- Search Search Please fill out this field.

What Is a Business Plan?

Understanding business plans, how to write a business plan, common elements of a business plan, the bottom line, business plan: what it is, what's included, and how to write one.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

- How to Start a Business: A Comprehensive Guide and Essential Steps

- How to Do Market Research, Types, and Example

- Marketing Strategy: What It Is, How It Works, How To Create One

- Marketing in Business: Strategies and Types Explained

- What Is a Marketing Plan? Types and How to Write One

- Business Development: Definition, Strategies, Steps & Skills

- Business Plan: What It Is, What's Included, and How to Write One CURRENT ARTICLE

- Small Business Development Center (SBDC): Meaning, Types, Impact

- How to Write a Business Plan for a Loan

- Business Startup Costs: It’s in the Details

- Startup Capital Definition, Types, and Risks

- Bootstrapping Definition, Strategies, and Pros/Cons

- Crowdfunding: What It Is, How It Works, and Popular Websites

- Starting a Business with No Money: How to Begin

- A Comprehensive Guide to Establishing Business Credit

- Equity Financing: What It Is, How It Works, Pros and Cons

- Best Startup Business Loans

- Sole Proprietorship: What It Is, Pros & Cons, and Differences From an LLC

- Partnership: Definition, How It Works, Taxation, and Types

- What is an LLC? Limited Liability Company Structure and Benefits Defined

- Corporation: What It Is and How to Form One

- Starting a Small Business: Your Complete How-to Guide

- Starting an Online Business: A Step-by-Step Guide

- How to Start Your Own Bookkeeping Business: Essential Tips

- How to Start a Successful Dropshipping Business: A Comprehensive Guide

A business plan is a document that outlines a company's goals and the strategies to achieve them. It's valuable for both startups and established companies. For startups, a well-crafted business plan is crucial for attracting potential lenders and investors. Established businesses use business plans to stay on track and aligned with their growth objectives. This article will explain the key components of an effective business plan and guidance on how to write one.

Key Takeaways

- A business plan is a document detailing a company's business activities and strategies for achieving its goals.

- Startup companies use business plans to launch their venture and to attract outside investors.

- For established companies, a business plan helps keep the executive team focused on short- and long-term objectives.

- There's no single required format for a business plan, but certain key elements are essential for most companies.

Investopedia / Ryan Oakley

Any new business should have a business plan in place before beginning operations. Banks and venture capital firms often want to see a business plan before considering making a loan or providing capital to new businesses.

Even if a company doesn't need additional funding, having a business plan helps it stay focused on its goals. Research from the University of Oregon shows that businesses with a plan are significantly more likely to secure funding than those without one. Moreover, companies with a business plan grow 30% faster than those that don't plan. According to a Harvard Business Review article, entrepreneurs who write formal plans are 16% more likely to achieve viability than those who don't.

A business plan should ideally be reviewed and updated periodically to reflect achieved goals or changes in direction. An established business moving in a new direction might even create an entirely new plan.

There are numerous benefits to creating (and sticking to) a well-conceived business plan. It allows for careful consideration of ideas before significant investment, highlights potential obstacles to success, and provides a tool for seeking objective feedback from trusted outsiders. A business plan may also help ensure that a company’s executive team remains aligned on strategic action items and priorities.

While business plans vary widely, even among competitors in the same industry, they often share basic elements detailed below.

A well-crafted business plan is essential for attracting investors and guiding a company's strategic growth. It should address market needs and investor requirements and provide clear financial projections.

While there are any number of templates that you can use to write a business plan, it's best to try to avoid producing a generic-looking one. Let your plan reflect the unique personality of your business.

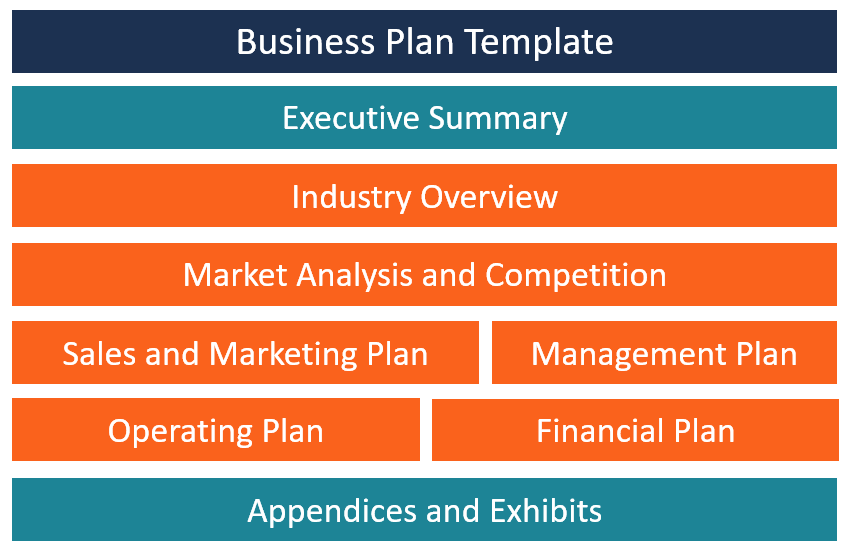

Many business plans use some combination of the sections below, with varying levels of detail, depending on the company.

The length of a business plan can vary greatly from business to business. Regardless, gathering the basic information into a 15- to 25-page document is best. Any additional crucial elements, such as patent applications, can be referenced in the main document and included as appendices.

Common elements in many business plans include:

- Executive summary : This section introduces the company and includes its mission statement along with relevant information about the company's leadership, employees, operations, and locations.

- Products and services : Describe the products and services the company offers or plans to introduce. Include details on pricing, product lifespan, and unique consumer benefits. Mention production and manufacturing processes, relevant patents , proprietary technology , and research and development (R&D) information.

- Market analysis : Explain the current state of the industry and the competition. Detail where the company fits in, the types of customers it plans to target, and how it plans to capture market share from competitors.

- Marketing strategy : Outline the company's plans to attract and retain customers, including anticipated advertising and marketing campaigns. Describe the distribution channels that will be used to deliver products or services to consumers.

- Financial plans and projections : Established businesses should include financial statements, balance sheets, and other relevant financial information. New businesses should provide financial targets and estimates for the first few years. This section may also include any funding requests.

Investors want to see a clear exit strategy, expected returns, and a timeline for cashing out. It's likely a good idea to provide five-year profitability forecasts and realistic financial estimates.

2 Types of Business Plans

Business plans can vary in format, often categorized into traditional and lean startup plans. According to the U.S. Small Business Administration (SBA) , the traditional business plan is the more common of the two.

- Traditional business plans : These are detailed and lengthy, requiring more effort to create but offering comprehensive information that can be persuasive to potential investors.

- Lean startup business plans : These are concise, sometimes just one page, and focus on key elements. While they save time, companies should be ready to provide additional details if requested by investors or lenders.

Why Do Business Plans Fail?

A business plan isn't a surefire recipe for success. The plan may have been unrealistic in its assumptions and projections. Markets and the economy might change in ways that couldn't have been foreseen. A competitor might introduce a revolutionary new product or service. All this calls for building flexibility into your plan, so you can pivot to a new course if needed.

How Often Should a Business Plan Be Updated?

How frequently a business plan needs to be revised will depend on its nature. Updating your business plan is crucial due to changes in external factors (market trends, competition, and regulations) and internal developments (like employee growth and new products). While a well-established business might want to review its plan once a year and make changes if necessary, a new or fast-growing business in a fiercely competitive market might want to revise it more often, such as quarterly.

What Does a Lean Startup Business Plan Include?

The lean startup business plan is ideal for quickly explaining a business, especially for new companies that don't have much information yet. Key sections may include a value proposition , major activities and advantages, resources (staff, intellectual property, and capital), partnerships, customer segments, and revenue sources.

A well-crafted business plan is crucial for any company, whether it's a startup looking for investment or an established business wanting to stay on course. It outlines goals and strategies, boosting a company's chances of securing funding and achieving growth.

As your business and the market change, update your business plan regularly. This keeps it relevant and aligned with your current goals and conditions. Think of your business plan as a living document that evolves with your company, not something carved in stone.

University of Oregon Department of Economics. " Evaluation of the Effectiveness of Business Planning Using Palo Alto's Business Plan Pro ." Eason Ding & Tim Hursey.

Bplans. " Do You Need a Business Plan? Scientific Research Says Yes ."

Harvard Business Review. " Research: Writing a Business Plan Makes Your Startup More Likely to Succeed ."

Harvard Business Review. " How to Write a Winning Business Plan ."

U.S. Small Business Administration. " Write Your Business Plan ."

SCORE. " When and Why Should You Review Your Business Plan? "

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1456193345-2cc8ef3d583f42d8a80c8e631c0b0556.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

Small Business Trends

How to create a business plan: examples & free template.

Whether you’re a seasoned entrepreneur or launching your very first startup, the guide will give you the insights, tools, and confidence you need to create a solid foundation for your business.

Table of Contents

How to Write a Business Plan

Executive summary.

It’s crucial to include a clear mission statement, a brief description of your primary products or services, an overview of your target market, and key financial projections or achievements.

Our target market includes environmentally conscious consumers and businesses seeking to reduce their carbon footprint. We project a 200% increase in revenue within the first three years of operation.

Overview and Business Objectives

Example: EcoTech’s primary objective is to become a market leader in sustainable technology products within the next five years. Our key objectives include:

Company Description

Example: EcoTech is committed to developing cutting-edge sustainable technology products that benefit both the environment and our customers. Our unique combination of innovative solutions and eco-friendly design sets us apart from the competition. We envision a future where technology and sustainability go hand in hand, leading to a greener planet.

Define Your Target Market

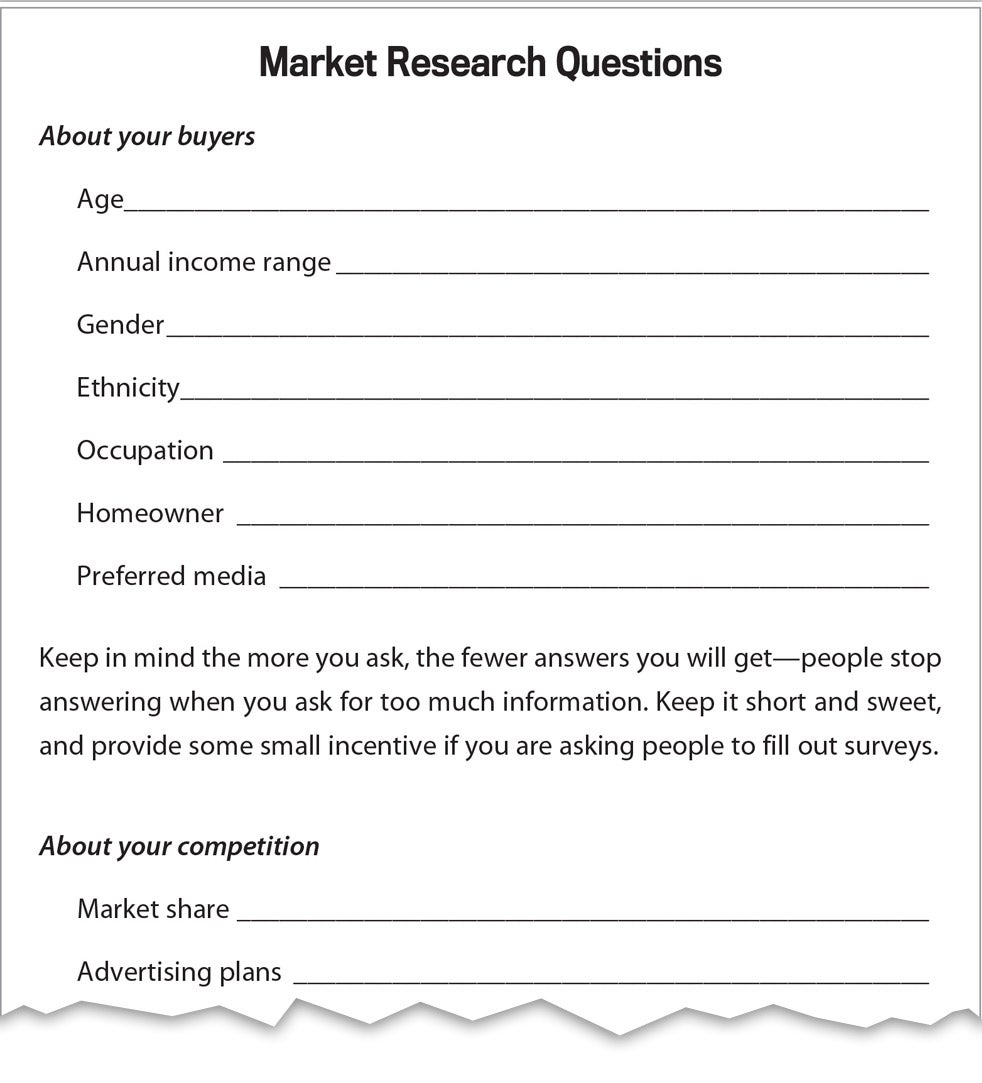

Market analysis.

The Market Analysis section requires thorough research and a keen understanding of the industry. It involves examining the current trends within your industry, understanding the needs and preferences of your customers, and analyzing the strengths and weaknesses of your competitors.

Our research indicates a gap in the market for high-quality, innovative eco-friendly technology products that cater to both individual and business clients.

SWOT Analysis

Including a SWOT analysis demonstrates to stakeholders that you have a balanced and realistic understanding of your business in its operational context.

Competitive Analysis

Organization and management team.

Provide an overview of your company’s organizational structure, including key roles and responsibilities. Introduce your management team, highlighting their expertise and experience to demonstrate that your team is capable of executing the business plan successfully.

Products and Services Offered

This section should emphasize the value you provide to customers, demonstrating that your business has a deep understanding of customer needs and is well-positioned to deliver innovative solutions that address those needs and set your company apart from competitors.

Marketing and Sales Strategy

Discuss how these marketing and sales efforts will work together to attract and retain customers, generate leads, and ultimately contribute to achieving your business’s revenue goals.

Logistics and Operations Plan

Inventory control is another crucial aspect, where you explain strategies for inventory management to ensure efficiency and reduce wastage. The section should also describe your production processes, emphasizing scalability and adaptability to meet changing market demands.

We also prioritize efficient distribution through various channels, including online platforms and retail partners, to deliver products to our customers in a timely manner.

Financial Projections Plan

This forward-looking financial plan is crucial for demonstrating that you have a firm grasp of the financial nuances of your business and are prepared to manage its financial health effectively.

Income Statement

Cash flow statement.

A cash flow statement is a crucial part of a financial business plan that shows the inflows and outflows of cash within your business. It helps you monitor your company’s liquidity, ensuring you have enough cash on hand to cover operating expenses, pay debts, and invest in growth opportunities.

| Section | Description | Example |

|---|---|---|

| Executive Summary | Brief overview of the business plan | Overview of EcoTech and its mission |

| Overview & Objectives | Outline of company's goals and strategies | Market leadership in sustainable technology |

| Company Description | Detailed explanation of the company and its unique selling proposition | EcoTech's history, mission, and vision |

| Target Market | Description of ideal customers and their needs | Environmentally conscious consumers and businesses |

| Market Analysis | Examination of industry trends, customer needs, and competitors | Trends in eco-friendly technology market |

| SWOT Analysis | Evaluation of Strengths, Weaknesses, Opportunities, and Threats | Strengths and weaknesses of EcoTech |

| Competitive Analysis | In-depth analysis of competitors and their strategies | Analysis of GreenTech and EarthSolutions |

| Organization & Management | Overview of the company's structure and management team | Key roles and team members at EcoTech |

| Products & Services | Description of offerings and their unique features | Energy-efficient lighting solutions, solar chargers |

| Marketing & Sales | Outline of marketing channels and sales strategies | Digital advertising, content marketing, influencer partnerships |

| Logistics & Operations | Details about daily operations, supply chain, inventory, and quality control | Partnerships with manufacturers, quality control |

| Financial Projections | Forecast of revenue, expenses, and profit for the next 3-5 years | Projected growth in revenue and net profit |

| Income Statement | Summary of company's revenues and expenses over a specified period | Revenue, Cost of Goods Sold, Gross Profit, Net Income |

| Cash Flow Statement | Overview of cash inflows and outflows within the business | Net Cash from Operating Activities, Investing Activities, Financing Activities |

Tips on Writing a Business Plan

4. Focus on your unique selling proposition (USP): Clearly articulate what sets your business apart from the competition. Emphasize your USP throughout your business plan to showcase your company’s value and potential for success.

FREE Business Plan Template

To help you get started on your business plan, we have created a template that includes all the essential components discussed in the “How to Write a Business Plan” section. This easy-to-use template will guide you through each step of the process, ensuring you don’t miss any critical details.

What is a Business Plan?

Why you should write a business plan.

Understanding the importance of a business plan in today’s competitive environment is crucial for entrepreneurs and business owners. Here are five compelling reasons to write a business plan:

What are the Different Types of Business Plans?

| Type of Business Plan | Purpose | Key Components | Target Audience |

|---|---|---|---|

| Startup Business Plan | Outlines the company's mission, objectives, target market, competition, marketing strategies, and financial projections. | Mission Statement, Company Description, Market Analysis, Competitive Analysis, Organizational Structure, Marketing and Sales Strategy, Financial Projections. | Entrepreneurs, Investors |

| Internal Business Plan | Serves as a management tool for guiding the company's growth, evaluating its progress, and ensuring that all departments are aligned with the overall vision. | Strategies, Milestones, Deadlines, Resource Allocation. | Internal Team Members |

| Strategic Business Plan | Outlines long-term goals and the steps to achieve them. | SWOT Analysis, Market Research, Competitive Analysis, Long-Term Goals. | Executives, Managers, Investors |

| Feasibility Business Plan | Assesses the viability of a business idea. | Market Demand, Competition, Financial Projections, Potential Obstacles. | Entrepreneurs, Investors |

| Growth Business Plan | Focuses on strategies for scaling up an existing business. | Market Analysis, New Product/Service Offerings, Financial Projections. | Business Owners, Investors |

| Operational Business Plan | Outlines the company's day-to-day operations. | Processes, Procedures, Organizational Structure. | Managers, Employees |

| Lean Business Plan | A simplified, agile version of a traditional plan, focusing on key elements. | Value Proposition, Customer Segments, Revenue Streams, Cost Structure. | Entrepreneurs, Startups |

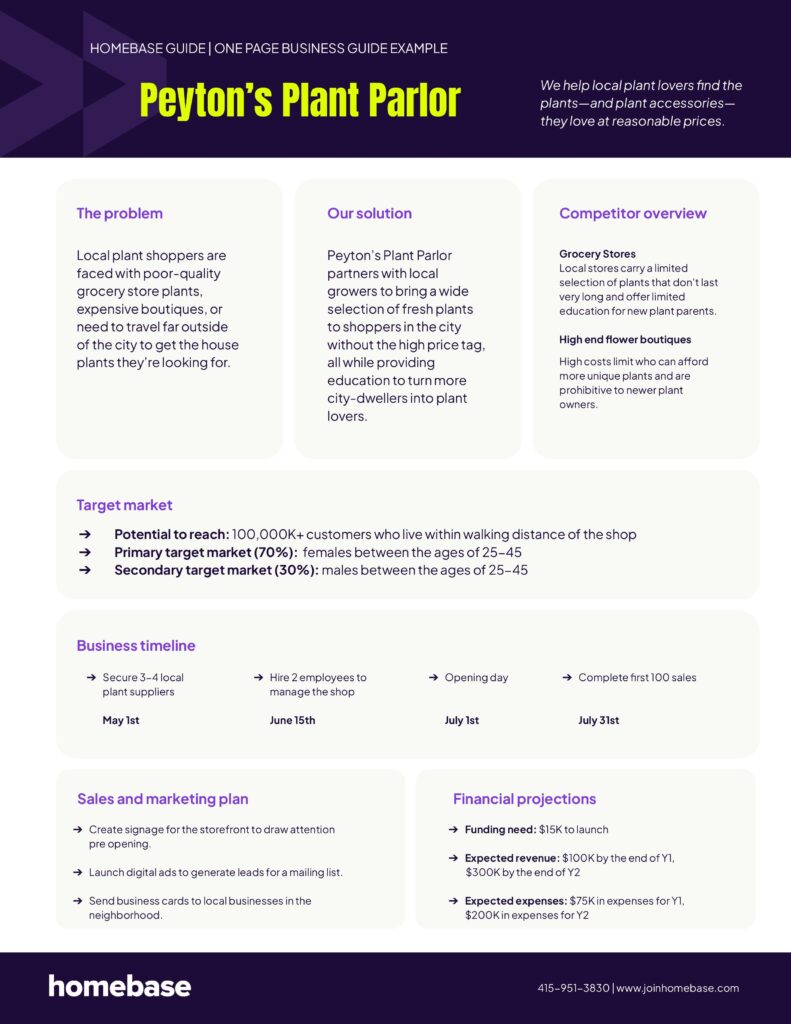

| One-Page Business Plan | A concise summary of your company's key objectives, strategies, and milestones. | Key Objectives, Strategies, Milestones. | Entrepreneurs, Investors, Partners |

| Nonprofit Business Plan | Outlines the mission, goals, target audience, fundraising strategies, and budget allocation for nonprofit organizations. | Mission Statement, Goals, Target Audience, Fundraising Strategies, Budget. | Nonprofit Leaders, Board Members, Donors |

| Franchise Business Plan | Focuses on the franchisor's requirements, as well as the franchisee's goals, strategies, and financial projections. | Franchise Agreement, Brand Standards, Marketing Efforts, Operational Procedures, Financial Projections. | Franchisors, Franchisees, Investors |

Using Business Plan Software

Upmetrics provides a simple and intuitive platform for creating a well-structured business plan. It features customizable templates, financial forecasting tools, and collaboration capabilities, allowing you to work with team members and advisors. Upmetrics also offers a library of resources to guide you through the business planning process.

| Software | Key Features | User Interface | Additional Features |

|---|---|---|---|

| LivePlan | Over 500 sample plans, financial forecasting tools, progress tracking against KPIs | User-friendly, visually appealing | Allows creation of professional-looking business plans |

| Upmetrics | Customizable templates, financial forecasting tools, collaboration capabilities | Simple and intuitive | Provides a resource library for business planning |

| Bizplan | Drag-and-drop builder, modular sections, financial forecasting tools, progress tracking | Simple, visually engaging | Designed to simplify the business planning process |

| Enloop | Industry-specific templates, financial forecasting tools, automatic business plan generation, unique performance score | Robust, user-friendly | Offers a free version, making it accessible for businesses on a budget |

| Tarkenton GoSmallBiz | Guided business plan builder, customizable templates, financial projection tools | User-friendly | Offers CRM tools, legal document templates, and additional resources for small businesses |

Business Plan FAQs

What is a good business plan.

A good business plan is a well-researched, clear, and concise document that outlines a company’s goals, strategies, target market, competitive advantages, and financial projections. It should be adaptable to change and provide a roadmap for achieving success.

What are the 3 main purposes of a business plan?

Can i write a business plan by myself, is it possible to create a one-page business plan.

Yes, a one-page business plan is a condensed version that highlights the most essential elements, including the company’s mission, target market, unique selling proposition, and financial goals.

How long should a business plan be?

What is a business plan outline, what are the 5 most common business plan mistakes, what questions should be asked in a business plan.

A business plan should address questions such as: What problem does the business solve? Who is the specific target market ? What is the unique selling proposition? What are the company’s objectives? How will it achieve those objectives?

What’s the difference between a business plan and a strategic plan?

How is business planning for a nonprofit different.

How to make a business plan

Table of Contents

How to make a good business plan: step-by-step guide.

A business plan is a strategic roadmap used to navigate the challenging journey of entrepreneurship. It's the foundation upon which you build a successful business.

A well-crafted business plan can help you define your vision, clarify your goals, and identify potential problems before they arise.

But where do you start? How do you create a business plan that sets you up for success?

This article will explore the step-by-step process of creating a comprehensive business plan.

What is a business plan?

A business plan is a formal document that outlines a business's objectives, strategies, and operational procedures. It typically includes the following information about a company:

Products or services

Target market

Competitors

Marketing and sales strategies

Financial plan

Management team

A business plan serves as a roadmap for a company's success and provides a blueprint for its growth and development. It helps entrepreneurs and business owners organize their ideas, evaluate the feasibility, and identify potential challenges and opportunities.

As well as serving as a guide for business owners, a business plan can attract investors and secure funding. It demonstrates the company's understanding of the market, its ability to generate revenue and profits, and its strategy for managing risks and achieving success.

Business plan vs. business model canvas

A business plan may seem similar to a business model canvas, but each document serves a different purpose.

A business model canvas is a high-level overview that helps entrepreneurs and business owners quickly test and iterate their ideas. It is often a one-page document that briefly outlines the following:

Key partnerships

Key activities

Key propositions

Customer relationships

Customer segments

Key resources

Cost structure

Revenue streams

On the other hand, a Business Plan Template provides a more in-depth analysis of a company's strategy and operations. It is typically a lengthy document and requires significant time and effort to develop.

A business model shouldn’t replace a business plan, and vice versa. Business owners should lay the foundations and visually capture the most important information with a Business Model Canvas Template . Because this is a fast and efficient way to communicate a business idea, a business model canvas is a good starting point before developing a more comprehensive business plan.

A business plan can aim to secure funding from investors or lenders, while a business model canvas communicates a business idea to potential customers or partners.

Why is a business plan important?

A business plan is crucial for any entrepreneur or business owner wanting to increase their chances of success.

Here are some of the many benefits of having a thorough business plan.

Helps to define the business goals and objectives

A business plan encourages you to think critically about your goals and objectives. Doing so lets you clearly understand what you want to achieve and how you plan to get there.

A well-defined set of goals, objectives, and key results also provides a sense of direction and purpose, which helps keep business owners focused and motivated.

Guides decision-making

A business plan requires you to consider different scenarios and potential problems that may arise in your business. This awareness allows you to devise strategies to deal with these issues and avoid pitfalls.

With a clear plan, entrepreneurs can make informed decisions aligning with their overall business goals and objectives. This helps reduce the risk of making costly mistakes and ensures they make decisions with long-term success in mind.

Attracts investors and secures funding

Investors and lenders often require a business plan before considering investing in your business. A document that outlines the company's goals, objectives, and financial forecasts can help instill confidence in potential investors and lenders.

A well-written business plan demonstrates that you have thoroughly thought through your business idea and have a solid plan for success.

Identifies potential challenges and risks

A business plan requires entrepreneurs to consider potential challenges and risks that could impact their business. For example:

Is there enough demand for my product or service?

Will I have enough capital to start my business?

Is the market oversaturated with too many competitors?

What will happen if my marketing strategy is ineffective?

By identifying these potential challenges, entrepreneurs can develop strategies to mitigate risks and overcome challenges. This can reduce the likelihood of costly mistakes and ensure the business is well-positioned to take on any challenges.

Provides a basis for measuring success

A business plan serves as a framework for measuring success by providing clear goals and financial projections . Entrepreneurs can regularly refer to the original business plan as a benchmark to measure progress. By comparing the current business position to initial forecasts, business owners can answer questions such as:

Are we where we want to be at this point?

Did we achieve our goals?

If not, why not, and what do we need to do?

After assessing whether the business is meeting its objectives or falling short, business owners can adjust their strategies as needed.

How to make a business plan step by step

The steps below will guide you through the process of creating a business plan and what key components you need to include.

1. Create an executive summary

Start with a brief overview of your entire plan. The executive summary should cover your business plan's main points and key takeaways.

Keep your executive summary concise and clear with the Executive Summary Template . The simple design helps readers understand the crux of your business plan without reading the entire document.

2. Write your company description

Provide a detailed explanation of your company. Include information on what your company does, the mission statement, and your vision for the future.

Provide additional background information on the history of your company, the founders, and any notable achievements or milestones.

3. Conduct a market analysis

Conduct an in-depth analysis of your industry, competitors, and target market. This is best done with a SWOT analysis to identify your strengths, weaknesses, opportunities, and threats. Next, identify your target market's needs, demographics, and behaviors.

Use the Competitive Analysis Template to brainstorm answers to simple questions like:

What does the current market look like?

Who are your competitors?

What are they offering?

What will give you a competitive advantage?

Who is your target market?

What are they looking for and why?

How will your product or service satisfy a need?

These questions should give you valuable insights into the current market and where your business stands.

4. Describe your products and services

Provide detailed information about your products and services. This includes pricing information, product features, and any unique selling points.

Use the Product/Market Fit Template to explain how your products meet the needs of your target market. Describe what sets them apart from the competition.

5. Design a marketing and sales strategy

Outline how you plan to promote and sell your products. Your marketing strategy and sales strategy should include information about your:

Pricing strategy

Advertising and promotional tactics

Sales channels

The Go to Market Strategy Template is a great way to visually map how you plan to launch your product or service in a new or existing market.

6. Determine budget and financial projections

Document detailed information on your business’ finances. Describe the current financial position of the company and how you expect the finances to play out.

Some details to include in this section are:

Startup costs

Revenue projections

Profit and loss statement

Funding you have received or plan to receive

Strategy for raising funds

7. Set the organization and management structure

Define how your company is structured and who will be responsible for each aspect of the business. Use the Business Organizational Chart Template to visually map the company’s teams, roles, and hierarchy.

As well as the organization and management structure, discuss the legal structure of your business. Clarify whether your business is a corporation, partnership, sole proprietorship, or LLC.

8. Make an action plan

At this point in your business plan, you’ve described what you’re aiming for. But how are you going to get there? The Action Plan Template describes the following steps to move your business plan forward. Outline the next steps you plan to take to bring your business plan to fruition.

Types of business plans

Several types of business plans cater to different purposes and stages of a company's lifecycle. Here are some of the most common types of business plans.

Startup business plan

A startup business plan is typically an entrepreneur's first business plan. This document helps entrepreneurs articulate their business idea when starting a new business.

Not sure how to make a business plan for a startup? It’s pretty similar to a regular business plan, except the primary purpose of a startup business plan is to convince investors to provide funding for the business. A startup business plan also outlines the potential target market, product/service offering, marketing plan, and financial projections.

Strategic business plan

A strategic business plan is a long-term plan that outlines a company's overall strategy, objectives, and tactics. This type of strategic plan focuses on the big picture and helps business owners set goals and priorities and measure progress.

The primary purpose of a strategic business plan is to provide direction and guidance to the company's management team and stakeholders. The plan typically covers a period of three to five years.

Operational business plan

An operational business plan is a detailed document that outlines the day-to-day operations of a business. It focuses on the specific activities and processes required to run the business, such as:

Organizational structure

Staffing plan

Production plan

Quality control

Inventory management

Supply chain

The primary purpose of an operational business plan is to ensure that the business runs efficiently and effectively. It helps business owners manage their resources, track their performance, and identify areas for improvement.

Growth-business plan

A growth-business plan is a strategic plan that outlines how a company plans to expand its business. It helps business owners identify new market opportunities and increase revenue and profitability. The primary purpose of a growth-business plan is to provide a roadmap for the company's expansion and growth.

The 3 Horizons of Growth Template is a great tool to identify new areas of growth. This framework categorizes growth opportunities into three categories: Horizon 1 (core business), Horizon 2 (emerging business), and Horizon 3 (potential business).

One-page business plan

A one-page business plan is a condensed version of a full business plan that focuses on the most critical aspects of a business. It’s a great tool for entrepreneurs who want to quickly communicate their business idea to potential investors, partners, or employees.

A one-page business plan typically includes sections such as business concept, value proposition, revenue streams, and cost structure.

Best practices for how to make a good business plan

Here are some additional tips for creating a business plan:

Use a template

A template can help you organize your thoughts and effectively communicate your business ideas and strategies. Starting with a template can also save you time and effort when formatting your plan.

Miro’s extensive library of customizable templates includes all the necessary sections for a comprehensive business plan. With our templates, you can confidently present your business plans to stakeholders and investors.

Be practical

Avoid overestimating revenue projections or underestimating expenses. Your business plan should be grounded in practical realities like your budget, resources, and capabilities.

Be specific

Provide as much detail as possible in your business plan. A specific plan is easier to execute because it provides clear guidance on what needs to be done and how. Without specific details, your plan may be too broad or vague, making it difficult to know where to start or how to measure success.

Be thorough with your research

Conduct thorough research to fully understand the market, your competitors, and your target audience . By conducting thorough research, you can identify potential risks and challenges your business may face and develop strategies to mitigate them.

Get input from others

It can be easy to become overly focused on your vision and ideas, leading to tunnel vision and a lack of objectivity. By seeking input from others, you can identify potential opportunities you may have overlooked.

Review and revise regularly

A business plan is a living document. You should update it regularly to reflect market, industry, and business changes. Set aside time for regular reviews and revisions to ensure your plan remains relevant and effective.

Create a winning business plan to chart your path to success

Starting or growing a business can be challenging, but it doesn't have to be. Whether you're a seasoned entrepreneur or just starting, a well-written business plan can make or break your business’ success.

The purpose of a business plan is more than just to secure funding and attract investors. It also serves as a roadmap for achieving your business goals and realizing your vision. With the right mindset, tools, and strategies, you can develop a visually appealing, persuasive business plan.

Ready to make an effective business plan that works for you? Check out our library of ready-made strategy and planning templates and chart your path to success.

Get on board in seconds

Join thousands of teams using Miro to do their best work yet.

What is a Business Plan? Definition and Resources

9 min. read

Updated May 10, 2024

If you’ve ever jotted down a business idea on a napkin with a few tasks you need to accomplish, you’ve written a business plan — or at least the very basic components of one.

The origin of formal business plans is murky. But they certainly go back centuries. And when you consider that 20% of new businesses fail in year 1 , and half fail within 5 years, the importance of thorough planning and research should be clear.

But just what is a business plan? And what’s required to move from a series of ideas to a formal plan? Here we’ll answer that question and explain why you need one to be a successful business owner.

- What is a business plan?

A business plan lays out a strategic roadmap for any new or growing business.

Any entrepreneur with a great idea for a business needs to conduct market research , analyze their competitors , validate their idea by talking to potential customers, and define their unique value proposition .

The business plan captures that opportunity you see for your company: it describes your product or service and business model , and the target market you’ll serve.

It also includes details on how you’ll execute your plan: how you’ll price and market your solution and your financial projections .

Reasons for writing a business plan

If you’re asking yourself, ‘Do I really need to write a business plan?’ consider this fact:

Companies that commit to planning grow 30% faster than those that don’t.

Creating a business plan is crucial for businesses of any size or stage. It helps you develop a working business and avoid consequences that could stop you before you ever start.

If you plan to raise funds for your business through a traditional bank loan or SBA loan , none of them will want to move forward without seeing your business plan. Venture capital firms may or may not ask for one, but you’ll still need to do thorough planning to create a pitch that makes them want to invest.

But it’s more than just a means of getting your business funded . The plan is also your roadmap to identify and address potential risks.

It’s not a one-time document. Your business plan is a living guide to ensure your business stays on course.

Related: 14 of the top reasons why you need a business plan

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

What research shows about business plans

Numerous studies have established that planning improves business performance:

- 71% of fast-growing companies have business plans that include budgets, sales goals, and marketing and sales strategies.

- Companies that clearly define their value proposition are more successful than those that can’t.

- Companies or startups with a business plan are more likely to get funding than those without one.

- Starting the business planning process before investing in marketing reduces the likelihood of business failure.

The planning process significantly impacts business growth for existing companies and startups alike.

Read More: Research-backed reasons why writing a business plan matters

When should you write a business plan?

No two business plans are alike.

Yet there are similar questions for anyone considering writing a plan to answer. One basic but important question is when to start writing it.

A Harvard Business Review study found that the ideal time to write a business plan is between 6 and 12 months after deciding to start a business.

But the reality can be more nuanced – it depends on the stage a business is in, or the type of business plan being written.

Ideal times to write a business plan include:

- When you have an idea for a business

- When you’re starting a business

- When you’re preparing to buy (or sell)

- When you’re trying to get funding

- When business conditions change

- When you’re growing or scaling your business

Read More: The best times to write or update your business plan

How often should you update your business plan?

As is often the case, how often a business plan should be updated depends on your circumstances.

A business plan isn’t a homework assignment to complete and forget about. At the same time, no one wants to get so bogged down in the details that they lose sight of day-to-day goals.

But it should cover new opportunities and threats that a business owner surfaces, and incorporate feedback they get from customers. So it can’t be a static document.

Related Reading: 5 fundamental principles of business planning

For an entrepreneur at the ideation stage, writing and checking back on their business plan will help them determine if they can turn that idea into a profitable business .

And for owners of up-and-running businesses, updating the plan (or rewriting it) will help them respond to market shifts they wouldn’t be prepared for otherwise.

It also lets them compare their forecasts and budgets to actual financial results. This invaluable process surfaces where a business might be out-performing expectations and where weak performance may require a prompt strategy change.

The planning process is what uncovers those insights.

Related Reading: 10 prompts to help you write a business plan with AI

- How long should your business plan be?

Thinking about a business plan strictly in terms of page length can risk overlooking more important factors, like the level of detail or clarity in the plan.

Not all of the plan consists of writing – there are also financial tables, graphs, and product illustrations to include.

But there are a few general rules to consider about a plan’s length:

- Your business plan shouldn’t take more than 15 minutes to skim.

- Business plans for internal use (not for a bank loan or outside investment) can be as short as 5 to 10 pages.

A good practice is to write your business plan to match the expectations of your audience.

If you’re walking into a bank looking for a loan, your plan should match the formal, professional style that a loan officer would expect . But if you’re writing it for stakeholders on your own team—shorter and less formal (even just a few pages) could be the better way to go.

The length of your plan may also depend on the stage your business is in.

For instance, a startup plan won’t have nearly as much financial information to include as a plan written for an established company will.

Read More: How long should your business plan be?

What information is included in a business plan?

The contents of a plan business plan will vary depending on the industry the business is in.

After all, someone opening a new restaurant will have different customers, inventory needs, and marketing tactics to consider than someone bringing a new medical device to the market.

But there are some common elements that most business plans include:

- Executive summary: An overview of the business operation, strategy, and goals. The executive summary should be written last, despite being the first thing anyone will read.

- Products and services: A description of the solution that a business is bringing to the market, emphasizing how it solves the problem customers are facing.

- Market analysis: An examination of the demographic and psychographic attributes of likely customers, resulting in the profile of an ideal customer for the business.

- Competitive analysis: Documenting the competitors a business will face in the market, and their strengths and weaknesses relative to those competitors.

- Marketing and sales plan: Summarizing a business’s tactics to position their product or service favorably in the market, attract customers, and generate revenue.

- Operational plan: Detailing the requirements to run the business day-to-day, including staffing, equipment, inventory, and facility needs.

- Organization and management structure: A listing of the departments and position breakdown of the business, as well as descriptions of the backgrounds and qualifications of the leadership team.

- Key milestones: Laying out the key dates that a business is projected to reach certain milestones , such as revenue, break-even, or customer acquisition goals.

- Financial plan: Balance sheets, cash flow forecast , and sales and expense forecasts with forward-looking financial projections, listing assumptions and potential risks that could affect the accuracy of the plan.

- Appendix: All of the supporting information that doesn’t fit into specific sections of the business plan, such as data and charts.

Read More: Use this business plan outline to organize your plan

- Different types of business plans

A business plan isn’t a one-size-fits-all document. There are numerous ways to create an effective business plan that fits entrepreneurs’ or established business owners’ needs.

Here are a few of the most common types of business plans for small businesses:

- One-page plan : Outlining all of the most important information about a business into an adaptable one-page plan.

- Growth plan : An ongoing business management plan that ensures business tactics and strategies are aligned as a business scales up.

- Internal plan : A shorter version of a full business plan to be shared with internal stakeholders – ideal for established companies considering strategic shifts.

Business plan vs. operational plan vs. strategic plan

- What questions are you trying to answer?

- Are you trying to lay out a plan for the actual running of your business?

- Is your focus on how you will meet short or long-term goals?

Since your objective will ultimately inform your plan, you need to know what you’re trying to accomplish before you start writing.

While a business plan provides the foundation for a business, other types of plans support this guiding document.

An operational plan sets short-term goals for the business by laying out where it plans to focus energy and investments and when it plans to hit key milestones.

Then there is the strategic plan , which examines longer-range opportunities for the business, and how to meet those larger goals over time.

Read More: How to use a business plan for strategic development and operations

- Business plan vs. business model

If a business plan describes the tactics an entrepreneur will use to succeed in the market, then the business model represents how they will make money.

The difference may seem subtle, but it’s important.

Think of a business plan as the roadmap for how to exploit market opportunities and reach a state of sustainable growth. By contrast, the business model lays out how a business will operate and what it will look like once it has reached that growth phase.

Learn More: The differences between a business model and business plan

- Moving from idea to business plan

Now that you understand what a business plan is, the next step is to start writing your business plan .

The best way to start is by reviewing examples and downloading a business plan template. These resources will provide you with guidance and inspiration to help you write a plan.

We recommend starting with a simple one-page plan ; it streamlines the planning process and helps you organize your ideas. However, if one page doesn’t fit your needs, there are plenty of other great templates available that will put you well on your way to writing a useful business plan.

Tim Berry is the founder and chairman of Palo Alto Software , a co-founder of Borland International, and a recognized expert in business planning. He has an MBA from Stanford and degrees with honors from the University of Oregon and the University of Notre Dame. Today, Tim dedicates most of his time to blogging, teaching and evangelizing for business planning.

Table of Contents

- Reasons to write a business plan

- Business planning research

- When to write a business plan

- When to update a business plan

- Information to include

- Business vs. operational vs. strategic plans

Related Articles

6 Min. Read

How and Where to Write About Technology in Your Business Plan

7 Min. Read

3 Key Steps to Create a Promotional Plan

16 Min. Read

How to Write a Mission Statement + 10 Great Examples

3 Min. Read

Celebrate National Write a Business Plan Month in December

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

- Start free trial

Start selling with Shopify today

Start your free trial with Shopify today—then use these resources to guide you through every step of the process.

The 12 Key Components of a Business Plan

There are 12 components of a business plan entrepreneurs must know as they lay out how their business will work.

Entrepreneurs who create business plans are more likely to succeed than those who don’t.

Not only can a sound plan help your business access investment capital but—as the study found—it can even determine the success or failure of your venture.

Here are the critical components of a business plan to help you craft your own.

What is a business plan?

A business plan is a document outlining your business goals and your strategies for achieving them. It might include your company’s mission statement , details about your products or services, how you plan to bring them to market, and how much time and money you need to execute the plan.

For a thorough explanation of how to write a business plan, refer to Shopify’s guide .

12 components of a business plan

Business plans vary depending on the product or service. Some entrepreneurs choose to use diagrams and charts, while others rely on text alone. Regardless of how you go about it, good business plans tend to include the following elements:

- Executive summary

- Company description

- Market analysis

- Marketing plan

- Competitive analysis

- Organizational structure

- Products and services

- Operating plan

- Financial plan

- Funding sources

1. Executive summary

The executive summary briefly explains your business’s products or services and why it has the potential to be profitable. You may also include basic information about your company, such as its location and the number of employees.

2. Company description

The company description helps customers, lenders, and potential investors gain a deeper understanding of your product or service. It provides detailed descriptions of your supply chains and explains how your company plans to bring its products or services to market.

3. Market analysis

The market analysis section outlines your plans to reach your target audience . It usually includes an estimate of the potential demand for the product or service and a summary of market research .

The market analysis also includes information about marketing strategies, advertising ideas, or other ways of attracting customers.

Another component of this section is a detailed breakdown of target customers. Many businesses find it helpful to analyze their target market using customer segments , often with demographic data such as age or income. This way, you can customize your marketing plans to reach different groups of customers.

4. Marketing plan

The marketing plan section details how you plan to attract and retain customers. It covers the marketing mix: product, price, place, and promotion. It shows you understand your market and have clear, measurable goals to guide your marketing strategy.

For example, a fashion retail store might focus on online sales channels, competitive pricing strategies, high-quality products, and aggressive social media promotion.

5. Sales plan

This section focuses on the actions you’ll take to achieve sales targets and drive revenue. It’s different from a marketing plan because it’s more about the direct process of selling the product to your customer. It looks at the methods used from lead generation to closing the sale, as well as revenue targets.

An ecommerce sales strategy might involve optimizing your online shopping experience, using targeted digital marketing to drive traffic, and employing tactics like flash sales , personalized email marketing, or loyalty programs to boost sales.

6. Competitive analysis

It’s essential that you understand your competitors and distinguish your business. There are two main types of competitors: direct and indirect competitors.

- Direct competitors. Direct competitors offer the same or similar products and services. For example, the underwear brand Skims is a direct competitor with Spanx .

- Indirect competitors. Indirect competitors, on the other hand, offer different products and services that may satisfy the same customer needs. For example, cable television is an indirect competitor to Netflix.

A competitive analysis explains your business’s unique strengths that give it a competitive advantage over other businesses.

7. Organizational structure

The organizational structure explains your company’s legal structure and provides information about the management team. It also describes the business’s operating plan and details who is responsible for which aspects of the company.

8. Products and services

This component goes in-depth on what you’re actually selling and why it’s valuable to customers. It’ll provide a description of your products and services with all their features, benefits, and unique selling points. It may also discuss the current development stage of your products and plans for the future.

The products and services section also looks at pricing strategy , intellectual property (IP) rights, and any key supplier information. For example, in an ecommerce business plan focusing on eco-friendly home products, this section would detail the range of products, explain how they are environmentally friendly, outline sourcing and production practices, discuss pricing, and highlight any certifications or eco-labels the products have received.

9. Operating plan

Here is where you explain the day-to-day operations of the business. Your operating plan will cover aspects from production or service delivery to human and resource management. It shows readers how you plan to deliver on your promises.

For example, in a business plan for a startup selling artisanal crafts, this section would include details on how artisans are sourced, how products are cataloged and stored, the ecommerce platform used for sales, and the logistics for packaging and shipping orders worldwide.

10. Financial plan

The financial plan is one of the most critical parts of the business plan, especially for companies seeking outside funding.

A plan often includes capital expenditure budgets, forecasted income statements , and cash flow statements , which can help predict when your company will become profitable and how it expects to survive in the meantime.

If your business is already profitable, your financial plan can help with convincing investors of future growth. At the end of the financial section, you may also include a value proposition , which estimates the value of your business.

11. Funding sources

Some businesses planning to expand or to seek funds from venture capitalists may include a section devoted to their long-term growth strategy, including ways to broaden product offerings and penetrate new markets.

12. Appendix

The final component of a business plan is the appendix. Here, you may include additional documents cited in other sections or requested by readers. These might be résumés, financial statements, product pictures, patent approvals, and legal records.

Components of a business plan FAQ

What are 8 common parts of a good business plan.

Some of the most common components of a business plan are an executive summary, a company description, a marketing analysis, a competitive analysis, an organization description, a summary of growth strategies, a financial plan, and an appendix.

What is a business plan format?

A business plan format is a way of structuring a business plan. Shopify offers a free business plan template for startups that you can use to format your business plan.

What are the 5 functions of a business plan?

A business plan explains your company’s products or services, how you expect to make money, the reliability of supply chains, and factors that might affect demand.

Keep up with the latest from Shopify

Get free ecommerce tips, inspiration, and resources delivered directly to your inbox.

By entering your email, you agree to receive marketing emails from Shopify.

popular posts

The most intuitive, powerful

Shopify yet

Shopify Editions Summer ’24

Subscribe to our blog and get free ecommerce tips, inspiration, and resources delivered directly to your inbox.

Unsubscribe anytime. By entering your email, you agree to receive marketing emails from Shopify.

Latest from Shopify

Jul 2, 2024

Jul 1, 2024

Learn on the go. Try Shopify for free, and explore all the tools you need to start, run, and grow your business.

Try Shopify for free, no credit card required.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Write a Business Plan, Step by Step

Rosalie Murphy is a small-business writer at NerdWallet. Since 2021, she has covered business insurance, banking, credit cards and e-commerce software, and her reporting has been featured by The Associated Press, MarketWatch, Entrepreneur and many other publications. Rosalie holds a graduate certificate in Quantitative Business Management from Kent State University and is now pursuing an MBA. She is based in Chicago.

Ryan Lane is an editor on NerdWallet’s small-business team. He joined NerdWallet in 2019 as a student loans writer, serving as an authority on that topic after spending more than a decade at student loan guarantor American Student Assistance. In that role, Ryan co-authored the Student Loan Ranger blog in partnership with U.S. News & World Report, as well as wrote and edited content about education financing and financial literacy for multiple online properties, e-courses and more. Ryan also previously oversaw the production of life science journals as a managing editor for publisher Cell Press. Ryan is located in Rochester, New York.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

What is a business plan?

1. write an executive summary, 2. describe your company, 3. state your business goals, 4. describe your products and services, 5. do your market research, 6. outline your marketing and sales plan, 7. perform a business financial analysis, 8. make financial projections, 9. summarize how your company operates, 10. add any additional information to an appendix, business plan tips and resources.

A business plan outlines your business’s financial goals and explains how you’ll achieve them over the next three to five years. Here’s a step-by-step guide to writing a business plan that will offer a strong, detailed road map for your business.

ZenBusiness

A business plan is a document that explains what your business does, how it makes money and who its customers are. Internally, writing a business plan should help you clarify your vision and organize your operations. Externally, you can share it with potential lenders and investors to show them you’re on the right track.

Business plans are living documents; it’s OK for them to change over time. Startups may update their business plans often as they figure out who their customers are and what products and services fit them best. Mature companies might only revisit their business plan every few years. Regardless of your business’s age, brush up this document before you apply for a business loan .

» Need help writing? Learn about the best business plan software .

This is your elevator pitch. It should include a mission statement, a brief description of the products or services your business offers and a broad summary of your financial growth plans.

Though the executive summary is the first thing your investors will read, it can be easier to write it last. That way, you can highlight information you’ve identified while writing other sections that go into more detail.

» MORE: How to write an executive summary in 6 steps

Next up is your company description. This should contain basic information like:

Your business’s registered name.

Address of your business location .

Names of key people in the business. Make sure to highlight unique skills or technical expertise among members of your team.

Your company description should also define your business structure — such as a sole proprietorship, partnership or corporation — and include the percent ownership that each owner has and the extent of each owner’s involvement in the company.

Lastly, write a little about the history of your company and the nature of your business now. This prepares the reader to learn about your goals in the next section.

» MORE: How to write a company overview for a business plan

The third part of a business plan is an objective statement. This section spells out what you’d like to accomplish, both in the near term and over the coming years.

If you’re looking for a business loan or outside investment, you can use this section to explain how the financing will help your business grow and how you plan to achieve those growth targets. The key is to provide a clear explanation of the opportunity your business presents to the lender.

For example, if your business is launching a second product line, you might explain how the loan will help your company launch that new product and how much you think sales will increase over the next three years as a result.

» MORE: How to write a successful business plan for a loan

In this section, go into detail about the products or services you offer or plan to offer.

You should include the following:

An explanation of how your product or service works.

The pricing model for your product or service.

The typical customers you serve.

Your supply chain and order fulfillment strategy.

You can also discuss current or pending trademarks and patents associated with your product or service.

Lenders and investors will want to know what sets your product apart from your competition. In your market analysis section , explain who your competitors are. Discuss what they do well, and point out what you can do better. If you’re serving a different or underserved market, explain that.

Here, you can address how you plan to persuade customers to buy your products or services, or how you will develop customer loyalty that will lead to repeat business.

Include details about your sales and distribution strategies, including the costs involved in selling each product .

» MORE: R e a d our complete guide to small business marketing

If you’re a startup, you may not have much information on your business financials yet. However, if you’re an existing business, you’ll want to include income or profit-and-loss statements, a balance sheet that lists your assets and debts, and a cash flow statement that shows how cash comes into and goes out of the company.

Accounting software may be able to generate these reports for you. It may also help you calculate metrics such as:

Net profit margin: the percentage of revenue you keep as net income.

Current ratio: the measurement of your liquidity and ability to repay debts.

Accounts receivable turnover ratio: a measurement of how frequently you collect on receivables per year.

This is a great place to include charts and graphs that make it easy for those reading your plan to understand the financial health of your business.

This is a critical part of your business plan if you’re seeking financing or investors. It outlines how your business will generate enough profit to repay the loan or how you will earn a decent return for investors.

Here, you’ll provide your business’s monthly or quarterly sales, expenses and profit estimates over at least a three-year period — with the future numbers assuming you’ve obtained a new loan.

Accuracy is key, so carefully analyze your past financial statements before giving projections. Your goals may be aggressive, but they should also be realistic.

NerdWallet’s picks for setting up your business finances:

The best business checking accounts .

The best business credit cards .

The best accounting software .

Before the end of your business plan, summarize how your business is structured and outline each team’s responsibilities. This will help your readers understand who performs each of the functions you’ve described above — making and selling your products or services — and how much each of those functions cost.

If any of your employees have exceptional skills, you may want to include their resumes to help explain the competitive advantage they give you.

Finally, attach any supporting information or additional materials that you couldn’t fit in elsewhere. That might include:

Licenses and permits.

Equipment leases.

Bank statements.

Details of your personal and business credit history, if you’re seeking financing.

If the appendix is long, you may want to consider adding a table of contents at the beginning of this section.

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

Here are some tips to write a detailed, convincing business plan:

Avoid over-optimism: If you’re applying for a business bank loan or professional investment, someone will be reading your business plan closely. Providing unreasonable sales estimates can hurt your chances of approval.

Proofread: Spelling, punctuation and grammatical errors can jump off the page and turn off lenders and prospective investors. If writing and editing aren't your strong suit, you may want to hire a professional business plan writer, copy editor or proofreader.

Use free resources: SCORE is a nonprofit association that offers a large network of volunteer business mentors and experts who can help you write or edit your business plan. The U.S. Small Business Administration’s Small Business Development Centers , which provide free business consulting and help with business plan development, can also be a resource.

- Sources of Business Finance

- Small Business Loans

- Small Business Grants

- Crowdfunding Sites

- How to Get a Business Loan

- Small Business Insurance Providers

- Best Factoring Companies

- Types of Bank Accounts

- Best Banks for Small Business

- Best Business Bank Accounts

- Open a Business Bank Account

- Bank Accounts for Small Businesses

- Free Business Checking Accounts

- Best Business Credit Cards

- Get a Business Credit Card

- Business Credit Cards for Bad Credit

- Build Business Credit Fast

- Business Loan Eligibility Criteria

- Small-Business Bookkeeping Basics

- How to Set Financial Goals

- Business Loan Calculators

- How to Calculate ROI

- Calculate Net Income

- Calculate Working Capital

- Calculate Operating Income

- Calculate Net Present Value (NPV)

- Calculate Payroll Tax

12 Key Elements of a Business Plan (Top Components Explained)

Starting and running a successful business requires proper planning and execution of effective business tactics and strategies .

You need to prepare many essential business documents when starting a business for maximum success; the business plan is one such document.

When creating a business, you want to achieve business objectives and financial goals like productivity, profitability, and business growth. You need an effective business plan to help you get to your desired business destination.

Even if you are already running a business, the proper understanding and review of the key elements of a business plan help you navigate potential crises and obstacles.

This article will teach you why the business document is at the core of any successful business and its key elements you can not avoid.

Let’s get started.

Why Are Business Plans Important?

Business plans are practical steps or guidelines that usually outline what companies need to do to reach their goals. They are essential documents for any business wanting to grow and thrive in a highly-competitive business environment .

1. Proves Your Business Viability

A business plan gives companies an idea of how viable they are and what actions they need to take to grow and reach their financial targets. With a well-written and clearly defined business plan, your business is better positioned to meet its goals.

2. Guides You Throughout the Business Cycle

A business plan is not just important at the start of a business. As a business owner, you must draw up a business plan to remain relevant throughout the business cycle .

During the starting phase of your business, a business plan helps bring your ideas into reality. A solid business plan can secure funding from lenders and investors.

After successfully setting up your business, the next phase is management. Your business plan still has a role to play in this phase, as it assists in communicating your business vision to employees and external partners.

Essentially, your business plan needs to be flexible enough to adapt to changes in the needs of your business.

3. Helps You Make Better Business Decisions

As a business owner, you are involved in an endless decision-making cycle. Your business plan helps you find answers to your most crucial business decisions.

A robust business plan helps you settle your major business components before you launch your product, such as your marketing and sales strategy and competitive advantage.

4. Eliminates Big Mistakes

Many small businesses fail within their first five years for several reasons: lack of financing, stiff competition, low market need, inadequate teams, and inefficient pricing strategy.

Creating an effective plan helps you eliminate these big mistakes that lead to businesses' decline. Every business plan element is crucial for helping you avoid potential mistakes before they happen.

5. Secures Financing and Attracts Top Talents

Having an effective plan increases your chances of securing business loans. One of the essential requirements many lenders ask for to grant your loan request is your business plan.

A business plan helps investors feel confident that your business can attract a significant return on investments ( ROI ).

You can attract and retain top-quality talents with a clear business plan. It inspires your employees and keeps them aligned to achieve your strategic business goals.

Key Elements of Business Plan

Starting and running a successful business requires well-laid actions and supporting documents that better position a company to achieve its business goals and maximize success.

A business plan is a written document with relevant information detailing business objectives and how it intends to achieve its goals.

With an effective business plan, investors, lenders, and potential partners understand your organizational structure and goals, usually around profitability, productivity, and growth.

Every successful business plan is made up of key components that help solidify the efficacy of the business plan in delivering on what it was created to do.

Here are some of the components of an effective business plan.

1. Executive Summary

One of the key elements of a business plan is the executive summary. Write the executive summary as part of the concluding topics in the business plan. Creating an executive summary with all the facts and information available is easier.

In the overall business plan document, the executive summary should be at the forefront of the business plan. It helps set the tone for readers on what to expect from the business plan.

A well-written executive summary includes all vital information about the organization's operations, making it easy for a reader to understand.

The key points that need to be acted upon are highlighted in the executive summary. They should be well spelled out to make decisions easy for the management team.

A good and compelling executive summary points out a company's mission statement and a brief description of its products and services.

An executive summary summarizes a business's expected value proposition to distinct customer segments. It highlights the other key elements to be discussed during the rest of the business plan.

Including your prior experiences as an entrepreneur is a good idea in drawing up an executive summary for your business. A brief but detailed explanation of why you decided to start the business in the first place is essential.

Adding your company's mission statement in your executive summary cannot be overemphasized. It creates a culture that defines how employees and all individuals associated with your company abide when carrying out its related processes and operations.

Your executive summary should be brief and detailed to catch readers' attention and encourage them to learn more about your company.

Components of an Executive Summary

Here are some of the information that makes up an executive summary:

- The name and location of your company

- Products and services offered by your company

- Mission and vision statements

- Success factors of your business plan

2. Business Description

Your business description needs to be exciting and captivating as it is the formal introduction a reader gets about your company.

What your company aims to provide, its products and services, goals and objectives, target audience , and potential customers it plans to serve need to be highlighted in your business description.

A company description helps point out notable qualities that make your company stand out from other businesses in the industry. It details its unique strengths and the competitive advantages that give it an edge to succeed over its direct and indirect competitors.

Spell out how your business aims to deliver on the particular needs and wants of identified customers in your company description, as well as the particular industry and target market of the particular focus of the company.

Include trends and significant competitors within your particular industry in your company description. Your business description should contain what sets your company apart from other businesses and provides it with the needed competitive advantage.

In essence, if there is any area in your business plan where you need to brag about your business, your company description provides that unique opportunity as readers look to get a high-level overview.

Components of a Business Description

Your business description needs to contain these categories of information.

- Business location

- The legal structure of your business

- Summary of your business’s short and long-term goals