- Survey Software The world’s leading omnichannel survey software

- Online Survey Tools Create sophisticated surveys with ease.

- Mobile Offline Conduct efficient field surveys.

- Text Analysis

- Close The Loop

- Automated Translations

- NPS Dashboard

- CATI Manage high volume phone surveys efficiently

- Cloud/On-premise Dialer TCPA compliant Cloud on-premise dialer

- IVR Survey Software Boost productivity with automated call workflows.

- Analytics Analyze survey data with visual dashboards

- Panel Manager Nurture a loyal community of respondents.

- Survey Portal Best-in-class user friendly survey portal.

- Voxco Audience Conduct targeted sample research in hours.

- Predictive Analytics

- Customer 360

- Customer Loyalty

- Fraud & Risk Management

- AI/ML Enablement Services

- Credit Underwriting

Find the best survey software for you! (Along with a checklist to compare platforms)

Get Buyer’s Guide

- 100+ question types

- Drag-and-drop interface

- Skip logic and branching

- Multi-lingual survey

- Text piping

- Question library

- CSS customization

- White-label surveys

- Customizable ‘Thank You’ page

- Customizable survey theme

- Reminder send-outs

- Survey rewards

- Social media

- SMS surveys

- Website surveys

- Correlation analysis

- Cross-tabulation analysis

- Trend analysis

- Real-time dashboard

- Customizable report

- Email address validation

- Recaptcha validation

- SSL security

Take a peek at our powerful survey features to design surveys that scale discoveries.

Download feature sheet.

- Hospitality

- Financial Services

- Academic Research

- Customer Experience

- Employee Experience

- Product Experience

- Market Research

- Social Research

- Data Analysis

- Banking & Financial Services

- Retail Solution

- Risk Management

- Customer Lifecycle Solutions

- Net Promoter Score

- Customer Behaviour Analytics

- Customer Segmentation

- Data Unification

Explore Voxco

Need to map Voxco’s features & offerings? We can help!

Watch a Demo

Download Brochures

Get a Quote

- NPS Calculator

- CES Calculator

- A/B Testing Calculator

- Margin of Error Calculator

- Sample Size Calculator

- CX Strategy & Management Hub

- Market Research Hub

- Patient Experience Hub

- Employee Experience Hub

- Market Research Guide

- Customer Experience Guide

- The Voxco Guide to Customer Experience

- NPS Knowledge Hub

- Survey Research Guides

- Survey Template Library

- Webinars and Events

- Feature Sheets

- Try a sample survey

- Professional services

- Blogs & White papers

- Case Studies

Find the best customer experience platform

Uncover customer pain points, analyze feedback and run successful CX programs with the best CX platform for your team.

Get the Guide Now

We’ve been avid users of the Voxco platform now for over 20 years. It gives us the flexibility to routinely enhance our survey toolkit and provides our clients with a more robust dataset and story to tell their clients.

VP Innovation & Strategic Partnerships, The Logit Group

- Client Stories

- Voxco Reviews

- Why Voxco Research?

- Why Voxco Intelligence?

- Careers at Voxco

- Vulnerabilities and Ethical Hacking

Explore Regional Offices

- Cloud/On-premise Dialer TCPA compliant Cloud & on-premise dialer

- Fraud & Risk Management

Get Buyer’s Guide

- Banking & Financial Services

Explore Voxco

Watch a Demo

Download Brochures

- CX Strategy & Management Hub

- Blogs & White papers

VP Innovation & Strategic Partnerships, The Logit Group

- Our clients

- Client stories

- Featuresheets

Descriptive research questions: Definition, examples and designing methodology

- October 4, 2021

SHARE THE ARTICLE ON

Conducting thorough market research is all about framing the right questions that provide accurate answers to research questions. The two main categories of questions namely: Quantitative and Qualitative questions focus on differential aspects.

While quantitative research questions are based on numerical data that provides a substantial backing to the decision making process, qualitative research questions aim to derive insights based on textual responses. Both these questions are used based on their relevance and suitability to meet end objectives of the user.

One such useful quantitative question type are the descriptive research questions.

What is descriptive research?

Descriptive research questions aim to provide a description of the variable under consideration. It is one of the easiest and commonly used ways to quantify research variables.

Questions that begin with:

- How much: How much time does an average teenager spend on watching documentaries on OTT platforms?

Variable: time spent on watching documentaries

Group: Teenagers

- How often: How often do you take an international family trip in a year?

Variable: International trips

Group: Families

- How likely: How likely is it for a person to purchase life insurance within the age group of 20-26?

Variable: Likelihood of purchasing a life insurance

Group: People within the age group of 20-26

- What percentage: What percentage of high school students exercise on a daily basis?

Variable: Daily Exercise

Group: High School Students

- How many: How many smartphone users make use of curated apps to manage daily tasks?

Variable: Usage of curated apps

Group: Smartphone users

- What proportion: What proportion of students prefer online education to offline education?

Variable: Educational format

Group: Students

- How regularly: How regularly does a woman engage or purchase from a cosmetic brand outlet as against e-commerce websites?

Variable: Purchasing Behaviour of cosmetics

Group: Women

- What is: What is the ratio of passengers indulging in train travel to travelling by flight?

Variable: Travelling medium

Group: Passengers

- What are: What are the influencing factors that impact the choice of purchasing a house in the UK?

Variable: Influencing factors

Group: UK property investors/ New buyers

Among other such phrases are all classified as descriptive questions. By gathering sufficient responses to such questions, end users are able to make intelligent decisions based on hard figures that help in gathering stakeholder confidence.

For example: What percentage of college students make use of e-libraries for their academic needs. In this example the variable under observation is usage of e-libraries and the group that is evaluated are the college going students.

By providing percentages, averages, sum, proportions and other such figures, descriptive research questions provide a complete view of the target groups responses with respect to that variable. The above example has restricted the usage of variables to one, but many researchers alternatively choose to incorporate multiple variables under a single head.

Why are descriptive research questions important?

Descriptive research questions are a systematic methodology that helps in understanding the what, where, when and how. Important variables can be rigidly defined using descriptive research, unlike qualitative research where the subjectivity in responses makes it relatively difficult to get a grasp on the overall picture. The multiple methods available allow for in-person as well as online research to be carried out based on whatever the need of the end user is.

The data provided by descriptive research assists comprehensive understanding by providing an in-depth view of the variable that is being studied.

Steps to conduct Cluster Sampling

These are the following steps used to perform single-stage cluster sampling:

- Decide on a target population and desired sample size.

- Divide the target population into clusters based on a specific criteria.

- Select clusters using methods of random selection while keeping in mind the desired sample size.

- Collect data from the final sample group.

Further steps may be taken using two-stage or multistage sampling to achieve desired sample size if it cannot be achieved through one-stage sampling.

Types of descriptive research questions?

Descriptive research questions has divisions based on multiple business applications:

Market performance:

Descriptive research questions can be centred around organizational market performance in terms of sales figures, competitive appeal, updated practices, market share analytics, concept studies and other data collection processes that intend to gather market know-how. Target market analysis can also be done using descriptive question types wherein organizations can precisely define their niche audience.

Consumer behaviour:

Consumer perceptions and ideas about what suits them best can be understood using descriptive question types. These studies are used to design curated products that meet target market requirements. Anything from products, services, offers, incentives, promotions and marketing, pricing, packaging, feedback mechanism can be put into perspective and gauged to extract material results.

Internal trends:

While market performance looks at external variables, internal trends focus on departmental contributions, revenue generation, product specific demands, sales figures etc. This internal summary helps appraise performance within the organization and contrast it with external performance for benchmarking purposes.

How to frame descriptive research questions?

There is no rocket science behind framing the right question for your variable. It’s just a matter of figuring out what you want to assess and the numerical measure you’re looking for. The usage of descriptive questions in your study also comes with the condition of keeping the entire process concise and to the point.

To start off, figure out the variable that you wish to gauge and the target group that needs to be evaluated. This will determine the centre point of your research questions. Avoid providing vague descriptions and instead, try narrowing the details. Such a practice will direct the questioning to the exact audience you wish to examine without adding in unnecessary responses.

Choose the starting phrase that encompasses what you’re looking to measure. For example: If you’re looking to examine or separate a certain type of person from the entire target audience, phrases such as “what proportion” or “what percentage” can prove highly useful.

Questioning tips:

- Proceed from general to specific questions while making sure that you don’t lose focus of your target variable and audience.

- Avoid using ambiguous terminologies that are likely to confuse your respondents into misunderstanding questions as this can adversely affect the quality of your responses.

- Keep the questions simple and easy to understand in such a way that all targeted respondents are able to grasp the overall meaning equally.

- Avoid leading questions that skew the respondent into answering a certain way. Research is all about getting the information that you want in an authentic manner and such questions can sway the respondent into giving artificial responses.

Make sure that your answer choices are balanced. This is another bias that forces the respondent into altering their actual responses. Try to provide equal representation to all possible answers such that the probability of receiving each response is equally likely.

Lastly, look for variables of questions that you can club together without affecting the overall questioning process. However, it is often useful to bifurcate combined questions wherever you can, combining relevant questions together can provide useful information about existing relationships. This goes without saying that such clubbing must not act as a hindrance to the understanding of these variables as separate characteristics.

Explore Voxco Survey Software

+ Omnichannel Survey Software

+ Online Survey Software

+ CATI Survey Software

+ IVR Survey Software

+ Market Research Tool

+ Customer Experience Tool

+ Product Experience Software

+ Enterprise Survey Software

Descriptive Statistics with its statistical approach

Descriptive Statistics with its statistical approach Transform your insight generation process Use our in-depth online survey guide to create an actionable feedback collection survey process.

Non-Probability Sampling: Definition, Method and Examples

Enhancing Response Rates in CATI Surveys: Strategies and Techniques SHARE THE ARTICLE ON Table of Contents Research studies often try to find correlations, differences, or

Customer Experience in Retail

Customer Experience in Retail SHARE THE ARTICLE ON Table of Contents With the arrival of the Covid-19 pandemic, we could see many retail stores closing

A detailed guide on how to evaluate a research report

How to Evaluate a Research Report with Precision: Bridging the Gap SHARE THE ARTICLE ON Table of Contents Why do you need a research report?

What is Secondary Market Research?

What is Secondary Market Research? SHARE THE ARTICLE ON Table of Contents Gathering data directly from the source (primary research) may not be feasible in

How to avoid double-barreled questions in a survey?

How to avoid double-barreled questions in a survey? SHARE THE ARTICLE ON Table of Contents When writing survey questions, if you are not careful about

We use cookies in our website to give you the best browsing experience and to tailor advertising. By continuing to use our website, you give us consent to the use of cookies. Read More

Looking for the best research tools?

Voxco offers the best online & offline survey research tools!

Ohio State nav bar

The Ohio State University

- BuckeyeLink

- Find People

- Search Ohio State

Research Questions & Hypotheses

Generally, in quantitative studies, reviewers expect hypotheses rather than research questions. However, both research questions and hypotheses serve different purposes and can be beneficial when used together.

Research Questions

Clarify the research’s aim (farrugia et al., 2010).

- Research often begins with an interest in a topic, but a deep understanding of the subject is crucial to formulate an appropriate research question.

- Descriptive: “What factors most influence the academic achievement of senior high school students?”

- Comparative: “What is the performance difference between teaching methods A and B?”

- Relationship-based: “What is the relationship between self-efficacy and academic achievement?”

- Increasing knowledge about a subject can be achieved through systematic literature reviews, in-depth interviews with patients (and proxies), focus groups, and consultations with field experts.

- Some funding bodies, like the Canadian Institute for Health Research, recommend conducting a systematic review or a pilot study before seeking grants for full trials.

- The presence of multiple research questions in a study can complicate the design, statistical analysis, and feasibility.

- It’s advisable to focus on a single primary research question for the study.

- The primary question, clearly stated at the end of a grant proposal’s introduction, usually specifies the study population, intervention, and other relevant factors.

- The FINER criteria underscore aspects that can enhance the chances of a successful research project, including specifying the population of interest, aligning with scientific and public interest, clinical relevance, and contribution to the field, while complying with ethical and national research standards.

- The P ICOT approach is crucial in developing the study’s framework and protocol, influencing inclusion and exclusion criteria and identifying patient groups for inclusion.

- Defining the specific population, intervention, comparator, and outcome helps in selecting the right outcome measurement tool.

- The more precise the population definition and stricter the inclusion and exclusion criteria, the more significant the impact on the interpretation, applicability, and generalizability of the research findings.

- A restricted study population enhances internal validity but may limit the study’s external validity and generalizability to clinical practice.

- A broadly defined study population may better reflect clinical practice but could increase bias and reduce internal validity.

- An inadequately formulated research question can negatively impact study design, potentially leading to ineffective outcomes and affecting publication prospects.

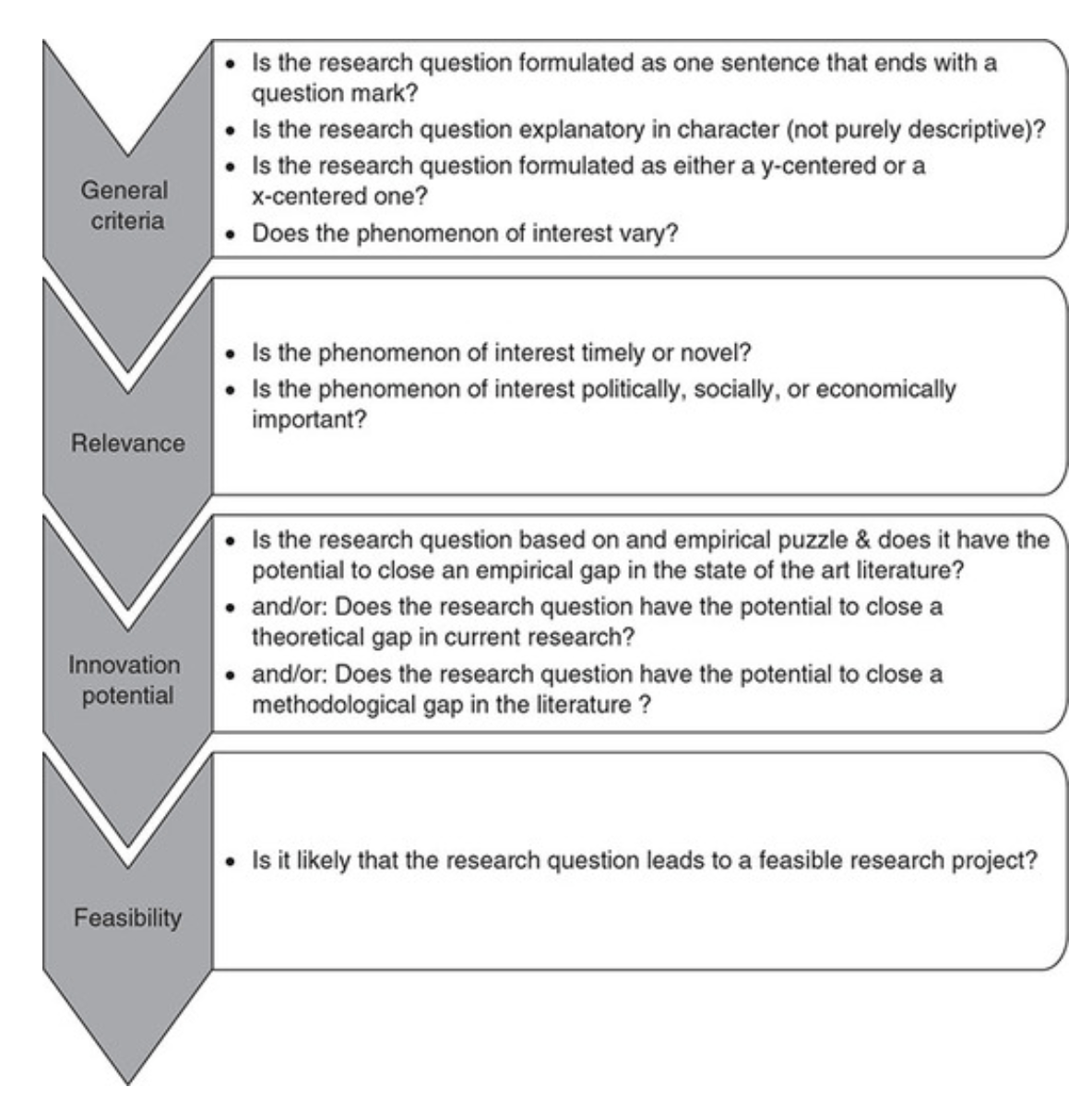

Checklist: Good research questions for social science projects (Panke, 2018)

Research Hypotheses

Present the researcher’s predictions based on specific statements.

- These statements define the research problem or issue and indicate the direction of the researcher’s predictions.

- Formulating the research question and hypothesis from existing data (e.g., a database) can lead to multiple statistical comparisons and potentially spurious findings due to chance.

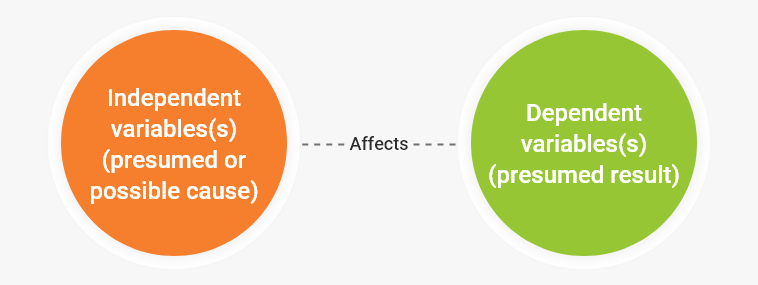

- The research or clinical hypothesis, derived from the research question, shapes the study’s key elements: sampling strategy, intervention, comparison, and outcome variables.

- Hypotheses can express a single outcome or multiple outcomes.

- After statistical testing, the null hypothesis is either rejected or not rejected based on whether the study’s findings are statistically significant.

- Hypothesis testing helps determine if observed findings are due to true differences and not chance.

- Hypotheses can be 1-sided (specific direction of difference) or 2-sided (presence of a difference without specifying direction).

- 2-sided hypotheses are generally preferred unless there’s a strong justification for a 1-sided hypothesis.

- A solid research hypothesis, informed by a good research question, influences the research design and paves the way for defining clear research objectives.

Types of Research Hypothesis

- In a Y-centered research design, the focus is on the dependent variable (DV) which is specified in the research question. Theories are then used to identify independent variables (IV) and explain their causal relationship with the DV.

- Example: “An increase in teacher-led instructional time (IV) is likely to improve student reading comprehension scores (DV), because extensive guided practice under expert supervision enhances learning retention and skill mastery.”

- Hypothesis Explanation: The dependent variable (student reading comprehension scores) is the focus, and the hypothesis explores how changes in the independent variable (teacher-led instructional time) affect it.

- In X-centered research designs, the independent variable is specified in the research question. Theories are used to determine potential dependent variables and the causal mechanisms at play.

- Example: “Implementing technology-based learning tools (IV) is likely to enhance student engagement in the classroom (DV), because interactive and multimedia content increases student interest and participation.”

- Hypothesis Explanation: The independent variable (technology-based learning tools) is the focus, with the hypothesis exploring its impact on a potential dependent variable (student engagement).

- Probabilistic hypotheses suggest that changes in the independent variable are likely to lead to changes in the dependent variable in a predictable manner, but not with absolute certainty.

- Example: “The more teachers engage in professional development programs (IV), the more their teaching effectiveness (DV) is likely to improve, because continuous training updates pedagogical skills and knowledge.”

- Hypothesis Explanation: This hypothesis implies a probable relationship between the extent of professional development (IV) and teaching effectiveness (DV).

- Deterministic hypotheses state that a specific change in the independent variable will lead to a specific change in the dependent variable, implying a more direct and certain relationship.

- Example: “If the school curriculum changes from traditional lecture-based methods to project-based learning (IV), then student collaboration skills (DV) are expected to improve because project-based learning inherently requires teamwork and peer interaction.”

- Hypothesis Explanation: This hypothesis presumes a direct and definite outcome (improvement in collaboration skills) resulting from a specific change in the teaching method.

- Example : “Students who identify as visual learners will score higher on tests that are presented in a visually rich format compared to tests presented in a text-only format.”

- Explanation : This hypothesis aims to describe the potential difference in test scores between visual learners taking visually rich tests and text-only tests, without implying a direct cause-and-effect relationship.

- Example : “Teaching method A will improve student performance more than method B.”

- Explanation : This hypothesis compares the effectiveness of two different teaching methods, suggesting that one will lead to better student performance than the other. It implies a direct comparison but does not necessarily establish a causal mechanism.

- Example : “Students with higher self-efficacy will show higher levels of academic achievement.”

- Explanation : This hypothesis predicts a relationship between the variable of self-efficacy and academic achievement. Unlike a causal hypothesis, it does not necessarily suggest that one variable causes changes in the other, but rather that they are related in some way.

Tips for developing research questions and hypotheses for research studies

- Perform a systematic literature review (if one has not been done) to increase knowledge and familiarity with the topic and to assist with research development.

- Learn about current trends and technological advances on the topic.

- Seek careful input from experts, mentors, colleagues, and collaborators to refine your research question as this will aid in developing the research question and guide the research study.

- Use the FINER criteria in the development of the research question.

- Ensure that the research question follows PICOT format.

- Develop a research hypothesis from the research question.

- Ensure that the research question and objectives are answerable, feasible, and clinically relevant.

If your research hypotheses are derived from your research questions, particularly when multiple hypotheses address a single question, it’s recommended to use both research questions and hypotheses. However, if this isn’t the case, using hypotheses over research questions is advised. It’s important to note these are general guidelines, not strict rules. If you opt not to use hypotheses, consult with your supervisor for the best approach.

Farrugia, P., Petrisor, B. A., Farrokhyar, F., & Bhandari, M. (2010). Practical tips for surgical research: Research questions, hypotheses and objectives. Canadian journal of surgery. Journal canadien de chirurgie , 53 (4), 278–281.

Hulley, S. B., Cummings, S. R., Browner, W. S., Grady, D., & Newman, T. B. (2007). Designing clinical research. Philadelphia.

Panke, D. (2018). Research design & method selection: Making good choices in the social sciences. Research Design & Method Selection , 1-368.

- What is descriptive research?

Last updated

5 February 2023

Reviewed by

Cathy Heath

Descriptive research is a common investigatory model used by researchers in various fields, including social sciences, linguistics, and academia.

Read on to understand the characteristics of descriptive research and explore its underlying techniques, processes, and procedures.

Analyze your descriptive research

Dovetail streamlines analysis to help you uncover and share actionable insights

Descriptive research is an exploratory research method. It enables researchers to precisely and methodically describe a population, circumstance, or phenomenon.

As the name suggests, descriptive research describes the characteristics of the group, situation, or phenomenon being studied without manipulating variables or testing hypotheses . This can be reported using surveys , observational studies, and case studies. You can use both quantitative and qualitative methods to compile the data.

Besides making observations and then comparing and analyzing them, descriptive studies often develop knowledge concepts and provide solutions to critical issues. It always aims to answer how the event occurred, when it occurred, where it occurred, and what the problem or phenomenon is.

- Characteristics of descriptive research

The following are some of the characteristics of descriptive research:

Quantitativeness

Descriptive research can be quantitative as it gathers quantifiable data to statistically analyze a population sample. These numbers can show patterns, connections, and trends over time and can be discovered using surveys, polls, and experiments.

Qualitativeness

Descriptive research can also be qualitative. It gives meaning and context to the numbers supplied by quantitative descriptive research .

Researchers can use tools like interviews, focus groups, and ethnographic studies to illustrate why things are what they are and help characterize the research problem. This is because it’s more explanatory than exploratory or experimental research.

Uncontrolled variables

Descriptive research differs from experimental research in that researchers cannot manipulate the variables. They are recognized, scrutinized, and quantified instead. This is one of its most prominent features.

Cross-sectional studies

Descriptive research is a cross-sectional study because it examines several areas of the same group. It involves obtaining data on multiple variables at the personal level during a certain period. It’s helpful when trying to understand a larger community’s habits or preferences.

Carried out in a natural environment

Descriptive studies are usually carried out in the participants’ everyday environment, which allows researchers to avoid influencing responders by collecting data in a natural setting. You can use online surveys or survey questions to collect data or observe.

Basis for further research

You can further dissect descriptive research’s outcomes and use them for different types of investigation. The outcomes also serve as a foundation for subsequent investigations and can guide future studies. For example, you can use the data obtained in descriptive research to help determine future research designs.

- Descriptive research methods

There are three basic approaches for gathering data in descriptive research: observational, case study, and survey.

You can use surveys to gather data in descriptive research. This involves gathering information from many people using a questionnaire and interview .

Surveys remain the dominant research tool for descriptive research design. Researchers can conduct various investigations and collect multiple types of data (quantitative and qualitative) using surveys with diverse designs.

You can conduct surveys over the phone, online, or in person. Your survey might be a brief interview or conversation with a set of prepared questions intended to obtain quick information from the primary source.

Observation

This descriptive research method involves observing and gathering data on a population or phenomena without manipulating variables. It is employed in psychology, market research , and other social science studies to track and understand human behavior.

Observation is an essential component of descriptive research. It entails gathering data and analyzing it to see whether there is a relationship between the two variables in the study. This strategy usually allows for both qualitative and quantitative data analysis.

Case studies

A case study can outline a specific topic’s traits. The topic might be a person, group, event, or organization.

It involves using a subset of a larger group as a sample to characterize the features of that larger group.

You can generalize knowledge gained from studying a case study to benefit a broader audience.

This approach entails carefully examining a particular group, person, or event over time. You can learn something new about the study topic by using a small group to better understand the dynamics of the entire group.

- Types of descriptive research

There are several types of descriptive study. The most well-known include cross-sectional studies, census surveys, sample surveys, case reports, and comparison studies.

Case reports and case series

In the healthcare and medical fields, a case report is used to explain a patient’s circumstances when suffering from an uncommon illness or displaying certain symptoms. Case reports and case series are both collections of related cases. They have aided the advancement of medical knowledge on countless occasions.

The normative component is an addition to the descriptive survey. In the descriptive–normative survey, you compare the study’s results to the norm.

Descriptive survey

This descriptive type of research employs surveys to collect information on various topics. This data aims to determine the degree to which certain conditions may be attained.

You can extrapolate or generalize the information you obtain from sample surveys to the larger group being researched.

Correlative survey

Correlative surveys help establish if there is a positive, negative, or neutral connection between two variables.

Performing census surveys involves gathering relevant data on several aspects of a given population. These units include individuals, families, organizations, objects, characteristics, and properties.

During descriptive research, you gather different degrees of interest over time from a specific population. Cross-sectional studies provide a glimpse of a phenomenon’s prevalence and features in a population. There are no ethical challenges with them and they are quite simple and inexpensive to carry out.

Comparative studies

These surveys compare the two subjects’ conditions or characteristics. The subjects may include research variables, organizations, plans, and people.

Comparison points, assumption of similarities, and criteria of comparison are three important variables that affect how well and accurately comparative studies are conducted.

For instance, descriptive research can help determine how many CEOs hold a bachelor’s degree and what proportion of low-income households receive government help.

- Pros and cons

The primary advantage of descriptive research designs is that researchers can create a reliable and beneficial database for additional study. To conduct any inquiry, you need access to reliable information sources that can give you a firm understanding of a situation.

Quantitative studies are time- and resource-intensive, so knowing the hypotheses viable for testing is crucial. The basic overview of descriptive research provides helpful hints as to which variables are worth quantitatively examining. This is why it’s employed as a precursor to quantitative research designs.

Some experts view this research as untrustworthy and unscientific. However, there is no way to assess the findings because you don’t manipulate any variables statistically.

Cause-and-effect correlations also can’t be established through descriptive investigations. Additionally, observational study findings cannot be replicated, which prevents a review of the findings and their replication.

The absence of statistical and in-depth analysis and the rather superficial character of the investigative procedure are drawbacks of this research approach.

- Descriptive research examples and applications

Several descriptive research examples are emphasized based on their types, purposes, and applications. Research questions often begin with “What is …” These studies help find solutions to practical issues in social science, physical science, and education.

Here are some examples and applications of descriptive research:

Determining consumer perception and behavior

Organizations use descriptive research designs to determine how various demographic groups react to a certain product or service.

For example, a business looking to sell to its target market should research the market’s behavior first. When researching human behavior in response to a cause or event, the researcher pays attention to the traits, actions, and responses before drawing a conclusion.

Scientific classification

Scientific descriptive research enables the classification of organisms and their traits and constituents.

Measuring data trends

A descriptive study design’s statistical capabilities allow researchers to track data trends over time. It’s frequently used to determine the study target’s current circumstances and underlying patterns.

Conduct comparison

Organizations can use a descriptive research approach to learn how various demographics react to a certain product or service. For example, you can study how the target market responds to a competitor’s product and use that information to infer their behavior.

- Bottom line

A descriptive research design is suitable for exploring certain topics and serving as a prelude to larger quantitative investigations. It provides a comprehensive understanding of the “what” of the group or thing you’re investigating.

This research type acts as the cornerstone of other research methodologies . It is distinctive because it can use quantitative and qualitative research approaches at the same time.

What is descriptive research design?

Descriptive research design aims to systematically obtain information to describe a phenomenon, situation, or population. More specifically, it helps answer the what, when, where, and how questions regarding the research problem rather than the why.

How does descriptive research compare to qualitative research?

Despite certain parallels, descriptive research concentrates on describing phenomena, while qualitative research aims to understand people better.

How do you analyze descriptive research data?

Data analysis involves using various methodologies, enabling the researcher to evaluate and provide results regarding validity and reliability.

Get started today

Go from raw data to valuable insights with a flexible research platform

Editor’s picks

Last updated: 21 December 2023

Last updated: 16 December 2023

Last updated: 6 October 2023

Last updated: 25 November 2023

Last updated: 12 May 2023

Last updated: 15 February 2024

Last updated: 11 March 2024

Last updated: 12 December 2023

Last updated: 18 May 2023

Last updated: 6 March 2024

Last updated: 10 April 2023

Last updated: 20 December 2023

Latest articles

Related topics, log in or sign up.

Get started for free

- school Campus Bookshelves

- menu_book Bookshelves

- perm_media Learning Objects

- login Login

- how_to_reg Request Instructor Account

- hub Instructor Commons

- Download Page (PDF)

- Download Full Book (PDF)

- Periodic Table

- Physics Constants

- Scientific Calculator

- Reference & Cite

- Tools expand_more

- Readability

selected template will load here

This action is not available.

8.3: Quantitative research questions

- Last updated

- Save as PDF

- Page ID 25644

- Matthew DeCarlo

- Radford University via Open Social Work Education

Learning Objectives

- Describe how research questions for exploratory, descriptive, and explanatory quantitative questions differ and how to phrase them

- Identify the differences between and provide examples of strong and weak explanatory research questions

Quantitative descriptive questions

The type of research you are conducting will impact the research question that you ask. Probably the easiest questions to think of are quantitative descriptive questions. For example, “What is the average student debt load of MSW students?” is a descriptive question—and an important one. We aren’t trying to build a causal relationship here. We’re simply trying to describe how much debt MSW students carry. Quantitative descriptive questions like this one are helpful in social work practice as part of community scans, in which human service agencies survey the various needs of the community they serve. If the scan reveals that the community requires more services related to housing, child care, or day treatment for people with disabilities, a nonprofit office can use the community scan to create new programs that meet a defined community need.

Quantitative descriptive questions will often ask for percentage, count the number of instances of a phenomenon, or determine an average. Descriptive questions may only include one variable, such as ours about debt load, or they may include multiple variables. Because these are descriptive questions, we cannot investigate causal relationships between variables. To do that, we need to use a quantitative explanatory question.

Quantitative explanatory questions

Most studies you read in the academic literature will be quantitative and explanatory. Why is that? If you recall from Chapter 7, explanatory research tries to build nomothetic causal relationships. They are generalizable across space and time, so they are applicable to a wide audience. The editorial board of a journal wants to make sure their content will be useful to as many people as possible, so it’s not surprising that quantitative research dominates the academic literature.

Structurally, quantitative explanatory questions must contain an independent variable and dependent variable. Questions should ask about the relationship between these variables. My standard format for an explanatory quantitative research question is: “What is the relationship between [independent variable] and [dependent variable] for [target population]?” You should play with the wording for your research question, revising it as you see fit. The goal is to make the research question reflect what you really want to know in your study.

Let’s take a look at a few more examples of possible research questions and consider the relative strengths and weaknesses of each. Table 8.1 does just that. While reading the table, keep in mind that I have only noted what I view to be the most relevant strengths and weaknesses of each question. Certainly each question may have additional strengths and weaknesses not noted in the table.

Making it more specific

A good research question should also be specific and clear about the concepts it addresses. A student investigating gender and household tasks knows what they mean by “household tasks.” You likely also have an impression of what “household tasks” means. But are your definition and the student’s definition the same? A participant in their study may think that managing finances and performing home maintenance are household tasks, but the researcher may be interested in other tasks like childcare or cleaning. The only way to ensure your study stays focused and clear is to be specific about what you mean by a concept. The student in our example could pick a specific household task that was interesting to them or that the literature indicated was important—for example, childcare. Or, the student could have a broader view of household tasks, one that encompasses childcare, food preparation, financial management, home repair, and care for relatives. Any option is probably okay, as long as the researcher is clear on what they mean by “household tasks.”

Table 8.2 contains some “watch words” that indicate you may need to be more specific about the concepts in your research question.

It can be challenging in social work research to be this specific, particularly when you are just starting out your investigation of the topic. If you’ve only read one or two articles on the topic, it can be hard to know what you are interested in studying. Broad questions like “What are the causes of chronic homelessness, and what can be done to prevent it?” are common at the beginning stages of a research project. However, social work research demands that you examine the literature on the topic and refine your question over time to be more specific and clear before you begin your study. Perhaps you want to study the effect of a specific anti-homelessness program that you found in the literature. Maybe there is a particular model to fighting homelessness, like Housing First or transitional housing that you want to investigate further. You may want to focus on a potential cause of homelessness such as LGBTQ discrimination that you find interesting or relevant to your practice. As you can see, the possibilities for making your question more specific are almost infinite.

Quantitative exploratory questions

In exploratory research, the researcher doesn’t quite know the lay of the land yet. If someone is proposing to conduct an exploratory quantitative project, the watch words highlighted in Table 8.2 are not problematic at all. In fact, questions such as “What factors influence the removal of children in child welfare cases?” are good because they will explore a variety of factors or causes. In this question, the independent variable is less clearly written, but the dependent variable, family preservation outcomes, is quite clearly written. The inverse can also be true. If we were to ask, “What outcomes are associated with family preservation services in child welfare?”, we would have a clear independent variable, family preservation services, but an unclear dependent variable, outcomes. Because we are only conducting exploratory research on a topic, we may not have an idea of what concepts may comprise our “outcomes” or “factors.” Only after interacting with our participants will we be able to understand which concepts are important.

Key Takeaways

- Quantitative descriptive questions are helpful for community scans but cannot investigate causal relationships between variables.

- Quantitative explanatory questions must include an independent and dependent variable.

Image attributions

Ask by terimakasih0 CC-0

Have a language expert improve your writing

Run a free plagiarism check in 10 minutes, automatically generate references for free.

- Knowledge Base

- Methodology

- Descriptive Research Design | Definition, Methods & Examples

Descriptive Research Design | Definition, Methods & Examples

Published on 5 May 2022 by Shona McCombes . Revised on 10 October 2022.

Descriptive research aims to accurately and systematically describe a population, situation or phenomenon. It can answer what , where , when , and how questions , but not why questions.

A descriptive research design can use a wide variety of research methods to investigate one or more variables . Unlike in experimental research , the researcher does not control or manipulate any of the variables, but only observes and measures them.

Table of contents

When to use a descriptive research design, descriptive research methods.

Descriptive research is an appropriate choice when the research aim is to identify characteristics, frequencies, trends, and categories.

It is useful when not much is known yet about the topic or problem. Before you can research why something happens, you need to understand how, when, and where it happens.

- How has the London housing market changed over the past 20 years?

- Do customers of company X prefer product Y or product Z?

- What are the main genetic, behavioural, and morphological differences between European wildcats and domestic cats?

- What are the most popular online news sources among under-18s?

- How prevalent is disease A in population B?

Prevent plagiarism, run a free check.

Descriptive research is usually defined as a type of quantitative research , though qualitative research can also be used for descriptive purposes. The research design should be carefully developed to ensure that the results are valid and reliable .

Survey research allows you to gather large volumes of data that can be analysed for frequencies, averages, and patterns. Common uses of surveys include:

- Describing the demographics of a country or region

- Gauging public opinion on political and social topics

- Evaluating satisfaction with a company’s products or an organisation’s services

Observations

Observations allow you to gather data on behaviours and phenomena without having to rely on the honesty and accuracy of respondents. This method is often used by psychological, social, and market researchers to understand how people act in real-life situations.

Observation of physical entities and phenomena is also an important part of research in the natural sciences. Before you can develop testable hypotheses , models, or theories, it’s necessary to observe and systematically describe the subject under investigation.

Case studies

A case study can be used to describe the characteristics of a specific subject (such as a person, group, event, or organisation). Instead of gathering a large volume of data to identify patterns across time or location, case studies gather detailed data to identify the characteristics of a narrowly defined subject.

Rather than aiming to describe generalisable facts, case studies often focus on unusual or interesting cases that challenge assumptions, add complexity, or reveal something new about a research problem .

Cite this Scribbr article

If you want to cite this source, you can copy and paste the citation or click the ‘Cite this Scribbr article’ button to automatically add the citation to our free Reference Generator.

McCombes, S. (2022, October 10). Descriptive Research Design | Definition, Methods & Examples. Scribbr. Retrieved 29 April 2024, from https://www.scribbr.co.uk/research-methods/descriptive-research-design/

Is this article helpful?

Shona McCombes

Other students also liked, a quick guide to experimental design | 5 steps & examples, correlational research | guide, design & examples, qualitative vs quantitative research | examples & methods.

- (855) 776-7763

Training Maker

All Products

Qualaroo Insights

ProProfs.com

- Sign Up Free

Do you want a free Survey Software?

We have the #1 Online Survey Maker Software to get actionable user insights.

How to Write Quantitative Research Questions: Types With Examples

For research to be effective, it becomes crucial to properly formulate the quantitative research questions in a correct way. Otherwise, you will not get the answers you were looking for.

Has it ever happened that you conducted a quantitative research study and found out the results you were expecting are quite different from the actual results?

This could happen due to many factors like the unpredictable nature of respondents, errors in calculation, research bias, etc. However, your quantitative research usually does not provide reliable results when questions are not written correctly.

We get it! Structuring the quantitative research questions can be a difficult task.

Hence, in this blog, we will share a few bits of advice on how to write good quantitative research questions. We will also look at different types of quantitative research questions along with their examples.

Let’s start:

How to Write Quantitative Research Questions?

When you want to obtain actionable insight into the trends and patterns of the research topic to make sense of it, quantitative research questions are your best bet.

Being objective in nature, these questions provide you with detailed information about the research topic and help in collecting quantifiable data that can be easily analyzed. This data can be generalized to the entire population and help make data-driven and sound decisions.

Respondents find it easier to answer quantitative survey questions than qualitative questions . At the same time, researchers can also analyze them quickly using various statistical models.

However, when it comes to writing the quantitative research questions, one can get a little overwhelmed as the entire study depends on the types of questions used.

There is no “one good way” to prepare these questions. However, to design well-structured quantitative research questions, you can follow the 4-steps approach given below:

1. Select the Type of Quantitative Question

The first step is to determine which type of quantitative question you want to add to your study. There are three types of quantitative questions:

- Descriptive

- Comparative

- Relationship-based

This will help you choose the correct words and phrases while constructing the question. At the same time, it will also assist readers in understanding the question correctly.

2. Identify the Type of Variable

The second step involves identifying the type of variable you are trying to measure, manipulate, or control. Basically, there are two types of variables:

- Independent variable (a variable that is being manipulated)

- Dependent variable (outcome variable)

If you plan to use descriptive research questions, you have to deal with a number of dependent variables. However, where you plan to create comparative or relationship research questions, you will deal with both dependent and independent variables.

3. Select the Suitable Structure

The next step is determining the structure of the research question. It involves:

- Identifying the components of the question. It involves the type of dependent or independent variable and a group of interest (the group from which the researcher tries to conclude the population).

- The number of different components used. Like, as to how many variables and groups are being examined.

- Order in which these are presented. For example, the independent variable before the dependent variable or vice versa.

4. Draft the Complete Research Question

The last step involves identifying the problem or issue that you are trying to address in the form of complete quantitative survey questions. Also, make sure to build an exhaustive list of response options to make sure your respondents select the correct response. If you miss adding important answer options, then the ones chosen by respondents may not be entirely true.

Types of Quantitative Research Questions With Examples

Quantitative research questions are generally used to answer the “who” and “what” of the research topic. For quantitative research to be effective, it is crucial that the respondents are able to answer your questions concisely and precisely. With that in mind, let’s look in greater detail at the three types of formats you can use when preparing quantitative market research questions.

1. Descriptive

Descriptive research questions are used to collect participants’ opinions about the variable that you want to quantify. It is the most effortless way to measure the particular variable (single or multiple variables) you are interested in on a large scale. Usually, descriptive research questions begin with “ how much,” “how often,” “what percentage,” “what proportion,” etc.

Examples of descriptive research questions include:

2. Comparative

Comparative research questions help you identify the difference between two or more groups based on one or more variables. In general, a comparative research question is used to quantify one variable; however, you can use two or more variables depending on your market research objectives.

Comparative research questions examples include:

3. Relationship-based

Relationship research questions are used to identify trends, causal relationships, or associations between two or more variables. It is not vital to distinguish between causal relationships, trends, or associations while using these types of questions. These questions begin with “What is the relationship” between independent and dependent variables, amongst or between two or more groups.

Relationship-based quantitative questions examples include:

Ready to Write Your Quantitative Research Questions?

So, there you have it. It was all about quantitative research question types and their examples. By now, you must have figured out a way to write quantitative research questions for your survey to collect actionable customer feedback.

Now, the only thing you need is a good survey maker tool, like ProProfs Survey Maker, that will glide your process of designing and conducting your surveys . You also get access to various survey question types, both qualitative and quantitative, that you can add to any kind of survey along with professionally-designed survey templates .

About the author

Emma David is a seasoned market research professional with 8+ years of experience. Having kick-started her journey in research, she has developed rich expertise in employee engagement, survey creation and administration, and data management. Emma believes in the power of data to shape business performance positively. She continues to help brands and businesses make strategic decisions and improve their market standing through her understanding of research methodologies.

Popular Posts in This Category

60+ Close Ended Questions: A Complete Guide With Examples

15 Effective Employee Retention Strategies (2024)

How Many Questions Should Be Asked in a Survey?

Survey Question: 250+Examples, Types & Best Practices

How to Write Qualitative Research Questions: Types & Examples

Market Research Surveys – Types, Steps, Tips, & 20+ Questions

- Skip to main content

- Skip to primary sidebar

- Skip to footer

- QuestionPro

- Solutions Industries Gaming Automotive Sports and events Education Government Travel & Hospitality Financial Services Healthcare Cannabis Technology Use Case NPS+ Communities Audience Contactless surveys Mobile LivePolls Member Experience GDPR Positive People Science 360 Feedback Surveys

- Resources Blog eBooks Survey Templates Case Studies Training Help center

Home Market Research

Descriptive Research: Definition, Characteristics, Methods + Examples

Suppose an apparel brand wants to understand the fashion purchasing trends among New York’s buyers, then it must conduct a demographic survey of the specific region, gather population data, and then conduct descriptive research on this demographic segment.

The study will then uncover details on “what is the purchasing pattern of New York buyers,” but will not cover any investigative information about “ why ” the patterns exist. Because for the apparel brand trying to break into this market, understanding the nature of their market is the study’s main goal. Let’s talk about it.

What is descriptive research?

Descriptive research is a research method describing the characteristics of the population or phenomenon studied. This descriptive methodology focuses more on the “what” of the research subject than the “why” of the research subject.

The method primarily focuses on describing the nature of a demographic segment without focusing on “why” a particular phenomenon occurs. In other words, it “describes” the research subject without covering “why” it happens.

Characteristics of descriptive research

The term descriptive research then refers to research questions, the design of the study, and data analysis conducted on that topic. We call it an observational research method because none of the research study variables are influenced in any capacity.

Some distinctive characteristics of descriptive research are:

- Quantitative research: It is a quantitative research method that attempts to collect quantifiable information for statistical analysis of the population sample. It is a popular market research tool that allows us to collect and describe the demographic segment’s nature.

- Uncontrolled variables: In it, none of the variables are influenced in any way. This uses observational methods to conduct the research. Hence, the nature of the variables or their behavior is not in the hands of the researcher.

- Cross-sectional studies: It is generally a cross-sectional study where different sections belonging to the same group are studied.

- The basis for further research: Researchers further research the data collected and analyzed from descriptive research using different research techniques. The data can also help point towards the types of research methods used for the subsequent research.

Applications of descriptive research with examples

A descriptive research method can be used in multiple ways and for various reasons. Before getting into any survey , though, the survey goals and survey design are crucial. Despite following these steps, there is no way to know if one will meet the research outcome. How to use descriptive research? To understand the end objective of research goals, below are some ways organizations currently use descriptive research today:

- Define respondent characteristics: The aim of using close-ended questions is to draw concrete conclusions about the respondents. This could be the need to derive patterns, traits, and behaviors of the respondents. It could also be to understand from a respondent their attitude, or opinion about the phenomenon. For example, understand millennials and the hours per week they spend browsing the internet. All this information helps the organization researching to make informed business decisions.

- Measure data trends: Researchers measure data trends over time with a descriptive research design’s statistical capabilities. Consider if an apparel company researches different demographics like age groups from 24-35 and 36-45 on a new range launch of autumn wear. If one of those groups doesn’t take too well to the new launch, it provides insight into what clothes are like and what is not. The brand drops the clothes and apparel that customers don’t like.

- Conduct comparisons: Organizations also use a descriptive research design to understand how different groups respond to a specific product or service. For example, an apparel brand creates a survey asking general questions that measure the brand’s image. The same study also asks demographic questions like age, income, gender, geographical location, geographic segmentation , etc. This consumer research helps the organization understand what aspects of the brand appeal to the population and what aspects do not. It also helps make product or marketing fixes or even create a new product line to cater to high-growth potential groups.

- Validate existing conditions: Researchers widely use descriptive research to help ascertain the research object’s prevailing conditions and underlying patterns. Due to the non-invasive research method and the use of quantitative observation and some aspects of qualitative observation , researchers observe each variable and conduct an in-depth analysis . Researchers also use it to validate any existing conditions that may be prevalent in a population.

- Conduct research at different times: The analysis can be conducted at different periods to ascertain any similarities or differences. This also allows any number of variables to be evaluated. For verification, studies on prevailing conditions can also be repeated to draw trends.

Advantages of descriptive research

Some of the significant advantages of descriptive research are:

- Data collection: A researcher can conduct descriptive research using specific methods like observational method, case study method, and survey method. Between these three, all primary data collection methods are covered, which provides a lot of information. This can be used for future research or even for developing a hypothesis for your research object.

- Varied: Since the data collected is qualitative and quantitative, it gives a holistic understanding of a research topic. The information is varied, diverse, and thorough.

- Natural environment: Descriptive research allows for the research to be conducted in the respondent’s natural environment, which ensures that high-quality and honest data is collected.

- Quick to perform and cheap: As the sample size is generally large in descriptive research, the data collection is quick to conduct and is inexpensive.

Descriptive research methods

There are three distinctive methods to conduct descriptive research. They are:

Observational method

The observational method is the most effective method to conduct this research, and researchers make use of both quantitative and qualitative observations.

A quantitative observation is the objective collection of data primarily focused on numbers and values. It suggests “associated with, of or depicted in terms of a quantity.” Results of quantitative observation are derived using statistical and numerical analysis methods. It implies observation of any entity associated with a numeric value such as age, shape, weight, volume, scale, etc. For example, the researcher can track if current customers will refer the brand using a simple Net Promoter Score question .

Qualitative observation doesn’t involve measurements or numbers but instead just monitoring characteristics. In this case, the researcher observes the respondents from a distance. Since the respondents are in a comfortable environment, the characteristics observed are natural and effective. In a descriptive research design, the researcher can choose to be either a complete observer, an observer as a participant, a participant as an observer, or a full participant. For example, in a supermarket, a researcher can from afar monitor and track the customers’ selection and purchasing trends. This offers a more in-depth insight into the purchasing experience of the customer.

Case study method

Case studies involve in-depth research and study of individuals or groups. Case studies lead to a hypothesis and widen a further scope of studying a phenomenon. However, case studies should not be used to determine cause and effect as they can’t make accurate predictions because there could be a bias on the researcher’s part. The other reason why case studies are not a reliable way of conducting descriptive research is that there could be an atypical respondent in the survey. Describing them leads to weak generalizations and moving away from external validity.

Survey research

In survey research, respondents answer through surveys or questionnaires or polls . They are a popular market research tool to collect feedback from respondents. A study to gather useful data should have the right survey questions. It should be a balanced mix of open-ended questions and close ended-questions . The survey method can be conducted online or offline, making it the go-to option for descriptive research where the sample size is enormous.

Examples of descriptive research

Some examples of descriptive research are:

- A specialty food group launching a new range of barbecue rubs would like to understand what flavors of rubs are favored by different people. To understand the preferred flavor palette, they conduct this type of research study using various methods like observational methods in supermarkets. By also surveying while collecting in-depth demographic information, offers insights about the preference of different markets. This can also help tailor make the rubs and spreads to various preferred meats in that demographic. Conducting this type of research helps the organization tweak their business model and amplify marketing in core markets.

- Another example of where this research can be used is if a school district wishes to evaluate teachers’ attitudes about using technology in the classroom. By conducting surveys and observing their comfortableness using technology through observational methods, the researcher can gauge what they can help understand if a full-fledged implementation can face an issue. This also helps in understanding if the students are impacted in any way with this change.

Some other research problems and research questions that can lead to descriptive research are:

- Market researchers want to observe the habits of consumers.

- A company wants to evaluate the morale of its staff.

- A school district wants to understand if students will access online lessons rather than textbooks.

- To understand if its wellness questionnaire programs enhance the overall health of the employees.

FREE TRIAL LEARN MORE

MORE LIKE THIS

Journey Orchestration Platforms: Top 11 Platforms in 2024

May 2, 2024

Taking Action in CX – Tuesday CX Thoughts

Apr 30, 2024

QuestionPro CX Product Updates – Quarter 1, 2024

Apr 29, 2024

NPS Survey Platform: Types, Tips, 11 Best Platforms & Tools

Apr 26, 2024

Other categories

- Academic Research

- Artificial Intelligence

- Assessments

- Brand Awareness

- Case Studies

- Communities

- Consumer Insights

- Customer effort score

- Customer Engagement

- Customer Experience

- Customer Loyalty

- Customer Research

- Customer Satisfaction

- Employee Benefits

- Employee Engagement

- Employee Retention

- Friday Five

- General Data Protection Regulation

- Insights Hub

- Life@QuestionPro

- Market Research

- Mobile diaries

- Mobile Surveys

- New Features

- Online Communities

- Question Types

- Questionnaire

- QuestionPro Products

- Release Notes

- Research Tools and Apps

- Revenue at Risk

- Survey Templates

- Training Tips

- Uncategorized

- Video Learning Series

- What’s Coming Up

- Workforce Intelligence

- Descriptive Research Designs: Types, Examples & Methods

One of the components of research is getting enough information about the research problem—the what, how, when and where answers, which is why descriptive research is an important type of research. It is very useful when conducting research whose aim is to identify characteristics, frequencies, trends, correlations, and categories.

This research method takes a problem with little to no relevant information and gives it a befitting description using qualitative and quantitative research method s. Descriptive research aims to accurately describe a research problem.

In the subsequent sections, we will be explaining what descriptive research means, its types, examples, and data collection methods.

What is Descriptive Research?

Descriptive research is a type of research that describes a population, situation, or phenomenon that is being studied. It focuses on answering the how, what, when, and where questions If a research problem, rather than the why.

This is mainly because it is important to have a proper understanding of what a research problem is about before investigating why it exists in the first place.

For example, an investor considering an investment in the ever-changing Amsterdam housing market needs to understand what the current state of the market is, how it changes (increasing or decreasing), and when it changes (time of the year) before asking for the why. This is where descriptive research comes in.

What Are The Types of Descriptive Research?

Descriptive research is classified into different types according to the kind of approach that is used in conducting descriptive research. The different types of descriptive research are highlighted below:

- Descriptive-survey

Descriptive survey research uses surveys to gather data about varying subjects. This data aims to know the extent to which different conditions can be obtained among these subjects.

For example, a researcher wants to determine the qualification of employed professionals in Maryland. He uses a survey as his research instrument , and each item on the survey related to qualifications is subjected to a Yes/No answer.

This way, the researcher can describe the qualifications possessed by the employed demographics of this community.

- Descriptive-normative survey

This is an extension of the descriptive survey, with the addition being the normative element. In the descriptive-normative survey, the results of the study should be compared with the norm.

For example, an organization that wishes to test the skills of its employees by a team may have them take a skills test. The skills tests are the evaluation tool in this case, and the result of this test is compared with the norm of each role.

If the score of the team is one standard deviation above the mean, it is very satisfactory, if within the mean, satisfactory, and one standard deviation below the mean is unsatisfactory.

- Descriptive-status

This is a quantitative description technique that seeks to answer questions about real-life situations. For example, a researcher researching the income of the employees in a company, and the relationship with their performance.

A survey will be carried out to gather enough data about the income of the employees, then their performance will be evaluated and compared to their income. This will help determine whether a higher income means better performance and low income means lower performance or vice versa.

- Descriptive-analysis

The descriptive-analysis method of research describes a subject by further analyzing it, which in this case involves dividing it into 2 parts. For example, the HR personnel of a company that wishes to analyze the job role of each employee of the company may divide the employees into the people that work at the Headquarters in the US and those that work from Oslo, Norway office.

A questionnaire is devised to analyze the job role of employees with similar salaries and who work in similar positions.

- Descriptive classification

This method is employed in biological sciences for the classification of plants and animals. A researcher who wishes to classify the sea animals into different species will collect samples from various search stations, then classify them accordingly.

- Descriptive-comparative

In descriptive-comparative research, the researcher considers 2 variables that are not manipulated, and establish a formal procedure to conclude that one is better than the other. For example, an examination body wants to determine the better method of conducting tests between paper-based and computer-based tests.

A random sample of potential participants of the test may be asked to use the 2 different methods, and factors like failure rates, time factors, and others will be evaluated to arrive at the best method.

- Correlative Survey

Correlative surveys are used to determine whether the relationship between 2 variables is positive, negative, or neutral. That is, if 2 variables say X and Y are directly proportional, inversely proportional or are not related to each other.

Examples of Descriptive Research

There are different examples of descriptive research, that may be highlighted from its types, uses, and applications. However, we will be restricting ourselves to only 3 distinct examples in this article.

- Comparing Student Performance:

An academic institution may wish 2 compare the performance of its junior high school students in English language and Mathematics. This may be used to classify students based on 2 major groups, with one group going ahead to study while courses, while the other study courses in the Arts & Humanities field.

Students who are more proficient in mathematics will be encouraged to go into STEM and vice versa. Institutions may also use this data to identify students’ weak points and work on ways to assist them.

- Scientific Classification

During the major scientific classification of plants, animals, and periodic table elements, the characteristics and components of each subject are evaluated and used to determine how they are classified.

For example, living things may be classified into kingdom Plantae or kingdom animal is depending on their nature. Further classification may group animals into mammals, pieces, vertebrae, invertebrae, etc.

All these classifications are made a result of descriptive research which describes what they are.

- Human Behavior

When studying human behaviour based on a factor or event, the researcher observes the characteristics, behaviour, and reaction, then use it to conclude. A company willing to sell to its target market needs to first study the behaviour of the market.

This may be done by observing how its target reacts to a competitor’s product, then use it to determine their behaviour.

What are the Characteristics of Descriptive Research?

The characteristics of descriptive research can be highlighted from its definition, applications, data collection methods, and examples. Some characteristics of descriptive research are:

- Quantitativeness

Descriptive research uses a quantitative research method by collecting quantifiable information to be used for statistical analysis of the population sample. This is very common when dealing with research in the physical sciences.

- Qualitativeness

It can also be carried out using the qualitative research method, to properly describe the research problem. This is because descriptive research is more explanatory than exploratory or experimental.

- Uncontrolled variables

In descriptive research, researchers cannot control the variables like they do in experimental research.

- The basis for further research

The results of descriptive research can be further analyzed and used in other research methods. It can also inform the next line of research, including the research method that should be used.

This is because it provides basic information about the research problem, which may give birth to other questions like why a particular thing is the way it is.

Why Use Descriptive Research Design?

Descriptive research can be used to investigate the background of a research problem and get the required information needed to carry out further research. It is used in multiple ways by different organizations, and especially when getting the required information about their target audience.

- Define subject characteristics :

It is used to determine the characteristics of the subjects, including their traits, behaviour, opinion, etc. This information may be gathered with the use of surveys, which are shared with the respondents who in this case, are the research subjects.

For example, a survey evaluating the number of hours millennials in a community spends on the internet weekly, will help a service provider make informed business decisions regarding the market potential of the community.

- Measure Data Trends

It helps to measure the changes in data over some time through statistical methods. Consider the case of individuals who want to invest in stock markets, so they evaluate the changes in prices of the available stocks to make a decision investment decision.

Brokerage companies are however the ones who carry out the descriptive research process, while individuals can view the data trends and make decisions.

Descriptive research is also used to compare how different demographics respond to certain variables. For example, an organization may study how people with different income levels react to the launch of a new Apple phone.

This kind of research may take a survey that will help determine which group of individuals are purchasing the new Apple phone. Do the low-income earners also purchase the phone, or only the high-income earners do?

Further research using another technique will explain why low-income earners are purchasing the phone even though they can barely afford it. This will help inform strategies that will lure other low-income earners and increase company sales.

- Validate existing conditions

When you are not sure about the validity of an existing condition, you can use descriptive research to ascertain the underlying patterns of the research object. This is because descriptive research methods make an in-depth analysis of each variable before making conclusions.

- Conducted Overtime

Descriptive research is conducted over some time to ascertain the changes observed at each point in time. The higher the number of times it is conducted, the more authentic the conclusion will be.

What are the Disadvantages of Descriptive Research?

- Response and Non-response Bias

Respondents may either decide not to respond to questions or give incorrect responses if they feel the questions are too confidential. When researchers use observational methods, respondents may also decide to behave in a particular manner because they feel they are being watched.

- The researcher may decide to influence the result of the research due to personal opinion or bias towards a particular subject. For example, a stockbroker who also has a business of his own may try to lure investors into investing in his own company by manipulating results.

- A case-study or sample taken from a large population is not representative of the whole population.