Everything that you need to know to start your own business. From business ideas to researching the competition.

Practical and real-world advice on how to run your business — from managing employees to keeping the books.

Our best expert advice on how to grow your business — from attracting new customers to keeping existing customers happy and having the capital to do it.

Entrepreneurs and industry leaders share their best advice on how to take your company to the next level.

Looking for your local chamber?

Interested in partnering with us?

Start » startup, smart strategies for presenting your business plan.

Whether you're pitching investors or applying for a bank loan, it's important to nail your business plan presentation. Here are some tips for crafting and presenting yours.

For entrepreneurs who plan to apply for funding or raise investor capital, it's essential to write a solid business plan before launching a business . This document outlines the most important details about your new venture — including your mission, your founding team, your market research and, most importantly, your financial projections.

Once your business plan is written, you may be asked to present it in a variety of circumstances. Much like a professional resume, your plan will need to be tailored and tweaked to appeal to the specific audience you're trying to reach.

Whether you're preparing to write your first plan or refining your existing one, here are some expert-recommended tips for successfully presenting it to anyone who's evaluating your business.

When will you need to present your business plan?

A business plan should contain in-depth details about your business's market, revenue strategy and company structure to communicate the big picture, said Gerald Padilla, vice president of sales and marketing at Joorney Business Plans . The most common circumstances where you'll need to present your plan include:

- Applying for a business loan, especially through a bank or the Small Business Administration .

- Pitching investors and board members.

- Renting a commercial space.

Matthew Wolf, head of advisory and senior consultant for Joorney Business Plans, said that even if your business plan is just an internal document for now, writing one forces you to think critically about how your business will achieve success, while also keeping you accountable.

[Read: 5 Business Plan Templates to Help You Plan for Success . ]

You should be able to clearly state who you are, what you do and why you are relevant.

David Reiling, CEO of Sunrise Banks

Crafting the right business plan for your audience

If you want your business plan to be effective, you should customize and tailor it to the audience you're pitching, said Padilla.

"It's impossible to be everything to everyone," added David Reiling, CEO of Sunrise Banks . "You should be able to clearly state who you are, what you do and why you are relevant."

Here are a few tips to help you do just that.

- Lenders. Banks and the SBA require specific information in their business plan in order to approve a loan , said Padilla. It's important to understand those requirements and address each one within your business plan. "Debt providers are interested in your cash flow being sufficient to cover the principal and interest of the loan for the term," added Wolf.

- Investors. In general, said Wolf, equity investors are interested in returns on investment, as well as debt coverage, which affects free cash flow and returns on investment. However, some investors may also be attracted to different aspects of your business. "Some may be endeared to the product or service concept, while others may invest in the team or CEO because they see the value in their qualities," Padilla told CO—. "Be sure to understand the investors you may be presenting to and their interests."

- Landlords. Padilla noted that the potential landlord of a commercial space may ask for a business plan to understand the type of venture the business owner is proposing for use within the lease space. "They want to get clear details of the applicant's business activity before they accept the potential tenant's lease application," he said.

How to present your business plan

Regardless of your audience, there are a few key things to keep in mind when preparing to present your business plan.

First and foremost, you should ensure that all information included is credible and error-free.

"You want the business plan to reflect your professionalism and add to your credibility," said Padilla. "When using statistics, facts or figures, always cite the source of the data to support your ideas."

[Read: How to Write a Great Business Plan . ]

Reiling noted that you'll want to keep your plan simple so you can present it easily. Consulting resources like the SBA and SCORE can help you strike the right balance between simplicity and providing enough relevant information, he said.

"Bigger isn't necessarily better," Reiling added. "It's the content that matters."

On that note, Wolf advised making your plan as engaging as possible so you can capture the attention of the audience from the beginning.

"Be sure to have a clear go-to-market strategy and think deeply on your business's true competitive advantages," he said.

Finally, be sure to review your plan before each presentation to ensure you're providing the most accurate, up-to-date information on your business and its progress.

"Business plans should be living documents that are revisited and changed to reflect where a business is versus where it projected it would be," said Reiling. "It's the roadmap for a business."

CO— aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

CO—is committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here .

Subscribe to our newsletter, Midnight Oil

Expert business advice, news, and trends, delivered weekly

By signing up you agree to the CO— Privacy Policy. You can opt out anytime.

For more business preparation

How to change your ein, or how to fix an incorrect ein, micro-business vs. startup: what’s the difference, micro businesses: what are they and how do you start one.

By continuing on our website, you agree to our use of cookies for statistical and personalisation purposes. Know More

Welcome to CO—

Designed for business owners, CO— is a site that connects like minds and delivers actionable insights for next-level growth.

U.S. Chamber of Commerce 1615 H Street, NW Washington, DC 20062

Social links

Looking for local chamber, stay in touch.

How to Write a Successful Bank Business Plan (+ Template)

Creating a business plan is essential. Still, it can be beneficial for bank s that want to improve their strategy or raise funding.

A well-crafted business plan outlines your company’s vision and documents a step-by-step roadmap of how you will accomplish it. To create an effective business plan, you must first understand the components essential to its success.

This article provides an overview of the key elements that every bank business owner should include in their business plan.

Download the Ultimate Business Plan Template

What is a Bank Business Plan?

A bank business plan is a formal written document describing your company’s business strategy and feasibility. It documents the reasons you will be successful, your areas of competitive advantage, and it includes information about your team members. Your business plan is a critical document that will convince investors and lenders (if needed) that you are positioned to become a successful venture.

Why Write a Bank Business Plan?

A bank business plan is required for banks and investors. The document is a clear and concise guide of your business idea and the steps you will take to make it profitable.

Entrepreneurs can also use this as a roadmap when starting their new company or venture, especially if they are inexperienced in starting a business.

Writing an Effective Bank Business Plan

The following are the key components of a successful bank business plan:

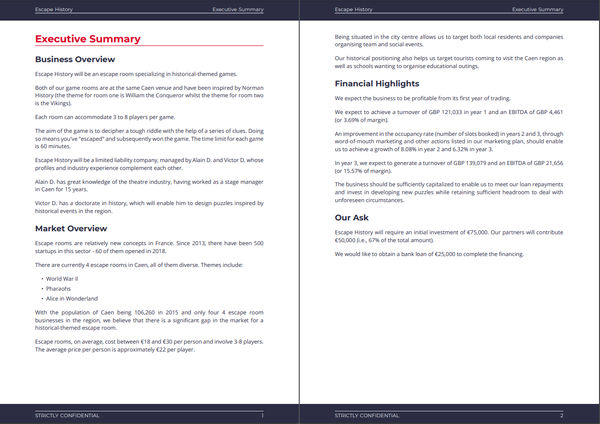

Executive Summary

The executive summary of a bank business plan is a one- to two-page overview of your entire business plan. It should summarize the main points, which will be presented in full in the rest of your business plan.

- Start with a one-line description of your bank company

- Provide a summary of the key points in each section of your business plan, which includes information about your company’s management team, industry analysis, competitive analysis, and financial forecast, among others.

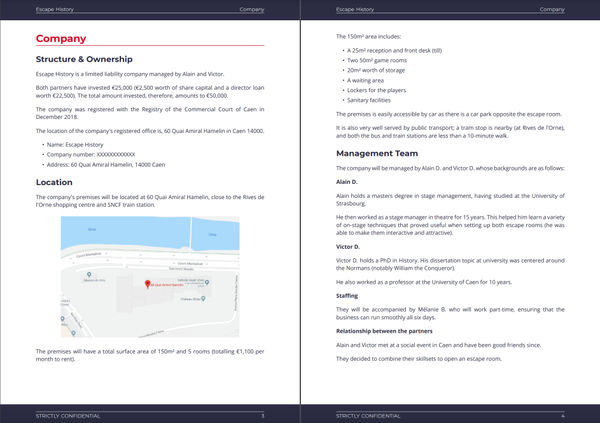

Company Description

This section should include a brief history of your company. Include a short description of how your company started and provide a timeline of milestones your company has achieved.

You may not have a long company history if you are just starting your bank business. Instead, you can include information about your professional experience in this industry and how and why you conceived your new venture. If you have worked for a similar company or been involved in an entrepreneurial venture before starting your bank firm, mention this.

You will also include information about your chosen bank business model and how, if applicable, it is different from other companies in your industry.

Industry Analysis

The industry or market analysis is an essential component of a bank business plan. Conduct thorough market research to determine industry trends and document the size of your market.

Questions to answer include:

- What part of the bank industry are you targeting?

- How big is the market?

- What trends are happening in the industry right now (and if applicable, how do these trends support your company’s success)?

You should also include sources for your information, such as published research reports and expert opinions.

Customer Analysis

This section should include a list of your target audience(s) with demographic and psychographic profiles (e.g., age, gender, income level, profession, job titles, interests). You will need to provide a profile of each customer segment separately, including their needs and wants.

For example, a bank business’ customers may include small businesses, large corporations, and individuals. Each customer segment will have different requirements that your bank company will need to cater to.

You can include information about how your customers decide to buy from you and what keeps them buying from you.

Develop a strategy for targeting those customers who are most likely to buy from you, as well as those that might be influenced to buy your products or bank services with the right marketing.

Competitive Analysis

The competitive analysis helps you determine how your product or service will differ from competitors, and what your unique selling proposition (USP) might be that will set you apart in this industry.

For each competitor, list their strengths and weaknesses. Next, determine your areas of competitive advantage; that is, in what ways are you different from and ideally better than your competitors.

Below are sample competitive advantages your bank business may have:

- Proven track record with a focus on customer service.

- Superior technology that makes banking easier and more convenient for customers.

- Range of products and services to meet the needs of different customer segments.

- Sound financial position with a commitment to responsible lending practices.

- Extensive branch and ATM network.

Marketing Plan

This part of the business plan is where you determine and document your marketing plan. . Your plan should be laid out, including the following 4 Ps.

- Product/Service : Detail your product/service offerings here. Document their features and benefits.

- Price : Document your pricing strategy here. In addition to stating the prices for your products/services, mention how your pricing compares to your competition.

- Place : Where will your customers find you? What channels of distribution (e.g., partnerships) will you use to reach them if applicable?

- Promotion : How will you reach your target customers? For example, you may use social media, write blog posts, create an email marketing campaign, use pay-per-click advertising, or launch a direct mail campaign. Or you may promote your bank business via PR or events.

Operations Plan

This part of your bank business plan should include the following information:

- How will you deliver your product/service to customers? For example, will you do it in person or over the phone?

- What infrastructure, equipment, and resources are needed to operate successfully? How can you meet those requirements within budget constraints?

You also need to include your company’s business policies in the operations plan. You will want to establish policies related to everything from customer service to pricing, to the overall brand image you are trying to present.

Finally, and most importantly, your Operations Plan will outline the milestones your company hopes to achieve within the next five years. Create a chart that shows the key milestone(s) you hope to achieve each quarter for the next four quarters, and then each year for the following four years. Examples of milestones for a bank business include reaching $X in sales. Other examples include expanding to new markets, launching new products and services, and hiring key personnel.

Management Team

List your team members here, including their names and titles, as well as their expertise and experience relevant to your specific bank industry. Include brief biography sketches for each team member.

Particularly if you are seeking funding, the goal of this section is to convince investors and lenders that your team has the expertise and experience to execute on your plan. If you are missing key team members, document the roles and responsibilities you plan to hire for in the future.

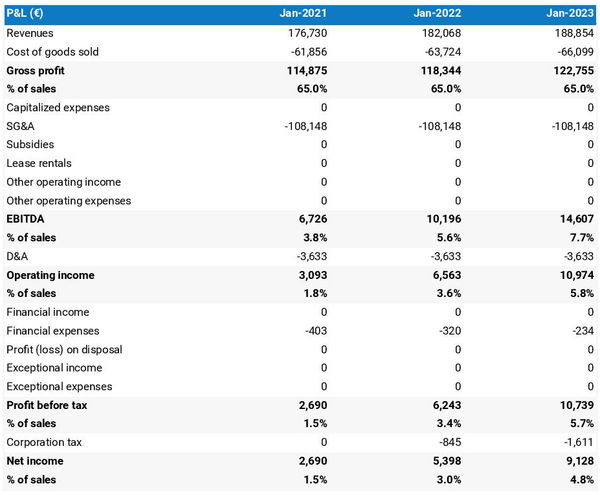

Financial Plan

Here, you will include a summary of your complete and detailed financial plan (your full financial projections go in the Appendix).

This includes the following three financial statements:

Income Statement

Your income statement should include:

- Revenue : how much revenue you generate.

- Cost of Goods Sold : These are your direct costs associated with generating revenue. This includes labor costs and the cost of any equipment and supplies used to deliver the product/service offering.

- Net Income (or loss) : Once expenses and revenue are totaled and deducted from each other, this is the net income or loss.

Sample Income Statement for a Startup Bank

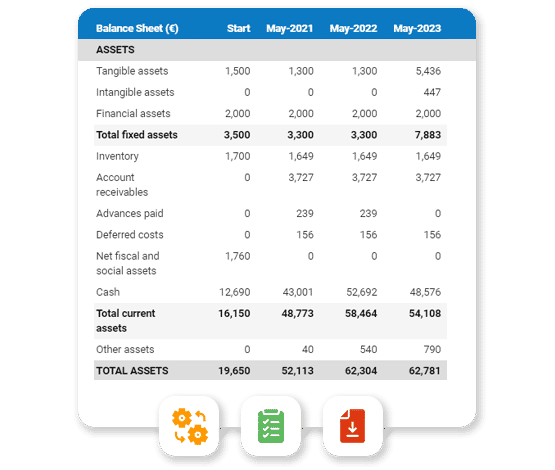

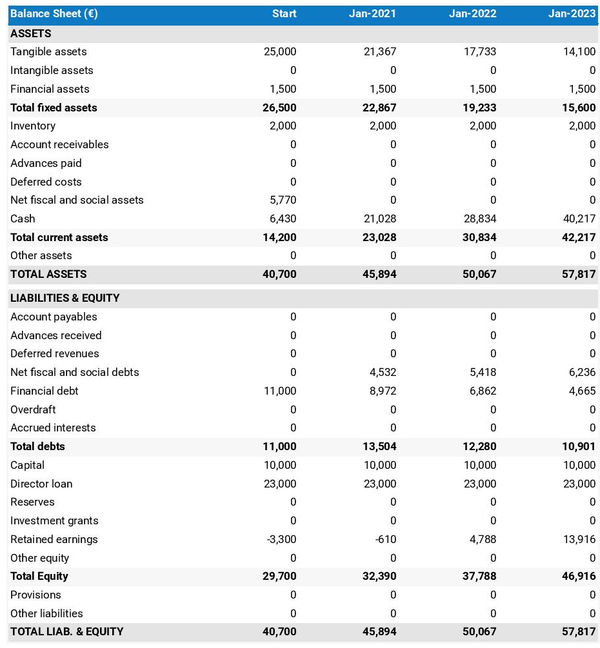

Balance sheet.

Include a balance sheet that shows your assets, liabilities, and equity. Your balance sheet should include:

- Assets : Everything you own (including cash).

- Liabilities : This is what you owe against your company’s assets, such as accounts payable or loans.

- Equity : The worth of your business after all liabilities and assets are totaled and deducted from each other.

Sample Balance Sheet for a Startup Bank

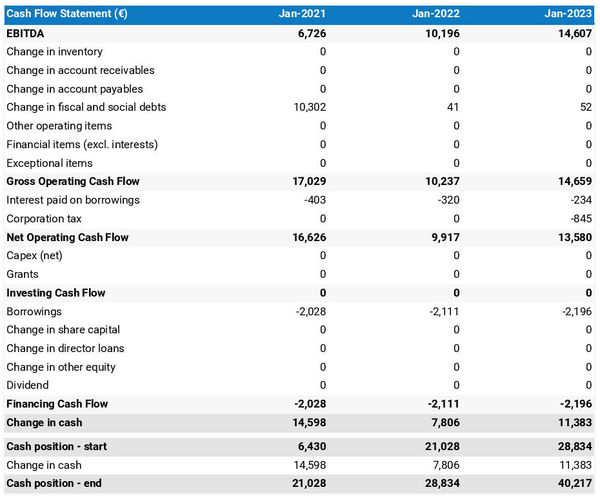

Cash flow statement.

Include a cash flow statement showing how much cash comes in, how much cash goes out and a net cash flow for each year. The cash flow statement should include cash flow from:

- Investments

Below is a sample of a projected cash flow statement for a startup bank business.

Sample Cash Flow Statement for a Startup Bank

You will also want to include an appendix section which will include:

- Your complete financial projections

- A complete list of your company’s business policies and procedures related to the rest of the business plan (marketing, operations, etc.)

- Any other documentation which supports what you included in the body of your business plan.

Writing a good business plan gives you the advantage of being fully prepared to launch and grow your bank company. It not only outlines your business vision but also provides a step-by-step process of how you will accomplish it.

Now that you know how to write a business plan for your bank, you can get started on putting together your own.

Finish Your Business Plan in 1 Day!

Wish there was a faster, easier way to finish your business plan?

With our Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Other Helpful Articles

Commercial Bank Business Plan

Investment Bank Business Plan

Digital Bank Business Plan

Please turn on JavaScript in your browser

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

Tips on presenting your business plan to investors

Find out what you need to know before you walk into an investor pitch. Presented by Chase for Business .

You put days, months — maybe even years — into crafting your business plan. You double- and triple-checked all the numbers. You had it professionally designed. And now the day has come. All that hard work has paid off and you have a chance to present your plan to a potential investor or group of investors. And while who you know is often a big advantage in business, in this case, what you know is even more important.

Know your business plan

Once you’ve made it to the step of presenting your winning business plan to potential investors, chances are they’ve already read it, or at least part of it, and want to hear more. Be sure you know your plan inside and out. They may ask you to give a 30-second elevator speech, which is a high-level summary of your business, your customers and what sets you apart. Or they may want you to recite the entire executive summary from memory. The point is, you have to be ready for anything. Prepare to reiterate, elaborate or consolidate what’s in your plan, and anticipate any questions investors may have.

Know your audience

Many career investors will speak about their experiences, their backgrounds, what they look for in business partners, what they like to hear during a pitch (and what they don’t), industries they’re interested in and more. That’s why it could be valuable to do some research upfront. Look for any interviews they may have given, articles or blogs they’ve authored and what’s on their social profiles. If you know anyone in their network, talk to them. The better you know the audience you’ll be presenting to, the more you can cater the presentation to appeal to them. For instance, if you know that a potential investor is a staunch environmentalist who believes in saving trees, you may not want to bring a dozen copies of a 30-page business plan to the meeting.

Know your customers

Investors want to know the people they may be getting involved with, and that includes your customers. Thoroughly research your target audience. Instead of presenting a bulleted list about your customers, you might engage investors by telling a story. Walk them through a typical day in the life of a customer. Where do they live? What do they like to do? What are their needs? And how does your product or service help fulfill those needs? If investors become vested in your customers, they may be more likely to invest in your business.

Know your data

When it comes to letting go of their hard-earned money, most investors just want you to show them the numbers. It wouldn’t be unusual for a potential investor to ask for market statistics, revenue forecasts or customer acquisition costs during a pitch. Be sure you have realistic data and can back it up. After all, no matter how much investors like you as a person or believe in your product, their main goal is to make money. Their wheels are always turning as they try to figure how much of a return they can get on their investment and how long it will take.

Know your environment

You were so excited to get the meeting invite with a potential investor that you glossed over the details. But taking a closer look can make all the difference between being well prepared and scrambling at the last minute.

For an in-person meeting, the invite most likely includes the address, floor number, conference room name or specific location. If you’re close enough and have the time before the meeting, you may want to consider visiting the location. And if you’re able to get into the conference room, even better. If it’s not possible to visit, think about calling the meeting coordinator to ask any specific questions about the meeting room. Either way, here are some things you may want to confirm before the big day:

- What is the size/layout of the room?

- Is there one big conference table?

- Is there a large TV or monitor?

- Will everyone be sitting?

- Will you need a microphone?

- Does the room have an internet connection? Is it password protected?

- Are there available outlets?

- Will you need to bring an extension cord or an HDMI cable?

If the meeting is virtual, you’ll still want to prepare but in a different kind of way. With this type of meeting, you may have to work a little harder to keep your audience’s attention. Be ready with these tips:

- Make sure the sound, picture and material are clear, crisp and engaging.

- Set up your space ahead of time.

- Check the lighting in the room at the time of day as the meeting so that you can open or close shades, add additional lamps or make any adjustments.

- Be sure the background is uncluttered and professional.

- Try signing on to the video platform you’ll be using to avoid any last-minute login issues.

- Check that your speakers and computer microphone are working properly.

- Do a practice run with a friend or family member, and record the presentation to see what it will look like from your audience’s point of view.

Know your time

The last thing you want to do is prepare an amazing 30-minute presentation, only to find out you only have 10 minutes to present. Even though the meeting invite may indicate a one-hour meeting, things change and some meeting booking programs don’t allow customizations. It wouldn’t hurt to confirm how much time you have to present so there are no surprises.

The bottom line

In the same way it helps to develop a business plan checklist when crafting a business plan, it’s also important to put the same time and effort into creating a strategy for presenting that plan to potential investors. Following these tips can be a great place to start. As with anything in business and in life, knowledge is key. The more you know, the more prepared and comfortable you’ll be come pitch day.

For more ideas on how to get funding to grow your business, speak with a Chase business banker .

For informational/educational purposes only: The opinions expressed in this article may differ from those of other employees and departments of JPMorgan Chase & Co. Opinions and strategies described may not be appropriate for everyone and are not intended as specific advice/recommendation for any individual. Information has been obtained from sources believed to be reliable, but JPMorgan Chase & Co. or its affiliates and/or subsidiaries do not warrant its completeness or accuracy. You should carefully consider your needs and objectives before making any decisions and consult the appropriate professional(s). Outlooks and past performance are not guarantees of future results.

JPMorgan Chase Bank, N.A. Member FDIC. ©2023 JPMorgan Chase & Co.

What to read next

Professional development chase chats: creating an island of sanity.

Innovative business leaders discuss ways to help employees cope with life and work so everyone profits.

START YOUR BUSINESS The idea of working for someone wasn’t in the cards

From building a solid spaghetti tower to a hip design firm, these three millennials are changing the paradigm.

GROW YOUR BUSINESS How this entrepreneur is helping Black businesses thrive

Find out how this entrepreneur is bringing Black business owners together.

MANAGE YOUR BUSINESS Tips on writing your purpose, mission and vision statements

See how these three statements can work separately and together for your business.

Bank Business Plan Template

Written by Dave Lavinsky

Bank Business Plan

Over the past 20+ years, we have helped over 500 entrepreneurs and business owners create business plans to start and grow their banks.

If you’re unfamiliar with creating a bank business plan, you may think creating one will be a time-consuming and frustrating process. For most entrepreneurs it is, but for you, it won’t be since we’re here to help. We have the experience, resources, and knowledge to help you create a great business plan.

In this article, you will learn some background information on why business planning is important. Then, you will learn how to write a bank business plan step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What Is a Bank Business Plan?

A business plan provides a snapshot of your bank as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategies for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for Your Bank Business

If you’re looking to start a bank or grow your existing bank, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your bank to improve your chances of success. Your bank business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Banks

With regards to funding, the main sources of funding for a bank are personal savings, credit cards, bank loans, and angel investors. When it comes to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to ensure that your financials are reasonable, but they will also want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business. Personal savings and bank loans are the most common funding paths for banks.

Finish Your Business Plan Today!

How to write a business plan for a bank.

If you want to start a bank or expand your current one, you need a business plan. The guide below details the necessary information for how to write each essential component of your bank business plan.

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your executive summary is to quickly engage the reader. Explain to them the kind of bank you are running and the status. For example, are you a startup, do you have a bank that you would like to grow, or are you operating a chain of banks?

Next, provide an overview of each of the subsequent sections of your plan.

- Give a brief overview of the bank industry.

- Discuss the type of bank you are operating.

- Detail your direct competitors. Give an overview of your target customers.

- Provide a snapshot of your marketing strategy. Identify the key members of your team.

- Offer an overview of your financial plan.

Company Overview

In your company overview, you will detail the type of bank you are operating.

For example, you might specialize in one of the following types of banks:

- Commercial bank : this type of bank tends to concentrate on supporting businesses. Both large corporations and small businesses can turn to commercial banks if they need to open a checking or savings account, borrow money, obtain access to credit or transfer funds to companies in foreign markets.

- Credit union: this type of bank operates much like a traditional bank (issues loans, provides checking and savings accounts, etc.) but banks are for-profit whereas credit unions are not. Credit unions fall under the direction of their own members. They tend to serve people affiliated with a particular group, such as people living in the same area, low-income members of a community or armed service members. They also tend to charge lower fees and offer lower loan rates.

- Retail bank: retail banks can be traditional, brick-and-mortar brands that customers can access in-person, online, or through their mobile phones. They also offer general public financial products and services such as bank accounts, loans, credit cards, and insurance.

- Investment bank: this type of bank manages the trading of stocks, bonds, and other securities between companies and investors. They also advise individuals and corporations who need financial guidance, reorganize companies through mergers and acquisitions, manage investment portfolios or raise money for certain businesses and the federal government.

In addition to explaining the type of bank you will operate, the company overview needs to provide background on the business.

Include answers to questions such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include the number of clients served, the number of clients with positive reviews, reaching X number of clients served, etc.

- Your legal business Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry or market analysis, you need to provide an overview of the bank industry.

While this may seem unnecessary, it serves multiple purposes.

First, researching the bank industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your marketing strategy, particularly if your analysis identifies market trends.

The third reason is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section of your bank business plan:

- How big is the bank industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential target market for your bank? You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section of your bank business plan must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: individuals, small businesses, families, and corporations.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of bank you operate. Clearly, corporations would respond to different marketing promotions than individuals, for example.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, including a discussion of the ages, genders, locations, and income levels of the potential customers you seek to serve.

Psychographic profiles explain the wants and needs of your target customers. The more you can recognize and define these needs, the better you will do in attracting and retaining your customers.

Finish Your Bank Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other banks.

Indirect competitors are other options that customers have to purchase from that aren’t directly competing with your product or service. This includes trust accounts, investment companies, or the stock market. You need to mention such competition as well.

For each such competitor, provide an overview of their business and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as

- What types of customers do they serve?

- What type of bank are they?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you provide loans and retirement savings accounts?

- Will you offer products or services that your competition doesn’t?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For a bank business plan, your marketing strategy should include the following:

Product : In the product section, you should reiterate the type of bank company that you documented in your company overview. Then, detail the specific products or services you will be offering. For example, will you provide savings accounts, auto loans, mortgage loans, or financial advice?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of your plan, you are presenting the products and/or services you offer and their prices.

Place : Place refers to the site of your bank. Document where your company is situated and mention how the site will impact your success. For example, is your bank located in a busy retail district, a business district, a standalone office, or purely online? Discuss how your site might be the ideal location for your customers.

Promotions : The final part of your bank marketing plan is where you will document how you will drive potential customers to your location(s). The following are some promotional methods you might consider:

- Advertise in local papers, radio stations and/or magazines

- Reach out to websites

- Distribute flyers

- Engage in email marketing

- Advertise on social media platforms

- Improve the SEO (search engine optimization) on your website for targeted keywords

Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your bank, including reconciling accounts, customer service, accounting, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to sign up your Xth customer, or when you hope to reach $X in revenue. It could also be when you expect to expand your bank to a new city.

Management Team

To demonstrate your bank’s potential to succeed, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally, you and/or your team members have direct experience in managing banks. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act as mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in managing a bank or successfully running a small financial advisory firm.

Financial Plan

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet, and cash flow statements.

Income Statement

An income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenue and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you see 5 clients per day, and/or offer sign up bonuses? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets

Balance sheets show your assets and liabilities. While balance sheets can include much information, try to simplify them to the key items you need to know about. For instance, if you spend $50,000 on building out your bank, this will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a lender writes you a check for $50,000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement

Your cash flow statement will help determine how much money you need to start or grow your business, and ensure you never run out of money. What most entrepreneurs and business owners don’t realize is that you can turn a profit but run out of money and go bankrupt.

When creating your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a bank:

- Cost of furniture and office supplies

- Payroll or salaries paid to staff

- Business insurance

- Other start-up expenses (if you’re a new business) like legal expenses, permits, computer software, and equipment

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your bank location lease or a list of accounts and loans you plan to offer.

Writing a business plan for your bank is a worthwhile endeavor. If you follow the template above, by the time you are done, you will truly be an expert. You will understand the bank industry, your competition, and your customers. You will develop a marketing strategy and will understand what it takes to launch and grow a successful bank.

Bank Business Plan Template FAQs

What is the easiest way to complete my bank business plan.

Growthink's Ultimate Business Plan Template allows you to quickly and easily write your bank business plan.

How Do You Start a Bank Business?

Starting a bank business is easy with these 14 steps:

- Choose the Name for Your Bank Business

- Create Your Bank Business Plan

- Choose the Legal Structure for Your Bank Business

- Secure Startup Funding for Your Bank Business (If Needed)

- Secure a Location for Your Business

- Register Your Bank Business with the IRS

- Open a Business Bank Account

- Get a Business Credit Card

- Get the Required Business Licenses and Permits

- Get Business Insurance for Your Bank Business

- Buy or Lease the Right Bank Business Equipment

- Develop Your Bank Business Marketing Materials

- Purchase and Setup the Software Needed to Run Your Bank Business

- Open for Business

Don’t you wish there was a faster, easier way to finish your Bank business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. Click here to see how a Growthink business plan consultant can create your business plan for you.

Other Helpful Business Plan Articles & Templates

- Business Plan for Investors

- Bank/SBA Business Plan

- Operational/Strategic Planning Services

- L1 Visa Business Plan

- E1 Treaty Trader Visa Business Plan

- E2 Treaty Investor Visa Business Plan

- EB-1 Business Plan

- EB-2 NIW Business Plan

- EB-5 Business Plan

- Innovator Founder Visa Business Plan

- Start-Up Visa Business Plan

- Expansion Worker Visa Business Plan

- Manitoba MPNP Visa Business Plan

- Nova Scotia NSNP Visa Business Plan

- British Columbia BC PNP Visa Business Plan

- Self-Employed Visa Business Plan

- OINP Entrepreneur Stream Business Plan

- LMIA Owner Operator Business Plan

- ICT Work Permit Business Plan

- LMIA Mobility Program – C11 Entrepreneur Business Plan

- USMCA (ex-NAFTA) Business Plan

- Franchise Business Plan

- Landlord business plan

- Nonprofit Start-Up Business Plan

- USDA Business Plan

- Cannabis business plan

- Ecommerce business plan

- Online boutique business plan

- Mobile application business plan

- Daycare business plan

- Restaurant business plan

- Food delivery business plan

- Real estate business plan

- Business Continuity Plan

- Pitch Deck Consulting Services

- Financial Due Diligence Services

- ICO whitepaper

- ICO consulting services

- Confidential Information Memorandum

- Private Placement Memorandum

- Feasibility study

- Fractional CFO

- How it works

- Business Plan Examples

How to Write a Business Plan to Start a Bank

FEB.10, 2024

Bank Business Plan Checklist

A bank business plan is a document that describes the bank’s goals, strategies, operations, and financial projections. It communicates the bank’s vision and value proposition to potential investors, regulators, and stakeholders. A SBA business plan should be clear, concise, and realistic. It should also cover all the essential aspects of the bank’s business model.

Here is a checklist of the main sections that you should keep in mind while building a bank business plan:

- Executive summary

- Company description

- Industry analysis

- Competitive analysis

- Service or product list

- Marketing and sales plan

- Operations plan

- Management team

- Funding request

- Financial plan

Sample Business Plan for Bank

The following is a bank business plan template that operates in the USA. This bank business plan example is regarding ABC Bank, and it includes the following sections:

Executive Summary

ABC Bank is a new bank for California’s SMBs and individuals. We offer convenient banking services tailored to our customers’ needs and preferences. We have a large target market with over 500,000 SMBs spending billions on banking services annually. We have the licenses and approvals to operate our bank and raised $20 million in seed funding. We are looking for another $30 million in debt financing.

Our goal is to launch our bank by the end of 2024 and achieve the following objectives in the first five years of operation:

- Acquire 100,000 customers and 10% market share

- Generate $100 million in annual revenue and $20 million in net profit

- Achieve a return on equity (ROE) of 15% and a return on assets (ROA) of 1.5%

- Expand our network to 10 branches and 50 ATMs

- Increase our brand awareness and customer loyalty

Our bank has great potential to succeed and grow in the banking industry. We invite you to read the rest of our microfinance business plan to learn about how to set up a business plan for the bank and how we will achieve our goals.

Industry Analysis

California has one of the biggest and most active banking industries in the US and the world. According to the Federal Deposit Insurance Corp , California has 128 financial institutions, with total assets exceeding $560 billion.

The California banking industry is regulated and supervised by various federal and state authorities. However, they also face several risks and challenges, such as:

- High competition and consolidation

- Increasing regulation and compliance

- Rising customer demand for digital and mobile banking

- Cyberattacks and data breaches

- Environmental and social issues

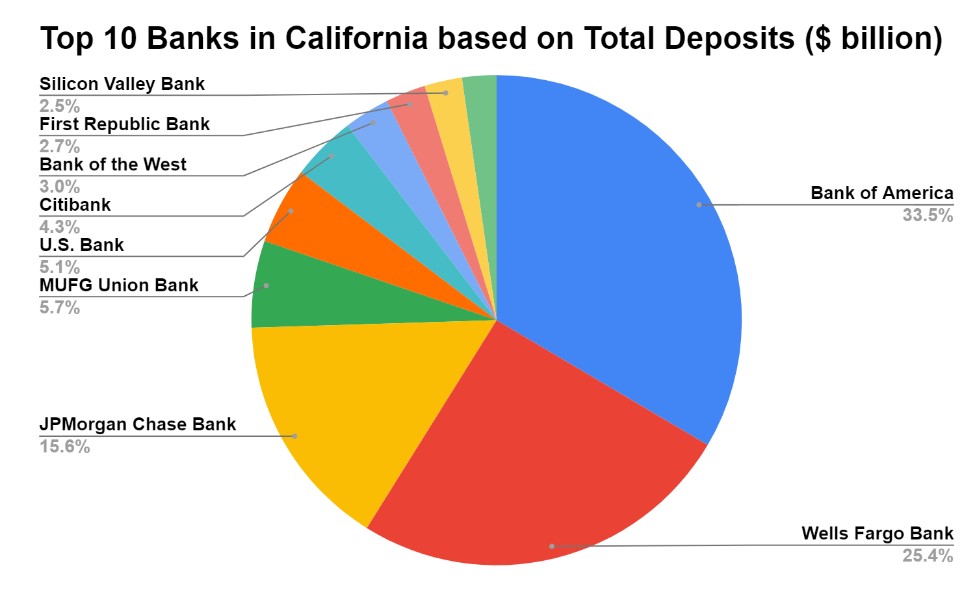

The banking industry in California is highly competitive and fragmented. According to the FDIC, the top 10 banks and thrifts in California by total deposits as of June 30, 2023, were:

Customer Analysis

We serve SMBs who need local, easy, and cheap banking. We divide our customers into four segments by size, industry, location, and needs:

SMB Segment 1 – Tech SMBs in big cities of California. These are fast-growing, banking-intensive customers. They account for a fifth of our market share and a third of our revenue and are loyal and referable.

SMB Segment 2 – Entertainment SMBs in California’s entertainment hubs. These are high-profile, banking-heavy customers. They make up a sixth of our market and a fourth of our revenue and are loyal and influential.

SMB Segment 3 – Tourism SMBs in California’s tourist spots. These are seasonal, banking-dependent customers. They represent a quarter of our market and a fifth of our revenue and are loyal and satisfied.

SMB Segment 4 – Other SMBs in various regions of California. These are slow-growing, banking-light customers. They constitute two-fifths of our market and a quarter of our revenue and are loyal and stable.

Competitive Analysis

We compete with other banks and financial institutions that offer similar or substitute products and services to our target customers in our target market. We group our competitors into four categories based on their size and scope:

1. National Banks

- Key Players – Bank of America, Wells Fargo, JPMorgan Chase, Citibank, U.S. Bank

- Strengths – Large customer base, strong brand, extensive branch/ATM network, innovation, robust operations, solid financial performance

- Weaknesses – High competition, regulatory costs, low customer satisfaction, high attrition

- Strategies – Maintain dominance through customer acquisition/retention, revenue growth, efficiency

2. Regional Banks

- Key Players – MUFG Union Bank, Bank of the West, First Republic Bank, Silicon Valley Bank, East West Bank

- Strengths – Loyal customer base, brand recognition, convenient branch/ATM network, flexible operations

- Weaknesses – Moderate competition, regulatory costs, customer attrition

- Strategies – Grow market presence through customer acquisition/retention, revenue optimization, efficiency

3. Community Banks

- Key Players – Mechanics Bank, Bank of Marin, Pacific Premier Bank, Tri Counties Bank, Luther Burbank Savings

- Strengths – Small loyal customer base, reputation, convenient branches, ability to adapt

- Weaknesses – Low innovation and technology adoption

- Strategies – Maintain niche identity through customer loyalty, revenue optimization, efficiency

4. Online Banks

- Key Players – Ally Bank, Capital One 360, Discover Bank, Chime Bank, Varo Bank

- Strengths – Large growing customer base, strong brand, no branches, lean operations, high efficiency

- Weaknesses – High competition, regulatory costs, low customer satisfaction and trust, high attrition

- Strategies – Disrupt the industry by acquiring/retaining customers, optimizing revenue, improving efficiency

Market Research

Our market research shows that:

- California has a large, competitive, growing banking market with 128 banks and $560 billion in assets.

- Our target customers are the SMBs in California, which is 99.8% of the businesses and employ 7.2-7.4 million employees.

- Our main competitors are national and regional banks in California that offer similar banking products and services.

We conclude that:

- Based on the information provided in our loan officer business plan , there is a promising business opportunity for us to venture into and establish a presence in the banking market in California.

- We should focus on the SMBs in California, as they have various unmet banking needs, preferences, behavior, and a high potential for growth and profitability.

Operations Plan

Our operational structure and processes form the basis of our operations plan, and they are as follows:

- Location and Layout – We have a network of 10 branches and 50 ATMs across our target area in California. We strategically place our branches and ATMs in convenient and high-traffic locations.

- Equipment and Technology – We use modern equipment and technology to provide our products and services. We have c omputers and software for banking functions; security systems to protect branches and ATMs; communication systems to communicate with customers and staff; i nventory and supplies to operate branches and ATMs.

- Suppliers and Vendors – We work with reliable suppliers and vendors that provide our inventory and supplies like cash, cards, paper, etc. We have supplier management systems to evaluate performance.

- Staff and Management – Our branches have staff like branch managers, customer service representatives, tellers, and ATM technicians with suitable qualifications and experience.

- Policies and Procedures – We have policies for customer service, cash handling, card handling, and paper handling to ensure quality, minimize losses, and comply with regulations. We use various tools and systems to implement these policies.

Management Team

The following individuals make up our management team:

- Earl Yao, CEO and Founder – Earl is responsible for establishing and guiding the bank’s vision, mission, strategy, and overall operations. He brings with him over 20 years of banking experience.

- Paula Wells, CFO and Co-Founder – Paula oversees financial planning, reporting, analysis, compliance, and risk management.

- Mark Hans, CTO – Mark leads our technology strategy, infrastructure, innovation, and digital transformation.

- Emma Smith, CMO – Emma is responsible for designing and implementing our marketing strategy and campaigns.

- David O’kane, COO – David manages the daily operations and processes of the bank ensuring our products and services meet the highest standards of quality and efficiency.

Financial Projections

Our assumptions and drivers form the basis of our financial projections, which are as follows:

Assumptions: We have made the following assumptions for our collection agency business plan :

- Start with 10 branches, 50 ATMs in January 2024

- Grow branches and ATMs 10% annually

- 10,000 customers per branch, 2,000 per ATM

- 5% average loan rate, 2% average deposit rate

- 80% average loan-to-deposit ratio

- $10 average fee per customer monthly

- $100,000 average operating expense per branch monthly

- $10,000 average operating expense per ATM monthly

- 25% average tax rate

Our financial projections are as per our:

- Projected Income Statement

- Projected Cash Flow Statement

- Projected Balance Sheet

- Projected Financial Ratios and Indicators

Select the Legal Framework for Your Bank

Our legal structure and requirements form the basis of our legal framework, which are as follows:

Legal Structure and Entity – We have chosen to incorporate our bank as a limited liability company (LLC) under the laws of California.

Members – We have two members who own and control our bank: Earl Yao and Paula Wells, the founders and co-founders of our bank.

Manager – We have appointed Mark Hans as our manager who oversees our bank’s day-to-day operations and activities.

Name – We have registered our bank’s name as ABC Bank LLC with the California Secretary of State. We have also obtained a trademark registration for our name and logo.

Registered Agent – We have designated XYZ Registered Agent Services LLC as our registered agent authorized to receive and handle legal notices and documents on behalf of our bank.

Licenses and Approvals – We have obtained the necessary licenses and approvals to operate our bank in California, including:

- Federal Deposit Insurance Corporation (FDIC) Insurance

- Federal Reserve System Membership

- California Department of Financial Protection and Innovation (DFPI) License

- Business License

- Employer Identification Number (EIN)

- Zoning and Building Permits

Legal Documents and Agreements – We have prepared and signed the necessary legal documents and agreements to form and operate our bank, including:

- Certificate of Formation

- Operating Agreement

- Membership Agreement

- Loan Agreement

- Card Agreement

- Paper Agreement

Keys to Success

We analyze our market, customers, competitors, and industry to determine our keys to success. We have identified the following keys to success for our bank.

Customer Satisfaction

Customer satisfaction is vital for any business, especially a bank relying on loyalty and referrals. It is the degree customers are happy with our products, services, and interactions. It is influenced by:

- Product and service quality – High-quality products and services that meet customer needs and preferences

- Customer service quality – Friendly, professional, and helpful customer service across channels

- Customer experience quality – Convenient, reliable, and secure customer access and transactions

We will measure satisfaction with surveys, feedback, mystery shopping, and net promoter scores. Our goal is a net promoter score of at least 8.

Operational Efficiency

Efficiency is key in a regulated, competitive environment. It is using resources and processes effectively to achieve goals and objectives. It is influenced by:

- Resource optimization – Effective and efficient use and control of capital, staff, and technology

- Process improvement – Streamlined, standardized processes measured for performance

- Performance management – Managing financial, operational, customer, and stakeholder performance

We will measure efficiency with KPIs, metrics, dashboards, and operational efficiency ratios. Our goal is an operational efficiency ratio below 50%.

Partner with OGSCapital for Your Bank Business Plan Success

Highly efficient service.

Highly Efficient Service! I am incredibly happy with the outcome; Alex and his team are highly efficient professionals with a diverse bank of knowledge.

Are you looking to hire business plan writers to start a bank business plan? At OGSCapital, we can help you create a customized and high-quality bank development business plan to meet your goals and exceed your expectations.

We have a team of senior business plan experts with extensive experience and expertise in various industries and markets. We will conduct thorough market research, develop a unique value proposition, design a compelling financial model, and craft a persuasive pitch deck for your business plan. We will also offer you strategic advice, guidance, and access to a network of investors and other crucial contacts.

We are not just a business plan writing service. We are a partner and a mentor who will support you throughout your entrepreneurial journey. We will help you achieve your business goals with smart solutions and professional advice. Contact us today and let us help you turn your business idea into a reality.

Frequently Asked Questions

How do I start a small bank business?

To start a small bank business in the US, you need to raise enough capital, understand how to make a business plan for the bank, apply for a federal or state charter, register your bank for taxes, open a business bank account, set up accounting, get the necessary permits and licenses, get bank insurance, define your brand, create your website, and set up your phone system.

Are banks profitable businesses?

Yes, banks are profitable businesses in the US. They earn money through interest on loans and fees for other services. The commercial banking industry in the US has grown 5.6% per year on average between 2018 and 2023.

Download Bank Business Plan Sample in pdf

OGSCapital’s team has assisted thousands of entrepreneurs with top-rate business plan development, consultancy and analysis. They’ve helped thousands of SME owners secure more than $1.5 billion in funding, and they can do the same for you.

Add comment

E-mail is already registered on the site. Please use the Login form or enter another .

You entered an incorrect username or password

Comments (0)

mentioned in the press:

Search the site:

OGScapital website is not supported for your current browser. Please use:

How to write a business plan for a bank loan?

Whether you need a bank loan to start up a new business, grow an existing business or anything in between, writing a business plan can help make it a reality!

It involves outlining your goals and explaining how you plan to achieve them. A professional business plan is crucial to obtaining a bank loan and planning your outlook for both the short and long-term future.

Yet, most entrepreneurs view writing a business plan as a daunting task. But, it doesn't have to be!

In this guide, we explain what writing a business plan for a bank loan entails, why you need one, what tool you should use, and what content should be included.

Ready? Let's get started!

In this guide:

What is a business plan?

Do i need a business plan to secure a business loan, do banks actually look at business plans or is it just a box-ticking exercise, what do banks look for in a business plan, what tool should i use to write a business plan for a bank loan, what does a business plan for a bank loan look like, do i need a 3 or 5 year business plan for a bank, how long does a business plan for a bank loan need to be, key financial metrics and ratios banks look at when deciding on a loan application, examples and templates of business plans for a bank loan, pdf vs. powerpoint pitch: what format should you use to present your business plan to the bank, can i apply for multiple loans at the same time.

- Is it worth using a credit broker to apply to multiple lenders?

How long does the loan approval process usually take?

Key takeaways.

A business plan is a written document that contains two key parts:

- A written presentation that outlines what the company does, its medium term objectives and explains how it plans to achieve them.

- A financial plan that includes a cash flow statement, profit and loss statement and a balance sheet.

To get a business loan approved you need to convince the lender that your business will be able to repay it.

Regulated lenders also have legal obligations to demonstrate to their regulators that they are lending responsibly, meaning that your business can afford the loan.

Therefore, whilst a business plan is not strictly necessary to obtain a business loan, most banks will likely ask you to provide one, as it provides an objective way of assessing your borrowing capacity and to demonstrate affordability.

Imagine the following situation, a business borrows £100k from a regulated bank, and then goes bust. The regulator decides to investigate the bank. The bank can then provide the business plan to help demonstrate that the loan was affordable and that it behaved responsibly.

Need a solid financial forecast?

The Business Plan Shop does the maths for you. Simply enter your revenues, costs and investments. Click save and our online tool builds a three-way forecast for you instantly.

Most banks will look at your business plan when you hand in a loan application. How in-depth the bank looks at it though will depend on whether you are borrowing against assets or cash flow.

Asset-based lending

Borrowing against assets involves lending money to businesses whilst using their assets as collateral. These loans are also called secured loans.

Secured loans help reduce risks for lenders, they can seize the collateral if the borrower is unable to repay and sell the asset to recoup part of their losses. That's what happens with mortgages, for example.

Banks usually have pre-set loan-to-value ratios (LTVs) for the most common types of assets (property, equipment, vehicles etc.).

A loan-to-value assessment simply compares the appraised value of your asset against the value of the business loan.

For example, if you're buying a car worth £10,000 and the LTV ratio used by the bank is 70%, they can lend you up to £7,000 and will take the car as collateral.

The bank still needs to assess that you can afford the £7,000 business loan. They might ask you for a business plan, but might decide not to do so given that it's a small amount. They might simply look at your trading history or ask for a personal guarantee from the business owner instead.

BDC Bank - a Canadian bank - says that "financial institutions don’t use the same loan-to-value ratio for all asset types because of different asset liquidity levels".

In layman's terms, liquidity means how easy it is to sell the asset. If it's a delivery van, it's very easy as there is an established secondhand market (high liquidity), if it's a chemical plant it might take up to a year (low liquidity).

In a nutshell, the easier it is to sell the asset (if it needs to be seized), the higher the loan amount.

According to BDC Bank , likely LTV ratios for common asset types are:

- Marketable securities (high in liquidity): 90%

- Accounts receivables: 75%

- Commercial and industrial real estate: 65% to 100%

- Inventory (low in liquidity): 50%.

Capital Source Group - an alternate lender - says that some banks require a down payment of up to 20% of the market value of the equipment, referring to firms seeking finance to purchase key equipment, and mentions an indicative baseline LTV ratio of 50%.

Cash-flow-based lending

As we've seen above, asset-based lending is relatively straightforward, and lower risk as the asset is used as collateral. The decision making is more complicated if your business borrows against cash flows (for e.g. working capital purposes).

Cash-flow-based borrowing involves lending money to businesses based on their predicted cash flows. The bank has to assess how much you can borrow based on historical and projected financials.

Doing so requires to have a clear understanding of the future cash flows of the business, which can only be obtained through a business plan.

Most banks ask for business plans when you apply for a business loan because they need it to understand:

Who the borrower is

Whether or not there is collateral.

- If there is a trading history that supports the cash flow forecast

- What borrowing capacity and affordability can be inferred from the forecast

Firstly, the bank has to understand what entity or person it is lending money to. For example, if you take over a business, you could buy either its assets or shares.

If you were to buy their assets, a new company would likely be created but if you were to purchase their shares, you could do it directly or via a holding company (likelier option).

Depending on which option you choose, the bank has to decide whether it's lending to your current business, yourself or the holding company. The answer to this question then determines the level of risk the bank is undertaking.

Next, the bank has to decide whether or not there is sufficient collateral. Can it secure the loan against the business assets or does it need to request a personal warranty from the business owner(s)?

It will assess:

- Whether or not your current business has any assets that can be used as collateral

- If you, the business owner, have a house or cash in the bank or can offer a credible personal guarantee

- Whether or not the holding company will provide its shares as collateral or if it needs to ask its shareholders for a personal guarantee (or both)

Once the bank understands the value of the security, it can better estimate the borrowing capacity of the entity.

Does the trading history support the cash flow forecast

The bank will want to know if there is any trading history to support your cash flow forecast.

If there isn't, it becomes harder to judge and riskier from a lender's viewpoint.

Borrowing capacity and affordability: total indebtedness and credit metrics

Lastly, the bank will estimate your business credit score by taking into consideration: whether or not you have any outstanding debt, what your past repayments were like, and credit metrics such as fixed charge coverage ratio, net debt-to-equity ratio, and interest coverage ratio (we'll detail these 3 ratios later in this guide).

Need inspiration for your business plan?

The Business Plan Shop has dozens of business plan templates that you can use to get a clear idea of what a complete business plan looks like.

Writing a business plan can be both tedious and difficult if you start from scratch. Luckily for you, online business plan software can help you write a professional plan in no time.

There are several advantages to using specialised software like The Business Plan Shop:

- You are guided through the writing process by detailed instructions and examples for each part of the plan

- You can be inspired by already written business plan templates

- You can easily make your financial forecast by letting the software take care of the financial calculations for you

- You get a professional document, formatted and ready to be sent to your bank

- You can easily compare your forecast against actuals from your accounting system to ensure you are on track to deliver your plan, and adjust your forecast to keep it up to date as time goes by

If you are interested in this type of solution, you can try our software for free by signing up to The Business Plan Shop today .

There are seven key sections that any business plan for a bank loan must include:

- Executive summary

- Company Overview

- Products and services

- Market analysis

- Financial projections

Let's have a look at each one in more detail.

1. Executive summary

Your executive summary should provide the bank with a quick snapshot of your business (who you are, what you sell, and what your financial projections look like). Remember that this is the first section of your business plan that they will look at - you need to keep them interested and do not need to go into depth.

You should also include details such as the loan amount sought and its purpose, providing the bank with a clear understanding of how the funds will be utilized to support your business's growth and operations.

For example, if you're a small manufacturing company seeking a loan to purchase new equipment, your executive summary would outline the specific amount needed for equipment acquisition and how it will contribute to increasing production capacity and efficiency.

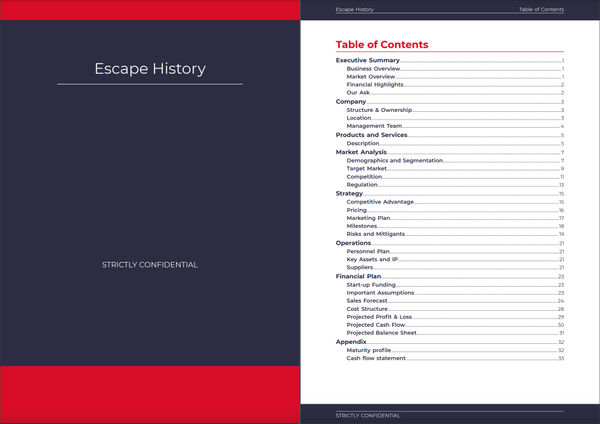

Above is an example of how the "Our Ask" section which details the funding requirements might look like. This image was taken from one of our business plan templates .

Additionally, the executive summary may highlight any collateral or security offered to mitigate the lender's risk.

This could include assets such as real estate, equipment, inventory, or accounts receivable that you're willing to pledge as security for the loan.

By clearly outlining the collateral available to secure the loan, you demonstrate your commitment to fulfilling your financial obligations and provide assurance to the bank regarding the loan's repayment.

Moreover, the executive summary may touch upon the key terms and conditions your business is willing to accept, such as interest rates, repayment schedules, and loan covenants, to ensure the loan aligns with your business's financial objectives and capabilities.

For instance, if you're a small retail store seeking a loan to open a second store, you may try to negotiate a loan repayment holiday to defer the principal repayments until after the second store has started trading in order to improve cash flow.

2. Company overview

In this section, you should explain what structure your business takes up (sole trader, partnership or limited liability company). This way, the bank understands whether or not you are liable if your business defaults on its loan. If you are not they might ask you for a personal guarantee.

If you are a partnership or limited liability company, state who your partners are and what percentage of the business they own. Also, outline any skills and experience they have that make them suitable for their role.

Finally, you should state where your business(es) are located and why that particular location was chosen (for example, it could be because of the parking slots available or transport links, making it very accessible for potential customers).

3. Products and services

You should include a detailed list of the products or services that you sell. Whilst you don't have to specify every single item or service, you should aim to include all of the key ones.

For example, for a hair salon, this might be hair care, washing, stylish haircuts, combing, hair colouring, waving, and hair straightening.

4. Market analysis

The market analysis section of your business plan for a bank loan is where you bring together your local and national market research. Using charts and graphs along with text makes it easier to illustrate your points clearly.

You should also state who you plan to target and the competitors in your local market. For example, if you were a coffee shop business, you could target people seeking a takeaway coffee, those looking for a lunch or snack or people looking for a place to work.

Finally, you should state the regulation in effect in the local market and whether there are any plans to make changes in the future (by the council for example).

5. Strategy

Your strategy section helps explain how you plan to make your business a success. Both marketing and pricing strategies feature in this section.

Explain how you've determined your prices and whether or not they differ from your competitors. Remember that this will depend on your overall pricing strategy (cost-plus pricing, competitive, price skimming, etc.).

Your marketing plan should explain how you plan to attract and retain customers. For example, you could have an attractive storefront with your logo to encourage potential customers to visit inside. You might also offer loyalty cards (for example, buy 3 burgers, get the fourth one free).

Finally, key milestones must also be outlined so that both parties are aware of what needs to be achieved within an agreed-upon timeframe along with measures taken against any foreseeable risks and mitigants related thereto.

6. Operations

The operations section of your business plan for a bank loan should include information about your staffing team. List any current and future recruitment plans, employee skills, experience and what roles they are going to take up.

Plus, you should state what suppliers you chose and why. For example, you might have chosen a particular supplier thanks to their eco-friendly stance or brand reputation.

7. Financial projections

Arguably the most important section in your business plan for a bank, your financial projections help the bank decide whether or not they should lend to your company.

This section includes your balance sheet, profit and loss statement and cash flow forecast. Figures from these three statements are used to compute key ratios (see the section below).

Profit and loss statement

A projected P&L statement shows how much money the company might make and how much it will grow in the future.

It helps stakeholders understand how successful the company could be.

Balance sheet

A balance sheet shows what your business owns (assets), what it owes (liabilities), and what has been invested by the owners (equity).

Looking at a balance sheet enables investors, lenders, and business owners to assess the capital structure of the business.

One key aspect of this analysis is achieved by calculating key liquidity (short-term) and solvability (long-term) ratios to understand if the company can pay its debts as they fall due.

Cash flow statement

A projected cash flow statement is a document used to plan out how much cash your business will generate (inflows) and spend over a certain period (outflows).

This document shows the expected cash flows from the operations, investments and other financial activities.

Having this information can help you decide how much money your business needs to save for future expenses or investments, as well as anticipate potential cash shortfalls.

When seeking a bank loan, one common question that arises is the duration of the business plan required.

Understanding whether you need a 3-year plan or a more detailed 5-year money lending business plan can impact your credit application process.

For startups, and most small businesses, a 3-year business plan strikes the right balance between providing a clear vision of the future and not overwhelming with excessive detail.

This shorter timeframe is also often preferred by banks as it allows for a focused projection of your business's trajectory without straying too far into the unknown.

For these reasons, three-years is the de facto standard business plan duration for a loan application.

That being said, it might make sense for businesses to use a 5-year business plan in certain situations. For example when there are delayed cash flows because of a longer development or sales cycle or when the loan is used to fund significant capital investments.

Consider a manufacturing company investing in a new factory to increase production capacity. A 5-year plan would detail the initial investment and leave enough time to show the expected returns and the long-term impact on revenue, costs, and market position.

This longer-term view offers a more comprehensive picture of your business's growth potential and can demonstrate to the bank that you have a clear strategy for sustained success.

In summary, whether you opt for a 3 or 5-year business plan depends on the nature of your business, its growth trajectory, and the level of detail required to support your loan application.

Like most business plans, there's no specific number of pages that yours must have. A good rule of thumb, however, is to keep it between 15 and 35 pages.

As long as you've covered all of the key sections, ranging from the executive summary to the financial projections, your business plan for a bank loan should be good to go.

Remember, quality is more important than quantity.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

It's worth noting that ratio targets set by lenders are industry dependent.

There are usually three key financial ratios that banks calculate before lending money:

1. Fixed charged coverage ratio

This solvency ratio assesses how much headroom a business has over its upcoming debt repayments.

It is calculated by dividing the Cash flow available for debt service (or CFADS), which measures how much cash flow is available to pay off debt obligations, by the amount to be paid to service the debt (interest plus principal repayments).

It is one of the main ratios used by lenders to assess the borrowing capacity and the financial risk of a given business.

For businesses utilising bank debt, lenders usually expect the fixed charge coverage ratio to be above 2.0x, which implies that the business is expected to generate twice as much cash as is needed to service the debt, leaving a healthy buffer.

In any case, the ratio should be above 1.0x, below 1.0x the business is not generating enough cash to service its debt which puts lenders at risk.

For example, if your business records a CFADS of £500,000 and total debt service amounting to £250,000 (£50,000 of interest payments, and £200,000 of principal repayments), it will have a fixed charge coverage ratio of 2.0x.

2. Debt-to-EBITDA

This solvency ratio is used to assess the level of debt and borrowing capacity of the business. It compares the level of debt to the firm’s EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), used as a proxy for the operating cash flow.

For example, if your company has debt worth £20m and an EBITDA of £5M, your debt to EBITDA ratio would be £20m/£5m = 4.0x.

In simple terms, a company with a debt-to-EBITDA ratio of 4.0x would need at least 4 years to repay its debt. Whether or not this is too high will depend on the sector and the risk appetite of the lender.

3. Interest coverage ratio