Join industry leaders & Get the latest news in your inbox

Try it out!

- Advice for Agents

- Legal Issues

Assigning an Agreement of Purchase and Sale

Martin Rumack | Jul 26, 2016 | 0 comments

At its essence, an assignment of an Agreement of Purchase and Sale – informally known as “flipping a home” – is a simple concept: A buyer of a new home allows someone else to take over the purchase contract, which allows that person to buy the home.

More specifically, the original buyer enters into a formal Agreement of Purchase and Sale with a builder, and then allows another person – who we will call the “new buyer” – to step into his or her shoes through what is legally known as an “assignment” of that original agreement or offer to buy. The new buyer pays the original buyer a higher price than what was set out in that original agreement; the difference is the original buyer’s profit. All of this takes place after the original buyer has agreed to buy from the builder, but before the deal closes; the original buyer never takes title to the property.

This arises primarily with homes: For newly built homes with typically long closing dates (often 18 months or more), an assignment is particularly attractive in situations where the builder has already sold all of the units in the development early on, but where there is still demand for soon-to-be-completed homes and new condominium units in the development.

The assignment of a new condominium unit is also interesting for similar reasons, although the time frame may be significantly longer depending on when the assignment occurs. This puts the original buyer in position to make a profit by inflating the new price well above what he or she agreed to pay the builder in the first place.

What is the benefit to the new buyer? There can be several:

- The new buyer may be able to buy into a desirable neighbourhood at a time when there are no more units available to be purchased directly from the builder;

- Even taking the original buyer’s profit into account, the assignment may give the new buyer a price advantage over other properties that are currently on the market; and

- Depending on the timing of the assignment, the new buyer may be positioned to choose finishes and make minor changes to the yet-to-be-built home.

- Whatever the respective motivations of the original and new buyer, the assignment of an Agreement of Purchase and Sale has many specific features – and just as many potential pitfalls.

When can an agreement of purchase and sale be assigned?

Unlike the standard Ontario Real Estate Association (OREA) agreements, many builders’ own (customized) Agreements of Purchase and Sale contain a clause that generally prohibits the assignment of the contract outright – or else allows it only with strict conditions and in exchange for a significant fee payable to the builder.

In fact, the vast majority of new home or condominium-purchase agreements do not allow the original buyer to assign the contract to someone else and stipulate that any attempt by the buyer to do so, or to list the home for sale on the MLS system or otherwise, or else list the property for rent, will put the original buyer in breach of the agreement. This triggers the builder’s right, with notice, to terminate the original agreement, keep the original buyer’s deposit and seek additional damages from him or her. (And in most cases, the original buyer’s agreement is “dead”; he or she cannot go back and try to complete the transaction as if no assignment had taken place).

All of this means that anyone who has agreed to purchase a home from a builder should give careful consideration to, and should seek legal advice prior to signing the agreement, or in the case of condominium units during the 10-day cooling-off period in order to determine whether it’s possible to assign the agreement in the first place.

This in turn involves a careful review of the clauses in that agreement.

Typical (and not-so-typical) provisions

As a practical matter, there are as many variations in these types of provisions as there are builders.

Many Agreements of Purchase and Sale will include a largely standard “no assignment” clause, which disentitles the original buyer from “directly or indirectly” taking any steps to “lease, list for sale, advertise for sale, assign, convey, sell, transfer or otherwise dispose of” the property or any interest in it.

A potential exception – and this is important – arises if the builder gives prior written consent, although in the more draconian version of these kinds of contract, that consent may be “unreasonably and arbitrarily withheld” by the builder, essentially on its whim. In other words, the buyer is not allowed to deal with the property, unless the builder pre-approves it in writing, but in many cases the builder has no obligation to give that approval and may withhold it for any reason whatsoever, including unreasonable and arbitrary ones.

(With that said, the “no assignment” clause in some agreements will allow for express exceptions or situations where the builder will not withhold consent, for example: a) assignments made to a member of the original buyer’s immediate family; or b) where the builder has determined that a sufficient and satisfactory percentage of the available units have already been sold).

The bottom line is that the basic clause in an Agreement of Purchase and Sale may or may not allow for the assignment of the agreement to a new buyer, and if it is allowed, it will be subject to specified conditions such as obtaining the builder’s written consent. Most agreements will embellish this basic clause by adding further written stipulations such as:

- Having both the original buyer and the new buyer sign an Assignment Agreement that has been drafted by the builder;

- Mandating the original buyer will not assign the agreement until the builder has managed to sell a certain percentage of the units in the overall development (for example, 85 or 90 per cent), and even then it must be with the builder’s written consent as usual;

- Requiring the original buyer to pay a fee to the builder of (for example) $5,000 plus taxes as part of obtaining the builder’s consent to the assignment;

- Requiring the original buyer to pay another fee plus taxes to the builder’s lawyer (ostensibly as a sort of “legal processing fee”);

- Getting the pre-approval of any lending institution or mortgagee that is providing funding to the builder for construction or otherwise;

- Assuming the builder agrees to the assignment in the first place, prohibiting any further assignments of the offer by the new buyer to any subsequent party;

- Confirming that the breach of any of the original buyer’s promises in relation to how and when an assignment can occur will be considered a breach of the whole agreement (and one that cannot be remedied); and

- Requiring the original buyer to confirm in writing that the property is not being purchased for short-term speculative purposes.

Note that even if the Agreement of Purchase and Sale does not expressly allow or provide for it in writing, some builders will permit an original buyer to make an assignment nonetheless. This is because it is always in the builder’s discretion to give up (usually for a fee) its right to technically insist on the purchase going ahead with the original buyer.

Getting the builder’s consent

It’s important to remember that, initially, the original buyer and the builder had a valid legal contract in place that obliged the buyer to purchase a home or condominium unit from the builder. That original buyer, for whatever reason – whether it’s a change of circumstances (such as a change in a marital situation, job transfer to another city, province or country; birth of children resulting in a home/condominium unit being too small for the buyer), cold feet, or simply the desire to make a profit – has subsequently decided to “sell” that right to buy to the new buyer.

To protect the builder, the assignment will contain clauses that are designed to safeguard the builder’s rights. The most important one is that, as discussed, the builder must give its written consent to the assignment. This will often involve specific builder-imposed requirements, fees and forms that must be completed.

Once consent has been obtained, there may be additional restrictions on the manner in which the original owner can market the property. For example, some builders will insist that the property is not to be listed on the MLS system (where it may be competing with the builder’s own listings for still-unsold homes and units in the same development); if the original owner does so nonetheless, it will be tantamount to a breach of the Agreement of Purchase and Sale, which could entitle the builder to damages, or rescission of the Agreement of the Purchase and Sale while retaining the deposits paid, as well as the monies paid for extras.

However, aside from any marketing/advertising restrictions that may be imposed, the original buyer must clearly indicate in any listing that it is an assignment of an Agreement of Purchase and Sale, not merely an ostensible sale from the original buyer.

Continuing liability after assignment

One key provision in the Agreement of Purchase and Sale – and one that is easy to overlook – may significantly impact whether an original buyer will want to assign his or her agreement at all.

Even though the original buyer has essentially transferred his or her right to buy the property to the new buyer, the original buyer is not fully off the hook. Rather, under the terms of the assignment document, the original buyer can remain liable to go through with the contract if the new buyer does not complete the transaction with the builder.

This written obligation appears in the original buyer’s Agreement of Purchase and Sale, and is couched in phrases that give the buyer continuing liability for the “covenants, agreements and obligations” contained the original agreement. But the net effect is that the original buyer remains fully liable should the agreement between the builder and the new buyer collapse. The agreement may also stipulate that the assignee, meaning the person receiving the benefit of the assignment (the new buyer) must sign an “assumption covenant”, which creates a binding contract between the new buyer and the builder.

(Incidentally, in contrast some builder’s agreements quite conveniently allow the builder itself to freely assign the agreement to any other builder registered with Tarion, which completely releases the builder from its obligations.)

The original buyer’s continuing liability under the Assignment Agreement is a major drawback in these types of arrangements. The original buyer always has to balance the risks and rewards inherent in this scenario.

Documenting the transaction

Assuming that the assignment of an offer is even permitted by the builder, then (as with all contracts) it must be documented to reflect and protect the legal right of the parties.

The technical aspects of an assignment require more than simply taking the original buyer’s Agreement of Purchase and Sale with the builder, scratching out his or her name, and replacing it with the new buyer. (Although, in some cases people do try to “squeeze in” assignment-of-offer terminology into a new Agreement of Purchase and Sale made out in the new buyer’s name – but this is definitely NOT recommended).

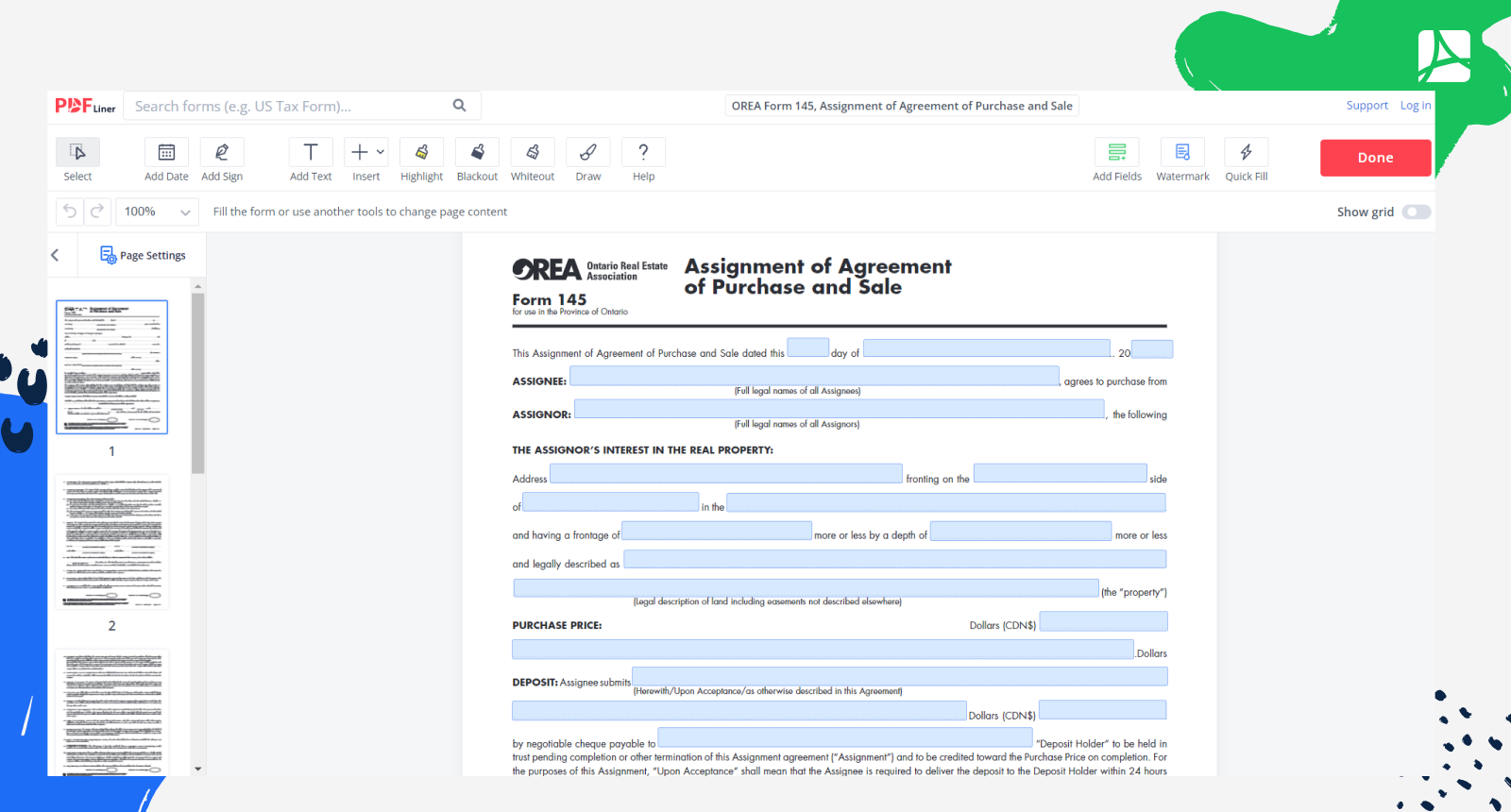

Rather, a properly documented transaction makes reference to the Agreement of Purchase and Sale between the original buyer and the builder, but adds a separate document called an “Assignment of Agreement of Purchase and Sale.”

OREA provides a standard form that can be used, although in many cases those builders who permit assignments will insist that the original buyer and the new buyer use the builder’s customized assignment forms, rather than the OREA standardized version.

The specifics of the deal – who pays what?

1) recouping the original buyer’s costs .

At the point where the assignment is being negotiated, the original buyer has typically paid a deposit to the builder, may have pre-paid for certain upgrades and extras and has a large balance owing. This means that in the course of striking a deal to achieve the assignment, the original buyer should give some serious thought to the various costs, fees, pre-paid deposits and tax repercussions of the deal, and how these should be reflected in the price that he or she will want the new buyer to pay under the Assignment Agreement. The timing of the payment(s) will also be a consideration.

For both original buyer and new buyer who are considering an assignment arrangement, here are some of the questions to ask:

- Does the price to be paid by the new buyer include any fee that the builder is charging in exchange for the original buyer’s right to assign the Agreement of Purchase and Sale?

- Does it include any deposits paid by the original buyer to the builder, after the agreement was signed? Does it include any interest that has been earned on those deposits?

- Does it clearly state that the new buyer will take over the entire contract, including the adjustments that are to be paid to the builder on closing? Or are those adjustments to be split between new and original buyer?

- Does the price include money paid by the original buyer for extras and upgrades?

- Are there any additional deposits that are still owing to the builder, under the original agreement?

- Who is responsible to pay the additional fee (the builder-imposed fee) in exchange for the builder giving consent? Usually this will be the original buyer, but the parties may negotiate otherwise.

- Does the new buyer agree to take on responsibility under the original agreement for making additional deposit payments until the final closing date (which may still be months or even years away)?

- Does the new buyer have a full understanding of the amount of all the adjustments that must be paid to the builder pursuant to the original agreement?

- If the original buyer has negotiated any special financial incentives into the Agreement of Purchase and Sale that has been reached with the builder, have these been addressed in terms of whether the new buyer will receive the benefit of them?

In any case, the final purchase price payable from the new buyer to the original buyer will typically be made up of:

- The outstanding balance owed to the builder by the original buyer, that will now be payable by the new buyer;

- The total deposits already paid by the original buyer to the builder;

- The total payments already paid by the original buyer to the builder for any upgrades and extras and

- The profit that the original buyer stands to make in the deal.

2) Deposits and interest on deposits

The treatment of deposits and the interest they may have earned merits a brief separate discussion.

Under virtually all Agreements of Purchase and Sale with builders, the original buyer will be required to pay a series of deposits to the builder, starting with the initial deposit paid when the agreement is signed and on a set payment schedule thereafter. The total of those deposits can be significant.

Once the agreement has been assigned to the new buyer, how those deposits are treated will form part of the negotiations. Typically, the original buyer will get those deposits back from the new buyer as part of the overall purchase price of the assignment transaction; he or she will usually receive them at the time the assignment agreement is entered into and the builder has consented to the assignment.

The potential problem with an Assignment Agreement is financing. The original buyer will want his deposit funds returned before closing, but if the new buyer does not have funds on-hand, he or she may find that financing is very difficult to obtain because banks do not advance mortgage funds at the time an Assignment Agreement is entered into; rather, the financial institution will provide funds only on final closing. This can serve as a roadblock to the new buyer’s ability to repay the deposits and potentially to embark on the transaction at all.

The question of who is entitled to the interest on any deposits pre-paid to the builder is also a topic for the original and new buyers to discuss. In many cases, the interest will be only a small amount (if any) and may be credited to the new buyer, rather than the original one. However, in cases where the original buyer has paid significant deposits over time, and where larger interest amounts have accrued, the parties may want to negotiate a different outcome.

3) Land Transfer Tax

When negotiating the deal, the original buyer and the new buyer must discuss the structure of the deal between them, to ascertain the exact selling price on which the Land Transfer Tax (and any Municipal Land Transfer Tax) should be payable; whether it is the original buyer’s price with the builder (net of HST and the HST New Housing Rebate, which is discussed below), or whether it’s the newly inflated price being paid by the new buyer under the assignment.

Generally speaking, it will be the latter, although in some assignment arrangements the parties have attempted to structure it so that they pay the Land Transfer Tax based on the lower initial price asked by the builder, while taking the position that difference between that and the increased price is merely the “fee” paid to acquire the original Agreement of Purchase and Sale entered into with the builder (thus avoiding having the tax calculated on the higher sale price).

In any case, once the Assignment Agreement is reached, it will be the new buyer who is obliged to pay Land Transfer Tax and any Municipal Land Transfer Tax on closing, not the original buyer.

4) HST and the HST New Housing Rebate

The issue of how HST is to be treated in an assignment scenario is crucial, but is fraught with pitfalls.

The first issue is how HST on the transaction should be calculated. Because the new buyer’s price will inevitably be higher than the one the original buyer agreed to pay to the builder, there is an important issue as to whether the difference – meaning the original buyer’s profit – should be subject to HST (and if so, who will pay it in the transaction).

This determination hinges on whether the assignment is a “taxable supply” under the tax legislation and on whether the original buyer can be considered or deemed a so-called “builder” of the home for HST purposes. This, in turn, involves a number of complex legal concepts and factual findings – including the intentions of the original buyer as to whether the home is going to be a primary residence.

Next, there is the issue of the HST New Housing Rebate. In a typical scenario, the original buyer may have been entitled to the HST New Housing Rebate, based on meeting numerous qualifying requirements and stipulations. However, once he or she assigns the agreement, that eligibility is obviously lost because he or she is no longer taking title to the home on closing. Only one HST New Housing Rebate application per dwelling can be filed.

But once there has been an assignment, it is the new buyer’s circumstances that will determine whether the opportunity for an HST Rebate exists. He or she will have to meet the stipulated legislated requirements and may either apply directly to the Canada Revenue Agency (CRA), or arrange with the builder to have the rebate amount credited right at closing.

Note that the new buyer may want to take steps to protect his or her position in this regard. For example, when negotiating the Assignment Agreement, the new buyer should make the agreement conditional on receiving written confirmation from the builder that any HST New Housing Rebate will be credited to him or her on closing, assuming that the qualifying requirements are otherwise met. Otherwise, if this commitment is not in writing, the builder, being entitled to exercise its discretion on whether to credit the buyer with the rebate amount on final closing, can withhold it and force the new buyer to apply to CRA directly after closing. Obtaining this commitment in writing is especially important, given the likely lack of prior dealing between the builder and the new buyer.

Other things to consider:

1) who is responsible for the documentation.

In addition to ascertaining whether the original buyer or the new buyer will pay for certain items, it is also important to determine – in advance – which of them will take care of arranging the documentation. The questions to ask:

- Who will prepare the documents needed to achieve the assignment? And who will bear the cost?

- Will the builder’s lawyer prepare the builder’s needed consent to the assignment?

- Since the new buyer cannot renegotiate any of the provisions of the agreement that the original buyer entered into with the builder, are any of those terms objectionable, and if so, how will they be resolved and who will bear the cost?

As discussed, the Assignment Agreement will be conditional on the builder giving its consent. From the new buyer’s standpoint, it should also be made conditional on him or her giving close review to the original Agreement of Purchase and Sale (as signed by the original buyer), the Assignment Agreement, as well as any amendments, waivers, notices (and for condominium purchases, the Disclosure Statement). If for no other reason, it will give the new buyer a chance to consider the specific list of adjustments for which he or she will be responsible to pay on closing. Needless to say, this review should be undertaken with the guidance of an experienced lawyer.

Once the terms of the assignment are settled and the builder’s written consent has been obtained, the Assignment Agreement must be drafted and is attached to the original Agreement of Purchase and Sale that the original buyer entered into with the builder.

Incidentally, the builder may have certain requirements that must be incorporated into the process and accommodated as well. For example, the builder will require the new buyer to provide I.D. and will need confirmation that he or she has the financing required to close in place.

2) Tarion registration

When negotiating the assignment arrangement, the original and new buyers must be aware of the impact of the New Home Warranty Program as administered by Tarion, particularly if the home being “flipped” is a condominium unit.

3) Financing

There may be financial issues for the new buyer to work out before the deal can go ahead.

As usual, the transaction may be conditional on financing, which will be arranged on the higher price that the new buyer has agreed to pay. However, since some mortgage brokers may be unfamiliar with financing an assignment transaction, getting approval for the new buyer’s purchase may be challenging. This is something that needs to be investigated long before the original buyer and the new buyer start their negotiations in earnest.

4) Commission

A final issue to be negotiated is who is paying the commission with respect to the Assignment Agreement transaction. This includes consideration of the specific commission rate, together with the details on how and when the commission gets paid.

While an Assignment Agreement can be beneficial to both the original and the new buyer – and even to the builder (in extra fees) there are many issues to be addressed and negotiated.

As an agent, make sure your client obtains legal advice prior to finalizing any agreement to assign the original Agreement of Purchase and Sale.

Be careful… be aware… and think!

- Agreement of Purchase and Sale

Toronto lawyer Martin Rumack’s practice areas include real estate law, corporate and commercial law, wills, estates, powers of attorney, family law and civil litigation. He is co-author of Legal Responsibilities of Real Estate Agents, 4th Edition, available at the TREB bookstore and at LexisNexis . Visit Martin Rumack’s website .

Submit a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Sign me up for the REM Newsletter!

Profile Picture Drop file here

MOST POPULAR

Real estate regulators across Canada: How the industry works by province or territory

BY Jamie Burke Apr 22,2024

7 solutions to alleviate Canada's housing crisis: RBC Economics

BY REM Editorial Team Apr 22,2024

Micro-units: A chance to rethink urban living, prioritize affordability & build a better Toronto for all

BY Riz Dhanji Apr 19,2024

Open house mastery: Proven methods to attract clients

BY REM Advertorials Apr 19,2024

- Agreement of Purchase and Sale

- Conveyancing

- Estate Administration

- Estate Planning

- Chattels and Fixtures

- Surveys and Boundaries

- RECO Discipline

- Contract Law

- Agent Obligations

- Residential Tenancies

- Market Conditions

- Interesting

- Expert Witness

- Arbitrations and Mediations

- AEA Program

- List of Courses

- Testimonials

Assignments – How to Complete the Forms

There is a standard form Agreement for assignments prepared by OREA. You should be using it.

I do understand that quite a few real estate agents are unfamiliar with the document and not quite sure how to fill it out correctly.

Therefore, I have reproduced the document, in part here. My commentary appears in Italics. I have chosen not to reproduce those parts of the Agreement that would otherwise appear in the standard Agreement of Purchase and Sale.

Also, we will go through an example.

John Smith bought a condo from ABC Developers Inc, at the pre-sales when the site first opened for $400,000 with three deposits of $15,000.00 each. So far he has paid two deposits.

The market has escalated and he has now sold the condo to Mary Jones for $575,000,00.

So, the question is: how do we fill out the form?

Brian Madigan’s Annotated Abbreviated Assignment Agreement

Assignment of Agreement of Purchase and Sale Condominium

Parties to Agreement

Assignor: John Smith

Assignee: Mary Jones

THE ASSIGNOR’S INTEREST IN THE REAL PROPERTY:

Also includes

together with seller’s proportionate undivided tenancy-in-common interest in the common elements appurtenant to the Unit

The reference to seller here means ABC Developer Inc.

Purchase Price: $575,000.00

Deposit: $20,000.00

That was the full purchase price on the second deal, not just the assignment uplift. The deposit will be held by the Listing Agent for John Smith.

The Assignee and Assignor acknowledge that the Purchase Price noted above includes both the purchase price the Assignor is paying for the property as indicated in the Agreement of Purchase and Sale between the Assignor and the seller of the property attached hereto as Schedule C, and also includes the amount being paid by the Assignee to the Assignor as payment for the Assignment Agreement.

That means the original purchase price of $400,000.00 plus the market uplift of $175,000.00.

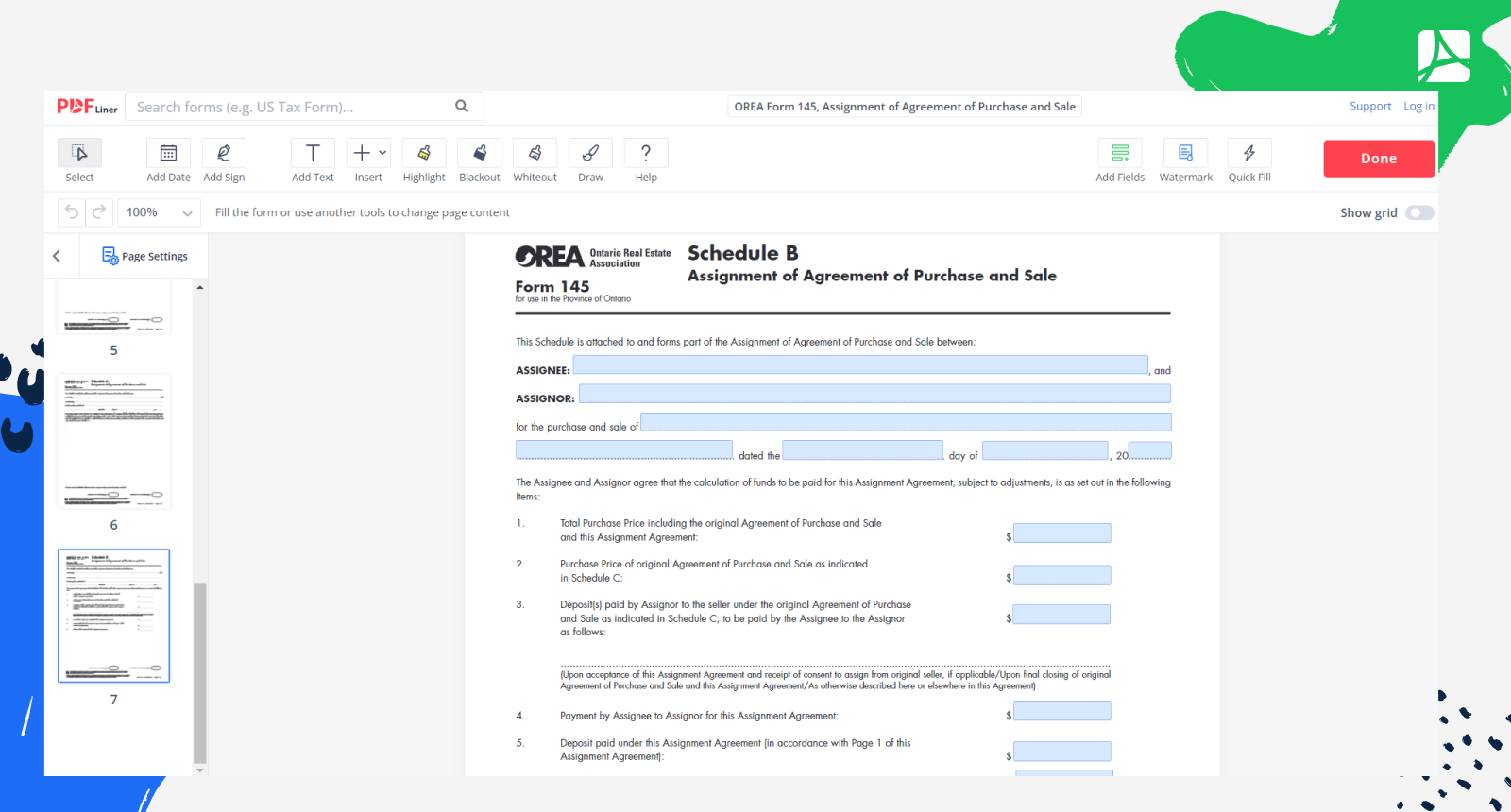

The Assignee and Assignor agree that the funds for this transaction will be calculated and paid as set out in Schedule B attached hereto and forming part of this Agreement.

This is the “paid on closing arrangement” and the outline for the funds.

Assignee agrees to pay the balance as more particularly set out in Schedules A and B attached.

Schedules A, B (Calculation of funds for this Agreement),

Schedule A is the regular one that you will come across. Schedule B is the actual breakdown and calculation of the various funds. It is peculiar to assignments.

We will break this down later.

C (Agreement of Purchase and Sale that is the subject of this Assignment),

This is a full and complete copy of the original Agreement from ABC Developers Inc.

2. ASSIGNMENT: The Assignor agrees to grant and assign to the Assignee, forthwith all the Assignor’s rights, title and interest, in, under and to the Agreement of Purchase and Sale attached hereto in Schedule “C”.

This is the assignment and the full transfer of rights under the underlying Agreement.

3. ASSIGNEE COVENANTS: The Assignee hereby covenants and agrees with the Assignor that forthwith upon the assignment of the Agreement of Purchase and Sale it will assume, perform, comply with and be bound by, all obligations, warranties and representations of the Assignor as contained in the Agreement of Purchase and Sale as if the Assignee had originally executed the Agreement of Purchase and Sale as buyer with the seller.

This is the assumption by the assignee, the new Buyer to take over.

4. ASSIGNOR COVENANTS: The Assignor covenants and represents that:

(a) the Assignor has the full right, power and authority to assign the prior Agreement of Purchase and Sale attached hereto as Schedule “C” (the “Agreement of Purchase and Sale”) and the Assignor’s interest in the property;

(b) the Agreement of Purchase and Sale attached hereto as Schedule “C” is a full and complete copy thereof and has not been amended, supplemented, terminated or otherwise changed in any way and is in good standing and has not previously been assigned.

(c) the Assignor will not amend the Agreement of Purchase and Sale without the Assignee’s prior written consent;

(d) after acceptance of this Assignment Agreement until the earlier of termination or completion of the Agreement of Purchase and Sale attached hereto as Schedule “C”, the Assignor will not further assign the Agreement of Purchase and Sale.

(e) neither party to the Agreement of Purchase and Sale (Schedule C) has done any act in breach of the said Agreement of Purchase and Sale or committed any omission with respect to the said Agreement of Purchase and Sale.

This is the outline of the new role for the Assignor.

7. FUTURE USE: Assignor and Assignee agree that there is no representation or warranty of any kind that the future intended use of the property by Assignee is or will be lawful except as may be specifically provided for in this Assignment.

The property started out as a farm and it is in the process of becoming a residential condominium. But, the Assignor doesn’t promise that.

8. INSPECTION: Assignee acknowledges having had the opportunity to inspect the property or the plans and documents for the property to be constructed and understands that upon acceptance of this offer there shall be a binding Assignment agreement between Assignee and Assignor.

Very, very peculiar, looking at the plans is an “inspection”. This makes no sense! It really should be here like that, but it is, so you have to be aware and make sure that the second Buyer is aware of that too. There really are no inspections!

10. RESIDENCY: (a) Subject to (b) below,

the Assignor represents and warrants that the Assignor is not and on completion will not be a non-resident under the non-residency provisions of the Income Tax Act which representation and warranty shall survive and not merge upon the completion of this transaction and the Assignor shall deliver to the Assignee a statutory declaration that Assignor is not then a non-resident of Canada;

(b) provided that if the Assignor is a non-resident under the non-residency provisions of the Income Tax Act, the Assignee shall be credited towards the Purchase Price with the amount, if any, necessary for Assignee to pay to the Minister of National Revenue to satisfy Assignee’s liability in respect of tax payable by Assignor under the non-residency provisions of the Income Tax Act by reason of this sale. Assignee shall not claim such credit if Assignor delivers on completion the prescribed certificate.

This is consistent with the Buyer’s obligation to verify the residency of the Seller in most transactions.

12. PROPERTY ASSESSMENT: The Assignee and Assignor hereby acknowledge that the Province of Ontario has implemented current value assessment and properties may be re-assessed on an annual basis.

The Assignee and Assignor agree that no claim will be made against the Assignee or Assignor, or any Brokerage, Broker or Salesperson, for any changes in property tax as a result of a re-assessment of the property, save and except any property taxes that accrued prior to the completion of this transaction.

This disclaimer doesn’t really work as it applies to those who are not party to the transaction.

15. APPROVAL OF THE AGREEMENT: In the event that consent to this Assignment is required to be given by the seller in the Agreement of Purchase and Sale attached hereto in Schedule C, the Assignor will apply, at the sole expense of the Assignor, forthwith for the requisite consent, and if such consent is refused, then this agreement shall be null and void and the deposit monies paid hereunder shall be refunded without interest or other penalty to the Assignee.

From time to time, there will be a restriction upon assignment. Some clauses are enforceable and some are not. In some cases, there is a fee that is required to be paid to the Seller.

16. AGREE TO CO-OPERATE: Except as otherwise expressed herein to the contrary, each of the Assignor and Assignee shall, without receiving additional consideration therefor, co-operate with and take such additional actions as may be requested by the other party, acting reasonably, in order to carry out the purpose and intent of this Assignment.

This is important. The transaction may continue for several years. This states that the Assignor, John Smith will continue to assist in the transaction as required, and no further compensation need be paid.

But, what if John becomes mentally disabled or dies? In that case, Mary Jones needs a Continuing Power of Attorney for Property that applies only to this property and is not revoked upon death. There is no requirement or obligation for this otherwise in the standard form.

17. DEFAULT BY SELLER: The Assignee and Assignor acknowledge and agree that if this Assignment Agreement is not completed due to the default of the seller for the Agreement of Purchase and Sale (Schedule C) that is the subject of this Assignment, the Assignor shall not be liable for any expenses, losses or damages incurred by the Assignee and this Assignment Agreement shall become null and void and all moneys paid by the Assignee under this Assignment Agreement shall be returned to the Assignee in full without interest.

What if the original condo developer runs into financial trouble? John Smith is not responsible, although he does agree to refund all the money. That might be quite a challenge after he has spent it all and left the country.

20. AGREEMENT IN WRITING: If there is conflict or discrepancy between any provision added to this Assignment (including any Schedule attached hereto) and any provision in the standard pre-set portion hereof, the added provision shall supersede the standard pre-set provision to the extent of such conflict or discrepancy. This Assignment including any Schedule attached hereto, shall constitute the entire agreement between Assignee and Assignor. There is no representation, warranty, collateral agreement or condition, which affects this Assignment other than as expressed herein. This Assignment shall be read with all changes of gender or number required by the context.

This provision is important because it contains an “entire agreement” clause.

BALANCE OF PAYMENT UNDER THIS ASSIGNMENT AGREEMENT:

The Assignee will deliver the balance of payment for this Assignment Agreement as more particularly set out in Item 6. on Schedule B, subject to adjustments, with funds drawn on a lawyer’s trust account in the form of a bank draft, certified cheque or wire transfer using the Large Value Transfer System,

to the Assignor prior to completing the transaction in the Agreement of Purchase and Sale attached hereto as Schedule “C”

to be held in trust without interest pending completion or other termination of the Agreement of Purchase and Sale attached hereto as Schedule “C”.

The title transfer date is the final closing. Funds are to be held in trust until then. That could be quite some time. Opting for an earlier occupancy closing could be risky.

The Assignee and Assignor agree that the calculation of funds to be paid for this Assignment Agreement, subject to adjustments, is as set out in the following Items:

1. Total Purchase Price including the original Agreement of Purchase and Sale and this Assignment Agreement:

2. Purchase Price of original Agreement of Purchase and Sale as indicated in Schedule C:

3. Deposit(s) paid by Assignor to the seller under the original Agreement of Purchase and Sale as indicated in Schedule C, to be paid by the Assignee to the Assignor as follows:

It is important to get the correct calculations here.

- This is $575,000.00.

- This is $400,000.00

- This is $30,000.00 (one more $15,000.00 payment is yet to be made)

(Upon acceptance of this Assignment Agreement and receipt of consent to assign from original seller, if applicable)

(Upon occupancy by the Assignee and receipt of consent to assign from the original seller, if applicable)

(Upon final closing of original Agreement of Purchase and Sale and this Assignment Agreement)

4. Payment by Assignee to Assignor for this Assignment Agreement:

5. Deposit paid under this Assignment Agreement (in accordance with Page 1 of this Assignment Agreement):

6. Balance of the payment for this Assignment Agreement:

Kindly note that you have to figure out when the closing will be, now, occupancy, or title transfer.

- $175,000.00 (that’s the market lift),

- $20,000.00 (this is the deposit on the assignment not the ABC deal),

- $185,000.00, (that’s the market lift, less the deposit paid, plus credit for the Assignor’s deposit paid to ABC, so $175,000.00 less the $20,000.00 deposit ($155,000.00) plus the $30,000.00 in deposits paid so far to ABC, or $185,000.00. The Assignee will pay the next deposit instalment in favour of the Seller when it becomes due.

It is noteworthy that the Assignment transaction could be closed upon occupancy or upon the final title transfer. Title transfer would be much preferred and the least risky alternative. The Schedule A requirement is to pay the funds ahead of time.

Brian Madigan LL.B., Broker

www.OntarioRealEstateSource.com

Brian, this is fabulous. Helps to understand clause construction and the 3 schedules (A,B,C) of an assignment deal. This actually makes me think of a dozen more questions but for next time.

Thanks very much!

Hi Brian, I found this helpful. Thankyou. What form would you use for a Potl? Condo or freehold?

OREA Form 111

Wow this really helped with filling out the forms. Thank you so much. You’re a life saver.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Privacy Overview

(905) 683-2741 | [email protected]

Barristers, Solicitors, Notaries

- Lawson, Clark & Oldman

- Oct 15, 2018

Assigning Agreements of Purchase and Sale for Used Residential Properties

The Ontario Real Estate Association (OREA) form of Agreement of Purchase and Sale (APS) for residential resale homes contains many boilerplate provisions that are found in most contracts. However, one provision that is not contained in this standard APS is in respect to “assignment”. An assignment occurs when a party assigns (i.e., transfers) all of its legal rights and interest in the APS to a third party (the “Assignee”), following which this Assignee then becomes the party in the place and stead of the person who has made this assignment (the “Assignor”). The Assignee is not buying the property from the Assignor, but is rather buying the Assignor’s right to acquire the property from the Seller. The Assignee assumes and agrees to perform all of the Assignor’s obligations under the original APS, including paying the purchase price and adjustment costs on closing – in essence, the Assignee steps into the shoes of the Assignor as Buyer and completes the transaction with the Seller.

Unlike builder agreements for new homes, which usually expressly prohibit assignment without first obtaining the builder’s consent, the standard OREA APS for resale properties does not expressly forbid assignment. As such, these agreements are assignable by default, without needing the consent of the other party. If either party wishes to restrict the ability for the other party to assign its interest in the OREA APS, they would need to insert such restrictive language explicitly in Schedule A to the APS.

Assignments of resale properties can occur for a variety of reasons. For instance, someone can enter into an APS to buy a property, but then has a change of heart or circumstance and now needs a way out of the deal. Another example is when a couple’s offer for their dream home is not accepted in a bidding war, so they decide to make the couple who won the war a better offer in exchange for the right and interest in the APS. Also, if you signed an APS in your individual capacity, but for tax and liability reasons you want your corporation to hold title in your place, you can assign your rights and interest in the APS to such corporation. Finally, many real estate investors tend to be drawn to assignments as they can be a quick way to make a profit.

When the Assignor and Assignee have agreed to an assignment, this agreement needs to be put to writing. OREA has prepared a standard form agreement for this arrangement as well, called an Assignment Agreement. The Assignment Agreement outlines the Assignor’s and the Assignee’s obligations and representations made to one another. In it, the Assignor promises that the original APS is in good standing, that the Assignor is not in breach of any of its obligations to the Seller, and that the Assignor has the right to assign the original APS (i.e., there is no language to the contrary in the original APS). The Assignee must assume all of the Assignor’s obligations per the original APS, in addition to paying the Assignor the stipulated assignment fee as per the Assignment Agreement. The Assignee should always get a copy of the original APS from the Assignor and it should be attached to the Assignment Agreement as a schedule.

The flow of funds between the Assignee, Assignor and Seller can sometimes be confusing. The Assignee on closing pays the Seller the purchase price as listed on the original APS, including all adjustment costs and land transfer tax and other closing costs. The amount the Assignee pays to the Assignor usually equals the price paid to the Assignor as per the Assignment Agreement, minus the original purchase price to be paid to the Seller, plus the deposits paid by the Assignor to the Seller on the original APS. Typically, the balance of the purchase price on the Assignment Agreement to be paid to the Assignor should be paid by the Assignee upon the closing of the original APS.

There are, of course, certain risks and complications for the Assignor and Assignor in these transactions for which they should be made aware. The Assignor is generally still obligated to close on the transaction with the Seller via the original APS if the Assignee defaults or fails to close (but the Assignor would have recourse against the Assignee in this case). If the balance of the funds owed to the Assignor is set to be paid upon the acceptance and execution of the Assignment Agreement (as opposed to being payable upon the closing of the original APS) and the transaction does not close with the Seller, then the Assignee (a) would not receive the property and (b) would be out of pocket the funds it has already provided the Assignor. The Seller may also not always not cooperate with the Assignee, and may insist on only dealing with the Assignor and Assignor’s lawyer. This may occur if the Seller is resentful after discovering that the Assignor profited from assigning the APS. The Seller may feel as if he/she sold the property for under market value if the Assignor is able to assign the original APS for a profit. If the Seller refuses to close with the Assignee or defaults as per its obligations in the original APS, the Assignment Agreement is deemed to be void and the Assignor must return the Assignee’s deposit as per the Assignment Agreement.

An assignment can be an effective way to exit a deal, to get another chance at securing a property you lost in a bidding war, and/or to make a profit. In these types of transactions there is typically three different lawyers: one acting for the Seller, one for the Assignee, and another for the Assignor. Many real estate lawyers are not completely comfortable or competent with handling a real estate transaction involving an assignment. If you find yourself in the position of being an Assignor or an Assignee, be sure to consult with a real estate lawyer with experience in these types of unique deals to ensure your specific rights are protected and the funds are distributed properly.

- Real Estate

Recent Posts

Selling your Business? Don't Forget About Third-Party Consents

The Interplay Between Pre-Incorporation Contracts and Real Estate Deposits

Commercial Real Estate Transactions - Due Diligence Considerations for Vendors

TDJ Law: OREA Form 100

Welcome to TDJ Law's resource page for the OREA Form 100, an essential document for any real estate transaction in Ottawa, Ontario. Here, you'll find a comprehensive guide to understanding and using this form, as well as a direct link to download it.

What is the OREA Form 100?

OREA Form 100 , also known as the Agreement of Purchase and Sale, is a standard contract in Ottawa real estate transactions. This legally binding document outlines the terms and conditions related to the sale of a property. It contains critical information such as the price, closing date, and any conditions that must be met for the sale to proceed.

Who Needs the OREA Form 100?

Whether you're a buyer or a seller, if you're participating in a real estate transaction in Ottawa, you'll likely need to use the OREA Form 100. It provides a clear framework for the agreement between the buyer and seller, ensuring all parties understand the specifics of the sale. Real estate agents, lawyers, and individuals managing private sales also frequently use this form.

Why Use the OREA Form 100?

The Agreement of Purchase and Sale serves as the foundation of any real estate deal in Ottawa. It provides legal protection to all parties involved, reducing potential disputes or confusion during the transaction. By clearly defining the terms of the sale, this form ensures that both buyer and seller enter the agreement with full knowledge of their responsibilities and rights.

Accessing the Form

For easy access to OREA Form 100, simply click here .

We recommend consulting with a legal or real estate professional at TDJ Law when filling out this document to ensure that your interests are adequately protected.

At TDJ Law, we're dedicated to providing you with the resources and expertise you need for a smooth and successful real estate transaction. If you have any questions or require assistance with the OREA Form 100 or any aspect of the agreement of purchase and sale in Ottawa, please feel free to contact us .

2024 © TDJ LAW. All Rights Reserved

- Real Estate Lawyer

- Wills & Estate Planning

- Business Law

- Marty’s Musings

- Testimonials

- Assigning an Agreement of Purchase and Sale (Prior to Closing)

- Marty's Musings

By Martin Rumack

September 3, 2016

What is an Assignment of an Agreement of Purchase and sale?

At its essence, an Assignment of an Agreement of Purchase and Sale – informally known as “flipping a home” – is a simple concept: A buyer of a new home allows someone else to take over the purchase contract, which allows that person to buy that same home him or herself.

More specifically, the original buyer enters into a formal Agreement of Purchase and Sale with a Builder, and then allows another person – who we will call the “new buyer” – to step into his or her shoes through what is legally known as an “Assignment” of that original Agreement or Offer to buy. The new buyer pays the original buyer a higher price than what was set out in that original Agreement, with the difference begin the original buyer’s profit. All of this takes place after the original buyer has agreed to buy from the Builder, but before the deal closes ; the original buyer never takes title to the property.

This arises primarily with homes: For newly-built homes with typically long closing dates (e.g. often 18 months or more), an Assignment is particularly attractive in situations where the Builder has already sold all of the units in the development early on, but where there is still demand for soon-to-be-completed homes and new condominium units in the development. The assignment of a new condominium unit is also interesting for similar reasons, although the time frame may be significantly longer depending on when the assignment occurs. This puts the original buyer in position to make a profit by inflating the new price well above what he or she agreed to pay the Builder in the first place.

And what is the benefit to the new buyer? There can be several:

- The new buyer may be able to buy into a desirable neighbourhood at a time when there are no more units available to be purchased directly from the Builder;

- Even taking the original buyer’s profit into account, the assignment may give the new buyer a price advantage over other properties that are currently on the market; and

- Depending on the timing of the assignment, the new buyer may be position to choose finishes and make minor changes to the yet-to-be-built home.

Whatever the respective motivations of the original and new buyer, the assignment of an Agreement of Purchase and Sale has many specific features – and just as many potential pitfalls. What follows is a discussion of some of the key points.

When Can An Agreement of Purchase and Sale Be Assigned?

Unlike the standard Toronto Real Estate Board (TREB) or Ontario Real Estate Association (OREA) agreements, many Builders’ own ( i.e. customized) Agreements of Purchase and Sale contain a clause that generally prohibits the assignment of the contract outright – or else allows it only certain very strict conditions and in exchange for a significant fee payable to the Builder.

In fact, the vast majority of new home or condominium-purchase agreements do not allow the original buyer to assign the contract to someone else and stipulate that any attempt by the buyer to do so, or to list the home for sale on the Multiple Listing Service (MLS) or otherwise, or else list the property for rent, will put the original buyer in breach of the Agreement. This triggers the Builder’s right, with notice, to terminate the original Agreement, keep the original buyer’s deposit, and seek additional damages from him or her. (And in most cases, the original buyer’s Agreement is “dead”; i.e. he or she cannot go back and try to complete the transaction as if no assignment had taken place).

All of this means that anyone who has agreed to purchase a home from a Builder should give careful consideration to, and should seek legal advice prior to signing the Agreement, or in the case of condominium units during the 10-day cooling-off period in order to determine whether it’s possible to assign the Agreement in the first place.

This in turn involves a careful review of the clauses in that Agreement.

Typical (and Not-So-Typical) Provisions:

As a practical matter, there are as many variations in these types of provisions as there are Builders.

Many Agreements of Purchase and Sale will include a largely-standard “No Assignment” clause, which disentitles the original buyer from “directly or indirectly” taking any steps to “lease, list for sale, advertise for sale, assign, convey, sell, transfer or otherwise dispose of” the property or any interest in it.

A potential exception – and this is important – arises if the Builder gives prior written consent , although in the more draconian version of these kinds of contract, that consent may be “unreasonably and arbitrarily withheld” by the Builder, essentially on its whim. In other words, the buyer is not allowed to deal with the property, unless the Builder pre-approves it in writing, but in many cases the Builder has no obligation to give that approval and may withhold it for any reason whatsoever, including unreasonable and arbitrary ones.

(With that said, the “No Assignment” clause in some Agreements will allow for express exceptions or situations where the Builder will not withhold consent, for example: a) Assignments made to a member of the original buyer’s immediate family; or b) where the Builder has determined that a sufficient and satisfactory percentage of the available units have already been sold).

The bottom line is that the basic clause in an Agreement of Purchase and Sale may or may not allow for the assignment of the Agreement to a new buyer, and if it is allowed, it will be subject to specified conditions such as obtaining the Builder’s written consent. Most Agreements will embellish this basic clause by adding further written stipulations such as:

- Having both the original buyer and the new buyer sign an Assignment Agreement that has been drafted by the Builder;

- Mandating the original buyer will not assign the Agreement until the Builder has managed to sell a certain percentage of the units in the overall development (e.g. 85 or 90%), and even then it must be with the Builder’s written consent as usual;

- Requiring the original buyer to pay a fee to the Builder of (for example) $5,000 plus taxes as part of obtaining the Builder’s consent to the assignment;

- Requiring the original buyer to pay another fee plus taxes to the Builder’s lawyer (ostensibly as a sort of “legal processing fee”);

- Getting the pre-approval of any lending institution or mortgagee that is providing funding to the Builder for construction or otherwise;

- Assuming the Builder agrees to the assignment in the first place, prohibiting any further assignments of the offer by the new buyer to any subsequent party;

- Confirming that the breach of any of the original buyer’s promises in relation to how and when an assignment can occur will be considered a breach of the whole agreement (and one that cannot be remedied); and

- Requiring the original buyer to confirm in writing that the property is not being purchased for short-term speculative purposes.

- Note that even if the Agreement of Purchase and Sale does not expressly allow or provide for it in writing, some Builders will permit an original buyer to make an assignment nonetheless. This is because it is always in the Builder’s discretion to give up (usually for a fee) its right to technically insist on the purchase going ahead with the original buyer.

Getting the Builder’s Consent

It’s important to remember that, initially, the original buyer and the Builder had a valid legal contract in place that obliged the buyer to purchase a home or condominium unit from the Builder. That original buyer, for whatever reason – whether it’s a change of circumstances (such as a change in a marital situation, job transfer to another city, province or country; birth of children resulting in a home/condominium unit being too small for the buyer), cold feet, or simply the desire to make a profit – has subsequently decided to “sell” that right to buy to the new buyer.

To protect the Builder, the Assignment will contain clauses that are designed to safeguard the Builder’s rights. The most important one is that, as discussed, the Builder must give its written consent to the Assignment. This will often involve specific Builder-imposed requirements, fees and forms which must be completed.

Once consent has been obtained, there may be additional restrictions on the manner in which the original owner can market the property. For example, some Builders will insist that the property is not to be listed on MLS (where it may be competing with the Builder’s own listings for still-unsold home and units in the same development); if the original owner does so nonetheless, it will be tantamount to a breach of the Agreement of Purchase and Sale which could entitle the Builder to damages, or rescission of the Agreement of the Purchase and Sale while retaining the deposits paid, as well as the monies paid for extras.

However, aside from any marketing / advertising restrictions that may be imposed, the original buyer must clearly indicate in any listing that it is an assignment of an Agreement of Purchase and Sale, not merely an ostensible sale from the original buyer.

Continuing Liability After Assignment

One key provisions in the Agreement of Purchase and Sale – and one that is easy to overlook – may significantly impact whether an original buyer will want to assign his or her agreement at all.

Even though the original buyer has essentially transferred his or her right to buy the property to the new buyer, the original buyer is not fully off-the-hook. Rather, under the terms of the Assignment document, the original buyer can remain liable to go through with the contract if the new buyer does not complete the transaction with the Builder.

This written obligation appears in the original buyer’s Agreement of Purchase and Sale, and is couched in phrases that give the buyer continuing liability for the “covenants, agreements, and obligations” contained the original agreement. But the net effect is that the original buyer remains fully liable should the agreement between the Builder and the new buyer collapse. The Agreement may also stipulate that the assignee, meaning the person receiving the benefit of the assignment (i.e. the new buyer) must sign an “assumption covenant” which creates a binding contract between the new buyer and the Builder.

(Incidentally, in contrast some Builder’s agreements quite conveniently allow the Builder itself to freely assign the agreement to any other Builder registered with Tarion, which assignment completely releases the Builder from its obligations.)

The original buyer’s continuing liability under the Assignment Agreement is a major drawback in these types of arrangements. The original buyer always has to balance the risks and rewards inherent in this scenario.

Documenting the Transaction

Assuming that the assignment of an offer is even permitted by the Builder, then (as with all contracts) it must be documented to reflect and protect the legal right of the parties.

The technical aspects of an assignment require more than simply taking the original buyer’s Agreement of Purchase and Sale with the Builder, scratching out his or her name, and replacing it with the new buyer. (Although, in some cases people do try to “squeeze in” assignment-of-offer terminology into a new Agreement of Purchase and Sale made out in the new buyer’s name – but this is definitely NOT recommended).

Rather, a properly-documented transaction makes reference to the Agreement of Purchase and Sale between the original buyer and the Builder, but adds a separate document called an “Assignment of Agreement of Purchase and Sale.” The Ontario Real Estate Association (OREA) provides a standard form that can be used, although in many cases those Builders who permit Assignments will insist that the original buyer and the new buyer use the Builder’s customized assignment forms, rather than the OREA standardized version.

The Specifics of the Deal –Who Pays What?

Recouping the Original Buyer’s Costs

At the point where the Assignment is being negotiated, the original buyer has typically paid a deposit to the Builder, may have pre-paid for certain upgrades and extras, and has a large balance owing. This means that in the course of striking a deal to achieve the assignment, the original buyer should give some serious thought to the various costs, fees, pre-paid deposits, and tax repercussions of the deal, and how these should be reflected in the price that he or she will want the new buyer to pay under the Assignment Agreement. The timing of the payment(s) will also be a consideration.

For both original buyer and new buyer who are considering an assignment arrangement, here are some of the questions to ask:

- Does the price to be paid by the new buyer include any fee that the Builder is charging in exchange for the original buyer’s right to assign the Agreement of Purchase and Sale?

- Does it include any deposits paid by the original buyer to the Builder, after the Agreement was signed? Does it include any interest that has been earned on those deposits?

- Does it clearly state that the new buyer will take over the entire contract, including the adjustments that are to be paid to the Builder on closing? Or are those adjustments to be split between new and original buyer?

- Does the price include money paid by the original buyer for extras and upgrades?

- Are there any additional deposits that are still owing to the Builder, under the original agreement?

- Who is responsible to pay the additional fee ( i.e. the Builder-imposed fee) in exchange for the Builder giving consent? Usually, this will be the original buyer, but the parties may negotiate otherwise.

- Does the new buyer agree to take on responsibility under the original Agreement for making additional deposit payments until the final closing date (which may still be months or even years away)?

- Does the new buyer have a full understanding of the amount of all the adjustments that must be paid to the Builder pursuant to the original Agreement?

- If the original buyer has negotiated any special financial incentives into the Agreement of Purchase and Sale that has been reached with the Builder, have these been addressed in terms of whether the new buyer will receive the benefit of them?

In any case, the final purchase price payable from the new buyer to the original buyer will typically be made up of:

- The outstanding balance owed to the Builder by the original buyer, that will now be payable by the new buyer;

- The total deposits already paid by the original buyer to the Builder;

- The total payments already paid by the original buyer to the Builder for any upgrades, extras, etc.; and

- The profit that the original buyer stands to make in the deal.

Deposits, and Interest on Deposits

The treatment of deposits, and the interest they may have earned, merits a brief separate discussion.

Under virtually all Agreements of Purchase and Sale with Builders, the original buyer will be required to pay a series of deposits to the Builder, starting with the initial deposit paid when the Agreement is signed, and on a set payment schedule thereafter. The total of those deposits can be significant.

Once the Agreement has been assigned to the new buyer, how those deposits are treated will form part of the negotiations. Typically, the original buyer will get those deposits back from the new buyer as part of the overall purchase price of the assignment transaction; he or she will usually receive them at the time the assignment agreement is entered into and the Builder has consented to the assignment.

The potential problem with an Assignment Agreement is financing. The original buyer will want his deposit funds returned before closing, but if the new buyer does not have funds on-hand, he or she may find that financing is very difficult to obtain because banks do not advance mortgage funds at the time an Assignment Agreement is entered into; rather, the financial institution will provide funds only on final closing. This can serve as a roadblock to the new buyer’s ability to repay the deposits and potentially to embark on the transaction at all.

The question of who is entitled to the Interest on any deposits pre-paid to the Builder is also a topic for the original and new buyers to discuss. In many cases, the interest will be only a small amount (if any) and may be credited to the new buyer, rather than the original one. However, in cases where the original buyer has paid significant deposits over time, and where larger interest amounts have accrued, the parties may want to negotiate a different outcome.

Land Transfer Tax

Land Transfer Tax is also an important consideration in Assignment Agreement arrangements.

When negotiating the deal, the original buyer and the new buyer must discuss the structure of the deal between them, to ascertain the exact selling price on which the Land Transfer Tax (and any Municipal Land Transfer Tax) should be payable i.e . whether it is the original buyer’s price with the Builder (net of HST and the HST New Housing Rebate, which is discussed below), or whether it’s the newly-inflated price being paid by the new buyer under the Assignment.

Generally speaking, it will be the latter, although in some assignment arrangements the parties have attempted to structure it so that they pay the Land Transfer Tax based on the lower initial price asked by the Builder, while taking the position that difference between that and the increased price is merely the “fee” paid to acquire the original Agreement of Purchase and Sale entered into with the Builder (thus avoiding having the tax calculated on the higher sale price).

In any case, once the Assignment Agreement is reached, it will be the new buyer who is obliged to pay Land Transfer Tax and any Municipal Land Transfer Tax on closing, not the original buyer.

HST and the HST New Housing Rebate

The issue of how HST is to be treated in an assignment scenario is a crucial one, but is fraught with pitfalls.

The first issue is how HST on the transaction should be calculated. Because the new buyer’s price will inevitably be higher than the one the original buyer agreed to pay to the Builder, there is an important issue as to whether the difference – meaning the original buyer’s profit – should be subject to HST (and if so, who will pay it in the transaction).

This determination hinges on whether the assignment is a “taxable supply” under the tax legislation, and on whether the original buyer can be considered or deemed a so-called “builder” of the home for HST purposes. This, in turn, involves a number of complex legal concepts and factual findings – including the intentions of the original buyer as to whether the home is going to be a primary residence.

Next, there is the issue of the HST New Housing Rebate. In a typical scenario, the original buyer may have been entitled to the HST New Housing Rebate, based on meeting numerous qualifying requirements and stipulations. However, once he or she assigns the Agreement, that eligibility is obviously lost because he or she is no longer taking title to the home on closing. Only one HST New Housing Rebate application per dwelling can be filed.

But once there has been an assignment, it is the new buyer’s circumstances that will determine whether the opportunity for an HST Rebate exists. He or she will have to meet the stipulated legislated requirements, and may either apply directly to the Canada Revenue Agency (CRA), or arrange with the Builder to have the rebate amount credited right at closing.

(Note that the new buyer may want to take steps to protect his or her position in this regard. For example, when negotiating the Assignment Agreement, the new buyer should make the agreement conditional on receiving written confirmation from the Builder that any HST New Housing Rebate will be credited to him or her on closing (assuming that the qualifying requirements are otherwise met). Otherwise, if this commitment is not in writing then the Builder, being entitled to exercise its discretion on whether to credit the buyer with the rebate amount on Final Closing, can withhold it and force the new buyer to apply to CRA directly after closing. Obtaining this commitment in writing is especially important given the likely lack of prior dealing between the Builder and the new buyer.

Other Things To Consider

Who is Responsible for the Documentation?

In addition to ascertaining whether the original buyer or the new buyer will pay for certain items, it is also important to determine – in advance – which of them will take care of arranging the documentation. The questions to ask:

- Who will prepare the documents needed to achieve the Assignment? And who will bear the cost?

- Will the Builder’s lawyer prepare the Builder’s needed consent to the Assignment?

- Since the new buyer cannot renegotiate any of the provisions of the Agreement that the original buyer entered into with the Builder, are any of those terms objectionable, and if so, how will they be resolved and who will bear the cost?

As discussed, the Assignment Agreement will be conditional on the Builder giving its consent. From the new buyer’s standpoint, it should also be made conditional on him or her giving close review to the original Agreement of Purchase and Sale (as signed by the original buyer), the Assignment Agreement, as well as any amendments, waivers, notices (and for condominium purchases, the Disclosure Statement) etc. If for no other reason, it will give the new buyer a chance to consider the specific list of adjustments for which he or she will be responsible to pay on closing. Needless to say, this review should be undertaken with the guidance of an experienced lawyer.

Once the terms of the assignment are settled and the Builder’s written consent has been obtained, the Assignment Agreement must be drafted and is attached to the original Agreement of Purchase and Sale that the original buyer entered into with the Builder.

Incidentally, the Builder may have certain requirements that must be incorporated into the process and accommodated as well. For example, the Builder will require the new buyer to provide I.D., and will need confirmation that he or she has the financing required to close in place.

Tarion Registration

When negotiating the assignment arrangement, the original and new buyers must be aware of the impact of the New Home Warranty Program as administered by Tarion, particularly if the home being “flipped” is a condominium unit.

There may be financial issues for the new buyer to work out before the deal can go ahead.

As usual, the transaction may be conditional on financing, which will be arranged on the higher price that the new buyer has agreed to pay. However, since some mortgage brokers may be unfamiliar with financing an assignment transaction, getting approval for the new buyer’s purchase may be challenging. This is something that needs to be investigated long before the original buyer and the new buyer start their negotiations in earnest.

A final issue to be negotiated is who is paying the commission with respect to the Assignment Agreement transaction. This includes consideration of the specific commission rate, together with the details on how and when the commission gets paid.

While an Assignment Agreement can be beneficial to both the original and the new buyer – and even to the Builder (in extra fees) there are many issues to be addressed and negotiate.

As an agent, make sure your client obtains legal advice prior to finalizing any agreement to assign the original Agreement of Purchase and Sale.

Be careful… be aware… and think!”

Leave a Reply

Your email address will not be published. Required fields are marked

Connect With Martin!

Toronto Office 2 St. Clair Avenue East, Suite #202, Toronto, ON, M4T2T5

(416) 961-3441

(416) 961-1045

We're here to help you when legal advice and legal solutions are what you need. There are no problems too big or too small to solve when it comes to Martin Rumack. Call us today and we'll help you navigate your challenges.

Let's have a conversation

your email address

your phone number

comments/questions

- Mon-Fri 9:00 - 17:00

- [email protected]

- 647-300-8391

Agreement of Purchase and Sale (APS)

The Agreement of Purchase and Sale (APS) is a crucial legal document governing Ontario’s real estate transactions . It is used by the Ontario Real Estate Association (OREA) and sets out the terms and conditions of the sale between the buyer and seller. This document is legally binding and outlines the obligations of both parties throughout the sale process. Here is a closer look at the OREA APS and what it entails:

What is an Agreement of Purchase and Sale (APS)?

What is the orea agreement of purchase and sale (aps), identification of parties, property description, chattels included, purchase price and deposit, irrevocability, adjustments and closing date, requisition date, warranties and representations, time is of the essence, common conditions used in aps, financing condition, home inspection condition, sale of buyer’s property, title search, legal review, orea aps vs. custom agreements, legal considerations.

An Agreement of Purchase and Sale (APS) is a legally binding contract establishing the terms and conditions under which a property is sold from a seller to a buyer. This document contains all the essential details of the transaction, such as the purchase price, property description, closing date, and any conditions that must be met before the closing, such as financing or inspection, as well as any items included or excluded from the sale. The APS serves as a guide for the transaction, ensuring both parties understand their responsibilities and the steps required to complete the sale. Additionally, it provides legal protection by outlining the remedies available if either party fails to fulfill their obligations as specified in the agreement.

The OREA Agreement of Purchase and Sale (APS) is a specific version of the APS tailored for real estate transactions in Ontario, Canada, standardized by the Ontario Real Estate Association (OREA). This document is crafted to meet Ontario’s real estate market’s unique legal and regulatory requirements.

What are the Standard Clauses in an APS?

Here are some of the standard clauses in an OREA APS:

Clearly states the names and roles of the buyer(s) and seller(s) involved in the transaction.

Provides a detailed description of the sold property, including address and legal description.

The “Chattels Included” clause in the Agreements of Purchase and Sale specifies which moveable property items are included in the sale, such as appliances, furniture, and window coverings. This clause helps avoid misunderstandings between the buyer and seller.

Fixtures Excluded

The “Fixtures Excluded” clause in an Agreement of Purchase and Sale (APS) specifies which items are physically attached to the property but not included in the sale. The seller removes these fixtures before the transfer of ownership. Fixtures that are bolted, nailed, screwed, or permanently attached to the walls, floors, or ceilings are typically included. However, the seller can retain ownership of certain fixtures by listing them in the “Fixtures Excluded” clause. This clause provides clarity and transparency to avoid misunderstandings.

Specifies the agreed-upon purchase price and details regarding the deposit amount, including how and when it will be paid.

In an Agreement of Purchase and Sale (APS), “irrevocability” is a specific period during which the offeror cannot withdraw their proposal. During this time, the offer remains open for acceptance by the offeree. Including an irrevocability clause provides a timeframe for decision-making and demonstrates the offeror’s commitment to the transaction.

This defines the transaction’s closing date and any adjustments to be made at closing (such as property taxes and utility bills).

The Requisition Date is a deadline by which the buyer must examine the title to the property and raise any objections. This allows the buyer to conduct due diligence, verify that the property title is free of any issues, and notify the seller of any issues found. If the buyer fails to raise any issues by the Requisition Date, they may forfeit their right to object to title issues discovered later.

Lists any conditions that must be met for the transaction to proceed, such as financing approval, home inspection results, or the sale of the buyer’s current home. These are typically outlined in Schedule “A” attached to the APS agreement.

Statements by the seller regarding the condition of the property and any guarantees or warranties being made.

“Time is of the Essence” is a legal principle in contracts, like Agreements of Purchase and Sale (APS), to signify that deadlines and schedules are critical and must be strictly followed. Failure to meet deadlines can be considered a breach of the contract. This clause elevates punctuality and schedule adherence from expectations to binding, enforceable obligations. Its purpose is to ensure the timely fulfillment of duties, facilitate a smoother transaction process, and provide a clear basis for legal recourse in case of undue delays.

Common conditions used in an Agreement of Purchase and Sale (APS) are provisions that must be met for the transaction to proceed to completion. These conditions are designed to protect the parties’ interests, allowing them to perform due diligence and ensure that specific criteria are met before the sale is finalized. Here are some of the most common conditions found in APS documents:

This condition allows the buyer a specified period to secure financing or mortgage approval from a financial institution. If the buyer cannot arrange the necessary financing within the stipulated time, they can opt out of the purchase.

It grants the buyer the right to have the property inspected by a professional home inspector . If significant issues not previously disclosed are discovered, the buyer can renegotiate the terms, request repairs, or withdraw from the sale.