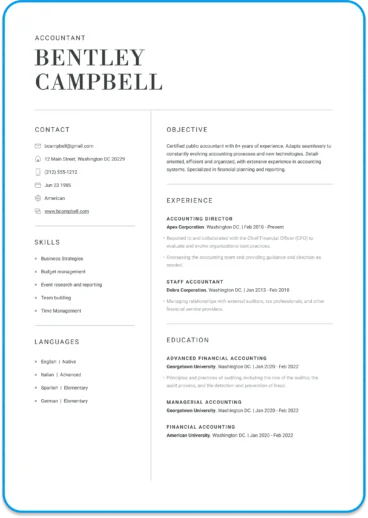

- Resume Templates Simple Professional Modern Creative View all

- Resume Examples Nurse Student Internship Teacher Accountant View all

- Resume Builder

- Cover Letter Templates Simple Professional Modern Creative View all

- Cover Letter Examples Nursing Administrative Assistant Internship Graduate Teacher View all

- Cover Letter Builder

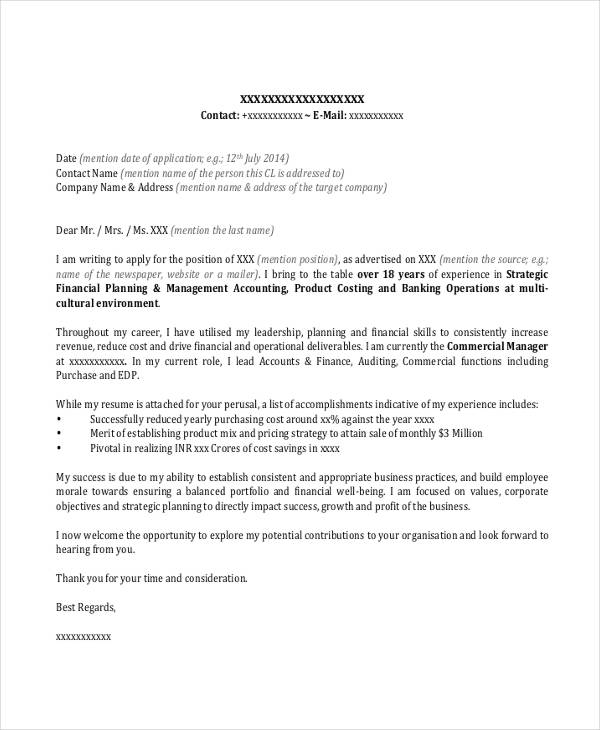

Banking cover letter example

Sometimes it’s bad news when you get a letter from the bank. But let’s talk about writing a letter to the bank. Because if you’re a banker looking for work, you’re going to need to write one — a persuasive banker cover letter.

Even if you’ve already created the perfect resume, you’re only half done. This article will discuss the crucial other half of your banker application, the cover letter. Resume.io is a leading provider of job search advice and tools, with resources that include more than 180 occupation-specific writing guides and corresponding cover letter examples.

The guide you're reading now is backed by a banking cover letter example that you can adapt for your own use.

What we’ll discuss here:

- Why a banking cover letter is a critical component of your job application

- How a cover letter is structured and what each component should contain for optimal impact: header, greeting, introduction, body and conclusion

- Proper design for a banker cover letter and why looks matter

- The psychology of persuasive writing

- Mistakes to avoid

- Tips for writing a banking cover letter when you lack experience

The job outlook for banking

“Banking” is a blanket term for a wide variety of finance-related occupations, everything from investment banking to starting out as a bank teller, but in general bankers are well-paid and in demand. For example, loan officers earned a median annual salary of $63,960 in 2020, according to the Bureau of Labor Statistics. J ob growth of 1% was anticipated for this profession from 2020 through 2030, much slower than the occupational average.

The banking industry grows a bit more complicated every year as new financial products are designed and new technologies develop to manage and move money globally. Banks also have to guard against the increasingly sophisticated cybercrimes that banking activity inevitably attracts.

The good news is, if you’re a banker seeking a job, all you need are two pieces of paper. Just two! Imagine a business loan application that was so simple.

The two documents you need are an outstanding resume and an irresistible cover letter. The resume covers your employment history, education and skills. But the cover letter is how you get your foot in the door.

For more ideas, take a look at some other cover letter writing guides and examples in our accounting & finance category listed below.

- Accounting cover letter sample

- Finance cover letter sample

- Administration cover letter sample

- Bookkeeper cover letter sample

- Finance Assistant cover letter sample

- Finance Manager cover letter sample

- Bank Teller cover letter sample

- Auditor cover letter sample

- Private Equity cover letter sample

- Accounting and finance cover letter sample

- Bank Manager cover letter sample

- Loan Processor cover letter sample

- Accounting Internship cover letter sample

- Financial Advisor cover letter sample

- CFO cover letter sample

Why a banker needs a cover letter

Imagine you’ve been working at a bank for six years and you’d like to be considered for promotion to a new position. Would you just stick your resume under your boss’s door and wait to hear back?

Hopefully, you would approach your boss in person, ask if s/he had a moment to talk, and then make a brief but persuasive pitch, emphasizing your previous achievements on the job and explaining why you’re ready to embrace some new challenge. Then you can hand the boss your resume. Which of these strategies do you think would be more successful — the resume stuck under the door or the personal approach?

The whole point of a cover letter is to make a personal approach to someone who has the power to offer you a job. While your job application may be subjected to all kinds of electronic filters, ultimately you’ll need a human being to offer you a job. This is your chance to introduce yourself to that person.

There may be debate about whether or not to write a cover letter, but according to LinkedIn , you’re always better off making the extra effort.

Surveys of hiring managers have found that one of the top reasons resumes are rejected is because they aren’t accompanied by cover letters. A resume without a cover letter is like a flyer stuck under a windshield wiper: People usually throw them away.

Getting the tone right for your banker cover letter

Banking is among the most traditional and buttoned-down professions. Investment bankers don’t go to their jobs on Wall Street wearing tank tops. There’s a formality that pervades the industry, and it’s reflected in the way letters are written. Unless you belong to an uncontacted tribe in the Amazon, you’ve probably received a letter from a bank. Letters from banks tend to be friendly but professional, getting to the point quickly and informatively, and then inviting you to contact the bank if you have any questions or need any help.

Your cover letter should hit all the same notes. Keep it short, friendly and professional, yet use this space to make an irresistible pitch, and close with a call to action. The whole point of a cover letter is to establish a personal connection to a hiring manager. So while you’re writing a formal business letter, it should also be written with a personal touch.

Hold your cover letter to one page, with a maximum of 400 words, and put some thought into writing it. You need to find the right tone, and use that voice to highlight your experience, training and other qualifications for the job.

Always include a cover letter with a resume unless you are specifically asked not to. A few employers prefer that you send a resume only, and of course you have to respect their wishes. But it’s their loss, because a cover letter is a better vehicle than a resume to convey a candidate’s personality, enthusiasm, friendliness and professionalism.

![job application letter for a bank How to write a cover letter - expert guide [2024]](https://s3.resume.io/cdn-cgi/image/width=256,height=236,fit=cover,format=auto/uploads/blog_post/featured_image/314/How-to-Write-a-Cover-Letter-Expert-Guide.PNG)

Here is exactly how you can write a cover letter that will stand out from the crowd, and help you land that interview.

Best format for a banking cover letter

While your bank cover letter offers a lot of latitude when it comes to the tone and content, most cover letters should follow the same basic structure:

- The cover letter header

- The greeting

- The introduction

- The letter body

- The conclusion

- The signature.

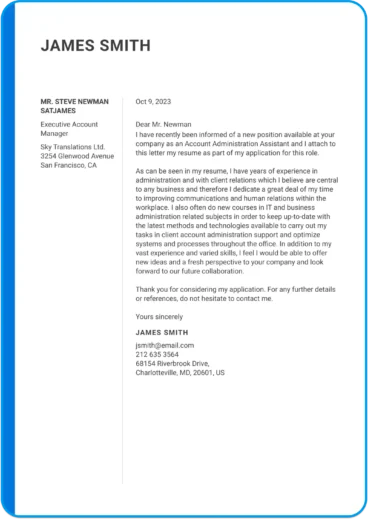

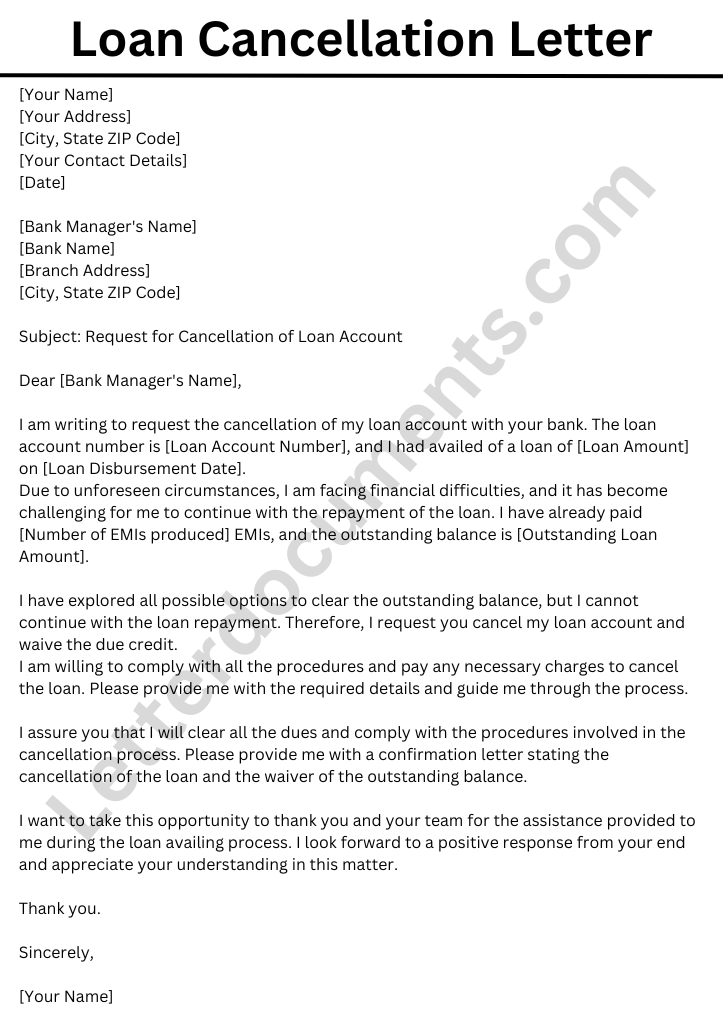

Below is a banker cover letter example that you can customize for the position and hiring organization.

17 August, 2020

Dear Mr. Looker,

As a fluent Arabic speaker with four years of investment banking experience in the US/MEA markets, the analyst position at Borton would offer a fascinating next step in my international investment banking career.

After my bachelor’s degree in Finance, I spent three years working in corporate finance, but after my online MBA from Wharton, I started an analyst role in the M&A team at Flux Capital. Over the past four years at Max, I have been the lead analyst for six deals totalling $1.8 billion and have collaborated closely on dozens of others. I have considerable experience in accounting and risk analysis in international markets, with FDI experience concentrated around the Middle East.

As well as working on the valuations and financial viability assessments, I created and updated pitch books and became proficient in writing executive summaries. I enclose non-confidential examples of my best writing work — words make a difference when you are building trust. Giving the right data to the right person gets any deal across the line.

Given that Flux Capital was a boutique firm, I was tasked with raising our profile at networking events and conferences, allowing me to finesse my influencing skills. I am applying to Borton because your scale offers a broader range of opportunities, but I am certain that my “small guy” business development mentality will nevertheless prove useful.

- Lead analyst on $850 million M&A of US/Saudi natural resources acquisition.

- Supported the IPO process for eight start-ups onto the NYSE over a four-year period.

- Used my programming experience to update our in-house financial viability tools.

I am familiar with the culture and reputation of Borton as my uncle is a client and it has been a long-held ambition to work for you. When a role became available, I simply had to put my name in the running for an interview.

Yours sincerely,

Let’s explore what each cover letter component should contain.

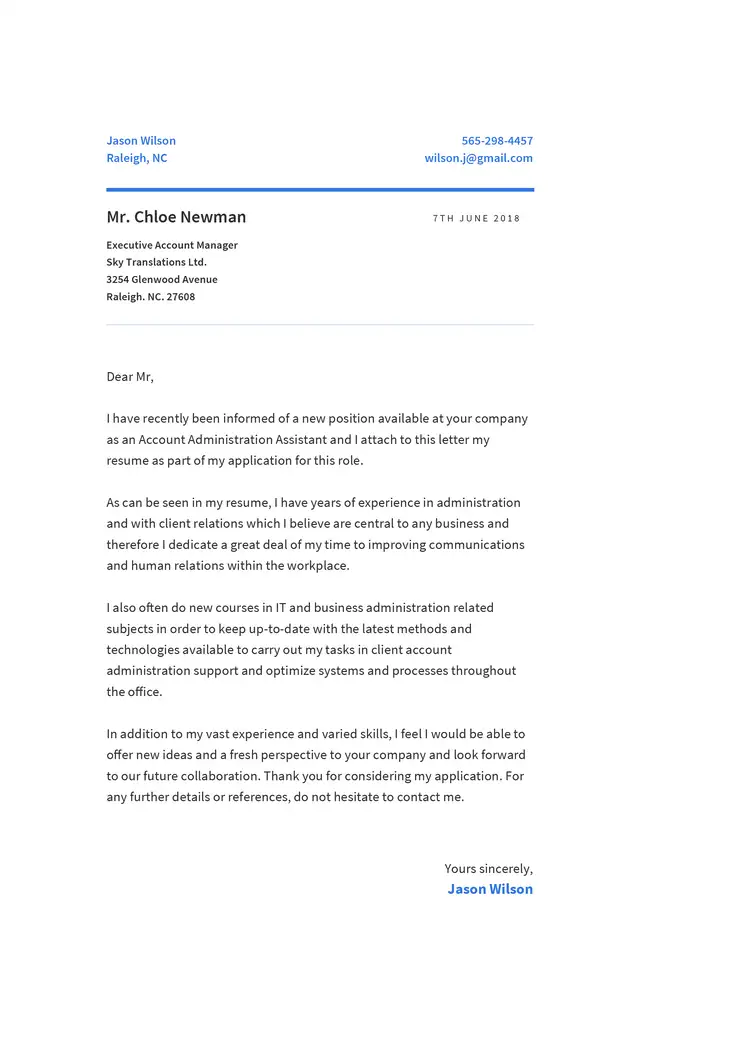

Cover letter header

The header of your letter should be an attractively designed section at the top that contains your name, address, phone number and email. Often it will also mention your occupation — for instance, “Investment Banker”.

Other than letting the company know how to reach you, the header is a design element that provides some visual relief from what would otherwise be solid paragraphs of black text.

Your banker resume and cover letter should be designed in the same style — fonts, font sizes and formatting. This gives you a “visual brand” and shows that you’re organized and you pay attention to detail.

Mixing several different fonts and styles will make your resume and cover letter look like Frankenstein’s monster — random parts badly stitched together. Strive for a coherent and consistent design.

Goal of the cover letter header: Distinguish yourself from other job applicants with a visually distinctive style that makes your letter inviting to read. Prominently displaying your contact information makes it easy for impressed recruiters to get in touch.

Greeting for a banker cover letter

This is the line that says, “Dear Mr. (or Ms.),” followed by the last name of the hiring manager.

You should almost always try to address your letter to a specific individual rather than the entire company. People like to read their own names, and letters that are addressed to an individual rather than an entire company are more likely to get a reply. Also, it shows your attention to detail if you’ve gone to the trouble of finding out the name of the appropriate person to address.

If you’re responding to a job listing that doesn’t mention the name of the hiring manager, it may be worthwhile to call the company and inquire. But if the company prefers that letters be addressed more generically, follow its wishes. Sometimes you have to use a greeting that says something like “Dear (Employer) Hiring Team.”

Goal of the cover letter greeting: Start off on a professional note while making a direct personal connection with the hiring manager.

Cover letter introduction

Your intro should be an attention-grabbing paragraph that identifies your job objective and briefly previews your qualifications for the job. Use energetic, lively language that shows enthusiasm and confidence, but beware of crossing a line into arrogance or excessive familiarity. Set the right tone from the beginning, and write an opening paragraph that will make your correspondent want to read more.

Goal of the cover letter introduction: Capture the hiring manager’s attention with an intriguing preview of your qualifications that motivates further reading..

Here’s an introduction idea from our banking cover letter sample.

Sample of a cover letter body

In the central two or three paragraphs of your letter, you have to make your primary case. This is where you describe your work experience, your past achievements in banking and any other qualifications that make you a good fit for the job you’re seeking.

Be specific in describing your accomplishments at past jobs, using facts and figures wherever possible (think numbers, dollar figures, percentages, etc.). Also, try to use an anecdote or two to describe a specific challenge you faced in the past as a banker and how you resolved it.

You may also choose to use the body of your letter to discuss your education, any special certifications or credentialing, and perhaps the reasons for your interest in this particular company. Compare your cover letter to your resume, and while some cross-over is inevitable, try to use the valuable space in your letter to say something your resume doesn’t.

Remember that your letter should not be about why you deserve a job, but about how you can help this company solve its problems, save money or increase efficiency. Emphasize how you can help them, not how they can help you.

Goal of the cover letter body: Persuade this employer that your contributions as a banker would be beneficial..

Our banker cover letter sample illustrates what you might include in the middle part.

Cover letter conclusion and signature

Your last paragraph should contain some kind of call to action —you are looking forward to a reply, you would be delighted to schedule an interview, etc.

You may even wish to ask if you could call in a week or so to follow up. This shows that you’re serious about this particular job and not just mailing letters at random. Put yourself in the shoes of the person you’re writing to — wouldn’t you pay just a bit more attention if you knew that this letter writer would be calling you soon?

However, it’s possible that some employers might find such a suggestion a bit pushy. Study your target, and write your pitch accordingly.

Your sign-off should generally be a simple “Sincerely” or the equivalent, followed by a space and your typed name. You can also insert your actual scanned signature if you like, though this is not considered essential in electronic correspondence.

Goal of the cover letter closing: End on a positive, self-assured note that suggests you expect the hiring manager will get in touch.

Below is the closing section of our banker cover letter example.

Layout, design and formatting of your banker cover letter

Your letter should look as good as it reads, and that’s why it’s important to follow some basic rules for good design and formatting.

- Fonts: Choose a modern, easy-to-read font that looks attractive but doesn’t call attention to itself. Beware of exotic fonts that may turn to garble on someone else’s computer.

- Font size: Use a font size of 10 to 12 points. If you’re having trouble holding your letter to one page, trim your text before you try to solve the problem by reducing the font size.

- Margins: Include one-inch margins on the left, right, bottom and top.

- Alignment: Body text should be aligned left, not justified from margin to margin. Leave a space between paragraphs, and keep the paragraphs short.

- White space: Don’t overlook the importance of leaving space on your page that contains nothing at all. Good design always includes an appropriate amount of white space to give the eye a break.

- File format: Unless you’re specifically asked for a Word file, save your cover letter as a PDF. The main advantage of a PDF is that it will preserve the formatting of your letter so that it looks the same on any computer. With other file types, you run the risk that some of your text may become unreadable, and it may jump all over the page in places where you didn’t put it.

- Use a professional template: To sidestep all of these potential pitfalls, use a professionally designed cover letter template from resume.io. We’ve taken care of all the formatting for you, so all you have to do is fill in your own content.

The psychology of writing a cover letter for a banker job

Never forget that you are writing a letter to a human being, and you need to think about how it will be received. Put yourself in the shoes of your correspondent, and write in a human voice that is professional but personable.

Psychologists say we all react to different stimuli with a combination of emotional and rational responses. Emotional responses are quicker and more automatic, but more deeply felt. Rational responses are slower and more deliberative. An ideal cover letter should inspire both.

So while this is a professional business letter, don’t hesitate to include language that appeals to the heart as well as the head. “Emotional language” might include some reference to your passions and desires, while “rational language” could be a more factual recitation of your employment history and banking career achievements.

Try using the AIDA model to inject your letter with emotional appeal:

- Grab the reader’s attention by telling a story about yourself related to the job

- Increase interest level by appealing to the hiring manager’s needs

- Create a desire to hire you by detailing how you satisfy the job requirements

- Close with a call to action.

It’s important to study each employer carefully to determine the best approach. If you’re aware of specific needs or problems the company has, and if you have your own strategy for resolving them, say so. It’s always a good idea to include something in a cover letter that shows you’re writing to a specific employer and not mass-mailing a letter to all.

You should also look at the tone of voice the company uses in addressing the public. Most banks use a friendly but formal voice on their websites and in communications with customers. You should endeavor to match the style and tone used by your prospective employer.

You should also consider your position as a banker relative to the employer. If a bank is seeking a new CEO and you’re eminently qualified, you would probably write in a more authoritative voice than a college student looking for her first internship.

Mistakes to avoid in a banking cover letter

Here are some of the common mistakes people make in writing cover letters:

- Writing errors: These include typos, misspellings and errors in grammar, punctuation and capitalization. Surveys have found that simple writing mistakes are the most common reason job applications are rejected.

- Clichés: “I am writing to….” Stop there! We already know you’re writing, because we’re reading your letter. “Please consider this letter my application for….” Ditto! Other clichés include describing yourself as a “self-starter” or a “team player” who “thinks outside the box. Avoid using stock phrases that every recruiter has read a thousand times before, and strive for fresh, original language.

- Non-customized letters: If your letter says nothing specific about the company you’re writing to, most hiring managers will assume it’s the same copy-and-paste letter that you’re also sending to all their competitors. Make every cover letter unique, targeted to a specific employer.

- Irrelevant info: Avoid discussing your hobbies or other aspects of your life that aren’t relevant to the job you’re seeking.

- Design errors: Strange fonts, tiny margins, huge blocks of text, zero white space and other formatting errors can disqualify your letter at a glance.

Banking cover letter sample with no experience

You may feel that you are stuck in a circular situation: You can’t get a banking job without experience and you can’t get experience without a banking job. That’s a frustration every worker has felt, yet they all got their first job somehow.

The key is to start with the skills you do have. If you are new to the banking industry, but not to the workforce, explain in your banker cover letter why you want to move into banking. Then, highlight the skills you used in your previous jobs that will transfer to banking.

Any business or project manager work ranks high, so check out resume.io cover letter examples for those fields, too. Emphasize your communication, organization and problem-solving skills — all abilities that will stand you in good stead in any career.

Consider mentioning your emotional intelligence , also known as emotional quotient or EQ, because, according to Forbes , hiring managers know that a vast majority of their high performers also rank high in this area.

Key takeaways for a banking cover letter

- Bankers who are seeking employment need an excellent resume and an outstanding cover letter, the latter in order to make a personal appeal to a hiring manager.

- A cover letter is your way of introducing yourself personally to a prospective employer. You should always include a cover letter in a job application unless you’re specifically asked not to.

- Cover letters have a formal structure that you should adhere to, and each component of your letter should serve a specific function.

- Design can be as important as content, and you must ensure that your letter adheres to basic rules about fonts, formatting and the overall look.

- Every cover letter should be unique and targeted to a specific employer.

- A professionally designed template can save you from a multitude of errors. The quickest and safest way to write a cover letter is to start with a proven structure where all you have to do is add your own information.

Free professionally designed templates

Banking cover letter examples

If you’re hoping to land your next banking role, then you need a cover letter that’s right on the money.

In our step-by-step guide, we’ll share our top tips and advice for writing an impressive application.

We’ve also created some banking cover letter examples to inspire your own. Check them out below.

CV templates

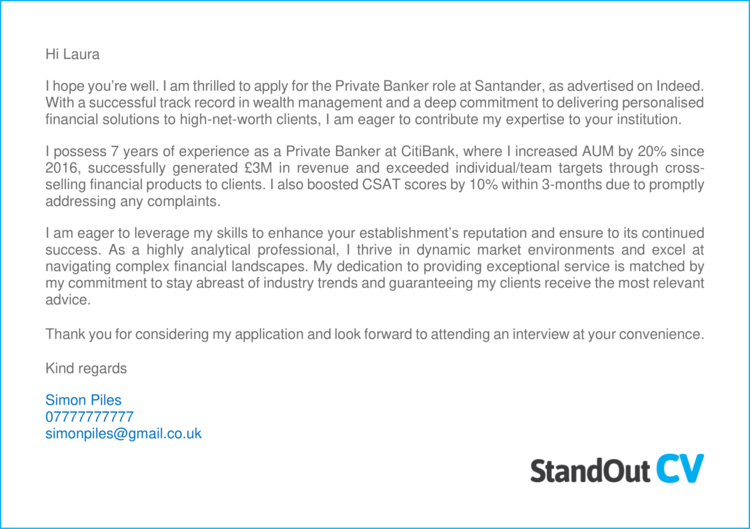

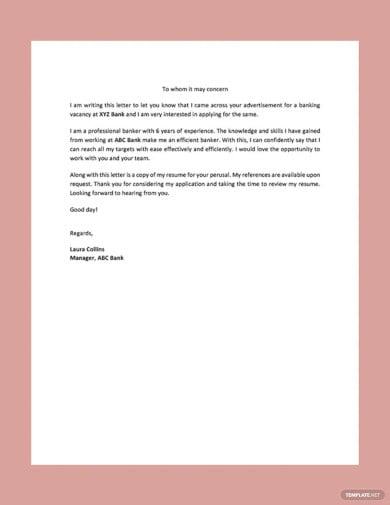

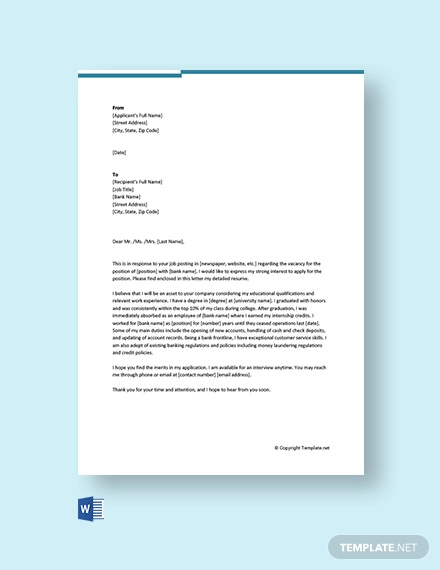

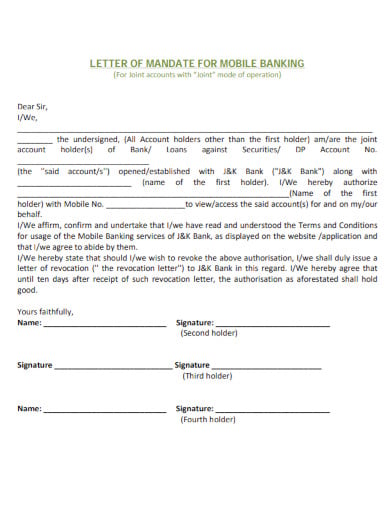

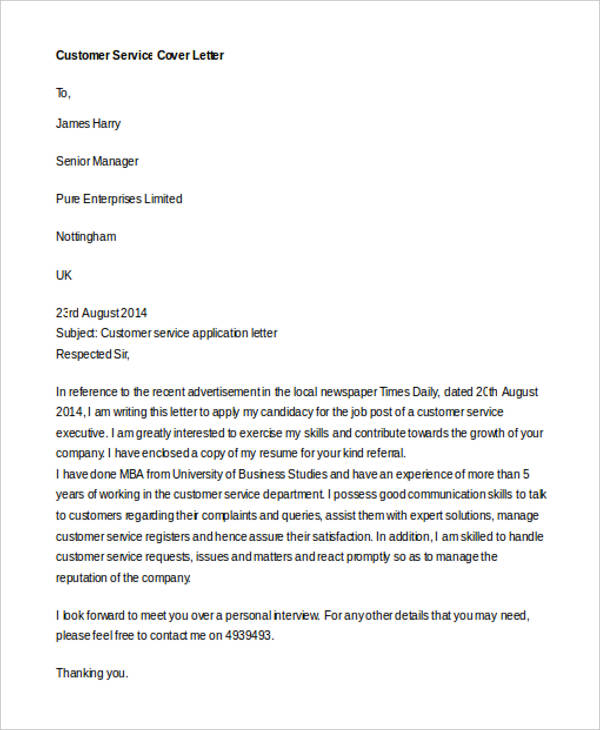

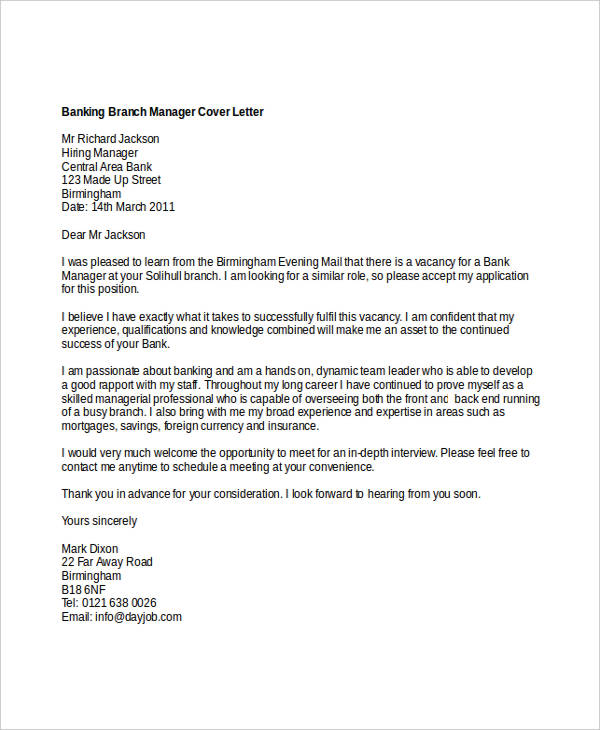

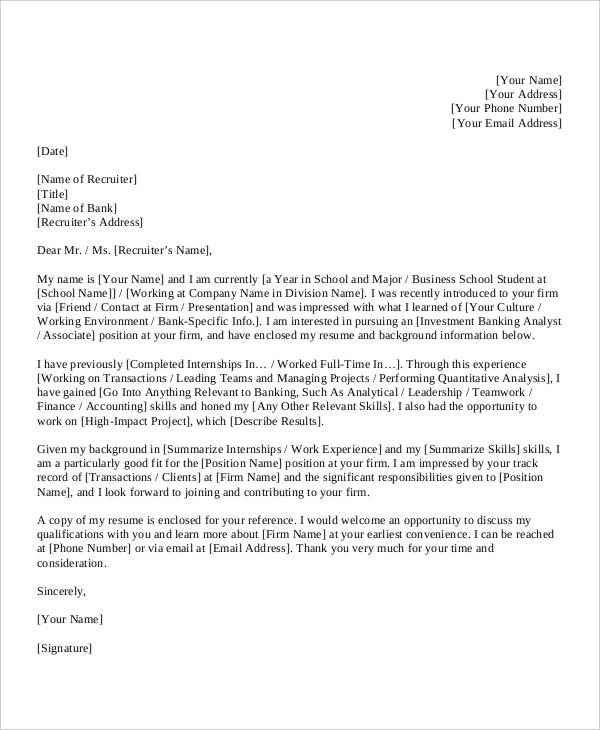

Banking cover letter example 1

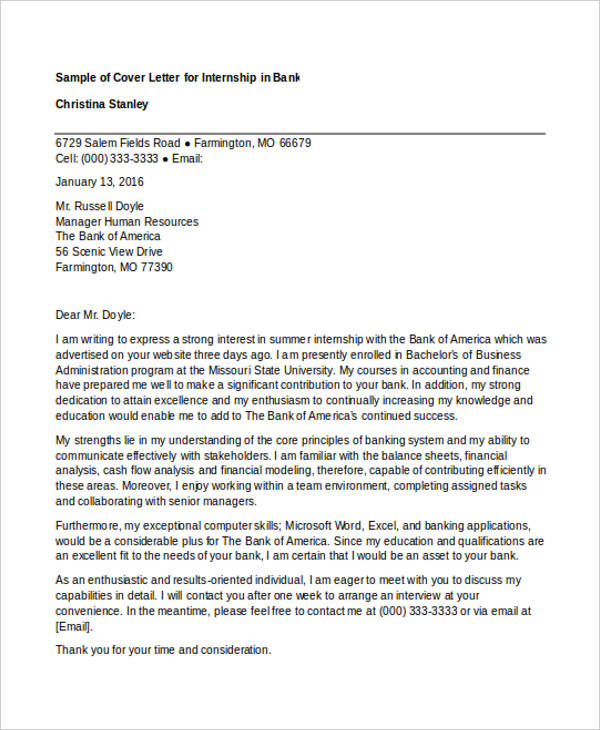

Banking cover letter example 2

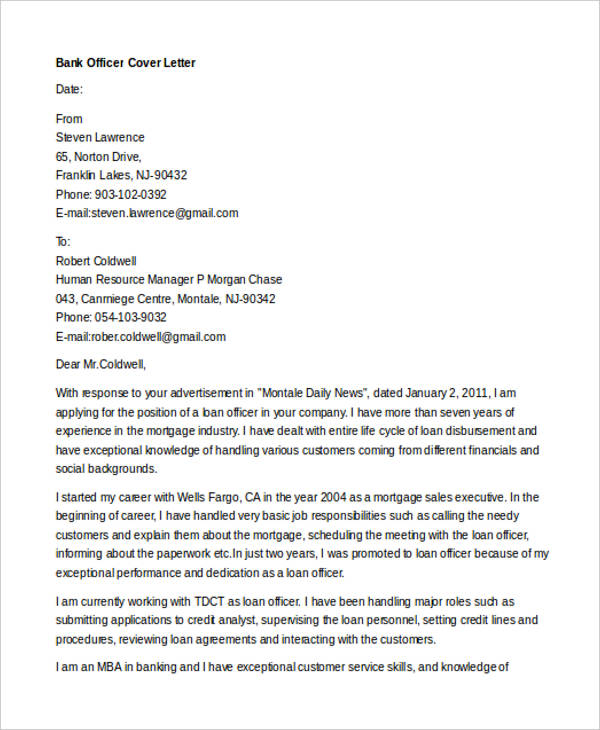

Banking cover letter example 3

These 3 Banking cover letter example s should provide you with a good steer on how to write your own cover letter, and the general structure to follow.

Our simple step-by-step guide below provides some more detailed advice on how you can craft a winning cover letter for yourself, that will ensure your CV gets opened.

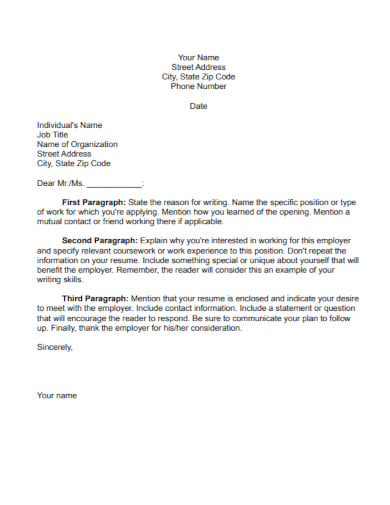

How to write a Banking cover letter

A simple step-by-step guide to writing your very own winning cover letter.

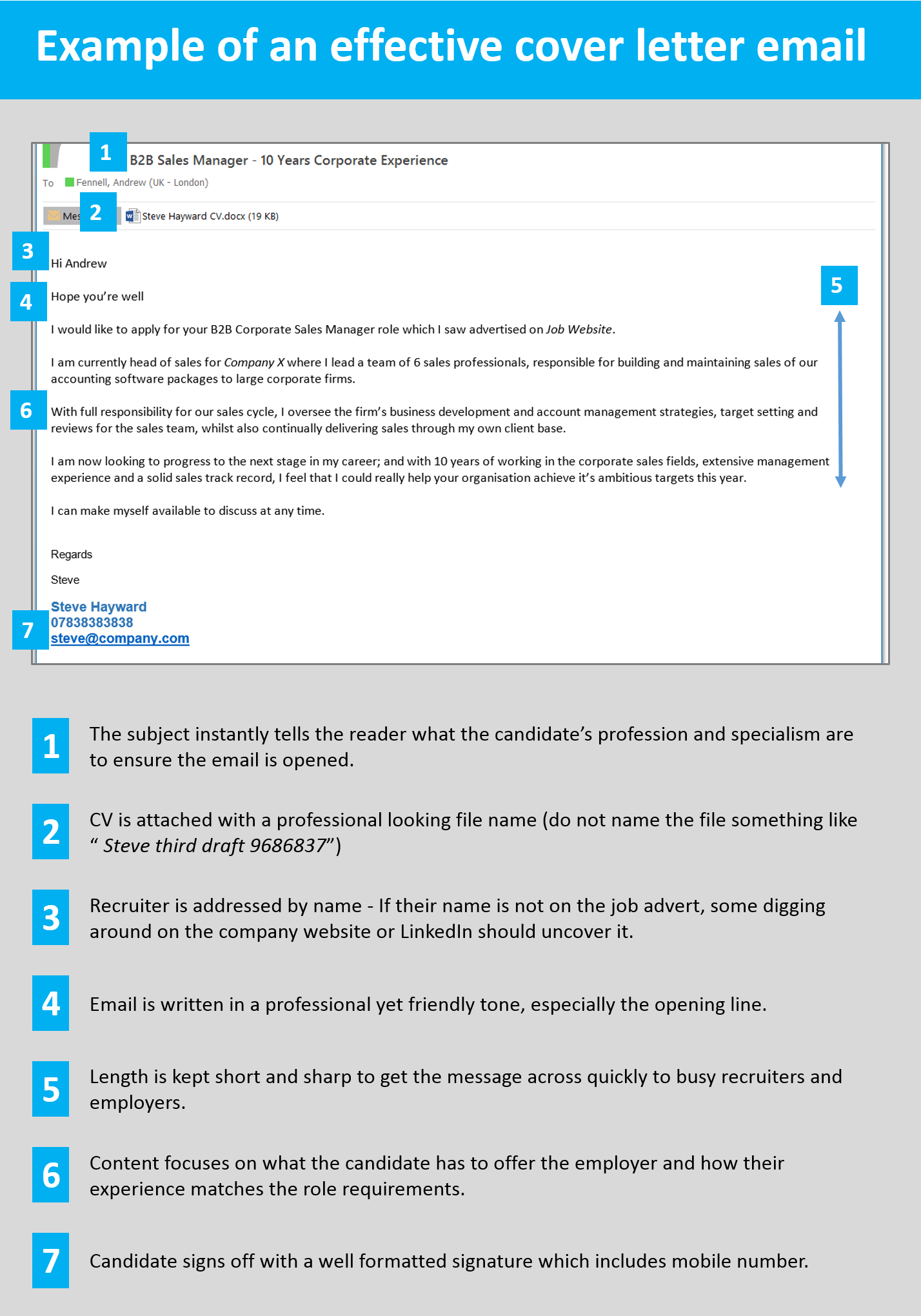

Write your cover letter in the body of an email/message

When writing your Banking cover letter, it’s best to type the content into the body of your email (or the job site messaging system) and not to attach the cover letter as a separate document.

This ensures that your cover letter gets seen as soon as a recruiter or employer opens your message.

If you attach the cover letter as a document, you’re making the reader go through an unnecessary step of opening the document before reading it.

If it’s in the body of the message itself, it will be seen instantly, which hugely increases the chances of it being read.

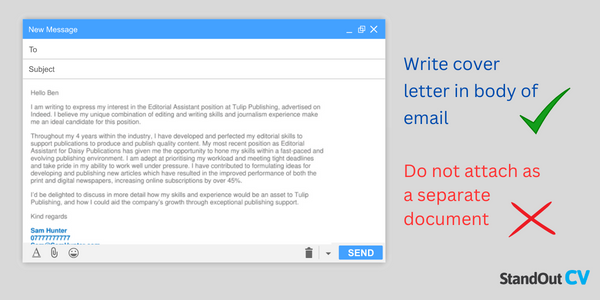

Start with a friendly greeting

To start building rapport with the recruiter or hiring manager right away, lead with a friendly greeting.

Try to strike a balance between professional and personable.

Go with something like…

- Hi [insert recruiter name]

- Hi [insert department/team name]

Stay away from old-fashioned greetings like “Dear sir/madam ” unless applying to very formal companies – they can come across as cold and robotic.

How to find the contact’s name?

Addressing the recruitment contact by name is an excellent way to start building a strong relationship. If it is not listed in the job advert, try to uncover it via these methods.

- Check out the company website and look at their About page. If you see a hiring manager, HR person or internal recruiter, use their name. You could also try to figure out who would be your manager in the role and use their name.

- Head to LinkedIn , search for the company and scan through the list of employees. Most professionals are on LinkedIn these days, so this is a good bet.

Identify the role you are applying for

Once you’ve opened up the cover letter with a warm greeting to start building a relationship, it is time to identify which role you want to apply for.

Recruiters are often managing multiple vacancies, so you need to ensure you apply to the correct one.

Be very specific and use a reference number if you can find one.

- I am interested in applying for the position of *Banking role* with your company.

- I would like to apply for the role of Sales assistant (Ref: 406f57393)

- I would like to express my interest in the customer service vacancy within your retail department

- I saw your advert for a junior project manager on Reed and would like to apply for the role.

See also: CV examples – how to write a CV – CV profiles

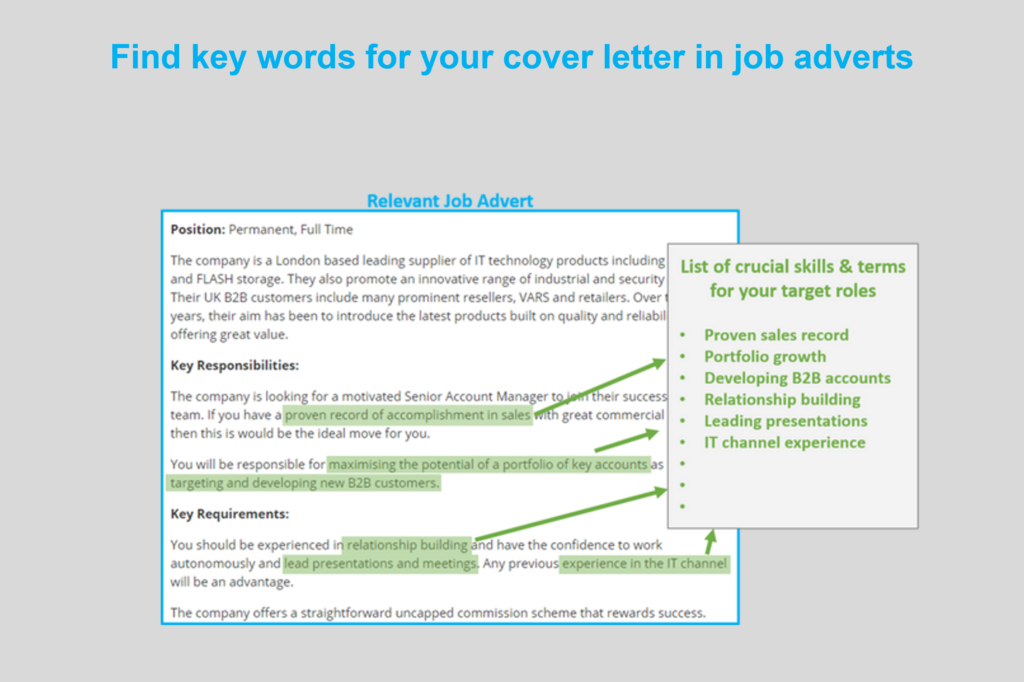

Highlight your suitability

The sole objective of your cover letter is to motivate recruiters into to opening your CV. And you achieve this by quickly explaining your suitability to the roles you are applying for.

Take a look at the job descriptions you are applying to, and make note of the most important skills and qualifications being asked for.

Then, when crafting your cover letter, make your suitability the central focus.

Explain why you are the best qualified candidate, and why you are so well suited to carry out the job.

This will give recruiters all the encouragement they need to open your CV and consider you for the job.

Keep it short and sharp

A good cover letter is short and sharp, getting to the point quickly with just enough information to grab the attention of recruiters.

Ideally your cover letter should be around 4-8 sentences long – anything longer will risk losing the attention of time-strapped recruiters and hiring managers .

Essentially you need to include just enough information to persuade the reader to open up your CV, where the in-depth details will sit.

Sign off professionally

To round of your CV, you should sign off with a professional signature.

This will give your cover letter a slick appearance and also give the recruiter all of the necessary contact information they need to get in touch with you.

The information to add should include:

- A friendly sign off – e.g. “Kindest regards”

- Your full name

- Phone number (one you can answer quickly)

- Email address

- Profession title

- Professional social network – e.g. LinkedIn

Here is an example signature;

Warm regards,

Jill North IT Project Manager 078837437373 [email protected] LinkedIn

Quick tip: To save yourself from having to write your signature every time you send a job application, you can save it within your email drafts, or on a separate documents that you could copy in.

What to include in your Banking cover letter

Here’s what kind of content you should include in your Banking cover letter…

The exact info will obviously depend on your industry and experience level, but these are the essentials.

- Your relevant experience – Where have you worked and what type of jobs have you held?

- Your qualifications – Let recruiters know about your highest level of qualification to show them you have the credentials for the job.

- The impact you have made – Show how your actions have made a positive impact on previous employers; perhaps you’ve saved them money or helped them to acquire new customers?

- Your reasons for moving – Hiring managers will want to know why you are leaving your current or previous role, so give them a brief explanation.

- Your availability – When can you start a new job ? Recruiters will want to know how soon they can get you on board.

Don’t forget to tailor these points to the requirements of the job advert for best results.

Banking cover letter templates

Copy and paste these Banking cover letter templates to get a head start on your own.

Hello Harry

I am keen to showcase my interest in the Bank Manager position at Investec. With a distinguished career in the financial service industry spanning over 15 years, I am excited about the opportunity to lead a dynamic team, steer exceptional customer experiences, and contribute to the success of your company.

Throughout my career at Metro Bank, I have held progressively responsible roles, where I honed my expertise in optimising branch operations, client service, team management, and business development across all activities. Some of the significant contributions I have played throughout my time at Metro Bank include, increasing deposits by 30% through integrating targeted marketing campaigns and relationship-building strategies, developing training programs which enhanced branch staff’s cross-selling of bank products by 50%, and lessening annual expenses by £80K by negotiating favourable contracts with suitable vendors.

My passion for fostering a customer-centric culture has been the driving force behind my success, and I am confident that my collaborative approach and ability to build and maintain relationships will ensure continued growth for Investec as a whole. Thank you very much for considering my application and I hope to hear from you very soon regarding scheduling an interview.

Kind regards

Ellen Mount ¦ 07777777777 ¦ [email protected]

I hope you’re well. I am thrilled to apply for the Private Banker role at Santander, as advertised on Indeed. With a successful track record in wealth management and a deep commitment to delivering personalised financial solutions to high-net-worth clients, I am eager to contribute my expertise to your institution.

I possess 7 years of experience as a Private Banker at CitiBank, where I increased AUM by 20% since 2016, successfully generated £3M in revenue and exceeded individual/team targets through cross-selling financial products to clients. I also boosted CSAT scores by 10% within 3-months due to promptly addressing any complaints.

I am eager to leverage my skills to enhance your establishment’s reputation and ensure to its continued success. As a highly analytical professional, I thrive in dynamic market environments and excel at navigating complex financial landscapes. My dedication to providing exceptional service is matched by my commitment to stay abreast of industry trends and guaranteeing my clients receive the most relevant advice.

Thank you for considering my application and look forward to attending an interview at your convenience.

Simon Piles ¦ 07777777777 ¦ [email protected]

Good morning, Gary

I am excited to apply for the Junior Teller role at Fidelity Bank. I am eager to leverage my skills and commitment towards maintaining the high standards of service associated with your institution.

Throughout my academic journey and part-time experiences, I have developed a deep understanding of banking procedures, where I gained valuable insights into the importance of accuracy, confidentiality, and efficiency in handling transactions. As a recent HND Banking Graduate from Lincoln College, I possess theoretical knowledge in financial accounting and economics.

Additionally, I completed a one-year internship at TD Group where I was exposed to real-world cash handling, account management, and customer interactions. During this internship I assisted in the implementation of a new process for addressing inquiries that reduced wait times by 20%, as well as assuring a 100% record of compliance with bank policies which led to successful audits with no major findings.

Please feel free to reach out to me via email or by phone at your convenience to schedule an interview. Thank you for considering my application.

Lisa McKenzie ¦ 07777777777 ¦ [email protected]

Writing an impressive cover letter is a crucial step in landing a Banking job, so taking the time to perfect it is well worth while.

By following the tips and examples above you will be able to create an eye-catching cover letter that will wow recruiters and ensure your CV gets read – leading to more job interviews for you.

Good luck with your job search!

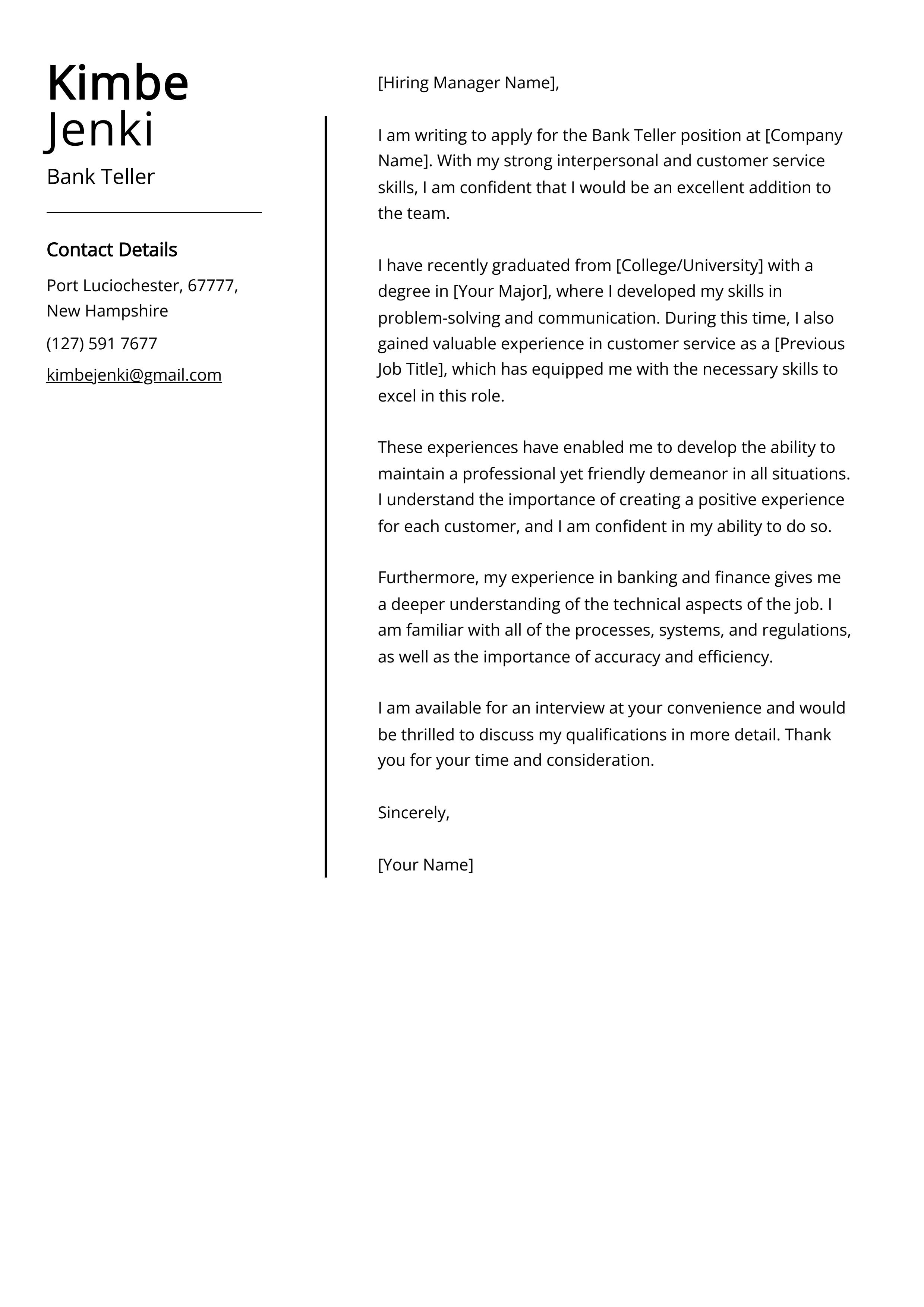

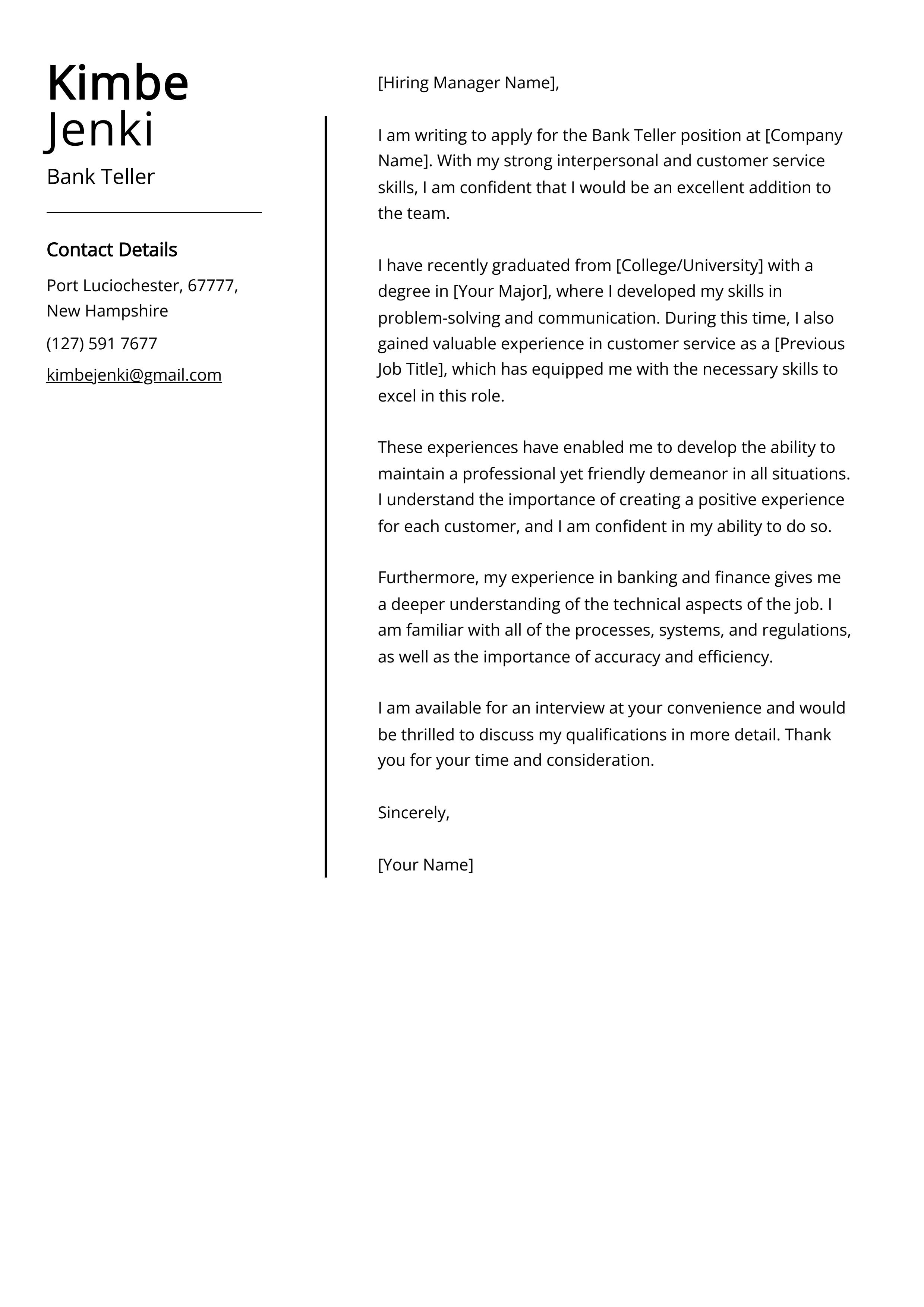

Bank Teller Cover Letter Examples and Templates for 2024

- Cover Letter Examples

How To Write a Bank Teller Cover Letter

- Cover Letter Text Examples

Your bank teller cover letter should demonstrate your ability to provide exceptional customer service and help grow the bank’s reputation through positive daily interactions. This guide provides examples and expert insights to help capture the most compelling aspects of your experience within the banking industry and land your next interview.

Bank Teller Cover Letter Templates and Examples

- Entry-Level

- Senior-Level

To write a stand-out bank teller cover letter, you need to transform your everyday job duties into powerful achievements. While not all of your responsibilities can be backed by hard numbers, it’s possible to make even the most mundane duty sound more proactive using the right language. Focus on demonstrating how your positive interactions with customers have contributed to your branch’s overall success. Below, we’ll provide guidance for each section of the bank teller cover letter:

1. Contact information and salutation

List all essential contact information in the header of your bank teller cover letter, including your name, phone number, email, and LinkedIn URL. Be sure to address the hiring manager by name — Mr. or Ms. [Last Name]. Doing so adds a personal touch to your cover letter and shows you’re truly interested in the position. If you can’t find the hiring manager’s name, use a variation of “Dear Hiring Manager.”

2. Introduction

Open your bank teller cover letter with a strong introduction to peak the hiring manager’s interest. Feature your years of experience within the banking industry and key qualifications the bank is looking for in a teller. Close your opening paragraph with one of your most notable accomplishments to immediately show you can create value for potential employers. For example, you might mention a high customer service rating or sales quota attainment.

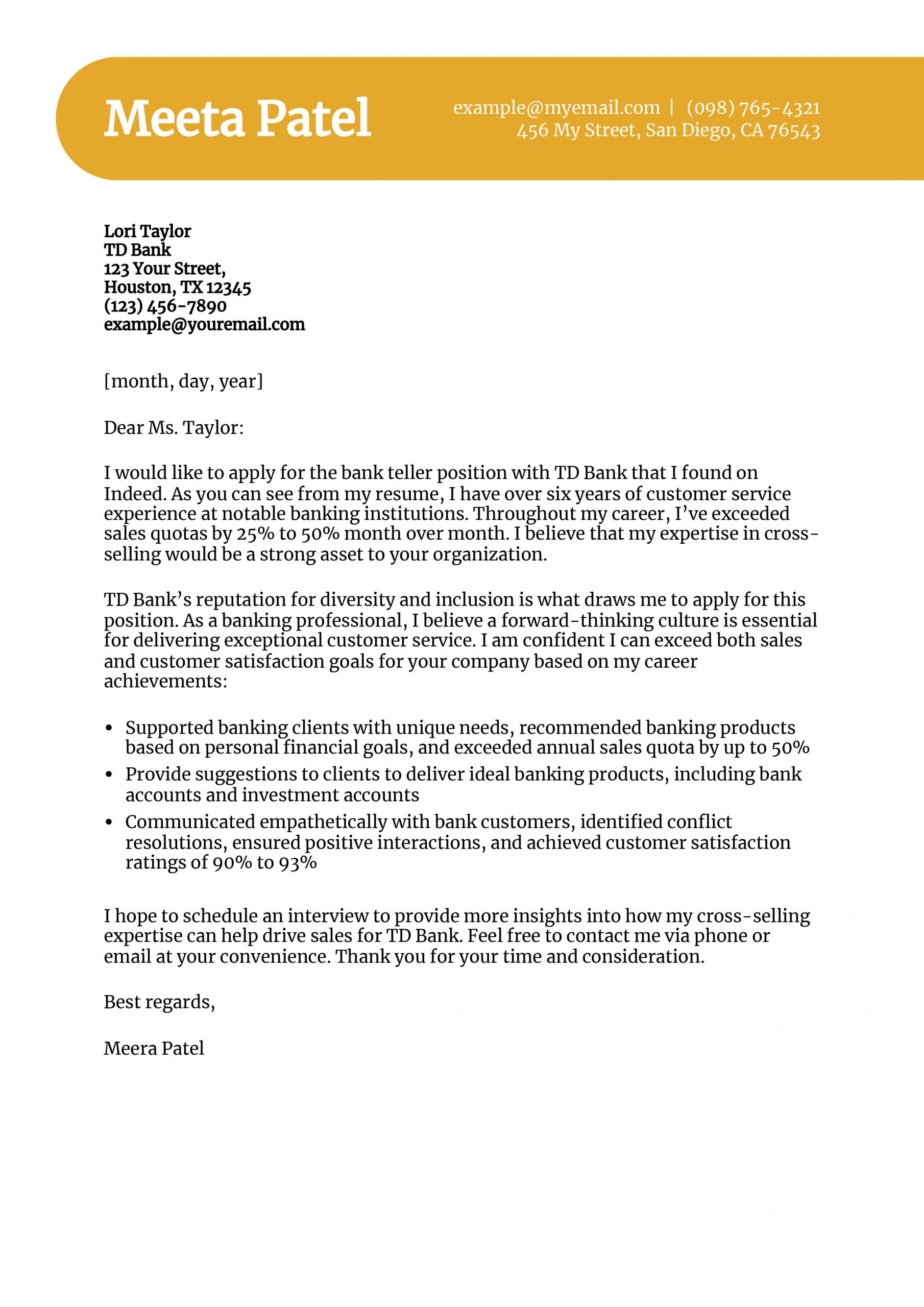

I would like to apply for the bank teller position with TD Bank that I found on Indeed. As you can see from my resume, I have over six years of customer service experience at notable banking institutions. Throughout my career, I’ve exceeded sales quotas by 25% to 50% month over month. My expertise in cross-selling would be a strong asset to your organization.

3. Body paragraphs

In the body paragraphs of your bank teller cover letter, provide an overview of your banking career. Start by highlighting details about the bank’s reputation or culture and why you’re interested in the role. Feature accomplishments that demonstrate your customer service, sales, and interpersonal skills, as these are essential for delivering a positive customer experience. Pay close attention to the job description when writing your body paragraphs, as it’s important to tailor your content toward the bank you’re targeting.

Wells Fargo’s reputation for delivering an exceptional customer experience strongly aligns with my professional background. During my time with PNC Bank, I communicated with a diverse range of customers to understand their unique banking needs and recommend ideal products. I can help your bank continue to grow its reputation as a customer-first organization based on my previous achievements:

- Interfaced with bank customers to identify banking needs, recommend financial solutions, and identify ideal products to achieve client goals, resulting in a 94% customer satisfaction score

- Managed customer requests quickly and efficiently, including cashing checks and money orders, depositing and withdrawing cash, checking account balances, and providing account information

- Cross-sold products using advanced knowledge of bank practices, accounts, credit cards, and personal loans

4. Bank teller skills and qualifications

Although you’ve already captured most of your professional skills on the resume, it’s best to still reinforce key terms from the job description in your bank teller cover letter. This is an opportunity to further highlight your knowledge of banking terminology and customer service best practices using tangible examples from your career. Below, we’ve compiled a list of common skills you may encounter while pursuing bank teller positions:

| Key Skills and Qualifications | |

|---|---|

| Bank operations | Bank telling |

| Cash management | Client relations |

| Commercial banking | Communication |

| Consultative sales | Cross-selling |

| Customer service | Customer success |

| Financial analysis | Online banking |

| Personal banking | Regulatory compliance |

| Retail banking | Teller operations |

| Team leadership | Wire transfers |

5. Closing section

The last paragraph of your bank teller cover letter should include a call to action. Invite the hiring manager to schedule an interview or contact you for additional information on your background. Also, further demonstrate how your background within the banking industry can benefit their clients and team. Be sure to thank the hiring manager for their time and consideration in the last sentence.

I hope to schedule an interview to provide more insights into how my cross-selling expertise can help drive sales for TD Bank. Feel free to contact me via phone or email at your convenience. Thank you for your time and consideration.

Best regards,

Meera Patel

Bank Teller Cover Letter Tips

1. emphasize your customer service experience.

As a front-line team member, hiring managers want to see you have the customer service skills to help grow the bank’s positive image and reputation. Every daily interaction plays a small but important role in this, so it’s important to showcase this aspect of your experience using tangible examples from your career. One way you can achieve this is by highlighting your customer service metrics or awards you’ve received for exceeding performance goals. You could also emphasize your ability to connect with banking customers and identify ideal solutions for their needs.

2. Showcase your knowledge of the banking industry

When building your cover letter, emphasize your understanding of banking terminology, services, and products. For example, you might mention you educated clients on potential types of personal loans based on their financial goals and referred them to appropriate specialists. Although you won’t be handling loan consultations yourself, having this extra layer of knowledge might give you an edge over other applicants during the job search.

3. Quantify your bank teller achievements

Incorporating performance metrics and hard numbers can greatly enhance the impact of your accomplishments. Focus on featuring data that demonstrates your expertise in customer service and sales. In the example below, the candidate highlights their proven track record exceeding sales quotas and achieving high customer satisfaction ratings:

- Supported banking clients with unique needs, recommended banking products based on personal financial goals, and exceeded annual sales quota by up to 50%

- Provide suggestions to clients to deliver ideal banking products, including bank accounts and investment accounts

- Communicated empathetically with bank customers, identified conflict resolutions, ensured positive interactions, and achieved customer satisfaction ratings of 90% to 93%

Bank Teller Text-Only Cover Letter Templates and Examples

Anthony Gentile Bank Teller | [email protected] | (123) 456-7890 | New York, NY | LinkedIn

January 1, 2024

Caleb Morris Hiring Manager Wells Fargo (987) 654-3210 [email protected]

Dear Mr. Morris:

I’m reaching out in regard to the bank teller position at Wells Fargo. With over three years of experience within the banking industry, I’ve cultivated an expertise in both customer service and sales. In 2023, I achieved a 94% customer satisfaction rating on surveys. I am confident I can achieve similar results for your company in the bank teller role.

- Cross-sold products using advanced knowledge of bank practices, accounts, and personal loans

I look forward to telling you more about how my customer service experience within the banking industry could benefit your customers and team. Feel free to contact me via phone or email at your convenience. I appreciate your time and consideration.

Anthony Gentile

Meeta Patel Bank Teller | [email protected] | (123) 456-7890 | Detroit, MI 12345 | LinkedIn

Lori Taylor Hiring Manager TD Bank (987) 654-3210 [email protected]

Dear Ms. Taylor:

TD Bank’s reputation for diversity and inclusion is what draws me to apply for this position. As a banking professional, I believe a forward-thinking culture is essential for delivering exceptional customer service. I can exceed both sales and customer satisfaction goals for your company based on my career achievements:

Raheem Richardson Bank Teller | [email protected] | (123) 456-7890 | Philadelphia, PA 12345 | LinkedIn

Amy Smith Hiring Manager Chase Bank (987) 654-3210 [email protected]

Dear Ms. Smith:

I’m reaching out to apply for the bank teller position with Chase Bank. During my time with Wells Fargo, I received three awards for exceeding goals in both sales and customer service delivery. I am confident that my knowledge and experience within the banking industry will allow me to drive positive results for your company.

Chase Bank’s reputation for trust, integrity, and ethical banking practices is what draws me to apply for this opportunity. Throughout my career, I’ve successfully exceeded sales goals while promoting products that are in the best interest of the customer’s long-term financial goals. I can provide valuable contributions to your organization based on my previous successes:

I look forward to speaking with you further regarding how my expertise in sales and customer service could be a strong asset to your team. Feel free to contact me via phone or email at your convenience. Thank you for your time and consideration.

Raheem Richardson

Bank Teller Cover Letter FAQs

Why should i include a bank teller cover letter -.

According to the Bureau of Labor Statistics , bank teller positions are expected to decline by 15% over the next decade. With a lower number of opportunities available on the open market, submitting a cover letter can help differentiate you from the competition during the job search. This allows you to convey your genuine enthusiasm and say something specific about why the bank’s reputation fuels your interest in joining their team.

How long should my bank teller cover letter be? -

It’s generally best to keep your cover letter concise during the application process. Limit your document to three or four paragraphs, with an emphasis on your most notable contributions and achievements. Including too much information may cause the hiring manager to lose interest, so always opt for a more straightforward approach.

Should I use artificial intelligence to write my cover letter? -

While it may be acceptable to use an artificial intelligence (AI) tool such as ChatGPT to get you started, relying on a machine learning algorithm to write your cover letter is the wrong approach. The purpose of this document is to provide a strong introduction that emphasizes unique insights into who you are as a professional. AI will never be able to capture these aspects the way you can.

Craft a new cover letter in minutes

Get the attention of hiring managers with a cover letter tailored to every job application.

Frank Hackett

Certified Professional Resume Writer (CPRW)

Frank Hackett is a professional resume writer and career consultant with over eight years of experience. As the lead editor at a boutique career consulting firm, Frank developed an innovative approach to resume writing that empowers job seekers to tell their professional stories. His approach involves creating accomplishment-driven documents that balance keyword optimization with personal branding. Frank is a Certified Professional Resume Writer (CPRW) with the Professional Association of Resume Writers and Career Coaches (PAWRCC).

Check Out Related Examples

Call Center Representative Cover Letter Examples and Templates

Customer Service Representative Cover Letter Examples and Templates

Customer Success Manager Cover Letter Examples and Templates

Build a resume to enhance your career.

- How Many Jobs Should You List on a Resume? Learn More

- How To Include Licenses and Certifications on Your Resume Learn More

- Top 10 Soft Skills Employers Love Learn More

Essential Guides for Your Job Search

- How to Write a Resume Learn More

- How to Write a Cover Letter Learn More

- Thank You Note Examples Learn More

- Resignation Letter Examples Learn More

6 Professional Banking Cover Letter Examples for 2024

Your banking cover letter must immediately highlight your understanding of financial trends and economic regulations. It should demonstrate familiarity with the specific banking institution to which you're applying. Be sure to showcase your previous banking experience and your ability to foster client relationships. Your cover letter needs to reflect both your analytical skills and your commitment to customer service excellence.

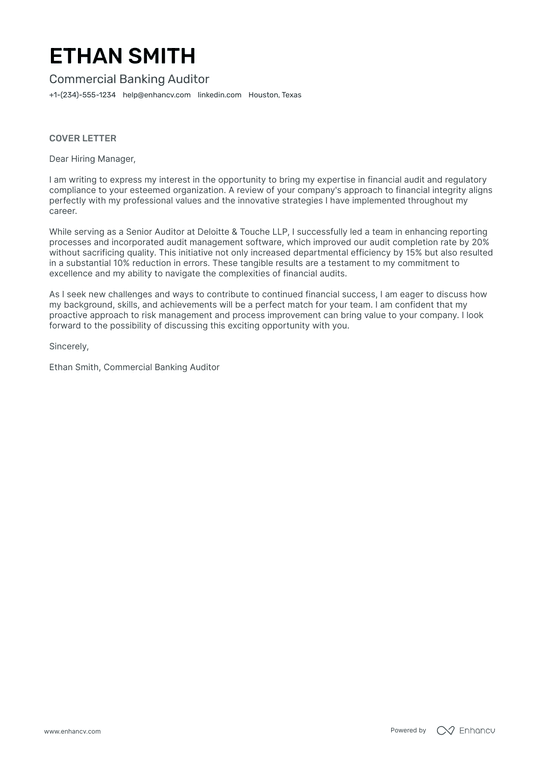

All cover letter examples in this guide

Commercial Banking

Corporate Banking

Loan Officer

Loan Processor

Phone Banking

Cover letter guide.

Banking Cover Letter Sample

Cover Letter Format

Cover Letter Salutation

Cover Letter Introduction

Cover Letter Body

Cover Letter Closing

No Experience Banking Cover Letter

Key Takeaways

Crafting a banking cover letter can often feel daunting. You might have already dived into job applications, only to realize a punchy cover letter is a must-have. It's not about echoing your resume; it's about showcasing a key professional triumph and bringing your journey to that success to life. Remember, formality is key, but dodging clichés will make you stand out. And keeping it concise to one page is crucial. Let's guide you through writing a cover letter that opens doors.

- Create a banking cover letter to persuade the recruiters you're the best candidate for the role;

- Use industry-leading banking cover letter templates and examples to save time;

- Dedicate your banking cover letter space to your best achievement;

- Make sure your banking cover letter meets recruiters' expectations and standards.

Avoid starting at the blank page for hours by using Enhancv's AI - just upload your resume and your banking cover letter will be ready for you to (tweak and) submit for your dream job.

If the banking isn't exactly the one you're looking for we have a plethora of cover letter examples for jobs like this one:

- Banking resume guide and example

- Financial Accountant cover letter example

- Public Accounting Auditor cover letter example

- Finance Coordinator cover letter example

- Corporate Accounting cover letter example

- Bank Manager cover letter example

- VP of Finance cover letter example

- Tax Manager cover letter example

- Cost Accounting cover letter example

- Finance Manager cover letter example

- Tax Director cover letter example

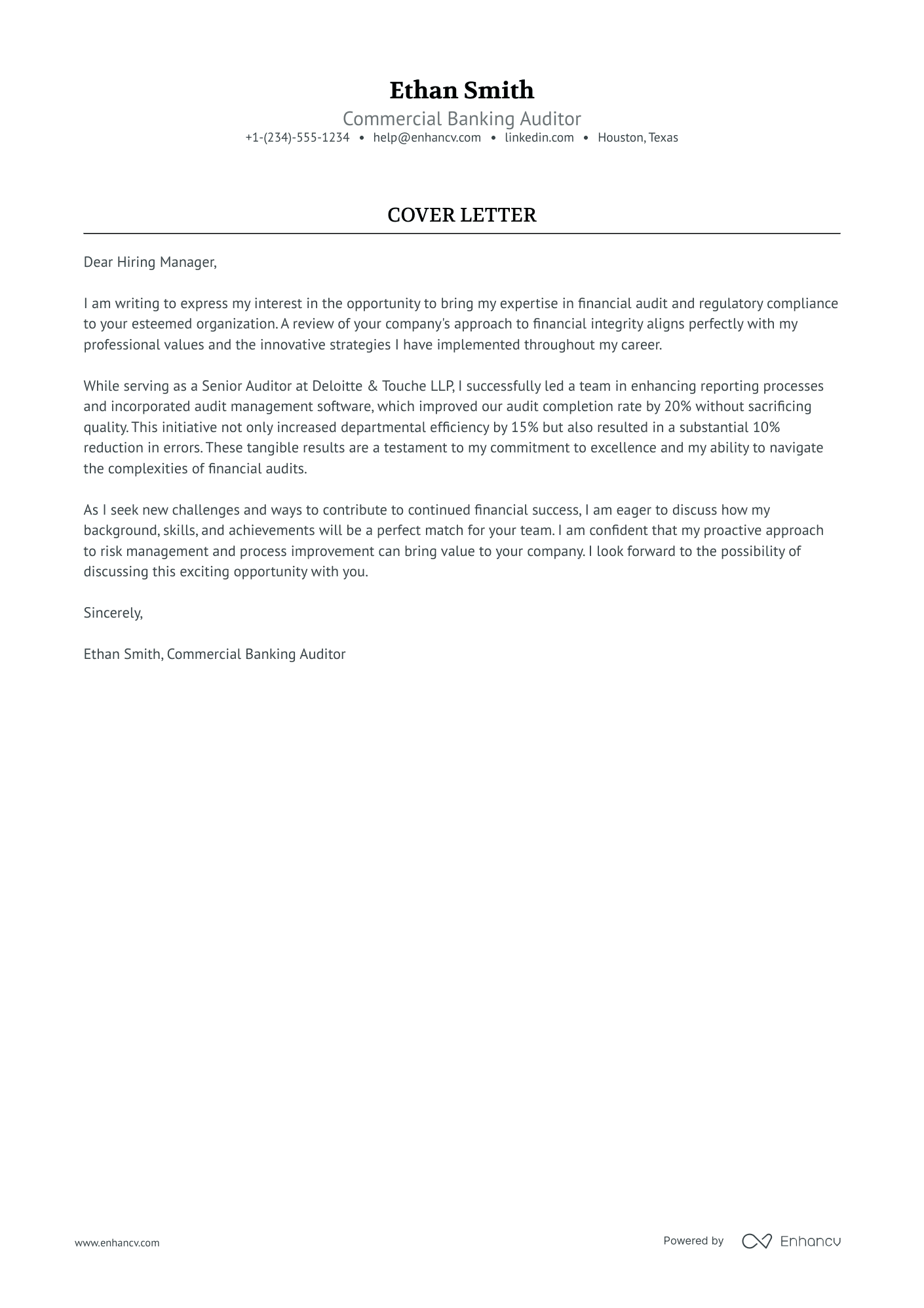

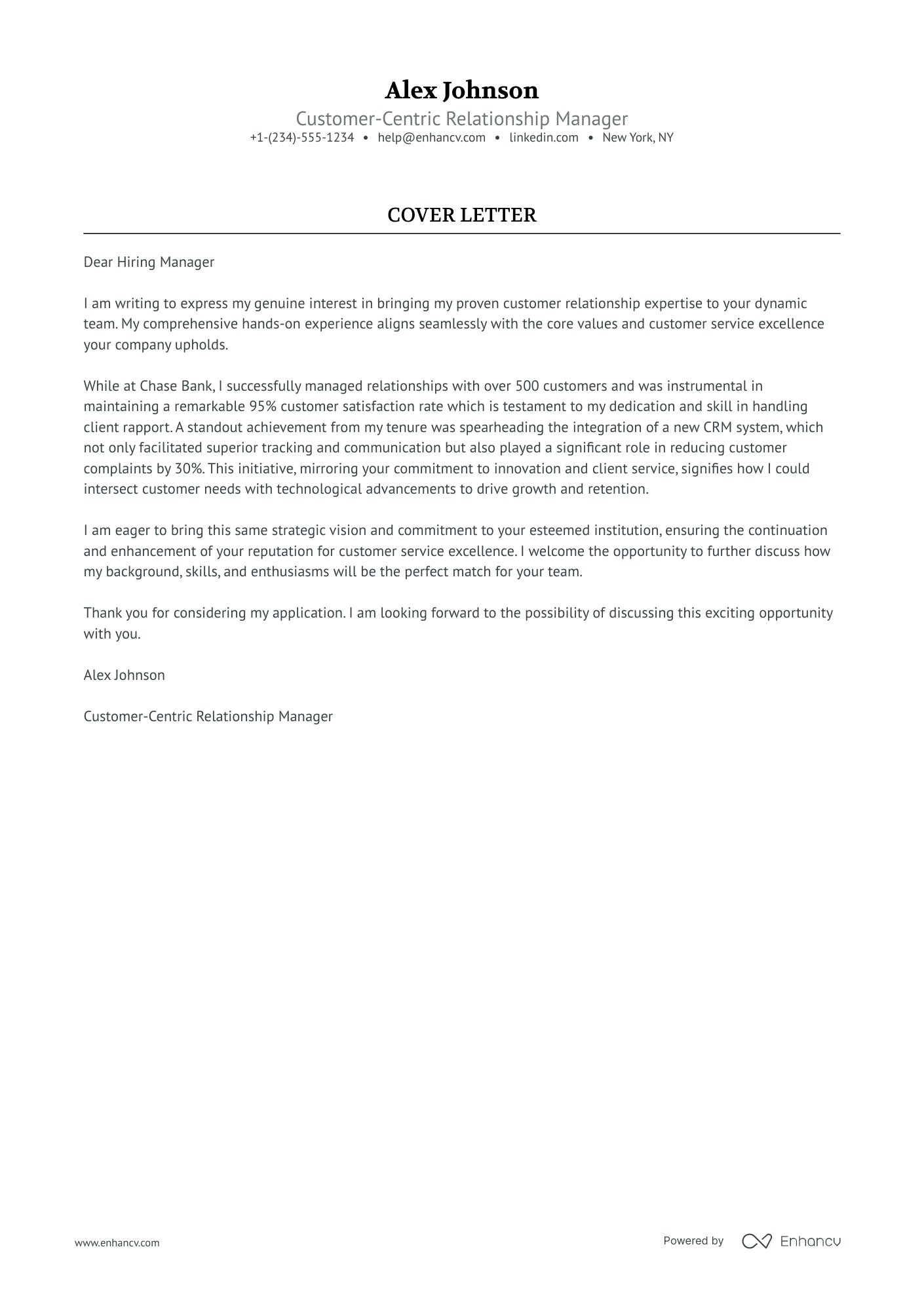

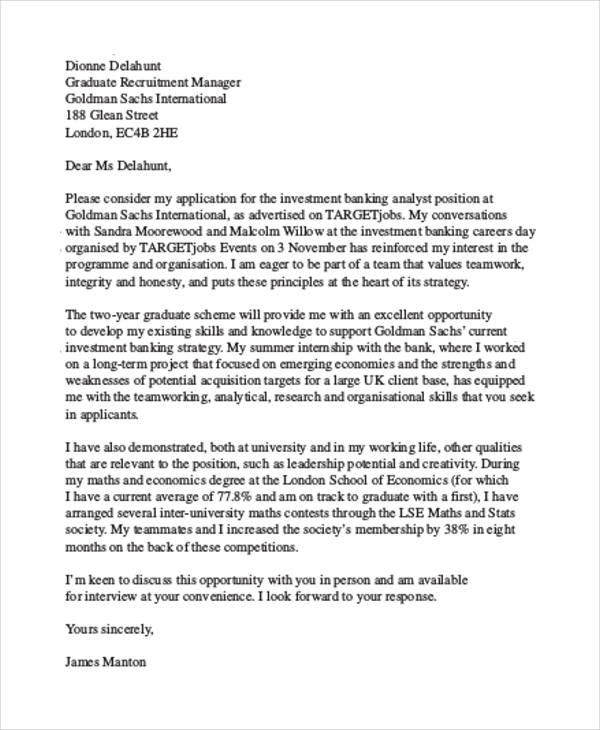

Banking cover letter example

Alex Johnson

New York, NY

+1-(234)-555-1234

- Explicitly stating relevant previous experience, such as managing relationships with over 500 customers at Chase Bank, provides concrete evidence of capability in the field and assures the hiring manager of the candidate's qualifications for the customer relationship role.

- Quantifying achievements, like citing a 95% customer satisfaction rate and a 30% reduction in customer complaints, helps to objectively demonstrate the candidate's impact and effectiveness in the previous position.

- Identifying a specific initiative, such as leading the integration of a new CRM system, exhibits the candidate’s ability to innovate and improve processes, which could translate into similar successes in the new role.

- Expressing eagerness to apply strategic vision and skills to the potential employer's institution, and aligning personal commitment with the company's core values, shows the hiring manager that the candidate is not only qualified but also genuinely interested in the company's mission.

What about your banking cover letter format: organizing and structuring your information

Here is one secret you should know about your banking cover letter assessment. The Applicant Tracker System (or ATS) won't analyze your cover letter.

You should thus focus on making an excellent impression on recruiters by writing consistent:

- Introduction

- Body paragraphs (and explanation)

- Promise or Call to action

- Signature (that's optional)

Now, let's talk about the design of your banking cover letter.

Ensure all of your paragraphs are single-spaced and have a one-inch margins on all sides (like in our cover letter templates ).

Also, our cover letter builder automatically takes care of the format and comes along with some of the most popular (and modern) fonts like Volkhov, Chivo, and Bitter.

Speaking of fonts, professionals advise you to keep your banking cover letter and resume in the same typography and avoid the over-used Arial or Times New Roman.

When wondering whether you should submit your banking cover letter in Doc or PDF, select the second, as PDF keeps all of your information and design consistent.

The top sections on a banking cover letter

- Header: This should include your contact information, the date, and the employer's contact details, providing a professional appearance and ensuring that the recruiter can easily identify and get in touch with you.

- Greeting: A personalized greeting addressing the hiring manager by name demonstrates that you have done your research and are genuinely interested in the position at their banking institution.

- Introduction: In this section, you should clearly state the banking position you are applying for and give a brief overview of your relevant experience, capturing the recruiter's interest and showing immediate relevance.

- Body: Here, you elaborate on your previous banking experience, quantitative achievements, and understanding of financial principles, showing how your background makes you the right fit for the specific banking role you are pursuing.

- Closing: The closing should reiterate your enthusiasm for the role, include a call to action politely prompting an interview, and thank the hiring manager for considering your application, leaving a professional and courteous final impression.

Key qualities recruiters search for in a candidate’s cover letter

Understanding of Financial Regulations: Banks must adhere strictly to financial regulations, and showing knowledge in this area indicates a candidate's readiness to operate within legal and ethical boundaries.

Attention to Detail: Handling financial transactions requires precision, and even small errors can have significant repercussions, making this trait critical in banking roles.

Customer Service Skills: Bankers often interact with customers, requiring the ability to manage relationships, address concerns effectively, and maintain customer satisfaction and trust.

Sales Experience: Many banking positions have sales components, such as promoting credit cards or loans, hence experience in sales reflects the potential for revenue generation.

Risk Management: The ability to identify and mitigate financial risks is crucial in banking to protect the institution's assets and maintain financial stability.

Numeracy and Analytical Skills: A strong aptitude for numbers and the ability to analyze financial data are essential for making informed decisions in a banking context.

What greeting should you use in your banking cover letter salutation

A simple "Hello" or "Hey" just won't work.

With your banking cover letter salutation , you set the tone of the whole communication.

You should thus address the hiring managers by using their first (or last name) in your greeting.

But how do you find out who's recruiting for the role?

The easiest way is to look up the role on LinkedIn or the corporate website.

Alternatively, you could also contact the organization via social media or email, for more information.

Unable to still obtain the recruiter's name?

Don't go down the "To whom it may concern path". Instead, start your cover letter with a "Dear HR team".

List of salutations you can use

- Dear Hiring Manager,

- Dear [Bank Name] Recruitment Team,

- Dear [Hiring Manager's Name],

- Dear [Department Name] Team,

- Dear Mr./Ms. [Last Name],

- Dear [Position Title] Hiring Committee,

Your banking cover letter intro: showing your interest in the role

On to the actual content of your banking cover letter and the introductory paragraph .

The intro should be no more than two sentences long and presents you in the best light possible.

Use your banking cover letter introduction to prove exactly what interests you in the role or organization. Is it the:

- Company culture;

- Growth opportunities;

- Projects and awards the team worked on/won in the past year;

- Specific technologies the department uses.

When writing your banking cover letter intro, be precise and sound enthusiastic about the role.

Your introduction should hint to recruiters that you're excited about the opportunity and that you possess an array of soft skills, e.g. motivation, determination, work ethic, etc.

Structuring your banking cover letter body to add more value

You've hinted at your value as a professional (this may be your passion for the job or interest in the company) in your introduction.

Next, it's time to pan out the body or middle of your banking cover letter .

When creating your resume, you've probably gone over the advert a million times to select the most relevant skills.

Well, it's time to repeat this activity. Or just copy and paste your previous list of job-crucial requirements.

Then, select one of your past accomplishments, which is relevant and would impress hiring managers.

Write between three and six paragraphs to focus on the value your professional achievement would bring to your potential, new organization.

Tell a story around your success that ultimately shows off your real value as a professional.

Finishing off your banking cover letter with what matters most

So far, you've done a fantastic job in tailoring your banking cover letter for the role and recruiter.

Your final opportunity to make a good impression is your closing paragraph.

And, no, a "Sincerely yours" just won't do, as it sounds too vague and impersonal.

End your banking cover letter with the future in mind.

So, if you get this opportunity, what do you plan to achieve? Be as specific, as possible, of what value you'd bring to the organization.

You could also thank recruiters for their interest in your profile and prompt for follow-up actions (and organizing your first interview).

No experience banking cover letter: making the most out of your profile

Candidates who happen to have no professional experience use their banking cover letter to stand out.

Instead of focusing on a professional achievement, aim to quantify all the relevant, transferrable skills from your life experience.

Once again, the best practice to do so would be to select an accomplishment - from your whole career history.

Another option would be to plan out your career goals and objectives: how do you see yourself growing, as a professional, in the next five years, thanks to this opportunity?

Be precise and concise about your dreams, and align them with the company vision.

Key takeaways

Writing your banking cover letter doesn't need to turn into an endless quest, but instead:

- Create an individual banking cover letter for each role you apply to, based on job criteria (use our builder to transform your resume into a cover letter, which you could edit to match the job);

- Stick with the same font you've used in your resume (e.g. Raleway) and ensure your banking cover letter is single-spaced and has a one-inch margin all around;

- Introduce your enthusiasm for the role or the company at the beginning of your banking cover letter to make a good first impression;

- Align what matters most to the company by selecting just one achievement from your experience, that has taught you valuable skills and knowledge for the job;

- End your banking cover letter like any good story - with a promise for greatness or follow-up for an interview.

Banking cover letter examples

Explore additional banking cover letter samples and guides and see what works for your level of experience or role.

Cover letter examples by industry

AI cover letter writer, powered by ChatGPT

Enhancv harnesses the capabilities of ChatGPT to provide a streamlined interface designed specifically focused on composing a compelling cover letter without the hassle of thinking about formatting and wording.

- Content tailored to the job posting you're applying for

- ChatGPT model specifically trained by Enhancv

- Lightning-fast responses

Everything About Reference Letters – Writing or Requesting

Perfecting your resume header so you get noticed, matthew, the writer of nearly 500 resumes, how do i conduct a resume review, does having color on my resume affect my chance of getting hired, how to write a cover letter for an internship.

- Create Resume

- Terms of Service

- Privacy Policy

- Cookie Preferences

- Resume Examples

- Resume Templates

- AI Resume Builder

- Resume Summary Generator

- Resume Formats

- Resume Checker

- Resume Skills

- How to Write a Resume

- Modern Resume Templates

- Simple Resume Templates

- Cover Letter Builder

- Cover Letter Examples

- Cover Letter Templates

- Cover Letter Formats

- How to Write a Cover Letter

- Resume Guides

- Cover Letter Guides

- Job Interview Guides

- Job Interview Questions

- Career Resources

- Meet our customers

- Career resources

- English (UK)

- French (FR)

- German (DE)

- Spanish (ES)

- Swedish (SE)

© 2024 . All rights reserved.

Made with love by people who care.

Resume Templates

Resume samples

Create and edit your resume online

Generate compelling resumes with our AI resume builder and secure employment quickly.

Write a cover letter

Cover Letter Examples

Cover Letter Samples

Create and edit your cover letter

Use our user-friendly tool to create the perfect cover letter.

Featured articles

- How to Write a Motivation Letter With Examples

- How to Write a Resume in 2024 That Gets Results

- Teamwork Skills on Your Resume: List and Examples

- What Are the Best Colors for Your Resume?

Latests articles

- How to Add a Conference or Seminar to Your Resume

- Top AI Skills for a Resume: Benefits and How To Include Them

- Top 5 Tricks to Transform Your LinkedIn Profile With ChatGPT

- Using ChatGPT to Prepare for Interviews: Top Tips and Steps

Dive Into Expert Guides to Enhance your Resume

Bank Teller Cover Letter Example

Start a Bank Teller cover letter that gets employers to act and helps you get the job faster. Impress hiring managers with the aid of ResumeCoach’s Bank Teller example letter template and professional tips and tricks for success.

Resume and Cover Letter Experts

Congratulations! You’ve stumbled upon a Bank Teller job opening with excellent benefits and working hours, what’s next?

First, start by making sure you have an outstanding resume that fits the job description. If you do not have it, take advantage of our easy-to-use resume builder and get a customized version in minutes.

Besides a resume, it’s critical that you include a cover letter with your application that highlights your strengths and accomplishments to grab the recruiter’s attention and get you the interview.

In this guide, you’ll learn how to:

- Create a cover letter that sets you apart from other applicants

- Write a Bank Teller cover letter with or without experience

- Address any employment gaps

Plus access to expertly written samples tailored for Bank Teller positions!

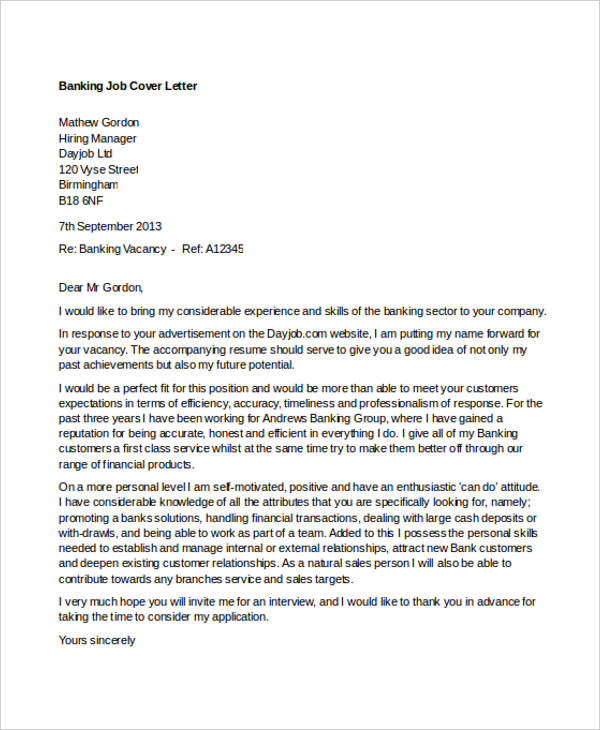

How to Write a Cover Letter for Bank Teller with Experience

If you have previous job experience, writing a cover letter may seem like a straightforward task.

However, it’s essential to ensure that your cover letter effectively highlights your skills and qualifications for the position you’re applying for.

Looking over the Experience section on your resume can help you know exactly what to mention, such as your past responsibilities and results .

Below are some tips on how to write a Bank Teller cover letter with experience.

1. Customize Your Cover Letter for the Job Posting

Tailoring your letter to the specific job posting can help you stand out from other applicants. Point out the abilities and work history that are most relevant to the job.

For example, if the job advertisement mentions cash handling as a requirement, mention in your cover letter how your experience relates to that.

Here is one way to do it:

I was pleased to see in the job posting that you are looking for someone who is comfortable working with customers and has experience in handling cash transactions.

During my previous job as a cashier, I learned how to provide excellent customer service while accurately processing transactions. I also have experience in reconciling cash drawers and preparing daily deposits, which I believe will be beneficial in this role.

Ensure that you use the same keywords used in the job advertisement to avoid Applicant Tracking System (ATS) filters and getting disqualified.

2. Start With a Strong Opening

Your opening should grab the reader’s attention and clearly state the position you’re applying for. You may also want to briefly explain why you’re interested in the job or why you’re a good fit for the company.

The examples below provide some effective ways to start your Bank Teller cover letter:

- I am thrilled to apply for the Bank Teller position at your Chatham branch. With over three years of experience in customer service and cash handling, I am confident that I possess the skills and expertise necessary to excel in this role.

- I am writing to express my interest in the Bank Teller position at your Chatham branch. With a strong background in cash handling and customer service, including three years of experience in a similar role, I strongly believe I would be a valuable addition to your team.

- I am excited to apply for the Bank Teller position at your Chatham branch. With a proven track record of success in customer service and cash handling, including three years of experience in a similar role, I believe I have the skills and knowledge necessary to thrive in this position.

Remember that the purpose of the first paragraph is to get the reader’s attention so that they want to read the rest of your cover letter!

3. Provide Specific Examples

Use specific examples from your previous job experience to demonstrate your skills and accomplishments. This could include projects you’ve worked on, awards you’ve received, or specific metrics that show how you’ve contributed to your previous company.

Don’t just say “ I collaborated in a project to improve cash handling ”.

Say “ I collaborated with my team to develop and implement a new process for reconciling cash drawers and preparing deposits, which resulted in a 20% reduction in errors and discrepancies ”.

The more specifics you provide, the more credible your claims become.

4. Emphasize your transferable skills

Even if your previous job experience isn’t directly related to the position you’re applying for, you likely have transferable skills that are relevant . Make sure to emphasize these abilities and explain how they would be valuable in the new role.

The list below showcases some basic skills all Bank Tellers should have:

- Active listening

- Strong verbal communication abilities

- An ability to satisfy customers while adhering to bank standards

According to the Bureau of Labor Statistics , some similar occupations where applicants can acquire these abilities include cashier, customer service representative, receptionist, or information clerk.

5. Close With a Strong Call to Action

Your closing paragraph should reiterate your interest in the position and include a call to action, such as requesting an interview or expressing your availability to discuss the position further.

When closing your cover letter for a Bank Teller position, a powerful call to action can help you stand out from other applicants and showcase your enthusiasm for the job.

For example, you could write something like, “ I am eager to contribute my strong communication skills and passion for customer service to your bank. I would welcome the opportunity to discuss my qualifications with you further and answer any questions you may have. Please feel free to contact me at your convenience to schedule an interview ”.

Mastering the Art of Bank Teller Cover Letters: Illustrative Examples

Now, let’s take a look at another 2 examples to recap and get a deeper understanding of how to write a powerful Bank Teller cover letter:

I am applying for the Bank Teller position at West Coast Bank. I have worked as a Bank Teller for two years. I am familiar with handling cash and providing customer service. I am also a quick learner and work well under pressure.

The previous example lacks specific details about the applicant’s achievements or contributions in their previous Bank Teller roles.

The statement merely points out basic job duties and traits that are expected of a Bank Teller, which does not make the applicant stand out or showcase their unique qualifications.

During my two years as a Bank Teller at West Side People’s Bank, I consistently exceeded my sales goals and achieved a 98% customer satisfaction rating. I also implemented a new cash management system that reduced cash handling errors by 30% and saved the bank over $8,000 annually.

This example is very effective because it points out the candidate’s ability to perform well, provide excellent service, and think critically about their work. It’s also very specific by mentioning numbers and percentages, adding a lot of credibility.

Example Cover Letter for Bank Teller With Experience

To familiarize yourself with the elements of a strong cover letter for a Bank Teller with experience, you can examine the sample cover letter below.

Hiring Manager’s name

Company name

Company address

Dear Mr/Ms. [Hiring Manager Name]

I am writing to apply for the Bank Teller position being advertised by [Company]. As an accomplished Teller with over three years of experience working with customers and financial services, I am certain that I fit the profile perfectly.

In my current position with [Current Company], I have played an active part in helping the branch achieve a record increase in revenue. During the last 3 sales campaigns, intake and sales have increased by around 12% on average.

Furthermore, I demonstrably showed my abilities to enhance customer service in-branch. My personal customer feedback score has never fallen below 90% and my performance has often helped to improve repeat trade by over 30%.

My resume is enclosed with further details on my career successes so far. Naturally, I would be delighted to talk in person to discuss any queries you may have about my credentials.

Please feel free to contact me via my personal phone number and email address. I look forward to hearing from you.

Sincerely, Name

Address Phone number Email address

Along with reviewing these types of examples, using a cover letter writing guide to assist you can significantly streamline the entire writing process.

How to Write a Cover Letter for Bank Teller with No Experience

Many job applicants are discouraged from applying when they come across job postings that require prior job experience.

It’s no wonder that fresh graduates and those looking to transition into a Bank Teller position ask themselves, “How do I write a cover letter for a Bank Teller with no experience?”

It’s important not to give up on applying even if you don’t have any relevant work history.

Instead, you can create a compelling cover letter that highlights how your skills and qualities align with the job requirements.

To do this, you need to thoroughly understand the company’s needs and goals.

Take some time to analyze what they are looking for in an employee. Use your education and any relevant internship experience to demonstrate how you are a good fit for the position.

In your cover letter, focus on 3 key areas :

- the company’s needs

- your relevant achievements,

- and your valuable skills.

By addressing these points, you can show the hiring manager that you understand what they are looking for and that you have the potential to be a valuable addition to their team.

If you don’t have as much experience as other applicants, you can still demonstrate your enthusiasm and willingness to learn.

Use your cover letter as an opportunity to showcase your motivation and dedication, and convince the employer that you are the best candidate for the job.

Look at the following examples tailored to Bank Teller positions to get some ideas:

I have no experience as a Bank Teller, but I am a quick learner and am excited to start my career in banking. I have great customer service skills and am a team player.

Unfortunately, it doesn’t provide any specific examples or evidence of skills or qualifications that would make the candidate a good fit for the position.

Also, the statements “I am a quick learner” and “I have great customer service skills” are generic and overused phrases that don’t provide any tangible evidence of the candidate’s abilities.

Although I don’t have direct experience as a Bank Teller, my previous customer service internship at Amazonics taught me how to interact with customers, solve problems efficiently and handle cash transactions accurately. I am excited to bring these skills to your team at Atlantica Bank.

This is an excellent example because it highlights transferable skills gained from a previous customer service internship and shows enthusiasm for the position .

It also specifically mentions relevant abilities such as handling cash transactions accurately, which are important for a Bank Teller role.

Example Cover Letter for Bank Teller With No Experience

When you are just starting in the profession , the blank page before you begin typing your letter may be nerve-wracking!

We get that, but there are tricks for writing a great cover letter when you have little to no experience.

Refer to the sample Bank Teller cover letter for fresh graduates provided below to familiarize yourself with the components of an effective letter for someone who would like to get a job as a teller in a bank but has no prior experience.

I am writing to express my interest in the Bank Teller position at [Bank Name]. Although I do not have any direct experience in the banking industry, I am excited about the opportunity to learn and grow in this role.

As a recent graduate with a degree in finance, I have developed strong analytical and problem-solving skills that I believe will be valuable in the position. Additionally, my part-time job as a retail sales associate has provided me with customer service experience and sales skills.

During my time as a retail sales associate at Mediazon, I consistently met my sales targets and was able to upsell to customers, resulting in a 15% increase in revenue compared to the previous quarter. I also maintained a 99% accuracy rate when handling cash and credit card transactions, ensuring that there were no discrepancies in the store’s financial records.

My experience in retail sales and customer service, combined with my attention to detail and accuracy when handling financial transactions, make me a strong candidate for the Bank Teller position at [Bank Name].

While I understand that the role of a Bank Teller requires a specific set of skills and knowledge, I am confident in my ability to learn quickly and adapt to new situations. I am a detail-oriented individual who takes pride in providing excellent customer service and ensuring accuracy in all tasks.

I am excited about the prospect of joining a team of professionals at [Bank Name] and contributing to the success of the organization. Thank you for considering my application. I look forward to the opportunity to discuss my qualifications further.

Please let me know if you require any further information or if there are any next steps I should be aware of.

Cover Letter for Bank Teller with Employment Gap

If you have experienced a gap in your employment history, you may struggle to determine what to include in your Bank Teller cover letter and resume. It can be disheartening to think that this gap may decrease your chances of landing the job.

However, a gap in your career does not necessarily disqualify you from the job. There are various legitimate reasons why someone may not have worked for a certain amount of time, such as to take care of a sick family member.

When applying for a Bank Teller position, it’s crucial to clarify any employment gaps since banks value attention to detail, accuracy, and credibility in their highly formal work environments.

Providing clear explanations for any gaps in your employment history is important when applying for a role, particularly in highly regulated industries such as banking where adherence to strict protocols and guidelines is essential .

By demonstrating professionalism, honesty, and commitment to the job application process, you can establish yourself as a trustworthy and reliable candidate for the position.

There are some things you should and shouldn’t include in your cover letter to address the issue:

- Explain why: Briefly describe the reason for the gap. A hiring manager may find out about it anyway and draw their own conclusions. You’re better off taking the first step.

- Don’t worry about old or really short gaps: It’s important to note that not every single gap needs to be addressed in your cover letter.

During the interview process, be prepared to answer any questions related to your employment gap. You could even try to turn it into a positive by shortly mentioning any relevant skills you acquired during that time.

Remember to adhere to the proper cover letter and resume format when creating your documents.

Let’s analyze 2 examples customized to Bank Teller roles for deeper insights:

I have a gap in my employment history, but I am eager to start working as a Bank Teller. I have great customer service skills and can handle cash transactions efficiently. I am a quick learner and can adapt to new situations easily.

Simply stating that you have gaps in your employment history without providing any context or explanation may raise concerns for the employer.

Additionally, the example does not provide any information about what the candidate has been doing during their time away, which could be perceived as a lack of productivity or commitment.

During my previous employment, I took a break to care for a family member who was ill. During that time, I volunteered at a local non-profit organization where I gained experience in cash handling and customer service.

I also took online courses to keep my skills up-to-date. I am excited to bring my experience and dedication to your team at Southern Entrepreneurs Bank.

The candidate mentions that they took a break to care for a sick family member, which is a valid reason for a gap in employment history.

The applicant also explains that they spent their time productively volunteering at a non-profit organization and taking online courses to improve their skills, which emphasizes their dedication and positions them as a strong candidate.

Example Cover Letter for Bank Teller With Employment Gap

If you are a Bank Teller with an employment gap in your resume, you may be wondering how to explain this to potential employers.

While taking time off from work can be a great opportunity for personal growth and development , it can also be a challenge when it comes to job searching.

However, with the right approach, it is possible to address the gap in a way that highlights your strengths and shows your commitment to your career .

In this example cover letter for a Bank Teller position, you can learn how to approach such an employment gap in a positive and professional manner .

I am excited to apply for the Bank Teller position at Bankomatic. I am confident that my experience and skills make me a strong candidate for this role and I am eager to contribute to your team’s success.

After several years working as a Bank Teller, I took a sabbatical to travel around Asia and gain new experiences. During this time, I had the opportunity to visit many different countries, learn about different cultures and customs, and enhance my communication and problem-solving skills.

I believe that these experiences have made me a more well-rounded and adaptable person, and have given me a fresh perspective that I can bring to my work.