How the US-China Trade War Affected the Rest of the World

U pendin g a decades-long effort to reduce global trade barriers, China and the United States began mutually escalating tariffs on $450 billion in trade flows in 2018 and 2019. These tariff increases reduced trade between the US and China, but little is known about how trade was affected in the rest of the world.

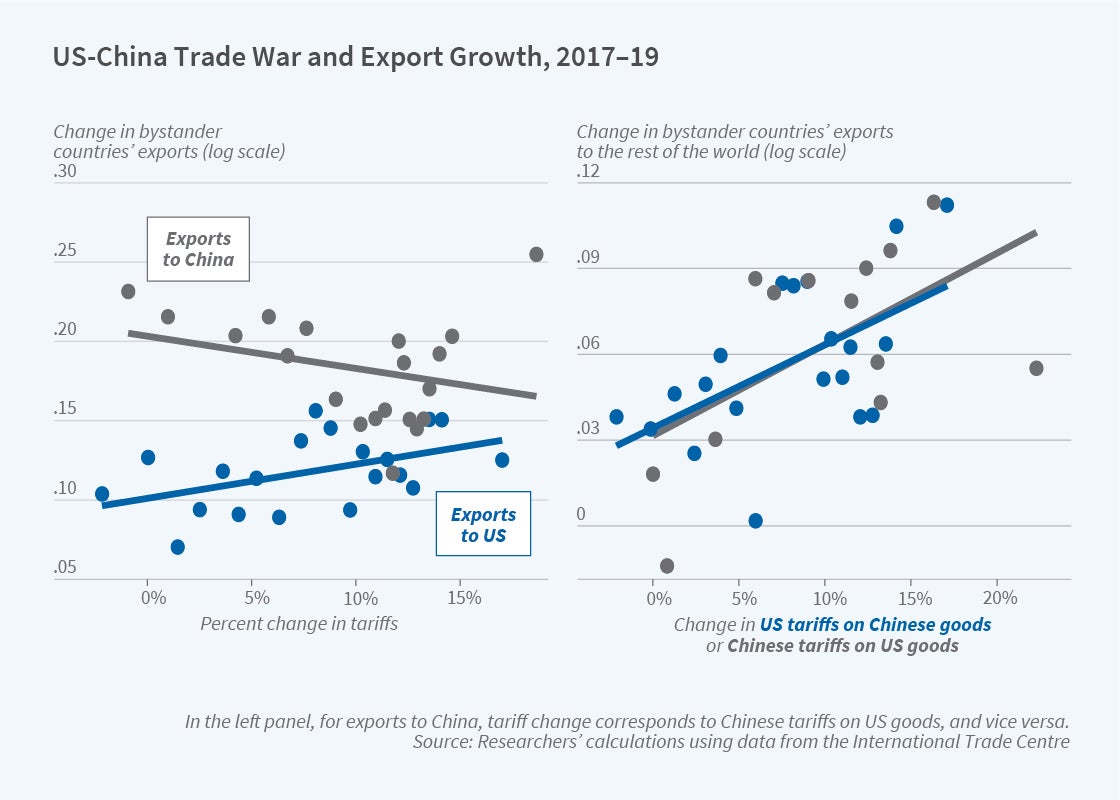

In The US-China Trade War and Global Reallocations (NBER Working Paper 29562 ), Pablo Fajgelbaum , Pinelopi K. Goldberg , Patrick J. Kennedy , Amit Khandelwal , and Daria Taglioni find that the trade war created trade opportunities for other nations and increased overall global trade by 3 percent. Export growth was stronger, on average, in countries with larger shares of their exports governed by strong trade agreements, and in countries with more foreign direct investment.

While the US and China largely taxed each other and depressed their bilateral trade flows, bystander countries increased their exports to the US and the rest of the world and global trade increased overall.

In 2018 and 2019, the US raised tariffs on imports from China. It also raised tariffs on a subset of products from other countries, mainly in machinery and metals. China retaliated and imposed tariffs on imports from the US. At the same time, it also lowered tariffs on imports from the rest of the world. The tariff increases were a major departure from long-run trends towards tariff liberalization across the globe.

To analyze the impact of these four sets of tariff changes on global trade, the researchers match the tariffs’ movements to global bilateral trade data from the International Trade Centre for the top 50 exporting countries, excluding oil exporters. Their analysis compares the export growth across products that were subject to different tariff increases by the US or China.

The US and China reduced exports of products subject to increased tariffs. US exports to China fell by 26.3 percent while exports to the rest of the world increased modestly, by 2.2 percent. China’s exports to the US declined by 8.5 percent and its exports to the rest of the world rose by a statistically insignificant 5.5 percent. The researchers further find that trade in the products targeted by the tariffs increased among bystander countries. These nations did more than reallocate global trade flows across destinations; their overall exports to the world increased. Because of this response from the rest of the world, on net, they calculate that the trade war raised global trade by 3 percent.

The researchers find that the winners and losers in the trade war are explained primarily by heterogeneity in exporters’ responses to trade-war-induced price changes, rather than by specialization patterns. Many of the countries with strong export growth were operating along downward sloping supply curves and selling products that substituted for those previously supplied by the US or China. The countries that benefited the most were those with a high degree of international integration, as proxied by their participation in trade agreements and foreign direct investment. France, for example, increased its exports both to the US and to the rest of the world in response to the tariffs. Spain increased its exports to the US, but its exports to the rest of the world shrank. In South Africa and the Philippines, the tariff increases reduced both exports to the US and exports to the rest of the world. Statistically significant increases in bystander countries’ exports in response to the tariffs occurred in 19 of the 48 countries in the data sample. One country reported a statistically significant decrease; there were no statistically significant impacts in the remaining 28 countries.

— Linda Gorman

Researchers

NBER periodicals and newsletters may be reproduced freely with appropriate attribution.

More from NBER

In addition to working papers , the NBER disseminates affiliates’ latest findings through a range of free periodicals — the NBER Reporter , the NBER Digest , the Bulletin on Retirement and Disability , the Bulletin on Health , and the Bulletin on Entrepreneurship — as well as online conference reports , video lectures , and interviews .

© 2023 National Bureau of Economic Research. Periodical content may be reproduced freely with appropriate attribution.

WORLD TRADE ORGANIZATION

Home | About WTO | News & events | Trade topics | WTO membership | Documents & resources | External relations

Contact us | Site map | A-Z | Search

español français

- research and analysis

- working papers

RESEARCH AND ANALYSIS: WORKING PAPERS

An economic analysis of the US-China trade conflict

This paper provides an economic analysis of the trade conflict between the US and China, providing an overview of the tariff increases, a discussion of the background of the trade conflict, and an analysis of the economic effects of the trade conflict, based both on empirics (ex post analysis) and on simulations (ex ante analysis).

> Guide to downloading files

Bilateral tariffs have increased on average to 17% between the US and China, and the Phase One Agreement signed in January 2020 between the two countries only leads to minor reductions in the tariffs to 16%. The trade conflict has led to a sizeable reduction in trade between the US and China in 2019 and is accompanied by considerable trade diversion to imports from other regions, leading to a reorganization of value chains in (East) Asia. The simulation analysis shows that the direct effects of the tariff increases on the global economy are limited (0.1% reduction in global GDP). The impact of the Phase One Agreement on the global economy is even smaller, although the US is projected to turn real income losses into real income gains because of the Chinese commitments to buy additional US goods. The biggest impact of the trade conflict is provoked by rising uncertainty about trade policy and the paper provides a framework to analyze the uncertainty effects.

No: ERSD-2020-04

Authors: Eddy Bekkers and Sofia Schroeter

Manuscript date: February 2020

Trade conflict, Economic simulations, Trade effects of tariffs

JEL classification numbers:

F12, F13, F14, F17

Disclaimer

This is a working paper, and hence it represents research in progress. The opinions expressed in this paper are those of its author. They are not intended to represent the positions or opinions of the WTO or its members and are without prejudice to members' rights and obligations under the WTO. Any errors are attributable to the author.

Download paper in pdf format (36 pages, 662KB; opens in a new window)

This website uses cookies in order to provide you the most relevant information. Please accept cookies for better performance. Read more »

Trade War Between China and US History Analysis Essay Example

The trade relationship between the USA and China are going through a difficult period. Over the last decades, the United States was a trade leader in the world market. Despite this, China is steadily gaining momentum and in just a few decades has become one of the major trade rivals of the United States of America. In the conditions of the globalization, US-Sino trade operations have reached the huge turnovers, and their commercial ties expanded significantly.

What’s at stake in US-China trade war

The trading volumes between 1979 and 2010 have increased from $2 billion to $457 billion. China is the third largest market for exports and the largest importer to the United States. Since the growth rate of Chinese imports in the US was much higher than the growth of US exports to China, the US trade deficit with China rose from $10 billion in 1990 to $273 billion in 2010 (Morrison, 2011).

There are numerous issues concerning the US-Sino trade relations that disturb many politicians and American citizens. However, Chinese citizens and politicians are also wary of the US actions. Nevertheless, the US-China trade relations are officially recognized as a mutually beneficial partnership. In fact, the trade cooperation flows smoothly into a trade war, which is conducted under the elegant cover of tolerance, cooperation, and community.

Your Best Essay Is Just One Click Away!

Therefore, this paper attempts:.

- to address the causes of a trade war between the US and China;

- to analyze the main points of conflict between the studied countries;

- to assess the one who acts dishonestly and whose actions are forced.

A methodology of the analysis and synthesis will be applied for given research. The paper will disclose a theme of the trade war between China and the USA in the context of several issues, find the reasons and the consequences of the actions on each issue and sum up the results of the analysis into the conclusion. The sources with the variety of points of view will be used in the study, and the analysis of some of them will be conducted. On the basis of the analyzed sources, a unanimous opinion on the US-China trade relations will be formulated and comments given on this issue.

The Reasons and Premises of Occurrence of the Conflict

There has always been, is and will be the winners and the losers, the leaders and the outsiders in the politico-economic game. As in any other game, leaders will always try to maintain their position, and their nearest rivals to oust the favorites to add the championship. Today, the economic situation in the world is that the United States is a leader, and China is a rapidly developing rival, who is rapidly approaching the leader and causes many inconveniences.

Order-Essays.com Offers Great PowerPoint Presentation Help!

We will create the best slides for your academic paper or business project!

The peculiarity of the Chinese economy is that it remains at the stage of the rapid growth. Based on the enormous resources that China has, this growth has reached the global proportions. The nature of the development process is that it is practically impossible to maintain the status quo for a long time. A subject develops or is degraded. There is no third. Therefore, China has to expand its activities not to have their development reversed. It is a natural process, and it should be understood. In turn, the United States is at the stage of the maturity. It means that the development is slowed down, and the task of the US is to hold the accumulated power. These two states can be compared to the tiger and the elephant. China looks like a tiger – fast, strong and agile. The US reminds an elephant – large, powerful, and dangerous, but hulking. Under these conditions, the conflict between the US and China is inevitable. For China, the United States is a hindrance to development. For the US, China is a dangerous competitor, threatening the present state of affairs.

Sensing a potential threat, the United States began to act in the post-war period. Until 1972, the US was trying to contain and isolate China.

It made the following steps to reach the goal:

- the United States established a trade embargo against mainland China;

- the United States supported the development of the Japanese army (a strategic adversary of China);

- the USA intervened in the Korean War;

- the USA supported the regime of Chiang Kai-shek in Taiwan;

- American government supported Tibetan guerrillas, who tried to get out of the Chinese control (Nathan & Scobell, 2012).

In general, a conflict arose due to the objective reasons, and the ways out of this situation depend only on the decisions of the leaderships of both countries.

Bilateral economic relations have always been a source of beneficial collaboration for both sides, but with time, the relationship between China and the United States are becoming increasingly lopsided. China uses its advantages and monetary policies to increase exports. It opens access to its domestic market in exchange for the foreign technology. In addition, Chinese companies are participating in the mass theft of the intellectual property (Friedberg, 2012). Economic relations between Washington and Beijing are quite complex. Fast-growing Chinese population and a rapidly growing economy have made China a great market for the US exports. In the recent years, China has been the fastest-growing export market for the United States. In turn, the US imports cheap Chinese goods that bring benefits to end consumers by increasing their purchasing power. Both US import and export are growing, but the US trade deficit with China is increasing rapidly.

American firms also use the Chinese market for the manufacture and final assembly of its products. It helps to reduce costs and offer competitive prices in the world market. At the same time, many American manufacturers complain of “unfair” competition on the part of Beijing, which is the understatement of the price of Chinese products. They argue that China contributes to the displacement of production capacity of American companies in Asia. As a result, thousands of Americans are losing their jobs (Morrison, 2011). Many politicians also express their fears that China buying the US securities for nearly one trillion dollars can serve an instrument for affecting the United States by Beijing. In the process of economic and political development in China, the country has not fully switched to a free market economy. Too many sectors of the economy in China are still controlled and regulated by the government. It causes the negative comments of many politicians and economists, as well as the supporters of a free-market economy. In addition, this fact more and more increases the friction between Beijing and Washington on many issues (Morrison, 2011).

Among them are the following:

- the issue of fixing and understating of the Chinese currency, the requirements allow the Yuan to rise to the real market level;

- the issue of partial compliance with Beijing’s WTO obligations;

- the issue of piracy is rampant in China as well as the lack of security of intellectual property;

- the issue of China’s industrial policy and policy of public procurement, in which the Chinese government protects

Chinese firms by the discrimination of foreign companies

Perhaps one of the most vulnerable areas of the US economy to the impact of the Chinese offensive is the labor market. Ordinary Americans primarily benefit from cheap Chinese imports, but at the same time, they are the first to suffer from it indirectly. The relocation of the US companies on the Chinese market, on the one hand, allows reducing the price of products that Americans are more advantageous to buy, but, on the other hand, Americans are losing their jobs. Local American labor markets are forced to confront the Chinese imports. The most sensitive areas of industry to the impact of cheap Chinese products are manufacturing of footwear, textiles and furniture (David, Dorn, & Hanson, 2013).

Allegations of unfair Chinese trade deal with many important sectors of American industry, including high-tech and eco-technologies. In 2011, the Solar World and six other US manufacturers of solar batteries and modules sued Chinese companies producing similar equipment. The plaintiff argued that the defendant had received unfair subsidies from the Chinese government, which allowed them to understate the price for the products of the transformation of solar energy greatly and sell it to the American market at the “unfair” value. The plaintiff argued that it could seriously harm the American solar manufacturing industry, which is already going through hard times. As a result, the US Commerce Department and International Trade Committees approved the import duties on Chinese solar processing production from 31% to 250%. This trial has brought discord into the US solar manufacturing industry. Hardware manufacturers consider duties necessary to protect American industry. However, installers disagree with it. They argue that such measures would hinder the installation sector. Others do not believe that the measures taken will effect on the Chinese producers since they still have options for delivery of their products, using a loophole in the law. They could collect the modules from foreign units of solar cells and deliver them to the United States duty-free (Darby, 2014).

Today, China produces about forty percent of furniture sold in the United States. In addition, certain types of metal are sold by China at low prices. It made the United States establish anti-dumping duties with the aim to protect domestic producers. Speaking of the textile industry, there are about 30 thousand exporters of textile products in China. The textile industry was the first in China where the Internet was used for sale transactions. After the US producers complained that Chinese products are destroying the American market, the US Department of Commerce has established “safe” limits on imports of Chinese textile products. At the same time, there is also an issue of extensive piracy of intellectual property in China. This problem entails the loss by American companies from 2.5 to 4 billion dollars annually. Although the law on the protection of intellectual property exists in China, its implementation is not properly controlled. As a result, Chinese companies massively use trademarks, patents, copyrights and technology, the rights to which they did not purchase. In China, the penalty for such crimes is too soft to be effective (Hughes, 2005).

One of the examples of China’s global trade policy is the purchase of IBM by the biggest Chinese computer maker Lenovo Group. This trading operation had a great psychological effect on Americans, as IBM has been the icon of the American business for a half a century. Although, Lenovo Group with the purchase of IBM has not acquired significant new technologies, this operation has caused a suspicion in the American politicians. They concern that China is trying to gain control of the key assets and technologies and that the 1.76 billion IBM-Lenovo deal is one of the many Chinese acquisitions committed to obtaining this control (Hughes, 2005).

While China attacks, the US has to take the defensive measures

Among other complaints, the united states filed a lawsuit at the wto on the following issues:.

- subsidizing of Chinese companies involved in wind energy;

- the introduction of the laws by Beijing that protect domestic manufacturers;

- imposing the restrictions on the electronic payment services.

Some US politicians argue that, given the high unemployment and low pace of development of the US economy, China’s economic policy should not be left without countermeasures. Strict measures are needed to force China to moderate its pace and abandon policies that harm the US economy. If China continues its policy of a rapid increase in exports, it can cause more tension in the US-Chinese conflict and lead to harmful consequences for both sides (Morrison, 2011).

Book The Best Top Expert at our service

Your order will be assigned to the most experienced writer in the relevant discipline. The highly demanded expert, one of our top-10 writers with the highest rate among the customers.

Henry Kissinger (2012) argues that the struggle between the US and China for domination is inevitable, if not already started. At the same time, the US-China cooperation appears outdated and even naive. Even though the results of the negotiations of the Doha Round of the WTO admit that the relations between Washington and Beijing continue to deteriorate. The number of complaints from both sides increases rapidly. Trying to protect their domestic producers, the US introduces measures of protectionism. Namely, in 2009, China filed a complaint with the WTO in response to the US plans to impose duties on imports of Chinese tires in America (Loridas, 2011). The US invited China to join the Trans-Pacific Partnership but under the conditions of change of the internal structure of the Chinese economy. Probably, the United States is trying if not to isolate but at least contain the rapid growth of the rival. Under the conditions of joining the Trans-Pacific Partnership, the US requires to make China’s economy not export-oriented but focused on consumption (Kissinger, 2012).

Analyzing the above-mentioned sources, their basic idea can be summarized in the following statement. China is a country with a booming economy, which is actively expanding its business scope, conquering the world markets and often using dishonest methods to attain its goal. The USA is a leader in the world trade and, at the same time, it positions itself the world’s police officer who tries to tame China and force it to play by the rules. The strength of these sources is a clear description of the aggressive actions of Beijing, as well as the countermeasures of the USA. A weakness is a superficial, factual analysis of the US-China relations. These sources did not sufficiently deeply penetrate into the reasons of origin and development of the conflict. In addition, there is a certain degree of bias in these sources as China seems to be the culprit and the United States are presented as a victim.

Analysis of the Issue

The Americans believe that China is stealing their jobs, understating the Yuan and selling their products at unfairly low prices. These aspects certainly have a negative impact on the employment of Americans, but misunderstandings on both sides cause a trade war between China and the United States. However, China is not stealing American jobs. Foreign companies, most of which are American, produce almost 60% of China’s exports to the United States. These companies have relocated their production capacity in response to the competitive pressure to reduce the production costs and, thereby, to offer the best price on the market and higher dividends to its shareholders. Thus, it becomes obvious of who is accusing China of unfair competition, increase exports, and reduced prices. They are the US importers, American consumers who buy Chinese products at low prices, and shareholders of the US companies stationed in China who get their share of the import operations. A long trade war between the US and China will significantly harm all of these categories of the population (Hughes, 2005).

Some critics of China’s trade policies argue that China has huge foreign reserves as a result of direct investment and trade surplus. They believe it is a proof that China understates the Yuan. Therefore, foreign companies that invest in China’s economy make it solely because of cheap labor and cheap currency. Moreover, when binding Yuan to the dollar, the Chinese currency undervaluation provides an unfair export advantage. This unfair advantage, according to critics, is the main cause of the US trade deficit with China. However, foreign business is in China for a very long time. This country has the world’s largest national market and allows the development of any multinational companies (Hughes, 2005).

The reason for such a situation in China is not so much in the manipulating the exchange rate, as in the tight control of the prices and capital. With a free economy, exchange rate pegs to the dollar, and substantial accumulation of foreign currency would lead to a sharp increase in the money supply and inflation. Because the Chinese government regulates the prices of key industries in China, it does not happen. The increase in foreign investment and money supply stimulates the growth of production more and more, leading to overheating of the economy. However, thanks to the control, this process does not trigger inflation. Maintaining a stable Yuan exchange rate is an important task for China’s economy. Therefore, China’s currency does not increase as expected, not because of the artificially low rate by the Chinese government but thanks to the strict control of prices and capital in the key sectors of the economy (Hughes 2005).

Many blame China in the US trade deficit, arguing that the Asian dragon lowers its currency, as well as product prices, causing an excessive demand for Chinese goods in the United States. However, Leightner J.E. (2010) believes that the United States is also guilty (if not more guilty than China) in this. He believes that the problem of the US trade deficit is excessive consumption of Americans. In contrast, one can observe the excessive savings in Chinese. In this case, one satisfies another.

The best way to know how to write good essays is by getting a sample of an essay from competent experts online. We can give you the essay examples you need for future learning.

Free Essay Examples are here .

Speaking about the ways of the conflict Cai, Yan, Lian, & Xin, (2013) consider that the protectionism of the US should be canceled. The authors state that the US and China should increase the trade cooperation. In that case, the cost of the conflict would be too high. However, this opinion seems to be biased and naive. After all, the current conditions of the US-China trade relations are the cause of the conflict. There are several ways to overcome the US-China conflict. Some support the policy of interaction, cooperation, and dialogue. Others prefer mixed methods, namely the use of dialogue when it can be effective in combination with invasive procedures of the WTO. There are also supporters of punitive measures against China as the only effective method to force China to play by the rules (Morrison, 2011)

The United States and China are big world players competing for leadership. The motives of both countries will inevitably lead to a conflict. The USA is still the leader and has a great impact on the world market including China. However, China also has the leverage over the US. Countries that finance the US trade deficit take the US currency and hold it. Thus, the size of the Chinese foreign exchange reserves of $1 trillion corresponds to Chinese goods and services of one trillion dollars in the US market. These $1 trillion dollars is a potential lever of the influence of China on the US economy. If China suddenly decides to sell all of its foreign assets, it will cause a depreciation of the dollar by 44 percent in Asia and Europe. In addition, China may harm the United States in another way. It can cause significant inflation in some sectors of the US economy by using its dollar reserves to buy US goods and services. This advantage of China is due to the fact of the excessive consumption of Americans. Enjoying consumption today, American citizens risk the well-being of future generations who may have to pay for the excessive consumption of its predecessors (Leightner, 2010). To avoid disastrous consequences of the US-China trade war, it is necessary that at least one player would step back if the reaching of the compromise would be failed.

Get a Free Price Quote

Trade War Between the US and China

There is a continuous conflict between China and the US, which is expressed in setting tariffs on one another’s products. In 2018, President Trump imposed tariffs on goods exported from China, stimulating Americans to buy local products, and this policy change became a significant trade barrier (Liu & Woo, 2018). Also, the US accused China of having unfair trade policies and the theft of intellectual property. The forced transition of American technology to China is another policy that is perceived as unfair. In turn, China claims that Trump engages in protectionism and accuses him of curbing the rise of the country as an international economic power. Despite the ongoing negotiations, both parties continue increasing tariffs. For example, in May 2019, the US imposed $200 billion at 25% of goods, and China responded by $60 billion at 25% (Palumbo & da Costa, 2019). This trade war makes a negative impact on the economies of both countries, leading to a trade deficit and higher prices.

For the US, it is possible to recommend achieving agreements on technology transition from the US to China and vice versa, which can be supported by stronger and clearer intellectual property rights. This solution would allow American companies that want to operate in China to have lower tariffs and a more favorable business environment in general. To promote a more balanced trade with China, it can be recommended to avoid a large surplus and deficit in imports compared to exports (Liu & Woo, 2018). Accordingly, the mutual reduction or delay of the imposed tariffs can be seen as another solution to the identified challenge. Although the resolution of the trade war between the US and China seems to be quite complicated, the focus on the mentioned recommendations is likely to be useful for the US.

Liu, T., & Woo, W. T. (2018). Understanding the US-China trade war. China Economic Journal , 11 (3), 319-340.

Palumbo, D., & da Costa, A. N. (2019). Trade war: US-China trade battle in charts . BBC News. Web.

Cite this paper

- Chicago (N-B)

- Chicago (A-D)

StudyCorgi. (2022, March 14). Trade War Between the US and China. https://studycorgi.com/trade-war-between-the-us-and-china/

"Trade War Between the US and China." StudyCorgi , 14 Mar. 2022, studycorgi.com/trade-war-between-the-us-and-china/.

StudyCorgi . (2022) 'Trade War Between the US and China'. 14 March.

1. StudyCorgi . "Trade War Between the US and China." March 14, 2022. https://studycorgi.com/trade-war-between-the-us-and-china/.

Bibliography

StudyCorgi . "Trade War Between the US and China." March 14, 2022. https://studycorgi.com/trade-war-between-the-us-and-china/.

StudyCorgi . 2022. "Trade War Between the US and China." March 14, 2022. https://studycorgi.com/trade-war-between-the-us-and-china/.

This paper, “Trade War Between the US and China”, was written and voluntary submitted to our free essay database by a straight-A student. Please ensure you properly reference the paper if you're using it to write your assignment.

Before publication, the StudyCorgi editorial team proofread and checked the paper to make sure it meets the highest standards in terms of grammar, punctuation, style, fact accuracy, copyright issues, and inclusive language. Last updated: March 14, 2022 .

If you are the author of this paper and no longer wish to have it published on StudyCorgi, request the removal . Please use the “ Donate your paper ” form to submit an essay.

- Interview: Trade war with China "negative for America," says Yale scholar

by Xinhua writers Deng Xianlai, Xu Yuan

WASHINGTON, March 29 (Xinhua) -- The trade war with China "has been a negative for America," as it's a politically motivated and disruptive policy never achieving Washington's goal of eliminating trade deficit, said a Yale University scholar.

"I've been long critical of the belief that the United States or any nation can resolve bilateral trade imbalances (by a trade war) in a multilateral world," Stephen Roach, a senior fellow at the Paul Tsai China Center of Yale Law School, told Xinhua in a recent interview.

Roach said that the persistent shortfall of domestic savings, rather than the practice of U.S. trading partners, is the root cause of Washington running trade deficits with not only China, but also a multitude of other countries around the world.

The lack of domestic savings "remains quite pronounced" to the extent that "our net domestic savings rate was slightly negative last year" after adjusting for depreciation, according to Roach, who, before joining Yale in the 2010s, was chairman of Morgan Stanley Asia.

"Lacking in domestic savings and wanting to invest and grow, we import surplus savings from abroad. And we run these massive multilateral trade deficits to attract the capital," said the economist.

"Did we achieve what we were hoping to do, which is a reduction of our broad trade deficit? Absolutely not," he said of the imposition of tariffs on Chinese goods, which was initiated by former U.S. President Donald Trump in 2018 and largely inherited by his successor, Joe Biden.

Launching a trade war with China, the investor-turned-scholar said, "is a reflection of the unfortunate political dimension of our anti-China bipartisan strategy that Washington has fully embraced. But it has not achieved the broad economic objectives that our politicians promised the American public that would take place."

Notwithstanding the tariffs, China remains "a major source of foreign supply to the United States" as well as "a major destination for U.S. export growth," Roach noted.

"By putting tariffs and other types of sanctions on our largest source of imported products, that's the functional equivalent of attacks on American companies and American consumers," he said, adding that on a "simple basic level, the trade war has been a negative for America."

A big shift in U.S. supply chains occurred in the past few years under the guidance of what was known as the "friendshoring" strategy, Roach said.

He added in a further explanation that in implementing the strategy, the U.S. government asked American companies to divert their supply chains away from countries Washington judged to be either politically or economically "threatening," and "toward nations that are more aligned with our value and political interests."

The United States has exhibited a greater willingness to ensure "national security" than pursue "economic efficiency," Roach said. In so doing, Washington has "put pressure on many nations around the world who have strong trade relationships with both the United States and China to pick sides" when conducting supply chain related activities.

The consequence of the United States strongly advocating for "friendshoring" has been "very disruptive," Roach said.

On the "de-risking" rhetoric promoted by the Biden administration to defuse concerns of a U.S.-China economic "decoupling," Roach said the distinction between the two terms "exists only in words, but not in reality."

Given that the products brought into the world market -- many of them by China -- have become increasingly sophisticated, "I just think it's very hard to draw the line" between de-risking and decoupling, Roach said.

"We are clearly, under the guise of de-risking, advocating a certain amount of decoupling," Roach said. "We're kidding ourselves if (we claim) we're not."

Roach warned against injecting "geopolitical fears" once seen in "great power battle" in the past into the disputes that currently exist between the United States and China, noting that doing so would send the bilateral relationship "on a very slippery slope." Enditem

Go to Forum >> 0 Comment(s)

Add your comments....

- User Name Required

- Your Comment

Technology is fuelling the US-China trade war

U S-China tensions have been rising since the Trump presidency imposed sanctions on Chinese goods in 2018, and are now at a fever-pitch. A new GlobalData report sheds light on what is fuelling the ongoing trade war, and how technology ended up at its centre.

Geopolitics in Tech, Media, & Telecom 2024 argues that the dominant force affecting the sector today is the trade war, with impacts reaching far beyond just the two countries. As each tries to decouple from the other, the processes of onshoring and friendshoring will become increasingly important, providing opportunities for friendly markets closer to each country.

As globalisation accelerated in the post-Cold-War period, offshoring led to Western companies moving much of their manufacturing and customer service work abroad to nations like China and India where wages were lower. Though this is still an integral part of the global economy, geopolitical tensions and increased awareness of issues such as climate change have meant a fundamental shift is taking place.

“The era of hyperglobalisation is over,” the report explains. “We are now moving towards a period of decoupling supply chains. Optimising production costs remains important, but the new order places a higher weight on security and resilience. The fragmentation of US-China relations has bifurcated supply chains and incentivised companies to reshore closer to home markets.”

EU caught between two superpowers

The EU finds itself caught between the two great powers, with its reliance on the US for political and military alliances encouraging the bloc to follow the country’s lead on China policy despite its close economic ties. For instance, the Dutch government banned tech company ASML from exporting machines used in semiconductor manufacture earlier in the year despite the company’s protestations, reportedly at the behest of the US.

The report suggests that the EU’s position, whilst difficult, could allow it to benefit if it sells itself as a neutral third party for companies that find restrictions from either country too damaging to business. It also notes that a Trump victory in 2024 could be detrimental to US-EU relations given the former president’s vocal criticism of aid to Ukraine , a key geopolitical issue for the Europeans. This could encourage lawmakers to think twice about building closer ties to the country.

India stands to benefit from US-China trade war

India has long hoped to draw some of the major outsourced manufacturing from China to its shores, and the trade war offers a golden opportunity, if the country is able to take it. Far-right leader Modi is likely to win a third term later this year, allowing him to continue his Make in India initiative that aims to encourage businesses to do just that.

The country faces hurdles to becoming a manufacturing hub, however, particularly in the tech sector. For one, “significant and urgent improvements to India’s physical infrastructure are necessary—notably to roads, rail, water, and electricity.” The country is also dependent on China for key components used in its manufacturing plants for consumer technology, making a complete decoupling “virtually impossible.”

Latin America will gain from US-China tensions

Latin America is perhaps the region with the most to gain from China-US tensions.

Due to its proximity and historically close – if not always warm – relations with the US, Mexico is “a prime location for friendshoring,” the process of moving manufacturing to friendly nations to minimise the political risks of outsourced production. Though the two countries’ relationship is partially dependent on the outcomes of the Mexican and US 2024 elections, it will remain a viable possibility for moving production throughout the 2020s.

Further south, the lithium mines of Argentina, Chile and Bolivia make them potential kingmakers in any future geopolitical disputes. Lithium is a vital component of batteries, which are only becoming more vital as the green transition continues. However, the three countries have quite different approaches to utilising these resources.

Chile hopes to nationalise its lithium industry, but due to neoliberal reforms made by previous governments in the 20 th century, it is locked into deals with American companies currently in control until the 2040s. Whether geopolitical events will allow the country to break these arrangements – legally or otherwise – remains to be seen, but it is currently unclear how this process would be achieved.

Bolivia on the other hand is allowing FDI from longstanding allies Russia and China, providing key access to the resource. This is particularly important to Russia, which not only lacks a developed domestic lithium industry but also faces heavy sanctions from the west following its invasion of Ukraine in 2022. China has a relatively large lithium industry, but ensuring future access to the massive reserves in South America will provide security in the long term.

Argentina’s approach to global trade has been dramatically altered by new president Javier Milei, who has vowed to move the nation away from trading with China. However, the report notes that the nation’s ongoing economic crisis is likely to soften his stance given the importance of relations to Argentina: “Argentina is highly dependent on China and used the Chinese currency swap line to repay part of its IMF debt in October 2023.

“Chinese mining companies have also increased their presence in the country, with Tibet Summit Resources investing $1.7bn into two new lithium mines in June 2023 and Ganfeng Lithium purchasing an existing mine for $962m in July 2022.”

Despite these opportunities, the potential for decoupling is not limitless. Trade between the US and China still ran to more than half a trillion dollars in 2023 and China remains the largest exporter to the EU . Additionally, the cost-of-living crisis and other major domestic challenges mean that the US is likely to focus on internal politics over foreign affairs during the 2024 election cycle.

Although tensions are fostering an increased awareness of the political risk of being tightly bound to China for trade, it will remain a key trading partner for the West for years to come.

"Technology is fuelling the US-China trade war" was originally created and published by Verdict , a GlobalData owned brand.

The information on this site has been included in good faith for general informational purposes only. It is not intended to amount to advice on which you should rely, and we give no representation, warranty or guarantee, whether express or implied as to its accuracy or completeness. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content on our site.

Baltimore bridge collapse: What happened and what is the death toll?

What is the death toll, when did the baltimore bridge collapse, why did the bridge collapse, who will pay for the damage and how much will the bridge cost.

HOW LONG WILL IT TAKE TO REBUILD THE BRIDGE?

What ship hit the baltimore bridge, what do we know about the bridge that collapsed.

HOW WILL THE BRIDGE COLLAPSE IMPACT THE BALTIMORE PORT?

Get weekly news and analysis on the U.S. elections and how it matters to the world with the newsletter On the Campaign Trail. Sign up here.

Writing by Lisa Shumaker; Editing by Daniel Wallis and Bill Berkrot

Our Standards: The Thomson Reuters Trust Principles. , opens new tab

Thomson Reuters

Lisa's journalism career spans two decades, and she currently serves as the Americas Day Editor for the Global News Desk. She played a pivotal role in tracking the COVID pandemic and leading initiatives in speed, headline writing and multimedia. She has worked closely with the finance and company news teams on major stories, such as the departures of Twitter CEO Jack Dorsey and Amazon’s Jeff Bezos and significant developments at Apple, Alphabet, Facebook and Tesla. Her dedication and hard work have been recognized with the 2010 Desk Editor of the Year award and a Journalist of the Year nomination in 2020. Lisa is passionate about visual and long-form storytelling. She holds a degree in both psychology and journalism from Penn State University.

Russian air defence units downed four Ukrainian drones late on Tuesday over the border region of Kursk and one more over the adjacent Belgorod region, the Russian Defence Ministry said on Telegram.

Sudan on Tuesday suspended the work of Saudi state-owned broadcasters Al Arabiya, Al Hadath and UAE-owned Sky News Arabia channel "due to its lack of commitment to the required professionalism and transparency and failure to renew its licenses", Sudanese state news agency (SUNA) said.

The operator of Kazakhstan's giant offshore Kashagan oilfield denied reports of an oil spill near the field and said on Tuesday its facilities were working normally.

IMAGES

COMMENTS

Summary of working paper 29562. Upending a decades-long effort to reduce global trade barriers, China and the United States began mutually escalating tariffs on $450 billion in trade flows in 2018 and 2019. These tariff increases reduced trade between the US and China, but little is known about how trade was affected in the rest of the world.

February 17, 2023. Credit: Depositphotos. As the largest commercial conflict in modern history, the China-U.S. trade war, launched by then-President Donald Trump almost five years ago, was ...

6.2% to 16.4% on US imports into China. The Phase 1 Agreement between the US and China reduced the tariffs on Chinese imports into the United States to 16%. To limit the scope of the paper, it focuses on the trade tensions between the US and China.1 The tariffs on Chinese imports have been motivated with at least four arguments: (i) address

The trade conflict has led to a sizeable reduction in trade between the US and China in 2019 and is accompanied by considerable trade diversion to imports from other regions, leading to a reorganization of value chains in (East) Asia. The simulation analysis shows that the direct effects of the tariff increases on the global economy are limited ...

In 2018, the United States launched a trade war with China, marking an abrupt departure from its historical leadership in integrating global markets. By late 2019, the United States had imposed tariffs on roughly $350 billion of Chinese imports, and China had retaliated on $100 billion of US exports. Economists have used a diversity of data and methods to assess the impacts of the trade war on ...

Trained in the United States and senior faculty at China's premier Peking University, he has established himself as China's leading authority on international trade and the current China-US trade war. In a series of essays, he puts the current trade war in context and provides a way past the rhetoric and towards dialogue." (Daniel Trefler ...

Abstract This paper studies the current trade war between China and the US from a historical standpoint. By comparing the ongoing trade war with similar trade conflicts in history, we reveal three major causes, with varying degrees of importance, from both economic and political perspectives. The trade war can principally be attributed to trade imbalances, the US midterm elections and rivalry ...

China-US trade war. In a series of essays, he puts the current trade war in context and provides a way past the rhetoric and towards dialogue." —Daniel Trefler, J. Douglas and Ruth Grant Chair Professor, University of Toronto "This is the book on China trade that every China-watcher and every trade economist keeps on her book shelf.

Trade surged: the value of U.S. goods imports from China rose from about $100 billion in 2001 to more than $500 billion in 2022. This leap in imports is due in part to China's critical position ...

a) to reduce the deficit of bilateral trade and increase the number of jobs; b) to limit access of Chinese companies to American technologies and. prevent digital modernization of the industry in ...

Abstract. This article constructs a measure of geopolitical and economic tensions in US-China relations based on the sen-timent expressed in major US news media and utilizes it to analyze the impact of bilateral tensions on US imports from China between 2002 and 2019. Our results suggest that bilateral tensions have had a negative effect on ...

1. Introduction. Since 2018, the ongoing trade war between the United States and China has shaken the world economy. In early 2018, the United States invoked Section 232 of the Trade Expansion Act of 1962 (alleging a national security threat) to increase tariffs on steel and aluminum products, which started U.S. trade disputes with major steel and aluminum exporters including China.

Abstract. The United States declared trade war after substantial defections from the internationalist (in geo-strategy and economics) lobby in U.S. politics to a new coalition between conflict-is-inevitable activists and anti-globalization proponents. Many internationalist businesses changed sides after experiencing disappointments on economic fronts including China's non-compliance with some ...

The ongoing trade war (or at least dispute) between the US and China has its roots in the early 2000s when American politicians and economists started complaining about the US trade deficit with China. Accusing China of wrong-doing, as far as the US trade deficit is concerned, is based on the three propositions that the yuan is undervalued ...

Global GDP amounted to 84.93 trillion in 2018 (Statista, 2019), hence a $600bn hit is a massive counter effect caused by the China-US trade war. Disruptive technologies in the past 20 years have had positive outcomes in society, with the inventions such as the smartphone and the Internet, which have facilitated global networking.

An economic conflict between China and the United States has been ongoing since January 2018, when U.S. President Donald Trump began setting tariffs and other trade barriers on China with the goal of forcing it to make changes to what the U.S. says are longstanding unfair trade practices and intellectual property theft. The Trump administration stated that these practices may contribute to the ...

What's at stake in US-China trade war. The trading volumes between 1979 and 2010 have increased from $2 billion to $457 billion. China is the third largest market for exports and the largest importer to the United States. Since the growth rate of Chinese imports in the US was much higher than the growth of US exports to China, the US trade ...

Despite the ongoing negotiations, both parties continue increasing tariffs. For example, in May 2019, the US imposed $200 billion at 25% of goods, and China responded by $60 billion at 25% (Palumbo & da Costa, 2019). This trade war makes a negative impact on the economies of both countries, leading to a trade deficit and higher prices.

Trade War: A negative side effect of protectionism that occurs when Country A raises tariffs on Country B's imports in retaliation for Country B raising tarrifs on Country A's imports. Trade wars ...

On April 2, China announced tariffs on US goods worth $3 billion on some 130 American products like fruits, nuts, wine and steel pipes, as well as pork and recycled aluminium. What and Why of Trade War. Trade war is a subset of Trade Protectionism. It is a conflict between two or more nations regarding trade tariff imposition on each other's ...

This paper introduces Sino-US trade war and trade situation between them,then research the influences of trade war to China and US,as well as global.We find that it will harm to both sides and other countries,including in economy, trade,diplomacy and many other fields.There will be more harm than benefit.Then we propose some suggestions, deepen the "Belt and Road" construction,improve the ...

Launching a trade war with China, the investor-turned-scholar said, "is a reflection of the unfortunate political dimension of our anti-China bipartisan strategy that Washington has fully embraced.

Power Is the Answer in U.S. Competition With China. A fight for global values demands a stronger coalition. March 31, 2024, 11:10 AM. By Michael Mazza, a senior director at The Project 2049 ...

Trade between the US and China still ran to more than half a trillion dollars in 2023 and China remains the largest exporter to the EU. Additionally, the cost-of-living crisis and other major ...

After the bridge collapse in 2007 in Minnesota, Congress allocated $250 million. Initial estimates put the cost of rebuilding the bridge at $600 million, according to economic analysis company ...