Root out friction in every digital experience, super-charge conversion rates, and optimise digital self-service

Uncover insights from any interaction, deliver AI-powered agent coaching, and reduce cost to serve

Increase revenue and loyalty with real-time insights and recommendations delivered straight to teams on the ground

Know how your people feel and empower managers to improve employee engagement, productivity, and retention

Take action in the moments that matter most along the employee journey and drive bottom line growth

Whatever they’re are saying, wherever they’re saying it, know exactly what’s going on with your people

Get faster, richer insights with qual and quant tools that make powerful market research available to everyone

Run concept tests, pricing studies, prototyping + more with fast, powerful studies designed by UX research experts

Track your brand performance 24/7 and act quickly to respond to opportunities and challenges in your market

Meet the operating system for experience management

- Free Account

- Product Demos

- For Digital

- For Customer Care

- For Human Resources

- For Researchers

- Financial Services

- All Industries

Popular Use Cases

- Customer Experience

- Employee Experience

- Employee Exit Interviews

- Net Promoter Score

- Voice of Customer

- Customer Success Hub

- Product Documentation

- Training & Certification

- XM Institute

- Popular Resources

- Customer Stories

- Artificial Intelligence

Market Research

- Partnerships

- Marketplace

The annual gathering of the experience leaders at the world’s iconic brands building breakthrough business results.

- English/AU & NZ

- Español/Europa

- Español/América Latina

- Português Brasileiro

- REQUEST DEMO

- Experience Management

- Ultimate Guide to Market Research

- Qualitative Research Questions

Try Qualtrics for free

How to write qualitative research questions.

11 min read Here’s how to write effective qualitative research questions for your projects, and why getting it right matters so much.

What is qualitative research?

Qualitative research is a blanket term covering a wide range of research methods and theoretical framing approaches. The unifying factor in all these types of qualitative study is that they deal with data that cannot be counted. Typically this means things like people’s stories, feelings, opinions and emotions , and the meanings they ascribe to their experiences.

Qualitative study is one of two main categories of research, the other being quantitative research. Quantitative research deals with numerical data – that which can be counted and quantified, and which is mostly concerned with trends and patterns in large-scale datasets.

What are research questions?

Research questions are questions you are trying to answer with your research. To put it another way, your research question is the reason for your study, and the beginning point for your research design. There is normally only one research question per study, although if your project is very complex, you may have multiple research questions that are closely linked to one central question.

A good qualitative research question sums up your research objective. It’s a way of expressing the central question of your research, identifying your particular topic and the central issue you are examining.

Research questions are quite different from survey questions, questions used in focus groups or interview questions. A long list of questions is used in these types of study, as opposed to one central question. Additionally, interview or survey questions are asked of participants, whereas research questions are only for the researcher to maintain a clear understanding of the research design.

Research questions are used in both qualitative and quantitative research , although what makes a good research question might vary between the two.

In fact, the type of research questions you are asking can help you decide whether you need to take a quantitative or qualitative approach to your research project.

Discover the fundamentals of qualitative research

Quantitative vs. qualitative research questions

Writing research questions is very important in both qualitative and quantitative research, but the research questions that perform best in the two types of studies are quite different.

Quantitative research questions

Quantitative research questions usually relate to quantities, similarities and differences.

It might reflect the researchers’ interest in determining whether relationships between variables exist, and if so whether they are statistically significant. Or it may focus on establishing differences between things through comparison, and using statistical analysis to determine whether those differences are meaningful or due to chance.

- How much? This kind of research question is one of the simplest. It focuses on quantifying something. For example:

How many Yoruba speakers are there in the state of Maine?

- What is the connection?

This type of quantitative research question examines how one variable affects another.

For example:

How does a low level of sunlight affect the mood scores (1-10) of Antarctic explorers during winter?

- What is the difference? Quantitative research questions in this category identify two categories and measure the difference between them using numerical data.

Do white cats stay cooler than tabby cats in hot weather?

If your research question fits into one of the above categories, you’re probably going to be doing a quantitative study.

Qualitative research questions

Qualitative research questions focus on exploring phenomena, meanings and experiences.

Unlike quantitative research, qualitative research isn’t about finding causal relationships between variables. So although qualitative research questions might touch on topics that involve one variable influencing another, or looking at the difference between things, finding and quantifying those relationships isn’t the primary objective.

In fact, you as a qualitative researcher might end up studying a very similar topic to your colleague who is doing a quantitative study, but your areas of focus will be quite different. Your research methods will also be different – they might include focus groups, ethnography studies, and other kinds of qualitative study.

A few example qualitative research questions:

- What is it like being an Antarctic explorer during winter?

- What are the experiences of Yoruba speakers in the USA?

- How do white cat owners describe their pets?

Qualitative research question types

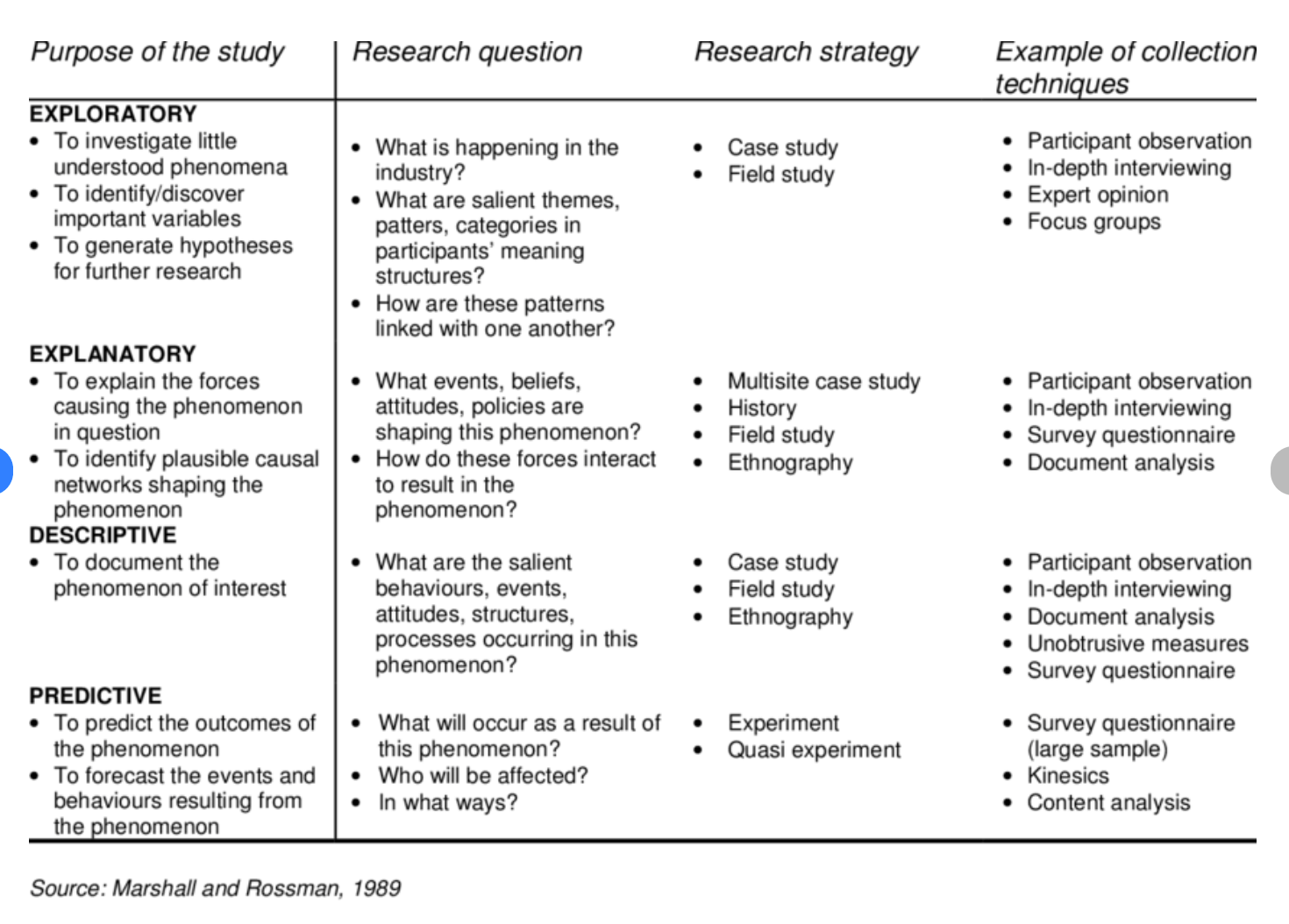

Marshall and Rossman (1989) identified 4 qualitative research question types, each with its own typical research strategy and methods.

- Exploratory questions

Exploratory questions are used when relatively little is known about the research topic. The process researchers follow when pursuing exploratory questions might involve interviewing participants, holding focus groups, or diving deep with a case study.

- Explanatory questions

With explanatory questions, the research topic is approached with a view to understanding the causes that lie behind phenomena. However, unlike a quantitative project, the focus of explanatory questions is on qualitative analysis of multiple interconnected factors that have influenced a particular group or area, rather than a provable causal link between dependent and independent variables.

- Descriptive questions

As the name suggests, descriptive questions aim to document and record what is happening. In answering descriptive questions , researchers might interact directly with participants with surveys or interviews, as well as using observational studies and ethnography studies that collect data on how participants interact with their wider environment.

- Predictive questions

Predictive questions start from the phenomena of interest and investigate what ramifications it might have in the future. Answering predictive questions may involve looking back as well as forward, with content analysis, questionnaires and studies of non-verbal communication (kinesics).

Why are good qualitative research questions important?

We know research questions are very important. But what makes them so essential? (And is that question a qualitative or quantitative one?)

Getting your qualitative research questions right has a number of benefits.

- It defines your qualitative research project Qualitative research questions definitively nail down the research population, the thing you’re examining, and what the nature of your answer will be.This means you can explain your research project to other people both inside and outside your business or organization. That could be critical when it comes to securing funding for your project, recruiting participants and members of your research team, and ultimately for publishing your results. It can also help you assess right the ethical considerations for your population of study.

- It maintains focus Good qualitative research questions help researchers to stick to the area of focus as they carry out their research. Keeping the research question in mind will help them steer away from tangents during their research or while they are carrying out qualitative research interviews. This holds true whatever the qualitative methods are, whether it’s a focus group, survey, thematic analysis or other type of inquiry.That doesn’t mean the research project can’t morph and change during its execution – sometimes this is acceptable and even welcome – but having a research question helps demarcate the starting point for the research. It can be referred back to if the scope and focus of the project does change.

- It helps make sure your outcomes are achievable

Because qualitative research questions help determine the kind of results you’re going to get, it helps make sure those results are achievable. By formulating good qualitative research questions in advance, you can make sure the things you want to know and the way you’re going to investigate them are grounded in practical reality. Otherwise, you may be at risk of taking on a research project that can’t be satisfactorily completed.

Developing good qualitative research questions

All researchers use research questions to define their parameters, keep their study on track and maintain focus on the research topic. This is especially important with qualitative questions, where there may be exploratory or inductive methods in use that introduce researchers to new and interesting areas of inquiry. Here are some tips for writing good qualitative research questions.

1. Keep it specific

Broader research questions are difficult to act on. They may also be open to interpretation, or leave some parameters undefined.

Strong example: How do Baby Boomers in the USA feel about their gender identity?

Weak example: Do people feel different about gender now?

2. Be original

Look for research questions that haven’t been widely addressed by others already.

Strong example: What are the effects of video calling on women’s experiences of work?

Weak example: Are women given less respect than men at work?

3. Make it research-worthy

Don’t ask a question that can be answered with a ‘yes’ or ‘no’, or with a quick Google search.

Strong example: What do people like and dislike about living in a highly multi-lingual country?

Weak example: What languages are spoken in India?

4. Focus your question

Don’t roll multiple topics or questions into one. Qualitative data may involve multiple topics, but your qualitative questions should be focused.

Strong example: What is the experience of disabled children and their families when using social services?

Weak example: How can we improve social services for children affected by poverty and disability?

4. Focus on your own discipline, not someone else’s

Avoid asking questions that are for the politicians, police or others to address.

Strong example: What does it feel like to be the victim of a hate crime?

Weak example: How can hate crimes be prevented?

5. Ask something researchable

Big questions, questions about hypothetical events or questions that would require vastly more resources than you have access to are not useful starting points for qualitative studies. Qualitative words or subjective ideas that lack definition are also not helpful.

Strong example: How do perceptions of physical beauty vary between today’s youth and their parents’ generation?

Weak example: Which country has the most beautiful people in it?

Related resources

Ethnographic research 11 min read, business research methods 12 min read, qualitative research design 12 min read, business research 10 min read, qualitative research interviews 11 min read, video in qualitative research 10 min read, descriptive research 8 min read, request demo.

Ready to learn more about Qualtrics?

Sciencing_Icons_Science SCIENCE

Sciencing_icons_biology biology, sciencing_icons_cells cells, sciencing_icons_molecular molecular, sciencing_icons_microorganisms microorganisms, sciencing_icons_genetics genetics, sciencing_icons_human body human body, sciencing_icons_ecology ecology, sciencing_icons_chemistry chemistry, sciencing_icons_atomic & molecular structure atomic & molecular structure, sciencing_icons_bonds bonds, sciencing_icons_reactions reactions, sciencing_icons_stoichiometry stoichiometry, sciencing_icons_solutions solutions, sciencing_icons_acids & bases acids & bases, sciencing_icons_thermodynamics thermodynamics, sciencing_icons_organic chemistry organic chemistry, sciencing_icons_physics physics, sciencing_icons_fundamentals-physics fundamentals, sciencing_icons_electronics electronics, sciencing_icons_waves waves, sciencing_icons_energy energy, sciencing_icons_fluid fluid, sciencing_icons_astronomy astronomy, sciencing_icons_geology geology, sciencing_icons_fundamentals-geology fundamentals, sciencing_icons_minerals & rocks minerals & rocks, sciencing_icons_earth scructure earth structure, sciencing_icons_fossils fossils, sciencing_icons_natural disasters natural disasters, sciencing_icons_nature nature, sciencing_icons_ecosystems ecosystems, sciencing_icons_environment environment, sciencing_icons_insects insects, sciencing_icons_plants & mushrooms plants & mushrooms, sciencing_icons_animals animals, sciencing_icons_math math, sciencing_icons_arithmetic arithmetic, sciencing_icons_addition & subtraction addition & subtraction, sciencing_icons_multiplication & division multiplication & division, sciencing_icons_decimals decimals, sciencing_icons_fractions fractions, sciencing_icons_conversions conversions, sciencing_icons_algebra algebra, sciencing_icons_working with units working with units, sciencing_icons_equations & expressions equations & expressions, sciencing_icons_ratios & proportions ratios & proportions, sciencing_icons_inequalities inequalities, sciencing_icons_exponents & logarithms exponents & logarithms, sciencing_icons_factorization factorization, sciencing_icons_functions functions, sciencing_icons_linear equations linear equations, sciencing_icons_graphs graphs, sciencing_icons_quadratics quadratics, sciencing_icons_polynomials polynomials, sciencing_icons_geometry geometry, sciencing_icons_fundamentals-geometry fundamentals, sciencing_icons_cartesian cartesian, sciencing_icons_circles circles, sciencing_icons_solids solids, sciencing_icons_trigonometry trigonometry, sciencing_icons_probability-statistics probability & statistics, sciencing_icons_mean-median-mode mean/median/mode, sciencing_icons_independent-dependent variables independent/dependent variables, sciencing_icons_deviation deviation, sciencing_icons_correlation correlation, sciencing_icons_sampling sampling, sciencing_icons_distributions distributions, sciencing_icons_probability probability, sciencing_icons_calculus calculus, sciencing_icons_differentiation-integration differentiation/integration, sciencing_icons_application application, sciencing_icons_projects projects, sciencing_icons_news news.

- Share Tweet Email Print

- Home ⋅

- Science Fair Project Ideas for Kids, Middle & High School Students ⋅

- Probability & Statistics

How to Do a Quantitative Research Questionnaire

How to Figure Survey Percentages

Research questionnaires are one of the primary methods for conducting quantitative research. They are inexpensive, and you can give a questionnaire in person, on the phone, by email, or mail. Quantitative surveys ask questions with specific, usually numerical answers so that you can analyze the data quickly. They are useful for gathering large amounts of data, but they are not designed to gather descriptive information.

Identify the objective of your research. This will guide you through the questionnaire writing process. Your objective should be as clear as possible, and highlight specific information you want to discover. For example, an objective such as "to identify how satisfied people are in their relationships," is not a clear objective because too much is left open for interpretation. A better objective would be, "to identify the level of satisfaction that couples who have been married for at least 1-5 years have in the communication aspect of their relationship."

Identify your sampling group. Your objective will determine what group(s) you will want to sample. In the example objective, you would want to focus your attention on married couples.

Determine the number of people you want to answer your questionnaire; this is your sample size. This will depend on the amount of time and money you can spend on research, but you should pick a target sample size.

Develop a numerical scale for your quantitative research questions. You will need to explain the scale to your participants. Popular research scales go from 1 to 5, or 1 to 10. You will need to explain your scale to your participants. For example, if you used the 1 to 10 scale to measure satisfaction, you would explain that answering with "1" means "Not Satisfied," while answering "10," would mean "very satisfied."

Write quantitative research questions that fit the scale you created. For example, you could ask, "On a scale of 1 to 10, how satisfied are you with the amount of verbal communication between you and your spouse?"

Review your questionnaire. Check that your questions are clear, and achieve the overall objective of your research. You can also ask friends, peers, and coworkers to preview your questionnaire before you officially give it out to give you an idea of its effectiveness.

There are many quantitative questions that don't require you to develop your own scale. For example, if you ask, "How tall are you," you're looking for a specific value.

Keep your questionnaire as short as possible. The easier something is to finish, the more likely people are to finish it.

Related Articles

How to determine sample size, how to calculate a sample size population, how to chi-square test, how to eliminate bias in qualitative research, how to interpret likert surveys, what are the advantages & disadvantages of using ordinal..., how to calculate p-hat, how to interpret cogat scores, how to report a sample size, how to figure out your composite score on your teas..., how to calculate my grades for college classes, what is the purpose of factor analysis, how to determine whether to use a one-sample, paired,..., similarities of univariate & multivariate statistical..., the advantages of a large sample size, how to determine your practice clep score, quantitative vs. qualitative data and laboratory testing, how do i create graph results for questionnaires, what is the meaning of sample size.

- Chanimal: Quantitative Research Considerations

Find Your Next Great Science Fair Project! GO

- (855) 776-7763

Training Maker

All Products

Qualaroo Insights

ProProfs.com

- Sign Up Free

FREE. All Features. FOREVER!

Try our Forever FREE account with all premium features!

How to Write Quantitative Research Questions: Types With Examples

“Research is creating new knowledge.” – Neil Armstrong

For research to be effective, it becomes crucial to properly formulate the quantitative research questions in a correct way. Otherwise, you will not get the answers you were looking for.

Has it ever happened that you conducted a quantitative research study and found out the results you were expecting are quite different from the actual results?

This could happen due to many factors like the unpredictable nature of respondents, errors in calculation, research bias, etc. However, your quantitative research usually does not provide reliable results when questions are not written correctly.

We get it! Structuring the quantitative research questions can be a difficult task.

Hence, in this blog, we will share a few bits of advice on how to write good quantitative research questions. We will also look at different types of quantitative research questions along with their examples.

Let’s start:

How to Write Quantitative Research Questions?

When you want to obtain actionable insight into the trends and patterns of the research topic to make sense of it, quantitative research questions are your best bet.

Being objective in nature, these questions provide you with detailed information about the research topic and help in collecting quantifiable data that can be easily analyzed. This data can be generalized to the entire population and help make data-driven and sound decisions.

Respondents find it easier to answer quantitative survey questions than qualitative questions. At the same time, researchers can also analyze them quickly using various statistical models.

However, when it comes to writing the quantitative research questions, one can get a little overwhelmed as the entire study depends on the types of questions used.

There is no “one good way” to prepare these questions. However, to design well-structured quantitative research questions, you can follow the 4-steps approach given below:

1. Select the Type of Quantitative Question

The first step is to determine which type of quantitative question you want to add to your study. There are three types of quantitative questions:

- Descriptive

- Comparative

- Relationship-based

This will help you choose the correct words and phrases while constructing the question. At the same time, it will also assist readers in understanding the question correctly.

2. Identify the Type of Variable

The second step involves identifying the type of variable you are trying to measure, manipulate, or control. Basically, there are two types of variables:

- Independent variable (a variable that is being manipulated)

- Dependent variable (outcome variable)

If you plan to use descriptive research questions, you have to deal with a number of dependent variables. However, where you plan to create comparative or relationship research questions, you will deal with both dependent and independent variables.

3. Select the Suitable Structure

The next step is determining the structure of the research question. It involves:

- Identifying the components of the question. It involves the type of dependent or independent variable and a group of interest (the group from which the researcher tries to conclude the population).

- The number of different components used. Like, as to how many variables and groups are being examined.

- Order in which these are presented. For example, the independent variable before the dependent variable or vice versa.

4. Draft the Complete Research Question

The last step involves identifying the problem or issue that you are trying to address in the form of complete quantitative survey questions . Also, make sure to build an exhaustive list of response options to make sure your respondents select the correct response. If you miss adding important answer options, then the ones chosen by respondents may not be entirely true.

Want to create a quantitative research survey hassle-free? Explore our library of 1,000,000+ readymade questions.

Types of Quantitative Research Questions With Examples

Quantitative research questions are generally used to answer the “who” and “what” of the research topic. For quantitative research to be effective, it is crucial that the respondents are able to answer your questions concisely and precisely. With that in mind, let’s look in greater detail at the three types of formats you can use when preparing quantitative market research questions.

1. Descriptive

Descriptive research questions are used to collect participants’ opinions about the variable that you want to quantify. It is the most effortless way to measure the particular variable (single or multiple variables) you are interested in on a large scale. Usually, descriptive research questions begin with “ how much,” “how often,” “what percentage,” “what proportion,” etc.

Examples of descriptive research questions include:

| Questions | Variable | Group |

|---|---|---|

| 1. How much rice do Indians consume per month? | Rice intake monthly | Indians |

| 2. How often do you use mobile apps for shopping purposes? | Mobile app used | a. Smartphone users |

| b. Shopping enthusiasts | ||

| 3. What is the preferred choice of cuisine for Americans? | Cuisine | Americans |

| 4. How often do students aged between 10-15 years use Instagram monthly? | Monthly use of Instagram | Students aged between 10-15 |

| 5. How often do middle-class adults go on vacation yearly? | Vacation | Middle-class adults |

2. Comparative

Comparative research questions help you identify the difference between two or more groups based on one or more variables. In general, a comparative research question is used to quantify one variable; however, you can use two or more variables depending on your market research objectives.

Comparative research questions examples include:

| Questions | Variable | Groups |

|---|---|---|

| 6. What is the difference in duration spent on social media between people aged 15- 20 and 20-25? | Time spent on social media | Group 1: People within the age group 15-20 |

| Group 2: People within the age group 20-25 | ||

| 7. What is the difference in the daily protein intake between men and women in America? | Daily protein intake | Group 1: Men based in America |

| Group 2: Women based in America | ||

| 8. What is the difference between watching web series weekly between a child and an adult? | Watching web series weekly | Group 1: Child |

| Group 2: Adult | ||

| 9. What is the difference in attitude towards sports between Millennial adults and older people born before 1981? | Attitude towards sports | Group 1: Millennial adults |

| Group 2: Older people born before 1981 | ||

| 10. What is the difference in the usage of Facebook between male and female American university students? | Usage of Facebook | Group 1: Male American university students |

| Group 2: Female American university students |

3. Relationship-based

Relationship research questions are used to identify trends, causal relationships, or associations between two or more variables. It is not vital to distinguish between causal relationships, trends, or associations while using these types of questions. These questions begin with “What is the relationship” between independent and dependent variables, amongst or between two or more groups.

Relationship-based quantitative questions examples include:

| Questions | Independent Variable | Dependent Variable | Group |

|---|---|---|---|

| 11. What is the relationship between gender and perspective towards comedy movies amongst Americans? | Perspective | Gender | Americans |

| 12. What is the relationship between job motivation and pay level amongst US residents? | Job motivation | Pay level | US residents |

| 13. What is the relationship between salary and shopping habits among the women of Australia? | Salary | Shopping habits | Australia |

| 14. What is the relationship between gender and fast food preference in young adults? | Gender | Fast food | Young Adults |

| 15. What is the relationship between a college degree and a job position in corporates? | College degree | Job Position | Corporates |

Ready to Write Your Quantitative Research Questions?

So, there you have it. It was all about quantitative research question types and their examples. By now, you must have figured out a way to write quantitative research questions for your survey to collect actionable customer feedback.

Now, the only thing you need is a good survey maker tool , like ProProfs Survey Maker , that will glide your process of designing and conducting your surveys . You also get access to various survey question types, both qualitative and quantitative, that you can add to any kind of survey along with professionally-designed survey templates .

About the author

Emma David is a seasoned market research professional with 8+ years of experience. Having kick-started her journey in research, she has developed rich expertise in employee engagement, survey creation and administration, and data management. Emma believes in the power of data to shape business performance positively. She continues to help brands and businesses make strategic decisions and improve their market standing through her understanding of research methodologies.

Popular Posts in This Category

75+ Human Resources Survey Questions To Ask Your Employees

Mastering Survey Success: Crafting Effective Introductions

Client Onboarding Questionnaire: Best Practices & 20+ Questions

20 Effective Strategies to Increase Customer Retention in 2024

90+ Market Research Questions to Ask Your Customers

Surveys vs Questionnaires: Compare the Differences

- Cookies & Privacy

- GETTING STARTED

- Introduction

- FUNDAMENTALS

- Acknowledgements

- Research questions & hypotheses

- Concepts, constructs & variables

- Research limitations

- Getting started

- Sampling Strategy

- Research Quality

- Research Ethics

- Data Analysis

How to structure quantitative research questions

There is no "one best way" to structure a quantitative research question. However, to create a well-structured quantitative research question, we recommend an approach that is based on four steps : (1) Choosing the type of quantitative research question you are trying to create (i.e., descriptive, comparative or relationship-based); (2) Identifying the different types of variables you are trying to measure, manipulate and/or control, as well as any groups you may be interested in; (3) Selecting the appropriate structure for the chosen type of quantitative research question, based on the variables and/or groups involved; and (4) Writing out the problem or issues you are trying to address in the form of a complete research question. In this article, we discuss each of these four steps , as well as providing examples for the three types of quantitative research question you may want to create: descriptive , comparative and relationship-based research questions .

- STEP ONE: Choose the type of quantitative research question (i.e., descriptive, comparative or relationship) you are trying to create

- STEP TWO: Identify the different types of variable you are trying to measure, manipulate and/or control, as well as any groups you may be interested in

- STEP THREE: Select the appropriate structure for the chosen type of quantitative research question, based on the variables and/or groups involved

- STEP FOUR: Write out the problem or issues you are trying to address in the form of a complete research question

STEP ONE Choose the type of quantitative research question (i.e., descriptive, comparative or relationship) you are trying to create

The type of quantitative research question that you use in your dissertation (i.e., descriptive , comparative and/or relationship-based ) needs to be reflected in the way that you write out the research question; that is, the word choice and phrasing that you use when constructing a research question tells the reader whether it is a descriptive, comparative or relationship-based research question. Therefore, in order to know how to structure your quantitative research question, you need to start by selecting the type of quantitative research question you are trying to create: descriptive, comparative and/or relationship-based.

STEP TWO Identify the different types of variable you are trying to measure, manipulate and/or control, as well as any groups you may be interested in

Whether you are trying to create a descriptive, comparative or relationship-based research question, you will need to identify the different types of variable that you are trying to measure , manipulate and/or control . If you are unfamiliar with the different types of variable that may be part of your study, the article, Types of variable , should get you up to speed. It explains the two main types of variables: categorical variables (i.e., nominal , dichotomous and ordinal variables) and continuous variables (i.e., interval and ratio variables). It also explains the difference between independent and dependent variables , which you need to understand to create quantitative research questions.

To provide a brief explanation; a variable is not only something that you measure , but also something that you can manipulate and control for. In most undergraduate and master's level dissertations, you are only likely to measure and manipulate variables. You are unlikely to carry out research that requires you to control for variables, although some supervisors will expect this additional level of complexity. If you plan to only create descriptive research questions , you may simply have a number of dependent variables that you need to measure. However, where you plan to create comparative and/or relationship-based research questions , you will deal with both dependent and independent variables . An independent variable (sometimes called an experimental or predictor variable ) is a variable that is being manipulated in an experiment in order to observe the effect this has on a dependent variable (sometimes called an outcome variable ). For example, if we were interested in investigating the relationship between gender and attitudes towards music piracy amongst adolescents , the independent variable would be gender and the dependent variable attitudes towards music piracy . This example also highlights the need to identify the group(s) you are interested in. In this example, the group of interest are adolescents .

Once you identifying the different types of variable you are trying to measure, manipulate and/or control, as well as any groups you may be interested in, it is possible to start thinking about the way that the three types of quantitative research question can be structured . This is discussed next.

STEP THREE Select the appropriate structure for the chosen type of quantitative research question, based on the variables and/or groups involved

The structure of the three types of quantitative research question differs, reflecting the goals of the question, the types of variables, and the number of variables and groups involved. By structure , we mean the components of a research question (i.e., the types of variables, groups of interest), the number of these different components (i.e., how many variables and groups are being investigated), and the order that these should be presented (e.g., independent variables before dependent variables). The appropriate structure for each of these quantitative research questions is set out below:

Structure of descriptive research questions

- Structure of comparative research questions

- Structure of relationship-based research questions

There are six steps required to construct a descriptive research question: (1) choose your starting phrase; (2) identify and name the dependent variable; (3) identify the group(s) you are interested in; (4) decide whether dependent variable or group(s) should be included first, last or in two parts; (5) include any words that provide greater context to your question; and (6) write out the descriptive research question. Each of these steps is discussed in turn:

Choose your starting phrase

Identify and name the dependent variable

Identify the group(s) you are interested in

Decide whether the dependent variable or group(s) should be included first, last or in two parts

Include any words that provide greater context to your question

Write out the descriptive research question

FIRST Choose your starting phrase

You can start descriptive research questions with any of the following phrases:

How many? How often? How frequently? How much? What percentage? What proportion? To what extent? What is? What are?

Some of these starting phrases are highlighted in blue text in the examples below:

How many calories do American men and women consume per day?

How often do British university students use Facebook each week?

What are the most important factors that influence the career choices of Australian university students?

What proportion of British male and female university students use the top 5 social networks?

What percentage of American men and women exceed their daily calorific allowance?

SECOND Identify and name the dependent variable

All descriptive research questions have a dependent variable. You need to identify what this is. However, how the dependent variable is written out in a research question and what you call it are often two different things. In the examples below, we have illustrated the name of the dependent variable and highlighted how it would be written out in the blue text .

| Name of the dependent variable | How the dependent variable is written out |

| Daily calorific intake | How many calories do American men and women consume per day? |

| Daily calorific intake | What percentage of American men and women exceed their daily calorific allowance? |

| Weekly Facebook usage | How often do British university students use Facebook each week? |

| Factors influencing career choices | What are the most important factors that influence the career choices of Australian university students? |

| Use of the top 5 social networks | What proportion of British male and female university students use the top 5 social networks? |

The first two examples highlight that while the name of the dependent variable is the same, namely daily calorific intake , the way that this dependent variable is written out differs in each case.

THIRD Identify the group(s) you are interested in

All descriptive research questions have at least one group , but can have multiple groups . You need to identify this group(s). In the examples below, we have identified the group(s) in the green text .

What are the most important factors that influence the career choices of Australian university students ?

The examples illustrate the difference between the use of a single group (e.g., British university students ) and multiple groups (e.g., American men and women ).

FOURTH Decide whether the dependent variable or group(s) should be included first, last or in two parts

Sometimes it makes more sense for the dependent variable to appear before the group(s) you are interested in, but sometimes it is the opposite way around. The following examples illustrate this, with the group(s) in green text and the dependent variable in blue text :

Group 1st; dependent variable 2nd:

How often do British university students use Facebook each week ?

Dependent variable 1st; group 2nd:

Sometimes, the dependent variable needs to be broken into two parts around the group(s) you are interested in so that the research question flows. Again, the group(s) are in green text and the dependent variable is in blue text :

How many calories do American men and women consume per day ?

Of course, you could choose to restructure the question above so that you do not have to split the dependent variable into two parts. For example:

How many calories are consumed per day by American men and women ?

When deciding whether the dependent variable or group(s) should be included first or last, and whether the dependent variable should be broken into two parts, the main thing you need to think about is flow : Does the question flow? Is it easy to read?

FIFTH Include any words that provide greater context to your question

Sometimes the name of the dependent variable provides all the explanation we need to know what we are trying to measure. Take the following examples:

In the first example, the dependent variable is daily calorific intake (i.e., calories consumed per day). Clearly, this descriptive research question is asking us to measure the number of calories American men and women consume per day. In the second example, the dependent variable is Facebook usage per week. Again, the name of this dependent variable makes it easy for us to understand that we are trying to measure the often (i.e., how frequently; e.g., 16 times per week) British university students use Facebook.

However, sometimes a descriptive research question is not simply interested in measuring the dependent variable in its entirety, but a particular component of the dependent variable. Take the following examples in red text :

In the first example, the research question is not simply interested in the daily calorific intake of American men and women, but what percentage of these American men and women exceeded their daily calorific allowance. So the dependent variable is still daily calorific intake, but the research question aims to understand a particular component of that dependent variable (i.e., the percentage of American men and women exceeding the recommend daily calorific allowance). In the second example, the research question is not only interested in what the factors influencing career choices are, but which of these factors are the most important.

Therefore, when you think about constructing your descriptive research question, make sure you have included any words that provide greater context to your question.

SIXTH Write out the descriptive research question

Once you have these details ? (1) the starting phrase, (2) the name of the dependent variable, (3) the name of the group(s) you are interested in, and (4) any potential joining words ? you can write out the descriptive research question in full. The example descriptive research questions discussed above are written out in full below:

In the section that follows, the structure of comparative research questions is discussed.

- A/B Monadic Test

- A/B Pre-Roll Test

- Key Driver Analysis

- Multiple Implicit

- Penalty Reward

- Price Sensitivity

- Segmentation

- Single Implicit

- Category Exploration

- Competitive Landscape

- Consumer Segmentation

- Innovation & Renovation

- Product Portfolio

- Marketing Creatives

- Advertising

- Shelf Optimization

- Performance Monitoring

- Better Brand Health Tracking

- Ad Tracking

- Trend Tracking

- Satisfaction Tracking

- AI Insights

- Case Studies

quantilope is the Consumer Intelligence Platform for all end-to-end research needs

What Are Quantitative Survey Questions? Types and Examples

Table of contents:

- Types of quantitative survey questions - with examples

- Quantitative question formats

- How to write quantitative survey questions

- Examples of quantitative survey questions

Leveraging quantilope for your quantitative survey

In a quantitative research study brands will gather numeric data for most of their questions through formats like numerical scale questions or ranking questions. However, brands can also include some non-quantitative questions throughout their quantitative study - like open-ended questions, where respondents will type in their own feedback to a question prompt. Even so, open-ended answers can be numerically coded to sift through feedback easily (e.g. anyone who writes in 'Pepsi' in a soda study would be assigned the number '1', to look at Pepsi feedback as a whole). One of the biggest benefits of using a quantitative research approach is that insights around a research topic can undergo statistical analysis; the same can’t be said for qualitative data like focus group feedback or interviews. Another major difference between quantitative and qualitative research methods is that quantitative surveys require respondents to choose from a limited number of choices in a close-ended question - generating clear, actionable takeaways. However, these distinct quantitative takeaways often pair well with freeform qualitative responses - making quant and qual a great team to use together. The rest of this article focuses on quantitative research, taking a closer look at quantitative survey question types and question formats/layouts.

Back to table of contents

Types of dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139745">quantitative survey questions - with examples

Quantitative questions come in many forms, each with different benefits depending on dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139784">your dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139740">market research objectives. Below we’ll explore some of these dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139745">quantitative dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139785">survey question dropdown#toggle" data-dropdown-menu-id-param="menu_term_281139785" data-dropdown-placement-param="top" data-term-id="281139785"> types, which are commonly used together in a single survey to keep things interesting for dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139737">respondents . The style of questioning used during dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139739">quantitative dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139750">data dropdown#toggle" data-dropdown-menu-id-param="menu_term_281139750" data-dropdown-placement-param="top" data-term-id="281139750"> collection is important, as a good mix of the right types of questions will deliver rich data, limit dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139737">respondent fatigue, and optimize the dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139757">response rate . dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139742">Questionnaires should be enjoyable - and varying the dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139755">types of dropdown#toggle" data-dropdown-menu-id-param="menu_term_281139755" data-dropdown-placement-param="top" data-term-id="281139755">quantitative research dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139755"> questions used throughout your survey will help achieve that.

Descriptive survey questions

dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139763">Descriptive research questions (also known as usage and attitude, or, U&A questions) seek a general indication or prediction about how a dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139773">group of people behaves or will behave, how that group is characterized, or how a group thinks.

For example, a business might want to know what portion of adult men shave, and how often they do so. To find this out, they will survey men (the dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139743">target audience ) and ask descriptive questions about their frequency of shaving (e.g. daily, a few times a week, once per week, and so on.) Each of these frequencies get assigned a numerical ‘code’ so that it’s simple to chart and analyze the data later on; daily might be assigned ‘5’, a few times a week might be assigned ‘4’, and so on. That way, brands can create charts using the ‘top two’ and ‘bottom two’ values in a descriptive question to view these metrics side by side.

Another business might want to know how important local transit issues are to residents, so dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139745">quantitative survey questions will allow dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139737">respondents to indicate the degrees of opinion attached to various transit issues. Perhaps the transit business running this survey would use a sliding numeric scale to see how important a particular issue is.

Comparative survey questions

dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139782">Comparative research questions are concerned with comparing individuals or groups of people based on one or more variables. These questions might be posed when a business wants to find out which segment of its dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139743">target audience might be more profitable, or which types of products might appeal to different sets of consumers.

For example, a business might want to know how the popularity of its chocolate bars is spread out across its entire customer base (i.e. do women prefer a certain flavor? Are children drawn to candy bars by certain packaging attributes? etc.). Questions in this case will be designed to profile and ‘compare’ segments of the market.

Other businesses might be looking to compare coffee consumption among older and younger consumers (i.e. dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139741">demographic segments), the difference in smartphone usage between younger men and women, or how women from different regions differ in their approach to skincare.

Relationship-based survey questions

As the name suggests, relationship-based survey questions are concerned with the relationship between two or more variables within one or more dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139741">demographic groups. This might be a dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139759">causal link between one thing and the other - for example, the consumption of caffeine and dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139737">respondents ’ reported energy levels throughout the day. In this case, a coffee or energy drink brand might be interested in how energy levels differ between those who drink their caffeinated line of beverages and those who drink decaf/non-caffeinated beverages.

Alternatively, it might be a case of two or more factors co-existing, without there necessarily being a dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139759">causal link - for example, a particular type of air freshener being more popular amongst a certain dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139741">demographic (maybe one that is controlled wirelessly via Bluetooth is more popular among younger homeowners than one that’s plugged into the wall with no controls). Knowing that millennials favor air fresheners which have options for swapping out scents and setting up schedules would be valuable information for new product development.

Advanced method survey questions

Aside from descriptive, comparative, and relationship-based survey questions, brands can opt to include advanced methodologies in their quantitative dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139742">questionnaire for richer depth. Though advanced methods are more complex in terms of the insights output, quantilope’s Consumer Intelligence Platform automates the setup and analysis of these methods so that researchers of any background or skillset can leverage them with ease.

With quantilope’s pre-programmed suite of 12 advanced methodologies , including MaxDiff , TURF , Implicit , and more, users can drag and drop any of these into a dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139742">questionnaire and customize for their own dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139740">market research objectives.

For example, consider a beverage company that’s looking to expand its flavor profiles. This brand would benefit from a MaxDiff which forces dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139737">respondents to make tradeoff decisions between a set of flavors. A dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139737">respondent might say that coconut is their most-preferred flavor, and lime their least (when in a consideration set with strawberry), yet later on in the MaxDiff that same dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139737">respondent may say Strawberry is their most-preferred flavor (over black cherry and kiwi). While this is just one example of an advanced method, instantly you can see how much richer and more actionable these quantitative metrics become compared to a standard usage and attitude question .

Advanced methods can be used alongside descriptive, comparison, or relationship questions to add a new layer of context wherever a business sees fit. Back to table of contents

Quantitative question formats

So we’ve covered the kinds of dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139736">quantitative research questions you might want to answer using dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139740">market research , but how do these translate into the actual format of questions that you might include on your dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139742">questionnaire ?

Thinking ahead to your reporting process during your dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139742">questionnaire setup is actually quite important, as the available chart types differ among the types of questions asked; some question data is compatible with bar chart displays, others pie charts, others in trended line graphs, etc. Also consider how well the questions you’re asking will translate onto different devices that your dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139737">respondents might be using to complete the survey (mobile, PC, or tablet).

Single Select questions

Single select questions are the simplest form of quantitative questioning, as dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139737">respondents are asked to choose just one answer from a list of items, which tend to be ‘either/or’, ‘yes/no’, or ‘true/false’ questions. These questions are useful when you need to get a clear answer without any qualifying nuances.

Multi-select questions

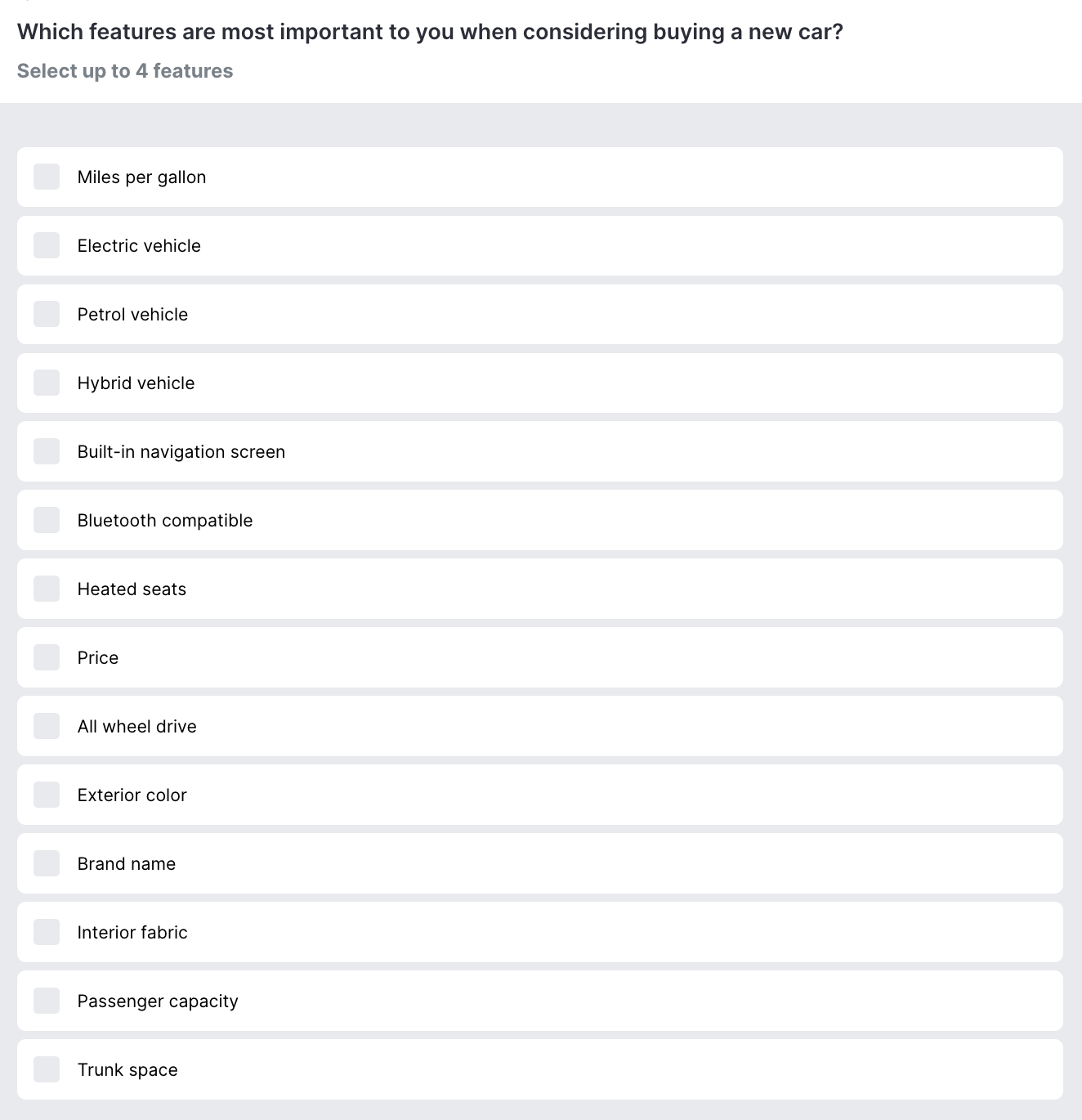

Multi-select questions (aka, dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139767">multiple choice ) offer more flexibility for responses, allowing for a number of responses on a single question. dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139737">Respondents can be asked to ‘check all that apply’ or a cap can be applied (e.g. ‘select up to 3 choices’).

For example:

Aside from asking text-based questions like the above examples, a brand could also use a single or multi-select question to ask respondents to select the image they prefer more (like different iterations of a logo design, packaging options, branding colors, etc.).

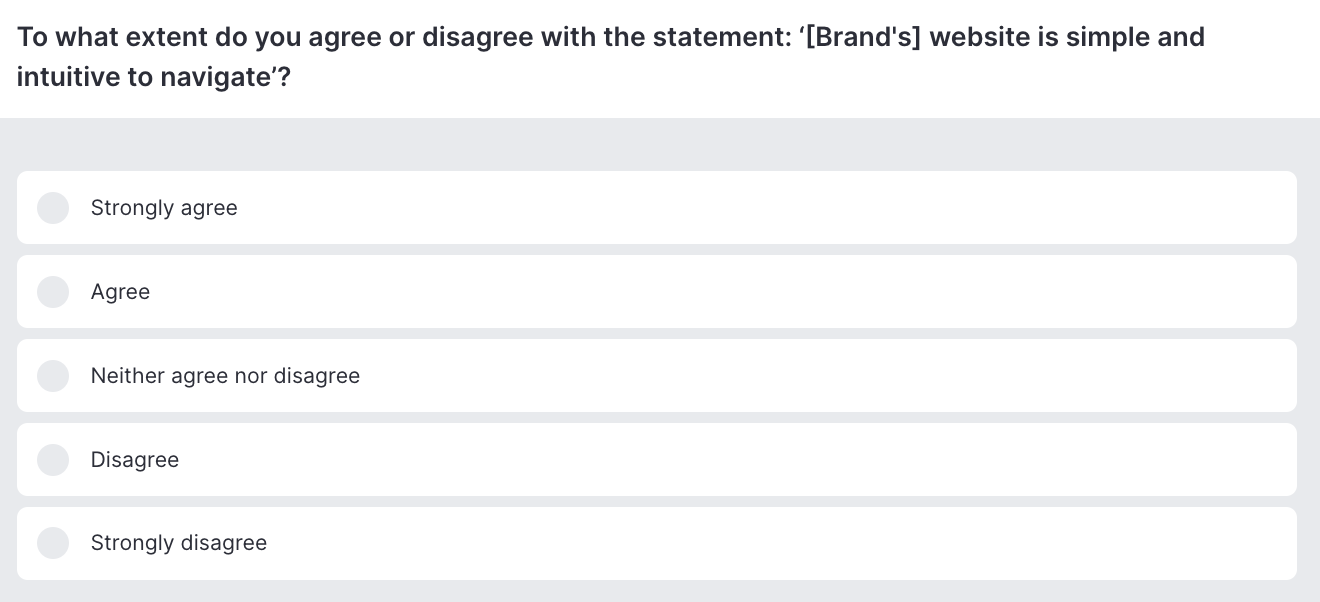

dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139749">Likert dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139766">scale dropdown#toggle" data-dropdown-menu-id-param="menu_term_281139766" data-dropdown-placement-param="top" data-term-id="281139766"> questions

A dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139749">Likert scale is widely used as a convenient and easy-to-interpret rating method. dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139737">Respondents find it easy to indicate their degree of feelings by selecting the response they most identify with.

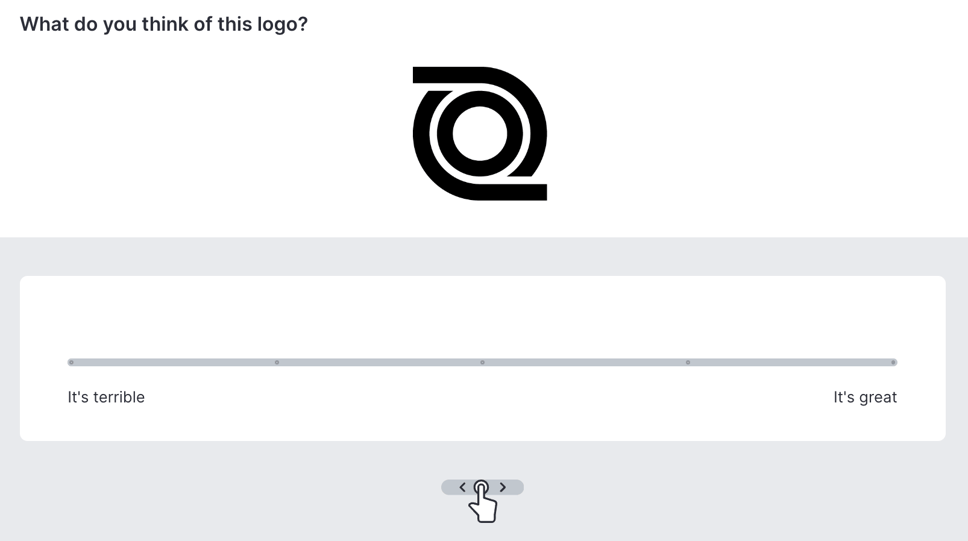

Slider scales

Slider scales are another good interactive way of formatting questions. They allow dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139737">respondents to customize their level of feeling about a question, with a bit more variance and nuance allowed than a numeric scale:

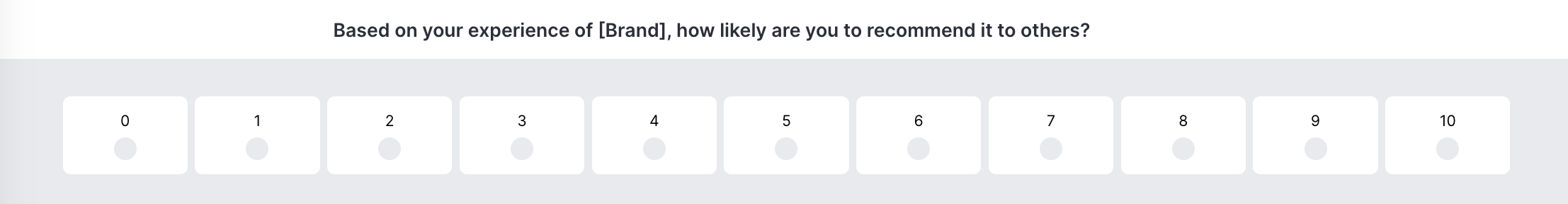

One particularly common use of a slider scale in a dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139740">market dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139770">research dropdown#toggle" data-dropdown-menu-id-param="menu_term_281139770" data-dropdown-placement-param="top" data-term-id="281139770"> study is known as a NPS (Net Promoter Score) - a way to measure dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139775">customer experience and loyalty . A 0-10 scale is used to ask customers how likely they are to recommend a brand’s product or services to others. The NPS score is calculated by subtracting the percentage of ‘detractors’ (those who respond with a 0-6) from the percentage of promoters (those who respond with a 9-10). dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139737">Respondents who select 7-8 are known as ‘passives’.

For example:

Drag and drop questions

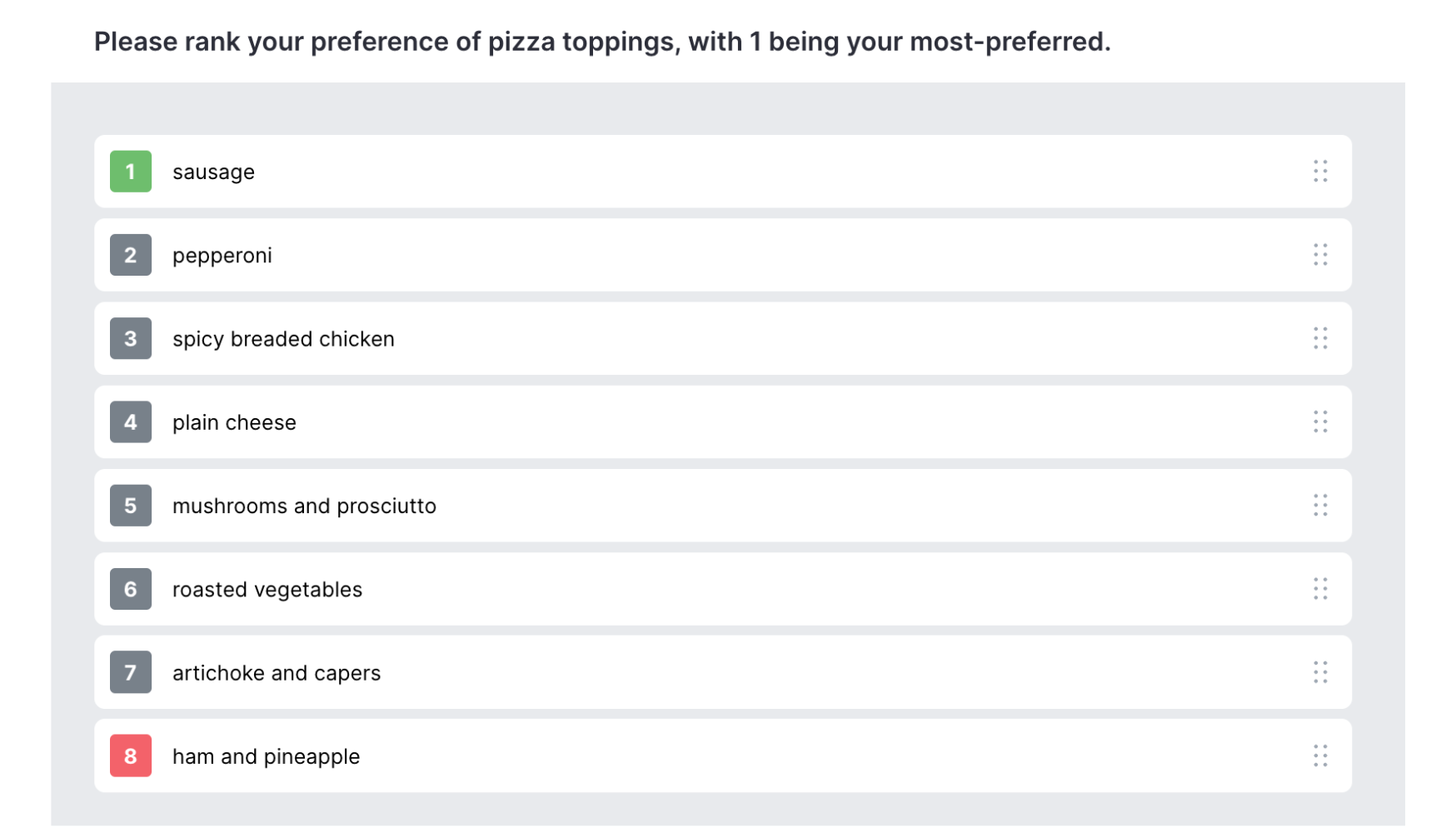

Drag-and-drop question formats are a more ‘gamified’ approach to survey capture as they ask dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139737">respondents to do more than simply check boxes or slide a scale. Drag-and-drop question formats are great for ranking exercises - asking dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139737">respondents to place answer options in a certain order by dragging with their mouse. For example, you could ask survey takers to put pizza toppings in order of preference by dragging options from a list of possible answers to a box displaying their personal preferences:

Matrix questions

Matrix questions are a great way to consolidate a number of questions that ask for the same type of response (e.g. single select yes/no, true/false, or multi-select lists). They are mutually beneficial - making a survey look less daunting for the dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139737">respondent , and easier for a brand to set up than asking multiple separate questions.

Items in a matrix question are presented one by one, as respondents cycle through the pages selecting one answer for each coffee flavor shown.

-1.png?width=1500&height=800&name=Untitled%20design%20(5)-1.png)

While the above example shows a single-matrix question - meaning a respondent can only select one answer per element (in this case, coffee flavors), a matrix setup can also be used for multiple-choice questions - allowing respondents to choose multiple answers per element shown, or for rating questions - allowing respondents to assign a rating (e.g. 1-5) for a list of elements at once. Back to table of contents

How to write dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139745">quantitative survey questions

We’ve reviewed the types of questions you might ask in a quantitative survey, and how you might format those questions, but now for the actual crafting of the content.

When considering which questions to include in your survey, you’ll first want to establish what your research goals are and how these relate to your business goals. For example, thinking about the three types of dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139745">quantitative survey questions explained above - descriptive, comparative, and relationship-based - which type (or which combination) will best meet your research needs? The questions you ask dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139737">respondents may be phrased in similar ways no matter what kind of layout you leverage, but you should have a good idea of how you’ll want to analyze the results as that will make it much easier to correctly set up your survey.

Quantitative questions tend to start with words like ‘how much,’ ‘how often,’ ‘to what degree,’ ‘what do you think of,’ ‘which of the following’ - anything that establishes what consumers do or think and that can be assigned a numerical code or value. Be sure to also include ‘other’ or ‘none of the above’ options in your quant questions, accommodating those who don’t feel the pre-set answers reflect their true opinion. As mentioned earlier, you can always include a small number of dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139748">open-ended questions in your quant survey to account for any ideas or expanded feedback that the pre-coded questions don’t (or can’t) cover. Back to table of contents

Examples of dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139745">quantitative survey questions

dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139745">Quantitative survey questions impose limits on the answers that dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139737">respondents can choose from, and this is a good thing when it comes to measuring consumer opinions on a large scale and comparing across dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139737">respondents . A large volume of freeform, open-ended answers is interesting when looking for themes from qualitative studies, but impractical to wade through when dealing with a large dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139756">sample size , and impossible to subject to dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139774">statistical analysis .

For example, a quantitative survey might aim to establish consumers' smartphone habits. This could include their frequency of buying a new smartphone, the considerations that drive purchase, which features they use their phone for, and how much they like their smartphone.

Some examples of quantitative survey questions relating to these habits would be:

Q. How often do you buy a new smartphone?

[single select question]

More than once per year

Every 1-2 years

Every 3-5 years

Every 6+ years

Q. Thinking about when you buy a smartphone, please rank the following factors in order of importance:

[drag and drop ranking question]

screen size

storage capacity

Q. How often do you use the following features on your smartphone?

[matrix question]

|

|

|

|

| ||

Q. How do you feel about your current smartphone?

[sliding scale]

I love it <-------> I hate it

Answers from these above questions, and others within the survey, would be analyzed to paint a picture of smartphone usage and attitude trends across a population and its sub-groups. dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139738">Qualitative research might then be carried out to explore those findings further - for example, people’s detailed attitudes towards their smartphones, how they feel about the amount of time they spend on it, and how features could be improved. Back to table of contents

quantilope’s Consumer Intelligence Platform specializes in automated, advanced survey insights so that researchers of any skill level can benefit from quick, high-quality consumer insights. With 12 advanced methods to choose from and a wide variety of quantitative question formats, quantilope is your one-stop-shop for all things dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139740">market research (including its dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139776">in-depth dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139738">qualitative research solution - inColor ).

When it comes to building your survey, you decide how you want to go about it. You can start with a blank slate and drop questions into your survey from a pre-programmed list, or you can get a head start with a survey dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139765">template for a particular business use case (like concept testing ) and customize from there. Once your survey is ready to launch, simply specify your dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139743">target audience , connect any panel (quantilope is panel agnostic), and watch as dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139737">respondents dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139783">answer questions in your survey in real-time by monitoring the fieldwork section of your project. AI-driven dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139764">data analysis takes the raw data and converts it into actionable findings so you never have to worry about manual calculations or statistical testing.

Whether you want to run your quantitative study entirely on your own or with the help of a classically trained research team member, the choice is yours on quantilope’s platform. For more information on how quantilope can help with your next dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139736">quantitative dropdown#toggle" data-dropdown-placement-param="top" data-term-id="281139768">research dropdown#toggle" data-dropdown-menu-id-param="menu_term_281139768" data-dropdown-placement-param="top" data-term-id="281139768"> project , get in touch below!

Get in touch to learn more about quantitative research with quantilope!

Related posts, quantilope academy is now open to the broader insights community, quantilope & greenbook webinar: tapping into consumers' subconscious through implicit research, master the art of tracking with quantilope's certification course, van westendorp price sensitivity meter questions.

Summer is here, and so is the sale. Get a yearly plan with up to 65% off today! 🌴🌞

- Form Builder

- Survey Maker

- AI Form Generator

- AI Survey Tool

- AI Quiz Maker

- Store Builder

- WordPress Plugin

HubSpot CRM

Google Sheets

Google Analytics

Microsoft Excel

- Popular Forms

- Job Application Form Template

- Rental Application Form Template

- Hotel Accommodation Form Template

- Online Registration Form Template

- Employment Application Form Template

- Application Forms

- Booking Forms

- Consent Forms

- Contact Forms

- Donation Forms

- Customer Satisfaction Surveys

- Employee Satisfaction Surveys

- Evaluation Surveys

- Feedback Surveys

- Market Research Surveys

- Personality Quiz Template

- Geography Quiz Template

- Math Quiz Template

- Science Quiz Template

- Vocabulary Quiz Template

Try without registration Quick Start

Read engaging stories, how-to guides, learn about forms.app features.

Inspirational ready-to-use templates for getting started fast and powerful.

Spot-on guides on how to use forms.app and make the most out of it.

See the technical measures we take and learn how we keep your data safe and secure.

- Integrations

- Help Center

- Sign In Sign Up Free

- How to ask quantitative survey questions: types & examples

Eren Eltemur

Are you looking for a way to collect objective data for your research? You can use quantitative questions to get objective data. You can use forms.app to create and customize your surveys with ready-made templates. This article will discuss creating quantitative survey questions with forms.app and the key principles of creating quantitive survey questions.

- What is a quantitative question?

A quantitive question is an objective question about any kind of research topic. You can use these types of questions in your research surveys, and you can create a research repor t that is produced using the quantitative data based on the analysis of the responses to these quantitative survey questions.

It offers assistance when you need to generalize your study and make predictions about the future. Surveys are an excellent instrument for quantitative research because they are flexible, affordable, and allow data collection from many respondents. Quantitive questions allow researchers to collect numeric data , and it is a method to gather statistical results .

The definition of a quantitative question

Quantitative and qualitative survey questions

The goal of quantitative research is to gather data that can be represented statistically. Researchers frequently use it to compare information about particular groups . Quantitative research can be directed towards a particular audience, generally identified by demographic data like age, gender, and region , even though the survey audience is relatively large.

Qualitative research focuses on individuals' unique behavior , including their routines or the reasons behind their choices. To understand more about sentiments, attitudes, and behaviors that are harder to measure but provide crucial extra context to quantitive research.

- 3 Types of quantitative survey questions

Quantitive questions and their equıvelent of survey questions can be separated on a basis. The branches of quantitative questions are methods, but when you want to include these principles in your surveys, you use form builder features such as the Likert scale, open-ended questions, opinion scale, multiple choice, short text, and long text . In the end, what gives meaning to these types of questions is their way of gathering answers . Here are the types of quantitive questions and their branches:

- Descriptive research questions : To make a general assumption about a group of people, such as their age, sex, and maybe ethnicity, or commonly used products, researchers can use these types of questions. There are common types of descriptive research questions:

- Frequency questions : To understand how often a particular event occurs.

- Percentage questions : To determine the proportion of a group, such as customers.

- Range questions : To find the highest and the lowest point of something, such as price.

- Profile questions : To describe a characteristic of a particular group.

- Case study questions : To get a detailed understanding of a specific topic.

- Comparative research questions : These types of questions are used to compare individuals or groups and can be classified as experimental or casual research.

- Experimental : Used to test the cause-and-effect relationship of a hypothesis by interventions and manipulations.

- Causal : To comprehend how variations in one variable affect another.

- Relationship-based research questions : These types of questions are used to understand the link between two groups or topics. Here are some types of relationship-based research questions:

- Correlation questions : Used to test the cause-and-effect relationship of a hypothesis without any interventions and manipulations.

- Meta-analysis : The combined result of multiple similar studies to find patterns and inconsistencies.

- Cross-sectional : The relationship between two things at a particular time to find a correlation.

- Case-control : Regardless of the outcome, the relationship between particular outcomes to find patterns.

- How to write better quantitative survey questions

Creating a better quantitative survey can be a complicated task because of the survey's nature. The intention of the questions must be chosen first to get the desired result. Clear, effective and unbiased survey questions are essential for quantitive surveys. For this reason, here is the three-step you must follow to get the desired result:

1 - Select the objective and type

You must select the type of question you want to ask. What is your intention? Are they descriptive, comparative, or relationship-based questions? By choosing your intention, you can ask the right questions and select the right words, which is the key element of your survey .

2 - Identify the variable

The dependent and independent variables, as well as the target audiences , should be decided by researchers. The many variables you seek to analyze, manipulate, or control must be identified regardless of whether you are trying to develop a descriptive, comparative, or relationship-based research question. Here are some examples for

variables: Number of books read per year, level of education, average working hours, and time spent on social media .

You can control a variable in addition to something you can measure. You might need to assess a few dependent variables if you merely intend to develop descriptive research questions. However, you will deal with dependent and independent variables in situations where you intend to create comparative and relationship-based research questions. In an experiment, an independent variable is a variable that is changed to observe the effect.

3 - Select the appropriate structure

The aims of the questions, the types of variables, the number of variables and the groups engaged all have an influence on the structure of the three different types of quantitative research questions.

a. Select your lead phrase.

b. Specify the dependent variable.

c. List the organizations in which you are interested.

d. Choose whether to include the dependent variable or groups.

- 16 great quantitative survey question examples

To make the steps and types clear as forms.app, we have gathered 16 quantitive question examples in surveys. Below you will see comparative, descriptive, and relationship-based research questions with specified variables and groups.

1 - What is the average life expectancy of individuals living in urban areas compared to the average life expectancy of individuals living in rural areas?

- Question type : Comparative

- Variable : life expectancy

- Groups : "urban" and "rural"

2 - What is the average number of sick days taken by employees who work more than 40 hours per week compared to employees who work less than 40 hours per week?

- Variable : Number of sick days taken

- Group : employees who work more than 40 hours per week and employees who work less than 40 hours per week

3 - What is the average height of adults in [ Asians ]?

- Question type : Descriptive

- Variable : Average height

- Group : Asians

4 - What is the average number of books read per year by people aged 18-24 compared to people aged 25-34?

- Variable : Number of books read per year

- Group : people aged 18-24, people aged 25-34

5 - What is the average number of cars per household in a [ specific country ]?

- Variable : average number of cars per household

- Group : specific country

6 - What is the average temperature [ in a specific city ] during the month of July?

- Variable : average temperature

- Group : specific city, the month of July

7 - Is there a relationship between exercise frequency and weight loss?

- Question type : Relationship

- Variable : Exercise frequency, Weight loss

- Group : n/a

8 - Is there a relationship between air pollution and lung cancer?

- Variable : Air pollution, Lung cancer

9 - Is there a relationship between the level of education and average credit score?

- Variable : Level of education, Average credit score

10 - What is the average number of customers served per hour at fast food restaurants in the city center compared to fast food restaurants in the suburbs?

- Variable : Number of customers served per hour

- Group : fast food restaurants in the city center, fast food restaurants in the suburbs

11 - What is the average age of business owners in a specific region?

- Variable : average age

- Group : business owners in a specific region

12 - What is the average commute time for residents who use public transportation compared to residents who drive alone?

- Variable : Commute time

- Group : Residents who use public transportation and residents who drive alone

13 - Is there a relationship between social media usage and academic performance among college students?

- Variable : Social media usage, academic performance

- Group : College students

14 - What is the average time spent on social media per day among teenagers compared to adults?

- Variable : Time spent on social media per day

- Group : Teenagers and Adults

15 - What is the average revenue per year for small business owners compared to large business owners?

- Variable : Revenue per year

- Group : Small business owners and large business owners

16 - Is there a relationship between gender and the likelihood of receiving a promotion in a specific company?

- Variable : Gender, the likelihood of receiving a promotion

- Group : specific company

- How to design a quantitative survey

Since the elements are clear now, you must clarify your topic and style, then create your survey considering your aim. For example , let's say we are creating a survey intended to learn about gender and its relationship with receiving a promotion. Our variable is gender and the likelihood of receiving a promotion, and our group is a particular company. Here are some example questions with suitable form fields you can use: