Market Research: A How-To Guide and Template

Discover the different types of market research, how to conduct your own market research, and use a free template to help you along the way.

MARKET RESEARCH KIT

5 Research and Planning Templates + a Free Guide on How to Use Them in Your Market Research

Updated: 02/21/24

Published: 02/21/24

Today's consumers have a lot of power. As a business, you must have a deep understanding of who your buyers are and what influences their purchase decisions.

Enter: Market Research.

![how to do a business market research → Download Now: Market Research Templates [Free Kit]](https://no-cache.hubspot.com/cta/default/53/6ba52ce7-bb69-4b63-965b-4ea21ba905da.png)

Whether you're new to market research or not, I created this guide to help you conduct a thorough study of your market, target audience, competition, and more. Let’s dive in.

Table of Contents

What is market research?

Primary vs. secondary research, types of market research, how to do market research, market research report template, market research examples.

Market research is the process of gathering information about your target market and customers to verify the success of a new product, help your team iterate on an existing product, or understand brand perception to ensure your team is effectively communicating your company's value effectively.

Market research can answer various questions about the state of an industry. But if you ask me, it's hardly a crystal ball that marketers can rely on for insights on their customers.

Market researchers investigate several areas of the market, and it can take weeks or even months to paint an accurate picture of the business landscape.

However, researching just one of those areas can make you more intuitive to who your buyers are and how to deliver value that no other business is offering them right now.

How? Consider these two things:

- Your competitors also have experienced individuals in the industry and a customer base. It‘s very possible that your immediate resources are, in many ways, equal to those of your competition’s immediate resources. Seeking a larger sample size for answers can provide a better edge.

- Your customers don't represent the attitudes of an entire market. They represent the attitudes of the part of the market that is already drawn to your brand.

The market research services market is growing rapidly, which signifies a strong interest in market research as we enter 2024. The market is expected to grow from roughly $75 billion in 2021 to $90.79 billion in 2025 .

.png)

Free Market Research Kit

- SWOT Analysis Template

- Survey Template

- Focus Group Template

You're all set!

Click this link to access this resource at any time.

Why do market research?

Market research allows you to meet your buyer where they are.

As our world becomes louder and demands more of our attention, this proves invaluable.

By understanding your buyer's problems, pain points, and desired solutions, you can aptly craft your product or service to naturally appeal to them.

Market research also provides insight into the following:

- Where your target audience and current customers conduct their product or service research

- Which of your competitors your target audience looks to for information, options, or purchases

- What's trending in your industry and in the eyes of your buyer

- Who makes up your market and what their challenges are

- What influences purchases and conversions among your target audience

- Consumer attitudes about a particular topic, pain, product, or brand

- Whether there‘s demand for the business initiatives you’re investing in

- Unaddressed or underserved customer needs that can be flipped into selling opportunity

- Attitudes about pricing for a particular product or service

Ultimately, market research allows you to get information from a larger sample size of your target audience, eliminating bias and assumptions so that you can get to the heart of consumer attitudes.

As a result, you can make better business decisions.

To give you an idea of how extensive market research can get , consider that it can either be qualitative or quantitative in nature — depending on the studies you conduct and what you're trying to learn about your industry.

Qualitative research is concerned with public opinion, and explores how the market feels about the products currently available in that market.

Quantitative research is concerned with data, and looks for relevant trends in the information that's gathered from public records.

That said, there are two main types of market research that your business can conduct to collect actionable information on your products: primary research and secondary research.

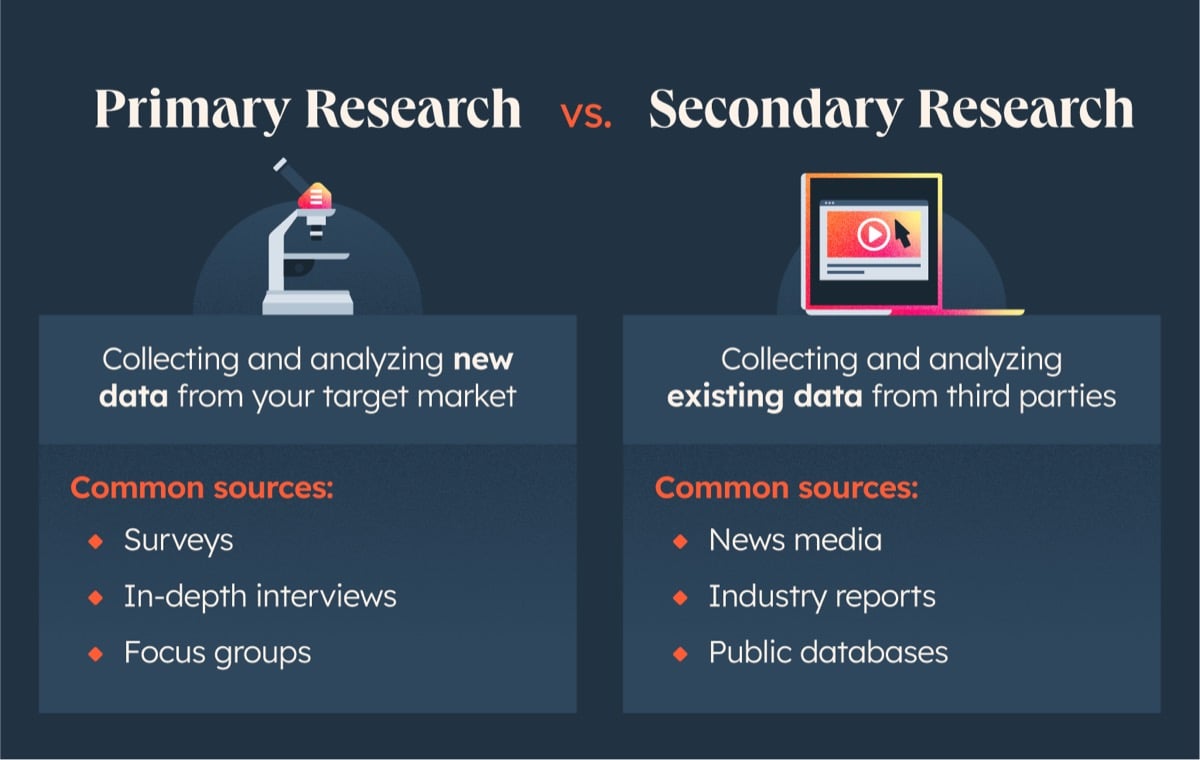

Primary Research

Primary research is the pursuit of first-hand information about your market and the customers within your market.

It's useful when segmenting your market and establishing your buyer personas.

Primary market research tends to fall into one of two buckets:

- Exploratory Primary Research: This kind of primary market research normally takes place as a first step — before any specific research has been performed — and may involve open-ended interviews or surveys with small numbers of people.

- Specific Primary Research: This type of research often follows exploratory research. In specific research, you take a smaller or more precise segment of your audience and ask questions aimed at solving a suspected problem.

Secondary Research

Secondary research is all the data and public records you have at your disposal to draw conclusions from (e.g. trend reports, market statistics, industry content, and sales data you already have on your business).

Secondary research is particularly useful for analyzing your competitors . The main buckets your secondary market research will fall into include:

- Public Sources: These sources are your first and most-accessible layer of material when conducting secondary market research. They're often free to find and review — like government statistics (e.g., from the U.S. Census Bureau ).

- Commercial Sources: These sources often come in the form of pay-to-access market reports, consisting of industry insight compiled by a research agency like Pew , Gartner , or Forrester .

- Internal Sources: This is the market data your organization already has like average revenue per sale, customer retention rates, and other historical data that can help you draw conclusions on buyer needs.

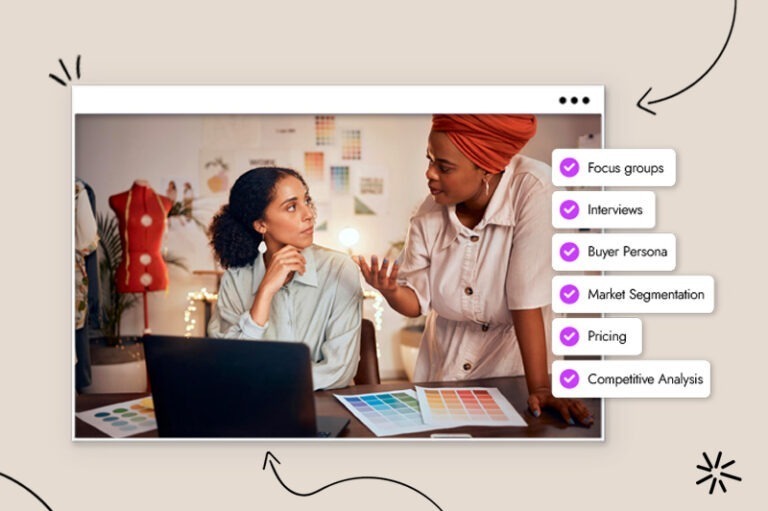

- Focus Groups

- Product/ Service Use Research

- Observation-Based Research

- Buyer Persona Research

- Market Segmentation Research

- Pricing Research

- Competitive Analysis Research

- Customer Satisfaction and Loyalty Research

- Brand Awareness Research

- Campaign Research

1. Interviews

Interviews allow for face-to-face discussions so you can allow for a natural flow of conversation. Your interviewees can answer questions about themselves to help you design your buyer personas and shape your entire marketing strategy.

2. Focus Groups

Focus groups provide you with a handful of carefully-selected people that can test out your product and provide feedback. This type of market research can give you ideas for product differentiation.

3. Product/Service Use Research

Product or service use research offers insight into how and why your audience uses your product or service. This type of market research also gives you an idea of the product or service's usability for your target audience.

4. Observation-Based Research

Observation-based research allows you to sit back and watch the ways in which your target audience members go about using your product or service, what works well in terms of UX , and which aspects of it could be improved.

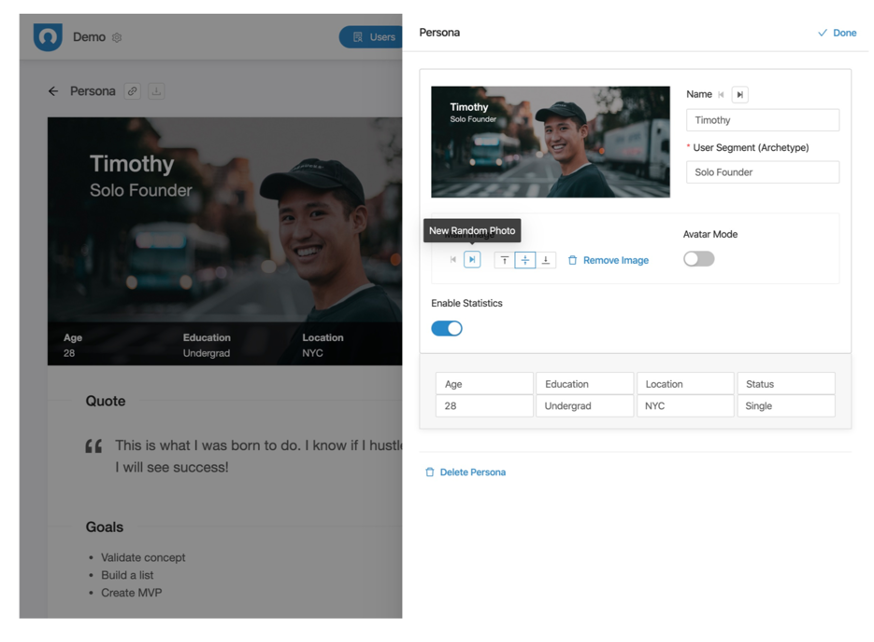

5. Buyer Persona Research

Buyer persona research gives you a realistic look at who makes up your target audience, what their challenges are, why they want your product or service, and what they need from your business or brand.

6. Market Segmentation Research

Market segmentation research allows you to categorize your target audience into different groups (or segments) based on specific and defining characteristics. This way, you can determine effective ways to meet their needs.

7. Pricing Research

Pricing research helps you define your pricing strategy . It gives you an idea of what similar products or services in your market sell for and what your target audience is willing to pay.

8. Competitive Analysis

Competitive analyses give you a deep understanding of the competition in your market and industry. You can learn about what's doing well in your industry and how you can separate yourself from the competition .

9. Customer Satisfaction and Loyalty Research

Customer satisfaction and loyalty research gives you a look into how you can get current customers to return for more business and what will motivate them to do so (e.g., loyalty programs , rewards, remarkable customer service).

10. Brand Awareness Research

Brand awareness research tells you what your target audience knows about and recognizes from your brand. It tells you about the associations people make when they think about your business.

11. Campaign Research

Campaign research entails looking into your past campaigns and analyzing their success among your target audience and current customers. The goal is to use these learnings to inform future campaigns.

- Define your buyer persona.

- Identify a persona group to engage.

- Prepare research questions for your market research participants.

- List your primary competitors.

- Summarize your findings.

1. Define your buyer persona.

You have to understand who your customers are and how customers in your industry make buying decisions.

This is where your buyer personas come in handy. Buyer personas — sometimes referred to as marketing personas — are fictional, generalized representations of your ideal customers.

Use a free tool to create a buyer persona that your entire company can use to market, sell, and serve better.

Don't forget to share this post!

Related articles.

![how to do a business market research SWOT Analysis: How To Do One [With Template & Examples]](https://blog.hubspot.com/hubfs/marketingplan_20.webp)

SWOT Analysis: How To Do One [With Template & Examples]

20+ Tools & Resources for Conducting Market Research

What's a Competitive Analysis & How Do You Conduct One?

TAM SAM SOM: What Do They Mean & How Do You Calculate Them?

![how to do a business market research How to Run a Competitor Analysis [Free Guide]](https://blog.hubspot.com/hubfs/Google%20Drive%20Integration/how%20to%20do%20a%20competitor%20analysis_122022.jpeg)

How to Run a Competitor Analysis [Free Guide]

![how to do a business market research 5 Challenges Marketers Face in Understanding Audiences [New Data + Market Researcher Tips]](https://blog.hubspot.com/hubfs/challenges%20marketers%20face%20in%20understanding%20the%20customer%20.png)

5 Challenges Marketers Face in Understanding Audiences [New Data + Market Researcher Tips]

Causal Research: The Complete Guide

Total Addressable Market (TAM): What It Is & How You Can Calculate It

What Is Market Share & How Do You Calculate It?

![how to do a business market research 3 Ways Data Privacy Changes Benefit Marketers [New Data]](https://blog.hubspot.com/hubfs/how-data-privacy-benefits-marketers_1.webp)

3 Ways Data Privacy Changes Benefit Marketers [New Data]

Free Guide & Templates to Help Your Market Research

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

Send us an email

How to do market research: The complete guide for your brand

Written by by Jacqueline Zote

Published on April 13, 2023

Reading time 10 minutes

Blindly putting out content or products and hoping for the best is a thing of the past. Not only is it a waste of time and energy, but you’re wasting valuable marketing dollars in the process. Now you have a wealth of tools and data at your disposal, allowing you to develop data-driven marketing strategies . That’s where market research comes in, allowing you to uncover valuable insights to inform your business decisions.

Conducting market research not only helps you better understand how to sell to customers but also stand out from your competition. In this guide, we break down everything you need to know about market research and how doing your homework can help you grow your business.

Table of contents:

What is market research?

Why is market research important, types of market research, where to conduct market research.

- Steps for conducting market research

- Tools to use for market research

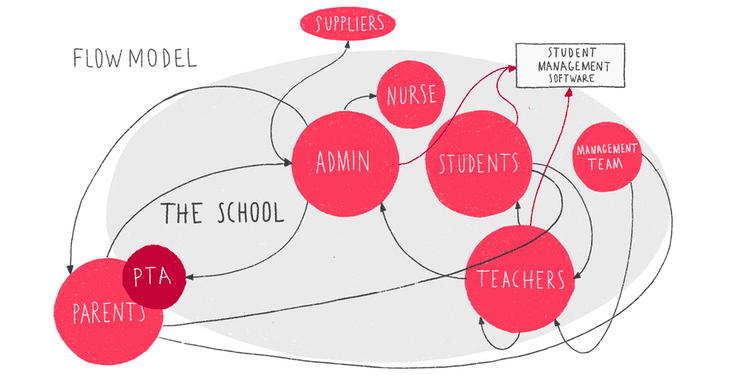

Market research is the process of gathering information surrounding your business opportunities. It identifies key information to better understand your audience. This includes insights related to customer personas and even trends shaping your industry.

Taking time out of your schedule to conduct research is crucial for your brand health. Here are some of the key benefits of market research:

Understand your customers’ motivations and pain points

Most marketers are out of touch with what their customers want. Moreover, these marketers are missing key information on what products their audience wants to buy.

Simply put, you can’t run a business if you don’t know what motivates your customers.

And spoiler alert: Your customers’ wants and needs change. Your customers’ behaviors today might be night and day from what they were a few years ago.

Market research holds the key to understanding your customers better. It helps you uncover their key pain points and motivations and understand how they shape their interests and behavior.

Figure out how to position your brand

Positioning is becoming increasingly important as more and more brands enter the marketplace. Market research enables you to spot opportunities to define yourself against your competitors.

Maybe you’re able to emphasize a lower price point. Perhaps your product has a feature that’s one of a kind. Finding those opportunities goes hand in hand with researching your market.

Maintain a strong pulse on your industry at large

Today’s marketing world evolves at a rate that’s difficult to keep up with.

Fresh products. Up-and-coming brands. New marketing tools. Consumers get bombarded with sales messages from all angles. This can be confusing and overwhelming.

By monitoring market trends, you can figure out the best tactics for reaching your target audience.

Not everyone conducts market research for the same reason. While some may want to understand their audience better, others may want to see how their competitors are doing. As such, there are different types of market research you can conduct depending on your goal.

Interview-based market research allows for one-on-one interactions. This helps the conversation to flow naturally, making it easier to add context. Whether this takes place in person or virtually, it enables you to gather more in-depth qualitative data.

Buyer persona research

Buyer persona research lets you take a closer look at the people who make up your target audience. You can discover the needs, challenges and pain points of each buyer persona to understand what they need from your business. This will then allow you to craft products or campaigns to resonate better with each persona.

Pricing research

In this type of research, brands compare similar products or services with a particular focus on pricing. They look at how much those products or services typically sell for so they can get more competitive with their pricing strategy.

Competitive analysis research

Competitor analysis gives you a realistic understanding of where you stand in the market and how your competitors are doing. You can use this analysis to find out what’s working in your industry and which competitors to watch out for. It even gives you an idea of how well those competitors are meeting consumer needs.

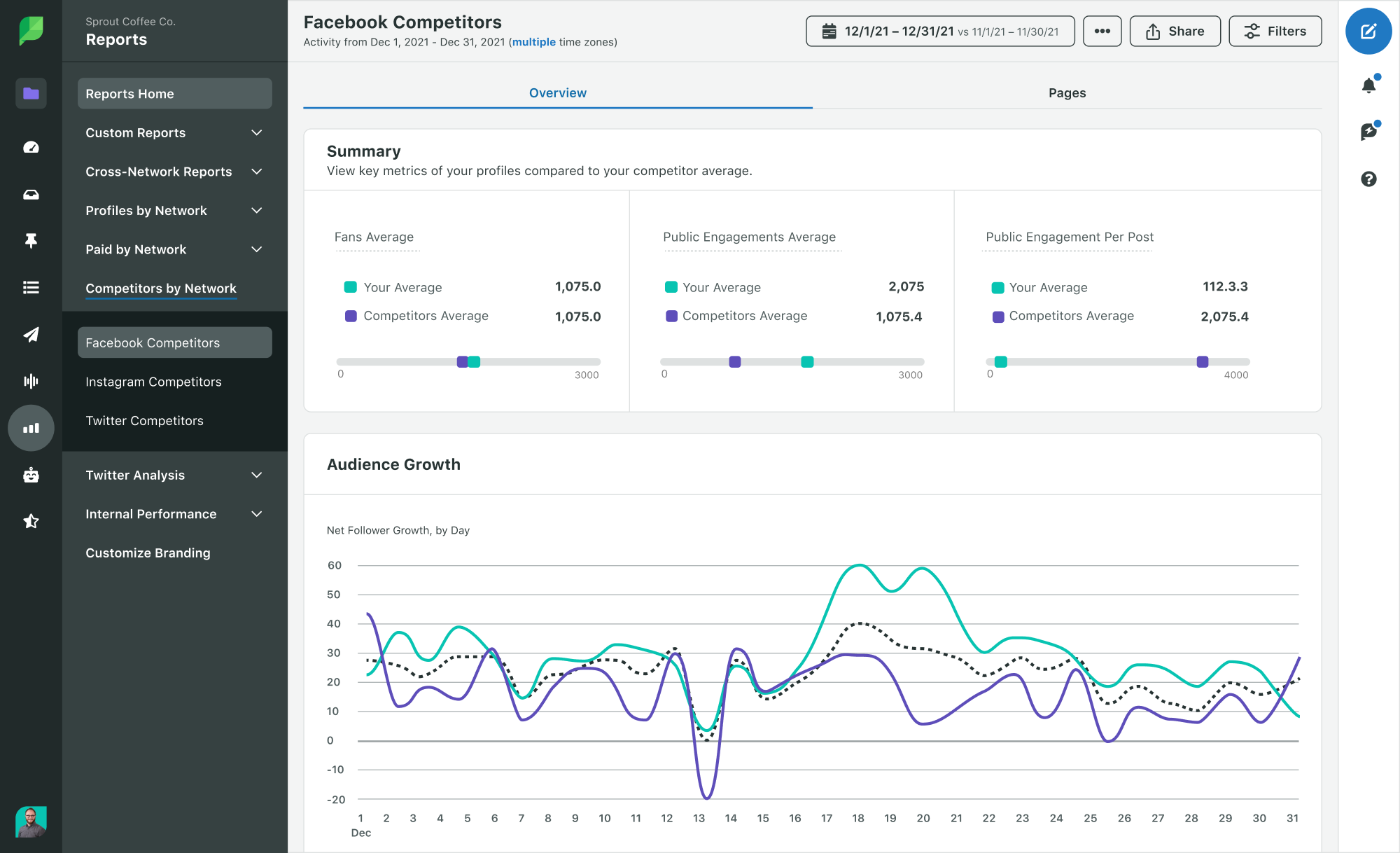

Depending on the competitor analysis tool you use, you can get as granular as you need with your research. For instance, Sprout Social lets you analyze your competitors’ social strategies. You can see what types of content they’re posting and even benchmark your growth against theirs.

Brand awareness research

Conducting brand awareness research allows you to assess your brand’s standing in the market. It tells you how well-known your brand is among your target audience and what they associate with it. This can help you gauge people’s sentiments toward your brand and whether you need to rebrand or reposition.

If you don’t know where to start with your research, you’re in the right place.

There’s no shortage of market research methods out there. In this section, we’ve highlighted research channels for small and big businesses alike.

Considering that Google sees a staggering 8.5 billion searches each day, there’s perhaps no better place to start.

A quick Google search is a potential goldmine for all sorts of questions to kick off your market research. Who’s ranking for keywords related to your industry? Which products and pieces of content are the hottest right now? Who’s running ads related to your business?

For example, Google Product Listing Ads can help highlight all of the above for B2C brands.

The same applies to B2B brands looking to keep tabs on who’s running industry-related ads and ranking for keyword terms too.

There’s no denying that email represents both an aggressive and effective marketing channel for marketers today. Case in point, 44% of online shoppers consider email as the most influential channel in their buying decisions.

Looking through industry and competitor emails is a brilliant way to learn more about your market. For example, what types of offers and deals are your competitors running? How often are they sending emails?

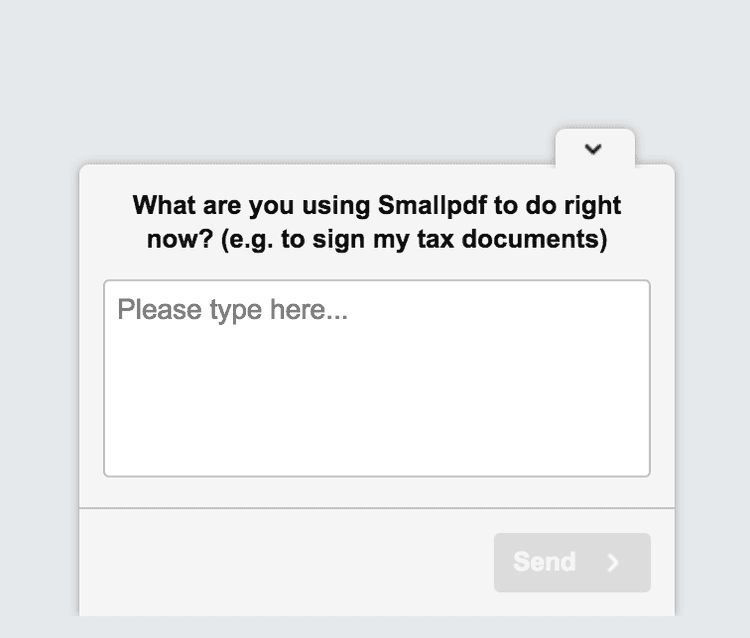

Email is also invaluable for gathering information directly from your customers. This survey message from Asana is a great example of how to pick your customers’ brains to figure out how you can improve your quality of service.

Industry journals, reports and blogs

Don’t neglect the importance of big-picture market research when it comes to tactics and marketing channels to explore. Look to marketing resources such as reports and blogs as well as industry journals

Keeping your ear to the ground on new trends and technologies is a smart move for any business. Sites such as Statista, Marketing Charts, AdWeek and Emarketer are treasure troves of up-to-date data and news for marketers.

And of course, there’s the Sprout Insights blog . And invaluable resources like The Sprout Social Index™ can keep you updated on the latest social trends.

Social media

If you want to learn more about your target market, look no further than social media. Social offers a place to discover what your customers want to see in future products or which brands are killin’ it. In fact, social media is become more important for businesses than ever with the level of data available.

It represents a massive repository of real-time data and insights that are instantly accessible. Brand monitoring and social listening are effective ways to conduct social media research . You can even be more direct with your approach. Ask questions directly or even poll your audience to understand their needs and preferences.

The 5 steps for how to do market research

Now that we’ve covered the why and where, it’s time to get into the practical aspects of market research. Here are five essential steps on how to do market research effectively.

Step 1: Identify your research topic

First off, what are you researching about? What do you want to find out? Narrow down on a specific research topic so you can start with a clear idea of what to look for.

For example, you may want to learn more about how well your product features are satisfying the needs of existing users. This might potentially lead to feature updates and improvements. Or it might even result in new feature introductions.

Similarly, your research topic may be related to your product or service launch or customer experience. Or you may want to conduct research for an upcoming marketing campaign.

Step 2: Choose a buyer persona to engage

If you’re planning to focus your research on a specific type of audience, decide which buyer persona you want to engage. This persona group will serve as a representative sample of your target audience.

Engaging a specific group of audience lets you streamline your research efforts. As such, it can be a much more effective and organized approach than researching thousands (if not millions) of individuals.

You may be directing your research toward existing users of your product. To get even more granular, you may want to focus on users who have been familiar with the product for at least a year, for example.

Step 3: Start collecting data

The next step is one of the most critical as it involves collecting the data you need for your research. Before you begin, make sure you’ve chosen the right research methods that will uncover the type of data you need. This largely depends on your research topic and goals.

Remember that you don’t necessarily have to stick to one research method. You may use a combination of qualitative and quantitative approaches. So for example, you could use interviews to supplement the data from your surveys. Or you may stick to insights from your social listening efforts.

To keep things consistent, let’s look at this in the context of the example from earlier. Perhaps you can send out a survey to your existing users asking them a bunch of questions. This might include questions like which features they use the most and how often they use them. You can get them to choose an answer from one to five and collect quantitative data.

Plus, for qualitative insights, you could even include a few open-ended questions with the option to write their answers. For instance, you might ask them if there’s any improvement they wish to see in your product.

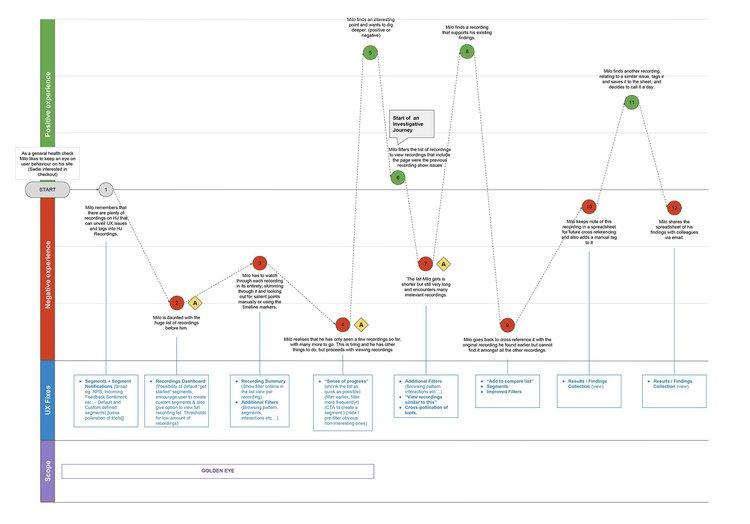

Step 4: Analyze results

Once you have all the data you need, it’s time to analyze it keeping your research topic in mind. This involves trying to interpret the data to look for a wider meaning, particularly in relation to your research goal.

So let’s say a large percentage of responses were four or five in the satisfaction rating. This means your existing users are mostly satisfied with your current product features. On the other hand, if the responses were mostly ones and twos, you may look for opportunities to improve. The responses to your open-ended questions can give you further context as to why people are disappointed.

Step 5: Make decisions for your business

Now it’s time to take your findings and turn them into actionable insights for your business. In this final step, you need to decide how you want to move forward with your new market insight.

What did you find in your research that would require action? How can you put those findings to good use?

The market research tools you should be using

To wrap things up, let’s talk about the various tools available to conduct speedy, in-depth market research. These tools are essential for conducting market research faster and more efficiently.

Social listening and analytics

Social analytics tools like Sprout can help you keep track of engagement across social media. This goes beyond your own engagement data but also includes that of your competitors. Considering how quickly social media moves, using a third-party analytics tool is ideal. It allows you to make sense of your social data at a glance and ensure that you’re never missing out on important trends.

Email marketing research tools

Keeping track of brand emails is a good idea for any brand looking to stand out in its audience’s inbox.

Tools such as MailCharts , Really Good Emails and Milled can show you how different brands run their email campaigns.

Meanwhile, tools like Owletter allow you to monitor metrics such as frequency and send-timing. These metrics can help you understand email marketing strategies among competing brands.

Content marketing research

If you’re looking to conduct research on content marketing, tools such as BuzzSumo can be of great help. This tool shows you the top-performing industry content based on keywords. Here you can see relevant industry sites and influencers as well as which brands in your industry are scoring the most buzz. It shows you exactly which pieces of content are ranking well in terms of engagements and shares and on which social networks.

SEO and keyword tracking

Monitoring industry keywords is a great way to uncover competitors. It can also help you discover opportunities to advertise your products via organic search. Tools such as Ahrefs provide a comprehensive keyword report to help you see how your search efforts stack up against the competition.

Competitor comparison template

For the sake of organizing your market research, consider creating a competitive matrix. The idea is to highlight how you stack up side-by-side against others in your market. Use a social media competitive analysis template to track your competitors’ social presence. That way, you can easily compare tactics, messaging and performance. Once you understand your strengths and weaknesses next to your competitors, you’ll find opportunities as well.

Customer persona creator

Finally, customer personas represent a place where all of your market research comes together. You’d need to create a profile of your ideal customer that you can easily refer to. Tools like Xtensio can help in outlining your customer motivations and demographics as you zero in on your target market.

Build a solid market research strategy

Having a deeper understanding of the market gives you leverage in a sea of competitors. Use the steps and market research tools we shared above to build an effective market research strategy.

But keep in mind that the accuracy of your research findings depends on the quality of data collected. Turn to Sprout’s social media analytics tools to uncover heaps of high-quality data across social networks.

- Leveling Up

- Marketing Disciplines

The 43 best marketing resources we recommend in 2024

Executing a successful demand generation strategy [with examples]

How customer relationship marketing on social media drives revenue

- Other Platforms

SMS marketing 101: What is SMS Marketing (+ examples)

- Now on slide

Build and grow stronger relationships on social

Sprout Social helps you understand and reach your audience, engage your community and measure performance with the only all-in-one social media management platform built for connection.

- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- *New* Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Business Insights →

Business Insights

Harvard Business School Online's Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

- Career Development

- Communication

- Decision-Making

- Earning Your MBA

- Negotiation

- News & Events

- Productivity

- Staff Spotlight

- Student Profiles

- Work-Life Balance

- Alternative Investments

- Business Analytics

- Business Strategy

- Business and Climate Change

- Design Thinking and Innovation

- Digital Marketing Strategy

- Disruptive Strategy

- Economics for Managers

- Entrepreneurship Essentials

- Financial Accounting

- Global Business

- Launching Tech Ventures

- Leadership Principles

- Leadership, Ethics, and Corporate Accountability

- Leading with Finance

- Management Essentials

- Negotiation Mastery

- Organizational Leadership

- Power and Influence for Positive Impact

- Strategy Execution

- Sustainable Business Strategy

- Sustainable Investing

- Winning with Digital Platforms

How to Conduct Market Research for a Startup

- 17 Mar 2022

With every innovative product idea comes the pressing question: “Will people want to buy it?”

As an entrepreneur with a big idea, what’s the best way to determine how potential customers will react to your product? Conducting market research can provide the data needed to decide whether your product fits your target market.

Before launching a new venture, you should understand market research. Here’s how to conduct market research for a startup and why it’s important.

Access your free e-book today.

What Is Market Research?

Market research is the process of gathering information about customers and the market as a whole to determine a product or service’s viability. Market research includes interviews, surveys, focus groups, and industry data analyses.

The goal of market research is to better understand potential customers, how well your product or service fits their needs, and how it compares to competitors’ offerings.

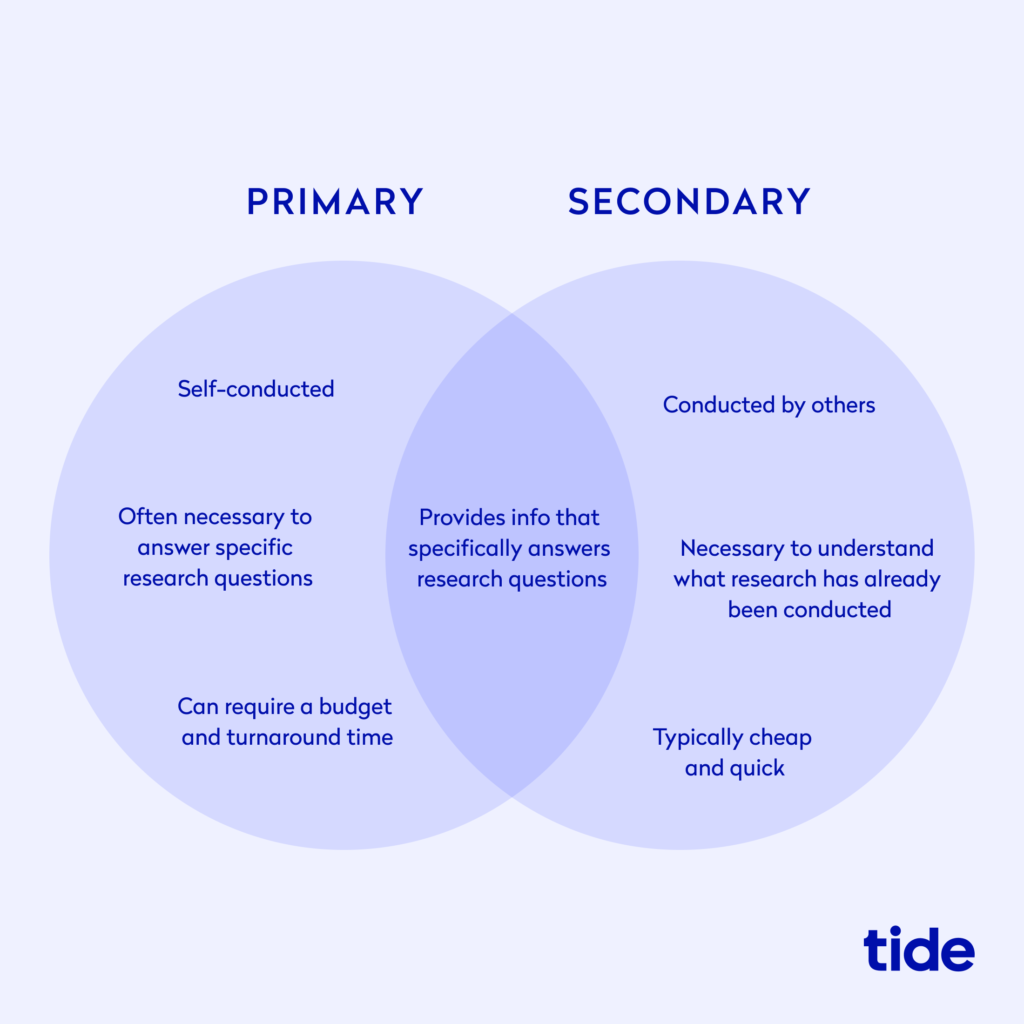

There are two types of research you can conduct: primary and secondary.

- Primary research requires collecting data to learn about your specific customers or target market segment. It’s useful for creating buyer personas, segmenting your market, and improving your product to cater to customers’ needs .

- Secondary research is conducted using data you didn’t collect yourself. Industry reports, public databases, and other companies’ proprietary data can be used to gain insights into your target market segment and industry.

Why Is Market Research Important for Entrepreneurs?

Before launching your venture, it’s wise to conduct market research to ensure your product or service will be well received. Feedback from people who fall into your target demographics can be invaluable as you iterate on and improve your product.

Performing market research can also help you determine a pricing strategy by gauging customers’ willingness to pay for your product. Additionally, it can improve the user experience by revealing what features matter most to potential customers.

When assessing which startups to fund, investors place heavy importance on thorough market research that indicates promising potential. Providing tangible proof that your product fulfills a market need and demonstrating you’ve taken the time to iterate on and improve it signal that your startup could be a worthwhile investment.

Related: How to Talk to Potential Investors: 5 Tips

How to Do Market Research for a Startup

1. form hypotheses.

What questions do you aim to answer through market research? Using those questions, you can make predictions called hypotheses . Defining your hypotheses upfront can help guide your approach to selecting subjects, researching questions, and testing designs.

An example question you may ask is: “How much are people in my target demographic willing to pay for the current version of my product?” Your hypothesis could be: “If my product contains all its current features, customers will be willing to pay $500 for it.”

Another example question you may ask is: “What’s the user’s biggest pain point, and is my product meeting their needs?” Your hypothesis could be: “I believe the user’s biggest pain point is needing an easy, unintimidating way to learn basic car maintenance, and I predict that my product meets that need.”

You can and should test multiple hypotheses, but try to select no more than a few per test, so the research stays focused.

Related: A Beginner’s Guide to Hypothesis Testing in Business

2. Select the Type of Research Needed to Test Hypotheses

Once you’ve formed your hypotheses, determine which type of research to conduct.

If your hypotheses focus on determining your startup’s place in the broader market, start with secondary research. This can include using existing data to determine market size, how much of that market your startup could reasonably own, who your biggest competitors are, and how your brand and product compare to theirs.

If your hypotheses require primary research, decide which data collection method best fits your needs. These can include one-on-one interviews, surveys, focus groups, and polls. Primary research allows you to gather insights into customer satisfaction and loyalty, brand awareness and perception, and real-time product usability.

3. Identify Target Demographics and Recruit Subjects

To gather meaningful insights, you need to understand your target demographic. Do you aim to cater to working parents, young athletes, or pet owners? Determine the type of person who can benefit from your product.

If you conduct primary research, you need to recruit subjects. This can be done in several ways, including:

- Word of mouth: The simplest but least reliable way to recruit participants is by word of mouth. Ask people you know to refer others to be research subjects, then screen them to confirm they fit your target demographic.

- Promoting the study on social media: Many social media platforms enable you to show an ad to people who fall into specific demographic categories or have certain interests. This allows you to get the word out to a large number of people who qualify.

- Hiring a third-party market research company: Some companies provide full market research services and recruit participants and conduct research on your behalf.

However you recruit subjects, ensure they take a screener survey beforehand, which allows you to determine whether they fit the specific demographic you want to study or have a trait that eliminates them from the research pool. It also provides demographic data—such as age and race—that enables you to select a diverse subset of your target demographic.

In addition, you can offer compensation to boost participation, such as money, meal vouchers, gift cards, or early access to your product. Make it clear that compensation is in appreciation for subjects’ time and honest feedback.

4. Conduct the Research

Once you’ve determined the type of research and target demographic necessary to test your hypotheses, conduct your research. To reduce bias, enlist someone unfamiliar with your hypotheses to perform interviews or lead focus groups.

Ask questions based on your audience and hypotheses. For instance, if you’re aiming to test existing customers’ purchase motivations, you may ask: “What challenge were you trying to solve when you first bought the product?”

If examining brand perception, your audience should consist of potential customers who don’t yet know your brand. Present them with a list of competitor logos—with yours in the mix—and ask them to rank the brands by perceived reliability.

While the questions you ask are vehicles to prove or disprove hypotheses, ensure they don’t lead subjects in one direction. To craft unbiased research questions , use neutral language and vary the order of options in multiple-choice questions. This can keep subjects from selecting the same option each time if they sense the third option is always mapped to a certain outcome. It also helps account for primacy bias (the tendency to select the first option in a list) and recency bias (the tendency to select the final option in a list).

Once you’ve collected data, ensure it’s organized efficiently and securely so you can protect subjects’ identities .

Related: 3 Examples of Bad Survey Questions and How to Fix Them

5. Gather Insights and Determine Action Items

After you’ve organized your data, analyze it to extract actionable insights. While some of the data will be qualitative rather than quantitative, you can detect patterns in responses to make it quantifiable. For instance, noting that 15 of 20 subjects mentioned feeling overwhelmed when attempting to assemble your product.

Once you’ve analyzed the data and communicated emerging trends using data visualizations , outline action items.

If the majority of users in your target demographic reported feeling overwhelmed while assembling your product, action items might include:

- Creating different versions of assembly instructions to test with other groups, varying diagrams and instructional language

- Researching instruction manual best practices

Each round of market research can offer more information about how your product is perceived and experienced by potential users.

Market Research as an Ongoing Endeavor

While it’s useful to conduct market research before launching your product, you should revisit your hypotheses and form new ones over the course of building your venture.

By conducting market research with each version of your product, you can gradually improve it and ensure it continues to fit target customers’ needs.

Are you interested in bolstering your entrepreneurship skills? Explore our four-week online course Entrepreneurship Essentials and our other entrepreneurship and innovation courses to learn to speak the language of the startup world.

About the Author

How to Do Market Research: The Complete Guide

Learn how to do market research with this step-by-step guide, complete with templates, tools and real-world examples.

Access best-in-class company data

Get trusted first-party funding data, revenue data and firmographics

What are your customers’ needs? How does your product compare to the competition? What are the emerging trends and opportunities in your industry? If these questions keep you up at night, it’s time to conduct market research.

Market research plays a pivotal role in your ability to stay competitive and relevant, helping you anticipate shifts in consumer behavior and industry dynamics. It involves gathering these insights using a wide range of techniques, from surveys and interviews to data analysis and observational studies.

In this guide, we’ll explore why market research is crucial, the various types of market research, the methods used in data collection, and how to effectively conduct market research to drive informed decision-making and success.

What is market research?

Market research is the systematic process of gathering, analyzing and interpreting information about a specific market or industry. The purpose of market research is to offer valuable insight into the preferences and behaviors of your target audience, and anticipate shifts in market trends and the competitive landscape. This information helps you make data-driven decisions, develop effective strategies for your business, and maximize your chances of long-term growth.

Why is market research important?

By understanding the significance of market research, you can make sure you’re asking the right questions and using the process to your advantage. Some of the benefits of market research include:

- Informed decision-making: Market research provides you with the data and insights you need to make smart decisions for your business. It helps you identify opportunities, assess risks and tailor your strategies to meet the demands of the market. Without market research, decisions are often based on assumptions or guesswork, leading to costly mistakes.

- Customer-centric approach: A cornerstone of market research involves developing a deep understanding of customer needs and preferences. This gives you valuable insights into your target audience, helping you develop products, services and marketing campaigns that resonate with your customers.

- Competitive advantage: By conducting market research, you’ll gain a competitive edge. You’ll be able to identify gaps in the market, analyze competitor strengths and weaknesses, and position your business strategically. This enables you to create unique value propositions, differentiate yourself from competitors, and seize opportunities that others may overlook.

- Risk mitigation: Market research helps you anticipate market shifts and potential challenges. By identifying threats early, you can proactively adjust their strategies to mitigate risks and respond effectively to changing circumstances. This proactive approach is particularly valuable in volatile industries.

- Resource optimization: Conducting market research allows organizations to allocate their time, money and resources more efficiently. It ensures that investments are made in areas with the highest potential return on investment, reducing wasted resources and improving overall business performance.

- Adaptation to market trends: Markets evolve rapidly, driven by technological advancements, cultural shifts and changing consumer attitudes. Market research ensures that you stay ahead of these trends and adapt your offerings accordingly so you can avoid becoming obsolete.

As you can see, market research empowers businesses to make data-driven decisions, cater to customer needs, outperform competitors, mitigate risks, optimize resources and stay agile in a dynamic marketplace. These benefits make it a huge industry; the global market research services market is expected to grow from $76.37 billion in 2021 to $108.57 billion in 2026 . Now, let’s dig into the different types of market research that can help you achieve these benefits.

Types of market research

- Qualitative research

- Quantitative research

- Exploratory research

- Descriptive research

- Causal research

- Cross-sectional research

- Longitudinal research

Despite its advantages, 23% of organizations don’t have a clear market research strategy. Part of developing a strategy involves choosing the right type of market research for your business goals. The most commonly used approaches include:

1. Qualitative research

Qualitative research focuses on understanding the underlying motivations, attitudes and perceptions of individuals or groups. It is typically conducted through techniques like in-depth interviews, focus groups and content analysis — methods we’ll discuss further in the sections below. Qualitative research provides rich, nuanced insights that can inform product development, marketing strategies and brand positioning.

2. Quantitative research

Quantitative research, in contrast to qualitative research, involves the collection and analysis of numerical data, often through surveys, experiments and structured questionnaires. This approach allows for statistical analysis and the measurement of trends, making it suitable for large-scale market studies and hypothesis testing. While it’s worthwhile using a mix of qualitative and quantitative research, most businesses prioritize the latter because it is scientific, measurable and easily replicated across different experiments.

3. Exploratory research

Whether you’re conducting qualitative or quantitative research or a mix of both, exploratory research is often the first step. Its primary goal is to help you understand a market or problem so you can gain insights and identify potential issues or opportunities. This type of market research is less structured and is typically conducted through open-ended interviews, focus groups or secondary data analysis. Exploratory research is valuable when entering new markets or exploring new product ideas.

4. Descriptive research

As its name implies, descriptive research seeks to describe a market, population or phenomenon in detail. It involves collecting and summarizing data to answer questions about audience demographics and behaviors, market size, and current trends. Surveys, observational studies and content analysis are common methods used in descriptive research.

5. Causal research

Causal research aims to establish cause-and-effect relationships between variables. It investigates whether changes in one variable result in changes in another. Experimental designs, A/B testing and regression analysis are common causal research methods. This sheds light on how specific marketing strategies or product changes impact consumer behavior.

6. Cross-sectional research

Cross-sectional market research involves collecting data from a sample of the population at a single point in time. It is used to analyze differences, relationships or trends among various groups within a population. Cross-sectional studies are helpful for market segmentation, identifying target audiences and assessing market trends at a specific moment.

7. Longitudinal research

Longitudinal research, in contrast to cross-sectional research, collects data from the same subjects over an extended period. This allows for the analysis of trends, changes and developments over time. Longitudinal studies are useful for tracking long-term developments in consumer preferences, brand loyalty and market dynamics.

Each type of market research has its strengths and weaknesses, and the method you choose depends on your specific research goals and the depth of understanding you’re aiming to achieve. In the following sections, we’ll delve into primary and secondary research approaches and specific research methods.

Primary vs. secondary market research

Market research of all types can be broadly categorized into two main approaches: primary research and secondary research. By understanding the differences between these approaches, you can better determine the most appropriate research method for your specific goals.

Primary market research

Primary research involves the collection of original data straight from the source. Typically, this involves communicating directly with your target audience — through surveys, interviews, focus groups and more — to gather information. Here are some key attributes of primary market research:

- Customized data: Primary research provides data that is tailored to your research needs. You design a custom research study and gather information specific to your goals.

- Up-to-date insights: Because primary research involves communicating with customers, the data you collect reflects the most current market conditions and consumer behaviors.

- Time-consuming and resource-intensive: Despite its advantages, primary research can be labor-intensive and costly, especially when dealing with large sample sizes or complex study designs. Whether you hire a market research consultant, agency or use an in-house team, primary research studies consume a large amount of resources and time.

Secondary market research

Secondary research, on the other hand, involves analyzing data that has already been compiled by third-party sources, such as online research tools, databases, news sites, industry reports and academic studies.

Here are the main characteristics of secondary market research:

- Cost-effective: Secondary research is generally more cost-effective than primary research since it doesn’t require building a research plan from scratch. You and your team can look at databases, websites and publications on an ongoing basis, without needing to design a custom experiment or hire a consultant.

- Leverages multiple sources: Data tools and software extract data from multiple places across the web, and then consolidate that information within a single platform. This means you’ll get a greater amount of data and a wider scope from secondary research.

- Quick to access: You can access a wide range of information rapidly — often in seconds — if you’re using online research tools and databases. Because of this, you can act on insights sooner, rather than taking the time to develop an experiment.

So, when should you use primary vs. secondary research? In practice, many market research projects incorporate both primary and secondary research to take advantage of the strengths of each approach.

One rule of thumb is to focus on secondary research to obtain background information, market trends or industry benchmarks. It is especially valuable for conducting preliminary research, competitor analysis, or when time and budget constraints are tight. Then, if you still have knowledge gaps or need to answer specific questions unique to your business model, use primary research to create a custom experiment.

Market research methods

- Surveys and questionnaires

- Focus groups

- Observational research

- Online research tools

- Experiments

- Content analysis

- Ethnographic research

How do primary and secondary research approaches translate into specific research methods? Let’s take a look at the different ways you can gather data:

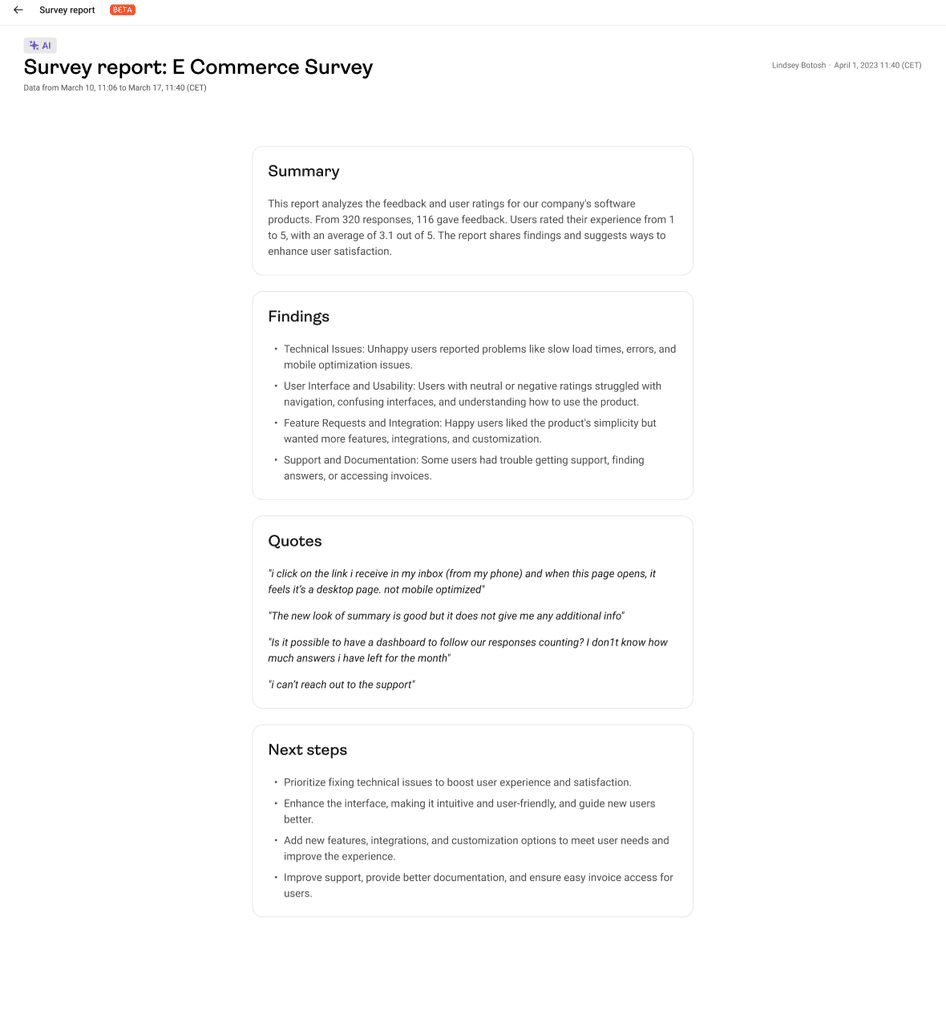

1. Surveys and questionnaires

Surveys and questionnaires are popular methods for collecting structured data from a large number of respondents. They involve a set of predetermined questions that participants answer. Surveys can be conducted through various channels, including online tools, telephone interviews and in-person or online questionnaires. They are useful for gathering quantitative data and assessing customer demographics, opinions, preferences and needs. On average, customer surveys have a 33% response rate , so keep that in mind as you consider your sample size.

2. Interviews

Interviews are in-depth conversations with individuals or groups to gather qualitative insights. They can be structured (with predefined questions) or unstructured (with open-ended discussions). Interviews are valuable for exploring complex topics, uncovering motivations and obtaining detailed feedback.

3. Focus groups

The most common primary research methods are in-depth webcam interviews and focus groups. Focus groups are a small gathering of participants who discuss a specific topic or product under the guidance of a moderator. These discussions are valuable for primary market research because they reveal insights into consumer attitudes, perceptions and emotions. Focus groups are especially useful for idea generation, concept testing and understanding group dynamics within your target audience.

4. Observational research

Observational research involves observing and recording participant behavior in a natural setting. This method is particularly valuable when studying consumer behavior in physical spaces, such as retail stores or public places. In some types of observational research, participants are aware you’re watching them; in other cases, you discreetly watch consumers without their knowledge, as they use your product. Either way, observational research provides firsthand insights into how people interact with products or environments.

5. Online research tools

You and your team can do your own secondary market research using online tools. These tools include data prospecting platforms and databases, as well as online surveys, social media listening, web analytics and sentiment analysis platforms. They help you gather data from online sources, monitor industry trends, track competitors, understand consumer preferences and keep tabs on online behavior. We’ll talk more about choosing the right market research tools in the sections that follow.

6. Experiments

Market research experiments are controlled tests of variables to determine causal relationships. While experiments are often associated with scientific research, they are also used in market research to assess the impact of specific marketing strategies, product features, or pricing and packaging changes.

7. Content analysis

Content analysis involves the systematic examination of textual, visual or audio content to identify patterns, themes and trends. It’s commonly applied to customer reviews, social media posts and other forms of online content to analyze consumer opinions and sentiments.

8. Ethnographic research

Ethnographic research immerses researchers into the daily lives of consumers to understand their behavior and culture. This method is particularly valuable when studying niche markets or exploring the cultural context of consumer choices.

How to do market research

- Set clear objectives

- Identify your target audience

- Choose your research methods

- Use the right market research tools

- Collect data

- Analyze data

- Interpret your findings

- Identify opportunities and challenges

- Make informed business decisions

- Monitor and adapt

Now that you have gained insights into the various market research methods at your disposal, let’s delve into the practical aspects of how to conduct market research effectively. Here’s a quick step-by-step overview, from defining objectives to monitoring market shifts.

1. Set clear objectives

When you set clear and specific goals, you’re essentially creating a compass to guide your research questions and methodology. Start by precisely defining what you want to achieve. Are you launching a new product and want to understand its viability in the market? Are you evaluating customer satisfaction with a product redesign?

Start by creating SMART goals — objectives that are specific, measurable, achievable, relevant and time-bound. Not only will this clarify your research focus from the outset, but it will also help you track progress and benchmark your success throughout the process.

You should also consult with key stakeholders and team members to ensure alignment on your research objectives before diving into data collecting. This will help you gain diverse perspectives and insights that will shape your research approach.

2. Identify your target audience

Next, you’ll need to pinpoint your target audience to determine who should be included in your research. Begin by creating detailed buyer personas or stakeholder profiles. Consider demographic factors like age, gender, income and location, but also delve into psychographics, such as interests, values and pain points.

The more specific your target audience, the more accurate and actionable your research will be. Additionally, segment your audience if your research objectives involve studying different groups, such as current customers and potential leads.

If you already have existing customers, you can also hold conversations with them to better understand your target market. From there, you can refine your buyer personas and tailor your research methods accordingly.

3. Choose your research methods

Selecting the right research methods is crucial for gathering high-quality data. Start by considering the nature of your research objectives. If you’re exploring consumer preferences, surveys and interviews can provide valuable insights. For in-depth understanding, focus groups or observational research might be suitable. Consider using a mix of quantitative and qualitative methods to gain a well-rounded perspective.

You’ll also need to consider your budget. Think about what you can realistically achieve using the time and resources available to you. If you have a fairly generous budget, you may want to try a mix of primary and secondary research approaches. If you’re doing market research for a startup , on the other hand, chances are your budget is somewhat limited. If that’s the case, try addressing your goals with secondary research tools before investing time and effort in a primary research study.

4. Use the right market research tools

Whether you’re conducting primary or secondary research, you’ll need to choose the right tools. These can help you do anything from sending surveys to customers to monitoring trends and analyzing data. Here are some examples of popular market research tools:

- Market research software: Crunchbase is a platform that provides best-in-class company data, making it valuable for market research on growing companies and industries. You can use Crunchbase to access trusted, first-party funding data, revenue data, news and firmographics, enabling you to monitor industry trends and understand customer needs.

- Survey and questionnaire tools: SurveyMonkey is a widely used online survey platform that allows you to create, distribute and analyze surveys. Google Forms is a free tool that lets you create surveys and collect responses through Google Drive.

- Data analysis software: Microsoft Excel and Google Sheets are useful for conducting statistical analyses. SPSS is a powerful statistical analysis software used for data processing, analysis and reporting.

- Social listening tools: Brandwatch is a social listening and analytics platform that helps you monitor social media conversations, track sentiment and analyze trends. Mention is a media monitoring tool that allows you to track mentions of your brand, competitors and keywords across various online sources.

- Data visualization platforms: Tableau is a data visualization tool that helps you create interactive and shareable dashboards and reports. Power BI by Microsoft is a business analytics tool for creating interactive visualizations and reports.

5. Collect data

There’s an infinite amount of data you could be collecting using these tools, so you’ll need to be intentional about going after the data that aligns with your research goals. Implement your chosen research methods, whether it’s distributing surveys, conducting interviews or pulling from secondary research platforms. Pay close attention to data quality and accuracy, and stick to a standardized process to streamline data capture and reduce errors.

6. Analyze data

Once data is collected, you’ll need to analyze it systematically. Use statistical software or analysis tools to identify patterns, trends and correlations. For qualitative data, employ thematic analysis to extract common themes and insights. Visualize your findings with charts, graphs and tables to make complex data more understandable.

If you’re not proficient in data analysis, consider outsourcing or collaborating with a data analyst who can assist in processing and interpreting your data accurately.

7. Interpret your findings

Interpreting your market research findings involves understanding what the data means in the context of your objectives. Are there significant trends that uncover the answers to your initial research questions? Consider the implications of your findings on your business strategy. It’s essential to move beyond raw data and extract actionable insights that inform decision-making.

Hold a cross-functional meeting or workshop with relevant team members to collectively interpret the findings. Different perspectives can lead to more comprehensive insights and innovative solutions.

8. Identify opportunities and challenges

Use your research findings to identify potential growth opportunities and challenges within your market. What segments of your audience are underserved or overlooked? Are there emerging trends you can capitalize on? Conversely, what obstacles or competitors could hinder your progress?

Lay out this information in a clear and organized way by conducting a SWOT analysis, which stands for strengths, weaknesses, opportunities and threats. Jot down notes for each of these areas to provide a structured overview of gaps and hurdles in the market.

9. Make informed business decisions

Market research is only valuable if it leads to informed decisions for your company. Based on your insights, devise actionable strategies and initiatives that align with your research objectives. Whether it’s refining your product, targeting new customer segments or adjusting pricing, ensure your decisions are rooted in the data.

At this point, it’s also crucial to keep your team aligned and accountable. Create an action plan that outlines specific steps, responsibilities and timelines for implementing the recommendations derived from your research.

10. Monitor and adapt

Market research isn’t a one-time activity; it’s an ongoing process. Continuously monitor market conditions, customer behaviors and industry trends. Set up mechanisms to collect real-time data and feedback. As you gather new information, be prepared to adapt your strategies and tactics accordingly. Regularly revisiting your research ensures your business remains agile and reflects changing market dynamics and consumer preferences.

Online market research sources

As you go through the steps above, you’ll want to turn to trusted, reputable sources to gather your data. Here’s a list to get you started:

- Crunchbase: As mentioned above, Crunchbase is an online platform with an extensive dataset, allowing you to access in-depth insights on market trends, consumer behavior and competitive analysis. You can also customize your search options to tailor your research to specific industries, geographic regions or customer personas.

- Academic databases: Academic databases, such as ProQuest and JSTOR , are treasure troves of scholarly research papers, studies and academic journals. They offer in-depth analyses of various subjects, including market trends, consumer preferences and industry-specific insights. Researchers can access a wealth of peer-reviewed publications to gain a deeper understanding of their research topics.

- Government and NGO databases: Government agencies, nongovernmental organizations and other institutions frequently maintain databases containing valuable economic, demographic and industry-related data. These sources offer credible statistics and reports on a wide range of topics, making them essential for market researchers. Examples include the U.S. Census Bureau , the Bureau of Labor Statistics and the Pew Research Center .

- Industry reports: Industry reports and market studies are comprehensive documents prepared by research firms, industry associations and consulting companies. They provide in-depth insights into specific markets, including market size, trends, competitive analysis and consumer behavior. You can find this information by looking at relevant industry association databases; examples include the American Marketing Association and the National Retail Federation .

- Social media and online communities: Social media platforms like LinkedIn or Twitter (X) , forums such as Reddit and Quora , and review platforms such as G2 can provide real-time insights into consumer sentiment, opinions and trends.

Market research examples

At this point, you have market research tools and data sources — but how do you act on the data you gather? Let’s go over some real-world examples that illustrate the practical application of market research across various industries. These examples showcase how market research can lead to smart decision-making and successful business decisions.

Example 1: Apple’s iPhone launch

Apple ’s iconic iPhone launch in 2007 serves as a prime example of market research driving product innovation in tech. Before the iPhone’s release, Apple conducted extensive market research to understand consumer preferences, pain points and unmet needs in the mobile phone industry. This research led to the development of a touchscreen smartphone with a user-friendly interface, addressing consumer demands for a more intuitive and versatile device. The result was a revolutionary product that disrupted the market and redefined the smartphone industry.

Example 2: McDonald’s global expansion

McDonald’s successful global expansion strategy demonstrates the importance of market research when expanding into new territories. Before entering a new market, McDonald’s conducts thorough research to understand local tastes, preferences and cultural nuances. This research informs menu customization, marketing strategies and store design. For instance, in India, McDonald’s offers a menu tailored to local preferences, including vegetarian options. This market-specific approach has enabled McDonald’s to adapt and thrive in diverse global markets.

Example 3: Organic and sustainable farming

The shift toward organic and sustainable farming practices in the food industry is driven by market research that indicates increased consumer demand for healthier and environmentally friendly food options. As a result, food producers and retailers invest in sustainable sourcing and organic product lines — such as with these sustainable seafood startups — to align with this shift in consumer values.

The bottom line? Market research has multiple use cases and is a critical practice for any industry. Whether it’s launching groundbreaking products, entering new markets or responding to changing consumer preferences, you can use market research to shape successful strategies and outcomes.

Market research templates

You finally have a strong understanding of how to do market research and apply it in the real world. Before we wrap up, here are some market research templates that you can use as a starting point for your projects:

- Smartsheet competitive analysis templates : These spreadsheets can serve as a framework for gathering information about the competitive landscape and obtaining valuable lessons to apply to your business strategy.

- SurveyMonkey product survey template : Customize the questions on this survey based on what you want to learn from your target customers.

- HubSpot templates : HubSpot offers a wide range of free templates you can use for market research, business planning and more.

- SCORE templates : SCORE is a nonprofit organization that provides templates for business plans, market analysis and financial projections.

- SBA.gov : The U.S. Small Business Administration offers templates for every aspect of your business, including market research, and is particularly valuable for new startups.

Strengthen your business with market research

When conducted effectively, market research is like a guiding star. Equipped with the right tools and techniques, you can uncover valuable insights, stay competitive, foster innovation and navigate the complexities of your industry.

Throughout this guide, we’ve discussed the definition of market research, different research methods, and how to conduct it effectively. We’ve also explored various types of market research and shared practical insights and templates for getting started.

Now, it’s time to start the research process. Trust in data, listen to the market and make informed decisions that guide your company toward lasting success.

Related Articles

- Entrepreneurs

- 15 min read

What Is Competitive Analysis and How to Do It Effectively

Rebecca Strehlow, Copywriter at Crunchbase

17 Best Sales Intelligence Tools for 2024

- Market research

- 10 min read

How to Do Market Research for a Startup: Tips for Success

Jaclyn Robinson, Senior Manager of Content Marketing at Crunchbase

Search less. Close more.

Grow your revenue with Crunchbase, the all-in-one prospecting solution. Start your free trial.

Salesforce is closed for new business in your area.

How to Do Market Research

Noah Parsons

18 min. read

Updated February 21, 2024

One of the biggest and most expensive mistakes I’ve made in my business career could have been avoided by doing a little homework.

In the late 2000s, my team and I came up with what we thought was a great idea for a product . Tons of businesses would need it, and it was almost guaranteed to be a huge hit!

But, we neglected to do our market research.

We ended up with a product searching for a market instead of figuring out who our ideal customer was and building a product specifically for them.

You can avoid making this same mistake.

Let’s learn from my experience and go over the basics of how to conduct market research.

- What is market research?

Market research is the process of gathering information about your potential customers.

It helps you define your target market, craft customer personas , and understand the viability of your business, by answering questions like:

- Who are your customers?

- What are their buying and shopping habits?

- How many of them are there?

By exploring your ideal customers’ problems, desires, and current solutions, you can build your product, service, and overall business strategy to better serve them.

- Why is market research important?

When starting a business , conducting market research to get to know your customers is one of the most important things you can do.

If you don’t understand your customer, you don’t know:

- How you can solve their problems .

- What kind of marketing messages and advertising work.

- If your product or service is actually something your customers will spend money on.

Beyond that, market research can help you:

- Reduce risk: Inform critical decisions with real-world data.

- Understand your competitors: Know how competitors and alternatives to your business represent themselves in pricing, quality, and placement.

- Identify market trends: Stay ahead by spotting emerging trends and shifts in the market.

- Enhance customer experience: Improve customer satisfaction by addressing their pain points.

Gathering data on your customers should become a regular practice for your business.

The more in tune you are with your customers, the better you can serve them and the more likely you are to grow your business. You should never just let assumptions about your customers drive business decisions.

Developing primary and secondary data through market research is how you get an accurate reflection of your customers’ needs.

Further Reading: 6 things to consider before entering a market

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

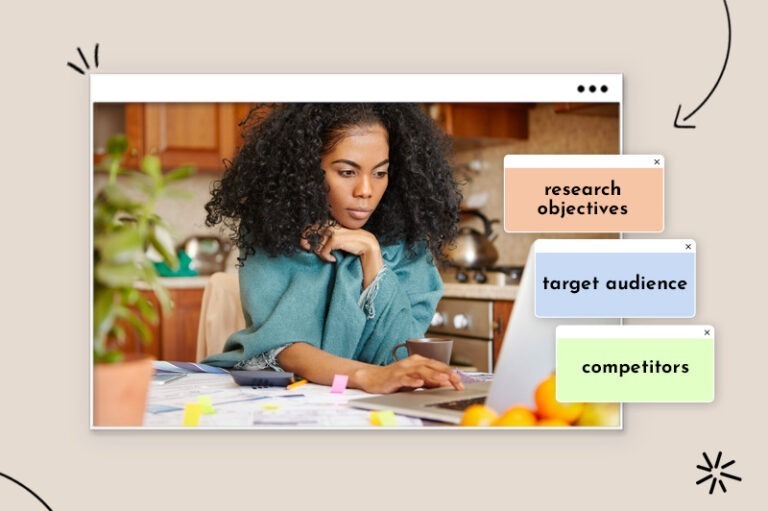

Things to consider before conducting market research

Market research can be incredibly time-consuming (and even a waste of time) when done without the right preparation.

Here are a few questions to answer to help ensure you make the most of your efforts.

What are your objectives?

A research objective is a stated purpose that explains why you’re doing market research. It should include a specific result you intend to achieve, using available resources within a certain time frame.

Without an objective, you’ll pour over a sea of data without knowing what you’re looking for. And if you speak to customers without a goal, you’ll struggle to ask useful questions and dig deeper.

Don’t overthink it.

Your objective should be easy to understand and connected to your business needs.

For example, if you’re just starting, your objective may be to verify before investing in production if your chosen customer base is interested and willing to purchase your product or service.

What research methods will you use?

You don’t need to have every question prepped or a list of people to interview at the start—but you should know what research methods you intend to use.

The research options you choose will impact the data you collect, and the time it will take to complete it. By doing this ahead of time, you’ll be better prepared to create a timeline of when to take specific actions and what milestones to hit to stay on track.

What tools and resources do you need?

You likely won’t know every resource you’ll need until you start doing research. However, that doesn’t mean you can’t be proactive.

If you know the methods you’ll be using, research what tools you’ll need to:

- Conduct interviews

- Create surveys

- Observe customer behavior

If you use third-party data, identify reputable sources to provide the information you want.

- How to conduct market research

Every business will do market research differently. The sources, the methods of data collection, and how you’ll use that data are entirely up to you.

However, the core steps you should take remain the same. Here’s my recommendation for how to structure your research efforts:

1. Start by identifying your target market

Imagine that someone walks into your business, reaches out online, or picks up the phone and calls you.

It’s your perfect customer: someone who has the problem that you solve and is willing to spend money on your solution.

Now imagine the details about this person. Who are they? Can you describe them?

Ideal customers and common traits

This “ideal customer” is your target market . Your business might have several target markets, but it will usually serve you best to keep your list of target customers to two or three.

Each of your target markets should share common traits . These might be demographic traits such as:

- Income levels

- Locations

They might be psychographic traits—groups of people that like the same things or have similar interests. Or, your target market might be a certain type of employee at another company, such as a Chief Technology Officer or head of marketing.

Most often, target markets are blends of demographic and psychographic groups. For example, you might develop a new type of shoe targeted at female triathletes. Or you might be opening a hair salon targeting urban, hipster men.

Further Reading: Why niche audiences are important and how to find yours

Market segmentation

Creating multiple target markets for your company is doing what’s called “ market segmentation .”

This sounds complex, but all you’re doing is dividing your target markets into different groups you hope to sell to. Each market segment might have different characteristics and buy your product or service for different reasons.

You might create different marketing campaigns or customize your product or service for each segment.

Further Reading:

Target marketing explained

Your target market is your ideal customer who needs your solution. They share common traits like age, gender, income, interests, or job roles. To start, focus your efforts on one target customer.

Consider focusing on a younger audience

Younger consumers are often overlooked in favor of older customers who currently make purchasing decisions. However, if you can crack the interests of a younger audience, it may lead to long-term loyalty.

2. Find out if your market is big enough

Are there enough potential customers to sustain you and your competitors? If the answer is no, then you need to consider changing your product or service offering.

Use the attributes you defined in the target market step and determine how many people meet your demographic, psychographic, or location criteria. I’ve got some links to resources to help you figure this out at the end of this article.

For example: If your target market only has a few thousand potential customers, you must either sell to them frequently or at a fairly high price to create a sustainable, profitable business.

Further Reading: How to use TAM, SAM, SOM to determine market size

If you are targeting an existing market with established competitors, you do what’s called industry research .

For example, perhaps you are building a new company in the market for sports drinks or the market for cell phones. In cases like this, understanding how much people buy of existing offerings will give you the best sense of your potential market size.

In this case, you want to look for industry reports and read trade publications for your industry. These publications often summarize the market size.

Further Reading: Differences between industry and market research explained

3. Talk to your potential customers

Once you have identified your target market, or at least made a good guess at who your target market is, you need to take the most important step in this entire market research process.

You need to get up from your desk, leave behind your computer, and go outside. That’s right, you need to go and talk to people in your potential target markets.

Yes, you can do online surveys and other research, but that’s no substitute for actually talking to potential customers.

You’ll gain more insight into your customers through first-hand accounts than any survey will ever tell you.

Do this one thing, and you’ll be miles ahead of your competition. Why? Because most people skip this step. It’s intimidating to talk to strangers. What if they don’t want to buy what you plan on making?

So, don’t be like most entrepreneurs (including me!) and skip this critical step.

It can mean the difference between success and failure. Getting this step done early will help you refine your business model and make a clear impact on your future success.

Further Reading: How to Create a Market Penetration Strategy

4. Identify and analyze your competitors

Part of understanding your customers is knowing what solutions they already use.

These are your competitors, and they may directly compete with you or provide a reasonable substitution customers settle for.

You’ll understand how to position your business to take advantage of potential opportunities and mitigate risks by analyzing who they are, what they do, and how customers respond.

Document your known competitors

To keep things simple, start by listing your known competitors . Account for businesses that offer a similar product/service, and those that indirectly compete with their solution or industry expertise.

Example: You operate an outdoor goods retail store. Your mission is to provide hands-on direction for customers to find camping, hiking, and survival gear that they will love. You offer a wide selection of well-known brands, local options, and in-house creations.