- ABAP Snippets

- Top SAP Courses

- Top SAP Books

SAP and ABAP Free Tutorials

Account assignment in SAP Purchasing (MM) – FAQ

This note provides answers to frequently asked questions regarding account assignment in purchasing documents. This post is based on Snote 496082.

Table of Contents

FAQ: Account Assignement in SAP Purchasing

Account assignement : g/l account for a sales order.

Question: Why is the G/L account for a sales order with nonvaluated individual sales order stock different from the account with valuated indivi dual sales order stock?

Answer: See Note 458270.

Multiple Account Assignment in Purchasing

Question: Can you create several assets at the same time in the new purchasing transactions?

Answer: You can create several assets at the same time. However, you must first ensure that at least as many account assignment lines have bee n created as the number of assets that you want to create. You can do this very easily using the copy function.

G/L Account is not saved if switch to a material group

Question: You create a purchase order with account assignment using transaction ME22. You enter a material group, from which a G/L account is de termined using the valuation class. If you then switch to a material group that does not determine a G/L account via the valuation class, the system deletes the previous G/L account and prompts you to enter a G/L account. If you cancel the account assignment screen and change the material group back on the item detail screen, the previously determined G/L account is not determined again. Why is this ?

Answer: Unfortunately, this system behavior cannot be changed. First, enter any G/L account, so that the item is valid. If you then switch to the old material group again, the system also determines the correct G/L account again.

Entering the same account assignments for different items

Question: Is there an easy way of entering the same account assignments for different items in the new EnjoySAP transactions?

Answer: Ensure that Note 315676 has been implemented in your system and follow the procedure described there

Repeat account assignment function not work in the new EnjoySAP

Question: Why does the repeat acc. assignment function not work in the new EnjoySAP transactions when you create new account assignments in multiple acc. assign. ?

Solution: Use the copy function in multiple acc. assignment to create identical account assignment lines. You can use the repeat account assi gnment function to create similar account assignments for different items with the same account assignment category. To do this, proce ed as described in the answer to question 4.

Issue message KI 161 “Cost center &/& does n ot exist on &

Question: When you change the account assignment of an existing purchase order, why does the system issue message KI 161 “Cost center &/& does n ot exist on &” ? The same phenomenon occurs for other account assignment objects (for example, profit center).

Solution: Refer to Note 193371.

Can you create assets from the single account assignment screen?

Solution: Assets can only be created from the multiple account assignment screen (“Account assignment” tab). You can switch between single account assignment and multiple account assignment on the “Account assignment” tab page by clicking the icon above on the left.

Why does the system not display an account assignment tab page even though you have entered an account assignment category?

Solution: After you have implemented Note 520149, the account assignment tab is not displayed until all the required information is available, for example, the company code.

Why are account assignment objects derived in some situations, even though the relevant field on the account assignment tab page is hidden?

Solution: Refer to Note 619203.

ME 453 “Changing consump. or spec. stock indicator not allowed

You create a purchase order with reference to a subcontracting purchase requisition. This purchase requisition was created with an unknown account assignment, that is, account assignment category “U”. When you change the account assignment category in the purchase order, the system issues error message ME 453 “Changing consump. or spec. stock indicator not allowed (subcontracting)”.

Solution: See Note 205597

Select a valuated goods receipt together with multiple account assignment

Why can you not select a valuated goods receipt together with multiple account assignment in a purchase order or purchase requisition?

Solution: See Note 204252.

EBAN-FISTL, -GEBER, -KBLNR, -GRANT and -FKBER (as in table EKPO) empty

Funds Management is active. Why are the fields EBAN-FISTL, -GEBER, -KBLNR, -GRANT and -FKBER (as in table EKPO) empty? Solution: These fields are only filled if the account assignment category is set to “blank”. If you maintain an account assignment category in t he purchasing document, the system adds the information from these fields to the EBKN table (as in EKKN).

AA 334 “You cannot post to this asset (Asset & & blocked for acquisitions)

You try to change a purchase order item with acc. assignment category “A”, which contains a locked asset. The system issues error message AA 334 “You cannot post to this asset (Asset & & blocked for acquisitions)”. Solution: This is the standard system design. To make changes to this purchase order item, you have the following two options:

a) If you no longer require the purchase order item with the blocked asset, delete the purchase order item. b) Otherwise, you must activate the asset, make the required changes to the purchase order item, and then block the asset again.

The indicator for the account assignment screen

Question: What is the meaning of the indicator for the account assign. screen that you can set in Customizing for single account assignment/m ultiple account assignment? Solution: The indicator determines which account assignment screen is used by default for maintaining the account assign. for a purchase orde r item. For the EnjoySAP transactions, this value is simply a proposal that you can change in the purchasing document. For the old transactions, this value is the only one that you can use.

Question: Is there an unknown account assign. for standard purchase orders?

Solution: This is generally not allowed, and the system issues message ME 069 “Unknown account assignment not defined for use here”. There is an exception in the case of service items that are created with item category D (service) or B (limit).

Acc. Assignment check is not performed when Purchase Order is updated

Question: You change data in a purchase order item (for example, purchase order value, delivery date, and so on). Why does the system not perform another acc. assignment check?

Solution: This is the standard system design. When you created the purchase order item, if the system already checked the acc. assignment and there were no errors, another acc.?assignment check only takes place if you change a field that is relevant to account assign.?(for example, quantity, material number, and so on). If this system response does not meet your requirements, implement the account assignment check in the BAdI ME_PROCESS_PO_CUST. The BA dI is called each time the purchase order is changed.

“In case of account assignment, please enter acc. assignment data for item”

Question: If you delete all the account assign?lines that were entered in the account assignment screen, the system exits the account assign. tab page and goes to the material data. In addition, the system issues the error message “In case of account assignment, please enter acc. assignment data for item”.

Answer: In the current system design, if you delete all the account assignment lines, the system assumes that you do not want to maintain any account assignment data. This conflicts with the account assignment category and the system issues error message 06 436. You can then remove the account assignment indicator. Procedure: If you want to delete all the account assignment data that was entered, see the answer to question 24.

Third-party order processing (CS) and individual purchase order processing (CB)

Question: Which account assignment categories should you enter in schedule line categories for third-party order processing (CS) and individual purchase order processing (CB)? Solution: See Note 210997.

G/L Account is not transfered from Valuation class

Question: In a blanket purchase order or blanket purchase requisition with account assignment, you subsequently change the material group. Even though the new material group is assigned to another G/L account via the valuation class, the system does not redetermine the account assignment for the relevant item. The old G/L account remains.

Solution: See Note 449216.

Customizing Account assignment fields as required entry, optional entry, or display fields

Question: In Customizing, you can set the, or as completely hidden fields, depending on the account assignment category. These settings also determine whether the system deletes or retains the values for the account assignment fields when you change the account assignment category in a purchase order item.

Answer: In Customizing for materials management (MM), when you maintain account assignment categories (IMG: Materials Management-> Purchasing -> Account Assignment-> Maintain Account Assignment Categories), you can control the different account assignment fields as follows: Required entry: You must make an entry in the field, otherwise the system issues error message ME 083.

- Optional entry: Entry in this field is optional.

- Display: The field is displayed, but it is not ready for input.

- Hidden: The field is hidden. Example:

The acc. assignment category is K, the cost center is an optional entry field and it is filled with the value 1000. You change the acc. assignment category to P. Subject to the field settings for the cost center for the acc. assignment category P, the system response is as follows: The cost center is a required entry or an optional entry field: The system transfers the value 1000 for the cos t center.The cost center is a display field: First, the value 1000 for the cost center is deleted. If the system can determine a value again after you enter the changed acc. assignment category, this value is transferred. The cost center is a hidden field: The system deletes the value 1000 for the cost center.

System ignores the acc. assignment data of the purchase requisition for the second schedule line.

Question: You create a purchase order item assigned to an account with reference to a purchase requisition. For this purchase order item, you create a second schedule line with reference to another purchase requisition. The system ignores the acc. assignment data of the purchase requisition for the second schedule line. Solution: This is the standard system design. The system does not generate multiple acc. assignment in the purchase order item, even if the t wo referenced purchase requisitions are assigned to different CO objects. Refer to Note 47150 for the old transactions and to Notes 422609 and 771045 for the EnjoySAP transactions.

Undelete an item in a purchase requisition if assignment data is no longer valid

Question: Why can you undelete an item in a purchase requisition if the corresponding acc. assignment data is no longer valid? Solution: When you undelete an item in a purchase requisition, the system does not perform a new acc. assignment check. Therefore, the accoun t assignment data is not checked again. Nevertheless, errors occur if you try to create a purchase order with reference to this purchase requisition. When you undelete an item in a purchase order, however, the system does perform another acc. assignment check.

Transfer of Acc. Assign. with Reference Document

Question: You create a purchasing document with reference to a reference document. What account assig. data is transferred? Solution: The acc. assignment data is derived from the reference document. If you delete the acc.?assignment category and enter it again, a new automatic general ledger account determination takes place.

Question What is the correct procedure for changing acc. assignment data?

– If, for example, you want to change the acc. assignment category: Note that you MUST first delete all existing acc. assignment data for the relevant item. You can do this by initializing (deleting) the acc. assignment category and confirming by choosing ENTER. Following this, you can enter the new acc. assignment category and the relevant acc. assignment data.

– If you want to change acc. assignment data for the relevant item: For example, you want to change the main acc. assignment objects such as cost center, G/L account, sales order, network, or WBS ele ment, and so on. Here also, we recommend deleting all existing acc. assignment data by initializing (deleting) the account assignme nt category and confirming by choosing ENTER.If you are working with contracts, you must delete the acc. assignment line on the acc. assignment screen and enter a new line t o ensure that the data is derived correctly again. You MUST NOT change the current settings. For example, in some circumstances, the requirements type (OVZH) or the valuation of the requirements class (OVZG) is changed after th e purchasing document is created. This can cause errors in a valuation of goods movements (goods receipt, for example) and MUST BE AVOIDED.

Read more on? Account Assignment

Related Posts

The Most Important SAP Payment Terms Tables (ZTERM, Text…)

October 21, 2018 March 24, 2021

SAP Batch Management: User-exits and BAdIs

June 17, 2017 January 21, 2022

SAP Batch Management Tcodes, Tables and Customizing (SAP Batch Management)

June 16, 2017 January 21, 2022

- Programming

- Admin & EIM

- BI & BW

- FICO & BPC

- CRM & Sales

- Introductions

- SAP PRESS Subscription

Account Determination in SAP S/4HANA Materials Management

Various transactions in materials management (MM) are relevant for accounting, such as goods receipts, goods issues, and invoice receipts.

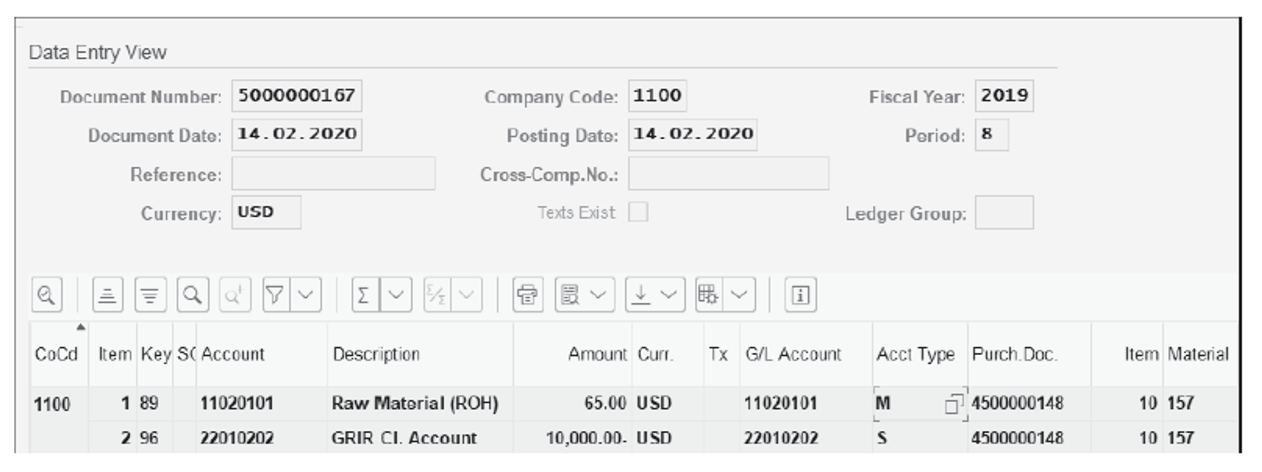

In such cases, the system always creates an accounting document and posts the amount in the appropriate general ledger accounts.

General ledger accounts are automatically determined with the help of automatic account determination settings. Consider, for example, a manufacturing enterprise that stores stock materials purchased from vendors. Whenever a material is received in a storage location with reference to a PO, the company wants its system to automatically determine and update the stock general ledger account. Similarly, whenever an invoice is posted, the system should automatically determine the vendor general ledger account and post the liability.

The SAP S/4HANA system provides automatic general ledger account posting via the automatic account determination process. When posting a goods receipt against a PO, the system creates an accounting document (along with the material document), and general ledger account postings are made. The system determines which general ledger accounts should be debited and credited based on configuration settings you’ve maintained for automatic account determination.

Essential Terms

Before discussing these configuration settings, let’s define a few essential terms:

Chart of Accounts

A chart of accounts provides a framework for recording values to ensure an orderly rendering of accounting data. The general ledger accounts it contains are used by one or more company codes. For each general ledger account, the chart of accounts contains the account number, the account name, and technical information.

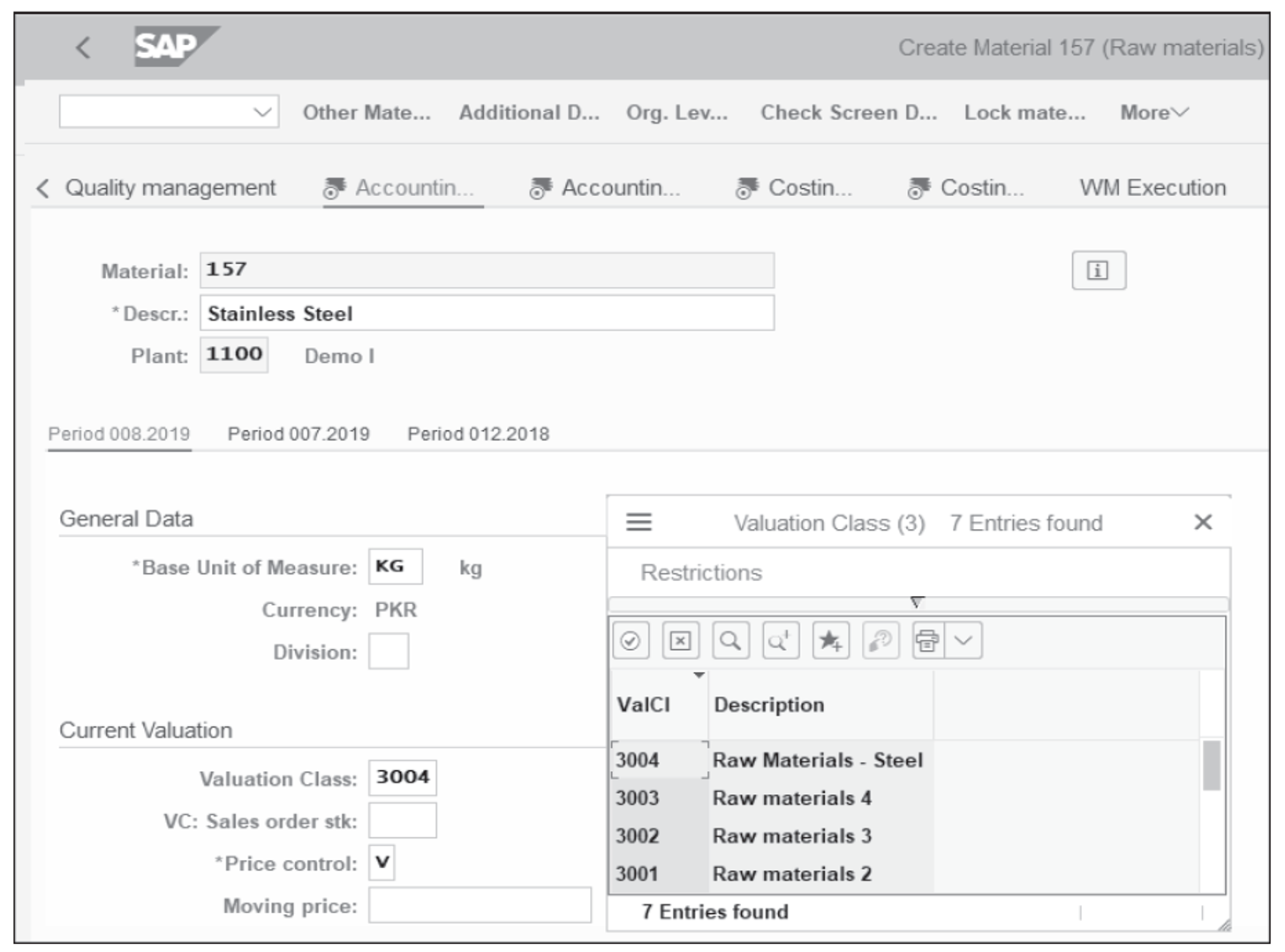

Valuation Class

A valuation class is used to determine the general ledger account for the materials stock account. In automatic account determination, valuation classes must be created and then assigned to material types. While creating material master records, selecting the appropriate valuation class under the Accounting 1 tab is required. The valuation class list in the material master record will depend on the material type. For example, in a standard SAP system, material type ROH (raw material) has three valuation classes: 3000, 3001, and 3002.

Transaction Key

Transaction keys are used to determine accounts or posting keys for line items that are automatically created by the system. They’re defined in the system and can’t be changed.

Now that you have an understanding of the key terms in automatic account determination and understand how it can work in your business, we’ll move on to describe the configuration steps and business processes involved.

Configuration with the Automatic Account Determination Wizard

Automatic account determination can be configured either with or without the automatic account determination wizard, a tool provided by SAP to help you manage the automatic account determination functionality. To configure automatic account determination using the wizard, follow the configuration menu path SAP IMG > Materials Management > Valuation and Account Assignment > Account Determination > Account Determination Wizard .

The wizard will ask you a number of questions and, based on your answers, finds the correct settings and saves them in the corresponding SAP tables. Except for a few restrictions (as documented in the wizard), the wizard will perform the following steps:

- Defines valuation control

- Groups valuation areas

- Defines valuation classes

- Defines account grouping for movement types

- Manages purchase accounts

- Configures automatic postings

We’ll explain how to set up automatic account determination without the wizard because this manual and step-by-step approach to account determination will help you understand how to work with the wizard. Further, using account determination without the wizard enables the creation of more complex configurations. Once you’ve gained the concepts and the fundamentals behind account determination, you can use the automatic account determination’s wizard tool to quickly setup account determination processes in SAP systems.

Configuration without the Automatic Account Determination Wizard

We’ll now follow a step-by-step approach to setting up account determination in an SAP system. We’ll cover the necessary configuration steps involved, followed by steps for assigning the configured objects in the master data. Business processes involving account determination and that use the master data are covered next. We’ll also cover the accounting entries that occur as the result of a stock posting.

Let’s walk through the required steps next:

Define a Valuation Control

In account determination, you can group together valuation areas by activating the valuation grouping code (also known as the valuation modifier ), which makes configuring automatic postings much easier. A valuation grouping code can be made active or inactive by choosing the respective radio button.

To define a valuation control, follow the configuration menu path SAP IMG > Materials Management > Valuation and Account Assignment > Account Determination > Account Determination without Wizard > Define Valuation Control .

By default, the valuation grouping code is active in the standard SAP system.

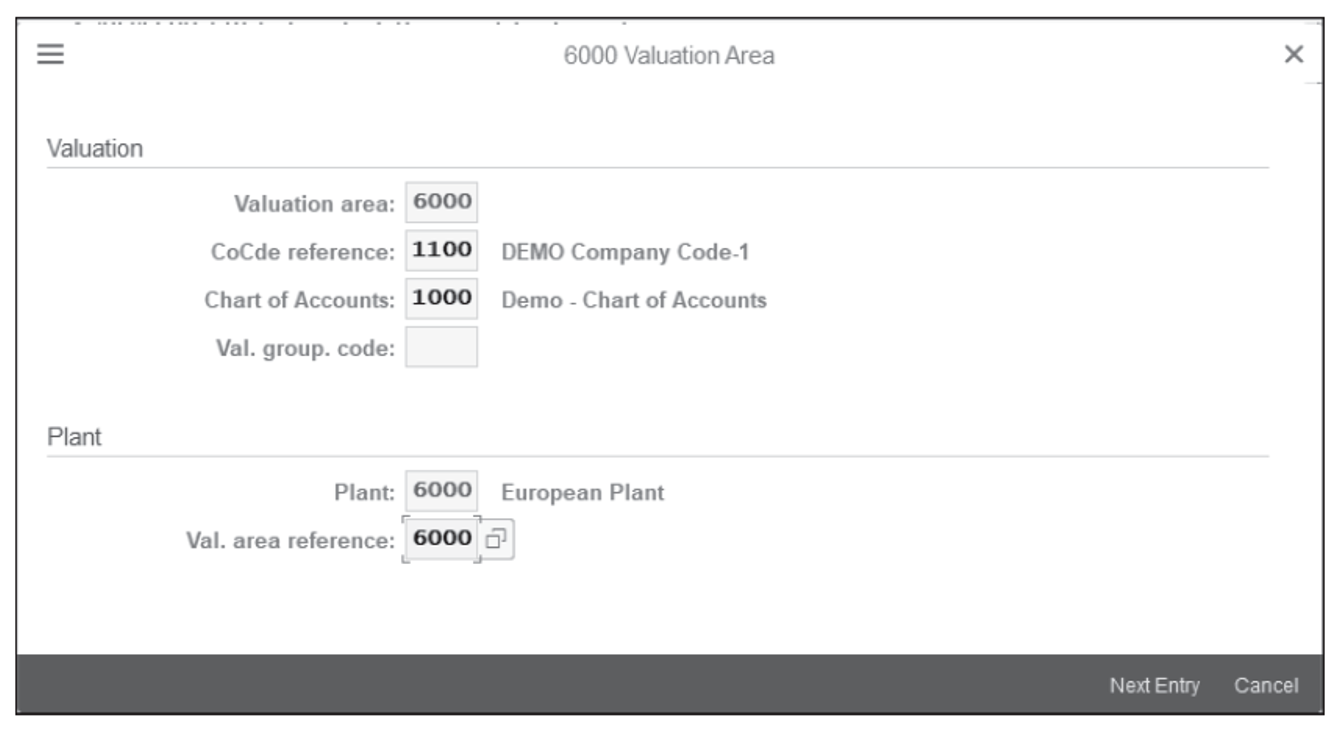

Assign Valuation Grouping Codes to Valuation Areas

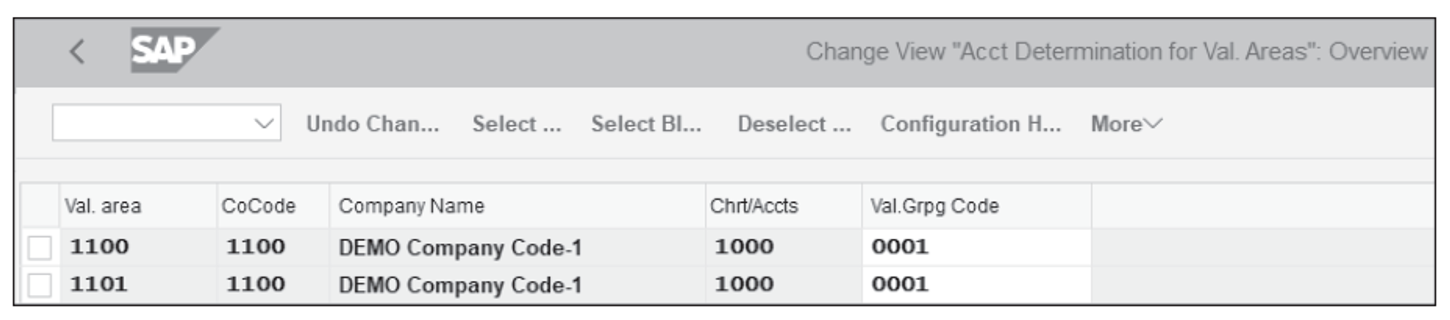

The valuation grouping code makes setting up automatic account determination easier. Within the chart of accounts, assign the same valuation grouping codes to the valuation areas you want assigned to that account. As shown in the figure below, valuation grouping code 0001 has been assigned to valuation area 1100 and company code 1100. If another valuation area also uses the same set of general ledger accounts as valuation area 0001, then assign valuation grouping code 0001 to that valuation area.

To assign valuation grouping codes to valuation areas, follow the configuration menu path SAP IMG > Materials Management > Valuation and Account Assignment > Account Determination > Account Determination without Wizard > Group Together Valuation Areas .

Define Valuation Classes

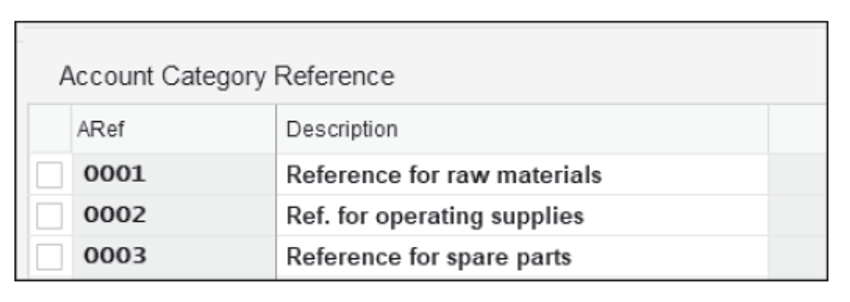

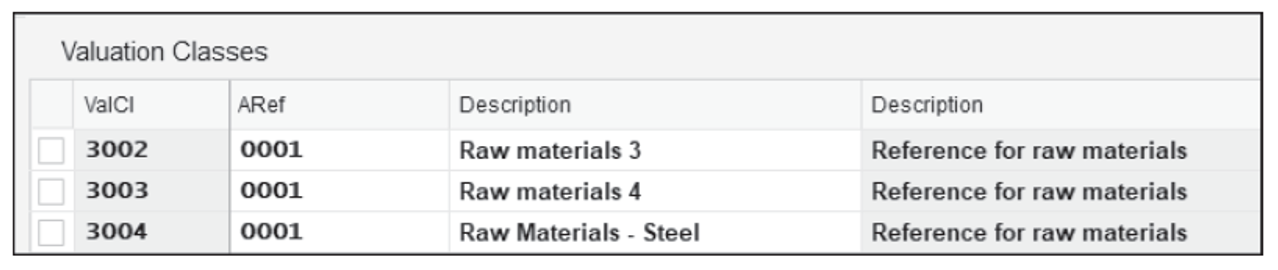

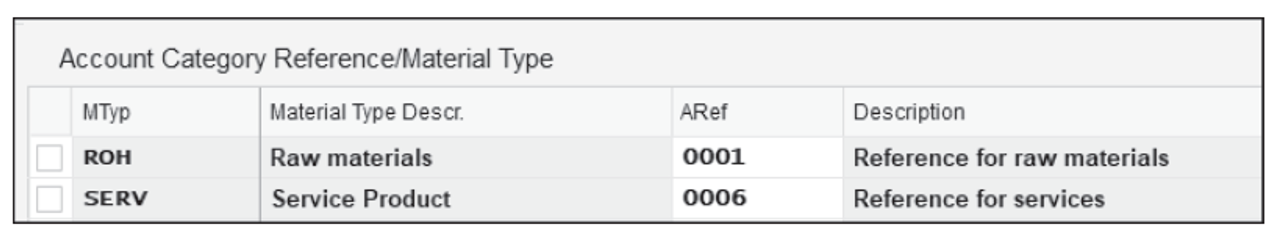

In this step, you’ll define the valuation classes allowed for each material type. Then, you’ll assign the account category reference to the material type. As shown in the second figure below, account category references 0001 and 0002 have been defined, and for each account category reference, one or more valuation classes can be assigned. Account category reference 0001 has been assigned to material type ROH, and valuation classes 3000, 3001, and 3002 have been assigned to account category reference 0001. Consequently, valuation classes 3000, 3001, and 3002 have been assigned to material type ROH. While creating the material master record for material type ROH, select any of these valuation classes. Similarly, for material type HALB, select valuation classes 7900 or 7901.

In this section, through an example, we’ll create the new valuation class 3004 and cover all the associated configuration settings required to ensure a working end-to-end business process.

To define which valuation classes are allowed for a material type, use Transaction OMSK or follow the configuration menu path SAP IMG > Materials Management > Valuation and Account Assignment > Account Determination > Account Determination without Wizard > Define Valuation Classes . On the screen that appears, you’ll see three options: Account Category Reference , Valuation Class , and Material Type/Account Category Reference . Follow these steps:

- Click on Account Category Reference and, if needed, create an account category reference, as shown here:

- Click on Valuation Class , shown below, and then click on the New Entries Create a new valuation class ( ValCl ) 3004 (with Description Raw Materials- Steel ) and assign the valuation class to account category reference ( ARef ) 0001 . 2

- Click on Account Category Reference and maintain a mapping between the material types and account references. For material type ( MType ) ROH , assign the account reference ( ARef ) 0001 , as shown here:

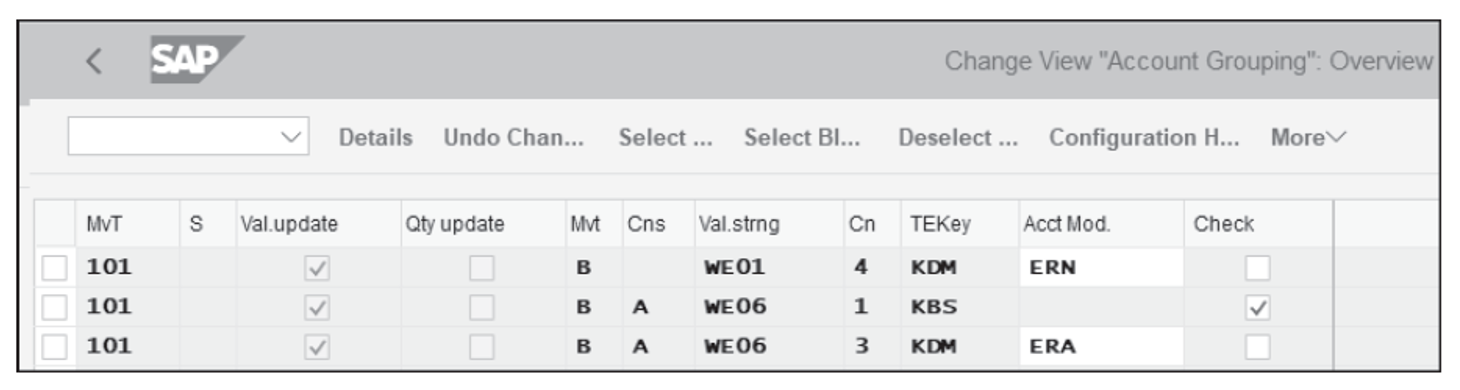

Define an Account Grouping for Movement Types

Now, assign an account grouping to movement types. The account grouping is a finer subdivision of the transaction/event keys for account determination. For example, during a goods movement, the offsetting entry for the inventory posting (Transaction GBB) can be made to different accounts, depending on the movement type. The account grouping is provided for the following transactions:

- Transaction GBB (Offsetting Entry for Inventory Posting)

- Transaction PRD (Price Differences)

- Transaction KON (Consignment Liabilities)

The account grouping in the standard system is only active for Transaction GBB. To define account groupings for movement types, follow the configuration menu path SAP IMG > Materials Management > Valuation and Account Assignment > Account Determination > Account Determination without Wizard > Define Account Grouping for Movement Types . Define the account grouping code, the movement type, and the transaction/event key combination, as shown in the next figure.

Note: Value strings group together the various transactions used in account determination. For example, the value string WE01 can be seen by following the configuration menu path SAP IMG > Materials Management > Valuation and Account Assignment > Account Determination > Account Determination Without Wizard > Define Account Grouping for Movement Types . On this screen, if you double-click on any entries that contain WE01, a list of transactions along with their descriptions will appear. The transactions that appear in the value string are hard coded in the system, so you should never try to change them.

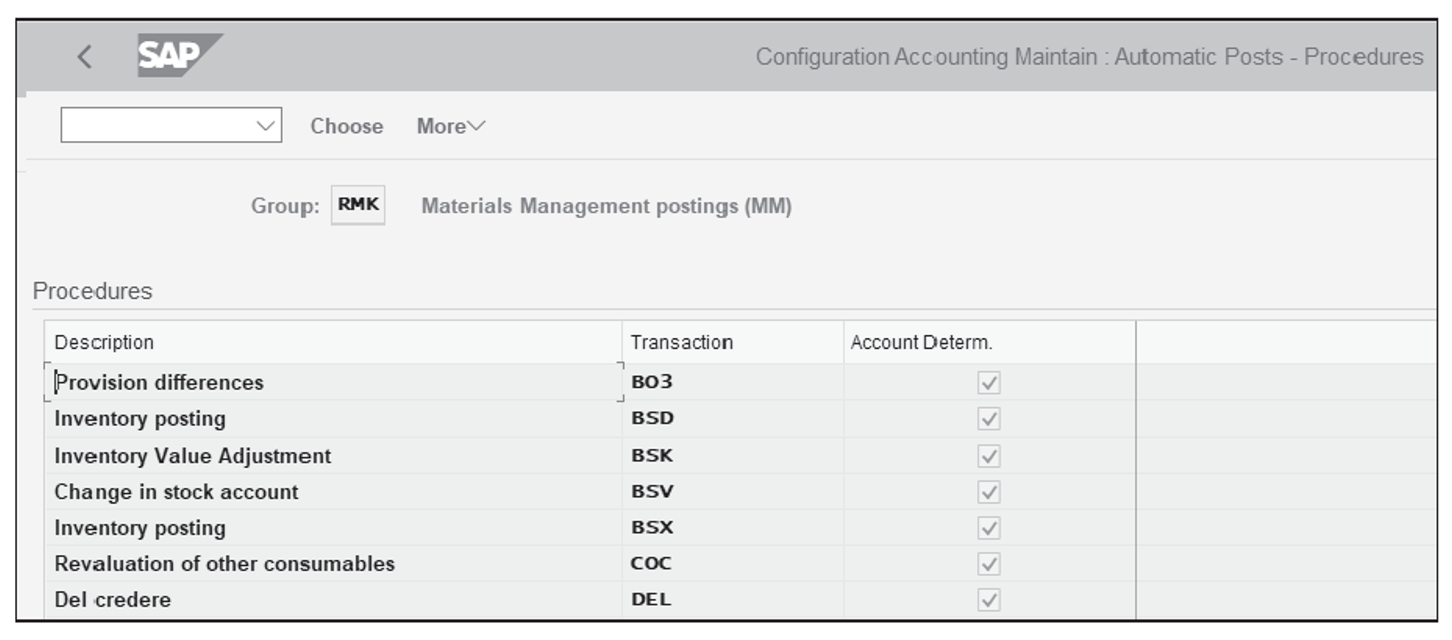

Configure Automatic Postings

In this step, enter the system settings for inventory management and invoice verification transactions that result in automatic posting to general ledger accounts. A transaction/event key is a key to differentiate account determination by business transaction. For example, we must differentiate general ledger account posted by goods receipt transaction and posted by invoice receipt transaction.

You don’t need to define these transaction keys; they are determined automatically from the transaction of the movement type (inventory management) or from the transaction of invoice verification. All you need to do is assign the relevant general ledger account to each posting transaction.

To assign general ledger accounts to transaction/event keys, use Transaction OMWB or follow the menu path SAP IMG > Materials Management > Valuation and Account Assignment > Account Determination > Account Determination without Wizard > Configure Automatic Posting . Click on Cancel , as shown below.

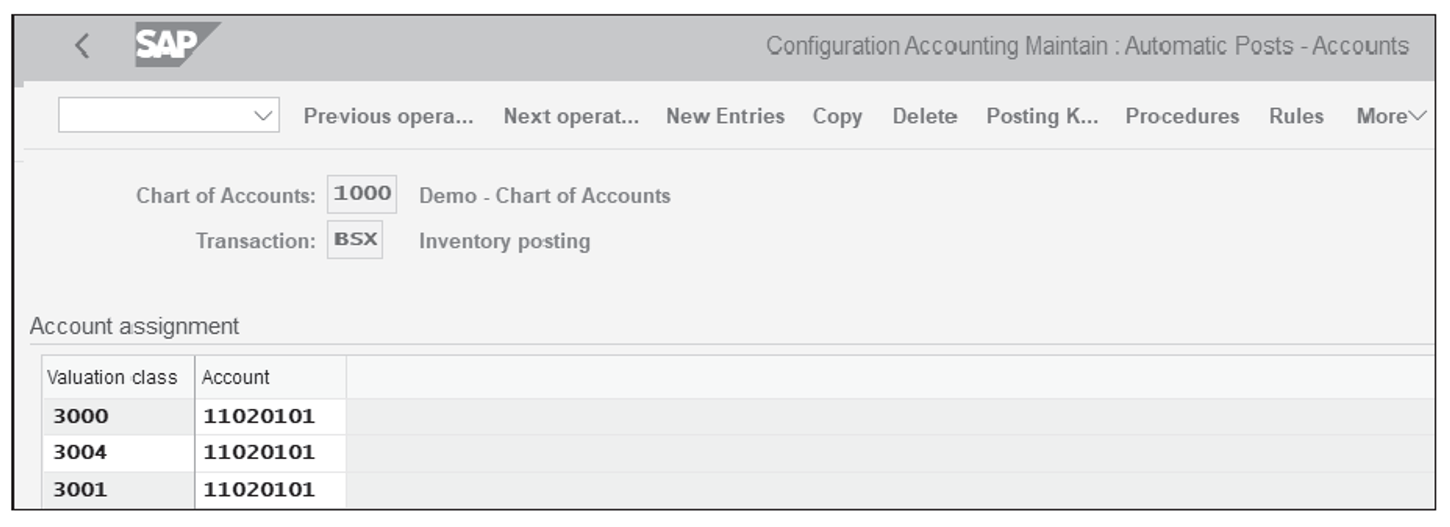

To assign a general ledger account, on the screen shown above, click on Account Assignment (not shown). A list of transaction keys will appear; double click on the key for which setting the general ledger accounts is required. Next, define the valuation grouping code (also known as the valuation modifier ), valuation class, and general ledger account, as shown below. Then, check the settings function by using the simulation function.

Use Transaction BSX for inventory posting and for assigning general ledgers. In the popup window that appears, enter the Chart of Accounts 1100 , and the screen shown below will appear.

This figure shows the Transaction BSX screen for posting inventory. Click New Entries and enter the newly created Valuation Class 3004 and assign the Account 11020101 .

Go back to the screen shown when utilizing Transaction OMWB, and this time, use Transaction WRX (for the goods receipt/invoice receipt [GR/IR] clearing account) and maintain the general ledger account of the newly created Valuation class 3004 . Similarly, repeat the same steps for Transaction PRD (for price difference account).

Let’s now look at the business processes and the associated master data setup and transactions, not only to check that the newly created valuation class 3004 works correctly, but also that the associated general ledger accounts are correct.

Master Data Setup

Access the screen shown below via Transaction MM01. Under the Accounting 1 tab of the material master 157 , assign the newly created Valuation Class 3004 .

Now, let’s discuss the account determination for the general ledger as it relates to goods receipt and goods issue postings. Post a good receipt of the material 157 with reference to a PO via Transaction MIGO. Then, display the goods receipt document and go to the Doc. info tab. Click on the FI Documents button, which will display a list of financial documents created for the goods receipt document. Select Accounting document to see the details of that accounting document.

As shown below, you’ll see the general ledger account postings, which are determined based on the automatic account determination configuration. General ledger account 11020201 (inventory raw material stock account) is debited, and GR/IR account 22010202 is credited.

In this blog post, we covered the account determination process that is useful to those running materials management with SAP .

Editor’s note : This post has been adapted from a section of the book Materials Management with SAP S/4HANA: Business Processes and Configuration by Jawad Akhtar and Martin Murray.

Recommendation

Manage your materials with SAP S/4HANA! Whether your focus is on materials planning, procurement, or inventory, this guide will teach you to configure and manage MM in SAP S/4HANA. Start by creating your organizational structure and defining business partners and material master data. Then follow step-by-step instructions for your essential processes, from purchasing and MRP runs to goods issue and receipt. Discover how to get more out of SAP S/4HANA by using batch management, demand-driven MRP, SAP Fiori reports, and other built-in tools.

SAP PRESS is the world's leading SAP publisher, with books on ABAP, SAP S/4HANA, SAP CX, intelligent technologies, SAP Business Technology Platform, and more!

Latest Blog Posts

A Look at Materials Management and Logistics in SAP S/4HANA

Sales Contract Management with SAP S/4HANA Logistics

The official sap press blog.

As the world’s leading SAP publisher, SAP PRESS’ goal is to create resources that will help you accelerate your SAP journey. The SAP PRESS Blog is designed to provide helpful, actionable information on a variety of SAP topics, from SAP ERP to SAP S/4HANA. Explore ABAP, FICO, SAP HANA, and more!

SAP Blog Topics

- Administration

- Business Intelligence

- Human Resources

Blog curated by

- Legal Notes

- Privacy Policy

- Terms of Use

- Guest Posting

Blog about all things SAP

ERProof » SAP CO » SAP CO Training » SAP CO Account Assignment

SAP CO Account Assignment

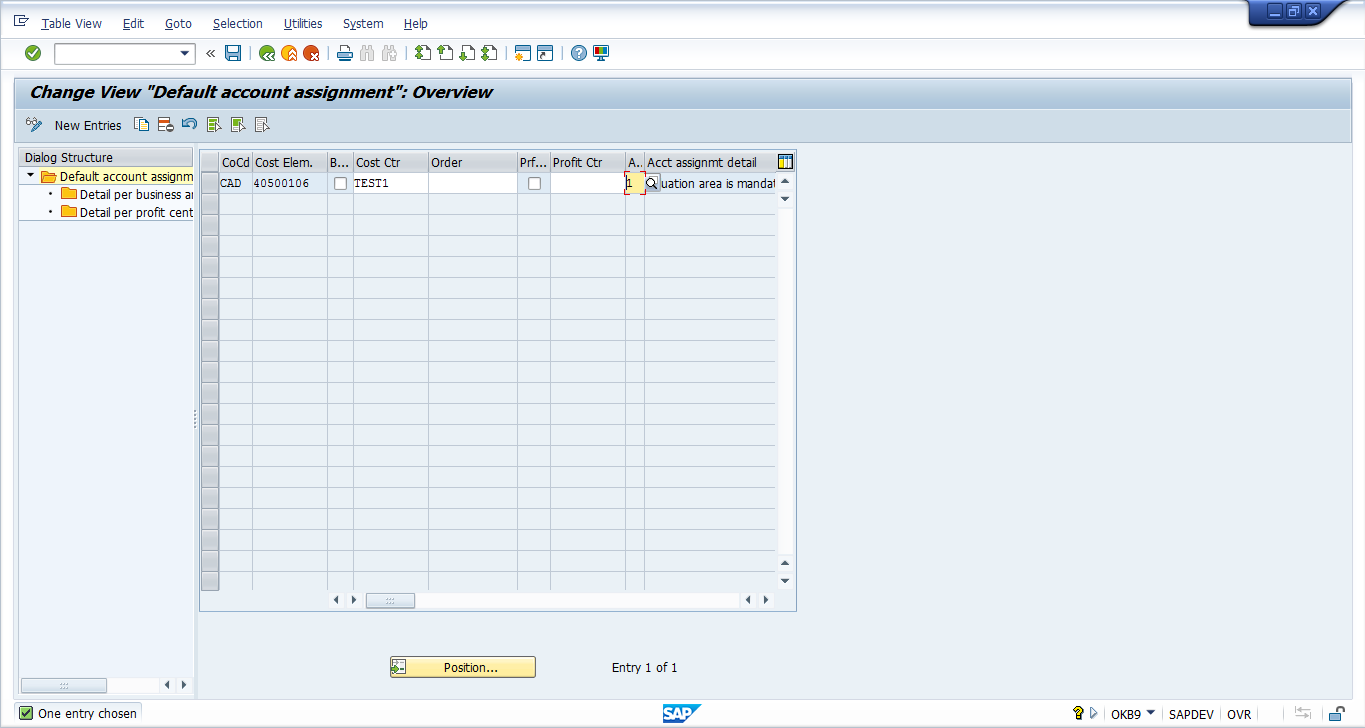

Normally, when a financial document is entered in SAP FI module , user has the option of entering the cost center in the financial document. However, when documents are entered from different modules or a cross-module financial transaction occurs, such as from MM or SD , there is no option of entering the cost center in the document. In this situation, the SAP system will derive the cost center through automatic SAP CO account assignment, substitutions, or through default settings made in the primary cost element.

Automatic SAP CO Account Assignment

The automatic account assignment has to be configured in the transaction code OKB9 . For posting made in external accounting, such as for price differences, exchange rate differences, etc., the SAP system automatically checks entries in the OKB9 settings and derives the cost center.

If you do not enter a CO object (order, cost center, or project) in external accounting postings made in FI, MM or SD modules and the posting is cost relevant, then the automatic account assignment checks the relevant cost center and makes the posting.

Here are examples of automatic account assignments:

- Banking fees, exchange rate differences and discounts in FI

- Minor differences and price differences in MM

The account assignment objects that can be maintained in the transaction OKB9 are:

- Cost center

- Profit center (profitability segment)

Normally, the automatic account assignment runs on the company code level along with the CO object. However, if the user wants to make the posting on the business area level, valuation area level or profit center level, it is also available in OKB9 settings. So basically it includes the following levels:

- Company code level

- Business area level

- Valuation area level

- Profit center level

The above 3 excluding the company code level are used in cases when the account assignment is needed below the company code level.

Prerequisites

Here are the prerequisites of activating automatic SAP CO account assignment:

- Activation of the cost center accounting

- Creation of cost centers

- Maintenance of cost elements

Additionally, you can also create orders and profit centers as per the business requirements.

Settings in Transaction OKB9

Let’s discuss settings that are possible for automatic SAP CO account assignment in OKB9 transaction.

Start SPRO transaction and navigate to the following path:

Controlling – Cost Center Accounting – Actual Postings – Manual Actual Postings – Edit Automatic Account Assignment (OKB9)

Alternatively, you can start OKB9 transaction directly from the command bar.

- If you want to have the setting on the company code level only, then enter the company code and the cost element along with the corresponding CO object, i.e. a cost center, an order or a profit center.

- If you want to have the settings on the valuation area level, then enter the company code and the cost element and chose the ‘valuation area’ option in the account assignment detail as ‘1’.

- Similarly, if you want to have the settings on the business area or profit center level, then choose the option ‘2’ or ‘3’ respectively.

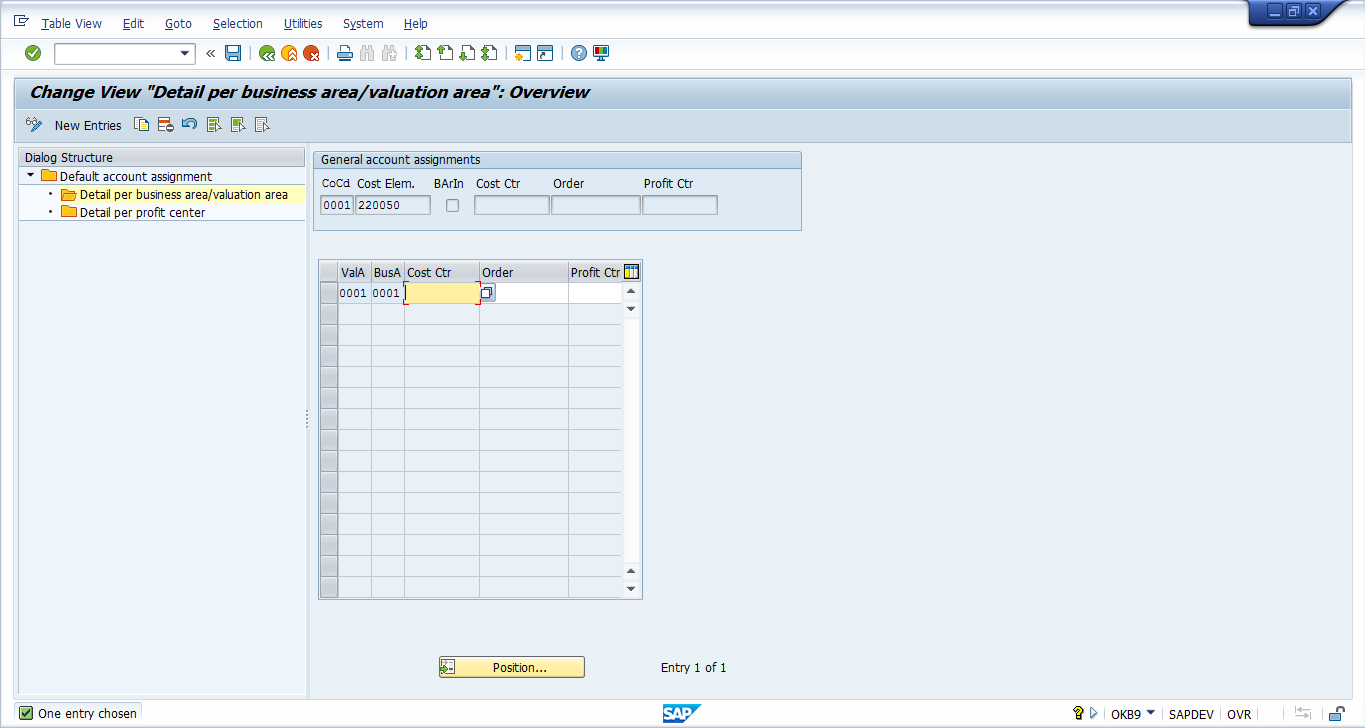

If you have chosen account assignment detail ‘1’ or ‘2’, then click on ‘Detail per business area/valuation area’ on the left sidebar.

Default SAP CO Account Assignment

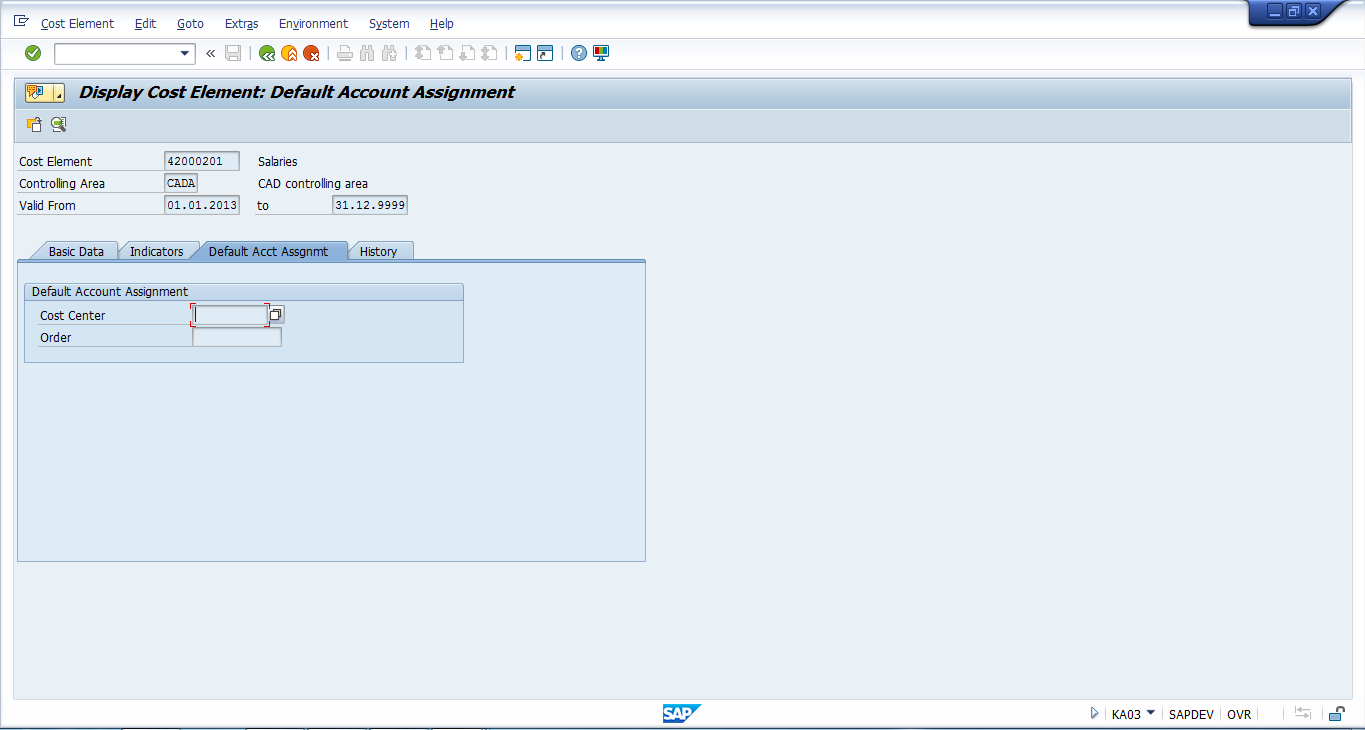

In order to determine the correct CO account assignment, the SAP system performs several checks in the following sequence. First it checks the document which a user is posting. If the cost center is empty in the document, then the system checks if any substitutions are maintained for the particular G/L account . Next, if the substitution is also missing, then the system moves on to the OKB9 settings for automatic SAP CO account assignments. Finally, if these settings are also missing, the SAP system checks master data of the primary cost element (G/L Account) under the tab of Default Account Assignment . You can display this master data using the transaction KA03 .

You can maintain the cost center and the order in the master data of the primary cost element.

So, basically the order of checks the system makes is:

- Financial document – Cost center

- Substitutions – transaction OKC9

- Automatic account assignments – transaction OKB9

- Default account assignments – transaction KA03 / KA02

Lastly, if any of the above is not maintained, then the SAP system throws an error ‘Account X requires an assignment to a CO Object’ and doesn’t allow posting of a document.

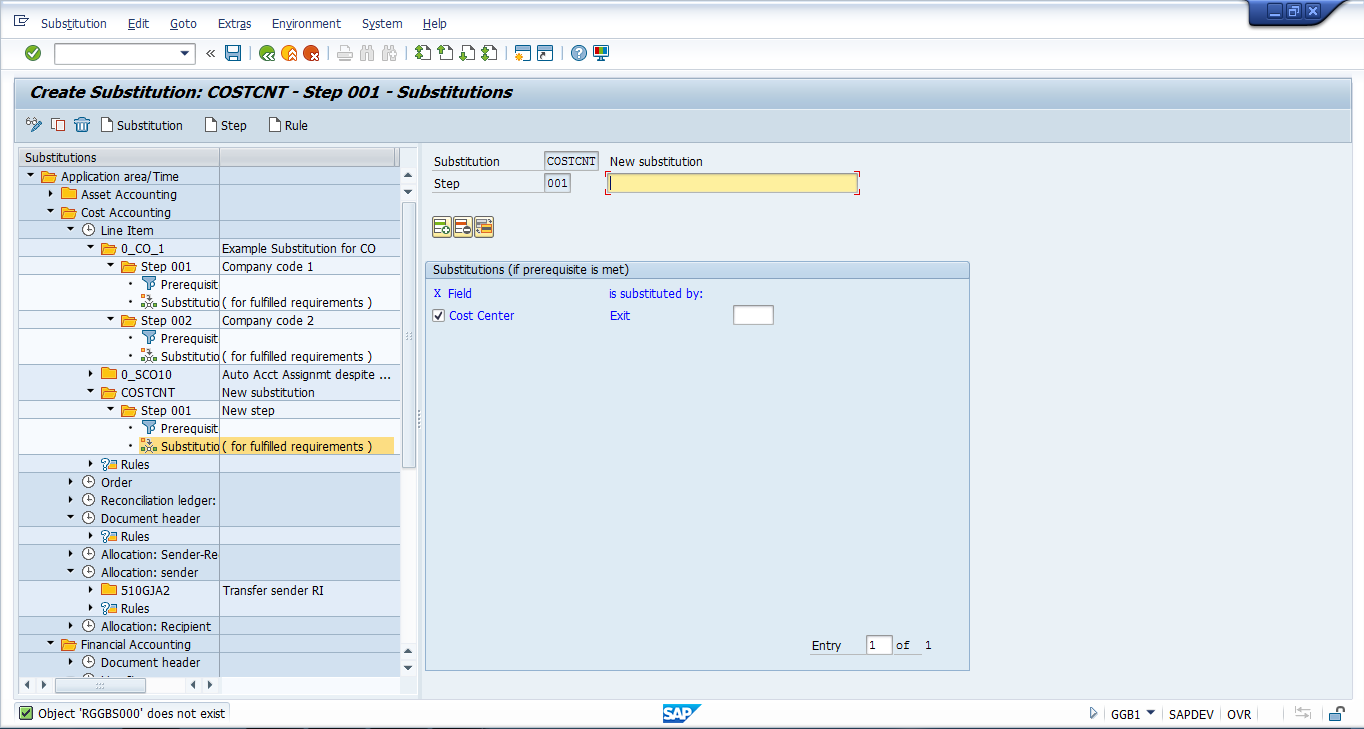

SAP CO Account Assignment using Substitution

In cases where you don’t need OKB9 or default account assignment, the user can go for user exits where a specific G/L account is mentioned under the company and the value in the cost center is substituted by the cost center given in the substitution.

The transaction for maintaining the substitution is GGB1 .

Usage of substitutions for SAP CO account assignment is justified by the business requirement and usually SAP CO account assignment requirements are fulfilled by OKB9 or default account assignments.

Did you like this tutorial? Have any questions or comments? We would love to hear your feedback in the comments section below. It’d be a big help for us, and hopefully it’s something we can address for you in improvement of our free SAP CO tutorials.

Navigation Links

Go to next lesson: SAP Adjustment Postings

Go to previous lesson: SAP Profit Center

Go to overview of the course: Free SAP CO Training

4 thoughts on “SAP CO Account Assignment”

it is helpful material i ask for more clear details for using substitution method for Account Assignment. thanks in advance

Sir, I am not receiving the training mails from yesterday 7/1/2019. I have completed my training till here(SAP CO Account Assignment) please do send the rest of the training emails for SAP CO. Hope you will do the needful.

I am getting the same error “Account 500911 requires an assignment to a CO object”. In OKB9, we have given company code, Cost element and ticked the check box ‘Indicator: Find profitability segment using substitution’ (V_TKA3A-BSSUBST) and not filled anything like cost center, order and profit center. in OKC9 we have created substitution. All the process happening through Idoc Message Type SINGLESETTRQS_CREATE and inside BAPI BAPI_SINGLESETTREQS_CREATEMULT triggering and raising this error. Cost center is not maintained in 1. Financial document – Cost center 2. Automatic account assignments – transaction OKB9 and 3. Default account assignments – transaction KA03/KA02 But we have substitution in transaction OKC9 to determine cost centre.

Where woulbe be the issue?

good explanation

Leave a Reply Cancel reply

Do you have a question and want it to be answered ASAP? Post it on our FORUM here --> SAP FORUM !

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- ERPCorp FI/CO Books

- Access SAP Modules

- SAP Webinars

- Client Roster

- BECOME A MEMBER

ERPCorp SAP FICO Blog

Display sap mm-fi automatic account assignment.

by John Jordan

Table of Contents

Introduction, display obyc accounts with se16n, more information.

You use configuration Transaction OBYC to assign SAP General Ledger (GL) accounts in Financial Accounting (FI) to movement types in Materials Management (MM), also known as SAP MM-FI Automatic Account Determination or Assignment.

End users do not typically have the authorization to run configuration Transaction OBYC.

You can easily display automatic account assignments as follows:

View table T030, which stores OBYC configuration settings, with Transaction SE16N.

Type in Table T030 and press Enter to display the selection screen shown in Figure 1.

Figure 1 : Table T030 Selection Screen To Display SAP MM-FI Configuration Settings

You restrict the table entries displayed on the subsequent results screen by making entries in the Selection Criteria section. To display G/L accounts posted during goods issues (GI) to production orders, make the following entries:

- Chart of Accounts : Restrict your selection by your chart of accounts, INT in this example

- Transaction : You display inventory movements with Transaction GBB

- Valuation Grouping Code : A group of company codes (set up with transaction OMWD)

- Account modifier : VBR for GI to production orders

- Valuation Class : You assign a valuation class in the Costing 2 view

Click the execute icon to display the screen shown in Figure 2.

Figure 2 : Table T030 Entries Display SAP MM-FI Configuration Settings

This screen displays the G/L Accounts posted during goods issues to production orders.

For more information on entries in table T030, follow IMG menu path:

Materials Management • Valuation and Account Assignment • Account Determination • Account Determination Without Wizard • Configure Automatic Postings

Figure 3 displays the menu path.

Figure 3 : Configure Automatic Postings Menu Path

Click the paper and glasses icon to the left of Configure Automatic Postings at the bottom to display standard SAP documentation on setting up automatic postings.

Activity Type

An activity type identifies activities provided by a cost center to manufacturing orders. The secondary cost element associated with an activity type identifies the activity costs on cost center and detailed reports

Alternative Hierarchy

While there can only be one cost center standard hierarchy, you can create as many alternative hierarchies as you like. You create an alternative hierarchy by creating cost center groups

Automatic Account Assignment

Automatic account assignment allows you to enter a default cost center per cost element within a plant with Transaction OKB9.

Condition Type

A condition type is a key that identifies a condition. The condition type indicates, for example, whether the system applies a price, a discount, a surcharge, or some other pricing, such as freight costs and sales taxes.

Cost Center Accounting

A cost center is a function within an organization that does not directly add to profit but still costs money to operate, such as the accounting, HR, or IT departments. The main use of a cost center is to track actual expenses for comparison to the budget.

Cost Estimate

A cost estimate calculates the plan cost to manufacture a product or purchase a component. It determines material costs by multiplying BOM quantities by the standard price, labor costs by multiplying operation standard quantities by plan activity price, and overhead values by costing sheet configuration.

Cost Object

An SAP Cost object such as a cost center or internal order describes where the cost occurs. A cost element or account describes what the cost is.

Costing Lot Size

The costing lot size in the Costing 1 view determines the quantity cost estimate calculations are based on. The costing lot size should be set as close as possible to actual purchase and production quantities to reduce lot size variance.

Goods Issue

A goods issue is the movement (removal) of goods or materials from inventory to manufacturing or to a customer. When goods are issued, it reduces the number of stock in the warehouse.

Goods Receipt

It is a goods movement that is used to post goods received from external vendors or from in-plant production. All goods receipts result in an increase of stock in the warehouse.

Internal Order

An internal order monitors costs and revenue of an organization for short- to medium-term jobs. You can carry out planning at a cost element and detailed level, and you can carry out budgeting at an overall level with availability control.

Production Variance

Production variance is a type of variance calculation based on the difference between net actual costs debited to the order and target costs based on the preliminary cost estimate and quantity delivered to inventory. You calculate production variance with target cost version 1.

Profit Center

A profit center receives postings made in parallel to cost centers and other master data such as orders. Profit Center Accounting (PCA) is a separate ledger that enables reporting from a profit center point of view. You normally create profit centers based on areas in a company that generate revenue and have a responsible manager assigned.

If PCA is active, you will receive a warning message if you do not specify a profit center, and all unassigned postings are made to a dummy profit center. You activate profit center accounting with configuration Transaction OKKP, which maintains the controlling area.

Purchasing Info Record

A purchasing info record stores all of the information relevant to the procurement of a material from a vendor. It contains the Purchase Price field, which the standard cost estimate searches for when determining the purchase price.

Scheduling Agreement

A scheduling agreement is a longer-term purchase arrangement with a vendor covering the supply of materials according to predetermined conditions. These apply for a predefined period and a total purchase quantity.

Standard Hierarchy

A standard hierarchy represents your company structure. A standard hierarchy is guaranteed to contain all cost centers or profit centers because a mandatory field in cost and profit center master data is a standard hierarchy node.

To learn more about MM-FI, and SAP S/4HANA FICO topics become a member Click here now :

Standard Price

The standard price in the Costing 2 view determines the inventory valuation price if price control is set at standard (S). The standard price is updated when a standard cost estimate is released. You normally value manufactured goods at the standard price.

You can apply surcharges to material prices and activity prices in order to take into account increases or decreases in item prices over time when calculating the lifecycle costs for a project.

Target Costs

Target costs are plan costs adjusted by the delivered quantity. For example, if the quantity delivered to inventory is 50% of the plan quantity, target costs are calculated as 50% of the plan costs.

Material Master

A material master contains all of the information required to manage a material. Information is stored in views, and each view corresponds to a department or area of business responsibility. Views conveniently group information together for users in different departments, for example, sales and purchasing.

Origin Group

An origin group separately identifies materials assigned to the same cost element, allowing them to be assigned to separate cost components. The origin group can also determine the calculation base for overhead in costing sheets.

Price Control

The Price control field in the Costing 2 view determines whether inventory is valuated at standard or moving average price.

The price unit is the number of units to which the price refers. You can increase the accuracy of the price by increasing the price unit. To determine the unit price, divide the price by the price unit.

Process Order

Process orders are used for the production of materials or provide services in a certain quantity and on a certain date. They allow resource planning, process order management control, and account assignment and order settlement rules to be specified.

Procurement Alternative

A procurement alternative represents one of a number of different ways of procuring a material. You can control the level of detail in which the procurement alternatives are represented through the controlling level. Depending on the processing category, there are single-level and multilevel procurement alternatives. For example, a purchase order is single-level procurement, while production is multilevel procurement.

Production Order

A production order is used for discrete manufacturing. A BOM and routing are copied from master data to the order. A sequence of operations is supplied by the routing, which describes how to carry out work-steps. An operation can refer to a work center at which it is to be performed. An operation contains planned activities required to carry out the operation. Costs are based on the material components and activity price multiplied by a standard value.

Product Drilldown Reports

Product drilldown reports allow you to slice and dice data based on characteristics such as product group, material, plant, cost component, and period. Product drilldown reports are based on predefined summarization levels and are relatively simple to setup and run.

Production variance is a type of variance calculation based on the difference between net actual costs debited to the order and target costs based on the preliminary cost estimate and quantity delivered to inventory. You calculate production variance with target cost version 1. Production variances are for information only and are not relevant for settlement.

Production Version

A production version determines which alternative BOM is used together with which task list/master recipe to produce a material or create a master production schedule. For one material, you can have several production versions for various validity periods and lot-size ranges.

Purchase Price Variance

When raw materials are valued at the standard price, a purchase price variance will post during goods receipt if the goods receipt or invoice price is different from the material standard price.

Profitability Analysis

Costing-based profitability analysis enables you to evaluate market segments, which can be classified according to products, customers, orders (or any combination of these), or strategic business units, such as sales organizations or business areas concerning your company’s profit or contribution margin.

SAP Profit Center is a management-oriented organizational unit used for internal controlling purposes. Segmenting a company into profit centers allows us to analyze and delegate responsibility to decentralized units.

A purchasing info record stores all the information relevant to the procurement of a material from a vendor. It contains the Purchase Price field, which the standard cost estimate searches for when determining the purchase price.

Raw Materials

Raw materials are always procured externally and then processed. A material master record of this type contains purchasing data but not sales.

A routing is a list of tasks containing standard activity times required to perform operations to build an assembly. Routings, together with planned activity prices, provide cost estimates with the information necessary to calculate labor and activity costs of products.

Sales and Operations Planning

Sales and operations planning (SOP) allows you to enter a sales plan, convert it to a production plan, and transfer the plan to long-term planning.

S&OP is slowly being replaced by SAP Integrated Business Planning for Supply Chain (SAP IBP), which supports all S&OP features. S&OP is intended as a bridge or interim solution, which allows you a smooth transition from SAP ERP to on-premise SAP S/4HANA and SAP IBP. See SAP Note 2268064 for details.

SAP Fiori is a web-based interface that can be used in place of the SAP GUI. SAP Fiori apps access the Universal Journal directly, taking advantage of additional fields like the work center and operation for improved variance reporting.

Work in process (WIP) and variances are transferred to Financial Accounting, Profit Center Accounting (PCA), and Profitability Analysis (CO-PA) during settlement. Variance categories can also be transferred to value fields in CO-PA.

Settlement Profile

A settlement profile contains the parameters necessary to create a settlement rule for manufacturing orders and product cost collectors and is contained in the order type.

Settlement Rule

A settlement rule determines which portions of a sender’s costs are allocated to which receivers. A settlement rule is contained in a manufacturing order or product cost collector header data.

You need setup time to prepare equipment and machinery for the production of assemblies, and that preparation is generally the same regardless of the quantity produced. Setup time spread over a smaller production quantity increases the unit cost.

Simultaneous Costing

The process of recording actual costs for cost objects, such as manufacturing orders and product cost collectors in cost object controlling, is called simultaneous costing. Costs typically include goods issues, receipts to and from an order, activity confirmations, and external service costs.

Source Cost Element

Source cost elements identify costs that debit objects, such as manufacturing orders and product cost collectors.

Source List

A source list is a list of available sources of supply for a material, which indicates the periods during which procurement is possible. Usually, a source list is a list of quotations for a material from different vendors.

You can specify a preferred vendor by selecting a fixed source of supply indicator. If you do not select this indicator for any source, a cost estimate will choose the lowest cost source as the cost of the component. You can also indicate which sources are relevant to MRP.

The standard price in the Costing 2 view determines the inventory valuation price when price control is set at standard (S). The standard price is updated when a standard cost estimate is released. You normally value manufactured goods at the standard price.

Subcontracting

You supply component parts to an external vendor who manufactures the complete assembly. The vendor has previously supplied a quotation, which is entered in a purchasing info record with a category of subcontracting.

Tracing Factor

Tracing factors determine the cost portions received by each receiver from senders during periodic allocations, such as assessments and distributions.

Universal Journal

The efficiency and speed of the SAP HANA in-memory database allowed the introduction of the Universal Journal single line-item tables ACDOCA (actual) and ACDOCP (plan). The Universal Journal allows all postings from the previous financial and controlling components to be combined in single items. The many benefits include the development of real-time accounting. In this book, we discuss both period-end and event-based processing.

Valuation Class

The valuation class in the Costing 2 view determines which general ledger accounts are updated as a result of inventory movement or settlement.

Valuation Date

The valuation date determines which material and activity prices are selected when you create a cost estimate. Purchasing info records can contain different vendor-quoted prices for different dates. Different plan activity rates can be entered per fiscal period.

Valuation Grouping Code

The valuation grouping code allows you to assign the same general ledger account assignments across several plants with Transaction OMWD to minimize your work. The grouping code can represent one or a group of plants.

Valuation Type

You use valuation types in the split valuation process, which enables the same material in a plant to have different valuations based on criteria such as batch. You assign valuation types to each valuation category, which specify the individual characteristics that exist for that valuation category. For example, you can valuate stocks of a material produced in-house separately from stocks of the same material purchased externally from vendors. You then select procurement type as the valuation category and internal and external as the valuation types.

Valuation Variant

The valuation variant is a costing variant component that allows different search strategies for materials, activity types, subcontracting, and external processing. For example, the search strategy for purchased and raw materials typically searches first for a price from the purchasing info record.

Valuation Variant for Scrap and WIP

This valuation variant allows a choice of cost estimates to valuate scrap and WIP in a WIP at target scenario. If the structure of a routing is changed after a costing run, WIP can still be valued with the valuation variant for scrap and WIP resulting in a more accurate WIP valuation.

Valuation View

In the context of multiple valuation and transfer prices, you can define the following views: – Legal valuation view – Group valuation view – Profit center valuation view

Work Center

Operations are carried out at work centers representing; for example, machines, production lines, or employees. Work center master data contains a mandatory cost center field. A work center can only be linked to one cost center, while a cost center can be linked to many work centers.

Work in Process

Work in process (WIP) represents production costs of incomplete assemblies. For balance sheet accounts to accurately reflect company assets at period end, WIP costs are moved temporarily to WIP balance sheet and profit and loss accounts. WIP is canceled during period-end processing following delivery of assemblies to inventory.

Meet John Jordan, Kent Bettisworth, Gerald Steele and other SAP expert speakers in person at SAP Controlling Financials 2024 Conference in San Diego, CA

Use exclusive coupon code: jj100 for $100 off click here.

For the latest updates

About the author

John Jordan

Author's recent posts

Captcha Image

- Terms of Use

- Privacy Policy

- SAP ERP Solutions

- What does SAP stands for

ETCircle.com SAP FI and CO consultant information

Customers: account assignment groups | ovk8.

In this configuration activity we are able to define account assignment groups for customers used in Sales and Distribution Module ( SD ).

Transaction: OVK8

IMG Path: Sales and Distribution -> Basic Functions -> Account Assignment/Costing -> Revenue Account Determination -> Check Master Data Relevant For Account Assignment

Tables: TVKT, TVKTT

If you use the IMG Menu, you will have to choose the second option on the pre-selection screen.

On the main screen there is a list of Account Assignment Groups for Customers. You can create new here if you need.

Tags Account Assignment OVK8 TVKT TVKTT

About Emiliyan Tanev

Related articles, assign g/l accounts | vkoa, materials: account assignment groups | ovk5, define automatic credit control | ova8, configure automatic postings | omwb.

In this FICO configuration activity we are able to define account determination for automatic postings …

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Notify me of followup comments via e-mail. You can also subscribe without commenting.

- Explore catalog

- SAP Certification

- SAP Learning Class

- Redeem Activation Code

- SAP S/4HANA

- Customer Experience

- Network and Spend Management

- Supply Chain Management

- HR and People Engagement with SAP SuccessFactors

Training course schedule

Where to start with SAP Training

- Buy a one exam attempt subscription

- Buy a six exam attempt subscription

- List of valid certifications

- Validate your certification

Redeem activation code

Access your subscription

- How to book training online

- Available training methods

Maximize your training budget with an SAP Preferred Card

Dear Learner,

we want to inform you that the Wishlist function on training.sap.com will be discontinued effective 5 th of June 2024. Please review any courses currently saved in your Wishlist and either take notes of the details or add them directly to your basket before this feature is sunsetted. This change is part of our commitment to enhancing your user experience. Should you have any questions or require assistance, please feel free to contact our regional support team with contact information located in the footer of the website.

Thank you for your understanding and for choosing SAP for your learning needs.

Profit Center Accounting in SAP S/4HANA

- SAP S/4HANA 2023

Course announcements

- This course is also available in a self-paced e-learning format with an active subscription to the SAP Learning Hub, as S4F28E.

- Participants of this course will gain an overview of the fundamental business processes and tasks of profit center accounting with SAP S/4HANA.

Course information

- Profitability Management

- Outlining Profitability and Sales Accounting Options

- Outlining Global Settings in SAP General Ledger Accounting

- Profit Center Master Data

- Creating Profit Center Master Data

- Assigning Profit Centers to Account Assignment Objects

- Profit Center Accounting (PCA) Actual Postings

- Explaining Profit Center Updates

- Explaining the Data Flow in Financial Accounting

- Integrating Profit Centers and Materials Management (MM)

- Integrating Cost Object Controlling (COC) and PCA

- Integrating Sales and Distribution (SD) and PCA

- Processing Allocations in PCA

- Profit Center Planning

- Outlining the basic concept of Profit Center Planning with SAP BPC Optimized for SAP S/4HANA

- Transfer Pricing

- Overview of transfer price concept

- This course will prepare you to:

- Describe and maintain global Profit Center Accounting settings and master data

- Understand the transaction data that is generated on Profit Centers from actual postings in other components of the SAP S/4HANA application

- Application Consultant

- Business Process Owner / Team Lead / Power User

Prerequisites

Recommended.

- Course Business Processes in Financial Accounting in SAP S/4HANA ( S4F10 ) or

- Course Business Processes in Management Accounting in SAP S/4HANA ( S4F20 )

Course based on software release

- SAP S/4HANA 2021 SPS0

- The profit center derivation is explained as part of SAP General Ledger Accounting with document splitting activated.

- The focus of this training is on the Profitability Management, Profit Center Master Data and Actual Postings topics.

- This course describes the basic concept of Profit Center Planning in SAP S/4HANA. This course describes only the basic concept of Transfer Pricing without system demonstrations and exercises.

Find a course date

Can't find a suitable date, booking for 1-2 people.

Make a request for us to schedule training around what works for you? We will do our best to consider your request.

Booking for 3+ people?

Our 3 to RUN initiative empowers you to schedule our chosen classroom training course or virtual SAP Live Class on a date that suits you. You need at least three confirmed participants to register and SAP will add it to your schedule.

Have questions? Visit the Help Center

This browser is not supported.

SAP Training Shop is not currently supported on Internet Explorer. For a premium experience please use an alternative browser.

/support/notes/service/sap_logo.png)

3475973 - Indicator Agrreement of cost center in "Activate Account Assignment Objects" couldn't be edited

When checking the configuration under the following path by T-code ORFA, for cost center(KOSTL), indicator "Acct Assignment Object Same in Asset Master and Posting" is grey as the picture below,

Asset Accounting ->Integration with General Ledger Accounting ->Additional Account Assignment Objects ->Activate Account Assignment Objects

"Image/data in this KBA is from SAP internal systems, sample data, or demo systems. Any resemblance to real data is purely coincidental."

Environment

- SAP R/3 Enterprise

- SAP ERP Central Component

- SAP enhancement package for SAP ERP

- SAP enhancement package for SAP ERP, version for SAP HANA

- SAP S/4HANA Finance

- SAP S/4HANA

T093_ACCOBJ, XIDENT , KBA , FI-AA-AA , Basic Functions , How To

About this page

Search for additional results.

Visit SAP Support Portal's SAP Notes and KBA Search .

Privacy | Terms of use | Legal Disclosure | Copyright | Trademark

Analyzing the Core Components of Business Master Data

After completing this lesson, you will be able to:

- Analyze the attributes and functions of a business partner

- Evaluate the integration of contract accounts and contracts

Overview of Business Master Data

The business partner, residing within the cross-application component, signifies a person or an organization with whom business relationships are cultivated. The notion of a business partner is versatile, enabling representations through different views, courtesy of the business partner role. This versatility extends to the business partner category that classifies a business partner and the data to be maintained. Therefore, a business partner in the contract partner role is a prerequisite for creating a contract account, establishing the building blocks for a system where a single business partner can maintain multiple contract accounts, each suited to different scenarios like owning or renting an apartment.

Within the structure of Contract Accounting, the contract account holds a distinctive position, combining all contracts of a contract partner that abide by the same accounting and invoicing terms. Adding to its comprehensive characteristics, a contract account is equipped with a company code group. Comprising of the company codes of its contracts, this attribute opens the door for intercompany invoicing. Beyond being a repository, a contract account serves a functional role where contract accounting documents and invoicing documents are posted.

While a contract account is mandatory before creating a contract, one contract account can cater to several contracts, each as distinct as the division they represent for billing and invoicing.

Stepping into the realm of utilities, the contract is a pure utilities object, marking the agreement between a contract partner and the utilities company that is applicable to a singular division. Besides housing a company code, an essential tool to post the receivables and revenues of a division, a contract carries control data for processes like invoicing, billing, and deregulation. This makes it the posting destination for billing documents.

Elaborating on its inherent properties, a contract is twofold in its dependencies, leaning on both installation and device. A contract establishes its association with the installation during the Move-In process and serves as a crucial link between the technical and business master data. In this tightly interconnected structure, every element functions harmoniously to promote efficient operations.

Business Partner

In the SAP ecosystem, the Business Partner principle allows for a singular person, organization, or group to be centrally stored within the system under a unique number. They can assume multiple roles to manage diverse business relationships, a feature that introduces streamlined efficiency and simplicity to the process.

The Business Partner category lends itself to classifying the business partner and the corresponding data to be maintained. Clearly defined requirements are attached to each category, such as a company name and legal form for Organizations, a person's name, marital status for individuals, and a specific group type for groups. Uniquely identified under one category, a Business Partner cannot switch categories once created. This locked attribute is a fixed SAP value and cannot be customized.

Each business partner role offers a distinctive lens to view the business partner data. The General Data role, a fixed role in this system, maintains cross-role data such as names, addresses, and bank details. A Business Partner needs the Contract Partner role to function within the Contract Accounting component, even though it doesn't contain critical controlling data apart from the creditworthiness and SEPA mandate. In fact, while the bank account IBAN only needs the General Data role, the SEPA mandate requires the additional Contract Partner role.

Various roles can be attributed to a business partner under one central number. These roles can be added or revised after the business partner creation and are configured in Customizing, using default values provided by SAP. This flexibility allows the same business partner to be managed simultaneously as a customer and a vendor, needing these roles for mapping in Customer Vendor Integration (CVI).

In terms of organizing different number ranges, the Business Partner grouping comes into play. This feature, however, cannot be altered postcreation of the business partner and has to be configured in Customizing as it is not supplied by SAP. The grouping is essential for the CVI-mapping process.

In the realm of SAP ERP, a Contract Partner could also be created as an FI debtor and SD customer using the Sample Customer. In SAP S/4HANA, however, the Contract Partner assumes the additional roles of an FI debtor and SD customer. Here, the business partner becomes the leading object for managing customer and vendor master data, with CVI being the procedure to achieve synchronization of customer and vendor with the business partner.

The Business Partner's robust functionality allows for management of different addresses for varied address types, such as correspondence or delivery. Furthermore, it can handle different credit card numbers, which are eventually allocated to the Contract Account's payment method. It can also manage different bank accounts with IBAN that are later allocated to the Contract Account's payment method.

In conclusion, the Business Partner is the pivotal element to access the utilities master data environment in SAP S/4HANA Customer Engagement creating a holistic and unified understanding of the business ecosystems.

Contract Account

By integrating all contracts of a contract partner that operate under identical accounting and invoicing terms, the contract account serves as an organizational powerhouse that manages essential control data for accounting, invoicing, payment, and dunning. As a central receptacle, the contract account is the primary object where contract accounting and invoicing documents find their destination.

The creation of a contract account demands the presence of a business partner and relevant organizational data. The defining characteristic of a contract account, the contract account category, informs the varying number ranges and designates whether it can function as a collective bill account. The same contract account category, when tied with event 1017, assists in contract account creation by providing default values. To enable an efficient process of intercompany invoicing, the contract account module is equipped with a company code group entailing the company codes of its contracts.

Delving deeper into control data, a contract account hosts an array of control data for contract accounting, all of which can be crafted via Customizing. The account determination ID assists in determining the general ledger account via posting areas R000 and R001. The clearing category delineates the path for payment allocation and clearing of receivables, whereas the payment terms establish the due date and the cash discount deadline. The interest key lays out the terms for interest calculations, and the tolerance group sets up boundaries for payment differences.

In the domain of invoicing, important control data within contract accounts is facilitated by the Print Workbench component. The invoice form function employs the data from the invoicing document to invoke the printout function module. Furthermore, the invoice recipient - an alternate contract partner - is the designated invoice receiver. The collective bill account consolidates master data and postings of the allocated individual accounts, while the budget billing procedure describes the method of budget billing collection, such as budget bill or partial bill.

Payment processing in the contract account is guided by critical control data, which is formulated in Customizing. Payment methods play a pivotal role in processing incoming payments for receivables and outgoing payments for credit memos. While the payment method for incoming payments typically involves Direct Debit, requiring one of the contract partner's bank IDs with a SEPA mandate, outgoing payments usually employ Bank Transfer, needing one of the contract partner's bank IDs. An alternate payer, another contract partner, can be arranged to settle open items.

In terms of dunning processing, the contract account possesses important control data that permits configuration in Customizing. The dunning procedure outlines the dunning levels and subsequent dunning activities, while the correspondence variant consolidates all correspondence types for managing periodic correspondence.

From an operational perspective, the transaction code FQEVENTS provides access to the FI-CA Events. FQC0 enables the journey into FI-CA Posting Areas, and FICAIMG grants entry to the world of FI-CA Customizing. The comprehensive amalgamation of control data establishes the contract account as a key player in managing, synchronizing, and optimizing utility-related business procedures.

Defined as an agreement between a contract partner and the utilities company, a contract applies to a single, specific division. Significantly, its dependency is dual-fold, requiring both installation and device for optimal functioning. In terms of technical operations, a contract is the prime object where billing documents find their destination.

The process of creating a contract draws upon the presence of an installation, a contract account, and essential organizational data. A singular company code exists within each contract, providing a gateway to post the receivables and revenues corresponding to the division. Alongside this, every contract houses a division, mapped accurately to the utilities division categories like Electricity, Gas, Water, and Remote Heating.

The breadth of control data within a contract extends to areas of billing and invoicing. The Joint Invoicing indicator indicates whether a contract must be invoiced together with other contracts belonging to the contract account and outlines the procedure for the same. Critical parameters like the Outsorting Check Group that ensures automated outsorting checks during the billing execution, and the Manual Outsorting Group designed especially for critical customers to intentional check billing documents before they're invoiced, strengthen the contract's capabilities. Furthermore, contract control data also allows transfer of billing revenues to a profit center or CO-PA segment through Controlling Account Assignment.

Reaching into the realm of deregulation, the control data within a contract becomes a functional part of the grid usage billing process for the Distributor market role. Here, the Billing Service Provider (distributor) takes the helm as a market partner, churning out grid usage bills to be sent to the supplier. The Invoicing Service Provider (supplier), in turn, receives these bills and holds the capacity to invoice the grid usage charges directly to the customer. The payment class identifies the payment process and frequency between the distributor and the supplier.

This transactional dance of grid usage bill and payment advisories between the distributor and the supplier constitutes a market communication process. Mediated through electronic market messages (in the INVOICE format for grid usage bills and REMADV format for payment advisories), this process is facilitated by the SAP Market Communication for Utilities component, details of which are shared elaborately in Unit 12.

The final piece of the puzzle is assigning the contract to the installation, establishing an essential link between technical and business master data. This assignment takes place during the creation of the contract under the Move-In process, thus setting the wheels in motion for a structured, efficient utilities operation.

Log in to track your progress & complete quizzes

IMAGES

VIDEO

COMMENTS

Use. You can assign one or more account assignments to an item. Multiple account assignment allows you to apportion the costs covered by a purchase order partly to your own cost center and partly to others, for example. You specify which account assignment object is to be charged via the account assignment category. Account Assignment Category.

Entering Account Assignments. Specifying Single Account Assignment. Specifying Multiple Account Assignments (ME21, ME22) Outline Purchase Agreements with Vendors (MM-PUR-OA) Purchasing Info Records (MM-PUR-VM) Optimized Purchasing (MM-PUR-SQ) Entering Text, Printing, and Transmitting Documents. Reporting in Purchasing.

Learn how to configure and manage account assignments in SAP, including purchase types, CO object determination, and account assignment models.

Go to the Business Configuration work center. Go to the Implementation Projects view. Select the Project and select Open Activity List. Navigate to Fine-Tune and search for the activity Account Assignment Types. Open the activity and select Maintain Account Assignment Types. Select Add Row and in the drop-down for Primary Account Assignment you ...

Solution: The indicator determines which account assignment screen is used by default for maintaining the account assign. for a purchase orde r item. For the EnjoySAP transactions, this value is simply a proposal that you can change in the purchasing document. For the old transactions, this value is the only one that you can use.

The account grouping in the standard system is only active for Transaction GBB. To define account groupings for movement types, follow the configuration menu path SAP IMG > Materials Management > Valuation and Account Assignment > Account Determination > Account Determination without Wizard > Define Account Grouping for Movement Types. Define ...

This tutorial is part of our free SAP CO training. You will learn how account assignment works in SAP ERP and what are different sources of information about account assignment that the SAP system uses. Normally, when a financial document is entered in SAP FI module, user has the option of entering the cost center in the financial document.

You use configuration Transaction OBYC to assign SAP General Ledger (GL) accounts in Financial Accounting (FI) to movement types in Materials Management (MM), also known as SAP MM-FI Automatic Account Determination or Assignment. Display OBYC Accounts with SE16N. End users do not typically have the authorization to run configuration Transaction ...

Hi Expert, we need to create a new account assignment so that material FNZ will post to a different GL. how can i configure this thing? Please guide me step by step including the path/transaction code

#sap #mm #accountassignment #mmaccount #course #sapcourse #sapmmcontent #sapmmsyllabus #syllabus #sapconfiguration #mm #sapmm #sapmmconfiguration #sapmmconsu...

Reproducing the Issue. Open APP 'Manage your Solution'. Choose 'Configure your Solution'. Seach for SSCUI 101815. Choose the item and select ' Maintain Account Assignment Categories ' Configure. **The users are unable to edit any of the existing Account Assignment Categories.

In this configuration activity we are able to define account assignment groups for customers used in Sales and Distribution Module (SD).Transaction: OVK8 IMG Path: Sales and Distribution -> Basic Functions -> Account Assignment/Costing -> Revenue Account Determination -> Check Master Data Relevant For Account Assignment Tables: TVKT, TVKTT If you use the IMG Menu, you will have to choose the ...

The focus of this training is on the Profitability Management, Profit Center Master Data and Actual Postings topics. This course describes the basic concept of Profit Center Planning in SAP S/4HANA. This course describes only the basic concept of Transfer Pricing without system demonstrations and exercises.

Asset Accounting ->Integration with General Ledger Accounting ->Additional Account Assignment Objects ->Activate Account Assignment Objects "Image/data in this KBA is from SAP internal systems, sample data, or demo systems. Any resemblance to real data is purely coincidental." Read more...

The General Data role, a fixed role in this system, maintains cross-role data such as names, addresses, and bank details. A Business Partner needs the Contract Partner role to function within the Contract Accounting component, even though it doesn't contain critical controlling data apart from the creditworthiness and SEPA mandate.