CBSE NCERT Solutions

NCERT and CBSE Solutions for free

Case Study Questions Class 11 Accountancy With Answers

Students should practice Case Study Questions for Class 11 Accountancy with Answers before appearing in Class 11 Accountancy Board exams. We have provided below the class 11 Accountancy Case Study questions based on each chapter in your NCERT Book for Class 11 Accountancy. These chapter-wise questions have been prepared by teachers based on the latest examination pattern and syllabus issued by CBSE, NCERT KVS. The following Case Study questions and answers will be really useful to understand the type of questions that can be asked in exams

Class 11 Accountancy Case Study Questions and Answers

Practicing by going through the past year and Case Study questions for CBSE Class 11 Accountancy is very important to prepare for the Grade 11 Accountancy exams. We have provided below the best collection of questions which can come in your exams.

Chapter Wise Important Questions for Class 11 Accountancy with Answers

Class 11 Accountancy Part 1 Chapter 1 Introduction to Accounting Chapter 2 Theory Base of Accounting Chapter 3 Recording of Transactions – I Chapter 4 Recording of Transactions – II Chapter 5 Bank Reconciliation Statement Chapter 6 Trial Balance and Rectification of Errors Chapter 7 Depreciation, Provisions and Reserves Chapter 8 Bill of Exchange

Class 11 Accountancy Part 2 Chapter 9 Financial Statements – I Chapter 10 Financial Statements – II Chapter 11 Accounts from Incomplete Records Chapter 12 Applications of Computers in Accounting Chapter 13 Computerised Accounting System

Related Posts

States And Transitions Class 11 Computer Science Important Questions

The living world class 11 biology important questions.

Relational Databases Class 11 Informatics Practices Important Questions

DK Goel Solutions

- DK Goel Solutions Class 11

DK Goel Solutions Chapter 11 Books of Original Entry – Cash Book

Read below DK Goel Solutions Class 11 Chapter 11 Books of Original Entry Cash Book . These solutions have been prepared based on the latest Class 11 DK Goel Accountancy book issued for the current year and the questions given in each chapter.

In this chapter of DK Goel Accounting Solutions Class 11 , explain various concepts relating to cash books, what they mean, and their importance. It also provides basic steps on how to prepare cash books.

The chapter also includes lot of good quality problems or questions which can be very helpful to understand the concepts for Class 11 students of Accountancy and will also help build a strong foundation.

DK Goel Solutions Class 11 Chapter 11 solutions are free and will help you to prepare for Class 11 Accountancy

Books of Original Entry – Cash Book DK Goel Class 11 Accountancy Solutions

Students can refer below for solutions for all questions given in your DK Goel Accountancy Textbook for Class 11 in Chapter 11

Short Answer Questions for DK Goel Solutions Class 11 Chapter 11

Question 1:

Solution 1: For any type of transactions, it is useful to keep a different book, one to record cash transactions, another to record credit purchases of goods, and still another to record credit sales of goods.

All these books ( DK Goel Solutions Class 11 Chapter 11 )are referred to as initial entry books or main entry books or subsidiary books – it is a special type of Journal, a Journal sub-division.

Question 2:

Solution 2: Original entries are recorded in the below books:-

- Purchases Book

- Purchases Return Book

- Sales Return Book

- Bills Receivable Book

- Bills Payable Book

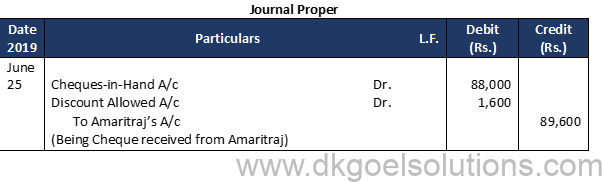

- Journal Proper

Question 3:

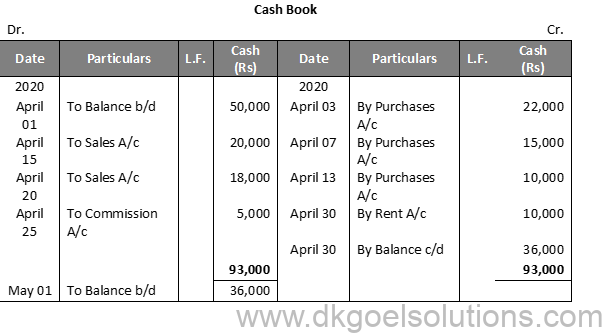

Solution 3: (a) Only monetary transactions are reported in the Cash Book, since this book documents only cash or bank-related transactions. The cash book almost still reflects a debit balance.

Since cash transfers cannot surpass cash receipts, the cash column in the cash book cannot display a credit balance. If the overall cash receipt is equal to the total bill, it will display zero balance at most.

(b) As cash Book is a book in which all transactions relating to cash receipts and cash transfers are registered, Cash Book is both Journal and Ledger. At the start of the cycle, it begins with cash or bank accounts.

Question 4:

Solution 4: As an original book and a ledger, the Cash book plays both roles. The Cash Book serves the dual purpose of the original entry or both books and the Ledger.

If we create a cash book, there is no need to create a separate cash account. A transaction is recorded in a cash book or cash account only if there is either cash inflow or cash outflow. The cash book therefore has a dual purpose.

Question 5:

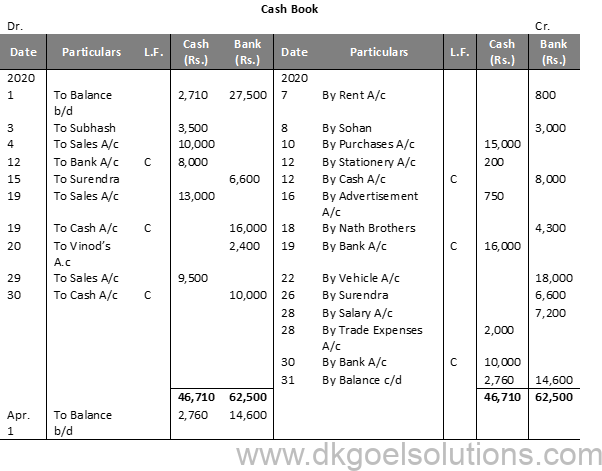

Solution 5: Some transactions are reported in a Two-Column Cash Book that refers to both cash and money, i.e. the balance of one will drop and, owing to such transactions, the other will increase.

Certain transactions are entered on all sides of the Cash Book. Against such entries, the letter ‘C’ is written in the L.F. column to indicate that these are contra transactions and are not posted into the Ledger Account.

(a) Cash deposited into the Bank 10,000

(b) Cash withdrawn from Bank for Office Use 1,000

Question 6:

Solution 6: The three advantages of Sub-Division of Journal are:-

(i) Division of work by capacity.

(ii) Ease of posting.

(iii) Save Time

Question 7:

Solution 7:

(i) Deposit of Cash into Bank:-

In the aforementioned trade, a cash account and a bank account are also influenced by the account. It is also contra-entry since all accounts are influenced concurrently by cash and bank.

Bank a/c Dr.

To Cash A/c

(ii) Withdrawal of money from bank for office use:-

Cash a/c Dr.

To Bank A/c

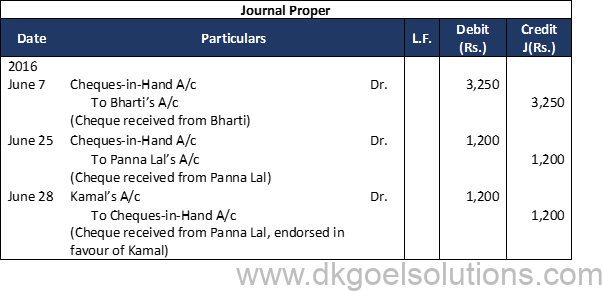

(iii) Deposit of cheque (received from other) into Bank:-

On the debit side “To Cheque-in-hand a/c” and on credit side “By Debtors a/c” with the same amount recorded.

Cheque-in-hand A/c

To Debtors A/c

(iv) Dishonour of cheque deposited into Bank:-

On the credit side “By Debtor a/c” and amount will be credited into the bank account.

Debtor a/c Dr

To Bank a/c

Question 8:

(i) Similarities of Cash Book with Journal:-

- The transactions in the cash book are documented from source records for the first time, much like a report.

- Transactions in the cashbook are reported date-wise, i.e. in a chronological order, when and when they are put, much like a document.

- Much as a log, cash book transfers are often posted in the ledger to the related accounts.

- A cash book also includes a ledger folio column, much like a journal.

(ii) Similarities of cash book with ledger:-

- The sort of cash book closely resembles the account of a ledger. Having similar columns, it has two evenly separated sides. The left side (receipt side) is the debit side and the credit side is the right side and the credit side is the right side (payment side).

- The cash book itself often functions as a cash account and as such, when a cash book is held, the cash account is not opened in the ledger. The cash book, however, is indeed a part of the ledger.

- In a cash book, much like a ledger account, the words ‘To’ and ‘By’ are sometimes used.

- Much like a ledger account, it is balanced.

Question 9:

Solution 9: Contra entries indicate entries on both sides of the cash book that are registered. When depositing or withdrawing money from the bank, these entries are made.

The two accounts, the cash account and the bank account, are influenced by Contra entries. In the Cash Book, these two accounts appear together only so that the result of entries is fulfilled in the Cash Book and there is no need to post them in the ledger.

Question 10:

Solution 10: Cash book is a journalised Ledger, it is a log because it first documents cash and bank transfers in it and a ledger since it often fits the function of a cash account. No distinct cash account is opened in the ledger when a cash book is prepared.

Question 11:

Solution 11:

Question 12:

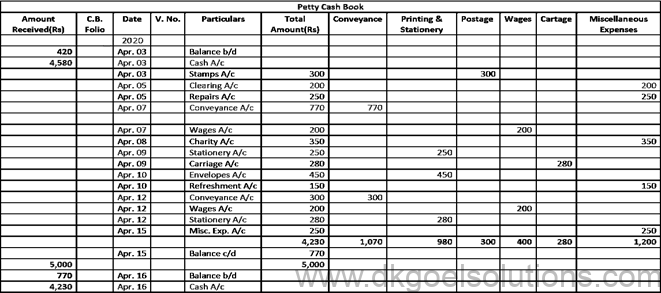

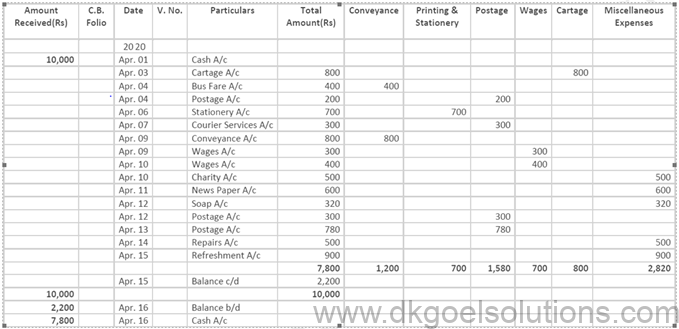

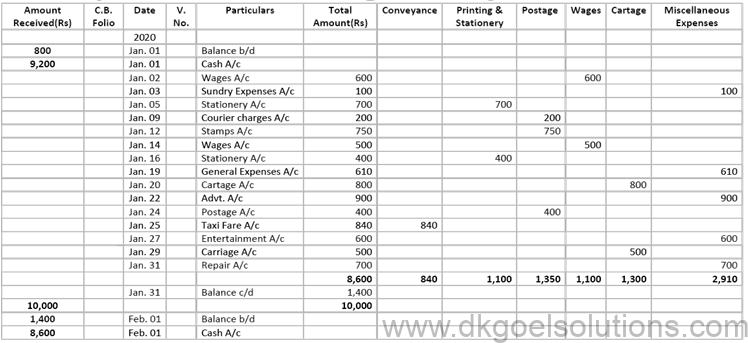

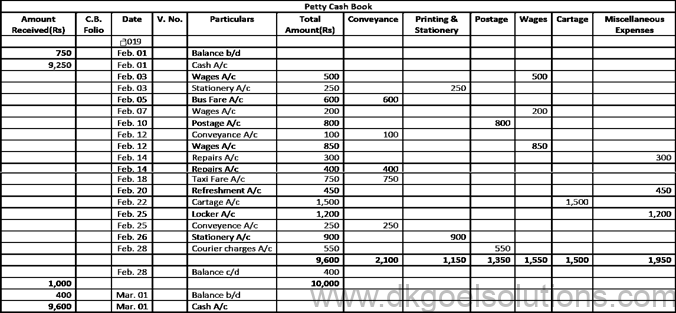

Solution 12: The book used for the purpose of tracking expenses containing minor sums is the Petty Cash Book. In addition to minor expenditures, principal cash receipts are reported.

The Petty Cash Book is prepared by the Petty Cashier which is the Petty Cash Account. In addition to large payments, it is retained as in a company, it is important to make a variety of minor payments, such as conveyance, stationary, cartage, etc.

Question 13:

Solution 13:

Question 14:

Solution 14: The Petty Cash imprint scheme is discussed below. Under this method, the amount needed for minor expenditures for a certain time is determined (say for a week, a fortnight or a month). At the beginning of an era, the amount so calculated is issued to the petty cashier and the amount charged by him during the period is repaid.

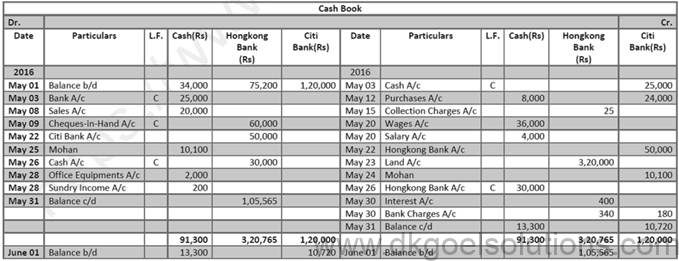

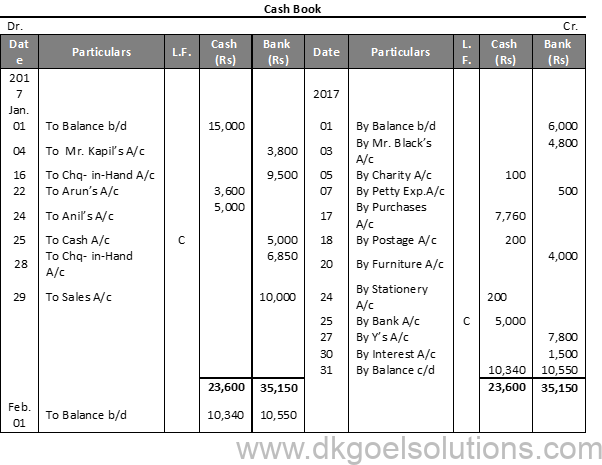

Numerical Question DK Goel Solutions Class 11 Chapter 11 :-

Question 1:

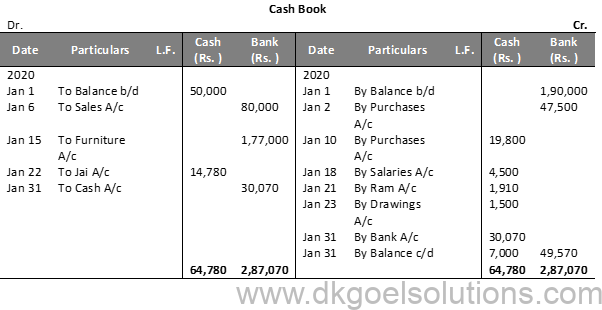

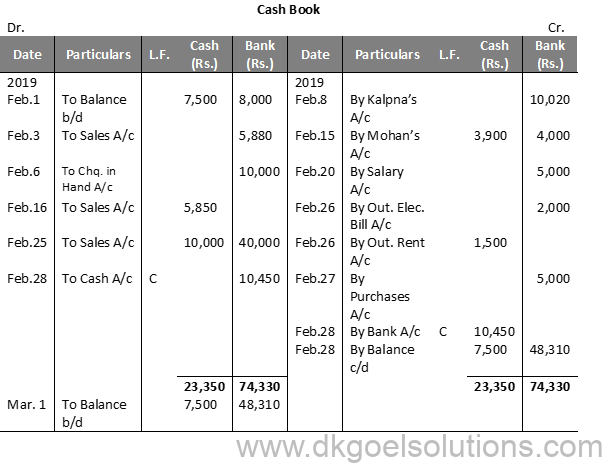

Solution 1:

Point in Mind:- The Cash Book Balancing is done like every other account. The debit column is often bigger than the credit column.

Question 2:

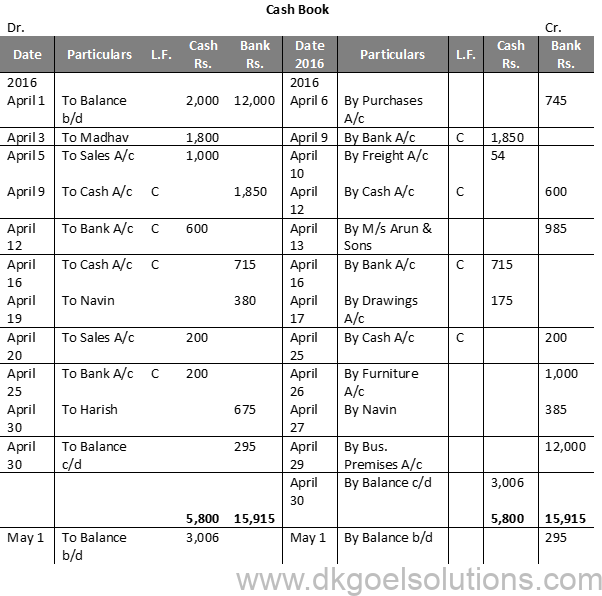

Solution 2:

Point in mind:- Only currency transfers are reported in the cash book. There is no recording of credit transfers. The debit side is still higher than the credit, since the cash available is never surpassed by transfers.

Question 3:

Solution 3:

Solution 4:

Question 5:

Solution 5:

Question 6:

Solution 6:

Question 7:

Question 8 (A):

Solution 8(A):

Question 8 (B):

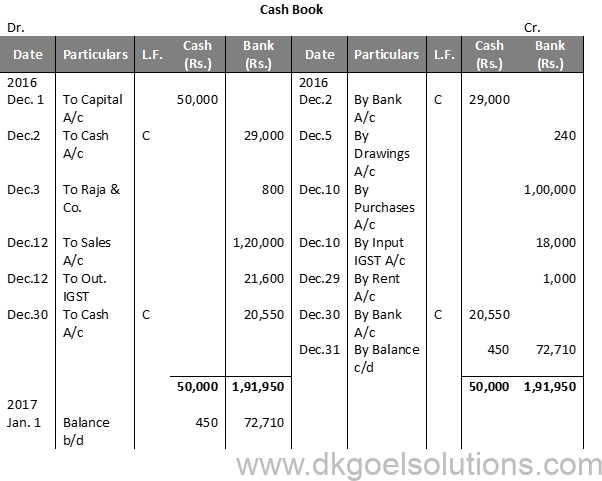

Solution 8 (B):

Working Note:-

Question 9:

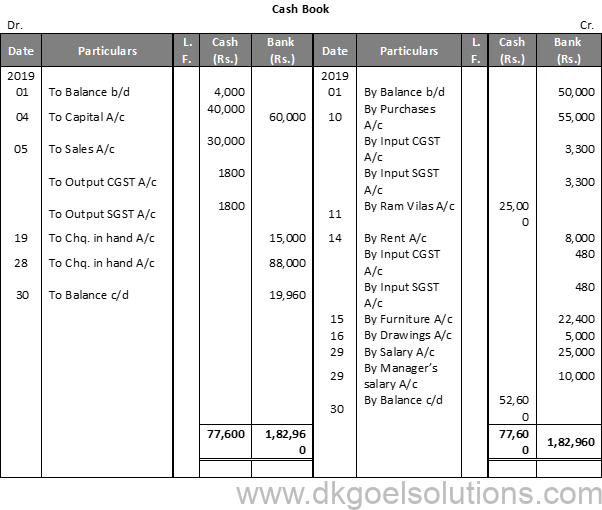

Solution 9:

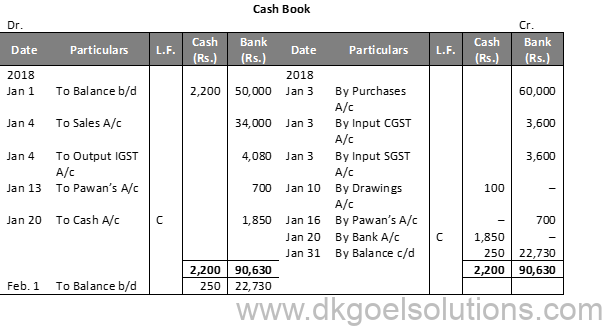

Working Note:- On 20th April, Entry for Credit sales of Rs. 80,000 plus CGST and SGST @ 6% each will he recorded in journal.

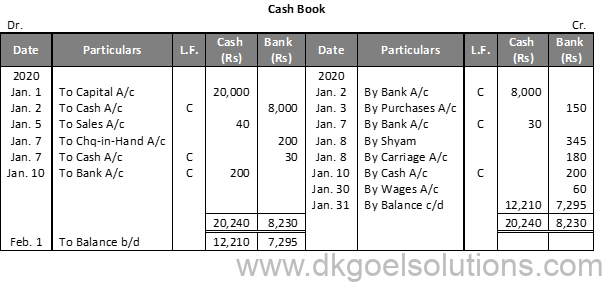

Question 10 (A):

Solution 10 (A):

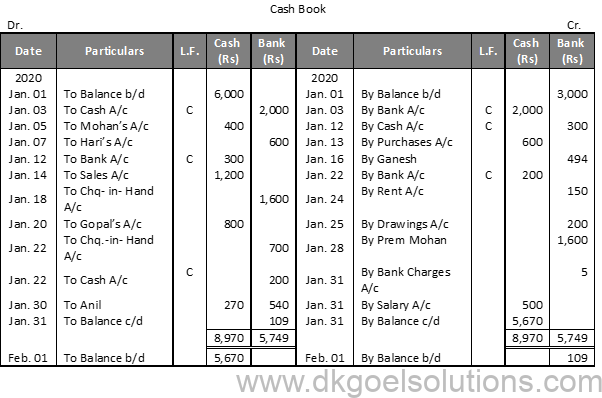

Working Note :- 1. Cheque received from Prem Mohan on 9 th and from Gopal on 20 th will be recorded through Journal. These will be recorded in the Cash Book on the dates of their deposit into the Bank.

Question 10 (B):

Solution 10 (B):

Working Note :-

Question 11 (A):

Solution 11 (A):

Question 11 (B):

Solution 11 (B):

Calculation of Cash deposit into the Bank:- Cash deposit into bank = Bal. of cash column of Dr. side – Total of Cash Column of Cr. side + Cash Bal. Cash deposit into bank = 50,000 – 29,000 + 450 Cash deposit into bank = 50,000 – 29,450 Cash deposit into bank = 20,550

Question 12:

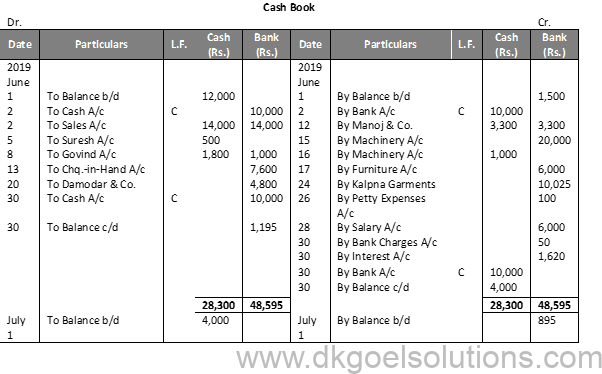

Solution 12:

Calculation of Cash Deposit into Bank:- Cash deposit into bank = Bal. of cash column of Dr. side – Total of Cash Column of Cr. side + Cash Balance Cash deposit into bank = 28,300 – 14,300 + 4,000 Cash deposit into bank = 28,300 – 18,300 Cash deposit into bank = 10,000

Question 13 (A):

Solution 13 (A):

Question 13 (B):

Solution 13 (B):

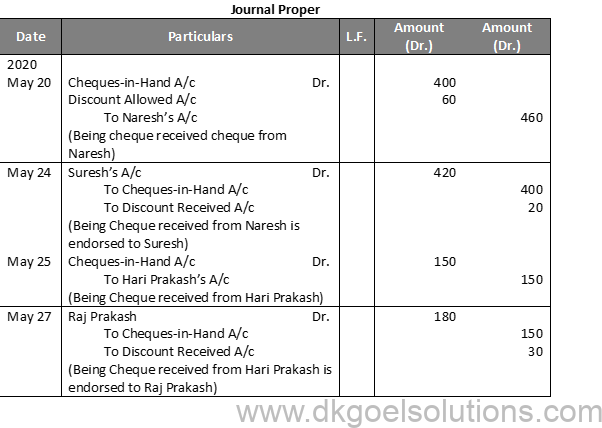

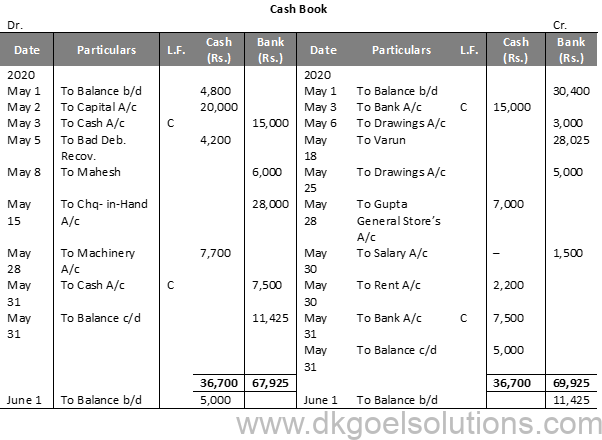

Working Note:- May 6th : Life Insurance Premium is treated as Drawings. May 12th : Entry for receipt of cheque will be recorded in Journal Proper. May 15th : To cheque in hand a/c Rs. 28,000 in bank column May 18th : by Varun Rs. 28,025 in Bank Column, Entry for discount withdrawn Rs. 2,000 will be passed through Journal Proper.

Calculation of Cash Deposit into Bank:- Cash deposit into bank = Bal. of cash column of Dr. side -Total of Cash Column of Cr. side + Cash Balance Cash deposit into bank = 36,700 – 24,200 + 5,000 Cash deposit into bank = 36,700 – 29,200 Cash deposit into bank = 7,500

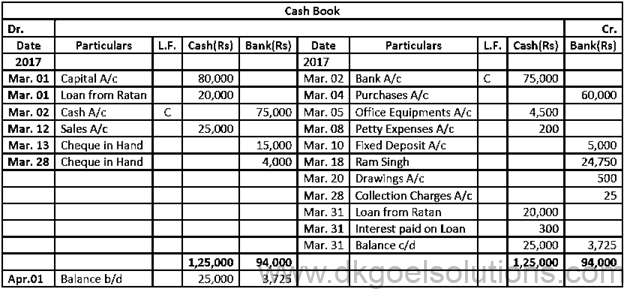

Question 14:

Solution 14:

Calculation of Cash Deposit into Bank:- Cash deposit into bank = Bal. of cash column of Debit side – Total of Cash Col. of Credit side + Cash Bal. Cash deposit into bank = 23,350—5,400-+-7,500 Cash deposit into bank = 23,350 – 12,900 Cash deposit into bank = 10,450

Question 15::

Solution 15:

Point in mind DK Goel Solutions Class 11 Chapter 11 : – Petty Cash Book is the book that is used for the purpose of recording expenses involving petty amounts. Besides petty expenses, receipts from main cash are recorded. Petty Cash Book is prepared by Petty Cashier and acts as the Petty Cash Account.

Question 16:

Solution 16:

Working Note :- The imprest system of Petty Cash is explained below. Under this system, an estimate is made of amount required for petty expenses for a certain period (say for a week, a fortnight or a month).

Question 17:

Solution 17:

Point in mind :- Petty Cash Book is the book which is used for the purpose of recording expenses involving petty amounts. Besides petty expenses, receipts from main cash are recorded. Petty Cash Book is prepared by Petty Cashier and acts as the Petty Cash Account.

Question 18:

Solution 18:

Question 19:

Solution 19:

Question 20:

Solution 20:

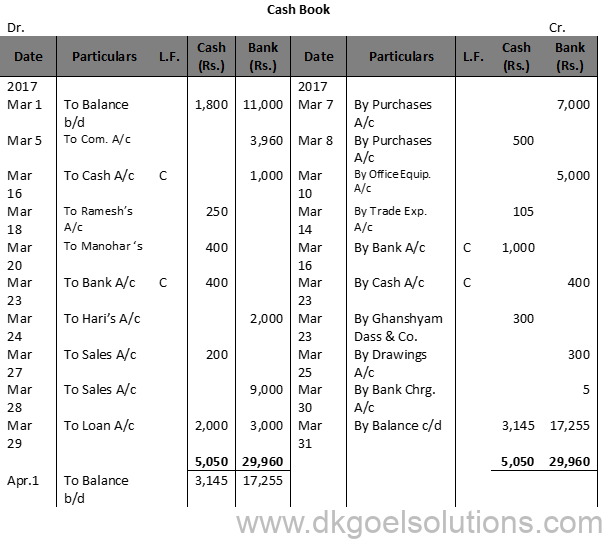

Calculation of interest on loan:- Time for loan = 1 Month Rate on Interest = 18% Interest on Loan = Rs. 20,000 × 1/12 × 18/100 Interest on Loan = Rs. 300

Question 21:

Solution 21:

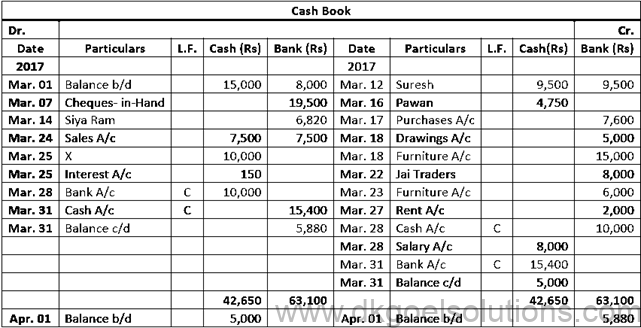

Calculation of Cash Deposit into Bank:- Cash deposit into bank = Bal. of cash column of Dr. side – Total of Cash Column of Cr. side + Cash Bal. Cash deposit into bank = 42,650 – 22,250 + 5,000 Cash deposit into bank = 42,650 – 27,250 Cash deposit into bank = 15,400

Question 22:

Solution 22:

Calculation of Cash Deposit into Bank:- Cash deposit into bank = Bal. of cash column of Dr. side – Total of Cash Column of Cr. side-+-Cash Bal. Cash deposit into bank = 42,650 – 22,250 + 5,000 Cash deposit into bank = 42,650 – 27,250 Cash deposit into bank = 15,400

Question 23:

Solution 23:

Question 24:

Solution 24:

Working Note ( DK Goel Solutions Class 11 Chapter 11 ) :-

Question 25:

Solution 25:

Question 26:

Solution 26:

Question 27:

Solution 27:

Working Note:- The imprest system of Petty Cash is explained below. Under this system, an estimate is made of amount required for petty expenses for a certain period (say for a week, a fortnight or a month).

Question 28:

Solution 28:

Question 29:

Solution 29;

Working Note :- The Petty Cash imprint scheme is discussed below. Under this method, the amount needed for minor expenditures for a certain time is determined (say for a week, a fortnight or a month). At the beginning of an era, the amount so calculated is issued to the petty cashier and the amount charged by him during the period is repaid.

As explained in DK Goel Solutions class 11 Chapter 11, cash book is a financial record holder which amalgamates all the cash receipts and disbursements, highlighting the financial transactions in cash. After the financial cash transactions are recorded in the cash book, they are added to the ledger. Only the bank-related and cash transactions are added to the cash book, and a cash book always highlights the debit balance.

Cash Book is considered to have dual nature being both journal and ledger, as it records all the business transactions relating to cash payments and cash receipts. It is one of the most crucial accounting books maintained by every company. A cash book is multi-functional as it acts as both ledger and books of original entry. A cashbook eliminates the need for a cash account for all organizations.

Contra Entry is a type of entry that affects both bank accounts and cash. In simple words, it defines any financial transaction involving the transfer of cash from a cash account to another bank account or from a cash account to another cash account, or from a bank account to another bank account.

A cash book is a written record of all the financial transactions relating to cash or banks arranged in a specific sequence. In contrast, a cash account is a form of a ledger account that depicts the day-to-day transactions of an organization.

Petty cash book is one of the popular accounting books utilized to record all the minor expenses. For instance, daily wages, stationery, postage and handling, and much more. These types of cash books are usually designed and handled by petty cashiers.

Here are the notable similarities between Cash Books and Journals – ● Identical to the journal, in the cash book, all the entries are arranged in chronological format according to the date and time of the transaction. ● Similar to the journals, the data from the cash books flows to the ledger. ● Cash Books also includes a ledger folio column, just like journals.

Cash Book | Class 11 Accountancy (Notes & Exercises)

By Suraj Chaudhary

May 1, 2024

This article has all the exercises of Cash Book class 11. If you have been looking for the questions and answers to the exercises of the Cash Book class 11 and notes, you are in the right place.

Concept Of Cash Transactions

Cash transactions refer to cash receipts and payments. The receipts of cash from various sources and payments of cash on various heads are important routine transactions of a business. The main sources of cash receipts are the sale of goods and services, the sale of old assets, the contribution of capital, loans borrowed, interest, rent, commission, and other receipts from customers.

- To have a systematic and permanent record of all cash transactions in a separate book.

- To obtain reliable and detailed information on all the cash receipts and payments easily and immediately.

- To keep effective control over the misappropriation of cash transactions.

- To know the main sources and heads of payment of cash.

- To know cash balances.

The cash book is a complete record of all the receipts and payments, which are made either in cash or through the bank. It has two sides. The debit side shows cash receipts and the credit side shows cash payments. All the cash and cheques received and deposited are shown on the cash receipt side. All the payments made in cash and or by cheque are shown on the payment side. At the end of the given period, its balance is obtained to know the amount of cash and bank balances.

Single-column cash books, Double column cash book,s and triple-column cash books are the types of cash books.

Contra Entry

Contra Entry is the act of recording a transaction both on the receipt and payment sides of the cash book. It completes the double effect of the transactions entering the amount one in the cash column and the next in the bank column. Again such an entry, the alphabet ‘C’ is mentioned in the L.F column. The alphabet ‘C’ indicates that the entry is contra and the posting is not necessary. Contra entry is passed for the deposited and withdrawn for office use.

Numericals:

Single Column Cash Book ( Cash Column )

The following transactions are extracted from the books of Mr. Bhakti Sharma: Bhadra-1 Commencement of business with cash of Rs 120,000 Bhadra-5 Sold goods in cash of Rs 40,500 Bhadra-6 Paid salaries of Rs 30,500 Bhadra-10 Purchased furniture of Rs 45,000 Bhadra-15 Received from the debtor of Rs 12,500 Bhadra-25 Purchased stationery of Rs 500 Bhadra-30 Paid to the creditors of Rs 15,000

(Receipt) (Payment)

The following transactions are extracted from Mr. Jackson’s Books for the month of Shrawn: Shrawn-1 Opening cash balance of Rs 25,000 Shrawn-5 Received cash from debtors of Rs 42,000 Shrawn-10 Purchased goods of Rs 12,500 Shrawn-12 Paid wages of Rs 7,200 Shrawn-13 Withdrawn cash by the owner of Rs 5,200 Shrawn-14 Paid rent of Rs 1,550 Shrawn-25 Purchased a machine of Rs 15,000 Required: Single column cash book

Single Column Cash Book ( Bank Column ) On Jestha 1, Mr. Luca Pacioli commenced a business with depositing cash of Rs 175,000 into Nepal Bank Ltd. The following transactions are provided during the month: Jestha-4 Received a cheque from Amir of Rs 40,000 Jestha-5 Withdrew from the bank for personal use of Rs 3,700 Jestha-15 Received interest by cheque of Rs 5,000 Jestha-25 Deposited cash into the bank of Rs 12,000 Jestha-27 Paid interest on overdraft of Rs 1,000 Jestha-28 Purchased furniture and paid by cheque of Rs 35,000 Required: Single column cash book with bank column

The following transactions are extracted from the books of Mr. Basanta for the month of Marga assuming that all transactions were settled through bank: Marga-1 Opening bank balance of Rs 250,000 Marga-4 Cheque received from Sajan of Rs 40,000 Marga-6 Purchased goods for Rs 105,000 Marga-10 Paid for sundry expenses of Rs 15,000 Marga-15 Paid for school fees of the owner’s son of Rs 5,000 Marga-22 Sold goods for Rs 60,000 Marga-28 Withdrew from bank for personal use of Rs 3,000 Required: Cash Book with Bank column

Double Column Cash Book ( Cash and Discount Columns ) The following information is related to a business: Jan-1 Cash in hand Rs 10,000 Jan-3 Bought goods for Rs 500 Jan-7 Deposited cash into the bank of Rs 650 Jan-13 Paid to Hari Rs 450 in full settlement of Rs 500 Jan-20 Received Rs 750 from Subash and discount allowed Rs 150 Jan-25 Withdrew from bank for office use Rs 1,000 Jan-27 Purchased books for the proprietor Rs 750 Required: Cash book with cash and discount columns

Double Column Cash Book ( Bank and Discount Columns ) The following information is taken from the books of Mr. Sabin assuming that all transactions were settled through the bank: Baisakh-2 Mr. Sabin started a business with Rs 30,000 by opening the bank account Baisakh-7 Purchased office equipment by issuing a cheque of Rs 2,500 Baisakh-9 Purchased goods for Rs 5,000 from Subash and paid 3,000 partially Baisakh-15 Sold goods for Rs 4,000 to Mr. Shakya and received a cheque of Rs 2,000 partially Baisakh-22 Issued a cheque of Rs 1,800 to Mr. Subash in full settlement of Rs 2,000 Baisakh-25 Withdrew from the bank for personal expenses by the owner of Rs 700 Baisakh-27 Received a cheque of Rs 1,700 from Mr. Shakya in full settlement. Baisakh-29 Issued a cheque for sundry expenses of Rs 750 Baisakh-30 Mr. Sabin brought additional capital of Rs 5,000 and deposited into the bank. Required: Cash book with bank and discount columns

Double column cash book ( Cash and Bank Columns ) Mr. Khetan has started a business with cash of Rs 75,000 and bank balance of Rs 125,000 on 1st January. The other information is as follows: January-7 Deposited into the bank Rs. 40,000 January-10 Sold goods for Rs 15,000 to Ram and received a cheque. January-15 Withdrew Rs 5,000 from the bank for office use and Rs 2,000 for personal use. January-25 Received dividend of Rs 8,000 January-30 Paid for sundry expenses Rs 800 Required: Cash book with cash and bank columns

The following transactions were recorded in the books of Mr. Robinson for the month of January : January-1 Opening balances of cash and bank of Rs 30,000 and Rs 160,000 respectively. January-4 Purchased goods of Rs 30,000 and paid by cheque. January-9 Sold goods on cash Rs 21,500 January-15 Deposited into the bank Rs 25,000 January-25 Paid wages of Rs 500 January-27 Withdrew cash of Rs 2,500 from the bank for personal use. January-30 Received commission by cheque of Rs 5,000 Required: Cash book with cash and bank columns

Enter the following transactions in the cash book of Raj for the month of Asadh with cash and bank columns: Asadh-1 Opening balances of cash Rs 5,000 and bank overdraft of Rs 10,000 Asadh-3 Mr. Raj brought Rs. 12,000 as additional capital Asadh-5 Deposited cash Rs 4,000 into the bank. Asadh-11 Paid Rs 8,000 by cheque to Hari Asadh-15 Paid for stationery Rs 400 Asadh-29 Received a cheque of Rs 1,000 from Hari

Mr. B.K. started a business with cash of Rs 22,000 and bank balance of Rs 100,000 on 1st February. The other related information is given below: February-2 Purchased goods for Rs 10,000 from Anil and paid Rs 6,000 by cheque. February-5 Sold goods to Mr. Bijay for Rs 8,000 and received a cheque. February-8 Paid by cheque to Anil Rs 4,000 February-12 Deposited Binay’s cheque into the bank. February-21 Paid salary by cheque of Rs 8,000 February-23 Paid rent Rs 4,000 and wages of Rs 1,000 February-25 Deposited the remaining balance of cash except Rs 500 into the bank. Required: Cash book with cash and bank columns

Triple Columns Cash Book (Cash, Bank and Discount Columns)

The following transactions are the transactions of Karun: Baisakh-1 Commenced a business with cash of Rs 100,000 Baisakh-3 Deposited into the bank Rs 80,000 Baisakh-6 Sold goods to Mr. KK for Rs 5,000 and received cash after 5% discount. Baisakh-10 Withdrawn cash of Rs 15,000 from the bank for office use and of Rs 5,000 for private use. Baisakh-15 Purchased goods from Mr. Ganesh for Rs 12,000 and paid cash Rs 7,000 as partial payment. Baisakh-25 Issued a cheque to Mr. Ganesh after deducting 5% discount as discount in full settlement. Required: Triple Column Cash Book

The following information is extracted from the books of Mr. Karan Bhatt: January-1 Opening balance of cash and bank Rs 12,000 and Rs 51,000 respectively. January-5 Purchased goods for Rs 35,000 from Amir and paid by cheque Rs 25,000 partially. January-8 Sold goods to Mr. Sanjay for Rs 30,000 and received a cheque of Rs 25,000 partially. January-18 Paid salary of Rs 10,000 by cheque and wages of Rs 2,000 in cash. January-20 Received Rs 4,500 from Sanjay in full settlement. January-22 Issued a cheque of Rs 9,000 to Mr. Amir in full settlement. Required: Triple column cash book

Following cash related transactions of Mr. Bhandari are given below: Chaitra-1 Started a business with cash and bank balance of Rs 20,000 and Rs 100,000 respectively. Chaitra-4 Purchased goods for Rs 100,000 from Achala and paid her partially by cheque of Rs 80,000. Chaitra-5 Sold goods to Mr. Y for Rs 50,000 and received a cheque of Rs 18,000 as partial payment. Chaitra-11 Paid rent of Rs 5,000 by cheque. Chaitra-17 Paid Rs 5,000 to Gopal in full settlement of Rs 6,000 Chaitra-21 Received cash from Mr. Y Rs 31,000 in full settlement. Chaitra-24 Deposited the remaining cash balance except Rs 2,000 into the bank. Required: Triple column cash book

Other Articles:

- Accounting Terminologies

Suraj Chaudhary is a writer, developer, founder, and a constant learner. He shares lessons and resources for living a fuller life every week. On this blog, he shares helpful guides and helpful articles that help his 70,000+ monthly readers find answers, solve problems, and meet their curious needs.

14 thoughts on “Cash Book | Class 11 Accountancy (Notes & Exercises)”

Outstanding post, you have pointed out some fantastic points, I likewise think this s a very wonderful website.

Leave a Comment Cancel reply

Slide to prove you're not a bot/spammer *

- New QB365-SLMS

- NEET Materials

- JEE Materials

- Banking first yr Materials

- TNPSC Materials

- DIPLOMA COURSE Materials

- 5th Standard Materials

- 12th Standard Materials

- 11th Standard Materials

- 10th Standard Materials

- 9th Standard Materials

- 8th Standard Materials

- 7th Standard Materials

- 6th Standard Materials

- 12th Standard CBSE Materials

- 11th Standard CBSE Materials

- 10th Standard CBSE Materials

- 9th Standard CBSE Materials

- 8th Standard CBSE Materials

- 7th Standard CBSE Materials

- 6th Standard CBSE Materials

- Tamilnadu Stateboard

- Scholarship Exams

- Scholarships

CBSE 11th Standard CBSE Accountancy question papers, important notes , study materials , Previuous Year questions, Syllabus and exam patterns. Free 11th Standard CBSE Accountancy books and syllabus online. Practice Online test for free in QB365 Study Material. Important keywords, Case Study Questions and Solutions. Updates about latest education news and Scholorships in one place.

11th Standard CBSE Subjects

11th Standard CBSE Study Materials

Class VI to XII

Tn state board / cbse, 3000+ q&a's per subject, score high marks.

Latest CBSE 11th Standard CBSE Study Material Updates

Talk to our experts

1800-120-456-456

DK Goel Solutions Class 11 Accountancy Chapter 11

Class 11 DK Goel Solutions Chapter 11 - Books of Original Entry – Cash Book

Download important dk goel solutions for class 11 accountancy chapter 11 - books of original entry - cash book free pdf .

To successfully answer all the questions that appear from this chapter in the exam, students must have a proper understanding of the in-depth topic, concepts and principles explained in Class 11 Accountancy Chapter 11. The solutions for the Class 11 Accountancy Chapter 11 is provided by Vedantu to help students in learning all of the concepts covered in this chapter thoroughly. The DK Goel Solutions Class 11 Accountancy Chapter 11 solves several examples of numerical type issues that demand a lot of practice. The DK Goel Solutions for Class 11 of the subject Accountancy PDF is available for free download and use by students at Vedantu. This downloaded PDF can be used by students anywhere and anytime as per their convenience.

When a businessperson begins with a commercial establishment, the central focus comes on keeping a proper trial for the daily financial proceedings. These financial proceedings (or transactions, as we call it) are maintained and put down regularly. The entries vary based on the nature and structure of a business. DK Goel solutions class 11 accountancy chapter 11 provides a comprehensive insight into the book of original entry and its sub-part cashbooks.

Book of Original Entry

Books of original entry include various accounting periodical entries. The economic activities are often briefed and noted down in a general ledger.

The purpose of this topic is to create an idea about the usage of the book of entry in commercial establishments for students of class 11, providing the highest quality of solution and detailed theoretical concepts.

They assist in reducing numerical and calculative mistakes, which might be a possibility in a ledger entry.

They contain accurate details, transactional narratives, and history for an inbound and outbound commercial establishment.

They can also be called as journals, subsidiary records, cash receipts, payment records of cash.

A book of original entry is defined as an accounting record or periodical entries, in which business economic proceedings are kept.

The Primary Purpose of maintaining periodical entries is to give authenticity, accuracy, and affirmation to business and monetary transactions in that particular commercial establishment.

Books of original entry cash book class 11 solutions have provided various illustrations and explanations to brief students on this particular concept.

There are many types of books of original entry; one of the most crucial entries involves the Cash Book. DK Goel Accountancy Class 11 Solutions Chapter 11 provides an absolute overview of Books of original entries.

It also provides a thorough brief on the usage of cash books for maintaining various business transactional records. This can be beneficial for students of class 11 to optimize their knowledge and achieve better academic scores.

There are certain benefits in the book of original entry for a commercial establishment. They can be utilized for subsequent credentials because they accommodate vital pieces of information. The most basic utilization can be that they can avert ledger from becoming unorganized. DK Goel Accountancy Class 11 Solutions Chapter 11 teaches that to students of class 11 so they can get familiar with this concept. It will also enable them to utilize it for their academic pursuits.

Cash Book

Cash is a sub-concept of the book of original entry. A cash book is known as a transactional record, which carries all the receipts of the monetary aspect.

Cashbook also includes monetary disposals, saving deposits, and withdrawals. The financial entries recorded in the cash book are often put up in the ledger at a later stage.

In Class 11 Accounts Chapter Cash Book Solutions, for question 1, there is equal emphasis on credit transactions on cash books. This will help students understand the importance of different credit transactions like inbound and outbound cash flows.

Similarly, in Question 10, the depository of a credit transaction and its effect on cash balance has been calculated and analyzed.

The Relevance of Cash Books

This record will have monetary explanations like remittances made to the trader.

Cash books also include the details of additional payments made by the customer on the purchase of goods and services.

It should be noted that the cash account and cash book are very different from each other. The cash account falls within the arena of the general ledger; however, the cash book is not considered the same.

Class 11 Accounts Chapter 11 Solutions DK Goel will help students of class 11 to understand this difference between cash book and report. This book will help students understand the difference between credit and debit. These two terms are very vital in cash book records. The entries are generally there in a progressive sequence.

Explore Popular Commerce Textbook Solutions for Class 11 and 12 Students

Importance of dk goel solutions for accountancy chapter 11 - books of original entry - cash book.

Many students find it challenging to comprehend numerous accounting challenges and to differentiate transactions based on monetary value interpretation. Vedantu's Accountancy Book Class 11 Solutions Chapter 11 gives in-depth study materials for this chapter and helps strengthen their foundation in the subject. These DK Goel Solutions for Accountancy are based on previous year's board exam sample questions and the most recent CBSE recommendations. As a result, going through the DK Goel Solutions simplifies your exam preparation.

The Accountancy solutions provide detailed and minute study material on the accounting principles that must be understood by the students. It differs based on the area or the country of establishment, and it fulfills the needs of the nation's economic and financial state, as well as the needs of the business organization. The DK Goel Accountancy Book Class 11 Solutions Chapter 11 contains all of the necessary solutions to various accounting problems.

The authorities have established a standard set of rules and standards that must be followed and employed during the process of recording transactions into the relevant accounting books. The DK Goel Solutions for Class 11 Accounts Chapter 11 provides a thorough overview of all the methods required to handle accountancy problems.

The 11th chapter of DK Goel Accounts Class 11 Solution by Vedantu lays out a thorough framework of accounting ideas in easy-to-understand language. It also includes solved examples from Accounts Class 11 Chapter 11. Following these Vedantu Solutions, students will discover the types of questions that are frequently asked in exams. As a result, these solutions make it easy to achieve good exam results.

FAQs on DK Goel Solutions Class 11 Accountancy Chapter 11

1. What are the various components of the Book of Original Entry?

The components of the book of original entry include available records, unusual records, sales, purchase records, inbound and outbound cash flows, and lastly, most importantly, cash book.

The other major components contained in books of original entry are transactional dates, details of the business trader.

The financial transactional information and amounts are also specified in the book of original entry. There are also some other significant references given in this record, such as documents, invoice details.

2. Why are Cash Books considered an essential part of a Book of Original Entry?

The reason for cash books to be an essential part of the book of original entry is that all the commercial transactions are noted down in the cash book for the initial stage. The primary set of transactional activities is recorded in the cashbook as part of the evidence.

This entry gives authenticity to the credit and debit side for any business. Cash books are known to keep only bank and monetary transactional records. The regulation to follow is to have a progressive order of entries.

3. How is the Cash Book different from the Ledger?

The main difference can be put out in the case of different regulatory formations. The task is to distinguish a commercial establishment’s income, profits, spending, and liability.

However, the cash book maintains a daily financial transaction record, both for inbound and outbound transactions. A business owner will always keep a check and maintain the balance between cash book and ledger. This will help them to scrutinize transactional details whenever they want to revisit documents for authenticity purposes.

4. According to Chapter 11 of Class 11 Accountancy, what is a balance sheet?

Starting a business necessitates extensive record-keeping. This is because the primary goal of every firm is to make money. However, many firms fail because they begin to operate at a loss. As a result, it's essential to keep accurate records, also known as balance sheets, so that each process can be tracked and analysed if and when something goes wrong. This can help a company avoid losing money. Apart from that, a daily record of the business's operations can be kept, and actions can be performed as needed.

5. According to Class 11 Accountancy, what is the need for accounting?

Accountancy can be an important aspect of a company's or a country's economic development. Accountancy is required to identify the financial health of any corporation and to provide first-hand knowledge on prospective sources of income, as well as to administrate critical areas to reduce expenses or overheads that will cause the business entity to lose money. In simple terms, accountancy is required to produce profits for a company, business and ultimately the country's economy.

Furthermore, you can avail all the well-researched and good quality chapters, sample papers, syllabus on various topics from the website of Vedantu and its mobile application available on the play store.

6. What is the basic concept explained in Chapter 11 of Accounts Class 11?

Official bodies have established a standard set of rules and standards that must be followed and employed during the process of recording transactions into the relevant accounting books. The DK Goel Solutions for Class 11 Accounts Chapter 11 provides a thorough overview of all the methods required to handle accountancy problems.

7. What are the reasons for which some organisations use incomplete records?

Most corporate organizations and agencies, listed corporations, or organisations employ the incomplete records accounting method in their accounting operations to recover money on the costs of a systematic accounting process. When an organisation has limited resources, it tries to preserve and save revenue in order to maintain the organization's economic activities. Even a shortage of qualified accountants and staff contributes to the extent of keeping incomplete records. This is a typical practice among many company entities when there is a limited amount of information regarding their financial situation available.

- School Solutions

- Star Program

- NCERT Solutions Class 12 Maths

- NCERT Solutions Class 12 Physics

- NCERT Solutions Class 12 Chemistry

- NCERT Solutions Class 12 Biology

- NCERT Solutions Class 12 Commerce

- NCERT Solutions Class 12 Economics

- NCERT Solutions Class 12 Accountancy

- NCERT Solutions Class 12 English

- NCERT Solutions Class 12 Hindi

- NCERT Solutions Class 11 Maths

- NCERT Solutions Class 11 Physics

- NCERT Solutions Class 11 Chemistry

- NCERT Solutions Class 11 Biology

- NCERT Solutions Class 11 Commerce

- NCERT Solutions Class 11 Accountancy

- NCERT Solutions Class 11 English

- NCERT Solutions Class 11 Hindi

- NCERT Solutions Class 11 Statistics

- NCERT Solutions Class 10 Maths

- NCERT Solutions Class 10 Science

- NCERT Solutions Class 10 English

- NCERT Solutions Class 10 Hindi

- NCERT Solutions Class 10 Social Science

- NCERT Solutions Class 9 Maths

- NCERT Solutions Class 9 Science

- NCERT Solutions Class 9 English

- NCERT Solutions Class 9 Hindi

- NCERT Solutions Class 9 Social Science

- NCERT Solutions Class 8 Maths

- NCERT Solutions Class 8 Science

- NCERT Solutions Class 8 English

- NCERT Solutions Class 8 Hindi

- NCERT Solutions Class 8 Social Science

- NCERT Solutions Class 7 Maths

- NCERT Solutions Class 7 Science

- NCERT Solutions Class 7 English

- NCERT Solutions Class 7 Hindi

- NCERT Solutions Class 7 Social Science

- NCERT Solutions Class 6 Maths

- NCERT Solutions Class 6 Science

- NCERT Solutions Class 6 English

- NCERT Solutions Class 6 Hindi

- NCERT Solutions Class 6 Social Science

- NCERT Solutions Class 5 Maths

- NCERT Solutions Class 5 English

- NCERT Solutions Class 5 EVS

- NCERT Solutions Class 4 Maths

- NCERT Solutions Class 4 English

- NCERT Solutions Class 4 EVS

- NCERT Solutions Class 4 Hindi

- NCERT Solutions Class 3 Maths

- NCERT Solutions Class 3 English

- NCERT Solutions Class 3 EVS

- NCERT Solutions Class 3 Hindi

- NCERT Solutions Class 2 Maths

- NCERT Solutions Class 2 English

- NCERT Solutions Class 2 Hindi

- NCERT Solutions Class 1 Maths

- NCERT Solutions Class 1 English

- NCERT Solutions Class 1 Hindi

- NCERT Books Class 12

- NCERT Books Class 11

- NCERT Books Class 10

- NCERT Books Class 9

- NCERT Books Class 8

- NCERT Books Class 7

- NCERT Books Class 6

- NCERT Books Class 5

- NCERT Books Class 4

- NCERT Books Class 3

- NCERT Books Class 2

- NCERT Books Class 1

- Important Questions Class 12

- Important Questions Class 11

- Important Questions Class 10

- Important Questions Class 9

- Important Questions Class 8

- Important Questions Class 7

- important questions class 6

- CBSE Class 12 Revision Notes

- CBSE Class 11 Revision Notes

- CBSE Class 10 Revision Notes

- CBSE Class 9 Revision Notes

- CBSE Class 8 Revision Notes

- CBSE Class 7 Revision Notes

- CBSE Class 6 Revision Notes

- CBSE Class 12 Syllabus

- CBSE Class 11 Syllabus

- CBSE Class 10 Syllabus

- CBSE Class 9 Syllabus

- CBSE Class 8 Syllabus

- CBSE Class 7 Syllabus

- CBSE Class 6 Syllabus

- CBSE Class 5 Syllabus

- CBSE Class 4 Syllabus

- CBSE Class 3 Syllabus

- CBSE Class 2 Syllabus

- CBSE Class 1 Syllabus

- CBSE Sample Question Papers For Class 12

- CBSE Sample Question Papers For Class 11

- CBSE Sample Question Papers For Class 10

- CBSE Sample Question Papers For Class 9

- CBSE Sample Question Papers For Class 8

- CBSE Sample Question Papers For Class 7

- CBSE Sample Question Papers For Class 6

- CBSE Sample Question Papers For Class 5

- CBSE Sample Question Papers For Class 4

- CBSE Sample Question Papers For Class 3

- CBSE Sample Question Papers For Class 2

- CBSE Sample Question Papers For Class 1

- CBSE Previous Year Question Papers Class 12

- CBSE Previous Year Question Papers Class 10

- Extra Questions For Class 8 Maths

- Extra Questions For Class 8 Science

- Extra Questions For Class 9 Maths

- Extra Questions For Class 9 Science

- Extra Questions For Class 10 Maths

- Extra Questions For Class 10 Science

- NEET 2021 Question Paper

- NEET 2020 Question Paper

- NEET 2019 Question Paper

- NEET 2018 Question Paper

- NEET 2017 Question Paper

- NEET 2016 Question Paper

- NEET 2015 Question Paper

- NEET Physics Questions

- NEET Chemistry Questions

- NEET Biology Questions

- NEET Sample Papers

- NEET Physics Syllabus

- NEET Chemistry Syllabus

- NEET Biology Syllabus

- NEET Mock Test

- NEET Eligibility Criteria

- JEE Main 2021 Question Paper

- JEE Main 2020 Question Paper

- JEE Main 2019 Question Paper

- JEE Main 2018 Question Paper

- JEE Main 2017 Question Paper

- JEE Main 2016 Question Paper

- JEE Main 2015 Question Paper

- JEE Main Sample Papers

- JEE Main Physics Syllabus

- JEE Main Chemistry Syllabus

- JEE Main Maths Syllabus

- JEE Main Physics Questions

- JEE Main Chemistry Questions

- JEE Main Maths Questions

- JEE main revision notes

- JEE Main Mock Test

- JEE Advanced Physics Questions

- JEE Advanced Chemistry Questions

- JEE Advanced Maths Questions

- JEE Advanced 2021 Question Paper

- JEE Advanced 2020 Question Paper

- JEE Advanced 2019 Question Paper

- JEE Advanced 2018 Question Paper

- JEE Advanced 2017 Question Paper

- JEE Advanced 2016 Question Paper

- JEE Advanced 2015 Question Paper

- JEE Advanced Physics Syllabus

- JEE Advanced Chemistry Syllabus

- JEE Advanced Maths Syllabus

- JEE Advanced Mock Test

- ISC Class 12 Syllabus

- ISC Class 11 Syllabus

- ICSE Class 10 Syllabus

- ICSE Class 9 Syllabus

- ICSE Class 8 Syllabus

- ICSE Class 7 Syllabus

- ICSE Class 6 Syllabus

- ISC Sample Question Papers for Class 12

- ISC Sample Question Papers for Class 11

- ICSE Sample Question Papers for Class 10

- ICSE Sample Question Papers for Class 9

- ICSE Sample Question Papers for Class 8

- ICSE Sample Question Papers for Class 7

- ICSE Sample Question Papers for Class 6

- ICSE Class 10 Revision Notes

- ICSE Class 9 Revision Notes

- ISC Important Questions for Class 12

- ISC Important Questions for Class 11

- ICSE Important Questions for Class 10

- ICSE Important Questions for Class 9

- ICSE Important Questions for Class 8

- ICSE Important Questions for Class 7

- ICSE Important Questions for Class 6

- ISC Class 12 Question Paper

- ICSE Class 10 Question Paper

- Maharashtra Board Syllabus

- Maharashtra Board Sample Question Paper

- Maharashtra Board Previous Year Question Paper

- AP Board Syllabus

- AP Board Sample Question Paper

- AP Board Previous Year Question Paper

- Tamilnadu Board Syllabus

- Tamilnadu Board Sample Question Paper

- Tamilnadu Board Previous Year Question Paper

- Telangana Board Syllabus

- Telangana Board Sample Question Paper

- Telangana Board Previous Year Question Paper

- Karnataka Board Syllabus

- Karnataka Board Sample Question Paper

- Karnataka Board Previous Year Question Paper

- Examination Full Forms

- Physics Full Forms

- Chemistry Full Forms

- Biology Full Forms

- Educational Full Form

- CUET Eligibility Criteria

- CUET Exam Pattern

- CUET Cutoff

- CUET Syllabus

- CUET Admit Card

- CUET Counselling

- CUET Previous Year Question Papers

- CUET Application Form

- CUET Sample Papers

- CUET Exam Centers

- CUET Exam Dates

- CUET Results

- Physics Formulas

- Chemistry Formulas

- Math Formulas

- Algebra Formulas

- Geometry Formulas

- Trigonometry Formulas

- Subscription

Important Questions for CBSE Class 11 Accountancy Chapter 4 – Recording Of Transactions 2

Home » CBSE » Important Questions for CBSE Class 11 Accountancy Chapter 4 – Recording Of Transactions 2

- CBSE Important Questions

- Important Questions Class 6

- CBSE Previous Year Question Papers

- CBSE Revision Notes

- CBSE Syllabus

- CBSE Extra Questions

- CBSE Sample Papers

- ISC & ICSE Syllabus

- ICSE Syllabus Class 9

- ICSE Syllabus Class 8

- ICSE Syllabus Class 7

- ICSE Syllabus Class 6

- ICSE Syllabus Class 10

- ICSE Question Paper

- ICSE Sample Question Papers

- ISC Sample Question Papers For Class 12

- ISC Sample Question Papers For Class 11

- ICSE Sample Question Papers For Class 10

- ICSE Sample Question Papers For Class 9

- ICSE Sample Question Papers For Class 8

- ICSE Sample Question Papers For Class 7

- ICSE Sample Question Papers For Class 6

- ICSE Revision Notes

- ICSE Important Questions

- ISC Important Questions For Class 12

- ISC Important Questions For Class 11

- ICSE Important Questions For Class 10

- ICSE Important Questions For Class 9

- ICSE Important Questions For Class 8

- ICSE Important Questions For Class 7

- ICSE Important Questions For Class 6

- Maharashtra board

- Rajasthan-Board

- Andhrapradesh Board

- AP Board syllabus

- Telangana Board

- Tamilnadu Board

- Tamilnadu Sample Question Paper

- Tamilnadu Syllabus

- Tamilnadu Previous Year Question Paper

- NCERT Solutions Class 12

- NCERT Solutions Class 10

- NCERT Solutions Class 11

- NCERT Solutions Class 9

- NCERT Solutions Class 8

- NCERT Solutions Class 7

- NCERT Solutions Class 6

- NCERT Solutions Class 5

- NCERT Solutions Class 4

- NCERT Solutions Class 3

- NCERT Solutions Class 2

- NCERT Solutions Class 1

- JEE Main Question Papers

- JEE Main Syllabus

- JEE Main Questions

- JEE Main Revision Notes

- JEE Advanced Question Papers

- JEE Advanced Syllabus

- JEE Advanced Questions

- JEE Advanced Sample Papers

- NEET Question Papers

- Neet 2021 Question Paper

- Neet 2020 Question Paper

- Neet 2019 Question Paper

- Neet 2018 Question Paper

- Neet 2017 Question Paper

- Neet 2016 Question Paper

- Neet 2015 Question Paper

- NEET Syllabus

Important Questions Class 11 Accountancy Chapter 4 – Recording of Transactions II (Financial Accounting – I)

Accountancy is a crucial subject for both the 11th and 12th Classes. Students need to understand the concepts and apply them correctly while solving numerical questions. Thorough knowledge of the basic principles and practices will serve as a stepping stone toward a successful career in Accounting. Chapter 4 for Class 11 Accountancy is about Recording of Transactions II (Financial Accounting – I) and gives a step-by-step method in the Accounting process, i.e. recording transactions in a specific journal. Students must go through the Important Questions Class 11 Accountancy Chapter 4 as this chapter covers the subdivisions of the journal into which transactions of similar nature are recorded. It also sheds light on preparing cash books, petty cash books, and special purpose books and posting them into the ledger accounts.

Quick Links

Important Questions of Cash Book Class 11 will help them to learn with a proper understanding of various transactions, and the special purposes of books such as cash books, purchases books, return books, etc, putting them in the ledger will give them more clarity about the purposes with concrete examples. Complete knowledge and their applications will give students added confidence to answer any question without ambiguity. Furthermore, they will know how to answer similar questions in the subsequent chapters while preparing for their examinations to score 100% and set the benchmark. st.

Creating a solid foundation in concepts and solving numerical where Accountancy is considered necessary. At Extramarks, we completely understand the importance of practicing such questions. For this purpose, Extramarks picks crucial questions from various sources such as NCERT books, NCERT Exemplar, other reference books, past years’ question papers, and so on to prepare a repository based on NCERT books that is aligned with CBSE guidelines. The accountancy subject experts have created step-by-step solutions so that students can learn important points easily and make them revise quickly with the help of Important Questions Class 11 Accountancy Chapter 4 and to give 100% performance in their examinations and create their first milestone.

Not just Class 11 Accountancy Chapter 4 Important Questions, students can register at the Extramarks website and access content such as NCERT Books, NCERT Solutions, CBSE revision notes , past years’ question papers, and so on for a complete study session. Trust Extramarks with their repository, it’s one

Stop solutions to all your problems.

Access CBSE Class 11 Accountancy Important Questions and Answers

Class 11 Accountancy Chapter-wise important questions are available for free to students, and these questions are perfect for self-study.

Sign up and get complete access to CBSE Class 11 Accountancy Important Questions for other chapters too:

Important Questions of Cash Book Class 11 Accountancy Chapter 4 with Solutions

To help the students maximize their potential, Extramarks has curated a list of Chapter 4 Class 11 Accountancy Important Questions that covers questions from various crucial topics that are in the chapter. The step-by-step solutions are conveyed in a straightforward manner so that students can understand, recall and apply their knowledge without much difficulty.

A list of Important questionnaires with answers from Class 11 Accountancy Chapter 4 is given below: .

Question 1. Cash purchase of goods is recorded in-

- Purchase Book

- None of these

Answer 1: (c) Cash Book

Explanation: Cash book is a book in which all transactions relating to cash receipts and cash payments are recorded. It starts with the cash or bank balances at the beginning of the period.

Question 2. What is the subdivision of a journal?

Answer 2: As the business expands, it might get a little challenging to record all the entries in a single book, i.e. journal. And as many transactions become repetitive, It becomes more accessible to then record transactions of similar nature in separate special books. For example, all cash transactions can be recorded in one book; all credit transactions can go in one book, all purchase transactions in one book, and so on. These special books are called day books or subsidiary books.

Question 3. State the following questions as true or false:

- More than one credit account and a single debit account in an entry is known as a compound entry.

- Subsidiary book is also known as a ledger.

- Credit purchase of machinery is entered in purchase book

- True. This entry is regarded as a compound entry as it involves more than 2 accounts.

- False. Subsidiary books are a set of intermediary accounts linked to the ledger.

- False. Purchase of machinery should be recorded in a journal with a proper account.

Question 4. Write the process of preparing a ledger from a journal.

Answer 4: The process of preparing a ledger account can be understood with the help of an example. Let us suppose a Machinery is purchased from Mr X, so the journal entry for the same would be;

Machinery A/c …Dr.

To Mr X A/c

In the above journal entry, Machinery A/c is debited, and Mr X A/c is credited. The steps for preparing a ledger account would then be as follows

For the account which is debited

- Identify the account that is debited in the journal entry. In our example, it is the machinery account.

- In the ‘Machinery A/c’, enter the date in the ‘Date’ column on the account’s debit side.

- On the debit side of the account, in the ‘Particulars’ column, enter ‘Mr. X’ (which was credited)

- In the Journal Folio or ‘J.F’ column, add the page number where the entry is mentioned in the journal

- In the ‘Amount’ column, add the corresponding amount of the journal entry.

For the account which is credited

- Identify the account that is credited in the journal entry. In our example, it is the ‘Mr X.’ account.

- In the ‘Mr. X.’ enter the date in the ‘Date’ column on the credit side of the account.

- In the debit side of the account, in the ‘Particulars’ column, enter ‘Machinery A/c’ (which was credited)

- In the Journal Folio or ‘J.F’ column, add the page number where the entry is mentioned in the journal.

Question 5. Give the meaning of the following terms

- Sales journal

- Purchase journal

- Petty cash book

- Sales Journal: Sales journal exclusively records all credit sales transactions.

- Purchase Journal: Purchase journal records all the transactions of credit purchases.

- Journal: Journal is referred to as books of original entry where all initial transactions are recorded.

- Petty Cash Book: Petty cash book is used to record all the small cash transactions that occur in a business for a particular period.

Question 6. What is the difference between a trade discount and a cash discount?

Answer 6: The following are the differences between trade discount and cash discount;

Question 7. Explain the Debit and Credit note in five sentences.

Debit Note: A debit note is prepared when the buyer returns goods to the supplier. It contains the name of the party to whom the goods are returned and the details for which the goods were returned. Every debit note will have a serial number and a date.

Credit Note: A credit note is prepared by the supplier when goods are returned to them by the buyer. The credit note contains the customer’s name and other details such as the goods received and the amount. Every credit note will have a date and a serial number.

Question 8. Write the difference between return inwards and return outwards.

Answer 8: The difference between return inwards and return outward is mentioned below:

Question 9. Record the following transactions during the week ending Dec.30, 2014,

with a weekly, imprest Rs. 500.

24 Stationery 100

25 Bus fare 12

25 Cartage 40

26 Taxi fare 80

27 Wages to casual labour 90

29 Postage 80

Answer 9: Petty Cash Book

Question 10. Enter the following transactions into cash book for the month of Jan 2018

- Cash received from Ravi 4,000

- Rent Paid in cash 2,000

- Purchased goods from Mahesh for cash 6,000

- Sold goods for cash 9,000

Answer 10: Cash book for the month of Jan 2018

Dr. Cr.

Working Notes:

Question 11. What is a petty cash book? Write the advantages of petty cash books?

Answer 11: Recording repetitive transactions in smaller denominations can be burdensome on the cash book; hence a separate book known as the ‘Petty Cash Book’ is created for the purpose of recording transactions of this nature. Examples of petty cash expenses include stationery, postage, conveyance, refreshments, etc. A petty cashier maintains a petty cash book.

The system of preparation for the petty cash book is the Imprest system. Under this system, the petty cashier receives a certain sum of money for a period; post the exhaustion of the funds, they are reimbursed so that they may have the same amount as in the starting period.

Advantages of Petty Cash Book:

- Avoid bulky cash books: By maintaining a petty cash book, the cash book is not burdened with transactions of repetitive nature, and small denominations make the cash book less bulky.

- Division of labour: The handling of petty cash expenses is delegated to the Petty Cashier; hence there is a division of labour, and the main cashier can work efficiently in the more essential areas.

- Prone to less error: The petty cash goes through regular audits so that it is prone to fewer errors and inefficiencies.

- Simple method: The method of recording transactions is pretty simple in a petty cash book. There are separate heads under which each petty expense can be placed. Also recording transactions in a petty cash book does not require formal knowledge of all accounting principles and techniques.

Question 12. What is a cash book? Explain the types of cash books.

Answer 12: A cash book is a book of original entries where all cash-related transactions are recorded, i.e. cash receipts and cash payments. Cash deposits and withdrawals are all recorded in sequential order. There are two columns on either side of the cash account of cash and bank, so all cash-related transactions are recorded in the cash column, whereas all bank-related entries go in the bank column. For example, cash sales by the business will be recorded in the cash column on the debit side, but payments made to creditors via cheque will be recorded in the bank column on the credit side of the cash account.

Types of cash books:

- Single Column Cash Book:

In a Single Column Cash Book, only cash-related transactions are recorded. It is helpful for enterprises that only maintain cash transactions. It has records of cash receipts and cash payments.

- Double Column Cash Book:

The Two Column Cash Book is more commonly referred to as the Double Column Cash Book. It contains two columns of cash on either side, i.e. debit and credit. One side is used to record cash transactions, and one side is used to record bank transactions.

Cash transactions are recorded in the cash column, and bank transactions relating to cheque deposits and payments made by cheques are recorded in the bank columns. Some organisations prefer the double column cash book as it contains both the cash and the bank account, thus eliminating the need for two separate ledgers.

- Triple Column Cash Book:

As the name suggests, a Triple Column Cash Book consists of three columns: cash, bank and discount. It is mostly used by those organisations that have large operations and conduct transactions in both cash and through banks while also giving discounts. The process of recording transactions is similar to a double-column cash book; the cash and bank columns are totalled periodically while the bank column is just totalled. The discount given to creditors is recorded on the debit side, while the discount received from creditors is recorded on the credit side.

- Petty Cash Book:

A Petty Cash book is used to record transactions that are not of very high value to the business. There is an opening credit balance, which is the amount put aside for petty cash expenses. Transactions relating to stationery, postage and stamps, daily wages, etc., are recorded in the petty cash book.

Question 13. Prepare double column cash book from the following transactions for the year August 2017:

01 Cash in hand 17,500

Cash at bank 5,000

03 Purchased goods for cash 3,000

05 Received cheque from Jasmeet 10,000

08 Sold goods for cash 7,000

10 Jasmeet’s cheque deposited into bank

12 Purchased goods and paid by cheque 20,000

15 Paid establishment expenses through bank 1,000

18 Cash sales 7,000

20 Deposited into bank 10,000

24 Paid trade expenses 500

27 Received commission by cheque 6,000

29 Paid Rent 2,000

30 Withdrew cash for personal use 1,200

31 Salary paid 6,000

Answer 13: Cash Book

Dr. Cr.

Benefits of Solving Cash Book Class 11 Extra Questions

Accountancy can appear to be difficult at first, but with the proper understanding and practice, students can find this subject quite interesting when it comes to solving numerical questions. When students have a good hold over passing journal entries and posting them into ledger accounts, then subsequent chapters would not feel difficult at all. Solving important questions Class 11 Accountancy Chapter 4 will help students get that confidence in passing journal entries, recording them in special purpose books and then finally posting them into ledgers.

Following are the benefits of solving Important Questions Class 11 Accountancy Chapter 4:

- Practising important questions from chapter 4 in Accountancy will help students ace their examinations and get better results.

- The step-by-step solutions are prepared by subject matter experts with years of experience to provide credible study material based on the NCERT books which is complete in every way and students need not look elsewhere for any other resources. Hence, students can rely upon and trust these solutions completely.

- The important questions are prepared keeping in mind the CBSE syllabus and guidelines, which can give a thorough revision of the entire chapter. These resources are reliable and accurate. In fact these resources are the best study material for getting a 100% score and creating your first milestone in high school.

- That’s not enough, many questions in the competitive exams are taken from NCERT books so these resources are definitely going to pay you in the long run. Practice, practice and practice. Practicing from the Important Questions Class 11 Accountancy Chapter 4 will speed up your learning and revision from various sample papers will boost their performance naturally and effortlessly.

Extramarks provides a repository of credible resources such as NCERT textbooks, NCERT revision notes, CBSE sample papers , CBSE past year question papers , CBSE extra questions , and CBSE mock examinations. In order to access these resources, students can click on the URLs mentioned below:

- NCERT books

- CBSE syllabus

- CBSE sample papers

- CBSE past year’ question papers

- Important formulas

- CBSE extra questions

- Click to share on Facebook (Opens in new window)

- Click to share on Twitter (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- Click to share on WhatsApp (Opens in new window)

Q.1 Prepare a petty Cash Book on the Imprest System from the following:

Marks: 6 Ans

Q.2 Why is the cash book called a journal as well as ledger

Marks: 1 Ans

All transactions are primarily recorded in the cash book and therefore, it is called a journal. Cash book is just similar to a cash account and therefore, it is called a ledger.

Enter the following transactions in a Single Column Cash book:

Please register to view this section

Cbse class 11 accountancy important questions, chapter 1 - introduction to accounting.

Chapter 2 - Theory Base of Accounting

Chapter 3 - recording of transactions– 1, chapter 5 - bank reconciliation statement, chapter 6 - trial balance and rectification of errors, chapter 7 – depreciation, provisions & reserves, chapter 8 - bill of exchange, chapter 9 - financial statements – 1, chapter 10 - financial statements 2, chapter 11 - accounts from incomplete records, chapter 12 - applications of computers in accounting, chapter 13 - computerised accounting system, faqs (frequently asked questions), 1. what are the topics covered in chapter 4 in accountancy.

The topics that are covered in Chapter 4 Recording of Transaction-II are as follows:

- Single Column Cash Book

- Posting of the Double Column Cash Book

- Petty Cash Book

- Posting from the Petty Cash Book

- Conveyance Account

- Balancing of Cash Book

- Sales Account

- Purchases Account

2. How can one score good grades in Accountancy?

To score good grades in Accountancy, firstly, students should be thorough with the key concepts of the chapters, and secondly, they should consistently practice the questions from NCERT books, reference books and past years’ papers. In case students want to practice with additional study material to check their preparation, they can access Accountancy Class 11 Chapter 4 Important Questions from the Extramarks website to ensure 100% score in the exam results. Trust Extramarks , it is one stop solution to all your problems.

CBSE Related Links

Fill this form to view question paper

Otp verification.

Recording of Transactions – II – Bank Column Cash Book Solutions

Watch Video🎥

myCBSEguide

- Business Studies

- Class 11 Business Studies...

Class 11 Business Studies Case Study Questions

Table of Contents

myCBSEguide App

Download the app to get CBSE Sample Papers 2023-24, NCERT Solutions (Revised), Most Important Questions, Previous Year Question Bank, Mock Tests, and Detailed Notes.

CBSE Class 11 Business Studies Case Study Questions are available on myCBSEguide App . You can also download them from our student dashboard .

For students appearing for grade 11 CBSE exams from the Commerce stream, Business Studies is a fundamental subject. Business Studies is considered to be quite interesting as well as an occupying subject as compared to all other core subjects of the CBSE class 11 commerce stream. To ace this CBSE exam, students are not only required to work hard but they ought to learn to do smart work too.

Among all the other core subjects of the Commerce stream i.e accountancy, economics and business studies, Business Studies is the one that is purely theoretical. It is termed to be comparatively easier and more scoring than the other mandatory subjects of the commerce stream. Many students who opt for the commerce stream after their 10-grade exams desire to learn in-depth about the business organizations and their work, for them the subject is of utmost importance. Business Studies is an essential component of the class 11 commerce stream curriculum.

In order to ace the subject the student needs to have conceptual clarity. CBSE has designed the syllabus for class 11 Business Studies so as to provide students with a basic understanding of the various principles prevalent in the Business organizations as well as their interaction with their corresponding environment.

Case Study Questions in class 11 (Business Studies)

Case-based questions have always been an integral part of the Business Studies question paper for many years in the past. The case studies have always been considered to be challenging for the students, for such questions demand the application of their knowledge of the fundamental business concepts and principles. Last year i.e- 2021 CBSE introduced a few changes in the Business Studies question paper pattern to enhance and develop analytical and reasoning skills among students.

It was decided that the questions would be based on real-life scenarios encountered by the students.CBSE not only changed the way case-based questions were formulated but also incremented their weightage in the Business Studies question paper. The sole purpose of increasing the weightage of case-based questions in the class 11 curriculum by CBSE was to drift from rote learning to competency and situation-based learning.

What is a case study question? (Business Studies)

In Business Studies, a case study is more like a real-world test of how the implementation works. It is majorly a report of an organization’s implementation of anything, such as a practice,a product, a system, or a service. The questions would be based on the NCERT textbook for class 11 Business Studies. Case-based questions will definitely carry a substantial weightage in the class 11 Business Studies question paper. questions.

A hypothetical text will be provided on the basis of which the student is expected to solve the given case-based question asked in the Business Studies class 11 exam. Initially, the newly introduced case-based questions appeared to be confusing for both the students and the teachers. Perhaps, they were reluctant to experiment with something new but now a lot more clarity is there that has made the question paper quite student-friendly.

Case study questions could be based on any chapter or concept present in the NCERT textbook. Thus, it is expected from the students to thoroughly revise and memorize the key business fundamentals.

Business Studies syllabus of class 11 CBSE

The entire Business Studies course is divided into 2 parts:

- Part A, Foundation of Business

- Part B, Finance and Trade

The class 11 Business Studies exam is for a total of 100 marks, 80 marks are for the theory and the remaining 20 for the project. Most of the questions are based on the exercises from the NCERT textbook. It is recommended to rigorously go through the contents of the book. A single textbook has been published by NCERT for Class 11 Business studies. There are a total of 10 chapters in this book divided into 2 parts.

CBSE Class – 11

Business Studies (Code No. 054)

Theory: 80 Marks Time: 3 Hours Project: 20 Marks

Case Study Passage (Business Studies class)

As part of these questions, the students would be provided with a hypothetical situation or text, based on which analytical questions will have to be answered by them. It is a must for the students to read the passage in depth before attempting the questions. In the coming examination cycle (2022-23), case-based questions have a weightage of around 30%. These questions can be based on each chapter in the NCERT book for Business Studies, grade 11.

Students must prepare well for the case-based questions before appearing for their Business Studies exam as these questions demand complete knowledge of the various concepts in their syllabus. CBSE plans to increase the weightage of such questions in the upcoming years.

Sample case-based Questions in Business Studies

Business Studies as a subject provides a way of perceiving and interacting with the business ecosystem. It is a core subject of the commerce stream that is purely theoretical and relevantly easier than the other compulsory subjects of the stream. Class 11 Business Studies syllabus is closely related to trade and commerce. The subject cannot be ignored as it is the foundation of many concepts and theories which are studied at an advanced level in class 12.

The case-based questions asked in the CBSE Business Studies question paper for class 11 are of two types:

As per the latest circular issued by CBSE on Assessment and Evaluation practices of the board for the session 2022-23, CBSE has clearly mentioned that competency-based questions including case studies will be different from subjective questions.

The questions can also be categorized on their difficulty level:

- Direct: such questions can be easily solved. Their answer is visible in the given passage itself.

- Indirect/ Analytical: such questions are confusing and tricky. These can be solved by the application of the theory or principle that is highlighted in the provided text.

How To Prepare For Case-based Questions? (Business Studies grade 11)

Students need to prepare well for the case-based questions before appearing for their class 11 Business Studies exam. Here are some tips which will help the student to solve the case-based questions at ease:

- Read the provided text carefully

- Try to comprehend the situation and focus on the question asked

- Analyze and carefully answer the question asked

- In general, the passage given would be lengthy in Business Studies case-based questions but their solutions are comparatively short and simple

- One can significantly save time if they follow a reversal pattern, that is going through the questions before reading the comprehensive case study passage.

- Answer in a concise manner

- One should concentrate on solidifying key fundamental principles/theories

- Go through the NCERT textbook in depth. The language used is crisp and simple.

- While providing solutions to the case-based question, pick the keyword/keyline based on which you are driving insights.

In order to excel in the Business Studies class 11 exam, one needs to ignore the shortcut techniques and get to read the NCERT textbook rigorously. Case studies can be easily solved if your key fundamentals are strong and clear. The best part of having these questions is that the asked question itself projects a hint of its answer. These simple points if kept in mind will definitely help the students to fetch good marks in case study questions, class 11 Business Studies.

Case study question examples in Business Studies

Here a re some given case study questions for CBSE class 11 Business Studies. If you wish to get more case study questions and other study material, download the myCBSEguide app now. You can also access it through our student dashboard.

Business Studies Case Study 1

Read the hypothetical text given and answer the following questions:

Manish, Rahul and Madhav live in the same locality. They used to meet and discuss their ideas. After discussing the recent fire breakout in their area, they decided to take fire insurance for their house or work area. Manish gets his house insured against fire for ₹1 lakh and during the policy period, his house gets damaged due to fire and the actual loss amounts to ₹2.5 lakh. The insurance company acquired the burning material and approved his claim. Rahul gets his godown insured against fire for ₹1 lakh but does not take enough precautions to minimize the chances of fire like installing fire extinguishers in the factory. During the policy, a fire takes place in his godown and he does not take any preventive steps like throwing water and calling the employees from the fire fighting department to control the fire. He suffered a loss of ₹1,20,000. Madhav took a fire insurance policy of ₹20 lakh for his factory at an annual payment of ₹24,000. In order to reduce the annual premium, he did not disclose that highly explosive chemicals are being manufactured in his factory. Due to a fire, his factory gets severely damaged. The insurance company refused to make payment for the claim as it became aware of the highly explosive chemicals.

How much can Manish claim from the insurance company?

- None of the above

How much compensation can Rahul get from the insurance company?

Which principle is violated in the case of Rahul?

- Insurable Interest

- Utmost Good Faith

How much amount is the insurance company liable to pay to Madhav if he files a case against it?

- Insufficient information

Which principle of Insurance is violated by Madhav?

- Insurable interest

- Subrogation

- Proximate Cause

The insurance company acquired the burnt material and approved his claim. Which principle of Insurance is highlighted in the given statement.

- (a) Mitigation