Insurance Company Strategic Plan Template

- Great for beginners

- Ready-to-use, fully customizable Subcategory

- Get started in seconds

In the fast-paced world of insurance, having a solid strategic plan is essential for staying ahead of the competition. ClickUp's Insurance Company Strategic Plan Template is designed to help insurance companies like yours define their long-term goals, set objectives, and outline strategies for growth, risk management, customer acquisition and retention, product development, regulatory compliance, and financial performance.

With this template, you can:

- Map out your company's vision and mission

- Identify key performance indicators (KPIs) to track progress

- Set realistic targets and timelines for achieving your goals

- Collaborate with your team to ensure everyone is aligned and working towards the same objectives

Take your insurance company to new heights with ClickUp's Insurance Company Strategic Plan Template. Start planning for success today!

Benefits of Insurance Company Strategic Plan Template

Crafting an effective strategic plan is crucial for insurance companies striving for long-term success. With the Insurance Company Strategic Plan Template, you can:

- Define clear and actionable goals to guide your company's growth and development

- Strategically manage risks to protect your company and its clients

- Increase customer acquisition and retention through targeted marketing strategies

- Drive innovation and product development to stay ahead of the competition

- Ensure compliance with ever-changing regulations and industry standards

- Optimize financial performance to achieve sustainable profitability

Main Elements of Insurance Company Strategic Plan Template

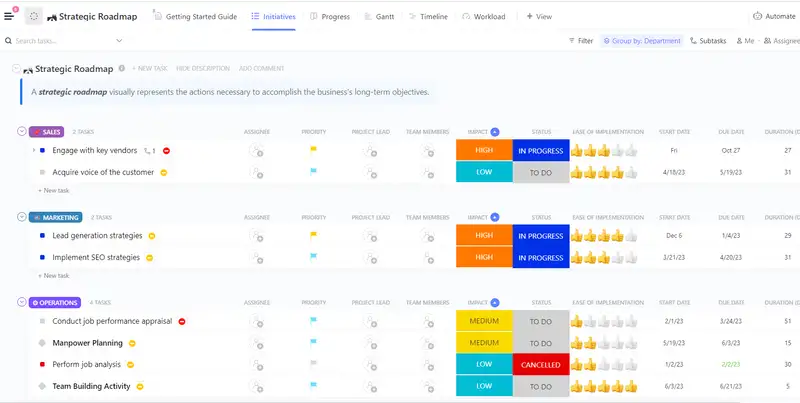

ClickUp's Insurance Company Strategic Plan template provides the essential tools to effectively manage and execute your company's strategic initiatives.

- Custom Statuses: Track the progress of each initiative with five different statuses, including Cancelled, Complete, In Progress, On Hold, and To Do.

- Custom Fields: Utilize eight custom fields such as Duration Days, Impact, Progress, and Team Members to capture important information about each initiative and easily track their development.

- Custom Views: Access six different views, including Progress, Gantt, Workload, Timeline, Initiatives, and Getting Started Guide, to gain a comprehensive overview of your strategic plan and monitor progress at a glance.

- Project Management: Leverage features like Gantt charts, workload management, and timelines to effectively plan and allocate resources, set realistic timelines, and ensure successful execution of your initiatives.

How to Use Strategic Plan for Insurance Company

If you're an insurance company looking to create a strategic plan, follow these six steps using the Insurance Company Strategic Plan Template in ClickUp:

1. Define your mission and vision

Start by clearly defining your insurance company's mission and vision. What is your ultimate purpose and what do you aspire to achieve? This will serve as the guiding principle for your strategic plan.

Use a Doc in ClickUp to outline and articulate your mission and vision statements.

2. Identify your target market

Determine your target market by analyzing demographics, customer needs, and market trends. Who are your ideal customers and what insurance products or services do they require? Understanding your target market will help you tailor your strategies to meet their specific needs.

Utilize custom fields in ClickUp to track and analyze data related to your target market.

3. Set strategic goals and objectives

Based on your mission, vision, and target market, establish strategic goals and objectives for your insurance company. What do you want to achieve in terms of market share, customer satisfaction, profitability, and growth? Make sure your goals are specific, measurable, attainable, relevant, and time-bound (SMART).

Create Goals in ClickUp to set and track your strategic objectives.

4. Develop action plans

Once you have your goals in place, develop action plans to outline the steps and initiatives needed to achieve them. Break down each goal into actionable tasks, assign responsibilities, and set deadlines. This will ensure that everyone on your team knows what needs to be done and when.

Utilize tasks and subtasks in ClickUp to create and assign action plans for each strategic goal.

5. Monitor progress and make adjustments

Regularly monitor the progress of your strategic plan and make adjustments as necessary. Track key performance indicators (KPIs) related to your goals, such as customer retention rate, premium growth, and claims ratio. If you're not on track to meet your objectives, identify areas for improvement and make necessary changes to your action plans.

Use Dashboards in ClickUp to visualize and monitor the progress of your strategic goals.

6. Communicate and engage your team

Ensure that your strategic plan is communicated to and understood by all members of your insurance company. Encourage open communication, collaboration, and engagement among your team members. Regularly update them on the progress of the plan and celebrate milestones and achievements along the way.

Utilize ClickUp's integrations, such as Email and AI-powered automations, to streamline communication and keep everyone informed.

By following these steps and utilizing ClickUp's features, you can create an effective and actionable strategic plan for your insurance company, setting you on the path to success.

Get Started with ClickUp’s Insurance Company Strategic Plan Template

Insurance companies can use this Insurance Company Strategic Plan Template to align their teams and ensure a clear roadmap for success in a competitive industry.

First, hit “Add Template” to sign up for ClickUp and add the template to your Workspace. Make sure you designate which Space or location in your Workspace you’d like this template applied.

Next, invite relevant members or guests to your Workspace to start collaborating.

Now you can take advantage of the full potential of this template to create a comprehensive strategic plan:

- Use the Progress View to track the progress of each strategic initiative and ensure alignment with company goals

- The Gantt View will help you visualize the timeline and dependencies of each initiative for effective project management

- Use the Workload View to balance resource allocation and ensure the team is not overwhelmed with tasks

- The Timeline View will provide a clear overview of milestones and deadlines for each strategic initiative

- The Initiatives View will help you track and manage individual initiatives and their progress

- Use the Getting Started Guide View to quickly get acquainted with the template and its features

- Organize initiatives into five different statuses: Cancelled, Complete, In Progress, On Hold, To Do, to keep track of progress

- Update statuses as you progress through initiatives to keep stakeholders informed of progress

- Monitor and analyze initiatives to ensure the strategic plan is effectively implemented and drives business growth.

Related Templates

- Patrol Officers Strategic Plan Template

- Refinery Operators Strategic Plan Template

- Interior Designers Strategic Plan Template

- Improving Productivity Strategic Plan Template

- Pr Professionals Strategic Plan Template

Template details

Free forever with 100mb storage.

Free training & 24-hours support

Serious about security & privacy

Highest levels of uptime the last 12 months

- Product Roadmap

- Affiliate & Referrals

- On-Demand Demo

- Integrations

- Consultants

- Gantt Chart

- Native Time Tracking

- Automations

- Kanban Board

- vs Airtable

- vs Basecamp

- vs MS Project

- vs Smartsheet

- Software Team Hub

- PM Software Guide

Sample Insurance Business Plan

Writing a business plan is a crucial step in starting an insurance company. Not only does it provide structure and guidance for the future, but it also helps to create funding opportunities and attract potential investors. For aspiring insurance company owners, having access to a sample insurance business plan can be especially helpful in providing direction and gaining insight into how to draft their own insurance business plan.

Download our Ultimate Insurance Business Plan Template

Having a thorough business plan in place is critical for any successful insurance venture. It will serve as the foundation for your operations, setting out the goals and objectives that will help guide your decisions and actions. A well-written business plan can give you clarity on realistic financial projections and help you secure financing from lenders or investors. An insurance business plan example can be a great resource to draw upon when creating your own plan, making sure that all the key components are included in your document.

The insurance business plan sample below will give you an idea of what one should look like. It is not as comprehensive and successful in raising capital for your insurance company as Growthink’s Ultimate Insurance Business Plan Template , but it can help you write an insurance business plan of your own.

Insurance Business Plan Example – SafeGuard Assurance

Table of contents, executive summary, company overview, industry analysis, customer analysis, competitive analysis, marketing plan, operations plan, management team, financial plan.

Welcome to SafeGuard Assurance, located in the heart of Fresno, CA. As a novel insurance provider, we are dedicated to understanding and serving the unique needs of our local residents and businesses. Our comprehensive array of products and services includes Insurance Coverage Evaluation, Policy Issuance and Management, Claims Processing and Settlement, alongside Risk Management Consulting and Customer Support and Education. With a foundation built on excellence and a deep understanding of the insurance landscape, we are committed to becoming the premier choice for those seeking reliable and comprehensive coverage. Our strategic positioning within Fresno allows us to make a significant impact in our community, setting us apart as an ideal partner for insurance solutions.

Our success is underpinned by several key factors. The invaluable experience of our founder, who has previously steered an insurance enterprise to success, provides us with a foundation of proven strategies and insights. Our superior insurance expertise enables us to deliver unmatched service and value to our clients, distinguishing us from our competitors. Since launching as an S Corporation on January 4, 2024, we’ve achieved significant milestones, including developing our brand identity, securing a prime headquarters location, and more. These accomplishments mark our journey towards becoming Fresno’s leading insurance provider.

The insurance industry in the United States, with total premiums exceeding $1.3 trillion in 2020, plays a crucial role in the economy and financial stability. Projected to grow at an annual rate of around 3.5% from 2021 to 2025, the industry’s expansion is driven by increasing awareness of insurance importance, technological advancements, and evolving customer needs. For SafeGuard Assurance, this growth presents an opportunity to leverage industry trends like digital platforms and personalized policies to offer tailored insurance solutions. Located in Fresno, CA, our company is well-positioned to capitalize on these developments, establishing a competitive presence in the expanding insurance market.

SafeGuard Assurance targets Fresno’s local residents and small to medium-sized businesses, aiming to meet their diverse insurance needs with comprehensive solutions. Our strategy focuses on creating customized offerings for young professionals, established families, agricultural businesses, and real estate investors, ensuring access to suitable coverage. By catering to specific niche markets within Fresno, we plan to address the unique insurance requirements of these segments, providing valuable protection and peace of mind, and building a strong, loyal customer base in the process.

Our main competitors in the Fresno area include Sara Sordi Insurance Services, known for personalized customer service and local market knowledge; Kurt Sieve – State Farm Insurance Agent, which combines local service with the backing of a national brand; and Gennock Insurance, recognized for its specialization and affordable pricing strategy. Despite the strengths of these competitors, SafeGuard Assurance’s unparalleled insurance expertise and commitment to leveraging the latest technology provide us with a competitive advantage. Our ability to offer customized solutions and a customer-centered digital approach sets us apart, ensuring we meet the evolving needs of our clients more effectively than our competitors.

SafeGuard Assurance provides a comprehensive suite of services, including Insurance Coverage Evaluation, Policy Issuance and Management, Claims Processing and Settlement, Risk Management Consulting, and Customer Support and Education. Our competitive pricing and commitment to excellence position us as a trusted partner in our clients’ financial security. Our promotional strategy encompasses a blend of online marketing, traditional advertising, email campaigns, community engagement, and referral programs. By leveraging these methods, we aim to attract and retain customers in Fresno, CA, and establish SafeGuard Assurance as a leader in the insurance industry.

To ensure our success, SafeGuard Assurance will focus on key operational processes including customer inquiries and support, policy management, claims processing, financial management, regulatory compliance, marketing and sales, human resources and training, and technology and data management. Our upcoming milestones include securing necessary licenses, establishing our product lines, launching the company, forming strategic partnerships, implementing a risk management system, recruiting a skilled team, achieving operational efficiency, reaching $15,000/month in revenue, establishing a strong customer service reputation, and evaluating and adjusting our business strategies accordingly.

Under the leadership of Grace Roberts, our President, SafeGuard Assurance boasts a management team with the expertise to successfully execute our business plan. Grace’s extensive experience in the insurance industry, marked by strategic growth and a commitment to customer satisfaction, provides us with the guidance needed to achieve our long-term objectives. Her deep understanding of market dynamics, regulatory compliance, and risk management is instrumental in fostering a culture of excellence and integrity within our organization.

Welcome to SafeGuard Assurance, a new insurance provider serving the vibrant community of Fresno, CA. As a local insurance company, we understand the unique needs of our residents and businesses, setting us apart in a region where high-quality local insurance options have been limited. Our commitment to excellence and deep understanding of the insurance landscape positions us as a premier choice for those seeking reliable and comprehensive coverage.

At SafeGuard Assurance, our array of products and services is carefully designed to meet the diverse needs of our customers. We specialize in Insurance Coverage Evaluation, ensuring our clients receive the most appropriate and cost-effective coverage. Our seamless Policy Issuance and Management processes are designed to provide peace of mind, while our Claims Processing and Settlement services are efficient and customer-focused. Recognizing the importance of proactive measures, we also offer Risk Management Consulting to help our clients minimize potential risks. Moreover, we are dedicated to Customer Support and Education, ensuring our clients are well-informed and confident in their insurance decisions.

Rooted in the heart of Fresno, CA, SafeGuard Assurance is strategically positioned to serve and make a significant impact within our local community. Our deep understanding of the local market dynamics, paired with our commitment to personalized service, makes us an ideal partner for individuals and businesses in Fresno.

Our ability to succeed is rooted in several key factors. Firstly, our founder brings invaluable experience from successfully running a previous insurance enterprise, ensuring that SafeGuard Assurance is built on a foundation of proven strategies and insights. Additionally, our superior insurance expertise distinctly sets us apart from our competitors, enabling us to provide unmatched service and value to our clients.

Since our inception on January 4, 2024, SafeGuard Assurance has made significant strides as a S Corporation. We’ve accomplished several key milestones, including the creation of our distinctive logo, the development of our brand name, and securing a prime location for our headquarters. These achievements mark the beginning of our journey towards becoming a leading insurance provider in Fresno, CA.

The insurance industry in the United States is a massive market, with total premiums reaching over $1.3 trillion in 2020. This figure represents the size and importance of the industry in the country, providing a wide range of coverage options for individuals, businesses, and organizations. With such a substantial market value, the insurance industry plays a crucial role in the overall economy and financial stability.

The insurance market in the United States is expected to continue growing in the coming years, with a projected annual growth rate of around 3.5% from 2021 to 2025. This growth is driven by various factors, including an increasing awareness of the importance of insurance coverage, technological advancements in the industry, and evolving customer needs. As the market expands, there will be more opportunities for insurance companies to offer innovative products and services to meet the changing demands of consumers.

Recent trends in the insurance industry, such as the rise of digital platforms, personalized policies, and a focus on customer experience, bode well for SafeGuard Assurance, a new insurance company serving customers in Fresno, CA. By leveraging these trends and offering tailored insurance solutions to meet the specific needs of individuals and businesses in the area, SafeGuard Assurance can position itself as a competitive player in the market. With the industry’s overall growth and evolving landscape, there is ample room for SafeGuard Assurance to thrive and establish a strong presence in the insurance sector.

Below is a description of our target customers and their core needs.

Target Customers

SafeGuard Assurance will target local residents in its initial customer base, focusing on providing comprehensive insurance solutions that meet the diverse needs of this community. The company will tailor its offerings to suit the unique requirements of Fresno’s residents, ensuring that everyone from young professionals to established families has access to suitable coverage. This strategy is central to building a strong, loyal customer base in the area.

Aside from local residents, SafeGuard Assurance will also aim to serve small and medium-sized businesses within Fresno. This segment represents a significant opportunity for growth, as these entities seek to protect their assets, employees, and potential liabilities. By offering customized insurance packages that cater specifically to the business sector, SafeGuard Assurance will position itself as a key partner in the local economy’s health and resilience.

Furthermore, SafeGuard Assurance will target specific niche markets within the broader Fresno community, such as agricultural businesses and real estate investors. These sectors have unique insurance needs that are not always adequately met by larger, more generic insurers. By developing specialized insurance products for these niches, SafeGuard Assurance will tap into underserved markets, offering them valuable protection and peace of mind.

Customer Needs

SafeGuard Assurance meets the critical needs of residents by offering high-quality insurance services designed to provide peace of mind and financial stability in times of need. Customers can expect personalized attention and products tailored to their unique circumstances, ensuring that their coverage matches their lifestyle and risk profile. This commitment to excellence sets the foundation for a trusted relationship between the insurer and the insured.

Moreover, SafeGuard Assurance goes beyond traditional insurance offerings by incorporating comprehensive support and guidance. Customers can rely on an experienced team of professionals who are readily available to assist with claims, answer questions, and provide advice on how to best protect their assets. This proactive approach to customer service ensures that individuals feel supported and valued throughout their insurance journey.

Additionally, the company addresses a broader spectrum of customer needs by ensuring ease of access to information and services. Through a user-friendly online platform and mobile application, customers can manage their policies, make payments, and access important documents with ease. This convenience empowers customers, allowing them to take control of their insurance experience in a way that fits their busy lifestyles.

SafeGuard Assurance’s competitors include the following companies:

Sara Sordi Insurance Services offers a comprehensive range of insurance products, including home, auto, life, and business insurance. They tailor their services to meet the unique needs of each client, ensuring personalized coverage options. Price points vary depending on the type and extent of coverage desired by customers, but they are competitive within the Fresno market. The firm operates primarily in the Fresno area, focusing on local residents and businesses. This geographic concentration allows them to develop strong relationships with their clients and understand the specific risks and needs associated with the region. Sara Sordi Insurance Services segments its customer base primarily by individual and small to medium-sized businesses, catering to a broad demographic that values personalized service and local expertise. A key strength of Sara Sordi Insurance Services is their personalized customer service and local market knowledge. However, their focus on Fresno may limit their appeal to customers outside this geographic area, representing a potential weakness in their business model.

Kurt Sieve – State Farm Insurance Agent specializes in a wide array of insurance products such as auto, home, property, business, life, and health insurance. They leverage the strong brand and comprehensive support services of State Farm to offer customers in Fresno reliable and diverse coverage options. Pricing is competitive and often bundled for customers seeking multiple types of insurance, providing cost-saving opportunities. The agency’s location in Fresno positions it well to serve the local community, but as part of the broader State Farm network, it can leverage national resources and expertise. This enables Kurt Sieve to serve a diverse range of customers, from individuals to families and businesses, catering to their varied insurance needs. A significant strength of Kurt Sieve – State Farm Insurance Agent is the blend of local personalized service with the backing of a nationally recognized brand. However, as part of a larger corporation, there might be less flexibility in customizing policies to the unique needs of certain clients, potentially a weakness for those seeking highly tailored insurance solutions.

Gennock Insurance provides specialized insurance products focusing on auto, home, and commercial insurance. They offer competitive pricing models that are designed to be affordable for a wide range of customers, including discounts for bundling multiple policies. Their services are aimed at ensuring clients receive the best possible coverage for their specific situation. Operating within the Fresno area, Gennock Insurance has a strong understanding of the local market dynamics and insurance requirements. This local focus allows them to serve individuals and businesses within Fresno effectively, tailoring their offerings to meet the community’s needs. The company’s key strength lies in its specialization and affordable pricing strategy, making it an attractive option for price-sensitive customers. However, their narrower focus on auto, home, and commercial insurance might limit their appeal to customers seeking a broader range of insurance products under one roof, which could be viewed as a weakness.

Competitive Advantages

Our competitive edge in the insurance market is significantly sharpened by our unparalleled insurance expertise. We understand that navigating through insurance policies can be overwhelming for our customers. That’s why we equip our team with extensive training and up-to-date knowledge about the insurance industry. This ensures that we not only guide our customers to the best options that suit their needs but also simplify the complex terms and conditions of insurance policies. Our expertise allows us to tailor unique solutions for our customers, making us a preferred choice over competitors who may offer generic services.

Additionally, our commitment to leveraging the latest technology in our operations bestows upon us another competitive advantage. By integrating advanced tech solutions, we can offer faster service, more accurate policy management, and enhanced customer service. This digital approach not only streamlines our processes but also provides our customers with an easy and efficient way to manage their policies, file claims, and get support. It’s this forward-thinking and customer-centered approach that sets us apart in the Fresno market, ensuring that our customers receive not just insurance, but assurance of safety and security. Our aim is to exceed expectations, providing a service that’s not just about policies, but about people.

Our marketing plan, included below, details our products/services, pricing and promotions plan.

Products and Services

SafeGuard Assurance emerges as a key player in the insurance industry, offering a comprehensive suite of services designed to meet the diverse needs of its clientele. At the heart of its offerings is Insurance Coverage Evaluation, a critical service priced on average at $150. This service enables clients to understand their current insurance coverage comprehensively, ensuring they are neither underinsured nor overpaying for unnecessary coverage. This personalized evaluation aids in making informed decisions regarding insurance investments, aligning coverage with the client’s specific needs and risk profile.

Following the evaluation, SafeGuard Assurance excels in Policy Issuance and Management, with services starting at an average cost of $200. This encompasses the drafting, issuance, and ongoing management of insurance policies. Tailored to meet individual or business requirements, this service ensures that policies remain relevant and up-to-date with the client’s evolving needs, offering peace of mind and security against unforeseen events.

Claims Processing and Settlement is another critical service provided, with fees averaging around $100 per claim. This service streamlines the typically cumbersome process of filing and settling claims, offering clients a hassle-free experience. SafeGuard Assurance prioritizes efficiency and transparency in this process, ensuring clients receive the compensation they are entitled to in a timely manner, thus mitigating the financial impact of accidents, damages, or losses.

Risk Management Consulting is offered at an average price of $250, reflecting its comprehensive nature. This service involves a detailed analysis of the client’s exposure to potential risks, followed by the development of strategies to minimize or mitigate these risks. By identifying vulnerabilities and recommending protective measures, SafeGuard Assurance plays a crucial role in safeguarding the client’s assets and financial health against potential threats.

Lastly, Customer Support and Education stand as core components of SafeGuard Assurance’s offerings, with services provided at no additional cost. This encompasses ongoing support for any questions or concerns clients may have regarding their policies, as well as educational resources and workshops designed to enhance their understanding of insurance products, risk management, and best practices for securing their assets. This commitment to customer education and support underscores SafeGuard Assurance’s dedication to empowering clients, ensuring they are well-informed and confident in their insurance choices.

In conclusion, SafeGuard Assurance offers a broad spectrum of services tailored to protect and educate its clients, ensuring they are well-equipped to navigate the complexities of the insurance landscape. With competitive pricing and a commitment to excellence, SafeGuard Assurance positions itself as a trusted partner in securing the financial future of individuals and businesses alike.

Promotions Plan

SafeGuard Assurance takes a comprehensive approach to attracting customers through a variety of promotional methods, with a strong focus on online marketing. Understanding the digital landscape allows this company to effectively reach its target audience in Fresno, CA, and beyond. Online marketing tactics include search engine optimization (SEO) to ensure that SafeGuard Assurance appears at the top of relevant search results, making it easier for potential customers to find their services. Additionally, the company will leverage social media platforms to engage with the community, share valuable insurance-related content, and advertise their services directly to users based on their interests and demographics.

Beyond online marketing, SafeGuard Assurance will also invest in traditional advertising methods. This includes placing ads in local newspapers and magazines to reach those in the Fresno area who may prefer print media. Radio spots will also serve as an effective tool to reach a broader audience during peak listening times, conveying the value and reliability of SafeGuard Assurance’s offerings.

Email marketing campaigns will be another cornerstone of the promotional strategy. By collecting email addresses through their website and in-person interactions, SafeGuard Assurance will send out regular newsletters, special offers, and updates about their services. This direct line of communication will help to build and maintain relationships with current and prospective customers alike.

Community engagement is also a critical component of the promotional strategy. SafeGuard Assurance will participate in local events, sponsor community projects, and host informative seminars about insurance and financial planning. These efforts will not only increase brand visibility but also position SafeGuard Assurance as a trusted and integral part of the Fresno community.

Referral programs will incentivize current customers to refer friends and family, effectively turning satisfied customers into brand ambassadors. This word-of-mouth marketing is invaluable and will be supported by offering discounts or special offers for both the referrer and the referee.

In conclusion, SafeGuard Assurance employs a multi-faceted promotional strategy that combines the power of online marketing with traditional advertising, email campaigns, community engagement, and referral programs. These efforts are designed to not only attract customers in Fresno, CA, but also to build lasting relationships and establish SafeGuard Assurance as a leader in the insurance industry.

Our Operations Plan details:

- The key day-to-day processes that our business performs to serve our customers

- The key business milestones that our company expects to accomplish as we grow

Key Operational Processes

To ensure the success of SafeGuard Assurance, there are several key day-to-day operational processes that we will perform.

- Handle customer inquiries promptly via phone, email, and social media platforms to maintain high customer satisfaction.

- Provide detailed information on insurance products and services to potential and existing customers.

- Resolve any issues or complaints in a timely and efficient manner.

- Process new insurance applications, including verification of information and risk assessment.

- Update and modify existing policies as per customer requests or upon renewal.

- Ensure all policy documents are accurate and dispatched to customers promptly.

- Receive and review insurance claims to determine validity and coverage.

- Coordinate with assessors and claimants to gather necessary documentation and evidence.

- Process approved claims for payment and inform claimants of any decisions or requirements.

- Monitor daily financial transactions, including premium payments and claim disbursements.

- Prepare and analyze financial reports to ensure financial stability and profitability.

- Manage budgeting and forecasting to support strategic decision-making.

- Stay updated on insurance laws and regulations to ensure company compliance.

- Prepare and submit required reports and documents to regulatory bodies.

- Implement internal policies and procedures to meet or exceed regulatory standards.

- Develop and execute marketing strategies to attract new customers and retain existing ones.

- Conduct market research to identify customer needs and adjust product offerings accordingly.

- Collaborate with sales teams to set sales targets and strategies to achieve them.

- Recruit, hire, and onboard new staff to fill key positions within the company.

- Conduct regular training sessions for employees to enhance their skills and knowledge.

- Manage employee performance and development to maintain a motivated and efficient workforce.

- Implement and maintain IT systems to support operations, including customer management and financial systems.

- Ensure data security and privacy measures are in place to protect sensitive customer information.

- Analyze data to identify trends and insights for improving service delivery and business performance.

SafeGuard Assurance expects to complete the following milestones in the coming months in order to ensure its success:

- Obtain Necessary Licenses and Permits : Secure all required state and local licenses to legally operate as an insurance provider in Fresno, CA. This step is fundamental and ensures that the company operates within legal boundaries, establishing trust with potential customers and partners.

- Establish Insurance Product Lines : Finalize the types of insurance products SafeGuard Assurance will offer, such as auto, health, home, and life insurance. Tailoring product offerings to meet the specific needs of the Fresno community will be key to attracting and retaining customers.

- Launch Our Insurance Company : Officially open for business. This includes launching marketing campaigns to build brand awareness, opening the customer service lines, and ensuring the company’s website and digital channels are fully operational for quotes, purchases, and claims processing.

- Build Strategic Partnerships : Form alliances with local businesses, such as car dealerships, real estate agencies, and healthcare providers, to cross-promote services and products. These partnerships can enhance customer base growth and reinforce market presence.

- Implement a Robust Risk Management System : Develop a comprehensive system for assessing and managing the risks associated with the insurance policies offered. This will help in pricing products correctly, avoiding fraudulent claims, and ensuring financial stability.

- Recruit and Train a Skilled Team : Hire a team of professionals who are not only skilled in insurance but are also familiar with the Fresno market. Training should focus on customer service, claims processing, and compliance with insurance regulations to ensure a high level of service quality.

- Achieve Operational Efficiency : Streamline operations through technology and process improvements to reduce costs, improve customer experience, and enhance claim processing speed. Operational efficiency will be crucial for profitability and competitiveness.

- Get to $15,000/Month in Revenue : This financial milestone will be a strong indicator of market acceptance and the effectiveness of SafeGuard Assurance’s business strategies. Achieving this milestone will also provide the necessary cash flow to support ongoing operations and future growth initiatives.

- Establish a Strong Customer Service Reputation : Develop a reputation for excellent customer service by efficiently handling claims, inquiries, and complaints. Positive word-of-mouth and customer reviews can significantly influence new business and retention rates.

- Evaluate and Adjust Business Strategies : Regularly review business performance against goals, market trends, and competitive activities. Be prepared to adjust strategies, including marketing, product offerings, and customer service approaches, to ensure continued growth and success.

SafeGuard Assurance management team, which includes the following members, has the experience and expertise to successfully execute on our business plan:

Grace Roberts, President

With a proven track record of steering companies towards success, Grace Roberts stands as a beacon of leadership and innovation within the insurance industry. Her tenure as the head of a previous insurance company is marked by strategic growth, operational excellence, and an unwavering commitment to customer satisfaction. Grace’s extensive experience in navigating the complex landscape of insurance has endowed her with a deep understanding of market dynamics, regulatory compliance, and risk management. These skills are not only pivotal in her role as President of SafeGuard Assurance but also instrumental in guiding the company towards achieving its long-term objectives and fostering a culture of excellence and integrity.

To reach our growth goals, SafeGuard Assurance requires $322,000 in funding. This investment will be allocated towards capital investments such as location buildout, furniture, equipment, computers, and non-capital investments including working capital, initial rent/lease, staff salaries for the first three months, initial marketing and advertising, supplies, and insurance. This funding is crucial for establishing our operations, ensuring we can effectively serve the Fresno community and achieve our objectives.

Financial Statements

Balance sheet.

[insert balance sheet]

Income Statement

[insert income statement]

Cash Flow Statement

[insert cash flow statement]

Insurance Business Plan Example PDF

Download our Insurance Business Plan PDF here. This is a free insurance business plan example to help you get started on your own insurance company plan.

How to Finish Your Insurance Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your insurance business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

How To Write an Insurance Company Business Plan + Template

Creating a business plan is essential for any business, but it can be especially helpful for insurance companies that want to improve their strategy and/or raise funding.

A well-crafted business plan not only outlines the vision for your company, but also documents a step-by-step roadmap of how you are going to accomplish it. In order to create an effective business plan, you must first understand the components that are essential to its success.

This article provides an overview of the key elements that every insurance company owner should include in their business plan.

Download the Ultimate Insurance Business Plan Template

What is an Insurance Company Business Plan?

An insurance company business plan is a formal written document that describes your company’s business strategy and its feasibility. It documents the reasons you will be successful, your areas of competitive advantage, and it includes information about your team members. Your business plan is a key document that will convince investors and lenders (if needed) that you are positioned to become a successful venture.

Why Write an Insurance Company Business Plan?

An insurance company business plan is required for banks and investors. The document is a clear and concise guide of your business idea and the steps you will take to make it profitable.

Entrepreneurs can also use this as a roadmap when starting their new company or venture, especially if they are inexperienced in starting a business.

Writing an Effective Insurance Company Business Plan

The following are the key components of a successful insurance company business plan:

Executive Summary

The executive summary of an insurance company business plan is a one to two page overview of your entire business plan. It should summarize the main points, which will be presented in full in the rest of your business plan.

- Start with a one-line description of your insurance company

- Provide a short summary of the key points in each section of your business plan, which includes information about your company’s management team, industry analysis, competitive analysis, and financial forecast among others.

Company Description

This section should include a brief history of your company. Include a short description of how your company started, and provide a timeline of milestones your company has achieved.

If you are just starting your insurance company , you may not have a long company history. Instead, you can include information about your professional experience in this industry and how and why you conceived your new venture. If you have worked for a similar company before or have been involved in an entrepreneurial venture before starting your insurance company firm, mention this.

You will also include information about your chosen insurance company business model and how, if applicable, it is different from other companies in your industry.

Industry Analysis

The industry or market analysis is an important component of an insurance company business plan. Conduct thorough market research to determine industry trends and document the size of your market.

Questions to answer include:

- What part of the insurance industry are you targeting?

- How big is the market?

- What trends are happening in the industry right now (and if applicable, how do these trends support the success of your company)?

You should also include sources for the information you provide, such as published research reports and expert opinions.

Customer Analysis

This section should include a list of your target audience(s) with demographic and psychographic profiles (e.g., age, gender, income level, profession, job titles, interests). You will need to provide a profile of each customer segment separately, including their needs and wants.

For example, the customers of an insurance company may include individuals, families, small businesses, and large corporations.

You can include information about how your customers make the decision to buy from you as well as what keeps them buying from you.

Develop a strategy for targeting those customers who are most likely to buy from you, as well as those that might be influenced to buy your products or insurance company services with the right marketing.

Competitive Analysis

The competitive analysis helps you determine how your product or service will be different from competitors, and what your unique selling proposition (USP) might be that will set you apart in this industry.

For each competitor, list their strengths and weaknesses. Next, determine your areas of competitive differentiation and/or advantage; that is, in what ways are you different from and ideally better than your competitors.

Below are sample competitive advantages your insurance company may have:

- Specialized industry knowledge

- Proven track record

- Strong customer relationships

- Robust product offerings

- Innovative solutions

Marketing Plan

This part of the business plan is where you determine and document your marketing plan. . Your plan should be clearly laid out, including the following 4 Ps.

- Product/Service : Detail your product/service offerings here. Document their features and benefits.

- Price : Document your pricing strategy here. In addition to stating the prices for your products/services, mention how your pricing compares to your competition.

- Place : Where will your customers find you? What channels of distribution (e.g., partnerships) will you use to reach them if applicable?

- Promotion : How will you reach your target customers? For example, you may use social media, write blog posts, create an email marketing campaign, use pay-per-click advertising, launch a direct mail campaign.

- Or, you may promote your insurance company business via word of mouth.

Operations Plan

This part of your insurance company business plan should include the following information:

- How will you deliver your product/service to customers? For example, will you do it in person or over the phone only?

- What infrastructure, equipment, and resources are needed to operate successfully? How can you meet those requirements within budget constraints?

The operations plan is where you also need to include your company’s business policies. You will want to establish policies related to everything from customer service to pricing, to the overall brand image you are trying to present.

Finally, and most importantly, in your Operations Plan, you will lay out the milestones your company hopes to achieve within the next five years. Create a chart that shows the key milestone(s) you hope to achieve each quarter for the next four quarters, and then each year for the following four years. Examples of milestones for an insurance company include reaching $X in sales. Other examples include expanding to a new geographic market, launching a new product or service line, or signing on new major customers.

Management Team

List your team members here including their names and titles, as well as their expertise and experience relevant to your specific insurance industry. Include brief biography sketches for each team member.

Particularly if you are seeking funding, the goal of this section is to convince investors and lenders that your team has the expertise and experience to execute on your plan. If you are missing key team members, document the roles and responsibilities you plan to hire for in the future.

Financial Plan

Here you will include a summary of your complete and detailed financial plan (your full financial projections go in the Appendix).

This includes the following three financial statements:

Income Statement

Your income statement should include:

- Revenue : how much revenue you generate.

- Cost of Goods Sold : These are your direct costs associated with generating revenue. This includes labor costs, as well as the cost of any equipment and supplies used to deliver the product/service offering.

- Net Income (or loss) : Once expenses and revenue are totaled and deducted from each other, this is the net income or loss.

Sample Income Statement for a Startup Insurance Company

Balance sheet.

Include a balance sheet that shows your assets, liabilities, and equity. Your balance sheet should include:

- Assets : All of the things you own (including cash).

- Liabilities : This is what you owe against your company’s assets, such as accounts payable or loans.

- Equity : The worth of your business after all liabilities and assets are totaled and deducted from each other.

Sample Balance Sheet for a Startup Insurance Company

Cash flow statement.

Include a cash flow statement showing how much cash comes in, how much cash goes out and a net cash flow for each year. The cash flow statement should include:

- Cash Flow From Operations

- Cash Flow From Investments

- Cash Flow From Financing

Below is a sample of a projected cash flow statement for a startup insurance company business.

Sample Cash Flow Statement for a Startup Insurance Company

You will also want to include an appendix section which will include:

- Your complete financial projections

- A complete list of your company’s business policies and procedures related to the rest of the business plan (marketing, operations, etc.)

- Any other documentation which supports what you included in the body of your business plan.

Writing a good business plan gives you the advantage of being fully prepared to launch and/or grow your insurance company . It not only outlines your business vision but also provides a step-by-step process of how you are going to accomplish it. All in all, a business plan is a key to the success of any business.

Finish Your Insurance Business Plan in 1 Day!

Other helpful articles.

How To Write an Insurance Agency Business Plan + Template

Insurance Business Plan Template

Written by Dave Lavinsky

Business Plan Outline

- Insurance Business Plan Home

- 1. Executive Summary

- 2. Company Overview

- 3. Industry Analysis

- 4. Customer Analysis

- 5. Competitive Analysis

- 6. Marketing Plan

- 7. Operations Plan

- 8. Management Team

- 9. Financial Plan

Insurance Agency Business Plan

You’ve come to the right place to create your own business plan.

We have helped over 100,000 entrepreneurs and business owners create business plans and many have used them to start or grow their insurance companies.

Essential Components of a Business Plan For an Insurance Agency

Below we describe what should be included in each section of a business plan for a successful insurance agency and links to a sample of each section:

- Executive Summary – In the Executive Summary, you will provide a high-level overview of your business plan. It should include your agency’s mission statement, as well as information on the products or services you offer, your target market, and your insurance agency’s goals and objectives.

- Company Overview – This section provides an in-depth company description, including information on your insurance agency’s history, ownership structure, and management team.

- Industry Analysis – Also called the Market Analysis, in this section, you will provide an overview of the industry in which your insurance agency will operate. You will discuss trends affecting the insurance industry, as well as your target market’s needs and buying habits.

- Customer Analysis – In this section, you will describe your target market and explain how you intend to reach them. You will also provide information on your customers’ needs and buying habits.

- Competitive Analysis – This section will provide an overview of your competition, including their strengths and weaknesses. It will also discuss your competitive advantage and how you intend to differentiate your insurance agency from the competition.

- Marketing Plan – In this section, you will detail your marketing strategy, including your advertising and promotion plans. You will also discuss your pricing strategy and how you intend to position your insurance agency in the market.

- Operations Plan – This section will provide an overview of your agency’s operations, including your office location, hours of operation, and staff. You will also discuss your business processes and procedures.

- Management Team – In this section, you will provide information on your insurance agency’s management team, including their experience and qualifications.

- Financial Plan – This section will detail your insurance agency’s financial statements, including your profit and loss statement, balance sheet, and cash flow statement. It will also include information on your funding requirements and how you intend to use the funds.

Next Section: Executive Summary >

Insurance Agency Business Plan FAQs

What is an insurance agency business plan.

An insurance agency business plan is a plan to start and/or grow your insurance business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your insurance agency business plan using our Insurance Agency Business Plan Template here .

What Are the Main Types of Insurance Companies?

There are a few types of insurance agencies. Most companies provide life and health insurance for individuals and/or households. There are also agencies that specialize strictly in auto and home insurance. Other agencies focus strictly on businesses and provide a variety of liability insurance products to protect their operations.

What Are the Main Sources of Revenue and Expenses for an Insurance Agency Business?

The primary source of revenue for insurance agencies are the fees and commissions paid by the client for the insurance products they choose.

The key expenses for an insurance agency business are the cost of purchasing the insurance, licensing, permitting, and payroll for the office staff. Other expenses are the overhead expenses for the business office, utilities, website maintenance, and any marketing or advertising fees.

How Do You Get Funding for Your Insurance Agency Business Plan?

Insurance agency businesses are most likely to receive funding from banks. Typically you will find a local bank and present your business plan to them. Other options for funding are outside investors, angel investors, and crowdfunding sources. This is true for a business plan for insurance agent or an insurance company business plan.

What are the Steps To Start an Insurance Business?

Starting an insurance business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop An Insurance Business Plan - The first step in starting a business is to create a detailed insurance business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your insurance business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your insurance business is in compliance with local laws.

3. Register Your Insurance Business - Once you have chosen a legal structure, the next step is to register your insurance business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your insurance business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Insurance Equipment & Supplies - In order to start your insurance business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your insurance business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Learn more about how to start a successful insurance business:

- How to Start an Insurance Business

Where Can I Get an Insurance Business Plan PDF?

You can download our free insurance business plan template PDF here . This is a sample insurance business plan template you can use in PDF format.

- Small Business Loans

- Working Capital Loans

- Short Term Business Loans

- Equipment Financing and Leasing

- Types of Funding Solutions

- Customer Reviews

- Meet Our Customers

- Sponsorships

- How We Work

- Search for: Search Button

- Planning for Growth

How to Create an Insurance Company Business Plan

- by James Woodruff James Woodruff has been a ... more

- December 23, 2019

- 4 Minute Read

- Home > Blog > Planning for Growth > How to Create an Insurance Company Business Plan

Independent insurance agents need a strong business plan when they intend to start and grow their own company. The plan contains the initial ideas for the company’s products, target customers, competition and funding.

But, just because an owner took the time and effort to prepare an insurance company business plan doesn’t mean it shouldn’t be revised as the company grows. Things will change, and revenues and expenses won’t always match up with expectations.

If you’re curious about how to make your insurance business grow and become profitable, it’s time to revisit your original business plan. Let’s consider the plight of John, an independent insurance agent in Smalltown, USA.

John has been in business for a year working out of his house. He’s gotten a few new clients, but business hasn’t come in as quickly as he had hoped. John decides to review his original business plan and make updates based on where the business is now and where he wants it to go.

We’re going to move through all the must-haves of an insurance company business plan through the lens of John’s updates:

Legal Structure

Since the beginning, John has been operating as a sole proprietor. Now, he feels it’s time to hire his first employee and lease an office to gain credibility. He will need to register the business name with the state, incorporate the business and obtain federal and state tax ID numbers.

Licenses and Insurance

In addition to getting a business owner’s policy and obtaining local business licenses and permits, insurance agents need specific insurance policies to sell their products. Accordingly, John has taken out an errors and omissions policy and a surety bond to cover any professional mistakes, such as overlooking the renewal date for a client’s policy.

Insurance Products

John’s initial idea was to keep the business simple and sell personal auto and homeowners insurance to individuals. However, he learns that he must widen his product offerings to reach a broader number of potential customers and expand his income.

John decides to add life insurance and commercial insurance products to his offerings. Commercial insurance will include insurance for general business liability, property damage and bodily injuries. He knows that he may need to take additional courses and apply for other state licenses to sell these products, so he includes that in this section of the business plan as well.

The best way for a new insurance agent to offer more insurance products is to join a cluster group. These are groups of insurance agents who join together to sell products of major insurance carriers. Because of their higher number of members, a cluster group can qualify to sell more products and negotiate better rates with large insurance companies than a single agent can by themselves.

Competition

John has several competitors in Smalltown who are also independent agents, but they have been in business for several years and have dedicated clientele. They also offer a wider range of insurance products, so poaching their customers would be difficult and expensive.

Smalltown has several captive agents who only represent specific major insurance carriers, such as Allstate, State Farm and Nationwide. These agents are backed with strong corporate advertising campaigns and promotional material from their employers.

Competitive Advantages

Since all of the independent agents offer basically the same products, John has to provide a broad range of products with better service. He needs to position himself as a client’s go-to agent for advice and one-stop shopping for all of their insurance needs.

Competing by offering better service means spending time — whatever it takes — with a customer to accurately determine their needs, provide advice and make practical, affordable recommendations. This will establish John as a trusted adviser and, hopefully, lead to referrals.

Online Presence

John set up a website on his own when he started. However, the website has been ineffective at generating leads for new customers. John needs to hire a website designer to build an attractive and competitive website that will bring in traffic and new leads. It also needs to be mobile-friendly.

As the business grows, John can ask for reviews from satisfied customers to post on his website. He can also collect emails from prospects and build an email marketing program that suggests contacting the agency for free quotes.

Social marketing is a fact of life in today’s markets, so John should increase his online presence with LinkedIn, Twitter, Facebook and Instagram.

John has not been active enough in the community. He needs to join community organizations, like the local Chamber of Commerce, and start networking more. The Agent Support Network of America lists some marketing tips catered to independent insurance agents, including:

- Contacting real estate agents and setting up partnerships with them

- Sponsoring a table at community and charity events

- Creating a referral program with rewards such as movie tickets, gift cards to local restaurants, or discounts on the referrer’s premiums

Advertising

Create brochures and fliers, and place ads in local newspapers. While consumers head mostly to the internet to search for agents, people still read newspapers and they represent a source for business.

Setting Objectives

The revised insurance company business plan should have quantifiable objectives with measurable performance metrics. As examples, these would include measurement of:

- New customer leads per month

- Number of new policies sold

- Website traffic

- Leads from website

- Marketing and advertising budget and expenses

Paying business expenses and funding growth takes money. Although John started his business with savings, income in the first year did not meet the original projections. John will need to prepare a new budget that includes additional costs for advertising, marketing, administrative wages, new licenses, utilities and office rent.

The revised budget will have to specify where the additional funds will come from. He may have to tap into his working capital or consider a small business loan to carry out some of these investments.

An insurance company business plan is the foundation for the growth and development of the company. It is not a stagnant document that gets reviewed once a year and placed on the shelf. It is a road map with guideposts and goals that will enable an owner to reach their objectives. If you’ve been wondering how to make your insurance business grow, revisiting your business plan should be your first step.

RECOMMENDED FOR YOU

How to Start a Small Business: 5 Tips for Success

The 6 most important characteristics of small business owners, how to create an auto repair shop business plan, how profitable are auto repair shops it depends on these six factors.

You are leaving NationalFunding.com

You are now leaving the National Funding website, and are being connected to a third party website. Please note that National Funding is not responsible for the information, content, or product(s) found on third party websites.

Strategic Planning

Think MarshBerry. Think Forward.

Strategic Planning Services

Set the course that inspires commitment and enables success.

Strategic planning for insurance companies and wealth advisory firms is important to creating a shared vision for financial, operational, and staffing goals. What sets MarshBerry’s strategic planning process above others is it goes beyond simply creating the plan. It charts a course for where and how to get there with key objectives, short- and long-term action plans and implementation schedules that are focused, relevant, aligned and actionable.

The strategic planning advisors at MarshBerry will work with you to build a comprehensive roadmap for growth with specific expertise in the insurance brokerage and wealth and retirement plan advisory industries. Knowing the business dynamics, what will work for you and your business, along with the data to back up the advice, helps set the stage for your firms’ commitment to achieving results.

Whether it is outlining your strategic plan, providing board advisory or exploring strategic options, MarshBerry has proven experience in providing effective strategic business planning for insurance companies and wealth advisory firms.

Examples of Strategic Planning Components

- Revenue and Expense Inputs

- Benchmarking Statistics

- Growth Projections

- Financial Stability

- Service & Support Productivity

- Producer Performance

- Perpetuation

- Age of Staff

- Implementation Schedule

- Accountability Map

Strategic Planning Services for Insurance Brokerages & Wealth Management Firms

In the dynamic world of insurance, a well-defined strategic plan can make a significant difference. MarshBerry’s team of experienced professionals assists insurance brokerages in developing and executing strategic plans that align with long-term objectives and growth potential.

Our wealth management strategic planning services focus on the unique requirements of wealth management firms. Our experts guide you through market trends and financial complexities, delivering strategies that drive growth and enhance value.

Why Choose MarshBerry for Your Strategic Planning Needs?

Choosing MarshBerry means choosing a strategic partner dedicated to your success. Our team brings extensive industry experience and a deep understanding of insurance brokerages and wealth management firms, making us an unparalleled choice for strategic planning services.

Beyond the planning phase, we provide continuous support and guidance to ensure your firm’s sustained success. Partner with MarshBerry today and propel your strategic growth journey forward.

Contact MarshBerry today to learn how our strategic planning services for insurance brokerages and wealth management firms can elevate your business strategy.

Perpetuation Planning

Contact the advisory team.

MarshBerry’s team of advisors are thought leaders and experts in the insurance brokerage and financial services industries. As a client, your firm benefits from their combined hands-on experience and professional designations in finance, accounting and economics. No matter what your needs are, they have the understanding to craft a personalized solution.

Kim Kovalski joined MarshBerry in 2021 and is charged with providing strategic and operational consulting services to MarshBerry’s client base of independently-owned insurance agents & brokers, specialty distributors, wealth advisory industry, private equity firms, banks & credit unions and insurance carriers.

Brian is a Director at MarshBerry and a member of MarshBerry’s Financial Advisory team. He has extensive experience advising insurance brokers in mergers and acquisitions (M&A), capital raising, and other financial advisory services such as valuation, compensation consulting and perpetuation planning.

As a shareholder of the firm, and a Director in MarshBerry’s Financial Advisory Division, Tommy focuses his time on delivering valuable advice and counsel to his clients. In his 14+ year career, Tommy has built extensive knowledge in the insurance distribution space in areas involving merger and acquisition advisory, organic growth best practices, financial management, valuation, perpetuation and strategic planning.

Don Folino is part of MarshBerry's Growth Advisory division where he helps insurance agencies and brokerages build infrastructures that drive organic growth, as well as working with them through the continued development and execution of that process.

As Vice President of Growth Advisory, Eric's primary responsibility is to help firms create executional strategic plans to increase firm value, energize their recruiting efforts and increase sales velocity.

Christopher Darst joined MarshBerry in 1998 as a Financial Analyst responsible for the preparation of business valuation reports, perpetuation plans, and general consulting projects. In 2001, he moved to California to help launch the Dana Point office. With increased experience and responsibility, Chris expanded his responsibilities to include merger and acquisition ("M&A") work for various MarshBerry clients.

- Netherlands

- LinkedIn Twitter Facebook Instagram

Claro Insurance

- Login to ARC

Lines of business

- Resources Resources Downloadables Services for you Events & webinars Insurance data science Spotify playlist

- About Claro

- May 17, 2024

How to Create a Business Plan for a Health Insurance Agency

Why is an agency business plan important, provides direction and focus.

A business plan is like a compass for your insurance agency. It defines your goals, outlines your strategies, and establishes the milestones you need to achieve. This direction helps you stay focused on what’s important, ensuring that every action you take aligns with your overall objectives.

Attracts Investors and Partners

If you’re looking to secure funding or attract business partners, a comprehensive business plan is indispensable. Investors want to see a clear and detailed plan that demonstrates the potential for profitability and growth. A well-prepared business plan shows that you’ve done your homework and are serious about your venture.

Identifies Potential Challenges

Every business faces challenges, and an insurance agency is no exception. A business plan helps you anticipate potential obstacles and devise strategies to overcome them. By thinking ahead, you can mitigate risks and navigate through tough times more effectively.

Sets Benchmarks and Metrics

A business plan establishes benchmarks and key performance indicators (KPIs) to measure your agency’s progress. These metrics allow you to track your performance, identify areas for improvement, and make informed decisions to drive growth.

Ensures Operational Efficiency

Detailed planning helps streamline your operations. By defining processes, roles, and responsibilities, a business plan ensures that your team operates efficiently and effectively, minimizing wasted time and resources.

What Should Be Included in the Business Plan for an Insurance Agency?

Creating a robust business plan involves several key components. Here’s a comprehensive guide to what should be included:

Executive Summary

The executive summary provides a snapshot of your agency. It should include your mission statement, business objectives, and an overview of your strategies. This section should be concise yet compelling to capture the interest of readers, especially potential investors.

Company Description

This section offers a detailed description of your insurance agency. Include information about your agency’s history, the types of insurance products you offer, the market you serve, and your unique selling propositions (USPs).

Market Analysis

Conduct a thorough market analysis to understand the landscape you’re operating in. Identify your target market, analyze your competitors, and outline market trends. This analysis should demonstrate your understanding of the market and justify the demand for your services.

Organization and Management Structure

Detail your agency’s organizational structure. Include information about the ownership, management team, and board of directors if applicable. Describe the roles and responsibilities of each team member and highlight their qualifications and experience.

Products and Services

Provide a detailed description of the insurance products and services your agency offers. Explain the benefits of each product, your pricing strategy, and any unique features that set your offerings apart from the competition.

Marketing and Sales Strategy

Outline your strategies for attracting and retaining clients. This should include your marketing plan, advertising strategies, sales tactics, and customer service approach. Define your brand positioning and explain how you plan to communicate your value proposition to your target market.

Operational Plan

The operational plan details the day-to-day operations of your agency. Include information about your business location, facilities, technology, and equipment. Describe your workflow processes, customer service protocols, and any other operational details critical to running your agency smoothly.

Financial Plan

A comprehensive financial plan is crucial. Include projections for revenue, expenses, and profitability. Provide a break-even analysis, cash flow statement, income statement, and balance sheet. This section should demonstrate the financial viability of your agency and provide a roadmap for achieving financial stability and growth.

Risk Management Plan

Identify potential risks to your business and outline strategies for mitigating them. This could include market risks, financial risks, operational risks, and compliance risks. A proactive approach to risk management is essential for long-term success.

Include any additional information that supports your business plan. This could be resumes of key team members, legal documents, detailed market research data, or technical specifications of your products.

A well-developed business plan is the cornerstone of a successful insurance agency. It provides direction, attracts investors, identifies challenges, sets benchmarks, and ensures operational efficiency. By including the essential components outlined above, you can create a comprehensive business plan that not only lays the foundation for your agency’s success but also positions it for sustainable growth in the competitive insurance market. Start planning today and pave the way for your insurance agency’s prosperous future.

Understanding Your Clients: Common Questions When Purchasing Life Insurance

As insurance agents, one of our primary responsibilities is to guide clients through the process of purchasing life insurance. Understanding the common questions and concerns

The Importance of Supplemental Insurance

In the world of insurance, providing comprehensive coverage and peace of mind to clients is paramount. While traditional health insurance plans offer a solid foundation,

How to Explain Health Insurance Plans to Your Clients

Explaining health insurance plans to your clients in a clear and effective manner is crucial for helping them make informed decisions. Here’s a step-by-step approach

Subscribe now and receive the updates in your email

Newly Launched - World's Most Advanced AI Powered Platform to Generate Stunning Presentations that are Editable in PowerPoint

Researched by Consultants from Top-Tier Management Companies

Powerpoint Templates

Icon Bundle

Kpi Dashboard

Professional

Business Plans

Swot Analysis

Gantt Chart

Business Proposal

Marketing Plan

Project Management

Business Case

Business Model

Cyber Security

Business PPT

Digital Marketing

Digital Transformation

Human Resources

Product Management

Artificial Intelligence

Company Profile

Acknowledgement PPT

PPT Presentation

Reports Brochures

One Page Pitch

Interview PPT

All Categories

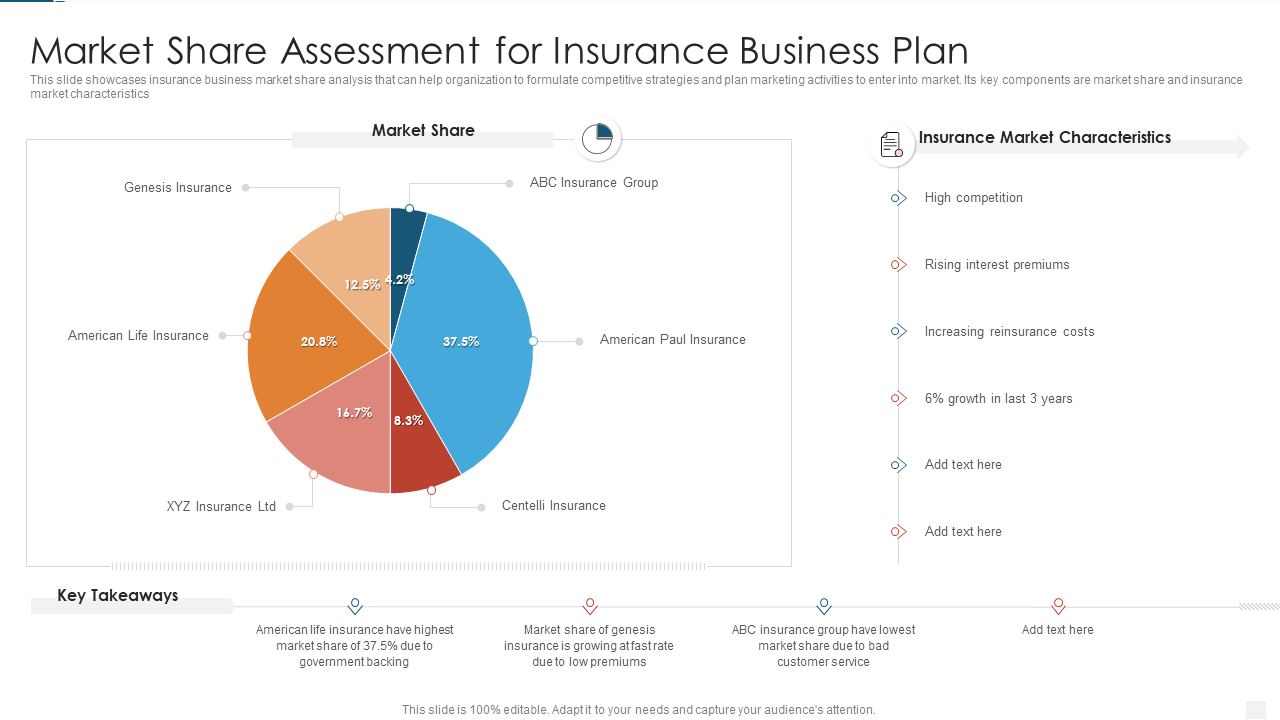

Top 5 Insurance Business Plan Templates with Examples and Samples

Success in the insurance business is not about avoiding risks, but rather understanding and managing them effectively.

- Warren Buffett

With his remarkable business acumen, Warren Buffett shares a profound quote that captures the essence of what it takes to succeed in the insurance industry. In a world filled with uncertainties, insurance serves as a safety net, providing individuals and businesses with financial protection against unforeseen events.

Insurance agency leans on insurance business plan templates as their trusted allies, helping them through the complexities of the industry. These templates offer an insurance broker/ insurance agency structured framework to clearly define goals, strategies, and financial projections.