This site uses cookies to store information on your computer. Some are essential to make our site work; others help us improve the user experience. By using the site, you consent to the placement of these cookies. Read our privacy policy to learn more.

Highlights of internal audit research

Academic research provides many insights into internal audit. here are some of them..

- Audit & Assurance

Academic research in internal audit provides best practices and pertinent information for external and internal auditors. Below, we summarize recent internal audit research from leading academic accounting journals. The research reveals useful information such as how incentive - based compensation for internal auditors might compromise their objectivity, how smaller companies use continuous audit technology, and how the quality of the internal audit function could affect delays in issuing financial statements.

HOW INTERNAL AUDIT FUNCTION CAN REDUCE AUDIT DELAY

After the passage of the Sarbanes - Oxley Act of 2002, the number of days required to complete audits and issue financial statements increased. Researchers Mina Pizzini, Shu Lin, and Douglas Ziegenfuss explored whether the quality of the internal audit function affects this delay. Their work, published in the February 2015 issue of Auditing: A Journal of Practice & Theory , examines the impact of the internal audit function on timely reporting by developing a proxy for the internal audit function to measure the quality and volume of an organization's internal auditing contributions. Their model of internal audit function quality, which is based on professional standards and prior research, encompasses five dimensions: competence, objectivity, fieldwork quality, fieldwork scope, and an organization's investment in internal auditing.

Using data from 216 organizations, the authors calculated "audit delay" as a measure of the quality of the internal audit function and its associated contribution to the financial statement audit. They found that higher - quality internal audit functions reduce audit delays by approximately 3.1 to 3.9 days. The research attributes the reduction to the competence of the internal audit personnel and the quality of the audit effort put forth. The research also found that when external auditors rely on procedures performed by an independent audit function, audit delay is reduced by 4.1 to 6.6 days. Particularly revealing is the fact that this delay is not seen when internal auditors serve as direct assistants to the external auditors.

The article, titled "The Impact of Internal Audit Function Quality and Contribution on Audit Delay," provides insights into the benefits that can be achieved through a quality internal audit function and better coordination with the external auditor. These findings confirm the benefits of investing in high - quality internal auditors and should encourage external auditors to leverage the resources the internal audit function offers to provide a timely audit.

HOW INTERNAL AUDITOR BONUSES IMPACT EXTERNAL AUDIT FEES

Reliance by external auditors on the efforts of their clients' internal audit function has been shown to result in a more efficient and effective financial statement audit. Such reliance requires a determination that the internal auditor is both competent and objective according to PCAOB Auditing Standard 2201, An Audit of Internal Control Over Financial Reporting That Is Integrated With an Audit of Financial Statements . Recent research examines the impact on perceived objectivity when a chief audit executive receives incentive - based compensation. While bonuses provide positive benefits such as retention and motivation, AU - C Section 610, Using the Work of Internal Auditors , requires external auditors to consider an "appropriate remuneration policy" as a factor in the evaluation of objectivity.

Authors Lucy Chen, Sally Chung, Gary Peters, and Jeannie Wynn surveyed 183 organizations listed on the New York Stock Exchange and analyzed their financial data for fiscal year 2006. The authors' rigorous research design considered variables that might affect the survey results, such as the client's industry, total assets, nonaudit fees, auditor longevity, audit committee composition, and the age of the client. A survey of the chief audit executives of 420 NYSE - listed companies resulted in usable data from 183 organizations about their incentive - based compensation. The authors combined the results with an analysis of financial, audit fee, and compensation data from proxy statements, Audit Analytics, Compustat, and Thomson Reuters Institutional Holdings.

Eighty - one percent of responding organizations provided incentive - based compensation. Of these, 64% provided stock or stock option bonuses.

The authors concluded that there is a correlation between incentive - based compensation linked to company performance and higher audit fees. Incentive - based compensation of the internal audit function influences external auditors' determination of internal auditor objectivity and, accordingly, increases their assessment of risk, particularly when such bonuses are paid in stock and not cash. Assessment of higher risk tends to increase audit fees.

The authors' results provide insight for businesses when designing the compensation plan for their internal auditors and also for external auditors in their audit risk assessment. "Does Incentive - Based Compensation for Chief Internal Auditors Impact Objectivity? An External Audit Risk Perspective" appeared in the May 2017 issue of Auditing: A Journal of Practice & Theory .

HOW SMALL BUSINESSES ARE USING CONTINUOUS AUDITING TECHNOLOGY

Continuous auditing technology provides numerous real - time benefits that help a company achieve auditing, data analysis, and other management objectives. Research appearing in the International Journal of Accounting Information Systems (April 2016) compares its use in large businesses to its use in small, non - publicly held businesses with fewer than 500 employees.

Authors Pall Rikhardsson and Richard Dull conducted interviews with CFOs and other financial personnel at seven small businesses in Iceland. While their study is relatively small, this area is one that has not been explored previously in internal audit research. The study highlights intriguing differences between how large and small companies use continuous auditing technology.

In the article, titled "An Exploratory Study of the Adoption, Application and Impacts of Continuous Auditing Technologies in Small Businesses," the authors stated that, according to their research, small businesses generally buy packaged software audit systems and run their continuous auditing efforts through the finance department instead of through an internal audit function. These companies are typically motivated to adopt continuous auditing technologies to improve management information systems and to fix a specific data problem. This contrasts with larger companies that implement continuous auditing technology in order to improve processes and make them more transparent.

The companies reported that the use of continuous auditing technology resulted in a perceived increase in business value, as well as reductions in time and costs. The authors found that additional benefits included an increase in preventive controls, a decrease in corrective controls, and a greater understanding of the value and reliability of financial data. Even though the packaged systems these companies purchased were generally not capable of performing advanced audit functions, interviewees reported that IT innovation was another positive side effect of using continuous auditing technology.

None of the survey respondents indicated changes in their audit approach, unlike larger companies that integrate continuous auditing technology with their internal audit function. Research results highlight the need for small businesses to ensure that all stakeholders in their organization are part of the decision - making process for new technologies, such as continuous auditing technologies, to ensure maximum benefits and improved systems.

HOW TO SUCCEED IN RECRUITING INTERNAL AUDITORS

An increasingly dynamic risk landscape combined with disruptive technology requires a focus on recruiting and retaining quality staff for the internal audit function. The article, titled "Attracting Applicants for In - House and Outsourced Internal Audit Positions: Views From External Auditors" ( Accounting Horizons , March 2016), examines external auditors' unfavorable view about the internal audit profession and how this view negatively influences the size and quality of the applicant pool.

Authors Geoffrey Bartlett, Joleen Kremin, Kelli Saunders, and David Wood performed an experiment involving 93 experienced auditing professionals and found that external auditors are twice as likely to apply for a position described as an "accounting position" than an identical one described as either an " in - house " or "outsourced" internal audit position. These findings suggest that external auditors have negative perceptions of internal audit, which can cause significant challenges in recruiting talent from a pool of experienced candidates.

The authors performed a second experiment and found that external auditors would present a relatively unfavorable picture of internal audit to a fictional " high - performing student" seeking work in the field while recommending internal audit more favorably to a theoretical student described as a "mediocre performer."

The authors used the results of a survey of 41 current or former external auditors to offer insights into potential improvements for critical areas of internal audit to make it a more appealing career. The suggestion that survey participants made most frequently included making the type of work more interesting (by requiring less mundane internal control work), followed by raising the status of the internal audit function, allowing more opportunities for value - added work, increasing pay, and providing more opportunities for advancement within an organization. Other recommendations respondents made included enhancing work/life balance, allowing auditors the flexibility to work from home, and possibly renaming the internal audit function to make the position more attractive.

Editor's note

This article is part of an occasional series that samples accounting research and distills key findings for busy practitioners and preparers. These summaries explain the implications of a wide range of research and give CPAs the opportunity to apply the results in day-to-day activities. Readers interested in more detail should review the full text of each article to explore the hypothesis, research process, statistical analysis, supporting theories, and conclusions.

About the authors

Cynthia E. Bolt-Lee, CPA, M.Tax. , is a professor of accounting in the Baker School of Business at The Citadel in Charleston, S.C. D. Scott Showalter, CPA, CGMA , is the director of the master of accounting program and a professor of practice in accounting at North Carolina State University in Raleigh, N.C. Al Y.S. Chen, CPA/CITP, CGMA, Ph.D. , is a professor of accounting at North Carolina State University.

To comment on this article or to suggest an idea for another article, contact Courtney Vien, a JofA senior editor, at [email protected] or 919-402-4125.

AICPA resources

- " How Internal Audit Can Improve by Embracing Technology ," FM magazine, March 13, 2018

- " 5 Ways Internal Audit Can Strengthen Relationships but Keep Its Independence ," FM magazine, Dec. 2016

- " How to Lead an Effective Internal Audit Function ," FM magazine, March 8, 2016

Publication

- Audit and Accounting Manual (#AAMAAM18P, paperback; #WAM-XX, online access)

CPE self-study

- COSO Internal Control Certificate Program, in two formats: Workshop Learning Pathway and Self-Study Learning Pathway, available at certificates.aicpastore.com

For more information or to make a purchase, go to aicpastore.com or call the Institute at 888-777-7077.

Online resources

- Accounting and Auditing Publications

- Audit and Attest

- Audit Data Analytics

- Enhancing Audit Quality

Where to find June’s flipbook issue

The Journal of Accountancy is now completely digital.

SPONSORED REPORT

Manage the talent, hand off the HR headaches

Recruiting. Onboarding. Payroll administration. Compliance. Benefits management. These are just a few of the HR functions accounting firms must provide to stay competitive in the talent game.

FEATURED ARTICLE

2023 tax software survey

CPAs assess how their return preparation products performed.

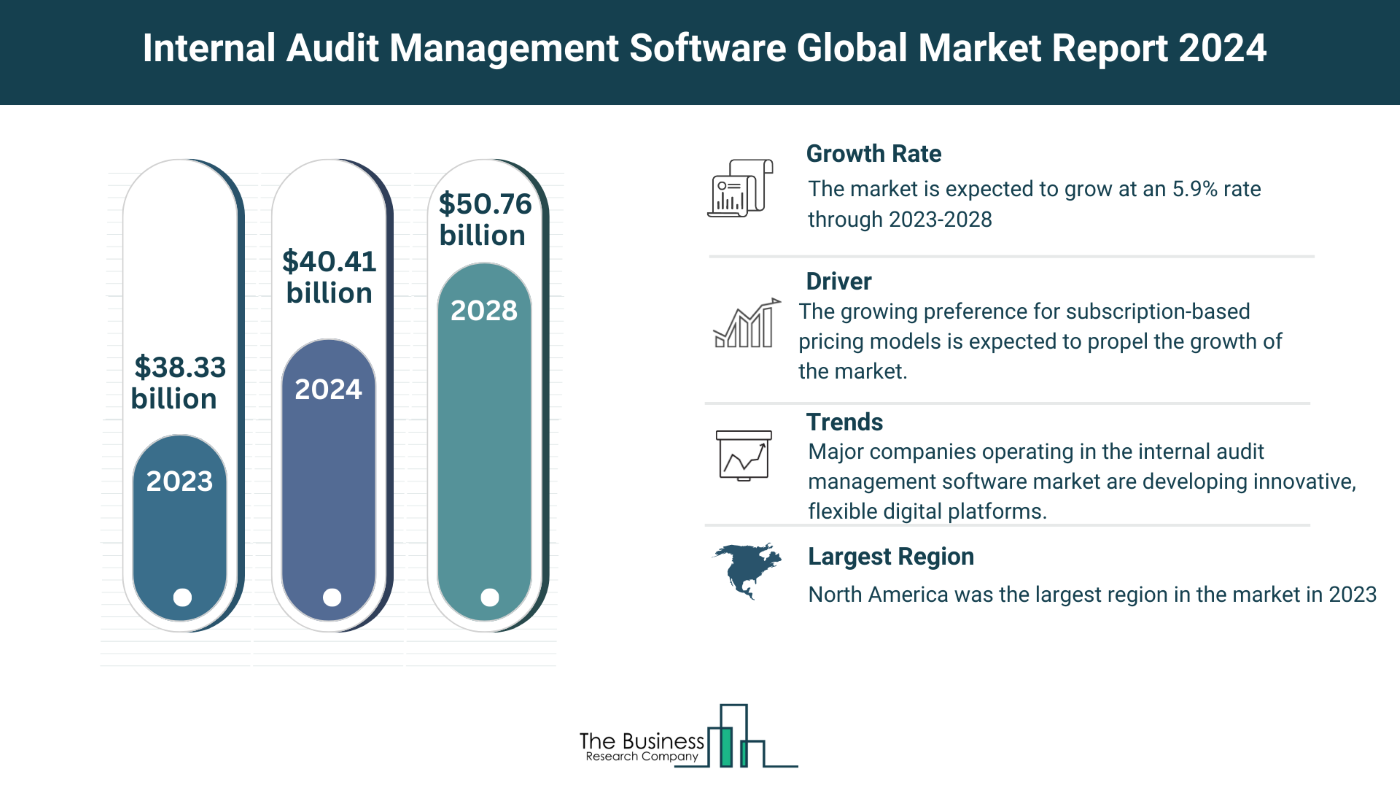

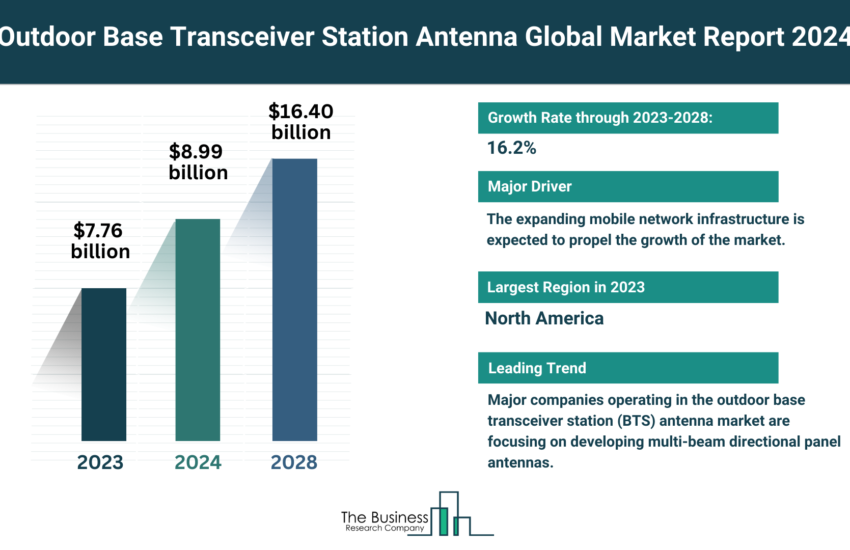

Building the internal-audit function of the future

The primary role of internal-audit (IA) functions is to help decision makers protect organizational assets and reputations, as well as to support operational sustainability—functions that have come under increasing pressure over the past year. With the COVID-19 pandemic leading to a sharp rise in home-based working, asset risks have increased, while a disrupted business environment has fueled uncertainty around reputations and sustainability. Over the coming year, the challenge for IA functions will be to ensure that they continue to provide secure oversight while adapting to a dynamic risk landscape.

In normal times, the IA function focuses on offering assurance around business-process risks and controls. However, as risks have multiplied and become more complex, IA has been required to deliver a wider range of services, often on short notice. In some cases—for example, at financial institutions—IA also has responsibilities around governance, risk appetite, and a risk and control culture that has been under the spotlight in recent years.

The IA remit is not new, per se. What is new is the number of emerging risks that IA must track. These, for example, relate to digital operations in a dispersed working environment, the accelerating pace of business-model change, and the depth of uncertainty in many markets. In this dynamic context, auditors are presented with challenges in three key areas:

- the wholesale shift to remote working, which has implications for assets, governance, and audit coverage because established protocols can’t always be implemented

- new and more severe risks, for example, around information security

- the need for new strategies and processes, including innovative tools and skill sets, due to the impacts of the pandemic

A few businesses started to make preparations ahead of the disruptive wave of the pandemic. But even innovation leaders must recalibrate for a post-COVID-19 environment.

As the risk landscape becomes more complex, the onus is on IA functions to review their current operations—ensuring they are equipped for a working landscape that, in some areas, has seen years of change in just a few months. For a few leading organizations, the recent shake has come as no surprise. These businesses saw the disruptive wave picking up ahead of the pandemic and started to make preparations. However, even innovation leaders need to recalibrate for a post-COVID-19 environment in which we expect to see faster business cycles and increased complexity. For some organizations, particularly financial-services firms, any change will need to be balanced against regulatory mandates. However, the aggregate picture is consistent across the board—an imperative to align with a new normal and unlock more efficient and effective assurance processes.

To manage these challenges and align capabilities with emerging risks, decision makers may take action in three no-regret areas, as outlined below.

Recognize that changing work patterns and economic relocations have created new risks

Remote working, macroeconomic shifts, and structural changes have heightened existing risks and created new ones, for example, relating to remote supervision and training. Audit functions must refocus on areas they may not have considered high risk or on risks they may not have considered at all. In a physically compromised environment, for example, basic control steps such as supervision and segregation of duties may be compromised—especially where they rely on technology work-arounds that preclude physical oversight and inquiry. Remote-technology latency issues, meanwhile, may undermine time-sensitive processes.

Given the impact of the pandemic on work patterns, some audits may require additional rigor. Protocols for information security, for example, traditionally leverage technology controls to prevent improper access. However, these may not sufficiently withstand the demands of remote working. Indeed, new environmental parameters may be necessary. There may also be more prosaic challenges: some staff working from home will share a workspace, presenting additional security concerns.

Given the potentially permanent shift to increased home-based working, IA teams should comprehensively review information-security protocols to ensure they address environmental risks. Additional controls may be required, including attestations that staff are able to secure data, and expanded compliance testing. Since IA often has access to vast stores of confidential data, it should also review its own security procedures, including items such as data-download capabilities and printing regimes.

As well as shoring up databases, audit functions should revisit cybersecurity and the need to protect access to their networks, which may be more prone to attacks in a remote environment—either due to human error or vulnerabilities in systems not designed for remote work. Transactions initiated by clients and customers normally go through multiple oversight routines, including call-back procedures. However, in the current environment, such procedures may be more exposed to risk. Specific to the industrial and operational context, institutions should analyze third-party interactions and consider how they may impact institutions’ risk profiles and control processes.

Finally, IA should work with business lines and second-line functions to review their risk and control matrices, ensuring that new risks are included in taxonomies and checking that existing controls are appropriate and effective.

Leverage advanced analytics to ensure more real-time risk identification and timely update of audit plans and scope

The events of the past year have reinforced the reality that early identification of emerging risks is an essential element in identifying control weaknesses. Leading companies have responded by investing in advanced-analytics techniques. These have enabled audit teams to undertake a broader range of activities with a higher degree of accuracy across risk assessment, audit planning, and execution. They have also helped ensure that the prioritization of audits and scope of testing reflect a highly dynamic environment, both internally and externally.

The goal of audit analytics, however, should not solely be to “automate” audit processes. Instead, firms should reimagine testing concepts to achieve much higher levels of efficiency and effectiveness and sharpen identification of emerging risks. The most valuable use cases are likely to be associated with patterns or risks that were previously undetectable. Artificial intelligence (AI) is particularly well adapted to this kind of application, and can provide the insight required to both launch new audits and reprioritize existing cases.

In one example, a pharmaceutical company modernized its approach to prioritizing clinical sites for audits. The firm developed a machine-learning model that processed multiple signals—including site characteristics (type of site, location, experience), historical performance (previous quality issues, audits), in-trial direct observations (adverse events, deviations), and in-trial secondary signals (data-submission delays, aberrations in dropout rates). The model was trained on historic data, then tailored for the sites/trials in scope. It was then able to more accurately identify potential issues and flag higher-risk sites. The model also informed monitoring frequency at sites in different risk tiers. The results from ongoing audits were used to further improve the model’s predictive power over time.

Many audit functions are currently at the beginning of the journey toward leveraging the full potential of analytics. In many cases these efforts are inhibited by data challenges, including a lack of single, verifiable sources of data (data lakes). Still, short sprints on select use cases can yield powerful results, both in terms of improving the effectiveness of the audit process and making a case for development funding and transformative change.

Enhance execution and accelerate reporting to reflect rapid changes in operating environments

Balancing speed with rigor and comprehensiveness is a perennial challenge. Audit and reporting cycle times are often too long and lack the agility required in a dynamic environment. Audit functions can adapt via new technologies (for example, collaboration tools), increased automation, and enhanced reporting mechanisms. These kinds of solutions can enable faster audit cycles and more timely reporting.

Audit functions that incorporate new technologies and increased automation can enable faster audit cycles and more timely reporting.

Simultaneously, IA teams should ensure they incorporate control monitoring of second-line functions in the scope of scheduled reviews. Testing of second-line monitoring should not replicate second-line functions. Rather, it should ensure that the activity is effective and additive to the control process and is focused on key risks and exposures. Cases where the work is duplicative or ineffectual should be discontinued.

Current audit processes may also lack mechanisms to speedily report key issues to senior management and the audit committee (AC). This is often caused by the “cycle time” in the audit process, which comprises planning, risk assessment, walk-throughs, testing, issue identification, issue agreement and clearance, management responses, and final opinion determination. While middle management will usually discuss issues early in the cycle, reporting to senior management and the AC is often delayed until completion of the process. The cycle often plays out over 90 days or longer—too long in a fast-changing business environment. Reporting is often further set back because of the normal quarterly cycle of AC meetings.

One way to enhance and embed more timely reporting would be through an “internal audit dashboard,” which could be made available to senior management (and potentially AC) on a real-time basis. The dashboard would provide performance metrics based on factors including scope, timing, status, and potential issues, and serve as the basis for a more regular dialogue with senior management.

As we approach the coming year amid significant uncertainty, IA functions are likely to be consumed by near-term COVID-19-related priorities. However, this may also be a good moment for a focused dialogue on potential efficiency initiatives and a plan to recalibrate IA functions for a more uncertain and complex commercial landscape.

Ida Kristensen is a senior partner in McKinsey’s New York office, where Merlina Manocaran is a partner and Haris Usman is an associate partner. Edmond Sannini is a senior adviser in the New Jersey office.

Explore a career with us

Related articles.

A fast-track risk-management transformation to counter the COVID-19 crisis

The neglected art of risk detection

Value and resilience through better risk management

Thank you for visiting nature.com. You are using a browser version with limited support for CSS. To obtain the best experience, we recommend you use a more up to date browser (or turn off compatibility mode in Internet Explorer). In the meantime, to ensure continued support, we are displaying the site without styles and JavaScript.

- View all journals

- My Account Login

- Explore content

- About the journal

- Publish with us

- Sign up for alerts

- Review Article

- Open access

- Published: 11 March 2024

Artificial intelligence and the future of the internal audit function

- Fekadu Agmas Wassie ORCID: orcid.org/0000-0002-6917-4960 1 &

- László Péter Lakatos 2

Humanities and Social Sciences Communications volume 11 , Article number: 386 ( 2024 ) Cite this article

6076 Accesses

1 Altmetric

Metrics details

- Business and management

- Information systems and information technology

Artificial intelligence (AI) can support the company’s internal audit function (IAF) by delivering substantial strategic oversight, minimizing manual procedures, and making possible additional value-added auditing service. Currently, there are research gaps in the literature, such as limited studies on the topic, low AI adoption rates in the IAF across different countries and regions, and a shortage of comprehensive frameworks for effectively using AI in the IAF. Hence, this review work aims to fill the research gap by offering an outline of research avenues on the topic in the literature and suggesting a new compressive framework for the effective use of AI in the IAF. This paper undertakes a systematic literature review (SLR) approach and aspires to highlight the state of research on the use of AI in the IAF, to deliver insight for scholars and industry experts on the issue, and to reveal the implications for IAF of the new AI technology. Moreover, to quickly make artificial intelligence work in internal audit functions, the CACS framework was recommended with attributes such as commitment, access, capability, and skills development (CACS). This work provides significant contributions for guiding future research directions and the development of theoretical foundations for the IAF field. On a practical level, the work will help internal auditors to assess and understand the potential advantages and risks of implementing AI in their organization’s IAF. For regulators, this review should prove useful for updating regulations on internal auditing in the context of using advanced technology such as AI and for ensuring the compliance of internal auditing practices to the evolving technology. Organizations can also benefit from this review to decide whether AI investments in their IAF are justified. This review made an initial extensive SLR on AI use in the IAF as a basis for developing new research avenues in auditing and accounting.

Similar content being viewed by others

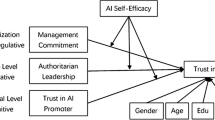

Impact of Artificial Intelligence on HR practices in the UAE

An empirical investigation of trust in AI in a Chinese petrochemical enterprise based on institutional theory

An example of governance for AI in health services from Aotearoa New Zealand

Introduction and motivation.

Business stakeholders want to confirm that organizational management makes proper decisions regarding, such things as risk management, the preservation of transparency, and the regularization of information with appropriate monitoring (Panda & Leepsa, 2017 ). To satisfy those motives, business organizations must have effective governance structures and guidelines. An effective governance structure and guidelines can support the attainment of objectives, the management of risk, and the improvement of corporate governance (Chowdhury, 2021 ). The organization’s corporate governance system depends on the Internal Audit Function (IAF) to deliver an independent opinion, assist with every matter, and encourage and advance improvement and innovation (Tiron-Tudor et al., 2021 ). The contribution of Artificial Intelligence (AI) can be measured by those improvements and innovations (Goertzel, 2014 ) that help organizations to generate substantial competencies.

The introduction of AI holds the promise of delivering substantial improvements in the IAF’s role by empowering the IAF to process dispersed and big data of the company instantly (Ghanoum & Alaba, 2020 ). Instead of only offering assurance on the sample data, with the support of AI, IAF can carry out audits on the total population. An autonomous and objective assurance task which is accessible within the company could then be considered to be an internal audit function (MacRae & Gils, 2014 ). This enhanced capability would deliver increasing satisfaction to the stakeholders regarding company operations and governance which is the responsibility of IAF (Florea & Florea, 2016 ). Governed by the International Professional Practicing Framework (IPPF), the IAF is one of the compulsory components of the Corporate Governance Code, and the Institute of Internal Auditors framework (Ergen, 2019 ). Looking back over the past decade, it is evident that the current audit profession has changed dramatically. Internal auditors need to be even more flexible and remain current with the changing technological environment. The spread of AI technology is highlighting the need for significant improvements in the functionality of IAF (Kozlowski, 2018 ). It is becoming increasingly clear that the aim of IAF needs to be transformed from sample-dependent and compliance audits to more sophisticated, comprehensive, practical, systematized, problem-resolving, predictive, and fraud-discovering audits (Ghanoum & Alaba, 2020 ). As one example, assessing smart controls and delivering advice for their improvement has become a requirements of IAF.

Empirically, the impacts of AI on the effectiveness of IAF have been rarely assessed (Lehner et al., 2023 ). Accordingly, this review may substantiate the literature shortage about AI used in IAF. Considering the overall importance of AI for organizations, the use of AI in IAF is a timely and relevant topic. The paper reviewed articles from the Web of Science (WoS) database that were published between 2019 and 2023. The review found that AI and IAF (separately) are extensively studied areas. However, there are limited studies on the use of AI in the IAF (Couceiro et al., 2020 ; Seethamraju & Hecimovic, 2022 ; Ghanoum & Alaba, 2020 ). Although the concept and application of AI are receiving wide acceptance, they have not yet been applied in some countries. Most studies focus on Australia, China, and Oman (Zhou, 2021 ; Khan et al., 2021 ; Rehmanand & Hashim, 2022 ). Besides, it was found that Asia and Europe are the most studied areas (Lehner et al., 2023 ). The review also revealed that most of the studies used the previously developed and common TOE (Technological Organizational Environmental) framework (Seethamraju & Hecimovic, 2022 ; Chen et al., 2021 ). The review highlights research gaps in the area under study, such as limited studies on the topic and low AI adoption rates in the IAF across different countries and regions. In addition, there is a shortage of comprehensive frameworks for effectively using AI in IAF. Hence, this review work tries to fill the research gap by offering an outline of research avenues on the topic and suggesting a new compressive framework (CACS) for the effective use of AI in the IAF.

Using the systematic literature review (SLR), this paper was designed to fill the research gap through a systematic analysis of research on the use of AI in the IAF. SLR is an appropriate method to deliver critical insight into this area, enabling the expansion of understanding of the use of AI in IAF, attaining an extensive view of the present situation, and looking for future research avenues. A thorough review of the prevailing field of knowledge is vital to highlight a reliable direction for future studies (Massaro et al., 2016 ). Therefore, the objectives of this paper are to identify, assess, and evaluate the present state of research, to give critical insights on the publications made on the issue, and to highlight future research avenues. In this way, the paper aims to expand the understanding of what has been published on the theme and suggest future research areas that can assist organizations in using AI in the IAF.

This review work provides essential contributions in both theoretical and practical aspects. For theory, it highlights the research areas which have not been investigated (research gaps), thus guiding future research directions and the development of theoretical foundations. Moreover, this review contributes to developing a theoretical framework (CACS), assisting stakeholders to understand and conceptualize the use of AI in the IAF, which can be a basis for future investigations. For practice, this review helps internal auditors assess and understand the potential advantages and risks of implementing AI in their organization’s IAF. It also helps internal auditors identify the new skills required to adopt and effectively use AI in their audit tasks, highlighting training and skill development areas. For regulators, this review is helpful for updating regulations on internal auditing in the context of using advanced technology such as AI and for ensuring the compliance of internal auditing practices to the evolving technology. Finally, organizations can benefit from this review to decide whether AI investments for their IAFs are justified. For this reason, the recently introduced CACS framework with four attributes was recommended for implementing AI in the IAF. Thus, organizations can benefit from the framework to quickly implement and utilize AI in their IAF.

In framing the intellectual area of study on the use of AI in the IAF, this review’s research design is based on the procedure necessary to develop the SLR. Accordingly, the research questions in this work are informed by the requisites of the SLR and in the order of the study’s analysis. The current state of research on the use of AI in IAF needs to be explored before developing directions for future research interests:

RQ1 . What is the current state of research on the use of AI in IAF?

RQ2 . What are the future avenues of research on the use of AI in IAF?

The research questions in this review work were developed as applied by Lehner et al. ( 2023 ), Silva et al. ( 2021 ), and Bracci et al. ( 2019 ). Thus, concerning the first research question (RQ1), the review aims to highlight which journals publish the most articles and the most prolific authors. Moreover, studies on the use of AI in the IAF were identified with geographic regions and countries to identify less studied regions. Therefore, in this review, it was also essential to identify the most used research method for the topic and the trends over the years. The second research question (RQ2) aims to provide insight for future research avenues on the use of AI in IAF by revealing the regions, topics, and research methods that have been studied the least. Finally, this review will propose a framework for using AI in the IAF and elaborate the practical implications of this framework.

This review has five sections: literature review, research methods, major results, discussions, and conclusions. The first section provides a brief literature review of the arguments and existing frameworks for using AI in the IAF. The second section details the method applied (SLR) for this review work. The third section presents the major results of the SLR on the use of AI in IAF. Finally, the fourth and fifth sections discuss future avenues of research and a conclusion to summarize the results.

Literature review

Artificial intelligence and internal audit function.

The way of doing business is getting more complex than earlier because of technological advances and real time operation improvements; hence, companies need to employ AI and remain updated every time there are new advances (Libert et al., 2017 ). Nevertheless, because of various barriers related to AI implementation, many companies are not utilizing it (Ammanath et al., 2020 ). Currently, only large companies have easy access to AI. By applying it to their internal audit function, they gain a more competitive advantage.

AI is a mix of software and hardware that performs similarly to the human brain. Based on the available data, it can assess, decide, and perform complex judgment procedures. (Moffitt et al., 2018 ). It analyzes, examines, and processes a considerable amount of data, and uses this data to further refine the algorithm. By combining technical knowledge with interactive interview skills, project management skills, responsive intelligence, and logical thinking, the IAF can support AI in the early data feed (Ghahramani, 2015 ).

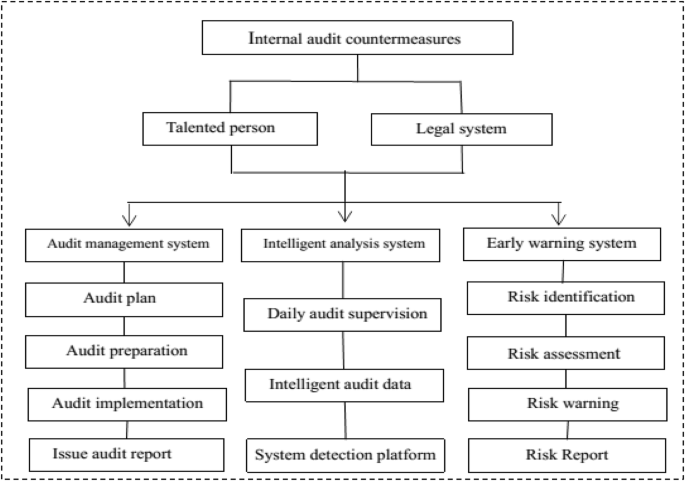

A robust structure of internal audit functions, policies, and guidelines is necessary to gain the full benefit of AI (Rehmanand & Hashim, 2022 ). For organizations have extensive hierarchical data and AI, numerous automated businesses have benefited from their IAF. Here, an essential task of IAF is to audit the gathering, transformation, storage, control, and compliance of automated data to verify the audit requirement for a comprehensive examination and review of the usage of the data. AI also brings new difficulties and needs for the internal audit function of an organization; the resolutions of anomalies is conducted in different ways than the practice before, with AI following a strict procedure (see Fig. 1 ). Thus, the State has to make official and comprehensive regulations and rules to control the legitimacy, characteristics, transformation, and usage of automated data through AI in the IAF in order to offer the legal foundation for the legal improvement of the internal audit function (Zhou, 2021 ).

The figure shows the AI resolution of anomalies in the IAF of the organizations. Source: as applied by Zhou ( 2021 ).

Looking into the future, internal audit, staff will train AI to act without hesitation to peruse circumstances that need an extensive investigation or even forecast when the failed case on control will happen. However, AI could assist the internal audit function in additional ways as well, e.g., considering the role of AI in assessing the quality of data (Puthukulam et al., 2021 ). Improvements in low-cost data storage (like the cloud) have permitted the formation and accumulation of vast amounts of data subject to IAF, thus making tests of the completeness, faithfulness, accuracy, and reliability of the data difficult considering the complete due to the size of the big data. The future AI will be able to constantly manage this data and warn internal auditors in the IAF about the condition of the data being transmitted and stored as well as the prospective fraud and related disclosures (Erb, 2018 ).

The AI’s capability to understand and perform quicker than human beings will make it generally difficult to generate innovative methods of planning and testing controls to assess the effectiveness of AI (Seethamraju & Hecimovic, 2022 ). This circumstance will make it even more essential for consultants to collaborate in order to assist with the challenge of closing the knowledge gap (Erb, 2018 ). As each of the challenges are overcome, AI will positively impact the internal audit function by concurrently discovering risks and examining procedures and control design. The initial implementers of AI in various institutions may not be a cybersecurity section but rather the IAF. Thus, future internal auditors must be considered technical experts responsible for initiating this innovative and astonishing technology (Erb, 2018 ).

Does artificial intelligence replace internal auditors’ jobs?

Many scholars have argued that AI would reduce job opportunities for internal auditors, while others have argued that it is an opportunity for them. According to Mach ( 2022 ), several companies and institutions do not utilize AI in their IAF due to the perception that AI will substitute actual employees. However, the evidence to date is that AI does not replace actual employees. It appears that internal auditors and AI can perform together to improve processes and effectiveness. AI will not replace the auditor’s assessment of interviews, decisions, and judgment. Instead, it improves their performance by providing them with advanced tools and prospective outcomes.

Moreover, according to Muspratt ( 2018 ), although many have thought that AI would terminate internal auditors’ jobs, however the truth is more complex than originally perceived. It turns out that AI helps to develop the market for the work of the internal auditors’ by creating further advantages for workers to emphasize their work’s complex matters that need human involvement. Moreover, AI has proven useful for managing the tedious and routine procedures that frequently take the most working days. Additionally, the paper demonstrates that the AI technology is intended to support creativity and provide assistance, thus allowing internal auditors to be more effective in the tasks that they have been given to perform. Generally, the view is optimistic for AI to become a useful tool for the internal audit profession in the long run. But the development path will not be smooth and occasional troubles can be expected along the way (Q.ai-Contributor-Group, 2022 ).

Conversely, according to Parker ( 2022 ), people-oriented work has diminished in some industries because of capital-oriented advanced technologies. If internal auditors in the IAF in the future do not advance their skills, there is a risk that AI-powered machines could replace their positions. In addition, as one scholar has demonstrated, many people have lost their jobs because AI has replaced almost all routine activities and further tasks with computers and robots. Since it has a high degree of accuracy, almost all companies desire to utilize AI-oriented robots in their IAF. Soon, this challenge will extended to other industries, and the job loss caused by AI will become an existential matter for large classes of workers (Adhikari, 2021 ). Likewise, the health research funding (HRF, 2022 ) has argued that as AI-oriented machines are introduced to accomplish people’s work faster and at lower costs, the level of jobs lost is rise with even the internal audit profession being at risk. Similarly, other scholars have contended that when AI becomes more common in organizations, it could reduce job openings because AI will be able to manage routine activities that previously were performed by employed staff (Tableau, 2021 ; Yakimova, 2020 ).

Generally, the message from the above arguments, is clear: - it is time for internal auditors to use their skills and talents in their jobs. In order to be prepared, it is essential that internal audit professionals remain up-to-date with the AI technology. By familiarizing themselves with this technology, the necessary skills and understanding will be developed. Otherwise, it will be a challenge rather than a prospect for them. In the era of AI, to qualify for work in the internal audit function, a prospective employee will need to understand the technology better, to get proper training, and to acquire the necessary mindset that the use of AI is a competitive advantage.

Theoretical framework

Several explanatory frameworks have been introduced to assess technology adoption and its impact on organizations. According to Sadoughi et al. ( 2019 ) and Rad et al. ( 2018 ), some theories comprise the technology acceptance model, the theory of reasoned action, the innovation diffusion theory, the diffusion of innovation model, and the theory of planned behavior. Above all, two well-known models were developed to measure the applicability of technologies in organizations. Those technology adoption models are the Unified Theory of Acceptance and Use of Technology (UTAUT) model and the Technological, Organizational, and Environmental (TOE) framework.

The UTAUT framework was developed by Venkatesh et al. ( 2003 ). The model was developed to identify the common factors impacting users while undertaking technology adoption selection through various domains. The model established four significant factors that directly impact technology adoption intention and usage (performance expectancy, effort expectancy, social influence, and facilitating conditions).

The TOE framework is the combination and extension of the innovation diffusion theory (IDT) and technology acceptance model (TAM) (Hossain & Quaddus, 2011 ). In reaction to the criticisms and gaps in the diffusion of innovation (DOI) model in presenting the predictors of technology and innovation adoption at the institutional level and emphasizing the significance of circumstantial constructs in the adoption procedure, Tornatzky and Fleischer ( 1990 ) introduced the TOE framework. In the framework, technology adoption in organizations is projected by three symbiotic components: organizational features, external environment, and technological features (Tornatzky & Fleischer, 1990 ).

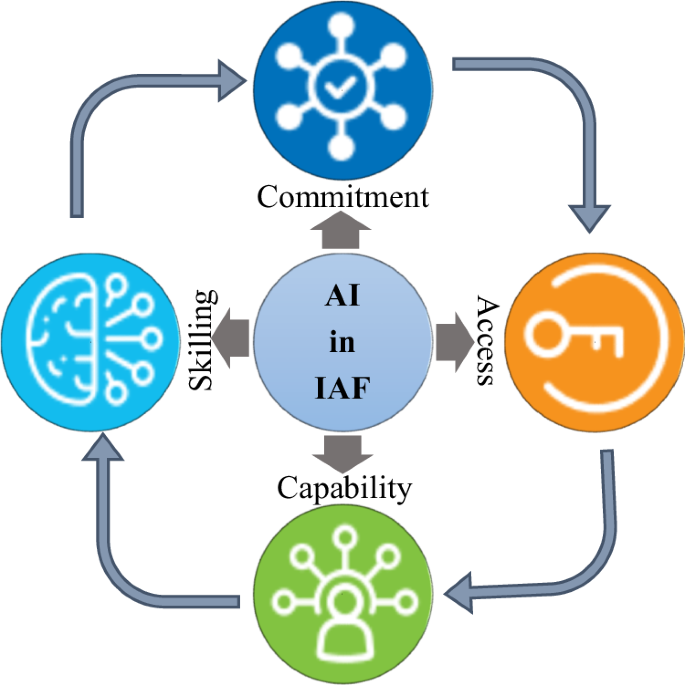

The CACS framework (commitment, access, capability, and skilling) was recently introduced by MetricStream (2020) and has also proven to be valuable in this review work. The framework was proposed explicitly for AI utilization in audit activities, it is also an alternative technology adoption framework. Since this framework was recently developed and takes into consideration the current technological changes and the concepts contained in previous theoretical frameworks, this review will suggest that companies implement it and that researchers consider it for use in their studies. The framework will be elaborated in the later section of the paper.

Research method

This part presents the methods used in this review to highlight the existing scholarly literature on the use of AI in IAF, explicitly using the systematic literature review (SLR). SLR is an organized and comprehensive study method that involves gathering, critically assessing, and integrating the prevailing academic literature on a particular topic or research question (Massaro et al., 2016 ). On a specific subject matter, it aims to deliver objective and evidence-based highlights of the existing state of knowledge. According to Massaro et al. ( 2016 ), the SLR is a method complementary to a traditional literature review. The SLR method is vital for providing existing insights, critical views, and future research interests in emerging fields like AI in IAF. Massaro et al. ( 2016 ) also state that the SLR pursues to sustain replicability using a straightforward search and sampling strategy that document the data analysis and evaluation steps that were used. Applying the SLR method includes a step-by-step plan to identify the scholarly literature, as Massaro et al. ( 2016 ) suggested. Overall, this review aims to attain insights into the emerging research field of AI use in IAF and to understand future avenues of research in the field.

Database, search, and sampling strategy

Keyword search is more appropriate for an emerging field like a review work targeted to study AI use in IAF (Massaro et al., 2016 ). A similar approach was applied to sampling sources for two reasons. First, the joint use of AI in IAF has been highlighted recently in a limited number of journals. However, individually (AI and IAF), large body of publications across academic disciplines for a substantial amount of time was evident. Second, with AI use for IAF research, publications have expanded in numerous academic fields of interest (Lehner et al., 2023 ).

Moreover, published work quality is guaranteed through a peer-review process, the most accepted approach. Due to these reasons and to ensure the study’s replicability, published works from recognized databases were considered for the primary analysis. Web of Science (WoS) is one of the most extensive databases comprising thousands of high-quality journals in arts and humanities, social sciences, and natural sciences. Using the database will allow all quality and reliable research undertaken in the study area to be considered for this work since it is a prominent source for books, articles, reviews, and conferences. In addition, government reports, websites, and blogs were used to support and demonstrate the primary analysis results. Government reports are helpful while making a study by providing authoritative and official data and insights on policy implications. Websites were also used to highlight current and up-to-date information and diverse perspectives on the topic (since the topic is volatile). Moreover, blogs were used to get insights from subject matter expertize and timely discussions on the topic (Wilson et al., 2015 ).

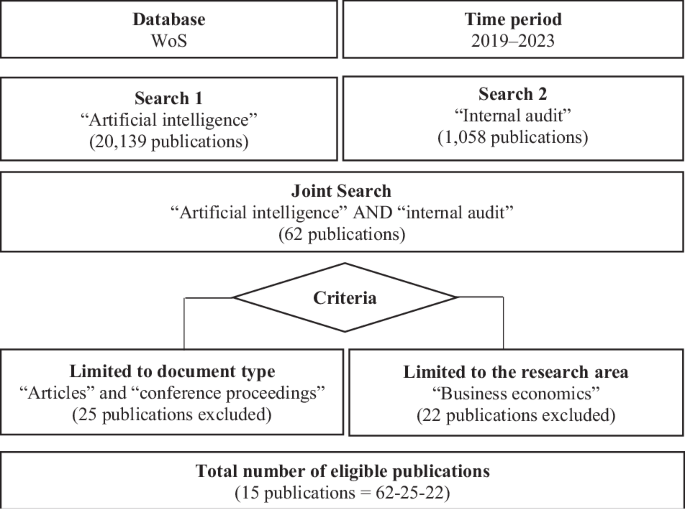

In three steps, the study undertakes the search and sampling process. The summary of the search and sampling process is presented in Fig. 2 . First, a keyword search for “artificial intelligence” and “internal audit” was executed. In the database (WoS), the filled “Topic” was used to perform the search, including title, abstract, and indexed publication keywords. Publications made from 2019 to 2023 (period) were considered to get insights on the quickly changing technological advancements (AI) and their use in organizations (IAF). As shown in Fig. 2 , the separate unrestricted search results were 20,139 and 1058 publications for the keywords “artificial intelligence” and “internal audit”, respectively, from 2019 to 2021. Second, a joint search was executed using both keywords “artificial intelligence” AND “internal audit”, resulting in 62 publications (only 0.3% of the total publication). Footnote 1 This result supports the literature (Lehner et al., 2023 ), concluding that there are limited investigations made on the use of AI in IAF.

The figure shows the summary of the search and sampling process of the review. Note. As applied by Silva et al. ( 2021 ).

Third, restriction criteria were applied to filter out the relevant publications on the topic (since the WoS has wide-ranging journals in numerous disciplines). The restrictions are the document type (only articles and conference proceedings included) and research areas (business economics). Articles are the best categories for a review highlighting empirical insights (Lehner et al., 2023 ). Similarly, considering the suggestion of Massaro et al. ( 2016 ), conference proceedings are also included to capture future research insights. The research area restriction limited the search to business economics. The database (WoS) has one research area, “Business Economics”, relevant to this review. After applying both restriction criteria, the joint search (“artificial intelligence” AND “internal audit”) results in 15 publications, which are the sample units for this review (see Fig. 2 ). Footnote 2 Notably, 13 research articles and two conference proceedings were considered out of this paper’s total selected publications (15). Then, all essential information (relevant to evaluate the output) of the selected publications was downloaded, such as publication year, author(s), document title, abstract, keywords, source title and type, and document type.

Analytical framework

The necessary step of SLR before data analysis is to outline the units of analysis included in the selected analytical framework. This study used the outlines and units of analysis as suggested by Massaro et al. ( 2016 ) and applied by studies like Bracci et al. ( 2019 ). Hence, this study addressed these units in three analysis clusters to comprehensively view the scholarly literature on AI use in IAF (addressing the first research question (RQ1)).

Firstly, the relevance and novelty of selected publications on the topic were identified, measured by citation analysis and frequency distribution of publications per year. The review observed that not all publications have a similar impact on the field, confirming the argument of Massaro et al. ( 2016 ).

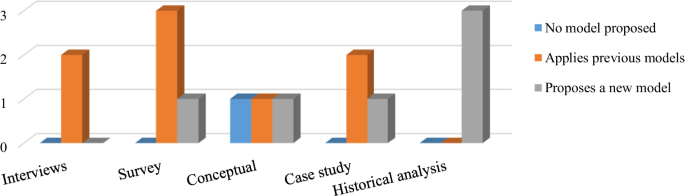

Second, the review targeted the assessment of the research method of the publications encompassed in the sample since evaluating how the theory is used in the studies is necessary. Specifically, as applied by Bracci et al. ( 2019 ), the study assessed the theoretical contribution provided by the study in three different sets: no framework was proposed, applying a previous framework and proposing a new framework.. The review also assessed how the theoretical contribution linked to the research method applied (interviews, historical analysis, case study, survey, and conceptual analysis). This analysis is used as a proxy for evaluating theoretical superiority and methodology fit within the research area (use of AI in IAF) (Bracci et al., 2019 ).

Finally, the research context considered in each selected publication was assessed since it previews the publications in time and location. It offers a way to forward suggestions on how AI in IAF research can be furthered (which also answers the second research question (RQ2)) through assessing the link with theory, enlarging geographical coverage, or undertaking comparative investigations. Table 1 shows the summary of the sampled publications used for this review and a detailed analysis to be covered in the latter sections of this paper.

Main results

Research area– identifying the research novelty in time on the use of ai in iaf.

As more and more journals continue to accept theoretical outcomes of articles published in this area, the research area’s continuity and novelty will be confirmed. Table 2 shows the journals with sampled publications regarding the use of AI in IAF. Moreover, as Massaro et al. ( 2016 ) stated, field-level relevance is shown through the journal’s impact factor. The review found that the International Journal of Accounting Information Systems (with a 1.159 impact factor) has published the most by contributing 2 (13.29%) publications. Footnote 3 Considering the impact factor (based on Scimago Journal Rank (SJR) 2022), the Accounting, Auditing & Accountability Journal (with 1.729 impact factor) was found to be the second most published journal, contributing one article. Moreover, Minds and Machines (with a 1.232 impact factor) and the Australian Journal of Management (with a 1.132 impact factor) followed the third and fourth journals by contributing one article each. The result shows that publications are made in journals relevant to the topic (journals focusing on auditing and information systems).

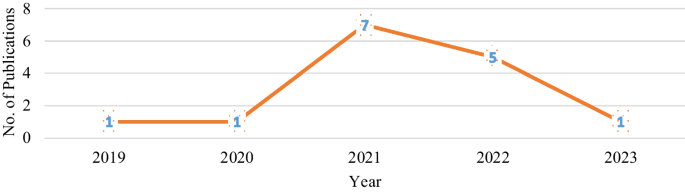

In the sampled periods, the review found that the topic shows a substantial increment of publications in auditing and information technology research. The trend/distribution of sampled publications from 2019 to 2023 is presented in Fig. 3 . It shows that in 2019 and 2020, the topic did not get substantial attention since only two publications (one publication for each year) were made. Surprisingly, in 2021 and 2022, the topic became more visible and contributed to 12 publications. In 2023, until this review was done, only one publication was found, and this may be due to the year not ending yet. However, the increment of publication over time varies significantly from year to year.

The figure shows the trend of sampled publications from 2019 to 2023.

The five most cited publications in the sample are presented in Table 3 (all self-citations were removed). This analysis helps us understand the publication’s importance (Massaro et al., 2016 ). In the database (WoS), the most cited publication in the sample is the one contributed by Mokander et al. ( 2021 ), having 11 citations Footnote 4 , followed by Jans and Hosseinpour ( 2019 ), with 10 citations. Three of the most cited papers were published in 2021. Except for the study made by Jans and Hosseinpour ( 2019 ), the other most cited studies used previous frameworks.

Research methods– emerging theoretical superiority

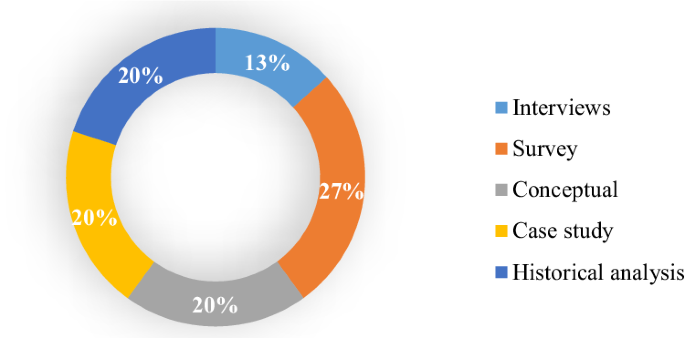

The distribution of sampled publications per research method used is presented in Fig. 4 . The criteria to classify the research methods were used as applied by Bracci et al. ( 2019 ). Those methods include interviews, surveys, conceptual studies, case studies, and historical analysis. The result shows that most publications tend to be classified as surveys (27%). Hence, much of the research area is enriched with empirical evidence. Three methods with similar scores (20% each) were utilized in the study: conceptual, case study, and historical analysis. However, the review found that most studies were explanatory, indicating the need to study the research area further. Moreover, the result shows that it was easy to transform the concepts of the topic into variables, allowing us to undertake quantitative analysis (through a survey). The publications that applied conceptual methods used a qualitative approach to argue and debate the subject matter.

The figure shows the distribution of sampled publications per research method used.

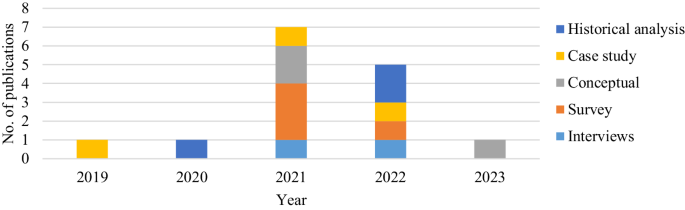

The trends of the methods adopted over time are presented in Fig. 5 . This work recognized substantial phenomena from the trend. First, the review observed using different research methods during the peak periods (2021 and 2022). Four different methods were used during those periods. Moreover, most of the studies were empirical from the peak period publications. They indicate that the authors contribute substantial empirical insights for applying frameworks for using AI in the IAF (to real-world contexts). However, the limited publications made as conceptual work indicate that AI use in the IAF still needs more theory development and shared views (in definitions). The result confirms that a survey was the most adopted research method, as shown in Fig. 5 .

The figure shows the trends of the methods adopted over time in the selected publications.

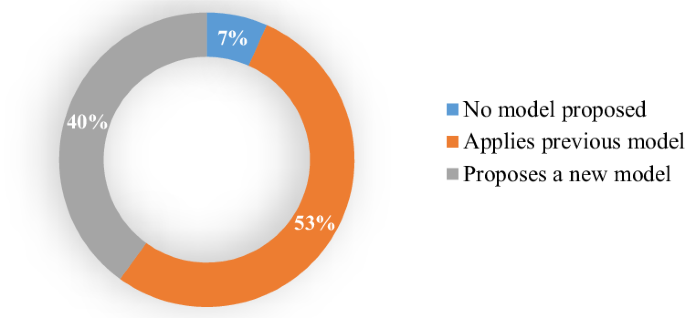

Regarding the theoretical framework related to the use of IA in the IAF, the theoretical contribution of the studies in the sample was assessed (see Fig. 6 ). As studies introduce new frameworks, it may confirm the research topic’s novelty and an emerging interest in the subject area. Similarly, applying the existing frameworks reflects the effort needed for the replicability and continuity of contributions on the topic (Lehner et al., 2023 ; Massaro et al., 2016 ). Both approaches are vital in further identifying the emerging state of theory and development of AI in the IAF (Lehner et al., 2023 ). Considering the recent and quickly changing technological advancement, this work expects a heterogeneous distribution of frameworks.

The figure shows the distribution of the theoretical frameworks used in the selected publications.

The review found that most studies (53%) included in the sample used previous frameworks to study the topic (see Fig. 6 ). The technological–organisational–environment (TOE) was the most utilized framework in the selected studies. For instance, the study of Seethamraju and Hecimovic ( 2022 ) used the framework to study AI adoption in auditing. They conclude that AI can enhance audit quality and provide value-adding services to the organization. However, the AI adoption needs to reconsider the audit practice with the expected lack of control in AI ‘black-box’, which may be exposed to extensive examination of the audit quality.

In contrast, only one study did not use any specific framework, representing 7% of the publications selected for this review. In addition, 40% of the sampled studies proposed new models to use AI in the IAF. Fortunately, these studies addressed the topic by investigating the adoption and use of AI in the IAF (Chen et al., 2021 ; Korol et al., 2022 ). Other authors also offered new insights on the use of AI in the IAF by pursuing to resolve the complexity of AI use holistically.

The relation between the research method and the framework used by the sampled publications is presented in Fig. 7 . It shows the relevance and expansion of methods on the topic. In the interview category, the two studies used the previous frameworks.

The figure shows the relation between the research method and the theoretical framework applied in the sampled publications.

Moreover, three studies used the previous frameworks in the survey category, while one proposed a new one. Likewise, three publications were found in the conceptual category with no model, used previous frameworks, and proposed a new model (separately). Two studies used the previous frameworks in the case study category, while one proposed a new one. Finally, all three studies proposed new frameworks in the historical analysis category. The results indicate the quantitative nature of the research on the topic, and the area still needs further theoretical debate. In this review, it is also important to note that the interview is not a widely used research method.

Research context– placing publications in time and location

The distribution of sampled publications per location (country and region) is presented in Table 4 . This analysis is essential to get insight into the locations studied in the literature and identify the areas yet to be explored, thus assisting in identifying future research avenues (Massaro et al., 2016 ). This review analyses the location in two categories: country and region. Considering the country, most of the studies are located in Australia, representing 20 per cent of the sample, followed by China and Oman with the same score (13.32%). Considering the region, Asia and Europe have the most studies, representing 33.33 per cent of the sample. Australia was the second region, constituting 20% of the sampled articles. However, North America and South America are the least studied regions, each only contributing 7% of the publications. The review observed two phenomena from the results. First, the selected studies considered single-country cases, indicating no comparative analysis was made (between cases from two or more countries). A comparative analysis is vital for the topic (AI in the IAF) to measure and conceptualize it in diverse contexts. Second, most of the studies on the topic were conducted in developed countries and regions, indicating the shortage of research in other contexts. This phenomenon confirms the study of Allbabidi ( 2021 ), who stated that most of the studies on adopting and using AI for auditing are undertaken in developed countries. Thus, studies must further investigate the topic in developing countries and regions (e.g. Africa).

Discussion: future research avenues

This review generally highlights that, as a research field, the use of AI in the IAF has yet to reach a substantial level of consideration. The analysis reveals that there is a fluctuating contribution of publications per year. It shows that in 2019 and 2020, the topic did not get substantial attention, and in 2021 and 2022, the topic became more visible, contributing to most of the publications (12 articles). The limited number of publications may initiate debate on the relevance of the research interest in using AI in IAF. This review also found that 40% of sampled studies proposed new models to use AI in the IAF, and they investigated the adoption and use of AI in the IAF (Chen et al., 2021 ; Zhang et al., 2022 ).

The analysis demonstrated that the publications contribute to understanding AI’s concepts, definition, and operation in different applications. Nevertheless, in an IAF context, the review revealed a lack of in-depth studies and fewer attempts to bring existing theories to AI implementation and auditing. The finding signals that additional investigations must be undertaken, although methodological and theoretical risks are expected. Future researchers can contribute to the field by conceptualizing the topic and use of AI in the IAF and investigating how to implement AI in the IAF. Moreover, they may contribute to how to measure the implementation level from theoretical and practical backgrounds. Research attention in such queries initiates insights built on the use of AI in the IAF topics and main arguments: How can AI contribute to developing IAF? What are the benefits, and how does AI affect the decision processes of IAF and policymakers? Similarly, how is AI affected by auditing concepts?

From the review, it was evident that several scholars believe that utilizing AI in the IAF will minimize human errors and provide efficiency. For instance, using AI for the organizational process minimizes human errors, assists the decision-making process, and provides more advantages for the company (Parker, 2022 ; Q.ai-Contributor-Group, 2022 ; Adhikari, 2021 ; Tableau, 2021 ; Opr, 2020 ; Couceiro et al., 2020 ). With the assistance of AI, judgements in IAF are made from the earlier information collected through employing a definite mix of algorithms—subsequently, a significant likelihood of attaining accuracy to a greater extent of precision. Puthukulam et al. ( 2021 ) demonstrated ample usage of big data and analytics in the IAF of large companies. The robotics of IAF and the utilization of AI could get forward actionable predictions that could assist internal auditors in making the correct insights. AI could assist the IAF in auditing tasks efficiently and effectively (Muspratt, 2018 ; Seethamraju & Hecimovic, 2022 ).

Although AI creates opportunities for researchers on how to use it in the IAF and how it progresses the efficiency of IAF, it is also relevant to investigate the dark side of using AI. For example, in the application of AI technology, it is possible to experience information loss or damage for many reasons, such as (but not limited to) machine impairments or Cyber-attacks (HRF, 2022 ). Other scholars argue that AI’s implementation and maintenance cost is another challenge (Edmondson, 2020 ). Such views call for additional investigations on the potential use of AI in the IAF.

Methodologically, researchers may undertake comprehensive studies on how the use of AI in the IAF is conceptualized and may introduce new models for its measurement and application. In this context, this review finds that many researchers (Chen et al., 2021 ; Jans & Hosseinpour, 2019 ; Xavier et al., 2022 ; Westland, 2020 ; Zhou, 2021 ; Korol et al., 2022 ) tried to study the topic by introducing new models. The efforts of those researchers encouraged other scholars to contribute new insights into the theoretical frameworks in the field. In addition, it was found that measuring the use of AI in the IAF was not complex. Most studies in this review applied the survey method, indicating that quantitative approaches are the most utilized. However, the limited publications made as conceptual work indicate that AI use in the IAF still needs more theory development and shared views (in definitions).

Considering the locations in previous publications, this review found that no study was undertaken considering two country cases (comparative analysis). Moreover, it was found that most studies undertaken on the topic are based in developed countries, confirming Allbabidi’s ( 2021 ) study. In those circumstances, future researchers can contribute by undertaking comparative analysis and covering different locations, especially developing regions (like Africa) and countries.

Overall, there are limited studies on the use of AI in the IAF (Couceiro et al., 2020 ; Seethamraju & Hecimovic, 2022 ; Ghanoum & Alaba, 2020 ). Although the concept and application of AI are getting wide acceptance, they have not yet been applied in some countries. Most studies are in Australia, China, and Oman (Zhou, 2021 ; Khan et al., 2021 ; Rehmanand & Hashim, 2022 ). Besides, it was found that Asia and Europe are the most studied areas (Lehner et al., 2023 ). The review also revealed that most of the studies used the previously developed and common framework, which is technological–organizational–environmental (TOE) (Seethamraju & Hecimovic, 2022 ; Chen et al., 2021 ). The review highlights research gaps in the area under study, such as limited studies on the topic and low AI adoption rates in the IAF across different countries and regions. Besides, there is a shortage of comprehensive frameworks for effectively using AI in IAF. Hence, this review work tries to fill the research gap by offering an outline of research avenues on the literature topic and suggesting a new compressive framework (CACS) for the effective use of AI in the IAF.

Accordingly, considering the review, this study suggests that future researchers can use and validate the newly introduced commitment, access, capability, and skilling (CACS) framework, which is a wide-ranging step in this direction (Metricstream, 2020 ). AI could let organizations and their internal audit functions grow quicker due to the difficulties of data analysis and management of risk. The journey of AI can be accelerated with the help of IAF, given the CACS framework displayed in Fig. 8 . Implementing the suggested CACS could be the turning point for internal audit, letting people move away and creating a method for AI to evaluate the big and disorganized data.

The figure shows the commitment, access, capability, and skilling (CACS) framework for AI utilization in the IAF. Source: as suggested by MetricStream ( 2020 ).

Using the CACS framework (Fig. 8 ), the advanced audit performance needs commitment and specific focus. The first step in the path of a technology-oriented mindset is the acceptance and recognition of innovative technologies to assist IAF (Khan et al., 2021 ; Zhou, 2021 ). The values of AI would be better recognized when there is an organizational commitment to discovering sections of IAF that could be brought under the fold of robotics. Moreover, cracking complex data sets using analytics could protect multimillion dollars (Metricstream, 2020 ).

Access is the second critical attribute for the effective utilization of AI in the IAF. Internal auditors face many difficulties, and one of the main challenges is related to access; this is because, in some periods, the process holders are open to allowing them in, and in others, they are not. This practice is a custom or association matter rather than a technological issue; however, it is very relevant for using AI in IAF (Seethamraju & Hecimovic, 2022 ). Access to the operating system that processes and analyses owners is undoubtedly an obstacle to internal auditors, which they have to pass before they begin the path to utilize intelligent technology, which is for monitoring continuously (Metricstream, 2020 ).

The other critical attribute essential for any IAF to utilize AI is system capabilities, as it is where the data reliability initiative commences. The exclusive feature of data storage and analysis begins with knowing the system’s capability (Rehmanand & Hashim, 2022 ). In addition to AI’s assessment of the performance of control systems and examination of financial or information systems in the IAF, the essential point is understanding how big data will be handled and processed in the system. For having and telling a material story, there should be the capability of IAF to join the data spots (Metricstream, 2020 ).

Finally, the successful utilization of AI in the IAF of a company is highly dependent on skilling. Providing training and development for internal auditors is critical since, from a firm viewpoint, it is essential to discover where employees with the necessary skills are seated in the internal audit team and then put them together for fair resource allocation (Nonnenmacher et al., 2021 ). In time, this could be a challenge since there might be associates in the audit group or team who started working when the technology was less used in their tasks. Making them acquire a technological mindset or training them might be difficult. The key is optional to hire new staff but rather leverage the prevailing talent (Metricstream, 2020 ). In general, the four attributes are essential for implementing and utilizing AI in the IAF of an organization. One of the targets of this paper is to provide the practical implication and applicability of the subject matter. Thus, companies need to use those attributes in the framework to quickly implement and utilize AI in their IAF.

Conclusion and practical implication

A strong structure of internal audit functions, policies, and guidelines is necessary to gain the opportunities of AI. AI can support the company’s internal audit function by delivering substantial strategic oversight, minimizing analysis based on manual procedures, and offering additional wide-ranging audits. The way of doing business is getting more complex than earlier, and it is because of the advances in technology and instant improvements in the manner of operations; hence, companies need to employ AI and update themselves continuously.

The present research on the use of AI in the IAF is in its emerging state. This review finds that many researchers tried to study the topic by introducing new models. The efforts of those researchers encouraged other scholars to contribute new insights into the theoretical frameworks in the field. However, there is a shortage of comprehensive frameworks for the use of AI in the IAF. In addition, it was found that measuring the use of AI in the IAF was not complex. Most studies in this review applied the survey method, indicating that quantitative approaches are the most utilized. However, the limited publications made as conceptual work indicate that AI use in the IAF still needs more theory development and shared views (in definitions). Besides, the review found that no study was undertaken considering two country cases (comparative analysis). Moreover, it was found that most studies undertaken on the topic are based in developed countries. Hence, future researchers can contribute by undertaking comparative analysis and covering different locations, especially developing regions (like Africa) and countries.

The findings of this review provide relevant theoretical and practical contributions for different stakeholders, including internal auditors, regulators, organizations, researchers, and the whole business community. Regarding theory, this review offers a comprehensive highlight of the prevailing research, contributing to formulating and arranging knowledge on the deeper understanding of how AI affects the IAF. Besides, it highlights the research areas that lack investigations (research gaps), guiding future research directions and theoretical foundations. Moreover, this review contributes to developing a theoretical framework (CACS), assisting stakeholders to understand and conceptualize the use of AI in the IAF, and can be a basis for future investigations.

Regarding practice, this review helps internal auditors assess and understand the potential advantages and risks of implementing AI in their organization’s IAF. It also helps internal auditors identify the new skills required to adopt and effectively use AI in their audit tasks, highlighting training and skill development areas. Besides, this review is helpful to regulators in updating regulations on internal auditing in the context of using advanced technology such as AI, ensuring the compliance of internal auditing practices to the evolving technology. Finally, organizations can benefit from this review to decide whether AI investments for their IAFs are justified. Considering the value of utilizing AI in the IAF of an organization, companies need to utilize AI and make it work in the IAF efficiently. For this reason, the recently introduced CACS framework with four attributes was recommended for implementing AI in the IAF. Thus, organizations can benefit from the framework to quickly implement and utilize AI in their IAF.

This review has some limitations, such as the data set used in the database (Web of Science), is limited to the selected keywords, and only includes research articles and conference papers. Although the researcher was aware of this limitation, it was believed that the Web of Science lets more replicable inquiries (a vital aspect of a systematic literature review). Moreover, the results are limited to the extent and depth of the data analyzed. Nevertheless, the reliability of the findings is ensured by the systematic literature review approach, yet the interpretations of the results are contingent on the beliefs and understanding of the researcher.

Data availability

Data sharing does not apply to this article as no datasets were generated or analyzed during the current study.

The refined Web of Science research string is documented as follows: Artificial intelligence (Topic) and internal audit (Topic) and Preprint Citation Index (Exclude – Database) and 2019 or 2020 or 2021 or 2022 or 2023 (Publication Years).

The refined Web of Science research string is documented as follows: Artificial intelligence (Topic) and internal audit (Topic) and Preprint Citation Index (Exclude – Database) and 2019 or 2020 or 2021 or 2022 or 2023 (Publication Years) and Article or Early Access (Document Types) and Business Economics (Research Areas).

For additional information: https://www.sciencedirect.com/journal/international-journal-of-accounting-information-systems .

Web of Science journal citation report 2023, for additional information: https://www.webofscience.com/wos/alldb/full-record/WOS:000714864800001 .

Adhikari I (2021) Eleven pros and cons of artificial intelligence. https://www.honestproscons.com . Accessed 21 Jan 2023

Allbabidi MH (2021) Hype or hope: digital technologies in auditing process. Asian J Bus Acc 14(1):59–85. https://doi.org/10.22452/ajba.vol14no1.3

Article Google Scholar

Ammanath B, Hupfer S, Jarvis D (2020) Thriving in the era of pervasive AI. https://deloitte.wsj.com . Accessed 25 Jan 2023

Bracci E, Papi L, Bigoni M, Gagliardo ED, Bruns H-J (2019) Public value and public sector accounting research: a structured literature review. J Public Budg 31(1):103–136. https://doi.org/10.1108/JPBAFM-07-2018-0077

Chen F-H, Hsu M-F, Huawei K-H (2021) Enterprise’s internal control for knowledge discovery in a big data environment by an integrated hybrid model. Inf Technol Manag 23:213–231. https://doi.org/10.1007/s10799-021-00342-8

Chowdhury EK (eds.) (2021) The essentials of machine learning in finance and accounting: prospects and challenges of using artificial intelligence in the audit process. Taylor and Francis Inc, London. https://www.taylorfrancis.com

Couceiro B, Pedrosa I, Marini A (2020) State of the art of artificial intelligence in internal audit context. Proceedings of the 15th Iberian Conference on Information Systems and Technologies, Seville, Spain. https://doi.org/10.23919/CISTI49556.2020.9140863

Edmondson J (2020) Risks and challenges of artificial intelligence for business. https://www.businesstechweekly.com . Accessed 6 Feb 2023

Erb D (2018) Artificial intelligence and the future of internal audit. https://www.berrydunn.com . Accessed 12 Apr 2023

Ergen M (2019) What is artificial intelligence? Technical considerations and future perception. Anatol J Cardiol 22(2):5–7. https://doi.org/10.14744/AnatolJCardiol.2019.79091