- Business Plan for Investors

- Bank/SBA Business Plan

- Operational/Strategic Planning Services

- L1 Visa Business Plan

- E1 Treaty Trader Visa Business Plan

- E2 Treaty Investor Visa Business Plan

- EB-1 Business Plan

- EB-2 NIW Business Plan

- EB-5 Business Plan

- Innovator Founder Visa Business Plan

- Start-Up Visa Business Plan

- Expansion Worker Visa Business Plan

- Manitoba MPNP Visa Business Plan

- Nova Scotia NSNP Visa Business Plan

- British Columbia BC PNP Visa Business Plan

- Self-Employed Visa Business Plan

- OINP Entrepreneur Stream Business Plan

- LMIA Owner Operator Business Plan

- ICT Work Permit Business Plan

- LMIA Mobility Program – C11 Entrepreneur Business Plan

- USMCA (ex-NAFTA) Business Plan

- Franchise Business Plan

- Landlord business plan

- Nonprofit Start-Up Business Plan

- USDA Business Plan

- Cannabis business plan

- Ecommerce business plan

- Online boutique business plan

- Mobile application business plan

- Daycare business plan

- Restaurant business plan

- Food delivery business plan

- Real estate business plan

- Business Continuity Plan

- Pitch Deck Consulting Services

- Financial Due Diligence Services

- ICO whitepaper

- ICO consulting services

- Confidential Information Memorandum

- Private Placement Memorandum

- Feasibility study

- Fractional CFO

- How it works

- Business Plan Examples

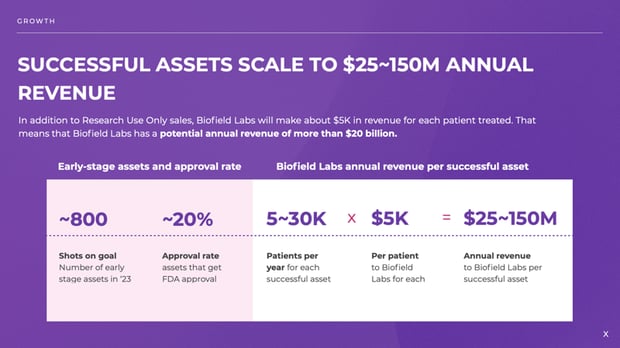

Venture Capital Business Plan: A Guide for Entrepreneurs

AUG.01, 2023

Are you looking for VC funding or funding from other potential investors? You need a good business idea – and an excellent business plan. Business planning and raising capital go hand-in-hand. An investor business plan is required to attract a venture capital firm. And the desire to raise capital (whether from an individual “angel” investor or a venture capitalist) is often the key motivator in business planning.

What is a venture capitalist?

A venture capitalist, often referred to as a VC, strategically allocates financial capital to early-stage, high-potential startup companies to foster exponential growth and catalyze groundbreaking innovation. By leveraging their investments, venture capitalists secure partial ownership and wield a profound influence over critical strategic decisions and operational facets. Furthermore, they impart invaluable guidance and mentorship and harness their extensive network of influential contacts and abundant resources.

Venture capitalists aim to attain considerable returns on their investments through the strategic divestment of their ownership stake in the company at a subsequent stage, commonly facilitated through an IPO or a trade sale, encompassing mergers or acquisitions. Given the inherent risks associated with their investment endeavors, venture capitalists adopt an exceptionally discerning approach, meticulously selecting a mere fraction of the myriad companies that seek their sought-after financial backing.

Their active pursuit centers around identifying enterprises that epitomize disruptive technologies or trailblazing business models, thrive within expansive and rapidly evolving markets, exhibit a significant competitive edge, and are steered by an adept and fervent management team. These are the essential elements of a compelling Business Plan for Investors that can attract the attention and support of venture capitalists.

What is a Venture Capital Firm?

Venture capital firms (VCs) are money companies that put money in and help new and scalable startups. VCs get funds from different investors and then give them to startups they think can change or make new markets. VCs use a team of experts who check the chance of new companies. These experts have different backgrounds and skills in different businesses, and they use their ideas to help VCs pick companies that are likely to do well.

Besides giving money, VCs also give their companies other benefits, such as advice and access to their network of people, which can be very important to early-stage companies.

Types of Venture Capital Investments

Venture capital investments can be classified into different types based on the company’s development stage. The main types are:

1. Seed Capital

Seed capital is the earliest funding given to an innovator or group with a vision for a novel product or service but has yet to transform it into a feasible business. Seed capital is typically used for market exploration, product creation, prototype evaluation, customer verification, etc. Seed capital is very precarious because there is no assurance that the vision will work or that there will be a market appetite for it. However, seed capital can also generate very high rewards if the vision becomes successful and attracts more funding.

2. Startup Capital

Startup capital is the funding given to a company that has created its product or service and has introduced it in the market but has yet to generate substantial revenue or profit. Startup capital is typically used for promotion, sales, distribution, customer acquisition, etc. Startup capital is less precarious than seed capital because there is some indication of product-market fit and traction. However, startup capital can also be challenging to obtain because there is still uncertainty about the scalability and sustainability of the business model.

3. Early Stage Capital

Early-stage capital is the funding granted to a company that has validated its product or service in the market and has begun generating revenue and profit but has yet to attain its full potential. Early-stage capital is typically used to diversify the product or service portfolio, penetrate new segments, recruit more talent, optimize operations, etc. Early-stage capital is less precarious than startup capital because there is more evidence and traction of the business. However, early-stage capital can also be challenging and demanding because there are more expectations and pressure from the investors.

4. Expansion Capital

Expansion capital is the funding given to a company that has attained a significant market presence, revenue, and profit growth and is ready to scale up its business to the next level. Expansion capital is usually used to acquire other entities, develop new products or services, open new outlets, increase production capability, etc. Expansion capital is less perilous than early-stage capital because the business has more stability and predictability. However, expansion capital can also be costly and dilutive because more investors are engaged, and more equity is surrendered.

5. Late Stage Capital

Late-stage capital is the funding bestowed to a company that has reached a mature stage of development and growth and is preparing for an exit event such as an IPO or a trade sale. Late-stage capital is usually used to enhance the company’s valuation, reputation, and visibility, improve financial performance, strengthen governance, etc. Late-stage capital is less perilous than expansion capital because there is more certainty and credibility in the business. However, late-stage capital can also be complex and restrictive because more regulations and obligations are involved. However, a SBA Business Plan can help late-stage companies comply with the requirements and expectations of investors.

6. Bridge Financing

Bridge financing is the interim funding granted to a company that requires short-term capital to fill an urgent need or gap until it obtains a lasting or stable source of financing. Bridge financing is typically utilized for satisfying payroll, settling bills, accomplishing a project, etc. Bridge financing is perilous because there is no assurance that the firm can secure lasting or stable financing. However, bridge financing can also be beneficial and adaptable because it can offer swift and effortless access to cash.

The following table compares the different types of venture capital investments based on their stage, amount, risk, return, and purpose:

Venture Capital and VC Funding Methods

Venture capital is a source of funding for entrepreneurs who need money to grow their businesses. VC funding methods are the terms and conditions venture capitalists agree on when investing in the companies they support. Different methods of making a venture capital deal exist based on the people involved, worth, chance, and choices. The main methods are:

1. Common stock

This is the most straightforward form of VC funding method. It involves issuing shares of common stock to investors in exchange for capital. A common stock gives the investors voting rights and dividends (if any) in proportion to their ownership stake. Common stock is usually preferred by early-stage companies with low valuation and high risk.

2. Preferred stock

This is a more complex and sophisticated form of VC funding method. It involves issuing shares of preferred stock to investors in exchange for capital. Preferred stock gives the investors preference over common stockholders regarding dividends, liquidation, and conversion rights. Preferred stock is usually preferred by later-stage companies that have higher valuations and lower risk.

3. Convertible debt

This is a mixed form of VC funding method. It means giving the investors a debt instrument that can be converted into shares later or when some conditions are satisfied. Convertible debt pays the investors interest and money back until it gets converted. Early companies with unclear worth and a high chance of failure often choose convertible debt.

4. SAFE (Simple Agreement for Future Equity)

This is a newer and simpler form of VC funding method. It means making a deal with the investors that lets them get shares in the future at a fixed worth or lower price. SAFE only involves issuing shares or debt instruments to the investors once a future financing event occurs. SAFE is usually preferred by seed-stage companies that have uncertain valuations and high risk.

Main Sections of a Venture Capital Business Plan

A venture business plan is a document describing your business idea, market opportunity, competitive advantage, financial projections, and funding needs. It is a tool that helps you communicate your vision and strategy to potential investors and partners. A venture business plan sample should include the following sections:

1. Executive Summary

The executive summary is pivotal in your venture business plan, serving as the primary section that demands attention. It aims to present a concise yet comprehensive overview of your business idea, target market, unique value proposition, traction and milestones, financial summary, and funding request. It is vital to draft the executive summary clearly and compellingly that captivates readers and incites their curiosity to explore your venture further.

2. Company Analysis

The company analysis section delves deeper into your company’s narrative, providing a detailed account of its history, mission, vision, values, goals, objectives, team, culture, and legal structure. This section highlights your company’s noteworthy achievements and inherent strengths while addressing the potential challenges and risks it faces. Moreover, it presents a compelling case for the qualifications and capabilities of your team, demonstrating their aptitude in executing the business plan.

3. Industry Analysis

The industry analysis section demonstrates your understanding of the market you operate in or plan to enter. It should provide relevant information about your industry’s size, growth, trends, drivers, challenges, opportunities, and outlook. It should also identify and analyze your industry’s key segments and sub-segments.

4. Customer Analysis

The customer analysis section is important as it outlines and describes your target market and various customer segments. It should encompass a detailed profile of your ideal customers, covering their demographics, psychographics, behaviors, needs, pains, desires, preferences, and purchasing patterns. Furthermore, this section should include an estimation of your product or service’s total addressable market (TAM), serviceable available market (SAM), and serviceable obtainable market (SOM).

5. Competitive Analysis

The competitive analysis section is crucial in identifying and evaluating direct and indirect competitors. It thoroughly assesses their strengths, weaknesses, strategies, products, services, prices, features, benefits, market share, customer satisfaction, and distinctive factors. Additionally, this section explains your market positioning strategy, emphasizing your competitive advantages and unique selling points.

6. Marketing Plan

The marketing plan section outlines your marketing strategy and tactics for reaching and attracting your target customers and generating sales and revenue. It should cover the following elements:

- Product and service

- Distribution

- Marketing process

- Marketing Physical Evidence

7. Operations Plan

The operations plan section describes how you will run and manage your business daily. It should cover the following aspects:

- Human Resources

- Legal issues and requirements

8. Financial Plan

The financial plan section provides a detailed projection of your financial performance and position for three to five years. It should include the following components:

- Income Statement

- Cash Flow Statement

- Balance Sheet

- Break-Even Analysis

- Funding Request

- Funding Sources

- Exit Strategy

OGSCapital for Your Venture Capital Business Plan

Are you looking for an answer to: How to write a venture capital business plan? Our business plan experts at OGSCapital can help. We have a team of professional business plan writers with over 15 years of experience offering business plan writing services. We have helped over 5,000 clients attract more than $2.7 billion in financing. Here are some of the reasons why you should choose OGSCapital for your venture capital business plan:

OGSCapital can provide you with the following benefits:

- A customized and high-quality business plan

- Comprehensive and in-depth market research and analysis

- A realistic and accurate financial model and projections

- A persuasive and compelling executive summary

- A professional and attractive design and layout of your business plan

- Fast and reliable delivery within 10 to 15 days

- A revision after receiving the first draft of your business plan

If you’re also confused about how to write a business plan for venture capital that stands out from the crowd and increases your chances of getting funded, contact our experts at OGSCapital today.

Frequently Asked Questions

1. What do venture capitalists look for in a business plan?

A business plan to raise venture capital should demonstrate a great business idea, a talented and experienced team, a unique and valuable product or service, a market validation, a huge and expanding market, and a good deal and exit strategy. Plus, it should be clear, concise, well-researched and realistic.

2. What is the golden rule for venture capitalists?

For venture capitalists, people matter more than ideas. They look for entrepreneurs and managers with passion, dedication, flexibility, and willingness to learn from feedback. Venture capitalists believe these are the essential qualities that make or break a venture.

Download Venture Capital Business Plan Sample in PDF

OGSCapital’s team has assisted thousands of entrepreneurs with top-rate business plan development, consultancy and analysis. They’ve helped thousands of SME owners secure more than $1.5 billion in funding, and they can do the same for you.

Add comment

E-mail is already registered on the site. Please use the Login form or enter another .

You entered an incorrect username or password

Comments (0)

mentioned in the press:

Search the site:

OGScapital website is not supported for your current browser. Please use:

Venture Capital Business Plan

- Written By Dave Lavinsky

As a startup company, one of the most important things you can do is to create a business plan that will secure funding from venture capitalists. But what exactly is a business plan for a venture capitalist?

A business plan is a comprehensive document that outlines the business goals and strategies of a company seeking venture capital investment. It typically includes detailed information about the company’s product or service, market analysis, financial projections, and management team bios.

A business plan for potential investors must be well-written and well-presented to impress those looking to fund your business. It should clearly state why the company needs funding and how it will be used. The financial projections should be realistic and backed up by market research. The management team should be able to demonstrate their expertise in running a business.

If you are a startup company looking for venture capital investment, it is essential to create a well-crafted business plan that will impress potential investors.

Who are Venture Capitalists?

A venture capitalist (VC) is an individual or firm that invests its capital in startup companies in exchange for ownership equity. They are typically looking for high-growth businesses with solid business plans and a team of experienced entrepreneurs.

VCs can provide much-needed capital to young companies, but they also bring expertise and guidance. In return for their investment, VCs typically require a seat on the company’s board of directors and a share of the profits.

What are Venture Capital Firms?

A venture capital firm is an organization that invests money in startup companies in exchange for a percentage of ownership in the company. In return for their investment, venture capitalists typically require a seat on the company’s board of directors and a share of the profits.

There are many venture capital firms around the world, but not all of them are interested in investing in every type of company. It is important to do your research and find the right VC firm for your business.

Types of Venture Capital Investment

There are two main types of venture capital investment: equity financing and debt financing.

Equity financing is when VCs invest venture capital in exchange for a percentage of ownership in the company. This type of financing is typically used by early-stage companies that need a large amount of capital to get started. In return for their investment, VCs typically require a seat on the company’s board of directors and a share of the profits.

Debt financing is when VCs provide a loan of venture capital to the company in exchange for interest payments. This type of financing is typically used by more established companies that need a smaller amount of capital. In return for their investment, VCs typically require a personal guarantee from the company’s founders.

There are different stages of investment or funding for startup companies . They are:

Seed Funding

Seed funding is the earliest stage of venture capital investment. It typically goes to businesses just starting and has not yet launched their product or service. Seed funding can be used to cover the costs of research and development, marketing, and other early-stage expenses.

Series A Funding

Series A funding is the next stage of venture capital investment. It is typically used to finance the launch of a product or service, expand into new markets, or hire additional staff. Series A funding can also be used to cover the costs of marketing and advertising.

Series B Funding

Series B funding is a form of venture capital that is usually used to help a company grow at a faster pace. It can be used to finance the expansion of a business into new markets, hire additional staff, or develop new products or services.

Series C Funding

Series C funding is typically used by companies that are ready to go public or be acquired by another company. It can also be used to finance a major expansion, such as the opening of new offices or the launch of a new product line.

How to Raise Venture Capital and VC Funding

There are several ways to raise venture capital for your startup company. One option is to take out loans from family, friends, or banks. Another option is to sell equity in your company to a venture capitalist.

If you are selling equity in your company for venture capital, it is important to have a well-crafted business plan that will impress potential investors. Your business plan should include detailed information about your product or service, market analysis, financial projections, and management team bios.

You can also use crowdfunding platforms to raise capital from a large group of people. crowdfunding is a great way to get your business off the ground, but it is important to remember that you will be giving up a percentage of ownership in your company.

What Capital Raising Options are Available for a Business?

There are a few different types of capital-raising options available for businesses. The most common options are:

One option for raising capital is to take out loans from banks or other financial institutions. This type of financing is typically used by more established businesses that have a good credit history.

Venture Capital

Another option for raising capital is to take out investments from a venture capitalist. A venture capitalist is an individual or firm that invests money in startup companies in exchange for a percentage of ownership in the company.

Crowdfunding

Crowdfunding is a newer form of financing that allows businesses to raise money from a large group of people via the internet. There are several crowdfunding platforms available, such as Kickstarter and Indiegogo.

Initial Public Offering (IPO)

An IPO is when a company sells shares of stock to the public for the first time. This type of financing is typically used by more established companies that are looking to raise a large amount of capital.

Small Business Administration (SBA) Loans

The SBA is a government agency that provides loans to small businesses. These loans are typically used by businesses that may not qualify for traditional bank financing.

Which Capital Raising Option is Right for Your Business?

The type of capital-raising option that is right for your business will depend on many factors, such as the stage of your business, the amount of money you need to raise, and your credit history.

If you are just starting, you may want to consider crowdfunding or an SBA loan. If you have a good credit history, you may be able to get a bank loan. If you are looking to raise a large amount of money, you may want to consider an IPO.

No matter which option you choose, it is important to have a well-crafted business plan that will impress potential investors. Your business plan should include detailed information about your product or service, market analysis, financial projections, and management team bios.

Startup Companies Business Plan Template

If you are a startup company looking for venture capital investment, it is essential to create a well-crafted business plan that will impress potential investors. Use this business plan template to get started:

Executive Summary

The executive summary is a brief overview of your company’s history, mission, and objectives. It should be no more than two pages long.

Company Description

The company description should provide an overview of your business, including your products or services, market analysis, and target customers.

Management Team

The management team section should include bios of your executive team and any other key personnel.

When writing about the management team section of a business plan, you should include bios of your executive team and any other key personnel. This section should also include a description of each team member’s experience and qualifications. This is also a great section to include the management team’s motivation and why the business is raising money.

Financial Projections

The financial projections section should include your company’s historical financial information, as well as your projected income statement, balance sheet, and cash flow statement.

When writing about the financial projections section of a business plan, you should include your company’s historical financial information, as well as your projected income statement, balance sheet, and cash flow statement. This information will help potential investors understand how your company is performing financially and what the future outlook is for your business.

Investor Information

The investor information section should include your company’s equity structure and any terms or conditions that would be attached to an investment.

This business plan template will help you get started on creating a professional and impressive business plan that will attract venture capitalists. Remember to tailor the template to your specific business needs.

Raising Venture Capital FAQs

What is venture capital.

Venture capital is a type of investment that is typically used to finance the launch or expansion of a business. Venture capitalists are usually interested in high-growth companies with the potential to generate large returns.

How do I raise venture capital?

There are several ways to raise venture capital, including taking out loans, selling equity in your company, or using crowdfunding platforms. It is important to have a well-crafted business plan when seeking investment from venture capitalists.

What are the different types of venture capital investment?

The three main types of venture capital investment are seed funding, series A funding, and series B funding. Seed funding is typically used to finance the launch of a new business, series A funding is used to finance the expansion of a business, and series B funding is typically used to finance the go public or being acquired by another company.

Recent Posts

How to Start A Car Rental Business

How to Start A Staffing Agency

Business Plan Outline and Example

Blog categories.

- Business Planning

- Venture Funding

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

How Venture Capitalists Make Decisions

- Paul Gompers,

- Will Gornall,

- Steven N. Kaplan,

- Ilya A. Strebulaev

For decades now, venture capitalists have played a crucial role in the economy by financing high-growth start-ups. While the companies they’ve backed—Amazon, Apple, Facebook, Google, and more—are constantly in the headlines, very little is known about what VCs actually do and how they create value. To pull the curtain back, Paul Gompers of Harvard Business School, Will Gornall of the Sauder School of Business, Steven N. Kaplan of the Chicago Booth School of Business, and Ilya A. Strebulaev of Stanford Business School conducted what is perhaps the most comprehensive survey of VC firms to date. In this article, they share their findings, offering details on how VCs hunt for deals, assess and winnow down opportunities, add value to portfolio companies, structure agreements with founders, and operate their own firms. These insights into VC practices can be helpful to entrepreneurs trying to raise capital, corporate investment arms that want to emulate VCs’ success, and policy makers who seek to build entrepreneurial ecosystems in their communities.

An inside look at an opaque process

Over the past 30 years, venture capital has been a vital source of financing for high-growth start-ups. Amazon, Apple, Facebook, Gilead Sciences, Google, Intel, Microsoft, Whole Foods, and countless other innovative companies owe their early success in part to the capital and coaching provided by VCs. Venture capital has become an essential driver of economic value. Consider that in 2015 public companies that had received VC backing accounted for 20% of the market capitalization and 44% of the research and development spending of U.S. public companies.

- PG Paul Gompers is the Eugene Holman Professor of Business Administration at Harvard Business School and a research associate at the National Bureau of Economic Research.

- WG Will Gornall is an assistant professor at the University of British Columbia Sauder School of Business.

- SK Steven N. Kaplan is the Neubauer Family Professor of Entrepreneurship and Finance and the Kessenich E.P. Faculty Director of the Polsky Center for Entrepreneurship at the University of Chicago.

- IS Ilya A. Strebulaev is the David S. Lobel Professor of Private Equity and a professor of finance at the Stanford Graduate School of Business. He is also the founder of the Stanford GSB Venture Capital Initiative and a research associate at the National Bureau of Economic Research.

Partner Center

A Guide to Venture Capital for Startups

Table of Contents

Introduction.

- What is Venture Capital

- Early Stage

- The Process

- Pros of Venture Capital for Startups

- Cons of Venture Capital for Startups

Every year, entrepreneurs create 50 million startups . But despite the millions of startup companies that exist in the world, only about 10% make it past their first year, and 90% of startups ultimately fail. One of the most common problems for startups? Cash flow.

As much as 82% of businesses that fail do so because of cash flow issues. Maybe they burn through funding too quickly, or they may fail to secure enough funding in the first place.

Venture capitalists know the risks of investing in businesses. But with the chance to help fund a unicorn —a private startup valued at over $1 billion—venture capitalists are more willing to take a chance on startups, even if they don’t have any other funding or assets in the early stages of the company.

What is Venture Capital?

Venture capital, sometimes abbreviated as VC, is a form of startup financing and a type of private equity that allows a startup business to offer a large share of their company to an investor or a few investors in exchange for funding or other benefits, like mentorship or talent.

Venture capital can come with high risks and high rewards for both investors and startups. Startups can secure funding through venture capital without needing to make monthly repayments, but they may need to give up some control over the creativity and management of the company. For investors, there’s a huge risk that the startup will fail, but there’s also an opportunity to make money if the startup takes off.

Types of Venture Capital

There are three main types of venture capital that a startup may pursue, depending on how new the business is. For instance, brand new startups that are still finalizing their ideas may pursue pre-seed funding , while businesses that are ready to start selling their product or service may seek out seed funding . Startups that have already had some success in their sales and are ready to expand production may try to secure early-stage funding .

Pre-Seed Funding

Brand new startups may seek VC through pre-seed funding. In this round of funding, a startup is beginning to form its business by creating a business plan and developing its first products or services to sell.

Although pre-seed funding typically involves a startup earning funding through bootstrapping or getting investments from family and friends, promising startups may gain attention from venture capitalists willing to take a risk on a disruptive idea.

Seed Funding

At the seed stage, a startup has a product or service that is ready to hit the market, but they need capital to start running the business until they make enough sales to turn a profit. This can be a great point for startups to seek out venture capital to fund the business without the stress of a repayment deadline, should sales not hit their goals.

Early-Stage Funding

Early-stage funding often involves rounds of funding that allow businesses to access more capital as they grow. Businesses that started selling a product or service and have had a lot of interest may seek out venture capital in early-stage funding to expand their operations and increase sales.

At this stage, a startup exhibits measurable growth, making it even more attractive for venture capitalists to invest.

The Process of Getting Venture Capital

The startup funding process for securing venture capital can be lengthy because venture capitalists are typically looking for a long-term partnership. They need time to thoroughly vet the startup and determine whether or not to invest. Securing VC funding typically takes about 3 to 9 months from initial contact to funding, although the time-frame will vary case by case. Then, it will be several years from when the firm or investor starts providing funding to when they exit.

Initial Contact and Meeting

Either the startup or the venture capital firm will initiate contact to express interest in funding. There are several ways a startup can reach out to a venture capital firm or investor, such as:

- Sending a cold email

- Connecting at an industry event

- Getting an introduction from someone in your network

After connecting, the parties will set up a meeting to discuss the startup and potential funding.

Share the Business Plan

If the venture capital firm is interested in the startup after the first meeting, they’ll want to see your pitch deck and business plan before you can move on to negotiating and signing a deal. The business plan should be thorough, spelling out the idea, the competition, the overall market, the target audience, how the business will operate, goals for the long-term, and how much funding the startup needs.

Due Diligence

The venture capital firm or investor will do due diligence by investigating the business. The firm or investor will need to thoroughly analyze the company, from its business plan to its management and operations.

The startup should also perform due diligence. Venture capitalists will often own up to half of the company’s equity, so the startup founder should review the VC firm or investor, such as reviewing the success of past investments.

Negotiation and Investment

Now that both parties have expressed interest and have gone through due diligence, they can begin negotiating the agreement terms. The negotiation will focus on how much funding the venture capitalist will invest and how much equity the startup will offer in exchange for the investor.

With the agreement signed, the venture capitalist will provide funding as outlined by the terms in the contract. This may involve providing all funding upfront, or the firm or investor may offer one amount upfront and additional funding as the company moves through series funding rounds. Typically, VC funding terms span 10 or more years , according to the U.S. Securities and Exchange Commission (SEC).

Unlike a bank or lender, a venture capitalist will have some ownership through equity in the company. That means they may be more involved in the operations, even joining the startup’s board of directors or advisory team.

The venture capital firm or investor may help with technical operations, management, or hiring new employees. The venture capitalist can also connect startups to other investors, talent, or customers.

Eventually, the venture capitalist will enact its exit strategy , or way of leaving the company by selling their shares. Typically, a venture capitalist will exit when they feel they have hit the maximum profit possible, or they may exit a startup that is on the down-trend in order to minimize the amount of money they are losing in the investment.

There are multiple exit strategies a venture capitalist might take, including:

- Initial public offering (IPO): The startup goes public, selling shares of the company to the public on the stock market. This is a popular exit strategy that is on the rise. In fact, 2021 was a record year with 1,035 IPOs in the U.S.

- Secondary sale: A venture capitalist may exit by selling their shares to another venture capitalist.

- Mergers and acquisitions (M&A): A merger is when two companies join to form one company, and an acquisition is when one company buys another. In acquisitions and some mergers, one company may buy the majority of shares in the startup, allowing the venture capitalist to exit.

- Buybacks: A successful startup may earn enough revenue and build up enough cash to buy out shares from investors.

Pros of Venture Capital

Venture capital for startups can be an accessible way to gain more than just funding but also to grow your network and gain mentorship, too. Some benefits of venture capital for new and growing businesses include:

Secure Funding Without Repayments

If a startup founder doesn’t feel comfortable making repayments to a bank or other lender by a set deadline, venture capital can be a more accessible path to funding. Venture capital provides funding in exchange for equity, so the repayment is in the form of part ownership of the company.

If the startup does fail, the founder doesn’t have to stress about repaying an institution. The venture capital assumes risk when they offer the investment, and they will have an exit strategy in place to sell their shares.

Tap Into Talent

In addition to funding, venture capitalists may also provide access to mentorship or other expertise. For startup founders who may not have all the skills needed to manage a business, bringing in a venture capitalist can help fill those gaps.

Venture capitalists may also assist in hiring new employees and can even offer connections to talent as the business looks to expand its team.

No Funds or Assets Needed

Although having a growing business that’s already making sales can help make your startup a less risky investment to venture capitalists, there are firms and investors willing to take on startups that are brand new.

In order to maintain the most control over the company, a startup should seek out other funding options first, but that’s not a requirement. Venture capitalists can offer a large amount of funding, and a startup doesn’t have to have funds or assets before seeking VC.

Cons of Venture Capital

Venture capital has a lot of potential benefits for new businesses. However, venture capital for startups can also come with challenges for founders—from high competition, to get funding in the first place, to losing majority ownership, to venture capitalists over time.

Give Equity

If a startup founder secures a loan or grant to start their business, they don’t have to give up equity, or ownership, in the company. But if they secure funding via venture capital, the VC investor or firm will typically take between 20% and 50% equity, making them a significant owner in the business.

Share Control Over the Company

By exchanging large shares of equity for large amounts of funding from a venture capital investor or firm, a startup is also giving up some of its control over the company. Venture capitalists can help strengthen the business by helping out with operations, but they may also influence the future of the company in a way that the startup founder(s) doesn’t always agree with.

VC negotiations typically offer 20% to 50% equity in a startup, already a significant portion of ownership in the business. But a Crunchbase analysis found that by the time a venture capitalist exits, ownership hits a median of 53%. Some of the companies in the study had much higher VC ownership numbers, such as Etsy (62%), TrueCar (82%), and Sabre (97%).

Difficult to Access

In some ways, venture capital makes it easier for startups to access funding, even if the business is more of an idea than an established company making sales. But there’s still a lot of planning and work that needs to happen before securing venture capital, and there can be a lot of competition to get attention from a firm or investor. In 2022, 5,044,748 new businesses were formed in the U.S. That same year, there were about 1,000 active VC firms in the country.

Startups not only need to have a solid business plan that shows how they are prepared to operate in the long-term, but the business idea needs to be innovative and the startup should have strong potential for growth to stand out from the thousands of other businesses competing for investments.

Is Venture Capital for Startups Right for Your Business?

Venture capital is one of several methods of funding a startup. The exchange of funding for private equity can be a great fit for startups expecting rapid growth, and it’s also a beneficial path for startups who don’t want to be stuck with monthly repayments on a loan. But venture capital for startups comes with its risks, too, including giving up some creative control to another firm or investor. Startup founders will need to weigh the benefits and risks and do their own due diligence when considering whether VC funding is the right path to jumpstarting their business.

More stories

10 Types of Startup Capital

The Killer Slide Every Pitch Deck Needs

What Is a Business Accelerator? Everything You Need To Know - HubSpot for Startups

Venture Capitalist and Business Plans – Things You Need to Know

- October 18, 2021

Who are they?

A venture capitalist is defined as a private equity investor, willing to provide capital to companies of all sizes including startup operations in exchange for an equity stake. The key to attracting a venture capitalist is proving to them that your business has high growth potential. Venture capitalists are known to be hard to impress so if you have the chance to engage with one, your best bet is to put your best pitch forward.

Now, it’s true venture capitalists can be hard to impress, but on the flip side of this just know that they’re always looking for an opportunity. They’re notorious risk-takers who, despite all the odds that are often stacked up against a business concept, they will still take a leap of faith.

How do VC’s think?

When it comes to a mature company, their processing and thinking are much easier to predict. The risk is lower because the concept has been proven and establishing value is fairly straightforward. As long as they can see growth, consistent growth that gives them a strong return on their investment, the investment decision comes relatively easy. But, in the case of a new venture or startup opportunity, that’s when a venture capitalist really has to put on their hard hat to find out if the investment they’re being asked to make makes sense for their bottom line.

What are they looking for?

A venture capitalist is going to want to hear about your concept, how well you know the market, where the trends are, and where your business fits in that mix. They’re also going to want to see solid financials that give them peace of mind that the investment they’re being asked to make will yield sizable, realistic returns. All of these things and others will need to be captured in a business plan.

What Do Venture Capitalists look for in your business plan?

A venture capitalist is going to go over your business plan with a fine-toothed comb, looking for any and every instance that raises a red flag and tells them to walk away. Don’t misunderstand; they want to invest in a needle in a haystack that increases the value of their portfolio. Yes, they want nothing more than to seize a promising opportunity, but first, they have to be sure. The best way to make them feel comfortable is with a sound business plan that includes:

- Management team: Finances matter to venture capitalists, but they tend to be more interested in the team they’ll be partnering with than capital. Their thinking is that if they’re investing in sound professionals who have a true understanding of how to build and conduct business, the return on investment is likely to come. They’re typically not looking for new business people or those who don’t have the type of resume that warrants an infusion. So, when it comes to this portion of your business plan, be sure to highlight the strengths of your management team and how they add value to your business.

- Market research: Showing venture capitalists that you understand the market is another important area your business plan will need to focus on. Showing that your business will operate in a large, defined market will put them at ease and assure them that they will be in a position to receive the large ROI’s they’ve grown accustomed to. Expectations are that your business plan will include a detailed market size analysis with growth projections for five years.

- Your competitive edge: Venture capitalists will want to know what your competitive edge is – What sets your business apart from all of the others operating in your space? What is the problem your business is solving and is yours capable of best solving it? Things like this are important because not only do they represent your competitive edge; they also represent barriers to entry and this, in turn, could position them for stronger returns.

We will Craft the Ideal Business Plan that Attracts Venture Capitalists to Your Business

A venture capitalist is a viable resource for any entrepreneur regardless of the stage or size of their business. Firms and individuals like these are looking for investment opportunities, but first, they must see a sound business plan that includes all of the areas touched on above and more. Financials that show a return, marketing that is based on sound, practical strategies, and assessments of all the major players. These areas and others are all included in plans developed by the professionals at The Coley Group. Our staff of seasoned MBA writers can take your concept and sculpt a business plan that positions you to secure the funds you need to move to the next level . Please feel free to contact us for more details on how we can assist you.

- Our Process

- Business Plans

- SBA Business Plans

- Investor Business Plans

- Franchise Business Plans

- Immigration Business Plans

- Non-Profit Business Plans

- Other Services

- Case Studies

- White Papers

- Request For Proposal

Can we talk about it?

- © 2024 The Coley Group. All Rights Reserved.

- Terms of Use

- Privacy Policy

Dallas WordPress Development: Big D Creative

- Starting a Business

- Growing a Business

- Small Business Guide

- Business News

- Science & Technology

- Money & Finance

- For Subscribers

- Write for Entrepreneur

- Entrepreneur Store

- United States

- Asia Pacific

- Middle East

- South Africa

Copyright © 2024 Entrepreneur Media, LLC All rights reserved. Entrepreneur® and its related marks are registered trademarks of Entrepreneur Media LLC

- Write Your Business Plan | Part 1 Overview Video

- The Basics of Writing a Business Plan

- How to Use Your Business Plan Most Effectively

- 12 Reasons You Need a Business Plan

- The Main Objectives of a Business Plan

- What to Include and Not Include in a Successful Business Plan

- The Top 4 Types of Business Plans

- A Step-by-Step Guide to Presenting Your Business Plan in 10 Slides

- 6 Tips for Making a Winning Business Presentation

- 12 Ways to Set Realistic Business Goals and Objectives

- 3 Key Things You Need to Know About Financing Your Business

- How to Perfectly Pitch Your Business Plan in 10 Minutes

- How to Fund Your Business Through Friends and Family Loans and Crowdsourcing

- How to Fund Your Business Using Banks and Credit Unions

- How to Fund Your Business With an SBA Loan

- How to Fund Your Business With Bonds and Indirect Funding Sources

- How to Fund Your Business With Venture Capital

- How to Fund Your Business With Angel Investors

- How to Use Your Business Plan to Track Performance

- How to Make Your Business Plan Attractive to Prospective Partners

- Is This Idea Going to Work? How to Assess the Potential of Your Business.

- When to Update Your Business Plan

- How to Write the Management Team Section to Your Business Plan

- How to Create a Strategic Hiring Plan

- How to Write a Business Plan Executive Summary That Sells Your Idea

- How to Build a Team of Outside Experts for Your Business

- Use This Worksheet to Write a Product Description That Sells

- What Is Your Unique Selling Proposition? Use This Worksheet to Find Your Greatest Strength.

- How to Raise Money With Your Business Plan

- Customers and Investors Don't Want Products. They Want Solutions.

- 5 Essential Elements of Your Industry Trends Plan

- How to Identify and Research Your Competition

- Who Is Your Ideal Customer? 4 Questions to Ask Yourself.

- How to Identify Market Trends in Your Business Plan

- How to Define Your Product and Set Your Prices

- How to Determine the Barriers to Entry for Your Business

- How to Get Customers in Your Store and Drive Traffic to Your Website

- How to Effectively Promote Your Business to Customers and Investors

- What Equipment and Facilities to Include in Your Business Plan

- How to Write an Income Statement for Your Business Plan

- How to Make a Balance Sheet

- How to Make a Cash Flow Statement

- How to Use Financial Ratios to Understand the Health of Your Business

- How to Write an Operations Plan for Retail and Sales Businesses

- How to Make Realistic Financial Forecasts

- How to Write an Operations Plan for Manufacturers

- What Technology Needs to Include In Your Business Plan

- How to List Personnel and Materials in Your Business Plan

- The Role of Franchising

- The Best Ways to Follow Up on a Buisiness Plan

- The Best Books, Sites, Trade Associations and Resources to Get Your Business Funded and Running

- How to Hire the Right Business Plan Consultant

- Business Plan Lingo and Resources All Entrepreneurs Should Know

- How to Write a Letter of Introduction

- What To Put on the Cover Page of a Business Plan

- How to Format Your Business Plan

- 6 Steps to Getting Your Business Plan In Front of Investors

How to Fund Your Business With Venture Capital Venture capitalists lend money and make equity investments in young companies.

By Eric Butow • Oct 27, 2023

Key Takeaways

- Venture capitalists are known for taking risks on new companies and innovative entrepreneurs in the hopes of gaining big returns.

- Business owners typically exchange a percentage of their company's ownership for VC backing.

- Venture capitalists are not as likely to provide seed money as angels.

- Startup capital is financing used to get a business with a proven idea up and running.

- Many will insist on placing one or more directors on the boards of companies they finance.

Opinions expressed by Entrepreneur contributors are their own.

This is part 5 / 10 of Write Your Business Plan: Section 2: Putting Your Business Plan to Work series.

Venture capitalists represent the most glamorous and appealing form of financing to many entrepreneurs. They are known for backing high-risk companies in the early stages, and a lot of the best-known entrepreneurial success stories owe their early financing to venture capitalists.

When many entrepreneurs write a business plan, obtaining venture capital backing is what they have in mind. That's understandable. Venture capitalists are associated with business success. They can provide large sums of money, valuable advice, priceless contacts, and considerable prestige by their mere presence. Just the fact that you've obtained venture capital backing means your business has, in their eyes at least, considerable potential for rapid and profitable growth.

Related: Everything You Need To Know About Attracting Venture Capitalists

Venture capitalists both lend to and make equity investments in young companies. The loans are often expensive, carrying rates of up to 20 percent. They sometimes also provide what may seem like very cheap capital. That means you don't have to pay out hard-to-get cash in the form of interest and principal installments. Instead, you give a portion of your or other owners' interest in the company in exchange for the VC's backing.

When Venture Capital Is an Option

Venture capital is most often used to finance companies that are young without being babies and that are established without being mature. But it can also help struggling firms as well as those that are on the edge of breaking into the big time.

The following are the major types and sources of capital, along with distinguishing characteristics of each:

Seed money. Seed money is the initial capital required to transform a business from an idea into an enterprise. Venture capitalists are not as likely to provide seed money as some other, less tough-minded financing sources, such as family investors. However, venture capitalists will back seedlings if the idea is strong enough and the prospects promising enough. If they see something new and exciting (usually an aspect of technology) and foresee rapid growth (and a strong potential for high earnings), they may jump in and back a fledgling startup. It's a long shot, but it does happen.

VCs, however, are less likely to provide equity capital to a seed-money-stage entrepreneur than they are to provide debt financing. This may come in the form of a straight loan, usually some kind of subordinated debt. It may also involve a purchase of bonds issued by the company. Frequently these will be convertible bonds that can be exchanged for shares of stock. Venture capitalists may also purchase shares of preferred stock in a startup. Holders of preferred shares receive dividends before common stockholders and also get paid before other shareholders if the company is dissolved.

Related: The Truth About Venture Capitalist Funding

Seed money is usually a relatively small amount of cash, up to $250,000 or so, that is used to prove a business concept has merit. It may be earmarked for producing working prototypes, doing market research, or otherwise testing the waters before committing to a full-scale endeavor.

Startup capital. Startup capital is financing used to get a business with a proven idea up and running. For example, a manufacturer might use startup capital to get production underway, set up marketing, and create some actual sales. This amount may reach $1 million.

Venture capitalists are frequently enthusiastic financiers of startups because they carry less risk than companies at the seed money stage but still offer the prospect of the high return on investment that VCs require.

Later-round financing. Venture capitalists may also come in on some later rounds of financing. First-stage financing is usually used to set up full-scale production and market development. Second-stage financing is used to expand the operations of an already up-and-running enterprise, often through financing receivables, adding production capacity, or boosting marketing. Mezzanine financing, an even later stage, may be required for a major expansion of profitable and robust enterprises. Bridge financing is often the last stage before a company goes public. It may be used to sustain a growing company during the often lengthy process of preparing and completing a public offering of stock.

Related: The Best Source Of Funding You'll Ever Find

Venture capitalists even invest in companies that are in trouble. These turnaround investments can be riskier than startups and, therefore, even more expensive to the entrepreneurs involved.

Venture capital isn't for everybody, but it provides a very important financing option for some young firms. When writing a business plan to raise money, you may want to consider venture capitalists and their unique needs.

What Venture Capitalists Want

While venture capitalists come in many forms, they have similar goals. They want their money back, and they want it back with a lot of interest and capital growth.

VCs typically invest in companies that they foresee being sold either to the public or to larger firms within the next several years. As part owners of the firm, they'll get their rewards when such sales go through. Of course, if there's no sale or if the company goes bankrupt, they don't even get their initial money back.

Related: What Is Entrepreneur Capital VS Venture Capital

VCs aren't quite the plungers they may seem. They're willing to assume risk, but they want to minimize it as much as possible. Therefore, they typically look for certain features in companies they are going to invest in. Those include:

- Rapid sales growth

- A proprietary new technology or dominant position in an emerging market

- A sound management team

- The potential to be acquired by a larger company or be taken public in a stock offering within three to five years

- High rates of return on their investment

Rates of Return

Like most financiers, venture capitalists want the return of any funds they lend or use to purchase equity interest in companies. But VCs have some very special requirements regarding the terms they want and, especially, the rates of return they demand.

Related: Why You Need To Think Twice About Venture Capital

Venture capitalists require that their investments have the likelihood of generating very high rates of return. A 30 percent to 50 percent annual rate of return is a benchmark many venture capitalists seek. That means if a venture capitalist invested $1 million in your firm and expected to sell out in three years with a 35 percent annual gain, he or she would have to be able to sell the stake for approximately $2.5 million.

These are high rates of return compared with the 2.5 percent or so usually offered by ten-year U.S. Treasury notes and the nearly 10 percent historical return of the U.S. stock market. Venture capitalists justify their desires for such high rates of return by the fact that their investments are high-risk.

Related: The Rise Of Alternative Venture Capital

Most venture-backed companies, in fact, are not successful and generate losses for their investors. Venture capitalists hedge their bets by taking a portfolio approach: If one in ten of their investments takes off and six do OK, then the three that stumble or fail will be a minor nuisance rather than an economic cold bath.

Cashing-Out Options

One key concern of venture capitalists is a way to cash out their investment. This is typically done through a sale of all or part of the company, either to a larger firm through an acquisition or to the public through an initial stock offering.

In effect, this need for cashing-out options means that if your company isn't seen as a likely candidate for a buyout or an initial public offering (IPO) in the next five years or so, VCs aren't going to be interested.

Related: Why Raising Capital Is A 4-Step Process

Being Acquired

A common way for venture capitalists to cash out is for the company to be acquired, usually by a larger firm. An acquisition can occur through a merger or using a payment of cash, stock, debt, or some combination.

Mergers and acquisitions don't have to meet the strict regulatory requirements of public stock offerings, so they can be completed much more quickly, easily, and cheaply than an IPO. Buyers will want to see audited financials, but you—or the financiers who may wind up controlling your company—can literally strike a deal to sell the company over lunch or a game of golf. About the only roadblocks that could be thrown up would be if you couldn't finalize the terms of the deal, if it turned out that your company wasn't what it seemed, or, rarely if the buyout resulted in a monopoly that generated resistance from regulators.

Related: 8 Key Factors VCs Consider When Evaluating Start-Ups

Venture capitalists assessing your firm's acquisition chances will look for characteristics like proprietary technology, distribution systems, or product lines that other companies might want to possess. They also like to see larger, preferably acquisition-minded, firms in your industry. For instance, Microsoft, the world's largest software firm, frequently acquires small personal computer software firms with talented personnel or unique technology. Venture capitalists looking at funding a software company are almost certain to include an assessment of whether Microsoft might be interested in buying out the company someday.

Going Public: Initial Public Offerings (IPOs)

Some fantastic fortunes have been created recently by venture-funded startups that went public. Initial public offerings of their stock have made numerous millionaires seemingly overnight. For example, when Twitter made its initial public offering for $26 in November 2013, the stock took off, gaining as much as 93 percent within a day and creating 1,600 millionaires. Wow! IPOs have made many millions for the venture investors who provided early-stage financing.

Related: Should You Accept Or Reject VC Funding

The 2012 passage of the Jumpstart Our Small Business Startups (JOBS) Act allows for confidential filing of IPO-related documents. This has made it easier for small business owners who do not want their numbers getting out to the public too soon. There was often concern about investors getting too much preliminary information that could influence their decision to commit to the company. Confidentiality has increased the number of IPO filings in the small business community.

Nonetheless, an IPO takes a lot of time. You'll need to add outside directors to your board, clean up the terms of any sweetheart deals with managers, family, or board members, and have a major accounting firm audit your operations for several years before going public. If you need money today, in other words, an IPO isn't going to provide it.

An IPO is also probably the most expensive way to raise money in terms of the amount you have to lay out up front. The bills for accountants, lawyers, printing, and miscellaneous fees for even a modest IPO will easily reach six figures. For this reason, IPOs are best used to raise amounts at least equal to millions of dollars in equity capital. Venture capitalists consider all these requirements when assessing an investment's potential for going public. Remember that the number of new businesses that go public is quite small.

Related: 3 Alternatives To Start-Up Venture Capital Funding

The Truth About IPOs

Many entrepreneurs dream of going public. But IPOs are not for every firm. The ideal IPO candidate has a record of rapidly growing sales and earnings and operates in a high-profile industry. Some have a lot of one and not much of the other. Low earnings but lots of interest characterize many biotech and internet-related IPOs. These tech companies are usually the ones that generate the huge IPOs and instant millionaires we read about.

Potential Pitfall of VC Funding

Many VCs insist on placing one or more directors on the boards of companies they finance. And these directors are rarely there just to observe. They take an active role in running the company.

VCs also are reluctant to provide financing without obtaining an interest in the companies they back, sometimes a very significant and controlling interest. This can make them just as influential as if they had a majority of the directors on the board, or more so.

Buzzword: Rate of Return

Rate of return is the income or profit earned by an investor on capital invested in a company. It is usually expressed as an annual percentage.

More in Write Your Business Plan

Section 1: the foundation of a business plan, section 2: putting your business plan to work, section 3: selling your product and team, section 4: marketing your business plan, section 5: organizing operations and finances, section 6: getting your business plan to investors.

Successfully copied link

- Customer Reviews

- Net 30 Account

- Wise Services

- Steps & Timeline

- Work at a Glance

- Market Research at a Glance

- Business Plan Writing Services

- Bank Business Plan

- Investor Business Plan

- Franchise Business Plan

- Cannabis Business Plan

- Strategic Business Plan

- Corporate Business Plan

- Merge and Acquisition Business Plan (M&A)

- Private Placement Memorandums (PPM)

- Sample Business Plans

- Professional Feasibility Study

- PowerPoint Presentations

- Pitch Deck Presentation Services

- Business Plan Printing

- Market Research

- L-1 Business Plan

- E-2 Business Plan

- EB-5 Business Plan

- EB-5 Regional Centers

- Immigration Attorneys

- Nonprofit Business Plan

- Exit Business Planning

- Business Planning

- Business Formation

- Business License

- Business Website

- Business Branding

- Business Bank Account

- Digital Marketing

- Business Funding Resources

- Small Business Loans

- Venture Capital

- Net 30 Apply

- Frequently Asked Questions

- Business Credit Cards

- Talk to Us 1-800-496-1056

Business Plan For Venture Capital

What is venture capital funding.

How Does Venture Capital Work?

Quick links.

- Investor Business Plans

- M&A Business Plan

- Private Placement

- Feasibility Study

- Hire a Business Plan Writer

- Business Valuation Calculator

- Business Plan Examples

- Real Estate Business Plan

- Business Plan Template

- Business Plan Pricing Guide

- Business Plan Makeover

- SBA Loans, Bank Funding & Business Credit

- Finding & Qualifying for Business Grants

- Leadership for the New Manager

- Content Marketing for Beginners

- All About Crowdfunding

- EB-5 Regional Centers, A Step-By-Step Guide

- Logo Designer

- Landing Page

- PPC Advertising

- Business Entity

- Business Licensing

- Virtual Assistant

- Business Phone

- Business Address

- E-1 Visa Business Plan

- EB1-A Visa Business Plan

- EB1-C Visa Business Plan

- EB2-NIW Business Plan

- H1B Visa Business Plan

- O1 Visa Business Plan

- Business Brokers

- Merger & Acquisition Advisors

- Franchisors

Proud Sponsor of

- 1-800-496-1056

- (613) 800-0227

- +44 (1549) 409190

- +61 (2) 72510077

How To Approach a Venture Capitalist For Company Funding

Written by Dave Lavinsky

When you’re starting a business, one of the biggest challenges is finding the money to get it off the ground. You may have considered seeking venture capital (VC) funding but don’t know where to start. This article will walk you through the process of approaching venture capitalists for funding.

Decide If a Venture Firm or VC Funding Is Right For You

Before you even bother to approach a venture capitalist, you need to decide if this type of funding is right for your business. There are many types of businesses that are venture-funded materials, not just software companies. Typically, VCs are looking to invest in companies that have the potential for high growth. They want to see a business with a large addressable market, a strong team, and a unique product or service. If your business doesn’t fit these criteria, you may want to look into other funding options, such as small business loans or crowdfunding.

Research Potential VCs & Network

There are hundreds of venture capitalists (VCs) and venture capital firms out there, so you need to do your homework to find the ones that may be a good fit for your business. Start by looking at VC firms that have invested in companies in your industry. Then, narrow down your list by looking at things like the size of investments they typically make and their investment stage preferences. You can also check out VC portfolio companies such as Crunchbase or PitchBook.

Although many entrepreneurs and firs time founders prefer a warm introduction there is nothing wrong with emailing, especially if they are not directly in your network. That being said, the best way to approach a VC is through a personal introduction. See if you have any mutual connections that can introduce you. If not, many first-time founders try attending industry events or conferences where VCs will be in attendance.

Finish Your VC Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

And know it’s in the exact format that venture capitalists want?

With Growthink’s Ultimate Business Plan Template , you can finish your plan in just 8 hours or less!

Click here to finish your VC business plan today.

Know How VCs Assess Companies

Before networking or pitching to a VC, entrepreneurs need to understand what most VCs want and how they assess companies. They are looking for a few key things:

- A large addressable market: They want to see that your product or service has the potential to be used by a large number of people.

- A strong founding team: Venture Capitalists invest in people as much as they do in ideas. They want to see that you have a strong team in place that has the skills and experience necessary to execute your plan.

- A unique product or service: They want to see that you have a differentiated offering that can’t be easily replicated by your competitors.

Develop A Solid Venture Capital Business Plan & Create a Pitch Deck

Once you understand what VCs tend to look for, you need to develop a solid plan that addresses these key points. Most entrepreneurs’ plans include things like a company mission and vision, an executive summary, a market analysis, a competitive analysis, and your go-to-market strategy.

In addition to a business plan, you’ll also need to create a pitch deck to present to potential investors and VC partners. Your pitch deck should be around 10-20 slides and cover topics like problem/solution, the business’s initial approach, market opportunity, business model, founding team, and financials.

Prepare For Due Diligence & Get A Valuation

If a VC is interested in investing in your company, it will likely do a thorough due diligence process. This is when they will dig into your financials, your business model, your competitive landscape, and anything else that could potentially affect their investment. It’s important to be prepared for this process and have all of your documentation in order.

Getting a valuation is one of the most important aspects of raising venture capital. This is because it will determine how much equity you will have to give up in order to raise the money you need. There are a few different methods that VCs use to value companies, so it’s important to understand these before you start pitching to investors.

Common Methods to Value Companies

- The venture capital method is typically used for early-stage companies that don’t have much revenue. This method values a company based on its potential future returns.

- The discounted cash flow method is typically used for more established companies that have a history of revenue and cash flow. This method values a company based on its expected future cash flows.

- The comparable companies method is typically used for public companies. This method values a company based on the valuation of similar companies in the market.

Knowing which method VCs will use to value your company will help you determine how much equity you will need to give up to raise the money you need.

Know Your Financials And Other Metrics

In addition to knowing your valuation, it’s also important to know your financials and other key metrics. This includes things like your burn rate, your churn rate, your customer acquisition costs, and your lifetime value of a customer. This information will be important when you are pitching to investors and negotiating your investment.

Rehearse Your Pitch

Once you have everything in order, it’s time to rehearse your pitch. This is where you will practice delivering your presentation to make sure that you are confident and polished when you meet with potential investors. Practicing will also help you memorize all the details so you can focus on delivering a great pitch.

You can practice your pitch with friends, family, or even VCs themselves. The more you practice, the better you will be at delivering your pitch and closing a deal.

Ask Them Questions

Finally, don’t forget to ask the VCs questions during your meeting. This shows that you are interested in their opinion and that you value their input, while also ensuring that the one you choose is the right VC for your startups. Asking questions also gives you an opportunity to get feedback on your business and see if there are any areas that you need to improve.

Some great questions to ask VCs include:

- What companies have you invested in?

- What kind of companies are you looking to invest in?

- How much money do you usually invest?

- What is your role in the companies you’ve invested in?

Pitching to VCs can be a daunting task, but it is necessary to get the funding you need to grow your business. By following these tips, you will be better prepared to approach VCs and close a deal.

Frequently Asked Questions

How do you find vcs.

There are a few different ways to find VCs. You can search online, attend investor events, or network with other entrepreneurs.

What is the best way to approach a venture capitalist?

The best way to approach a venture capitalist is to be prepared before trying to raise money. This includes having a well-researched business plan, a solid pitch deck, and knowing your financials.

What do VCs look for in a company?

VCs look for companies with high growth potential. They also want to see a strong management team, a solid business model, and a market opportunity.

What is the difference between a venture capitalist and an angel investor?

An angel investor is typically an individual who invests their own money in a company. A venture capitalist is usually a firm that invests other people's money.

What is a valuation?

A valuation is a process of determining the worth of a company. This can be done using different methods, such as the discounted cash flow method or the comparable companies' method.

How to Write a Venture Capital Business Plan

As the owner or CEO of a small business, you may be considering seeking venture capital investment at some point in the growth of your company. Venture capitalists are individuals or firms that invest in high-growth businesses, typically in exchange for equity.

There are several benefits to seeking venture capital investment, including the potential for a large infusion of cash and the ability to tap into the expertise of experienced investors. However, there are also some drawbacks to consider, such as giving up a portion of ownership in your company and potentially losing some control over its direction.

If you do decide that seeking venture capital investment is the right move for your business, you’ll need to put together a comprehensive business plan that outlines your company’s current state, its growth potential, and your plans for achieving that growth.

Tips for Writing a Business Plan for Venture Capital Firms

Here are some tips to help you write a venture capital-worthy business plan:

- Do your homework. Before you start writing your business plan, do your research on the venture capital process and what professional investors are looking for. This will help you craft a plan that is tailored to the needs of potential investors.

- Keep it clear and concise . Venture capital investors are busy people, so make sure your business plan is clear and to the point. When writing your business plan it is important to consider the investor’s perspective and include only the most essential information and present it in an easy-to-read format.

- Focus on growth potential . VCs are primarily interested in investing in businesses with high growth potential. Be sure to highlight your company’s unique selling points and explain how you plan to achieve rapid growth.

- Put together a solid team . Investors will also want to see that your company has a strong management team in place. Make sure to highlight the experience and accomplishments of your key team members.

- Have a clear exit strategy. Venture capital investors typically invest with an eye toward eventually selling their equity stake in startup companies. As such, they’ll want to see that you have a well-thought-out plan for how and when they will be able to cash out.

By following these tips, you can put together a strong business plan that will appeal to potential venture capitalists and give you the best chance of securing the investment you need to grow your business.

Benefits of Venture Capital Investment

There are several benefits to seeking venture capital investment, including:

- The potential for a large infusion of cash . Venture capitalists typically invest much larger sums of money than traditional lenders, such as banks. This can give your business the boost it needs to expand its operations and achieve rapid growth.

- The ability to tap into the expertise of experienced investors . In addition to the money they invest, VCs can also provide valuable guidance and mentorship to help you grow your business.