- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

The Facebook Trap

Why is it so hard for Facebook to fix itself? Because its biggest problems flow from its core mission of connecting everyone in the world.

Facebook has a clear mission: Connect everyone in the world. Clarity is good, but in Facebook’s case, it has also put the company in a bind because the mission — and the company’s vision for creating value through network effects — has also become the source of its biggest problems. As the company moved from connecting existing friends online to making new global connections (both examples of direct network effects) and now to connecting users to professional creators (indirect network effects), it has come under fire for everything from violating individual privacy to bullying small companies as a monopoly to radicalizing its users. Now, it is struggling to find solutions that don’t undercut its mission. The author calls this “the Facebook Trap.” To address the problems created by the platform — and by other social networks, too — it helps to clearly establish where the company should be held accountable. While it’s reasonable to push for changes in how Facebook’s recommendations work, it’s harder to decide how the platform should deal with organic connections, which would likely entail censoring users and blocking them from making connections that they want to make. Facebook isn’t the only company facing the conundrum of needing to undermine its own mission to minimize harm, and companies and governments will need to develop strategies for how to deal with this issue.

Founded in 2004, Facebook’s mission is to give people the power to build community and bring the world closer together. People use Facebook to stay connected with friends and family, to discover what’s going on in the world, and to share and express what matters to them.

- Andy Wu is an Assistant Professor in the Strategy Unit at Harvard Business School and a Senior Fellow at the Mack Institute for Innovation Management at the Wharton School of the University of Pennsylvania. He researches, teaches, and advises managers on innovation and growth strategy for technology ventures.

Partner Center

Course blog for INFO 2040/CS 2850/Econ 2040/SOC 2090

How Facebook Became a Powerhouse Through Network Effects

https://www.wired.com/2012/05/network-effects-and-global-domination-the-facebook-strategy/

A network effect is any situation where every new user that joins a platform provides benefit to all users that already are a part of that platform. The network therefore gains more value for users as more people use it. In the social media industry, Facebook takes a lead by targeting people’s innate drive to project their identity and network to other users. As the user-base expanded, this network effect compounded into a bandwagon effect – nobody wanted to be left out from this platform.

This positive feedback loop of new users made Facebook a monopoly in the social media industry. As it had more opportunities for connections than its competitors, new users chose it over other platforms. “I think that network effects should not be underestimated with what we do,” explained Facebook CEO, Mark Zuckerberg, whose platform now has over 2.6 billion users, due to the clever play on innate human tendencies to not want to be left out (Vogelstein). This idea is further compounded by a professor at the University of Halle, who stated that “once a social network effect-based company gains a clear leading position compared to competitors, it becomes so clearly more attractive than its competitors that a winner-takes-all trend sets in. ”

This directly relates to the idea of a global friend network – it is unlikely that there will be any single person that is completely isolated and unconnected. Humans are social creatures, and huge network effects can have large impacts on how the world works. The above article further emphasizes this idea by highlighting that network effects play such a huge role in Facebook’s power that the company could perhaps overtake Google’s Search engine. As so many people are present on Facebook, Google feels threatened by the fact that there may be enough information on Facebook itself when it comes to searching for answers online.

November 6, 2020 | category: Uncategorized

Leave a Comment

Leave a Reply

Name (required)

Mail (will not be published) (required)

XHTML: You can use these tags: <a href="" title=""> <abbr title=""> <acronym title=""> <b> <blockquote cite=""> <cite> <code> <del datetime=""> <em> <i> <q cite=""> <s> <strike> <strong>

Blogging Calendar

©2024 Cornell University Powered by Edublogs Campus and running on blogs.cornell.edu

What Are Network Effects and Why Are They Important?

A guide to the principle that powers some of the biggest platforms and startups today.

Many of the most successful companies of the 21st century — from Facebook to Twitter, Venmo to eBay — have been designed with network effects in mind. Their products are platforms that facilitate interactions. Sometimes the interactions are between peers, sometimes they’re between buyer and seller. Whatever the case, one principle tends to hold true: The more users that join the service, the more beneficial the service becomes for each user. That’s the basic definition of a network effect.

What Are Network Effects?

Economist Jeffrey Rohlfs articulated the idea of network effects in a 1974 paper , in which he observed that the utility a person derived from a telephone went way up as more people bought them, since a phone does you no good if you’re the only person who has one, but is quite handy if everybody you know is just a dial away. So as more people adopted the phone in the ensuing years, more interactions became possible, which made phones more useful, which enticed even more people to get them — increasing their value even further. This positive feedback is the network effect at work.

In today’s context, understanding network effects helps make sense of the massive growth experienced by many startups whose successes are tied to the interactions that take place on their platforms or marketplaces.

Unlike huge companies of the industrial age, which grew bigger as they produced more efficiently, these startups aren’t valuable because of “the capital they employ, the machinery they run, or the human resources they command. They are valuable because of the communities that participate in their platforms,” wrote the authors of the book Platform Revolution .

Take Airbnb. It doesn’t own any hotel rooms. It has millions of users interacting with each other on its site, though, and that is what gives it a competitive advantage.

And if you’ve ever shared a file through Dropbox, hailed a ride on Uber, booked a reservation on OpenTable or bought a coffee table through Craigslist, you’ve experienced value because of the number of people using that service and the quality of those users. The success of each of these companies is due in part to each one figuring out how to get enough people to join their platforms. It’s a “critical mass inflection point” that kicks growth into an exponential trajectory.

Companies boosted by network effects gain a significant edge, keeping users engaged and competitors at bay. And investors take notice; an investor gets a twinkle in their eye when they come across a startup with a business model that’s conducive to network effects.

Network effects are responsible for 70 percent of the value created by all tech companies since 1994, according to a 2017 report by the venture firm Nfx.

“When you think about what company to build, or where to invest, make sure to think network effect,” wrote investor and Nfx co-founder Gigi Levy Weiss. “Otherwise you’re giving up on the best defensibility for a startup and may not get the best result.”

Network Effect Examples

There are two main types of network effects — same-side network effect and cross-side network effect — each of which can be either positive or negative for a business.

Same-Side Network Effect (Positive)

In this case, more users of the same kind make the service more valuable to each user. This describes the telephone example above. Here’s another: If you write on Microsoft Word, it benefits you when others have Microsoft Office, too, so you can share compatible files with them.

The same goes for mobile payment services Venmo and Zelle, whose users can only capitalize on the convenience of exchanging money via phone if others register. Online gaming platforms, like Xbox Live or Playstation Network, also fit the bill.

A platform’s network effect refers to the interactions that take place between consumers (or between producers), not between consumers and producers.

Related Reading What Does a Growth Hacker Do in Marketing?

Same-Side Network Effect (Negative)

Same-side network effects can sometimes have negative consequences. Consider ChatRoulette as an example. The video chat site, which randomly connects users with each other without the need to register a login, exploded in popularity in the late 2000s. But for many users, the increasing number of unsavory participants on the site polluted the experience. Eventually this drove high-quality users away and the value of the platform shrank.

Another example is the congestion that clogs up a ride-hailing app like Lyft. As more users sign up and request pickups, customers may be waiting longer or spending more for a ride.

Cross-Side Network Effect (Positive)

This type of network effect occurs when people on one side of a market benefit from an increase of participants on the other side of the market. In view here are companies like Airbnb, OpenTable, Craigslist and eBay, all of which cultivate interactions between buyers on one side and sellers on the other. It’s easier, for example, to find an overnight accommodation on Airbnb when there are more available houses to choose from. And it becomes easier to rent out your house when more and more users join the site.

You can also see this with food delivery services GrubHub and Doordash. Delivery drivers benefit when there are more customers submitting orders and vice versa. Drivers earn more money fulfilling more orders and customers see shorter wait times when there are ample drivers to handle the workload.

Cross-Side Network Effect (Negative)

There are times when too many producers on one side of the market leads to drawbacks for the users on the other side. For instance, a search engine website that features an increasing amount of advertisers on the first page of results might annoy some users and eventually push them to abandon the platform. The same can be said for a streaming service, news site or e-commerce platform.

Related Reading Why Many Would-Be Network Effect Companies Fail in Their Infancy

Network Effect Case Study: OpenTable

The story of OpenTable serves as a helpful example to demonstrate the power of cross-side network effects. The company, founded by Chuck Templeton in 1998, was the internet’s first restaurant-reservation-booking service.

Michael Xenakis worked at OpenTable from 2000 to 2016, serving as managing director of its international operations, and, before that, as senior vice president of product management. He spoke with Built In about how the company experienced network effects and grew into an internet giant.

Solving the Chicken-and-the-Egg Problem

The story begins with founder Templeton’s lightbulb moment. Making a dinner reservation over the phone can be a lousy experience — the phone rings and rings and never gets answered, or you get put on hold for several minutes and the host eventually forgets you’re there. If people can quickly and easily book reservations online for hotels, flights and rental cars, why can’t they do the same for restaurants?

OpenTable’s solution was to bring diners and restaurants together on one online platform, so the two sides could find each other and make a reservation happen without a hitch.

The company had a chicken-and-egg problem to deal with first. How would it convince restaurants to sign up? The allure of more diners to fill empty seats was nice, but at this point in time, there weren’t any diners on the site. Tough sell. But how would OpenTable attract diners to its site if there weren’t any restaurants listed?

OpenTable’s strategy was to get restaurants on the platform first. But in order to convince them to sign up, OpenTable sold the restaurants something of stand-alone value, a service that would benefit them immediately — regardless of whether extra diners ever filled their tables. It sold them software.

The software functioned as an electronic reservation book that helped restaurants keep track of patrons and manage tables — tasks for which hosts had long relied on pen and paper (or their memory). Buying OpenTable’s software also meant that restaurants would join its online reservation service, but that part, Xenakis said, was not yet a selling point. In his estimation, when OpenTable was starting out, about 90 percent of its value proposition was tied up with its software, while only 10 percent was its reservation platform.

That was good enough to get started. OpenTable sold its software to dozens and dozens of high-end San Francisco restaurants, priming the supply side. Eventually, it had enough of them to create real value for diners.

“Fifty to 100 restaurants in San Francisco definitely would have an inflection point where the value to the diner was real,” Xenakis told Built In. “In the world of fine dining, that’s plenty of restaurants.”

Network Effect Kicking in

People started using the site. Whether they wanted steak or sushi — tonight or next week — they could book a reservation online at one of many local restaurants listed on OpenTable’s website. The service was fast and easy.

Buzz quickly spread about the site, and more and more hungry Bay Area patrons started using it instead of reaching for the phone when they wanted to make a reservation. “We didn’t spend any marketing dollars,” Xenakis said. “We just relied on the word-of-mouth of diners.”

“The diner proposition grew and it truly was a quintessential network effect that took root. And it took off from there.”

The influx of patrons flooding the site made joining OpenTable seem like a no-brainer for restaurants in the area; they wanted to go where the diners were.

“The diner proposition grew and it truly was a quintessential network effect that took root,” Xenakis said. “And it took off from there.”

Growth accelerated at a blinding rate in OpenTable’s early days, according to Xenakis. The company would concentrate on one market, drill down deep, then move on to the next one. First, they targeted all the U.S. cities in which there was an NFL team. Then it targeted the outskirts of each of those cities. Over time, there was scarcely an urban area that didn’t have a presence on OpenTable.

Recommended Reading 8 Things I Wish I Had Known Before Founding My Startup

Sustaining Growth

Since both diners and restaurants were on OpenTable — and each wanted something from the other — both parties were incentivized to stick around and keep using it.

In the book Platform Scale , business scholar Sangeet Paul Choudary writes , “Network effects also create stickiness,” later adding, “For a platform business, user commitment and active usage, not sign-ups or acquisitions, are true indicators of customer adoption.”

OpenTable explored additional ways to keep users engaged on its platform rather than booking a reservation the old-fashioned way (or flocking to a competitor). One way it did this was implement a loyalty program.

Customers of OpenTable received loyalty points for booking reservations at certain restaurants on off hours and off days. This was good for all parties involved: the restaurants (who didn’t want table space to go to waste), OpenTable (who got a kickback from the restaurants) and customers (who received points, which could be redeemed for money).

By Xenakis’ account, OpenTable didn’t anticipate just how much customers would be driven to use the platform so they could rack up points.

“Once we had [the points system] out there, it turned out that diners just loved collecting points — without even knowing what they were for,” he recalled. “So our biggest thing early days was [diners asking] ‘Where are my points?’”

The stickiness kept users coming back to the platform and filling seats.

Eventually, OpenTable’s growth began to flatline, at which point, according to Xenakis, the company beefed up its search engine marketing to stimulate growth on the demand side.

The company invested in the supply side too. It launched international operations, doubling its total addressable market.

Network effects helped propel OpenTable to an IPO in 2009 and an acquisition by Priceline (now Booking Holdings) for $2.6 billion in 2014. Today, more than 54,000 restaurants use OpenTable’s platform, which, according to the company’s internal data, books an average of 12 diners every second .

Recent Product Management Articles

Assessing the Strength of Network Effects in Social Network Platforms

Author abstract.

Network effects have risen to the forefront of platform competition discussions (e.g., the House Judiciary investigation of competition in digital markets, claiming that Facebook, for example, is entrenched due to strong network effects and high switching costs). While newer literature has developed much more sophistication in characterizing network effects, common regulatory perspective often assumes more simplistic views.

Paper Information

- Full Working Paper Text

- Working Paper Publication Date: February 2021

- HBS Working Paper Number: 21-086

- Faculty Unit(s): Technology and Operations Management

- 30 Apr 2024

When Managers Set Unrealistic Expectations, Employees Cut Ethical Corners

- 26 Apr 2024

Deion Sanders' Prime Lessons for Leading a Team to Victory

- 01 May 2024

- What Do You Think?

Have You Had Enough?

- 02 Apr 2024

What's Enough to Make Us Happy?

- 24 Jan 2024

Why Boeing’s Problems with the 737 MAX Began More Than 25 Years Ago

- Network Effects

Sign up for our weekly newsletter

- Youth Program

- Wharton Online

What Is the Network Effect?

Companies that rely on signups, memberships, or registrations truly rely on their users to expand their business. By harnessing the influence of the network effect, digital platforms can gain momentum and work toward becoming industry leaders.

What are network effects, and why do they matter to digital platforms? Learn how the network effect can help businesses scale and establish strengths in their industry.

The Network Effect Defined

The network effect is a business principle that illustrates the idea that when more people use a product or service, its value increases. The network effect significantly applies to digital platforms, dating all the way back to the internet itself. When the internet became more widely used, more people relied on it to conduct work, deepen personal connections, and for research and other functions.

Example: social network platforms

The network effect is especially prominent on online platforms that encourage users to add other users to the platform’s network. Social networks such as Facebook and Instagram are key examples of the network effect. The more people that use the platform in an individual’s network, the more likely it is that individual will use the platform, too.

Example: E-commerce platforms

E-commerce platforms, such as Amazon, also benefit from the network effect. As more retailers opt to sell their goods on Amazon, the more consumers will look to Amazon to shop. The reverse is also true.

Sustaining User Engagement

As platforms scale, they need to be prepared to keep users engaged on the platform or risk losing their users to competitors. For example, a website that is slow to load or that isn’t equipped to handle an exponential amount of users can crash, leaving users frustrated.

A company that doesn’t grow their hiring practices as the platform grows may lead to user experience problems that lead to customer drop-off. For free platforms, the user experience must provide value to users to continue to fuel network effects benefits.

Types of Network Effects

There are two main types of network effects: one-sided network effects and two-sided network effects. Both rely on growth, but the difference is in the parties that grow the network.

One-sided network effects

One-sided network effects relate to the growth of a single group of users of the platform. The more users on a platform, the more market share that platform will likely claim. The platform’s business growth can lead to more innovation on the platform itself and more value to its users.

A few examples of one-sided network effects include:

- WhatsApp messaging platform

- Skype communication platform

Two-sided network effects

Two-sided network effects relate to platforms that benefit from the growth of two groups. In a marketplace platform, the more consumers on the platform, the more sellers will want to secure their presence there.

The more sellers there are on a platform, the more choices users have. This can benefit the user and the seller when users don’t leave the site in further search of what they want.

Examples of two-sided network effects include:

- eBay online retail bidding platform

- Airbnb home-sharing platform

In two-sided platforms, ideally the growth of one side moves at a pace that benefits the other side. For example, too many home searchers on Airbnb, but not enough homes may lead to user drop-off. Not enough consumers on a platform may discourage sellers from focusing their time there.

Complementary Network Effects

Complementary network effects relate to occurrences in which separate companies mutually benefit from the growth of related companies. For example, an app developer that specializes in iOS mobile applications will likely benefit from more smartphone users buying iPhones.

Another type of complementary network effect occurs when one platform type becomes popular and leads to platform competition, resulting in more users among similar types of platforms. For example, the popularity of one food delivery platform could lead to the expansion of others in a geographic area. Users of GrubHub may also sign up for Uber Eats to compare delivery prices before ordering.

This type of network effect can lead to more users signing up for similar types of platforms. That can boost budding platforms and create a more saturated market.

That can lead to more innovation among platforms to differentiate their offering. Or, in the case of Facebook and Messenger parent company Meta acquiring competitors like Instagram and WhatsApp, some companies choose to purchase their competition when the network effect starts to diminish.

Examples of the Network Effect

For startups that have a goal to quickly scale their businesses, the network effect is key.

Different kinds of digital platforms are influenced by network effects, including:

- Social media networks : Facebook, LinkedIn, Instagram, Snapchat, Twitter, Pinterest, TikTok

- Digital transaction platforms : PayPal, Venmo

- User review sites : Yelp, Tripadvisor, Google

- Travel platforms : Expedia, Hotels.com

- Communication applications : WhatsApp, Messenger

- Ecommerce platforms : Amazon, eBay, Etsy

- Ticket resellers : Ticketmaster, StubHub, SeatGeek

- Food delivery platforms : Uber Eats, Grubhub, DoorDash

- Freelancing sites : Fiverr, Upwork, Thumbtack

Dating applications and ridesharing platforms also rely on user growth to continue to gain interest, sign up new users and sell services.

Tinder is an example of a platform that has relied on one-sided network effects to grow its platform. The dating application requires an abundance of users to give its users more choice and a greater ability to find their perfect match.

Uber is an example of a platform that relies on two-sided network effects. The more “riders” who use the platform, the more “drivers” will be motivated to sign up to provide driving services.

Benefits of Network Effects

As platforms grow their user base, so does their ability to sell services on the platform or make money by charging fees for users. That’s why many platforms operate on a free or “free-mium” basis. Getting the user to sign up is critical to enable the platform to grow and start to monetize.

Free-mium apps

Facebook, for example, has always offered free signups. For several years, the site operated as simply a social networking site where users could connect with other users. Then, Facebook Ads launched, giving the platform a way to make money while continuing to offer a free service to users and invest in making it better.

For two-sided platforms like Etsy, the platform can charge listing fees to host product sales on the platform, or charge sellers a commission percentage.

For free-mium apps, the app can offer free signups and play, but then give users the ability to purchase upgrades. For example, Pokemon Go, a smartphone videogame, charges nothing to sign up and play. Users do have the option to purchase tickets for special events or buy unique clothes for their avatars. The “add a friend” aspect to Pokemon Go motivates users to share the game with their actual friends, which can lead to more purchases for the game developer.

Network effects underly startup success

Venture Capital firm NFX says that in 2022 network effects contributed 70% of the value in tech. To arrive at that percentage, NFX began studying 336 top tech companies in 2017 that were valued at over $1 billion. They found that network effects underlie the success of tech startups that flourished.

NFX notes that Facebook Messenger uses the personal network effect to get more users to join when their friends join. It additionally uses the personal utility network effect for profound daily communication, for example, in communicating with friends and relatives.

Learn More About Network Effects in the Global Digital Economy

Network effects can influence everything from product or service pricing to product positioning and development in the digital economy . It makes perfect sense for some startups to create completely free products when they intend to use the network effect to scale their user base and monetize their service or offering later.

For innovative companies that are introducing novel products to the marketplace, they could achieve a coveted position as a winner-takes-all product or service. As we’ve seen with platforms ranging from social networks to ridesharing brands, achieving dominance in a space can lead to lasting profits and loyal users.

If you’re interested in learning more about topics like network effects and digital transformation, enroll in the Managing in the Global Digital Economy course . This four-week online course requires just two hours of time each week to complete. You’ll learn about how to use new technology and omnichannel strategies to adopt a competitive advantage for your business. Request information for yourself or your team today.

The Wharton School is accredited by the International Association for Continuing Education and Training (IACET) and is authorized to issue the IACET CEU.

- VC Investing

Network Effects: What VCs Really Look For (With Case Studies)

- 13 minute read

I'm often surprised by how little many Venture Capitalists know about network effects. When I ask them to define network effects and explain how to spot whether a startup is taking advantage of them, they often miss significant aspects. Most Investors confuse network effects with virality, winner-take-all dynamics, and even product-market fit. It's paramount for VCs to correctly identify network effects, as they are highly advantageous to the companies they invest in. Incorrectly calling network effects, on the other hand, may lead to a bad investment decision. In this post, I explain the fundamentals of network effects and provide a framework for VCs to quickly assess whether or not a startup is taking advantage of them. I illustrate this analysis grid with case studies of startups exploiting network effects—and others that seem to do so, but don't.

In This Article

- Bell's phone: the textbook case study

Characteristics of network effects

Opentable: exploiting network effects to increase market penetration, vcs beware: network effects are not just virality.

- Case Study 1: Hotmail And Viral Marketing

- Case Study 2: Dropbox And Referral Marketing

- Facemash: Zuck's Foray into Network Effects

- Facebook: Lesson Learned

- Utility vs. Community

- Conclusion: tl;dr

What are network effects and where do they come from?

Venture Capitalists frequently struggle to give a simple definition to explain this central concept in Venture Capital investing. Here's the one I use to train VCs in my program:

A network effect occurs when the value of a product or service increases with each additional user.

Let's use a simple example to illustrate this definition.

Bell's phone: the textbook case study

Alexander Graham Bell's invention of the phone in 1876 revolutionized the way people communicated. Bell saw the potential for a device that could transmit sound through electric signals over long distances. After several years of hard work and experimentation, he was able to patent the telephone.

At first, people were skeptical about using telephones since there wasn’t any infrastructure for them. But Bell had a plan. In a move that could be considered the first tech growth hack in history , he let people use the phones for free if they agreed to have them installed in their homes and businesses. This was a stroke of genius as it incentivized more people to get on board with the new technology and start using it.

As more people began using phones, they started to realize how useful they were and how convenient it was to be able to communicate with someone far away simply by picking up a receiver and speaking into it. This created a network effect whereby each additional user increased the value of phone service for everyone else who was already subscribed.

By 1900, there were nearly 600,000 phones in Bell’s telephone system ; that number shot up to 2.2 million phones by 1905 and 5.8 million by 1910. It was clear that Bell’s invention would be incredibly successful and forever change how we communicate.

It is easy to get lost in the various types of network effects at play in tech today. The folks at VC firm NfX are probably the most sophisticated on the topic (hint: it's in their name). They've listed no less than 16 different kinds of network effects, including social network, product, infrastructure, and data network effects.

However, since most VCs don't have time to dig into the subtleties of network effects, here are some rules of thumb to identify them:

- Is one more user making the experience better for existing ones? Again, let's go back to the telephone. If you have the only telephone ever built, it's not a fun experience. Two connected users vastly improve it. Three even more. And so on.

- Is the value of the product or service increasing exponentially or proportionally? Social networks are a great example of an exponential increase in value. As users multiply, it becomes easier to find more people to connect with and discover more content. Even with a small number of users in its early days, Facebook was able to generate incredible growth.

- Is the impact direct or indirect? In some cases, it is harder to identify network effects because they are indirect: adding users strengthens the product for all. Think of operating systems such as Windows, which is successfully integrated into third-party applications and with hardware manufacturers.

- How fast will the network effects materialize? The velocity of network effects is a significant characteristic—the faster they do so, the stronger their impact on a company’s performance. Consider WhatsApp: its rise to becoming one of the most popular messaging platforms was incredibly rapid. It took WhatsApp four years to reach 100 million users and two more years to quadruple to 400 million. That number grew again by 2.5x in the next two years.

One more concept central to network effects is the ability to generate increasing returns . Standford professor Brian Arthur described them as the tendency of products and services to become more valuable as they gain in popularity. In a 1996 Harvard Business Review article containing one of the first mentions of network effects , he examined how increasing returns can create a cycle of advantage for certain firms and disadvantage for others.

That's where we go next: understanding why VCs are so crazy about network effects.

Why Do Network Effects Make Companies Valuable?

Network effects are incredibly advantageous for businesses capitalizing on them because they provide an edge over competitors. In Venture Capital lingo, we call it a moat , a fancy word for a barrier to entry or to exit.

Businesses want two things: repeat customers (people loyal enough to return) and new customers (people willing to try out something new). Network effects address both of these needs. They incentivize existing customers not only to stay but also to recommend the product/service by sharing with their friends who may be willing to try something new.

The snowballing nature of network effects creates exponential growth potential. Small numbers can add up quickly.

In a recent interview with Tim Ferris, Benchmark's Bill Gurley illustrated how network effects made OpenTable, the restaurant reservation app, so successful . Like most platforms, adding more restaurants made the experience better for users; and adding more users made it more profitable for restaurants to use OpenTable's service.

The startup solved the “chicken & egg” problem inherent to platform business models by providing a valuable service for both restaurants and customers. By connecting these two groups, OpenTable was able to establish an extremely valuable revenue stream for itself and become one of the most successful companies in its field. The key to its success was recognizing how powerful network effects can be in this type of business model and leveraging them accordingly.

We started looking for startups exploiting network effects because they tend to cause outlier outcomes. Bill Gurley - Benchmark (Source: The Tim Ferriss Show)

Bill Gurley also tells a story involving OpenTable's CFO, who warned him that he was going to quit after realizing that the service would never become profitable. It turned out that the veteran retail professional had greatly underestimated OpenTable's potential market penetration, capping it at 17% in his model. However, as the company grew, it got close to 90% market penetration in the cities in which it was active.

Once a significant enough base of restaurants had joined the service, it was hard for others to ignore it. The momentum reached by OpenTable's network effects allowed it to rapidly expand its user base and become one of the leading providers of reservation services in the world.

Venture Capitalists evaluating investment opportunities often confuse network effects with virality, and sometimes with adjacent concepts such as winner-takes-all markets. Although they are often necessary for network effects to develop, these characteristics are only peripheral. As a result, Investors may lend incorrect qualities to the startups they invest in, ending up surprised when the unassailable moat does not materialize.

I believe that Investors confuse virality and network effects because both are related to the idea of rapid growth. However, there is an important distinction between the two concepts:

- Network effects occur when customers become more valuable as the user base grows

- Virality is a measure of how quickly a product or service spreads through word-of-mouth

Network effects are driven by customer satisfaction and loyalty, while viral strategies rely on incentives and referral programs to encourage people to share a product or service with their colleagues, friends, and family.

Let’s take an example.

I've been using the online appointment booking tool Calendly for a couple of years, and I'm highly satisfied with it. It's helped me eliminate considerable time I used to spend (re)scheduling meetings. Before it was as popular as it is now, I systematically recommended Calendly to clients, friends, and everyone in my network. Word-of-mouth at its best.

When a new user joins Calendly, booking appointments becomes easier for that person. But does it add anything to existing users’ experience? Not really. Existing users act as ambassadors. The first adopters are so committed that they take time to explain to their friends why they should also use such a tool. It’s virality at its best and helps reach product-market fit faster.

But there are no network effects. Competing services have met some success, and although there is no reason to stop using Calendly, it's not difficult to switch to another provider—compared, say, to moving out of Facebook or LinkedIn to join a competitor.

You've reached a Members-only area.

Unlock Full Access

Discover exclusive content curated for Venture Capital professionals and enthusiasts. Join our community and gain unlimited access to in-depth articles, expert guest interviews, MBA-level webinars, and networking opportunities.

Register for our 7-Day Free Trial : Click Here

Already a member? Please Log In Below:

Subscribe to our Newsletter

Join 12,000+ VCs & Founders globally who enjoy our weekly digest on Venture Capital. We keep your information confidential and you can unsubscribe at any time. Sweet!

- Free Case Studies

- Business Essays

Write My Case Study

Buy Case Study

Case Study Help

- Case Study For Sale

- Case Study Service

- Hire Writer

Facebook Case Analysis

Facebook, Inc. is an American online social media and social networking service company based in Menlo Park, California. Its website was launched on February 4, 2004, by Mark Zuckerberg, along with fellow Harvard College students and roommates Eduardo Saverin, Andrew McCollum, Dustin Moskovitz and Chris Hughes.

The founders initially limited the website’s membership to Harvard students. Later they expanded it to higher education institutions in the Boston area, the Ivy League schools, and Stanford University. Facebook gradually added support for students at various other universities, and eventually to high school students. Since 2006, anyone who claims to be at least 13 years old has been allowed to become a registered user of Facebook, though variations exist in this requirement, depending on local laws. The name comes from the face book directories often given to American university students. Facebook held its initial public offering (IPO) in February 2012, valuing the company at $104 billion, the largest valuation to date for a newly listed public company. It began selling stock to the public three months later. Facebook makes most of its revenue from advertisements that appear onscreen.

Facebook can be accessed from a large range of devices with Internet connectivity, such as desktop computers, laptops and tablet computers, and smartphones. After registering, users can create a customized profile indicating their name, occupation, schools attended and so on. Users can add other users as “friends”, exchange messages, post status updates, share photos, videos and links, use various software applications (“apps”), and receive notifications of other users’ activity. Additionally, users may join common-interest user groups organized by workplace, school, hobbies or other topics, and categorize their friends into lists such as “People From Work” or “Close Friends”. Additionally, users can report or block unpleasant people.

Facebook has more than 2.2 billion monthly active users as of January 2018. Its popularity has led to prominent media coverage for the company, including significant scrutiny over privacy and the psychological effects it has on users. In recent years, the company has faced intense pressure over the amount of fake news, hate speech and depictions of violence prevalent on its services, all of which it is attempting to counteract.

Facebook Case Study Examples

Facebook friendships: appropriate with teachers.

More than ever, society has grown dependent on social networks. We find that even among days of unbearable boredom, a simple notification can spark excitement. Social networks like Twitter and particularly Facebook have become the new addiction among socialites. So evidently, if you need to get the word out about something, a status update is […]

What will Myspace or Facebook Do for you in 20 years?

Myspace and Facebook is the big buzz to everybody from High school students to Middle-aged working Adults. Myspace and Facebook are both online communties. But Most people sit around all day on Myspace or Facebook doing nothing that will improve their grades or college plans for the future. I understand having a myspace/Fabook can be […]

Eyes for Facebook

That typical kid who sits next to you in class, and walks down the same hallways as you everyday, could be one of the many targeted victims of online bullying, abuse, or threats. You may not even notice. Nobody ever would if teachers or school officials weren’t monitoring their students Facebook pages. Its best to […]

The Era of Facebook

We have always been told not to judge a book by its cover; however with the recent popularity in social mediums such as Facebook, that is exactly what we are doing. Facebook only gives a partial glimpse into someone’s life. With the increasing amount of online communication, the amount of judgment based on these profiles […]

Facebook Friendships

Facebook, the most popular Social network in the world, Created for both teenagers and adult’s becoming a world sensation. Being ranked the most used social network by Compete.com, and even being called the new titan of the internet challenging even Google. Facebook was designed to help connect old friends, update mood status, Add pictures, and […]

Quick Links

Privacy Policy

Terms and Conditions

Testimonials

Our Services

Case Study Writing Service

Case Studies For Sale

Our Company

Welcome to the world of case studies that can bring you high grades! Here, at ACaseStudy.com, we deliver professionally written papers, and the best grades for you from your professors are guaranteed!

[email protected] 804-506-0782 350 5th Ave, New York, NY 10118, USA

Acasestudy.com © 2007-2019 All rights reserved.

Hi! I'm Anna

Would you like to get a custom case study? How about receiving a customized one?

Haven't Found The Case Study You Want?

For Only $13.90/page

The Leading Source of Insights On Business Model Strategy & Tech Business Models

Network Effects In A Nutshell

A network effect is a phenomenon in which as more people or users join a platform , the more the value of the service offered by the platform improves for those joining afterward. Imagine the case of a platform like LinkedIn. For each additional user, joining, which also enriches the online resume, makes the platform more valuable to recruiters, as they can easily find qualified candidates. This is an example of a two-sided network effect.

Table of Contents

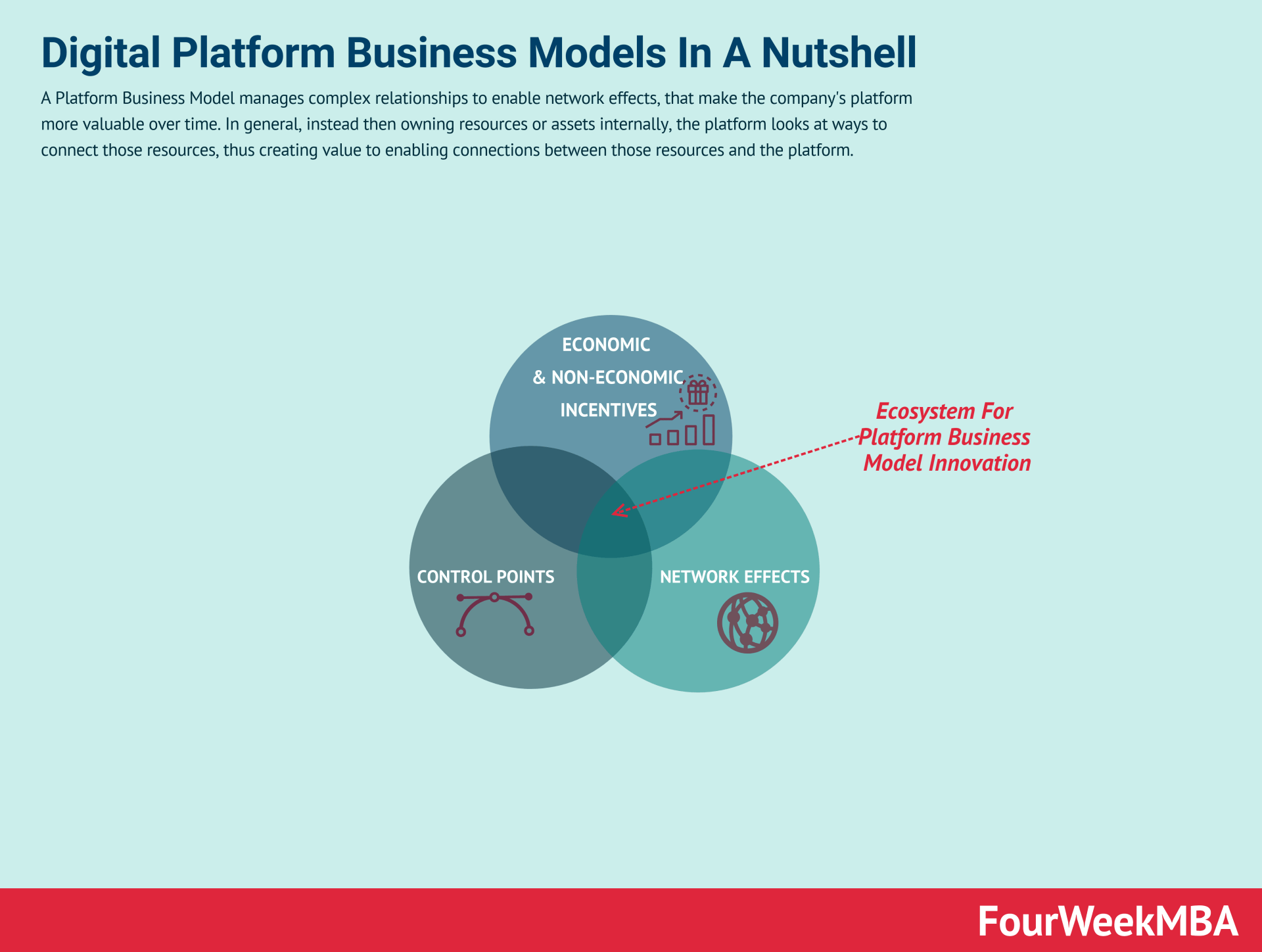

Platform business models and network effects

Network effects have become an essential element of a successful digital business, for several reasons. First, the Internet itself has become a facilitator for network effects.

As it becomes less and less expensive to connect users on platforms , those able to attract them in mass become extremely valuable over time.

Also, network effects facilitate scale. As digital businesses and platforms scale, they gain a competitive advantage, as they control more of the total shares of a market.

Last but not least, as we will see, network effects are considered among the defendable, or what confers to digital business, a competitive advantage.

Where in the past linear businesses gained a competitive advantage by buying assets and controlling supply chains. Digital companies gain competitive advantages by building network effects.

As we’ll see there are different kinds of network effects. And network effects can also be reverse or negative.

Competitive advantage = network effects

If you think about something like Instagram, the software is great but could fairly easily be replicated. But the network of users and the content they create is impossible to replicate. That is where the value is created. Or think about Reddit where the community creates the content. Or think about Waze where the users generate the data about which way has the least traffic. Fred Wilson, AVC, Business Model Innovation.

In the era of platform business models in most cases, technology can bring an initial advantage. However, over time technology might become a commodity as it can be easily copied and replicated as it becomes wider adopted.

What can’t be easily copied is the community comprised of the network of users part of the platform. That is because users interacting produce several positive network effects.

Positive network effects

As more users join the platform the more it becomes valuable. Think of the case of a dating app with a few users in your town. How many chances there are the app would be able to match you up quickly? A few, thus the app won’t be much valuable to you

Data ownership

The interactions between users also generate data that the platforms can control, analyze, and own, which can be leveraged to create a lasting advantage. Therefore, the value of the network isn’t necessarily in the technology but in the data produced by the interactions

From transactions to interactions

As network effects become a primary advantage of the platform business, which can’t be easily replicated. The company needs to shift its mindset and manage the interactions in the platform. This is a key step to take. Think of the case of a company like Amazon, which over the years passed from being e-commerce to a platform business.

Indeed, most of. the transactions that happen today on Amazon are mostly from third-party sellers. While Amazon understood the value of network effects and of flywheel models early on .

A platform business model implies that the company in charge of the ecosystem that generates those network effects learns how to keep those interactions happening. This implies a shift in mindset to think in terms of product sales to interactions happening on the platform.

To understand this concept read the full interview on digital platform businesses.

The power of network effects

Image credit: Ray Stern, CMO of Intuit.

Network Effects enable digital businesses to gain value quickly. That is because they have built-in asymmetries between the costs and value of the network. Where costs might increase linearly, the value of the network increases exponentially as the network grows.

Network effects have become a key ingredient in the digital era enabling the dominance of a particular business model : the platform business models .

The era of platform business models

Platform business models make up most of the value captured and created by digital businesses.

Companies like Google , Facebook , LinkedIn , PayPal , and more are platform business models , which benefited and created a strong competitive advantage by leveraging network effects.

Image Credit: Applico, Inc.

That’s because, in theory, platform business models manage to scale efficiently. Thus, where a traditional business, at a particular scale, it reaches a point of inefficiency where diseconomies of scale pick up.

A digital, platform business, might scale so efficiently, to be able to grow close to the total size of the market. This enables the formation of monopolies.

Thus, network effects become the real “assets” in the digital era. However, those “assets” won’t be seen on the company’s balance sheets.

Quite the opposite, platform business models enable exchanges among a large number of people within a network, but in most cases, they don’t control any of the assets owned by the people in the network.

Instead, those platform businesses only facilitate exchanges. And as a facilitator, they collect a “tax” as a transaction fee. That’s why modern platform business models might look and act more like nations, rather than corporations.

Read: Platform Business Models In A Nutshell

Types of network effects

Examples of network effects

Source and Image Credit : nfx.com

NFX points out thirteen main types of network effects:

- Physical (e.g., landline telephones)

- Protocol (e.g., Ethernet)

- Personal Utility (e.g., iMessage, WhatsApp )

- Personal (e.g., Facebook )

- Market Network (e.g., HoneyBook, AngelList)

- Marketplace (e.g., eBay, Craigslist)

- Platform (e.g., Windows, iOS, Android)

- Asymptotic Marketplace (e.g., Uber , Lyft )

- Data (e.g., Waze, Yelp!)

- Tech Performance (e.g., BitTorrent, Skype)

- Language (e.g., Google , Xerox)

- Belief (currencies, religions)

- Bandwagon (e.g., Slack, Apple )

As James Currier, from NFX , points out, “Network effects have emerged as the native defense in the digital world.” Within network effects as a defensible NFX points out three key elements: scale, brand, and embedding.

It is essential to highlight that the types of networks above are not exhaustive, neither set in the stone. But the framework offered by NFX is a great starting point to understand how network effects work.

In this guide, I want to focus on two main kinds of network effects:

- Direct or same-side.

- And indirect or cross-side.

Direct or same-side network effects

Direct or same-side network effects happen when an increasing number of users or customers also increases the value of the product or service for the same kind of user.

Direct network effects usually follow Metcalfe’s law (one of the laws on the basis of network effects).

In short, Metcalfe’s law, developed in communications theory, states that, as users of a network grow, this enables the exponential growth in the number of potential connections, thus also an exponential increase in utility of the platform.

Indirect or cross-side network effects

Indirect or cross-side network effects happen when an increased number of users on the side of the platform drives up the value of the product or service offered for the other side of the platform.

Indirect network effects aren’t necessarily symmetric. In other words, in some cases, increasing one side of a platform might have more profound effects, than increasing the other side.

For instance, in Uber’s case, as a two-sided platform, driven by the exchanges between drivers and riders, the former plays a more critical role.

Indeed, Uber uses dynamic pricing strategies that make the service less convenient for riders, but it keeps drivers going back to the platform.

Also, indirect network effects might not necessarily be reciprocal. Thus, increasing the one side of the network might improve the service for the other side. But the same might not apply if the other side of the network is increased.

Virality vs. network effects

Source : platformed.info

I want to clarify the critical difference between virality and network effects. Often (too often) those terms are used, or thought of as the same thing.

However, they are not, and understanding the critical difference between the two is vital to also formulate a better business strategy for a platform business model .

Network effects happen when a platform becomes more valuable as more users join it. Virality instead is a growth tool that companies can use to create more exposure for their product or platform.

Thus, a network effect is a way to create a lasting competitive advantage. And to offer more value to users. A viral effect is primarily a marketing tactic to gain traction and visibility for your product.

Network effects and virality can work together. For instance, as more users join through viral effects, if the platform is taking advantage of network effects, the more also it will become prone to improve its virality.

As highlighted in the interview with Sangeet Paul Choudary , best selling author of Platform Scale and Platform Revolution:

Network effects create value on the platform. Viral effects spread the word about the platform or the product externally.

And he continued:

So network effects, an example is the more users who are on Airbnb. The more hosts are setting up listings on Airbnb, the more choice there is for travelers. Now that’s a network effect. Or take the example of YouTube, the more videos that are being set up on YouTube, the more choice I have as a viewer to view things on YouTube.

Instead, virality happens when:

Now, if I take a video from YouTube and embed it on Facebook, that’s not a network effect, that’s a viral effect.

So a viral effect is a growth tool that brings external users back to the platform. Whereas a network effect increases the value on the platform, just like adding more than more and more videos onto YouTube.

Beware of negative network effects

Network congestion

As highlighted in the interview with Sangeet Paul Choudary , author of Platform Scale and Platform Revolution:

The more people using the highway system, the more traffic jams you end up in. Or the more people in a room, the less likely it is to have good decent conversation just because it gets crowded, but also because everybody is talking too loudly and so you can’t hear and you can’t meet the right person within that room.

He continues:

So we understand congestion in traditional terms because in the traditional world we have networks that were limited by scale.

When it comes to the digital world, instead, where there are fewer scale limitations. Or at least those can be initially overcome.

Thus, at least on the congestion side, it’s very hard to reach a point of negative network effects (for instance, if the platform crashes for usage).

Congestion, therefore, is primarily about the usage of the network.

In the bits world, it is possible not only to overcome congestion but also to build a more solid engineering infrastructure as usage increases. Of course, network congestions can also be bad for platforms (poor network design, over-subscription, security attach due to overused network parts).

Another form, of negative network effect, can take place for platform business models.

Network pollution

Where network congestion is primarily about the size of the platform.

As the platform scales, it gains network effects, as it becomes more valuable for an increasing number of users.

Yet, also for digital platforms scale might create situations of diseconomies .

As highlighted in the interview with Sangeet Paul Choudary :

What happens is the more users come on board, the more difficult it becomes to manage quality of the interactions.

Thus this makes the digital platform make sure to have a mechanism to manage the quality of those interactions to avoid that those negative network effects pick up.

If we think of social media, or publishing platforms at scale, among the most difficult task, that requires dozens if not hundreds of engineers and humans (Google might have thousands of human quality raters) to fix spam and low-quality user-generated content.

Examples of negative network effects

As highlighted negative network effects, dilute the value of the platform. And the way they can take over will depend on the kind of platform you’ve built. For instance:

Google case study

In a platform that leverages direct side network effects after a certain number of users, it might also result in increased spam on the platform which can’t be easily managed through automated processes, or human curation, thus diluting the value of the platform.

Take the case of how Google, back in the days, it was offering an index of the web with its core algorithm called PageRank. At a certain point had to figure out also how to manage the spam on its index.

Practitioners understood how to trick Google’s core algorithm into showing up spammy results on top of that. This would have jeopardized the value of the overall platform, thus resulting in a diluted value of that.

Thus Google had to start to build up a solid team dedicated to spam and update its algorithms to avoid spam in search results in order to keep its platform valuable.

Airbnb case study

In two-sided platforms, a kind of user joining the platform makes it more valuable for another type of user.

Take Airbnb where, for instance, more hosts improve value for users on the platform. On the two-sided more value is created by more hosts (travelers have more selection)? On the other hand, the value of the platform is diluted on the hosts’ side of the platform.

They will find themselves competing for the same users.

Thus it becomes crucial to understand what’s the proper ratio between travelers and hosts on the platform to make sure it keeps being valuable on both sides.

Tinder case study

Take the case of a dating app that draws value from having people encounter locally. If more users join but from locations spread across the world, no many local network effects are picking up.

Quite the opposite. If a critical mass is not reached at each local hub, the platform might lose value quickly. Imagine the case of a woman looking for a date. The faster she will be able to meet the best match.

The more the platform will be valuable. However, to be very valuable, the service has to make sure those people can meet in a place nearby. And it there are no matches available locally, the dating platform would lose value quickly.

Amazon from e-commerce to platform

When Amazon first started, its business model was an e-commerce.

Over the years, especially in the early 2000s, Amazon started to explore the option to feature more and more third-party stores, on top of Amazon.

By 2014, for the first time in its history, third-party sales passed the sales of Amazon own products. While the process of transitioning from e-commerce (simply selling its own products) to platform (enabling others to sell their own products), started in the early 2000s, it took over ten years for Amazon to complete this transition.

And this was all about network effects !

Today, Amazon is a platform business model , with built-in network effects.

Why is it about network effects?

Because, by the early 2000s, Amazon business model engine had to be structured in terms of network effects within its platform strategy .

Indeed, the more third-party sellers joined the platform, the more the platform became valuable to users, who could find more product variety.

And, Amazon could further pass lower prices to its customers. Once this process was repeated over and over, this is how Amazon built positive feedback loops into its business model.

And this was a paradigm shift!

Netflix, from platform to media company

While some companies transition to a platform strategy , and therefore, need to start thinking in terms of network effects.

Other companies go into the opposite direction.

Take the case of Netflix business model :

Netflix started primarily with a platform strategy , offering licensed content on top of its platform.

It first transitioned from CD rental, to DVD subscription services. Then it moved to on-demand streaming, with an effective subscription model, with no surplus charges, neither late fees.

Yet, starting in 2013, Netflix started to invest more and more on producing its own content!

By 2021, content produced by Netflix represented 34% of the total investments made in content. This is a huge jump, considering that in 2019 alone, that number was 21%.

This, I like to call, the “mediafication of Netflix” where Netflix is completing its transition from platform (where it solely focuses on building the underlying infrustructure to enable others to offer their content) to media powerhouse (think of it as the new Hollywood!).

The on-demand streaming platform is still driven by network effects, but those are trickier. Indeed, those are more cultural network effects.

Imagine the case of more and more people watching Netflix original series, those who don’t will feel left out, and they will feel compelled to join in!

Key take on negative network effects

Platform business models can leverage network effects to enable the core platform to become more valuable over time. However, they need to factor in negative network effects, which if picking up might not only prevent the success of the business but also destroy it.

Key takeaways on network effects

- The internet has become a facilitator for network effects.

- Digital businesses work on a set of premises and principles that are different from traditional or linear businesses.

- Network effects have become the “assets” for digital organizations.

- Those network effects don’t sit on companies’ balance sheets. Rather digital businesses can trigger and build them up to create a strong competitive advantage.

- Network effects enable digital businesses to scale efficiently and to get close to the total size of the market.

- Network effects can be direct (when they when an increased size of the network improves the value of the platform for the same kind of users) and indirect (where the increased size of one side of the network improves the service for the other side).

- Network effects are not the same thing as virality. Virality is a marketing tactic to acquire users or customers at a lower cost. Network effects represent a business strategy aimed at creating a long-term competitive advantage for digital businesses.

Understanding what a platform strategy entails

When it comes to platform business models it’s important to think in terms of markets and ecosystems. In short, as the platform usually makes money as fee-based on the interactions among key players on the platform, its main role will be the development of the market it sits on.

For instance, if we look at how various tech players evolved over the years based on a platform strategy , we can see how those first developed an ecosystem, and then “extracted” fees in the form of a tax from the key players once the new ecosystem had been built. Perhaps in the PC era, Microsoft’s Windows followed a platform strategy , where the PC worked as the hardware for Microsoft’s software products. On top of these, Microsoft built products, it helped other developers build their own products and it fostered an ecosystem to control the whole distribution.

As we moved from PC to smartphone other players like Apple use the same platform strategy . Perhaps, what made the iPhone interesting in the first place were the apps available in it. The App Store, therefore, evolved as a platform, that Apple fostered over the years, and that in 2020 made Apple $64 billion in revenues, as reported by CNBC .

This is what a platform strategy entails. That is why platform business models are evaluated in terms of the market they can capture.

The wider the total addressable market, the more it will be interesting also for potential investors to finance the development of that ecosystem, as the platform will be able over time to extract value in form of revenues from that (here we’re not discussing whether that’s fair or not, but just how digital platforms evolved in the web era).

It’s worth noticing that platforms usually grow a business ecosystem by killing the fragmented intermediaries existing in a market (think of what Uber initially did with Taxis, and what Airbnb initially did with Hotels). While these players do eat up part of an existing marketplace, the main argument is also that those do expand the existing ecosystem, as they scale it up, thus bringing more potential customers into a system that before was clogged by too many intermediaries.

As a quick example, many Uber users might use it in ways that never had been done with Taxis (perhaps with users going so far as to sell their cars to only moving locally through Uber’s app).

That is also why marketing for a platform business model looks more like a flywheel, where there is a continuous loop between key players that feed each other’s thus making the flywheel spin faster. The classic example is the Amazon flywheel .

Other examples are below:

Key Highlights

- Network Effects Definition: Network effects refer to the phenomenon where the value of a service or platform increases as more users join, making it more beneficial for both existing and new users.

- Direct or Same-Side Network Effects: More users on the same side of the platform (e.g., users of a social media platform) increase the value for each user.

- Indirect or Cross-Side Network Effects: More users on one side of the platform (e.g., job seekers on LinkedIn) increase the value for users on the other side (e.g., recruiters).

- Congestion (Increased Usage): Reduced quality or performance of the service due to increased usage, potentially leading to service slowdown or crashes.

- Network Pollution (Increased Size): Diminished value as the platform grows larger, affecting the quality of interactions, content, or services.

- Network effects are a core element of platform business models.

- They contribute to a platform’s competitive advantage, as they can’t be easily replicated.

- The community of users and the data they generate through interactions become valuable assets.

- Positive network effects improve the platform’s value for users.

- Viral effects are marketing tactics that create exposure and visibility for the platform.

- Amazon transitioned from an e-commerce model to a platform model, leveraging network effects with third-party sellers.

- Netflix shifted from a platform strategy to a media company strategy while maintaining cultural network effects.

- Businesses need to address potential negative network effects such as congestion or network pollution.

- Solutions include quality control, spam prevention, and managing the balance of user types.

- The internet facilitates network effects by connecting users at lower costs.

- Network effects enable digital businesses to scale efficiently and gain a competitive advantage.

- They have become the primary “assets” for digital organizations.

- Network effects play a critical role in shaping the success of platform business models.

- They offer a sustainable competitive advantage by making the platform more valuable as it grows.

- Proper management of negative network effects is essential to maintain the platform’s value and user satisfaction.

Case Studies

Read next:

- Platform Business Models In A Nutshell

- Linear Vs. Platform Business Models In A Nutshell

- What Are Diseconomies Of Scale And Why They Matter

Other business resources:

- Successful Types of Business Models You Need to Know

- The Complete Guide To Business Development

- Business Strategy: Definition, Examples, And Case Studies

- What Is a Business Model Canvas? Business Model Canvas Explained

- Blitzscaling Business Model Innovation Canvas In A Nutshell

- What Is a Value Proposition? Value Proposition Canvas Explained

- What Is a Lean Startup Canvas? Lean Startup Canvas Explained

- What Is Market Segmentation? the Ultimate Guide to Market Segmentation

- Marketing Strategy: Definition, Types, And Examples

- Marketing vs. Sales: How to Use Sales Processes to Grow Your Business

- How To Write A Mission Statement

Business models case studies:

- How Amazon Makes Money: Amazon Business Model in a Nutshell

- How Does WhatsApp Make Money? WhatsApp Business Model Explained

- How Does Google Make Money? It’s Not Just Advertising!

- The Google of China: Baidu Business Model In A Nutshell

- How Does Twitter Make Money? Twitter Business Model In A Nutshell

- How Does DuckDuckGo Make Money? DuckDuckGo Business Model Explained

- How Does Pinterest Work And Make Money? Pinterest Business Model In A Nutshell

- Fastly Enterprise Edge Computing Business Model In A Nutshell

- How Does Slack Make Money? Slack Business Model In A Nutshell

- TripAdvisor Business Model In A Nutshell

- How Does Fiverr Work And Make Money? Fiverr Business Model In A Nutshell

Connected Economic Concepts

Market Economy

Positive and Normative Economics

Asymmetric Information

Demand-Side Economics

Supply-Side Economics

Creative Destruction

Happiness Economics

Animal Spirits

State Capitalism

Boom And Bust Cycle

Paradox of Thrift

Circular Flow Model

Trade Deficit

Market Types

Rational Choice Theory

Conflict Theory

Peer-to-Peer Economy

Knowledge-Economy

Command Economy

Labor Unions

Bottom of The Pyramid

Glocalization

Market Fragmentation

L-Shaped Recovery

Comparative Advantage

Easterlin Paradox

Economies of Scale

Diseconomies of Scale

Economies of Scope

Price Sensitivity

Network Effects

Negative Network Effects

Main Free Guides:

- Business Models

- Business Competition

- Business Strategy

- Business Development

- Digital Business Models

- Distribution Channels

- Marketing Strategy

- Platform Business Models

- Revenue Models

- Tech Business Models

- Blockchain Business Models Framework

More Resources

About The Author

Gennaro Cuofano

Leave a reply cancel reply, discover more from fourweekmba.

Subscribe now to keep reading and get access to the full archive.

Type your email…

Continue reading

- 70+ Business Models

- Airbnb Business Model

- Amazon Business Model

- Apple Business Model

- Google Business Model

- Facebook [Meta] Business Model

- Microsoft Business Model

- Netflix Business Model

- Uber Business Model

IMAGES

VIDEO

COMMENTS

But one metric Mark Zuckerberg focused on in early years was retention. He measured it by DAUs over MAUs. In first 18 months, this number for Facebook went from 52% to 55% to 57%. That showed that ...

The Facebook Trap. Summary. Facebook has a clear mission: Connect everyone in the world. Clarity is good, but in Facebook's case, it has also put the company in a bind because the mission ...

In this paper, we present a quantitative case study of network effects in Facebook for the period 2011 to 2017. We estimate the value of Facebook, and analyse how this value depends on the number ...

The network therefore gains more value for users as more people use it. In the social media industry, Facebook takes a lead by targeting people's innate drive to project their identity and network to other users. As the user-base expanded, this network effect compounded into a bandwagon effect - nobody wanted to be left out from this platform.

What the research is: Experimentation is ubiquitous in online services such as Facebook, where the effects of product changes are explicitly tested and analyzed in randomized trials. Interference, sometimes referred to as network effects in the context of online social networks, is a threat to the validity of these randomized trials as the ...

Personal Direct: network effect #1. When Mark Zuckerberg launched Facebook (a version of Friendster for the college crowd using real-name identity) from a Harvard dorm room in 2004, he unleashed a powerful many-to-many personal direct network effect.Like LinkedIn, which launched 2 years before it, Facebook tapped into people's strong innate drive to maintain and project their personal ...

Network effects are one of the defining properties of the digital economy. It has been shown, both in theory and practice, that network effects contribute to the growth and potential success of businesses in the digital economy. In this paper, we present a quantitative case study of network effects in Facebook for the period 2011 to 2017.

Section 3 presents a case study of network effects in Facebook. A discussion of the results is presented in section 4. Finally, section 5 concludes the paper. 2. NETWORK EFFECTS Network effects ...

A. Overview. Network effects have risen to the forefront of platform competition discussions (e.g. the House Judiciary investigation of competition in digital markets, claiming that Facebook, for example, is entrenched due to strong network effects and high switching costs).1 While newer literature has developed much more sophistication in ...

Network Effects. New research on network effects from Harvard Business School faculty on issues including whether bundling is more effective in environments with strong versus weak network effects, and how purchase decisions are influenced in different social networks and in the brink-and-mortar world. Page 1 of 10 Results.

Many of the most successful companies of the 21st century — from Facebook to Twitter, Venmo to eBay — have been designed with network effects in mind. ... Network Effect Case Study: OpenTable. The story of OpenTable serves as a helpful example to demonstrate the power of cross-side network effects. The company, founded by Chuck Templeton in ...

Assessing the Strength of Network Effects in Social Network Platforms. Network-specific traits, such as the degree of clustering and the prevalence of multihoming, influence the strength and competitive impact of network effects. However, network size alone is often misleading, and network effects should be examined on a case-by-case basis.

The Network Effect Defined. The network effect is a business principle that illustrates the idea that when more people use a product or service, its value increases. The network effect significantly applies to digital platforms, dating all the way back to the internet itself. When the internet became more widely used, more people relied on it ...

We conducted a systematic review of empirical network effects research in 40 public administration and policy journals from 1998 to 2019. We reviewed and coded 89 articles and described the main social theories used in the network effectiveness literature and the associated mechanisms that translate network structures to network effects.

An indirect network effect can be explained by market success: in Facebook's case, application providers develop complementary products and services, improving the functionality of Facebook, and increasing its attractiveness further in a virtuous circle. (Cachia 2008, 9)

NFX Masterclass · Season 1: Network Effects · Episode 6. Speakers: James Currier · Pete Flint. Now that you understand the core ideas and concepts and language around the different defensibilities, as well as the 16 network effects, my partners and I are going to walk you through case studies so you can see how these things play out in ...

This case study offers an in-depth understanding of how firms can create value by modifying the business model architecture to adopt and use machine learning technology and thereby activate data network effects (Foss and Saebi, 2017, Teece, 2010). This case study thereby provides a positive answer to the research question.

Facebook case study The development of Facebook's strategy including business and revenue modelYou use Facebook, but have you ever wondered about its business model and how. ... Other products might require network effects to be properly tested, so in those cases we launch to everyone in a specific market, like a whole country'. 3. Mobile Products.

Network effects occur when a product or service increases in value as more users join, and often rely on our sense of community—as the Facebook case study clearly shows. By contrast, virality, which is a necessary but insufficient condition of network effects, relies on utility and practicality, a principle I illustrated with the Hotmail and ...

Facebook Insights Case Study Analysis for College: Network Effect. Facebook Case Analysis. Facebook, Inc. is an American online social media and social networking service company based in Menlo Park, California. Its website was launched on February 4, 2004, by Mark Zuckerberg, along with fellow Harvard College students and roommates Eduardo ...

This research tests different network effect laws with the real data of LinkedIn. The conclusion of this research is given through the attempt of solving the research questions in chapter 1. The ...

The world's largest social network, Facebook, has more than 1.31 billion mobile active users and 1.49 billion monthly active users (Facebook, 2015). Furthermore, recent studies show that 90% of 18-29 year olds in USA use social networks and a high percentage (between 85 and 99%) of students use Facebook (Brenner, 2013, Matney and Borland, 2009).