Researched by Consultants from Top-Tier Management Companies

Powerpoint Templates

Icon Bundle

Kpi Dashboard

Professional

Business Plans

Swot Analysis

Gantt Chart

Business Proposal

Marketing Plan

Project Management

Business Case

Business Model

Cyber Security

Business PPT

Digital Marketing

Digital Transformation

Human Resources

Product Management

Artificial Intelligence

Company Profile

Acknowledgement PPT

PPT Presentation

Reports Brochures

One Page Pitch

Interview PPT

All Categories

[Updated 2023] Top 20 Oil and Gas PPT Templates to Keep your Industry Up and Running!

![oil and gas presentation topics [Updated 2023] Top 20 Oil and Gas PPT Templates to Keep your Industry Up and Running!](https://www.slideteam.net/wp/wp-content/uploads/2020/03/Banner-22-1001x436.png)

Gunjan Gupta

The oil and gas industry is the largest sector in terms of dollar value as it produces energy for several other automated activities. The extraction and refining of these two natural resources pave the way to the generation of a long list of petroleum products like fuel, gasoline, plastics, asphalt, pharmaceuticals, and others. This industry is also a significant contributor to the GDP (gross domestic product) of many nations, hence, it is a crucial element in the global economy’s framework.

Investors and individuals looking to enter this field can be quickly overwhelmed by the million possibilities, complex jargon and unique metrics used throughout the sector. To help you cope with this issue, we have come up with 20 pre-designed oil and gas PPT templates. These templates have been designed to help anyone understand and present the fundamentals of the oil and gas industry comprehensively. Also, use these templates to explain the key concepts as well as standards of measurement in front of the senior decision-makers and close more deals.

Let us dive in!

Oil and Gas PPT templates to Download

Template 1: Oil and gas industry outlook case competition PowerPoint presentation slides

Gas and oil companies have always been the most successful businesses in the world. If you are running an oil company, this template is the right fit for you. This PPT Deck provides top-of-the-line slides to measure up your company against the competition and help you explain the fundamental process of importing and export of crude oil with ease. Apart from this, you can also utilize this template to present some facts and figures in front of your stakeholders, thus showing the overall positioning and profits of your organization.

Download Oil And Gas Industry Outlook Case Competition

Template 2: Coronavirus impact assessment and mitigation strategies in the oil and gas industry complete deck

More than 90% of the vehicles in the world run on oil. Also, a majority of our daily needs are dependent on oil, be it traveling, fulfillment of energy requirements or use of various substances. Therefore, a content-ready PPT template about the impact COVID-19 had on the oil and gas industry is really helpful. This PPT slide can help you deliver the assessment of the damage caused and present the strategies to mitigate it to your stakeholders. Moreover, you can edit this slide any which way, to suit your personal needs as it is fully customizable.

Download Coronavirus impact assessment and mitigation

Template 3: Covid business survive adapt and post recovery for oil and gas industry complete deck

Other than food and water the most commonly used resource is oil and just like every other business, COVID shook the pil and gas business hard. Present information about the strategies to survive, adapt and recover after being hit by the Covid-19 policies worldwide. Apart from this, you can use this as an introductory slide to give a brief overview of your oil and gas refinery undertakings.

Download Covid business survive adapt and post recovery

Template 4: Oil and gas refinery in working

This template can serve as a blueprint to explain the working of any oil and gas refinery with ease. Fit for every industrialist, this template will help you design a great presentation with ease whether it is academic, business-oriented or related to environmental issues. You can also use this template to showcase the steps of protecting this natural energy resource from depletion. Energy conservation pointers can also be comprehensively explained by including this slide into the work culture.

Template 5: Oil rig drilling machine with locations

You can use this template for any small scale or large scale industry depending upon your requirement. This template is built keeping into consideration the needs and requirements of the user and so it is fully responsive and editable. It can be adopted by oil and gas companies looking to expand their horizon and establish trust and loyalty in their audience.

Download Oil Rig Drilling Machine With Locations

Template 6: Oil and gas rig in the middle of the sea

Oil governs modern economies nowadays and is used to manufacture many other products like ink, perfumes, plastic, medicine, dyes, running cars and airplanes. If you require delivering a presentation on oil, global warming, renewable sources, energy conservation, etc. then this template is an ideal set for you. Download, make the changes and deliver your presentation with full confidence and agility.

Template 7: Oil and gas rig image

Use this Oil and Gas Rig extraction PPT template to create professional presentations effortlessly. With various editable layouts and design elements, this template will prove to be a great choice for anybody designing presentations related to subsoil, rig, pie, petroleum, extraction of oil and similar other topics. You can easily download this template and enhance your overall productivity with it.

Download Oil And Gas Rig Image

Template 8: Oil and gas factory image with smoke

Utilize this oil and gas factory PowerPoint template to create impressive presentations whether they are business-oriented or academic. You can also showcase the mechanism and operational efficiency of oil and gas factories with this resourceful slide. The environmental hazards of this factory can also be displayed with this editable layout. With custom-made design elements, this PPT is a great choice for topics like energy conservation, environment, building, smoke, pollution, and others of the lot.

Download Oil And Gas Factory Image With Smoke

Template 9: Oil and gas rig with flames from the chimney

Explain the offshore drilling structures and their types using this template. Showcase the entire mechanism of an offshore drilling system visually with this attractive layout. The upstream and downstream process of the reservoir and drilling process can also be elucidated using this slide, the content of which can be altered as per your individual requirements. This template is a good start to save, lots of time, energy and money as it is pre-designed and intuitively created. So, download it now to get started.

Download Oil And Gas Rig With Flames From Chimney

Template 10: Oil and gas filling station

Fuel is an important source to keep our transportation up and running. Use this oil and gas filling PPT template to showcase various stations in the city. Map out the various oil and gas filling stations for the customers’ ease and comfort with this editable layout. You can also use this slide to demonstrate the structure of a gas filling station and explain its entire mechanism to your audience.

Download Oil And Gas Filling Station

Template 11: Oil and gas extractor icon with pump and meter

This template is a perfect set for industrial groups or organizations, manufacturing companies, steel, engineering, gas, petroleum amongst others. Petrol pumps can use this icon template to demonstrate the process of filling the vehicles and inspire trust in the customers. Apart from this, it can also be used to showcase your licensed petrol pump and its overall functioning to the government officials.

Download Oil And Gas Extractor Icon With Pump And Meter

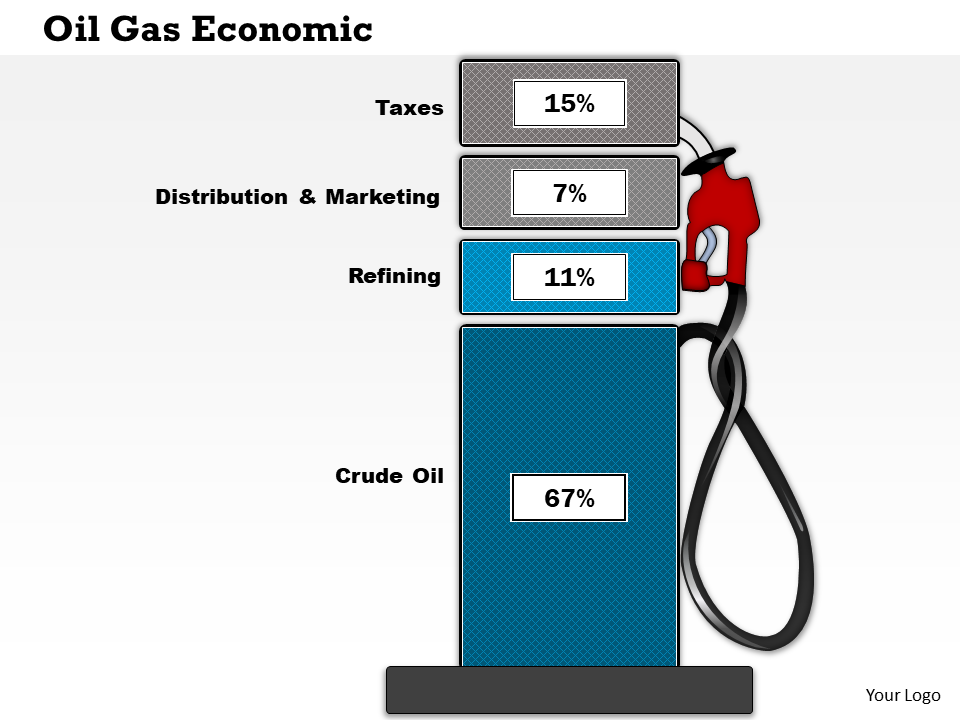

Template 12: Oil gas economic PowerPoint presentation slide template

This template is designed for all the gasoline stands selling petrol and eco-friendly fuel. You can also use this template to explain the various types of services offered by your gas filling station be it full service, minimum service or self-service depending upon the business dwellings. Additionally, present your fuel quotations in this template that are susceptible to changes. Since this template can be edited and customized it is fit for all your industrial dwellings. Engage your audience with this gas filling station PPT slide which can be incorporated in any business presentation.

Download Oil Gas Economic PowerPoint Presentation Slide Template

Template 13: Mining oil and gas extraction KPI dashboard showing steam to oil ratio and oil reserves

Oil and gas companies require a large amount of data to make better data-driven decisions. This template can prove to be very useful in providing insights related to oil and gas reserves, extraction units, revenue generation, oil production, etc. It can also help you understand both internal and external factors such as gas price volatility, changes in taxation, regulation, rise in alternative energy resources and others. Since the design of this slide is fully responsive, you can alter it as per your business needs.

Download Mining Oil And Gas Extraction KPI Dashboard Showing Steam To Oil Ratio And Oil Reserves

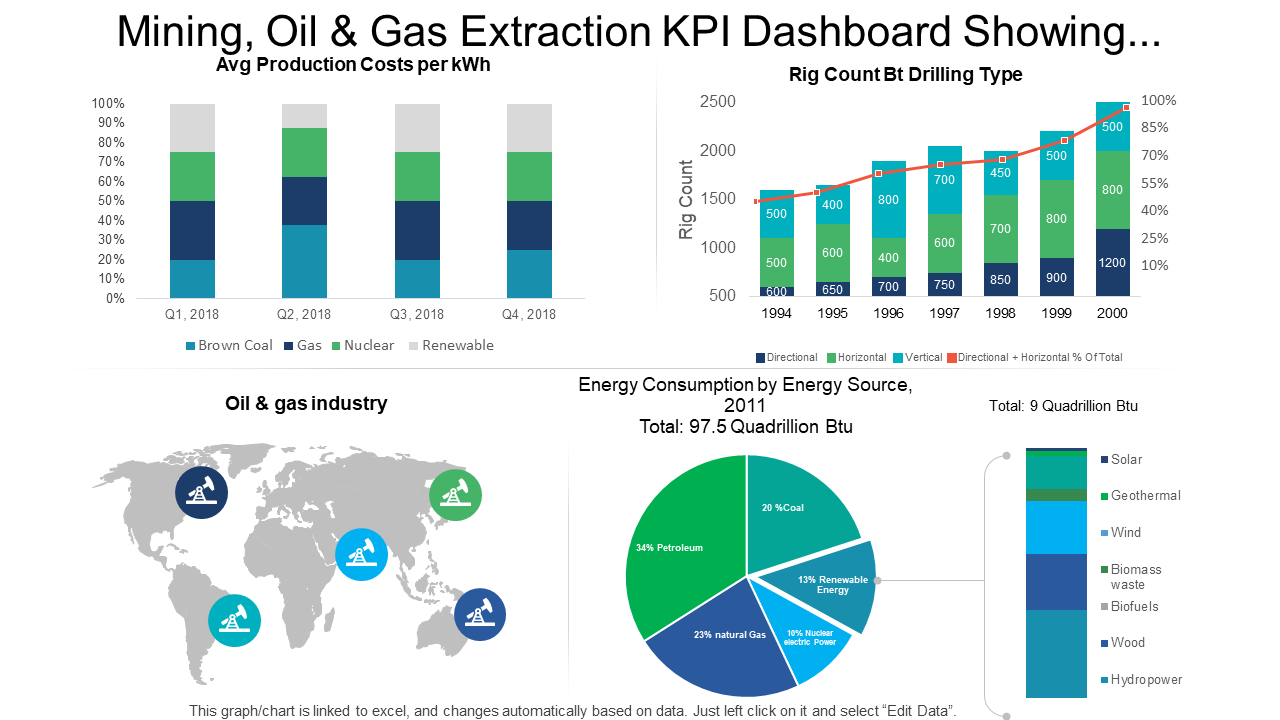

Template 14: Mining oil and gas extraction KPI dashboard showing average production costs and energy consumption

Oil and gas companies need to track large amounts of data and often in real time. Monitoring several different areas can be quite overwhelming, thus we have designed this mining oil and gas extraction dashboard PPT for you. Use this slide to evaluate key metrics like production cost, energy consumption, and other similar ones at one single place. Since this template is so responsive to all your needs and requirements it will help you meet your goals very easily.

Download Mining Oil And Gas Extraction KPI Dashboard

Template 15: Huge offshore oil drilling rig

Offshore structures are used across the globe for a variety of functions and water depths. Present a general overview of all the aspects of offshore drilling including right planning, transportation, fabrication, installation, commissioning of petroleum platforms and others using this fully resourceful template. You can also explain the basic fundamentals of the types of offshore structures, with this editable layout.

Download Huge Offshore Oil Drilling Rig

Template 16: Offshore oil rig drilling platform

Use this template to discuss the three primary types of offshore oil rigs. This template can also be useful to show the locations of various oil rigs and their mechanism to your workforce. Since, offshore drilling poses a lot of environmental challenges, you can use this template to present an overview of all of them to create awareness. This is a very intuitively designed template, so you can alter all its elements to make it fit your business.

Download Offshore Oil Rig Drilling Platform

Template 17: Oil rig central processing platform

Use this template to introduce upstream and downstream offshore drilling facilities like exploration, appraisal, development, and others. This PPT slide can be used to explain the complex structure of an oil rig and its subtypes depending upon the needs of the user. It also comes in an editable format, so you can make changes as and when necessary to suit your personal needs.

Download Oil Rig Central Processing Platform

Template 18: Supply vessel leaving oil rig

You can incorporate this template in your business and academic presentations to showcase the various tasks of a supply vessel in the supply chain. Elaborate more on the offshore supply vessel sizes and their uses in various activities with this fully responsive layout. Explaining multiple concepts is far easier with this pre-designed template as it has a very attractive layout, perfect to grab the immediate attention of the audience.

Download Supply Vessel Leaving Oil Rig

Template 19: Six oil and gas icons with flames and fuel drop

Just like any other industry, the oil and gas industry also has a few icons that can help you showcase different factors. In this template, we have included 6 icons symbolic of various factors. You can either use these icons separately to display various determinants or use them with one-other to explain various concepts with ease. Since these icons are fully editable, you can change all the elements whether that is color, font, shape, size, and others as deemed fit.

Download Six Oil And Gas Icons With Flames And Fuel Drop

Template 20: Evening view of oil producing rig

Showcase the process of exploring, extracting, storing and processing petroleum with this oil rig PPT template. Present an overview of the offshore drilling challenges and their impact on the environment by employing this fully editable slide. You can either use this PPT layout in conjunction with your business and academic presentations or present it as it is depending upon your needs.

Download Evening View Of Oil Producing Rig

Now that you have gone through our best oil and gas templates, all that’s left for you is to download and watch them give a boost to your business!

What are oil and gas?

Oil and gas are natural resources that are extracted from the Earth's subsurface. Oil is a liquid hydrocarbon that is commonly used as fuel for transportation, heating, and electricity generation. It is also used to produce a variety of petrochemical products, including plastics, lubricants, and fertilizers. Gas, on the other hand, is primarily composed of methane and is often used as fuel for heating and cooking. It can also be used to generate electricity and is an important feedstock for the production of petrochemicals. Oil and gas exploration and production are complex processes that involve drilling wells, extracting the resources, and transporting them to processing facilities or end-users. The oil and gas industry is a crucial component of the global economy, providing jobs, energy, and raw materials for a wide range of industries.

What are the 3 stages of oil and gas?

The three stages of oil and gas are exploration, production, and refining:

- Exploration: In this stage, geologists and geophysicists study the Earth's subsurface to identify potential oil and gas deposits. This involves analyzing rock formations, seismic data, and other geological information to locate areas where oil and gas may be present. Once a potential site is identified, exploratory drilling is carried out to confirm the presence and quantity of oil and gas reserves.

- Production: Once an oil or gas deposit is discovered and confirmed, the production stage begins. This involves drilling wells and extracting resources from the ground. The extracted oil and gas are then transported to processing facilities, where they are separated and refined into different products.

- Refining: The refining stage involves processing crude oil into a range of products, including gasoline, diesel fuel, and other petrochemicals. The refining process involves distillation, where crude oil is heated and separated into different components based on their boiling points. These components are then further processed and blended to create the final products that are used in various industries, including transportation, manufacturing, and agriculture.

What are the different types of oil & gas?

There are several different types of oil and gas, each with its own unique properties and characteristics. Here are some of the most common types:

- Crude oil: This is the most commonly known type of oil and is a liquid hydrocarbon that is extracted from underground reservoirs. Crude oil is a mixture of different hydrocarbons and may contain impurities such as sulfur.

- Natural gas: This is a naturally occurring gas made up primarily of methane, although it may also contain other hydrocarbons such as ethane, propane, and butane. Natural gas is often found alongside oil deposits and can be extracted from underground reservoirs or from shale rock formations through hydraulic fracturing.

- Liquefied petroleum gas (LPG): LPG is a mixture of propane and butane gases that are liquefied through compression. It is often used as a fuel for heating and cooking in homes and businesses.

- Gasoline: Gasoline is a refined product of crude oil and is used primarily as a fuel for transportation. It is a volatile, highly flammable liquid that is blended with other additives to improve its performance.

- Diesel fuel: Diesel fuel is also a refined product of crude oil and is used as fuel for heavy-duty vehicles and equipment. It has a higher energy density than gasoline and is often used in applications that require more power and torque.

- Jet fuel: Jet fuel is a specialized type of kerosene that is used to power jet engines in airplanes. It is a highly refined product of crude oil and must meet strict specifications for quality and performance.

Related posts:

- Top 25 Music PowerPoint Templates To Uplift the Soul

- [Updated 2023] Top 10 Business Strategy Google Slides Templates To Empower Your Team

- Top 10 Free Business Google Slides Templates for Entrepreneurs

- Top 25 Janitorial and Cleaning Services Proposal Templates for Clients

Liked this blog? Please recommend us

Top 35 Jigsaw Puzzles PowerPoint Templates To Spice Up Your Lectures!!

Top 25 Travel, Transportation and Logistics PowerPoint Templates to Keep your Boat Afloat!

![oil and gas presentation topics [Updated 2023] 30 Best Digital Marketing Strategy and Planning PowerPoint Templates to Exceed your Marketing Goals](https://www.slideteam.net/wp/wp-content/uploads/2020/03/Banner-13-335x146.png)

[Updated 2023] 30 Best Digital Marketing Strategy and Planning PowerPoint Templates to Exceed your Marketing Goals

Top 25 Food & Agriculture PowerPoint Templates to Create Delicious Looking Presentations

4 thoughts on “[updated 2023] top 20 oil and gas ppt templates to keep your industry up and running”.

This form is protected by reCAPTCHA - the Google Privacy Policy and Terms of Service apply.

Digital revolution powerpoint presentation slides

Sales funnel results presentation layouts

3d men joinning circular jigsaw puzzles ppt graphics icons

Business Strategic Planning Template For Organizations Powerpoint Presentation Slides

Future plan powerpoint template slide

Project Management Team Powerpoint Presentation Slides

Brand marketing powerpoint presentation slides

Launching a new service powerpoint presentation with slides go to market

Agenda powerpoint slide show

Four key metrics donut chart with percentage

Engineering and technology ppt inspiration example introduction continuous process improvement

Meet our team representing in circular format

Oil And Gas Pitch Deck Presentation Guide 2024 Insights | Template, Framework

February 20, 2024

Presentation and Pitch Expert. Ex Advertising.

$100mill In Funding. Bald Since 2010.

Welcome, ladies and gentlemen, to the “Crude Genius: The Oil and Gas Pitch Deck Guide” – where I’ll help you strike black gold in the world of investor presentations.

As I dive into this exhilarating adventure, brace yourselves for a wild ride through the ups and downs of this fossil fuel rollercoaster.

I’m bringing you a pitch deck guide that’ll make your competitors gasp in envy and your investors spill their coffee with excitement.

I’m Viktor, a pitch deck expert , and a presentation specialist . Over the past 13 years, I’ve helped businesses secure millions in funding and new business, and today, I’m here to guide you through the greasy world of building an oil and gas pitch deck.

It’s like building an oil rig, but without the oil and the rig.

So fasten your seatbelts, oil tycoons-in-training, and get ready for an adventure that’s gonna make you yell, “Houston, we have funding!”

Let’s drill, baby, drill!

Book a free personalized pitch deck consultation and save over 20 hours of your time.

Join hundreds of successful entrepreneurs who’ve transformed their pitch decks with my help.

Let me develop an investor ready deck by using my hands-off approach, which includes: market research, copy, design, financials, narrative and strategy.

One week turnaround time.

The least you will get is 10 actionable tips & strategies to own that next presentation, worth $599, for free.

9. Marketing and Sales Strategy

14. contact information, thank you / contact information, risk mitigation and contingencies, actionable steps for incorporating sustainability into your pitch deck, actionable steps for incorporating technological innovations into your pitch deck, actionable steps for incorporating financial modeling into your pitch deck, actionable steps for addressing regulatory compliance in your pitch deck, actionable steps for incorporating market analysis into your pitch deck, actionable steps for incorporating risk management into your pitch deck, actionable steps for incorporating energy transition into your pitch deck, actionable steps for incorporating engagement into your pitch deck, actionable steps for incorporating emerging markets into your pitch deck, actionable steps for incorporating case studies into your pitch deck, 7. mock news report on future success, can i publish my oil and gas pitch deck presentation on my website or social media, what is an oil and gas pitch deck.

An oil and gas pitch deck is a concise and visually appealing presentation that serves as a persuasive tool to attract investors, partners, or stakeholders in the oil and gas industry. It is typically used by companies seeking funding for exploration, production, or other ventures related to the oil and gas sector.

The pitch deck distills complex information about the company’s operations, financials, market analysis, growth strategy, and competitive advantages into a compelling narrative. It highlights the unique value proposition, potential returns on investment, and the overall viability of the project.

An effective oil and gas pitch deck includes key elements such as an engaging executive summary, a clear problem statement, a robust market analysis, a comprehensive overview of the project or company, a detailed financial plan, and a compelling call to action.

It should be concise, visually appealing, and designed to captivate the audience while conveying the business’s potential for success in the oil and gas industry.

H ow important is it to have a great oil and gas pitch deck when asking for funding?

Having a great oil and gas pitch deck is crucial when seeking funding for several reasons.

Let’s delve into some research to highlight the importance of a compelling pitch deck in the context of fundraising within the oil and gas industry.

- Captivating Investor Attention: According to a study conducted by DocSend, investors spend an average of just 3 minutes and 44 seconds reviewing a pitch deck . Thus, a well-crafted and visually engaging pitch deck becomes essential to capture and retain investor attention within this limited timeframe.

- First Impression Matters: Research from the Journal of Business Venturing suggests that investors form their initial impression of a pitch within the first 60 seconds. A strong pitch deck can effectively communicate the company’s value proposition, competitive advantage, and growth potential, making a positive impact right from the start.

- Differentiation and Competition: The oil and gas industry is highly competitive, with numerous projects vying for limited funding. A compelling pitch deck that clearly articulates the project’s unique value proposition, innovative approaches, and market differentiators can help set it apart from the competition, increasing the chances of securing funding.

- Confidence and Credibility: A well-prepared pitch deck demonstrates professionalism, preparedness, and a deep understanding of the market and industry dynamics. Research by Harvard Business School suggests that confidence and credibility play significant roles in investor decision-making, making a strong pitch deck essential for instilling trust and belief in the project’s potential.

- Information Retention: Studies have shown that visual aids significantly improve information retention. A visually appealing pitch deck with well-organized information, charts, and graphics can enhance the audience’s comprehension and memory of key details about the project, increasing the likelihood of generating investor interest and follow-up discussions.

In summary, a compelling oil and gas pitch deck is vital for capturing investor attention, making a strong first impression, differentiating from competitors, building confidence and credibility, and enhancing information retention.

By investing time and effort into crafting a great pitch deck, companies increase their chances of securing the funding needed to drive their oil and gas ventures forward.

What Does An Oil and Gas Pitch Deck Include?

An oil and gas pitch deck typically includes the following key components:

- Executive Summary: A concise overview of the project or company, highlighting its unique value proposition, market potential, and investment opportunity.

- Problem Statement: Clearly define the problem or opportunity in the oil and gas industry that the project aims to address, emphasizing the market need or gap.

- Market Analysis: Provide a comprehensive analysis of the target market, including market size, growth trends, competitive landscape, and potential risks or challenges. Use data, charts, and visuals to support your analysis.

- Business Overview: Present a detailed description of the project or company, including its mission, vision, goals, and core operations. Highlight any proprietary technologies, strategic partnerships, or competitive advantages that set you apart.

- Technical Overview: If applicable, provide technical details about the project, such as exploration methods, extraction techniques, or production processes. Explain any innovative or environmentally friendly aspects.

- Financials : Present financial information, including revenue projections, cost structures, profit margins, and return on investment potential. Include key financial metrics, such as net present value (NPV) and internal rate of return (IRR), to demonstrate financial viability.

- Growth Strategy: Outline your growth plan, including expansion opportunities, geographic targets, and marketing strategies. Emphasize how you plan to scale the project and achieve market dominance.

- Team and Advisors: Introduce the key members of the management team, highlighting their expertise, relevant experience, and track record. Mention any notable advisors or industry experts supporting the project.

- Milestones and Roadmap: Present a timeline of key milestones and deliverables, illustrating the project’s progression and expected outcomes. This helps demonstrate a clear path to success and provides investors with a sense of project management.

- Investment Proposal: Clearly state your funding requirements, specifying the amount sought, the equity or debt structure, and the proposed use of funds. Include a compelling call to action for investors to participate in the opportunity.

Remember, the content and structure of a pitch deck can vary depending on the specific project and target audience. It’s essential to customize the pitch deck to align with the investor’s interests, needs, and investment criteria.

10 Tips To Help You Create an Oil and Gas Pitch Deck Presentation

Creating an effective oil and gas pitch deck presentation requires careful planning, research, and attention to detail. Here’s a step-by-step guide to help you create a compelling pitch deck:

- Understand Your Audience: Research and identify the target investors or stakeholders who will be reviewing your pitch deck. Understand their interests, investment preferences, and any specific criteria they may have. Tailor your presentation to align with their needs.

- Define Your Key Messages: Clearly articulate the unique value proposition of your oil and gas project. Identify the most important messages you want to convey to your audience, such as the problem you’re solving, the market opportunity, and the potential returns on investment.

- Structure Your Presentation: Organize your pitch deck into logical sections, including the executive summary, problem statement, market analysis, business overview, financials, growth strategy, team, milestones, and investment proposal. Ensure a smooth flow and coherent narrative.

- Use Engaging Visuals: Incorporate visually appealing graphics, charts, and images to enhance comprehension and engagement. Visuals should support your key points and data, making complex information more accessible and memorable.

- Keep it Concise: Limit the content on each slide to the essential information. Use bullet points, short sentences, and clear headings to convey your message efficiently. Avoid overcrowding slides with excessive text or cluttered visuals.

- Communicate the Market Opportunity: Provide a thorough analysis of the oil and gas market, including size, trends, and competitive landscape. Highlight the market need or gap that your project addresses and demonstrate its growth potential.

- Showcase Your Team: Introduce your management team and key personnel, emphasizing their expertise, relevant experience, and achievements. Investors want to see a capable and committed team that can execute the project successfully.

- Quantify Financial Projections: Present realistic and well-supported financial projections, including revenue forecasts, cost structures, and profitability metrics. Use graphs or charts to illustrate the financial performance over time.

- Highlight Competitive Advantages: Clearly articulate your project’s competitive advantages, whether it’s unique technology, strategic partnerships, cost efficiencies, or regulatory advantages. Explain how these factors differentiate your project from competitors.

- Practice and Refine: Practice your pitch deck presentation to ensure a smooth delivery and effective communication. Seek feedback from trusted advisors or colleagues and refine your pitch deck based on their input.

Remember, a pitch deck should be concise, compelling, and visually appealing. It should tell a persuasive story about your oil and gas project, focusing on the value proposition, market opportunity, financial viability, and team capabilities. Tailor the presentation to the specific needs and interests of your target audience, and continuously refine and update the pitch deck as needed.

The Exact Oil and Gas Pitch Deck Slide Structure You Can Steal And Use

While the specific slide structure may vary depending on your project and target audience, here is a suggested outline for an oil and gas pitch deck that you can customize and use as a starting point:

1. Title Slide

- Company name/logo

- Presentation title

- Date

2. Executive Summary

- Brief overview of the project

- Key value proposition

- Investment opportunity

3. Problem Statement

- Clearly define the problem or market opportunity

- Explain the pain points or challenges in the oil and gas industry

4. Market Analysis:

- Market size and growth potential

- Competitive landscape

- Key market trends and dynamics

5. Solution/Technology

- Describe your project or technology

- Explain how it addresses the problem or market need

- Highlight any innovative or unique aspects

6. Business Model

- Revenue streams and pricing strategy

- Distribution channels

- Key partnerships or collaborations

7. Competitive Advantage

- Identify and articulate your project’s competitive advantages

- Highlight what sets you apart from competitors

- Explain any barriers to entry or intellectual property protection

8. Financials

- Revenue projections and growth trajectory

- Cost structure and profitability analysis

- Funding requirements and use of funds

- Target market segments

- Customer acquisition and retention strategies

- Marketing and sales channels

10. Team and Advisors

- Introduce key members of the management team

- Highlight their relevant experience and expertise

- Mention any notable advisors or industry experts

11. Milestones and Roadmap

- Present a timeline of key milestones and deliverables

- Outline the project’s development stages

- Highlight achievements to date

12. Risks and Mitigation

- Identify potential risks and challenges

- Discuss strategies to mitigate or overcome them

- Show that you have considered and planned for potential obstacles

13. Investment Proposal

- Specify the funding amount sought

- Describe the equity or debt structure

- Outline the expected returns on investment

- Provide contact details for further inquiries

- Include website, email, and phone number

Remember to customize each slide with relevant content, compelling visuals, and concise text. Use charts, graphs, and images to support your key points and make the presentation visually engaging. Adapt the slide structure based on the specific needs and preferences of your target audience.

For more guidance, check out my upstream company pitch deck outline and my oil and gas verticals pitch deck outline .

Get Your Copy Of My Pitch Deck Template That Helped Clients Get Millions In Funding

To attract the attention of potential buyers and investors in the oil and gas industry, it’s crucial to have a well-crafted pitch deck that effectively communicates your product or service. While there are ready-made templates available on platforms like Canva, Slidesgo, and Google Slides, they may not align perfectly with your brand. This means you’ll need to invest significant time and effort in customizing them to fit your brand guidelines.

However, there’s a more efficient solution.

By using a custom-written template, you can save time and create a pitch deck that perfectly reflects your brand identity. I have helped my clients develop exceptional oil and gas pitch decks using this approach, enabling them to secure impressive funding, deals, and investments.

If you’re seeking a streamlined method for creating a pitch deck tailored to your oil and gas business, feel free to reach out and access the template structure that has already proven successful for others.

The importance of understanding your audience when creating an oil and gas pitch deck

Understanding your audience is crucial when creating an oil and gas pitch deck for several reasons:

- Relevance : Tailoring your pitch deck to your specific audience ensures that the content and messaging resonate with them. By understanding their interests, preferences, and investment criteria, you can align your presentation to address their specific needs. This increases the chances of capturing their attention and generating interest in your project.

- Customization: Different investors or stakeholders may have varying levels of familiarity with the oil and gas industry. By understanding your audience, you can customize your pitch deck to match their level of knowledge and expertise. This allows you to strike the right balance between providing necessary background information and diving into more technical or industry-specific details.

- Value Proposition: Knowing your audience enables you to emphasize the aspects of your project that are most important to them. Whether it’s financial returns, environmental sustainability, technological innovation, or social impact, understanding your audience helps you highlight the specific value proposition that aligns with their interests. This increases the likelihood of capturing their attention and generating a positive response.

- Communication Style: Different investors or stakeholders may have varying preferences when it comes to communication style and presentation format. Some may prefer concise, data-driven slides, while others may appreciate a more narrative-driven approach. By understanding your audience, you can adapt your communication style to resonate with them, increasing the effectiveness of your pitch deck.

- Overcoming Objections: Understanding your audience allows you to anticipate and address potential objections or concerns they may have. By addressing their specific pain points, risks, or challenges, you can proactively provide solutions or mitigations, demonstrating your preparedness and credibility. This can help overcome skepticism and build trust with your audience.

- Investor-Project Fit: Not every investor or stakeholder will be the right fit for your project. Understanding your audience helps you identify those who align with your project’s goals, values, and investment criteria. By targeting the right audience, you increase the chances of finding investors who are genuinely interested in and supportive of your oil and gas venture.

This personalized approach increases the effectiveness of your pitch deck and enhances your chances of securing funding or support for your venture.

Why is it important to craft a compelling story when creating an oil and gas pitch deck?

Crafting a compelling story within your oil and gas pitch deck is essential for several reasons:

- Emotional Connection: Humans are wired to respond to narratives and storytelling. By presenting your oil and gas project as a compelling story, you engage your audience on an emotional level. This emotional connection can make your pitch deck more memorable, impactful, and persuasive.

- Capturing Attention: In a competitive landscape, capturing and maintaining your audience’s attention is crucial. A well-crafted story within your pitch deck helps grab attention from the start and keeps your audience engaged throughout the presentation. It sets the stage for the information you’re presenting and makes it more compelling and relatable.

- Communicating Complex Ideas: Oil and gas projects often involve technical or complex concepts. A story-driven approach helps simplify and communicate these ideas effectively. By presenting information in a narrative format, you can make it more accessible, relatable, and easier to understand for your audience.

- Creating a Memorable Experience: A compelling story has the power to leave a lasting impact on your audience. By structuring your pitch deck as a narrative, you create a memorable experience that sticks in the minds of investors. This can significantly increase the chances of them remembering your project and recalling its key points.

- Differentiation : In the oil and gas industry, where numerous projects are vying for attention, a compelling story helps differentiate your project from the rest. It allows you to showcase your project’s unique value proposition, vision, and mission in a way that stands out. This differentiation can make your project more appealing and memorable to potential investors.

- Engendering Trust and Confidence: A well-crafted story demonstrates your understanding of the industry, the problem you’re solving, and your ability to execute the project. It builds trust and confidence in your capabilities and vision. When investors connect with your story, they are more likely to trust you with their investment and feel confident in your ability to deliver results.

- Call to Action: A compelling story naturally leads to a clear call to action. By guiding your audience through a narrative journey, you can create a sense of urgency and excitement that motivates them to take the desired action, whether it’s investing in your project, partnering with you, or supporting your venture in some way.

To help you improve your narrative, check this selection on the best books for pitching . The authors have won billions in $ thanks to their ability to create stories when pitching and are sharing their methods with you.

In summary, crafting a compelling story within your oil and gas pitch deck helps you capture attention, communicate complex ideas, create a memorable experience, differentiate your project, build trust and confidence, and drive a clear call to action.

By leveraging the power of storytelling, you can make your pitch deck more engaging, persuasive, and effective in securing support and funding for your oil and gas venture.

How important are design and visuals when creating an oil and gas pitch deck?

Design and visuals play a crucial role in creating an impactful and engaging oil and gas pitch deck. Here’s why they are important:

- Capturing Attention: In a world filled with information overload, a visually appealing pitch deck stands out and captures the attention of investors. Well-designed slides with eye-catching visuals and aesthetics create a positive first impression and make your presentation more memorable.

- Enhancing Comprehension: Visual elements such as charts, graphs, infographics, and images can help simplify complex data and concepts. They make it easier for investors to understand key information and insights quickly. Visuals can enhance comprehension, especially for non-technical investors who may not be familiar with the intricacies of the oil and gas industry.

- Conveying Information Efficiently: Design elements such as fonts, colors, and layout can be used strategically to guide the audience’s focus and highlight key points. Visuals can help communicate information more efficiently than lengthy paragraphs of text, enabling you to convey your message effectively within a limited timeframe.

- Creating a Professional Image: A well-designed pitch deck gives the impression of professionalism, attention to detail, and preparedness. It reflects positively on your project and instills confidence in potential investors. Design elements can help establish your brand identity and create a consistent visual representation of your project.

- Increasing Memorability: Visuals have a stronger impact on memory retention than text alone. Incorporating memorable visuals can help your audience remember key information from your pitch deck long after the presentation. This is crucial as investors may review multiple pitch decks and recall is important to stand out.

- Reflecting Your Project’s Image: Design choices can evoke certain emotions or align with the tone and values of your project. For example, if your project emphasizes environmental sustainability, the design can incorporate eco-friendly colors and imagery. Visual elements can reinforce your project’s brand, messaging, and positioning.

- Supporting Your Storytelling: Visuals can be used to support and enhance the narrative of your pitch deck. They can help create an emotional connection with investors and strengthen the story you’re telling about the problem, solution, and impact of your oil and gas project.

Hold on. You might want to check my list on the best presentation books. Why?

It’s 1O crucial books that will help you improve the design and structure of your presentations, besides improving its delivery. Check it out below.

Remember, while design and visuals are important, they should complement and enhance the content of your pitch deck. Visual elements should be used purposefully and in a way that supports your message rather than overshadowing it. Strive for a balance between aesthetics, clarity, and the information you want to convey in your oil and gas pitch deck.

How to prepare for questions and objections when presenting an oil and gas pitch deck?

Preparing for questions and objections is crucial when presenting an oil and gas pitch deck. Here are some steps to help you effectively anticipate and address them:

- Know Your Material: Be intimately familiar with every aspect of your pitch deck. Understand the data, market analysis, financial projections, and technical details of your project. This knowledge will enable you to respond confidently and accurately to questions.

- Anticipate Potential Questions: Put yourself in the shoes of your audience and identify potential areas of interest, concern, or skepticism. Consider questions related to market demand, competition, financial projections, environmental impact, regulatory compliance, and operational challenges. Anticipating these questions allows you to proactively address them in your presentation.

- Conduct Research: Gather relevant industry research, market trends, and competitor analysis to support your claims and strengthen your responses. Having data and external sources to back up your assertions adds credibility and enhances your ability to address objections.

- Practice Q&A Sessions: Simulate a Q&A session with colleagues or mentors who can play the role of potential investors or critical stakeholders. Practice answering tough questions and receiving feedback on your responses. This exercise helps you refine your answers, improve your delivery, and build confidence in addressing objections.

- Prepare Clear and Concise Answers: Craft concise, well-thought-out responses to potential questions and objections. Avoid getting defensive or overly technical in your answers. Instead, focus on providing clear explanations, supported by relevant data or examples, to address concerns effectively.

- Turn Objections into Opportunities: Instead of viewing objections as roadblocks, see them as opportunities to showcase your preparedness and problem-solving skills. Respond to objections by highlighting mitigation strategies, contingency plans, or evidence of successful pilot projects or trials. Use objections as a chance to further demonstrate the viability and potential of your oil and gas venture.

- Be Transparent and Honest: Honesty and transparency are essential when addressing questions and objections. If you don’t have a specific answer, admit it and commit to following up with additional information. Demonstrating transparency builds trust and credibility with your audience.

- Stay Calm and Engage: During the Q&A session, maintain a calm and composed demeanor. Listen attentively to the questions, and engage with the questioner by asking clarifying questions if needed. This demonstrates your active involvement and willingness to address concerns.

- Maintain a Positive Attitude: Approach questions and objections with a positive mindset. View them as opportunities to further communicate the strengths and potential of your oil and gas project. A positive attitude helps you handle challenging questions with grace and confidence.

Remember, thorough preparation and practice are key to successfully addressing questions and objections. By anticipating and proactively addressing potential concerns, you can instill confidence in your audience and increase your chances of securing support and funding for your oil and gas venture.

10 best practices to consider when creating an oil and gas pitch deck

When creating an oil and gas pitch deck, here are some best practices to consider:

- Know Your Audience: Tailor your pitch deck to the specific needs and interests of your target audience, whether it’s investors, partners, or stakeholders. Customize the content, messaging, and tone to resonate with their preferences and align with their investment criteria.

- Keep it Concise: Aim for a concise and focused pitch deck, typically around 10-15 slides. Avoid information overload and lengthy explanations. Use bullet points, clear headings, and visuals to convey key points succinctly.

- Tell a Compelling Story: Craft a compelling narrative within your pitch deck that engages the audience emotionally and captures their attention. Present your project as a story with a clear problem, solution, and potential for impact or transformation.

- Highlight the Value Proposition: Clearly communicate your project’s unique value proposition, differentiating factors, and market advantages. Articulate the problem you’re solving and the benefits your project brings to the industry, environment, or stakeholders.

- Use Visuals Effectively: Incorporate visually appealing graphics, charts, and images to enhance comprehension and engagement. Visuals should support key points, data, and concepts, making complex information more accessible and memorable.

- Provide Strong Market Analysis: Present a comprehensive analysis of the oil and gas market, including size, growth trends, competitive landscape, and potential risks. Back up your claims with data and credible sources to demonstrate market potential.

- Showcase a Strong Team: Highlight the expertise, relevant experience, and track record of your management team. Investors want to see a capable and committed team that can execute the project successfully. Include key team members and their roles within the pitch deck.

- Demonstrate Financial Viability: Present realistic and well-supported financial projections, including revenue forecasts, cost structures, and profitability metrics. Use charts or graphs to illustrate financial performance and expected returns on investment.

- Address Risks and Mitigations: Acknowledge potential risks or challenges associated with your project and demonstrate your preparedness to mitigate them. Discuss strategies, contingencies, and milestones to overcome obstacles and ensure project success.

- Practice and Refine: Practice your pitch deck presentation to ensure a smooth and confident delivery. Seek feedback from trusted advisors or colleagues and refine your pitch deck based on their input. Continuously update and improve your pitch deck as needed.

Remember, the best practices outlined here are general guidelines, and you should adapt them to suit your specific project, industry context, and target audience. Customization, clarity, and a compelling presentation are key to creating an impactful oil and gas pitch deck.

Oil and Gas Funding Examples

Insane AMMOUNTS OF MONEY. But then again, it’s oil we’re talkin’.

Oil And Gas Business Idea In A Pitch Deck Format

My favourite part when writing these guides. Here’s a crazy idea that might spur your imagination and help you create a better pitch deck. This time, I’ve added questions to make you think about each slide and how it should be done.

Cover Slide

- Company Name: The Ails

- Tagline: Revolutionizing Oil Spill Cleanups with AI-Powered Nanotechnology

- Logo (if available)

Highlight the global problem of oil spills , their environmental impact, and the current limitations in addressing them. Use statistics to emphasize the scale of the problem.

Introduce The Ails as the solution: AI-powered anti-oil nanomicrobes deployable via supersonic rockets. Explain how they work in simple terms, using an analogy or metaphor if possible.

Dive deeper into the product. How are the nanomicrobes created? How does the AI work? How are they deployed and how do they clean up oil spills? Use visuals to help explain these complex concepts.

Market Opportunity

Present the size of the potential market. Who are the customers (oil companies, governments, environmental agencies)? What is the potential revenue?

Business Model

How will The Ails make money? Is it a one-time purchase, a subscription service, or something else?

Competitive Advantage

What makes The Ails unique? Is it the AI technology, the deployment method, the effectiveness of the nanomicrobes? How does it compare to current oil spill cleanup methods?

Go-to-Market Strategy

How will The Ails reach its customers? Through direct sales, partnerships, or online marketing?

Introduce the team behind The Ails. Highlight their expertise in AI, nanotechnology, and the oil and gas industry.

Financial Projections

Provide a snapshot of the financial projections for the next 5 years. Include revenue, expenses, and profitability.

What is The Ails seeking from investors? Is it funding, partnerships, advice?

Conclude the pitch deck with a thank you slide and provide contact information for further discussions.

Remember, each slide should be clear and concise, providing just enough information to engage the audience and provoke questions. Use visuals wherever possible to illustrate your points. And most importantly, tell a compelling story that shows your passion and commitment to solving this global problem.

Questions That Investors Ask Oil and Gas Pitch Deck Owners:

When presenting an oil and gas pitch deck to potential investors, you can expect a variety of questions. Here are some common questions that investors often ask:

Market and Industry:

- What is the size of the target market for your oil and gas project?

- What are the current trends and growth prospects in the oil and gas industry?

- How does your project differentiate itself from existing competitors?

- What are the potential regulatory or environmental risks associated with the industry?

Value Proposition and Technology:

- What problem does your project solve in the oil and gas sector?

- How does your technology or approach provide a competitive advantage?

- What is the potential impact of your project on cost efficiency, environmental sustainability, or operational effectiveness?

- Have you conducted pilot studies or proof-of-concept projects to validate your technology?

Financials and Returns

- What are the projected financials and revenue streams for your project?

- What are the expected costs and profitability margins?

- What is the payback period for investors and the potential return on investment?

- How do you mitigate financial risks associated with market fluctuations or unforeseen circumstances?

Operations and Execution

- What are the key milestones and timeline for project development and commercialization?

- What are the operational and logistical challenges associated with your project?

- How do you plan to address potential supply chain or infrastructure constraints?

- What is your strategy for scaling up operations and ensuring project success?

Team and Expertise

- What is the experience and expertise of your management team in the oil and gas industry?

- Have they successfully executed similar projects in the past?

- Do you have a well-rounded team with diverse skill sets to address different aspects of the project?

- Have you secured any partnerships or collaborations with industry experts or advisors?

- What are the potential risks and challenges associated with your project, and how do you plan to mitigate them?

- How have you addressed regulatory compliance, environmental impact, or community relations concerns?

- What contingency plans do you have in place to handle unexpected events or disruptions?

- Have you secured any insurance or risk management strategies to protect investors’ interests?

These are just a few examples of the questions investors may ask during or after reviewing your oil and gas pitch deck. It’s important to thoroughly prepare and have a solid understanding of your project, industry, financials, and potential risks to address these questions confidently and effectively.

What nobody will tell you: Crucial considerations to keep in mind when developing your oil and gas pitch deck and business

10 insights. These are things no advisor, startup event organizer or coach will tell you for free. We’ve done the research and combined it with our experience to give you these insights with no strings attached.

Sustainability and Environmental Impact

Incorporating sustainability and environmental impact considerations into an oil and gas pitch deck is increasingly crucial, not just from a regulatory and social responsibility perspective but also as a strategic business advantage. Investors and stakeholders are more inclined towards projects that demonstrate a clear commitment to minimizing environmental footprints and contributing to sustainable energy futures. Here’s a detailed insight into why sustainability and environmental impact are vital for oil and gas pitch decks, supported by actionable steps:

Importance of Sustainability and Environmental Impact in Oil and Gas Pitch Decks

- Regulatory Compliance : Oil and gas projects must adhere to stringent environmental regulations. Demonstrating compliance can prevent costly legal challenges and project delays.

- Investor Attraction : ESG (Environmental, Social, and Governance) criteria are becoming a cornerstone for investment decisions. Projects that highlight sustainability efforts are more likely to attract funding.

- Brand Reputation and Social License : Companies that prioritize environmental stewardship can improve their brand reputation, earning the social license to operate from communities and governments.

- Operational Efficiency and Cost Reduction : Implementing sustainable practices often leads to operational efficiencies and cost savings, for example, through reduced waste and energy consumption.

- Market Differentiation : In a competitive market, showcasing a commitment to sustainability can differentiate your project from others, making it more appealing to potential investors.

Research and Insights

Recent studies have shown a direct correlation between ESG performance and financial performance, indicating that companies focusing on sustainability tend to exhibit lower volatility and better profitability. According to the Energy Institute, integrating renewable energy technologies and carbon capture and storage (CCS) solutions not only helps in reducing GHG emissions but also in ensuring long-term viability in the transitioning energy market.

- Conduct and present a comprehensive EIA to identify potential environmental impacts of your project and propose mitigation measures.

- Highlight any anticipated biodiversity conservation efforts or contributions to local ecosystems.

- Outline your project’s strategy for managing and reducing carbon emissions, including the use of CCS technologies and methane leak reduction practices.

- Consider setting and sharing specific, measurable emissions reduction targets.

- Detail plans for integrating renewable energy sources into operations, such as solar power for on-site facilities or wind energy for offshore platforms.

- Showcase any investments in renewable energy projects or partnerships with clean energy providers.

- Present your strategies for responsible water use, wastewater treatment, and minimization of water pollution.

- Highlight any innovative technologies or practices that improve water efficiency and quality.

- Describe your approach to minimizing waste production and maximizing recycling and reuse within your operations.

- Incorporate circular economy principles into supply chain management and product lifecycle.

- Showcase initiatives aimed at supporting local communities, such as job creation, skill development, and supporting local businesses.

- Highlight any contributions to local infrastructure, healthcare, or education.

- Commit to transparent reporting on environmental and sustainability performance, adhering to international standards such as the Global Reporting Initiative (GRI).

- Outline your stakeholder engagement strategy, demonstrating how you will communicate and collaborate with local communities, governments, and NGOs.

Incorporating these elements into your oil and gas pitch deck not only demonstrates a proactive approach to sustainability but also aligns your project with the values and concerns of modern investors and communities. This strategic focus on sustainability can significantly enhance the appeal of your project, setting the foundation for successful funding and long-term success in the evolving energy landscape.

Innovations in Oil and Gas Technology

Innovations in oil and gas technology are pivotal for the sector’s evolution, addressing challenges such as operational efficiency, cost reduction, environmental sustainability, and safety enhancements. Presenting these innovations in your pitch deck is crucial for attracting investment and demonstrating competitive advantage. Here’s a detailed look at the significance of technological innovation in oil and gas pitch decks, accompanied by actionable steps:

Importance of Technological Innovation in Oil and Gas Pitch Decks

- Operational Efficiency and Cost Optimization : Advanced technologies can significantly reduce operational costs and enhance efficiency, making projects more economically viable.

- Environmental and Safety Improvements : Innovations often focus on reducing environmental impact and enhancing safety, key concerns for stakeholders and regulatory bodies.

- Competitive Edge : Showcasing proprietary or cutting-edge technologies in your pitch deck can differentiate your project in a crowded market.

- Regulatory Compliance : Technology can help in meeting increasingly stringent environmental and safety regulations.

- Adaptability and Future-Proofing : Demonstrating a commitment to innovation shows adaptability to future industry shifts, appealing to investors looking for long-term returns.

Research indicates that technology adoption in the oil and gas industry can lead to a 10-30% reduction in production costs, according to McKinsey & Company. Technologies like digital twins, AI and machine learning for predictive maintenance, and advanced seismic imaging for exploration are revolutionizing the sector. Additionally, the deployment of IoT devices for real-time monitoring is enhancing operational efficiency and safety.

- Detail any proprietary technologies your project utilizes, explaining how they offer a competitive advantage.

- Include data or case studies demonstrating the efficacy and impact of these technologies.

- Describe digital transformation efforts, such as the use of AI, machine learning, and IoT, for predictive maintenance, drilling optimization, and real-time monitoring.

- Show how digital tools improve decision-making and operational efficiency.

- Present innovative exploration technologies like 3D seismic imaging or electromagnetic surveying that reduce exploration risks and costs.

- Outline enhanced oil recovery (EOR) methods that improve well productivity and extend the life of mature fields.

- Explain the adoption of technologies for reducing emissions, such as flare reduction systems, methane leak detection using drones or satellites, and carbon capture and storage (CCS).

- Highlight safety innovations, including automated drilling systems and advanced monitoring for early hazard detection.

- Showcase any collaborations with tech companies, research institutions, or startups that enhance your project’s technological capabilities.

- Highlight participation in technology incubators or innovation hubs.

- Provide a roadmap of future technology adoption and innovation within your project, demonstrating a commitment to continuous improvement and adaptability.

- Discuss upcoming trends in the oil and gas technology landscape and how your project plans to leverage these.

- Emphasize your project’s investment in research and development (R&D) to foster innovation.

- Detail how R&D efforts are aligned with project goals and long-term viability.

Incorporating these elements into your oil and gas pitch deck can significantly strengthen your proposition to investors. By demonstrating a forward-thinking approach and a commitment to leveraging technological advancements, you can underline the potential for enhanced profitability, sustainability, and competitiveness of your project.

Financial Modeling and Investment Analysis

Financial modeling and investment analysis are cornerstone components of an oil and gas pitch deck, offering a quantitative foundation to evaluate the project’s economic viability, risks, and investment returns. These analyses provide investors with critical insights into the project’s financial health, potential profitability, and risk-adjusted returns, which are essential for making informed investment decisions. Here’s a detailed perspective on the importance of financial modeling and investment analysis for an oil and gas pitch deck, supported by actionable steps:

Importance of Financial Modeling and Investment Analysis

- Economic Viability : Financial models help demonstrate the project’s economic viability by projecting cash flows, profitability, and break-even points.

- Risk Assessment : Incorporating sensitivity and scenario analyses allows for the assessment of how changes in key variables (like oil prices, production rates, and operational costs) impact the project’s financial outcomes.

- Investment Attractiveness : Detailed investment analysis, including net present value (NPV), internal rate of return (IRR), and payback period, provides investors with clear metrics for evaluating the attractiveness of the project.

- Funding Strategy : A well-structured financial model outlines the required capital investment, anticipated revenues, and expenses, guiding discussions on equity, debt financing, and valuations.

- Regulatory and Fiscal Considerations : Financial models can account for regulatory, tax, and fiscal obligations, ensuring that the project remains viable under various regulatory scenarios.

Research indicates that robust financial models that accurately incorporate industry-specific risks and variable sensitivities significantly improve investment decision-making. According to the Society of Petroleum Engineers, incorporating dynamic variables related to oil price volatility, geopolitical risks, and operational efficiencies into financial models is critical for the oil and gas sector, given its susceptibility to external shocks.

- Create a detailed financial model that includes projections of income, cash flow, and balance sheet statements over the life of the project.

- Ensure the model reflects industry-specific factors such as exploration costs, development capital expenditure (CapEx), operational expenditure (OpEx), decommissioning costs, and salvage values.

- Perform sensitivity analysis on key assumptions (e.g., oil prices, production rates) to understand their impact on financial metrics.

- Include scenario analysis for different market conditions, highlighting how the project performs under bullish, bearish, and base case scenarios.

- Clearly outline key investment metrics such as NPV, IRR, payback period, and breakeven oil price.

- Provide a comparison of these metrics against industry benchmarks to establish the project’s relative attractiveness.

- Detail the proposed financing structure, including the mix of equity and debt, terms of financing, and implications for project ownership and returns.

- Discuss any potential for government subsidies, grants, or tax incentives that could improve the project’s financials.

- Integrate risk management strategies into the financial model, including hedges against oil price volatility, currency risks, and interest rate fluctuations.

- Explain how these strategies protect the project’s cash flows and returns.

- Account for all regulatory and fiscal obligations, including royalties, taxes, and environmental compliance costs, in the financial projections.

- Highlight any fiscal incentives available for the project and their impact on the financial model.

- Provide detailed projections on potential returns to investors, including dividend distributions, equity value appreciation, and exit strategies.

- Discuss the project’s valuation and the rationale behind it, offering investors a clear understanding of the potential for capital gains.

Incorporating these financial modeling and investment analysis elements into your oil and gas pitch deck will provide a solid foundation for discussions with potential investors. It demonstrates a thorough understanding of the financial aspects of the project, offering a transparent and compelling case for investment. This approach not only helps in securing funding but also builds confidence among stakeholders in the project’s management and strategic vision.

Regulatory Compliance and Policy Changes

Regulatory compliance and policy changes are critical aspects to address in an oil and gas pitch deck, reflecting the project’s adherence to legal and environmental standards and its resilience to regulatory shifts. The oil and gas industry is heavily regulated worldwide, with policies affecting operational practices, environmental impact, and fiscal terms. Demonstrating a thorough understanding and proactive management of these factors can significantly enhance the attractiveness of a project to investors and stakeholders. Here’s an in-depth look at the significance of regulatory compliance and policy changes, supported by actionable steps:

Importance of Regulatory Compliance and Policy Changes

- Operational Legitimacy : Compliance with regulations is a prerequisite for operational legitimacy and the ability to conduct business, affecting everything from exploration licenses to production quotas.

- Investor Confidence : Investors are increasingly cautious about regulatory risks, looking for projects that demonstrate compliance and strategic foresight to navigate future changes in the regulatory landscape.

- Cost Management : Understanding and planning for compliance can help in accurately forecasting project costs, including taxes, environmental mitigation expenses, and potential penalties for non-compliance.

- Market Access and Expansion : Compliance with international standards and policies can facilitate market access and expansion, especially in cross-border projects.

- Sustainability and Social License to Operate : Adhering to environmental regulations and policies is critical for maintaining a social license to operate, crucial for project sustainability and community relations.

Research highlights the dynamic nature of the regulatory environment in the oil and gas sector, with a growing focus on environmental sustainability, carbon emissions reduction, and safety improvements. According to the International Energy Agency (IEA), regulatory policies are increasingly influencing investment decisions in the energy sector, with a trend towards stricter environmental regulations and a push for cleaner energy sources.

- Provide a comprehensive overview of the regulatory framework applicable to your project, including local, national, and international regulations and policies.

- Highlight any recent changes or anticipated shifts in the regulatory landscape and their potential impact on the project.

- Outline your strategy for achieving and maintaining compliance with existing regulations and adapting to future changes. This could include investment in compliance infrastructure, regular audits, and engagement with regulatory bodies.

- Demonstrate a proactive approach to compliance, such as adopting standards that exceed current requirements, positioning the project as a leader in regulatory adherence.

- Detail your environmental impact assessment and any mitigation plans to address potential environmental challenges. Include strategies for waste management, emissions reduction, and biodiversity conservation.

- Explain how these plans align with current environmental regulations and any voluntary environmental standards or certifications pursued by the project.

- Showcase your efforts in engaging with regulatory bodies, local communities, and other stakeholders to ensure broad support for the project.

- Commit to transparency in reporting and compliance, detailing any mechanisms in place for regular reporting to regulatory authorities and stakeholders.

- Include a section on regulatory risk management, outlining potential regulatory risks and your contingency plans. This should cover strategies for dealing with changes in regulations, such as flexibility in operational practices or financial reserves to cover compliance costs.

- Highlight any insurance or financial instruments used to mitigate regulatory risks.

- Provide an analysis of the fiscal regime applicable to your project, including taxation, royalties, and other fiscal obligations.

- Discuss how the fiscal regime affects the project’s financial model and overall viability, and outline strategies for fiscal optimization.

Incorporating these aspects into your oil and gas pitch deck will demonstrate a comprehensive understanding of the regulatory environment and your project’s preparedness to navigate it. This approach reassures investors of the project’s commitment to compliance, its capability to manage regulatory risks, and its alignment with evolving industry standards and societal expectations.

Market Analysis and Forecasting

Market analysis and forecasting are essential components of an oil and gas pitch deck, providing critical insights into the current market conditions, future trends, and the project’s potential place within this landscape. This analysis helps in identifying market opportunities, understanding potential risks, and demonstrating the project’s viability and competitiveness to investors. Here’s a closer look at the significance of market analysis and forecasting, complemented by actionable steps:

Importance of Market Analysis and Forecasting

- Informed Decision Making : Market analysis provides a solid foundation for making informed decisions regarding project development, investment allocation, and strategic planning.

- Investor Confidence : A thorough market analysis reassures investors of the project’s awareness of market dynamics and its ability to navigate potential challenges, enhancing investor confidence.

- Competitive Positioning : Understanding the competitive landscape enables a project to position itself effectively, highlighting its unique value proposition in the pitch deck.

- Risk Mitigation : Forecasting market trends and potential shifts allows for the identification of risks and the development of strategies to mitigate them, making the project more resilient.

- Revenue Projections : Market analysis supports realistic and credible revenue projections, essential for evaluating the project’s financial viability and attractiveness to investors.

Market research reports from reputable sources like the International Energy Agency (IEA), U.S. Energy Information Administration (EIA), and OPEC provide valuable insights into global supply and demand trends, price forecasts, and regulatory changes affecting the oil and gas industry. These reports highlight the importance of technological advancements, geopolitical factors, and the global shift towards renewable energy as key drivers affecting the market.

- Present a comprehensive overview of the global and regional oil and gas markets, including current supply and demand dynamics, key players, and market size.

- Highlight any specific regional factors that may influence the market, such as political stability, regulatory changes, or significant discoveries.

- Analyze historical price trends of oil and gas, incorporating expert forecasts to provide a future outlook. Discuss factors influencing price volatility, such as geopolitical tensions, OPEC decisions, and technological breakthroughs.

- Explain how these price trends impact your project’s revenue and profitability projections.

- Conduct a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) to identify your project’s position in the competitive landscape.

- Compare your project’s cost structure, technology, efficiency, and environmental impact with those of key competitors.

- Identify and discuss key demand drivers in the oil and gas market, such as industrial growth, energy consumption patterns, and the impact of emerging technologies like electric vehicles.

- Highlight growth opportunities your project is poised to capture, such as untapped markets or regions with increasing energy demands.

- Outline potential market risks, including economic downturns, changes in energy policies, and new environmental regulations.

- Present strategies to mitigate these risks, such as diversification, hedging against price fluctuations, and investing in sustainable technologies.

- Discuss the impact of current and anticipated regulatory and environmental policies on the market, including carbon pricing, emissions targets, and renewable energy incentives.

- Explain how your project aligns with these policies and positions itself as a leader in compliance and sustainability.

- Employ scenario planning to illustrate how your project would perform under different market conditions (e.g., high vs. low oil prices, varying demand levels).

- This approach demonstrates the project’s resilience and adaptability to changing market dynamics.

Incorporating a detailed market analysis and forecasting section into your oil and gas pitch deck will provide investors with a clear understanding of the market conditions, your project’s strategic positioning, and its potential for success. This demonstrates not only your project’s viability but also your team’s thorough understanding of the market and capability to navigate its complexities.

Risk Management Strategies