S&P 500

Russell 2000, bitcoin usd, cmc crypto 200, investors heavily search lam research corporation (lrcx): here is what you need to know.

Lam Research (LRCX) is one of the stocks most watched by Zacks.com visitors lately. So, it might be a good idea to review some of the factors that might affect the near-term performance of the stock.

Shares of this semiconductor equipment maker have returned +0.4% over the past month versus the Zacks S&P 500 composite's +2.2% change. The Zacks Semiconductor Equipment - Wafer Fabrication industry, to which Lam Research belongs, has lost 0.1% over this period. Now the key question is: Where could the stock be headed in the near term?

While media releases or rumors about a substantial change in a company's business prospects usually make its stock 'trending' and lead to an immediate price change, there are always some fundamental facts that eventually dominate the buy-and-hold decision-making.

Earnings Estimate Revisions

Here at Zacks, we prioritize appraising the change in the projection of a company's future earnings over anything else. That's because we believe the present value of its future stream of earnings is what determines the fair value for its stock.

We essentially look at how sell-side analysts covering the stock are revising their earnings estimates to reflect the impact of the latest business trends. And if earnings estimates go up for a company, the fair value for its stock goes up. A higher fair value than the current market price drives investors' interest in buying the stock, leading to its price moving higher. This is why empirical research shows a strong correlation between trends in earnings estimate revisions and near-term stock price movements.

For the current quarter, Lam Research is expected to post earnings of $7.23 per share, indicating a change of +3.4% from the year-ago quarter. The Zacks Consensus Estimate remained unchanged over the last 30 days.

The consensus earnings estimate of $28.88 for the current fiscal year indicates a year-over-year change of -15.5%. This estimate has remained unchanged over the last 30 days.

For the next fiscal year, the consensus earnings estimate of $34.62 indicates a change of +19.9% from what Lam Research is expected to report a year ago. Over the past month, the estimate has remained unchanged.

Having a strong externally audited track record, our proprietary stock rating tool, the Zacks Rank, offers a more conclusive picture of a stock's price direction in the near term, since it effectively harnesses the power of earnings estimate revisions. Due to the size of the recent change in the consensus estimate, along with three other factors related to earnings estimates, Lam Research is rated Zacks Rank #2 (Buy).

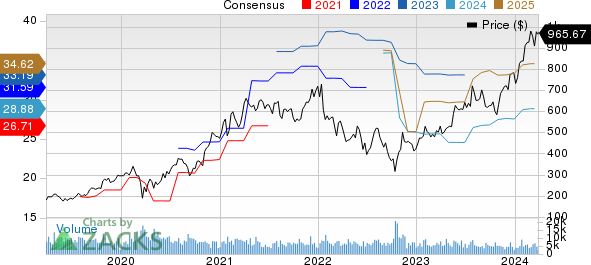

The chart below shows the evolution of the company's forward 12-month consensus EPS estimate:

12 Month EPS

Projected Revenue Growth

While earnings growth is arguably the most superior indicator of a company's financial health, nothing happens as such if a business isn't able to grow its revenues. After all, it's nearly impossible for a company to increase its earnings for an extended period without increasing its revenues. So, it's important to know a company's potential revenue growth.

For Lam Research, the consensus sales estimate for the current quarter of $3.71 billion indicates a year-over-year change of -4.2%. For the current and next fiscal years, $14.72 billion and $16.89 billion estimates indicate -15.5% and +14.7% changes, respectively.

Last Reported Results and Surprise History

Lam Research reported revenues of $3.76 billion in the last reported quarter, representing a year-over-year change of -28.8%. EPS of $7.52 for the same period compares with $10.71 a year ago.

Compared to the Zacks Consensus Estimate of $3.71 billion, the reported revenues represent a surprise of +1.3%. The EPS surprise was +6.52%.

The company beat consensus EPS estimates in each of the trailing four quarters. The company topped consensus revenue estimates each time over this period.

Without considering a stock's valuation, no investment decision can be efficient. In predicting a stock's future price performance, it's crucial to determine whether its current price correctly reflects the intrinsic value of the underlying business and the company's growth prospects.

While comparing the current values of a company's valuation multiples, such as price-to-earnings (P/E), price-to-sales (P/S) and price-to-cash flow (P/CF), with its own historical values helps determine whether its stock is fairly valued, overvalued, or undervalued, comparing the company relative to its peers on these parameters gives a good sense of the reasonability of the stock's price.

The Zacks Value Style Score (part of the Zacks Style Scores system), which pays close attention to both traditional and unconventional valuation metrics to grade stocks from A to F (an An is better than a B; a B is better than a C; and so on), is pretty helpful in identifying whether a stock is overvalued, rightly valued, or temporarily undervalued.

Lam Research is graded D on this front, indicating that it is trading at a premium to its peers. Click here to see the values of some of the valuation metrics that have driven this grade.

Bottom Line

The facts discussed here and much other information on Zacks.com might help determine whether or not it's worthwhile paying attention to the market buzz about Lam Research. However, its Zacks Rank #2 does suggest that it may outperform the broader market in the near term.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lam Research Corporation (LRCX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here . By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service .

New to Zacks? Get started here.

Member Sign In

Don't Know Your Password?

- Zacks #1 Rank

- Zacks Industry Rank

- Zacks Sector Rank

- Equity Research

- Mutual Funds

- Mutual Fund Screener

- ETF Screener

- Earnings Calendar

- Earnings Releases

- Earnings ESP

- Earnings ESP Filter

- Stock Screener

- Premium Screens

- Basic Screens

- Research Wizard

- Personal Finance

- Money Managing

- Real Estate

- Retirement Planning

- Tax Information

- My Portfolio

- Create Portfolio

- Style Scores

- Testimonials

- Zacks.com Tutorial

Services Overview

- Zacks Ultimate

- Zacks Investor Collection

- Zacks Premium

Investor Services

- ETF Investor

- Home Run Investor

- Income Investor

- Stocks Under $10

- Value Investor

- Top 10 Stocks

Other Services

- Method for Trading

- Zacks Confidential

Trading Services

- Black Box Trader

- Counterstrike

- Headline Trader

- Insider Trader

- Large-Cap Trader

- Options Trader

- Short Sell List

- Surprise Trader

- Alternative Energy

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK . If you do not, click Cancel.

Image: Bigstock

Investors Heavily Search Lam Research Corporation (LRCX): Here is What You Need to Know

Lam Research ( LRCX Quick Quote LRCX - Free Report ) is one of the stocks most watched by Zacks.com visitors lately. So, it might be a good idea to review some of the factors that might affect the near-term performance of the stock.

Shares of this semiconductor equipment maker have returned +0.4% over the past month versus the Zacks S&P 500 composite's +2.2% change. The Zacks Semiconductor Equipment - Wafer Fabrication industry, to which Lam Research belongs, has lost 0.1% over this period. Now the key question is: Where could the stock be headed in the near term?

While media releases or rumors about a substantial change in a company's business prospects usually make its stock 'trending' and lead to an immediate price change, there are always some fundamental facts that eventually dominate the buy-and-hold decision-making.

Earnings Estimate Revisions

Here at Zacks, we prioritize appraising the change in the projection of a company's future earnings over anything else. That's because we believe the present value of its future stream of earnings is what determines the fair value for its stock.

We essentially look at how sell-side analysts covering the stock are revising their earnings estimates to reflect the impact of the latest business trends. And if earnings estimates go up for a company, the fair value for its stock goes up. A higher fair value than the current market price drives investors' interest in buying the stock, leading to its price moving higher. This is why empirical research shows a strong correlation between trends in earnings estimate revisions and near-term stock price movements.

For the current quarter, Lam Research is expected to post earnings of $7.23 per share, indicating a change of +3.4% from the year-ago quarter. The Zacks Consensus Estimate remained unchanged over the last 30 days.

The consensus earnings estimate of $28.88 for the current fiscal year indicates a year-over-year change of -15.5%. This estimate has remained unchanged over the last 30 days.

For the next fiscal year, the consensus earnings estimate of $34.62 indicates a change of +19.9% from what Lam Research is expected to report a year ago. Over the past month, the estimate has remained unchanged.

Having a strong externally audited track record , our proprietary stock rating tool, the Zacks Rank, offers a more conclusive picture of a stock's price direction in the near term, since it effectively harnesses the power of earnings estimate revisions. Due to the size of the recent change in the consensus estimate, along with three other factors related to earnings estimates , Lam Research is rated Zacks Rank #2 (Buy).

The chart below shows the evolution of the company's forward 12-month consensus EPS estimate:

12 Month EPS

Projected Revenue Growth

While earnings growth is arguably the most superior indicator of a company's financial health, nothing happens as such if a business isn't able to grow its revenues. After all, it's nearly impossible for a company to increase its earnings for an extended period without increasing its revenues. So, it's important to know a company's potential revenue growth.

For Lam Research, the consensus sales estimate for the current quarter of $3.71 billion indicates a year-over-year change of -4.2%. For the current and next fiscal years, $14.72 billion and $16.89 billion estimates indicate -15.5% and +14.7% changes, respectively.

Last Reported Results and Surprise History

Lam Research reported revenues of $3.76 billion in the last reported quarter, representing a year-over-year change of -28.8%. EPS of $7.52 for the same period compares with $10.71 a year ago.

Compared to the Zacks Consensus Estimate of $3.71 billion, the reported revenues represent a surprise of +1.3%. The EPS surprise was +6.52%.

The company beat consensus EPS estimates in each of the trailing four quarters. The company topped consensus revenue estimates each time over this period.

Without considering a stock's valuation, no investment decision can be efficient. In predicting a stock's future price performance, it's crucial to determine whether its current price correctly reflects the intrinsic value of the underlying business and the company's growth prospects.

While comparing the current values of a company's valuation multiples, such as price-to-earnings (P/E), price-to-sales (P/S) and price-to-cash flow (P/CF), with its own historical values helps determine whether its stock is fairly valued, overvalued, or undervalued, comparing the company relative to its peers on these parameters gives a good sense of the reasonability of the stock's price.

The Zacks Value Style Score (part of the Zacks Style Scores system), which pays close attention to both traditional and unconventional valuation metrics to grade stocks from A to F (an An is better than a B; a B is better than a C; and so on), is pretty helpful in identifying whether a stock is overvalued, rightly valued, or temporarily undervalued.

Lam Research is graded D on this front, indicating that it is trading at a premium to its peers. Click here to see the values of some of the valuation metrics that have driven this grade.

Bottom Line

The facts discussed here and much other information on Zacks.com might help determine whether or not it's worthwhile paying attention to the market buzz about Lam Research. However, its Zacks Rank #2 does suggest that it may outperform the broader market in the near term.

See More Zacks Research for These Tickers

Normally $25 each - click below to receive one report free:.

Lam Research Corporation (LRCX) - free report >>

Published in

This file is used for Yahoo remarketing pixel add

Due to inactivity, you will be signed out in approximately:

Lam Research (LRCX) Expands Portfolio With New PLD System

Lam Research LRCX recently unveiled a pulsed laser deposition (PLD) system, namely Pulsus.

Notably, this production-oriented PLD tool uses advanced technology to deposit high-quality films with at least 40% scandium content, offering enhanced sensitivity and better performance for next-generation MEMS-based microphones and RF filters.

Further, the PLD tool enables the replacement of lead zirconate titanate with lead-free AlScN and offers high film uniformity and quality at a lower cost per wafer than conventional methods, aiding chipmakers in increasing manufacturing yields and accelerating product roadmaps for AR/VR and quantum computing applications.

Lam Research is expected to gain solid traction across advanced consumer and automotive devices on the back of its latest launch.

Moreover, it will enable the company to capitalize on growth opportunities present in the global PLD systems market. Per a RationalStat report, the global PLD systems market is expected to witness a CAGR of 7.8% between 2023 and 2030.

Lam Research Corporation Price and Consensus

Lam Research Corporation price-consensus-chart | Lam Research Corporation Quote

Expanding Portfolio

The latest move is in sync with Lam Research’s increasing efforts to strengthen its overall portfolio, which remains a key growth catalyst for the company. Its shares have gained 22.6% in the year-to-date period, outperforming the Zacks Computer & Technology sector’s growth of 11.5%.

In this regard, the company’s introduction of its Semiverse Solutions portfolio remains noteworthy. The portfolio includes software platforms for process modeling, design automation, and simulations, creating a virtual nanofabrication environment to speed up and reduce the cost of industry breakthroughs.

Further, LRCX is benefiting from strong momentum across its Coronus DX solution, the first bevel deposition solution for next-generation logic, 3D NAND and advanced packaging applications.

This innovative solution deposits a protective film on wafer edges, preventing defects and damage, increasing yield and enabling chipmakers to implement advanced processes for next-generation chips.

To Conclude

All the above-mentioned endeavors to bolster its portfolio strength will likely aid Lam Research in strengthening its overall financial performance in the upcoming period.

However, weakness in the systems business, primarily due to sluggish memory spending, remains a major concern for the company.

The Zacks Consensus Estimate for fiscal 2024 total revenues is pegged at $14.72 billion, implying a year-over-year decline of 15.5%.

The consensus mark for earnings for fiscal 2024 stands at $28.88 per share, indicating a fall of 15.5% from the year-ago quarter’s reported figure.

Zacks Rank & Other Stocks to Consider

Currently, Lam Research carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the broader technology sector are Airbnb ABNB, Badger Meter BMI and AMETEK AME, each carrying a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Shares of Airbnb have gained 22.2% in the year-to-date period. The long-term earnings growth rate for ABNB is 16.85%.

Shares of Badger Meter have increased 4.3% in the year-to-date period. The long-term earnings growth rate for BMI is 12.27%.

Shares of AMETEK have gained 11.4% in the year-to-date period. The long-term earnings growth rate for AME is 9.19%.

To read this article on Zacks.com click here.

Lam Research (LRCX) Expands Portfolio With New PLD System

Notably, this production-oriented PLD tool uses advanced technology to deposit high-quality films with at least 40% scandium content, offering enhanced sensitivity and better performance for next-generation MEMS-based microphones and RF filters.

Further, the PLD tool enables the replacement of lead zirconate titanate with lead-free AlScN and offers high film uniformity and quality at a lower cost per wafer than conventional methods, aiding chipmakers in increasing manufacturing yields and accelerating product roadmaps for AR/VR and quantum computing applications.

Lam Research is expected to gain solid traction across advanced consumer and automotive devices on the back of its latest launch.

Moreover, it will enable the company to capitalize on growth opportunities present in the global PLD systems market. Per a RationalStat report, the global PLD systems market is expected to witness a CAGR of 7.8% between 2023 and 2030.

Lam Research Corporation Price and Consensus

Lam Research Corporation price-consensus-chart | Lam Research Corporation Quote

Expanding Portfolio

The latest move is in sync with Lam Research’s increasing efforts to strengthen its overall portfolio, which remains a key growth catalyst for the company. Its shares have gained 22.6% in the year-to-date period, outperforming the Zacks Computer & Technology sector’s growth of 11.5%.

In this regard, the company’s introduction of its Semiverse Solutions portfolio remains noteworthy. The portfolio includes software platforms for process modeling, design automation, and simulations, creating a virtual nanofabrication environment to speed up and reduce the cost of industry breakthroughs.

Further, LRCX is benefiting from strong momentum across its Coronus DX solution, the first bevel deposition solution for next-generation logic, 3D NAND and advanced packaging applications.

This innovative solution deposits a protective film on wafer edges, preventing defects and damage, increasing yield and enabling chipmakers to implement advanced processes for next-generation chips.

To Conclude

All the above-mentioned endeavors to bolster its portfolio strength will likely aid Lam Research in strengthening its overall financial performance in the upcoming period.

However, weakness in the systems business, primarily due to sluggish memory spending, remains a major concern for the company.

The Zacks Consensus Estimate for fiscal 2024 total revenues is pegged at $14.72 billion, implying a year-over-year decline of 15.5%.

The consensus mark for earnings for fiscal 2024 stands at $28.88 per share, indicating a fall of 15.5% from the year-ago quarter’s reported figure.

Zacks Rank & Other Stocks to Consider

Currently, Lam Research carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the broader technology sector are Airbnb ABNB, Badger Meter BMI and AMETEK AME, each carrying a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Shares of Airbnb have gained 22.2% in the year-to-date period. The long-term earnings growth rate for ABNB is 16.85%.

Shares of Badger Meter have increased 4.3% in the year-to-date period. The long-term earnings growth rate for BMI is 12.27%.

Shares of AMETEK have gained 11.4% in the year-to-date period. The long-term earnings growth rate for AME is 9.19%.

Zacks Investment Research

- History of cooperation

- Areas of cooperation

- Procurement policy

- Useful links

- Becoming a supplier

- Procurement

- Rosatom newsletter

© 2008–2024Valtiollinen Rosatom-ydinvoimakonserni

- Rosatom Global presence

- Rosatom in region

- For suppliers

- Preventing corruption

- Press centre

Rosatom Starts Life Tests of Third-Generation VVER-440 Nuclear Fuel

- 16 June, 2020 / 13:00

This site uses cookies. By continuing your navigation, you accept the use of cookies. For more information, or to manage or to change the cookies parameters on your computer, read our Cookies Policy. Learn more

NS Energy is using cookies

We use them to give you the best experience. If you continue using our website, we'll assume that you are happy to receive all cookies on this website.

We have recently upgraded our technology platform. Due to this change if you are seeing this message for the first time please make sure you reset your password using the Forgot your password Link .

ROSATOM starts production of rare-earth magnets for wind power generation

Power Wind Plant

By NS Energy Staff Writer 06 Nov 2020

The first sets of magnets have been manufactured and shipped to the customer

Project Gallery

ROSATOM starts production of rare-earth magnets for wind power generation. (Credit: The State Atomic Energy Corporation ROSATOM.)

TVEL Fuel Company of ROSATOM has started gradual localization of rare-earth magnets manufacturing for wind power plants generators. The first sets of magnets have been manufactured and shipped to the customer.

In total, the contract between Elemash Magnit LLC (an enterprise of TVEL Fuel Company of ROSATOM in Elektrostal, Moscow region) and Red Wind B.V. (a joint venture of NovaWind JSC and the Dutch company Lagerwey) foresees manufacturing and supply over 200 sets of magnets. One set is designed to produce one power generator.

“The project includes gradual localization of magnets manufacturing in Russia, decreasing dependence on imports. We consider production of magnets as a promising sector for TVEL’s metallurgical business development. In this regard, our company does have the relevant research and technological expertise for creation of Russia’s first large-scale full cycle production of permanent rare-earth magnets,” commented Natalia Nikipelova, President of TVEL JSC.

“NovaWind, as the nuclear industry integrator for wind power projects, not only made-up an efficient supply chain, but also contributed to the development of inter-divisional cooperation and new expertise of ROSATOM enterprises. TVEL has mastered a unique technology for the production of magnets for wind turbine generators. These technologies will be undoubtedly in demand in other areas as well,” noted Alexander Korchagin, Director General of NovaWind JSC.

Source: Company Press Release

IMAGES

COMMENTS

Breakthrough isn't just a product. It's a process. Making semiconductors is a highly complex and iterative process. And as technology gets smaller, we think bigger meeting the challenges of precision control at the atomic scale. For every innovative product you see, we're already thinking… what's next?

Lam Research Corporation is an American supplier of wafer-fabrication equipment and related services to the semiconductor industry. Its products are used primarily in front-end wafer processing, which involves the steps that create the active components of semiconductor devices (transistors, capacitors) and their wiring (interconnects). ...

Find the latest Lam Research Corporation (LRCX) stock quote, history, news and other vital information to help you with your stock trading and investing.

Lam Research Corporation is a global supplier of innovative wafer fabrication equipment and services to the semiconductor industry. Lam's equipment and services allow customers to build smaller and better performing devices. In fact, today, nearly every advanced chip is built with Lam technology. We combine superior systems engineering ...

Lam Named Among the World's Most Admired Companies. Kelly Lymberopoulos. Feb 5, 2024. |. Corporate. Lam Research has once again been named as one of Fortune 's World's Most Admired Companies. This year, Lam ranked fourth on the global semiconductor industry rankings and #183 overall.

Lam Research Corporation Declares Quarterly Dividend. Lam Research Corporation (Nasdaq: LRCX) today announced that its Board of Directors has approved a quarterly dividend of $2.00 per share of common stock. The dividend payment will be made on April...

About Lam Research Lam Research Corporation is a global supplier of innovative wafer fabrication equipment and services to the semiconductor industry. Lam's equipment and services allow customers to build smaller and better performing devices. In fact, today, nearly every advanced chip is built with Lam technology. ...

About Lam Research Lam Research Corporation (NASDAQ: LRCX) is a global supplier of innovative wafer fabrication equipment and services to the semiconductor industry. Lam's equipment and services allow customers to build smaller and better performing devices. In fact, today, nearly every advanced chip is built with Lam technology.

Lam Research Corp. It operates through the following geographical segments: the United States, China, Europe, Japan, Korea, Southeast Asia, and Taiwan. The company was founded by David K. Lam in ...

Lam Research Corporation is an American supplier of wafer-fabrication equipment and related services to the semiconductor industry. Its products are used primarily in front-end wafer processing ...

Lam Research Corporation is a global supplier of innovative wafer fabrication equipment and services to the semiconductor industry. Lam's equipment and services allow customers to build smaller and better performing devices. In fact, today, nearly every advanced chip is built with Lam technology. We combine superior systems engineering ...

About Lam Research. Lam Research Corporation is a global supplier of innovative wafer fabrication equipment and services to the semiconductor industry. Lam's equipment and services allow customers to build smaller and better performing devices. In fact, today, nearly every advanced chip is built with Lam technology.

For the current quarter, Lam Research is expected to post earnings of $7.23 per share, indicating a change of +3.4% from the year-ago quarter. The Zacks Consensus Estimate remained unchanged over ...

Lam Research reported revenues of $3.76 billion in the last reported quarter, representing a year-over-year change of -28.8%. EPS of $7.52 for the same period compares with $10.71 a year ago.

Lam Research Corporation is a global supplier of innovative wafer fabrication equipment and services to the semiconductor industry. Lam's equipment and services allow customers to build smaller ...

Start Your 30-Day Free Trial. Chicago Capital LLC acquired a new position in Lam Research Co. (NASDAQ:LRCX - Free Report) during the 4th quarter, according to its most recent filing with the SEC. The fund acquired 1,882 shares of the semiconductor company's stock, valued at approximately $1,474,000. Several other institutional.

Lam Research LRCX recently unveiled a pulsed laser deposition (PLD) system, namely Pulsus. Notably, this production-oriented PLD tool uses advanced technology to deposit high-quality films with at ...

Lam Research Corporation price-consensus-chart | Lam Research Corporation Quote. Expanding Portfolio. The latest move is in sync with Lam Research's increasing efforts to strengthen its overall portfolio, which remains a key growth catalyst for the company. Its shares have gained 22.6% in the year-to-date period, outperforming the Zacks ...

16 June, 2020 / 13:00. 10 704. OKB Gidropress research and experiment facility, an enterprise of Rosatom machinery division Atomenergomash, has started life tests of a mock-up of the third-generation nuclear fuel RK3+ for VVER-440 reactors. The work is carried out within the contract between TVEL Fuel Company of Rosatom and Czech power company ...

TVEL Fuel Company of ROSATOM has started gradual localization of rare-earth magnets manufacturing for wind power plants generators. The first sets of magnets have been manufactured and shipped to the customer. In total, the contract between Elemash Magnit LLC (an enterprise of TVEL Fuel Company of ROSATOM in Elektrostal, Moscow region) and Red ...

Environmental Health & Safety. 2050 Net Zero Strategy. Responsible Supply Chain. Our Communities. Sustainable Operations. Sustainable Product Innovation. Lam Research ESG Report. Subsidiaries. Silfex.

Today, Elemash is one of the largest TVEL nuclear fuel production companies in Russia, specializing in fuel assemblies for nuclear power plants, research reactors, and naval nuclear reactors. Its fuel assemblies for RBMK, VVER, and fast reactors are used in 67 reactors worldwide. 2 It also produced MOX fuel assemblies for the BN-800 and the ...

Valuable research and technology reports. Get a D&B Hoovers Free Trial. Financial Data. Dun & Bradstreet collects private company financials for more than 23 million companies worldwide. Find out more. Get a D&B credit report on this company . Get a D&B credit report on this company .