Hacking the Case Interview

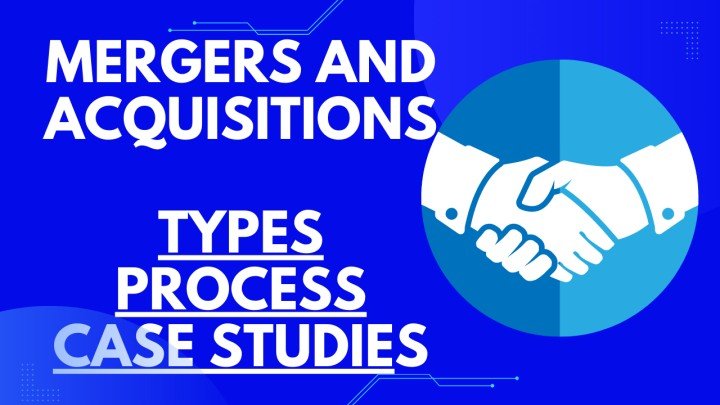

Merger & acquisition (M&A) cases are a common type of case you’ll see in consulting interviews. You are likely to see at least one M&A case in your upcoming interviews, especially at consulting firms that have a large M&A or private equity practice.

These cases are fairly straight forward and predictable, so once you’ve done a few cases, you’ll be able to solve any M&A case.

In this article, we’ll cover:

- Two types of merger & acquisition case interviews

- The five steps to solve any M&A case

- The perfect M&A case interview framework

- Merger & acquisition case interview examples

- Recommended M&A case interview resources

If you’re looking for a step-by-step shortcut to learn case interviews quickly, enroll in our case interview course . These insider strategies from a former Bain interviewer helped 30,000+ land consulting offers while saving hundreds of hours of prep time.

Two Types of Merger & Acquisition Case Interviews

A merger is a business transaction that unites two companies into a new and single entity. Typically, the two companies merging are roughly the same size. After the merger, the two companies are no longer separately owned and operated. They are owned by a single entity.

An acquisition is a business transaction in which one company purchases full control of another company. Following the acquisition, the company being purchased will dissolve and cease to exist. The new owner of the company will absorb all of the acquired company’s assets and liabilities.

There are two types of M&A cases you’ll see in consulting case interviews:

A company acquiring or merging with another company

- A private equity firm acquiring a company, also called a private equity case interview

The first type of M&A case is the most common. A company is deciding whether to acquire or merge with another company.

Example: Walmart is a large retail corporation that operates a chain of supermarkets, department stores, and grocery stores. They are considering acquiring a company that provides an online platform for small businesses to sell their products. Should they make this acquisition?

There are many reasons why a company would want to acquire or merge with another company. In making an acquisition or merger, a company may be trying to:

- Gain access to the other company’s customers

- Gain access to the other company’s distribution channels

- Acquire intellectual property, proprietary technology, or other assets

- Realize cost synergies

- Acquire talent

- Remove a competitor from the market

- Diversify sources of revenue

A private equity firm acquiring a company

The second type of M&A case is a private equity firm deciding whether to acquire a company. This type of M&A case is slightly different from the first type because private equity firms don’t operate like traditional businesses.

Private equity firms are investment management companies that use investor money to acquire companies in the hopes of generating a high return on investment.

After acquiring a company, a private equity firm will try to improve the company’s operations and drive growth. After a number of years, the firm will look to sell the acquired company for a higher price than what it was originally purchased for.

Example: A private equity firm is considering acquiring a national chain of tattoo parlors. Should they make this investment?

There are a few different reasons why a private equity firm would acquire a company. By investing in a company, the private equity firm may be trying to:

- Generate a high return on investment

- Diversify its portfolio of companies to reduce risk

- Realize synergies with other companies that the firm owns

Regardless of which type of M&A case you get, they both can be solved using the same five step approach.

The Five Steps to Solve Any M&A Case Interview

Step One: Understand the reason for the acquisition

The first step to solve any M&A case is to understand the primary reason behind making the acquisition. The three most common reasons are:

- The company wants to generate a high return on investment

- The company wants to acquire intellectual property, proprietary technology, or other assets

- The company wants to realize revenue or cost synergies

Knowing the reason for the acquisition is necessary to have the context to properly assess whether the acquisition should be made.

Step Two: Quantify the specific goal or target

When you understand the reason for the acquisition, identify what the specific goal or target is. Try to use numbers to quantify the metric for success.

For example, if the company wants a high return on investment, what ROI are they targeting? If the company wants to realize revenue synergies, how much of a revenue increase are they expecting?

Depending on the case, some goals or targets may not be quantifiable. For example, if the company is looking to diversify its revenue sources, this is not easily quantifiable.

Step Three: Create a M&A framework and work through the case

With the specific goal or target in mind, structure a framework to help guide you through the case. Your framework should include all of the important areas or questions you need to explore in order to determine whether the company should make the acquisition.

We’ll cover the perfect M&A framework in the next section of the article, but to summarize, there are four major areas in your framework:

Market attractiveness : Is the market that the acquisition target plays in attractive?

Company attractiveness : Is the acquisition target an attractive company?

Synergies : Are there significant revenue and cost synergies that can be realized?

Financial implications : What are the expected financial gains or return on investment from this acquisition?

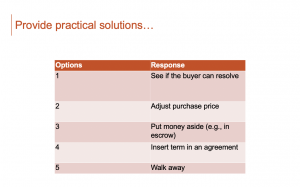

Step Four: Consider risks OR consider alternative acquisition targets

Your M&A case framework will help you investigate the right things to develop a hypothesis for whether or not the company should make the acquisition.

The next step in completing an M&A case depends on whether you are leaning towards recommending making the acquisition or recommending not making the acquisition.

If you are leaning towards recommending making the acquisition…

Explore the potential risks of the acquisition.

How will the acquisition affect existing customers? Will it be difficult to integrate the two companies? How will competitors react to this acquisition?

If there are significant risks, this may change the recommendation that you have.

If you are leaning towards NOT recommending making the acquisition…

Consider other potential acquisition targets.

Remember that there is always an opportunity cost when a company makes an acquisition. The money spent on making the acquisition could be spent on something else.

Is there another acquisition target that the company should pursue instead? Are there other projects or investments that are better to pursue? These ideas can be included as next steps in your recommendation.

Step Five: Deliver a recommendation and propose next steps

At this point, you will have explored all of the important areas and answered all of the major questions needed to solve the case. Now it is time to put together all of the work that you have done into a recommendation.

Structure your recommendation in the following way so that it is clear and concise:

- State your overall recommendation firmly

- Provide three reasons that support your recommendation

- Propose potential next steps to explore

The Perfect M&A Case Interview Framework

The perfect M&A case framework breaks down the complex question of whether or not the company should make the acquisition into smaller and more manageable questions.

You should always aspire to create a tailored framework that is specific to the case that you are solving. Do not rely on using memorized frameworks because they do not always work given the specific context provided.

For merger and acquisition cases, there are four major areas that are the most important.

1. Market attractiveness

For this area of your framework, the overall question you are trying to answer is whether the market that the acquisition target plays in is attractive. There are a number of different factors to consider when assessing the market attractiveness:

- What is the market size?

- What is the market growth rate?

- What are average profit margins in the market?

- How available and strong are substitutes?

- How strong is supplier power?

- How strong is buyer power?

- How high are barriers to entry?

2. Company attractiveness

For this area of your framework, the overall question you want to answer is whether the acquisition target is an attractive company. To assess this, you can look at the following questions:

- Is the company profitable?

- How quickly is the company growing?

- Does the company have any competitive advantages?

- Does the company have significant differentiation from competitors?

3. Synergies

For this area of your framework, the overall question you are trying to answer is whether there are significant synergies that can be realized from the acquisition.

There are two types of synergies:

- Revenue synergies

- Cost synergies

Revenue synergies help the company increase revenues. Examples of revenue synergies include accessing new distribution channels, accessing new customer segments, cross-selling products, up-selling products, and bundling products together.

Cost synergies help the company reduce overall costs. Examples of cost synergies include consolidating redundant costs and having increased buyer power.

4. Financial implications

For this area of your framework, the main question you are trying to answer is whether the expected financial gains or return on investment justifies the acquisition price.

To do this, you may need to answer the following questions:

- Is the acquisition price fair?

- How long will it take to break even on the acquisition price?

- What is the expected increase in annual revenue?

- What are the expected cost savings?

- What is the projected return on investment?

Merger & Acquisition Case Interview Examples

Let’s put our strategy and framework for M&A cases into practice by going through an example.

M&A case example: Your client is the second largest fast food restaurant chain in the United States, specializing in serving burgers and fries. As part of their growth strategy, they are considering acquiring Chicken Express, a fast food chain that specializes in serving chicken sandwiches. You have been hired to advise on whether this acquisition should be made.

To solve this case, we’ll go through the five steps we outlined above.

The case mentions that the acquisition is part of the client’s growth strategy. However, it is unclear what kind of growth the client is pursuing.

Are they looking to grow revenues? Are they looking to grow profits? Are they looking to grow their number of locations? We need to ask a clarifying question to the interviewer to understand the reason behind the potential acquisition.

Question: Why is our client looking to make an acquisition? Are they trying to grow revenues, profits, or something else?

Answer: The client is looking to grow profits.

Now that we understand why the client is considering acquiring Chicken Express, we need to quantify what the specific goal or target is. Is there a particular profit number that the client is trying to reach?

We’ll need to ask the interviewer another question to identify this.

Question: Is there a specific profit figure that the client is trying to reach within a specified time period?

Answer: The client is trying to increase annual profits by at least $200M by the end of the first year following the acquisition.

With this specific goal in mind, we need to structure a framework to identify all of the important and relevant areas and questions to explore. We can use market attractiveness, company attractiveness, synergies, and financial implications as the four broad areas of our framework.

We’ll need to identify and select the most important questions to answer in each of these areas. One potential framework could look like the following:

Let’s fast forward through this case and say that you have identified the following key takeaways from exploring the various areas in your framework:

- Chicken Express has been growing at 8% per year over the past five years while the fast food industry has been growing at 3% per year

- Among fast food chains, Chicken Express has the highest customer satisfaction score

- Revenue synergies would increase annual profit by $175M. This is driven by leveraging the Chicken Express brand name to increase traffic to existing locations

- Cost synergies would decrease annual costs by $50M due to increased buyer power following the acquisition

At this point, we are leaning towards recommending that our client acquire Chicken Express. To strengthen our hypothesis, we need to explore the potential risks of the acquisition.

Can the two companies be integrated smoothly? Is there a risk of sales cannibalization between the two fast food chains? How will competitors react to this acquisition?

For this case, let’s say that we have investigated these risks and have concluded that none of them pose a significant threat to achieving the client’s goals of increasing annual profit by $200M.

We’ll now synthesize the work we have done so far and provide a clear and concise recommendation. One potential recommendation may look like the following:

I recommend that our client acquires Chicken Express. There are three reasons that support this.

One, Chicken Express is an attractive acquisition target. They are growing significantly faster than the fast food industry average and have the highest customer satisfaction scores among fast food chains.

Two, revenue synergies would increase annual profit by $175M. The client can leverage the brand name of Chicken Express to drive an increase in traffic to existing locations.

Three, cost synergies would decrease annual costs by $50M. This is due to an increase in buyer power following the acquisition.

Therefore, our client will be able to achieve its goal of increasing annual profits by at least $200M. For next steps, I’d like to assess the acquisition price to determine whether it is reasonable and fair.

More M&A case interview practice

Follow along with the video below for another merger and acquisition case interview example.

For more practice, check out our article on 23 MBA consulting casebooks with 700+ free practice cases .

In addition to M&A case interviews, we also have additional step-by-step guides to: profitability case interviews , market entry case interviews , growth strategy case interviews , pricing case interviews , operations case interviews , and marketing case interviews .

Recommended M&A Case Interview Resources

Here are the resources we recommend to learn the most robust, effective case interview strategies in the least time-consuming way:

- Comprehensive Case Interview Course (our #1 recommendation): The only resource you need. Whether you have no business background, rusty math skills, or are short on time, this step-by-step course will transform you into a top 1% caser that lands multiple consulting offers.

- Hacking the Case Interview Book (available on Amazon): Perfect for beginners that are short on time. Transform yourself from a stressed-out case interview newbie to a confident intermediate in under a week. Some readers finish this book in a day and can already tackle tough cases.

- The Ultimate Case Interview Workbook (available on Amazon): Perfect for intermediates struggling with frameworks, case math, or generating business insights. No need to find a case partner – these drills, practice problems, and full-length cases can all be done by yourself.

- Case Interview Coaching : Personalized, one-on-one coaching with former consulting interviewers

- Behavioral & Fit Interview Course : Be prepared for 98% of behavioral and fit questions in just a few hours. We'll teach you exactly how to draft answers that will impress your interviewer

- Resume Review & Editing : Transform your resume into one that will get you multiple interviews

Land Multiple Consulting Offers

Complete, step-by-step case interview course. 30,000+ happy customers.

Ace Your M&A Case Study Using These 5 Key Steps

- Last Updated November, 2022

Mergers and acquisitions (M&A) are high-stakes strategic decisions where a firm(s) decides to acquire or merge with another firm. As M&A transactions can have a huge impact on the financials of a business, consulting firms play a pivotal role in helping to identify M&A opportunities and to project the impact of these decisions.

M&A cases are common case types used in interviews at McKinsey, Bain, BCG, and other top management consulting firms. A typical M&A case study interview would start something like this:

The president of a national drugstore chain is considering acquiring a large, national health insurance provider. The merger would combine one company’s network of pharmacies and pharmacy management business with the health insurance operations of the other, vertically integrating the companies. He would like our help analyzing the potential benefits to customers and shareholders.

M&A cases are easy to tackle once you understand the framework and have practiced good cases. Keep reading for insights to help you ace your next M&A case study interview.

In this article, we’ll discuss:

- Why mergers & acquisitions happen.

- Real-world M&A examples and their implications.

- How to approach an M&A case study interview.

- An end-to-end M&A case study example.

Let’s get started!

Why Do Mergers & Acquisitions Happen?

There are many reasons for corporations to enter M&A transactions. They will vary based on each side of the table.

For the buyer, the reasons can be:

- Driving revenue growth. As companies mature and their organic revenue growth (i.e., from their own business) slows, M&A becomes a key way to increase market share and enter new markets.

- Strengthening market position. With a larger market share, companies can capture more of an industry’s profits through higher sales volumes and/or greater pricing power, while vertical integration (e.g., buying a supplier) allows for faster responses to changes in customer demand.

- Capturing cost synergies. Large businesses can drive down input costs with scale economics as well as consolidate back-office operations to lower overhead costs. (Example of scale economies: larger corporations can negotiate higher discounts on the products and services they buy. Example of consolidated back-office operations: each organization may have 50 people in their finance department, but the combined organization might only need 70, eliminating 30 salaries.)

- Undertaking PE deals. Private equity firms will buy a majority stake in a company to take control and transform the operations of the business (e.g., bring in new top management or fund growth to increase profitability).

- Accessing new technology and top talent. This is especially common in highly competitive and innovation-driven industries such as technology and biotech.

For the seller, the reasons can be:

- Accessing resources. A smaller business can benefit from the capabilities (e.g., product distribution or knowledge) of a larger business in driving growth.

- Gaining needed liquidity. Businesses facing financial difficulties may look for a well-capitalized business to acquire them, alleviating the stress.

- Creating shareholder exit opportunities . This is very common for startups where founders and investors want to liquidate their shares.

There are many other variables in the complex process of merging two companies. That’s why advisors are always needed to help management to make the best long-term decision.

Real-world Merger and Acquisition Examples and Their Implications

Let’s go through a couple recent merger and acquisition examples and briefly explain how they will impact the companies.

Nail the case & fit interview with strategies from former MBB Interviewers that have helped 89.6% of our clients pass the case interview.

KKR Acquisition of Ocean Yield

KKR, one of the largest private equity firms in the world, bought a 60% stake worth over $800 million in Ocean Yield, a Norwegian company operating in the ship leasing industry. KKR is expected to drive revenue growth (e.g., add-on acquisitions) and improve operational efficiency (e.g., reduce costs by moving some business operations to lower-cost countries) by leveraging its capital, network, and expertise. KKR will ultimately seek to profit from this investment by selling Ocean Yield or selling shares through an IPO.

ConocoPhillips Acquisition of Concho Resources

ConocoPhillips, one of the largest oil and gas companies in the world with a current market cap of $150 billion, acquired Concho Resources which also operates in oil and gas exploration and production in North America. The combination of the companies is expected to generate financial and operational benefits such as:

- Provide access to low-cost oil and gas reserves which should improve investment returns.

- Strengthen the balance sheet (cash position) to improve resilience through economic downturns.

- Generate annual cost savings of $500 million.

- Combine know-how and best practices in oil exploration and production operations and improve focus on ESG commitments (environmental, social, and governance).

How to Approach an M&A Case Study Interview

Like any other case interview, you want to spend the first few moments thinking through all the elements of the problem and structuring your approach. Also, there is no one right way to approach an M&A case but it should include the following:

- Breakdown of value drivers (revenue growth and cost synergies)

- Understanding of the investment cost

- Understanding of the risks. (For example, if the newly formed company would be too large relative to its industry competitors, regulators might block a merger as anti-competitive.)

Example issue tree for an M&A case study:

- Will the deal allow them to expand into new geographies or product categories?

- Will each of the companies be able to cross-sell the others’ products?

- Will they have more leverage over prices?

- Will it lower input costs?

- Decrease overhead costs?

- How much will the investment cost?

- Will the value of incremental revenues and/or cost savings generate incremental profit?

- What is the payback period or IRR (internal rate of return)?

- What are the regulatory risks that could prevent the transaction from occurring?

- How will competitors react to the transaction?

- What will be the impact on the morale of the employees? Is the deal going to impact the turnover rate?

An End-to-end BCG M&A Case Study Example

Case prompt:

Your client is the CEO of a major English soccer team. He’s called you while brimming with excitement after receiving news that Lionel Messi is looking for a new team. Players of Messi’s quality rarely become available and would surely improve any team. However, with COVID-19 restricting budgets, money is tight and the team needs to generate a return. He’d like you to figure out what the right amount of money to offer is.

First, you’ll need to ensure you understand the problem you need to solve in this M&A case by repeating it back to your interviewer. If you need a refresher on the 4 Steps to Solving a Consulting Case Interview , check out our guide.

Second, you’ll outline your approach to the case. Stop reading and consider how you’d structure your analysis of this case. After you outline your approach, read on and see what issues you addressed, and which you didn’t consider. Remember that you want your structure to be MECE and to have a couple of levels in your Issue Tree .

Example M&A Case Study Issue Tree

- Revenue: What are the incremental ticket sales? Jersey sales? TV/ad revenues?

- Costs: What are the acquisition fees and salary costs?

- How will the competitors respond? Will this start a talent arms race?

- Will his goal contribution (the core success metric for a soccer forward) stay high?

- Age / Career Arc? – How many more years will he be able to play?

- Will he want to come to this team?

- Are there cheaper alternatives to recruiting Messi?

- Language barriers?

- Injury risk (could increase with age)

- Could he ask to leave our club in a few years?

- Style of play – Will he work well with the rest of the team?

Analysis of an M&A Case Study

After you outline the structure you’ll use to solve this case, your interviewer hands you an exhibit with information on recent transfers of top forwards.

In soccer transfers, the acquiring team must pay the player’s current team a transfer fee. They then negotiate a contract with the player.

From this exhibit, you see that the average transfer fee for forwards is multiple is about $5 million times the player’s goal contributions. You should also note that older players will trade at lower multiples because they will not continue playing for as long.

Based on this data, you’ll want to ask your interviewer how old Messi is and you’ll find out that he’s 35. We can say that Messi should be trading at 2-3x last season’s goal contributions. Ask for Messi’s goal contribution and will find out that it is 55 goals. We can conclude that Messi should trade at about $140 million.

Now that you understand the up-front costs of bringing Messi onto the team, you need to analyze the incremental revenue the team will gain.

Calculating Incremental Revenue in an M&A Case Example

In your conversation with your interviewer on the value Messi will bring to the team, you learn the following:

- The team plays 25 home matches per year, with an average ticket price of $50. The stadium has 60,000 seats and is 83.33% full.

- Each fan typically spends $10 on food and beverages.

- TV rights are assigned based on popularity – the team currently receives $150 million per year in revenue.

- Sponsors currently pay $50 million a year.

- In the past, the team has sold 1 million jerseys for $100 each, but only receives a 25% margin.

Current Revenue Calculation:

- Ticket revenues: 60,000 seats * 83.33% (5/6) fill rate * $50 ticket * 25 games = $62.5 million.

- Food & beverage revenues: 60,000 seats * 83.33% * $10 food and beverage * 25 games = $12.5 million.

- TV, streaming broadcast, and sponsorship revenues: Broadcast ($150 million) + Sponsorship ($50 million) = $200 million.

- Jersey and merchandise revenues: 1 million jerseys * $100 jersey * 25% margin = $25 million.

- Total revenues = $300 million.

You’ll need to ask questions about how acquiring Messi will change the team’s revenues. When you do, you’ll learn the following:

- Given Messi’s significant commercial draw, the team would expect to sell out every home game, and charge $15 more per ticket.

- Broadcast revenue would increase by 10% and sponsorship would double.

- Last year, Messi had the highest-selling jersey in the world, selling 2 million units. The team expects to sell that many each year of his contract, but it would cannibalize 50% of their current jersey sales. Pricing and margins would remain the same.

- Messi is the second highest-paid player in the world, with a salary of $100 million per year. His agents take a 10% fee annually.

Future Revenue Calculation:

- 60,000 seats * 100% fill rate * $65 ticket * 25 games = $97.5 million.

- 60,000 seats * 100% * $10 food and beverage * 25 games = $15 million.

- Broadcast ($150 million*110% = $165 million) + Sponsorship ($100 million) = $265 million.

- 2 million new jerseys + 1 million old jerseys * (50% cannibalization rate) = 2.5 million total jerseys * $100 * 25% margin = $62.5 million.

- Total revenues = $440 million.

This leads to incremental revenue of $140 million per year.

- Next, we need to know the incremental annual profits. Messi will have a very high salary which is expected to be $110 million per year. This leads to incremental annual profits of $30 million.

- With an upfront cost of $140 million and incremental annual profits of $30 million, the payback period for acquiring Messi is just under 5 years.

Presenting Your Recommendation in an M&A Case

- Messi will require a transfer fee of approximately $140 million. The breakeven period is a little less than 5 years.

- There are probably other financial opportunities that would pay back faster, but a player of the quality of Messi will boost the morale of the club and improve the quality of play, which should build the long-term value of the brand.

- Further due diligence on incremental revenue potential.

- Messi’s ability to play at the highest level for more than 5 years.

- Potential for winning additional sponsorship deals.

5 Tips for Solving M&A Case Study Interviews

In this article, we’ve covered:

- The rationale for M&A.

- Recent M&A transactions and their implications.

- The framework for solving M&A case interviews.

- AnM&A case study example.

Still have questions?

If you have more questions about M&A case study interviews, leave them in the comments below. One of My Consulting Offer’s case coaches will answer them.

Other people prepping for mergers and acquisition cases found the following pages helpful:

- Our Ultimate Guide to Case Interview Prep

- Types of Case Interviews

- Consulting Case Interview Examples

- Market Entry Case Framework

- Consulting Behavioral Interviews

Help with Case Study Interview Prep

Thanks for turning to My Consulting Offer for advice on case study interview prep. My Consulting Offer has helped almost 89.6% of the people we’ve worked with get a job in management consulting. We want you to be successful in your consulting interviews too. For example, here is how Kathryn Kelleher was able to get her offer at BCG.

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

© My CONSULTING Offer

3 Top Strategies to Master the Case Interview in Under a Week

We are sharing our powerful strategies to pass the case interview even if you have no business background, zero casing experience, or only have a week to prepare.

No thanks, I don't want free strategies to get into consulting.

We are excited to invite you to the online event., where should we send you the calendar invite and login information.

M&A case interviews overview

A detailed look at m&a case interviews with a sample approach and example.

M&A motivations | Approaching M&A cases | M&A question bank | Example case walk-through #1 | Example case walk-through #2

Acquisitions are exciting and make for great headlines, but the decision to pursue one is serious business - and makes for a great case interview topic!

For example, consider mega deals like Salesforce acquiring Tableau for $15.7B or Kraft and Heinz merging at a combined valued of $45B. Mergers and acquisitions (often abbreviated as M&A) are some of the splashiest business decisions, often due to the large size of the deals and ability to quickly shake up market share.

Like profitability or market entry cases , M&A questions will often come up during a case interview, either as the primary topic or as a component of a broader case.

Typical motivations for M&A activity (Top)

Before jumping into case interviews, let's talk about why a company might pursue a merger or an acquisition in the first place. There are 3 main factors that drive M&A decisions: growth, competition, and synergies.

M&A for growth purposes

When determining a long-term growth strategy, companies have several options they tend to consider: build, buy, or partner. Amazon's growth into the grocery industry is a great example of a company implementing both build and buy strategies.

Amazon began by leveraging their existing capabilities to build their offering internally, adding food products to their platform and same-day food delivery. However, in 2017 they announced the acquisition of Whole Foods . By purchasing an existing player in the grocery space, they were able to acquire not only the Whole Foods brand, customer base, and retail footprint, but also the employees, supplier relationships, and industry know-how. The acquisition allowed them to grow at a quicker pace than they would have been able to otherwise.

M&A for competitive purposes

Competition can be another big driver behind M&A activity. Consider Uber and Didi's merger in 2016. Both companies were spending enormous amounts of money to gain market share (Uber's losses were estimated at ~$2B), but were still not achieving profitability. By coming to a merger agreement, Uber and Didi were able to end the destructive competition in China and move forward as partners with a shared interest in each other's success.

M&A for synergy gains

Other companies pursue mergers or acquisitions due to the complementary nature of combining two businesses. These complementary aspects are called synergies and might include things like the ability to cut out redundant overhead functions or the ability to cross-sell products to shared customers.

The value of potential synergies is typically estimated prior to doing a deal and would be one of the biggest points of discussion for the buyer. Note that the task of estimating the value of synergies is often more art than science, and many companies overvalue the expected synergies they'll get from a deal. This is just one of the reasons more than 70% of M&A deals fail .

The synergies that can be realized through a merger or acquisition will be different for any given pair of companies and will be one of the primary determining factors in a purchase price. For example, the synergies between a mass retailer buying a smaller clothing company will be much larger than if a restaurant were to buy that same clothing company. Common cost structures and revenue streams often result in greater synergies. For example, two similar businesses that merge will be able to streamline their finance, HR, and legal functions, resulting in a more efficient operation.

M&A framework (Top)

Mergers and acquisitions are not entered into by companies lightly. These are incredibly strategic decisions that are enormously expensive, from both a time and resource perspective, so any leadership team will want to do their due diligence and consider these decisions from multiple angles.

While each M&A scenario will have its own unique factors and considerations, there are some recurring topics you'll most likely want to dive into. We'll cover these in five steps below.

💡 Remember that every case is unique. While these steps can apply to many M&A cases, you should always propose a framework tailored to the specific case question presented!

Step 1: Unpack the motivations

Before recommending a merger or acquisition, the first step is to understand the deeper purpose behind this strategic decision. The motivation might be hinted at in your case prompt, or it might be apparent given general knowledge of a particular industry.

For example, if the question is "Snack Co. is looking to expand into Asia and wants to determine if an acquisition of Candy Co. would be successful", you can tell that the underlying motivation for acquisition is growth through geographic expansion. If the question is about an airline looking to buy another airline, the drivers are likely the competitive nature of the industry and potential synergies in the cost structure.

Once you understand what's driving the M&A desire, you'll know what lens to apply throughout the remainder of the case. You'll also be able to weave in your business acumen in your final recommendation.

Step 2: Evaluate the market

As with many case interviews, a well-rounded market analysis is typically a good place to start. In this scenario, the market we're evaluating is that of the target company. The goal here is to develop a broad understanding of the attractiveness of the market, as the client is essentially investing in this space through M&A activity. For this step, consider:

- Size and forecasted growth of the market

- Barriers to entry such as regulations

- The competitive landscape

- Supplier and buyer dynamics

This step should not be skipped, even in the case of a merger between two companies in the same market. It can't be assumed that the market is attractive just because the buyer is in it already. Rather, if the market evaluation proves unattractive, the buyer should not only avoid the deal, but also address their existing strategy internally.

Step 3: Assess the target company

If the market is deemed to be attractive, the next question is if the target is the optimal company to acquire or merge with in that market. The main points to address here are:

- Is the target financially stable e.g. profitable with growing revenues?

- Does it have a large market share or growing customer base?

- Does it have a capable and experienced team?

- Does it have other intangible assets such as a powerful brand or a valuable patent?

Step 4: Identify potential benefits and risks

Next, consider the pros and cons of doing the deal. Where might the buyer be able to realize synergies with the target? What are the biggest risks to doing the deal? What might derail the integration? For this part, consider these key questions:

- Are there cost or revenue synergies between the two companies?

- What are the primary risks to integrating the two companies?

- Are there concerns around cultural fit (95% of executives say this is vital to a deal's success )?

Step 5: Present your recommendation

Finally, pull all of your findings together and share your final recommendation. Make sure to support your argument with data from the earlier steps and note what you would want to look at if you had more time.

💡 Shameless plug: Our consulting interview prep can help build your skills

M&A question bank (Top)

Below, you'll a see list of M&A case questions sourced from a top candidate - Ana Sousa , an ex-McKinsey Business Analyst currently pursuing her MBA at OSU.

Case A background :

Our client, NewPharma, is a major pharmaceutical company with USD 20 billion in annual revenue. Its corporate headquarters is located in Germany, with sales offices around the world. NewPharma has a long, successful record in researching, developing, and selling “small molecule” drugs. This class represents the majority of drugs today, such as aspirin. They would like to enter a new, fast-growing segment of biological drugs, which are made with large and more complex molecules, and can treat conditions not addressable by conventional drugs. The Research and Development (R&D) associated with biological molecules is completely different from small molecules. In order to acquire these capabilities, a pharma company can build them from scratch, partner with startups, or acquire them. Competition is already many years ahead of NewPharma, so they are looking to jumpstart their own program by acquiring BioAdvance, a leading biologicals startup headquartered in San Francisco. BioAdvance was founded 10 years ago by renowned scientists and now have 200 employees. It is publicly traded, and at current share price, they are worth around USD 2 billion.

Example interview question #1: You are asked to evaluate this potential acquisition and advise on the strategic fit for NewPharma. What would you consider when evaluating whether NewPharma should acquire BioAdvance?

Example interview question #2: let’s explore the setup with bioadvance after a potential acquisition. bioadvance’s existing drug pipeline is relatively limited, however, newpharma is more interested in leveraging bioadvance as a biological research “engine” that, when combined with newpharma’s current r&d assets, would produce a strong drug pipeline over the next 10 years. what are your hypotheses on major risks of integrating the r&d functions of both companies, example interview question #3: in the case of an acquisition, newpharma wants to consolidate all biologicals r&d into one center. there are two options to do so: combine them at newpharma’s headquarters in germany, or at bioadance’s headquarters in san francisco. currently, newpharma does not have any biological facilities or operations in germany, so new ones would need to be built. how would you think about this decision.

Case B background :

Total Energy Inc. (TEI) is a private, medium-sized company with a strong history of drilling and producing natural gas wells in Pennsylvania. They own an ample, and believe valuable, set of land assets where more wells could be drilled. The company is well capitalized but has seen profits decline for the last few years, with a projection of loss for the next year. One of the main drivers is the price of natural gas, which has dropped considerably, mainly because companies like TEI have perfected unconventional drilling techniques, leading to an oversupply of the North American market. Current prices are at a five year low. A larger competition has approached TEI’s leadership about acquiring them for an offer of USD 250 million.

Example interview question #1: TEI’s leadership would like your help in evaluating this offer, as well as identifying alternative strategies. How would you assess this matter?

Example interview question #2: the exploration team at tei has found that there is an oil field in texas that they could acquire, and immediately start drilling. drilling is one of the core competencies and strengths of tei. how would you think about this option in comparison to the selling offer.

Case C background :

Tech Cloud has developed a new research engine designed to increase online retail sales by reshaping customer search results based on real-time customer data analysis. An initial assessment indicates outstanding results in increasing sales, and therefore a tremendous potential for this product. However, Tech Cloud is a small startup, so they do not currently possess the capabilities to sell and install their algorithm in large scale. A major tech company has approached Tech Cloud with a partnership offer: to help them make the new product scalable, offering to pay $150M for it as is, and asking for 50% of profits on all future sales of the new research engine.

Example interview question #1: How would you assess whether Tech Cloud should or should not take this partnership offer?

Example interview question #2: what risks would you outline in this partnership, and how would you recommend tech cloud to mitigate them.

Case D background :

Snack Hack is the fifth largest fast-food chain in the world in number of stores in operation. As most competitors, Snack Hack sells fast-food combo meals for any time of the day. Although Snack Hack owns some of its store, it is mainly operating under a franchising business model, with 85% of its operating stores owned by franchisees. As part of a growth strategy, Snack Hack has been analyzing Creamy Dream as a potential acquisition target. Creamy Dream is a growing ice cream franchise with a global presence. While they also operate by franchising, there is a difference: Snack Hack franchises restaurants (stores), while Creamy Dream franchises areas or regions in which the franchisee is required to open a certain number of stores.

Example interview question #1: What would you explore in order to determine whether Snack Hack should acquire Creamy Dream?

Example interview question #2: what potential synergies can exist between snack hack and creamy dream, example interview question #3: one of the potential synergies that our team believes has great potential is increasing overall profitability by selling creamy dream ice cream at snack hack stores. how would you evaluate the impact of this synergy in profitability, example m&a case #1 (top).

We'll now use our framework to tackle one of the example questions we listed above. Let's focus on Case A and answer the following question:

You are asked to evaluate this potential acquisition and advise on the strategic fit for NewPharma. What would you consider when evaluating whether NewPharma should acquire BioAdvance?

Unpacking: why do they want to acquire.

Following our recommended framework, the first step is to identify the underlying purposes of the acquisition. In this case, you can tell from the context information that their strategic motivation is to enter a new type of drug market. The case has already stated your alternatives outside of this M&A: to build capabilities from scratch or make a partnership/acquisition of a different target.

Evaluating the market: is it an attractive space?

Step 2 in our framework is to evaluate the market. You are told the biological segment is fast-growing, and does not overlap with NewPharma current products, therefore there is no risk of cannibalization. You still need to know who currently competes in this segment, what is the general profitability of these drugs and how it compares to small molecule drugs, and deep dive on the regulation for these drugs, since pharma industry is strongly regulation-driven.

Assessing the target: is it a good company?

Next, we jump into step 3, which is assessing the target. This is where we were given the smallest amount of information, so there is much to cover. R&D is a time-consuming process, and NewPharma will not see profits for drugs they start developing together in case of an acquisition in many years, maybe decades. Therefore, the first thing to look at is the value of BioAdvance’s current drug pipeline, or, in other words, what drugs are they currently developing, their likelihood of success, and their expected revenues and profits.

Another key factor is their capabilities, which is what NewPharma is mostly interested in. What does BioAdvance bring to the table in terms of scientific talent, intellectual property, and research facilities? We also want to look at whether they have current contracts or partnerships with other competitors.

Furthermore, besides their main capability which is research, NewPharma should also learn about their marketing and sales capabilities, to identify any synergies in global sales, and also to understand how they currently promote biologicals, since NewPharma has no experience in this. A great structure would also consider any gaps BioAdvance might have, both in R&D and marketing capabilities. Lastly, NewPharma needs to conduct a due diligence to assess the value of BioAdvance, and therefore the acquisition price.

Identify risks and benefits

Step 4 is identifying the risks and benefits. In a high level, the risks include potential of them having a weak pipeline, which would mean not seeing any profits for years. In addition, NewPharma is a European country, while BioAdvance is from California, which means there is a risk of cultural barriers between both their leaderships and their R&D scientists. In addition, there is the risk that entering this new drug market is not aligned with NewPharma’s strategy or core competencies. The benefits include quickly adding R&D capabilities to catch up with their competitors and addressing a new segment of customers that they currently do not serve.

Example M&A case #2 (Top)

Let's walk through another example M&A case to illustrate how the framework we've introduced might be applied in practice. We'll lay out the thought process a candidate would be expected to demonstrate in a case interview. Here's our prompt:

"Our client, Edu Co., is a publishing company that has historically focused on K-12 curriculum and printed educational materials. They're looking at acquiring a startup that's developed digital classroom materials and assessments. How should they evaluate this opportunity?"

Our first step is to consider why Edu Co. is pursuing an acquisition. From the prompt, we can see that they're an established business looking to acquire a newer entry to the market. Edu Co. has focused on their core capabilities - content and printing - but has not invested in a digital product.

Edu Co. is clearly eyeing the startup target as a way to accelerate their growth into the edtech space. Rather than investing in building a digital product themselves, Edu Co. is looking to buy a company that already has a strong product, customer base, and team.

To begin, we would want to evaluate the digital education market. We might ask for more information on the size and growth rate to start. If we find out the market is large and forecasted to grow at 10% per year, that tells us it's a fairly attractive market.

In terms of barriers to entry, there is limited regulation around K-12 content and assessment. In the edtech space, the main concern is around the secure storage of information having to do with minors.

The competitive landscape is something we would want to ask for more information about. We would want to know how many other companies were pursuing these products and which had the most market share. If the market is highly fragmented, it means there is still room for a clear winner to emerge.

Regarding customer dynamics, we would want to know about any indications of changing preferences. For example, the push towards remote learning during COVID-19 would be relevant, as teachers and students have quickly become more comfortable with digital products.

Once we've determined that the market for digital education is attractive, we'll want to turn our attention to the target company. We would start by asking the interviewer for any information on the company's finances, team, market share, and other assets.

Assume the interviewer gives us revenue, profit, and market share data for the past 3 years. As part of our due diligence, we would want to ensure that all three of these metrics were either stable or growing. If we saw dips in this data, it would be important to dive deeper and understand why their performance had declined.

We would also want to know what their organizational structure looked like. If their staff was primarily sales & marketing (meaning they had outsourced their engineering work), they would be a less attractive target, as acquiring the tech personnel was one of the big reasons Edu Co. was looking to buy the business.

Finally, we would want to understand the technology they had developed. It would be important to understand the strengths and weaknesses of their product as well as any patents or IP.

Next, we would want to lay out any risks or benefits to acquiring the company.

The biggest risk we see is that the two company cultures are very different - Edu Co. is large, slower to make changes, and has an older workforce, whereas the other is much smaller, more agile, and younger. If we tried to integrate these two companies, there may be friction between the two working styles.

On the benefits side, there is potential for both cost and revenue synergies. On the cost side, we would be able to cut redundant administrative roles out, such as HR and finance. On the revenue side, Edu Co. may be able to leverage their customer relationships to cross sell digital products.

Present your final recommendation

Eventually, the interviewer would ask if Edu Co. should pursue the acquisition. Here, we would want to pull all the findings together and lay out our reasoning. Start with the answer first:

Recommendation: "Edu Co. should acquire the edtech startup. It's an attractive market that's growing rapidly and doesn't have a clear leader yet. Furthermore the startup appears to be well-positioned in the market: their revenues, profits, and market share have been growing. As Edu Co. looks to grow into the digital education space, this acquisition will give them a leg-up on competitors. Edu Co. will also be able to leverage their customer relationships to rapidly expand the use of this new digital product. However, Edu Co. will want to develop a robust integration plan to mitigate the risk of culture clash. They may want to consider letting the startup remain in their existing HQ to retain their agile working style."

Summary: putting it all together (Top)

As discussed, M&A cases are fairly common because they have the potential to cover a lot of ground, relevant business challenges.

Realize that in a real M&A case, the due diligence on the target alone could take weeks. It's likely your interviewer will have you dive deeper into one specific step to observe your thought process. In that case, stick with your structure, follow their lead, and always lay out the next steps you would follow if you had more time.

Finally, keep in mind that M&A doesn't just come up because it's fun to analyze; it's also an important source of revenue for the firms - Bain's private equity group does hundreds of due diligence cases annually and BCG's post-merger intergration (PMI) practice makes good money helping firms execute a merger successfully.

Read this next:

- Full cases from RocketBlocks

- 29 full cases from consulting firms

- Profitability case interviews

- Market entry case interviews

- Weird and unusual case interviews

- Pricing case interviews

- Market sizing case interviews

- PE due diligence interviews

- Supply chain case interviews

- Digital transformation consulting cases

See all RocketBlocks posts .

Get interview insights in your inbox:

New mock interviews, mini-lessons, and career tactics. 1x per week. Written by the Experts of RocketBlocks.

P.S. Are you preparing for consulting interviews?

Real interview drills. Sample answers from ex-McKinsey, BCG and Bain consultants. Plus technique overviews and premium 1-on-1 Expert coaching.

Launch your career.

- For schools

- Expert program

- Testimonials

Free resources

- Behavioral guide

- Consulting guide

- Product management guide

- Product marketing guide

- Strategy & BizOps guide

- Consulting case book

Interview prep

- Product management

- Product marketing

- Strategy & Biz Ops

Resume advice

- Part I: Master resume

- Part II: Customization

- Focus: PM resumes

- Focus: Consulting resumes

- Focus: BizOps resumes

Use Our Resources and Tools to Get Started With Your Preparation!

M&a cases, mergers & acquisitions (m&a) are often an answer to broader problems during a case interview.

Merger and acquisition (M&A) cases are fairly common in consulting case interviews , especially for candidates targeting consulting firms with a focus on strategy , corporate finance, or mergers and acquisitions. While they may not make up the majority of cases, they are frequently included to assess your ability to think strategically, analyze financial data, and understand the implications of complex business decisions.

M&A cases are particularly relevant for consulting roles that involve advising clients on growth strategies , restructuring , or corporate development. Overall, while not every case interview will feature an M&A scenario,we recommend you to be prepared to tackle them effectively as part of your case interview preparation.

What Are M&A Cases?

In an M&A case you are typically tasked with assessing the feasibility and implications of potential mergers, acquisitions, or divestitures for a client or company. This often involves analyzing market dynamics, financial statements, competitive landscapes, and strategic synergies to provide recommendations on whether to proceed with a deal and how to optimize its value. Success in M&A cases requires a holistic understanding of business strategy, financial analysis, and industry trends, coupled with strong communication and problem-solving skills.

Moreover, many growth strategy case studies eventually lead to M&A questions. For instance, companies with excess funds, searching for ways to grow quickly might be interested in acquiring upstream or downstream suppliers (vertical integration), direct competitors (horizontal integration), complementary businesses, or even unrelated businesses to diversify their portfolio. The most important requirement for an M&A is that it must increase the shareholders' value , and it must have a cultural fit even when the decision financially makes sense.

An example prompt for a typical M&A case would be the following:

"Your client is a mid-sized retail chain considering acquiring a smaller competitor in the same market. They believe this acquisition could expand their market reach and increase profitability. Your task is to evaluate the strategic rationale behind the acquisition, assess the financial implications, and provide recommendations on whether the client should proceed with the deal. What factors would you consider in making your recommendation?"

How Can You Approach an M&A Case – Key Areas to Analyze

First of all, there is no standard approach or pre-thought out framework you can use for all M&A cases (or cases in general). It is absolutely crucial that you understand the unique situation of your client and develop a customized solution for the task you were assigned.

To help you with your preparation, we have summarized key areas to analyze in an M&A case. However, it is very unlikely that you will be asked to cover all of them. It is simply too much for a 30-40 minute case interview, so usually the interviewer will put the focus on one or two aspects of the analysis and guide you to dive deeper.

It is also possible that your M&A case does not resolve the question if a deal should be aimed for or not, but rather focuses on issues in the post merger integration process. Therefore, it is absolutely crucial that you listen carefully during the case prompt, reassure yourself that you understand the problem and objective of the client correctly and adjust your approach accordingly.

1. Understand your client’s company.

Before you dive into your M&A analysis, you must understand your client’s company first. In which industry does the client operate? What is the product or service they offer? What are key customer segments and how is the company structured? Does the client possess other businesses that may offer potential for synergies for an M&A deal?

If you have truly understood your client’s business model, it will come much easier to you to develop a structure for your M&A analysis. Already the question of if you are advising a manufacturer or a service provider, will help you to come up with solid hypotheses on the objectives of the deal. For a service company, access to talent may be an obvious goal for the acquisition while a manufacturer may be more interested in creating cost synergies through vertical integration. But be careful and don’t jump to these kinds of conclusions too easily. You must understand the individual situation of your client in order to give valuable individual advice .

2. Understand the objectives of the M&A deal.

Begin by clarifying the objectives of the M&A deal. Analogous to making a purchase at a grocery store, M&A can generally be viewed as a " buying decision ". We know that a consumer first determines the "need" to buy a product. There are various objectives that a company may have for pursuing an M&A deal and understanding the strategic rationale behind the acquisition is crucial. Let’s take a look at potential reasons for M&A deals:

- Strategic acquisitions generally aim at improving the market position and realizing growth opportunities. Entering new geographic markets or industries, diversifying into new product lines, or reaching new customer segments are common ways to broaden market reach and strengthen the market position.

- Defensive acquisitions , also known as "defensive mergers" or "defensive takeovers," refer to strategic actions taken by a company to proactively protect itself against potential threats or risks. These acquisitions are typically pursued to secure the company's competitive position and reduce specific vulnerabilities. An example for a defensive acquisition would be purchasing or merging with competitors in the industry to consolidate market share and increase barriers to entry. By eliminating rivals or reducing competitive pressures, the acquiring company can protect its market dominance and pricing power.

- Synergies and value creation are a common reason for M&A deals as well. Combining operations, reducing duplicative functions, and streamlining processes can lead to cost savings and operational efficiencies. This also includes integrating suppliers or distributors into the value chain to improve supply chain efficiency, benefit from economies of scale , and capture additional margins. Additional value may also arise when strong brands are merged and brand relevance in the market is increased.

Whilst most mergers and acquisitions are evaluated with mid- to long-term objectives, opportunity-driven M&A deals are also an option. If a company is undervalued due to ineffective management or an unfavorable market, it may become an attractive acquisition target for a buyer with the power to bring it back to its potential value.

It becomes clear that the reasons for M&A deals are diverse and it is impossible to list them all. So, when identifying the objectives of your client, start at a high level, dig deeper when you receive the feedback from your interviewer that you are on the right track and communicate your hypothesis and logical thinking very clearly.

💡 Prep Tip: When you apply for an M&A consultancy, it is very likely that you will receive an M&A case. As these cases are not as standardized as for example market sizing cases or profitability cases , developing a very good business acumen is even more important. M&A deals are reported regularly in business news, so following these, will help you to develop a better understanding for the reasons behind M&A deals and the challenges that follow.

3. Analyze the target industry.

Once it's clear why the client is interested in acquiring a particular company, start by looking at the industry the client wants to buy. This analysis is crucial since the outlook of the industry might overshadow the target's ability to play in it. For instance, small/unprofitable targets in a growing market can be attractive in the same way as great targets can be unattractive in a dying market.

Potential questions to assess are:

- How big is the market?

- What are the market’s growth figures?

- Can the market be segmented, and does the target only play in one of the segments of the market?

- What is the focus? Is it a high volume/low margin or a low volume/high margin market?

- Are there barriers to entry?

- Who are the key competitors in the market?

- How profitable are the competitors?

- What are possible threats?

Porter's Five Forces can be a good starting point for a structured market analysis, but don’t use this framework as it is (and absolutely never mention its name in the interview; just think of what would happen if a company paid McKinsey for a market analysis and the $4,000 daily rate consultant came back with Porter’s Five Forces). Understand the framework as a helpful tool and adjust it to the individual scenario and market conditions your client is facing.

5. Analyze the target company.

After analyzing the target industry, understand the target company . Try to determine its strengths and weaknesses (see SWOT analysis ) and perform a financial valuation to determine the attractiveness of the potential target. You are technically calculating the NPV of the company, but this calculation is most likely not going to be asked for in the case interview. However, having the knowledge of when it is used (e.g., financial valuation) is crucial. The following information can be analyzed to determine the target attractiveness:

- The company’s market share

- The company’s growth figures as compared to that of competitors

- The company’s profitability as compared to that of competitors

- Does the company possess any relevant patents or other useful intangibles?

- Which parts of the company to be acquired can benefit from synergies?

- The company’s key customers

- How much is the target company asking for its purchase price & is it fair (see cost-benefit analysis )?

- Can the acquiring company afford to pay the valuation?

- Financial valuation will generally include industry & company analysis.

6. Analyze the feasibility of the M&A

Finally, make sure to investigate the feasibility of the acquisition. Take a look at the challenges and risks associated with the deal and get a clearer picture of the concrete conditions for a potential acquisition or merger.

Important questions here are:

- Is the target open for an acquisition or merger in the first place? If not, can the competition acquire it?

- Are there enough funds available (have a look at the balance sheet or cash flow statement )? Is there a chance of raising funds in the case of insufficient funds through loans etc.?

- Is the client experienced in the integration of acquired companies? Could a merger pose organizational/management problems for the client?

- Are there other risks associated with a merger? (For example, think of political implications and risks of failure, like with the failed merger of Daimler and Chrysler.)

7. Give a recommendation

At the end of your analysis, give your client a solid recommendation of what to do . Start with your answer first: Should the client acquire the target company or not? Should a merger be pursued or not? Then go on with the reasons behind and structure your recommendation logically. In most cases, three arguments to support your recommendation will be a good number. Prioritize them and communicate them on point.

But note: Even though you want to give a clear recommendation at the end of your case, answers to M&A questions are usually more complex than a simple “yes” or “no”. If you want to shine in your interview, demonstrate that you are aware of the risks and challenges the decision of your client may entail. Mention them shortly and give an outlook on further analysis you would conduct to confirm your recommendation.

Key Takeaways – M&A Cases in Consulting Case Interviews

M&A cases are not the most common ones in consulting case interviews, but nevertheless important to prepare for. There is no standard framework to solve them, but with our top five tips in mind, you will have a good basis for cracking your M&A case.

- Understand the Strategic Rationale: Clarify the objectives of the acquisition, whether it's for revenue growth, cost synergies, market expansion, talent acquisition, or other strategic reasons. This understanding will guide your analysis and recommendations throughout the case.

- Conduct Comprehensive Analysis: Approach the case with a structured and comprehensive analysis. Gather relevant information by asking relevant questions about market dynamics, competitive landscape, financials, synergies, integration challenges, and potential risks. Frameworks such as a SWOT analysis, Porter's Five Forces , or McKinsey's 7S Framework can help you, but should always be customized to the case at hand.

- Evaluate Financial Implications : Assess the financial implications of the M&A deal by conducting a detailed financial analysis. Analyze the target company's financial statements, perform valuation techniques (e.g., discounted cash flow analysis), and evaluate key financial metrics (e.g., ROI , NVP, or payback period). Especially if you are applying for financial consulting , consider the impact of financing options, such as debt, equity, or cash, on the deal's financial feasibility.

- Consider Integration Challenges: Address post-merger integration challenges in your analysis. Identify potential integration risks, such as cultural differences, organizational structure alignment, IT systems integration, and employee retention. Note the importance of a structured integration plan to ensure a smooth transition and maximize synergies between the two organizations.

- Communicate Clearly and Structurally: Present your analysis and recommendations in a clear, structured manner. Use concise and logical reasoning to support your recommendations, and be prepared to defend your approach with thought-through arguments.

💡 Bonus Tip: Practice makes perfect. M&A cases are complex and not easy to prepare for – especially if you study them by yourself. We recommend connecting with peers and practicing together. Conduct 1:1 mock interviews with other candidates to not only get more confidence in developing individualized and structured case approaches, but also receive feedback on your communication and professional appearance (you can find peers on our Meeting Board ). Especially for M&A cases, it may also be helpful to seek the support of a coach who can help you with finishing touches on your performance.

You are looking for M&A cases to practice with?

Check out our recommended resources or browse the Case Library for all cases on this topic.

👉 Company Case by TKMC: Portfolio optimization of a holding company

👉 Expert Case by Casper: Merger of two beer manufacturers

👉 PrepLounge Case: Chip equity

Related Cases

Bain Case: Old Winery

TKMC Case: Portfolio optimization of a holding company

General holding, chip equity, paper print.

Case interview sample question and answer tips – Mergers & Acquisitions

Instead of creating one in-house, we invited Marc Cosentino, the world’s foremost authority on case interviewing, to write a sample case interview question exclusively for MBA Crystal Ball readers.

Marc has twenty seven years of experience with case questions, has written over a 100 cases and trained over 150,000 students and alumni. His authoritative book ‘Case in Point’ was called the MBA Bible by the Wall Street Journal.

Case interview example with sample questions and answers

How to tackle a mergers & acquisitions case, by marc cosentino.

While there are a variety of cases an interviewer can give you, one of the most popular is a merger and acquisition case. A case interview example might be:

Interviewer: Our client company G is a high-end maker/manufacturer of luxury goods. It is unable to keep up with demand for alligator-skin products, hand bags, wallets, belts and briefcases. Not only is it having a hard time getting the alligator, it has seen the price of alligator double in the last nine months squeezing otherwise fat margins. The client is considering buying company H, a Louisiana-based company that sources, tans and processes alligator leather. What do they need to take into consideration?

The student should first summarize the question, streamline it, not repeat it word for word. The student should also ask a clarifying question or two. One good clarifying question in a M&A case is “Why do they want to buy the company?” Very few students ever ask why.

Student: Our client, company G, is considering acquiring company H and we’ve been tasked to determine whether this is a good idea. I have a couple of clarifying questions. Why do they want to buy H?

Interviewer: Why do you think?

It’s not uncommon for the interviewer to throw that questions right back at you – so be prepared. Learn some common reasons why one company might buy another.

Student: I can think of a number of reasons. Guaranteed uninterrupted source of alligator leather. Reduced alligator costs through lower margins and synergies. Pre-empt the competition from buying H and limiting our source, and maybe to diversify holdings.

If you memorize reasons to acquire before-hand you won’t have to stop and think about it and you’ll sound confident and professional. I don’t care who is giving the case, McKinsey, Amazon, Pepsi or Bain they all look for the same four things: structure of thought, confidence level, communication skills and creativity. The most important of the four is structure of thought. Each structure should be crafted to the individual case. Be cautious of books that sell you on the fact that one structure fits all cases. These are often just glorified cookie-cutter approaches that stifle original thought, create pedestrian answers that lack tactical or strategic brilliance, and make it harder to set yourself apart from the competition.

Student: I’d like to break this down into a few buckets. Company G, the luxury industry, company H, acquisition costs and risks, and exit strategy.

The student should turn their paper toward the interviewer and walk the interviewer through each bucket, touching on the headings first.

After explaining your structure, state your initial hypothesis. You can state “My hypothesis is…” or “My thoughts are that G should buy H to control costs and maintain fat margins.”It is important to remember to state a hypothesis.

Interviewer: Okay, good. This is what I know about G. (Hands the student a small chart).

Student: Thanks. (Does some quick calculations) It looks like revenues increased 2%, and its profit margin stayed constant at around 15%. How does that compare to the industry overall?

In every case there will be math. The most common math is percentages. You need to be able to do them on the fly – quickly in your head. Consultants like to put things in perspective which is why they always do two things: they quantify related numbers as percentages and ask for trends. If you don’t do those two things automatically, you need to start from this day on. At the end of the case the interviewer will ask you for a recommendation. Lead with the recommendation, state a clear “yes” or “no”. Do not say “I think they…” be definitive. Your M&A recommendation should include; yes or no, why, the risks involved (in order of severity) and the next steps, both for the short-term and long-term.

Student: Yes, G should buy H if the price is acceptable. Why? to ensure an uninterrupted flow of alligator and to control costs. The risks are that the bottom falls out of the alligator market or it becomes less fashionable. Some next steps: let H be H and don’t try to integrate the two companies. The cultures are too different. Continue to supply all customers at a small price increase because the margins on alligator is greater than on alligator products.

Once you give your recommendation there is a good chance, that regardless of your decision, the interviewer will take the other side of the argument and say “Let me tell you why you are wrong.”

The interviewer is looking for you to defend your answer without getting defensive, make a persuasive argument while keeping your confidence high. About the author: Marc Cosentino is the president of CaseQuestions.com and the former Associate Director of Career Services at Harvard for 18 years. Marc is a graduate of Harvard’s Kennedy School, Harvard’s Program on Negotiation and the University. His firm also works with Fortune 500 companies to help train their Ph.D.s how to think like business people.

This article is part of CrystalConnect, an outreach initiative by MBA Crystal Ball.

Also read, – Case competitions benefits and preparation tips – Case Study in business schools

Mini-MBA | Start here | Success stories | Reality check | Knowledgebase | Scholarships | Services Serious about higher ed? Follow us:

4 thoughts on “Case interview sample question and answer tips – Mergers & Acquisitions”

I Have scored 700 in GMAT and have 3 years of work experience with 2 years in startup as head of marketing and CEO of its child company with GPA of 4 /4 . Can you give me an idea whether i have a chance of admission in Rotman Canada with scholarship.

hi sir, i am an english literature student.i wan’t to do MBA.which will be easier and best to me after my BA?

@Kumar: It’s tough to answer such questions. Here’s why: https://www.mbacrystalball.com/blog/2011/10/26/how-not-to-select-business-schools-mba-application-don%e2%80%99ts/

But you do have a decent profile. So, go ahead and put in your best shot. Make sure you also target other bschools in Canada, since Rotman is so competitive. Always good to have a backup option.

@Vasundhara: You’ll have to share much more about yourself (like your work experience, career goals, test scores) for us to provide any helpful response.

Hello, I am from India. I am working in Investment Banking industry from One and half years. I want to know for which Master Degree I should go for…. I want to go abroad and work there in big Investment Banking firms . Thank you

Leave a Comment Cancel reply

How to master M&A consulting case studies?

M&A deals can involve huge sums of money. For instance, the beer company AB InBev spent $130bn on SAB Miller, one of its largest competitors, in 2015. As a comparison, South Africa's GDP was ~$300bn the same year.

These situations can be extremely stressful for companies' executives both on the buying and selling sides. Most CEOs only do a handful of acquisitions in their career and are therefore not that familiar with the process. If things go wrong, they could literally lose their job.

As a consequence, management consultants are often brought into these situations to help. Most top firms including McKinsey, BCG and Bain have Partners specialised in helping CEOs and CFOs navigate M&A.