Want to create or adapt books like this? Learn more about how Pressbooks supports open publishing practices.

18.1 Introduction

Learning objectives.

- Understand how corporations are structured and managed.

- Learn about shareholder rights and the powers and liabilities of corporate officers and directors.

- Learn the legal theories under which limited liability is taken away from corporations.

- Comprehend how corporations merge, consolidate, and dissolve.

Corporations are incredibly important to the stability and growth of the US economy. Without corporations, industries such as pharmaceuticals and technology would not be able to raise the capital needed to fund their research and development of new drugs and products. As discussed in Chapter 16, corporations are incorporated under state law and are subject to double taxation. Corporations are separate legal entities from the shareholders who own them.

18.2 Corporate Structure

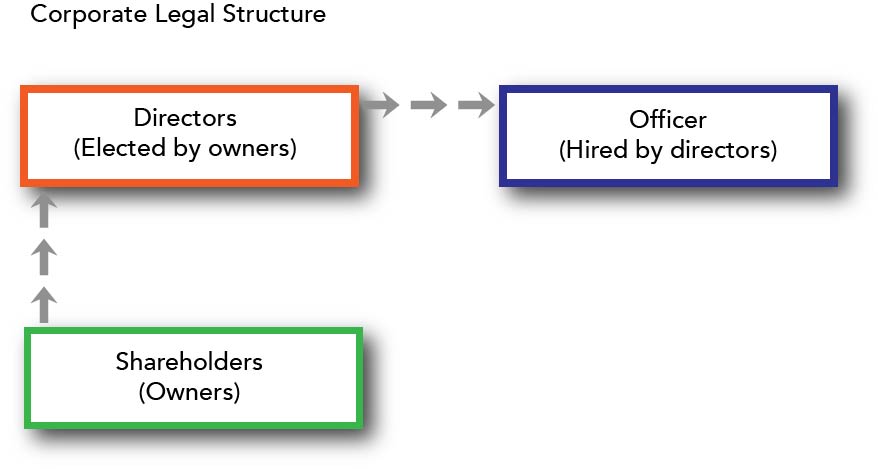

Under most state laws, corporations are required to have at least one director. A director is a person appointed or elected to sit on a board that manages the business of a corporation and supervises its officers. Directors are elected by shareholders and collectively are called the Board of Directors . Directors elect officers , who are responsible for the daily operations of the corporation. Officers often have titles such as president, chief operating officer, chief financial officer, or controller.

Figure 18.1 Corporate Legal Structure

18.3 Shareholder Rights

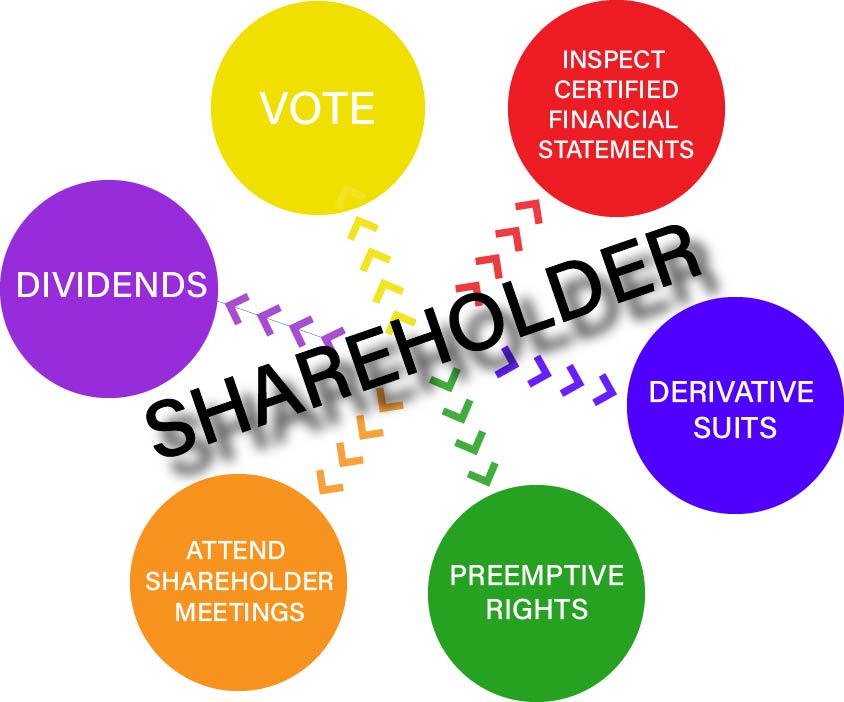

As owners of the corporation, shareholders have specific rights to help them assess their investment decisions. Shareholders are not entitled to manage the day-to-day operations of the business, but they enjoy the following rights.

Figure 18.2 Corporate Shareholder Rights

Shareholders have the right to inspect the certified financial records of a corporation. This right also extends to other information related to exercising their voting privilege and making investment decisions.

The right, however, is limited to good-faith inspections for proper purposes at an appropriate time and place. A proper purpose is one that seeks to protect the interests of both the corporation and the shareholder seeking the information. In other words, the inspection cannot be against the best interest of the corporation.

Courts have held that proper purposes include:

- Reasons for lack of dividend payments or low dividend amounts;

- Suspicion of mismanagement of assets or dividends; and

- Holding management accountable.

Corporations have a legitimate interest in keeping their financial and managerial documents private. Therefore, inspection of documents usually occurs at the corporation’s headquarters during regular business hours. Documents made available for inspection do not have to be allowed off premise if the corporation does not want them to be removed.

Shareholder Meetings

Shareholders have the right to notice and to attend shareholder meetings. Shareholder meetings must occur at least annually, and special meetings may be called to discuss important issues such as mergers, consolidations, change in bylaws, and sale of significant assets. Failure to give proper notice invalidates the action taken at the meeting.

A quorum of shareholders must be present at the meeting to conduct business. A quorum is the minimum number of shareholders (usually a majority) who must be present to take a vote. The corporation’s bylaws define what constitutes a quorum, if not set by state law.

If a shareholder is not able to be physically present during a meeting, he or she may vote by proxy. A proxy is a person authorized to vote on another’s stock shares.

Depending on the type of share owned, shareholders may have the right to vote. In general, shareholders of common stock are entitled to a vote for each share of stock owned. Owners of preferred stock often do not have a voting right in exchange for a higher dividend amount or preference in receiving dividends.

Common issues that shareholders vote on include:

- Election of directors;

- Mergers, consolidations, and dissolutions;

- Change of bylaws;

- Change in major corporate policies; and

- Sale of major assets.

Preemptive Rights

The Preemptive right is a shareholder’s privilege to buy newly issued stock in the corporation before the shares are offered to the public. Shareholders are allowed to buy shares in an amount proportionate to their current holdings to prevent dilution of the existing ownership interests.

Preemptive rights usually must be exercised within thirty to sixty days of being offered. This allows the corporation to complete the sale to shareholders before offering any remaining shares to the public.

Derivative Suit

A derivative suit is a lawsuit brought by a shareholder on the corporation’s behalf against a third party because of the corporation’s failure to take action on its own. Derivative actions are usually brought by shareholders against officers or directors for not acting in the best interest of the corporation.

To be eligible to bring a derivative action, a shareholder must own shares in the corporation at the time of the alleged injury. An individual or business cannot buy shares in a corporation to file a derivative suit for actions that occurred before becoming a shareholder.

Before bringing a derivative suit, shareholders must show that they attempted to get the officers and directors to act on behalf of the corporation first. Only after the officers and directors refuse to act may a derivative suit be filed.

Dissatisfaction with the corporation’s management is insufficient to justify a derivative suit. Derivative suits have been successful when misconduct or fraud of a director or officer is involved. If successful, any damages are awarded to the corporation, not the shareholders who brought the lawsuit.

A dividend is a portion of a corporation’s profits distributed to its shareholders on a pro rata basis. Dividends are usually paid in the form of cash or additional shares in the corporation.

Although shareholders have a right to a dividend when declared, the board of directors has the discretion to decide whether to declare a dividend. The board may decide to reinvest profits into the corporation, pay for a capital expense, purchase additional assets, or to expand the business. As long as the board of directors acts reasonably and in good faith, its decision regarding whether to declare a dividend is usually upheld by the courts.

18.4 Corporate Officer and Directors

Although shareholders own the corporation, the officers and directors are empowered to manage the day-to-day business of the corporation. The officers and directors owe a fiduciary duty to both the corporation and its shareholders. This means that the officers and directors must act in the best interest of the corporation and shareholders.

Duty of Loyalty

As part of their fiduciary duty, officers and directors have a duty of loyalty to the corporation and its shareholders. The duty of loyalty requires them to act:

- In good faith;

- For a lawful purpose;

- Without a conflict of interest; and

- To advance the best interests of the corporation.

Duty of loyalty issues frequently arise in the context of a director entering into a contract with the corporation or loaning it money. Other situations may involve a director taking a business opportunity away from the corporation for his or her own personal gain. The corporate opportunity doctrine prevents officers and directors from taking personal advantage of a business opportunity that properly belongs to the corporation.

Duty of Care

The duty of care requires officers and directors to act with the care that an ordinary prudent person would take in a similar situation. In other words, they have a duty not to be negligent.

The extent of this duty depends on the nature of the corporation and the type of role the director or officer fills. For example, the duty of care imposed on the board of directors of a federally-insured bank will be higher than the duty imposed on a small nonprofit organization.

In general, though, directors should understand the nature and scope of the corporation’s business and industry, as well as have any particular skills necessary to be successful in their role. Officers and directors also should stay informed about the corporation’s activities and hire experts when they lack the expertise necessary to make the best decisions for the corporation. The duty of care requires officers and directors to make informed decisions.

Compensation

Officers and directors are usually entitled to compensation for their work on behalf of the corporation. Some states restrict whether directors may receive compensation and, if so, how much. The issue of executive compensation has been a hot button issue in recent decades.

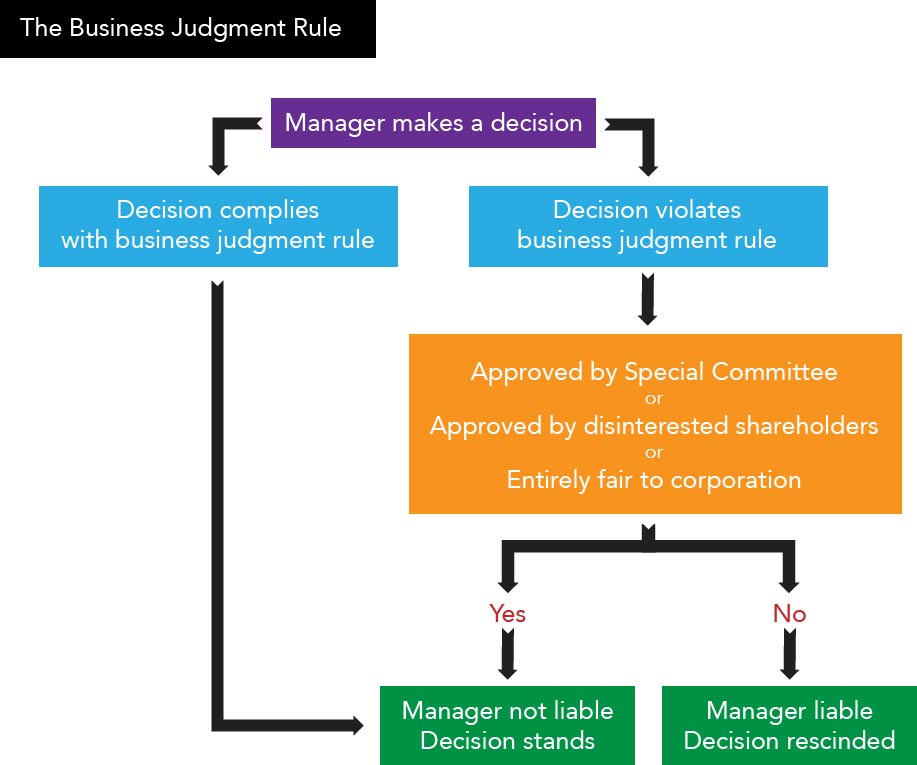

Business Judgment Rule

The business judgment rule is the presumption that corporate directors act in good faith, are well-informed, and honestly believe their actions are in the corporation’s best interest. The rule shields directors and officers from liability for unsuccessful or unprofitable decisions, as long as they were made in good faith, with due care, and within their authority.

It is important to understand that courts do not focus on the result of the business decision. Instead, courts look at the process that the decision makers went through. If the process is careless or not in the best interest of the corporation and shareholders, the business judgment rule will not protect them.

The business judgment rule does not protect officers and directors from decisions made in their own self-interest or self-dealing. In those situations, the action must be approved by disinterested members of the board of directors or shareholders. If the decision is subject to a derivative suit, the court may determine that the decision was fair to the corporation. If the decision is approved by the court or disinterested board members or shareholders, then the decision may be valid.

The business judgment rule does not protect officers and directors from decisions made in bad faith, as a result of fraud, through gross negligence, or as an abuse of discretion. In those situations, the officers and directors may be personally liable for their actions.

Figure 18.3 Business Judgment Rule Flowchart

18.5 Legal Theories

One of the main benefits of corporations is limiting shareholders’ liability to the amount of their investment in the corporation. In general, a shareholder may lose his or her investment in the corporation if it is not a successful business or if it is sued. Because corporations are a separate legal entity than their shareholders, shareholders are generally shielded from corporate liability. However, three exceptions to this rule allow shareholders to be held liable for the corporation’s actions.

Piercing the Corporate Veil

Piercing the Corporate Veil is a legal theory under which shareholders or the parent company are held liable for the corporation’s actions or debts. Under this theory, plaintiffs ask the court to look beyond the corporate structure and allow them to sue the shareholders or parent company as if no corporation existed. In essence, the court strips the “veil” of limited liability that incorporation provides and hold a corporation’s shareholders or directors personally liable.

This theory applies most often in closely held corporations. While legal requirements vary by state, courts are usually reluctant to pierce the corporate veil. However, courts will do so in cases involving serious misconduct, fraud, commingling of personal and corporate funds, and deliberate undercapitalization during incorporation.

Alter Ego Theory

The Alter Ego Theory is the doctrine that shareholders will be treated as the owners of a corporation’s property or as the real parties in interest when necessary to prevent fraud or to do justice. In other words, the court finds a corporation lacks a separate identity from an individual or corporate shareholder.

This theory applies most often when a corporation is a wholly-owned subsidiary of another company. Courts allow the alter ego theory when evidence exists that the parent company is controlling the actions of the subsidiary, and the corporate form is disregarded by the shareholders themselves. The rationale is that shareholders cannot benefit from limited liability when there is such unity of ownership and interest that a separate entity does not actually exist. To allow shareholders to “have it both ways” would result in injustice to the corporation’s debtors and those hurt by its actions.

Promotion of Justice Theory

The Promotion of Justice Theory is used when the corporate form is used to defraud shareholders or to avoid compliance with the law. Courts use this theory to prevent shareholders from using a corporation to achieve what they could not do directly themselves. For example, if a state limits the number of liquor licenses an individual may obtain at one time, a person cannot form multiple corporations to obtain more licenses.

18.6 Mergers, Consolidations, and Dissolutions

Once incorporated, corporations may last forever. However, they also may be merged or consolidated into other business entities or dissolved.

Often businesses will buy the assets of another business. When this happens, the seller remains in existence and retains its liabilities. The buyer does not become legally responsible for the seller’s actions through a mere purchase of assets.

Mergers and consolidations, however, involve the termination of the seller.

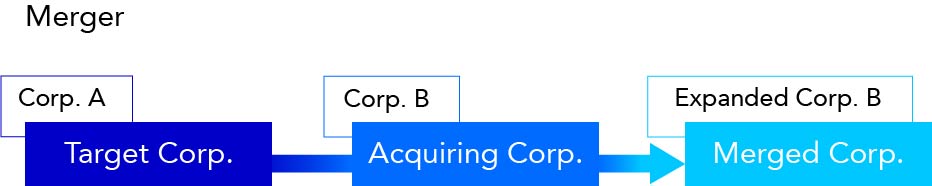

A merger occurs when one corporation absorbs another. The acquiring corporation continues to exist but the target corporation ceases to exist. The acquiring corporation acquires all the assets and liabilities of the target corporation.

Corporate mergers must conform to state laws and usually must be approved by the majority of shareholders of both corporations. Many states require approval by two-thirds of the shareholders. If approved, articles of merger must be filed in the state(s) where the corporations exist.

Figure 18.4 Merger

Consolidation

Consolidation occurs when two or more corporations are dissolved and a new corporation is created. The new corporation owns all the assets and liabilities of the former corporations.

Like mergers, consolidations must be approved by the majority or two-thirds of shareholders of all corporations involved. If approved, articles of consolidation must be filed in the state(s) where the corporations existed.

Mergers and consolidations are often scrutinized under antitrust laws to ensure that the resulting corporation is not a monopoly in the relevant market. Antitrust laws are discussed in Chapter 19.

Figure 18.5 Consolidation

Voluntary Dissolution

A corporation that has obtained its charter but has not begun its business may be dissolved voluntarily by its incorporators. They simply need to file articles of dissolution in the state of incorporation.

If a corporation has been in business, voluntary dissolution is possible when either (1) all shareholders give written consent or (2) the board of directors vote for dissolution and two-thirds of the shareholders approve.

To dissolve a corporation voluntarily, the corporation must file a statement of intent to dissolve. At that point, the corporation must cease all business operations except those necessary to wind up its business affairs. The corporation must give notice to all known creditors of its dissolution. If the corporation fails to give notice, then the directors become personally responsible for any debt and legal liability. The corporation is required to pay off all debts before distributing any remaining assets to shareholders.

Until the state issues the articles of dissolution, the statement of intent may be revoked if shareholders change their mind.

Involuntary Dissolution

States have the power to create corporations through granting corporate charters. Similarly, states have the right to revoke corporate charters. Actions brought by the state to cancel a corporate charter are called quo warranto proceedings .

Corporate charters may be canceled when a corporation:

- Did not file its annual report;

- Failed to pay its taxes and licensing fees;

- Obtained its charter through fraud;

- Abused or misused its authority;

- Failed to appoint or maintain a registered agent; or

- Ceased to do business for a certain period of time.

Shareholders may also request dissolution when:

- The shareholders are deadlocked and cannot elect a board of directors;

- When there is illegal, fraudulent or oppressive conduct by the directors or officers;

- When majority shareholders breach their fiduciary duty to the minority shareholders;

- Corporate assets are being wasted or looted; or

- The corporation is unable to carry out its purpose.

Finally, dissolution may occur as a result of bankruptcy or when the corporation is unable to cover its debts to creditors.

18.7 Concluding Thoughts

Corporations are owned by shareholders but are run by directors and officers. As a legal entity separate from its shareholders, corporations provide limited liability to shareholders who invest in them. However, personal liability may be imposed when fraud or other serious misconduct occurs. As long as their decisions are made in good faith, with due care, and within their authority, officers and directors are protected by the business judgment rule. Finally, corporations have a perpetual existence unless they are dissolved through their own action, by the state, or initiated by shareholders or creditors.

Fundamentals of Business Law Copyright © 2020 by Melissa Randall is licensed under a Creative Commons Attribution 4.0 International License , except where otherwise noted.

Share This Book

2.1 Business Structures

Learning outcomes.

By the end of this section, you will be able to:

- Identify the business form created by most organizations.

- Contrast the advantages and disadvantages that the corporate form has over sole proprietorships.

- Contrast the advantages and disadvantages that the corporate form has over partnerships.

- List and describe characteristics associated with a hybrid business structure.

The Most Common Types of Business Organization

The functions of most executive management teams are very similar for most businesses, and they will not differ in any significant manner based on how they may be structured or organized. However, the legal structure of any company will have a substantial impact on its operations, and it therefore deserves a significant amount of analysis and discussion. The four most common forms of business organizations are the following:

- Sole proprietorships

Partnerships

Corporations.

- Hybrids, such as limited liability companies (LLCs) and limited liability partnerships (LLPs)

The vast majority of businesses take the form of a proprietorship. However, based on the total dollar value of combined sales, more than 80 percent of all business in the United States is conducted by a corporation . 1 Because corporations engage in the most business, and because most successful businesses eventually convert into corporations, we will focus on corporations in this chapter. However, it is still important to understand the legal differences between different types of firms and their advantages and disadvantages.

Sole Proprietorships

A proprietorship is typically defined as an unincorporated business owned by a single person. The process of forming a business as a sole proprietor is usually a simple matter. A business owner merely decides to begin conducting business operations, and that person is immediately off and running. Compared to other forms of business organizations, proprietorships have the following four important advantages:

- They have a basic structure and are simple and inexpensive to form.

- They are subject to relatively few government rules and regulations.

- Taxation on sole proprietorships is far simpler than on other organizational forms. There are no separate taxes associated with a sole proprietorship, as there are with corporations. Sole proprietors simply report all their business income and losses on their personal income tax returns.

- Controlling responsibilities of the firm are not divided in any way. This results in less complicated managerial decisions and improved timeliness of necessary corrective actions.

However, despite the ease of their formation and these stated advantages, proprietorships have four notable shortcomings:

- A sole proprietor has unlimited personal liability for any financial obligations or business debts, so in the end, they risk incurring greater financial losses than the total amount of money they originally invested in the company’s formation. As an example, a sole proprietor might begin with an initial investment of $5,000 to start their business. Now, let’s say a customer slips on some snow-covered stairs while entering this business establishment and sues the company for $500,000. If the organization loses the lawsuit, the sole proprietor would be responsible for the entire $500,000 settlement (less any liability insurance coverage the business might have).

- Unlike with a corporation, the life of the business is limited to the life of the individual who created it. Also, if the sole proprietor brings in any new equity or financing, the additional investor (s) might demand a change in the organizational structure of the business.

- Because of these first two points, sole proprietors will typically find it difficult to obtain large amounts of financing. For these reasons, the vast majority of sole proprietorships in the United States are small businesses.

- A sole proprietor may lack specific expertise or experience in important business disciplines, such as finance, accounting, taxation, or organizational management. This could result in additional costs associated with periodic consulting with experts to assist in these various business areas.

It is often the case that businesses that were originally formed as proprietorships are later converted into corporations when growth of the business causes the disadvantages of the sole proprietorship structure to outweigh the advantages.

A partnership is a business structure that involves a legal arrangement between two or more people who decide to do business as an organization together. In some ways, partnerships are similar to sole proprietorships in that they can be established fairly easily and without a large initial investment or cost.

Partnerships offer some important advantages over sole proprietorships. Among them, two or more partners may have different or higher levels of business expertise than a single sole proprietor, which can lead to superior management of a business. Further, additional partners can bring greater levels of investment capital to a firm, making the process of initial business formation smoother and less risky.

A partnership also has certain tax advantages in that the firm’s income is allocated on a pro rata basis to the partners. This income is then taxed on an individual basis, allowing the company to avoid corporate income tax. However, similar to the sole proprietorship, all of the partners are subject to unlimited personal liability, which means that if a partnership becomes bankrupt and any partner is unable to meet their pro rata share of the firm’s liabilities, the remaining partners will be responsible for paying the unsatisfied claims.

For this reason, the actions of a single partner that might cause a company to fail could end up bringing potential ruin to other partners who had nothing at all to do with the actions that led to the downfall of the company. Also, as with most sole proprietorships, unlimited liability makes it difficult for most partnerships to raise large amounts of capital.

The most common type of organizational structure for larger businesses is the corporation. A corporation is a legal business entity that is created under the laws of a state. This entity operates separately and distinctly from its owners and managers. It is the separation of the corporate entity from its owners and managers that limits stockholders’ losses to the amount they originally invest in the firm. In other words, a corporation can lose all of its money and go bankrupt, but its owners will only lose the funds that they originally invested in the company.

Unlike other forms of organization, corporations have unlimited lives as business entities. It is far easier to transfer shares of stock in a corporation than it is to transfer one’s interest in an unincorporated business. These factors make it much easier for corporations to raise the capital necessary to operate large businesses. Many companies, such as Microsoft and Hewlett-Packard , originally began as proprietorships or partnerships, but at some point, they found it more advantageous to adopt a corporate form of organization as they grew in size and complexity.

An important disadvantage to corporations is income taxes. The earnings of most corporations in the United States are subject to something referred to as double taxation. First, the corporation’s earnings are taxed; then, when its after-tax earnings are paid out as dividend income to shareholders (stockholders) , those earnings are taxed again as personal income.

It is important to note that after recognizing this problem of double taxation, Congress created the S corporation , designed to aid small businesses in this area. S corporations are taxed as if they were proprietorships or partnerships and are exempt from corporate income tax. In order to qualify for S corporation status, a company can have no more than 100 stockholders. Thus, this corporate form is useful for relatively small, privately owned firms but precludes larger, more diverse organizations. A larger corporation is often referred to as a C corporation . The vast majority of small corporations prefer to elect S status. This structure will usually suit them very well until the business reaches a point where their financing needs grow and they make the decision to raise funds by offering their stock to the public. At such time, they will usually become C corporations. Generally speaking, an S corporation structure is more popular with smaller businesses because of the likely tax savings, and a C corporation structure is more prevalent among larger companies due to the greater flexibility in raising capital.

Hybrids: Limited Liability Corporations and Partnerships

Another form of business organization is the limited liability corporation (LLC) . This type of business structure has become a very popular type of organization. The LLC is essentially a hybrid form of business that has elements of both a corporation and a partnership. Another form of organizational structure is something called a limited liability partnership (LLP) , which is quite similar to the LLC in structure and in use. It is very common to see LLPs used as the organizational form for professional services firms, often in such fields as accounting, architecture, and law. Conversely, LLCs are typically used by other forms of businesses.

Similar to corporation structures, LLCs and LLPs will provide their principals with a certain amount of liability protection, but they are taxed as partnerships. Also, unlike in limited partnerships, where a senior general partner will have overall control of the business, investors in an LLC or LLP have votes that are in direct proportion to their percentage of ownership interest or the relative amount of their original investment.

A particular advantage of a limited liability partnership is that it allows some of the partners in a firm to limit their liability. Under such a structure, only designated partners have unlimited liability for company debts; other partners can be designated as limited partners, only liable up to the amount of their initial contribution. Limited partners are typically not active decision makers within the firm.

Some important differences between LLCs and LLPs are highlighted in Table 2.1 .

LLCs and LLPs have gained great popularity in recent years, but larger companies still find substantial advantages in being structured as C corporations. This is primarily due to the benefits of raising capital to support long-term growth. It is interesting to note that LLC and LLP organizational structures were essentially devised by attorneys. They generally are rather complicated, and the legal protection offered to their ownership principals may vary from state to state. For these reasons, it is usually necessary to retain a knowledgeable lawyer when establishing an organization of this type.

Obviously, when a company is choosing an organizational structure, it must carefully evaluate the advantages and disadvantages that come with any form of doing business. For example, if an organization is considering a corporation structure, it would have to evaluate the trade-off of having the ability to raise greater amounts of funding to support growth and future expansion versus the effects of double taxation. Yet despite such organizational concerns with corporations, time has proven that the value of most businesses, other than relatively small ones, is very likely to be maximized if they are organized as corporations. This follows from the idea that limited ownership liability reduces the overall risks borne by investors. All other things being equal, the lower a firm’s risk, the higher its value.

Growth opportunities will also have a tremendous impact on the overall value of a business. Because corporations can raise financing more easily than most other types of organizations, they are better able to engage in profitable projects, make investments, and otherwise take superior advantage of their many favorable growth opportunities.

The value of any asset will, to a large degree, depend on its liquidity. Liquidity refers to asset characteristics that enable the asset to be sold or otherwise converted into cash in a relatively short period of time and with minimal effort to attain fair market value for the owner. Because ownership of corporate stock is far easier to transfer to a potential buyer than is any interest in a business proprietorship or partnership, and because most investors are more willing to invest their funds in stocks than they are in partnerships that may carry unlimited liability, an investment in corporate stock will remain relatively liquid. This, too, is an advantage of a corporation and is another factor that enhances its value.

Link to Learning

Most people are surprised to learn than Amazon , the largest online retailer, is set up as an LLC. Amazon.com Services LLC is set up as a subsidiary of the larger Amazon.com Inc. Take a look at the Amazon LLC company profile provided by Dun & Bradstreet . Why do you think such a large corporation is set up as an LLC?

Incorporating a Business

Many business owners decide to structure their business as a corporation. In order to begin the process of incorporation, an organization must file a business registration form with the US state in which it will be based and carry on its primary business activities. The document that must be used for this application is generally referred to as the articles of incorporation or a corporate charter . Articles of incorporation are the single most important governing documents of a corporation. The registration allows the state to collect taxes and ensure that the business is complying with all applicable state laws.

The exact form of the articles of incorporation differs depending on the type of corporation. Some types of articles of incorporation include the following:

- Domestic corporation (in state)

- Foreign corporation (out of state or out of country)

- Close (closely held) corporation

- Professional corporation

- Nonprofit corporation (several different types of nonprofits)

- Stock corporation

- Non-stock corporation

- Public benefit corporation

It is important to note that articles of incorporation are only required to establish a regular corporation. Limited liability corporations require what are referred to as articles of organization (or similar documents) to register their business with a state. Some types of limited partnerships must also register with their state. However, sole proprietorships do not have to register; for this reason, they are often the preferred organizational structure for a person who is just starting out in business, at least initially.

Articles of incorporation provide the basic information needed to legally form the company and register the business in its state. The state will need to know the name of the business, its purpose, and the people who will be in charge of running it (the board of directors ). The state also needs to know about any stock that the business will be selling to the public. The websites of various secretaries of state will have information on the different types of articles of incorporation, the requirements, and the filing process.

- 1 Aaron Krupkin and Adam Looney. “9 Facts about Pass-Through Businesses.” Brookings. The Brookings Institution, May 15, 2017. https://www.brookings.edu/research/9-facts-about-pass-through-businesses

As an Amazon Associate we earn from qualifying purchases.

This book may not be used in the training of large language models or otherwise be ingested into large language models or generative AI offerings without OpenStax's permission.

Want to cite, share, or modify this book? This book uses the Creative Commons Attribution License and you must attribute OpenStax.

Access for free at https://openstax.org/books/principles-finance/pages/1-why-it-matters

- Authors: Julie Dahlquist, Rainford Knight

- Publisher/website: OpenStax

- Book title: Principles of Finance

- Publication date: Mar 24, 2022

- Location: Houston, Texas

- Book URL: https://openstax.org/books/principles-finance/pages/1-why-it-matters

- Section URL: https://openstax.org/books/principles-finance/pages/2-1-business-structures

© Jan 8, 2024 OpenStax. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution License . The OpenStax name, OpenStax logo, OpenStax book covers, OpenStax CNX name, and OpenStax CNX logo are not subject to the Creative Commons license and may not be reproduced without the prior and express written consent of Rice University.

- Marketplace

- Case Studies

- Join Provider Network

Business Formation Questions & Checklist

How and where to form your business are critical legal questions about business formation. If your business is formed incorrectly from the start, costly issues may arise down the road. A business lawyer will ask about your current structure and your future plans for your company -- such as who your partners and investors are, where you plan to operate, and what, if any, financial exit you foresee. Based on that information, your business lawyer will advise you on the proper business form to use -- LLC, LLP, S-Corp, C-Corp, B-Corp, etc. -- as well as where to form. It may be beneficial to form your business in your home state, or it may be better to form in a state with particularly favorable corporate rules, such as Delaware and Nevada.

Prepare for your first meeting or call with a business lawyer using Priori’s business formation resources, including our business formation worksheet. Using our business formation checklist that sets forth key business formation issues, you’ll be able to think through the most important legal questions about business formation in advance of your meeting with your lawyer. You can even send your completed business formation worksheet directly to your lawyer, so your lawyer can prepare in advance of your meeting and make your interaction as productive and cost-effective as possible. If needed, Priori can also connect you with a business lawyer in our vetted network who can assist you with all your legal questions about business formation.

IMAGES

VIDEO

COMMENTS

Study with Quizlet and memorize flashcards containing terms like One of the first steps in the incorporation process is, If one uses a business name that is the same as, or deceptively similar to, another's name, he may be liable for trade name infringement. T/F, The articles of incorporation must include information such as the name, number of ...

Study with Quizlet and memorize flashcards containing terms like One of the first steps in the incorporation process is ______, The articles of incorporation must include information such as the name, number of shares, and the name of its _______ , or person designated to receive legal documents on its behalf., The corporation's internal rules of management are called the . and more.

After reading this chapter, you should understand the following: The powers of a corporation to act. The rights of shareholders. The duties, powers, and liability of officers and directors. Power within a corporation is present in many areas. The corporation itself has powers, although with limitations. There is a division of power between ...

This page titled 18.2: Corporate Structure is shared under a CC BY 4.0 license and was authored, remixed, and/or curated by Melissa Randall and Community College of Denver Students via source content that was edited to the style and standards of the LibreTexts platform; a detailed edit history is available upon request.

18.2 Corporate Structure. Under most state laws, corporations are required to have at least one director. A director is a person appointed or elected to sit on a board that manages the business of a corporation and supervises its officers. Directors are elected by shareholders and collectively are called the Board of Directors.Directors elect officers, who are responsible for the daily ...

Express Powers. The corporation may exercise all powers expressly given it by statute and by its articles of incorporation. Section 3.02 of the Revised Model Business Corporation Act (RMBCA) sets out a number of express powers, including the following: to sue and be sued in the corporate name; to purchase, use, and sell land and dispose of assets to the same extent a natural person can; to ...

Transcribed image text: Scenario 1 - Corporate Formation and Shareholder Liability Ronald Powers, a well-known local entrepreneur, owned several businesses that filed for bankruptcy from 2010 to 2015. Last year, Powers established R. P. Properties, Inc. Powers is the sole shareholder and invested $2,500 in the company as a capital contribution.

Study with Quizlet and memorize flashcards containing terms like 1. One of the first steps in the incorporation process is ___ ., 2. If one uses a business name that is the same as, or deceptively similar to, another's name, he may be liable for trade name infringement., 3. The articles of incorporation must include information such as the name, number of shares, and the name of its ___ , or ...

18.2 Forecasting Sales; 18.3 Pro Forma Financials; 18.4 Generating the Complete Forecast; ... they risk incurring greater financial losses than the total amount of money they originally invested in the company's formation. As an example, a sole proprietor might begin with an initial investment of $5,000 to start their business. Now, let's ...

Worksheet 18.2: Corporate Formation and Powers. Log in. Sign up. Get a hint. One of the first steps in the incorporation process is. Click the card to flip.

a professional corporation. a nonprofit corporation. A corporation in which stock is widely held or available through a national or regional stock exchange is called. a publicly held corporation. a closely held corporation. a public corporation. none of the above. Essential to the formation of a de facto corporation is.

View Homework Help - Worksheet 18.2.docx from FINANCE 213 at Oregon State University, Corvallis. ... Correct Check My Work Feedback Formation and Powers . 2. ... View Assignment - Quiz 2 Final.docx from FI 001 at Michigan State University. NAME: _ B... assignment.

Corporate Formation and Powers Ch18. Course: Business Law. 467 Documents. Students shared 467 documents in this course. University: Đại học Kinh tế Quốc dân. ... BL A1 - This is my assignment for Business Law subject, this module in my study program. Business Law 100% (6) 16.

After reading this chapter, you should understand the following: The powers of a corporation to act. The rights of shareholders. The duties, powers, and liability of officers and directors. Power within a corporation is present in many areas. The corporation itself has powers, although with limitations. There is a division of power between ...

My goal is to present business law, the legal environment, business ethics, and digital law in a way that will spur students to ask questions, to go beyond rote memorization. Business law is an evolving outgrowth of its environment, and the legal environment keeps changing. This new tenth edition of Business Law.

Match all the terms with their definitions as fast as you can. Avoid wrong matches, they add extra time! Quizlet has study tools to help you learn anything. Improve your grades and reach your goals with flashcards, practice tests and expert-written solutions today.

Mandalay Shores Community Association 18.2 Corporate Formation and Powers -While promotional activities are uncommon today due to the ease of forming a corporation, it is important to understand that personal liability exists until the newly formed corporation assumes liability through novation -Incorporations procedures : o Select the State of ...

A corporation is a legal entity: created pursuant to a state statute. Corporations _____ enjoy many of the same rights and privileges under state and federal law that people enjoy. do. The _____, or owners, of a corporation elect the _____ who then hire the _____ to run the daily operations. Shareholders. directors.

Using our business formation checklist that sets forth key business formation issues, you'll be able to think through the most important legal questions about business formation in advance of your meeting with your lawyer. You can even send your completed business formation worksheet directly to your lawyer, so your lawyer can prepare in ...

The LibreTexts libraries are Powered by NICE CXone Expert and are supported by the Department of Education Open Textbook Pilot Project, the UC Davis Office of the Provost, the UC Davis Library, the California State University Affordable Learning Solutions Program, and Merlot. We also acknowledge previous National Science Foundation support under grant numbers 1246120, 1525057, and 1413739.

Dividends. A distribution of profits or income to shareholders. One main disadvantage of the corporate form of business is_____. Double taxation of distributed income. Under modern criminal law, a corporation ______ be held liable for the criminal acts of its employees. The punishment for guilt of a crime by a corporation consists of __________.

How is a balance of power part of our democracy? Estimated Time . Two or three 40-minute class sessions . Materials & Equipment . Class set of "My School and Federalism" worksheet Access to Unit 18, Learn It! " Federalism and the Federal Government" Class set of "The Structure of Government Reading" worksheet

The answer is no. By UPA Section 7 (2) and RUPA Section 202 (b) (1), the various forms of joint ownership by themselves do not establish partnership, whether or not the co-owners share profits made by the use of the property. To establish a partnership, the ownership must be of a business, not merely of property.