We earn commissions if you shop through the links below. Read more

Title Company

Back to All Business Ideas

How to Start a Title Company

Written by: Carolyn Young

Carolyn Young is a business writer who focuses on entrepreneurial concepts and the business formation. She has over 25 years of experience in business roles, and has authored several entrepreneurship textbooks.

Edited by: David Lepeska

David has been writing and learning about business, finance and globalization for a quarter-century, starting with a small New York consulting firm in the 1990s.

Published on December 30, 2021 Updated on June 5, 2024

Investment range

$2,250 - $32,100

Revenue potential

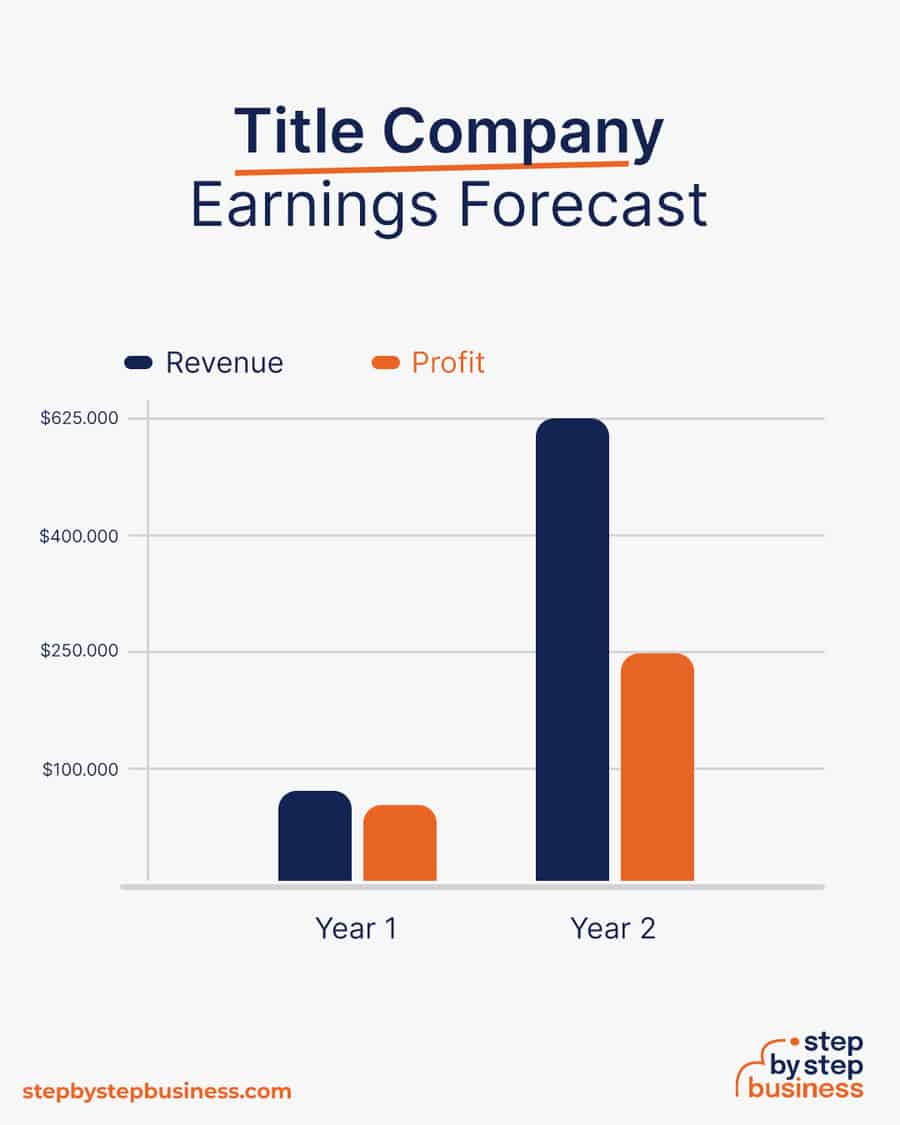

$80,000 - $625,000 p.a.

Time to build

1 – 3 months

Profit potential

$70,000 - $250,000 p.a.

Industry trend

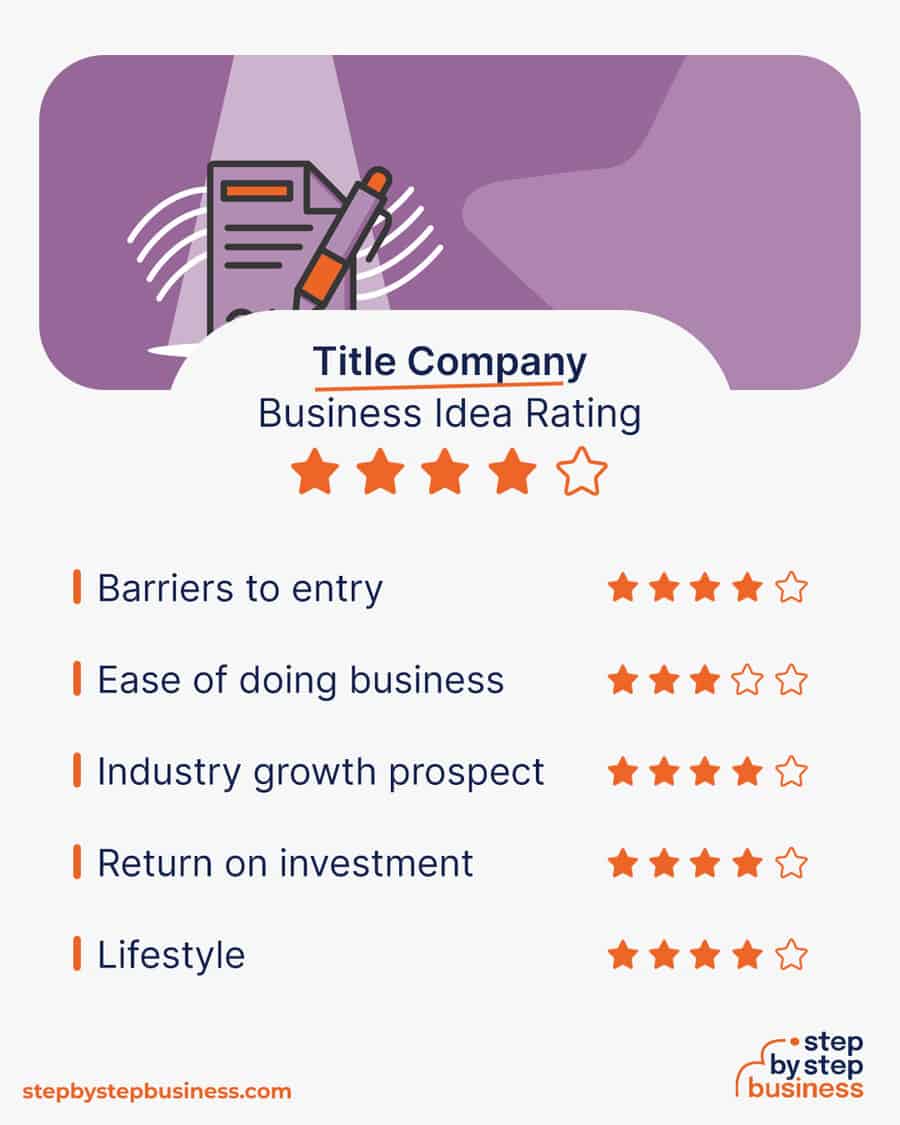

We rarely think about it, but title insurance is big business, with a US market value of $22 billion. Now might be a great time to start a title company, which helps ensure the smooth transfer of ownership of homes, property, and other assets, and get in on a fast growing market.

Of course, starting a business comes with challenges and will require preparation, hard work, and industry knowledge. Fortunately, you’ve come to the right place, as this step-by-step guide has all the information and insight you need to develop and launch your own title company.

Looking to register your business? A limited liability company (LLC) is the best legal structure for new businesses because it is fast and simple.

Form your business immediately using ZenBusiness LLC formation service or hire one of the Best LLC Services .

Step 1: Decide if the Business Is Right for You

Pros and cons.

Starting a title company, which handles the paperwork for funds transfers and works with title insurance underwriters to make sure everything is in legal and financial order, has pros and cons that you should consider before you decide if the business is right for you.

- Flexibility – Start as a mobile title agent

- Deliver Value – Provide an essential service to customers

- People-Focused – Work with new people every day

- Red Tape – Many documents require attention to detail

- Licensing – Training and exam required

Title insurance industry trends

The pandemic forced a digital transformation of the US title insurance industry. Documents can now be notarized digitally, eliminating the need for an in-person closing. For more on digital notarization and starting your own notary, read this Step By Step article .

Funds are also being transferred electronically, eliminating the need for buyers to bring a cashier’s check to closing. Mobile title companies, meanwhile, are offering their services to mortgage brokers.

Industry size and growth

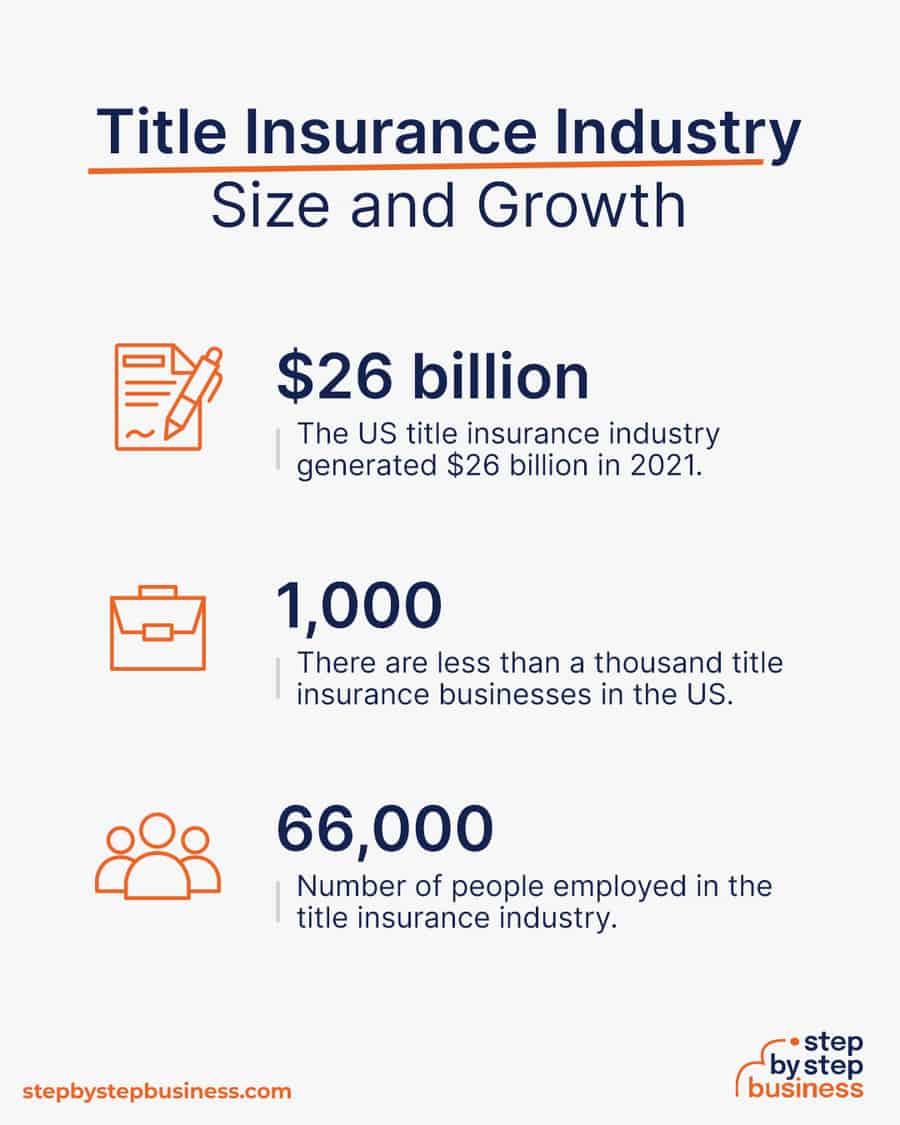

- Industry size and past growth – The US title insurance industry generated $26 billion in premiums in 2021, a stunning 36% growth from 2020, according to the American Land Title Association.(( https://www.alta.org/news/news.cfm?20220505-ALTA-Reports-Full-year-Q4-2021-Title-Premium-Volume-Market-Share-Data )) Market analyst IBISWorld says the industry grew an average of over 6% per year in the last five years.(( https://www.ibisworld.com/industry-statistics/market-size/title-insurance-united-states/ ))

- Number of businesses – There are less than a thousand title insurance businesses in the US.(( https://www.ibisworld.com/industry-statistics/number-of-businesses/title-insurance-united-states/ ))

- Number of people employed – The industry employs more than 66,000 people.(( https://www.ibisworld.com/industry-statistics/employment/title-insurance-united-states/ ))

Trends and challenges

Title insurance trends include:

- Most title companies now offer digital, touchless closing options

- Mobile title companies expanding to mortgage loan refinance transactions

Challenges in the title industry include:

- High level of competition

- Legal issues and missing heirs

Popular underwriters

What kind of people work in title insurance?

An insurance underwriter evaluates insurance applications.

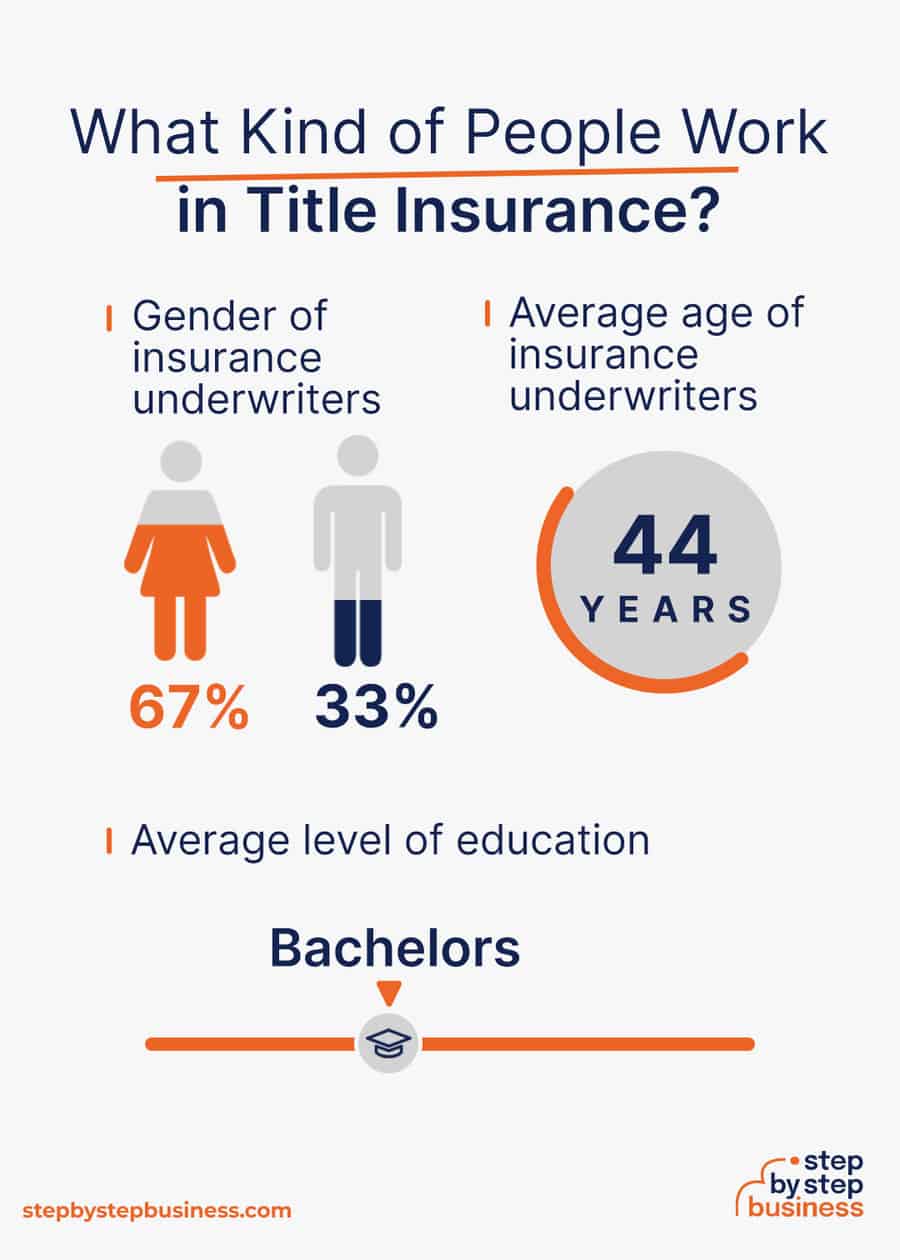

- Gender – 67% of insurance underwriters in the US are female, while 33% are male.(( https://www.zippia.com/insurance-underwriter-jobs/demographics/#gender-statistics ))

- Average level of education – 67% of insurance underwriters hold a bachelor’s degree.(( https://www.zippia.com/insurance-underwriter-jobs/demographics/#degree-level-types ))

- Average age – The average age of an insurance underwriter is 44 years old.(( https://www.zippia.com/insurance-underwriter-jobs/demographics/#age-statistics ))

How much does it cost to start a title company?

Startup costs for title companies range from $2,000 to $32,000. The lower end is the cost if you start as a mobile title agent, while the high end includes the rental and preparation of office space.

You’ll need a handful of items to successfully launch your title company. Here’s a list to get you started:

- Printers and copy machines

- Conference tables and chairs

| Startup Costs | Ballpark Range | Average |

|---|---|---|

| Setting up a business name and corporation | $150 - $200 | $175 |

| Licenses and permits | $100 - $300 | $200 |

| Insurance | $100 - $300 | $200 |

| Business cards and brochures | $200 - $300 | $250 |

| Website setup | $1,000 - $3,000 | $2,000 |

| Training and licensing | $300 - $500 | $400 |

| Surety and Fidelity bonds | $400 - $1.500 | $950 |

| Office space security deposit | $0 - $6,000 | $3,000 |

| Office equipment and furniture | $0 - $20,000 | $10,000 |

| Total | $2,250 - $32,100 | $17,175 |

How much can you earn from a title company?

Before you can start making money, you need to take the training and pass the exam to become a licensed title agent. Each state has its own requirements for licensing. Typically the process takes no more than 1-2 weeks, and will cost $75 to $200.

The typical fee paid to a title company or title insurance company at closing is about $300. As a mobile agent working from home, your profit margin should be about 90%.

In your first year or two, you could do 5 closings a week, bringing in nearly $80,000 in annual revenue. This would mean over $70,000 in profit, assuming that 90% margin. As your brand gains recognition, you’d likely rent an office and hire staff, reducing your margin to 40%. If you do 40 closings a week, your annual revenue would be almost $625,000, and you’d make a tidy profit of about $250,000.

What barriers to entry are there?

There are a few barriers to entry for a title company. Your biggest challenges will be:

- Training, studying and passing licensing exam

- Stiff competition from large, established title companies

Related Business Ideas

How to Start a Notary Business

How to Start an Insurance Agency

How to Start a Law Firm

Step 2: hone your idea.

Now that you know what’s involved in starting a title company, it’s a good idea to hone your concept in preparation to enter a competitive market.

Market research will give you the upper hand, even if you’re already positive that you have a perfect product or service. Conducting market research is important, because it can help you understand your customers better, who your competitors are, and your business landscape.

Why? Identify an opportunity

Research other title companies in your area to examine their services, price points, and customer reviews. You’re looking for a market gap to fill. For instance, maybe the local market is missing a mobile title service, or a reliable title insurance business with an appealing website.

You might consider targeting a niche market by specializing in a certain aspect of your industry, such as mortgage loan refinancing or a particular type of real estate transaction or joint venture.

This could jumpstart your word-of-mouth marketing and attract clients right away.

What? Determine your services

You’ll need to decide if you want to offer in-person closings, mobile closings, digital closings, or all three. You’ll also need to find a reliable title insurance underwriting company to partner with.

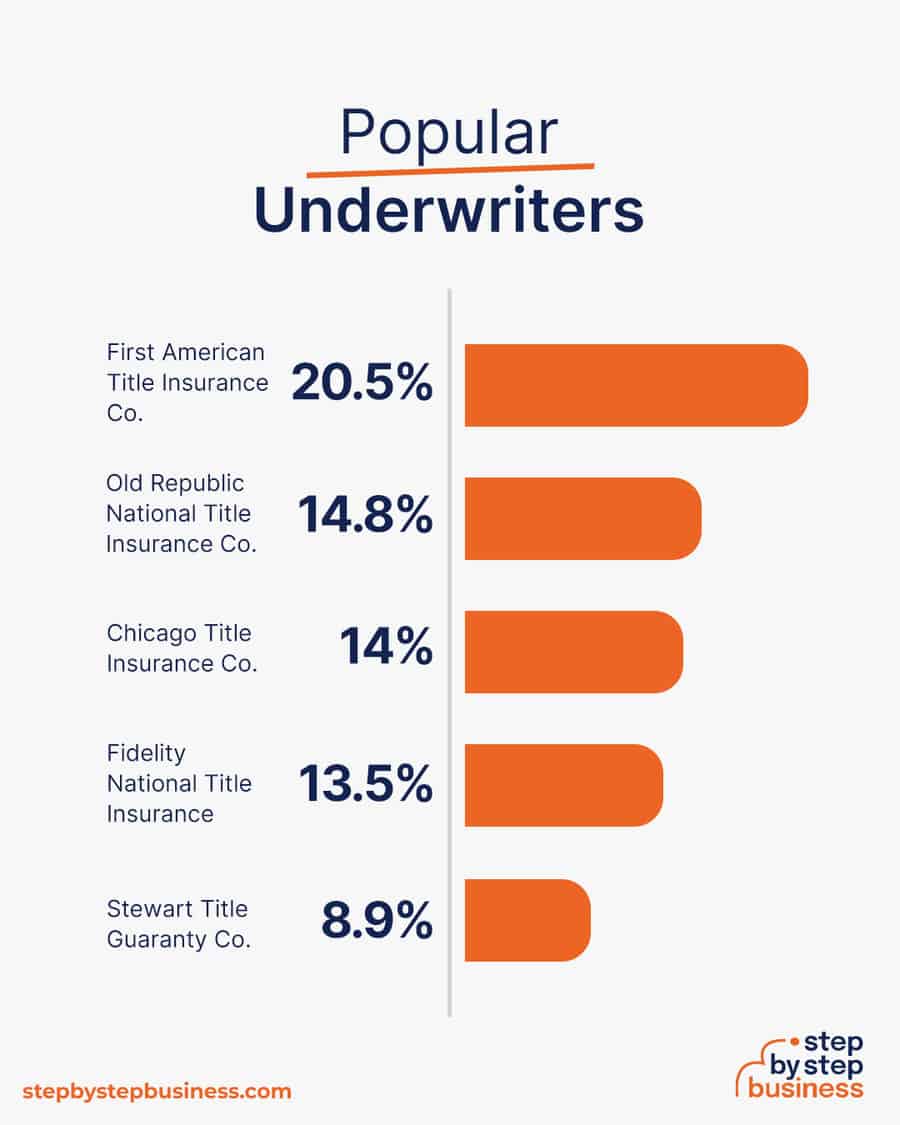

Four main companies, known as the Big Four, are the most used: Fidelity National Financial, First American Financial, Old Republic, and Stewart Information Services.

How much should you charge for closing services?

The average fee a title company receives for a closing is $300. As a mobile service working out of your home, your only costs will be for paperwork and fuel. When you open an office, you’ll have rent, overhead, and labor costs. You’ll still want to provide mobile services at this point, but you’ll be able to do in-person closings as well to increase your volume.

Once you know your costs, you can use this Step By Step profit margin calculator to determine your mark-up and final price points. Remember, the prices you use at launch should be subject to change if warranted by the market.

Who? Identify your target market

As a mobile service, your target market will be mainly mortgage brokers who will engage you for refinance transactions. Once you have an office for in-person closings, your target market will expand to realtors, but you’ll still want to connect with mortgage brokers for the mobile part of your business. Both of those target markets can be found on business-related sites like LinkedIn.

Where? Choose your business premises

In the early stages, you may want to run your business from home to keep costs low. But as your business grows, you’ll likely need to hire workers for various roles and may need to rent out an office. You can find commercial space to rent in your area on Craigslist , Crexi , and Commercial Cafe .

When choosing a commercial space, you may want to follow these rules of thumb:

- Central location accessible via public transport

- Ventilated and spacious, with good natural light

- Flexible lease that can be extended as your business grows

- Ready-to-use space with no major renovations or repairs needed

Step 3: Brainstorm a Title Company Name

Here are some ideas for brainstorming your business name:

- Short, unique, and catchy names tend to stand out

- Names that are easy to say and spell tend to do better

- The name should be relevant to your product or service offerings

- Ask around — family, friends, colleagues, social media — for suggestions

- Including keywords, such as “title service” or “title company”, boosts SEO

- Choose a name that allows for expansion: “Clear Title Solutions” over “Commercial Title Solutions”

- A location-based name can help establish a strong connection with your local community and help with the SEO but might hinder future expansion

Once you’ve got a list of potential names, visit the website of the US Patent and Trademark Office to make sure they are available for registration and check the availability of related domain names using our Domain Name Search tool. Using “.com” or “.org” sharply increases credibility, so it’s best to focus on these.

Find a Domain

Powered by GoDaddy.com

Finally, make your choice among the names that pass this screening and go ahead with domain registration and social media account creation. Your business name is one of the key differentiators that set your business apart. Once you pick your company name, and start with the branding, it is hard to change the business name. Therefore, it’s important to carefully consider your choice before you start a business entity.

Step 4: Create a Business Plan

Here are the key components of a business plan:

- Executive Summary: Highlight the main objectives and strategy of your tile installation business, focusing on providing high-quality, professional tiling services for residential and commercial properties.

- Business Overview: Describe your business’s specialization in tile installation, including services for floors, walls, and other surfaces in various materials like ceramic, porcelain, and natural stone.

- Product and Services: Detail the range of installation services offered, including new installations, repairs, and custom tile design work.

- Market Analysis: Evaluate the demand for tile installation in your area, considering factors like construction trends, homeowner renovations, and real estate developments.

- Competitive Analysis: Compare your services to other tile installers and flooring companies, highlighting your strengths in craftsmanship, material quality, or unique design offerings.

- Sales and Marketing: Outline your approach to attract customers, using methods such as local advertising, partnerships with contractors, and showcasing previous work.

- Management Team: Highlight the experience and qualifications of your team, especially in areas like construction, design, and project management.

- Operations Plan: Describe the process of project management, from client consultations to installation and completion of the work.

- Financial Plan: Provide an overview of financials, covering startup costs, pricing strategies, and revenue projections.

- Appendix: Include additional documents like project portfolios, customer testimonials, or supplier agreements to support your business plan.

If you’ve never created a business plan, it can be an intimidating task. You might consider hiring a business plan specialist to create a top-notch business plan for you.

Step 5: Register Your Business

Registering your business is an absolutely crucial step — it’s the prerequisite to paying taxes, raising capital, opening a bank account, and other guideposts on the road to getting a business up and running.

Plus, registration is exciting because it makes the entire process official. Once it’s complete, you’ll have your own business!

Choose where to register your company

Your business location is important because it can affect taxes, legal requirements, and revenue. Most people will register their business in the state where they live, but if you are planning to expand, you might consider looking elsewhere, as some states could offer real advantages when it comes to title companies.

If you’re willing to move, you could really maximize your business! Keep in mind, it’s relatively easy to transfer your business to another state.

Choose your business structure

Business entities come in several varieties, each with its pros and cons. The legal structure you choose for your title company will shape your taxes, personal liability, and business registration requirements, so choose wisely.

Here are the main options:

- Sole Proprietorship – The most common structure for small businesses makes no legal distinction between company and owner. All income goes to the owner, who’s also liable for any debts, losses, or liabilities incurred by the business. The owner pays taxes on business income on his or her personal tax return.

- Partnership – Similar to a sole proprietorship, but for two or more people. Again, owners keep the profits and are liable for losses. The partners pay taxes on their share of business income on their personal tax returns.

- Limited Liability Company (LLC) – Combines the characteristics of corporations with those of sole proprietorships or partnerships. Again, the owners are not personally liable for debts.

- C Corp – Under this structure, the business is a distinct legal entity and the owner or owners are not personally liable for its debts. Owners take profits through shareholder dividends, rather than directly. The corporation pays taxes, and owners pay taxes on their dividends, which is sometimes referred to as double taxation.

- S Corp – An S-Corporation refers to the tax classification of the business but is not a business entity. An S-Corp can be either a corporation or an LLC , which just needs to elect to be an S-Corp for tax status. In an S-Corp, income is passed through directly to shareholders, who pay taxes on their share of business income on their personal tax returns.

We recommend that new business owners choose LLC as it offers liability protection and pass-through taxation while being simpler to form than a corporation. You can form an LLC in as little as five minutes using an online LLC formation service. They will check that your business name is available before filing, submit your articles of organization , and answer any questions you might have.

Form Your LLC

Choose Your State

We recommend ZenBusiness as the Best LLC Service for 2024

Step 6: Register for Taxes

The final step before you’re able to pay taxes is getting an Employer Identification Number , or EIN. You can file for your EIN online or by mail or fax: visit the IRS website to learn more. Keep in mind, if you’ve chosen to be a sole proprietorship you can simply use your social security number as your EIN.

Once you have your EIN, you’ll need to choose your tax year. Financially speaking, your business will operate in a calendar year (January–December) or a fiscal year, a 12-month period that can start in any month. This will determine your tax cycle, while your business structure will determine which taxes you’ll pay.

The IRS website also offers a tax-payers checklist , and taxes can be filed online.

It is important to consult an accountant or other professional to help you with your taxes to ensure you are completing them correctly.

Step 7: Fund your Business

Securing financing is your next step and there are plenty of ways to raise capital:

- Bank loans: This is the most common method but getting approved requires a rock-solid business plan and strong credit history.

- SBA-guaranteed loans: The Small Business Administration can act as guarantor, helping gain that elusive bank approval via an SBA-guaranteed loan .

- Government grants: A handful of financial assistance programs help fund entrepreneurs. Visit Grants.gov to learn which might work for you.

- Friends and Family: Reach out to friends and family to provide a business loan or investment in your concept. It’s a good idea to have legal advice when doing so because SEC regulations apply.

- Crowdfunding: Websites like Kickstarter and Indiegogo offer an increasingly popular low-risk option, in which donors fund your vision. Entrepreneurial crowdfunding sites like Fundable and WeFunder enable multiple investors to fund your business.

- Personal: Self-fund your business via your savings or the sale of property or other assets.

Bank and SBA loans are probably the best options, other than friends and family, for funding a title insurance business.

Step 8: Apply for Licenses/Permits

Starting a title company business requires obtaining a number of licenses and permits from local, state, and federal governments.

You should check your state website for education and licensing requirements to become a licensed title agent. You’ll also need to check your state’s requirements for surety and fidelity bonds. The amount of the bonds that you need will vary by state.

Federal regulations, licenses, and permits associated with starting your business include doing business as (DBA), health licenses and permits from the Occupational Safety and Health Administration ( OSHA ), trademarks, copyrights, patents, and other intellectual properties, as well as industry-specific licenses and permits.

You may also need state-level and local county or city-based licenses and permits. The license requirements and how to obtain them vary, so check the websites of your state, city, and county governments or contact the appropriate person to learn more.

You could also check this SBA guide for your state’s requirements, but we recommend using MyCorporation’s Business License Compliance Package . They will research the exact forms you need for your business and state and provide them to ensure you’re fully compliant.

This is not a step to be taken lightly, as failing to comply with legal requirements can result in hefty penalties.

If you feel overwhelmed by this step or don’t know how to begin, it might be a good idea to hire a professional to help you check all the legal boxes.

Step 9: Open a Business Bank Account

Before you start making money you’ll need a place to keep it, and that requires opening a bank account . Keeping your business finances separate from your personal account makes it easy to file taxes and track your company’s income, so it’s worth doing even if you’re running your title company business as a sole proprietorship.

Opening a business bank account is quite simple, and similar to opening a personal one. Most major banks offer accounts tailored for businesses — just inquire at your preferred bank to learn about their rates and features.

Banks vary in terms of offerings, so it’s a good idea to examine your options and select the best plan for you. Once you choose your bank, bring in your EIN (or Social Security Number if you decide on a sole proprietorship), articles of incorporation, and other legal documents and open your new account.

Step 10: Get Business Insurance

Business insurance is an area that often gets overlooked yet it can be vital to your success as an entrepreneur. Insurance protects you from unexpected events that can have a devastating impact on your business.

Here are some types of insurance to consider:

- General liability: The most comprehensive type of insurance, acting as a catch-all for many business elements that require coverage. If you get just one kind of insurance, this is it. It even protects against bodily injury and property damage.

- Business Property: Provides coverage for your equipment and supplies.

- Equipment Breakdown Insurance: Covers the cost of replacing or repairing equipment that has broken due to mechanical issues.

- Worker’s compensation: Provides compensation to employees injured on the job.

- Property: Covers your physical space, whether it is a cart, storefront, or office.

- Commercial auto: Protection for your company-owned vehicle.

- Professional liability: Protects against claims from a client who says they suffered a loss due to an error or omission in your work.

- Business owner’s policy (BOP): This is an insurance plan that acts as an all-in-one insurance policy, a combination of any of the above insurance types.

Step 11: Prepare to Launch

As opening day nears, prepare for launch by reviewing and improving some key elements of your business.

Essential software and tools

Being an entrepreneur often means wearing many hats, from marketing to sales to accounting, which can be overwhelming. Fortunately, many websites and digital tools are available to help simplify many business tasks.

You can use industry-specific software, such as snapclose , eFileCabinet , or Certifid , to manage your documents, data collection, closing process, and accounting.

- Popular web-based accounting programs for smaller businesses include Quickbooks , Freshbooks , and Xero .

- If you’re unfamiliar with basic accounting, you may want to hire a professional, especially as you begin. The consequences for filing incorrect tax documents can be harsh, so accuracy is crucial.

Develop your website

Developing a website for your title company is a crucial step in expanding your market reach and brand visibility. You have two primary options: using a website builder , which is a cost-effective and user-friendly choice, particularly for those with limited technical skills, or hiring a professional web developer, which can be more expensive but offers a bespoke and potentially more sophisticated website.

Your website should highlight your services, expertise, and testimonials. Regularly update your blog with informative content about title services, real estate trends, and local market insights.

Starting a title company requires strategic marketing to establish your presence and attract clients. Here are some effective marketing strategies tailored for your title business:

- Optimize for Local SEO : Focus on local search engine optimization (SEO) to ensure your business appears at the top of search results when potential clients in your area search for title services. This includes using local keywords, optimizing your Google My Business listing, and ensuring your website is mobile-friendly.

- Get Listed in Local Directories : Register your business in local online directories and platforms like Yelp, Yellow Pages, and your local Chamber of Commerce website. This increases visibility and helps build your local online presence.

- Leverage Social Media : Utilize social media platforms to connect with local real estate agents, lenders, and potential clients. Share informative content, industry updates, and engage with your audience to build relationships.

- Network with Real Estate Professionals : Attend local real estate events, join real estate groups, and partner with real estate agencies to get referrals. Building relationships with these professionals can lead to a steady stream of clients.

- Utilize Email Marketing : Build an email list and send out regular newsletters with updates, tips, and promotions. This keeps your business top-of-mind for past and potential clients.

- Host Educational Workshops : Offer free workshops or webinars on topics relevant to home buyers, sellers, and real estate professionals. This positions you as an expert in the field and helps build trust.

- Engage in Community Events : Sponsor local events or participate in community activities. This increases your brand visibility and shows your commitment to the local community.

- Use Targeted Online Advertising : Invest in online advertising, such as Google Ads or Facebook Ads, targeting your local area to reach potential clients actively searching for title services.

Focus on USPs

Unique selling propositions, or USPs, are the characteristics of a product or service that set it apart from the competition. Customers today are inundated with buying options, so you’ll have a real advantage if they are able to quickly grasp how your title company meets their needs or wishes. It’s wise to do all you can to ensure your USPs stand out on your website and in your marketing and promotional materials, stimulating buyer desire.

Global pizza chain Domino’s is renowned for its USP: “Hot pizza in 30 minutes or less, guaranteed.” Signature USPs for your title company could be:

- Mobile title services on your time

- Touchless closings, quick and easy

- Closings with an expert to explain every detail

You may not like to network or use personal connections for business gain. But your personal and professional networks likely offer considerable untapped business potential. Maybe that Facebook friend you met in college is now running a title insurance business, or a LinkedIn contact of yours is connected to dozens of potential clients. Maybe your cousin or neighbor has been working in insurance or title underwriting for years and can offer invaluable insight and industry connections.

The possibilities are endless, so it’s a good idea to review your personal and professional networks and reach out to those with possible links to or interest in titles and insurance. You’ll probably generate new customers or find companies with which you could establish a partnership. Online businesses might also consider affiliate marketing as a way to build relationships with potential partners and boost business.

Step 12: Build Your Team

If you’re starting out small from a home office, you may not need any employees. But as your business grows, you will likely need workers to fill various roles. Potential positions for a title company business would include:

- Title Agents – to handle closings

- General Manager – scheduling, staff management

- Marketing Lead – SEO strategies, social media, call realtors

At some point, you may need to hire all of these positions or simply a few, depending on the size and needs of your business. You might also hire multiple workers for a single role or a single worker for multiple roles, again depending on need.

Free-of-charge methods to recruit employees include posting ads on popular platforms such as LinkedIn, Facebook, or Jobs.com. You might also consider a premium recruitment option, such as advertising on Indeed , Glassdoor , or ZipRecruiter . Further, if you have the resources, you could consider hiring a recruitment agency to help you find talent.

Step 13: Start Making Money!

Title companies perform an essential service that protects homeowners and lenders. It’s a large industry in the US, and its market size has nearly doubled in the last decade alongside a real estate boom.

A bold entrepreneur can grab a share of this lucrative market and make good money. You can start small as a mobile service and eventually grow to have multiple brick-and-mortar locations. Startup costs are relatively low, and the process of becoming licensed does not take long.

Now that you have all the information you need, you’re ready to start your entrepreneurial journey to building a title empire!

- Title Company Business FAQs

Every state has its own licensing requirements. Generally, you have to complete a certain number of education hours and pass an exam. Check your state’s website for requirements.

Title insurance protects the homeowner and lender from potential defects in a title. Defects might be unsatisfied liens, legal issues, or even clerical errors.

The process for conducting title searches and issuing title insurance policies involves a thorough examination of public records to determine the property’s ownership history and any potential issues. The title company resolves any problems discovered and issues title insurance policies to protect the buyer and lender from future claims or disputes.

A title company plays a vital role in the closing process by examining the property’s title, providing escrow services, issuing title insurance policies, and facilitating the closing meeting where documents are signed, funds are exchanged, and ownership is transferred.

When a title dispute arises, a title company typically handles the situation in the following manner:

- Investigation: The title company thoroughly investigates the nature of the dispute by examining the relevant title records, contracts, and other relevant documents. They may also conduct interviews with involved parties to gather additional information.

- Legal Analysis: The title company consults with their in-house or external legal counsel to analyze the dispute and determine the potential legal implications. They assess the validity of the claims and review applicable laws, regulations, and contractual agreements.

- Mediation and Negotiation: Depending on the circumstances, the title company may engage in mediation or negotiation with the involved parties to find a resolution. They may facilitate discussions and work towards a mutually acceptable outcome, which could involve modifying the terms of the title, reaching a settlement, or clarifying ownership rights.

- Legal Defense: If the dispute escalates and legal action is initiated, the title company may provide legal defense or engage legal representation on behalf of the insured party. This can involve representing the insured party’s interests in court, presenting evidence, and arguing the case to protect the insured party’s title rights.

- Financial Compensation: If the insured party experiences financial loss due to an unsuccessful defense of the title or a defect in the title, the title insurance policy may provide financial compensation to cover the damages, up to the policy’s limits and subject to its terms and conditions.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Decide if the Business Is Right for You

- Hone Your Idea

- Brainstorm a Title Company Name

- Create a Business Plan

- Register Your Business

- Register for Taxes

- Fund your Business

- Apply for Licenses/Permits

- Open a Business Bank Account

- Get Business Insurance

- Prepare to Launch

- Build Your Team

- Start Making Money!

Subscribe to Our Newsletter

Featured resources.

15 Profitable Manufacturing Business Ideas

Carolyn Young

Published on December 1, 2022

If you’re thinking of starting a business, manufacturing may not be at the top of your list. It sounds daunting, and getting started is likely tor ...

17 Business Ideas that Help the Community

Esther Strauss

Published on July 29, 2022

Just about everybody wants to live in a warm, welcoming close-knit community, and you can help build one by starting a business that helps peopleliv ...

24 Construction Business Ideas

David Lepeska

Published on July 13, 2022

As the US economy regains strength in the wake of the pandemic, the construction industry is anticipating strong growth with plenty ofopportunities, ...

No thanks, I don't want to stay up to date on industry trends and news.

Insurance Agency Business Plan Template

Written by Dave Lavinsky

Writing a Successful Business Plan For Your Insurance Agency + Template

If you’re looking to start or grow an insurance agency , you need a business plan. Your plan will outline your business goals and strategies, and how you plan on achieving them. It will also detail the amount of funding you need, and if needed, present a case to investors and lenders regarding why they should invest in your business.

In this article, we’ll explain why you should invest the time and energy into creating an insurance agency business plan, and provide you with an insurance agency business plan template that includes an overview of what should be included in each section. Download the Ultimate Insurance Agency Business Plan Template here >

Why Write a Business Plan For an Insurance Agency ?

There are many reasons to write a business plan for an insurance agency , even if you’re not looking for funding. A business plan can help you see potential pitfalls in your business strategy, as well as identify opportunities you may not have considered. It can also help you track your progress and adjust your plans as needed.

That said, if you are looking for funding, a business plan is essential. Investors and lenders want to see that you have a solid understanding of your industry, your customers, and your competition. They also want to know that you have a realistic view of your financial situation and how much money you’ll need to get started.

How To Write a Business Plan For an Insurance Agency

While every business plan is different, there are 10 essential components that all insurance agency business plans should include:

Executive Summary

Company description, industry analysis, customer analysis, competitor analysis, marketing plan, operations plan, management team, financial plan.

Keep in mind that you’ll need to tailor this information to your specific type of insurance agency , but these 10 components should be included in every plan.

The executive summary is the first section of your business plan, but it’s often written last. This is because it provides an overview of the entire document.

In the executive summary, briefly explain what your business does, your business goals, and how you plan on achieving them. You should also include a brief overview of your financial situation, including how much money you’ll need to get started.

For organizational purposes, you could create headings for each main section of your business plan to highlight the key takeaways.

For example, your insurance agency executive summary might look something like this:

Company Overview

[Insert Company Introduction / Short Summary]

Business Goals

[Insert Business Goals & How You Plan To Achieve Them]

Industry Overview

[Insert Industry Statistics on the Size of Your Market]

Competition

[Insert Overview of Competitors & Your Competitive Advantage]

[Insert Information About The Marketing Strategies You Will Use To Attract Clients/Customers]

Financial Overview

You can add and/or remove sections as needed, but these are the basics that should be included in every executive summary.

The next section of your insurance agency business plan is the company description, where you’ll provide an overview of your business.

Include information about your:

- Company History & Accomplishments To Date

Mission Statement and/or Company Values

With regards to the company overview, here you will document the type of insurance agency you operate. For example, there are several types of insurance agencies such as:

- Life insurance agency

- Health insurance agency

- Auto insurance agency

- Homeowners insurance agency

- Commercial Insurance Agency

For example, an insurance agency company description might look something like this:

We are an X type of insurance agency .

Company History

If an existing company: Since launching, our team has served X customers and generated $Y in revenue.

If startup: I conceived [company name] on this date. Since that time, we have developed the company logo, found potential space, etc.

This is just an example, but your company description should give potential investors a clear idea of who you are, what you do, and why you’re the best at what you do.

The next section of your business plan is the industry analysis. In this section, you’ll need to provide an overview of the industry you’re in, as well as any trends or changes that might impact your business.

Questions you will want to answer include:

- What is the overall size of the insurance industry?

- How is the industry growing or changing?

- What are the major trends affecting the insurance industry?

- Who are the major players in the insurance industry?

For example, your industry analysis might look something like this:

The size of the insurance industry is $XX billion.

It is currently growing at an annual rate of XX% and is expected to reach $XX billion by the year 20XX. The insurance industry has been booming in recent years.

Major trends affecting the industry are larger companies consolidating and the rise of digital marketing and e-commerce.

How We Fit Into The Industry

This is just an example, but your industry analysis should give potential investors a clear idea of the overall industry, and how your company fits into that industry.

The next section of your insurance agency business plan is the customer analysis. In this section, you’ll need to provide an overview of who your target customers are and what their needs are.

- Who are your target customers?

- What are their needs?

- How do they interact with your industry?

- How do they make purchasing decisions?

You want a thorough understanding of your target customers to provide them with the best possible products and/or services. Oftentimes, you will want to include the specific demographics of your target market, such as age, gender, income, etc., but you’ll also want to highlight the psychographics, such as their interests, lifestyles, and values.

This information will help you better understand your target market and how to reach them.

For example, your customer analysis might look something like this:

Target Market & Demographics

The demographic (age, gender, location, income, etc.) profile of our target insurance agency customer is as follows:

– Age: 25-60

– Gender: Male/Female

– Location: Anywhere in the United States

– Income: $50,000-$250,000

– Education: College degree or higher

Psychographics

Our core customer interests are as follows:

– Saving money: They are always looking for ways to save money, whether it’s on their insurance premiums or other household expenses.

– Convenience: They value convenience and want to be able to do business with companies that make their lives easier.

In summary, your customer analysis should give potential investors a clear idea of who your target market is and how you reach them.

The next section of your business plan is the competitor analysis. In this section, you’ll need to provide an overview of who your major competitors are and their strengths and weaknesses.

- Who are your major competitors?

- What are their strengths and weaknesses?

- How do they compare to you?

You want to make sure that you have a clear understanding of your competition so that you can position yourself in the market. Creating a SWOT Analysis (strengths, weaknesses, opportunities, threats) for each of your major competitors helps you do this.

For example, your competitor analysis might look something like this:

Major Competitors

XYZ Company is our major competitor. Its offerings include this, this and this. Its strengths include XYZ, and its weaknesses include XYZ.

Competitive Advantage

Your competitor analysis should give potential lenders and investors a clear idea of who your major competitors are and how you compare to them.

The next section of your business plan is the marketing plan. In this section, you’ll need to provide an overview of your marketing strategy and how you plan on executing it.

Specifically, you will document your “4 Ps” as follows:

- Products/Services : Here is where you’ll document your product/service offerings.

- Price : Detail your pricing strategy here.

- Place : Document where customers will find you and whether you will use distribution channels (e.g., partnerships) to reach them.

- Promotion : Here you will document how you will reach your target customers. For instance, insurance agencies often reach new customers via promotional tactics including online advertising, direct mail, and personal selling.

For example, your marketing plan might look something like this:

Products/Services

We offer the following products/services:

We will use a premium pricing strategy to establish ourselves as the highest quality brand.

We will serve customers directly and through a partnership with XYZ company.

As you can see, your marketing plan should give potential investors a clear idea of your marketing objectives, strategies, and tactics.

The next section of your business plan is the operations plan. In this section, you’ll need to provide an overview of your company’s day-to-day operations and how they will be structured.

- What are your company’s daily operations?

- How are your company’s operations structured?

- Who is responsible for each task?

Your operations plan should be detailed and concise. You want to make sure that potential investors have a clear understanding of your company’s day-to-day operations and how they are structured.

You will also include information regarding your long-term goals for your operations and how you plan on achieving them.

For example, your operations plan might look something like this:

Daily Operations

Our company’s daily operations include XYZ.

Operational Structure

Our company is structured as follows:

- Department 1

- Department 2

- Department 3

Each department is responsible for XYZ tasks.

Long-Term Goals

Our long-term goals for our operations are to achieve the following over the next five years.

Date 1: Goal 1

Date 2: Goal 2

Date 3: Goal 3

Date 4: Goal 4

Your operations plan should give readers a clear idea of your company’s day-to-day operations, how they are structured, and your long-term goals for the company.

The next section of your business plan is the management team. In this section, you’ll need to provide an overview of your management team and their experience.

- Who is on your management team?

- What are their qualifications?

- What is their experience?

Your management team ideally includes individuals who are experts in their respective fields. You want to make sure that lenders and investors have a clear understanding of your management team’s qualifications and experience, and feel they can execute on your plan.

For example, your management team might look something like this:

Our management team is comprised of the following X individuals with the following experience.

Team Member 1:

Team member 1’s qualifications and experience include XYZ.

Team Member 2:

Your management team should give potential lenders and investors a clear idea of who is on your team and how their qualifications and experience will help your company succeed.

The final core section of your business plan is the financial plan. In this section, you’ll need to provide an overview of your company’s financials.

- What are your company’s projected revenues?

- What are your company’s projected expenses?

- What is your company’s projected growth rate?

- How much funding do you need and for what purposes? For example, most startup insurance agencies need outside funding for pre-launch activities such as licenses, office space, and marketing initiatives.

Your financial plan should give potential investors a clear understanding of your company’s financials. While you may include a summary of this information in this section, you will include full financial statements in the appendix of your business plan.

For example, your financial plan might look something like this:

Our company’s projected revenues over the next five years are $XYZ.

Expenses & Net Income

Our company’s projected expenses and net income over the next five years are $XYZ.

Uses of Funding

This is just an example, but your financial plan should give potential investors a clear idea of your company’s financial projections.

The final section of your business plan is the appendix. In this section, you’ll need to provide any additional information that was not included in the previous sections.

This may include items such as:

- Full financial statements

- Resumes of key management team members

- Letters of reference

- Articles or press releases

- Marketing materials

- Product information

- Any other relevant information

By including this information in the appendix, you are allowing potential investors and lenders to learn more about your company.

In summary, writing an insurance agency business plan is a vital step in the process of starting and/or growing your own business.

A business plan will give you a roadmap to follow. It can also help you attract investors and partners.

By following the tips outlined in this article, you can be sure that your business plan will be effective and help you achieve your goals.

Finish Your Business Plan in 1 Day!

Wish there was a faster, easier way to finish your business plan?

With our Ultimate Insurance Agency Business Plan Template you can finish your plan in just 8 hours or less!

Finish your business plan today!

1777 SW Chandler Ave. Suite 267 Bend, OR 97702

Business Plan Services Business Plan Writing Business Plan Consultants

How to build an insurance agency business plan

A great business plan can guide you through every critical early step of building your company. As you start your insurance company , your plan can help you refine your vision, set objectives, and define the details of your business.

Done right, it can help you secure investors, financing, and more. Done poorly or not at all, your new agency may not get off the ground.

Let’s look at the benefits of creating a business plan and what yours should include.

Why do you need a business plan?

Before diving into the details of building a plan, let’s start with why you should write one in the first place.

After all, a good business plan requires careful research, writing, and review. But it’s worth the effort.

Companies that plan grow 30% faster than those who don’t.

A solid plan can help you make sound decisions when you’re first starting out and as you grow. Even down the road, it can help you secure funding from banks and investors. And insurance carriers often want to see your plan before they’ll partner with your agency.

Beyond these benefits and your own peace of mind, creating a business plan can help you:

- Set realistic objectives.

- Allocate resources.

- Streamline workflows.

- Improve communication.

- Grow your business.

Once your business gets off the ground, periodically reviewing your plan is a great way to clarify your goals and refine how you’ll reach them.

A Journal of Business Venturing study has shown that companies that plan grow 30% faster than those who don’t.

How do you write a business plan?

Business plans can be as different as the businesses they describe, but they generally provide highlights of your business in 5,000 words or less.

Your insurance agency plan must define your business strategy if you plan to seek financing. Essentially, your plan needs to be useful to you and intriguing to investors.

Standard business plan templates typically include these sections.

Executive summary

The executive summary is a snapshot of your insurance business.

For an established agency, this section might include its mission statement and detail its past successes. For a startup, the executive summary might highlight the experience of the business owners and their motivation for starting an insurance agency.

For both new and established businesses, you can also include your agency’s general financial information. This might be an overview of your book of business or a list of current investors.

The executive summary is usually the first impression investors have of your business. Make sure it packs a punch and provides a compelling story.

Company description

A company description gets more specific about what your business does on a day-to-day basis.

The company description explains your keys to success. These can be the value you provide to customers and what sets you apart from the competition. Sometimes they’re one and the same. Pinpoint what you bring to the local insurance market, like:

- A prime office location

- Unparalleled expertise

- Unique products

You may want to include a SWOT analysis that details your business’s strengths, weaknesses, opportunities, and threats.

List of products

This section lists every insurance product that your business offers or plans to offer in the future.

Be sure to include product benefits, sales forecasts, and how you plan to acquire and manage the products.

You may also want to explain how independent agents can secure direct appointments with insurance carriers. Many investors may be unfamiliar with this process.

Market analysis

The market analysis shows your understanding of the insurance market in general. And more importantly, where your agency fits in the mix.

If you plan to fill a niche, explain why and how. Either way, describe your target market and the competition.

Potential investors may also want to see specific market goals, such as your target market share along with an explanation of how and when you’ll achieve it.

Marketing strategy

Every insurance agency needs to reach new customers to grow its business and be successful. In this section, outline how you’ll market your business to attract new customers and increase sales to current ones.

Briefly summarize your strategy, including some details like whether you plan to use traditional and/or digital marketing channels. This might also be a good place to share your sales strategy for converting leads into customers.

Organization and management

The organization and management section introduces your executive and management teams, including a summary of their unique qualifications.

Detailing your team’s experience and talent helps establish your agency’s credibility. It also builds trust in your business and leadership team.

You may also want to include an organizational chart that breaks down your business infrastructure and operations.

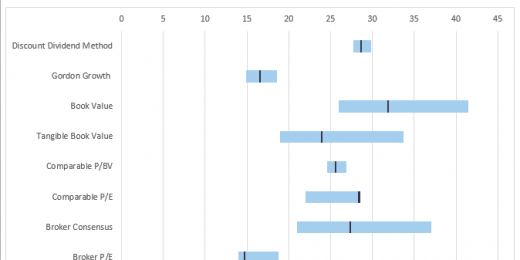

Financial plan

If your business is looking for funding, you’ll usually need to identify start-up costs and provide five years of prospective financial data. This typically includes:

- Balance sheets

- Income statements

- Cash-flow statements

- Capital expenditure budgets

You may want to include a break-even analysis that delves into the specific profitability of your products. Consider adding a short financial analysis of the most profitable industry trends.

Funding request

If you're seeking investors for your insurance company, add a funding request at the end of your business plan. Typically, a funding request mentions:

- The amount of funding you’re looking to secure.

- An estimate of your future funding needs.

- How you plan to use the funding.

- Your strategy for dealing with developments like a buyout.

If you’re ready to draft your business plan, the Small Business Administration (SBA) provides this business plan template to help you get started.

How to present your insurance agency business plan

Once you’ve completed your business plan, give it a chance to shine in the spotlight.

Presentation matters, so make it professional. Use an easy-to-read font and clear charts and diagrams to illustrate your points. Be prepared to provide both a digital and print version to potential business partners, banks, or investors.

How you present matters, too. Whenever possible, meet in person to build more trust and rapport.

And even though your business plan is full of details, your audience will likely ask you to expand or explain. Come prepared to respond to any potential objections.

Your thorough, compelling business plan can help build the foundation for your success. If you devote the time and energy needed to create a great one, it could pay large dividends for your business.

Complete Insureon’s easy online application today to compare quotes for business insurance from top-rated U.S. carriers. Once you find the right policy for your small business, you can begin coverage in less than 24 hours.

Hannah Filmore-Patrick, Contributing Writer

Hannah is a contributing writer with a diverse writing and content building background. She's worked on topics from technology to insurance. She's competent with both language and SEO, and continues to work with a variety of business verticals to create engaging, optimized content.

* Mandatory fields

By clicking "Get Started", I consent by electronic signature to being contacted by EverQuote, including by automatic telephone dialing and/or an artificial or prerecorded voice (including SMS and MMS - charges may apply), regarding EverQuote for Agents, even if my phone number is listed on a Do Not Call Registry. I also understand that my agreement to be contacted is not a condition of purchasing any goods or services, and that I may call (844) 707-8800 to speak with someone about EverQuote for Agents.

By clicking "Get Started", I affirm that I have read and agree to this website’s Privacy Policy and Terms of Use , including the arbitration provision and the E-SIGN Consent. Consent.

- Agents Blog

- Running & Growing your Agency

- Upcoming Webinars

- IAA Presentations

- Share this Hub

- EverQuote Pro Blog »

Launch Your New Insurance Agency With This Business Plan Template

Whether you're a brand new agent or one with several decades of experience, the idea of opening a new insurance agency probably seems daunting—where do you start?

One of the first things you’ll need to do is come up with a business plan for your insurance agency. After all, you can walk into a bank or a potential investor’s office looking for funding, but you won’t get very far unless you have a robust insurance agency business plan that proves you’re on the right track toward turning a profit in the near future.

Follow the steps below when building out your insurance business plan to maximize your chances of securing funding and getting your new agency off to a strong start.

7 Steps To Build Your Insurance Agency Business Plan

1. develop your executive and business summaries..

In business plan terms, the executive summary is the driving force behind your other decisions. It should explain why you’re starting your agency. The business summary is similar, but it should narrow down your “why” into a list of “hows.”

Ask yourself:

- Why do you want to open an agency?

- What types of insurance do you wish to sell?

- What do you hope to accomplish?

- What return on investment do you expect to receive?

- How are you going to generate demand and ensure supply for your service?

Jot your answers down so you can refer back to them as you move forward.

2. Decide whether you want to be a captive agent or an independent agent.

Many large agencies, such as Allstate and Farmers, work with captive agents who can only sell insurance for that specific provider. Independent agents, on the other hand, can sell insurance for multiple providers, but they get locked out of working with the big-name captive carriers who only work with captive agents. (Read more about captive agents here and get a seasoned agent’s POV on both types of agents here. )

Before you can nail down the details of the rest of your business plan, you’ll have to make a choice between these two options.

3. Do a market analysis.

Though it might seem like a tedious process, conducting a thorough market analysis is crucial to your success. Analyzing your local market—including the backgrounds, shopping behaviors, and preferences of your target customers—gives you the insights you’ll need to attract these folks to your business.

Your market analysis will look a little different depending on whether you prefer to be a captive or an independent agent. The state you live in is another factor that will affect your analysis—in fact, it may even influence your decision to be captive or independent.

Take a close look at the demographics of your region.

- How many homeowners live in your state?

- What’s the average insurance premium per home?

- How many people live in each home, on average?

- How many drivers live in your state?

- How many vehicles does the average household own?

- Do you live in an area with an aging population ?

- How many families live in your region?

- What insurance carriers do locals in your state gravitate toward?

- In your area, what might be some successful strategies for retaining clients (rather than just acquiring them)?

These questions are all important, but pay particular attention to the last one. If you open an agency without a plan for client retention, you’re going to struggle. And, unfortunately, this is one of the most overlooked aspects of an insurance agency business plan.

4. Identify where you’ll find your first clients.

It’s one thing to know there are X number of potential clients living in your state, but it’s quite another to have a plan that will help you reach out to those folks and land your first policy sales.

Some investors will require a list of leads before they’ll even consider funding your agency. Even if it’s not a requirement, it’s always a good idea to have a pipeline ready to go. This is where getting set-up for purchasing warm leads from EverQuote can put you in a great position for success.

Plus, tackling this step before you even open your doors will help you better understand the costs you’ll incur—and therefore how much startup funding you will need.

You might also consider other options, such as placing ads in local newspapers, going to networking events, investing in digital marketing, sponsoring local Little League teams, or asking for referrals.

5. Create a financial plan.

Many new agencies fail because their owners overlooked something critical during startup. Do your best to look at your financial plans from every angle:

- Where will you find leads, and how much will they cost?

- What is your advertising budget?

- Does this budget line up with the going rates of local newspapers, billboards, or online ads?

- Do you plan to have 1099 employees or W2 employees selling insurance for your agency?

- How will you decide on a commission and benefits structure for these employees?

- What retention and loss ratios (for clients and employees) do you expect based on the numbers of other agencies in your area?

- How will you handle the delay between policy renewals and income hitting your bank account?

- If there are X amount of people shopping for insurance in your area, what percentage of those people are in a niche you can serve?

- From that percentage of potential clients, how many do you think you can successfully land?

- If you sell policies to these customers, how much will you earn from their premiums?

- How do your projected profits compare to your expected advertising costs, the cost to buy leads, office rent, and other expenses?

Take detailed notes of your calculations, and try to run the numbers a few different ways to obtain a conservative outcome, a likely outcome, and a “best case scenario.”

6. Draw up a formal business plan using a proven format.

Your notes will be incredibly valuable as you move forward, but you’ll need a way to present them clearly and concisely in a way that looks attractive to investors.

Loan officers and investors don’t want to read long-form essays detailing your business background and your ideas for the future. Keep your format simple and straightforward, with clear sections that answer the questions investors will want to know.

We recommend a format similar to the following:

Executive Summary Overall mission Primary objectives Keys to success Financial plans Profit forecast for at least three years Business Summary Business overview Summary of startup costs Funding you’ll require Company executives/ownership Services Services you provide Market Analysis Overall business analysis Details of your competition Buying patterns of your competition Your planned buying patterns Market segmentation and analysis Target market strategies Include details for each market segment Strategy Your competitive edge Marketing strategy Sales strategy Yearly sales projections Key milestones Management Your plan for finding staff Financial Plan Funding you have accepted Funding you will need Detailed startup costs Calculations for your break-even point Projected profit Yearly profit Gross and net yearly profit Anticipated losses, if any Cash flow patterns Plans for balance sheet Calculations of important business ratios

7. Revise and adjust your plan over time.

You may not secure funding for your agency immediately. Even if you do, you’ll likely find that your real world numbers don’t match up exactly with your calculated projections. Plus, carriers frequently change their underwriting policies, and the economy itself is always in a state of flux.

Keep your business plan current by updating the information anytime circumstances change.

Start your journey with a full lead pipeline from EverQuote.

One of the scariest parts about starting a new agency is not being certain where and when you’ll be able to start making sales.

Skip the fear and the unknown and go right to making sales with warm real-time leads from EverQuote. Whether you’re still trying to find startup funding or your doors are already open, you can always boost your business and maximize your chances of a steady income by working with EverQuote.

Connect with us today.

Topics: Featured , Insurance Agency Growth

About the Author Chris Durling, VP of P&C Sales

Chris Durling is a visionary leader in P&C insurance sales and distribution, with over 10 years of experience in the industry.

Most Recent Articles

If you’re at all familiar with digital marketing—maybe you’ve dabbled in it a bit or even just done...

Scott Grates, insurance agent and co-founder of Insurance Agency Optimization, is renowned for his...

When it comes to nurturing your insurance agency’s online business reputation, there are numerous...

If the year 2023 had a buzzword, that buzzword was definitely AI. Artificial intelligence took off...

Despite current economic complexities, many industries are still hiring at a dependable pace. Among...

If you had to name the most tedious, time-consuming, thankless task in your insurance sales job,...

Creating a new insurance agency is a complex process, just like building any new business from the...

Previous Article

Next Article

Ready to see what partnering with EverQuote can do for you?

Our representatives are standing by to help you succeed.

Call 844-707-8800

Weekdays, 9AM-5PM (ET)

By clicking "Get Started", I affirm that I have read and agree to this website’s Privacy Policy and Terms of Use , including the arbitration provision and the E-SIGN Consent.

By clicking "Get Started", I affirm that I have read and agree to this website’s Privacy Policy and Terms of Use , including the arbitration provision and the E-SIGN Consent. For quality control purposes, activity on this website may be monitored or recorded by EverQuote or its service providers.

Terms of Use

Privacy Policy

For quality control purposes, activity on this website may be monitored or recorded by EverQuote or its service providers

+971 4 457 8200

Refer & earn.

Home > Business Plan Templates > Insurance Agency Business Plan Template With Examples

Insurance Agency Business Plan Template With Examples

Apr 7, 2024 | Business Plan Templates

As you navigate through this insurance agency business plan template, remember that the primary goal is to thoroughly represent your business concept, operational plans, and financial projections for your insurance agency.

This template is merely a guide; it’s essential to tailor it to fit your agency’s unique attributes and market positioning, ensuring your ideas and strategic direction are communicated effectively. Because every insurance agency is different in its own way, it is okay to modify this business plan to suit your specific situation better.

Always back up your findings with solid data wherever possible and provide clear, concise explanations. Insurance can be a complex field for many individuals.

Your ability to simplify these complexities into understandable terms will serve you well in your plan and in the agency’s overall operations.

Table of Contents

1. Executive Summary

The executive summary provides a brief, comprehensive synopsis of your insurance agency. While it appears at the beginning of your plan, it is often written last to ensure that it encapsulates all critical points from the rest of the sections.

Introduction and Agency Overview

Start by succinctly introducing your insurance agency—its name, the types of insurance it covers (auto, health, home, life, etc.), and why it stands out in the market.

Example: SecureNow Insurance Agency is a customer-centric firm that provides holistic, efficient, and tailored insurance solutions. Its primary focus is on auto, home, health, and comprehensive business insurance packages.

Mission and Vision Statement

Your mission and vision should communicate the agency’s core principles, strategic goals, and commitment to its clientele.

Example: Our mission is to ensure our clients have peace of mind by offering personalised insurance coverage that adequately caters to their particular needs. Our vision is to be the leading insurance agency known for its exceptional customer service and innovative insurance solutions.

Geographic Area and Accessibility

Detail the area where your insurance agency primarily operates. Discuss where you have a significant market presence and the main demographic in these regions.

Example: SecureNow operates within the tri-state area, serving thousands of individuals, families, and businesses within these regions, offering them convenience and quicker claim processing.

Type of Insurance Services Offered

Briefly describe the kind of insurance services you provide.

Example: SecureNow offers a multitude of comprehensive insurance products – auto insurance for various vehicle classes, home insurance covering homeowners and rentals, health insurance with personalised plans, and business insurance covering liability, worker’s compensation, and commercial property.

Key Goals and Objectives

Outline your key short-term and long-term goals. These should be SMART (Specific, Measurable, Achievable, Realistic, Time-bound) goals.

Example: Our primary goal for the next year is to grow our customer base by 25% and increase our policy renewal rate to 85%. Over the next five years, we aim to expand into two additional states and to be rated among the top 5 most trusted insurance agencies in our operating regions.

2. Services Overview

This section offers an in-depth understanding of your insurance agency’s offerings, their relevance, and their potential impact on your customers’ lives.

Service Definition and Themes

Describe in detail the insurance products and services your agency provides. Explain the guiding principles for each type of insurance policy.

Example: SecureNow Insurance Agency provides a range of insurance services, each framed to offer our customers maximum protection and peace of mind. They encompass Auto Insurance, accommodating a range of vehicles and drivers; Home Insurance, offering comprehensive coverage for homeowners and renters; Health Insurance, aligning with varying needs and budgets; and Business Insurance, offering tailored solutions from liability to commercial asset protection.

Range of Insurance Services

List and highlight the main features of the services under each insurance type.

Example: Our Auto Insurance includes liability coverage, collision, comprehensive, and personalised bundles. Our Home Insurance provides coverage for the structure, personal belongings, liability, and additional living expenses. Health Insurance varies from basic coverage options to more comprehensive plans, including specific disease policies. Business Insurance delivers solutions for property damage, worker’s compensation, liability protections, and more.

Target Customer Analysis

Detail who benefits most from your policies, indicating how they are targeted and why they are the principal focus of your services.

Example: Our target customers range from young drivers seeking auto insurance, homeowners and renters needing property protection, individuals and families requiring health coverage, and large and small businesses seeking to mitigate their operational risks. Our focus remains on these groups as they represent a broad segment of the population most in need of reliable, affordable, and customizable insurance solutions.

3. Agency History and Organisation

This section provides a historical background of your insurance agency and insight into its organisational structure.

Legal Status and Structure

Specify your agency’s legal status—is it a limited liability company (LLC) , a partnership , a corporation, or a sole proprietorship ? Discuss why the particular business structure was chosen.

Example: SecureNow operates as a Limited Liability Company (LLC), chosen for its protective attributes and flexibility. This structure offers protection against personal liability and provides operational and management flexibilities akin to a partnership.

Owners and Management Team

Briefly introduce your agency’s owners and management, outlining their experience and contributions.

Example: SecureNow is owned and managed by John Doe and Jane Smith. John, a seasoned insurance professional with over 20 years in the industry, manages strategic decisions and partnerships. With an extensive background in customer service and operations, Jane oversees day-to-day operations, ensuring top-notch customer service and smooth agency functioning.

Key Milestones

Highlight key milestones in your agency’s history to demonstrate growth and impact over time.

Example: SecureNow was established in 2010 as a two-person firm, initially only offering auto insurance. In 2012, we expanded our services to include home insurance, followed by health insurance in 2015. We introduced our comprehensive business insurance solutions in 2018. Today, we serve over 10,000 clients across the tri-state area, thanks to our continuously expanding product portfolio and customer-centric approach.

4. Business Model

This section will depict how your agency operates, generates revenue, and strives towards financial sustainability.

Primary Revenue Sources

Describe your insurance agency’s main sources of income; this could include commissions, contingency bonuses, and fee-based services.

Example: SecureNow’s primary revenue stream comes from commissions on each policy sold and renewed. We also earn contingency bonuses based on reaching certain targets set by the insurance carriers and fee-based income from consulting services for complex business insurance needs.

Planned Partnerships and Collaborations

Consider any partnerships or collaborations you intend to establish, including partnerships with other businesses, insurance carriers, and influential organisations.

Example: SecureNow is looking to form partnerships with major auto retailers and real estate agencies to provide insurance services to their customers, broadening our customer reach. We are also planning to collaborate with niche insurance carriers, expanding our range of specialised insurance products.

Special Projects

If any special initiatives are planned that can boost agency income or offer significant benefits to your agency, explain them here.

Example: One of our major upcoming initiatives is the launch of a comprehensive mobile app aimed at streamlining claim processes, making it easier for customers to buy, manage, and claim insurance. This app will not only help in customer retention but, with features like refer-a-friend, it will also help attract new customers .

5. Market Analysis

This section offers a deep dive into the market in which your insurance agency operates, including existing market needs, target demographics, and competitive environment.

Current Market Needs

Describe the insurance-related needs currently observed in your market. Use data and real examples to illustrate these needs.

Example: The tri-state area where we operate has a high concentration of small businesses (over 200,000), representing a significant demand for reliable business insurance solutions. Additionally, with an average of 5 million registered vehicles and a high homeownership rate, there is a substantial need for auto and home insurance packages.

Target Market Analysis

Detail the demographic, socioeconomic, and other relevant characteristics of the customers your agency aims to serve.

Example: Our target market encompasses small business owners in need of robust business insurance, drivers requiring comprehensive, affordable auto insurance, homeowners and renters seeking varying degrees of home insurance, and individuals/families at different life stages seeking health coverage. Our customer base is diverse and spans demographics, posing unique insurance needs, which we aim to cover comprehensively.

Competitive Analysis

Assess other insurance agencies operating in the same space, explore their approach, and underscore how your services differentiate.

Example: While other agencies in the region primarily deal with one or two types of insurance, SecureNow sets itself apart by providing a comprehensive roster of insurance services – auto, home, health, and business. Coupled with our personalised approach and excellent customer service, we offer a one-stop solution for varied insurance needs.

Positioning and Strategy

Explain how your agency is positioned to cater to market needs, target demographics, and competitive landscape. Detail your strategy to meet these needs.

Example: SecureNow positions itself as a full-service insurance agency, offering a wide range of products that cater to diverse customer segments under one roof. Our strategy involves educating our customers about their insurance needs and providing them with personalised solutions. We leverage our strong relationships with various insurance carriers to offer competitive rates and comprehensive coverage.

6. Marketing and Acquisition Strategy

This section outlines how you plan to attract new clients to your insurance agency, generate awareness about your range of services, and retain existing customers.

Marketing Strategy

Outline your approach to increase visibility and generate leads.

Example: SecureNow’s marketing strategy leverages both online and offline channels. We use Search Engine Optimization (SEO) and paid search advertising to increase our online visibility on popular search engines. Simultaneously, we utilise direct mail campaigns, local radio advertisements, and community events to broaden our reach within the local community.

Acquisition Plan

Describe your plan to acquire new customers. This plan may incorporate strategies like referral incentives, partnerships with other businesses, and lead-generation methods.