Working capital management: a literature review and research agenda

Purpose – The purpose of this paper is to review research on working capital management (WCM) and to identify gaps in the current body of knowledge, which justify future research directions. WCM has attracted serious research attention in the recent past, especially after the financial crisis of 2008. Design/methodology/approach – Using systematic literature review (SLR) method, the present study reviews 126 articles from referred journal and international conferences published on WCM. Findings – Detailed content analysis reveals that most of the research work is empirical and focuses mainly on two aspects, impact of working capital on profitability of firm and working capital practices. Major research work has concluded that WCM is essential for corporate profitability. The major issues with prior literature are lack of survey-based approach and lack of systematic theory development study, which opens all new areas for future research. The future research directions proposed in this paper may help develop a greater understanding of determinants and practices of WCM. Practical implications – Till date, literature on classification of WCM has been almost non-existent. This paper reviews a large number of articles on WCM and provides a classification scheme in to various categories. Subsequently, various emerging trends in the field of WCM are identified to help researchers specifying gaps in the literature and direct research efforts. Originality/value – This paper contains a comprehensive listing of publications on the WCM and their classification according to various attributes. The paper will be useful to researchers, finance professionals and others concerned with WCM to understand the importance of WCM. To the best of the authors’ knowledge, no detailed SLR on this topic has previously been published in academic journals.

- Related Documents

A systematic literature review on working capital management – an identification of new avenues

Purpose This paper aims to provide a review of the existing literature available on working capital (WC) and working capital management (WCM). Design/methodology/approach A systematic literature review (SLR) methodology is used to review 187 articles selected from referred journals, books and international conferences for the period 1980-2017. Findings This comprehensive review reveals that much of the focus in the existing literature is paid on investigating the empirical relationship between WCM and firm performance. Furthermore, the attention has been paid towards studying the WC practices. The behavioural aspects, qualitative studies, survey studies and systematic theory development have been ignored in most of the prior studies. These areas have a broader scope for future research. Research limitations/implications This study is based on literature review and theoretical in nature. Therefore, it does not have any empirical results. Practical implications So far, a limited literature review studies have been conducted in WCM perspective. This review provides various emerging trends, which may be considered in future research for providing a deep understanding of WCM. Originality/value This is the first time a detailed review of WCM literature has been conducted by using SLR for the period of 1980-2017. This review will be useful for researchers, business policymaker, finance professionals and all other having direct or indirect concerns with WCM study.

Process improvement project failure: a systematic literature review and future research agenda

Purpose Although scholars have considered the success factors of process improvement (PI) projects, limited research has considered the factors that influence failure. The purpose of this paper is to extend the understanding of PI project failure by systematically reviewing the research on generic project failure, and developing research propositions and future research directions specifically for PI projects. Design/methodology/approach A systematic literature review protocol resulted in a total of 97 research papers that are reviewed for contributions on project failure. Findings An inductive category formation process resulted in three categories of findings. The first category are the causes for project failure, the second category is about relatedness between failure factors and the third category is on failure mitigation strategies. For each category, propositions for future research on PI projects specifically are developed. Additional future research directions proposed lay in better understanding PI project failure as it unfolds (i.e. process studies vs cross-sectional), understanding PI project failure from a theoretical perspective and better understanding of PI project failure antecedents. Originality/value This paper takes a multi-disciplinary and project type approach, synthesizes the existing knowledge and reflects upon the developments in the field of research. Propositions and a framework for future research on PI project failure are presented.

Research in urban logistics: a systematic literature review

Purpose The last decades have witnessed an increased interest in urban logistics originating from both the research and the practitioners’ communities. Sustainable freight transports today are on the political, social and technological agenda of many actors operating in urban contexts. Due to the extent of the covered areas and the continuous progress in many fields, the resulting body of research on urban logistics appears quite fragmented. From an engineering management perspective, the purpose of this paper is to present a systematic literature review (SLR) that aims to consolidate the knowledge on urban logistics, analyse the development of the discipline, and provide future research directions. Design/methodology/approach The paper discusses the main evidence emerging from a SLR on urban logistics. The corpus resulting from the SLR has been used to perform a citation network analysis and a main path analysis that together underpin the identification of the most investigated topics and methodologies in the field. Findings Through the analysis of a corpus of 104 articles, the most important research contributions on urban logistics that represent the structural backbone in the development of the research over time in the field are detected. Based on these findings, this work identifies and discusses three areas of potential interest for future research. Originality/value This paper presents an SLR related to a research area in which the literature is extremely fragmented. The results provide insights about the research path, current trends and future research directions in the field of urban logistics.

Green competencies: insights and recommendations from a systematic literature review

PurposeThis study conceptualises the construct – green competencies. The concept is in the niche stage and needs further elaboration. Hence, to address the research gap, this study follows the steps proposed by Tranfield et al. (2003). The major part of the study comprises descriptive analysis and thematic analysis. Descriptive analysis of the selected 66 articles was examined with the classification framework, which contains year-wise distribution, journal-wise distribution, the focus of the concept, the economic sector, and dimensions of sustainable development. The paper conducts a thematic analysis of the following research questions. What are the green competencies and their conceptual definition? What are their dimensions?Design/methodology/approachThis paper applies a systematic literature review of green competencies literature, extends the state-of-the-art using the natural resource-based view, and discusses future research directions for academicians and practitioners.FindingsIn recent years, there was considerable interest in green competencies (GC), as reflected in the surge of articles published in this genre. This paper asserts that green competencies are a multidimensional construct comprised of green knowledge, green skills, green abilities, green attitudes, green behaviours, and green awareness.Originality/valueDespite the significance of green competencies, there has been a dearth of study to define the constructs and identify the dimensions. Hence, this study addresses the literature gap by conceptualisation and discusses dimensions of the construct.

Nexus between business process management (BPM) and accounting

Purpose Multidisciplinary business process management (BPM) research can reap significant impact. We can particularly benefit from incorporating accounting concepts to address some of the key BPM challenges, such as value-creation and return on investment of BPM activities. However, research which addresses a relationship between BPM and accounting is scarce. The purpose of this paper is to provide a detailed synthesis of the current literature that has integrated accounting aspects with BPM. The authors profile and thematically describe existing research, and derive evidence-based directions to guide future research. Design/methodology/approach A multi-staged structured literature review approach to search for the two broad themes, accounting and BPM, supported by NVivo (to manage the papers and the coding and analysis processes) was designed and followed. Findings The paper confirms the dearth of work that ties the two disciplines, despite the synergetic multidisciplinary results that can be attained. Available literature is mostly from the management accounting perspective and relates to describing how performance management, in particular performance measurement, can be applicable to process improvement initiatives together with tools such as activity-based costing and the balanced scorecard. There is a lack of research that examines BPM in relation to any financial accounting perspectives (such as external reporting). Future research directions are proposed together with implications for practitioners with the findings of this structured literature review. Research limitations/implications The paper provides a detailed synthesis of the existing literature on the nexus between accounting and BPM. It summarizes the implications for practitioners and provides directions for future research by identifying key gaps and opportunities with a sound contextual basis for extension and new work. Originality/value Effective literature reviews create strong foundations for future research and accumulate the otherwise scattered knowledge into a single place. This is the first structured literature review that provides a detailed synthesis of the research that ties together the accounting and BPM disciplines, providing a basis for future research directions together with implications for practitioners.

Organizational learning and Industry 4.0: findings from a systematic literature review and research agenda

PurposeIndustry 4.0 has been one of the most topics of interest by researches and practitioners in recent years. Then, researches which bring new insights related to the subjects linked to the Industry 4.0 become relevant to support Industry 4.0's initiatives as well as for the deployment of new research works. Considering “organizational learning” as one of the most crucial subjects in this new context, this article aims to identify dimensions present in the literature regarding the relation between organizational learning and Industry 4.0 seeking to clarify how learning can be understood into the context of the fourth industrial revolution. In addition, future research directions are presented as well.Design/methodology/approachThis study is based on a systematic literature review that covers Industry 4.0 and organizational learning based on publications made from 2012, when the topic of Industry 4.0 was coined in Germany, using data basis Web of Science and Google Scholar. Also, NVivo software was used in order to identify keywords and the respective dimensions and constructs found out on this research.FindingsNine dimensions were identified between organizational learning and Industry 4.0. These include management, Industry 4.0, general industry, technology, sustainability, application, interaction between industry and the academia, education and training and competency and skills. These dimensions may be viewed in three main constructs which are essentially in order to understand and manage learning in Industry 4.0's programs. They are: learning development, Industry 4.0 structure and technology Adoption.Research limitations/implicationsEven though there are relatively few publications that have studied the relationship between organizational learning and Industry 4.0, this article makes a material contribution to both the theory in relation to Industry 4.0 and the theory of learning - for its unprecedented nature, introducing the dimensions comprising this relation as well as possible future research directions encouraging empirical researches.Practical implicationsThis article identifies the thematic dimensions relative to Industry 4.0 and organizational learning. The understanding of this relation has a relevant contribution to professionals acting in the field of organizational learning and Industry 4.0 in the sense of affording an adequate deployment of these elements by organizations.Originality/valueThis article is unique for filling a gap in the academic literature in terms of understanding the relation between organizational learning and Industry 4.0. The article also provides future research directions on learning within the context of Industry 4.0.

Islamic social finance: a literature review and future research directions

Purpose This paper aims to study the main trends of scientific research in Islamic finance’s social aspects to clarify place, role and functions, especially in the context of increasing social problems. To achieve this goal, this paper focuses on the social component of Islamic finance, analyzes publications on social Islamic finance in the Web of Science database, covering the period from 1979 to 2020, specify the geographical localization of research networks, determines the most cited authors and their scientific position. Design/methodology/approach The authors have applied several literature review techniques, a bibliometric citation and co-citation analysis, a co-authorship analysis and a review of the most cited papers. The analyzes’ results allow us to offer five future questions in Islamic social finance, zakat and waqf, which have not been investigated before and could influence Islamic social finance and Islamic finance research. Findings The authors also derive and summarize five leading future research questions. Research limitations/implications This is a limitation of using only the Web of Science Core Collection database as the premier resource and the most trusted citation index for the world’s scientific and scholarly research. Further study might expand the types of analyzed units, include more keywords and include other databases, such as Scopus. Originality/value This paper can be considered as an inspirational one to future researchers and policymakers in Islamic social finance.

Defined strategies for financial working capital management

Purpose – The purpose of this paper is to develop strategies for financial working capital management and to present previous literature on financial working capital management and its measures. Design/methodology/approach – Qualitative comparative analysis is used to formulate the strategies, and the variables in the analysis have been selected from previous literature. Empirical data consists of 91 companies listed in the Helsinki Stock Exchange during 2008-2012. Findings – The results indicate 11 possible strategies for financial working capital management which all aim at increasing financial working capital. There are suitable strategies for all companies independent from their profitability, capital intensity or working capital requirements. Research limitations/implications – The presented strategies have been created theoretically and have not been tested in companies, which could be done in future research. Originality/value – This study has three contributions. First, previous literature on financial working capital management is reviewed. Second, a novel measure for financial working capital is developed. Third, strategies for financial working capital management are presented.

Life cycle assessment of anaerobic digestion systems

Purpose It is well known that sustainability is the ideal driving path of the entire world and renewable energy is the backbone of the ongoing initiatives. The current topic of argument among the sustainability research community is on the wise selection of processes that will maximize yield and minimize emissions. The purpose of this paper is to outline different parameters and processes that impact the performance of biogas production plants through an extensive literature review. These include: comparison of biogas plant efficiency based on the use of a diverse range of feedstock; comparison of environmental impacts and its reasons during biogas production based on different feedstock and the processes followed in the management of digestate; analysis of the root cause of inefficiencies in the process of biogas production; factors affecting the energy efficiency of biogas plants based on the processes followed; and the best practices and the future research directions based on the existing life cycle assessment (LCA) studies. Design/methodology/approach The authors adopted a systematic literature review of research articles pertaining to LCA to understand in depth the current research and gaps, and to suggest future research directions. Findings Findings include the impact of the type of feedstock used on the efficiency of the biogas plants and the level of environmental emissions. Based on the analysis of literature pertaining to LCA, diverse factors causing emissions from biogas plants are enlisted. Similarly, the root causes of inefficiencies of biogas plants were also analyzed, which will further help researchers/professionals resolve such issues. Findings also include the limitations of existing research body and factors affecting the energy efficiency of biogas plants. Research limitations/implications This review is focused on articles published from 2006 to 2019 and is limited to the performance of biogas plants using LCA methodology. Originality/value Literature review showed that a majority of articles focused mainly on the efficiency of biogas plants. The novel and the original aspect of this review paper is that the authors, alongside efficiency, have considered other critical parameters such as environmental emission, energy usage, processes followed during anaerobic digestion and the impact of co-digestion of feed as well. The authors also provide solid scientific reasoning to the emission and inefficiencies of the biogas plants, which were rarely analyzed in the past.

High-performance organization: a literature review

PurposeThis paper aims to review and synthesize notable literature on high-performance organization (HPO), from which future research directions can be recommended.Design/methodology/approachThis narrative literature review analyzes major HPO literature in popular books and peer-reviewed articles published in English in the period between 1982 and 2019.FindingsThe review revealed that HPO literature has evolved multiple times, illustrating the complex and multifaceted nature of this phenomenon. In particular, literature on HPO has evolved in four phases: (1) definitions and conceptual development of HPO; (2) exploration of approaches to achieve HPO; (3) empirical validation of HPO framework; and (4) complicated research models and designs on HPO. Several research gaps were identified, which definitely hold varying research value and can be seen as potential opportunities for future research.Research limitations/implicationsThe focus of this review is on HPO literature published in English rather than cover all existing literature.Originality/valueIt is among the first studies to review the HPO literature and its evolution. This review also recommends constructive areas for future research on HPO to focus on.

Export Citation Format

Share document.

- Search Search Please fill out this field.

- Working Capital Mgmt.

- Understanding It

Types of Working Capital

- Why Manage Capital?

Working Capital Cycle

- Limitations

The Bottom Line

- Corporate Finance

- Financial statements: Balance, income, cash flow, and equity

Working Capital Management Explained: How It Works

:max_bytes(150000):strip_icc():format(webp)/vikki-velasquez-investopedia-portrait-1-18b989d75f1f4d6d9b5b3a47cb3ffc5f.jpg)

What Is Working Capital Management?

Working capital management is a business strategy designed to manage a company's working capital. A company's working capital refers to the capital it has left over after accounting for its current liabilities. Working capital management ensures that a company operates efficiently by monitoring and using its current assets and liabilities to their most effective use. The efficiency of working capital management can be quantified using ratio analysis .

Key Takeaways

- Working capital management requires monitoring a company's assets and liabilities to maintain sufficient cash flow to meet its short-term operating costs and short-term debt obligations.

- Managing working capital primarily revolves around managing accounts receivable, accounts payable, inventory, and cash.

- Working capital management involves tracking various ratios, including the working capital ratio, the collection ratio, and the inventory ratio.

- Working capital management can improve a company's cash flow management and earnings quality by using its resources efficiently.

- Working capital management strategies may not materialize due to market fluctuations or may sacrifice long-term successes for short-term benefits.

Investopedia / Sydney Saporito

Understanding Working Capital Management

Working capital is a key metric used to measure a company's short-term financial health and well-being. It is the difference between a company's current assets and current liabilities. As such, it is the capital that is left after accounting for its current liabilities. Working capital management is a strategy that companies use to manage their leftover cash.

Current assets include anything that can be easily converted into cash within 12 months. These are the company's highly liquid assets. Some current assets include cash, accounts receivable (AR), inventory, and short-term investments. Current liabilities are any obligations due within the following 12 months. These include accruals for operating expenses and current portions of long-term debt payments.

The primary purpose of working capital management is to enable the company to maintain sufficient cash flow to meet its short-term operating costs and short-term debt obligations. A company's working capital is made up of its current assets minus its current liabilities.

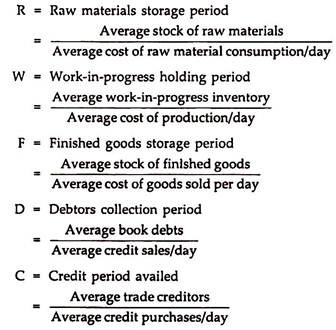

Working capital management monitors cash flow, current assets, and current liabilities using ratio analysis, such as working capital ratio , collection ratio, and inventory turnover ratio .

Working Capital Management Components

Certain balance sheet accounts are more important when considering working capital management. Though working capital often entails comparing all current assets to current liabilities, there are a few accounts that are more critical to track.

The core of working capital management is tracking cash and cash needs. This involves managing the company's cash flow by forecasting needs, monitoring cash balances, and optimizing cash flows (inflows and outflows) to ensure that the company has enough cash to meet its obligations.

Because cash is always considered a current asset, all accounts should be considered. However, companies should be mindful of restricted or time-bound deposits .

Receivables

To manage capital, companies must be mindful of their receivables. This is especially important in the short term as they wait for credit sales to be completed. This involves:

- Managing the company's credit policies

- Monitoring customer payments

- Improving collection practices

At the end of the day, having completed a sale does not matter if the company is unable to collect payment on the sale.

Account Payables

Account payables refers to one aspect of working capital management that companies can take advantage of that they often have greater control over. While other aspects of working capital management may be uncontrollable, such as selling goods or collecting receivables, companies often have a say in how they pay suppliers, what the credit terms are, and when cash outlays are made.

Companies primarily consider inventory during working capital management as it may be the most risky aspect of managing capital. When inventory is sold, a company must go to the market and rely on consumer preferences to convert inventory to cash.

If this cannot be completed quickly, the company may be forced to have its short-term resources stuck in an illiquid position. Alternatively, the company may be able to quickly sell the inventory but only with a steep price discount.

In its simplest form, working capital is the difference between current assets and current liabilities. However, different types of working capital may be important to a company to best understand its short-term needs.

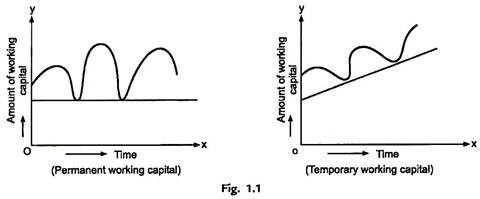

- Permanent Working Capital: Permanent working capital is the amount of resources the company will always need to operate its business without interruption. This is the minimum amount of short-term resources vital to a company's operations.

- Regular Working Capital: Regular working capital is a component of permanent working capital. It is the part of the permanent working capital that is required for day-to-day operations and makes up the most important part of permanent working capital.

- Reserve Working Capital: Reserve working capital is the other component of permanent working capital. Companies may require an additional amount of working capital on hand for emergencies, seasonality , or unpredictable events.

- Fluctuating Working Capital: Companies may be interested in only knowing what their variable working capital is. For example, companies may opt to pay for inventory as it is a variable cost . However, the company may have a monthly liability relating to insurance it does not have the option to decline. Fluctuating working capital only considers the variable liabilities the company has complete control over.

- Gross Working Capital: Gross working capital is simply the total amount of current assets of a business before considering any short-term liabilities.

- Net Working Capital: Net working capital is the difference between current assets and current liabilities.

Why Manage Working Capital?

Working capital management can improve a company's cash flow management and earnings quality through the efficient use of its resources. Management of working capital includes inventory management as well as management of accounts receivable and accounts payable .

Working capital management also involves the timing of accounts payable like paying suppliers. A company can conserve cash by choosing to stretch the payment of suppliers and to make the most of available credit or may spend cash by purchasing using cash—these choices also affect working capital management.

In addition to ensuring that the company has enough cash to cover its expenses and debt, the objectives of working capital management are to minimize the cost of money spent on working capital and maximize the return on asset investments.

Working Capital Management Ratios

Three ratios that are important in working capital management are the working capital ratio, the collection ratio, and the inventory turnover ratio.

Working Capital Ratio

The working capital ratio or current ratio is calculated by dividing current assets by current liabilities. This ratio is a key indicator of a company's financial health as it demonstrates its ability to meet its short-term financial obligations.

A working capital ratio below 1.0 often means a company may have trouble meeting its short-term obligations. That's because the company has more short-term debt than short-term assets. To pay all of its bills as they come due, the company may need to sell long-term assets or secure external financing.

Working capital ratios of 1.2 to 2.0 are considered desirable as this means the company has more current assets compared to current liabilities. However, a ratio higher than 2.0 may suggest that the company is not effectively using its assets to increase revenues. For example, a high ratio may indicate that the company has too much cash on hand and could be more efficiently utilizing that capital to invest in growth opportunities.

Collection Ratio (Days Sales Outstanding)

The collection ratio, also known as days sales outstanding (DSO) , is a measure of how efficiently a company manages its accounts receivable. The collection ratio is calculated by multiplying the number of days in the period by the average amount of outstanding accounts receivable.

This product is then divided by the total amount of net credit sales during the accounting period. To find the average amount of average receivables, companies most often simply take the average between the beginning and ending balances.

The collection ratio calculation provides the average number of days it takes a company to receive payment after a sales transaction on credit. Note that the DSO ratio does not consider cash sales. If a company's billing department is effective at collecting accounts receivable , the company will have quicker access to cash which is can deploy for growth. Meanwhile, if the company has a long outstanding period, this effectively means the company is awarding creditors with interest-free, short-term loans.

Inventory Turnover Ratio

Another important metric of working capital management is the inventory turnover ratio. To operate with maximum efficiency, a company must keep sufficient inventory on hand to meet customers' needs. However, the company also needs to strive to minimize costs and risk while avoiding unnecessary inventory stockpiles.

The inventory turnover ratio is calculated as the cost of goods sold (COGS) divided by the average balance in inventory. Again, the average balance in inventory is usually determined by taking the average of the starting and ending balances.

The ratio reveals how rapidly a company's inventory is used in sales and replaced. A relatively low ratio compared to industry peers indicates a risk that inventory levels are excessively high, meaning a company may want to consider slowing production to ease the cost of insurance, storage, security, or theft. Alternatively, a relatively high ratio may indicate inadequate inventory levels and risk to customer satisfaction.

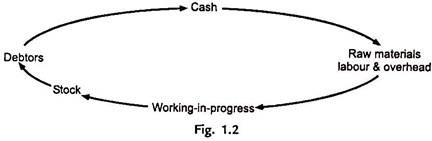

In addition to the ratios discussed above, companies may rely on the working capital cycle when managing working capital. Working capital management helps maintain the smooth operation of the net operating cycle, also known as the cash conversion cycle (CCC) . This is the minimum amount of time required to convert net current assets and liabilities into cash. The working capital cycle is a measure of the time it takes for a company to convert its current assets into cash, or:

Working Capital Cycle in Days = Inventory Cycle + Receivable Cycle - Payable Cycle

The working capital cycle represents the period measured in days from the time when the company pays for raw materials or inventory to the time when it receives payment for the products or services it sells. During this period, the company's resources may be tied up in obligations or pending liquidation to cash.

Inventory Cycle

The inventory cycle represents the time it takes for a company to acquire raw materials or inventory, convert them into finished goods, and store them until they are sold. During this stage, the company's cash is tied up in inventory.

Though it starts the cycle with cash on hand, the company agrees to part ways with working capital with the expectation that it will receive more working capital in the future by selling the product at a profit .

Accounts Receivable Cycle

The AR cycle represents the time it takes for a company to collect payment from its customers after it has sold goods or services. During this stage, the company's cash is tied up in accounts receivable.

Though the company can part ways with its inventory, its working capital is now tied up in accounts receivable and still does not give the company access to capital until these credit sales are received.

Accounts Payable Cycle

The AP cycle represents the time it takes for a company to pay its suppliers for goods or services received. During this stage, the company's cash is tied up in accounts payable.

On the positive side, this represents a short-term loan from a supplier meaning the company can hold onto cash even though they have received a good. On the negative side, this creates a liability that needs to be managed.

Limitations of Working Capital Management

With strong working capital management, a company should be able to ensure it has enough capital on hand to operate and grow. However, there are downsides to the approach. Working capital management only focuses on short-term assets and liabilities. It does not address the long-term financial health of the company and may sacrifice the best long-term solution in favor of short-term benefits.

Even with the best practices in place, working capital management cannot guarantee success. The future is uncertain, and it's challenging to predict how market conditions will affect a company's working capital. Whether there are changes in macroeconomic conditions and customer behavior, or there are disruptions in the supply chain, a company's forecast of working capital may simply not materialize as expected.

While effective working capital management can help a company avoid financial difficulties, it may not necessarily lead to increased profitability. Working capital management does not inherently increase profitability, make products more desirable, or increase a company's market position. Companies still need to focus on sales growth, cost control, and other measures to improve their bottom line. As that bottom line improves, working capital management can simply enhance the company's position.

Working capital management aims at more efficient use of a company's resources by monitoring and optimizing the use of current assets and liabilities. The goal is to maintain sufficient cash flow to meet its short-term operating costs and short-term debt obligations while maximizing its profitability. Working capital management is key to the cash conversion cycle, or the amount of time a firm uses to convert working capital into usable cash.

Why Is the Current Ratio Important?

The current ratio or the working capital ratio indicates how well a firm can meet its short-term obligations. It's also a measure of liquidity . If a company has a current ratio of less than 1.0, this means that short-term debts and bills exceed current assets, which could be a signal that the company's finances may be in danger in the short run.

Why Is the Collection Ratio Important?

The collection ratio, also known as days sales outstanding, is a measure of how efficiently a company can collect on its accounts receivable. If it takes a long time to collect, it can be a signal that there will not be enough cash on hand to meet near-term obligations. Working capital management tries to improve the collection speed of receivables.

Why Is the Inventory Ratio Important?

The inventory turnover ratio shows how efficiently a company sells its inventory. A relatively low ratio compared to industry peers indicates a risk that inventory levels are excessively high, while a relatively high ratio may indicate inadequate inventory levels.

Working capital management is at the core of operating a business. Without sufficient capital on hand, a company is unable to pay its bills, process its payroll, or invest in its growth. Companies can better understand their working capital structure by analyzing liquidity ratios and ensuring their short-term cash needs are always met.

Dr. Ajay Tyagi, via Google Books. " Capital Investment and Financing for Beginners ," Page 3. Horizon Books, 2017.

Dr. Ajay Tyagi, via Google Books. " Capital Investment and Financing for Beginners ," Page 4. Horizon Books, 2017.

Dr. Ajay Tyagi, via Google Books. " Capital Investment and Financing for Beginners ," Pages 4-5. Horizon Books, 2017.

:max_bytes(150000):strip_icc():format(webp)/shutterstock_112522391-5bfc2b9846e0fb0051bde2d3.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Analyzing the Efficiency of Working Capital Management: a New Approach Based on DEA-Malmquist Technology

- Original Research

- Published: 22 July 2022

- Volume 3 , article number 32 , ( 2022 )

Cite this article

- Ahmed Mohamed Habib ORCID: orcid.org/0000-0003-1728-6028 1 &

- Nahia Mourad 2

6755 Accesses

24 Citations

1 Altmetric

Explore all metrics

In this study, we analyze the efficiency of working capital management (WCME) for Gulf companies before and during the coronavirus crisis, then explore the influence of the coronavirus crisis on WCME. This study uses several techniques to achieve its goals, including the Malmquist index (MI), data envelopment analysis (DEA), and Tobit regression. The results demonstrate that most firms (approximately 84%) adopt a conservative strategy for their WCM. The WCME results revealed a statistical difference in the technological and pure efficiency scores for companies before and during the coronavirus crisis, while the results revealed no statistical difference in the technical, scale, and total factor productivity scores. Tobit’s results show that the coronavirus crisis had no significant influence on companies’ WCM performance. Finally, our results indicate that firms that are efficient in terms of WCM have higher sales returns and net income. The findings of this study have important implications for stakeholders to increase their awareness of companies’ WCM performance before and during a crisis. In addition, the results could have implications for trading strategies as investors and financiers seek to invest in companies with good WCM. The implications of WCM performance on social interests would cause decision-makers to use the best strategies and procedures to enhance WCM activities to improve their investments and image in the community in which it operates. We advance a novel contribution to the literature by analyzing and appraising the WCME for companies before and during the coronavirus crisis using a new approach based on DEA-Malmquist technology and then examining whether the coronavirus crisis has affected the WCME.

Similar content being viewed by others

Corporate Social Responsibility (CSR) Implementation: A Review and a Research Agenda Towards an Integrative Framework

The impact of corporate governance on financial performance: a cross-sector study

Meta-analyses on Corporate Social Responsibility (CSR): a literature review

Avoid common mistakes on your manuscript.

1 Introduction

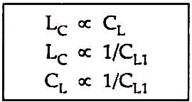

Businesses strive to make the best use of their limited resources. Resource allocation theory states that firms choose the most cost-effective distribution and allocation of resources for various productive activities [ 1 , 2 ]. As a result, firms that strive for excellence manage their WC to achieve best practices. The WC term arose from corporate finance and was initially mentioned at the inception of the twentieth century [ 3 , 4 ]. The WC is one of the most confusing accounting concepts. The lack of clarity concerning the employment of WC may be excused by the fact that there is no analogous classification of WC in firms’ balance sheets. WCM appears to have been primarily disregarded in businesses, even though bad WC decisions are responsible for a considerable portion of business failures, and WCM is essential for corporate financial management because it directly affects a firm’s profitability [ 5 ]. This is more striking as a large share of past firm bankruptcies was created by ineffective or inadequate WCM [ 6 ]. As WC significantly influences a firm’s operational and financial security, the literature confirms that it is necessary to develop an optimal WC strategy for a firm [ 7 , 8 ]. The literature suggests three strategies for managing WC: conservative, moderate, and aggressive [ 8 – 10 ]. The conservative strategy is safe for a firm and provides a high level of liquidity as it keeps current assets at high levels compared to current liabilities. In contrast, the aggressive strategy keeps current assets at low levels compared to current liabilities. Finally, the moderate strategy is considered a sensible method as it aims to minimize the drawbacks of the aforementioned methods and maximize their benefits. Exploring the suitable linkages between the items of current assets and liabilities will help a firm to adopt a good WC strategy. Therefore, a firm should adopt and manage its WC strategy on a solid and secure basis to achieve best practices.

The literature on corporate finance recognizes the significance of short-term business decisions on firm profitability. WCM is a recurring topic on a global scale because it is critical to ensure a business’s optimal path. WC is essential during economic downturns because it acts as a liquidity buffer [ 11 , 12 ]. Additionally, WC practices benefit firm profitability by facilitating solid sales and income growth [ 13 , 11 ]. While inventory stockpiling protects businesses from price fluctuations, trade credit increases sales and strengthens customer relationships. In addition, short-term debt related to financing the WC has low interest rates and is unaffected by inflation [ 14 ]. In contrast, the PricewaterhouseCoopers (PwC) Global report notes that promoting WC could free up €1.3 trillion in cash, allowing for a 55% increase in capital investment [ 15 ]. Furthermore, the report identifies new calls for global publicly traded firms’ business performance over the last 5 years as capital expenses have decreased, cash has shifted to be more costly and tough to convert, and the WC has slightly improved. Firms must cultivate and enhance their WC practices to improve business performance. On the other hand, excessive investment in WC necessitates financing and, as a result, additional payments, which may produce negative consequences and sacrifices for stockholders [ 13 , 16 ]. Kieschnick et al. [ 17 ] argue that an increase in WC financing increases the likelihood of bankruptcy because it requires additional financing requirements and financing expenses.

Moreover, various components of WCM contribute significantly to its effectiveness. Firms must make critical decisions about how much stock to keep on hand as having a large inventory protects them from costly stockouts and manufacturing process interruptions. Customers who are given more credit are more likely to use and verify products before making a payment, which benefits the company [ 18 ]. According to de Almeida and Eid [ 19 ], WC is a critical component of operational cash flow and is used to calculate the free cash flow. Effective WCM reduces a firm’s reliance on external funding, frees up cash for additional investments, and increases its financial flexibility. Business administration is constantly striving to maintain optimal WC volume. Increased WC investment energizes the sales process and provides discounts to suppliers for prompt payments at low WC levels. Nonetheless, once a certain level of WC investment is reached, additional interest costs are incurred, eroding firm value [ 20 ].

Two approaches have been used to assess a firm’s efficiency in terms of WCM. The first approach for assessing the WCME is to use ratio analysis as a parametric method. For example, quick and current ratios have been used to assess a firm’s liquidity [ 21 ]. In addition, Zimon and Tarighi [ 8 ] explored the WCM strategies of small- and medium-sized firms in Poland using liquidity and turnover ratios, cash conversion cycle (CCC), and other ratios. This approach has been criticized for its inherently static nature as a parametric method [ 22 ]. The CCC proposed by Richards and Laughlin [ 23 ] was also criticized for being mathematically incorrect, failing to focus on the total amount of funds committed, and lacking differentiation in the weights assigned to each component of WC [ 24 ]. According to Goel and Sharma [ 24 ], other measurement ratios, such as weighted CCC, have calculation issues owing to a lack of relevant data. Accordingly, researchers have developed alternative methods for measuring the WCME to overcome the weaknesses of the traditional approach. DEA is one such measure that has been used to calculate WCME as a non-parametric method in previous studies [ 25 – 30 ].

The DEA approach is distinguished by its ability to capture relationships between multiple outputs and inputs [ 31 – 33 ]. Additionally, DEA is a non-parametric technique that does not require prior assumptions about the distribution form of data or its residuals, and does not require any previous knowledge of the variable weights [ 34 , 35 , 36 ]. In addition, DEA is distinguished by its powerful benchmark in assessing the efficiency of firms, as it focuses on the best practices of firms rather than traditional methods, such as ratios and regression analyses, which rely on measures of average and central tendencies as criteria for evaluation, as it benchmarks a firm’s performance with maximum relative performance or best practices [ 37 , 38 ]. Therefore, DEA is considered a powerful approach for the continuous improvement process as it provides critical benchmark information for inefficient firms in achieving the best practices [ 33 , 38 ].

Empirical evidence shows that WCM has garnered substantial interest in accounting and finance research. Considering the Gulf firms, WCM is vital to firms’ economic development. Gulf member states are monarchies with distinct legal structures, and their public corporations operate in distinct institutional, economic, and political environments [ 39 ]. To integrate with the global economy, they shifted their focus from an oil-based economy to a knowledge-based one [ 40 ]. Gulf firms outrank the Middle East and North Africa (MENA) regions but not other regions with comparable per capita income levels. Thus, inefficient employment of assets and WC impedes progress toward sustainable and equitable growth. Gulf firms should invest in balancing their assets and WC to alleviate this trend. In addition, the existing literature on WCM has rarely focused on this crucial phenomenon in Gulf firms. Therefore, more research is needed to analyze the WCME for firms operating in the Gulf and investigate the influence of the coronavirus crisis on WCM performance, which is considered a novel contribution to the literature. Therefore, this study analyzes the efficiency of WCM by integrating the data envelopment analysis approach and the Malmquist productivity index in the context of a unique Gulf setting. The objective of this study was to investigate data from 2018 to 2020. The DEA-Malmquist analysis is extended to capture the efficiency of WCM in terms of technical efficiency (effch), technological efficiency (techch), pure efficiency (pech), scale efficiency (sech), and total factor productivity (tfpch) before and during the coronavirus crisis. The efficiency of the WCM results revealed a statistical difference in the technological and pure efficiency scores before and during the coronavirus crisis. Tobit’s results show that the coronavirus crisis had no significant influence on Gulf firms’ WCM performance. The findings of this study have important implications for stakeholders to increase their awareness of companies’ WCM performance before and during a crisis. In addition, the results could have implications for trading strategies as investors and financiers seek to invest in companies with good WCM. The implications of WCM performance on social interests would cause decision-makers to use the best strategies and procedures to enhance WCM activities to improve their investments and image in the community in which it operates.

The motivation for the study stems from market characteristics and the economic prospects of the Gulf. Most Gulf countries experienced increased inflation during the study period, resulting in higher interest rates, influencing a firm cost of capital. The Gulf Statistics Centre recently released a report on the Gulf countries’ inflation rates, which were 3.5% in April 2021, up from 3.5% the previous year. In April 2021, Saudi Arabia had the highest inflation rate in the Gulf, at 5.3%, up from 3.1% in April 2020, followed by Kuwait (3.1%), Oman (1.6%), and Qatar (1.6%). In the United Arab Emirates and Bahrain, inflation decreased about 0.5% and 0.1%, respectively. Besides, the coronavirus epidemic, on the other hand, had a tremendous impact on the entire world, as every country, industry, and civilization were affected in some way [ 41 ]. Many activities have been restricted because of the pandemic to slow the spread of the virus. We should turn everything off to limit the negative impact. When public authorities take decisive action to address the emerging health threat of coronavirus, business leaders are faced with the challenge of channeling their WCM through the issue. Recognizing the crisis impact on the people who drive the firm’s operations is critical. That highlights the importance of a resilient leader in a fast-changing environment and working differently. Also, the author has not found any research by reviewing previous studies on WCM in the context of the coronavirus pandemic. Using MI and DEA, this study is thought to be one of the earliest attempts to analyze and appraise the WCM performance of the firms. Moreover, Gulf firms were adversely impacted by the numerous issues that arose because of the outbreak. Based on these arguments and evidence, this study investigates the following:

RQ1. Are there, on average, significant differences in firms’ WCME over the study period? RQ2. Has coronavirus crisis affected firms’ WCME over the study period?

The remainder of this paper is organized as follows. Section 2 presents a literature review and hypotheses formulation. Section 3 clarifies the data and the methodology used. Section 4 presents the empirical results. Finally, Sect. 5 presents a summary and conclusions of the study.

2 Literature Review and Hypotheses Formulation

WCM is a critical component of a firm’s success [ 42 , 43 ]. Furthermore, the WCM can help with risk management and increase the value of a business [ 44 ]. Furthermore, a conservative approach to WCM necessitates increased inventory and accounts receivable investment, which has the advantage of lowering supply-chain costs and price fluctuations, posing less risk to businesses [ 21 , 45 ]. Increased sales and market share generate profits [ 46 ]. Firms that take a proactive approach to WCM reduce risk exposure by reducing inventory investment and credit terms with customers [ 13 ]. Besides, a study of Indian industrial firms between 2004 and 2013 revealed continuous growth in WCME. The DEA-based approach effectively overcame the limitations associated with traditional WCME measures [ 26 , 27 ]. Furthermore, an examination of Indian industrial firms revealed a high degree of efficiency volatility among manufacturing firms, with those operating at 50 to 60% efficiency lacking liquidity management expertise [ 28 , 29 ]. According to Ukaegbu [ 47 ], there is a negative relationship between WCM and Egyptian manufacturing firm profitability. According to a study conducted in 46 countries, lowering CCC could increase business profitability and value [ 16 ]. Furthermore, publicly traded European hospitals with a low leverage ratio show that increasing WCM increases profitability [ 48 ].

Prior research in developed countries revealed various WCME and firm performance outcomes [ 49 ]. While these studies have been extensive in developed countries, they have only recently been extended to developing countries. In developing countries, the relationship between WCME and profitability has been documented using a variety of proxies. Over 10 years, Akinlo [ 50 ] investigated the relationship between WCME and non-financial sector firm profitability in Nigeria. Inventory days, average payment period accounts receivable, and WCM efficiency were all calculated by WCME. The data were analyzed using fixed effects and a pooled ordinary least squares model. Nigerian businesses’ return on assets (ROA) decreases as accounts receivable, accounts payable, and inventory turnover days increase, but increases as CCC decreases. Altaf [ 51 ] investigated the effect of WCME on the performance of the Indian hospitality sector using a two-step efficient GMM (generalized method of moments). WC financing is calculated using the short-term debt-to-working-capital ratio. The results were a non-monotonic relationship with ROA and Tobin Q. That means that a low level of short-term debt benefits the performance of the business.

Wasiuzzaman [ 49 ] calculated the WC using inventory, receivables, payables, and WC balance. According to this study, WC is negatively correlated with ROA in Malaysian manufacturing firms. The payables and hypothesized relationships were incompatible. Soukhakian and Khodakarami [ 52 ] investigated whether WCME could significantly improve the ROA and economic performance of publicly traded Iranian industrial firms. Even though CCC was negatively associated with ROA, there was no significant relationship between WCM and refined economic value added when endogeneity was considered. Wang et al. [ 46 ] investigated the corporate relationships of non-financial listed firms in Pakistan over their existence. According to the findings, an increase in WCME (as measured by the net trade cycle) decreased ROA regardless of the life cycle stage. Zimon [ 10 ] analyzed WCM in small firms in Poland using a sample of 96 commercial firms operating in the construction industry from 2015 to 2017. The results demonstrate that firms operating within purchasing groups focus on financial safety and adopt a moderate-conservative strategy. Lyngstadaas [ 53 ] investigated the link between WCM packages and financial performance using a sample of 589 firms in the USA from 2012 to 2019. The results indicate that out of the 11 effective packages in terms of WCM, six are significant. Additionally, the results confirm that the six packages systematically relate to operational and financial WC performance.

In addition, Chamberlain and Aucouturier [ 54 ] explore the influence of WCM on the performance of publicly traded companies in Europe from 2004 to 2016. The results indicate that the links between WCM, profitability, and firm value are positive and significant. This study suggests that directors should take a nuanced view of WCM’s influence on performance. Zimon [ 7 ] reviewed prior research on WCM. This study shows that higher WC levels enable firms to increase their sales volume. The study concludes that directors should base their WCM strategies on high sales volumes to enhance firms’ WCM efficiency, profitability, and financial security. Aldubhani et al. [ 55 ] explored the linkage between WCM policies and profitability of manufacturing firms in Qatar from 2015 to 2019. The results reveal that firms with a shorter duration of receivables and CCC, and a longer duration of accounts payable and inventory turnover are more profitable. Jaworski and Czerwonka [ 56 ] explored the linkage between WCM measures using a sample of 326 Polish firms from 1998 to 2016. The results revealed a significant nonlinear linkage between working capital, liquidity, and profitability. Mazanec [ 57 ] explored the influence of WCM on a firm’s performance using 3828 transport firms in the Visegrad Group in the European Union in 2019. The results indicate that cash ratio affects firm performance in all models, excluding the Polish and Czech models. In addition, small firms are at a disadvantage in terms of WCM compared to medium-sized firms in Slovakia and the Czech Republic. Zimon and Tarighi [ 8 ] examined the influence of the COVID-19 crisis on WCM using a sample of 61 Polish firms from 2015 to 2020. The results demonstrate that firms manage a moderately conservative strategy for their WCM. Additionally, the results indicated that the COVID-19 crisis did not significantly alter firms’ WCM strategies. Tarkom [ 58 ] investigates the influence of the COVID-19 crisis on firms’ WCM using a sample of 2542 US-publicly traded US firms from 2019 to 2021. The results show that firms with more investment options and government incentives operate at lower levels during cash-conversion cycles. Additionally, the results demonstrated a significant negative influence of COVID-19 on WCM. This finding suggests that the influence can be mitigated by increasing government incentives and investment opportunities. Struwig and Watson [ 59 ] critically examined the WCM research conducted during the COVID-19 crisis in South Africa. The study concludes that during a crisis, the WC examination focuses on workforce safety and demand volatility. This suggests that effective cash management and digital transformation shifts are necessary to relieve undesirable changes in supply chains. Based on these arguments and evidence, this study hypothesizes the following:

H 1 . On average, there were significant differences in firms’ WCME over the study period. H 2 . The coronavirus crisis has affected the firms’ WCME over the study period.

3 Data and Methodology

The sample size included 459 publicly traded companies in the following industries: communication services, consumer discretionary, consumer staples, energy, health care, industrials, materials, real estate, and utilities. These companies are located in Oman, Qatar, Saudi Arabia, Kuwait, Bahrain, and the United Arab Emirates. According to Pastor and Ruiz [ 60 ] and Portela et al. [ 61 ], negative data values would limit the capacity of the DEA model to perform the analysis. As a result, 273 firms were excluded due to negative values in some cases and a lack of data in others. As a result, the final decision-making units (DMUs) are 186 firms. The primary data sources were based on the annual reports of the selected firms. These firms’ annual reports were obtained from the standard and poor’s DataStream, the platform of Mubasher-info, and firms’ websites.

Among the numerous approaches available for assessing DMU efficiency scores, the DEA approach was chosen to evaluate the efficiency of the firms under study because of its unique characteristics. First, as Mourad et al. [ 31 ], Shahwan and Habib [ 32 ], and Tone [ 33 ] argue, DEA is a versatile and powerful technique for capturing the relationship between specific outputs and inputs. Furthermore, DEA can provide critical information for continuous improvement, assisting inefficient DMUs in achieving best practices. Second, like Cooper et al. [ 37 ] and Habib and Shahwan [ 38 ] argued, DEA stands out as a benchmark technique that focuses on the best practices of DMUs rather than traditional methods that rely on measures of central tendencies. Finally, as demonstrated by Habib and Kayani [ 36 ], Mourad et al. [ 31 ] and Tuskan and Stojanovic [ 35 ], DEA distinguishes itself as a non-parametric technique that does not require prior assumptions about the distribution form of data (or its residuals). Furthermore, DEA does not require any previous knowledge of the variable weights.

To calculate efficiency using DEA, we require a set of inputs and outputs pertinent to the analysis’s primary objective [ 36 , 37 , 62 ]. DMUs are expected to provide outputs based on their possible inputs related to the primary objective under analysis. According to prior research, e.g., Gill and Biger [ 25 ], Goel and Sharma ( 24 , 26 , 27 , and Seth et al. [ 30 ], the inputs for calculating the WCME should include those items that account for a significant portion of WC investments. Additionally, each firm invests in WC to maintain consistency and increase sales. Thus, firms that generate more sales while supporting the same WC can be considered more efficient. As a result, net sales should be chosen as an output variable. Almost all prior research has overlooked the significance of net income as a by-product of WCM. A business that generates a higher net income while investing the same WC is more efficient. Following a review of the prior literature, the current DEA-WCME model used inventory, accounts receivable, accounts payable, and cost of goods sold as inputs and net sales and net income as outputs. Finally, the radial Malmquist DEA model is obtained by solving the next linear optimization problem:

where \({x}_{\mathrm{in}}^{\mathrm{s}}\) (resp. \({y}_{\mathrm{rn}}^{\mathrm{s}}\) ) is the value of the \(i\) -th input (resp. \(r\) -th output) of the \(n\) -th DMU observed in period \(s\) , the \({\left({\lambda }_{\mathrm{n}}\right)}_{\left\{1\le \mathrm{n}\le \mathrm{N}\right\}}\) are the weights corresponding to the DMUs. The DMU is considered relatively efficient in period \(s\) measured by frontier technology \(t\) if \({\delta }^{\mathrm{s}}\left({X}_{\mathrm{n}}^{\mathrm{t}},{Y}_{\mathrm{n}}^{\mathrm{t}}\right)=1\) ; otherwise it is inefficient. It should be noted that, \({e}_{n}^{1}=\frac{1}{{\delta }^{1}({X}_{n}^{1},{Y}_{n}^{1})}\) (resp. \({e}_{n}^{2}=\frac{1}{{\delta }^{2}({X}_{n}^{2},{Y}_{n}^{2})}\) ) is the constant return to scale (CCR) efficiency score for the \(n\) -th DMU in the first (resp. second) period.

Following the evaluation of the firms’ WCME using the DEA approach, the current study used the Tobit regression analysis to identify the potential statistical effect of the coronavirus on firms’ WCME. This model is a valuable tool for assessing the relationships between variables when the dependent variable contains censored data or has a range constraint [ 38 ],Verbeek 2008). The equation represents the Tobit linear regression relationship:

where \({e}_{i}\) represents each firm’s WCME; \({v}_{1}\) is the coronavirus as an independent variable defined by a dummy variable. To put it another way, if the time is related to the time before the coronavirus crisis, this indicator variable equals 1, and if it is associated with the time before the coronavirus crisis, it equals 0. Furthermore, to improve the accuracy of the analyses, the study used various control variables such as size, age, and leverage. Thus, \({v}_{2}\) represents the firm size as defined by the natural logarithm of total assets; \({v}_{3}\) represents the firm age as defined by the natural logarithm of firm age from the start of the activity until the end of the current year; \({v}_{4}\) represents firm leverage as defined by dividing a firm’s total liabilities by shareholders’ equity; \({v}_{5}\) refers to the communication services sector; \({v}_{6}\) refers to the consumer discretionary sector; \({v}_{7}\) refers to the consumer staples sector; \({v}_{8}\) refers to the energy sector; \({v}_{9}\) refers to the health care sector; \({v}_{10}\) refers to the industrials sector; \({v}_{11}\) refers to the materials sector; \({v}_{12}\) refers to the real estate sector. \({\beta }_{0}\) is a constant; \({\beta }_{i}\) represents the Tobit regression coefficients; and \({\varepsilon }_{i}\) are known by the Gaussian noises or errors.

4 Results and Discussion

4.1 results of the efficiency model.

Table 1 , panel A, shows the Malmquist index summary for the top ten DMUs under analysis (tfpch > 1) over the study period (2018–2020) in terms of WCME changes. In terms of improvement, the KWSE:HUMANSOFT achieved the best results (2.331), followed by the SASE:9510 (2.100), the DSM:NLCS (1.960), and so on. Table 1 , panel B, displays the Malmquist index summary for all DMUs under consideration during the study period (2018–2020) regarding WCME changes. According to the Malmquist index summary, technological efficiency or frontier-shift (techch) was the primary source of the increasing efficiency of the total factor productivity index of the DMUs under study, rather than technical efficiency or catch-up changes (effch). In terms of improvement (tfpch > 1), 100 DMUs out of 186 under investigation achieved the best results (tfpch > 1). Only 86 DMUs appeared to be inefficient, and they should reconsider operating processes and improve performance through necessary corrective actions to achieve best practices and improve overall factor productivity.

The DEA-Malmquist index summary of annual means in terms of WCME changes over the study period is shown in Table 2 , panel A. The Malmquist index increased by about 1.002 (0.2%) from the base year in the first period (2018–2019) before the coronavirus crisis. This increase is the result of an increase in technological efficiency or frontier-shift changes (techch) of about 1.083 (8.3%) multiplied by a decrease in technical efficiency or catch-up changes (effch) of about 0.926. (7.4%). Similarly, the situation has not changed significantly during the crisis; the Malmquist index for the second period (2019–2020) increased by about 1.034 (3.4%), with this increase attributed to the rise in technological efficiency changes of about 1.135 (13.5%) multiplied by a decrease in technical efficiency changes of about 0.911. (8.9%). Over the study period, the Malmquist index increased by about 1.018 (1.8%), the technological efficiency increased by approximately 1.108 (10.8%), and the technical efficiency decreased by about 0.918 (8.2%).

Table 2 , panel B, shows a complementary statistical test for confirming significant differences in firm efficiency scores regarding WCM over the study period using Wilcoxon tests (via IBM-SPSS ver26). The results showed no statistical difference in technical efficiency scores at a 5% significance level before and during the coronavirus crisis. Similarly, at a 5% significance level, there was no statistical difference in scale efficiency scores and total factor productivity scores. As a result, we retain the null hypothesis that the median of differences between effch (before the crisis) and effch (during the crisis) equals 0; sech (before the crisis) and sech (during the crisis) equal 0; tfpch (before the crisis) and tfpch (during the crisis) equal 0. Furthermore, the results revealed a statistical difference in technological efficiency scores and pure efficiency scores at a 5% significance level before and during the crisis. As a result, we reject the null hypothesis that the median of differences between techch (before the crisis) and techch (during the crisis) equals 0; pech (before the crisis) and pech (during the crisis) equals 0. All previous results indicate that H1 is partially supported.

4.2 Results of the Tobit Regression Model

Following the evaluation of the firms’ WCM performance using the DEA approach, it is helpful to identify some of the factors that affect WCM performance. In this section, the following factors are investigated for their impact on performance: the coronavirus crisis, size, age, leverage, and sector classification.

Tobit regression analysis was used to investigate factors influencing WCM performance using Stata/MP ver16. Table 3 depicts the effect of the variables under investigation on the WCM performance of the firms over the study period. Table 3 shows that firm size and sector (Sec1, the communication services sector; Sec2, the consumer discretionary sector) have a significant favorable influence at the 0.10 significance level or less. Furthermore, at the 0.10 significance level or less, the leverage and the industry sector (whether Sec5, the health care sector; Sec7, the materials sector) negatively influence.

The current study’s findings revealed that the coronavirus crisis had no significant influence on WCM performance. As a result, the H2 hypothesis is unsupported. This findings are consistent with Zimon and Tarighi [ 8 ] study as they reveal that the COVID-19 crisis did not significantly alter firms’ WCM strategies. In contrast, the findings are inconsistent with Tarkom [ 58 ] study, as they demonstrate a significant negative influence of the COVID-19 crisis on WCM. In contrast, the findings revealed that firm size and leverage significantly impact WCM performance. Moreover, the results showed that the sector category (whether Sec1, the communication services sector, Sec2, the consumer discretionary sector; Sec5, the health care sector; Sec7, the materials sector) have a significant influence on the WCM performance at the same time the sector category (whether Sec3, the consumer staples sector; Sec4, the energy sector; Sec6, the industrials sector; Sec8, the real estate sector) have no significant influence on the WCM performance.

4.3 Sensitivity Analysis and Model Validation

Internal and external validity can be used to analyze findings. Internal validity investigates whether the methods utilized to change the results are valid, whereas external validity explores whether could generalize the results away from the present data [ 63 , 38 , 64 ]. Sensitivity examinations are helpful for both types of evaluations. Thus, the internal validity is appraised by utilizing various variables’ combinations. Table 4 , panel A, presents the results of sequentially removing different variables used from the basic model. The current study adopted the Mann–Whitney U test to examine the efficiency scores of the modified DEA-WCME models to the original efficiency scores via the basic DEA-WCME model to verify if the removal of variable occurred a significant difference in the relative efficiency scores. Besides, the correlations of Spearman rank were computed as well.

It is exposed in Table 4 , panel A, that the accounts payable removal significantly decreased the model’s efficiency distinction by diminishing the average of firms’ efficiency scores of 0.61 to 0.51 and the rate of the efficient DMUs of 12.9 to 9.1%. Similarly, removing either input accounts receivable, cost of goods sold, or inventory significantly influenced the model results concerning the efficiency score distribution and the rate of the efficient DMUs. Moreover, the high correlations of Spearman ranks suggest that the firms’ rankings were not significantly altered through the efficiency models. It is not surprising that removing either input impacted the model results because they blend various resource kinds. Therefore, excluding each would occur significant information removal.

Finally, the current study used the consistency of the results over time to assess the external validity of the firms’ efficiency model. The firms’ efficiency model was re-applied utilizing 2018 data in this analysis and then matched the relative efficiency scores to the 2019 and 2020 results (Table 4 , panel B). The Mann–Whitney U test revealed no statistically significant variance in the efficiency score distribution for the study years 2018–2019 ( p = 0.497), 2019–2020 ( p = 0.944), and 2018–2020 ( p = 0.684). The Kruskal–Wallis H test revealed no statistically significant variation in the efficiency score distribution over the study ( p = 0.814). The correlation of Spearman rank between each year was also highly significant. As a result, the general distribution of efficiency scores and the rate of the efficient DMUs not appear to change significantly from period to period, and the firms ranked as efficient remain mostly harmonious from period to period.

5 Summary and Conclusion

Empirical evidence shows that WCM has garnered substantial interest in accounting and finance research. Tewolde [ 5 ] shows that inadequate WC decisions are responsible for a considerable portion of business failures, and that WCM affects a firm’s profitability. This is striking because an ineffective WCM strategy creates a large share of past firm insolvencies [ 6 ]. As WC significantly influences a firm’s operational and financial security, the literature confirms that it is necessary to develop a good strategy for a firm’s WCM [ 7 , 8 ]. Drawing on this, there are increasing concerns regarding the coronavirus crisis toward firms that adopt WCM strategies, which may harm their performance and value. Using a unique Gulf setting, this study analyzes the efficiency of WCM before and during the coronavirus crisis using an integration between the data envelopment analysis approach and the Malmquist productivity index, and then explores the influence of the crisis on WCME using Tobit regression. To the best of our knowledge, the current study is the first to develop and apply the data envelopment analysis methodology using the Malmquist productivity index to evaluate WCME. Besides, the authors advanced a novel contribution to the literature by examining whether the coronavirus crisis has affected the WCM for firms under investigation. This study is essential for regulators, management, and investors to increase their awareness of firms’ WCM performance before and during a crisis. In addition, it provides insight into how the coronavirus crisis affects firms’ WCM, which is likely to strengthen firms’ financial policy and improve their strategies. These findings are consistent with Zimon and Tarighi [ 8 ] study as they reveal that the COVID-19 crisis did not significantly alter firms’ WCM strategies. In contrast, the findings are inconsistent with Tarkom [ 58 ] study, as they demonstrate a significant negative influence of the COVID-19 crisis on WCM.

The results show that 157 firms (approximately 84%) adopt a conservative strategy as a safe strategy for their WCM, while 29 firms have adopted an aggressive strategy, suggesting that most firms strive to provide a high level of liquidity and maintain current assets at high levels compared to current liabilities. In addition, the results of the DEA-Malmquist analysis revealed that the annual means of WCME increased by approximately 0.2% before the coronavirus crisis due to technological efficiency or frontier-shift changes. The results did not change significantly during the coronavirus crisis, with only a 3.4% increase due to technological efficiency or frontier-shift changes. Furthermore, at the 5% significance level, the Wilcoxon test revealed no statistical difference in the efficiency scores of technical and scale efficiency, and total factor productivity before and during the coronavirus crisis. In contrast to previous findings, the results revealed a statistical difference in technological efficiency and pure efficiency scores at a 5% significance level. In addition, the current study’s findings showed that the coronavirus crisis and firm age have no significant influence on WCM performance. By contrast, the findings reveal that firm size and leverage substantially impact WCM performance. Furthermore, the results indicate that sector category (communication services, consumer discretionary, healthcare, and materials) significantly influences WCM performance. Finally, our results indicate that firms that are efficient in terms of WCM have higher sales returns and net income, as the sales and net income averages of firms with relative efficiency in terms of WCM are approximately 11 and 30 times higher, respectively, than inefficient firms in terms of WCM.

Given the study findings, decision-makers and WC managers of firms should develop the necessary means and schemes to ensure the best practices of WCME and address the inefficiency aspects in terms of technical efficiency and scale efficiency to ensure that a firm operates efficiently, which would likely positively reflect on the firm and the confidence of many stakeholders. These findings highlight the need to disclose WCM practices within traditional firm reports or integrated reporting, where conventional statements alone would be insufficient to appraise firm performance, especially given the current ecosystem’s rapid and consecutive development. The findings would also pique the interest of decision-makers and WC managers, who could use the DEA methodology to investigate and identify weaknesses in firm performance, and then take significant actions to optimize performance and achieve best practices.

This study has some limitations. This study focuses on 186 firms (558 firm-year observations) in the Gulf Cooperation Council (GCC), and the findings are limited to the period 2018–2020. Based on the findings of the sensitivity analysis and model validation, the findings can be generalized to other firms in GCC and Middle Eastern countries, and future research may include all non-financial sector firms for broader applicability. Managerial ability, intellectual capital, real earnings management, ESG criteria, and the likelihood of financial distress are also important elements of financial policy that are not considered in this study but can be investigated in future studies. Despite these limitations, our study contributes to the literature by providing empirical evidence that most firms adopt conservative WCM strategies. Additionally, the WCME results revealed a statistical difference in firms’ technological and pure efficiency scores before and during the coronavirus crisis. The study also shows that the coronavirus crisis had no significant influence on firms’ WCM performance. Finally, this study may have implications for many stakeholders, including decision-makers, WCM managers, financiers, investors, financial consultants, researchers, and others, in increasing their awareness of firms’ WCM performance before and during a crisis. In addition, the results could have implications for trading strategies as investors and financiers seek to invest in companies with good WCM. The implications of WCM performance on social interests would cause decision-makers to use the best strategies and procedures to enhance WCM activities to improve their investments and image in the community in which it operates.

Ferrier GD (1994) Ownership type, property rights, and relative Efficiency. In A. Charnes, W. W. Cooper, A. Y. Lewin, & L. M. Seiford (Eds.). Data envelopment analysis: theory, methodology, and applications (1 ed., pp. 273–283). Springer. https://doi.org/10.1007/978-94-011-0637-5_14