congress.

Deadlines are also extended for individuals serving in a combat zone or a contingency operation in support of the Armed Forces . This applies to Red Cross personnel, accredited correspondents and civilian personnel acting under the direction of the Armed Forces in support of those forces.

Spouses of individuals who served in a combat zone or contingency operation are generally entitled to the same deadline extensions with some exceptions. Extension details and more military tax information is available in IRS Publication 3, Armed Forces' Tax Guide .

Visit IRS.gov for tax information

Tax help and filing information is available anytime on IRS.gov. The IRS website offers a variety of online tools to help taxpayers answer common tax questions. For example, taxpayers can search the Interactive Tax Assistant , Tax Topics and Frequently Asked Questions to get answers to common questions. IRS.gov/payments provides information on electronic payment options.

Other resources:

- About Publication 54, Tax Guide for U.S. Citizens and Resident Aliens Abroad

- About Publication 519, U.S. Tax Guide for Aliens

Main Navigation

- Contact NeurIPS

- Code of Ethics

- Code of Conduct

- Create Profile

- Journal To Conference Track

- Diversity & Inclusion

- Proceedings

- Future Meetings

- Exhibitor Information

- Privacy Policy

NeurIPS 2024, the Thirty-eighth Annual Conference on Neural Information Processing Systems, will be held at the Vancouver Convention Center

Monday Dec 9 through Sunday Dec 15. Monday is an industry expo.

Registration

Pricing » Registration 2024 Registration Cancellation Policy » . Certificate of Attendance

Our Hotel Reservation page is currently under construction and will be released shortly. NeurIPS has contracted Hotel guest rooms for the Conference at group pricing, requiring reservations only through this page. Please do not make room reservations through any other channel, as it only impedes us from putting on the best Conference for you. We thank you for your assistance in helping us protect the NeurIPS conference.

Announcements

- The call for High School Projects has been released

- The Call For Papers has been released

- See the Visa Information page for changes to the visa process for 2024.

Latest NeurIPS Blog Entries [ All Entries ]

Important dates.

If you have questions about supporting the conference, please contact us .

View NeurIPS 2024 exhibitors » Become an 2024 Exhibitor Exhibitor Info »

Organizing Committee

General chair, program chair, workshop chair, workshop chair assistant, tutorial chair, competition chair, data and benchmark chair, diversity, inclusion and accessibility chair, affinity chair, ethics review chair, communication chair, social chair, journal chair, creative ai chair, workflow manager, logistics and it, mission statement.

The Neural Information Processing Systems Foundation is a non-profit corporation whose purpose is to foster the exchange of research advances in Artificial Intelligence and Machine Learning, principally by hosting an annual interdisciplinary academic conference with the highest ethical standards for a diverse and inclusive community.

About the Conference

The conference was founded in 1987 and is now a multi-track interdisciplinary annual meeting that includes invited talks, demonstrations, symposia, and oral and poster presentations of refereed papers. Along with the conference is a professional exposition focusing on machine learning in practice, a series of tutorials, and topical workshops that provide a less formal setting for the exchange of ideas.

More about the Neural Information Processing Systems foundation »

Artikel & Berita

Write my essay for me.

IMAGES

VIDEO

COMMENTS

WASHINGTON — The Internal Revenue Service today announced that individuals have until May 17, 2021 to meet certain deadlines that would normally fall on April 15, such as making IRA contributions and filing certain claims for refund. This follows a previous announcement from the IRS on March 17, that the federal income tax filing due date for ...

IR-2022-116, June 2, 2022 — The Internal Revenue Service is encouraging taxpayers who have yet to file their 2021 tax return - including those who requested an extension of time - to file a complete and accurate return electronically as early as possible once they have all their information together. There's no need to wait until the October deadline.

IR-2021-59, March 17, 2021. WASHINGTON — The Treasury Department and Internal Revenue Service announced today that the federal income tax filing due date for individuals for the 2020 tax year will be automatically extended from April 15, 2021, to May 17, 2021. The IRS will be providing formal guidance in the coming days.

WASHINGTON — The U.S. Department of the Treasury and the Internal Revenue Service announced today that the federal income tax filing due date for individuals for the 2020 tax year will be automatically extended from April 15, 2021, to May 17, 2021. The IRS will be providing formal guidance in the coming days. Additional details on the taxpayer relief announced today are available on IRS.gov. ###

Early deadline for 2024 entry. 18:00 (UK time) - any course at the universities of Oxford and Cambridge, or for most courses in medicine, veterinary medicine/science, and dentistry. You can add choices with a different deadline later, but don't forget you can only have five choices in total. 31 Jan.

Early Action application submission deadline: November 1: Early Action required materials submission deadline: Mid-December: Early Action decisions released ... Upload an optional Personal Statement with your application to let us know if there are specific circumstances that impacted your academic performance for a specific period of time or ...

The IRS and Treasury Department will postpone the April 15 tax-filing deadline to May 17, the agencies announced Wednesday. "This continues to be a tough time for many people, and the IRS wants ...

Student checking UCAS Application Deadline for 2021 . ... Personal Statement Service. The Old Dairy 12 Stephen Road Headington, Oxford, OX3 9AY United Kingdom. VAT Number 425 5446 95. 24/7 0800 334 5952 London 020 364 076 91 [email protected]. USA Address. 3979 Albany Post Road #2042

30 March 2021. On March 29, 2021, the U.S. Department of the Treasury and IRS issued Notice 2021-21, which formalizes tax filing and payment guidance initially provided on March 17, 2021, and provides details on the additional tax deadlines that have been postponed until May 17, 2021. As reported in GMS Flash Alert 2021-089, on March 17, 2021 ...

Idaho has extended the 2020 Idaho income tax filing deadline to May 17, 2021. This extension applies to all individual income tax returns and fiduciary returns (Form 66). Payment deadlines for individual income tax returns and fiduciary 1st quarter estimated payments have also been extended to May 17, 2021.

Personal Statements Note: This document should only be used as a reference and should not replace assignment guidelines. ... Upload and submit your statement in advance of the deadline in case of technical difficulties. Author: Christopher Brough Created Date: 10/8/2021 9:04:18 AM ...

And if you make estimated tax payments, the deadline remains April 15. ... When are the deadlines for 2021 estimated tax payments? The first is April 15, followed by June 15, Sept. 15 and Jan. 18 ...

The Post's personal finance columnist answers your tax deadline questions. ... 2021 at 12:00 p.m. EDT. With tax season in full swing amid a year of economic uncertainty, here are five things you ...

The filing deadline to submit 2021 tax returns or an extension to file and pay tax owed is Monday, April 18, 2022, for most taxpayers. By law, Washington, D.C., holidays impact tax deadlines for everyone in the same way federal holidays do.

The federal tax deadline, when tax returns and payments are due, will move to May 17. The IRS and Treasury Department announced the change in a statement on Wednesday. An extension gives the IRS ...

October 15, 2024 - Deadline to file your extended 2023 tax return. If you chose to file an extension request on your tax return, this is the due date for filing your tax return. December 31, 2024 - Required minimum distributions have to be taken for individuals age 73 or older by the end of 2024.

JD Application Instructions. Log in to your online LSAC account and follow these steps: Step 1 Check the "JD/First Year" box on your application. Step 2 Upload your Personal Statement. The personal statement must be no more than three pages in length, typewritten, 12 point font, and double-spaced. Step 3 Upload your Resume.

2021-2022 Academic Calendar; 2020-2021 Academic Calendar; 2019-2020 Academic Calendar; ... The Personal Statement can describe your legal interests, the particular area of study you intend to undertake as a law student, the reasons you wish to study at Berkeley Law, and your professional plans or goals following the completion of your degree ...

Periodic Monthly Statements (PMS) Dates for 2021. Month. Statement Dates 11th Workday. Statement Dates 15th Workday. January. 01/19/2021. 01/25/2021. February. 02/16/2021.

elected and newly appointed school officials must file their 2021 Personal/Relative and Financial Disclosure Statements (Disclosure Statements). All other deadlines remain unchanged. Additional information regarding the filing of 2021 Disclosure Statements, as well as answers to frequently asked questions, can be found on the SEC's webpage.

IR-2021-122, June 2, 2021. WASHINGTON - The Internal Revenue Service today reminded taxpayers living and working outside of the United States that they must file their 2020 federal income tax return by Tuesday, June 15. This deadline applies to both U.S. citizens and resident aliens abroad, including those with dual citizenship.

15 to June 15, 2021, the Texas Ethics Commission (TEC) is automatically extending the due date for annual 2021 personal financial statements (PFS) to June 30, 2021. The PFS covers the period January 1, 2020, through December 31, 2020. All state filers whose PFS deadline was April 30, 2021, have had their PFS filing deadline automatically moved ...

It could even be a checklist to reference when working on a case. Contact us for more details before submitting an article. GPSolo eReport is a member benefit of the ABA Solo, Small Firm and General Practice Division. It is a monthly electronic newsletter that includes valuable practice tips, news, technology trends, and featured articles on ...

2021 2020 2019 2018 2017 2016 2015 ... Main Conference Paper Submission Deadline May 22 '24 01:00 PM PDT * Main Conference Full Paper Submission Deadline: May 22 '24 01:00 PM PDT * Datasets and Benchmarks - Abstract Submission Deadline ... Mission Statement.

Personal Statement Deadline 2021 | Top Writers. 1 Customer reviews. 100% Success rate. Once your essay writing help request has reached our writers, they will place bids. To make the best choice for your particular task, analyze the reviews, bio, and order statistics of our writers. Once you select your writer, put the needed funds on your ...