- Scroll to top

- Get Started

Microfinance Mastery: Crafting a Winning Business Plan in India

- Author Content Team

- Published March 16, 2024

Microfinance has emerged as a powerful tool for financial inclusion and poverty alleviation in India. It involves providing small loans , savings , insurance , and other financial services to individuals and small businesses who lack access to traditional banking facilities.

The importance of microfinance in India can be attributed to the following reasons:

- Addressing Financial Exclusion : A significant portion of India’s population, especially in rural areas, remains unbanked and underserved by formal financial institutions.

- Empowering Women : Microfinance institutions (MFIs) have a strong focus on empowering women by providing them with access to credit and financial services, enabling them to start or expand their businesses and become financially independent.

- Promoting Entrepreneurship : Microfinance plays a crucial role in supporting small-scale entrepreneurship and self-employment opportunities, which are vital for economic growth and job creation in India.

- Poverty Reduction : By providing access to credit and other financial services, microfinance helps individuals and households improve their living standards , invest in education, healthcare, and other essential needs.

In India, microfinance has evolved from a niche sector to a well-recognized industry, with various models and stakeholders operating in the space, including:

- Non-Governmental Organizations (NGOs)

- Non-Banking Financial Companies (NBFCs)

- Small Finance Banks

- Self-Help Groups (SHGs)

As the microfinance industry continues to grow and mature, it is essential for new entrants and existing players to develop a comprehensive business plan that addresses the unique challenges and opportunities in this sector.

Key Components of a Microfinance Business Plan

A well-crafted business plan is crucial for the success of a microfinance company in India. It serves as a roadmap, outlining the company’s objectives , strategies, and operational details. The key components of a microfinance business plan include:

1. Executive Summary

The executive summary provides a concise overview of the entire business plan, highlighting the company’s mission, target market, products/services, competitive advantages, and financial projections. It should capture the essence of the plan and pique the reader’s interest.

2. Company Overview

In this section, you should provide background information about your microfinance company, including:

- Legal structure (e.g., non-profit, NBFC, or cooperative)

- Ownership and management team

- Company history and milestones (if applicable)

- Mission and vision statements

3. Products and Services

Clearly define the financial products and services your microfinance company plans to offer. These may include:

- Microcredit : Small loans for income-generating activities, consumption smoothing, or emergencies.

- Microsavings : Secure and accessible savings products for low-income individuals.

- Microinsurance : Affordable insurance products tailored to the needs of the target market.

- Financial literacy and training programs

4. Target Market and Customer Analysis

Conduct a thorough analysis of your target market and customer segments . This should include:

- Geographic coverage : Urban, rural, or a combination of both.

- Demographic profile : Age, gender, income levels, and occupation.

- Existing financial behavior and needs : Understanding the financial challenges and aspirations of your target customers.

5. Marketing and Outreach Strategy

Outline your marketing and outreach strategies to attract and retain customers. Consider the following:

- Branding and positioning : How you plan to differentiate your microfinance company from competitors.

- Marketing channels : Traditional (e.g., community meetings, door-to-door campaigns) and digital (e.g., social media, mobile apps).

- Partnerships and collaborations : Explore potential partnerships with local organizations, self-help groups, or community leaders.

6. Operations and Management

Describe the operational processes and management structure of your microfinance company, including:

- Loan origination and underwriting : Processes for evaluating loan applications and managing credit risk.

- Loan disbursement and collection : Efficient and cost-effective methods for disbursing loans and collecting repayments.

- Human resources : Recruitment, training, and retention strategies for staff.

- Technology and infrastructure : Systems and tools for managing operations, data, and customer relationships.

7. Financial Projections and Funding Requirements

Provide detailed financial projections for your microfinance company, including:

Additionally, outline your funding requirements and potential sources of capital, such as:

- Equity investments

- Debt financing

- Grants and subsidies

- Crowdfunding platforms

If you want to establish a successful microfinance company in India, it is imperative to include key components in your business plan. Doing so will showcase your comprehensive understanding of the industry, your target market, and the operational and financial aspects of your venture. This will help you secure funding, attract investors or partners, and navigate through the challenges of establishing and growing your business.

Market Analysis and Target Customer Segment

Conducting a thorough market analysis and identifying your target customer segment is crucial for the success of a microfinance company in India. This section of your business plan should provide a comprehensive understanding of the market landscape, potential customer base, and competitive dynamics.

Understanding the Microfinance Market in India

The microfinance industry in India has witnessed significant growth over the past decade, driven by various factors:

- Large Unbanked Population : According to industry estimates, over 60% of India’s population lacks access to formal banking services, creating a significant demand for microfinance products and services.

- Government Initiatives : The Indian government has implemented several initiatives, such as the Pradhan Mantri Jan-Dhan Yojana (PMJDY) and the Micro Units Development and Refinance Agency (MUDRA), to promote financial inclusion and support micro, small, and medium enterprises (MSMEs).

- Rising Urbanization and Migration : Rapid urbanization and rural-to-urban migration have increased the demand for microfinance services in urban and semi-urban areas.

- Growth of Self-Help Groups (SHGs) : SHGs have played a crucial role in facilitating microfinance activities, particularly in rural areas.

Target Customer Segment

To effectively cater to the diverse needs of the Indian population, it is essential to identify and understand your target customer segment. Here are some key factors to consider:

- Geographic Location : Determine whether your microfinance company will focus on rural, urban, or semi-urban areas, or a combination of these. Each region may have distinct socio-economic characteristics and financial needs.

- Demographic Profile : Define your target customer based on age, gender, income level, and occupation. For example, you may focus on women entrepreneurs, small business owners, or low-income households.

- Financial Needs and Behavior : Assess the specific financial requirements of your target customers, such as credit for income-generating activities, consumption smoothing, or emergency funds. Understanding their existing financial behavior and challenges will help you design tailored products and services.

- Level of Financial Literacy : Evaluate the financial literacy levels of your target customers. This will guide you in developing appropriate financial education and training programs to support their financial decision-making abilities.

Competitive Analysis

While the microfinance industry in India offers significant growth opportunities, it is also a competitive landscape. Conduct a thorough analysis of existing players in your target market, including:

- Microfinance Institutions (MFIs) : Identify the major MFIs operating in your target region, their product offerings, pricing strategies, and market share.

- Banks and Non-Banking Financial Companies (NBFCs) : Understand the microfinance products and services offered by traditional banks and NBFCs, as they may pose competition or potential partnership opportunities.

- Self-Help Groups (SHGs) : Assess the presence and influence of SHGs in your target area, as they play a crucial role in facilitating microfinance activities, particularly in rural regions.

- Fintech Companies : Evaluate the emergence of fintech companies offering digital microfinance solutions, as they may disrupt traditional models or present collaboration opportunities.

To effectively serve the underserved population in India, it is essential to conduct a thorough market analysis and identify your target customer segment. This will help you develop a customized business strategy, design appropriate products and services, and position your microfinance company to meet the specific needs of your target market.

Operations and Service Delivery Model

Establishing an efficient and scalable operations and service delivery model is crucial for the success of a microfinance company in India. This section of your business plan should outline the processes and strategies for effectively delivering financial services to your target customers.

Loan Origination and Underwriting

The loan origination and underwriting process is the backbone of a microfinance company’s operations. It involves the following key steps:

- Client Acquisition and Outreach : Identify potential customers through various channels, such as field officers, community meetings, referrals, or digital platforms.

- Application and Documentation : Collect and verify necessary information and documents from applicants, including proof of identity, income, and business details (if applicable).

- Credit Assessment and Risk Evaluation : Develop a robust credit assessment framework to evaluate borrowers’ creditworthiness, repayment capacity, and risk profiles. This may involve analyzing cash flows, collateral, and credit history (if available).

- Loan Approval and Disbursement : Once the loan application is approved, disburse the funds to the borrower through secure and convenient channels, such as bank transfers, mobile money, or cash disbursements.

Loan Repayment and Collection

Effective loan repayment and collection processes are essential for maintaining a healthy portfolio and ensuring sustainability. Consider the following strategies:

- Repayment Schedules : Design repayment schedules that align with your borrowers’ cash flows and income patterns, such as weekly, bi-weekly, or monthly installments.

- Collection Methods : Implement a combination of collection methods, including field visits, mobile money platforms, or partnerships with local agents or self-help groups.

- Delinquency Management : Establish clear policies and procedures for managing delinquent loans, including restructuring options, counseling, and legal recourse (if necessary).

- Portfolio Monitoring : Regularly monitor your loan portfolio to identify potential risks, delinquency trends, and areas for improvement.

Customer Service and Relationship Management

Providing exceptional customer service and building strong relationships with your borrowers is crucial for customer retention and growth. Consider the following practices:

- Customer Onboarding and Education : Develop comprehensive onboarding processes to educate borrowers about your products, terms, and conditions, as well as financial literacy training.

- Grievance Redressal : Implement a robust grievance redressal mechanism to address customer complaints and concerns promptly and effectively.

- Customer Feedback and Engagement : Regularly gather customer feedback through surveys, focus groups, or community meetings to understand their evolving needs and improve your services.

- Customer Relationship Management (CRM) System : Implement a CRM system to maintain detailed customer profiles, track interactions, and personalize communication and support.

Technology and Infrastructure

Leveraging technology and establishing a robust infrastructure can significantly enhance the efficiency and scalability of your operations. Consider the following aspects:

- Core Banking System : Implement a core banking system or loan management software to streamline loan origination, disbursement, and repayment processes.

- Mobile and Digital Platforms : Develop mobile applications or leverage digital platforms to enable convenient access to financial services, loan applications, and repayments.

- Data Management and Analytics : Establish secure data management systems and leverage data analytics to gain insights into customer behavior, portfolio performance, and operational efficiencies.

- Branch and Field Infrastructure : Determine the optimal mix of physical branches and field operations based on your target market’s needs and accessibility requirements.

Developing a well-structured operations and service delivery model can ensure efficient and scalable processes, exceptional customer service, and a healthy loan portfolio, ultimately contributing to the long-term success of your microfinance company in India.

Financial Projections and Funding Requirements

Developing comprehensive financial projections and assessing funding requirements are essential components of a microfinance business plan. This section should provide a detailed analysis of the company’s expected financial performance, resource needs, and potential funding sources.

Financial Projections

Financial projections are crucial for evaluating the viability and potential profitability of your microfinance company. These projections should include the following key statements:

1. Income Statement

The income statement projects your company’s expected revenue, expenses, and profitability over a specific period, typically three to five years. Key components include:

- Revenue Streams : Interest income from loan portfolios, fees, and other income sources.

- Operating Expenses : Personnel costs, administrative expenses, marketing, and loan loss provisions.

- Profitability Metrics : Net income, return on assets (ROA), and return on equity (ROE).

2. Balance Sheet

The balance sheet provides a snapshot of your company’s financial position, including assets, liabilities, and equity. Key components include:

- Assets : Cash and cash equivalents, loan portfolio, fixed assets, and other assets.

- Liabilities : Debt obligations, borrowings, and other liabilities.

- Equity : Contributed capital, retained earnings, and reserves.

3. Cash Flow Statement

The cash flow statement tracks the inflows and outflows of cash from operating, investing, and financing activities. This statement is crucial for assessing your company’s liquidity and ability to meet its financial obligations.

4. Key Assumptions and Sensitivity Analysis

Your financial projections should be based on well-researched assumptions, such as:

- Loan Portfolio Growth : Projected growth in loan disbursements and outstanding portfolio.

- Interest Rates : Expected interest rates for loan products and funding sources.

- Operational Efficiency : Anticipated improvements in operational efficiency and cost control measures.

- Loan Loss Rates : Estimated loan loss rates based on historical data and industry benchmarks.

Additionally, conduct a sensitivity analysis to assess the impact of changes in key assumptions on your financial performance.

Funding Requirements and Sources

Operating a microfinance company requires significant financial resources, particularly for loan portfolio growth and expansion. In this section, outline your funding requirements and potential sources:

- Equity Financing : Identify potential equity investors, such as impact investors, development finance institutions, or venture capitalists, and outline the equity funding requirements.

- Debt Financing : Assess the need for debt financing from banks, non-banking financial institutions, or specialized microfinance lenders. Determine the appropriate mix of short-term and long-term borrowings.

- Grants and Subsidies : Explore opportunities for grants, subsidies, or concessional funding from government agencies, development organizations, or foundations to support your operations or specific initiatives.

- Securitization and Capital Markets : Evaluate the potential for securitizing your loan portfolio or accessing capital markets through bond issuances or other structured finance instruments.

- Internal Accruals : Reinvest a portion of your company’s retained earnings to support growth and expansion plans.

Provide a clear breakdown of your funding requirements, sources, and associated costs, including interest rates, fees, and repayment schedules.

By providing detailed financial projections and a clear funding strategy, you can demonstrate the financial sustainability and potential for growth of your microfinance company, increasing your chances of securing capital and support from investors, lenders, and other stakeholders.

Risk Management and Regulatory Compliance

Operating a microfinance company in India involves navigating various risks and adhering to regulatory requirements. Effective risk management and compliance strategies are crucial for ensuring the long-term sustainability and credibility of your business. This section of your business plan should address the following key areas:

Risk Management

Microfinance companies face a range of risks that can impact their operations, profitability, and reputation. Implementing a robust risk management framework is essential to identify, assess, and mitigate these risks.

1. Credit Risk

Credit risk is the potential risk of borrowers defaulting on their loan obligations. To manage credit risk, consider the following strategies:

- Robust Credit Assessment : Implement rigorous credit assessment processes, including credit scoring models, cash flow analysis, and collateral evaluation (if applicable).

- Portfolio Diversification : Diversify your loan portfolio across different sectors, regions, and borrower profiles to minimize concentration risk.

- Loan Loss Provisioning : Maintain adequate loan loss provisions based on industry benchmarks and your portfolio’s risk profile.

2. Operational Risk

Operational risks arise from inadequate or failed internal processes, systems, or human errors. Mitigate these risks through:

- Process Standardization : Develop and implement standardized processes for loan origination, disbursement, collection, and customer service.

- Employee Training : Invest in comprehensive training programs for your staff to ensure adherence to policies and procedures.

- Internal Controls : Implement robust internal controls, including segregation of duties, regular audits, and monitoring mechanisms.

3. Liquidity Risk

Liquidity risk refers to the potential inability to meet financial obligations as they become due. Manage liquidity risk through:

- Cash Flow Forecasting : Develop accurate cash flow forecasting models to anticipate funding requirements and ensure adequate liquidity.

- Diversified Funding Sources : Maintain a diversified mix of funding sources, including equity, debt, and internal accruals, to mitigate reliance on a single source.

- Contingency Plans : Establish contingency plans, such as access to emergency credit lines or liquid asset reserves, to address unexpected liquidity shortfalls.

4. Reputational Risk

Reputational risk can arise from negative publicity, customer complaints, or unethical business practices. Protect your company’s reputation by:

- Ethical Practices : Promote ethical lending practices, transparency, and fair treatment of customers.

- Customer Grievance Redressal : Implement effective customer grievance redressal mechanisms to address complaints promptly and professionally.

- Community Engagement : Engage with local communities, self-help groups, and stakeholders to build trust and credibility.

Regulatory Compliance

Microfinance companies in India are subject to various regulatory requirements imposed by the Reserve Bank of India (RBI) and other relevant authorities. Ensure compliance with the following key regulations:

- Non-Banking Financial Company (NBFC) Regulations : If operating as an NBFC, comply with capital adequacy norms, asset classification, and provisioning requirements set by the RBI.

- Interest Rate Caps : Adhere to the interest rate caps and pricing guidelines established by the RBI or relevant state-level regulations.

- Customer Protection Norms : Implement robust customer protection measures, including fair lending practices, transparent communication, and responsible debt collection practices.

- Anti-Money Laundering (AML) and Know Your Customer (KYC) : Establish AML and KYC policies and procedures to comply with relevant regulations and prevent financial crimes.

- Data Protection and Privacy : Ensure compliance with data protection and privacy laws, safeguarding customer information and maintaining appropriate data security measures.

To ensure your microfinance company operates within industry standards, it’s important to manage risks and comply with regulations. By doing so, you can build trust with stakeholders and maintain ethical practices. This involves implementing strategies to prevent potential risks and ensuring that all regulatory requirements are met. By following these guidelines, your company can operate safely and gain the confidence of your stakeholders.

Key Takeaways

- Comprehensive Business Plan : A well-crafted business plan is essential for the success of a microfinance company in India, serving as a roadmap for operations, strategy, and growth.

- Market Analysis and Target Segment : Conduct a thorough analysis of the microfinance market landscape and identify your target customer segment based on factors such as geographic location, demographic profile, financial needs, and behavior.

- Operational Excellence : Establish efficient and scalable processes for loan origination, underwriting, disbursement, and collection, leveraging technology and robust infrastructure.

- Customer-Centric Approach : Prioritize exceptional customer service, financial education, and strong relationships with borrowers to drive customer retention and growth.

- Financial Projections and Funding Strategy : Develop comprehensive financial projections, including income statements, balance sheets, and cash flow statements, and identify potential funding sources, such as equity, debt, grants, and internal accruals.

- Risk Management Framework : Implement a robust risk management framework to address credit, operational, liquidity, and reputational risks, ensuring long-term sustainability.

- Regulatory Compliance : Adhere to relevant regulations imposed by the Reserve Bank of India and other authorities, including NBFC regulations, interest rate caps, customer protection norms, and anti-money laundering measures.

- Ethical and Responsible Practices : Promote ethical lending practices, transparency, fair treatment of customers, and engagement with local communities to build trust and credibility.

- Continuous Improvement : Regularly monitor and adapt your strategies based on customer feedback, market trends, and operational performance, fostering a culture of continuous improvement.

By incorporating these key takeaways into your microfinance business plan, you can create a solid foundation for a successful and sustainable venture that contributes to financial inclusion and economic empowerment in India.

Recent Posts

- Posted by Content Team

Microfinance Bank Business Model Explained

How Create A Strategic Blueprint for Microfinance Success

Money Lending Business Plan (Example and How to Create One)

This website stores cookies on your computer. Cookie Policy

How to Start a Microfinance Business in India?

by Shreya shrestha | Feb 22, 2021

In the midst of the COVID-19 pandemic, when almost every industry across India was witnessing a sharp downturn in its growth trajectory, the Indian microfinance industry developed a significant amount of resilience and was able to not only sustain itself but also register a massive growth of 31% in FY20, by jumping its loan portfolio to ₹2.36 lakh crores.

While this number might appear to be astounding at first glance, in reality, the Indian microfinance industry has been steadily growing over the past decade, and a recent research by Dr Swati Sharma of Amity Business School, Rajasthan, highlighted this fact.

Along with this, a quick look at the recent Statista report outlines the consistent growth the Indian microfinance industry has witnessed over the period of FY12-FY16, and all these reports go on to establish the fact, that not only is microfinance being widely accepted by the Indian populace but also demand for their services is constantly on the rise, making the proposition of starting a microfinance business in India even more attractive.

But, how can you start a microfinance business in India?

That is exactly what we will be talking about in today’s blog post, so without further ado, let’s get started.

Table of Contents

What Is a Microfinance Institution?

- Forming a Microfinance Company in India

Registering a Microfinance Business as an NBFC

Registering a microfinance business under section 8, in conclusion.

Before we learn how you can start a microfinance business in India, one of the most important aspects we need to invest our attention to is understanding the meaning of a microfinance company.

As per the RBI (Reserve Bank of India), microfinance or microfinance institutions can be defined as being financial institutions, which extend financial instruments such as small-ticket loans to the underbanked, low-income and weaker sections of the economy.

Primarily developed with the intention of increasing financial inclusion by providing the weaker sections of the economy an affordable and easily accessible tool to rise out of poverty, microfinance in today’s India provides its benefactors with a number of advantages such as:

- Providing easy and affordable access to credit instruments to the weaker sections of the society by leveraging group lending and thus fostering a joint liability mechanism among the benefactors such that on-time repayment can be seamlessly achieved.

- Providing easy and trustworthy access to traditional financial instruments such as saving bank accounts, such that financial inclusion can be raised among the poor.

- Ousting the use and increasing reliance of the poor on moneylenders and informal credit instruments, which are infamous for charging exorbitant rates of interest, and instead providing them access to affordable credit without the requirement of guarantors and assets or collaterals.

Starting a Microfinance Business in India

Now that you understand the meaning of a microfinance institution and the advantages it extends to its benefactors let us understand how you can start a microfinance business in India.

In India, there are two main ways of starting a microfinance business.

- Start an NBFC (non-banking financial institution), which is duly registered with the RBI.

- Register your microfinance business as a Section 8 company under the Section 8 of the Indian Companies Act, 2013.

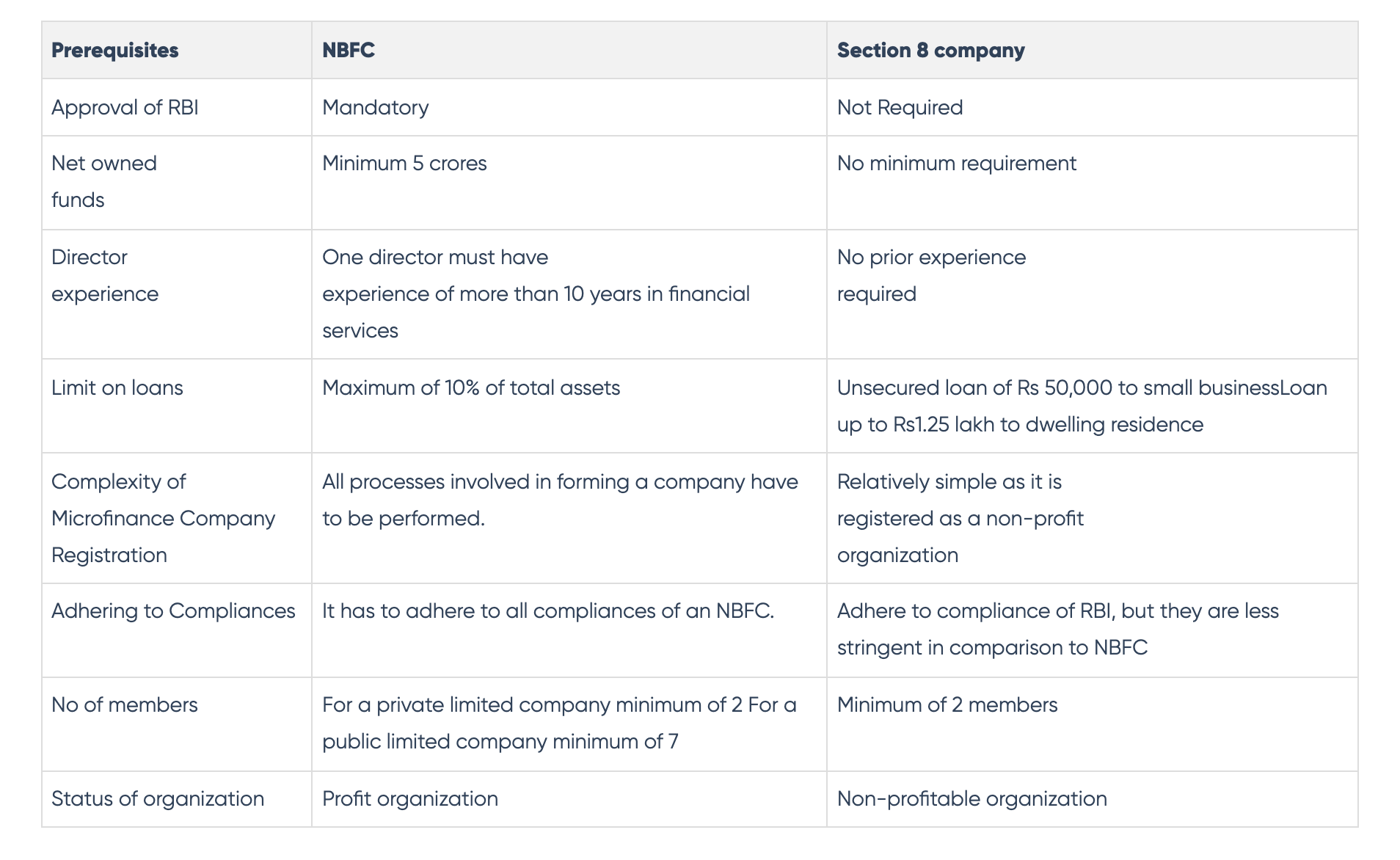

In either of the pathways you follow to start a microfinance business, there are a number of government outlined prerequisites you will need to follow. Some of the most significant of them are as shared below.

Now that you are aware of the prerequisites you need to fulfil in order to start a microfinance business in India, shared below is a rundown of the steps you need to follow in order to register it as an NBFC with the RBI.

- Register Your Company

In order to register your microfinance business as an NBFC, you will first need to form a private or a public limited company. In order to register as a private limited company, you will need to have at least two members present and a paid-up capital of ₹1 lakh, while on the other hand, if you want to start a public limited company, you will need to have at least 7 members and a minimum paid-up capital of ₹5 lakhs.

2. Raise Capital

Once you have registered your microfinance business as an NBFC, the next step of the process is to raise your capital. In the case of a microfinance business registered within India, you will need to raise a capital of ₹5 crores; however, if your company is registered within the northeastern territories of India, you will need to raise a capital of only ₹2 crores.

3. Deposit Your Capital

Once you have secured the capital amount of either ₹5 crores or ₹2 crores as applicable in your case, you will need to deposit the same with an SCB (Scheduled Commercial Bank) in the form of an FD (Fixed Deposit) and acquire a “No Lien” certificate against the same.

4. Submit Your Application

Once you have secured a “No Lien” certificate against your FD, the next step of the process is to submit your application along with your documents to the RBI. At the initial stage, you will need to fill out an online application on the RBI’s website, and post that; you will need to submit a hard copy of your application along with your newly issued licence and other certified documents with the local branch of the RBI.

Some of the most significant documents you will need in order to proceed with your application are as follows.

- Articles of Association and Memorandum of Association from your company registration.

- Incorporation certificate of your company

- A copy of your board resolution document

- A certified copy of your Fixed Deposit receipt from your auditor

- A banker’s certificate stating the net deposited fund along with the “No Lien” certificate

- Banker’s report of your company along with recent credit reports of all your directors

- Net-worth certificates of all your directors duly verified by your auditor along with the educational and professional qualifications of your directors.

- KYC and income proof of your directors

- Proof of past working experience in the financial sector, and

- Structural plan for your microfinance business

Submit all these documents with the duly registered authorities, and post additional clarifications, you will have your microfinance license from the RBI in a matter of few days.

Another pathway to register your microfinance business in India is by registering it under the Section 8 of the Indian Companies Act, 2013. In order to achieve the same, you will need to follow the below-outlined steps.

- Apply for DSC and DIN

The first step in order to register your microfinance business under Section 8 of the Indian Companies Act, 2013 is to apply for a DSC (Digital Signature Certificate) followed by a DIN (Director Identification Number). The idea behind this simply being, both these documents are crucial for approving all the e-forms you will be completing in the upcoming steps.

2. Company Name Approval

As the director of your microfinance business, once you have secured your DIN and DSC, the next step of the process is to seek name approval for your business by filling out the INC-1 form. As per the mandates prescribed by the Section 8 of the Companies Act, 2013, in order to register a microfinance business under this section, your company must contain a combination of the words, “Sanstha”, “Foundation”, or “Micro-Credit.”

3. File for Your MOA and AOA

Once you have secured the approval for your company name, the next step of the process is to file for your MOA (Memorandum of Association) and AOA (Article of Association), along with all the necessary documentation.

4. Apply for Your License

Once you have secured your MOA and AOA, the final step of the process is to submit all your documents to the RBI, along with your incorporation certificate and INC-12 form to obtain a license. Some of the most significant documents you will need to submit in order to secure a license for your microfinance business are as follows.

- Documents for identity proof of all directors as well as promoters.

- Documents for address proof of all directors as well as promoters.

- Photographs of all directors as well as promoters.

- Documents for proving ownership of registered office or rental document.

- NOC from the property owners

- Stamp duty as prescribed by the state

- Any other document which might be prescribed by the state government.

As is evident from the above explanation, it is much easier to register your microfinance business under Section 8 of the Companies Act, 2013, as compared to registering it as an NBFC.

As the demand for microfinance institutions continues to steadily increase among the Indian populace, in my opinion, starting a microfinance institution is the need of the hour. Now that you know how to get started with the registration process, go ahead and register your very own microfinance business in India today.

All the best.

The Reference Shelf

- Microfinance Company Registration [ Link ]

- Growth of Micro Finance in India: A Descriptive Study [ Link ]

- Chapter 1: Introduction [ Link ]

- Microfinance industry sees 31% rise in loan portfolio at Rs 2.36 lakh crore in FY20: Report [ Link ]

- All About MicroFinance Company Registration– The cheapest way to start the Micro Finance Company in India [ Link ]

- Gross loan portfolio volume of the microfinance industry in India from FY 2012 to FY 2016 [ Link ]

- How to Register a Micro Finance Company in India – A MFI – NBFC in India [ Link ]

How to Start Micro Finance Company | 9 Easy Steps

Microfinance companies play a crucial role in providing financial services to the underprivileged and economically weaker sections of society . If you are interested in how to start micro finance company , this guide will walk you through the process step-by-step.

Step 1: Conduct Market Research

The first step in starting a microfinance company is to conduct market research.

Some things to consider during your research are:

- Identify your target market: Who are your potential clients? What are their needs and preferences?

- Analyze the competition: Who are your competitors in the market? What sets your microfinance company apart from theirs?

- Analyze the demand: Is there a need for microfinance services in the area you are targeting? Are there potential clients who may be interested in your services?

- Potential customer base: Determine how many potential customers you can realistically reach with your marketing efforts.

Tip: Talk to potential customers and other players in the market to get a better understanding of the industry and its potential opportunities and challenges.

For this purpose, you can use Quora .

Step 2: Develop a Business Plan

Once you have conducted market research, you need to develop a business plan.

The business plan should include the following:

- Company Overview: Describe the mission, vision, and values of your microfinance company.

- Market Analysis: Provide a detailed analysis of the market, including the target customers, competition, and demand for microfinance services.

- Financial Plan: Outline the financial projections for your company, including the sources of funding, revenue streams, and expenses.

- Marketing Strategy: Describe your marketing strategy, including how you plan to reach out to potential customers and promote your services.

Tip: Your business plan should be a dynamic document that you can update as your business grows and changes.

Step 3: Obtain Company Registration Online

The next step is to obtain company registration online .

To start a microfinance company, you can choose to register your company as a non-banking financial company (NBFC) or a section 8 company .

Follow these steps To register your company as an NBFC :

- Apply for the certificate of registration with the Reserve Bank of India (RBI) on their website.

- Submit the application along with the required documents and pay the registration fee.

- Once your application is approved, you will receive the certificate of registration.

To register your company as a Section 8 Company , you need to follow these steps:

- Apply for the company registration online with the Ministry of Corporate Affairs (MCA) on their website.

- Once your application is approved, you will receive the certificate of incorporation.

Tip: Seek professional help by filling out the form on your right if you have any difficulties during the registration process.

Step 4: Obtain Licenses and Permits

To start micro finance company, you need to obtain the necessary licenses and permits.

Some of the licenses and permits required include:

- RBI License: As an NBFC, you need to obtain a license from the RBI to operate as a microfinance company.

- GST Registration: You need to register for GST if your company's turnover exceeds the threshold limit.

- PAN and TAN: You need to obtain a Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) from the Income Tax Department .

- Trade License: You need to obtain a trade license from the local municipal corporation.

- Other Licenses and Permits: Depending on the location and nature of your business, you may need to obtain other licenses and permits from the relevant authorities.

Tip: Make sure you have all the necessary licenses and permits before starting your microfinance company to avoid any legal issues.

"It's better to be safe than sorry."

Step 5: Set Up Your Office and Infrastructure

Finding the perfect location to start micro finance company can be a challenge.

But, it is crucial to ensure accessibility for both staff and customers.

Consider factors such as safety, transportation, and accessibility when selecting your office space .

Moreover, hiring staff with a passion for microfinance and a deep understanding of the local community can be beneficial to your company's success.

Also, investing in technology such as loan management software and accounting software can help streamline your operations and increase efficiency .

Tip: Create a comfortable and welcoming environment for your customers. It can include providing comfortable seating and refreshments and creating a welcoming atmosphere.

Additionally, make sure your office is easily accessible and visible to potential customers.

Use signage and advertising to attract attention and let people know about your services.

Step 6: Develop Your Product and Service Offerings

Developing your product and service offerings is a critical step in starting a microfinance company.

Here are some tips to help you get started:

- Identify your target market:

Determine the specific demographic you want to serve, such as women entrepreneurs or small business owners.

- Develop your product offerings:

Once you have identified your target market, develop microfinance products that meet their unique needs.

Consider offering a range of products, including loans, savings accounts, and insurance.

- Set interest rates and repayment terms:

Determine competitive interest rates and repayment terms that will attract borrowers while also ensuring that your company remains profitable.

- Streamline the loan application and approval process:

Develop an efficient loan application and approval process to ensure that borrowers can access funds quickly and easily.

- Provide financial education:

Offer financial education and training to your borrowers to help them understand the importance of responsible borrowing and financial management.

- Use technology to streamline operations:

Utilize loan management software and other technologies to help automate processes and improve efficiency.

- Stay competitive:

Keep an eye on the market and stay competitive by regularly reviewing your product offerings, interest rates, and loan terms.

By following these tips, you can develop a product and service offering that meets the needs of your target market and helps your microfinance company succeed.

Step 7: Build Your Customer Base

Building a solid customer base is crucial for the success of your microfinance company.

Here are some tips to help you build a strong customer base:

- Advertise Effectively:

Invest in targeted advertising to reach potential customers.

You can use online platforms such as social media, Google Ads, and email marketing to promote your services.

Also, consider offline advertising methods such as billboards and print ads in local newspapers.

- Word-of-Mouth Referrals:

Encourage your satisfied customers to refer their friends and family to your microfinance company.

Word-of-mouth referrals can be a powerful marketing tool and can help increase your customer base quickly.

- Establish Partnerships:

Partner with local organizations and institutions such as non-profit organizations, schools, and community groups to increase awareness about your services.

This can also help build trust and credibility with potential customers.

- Offer Incentives:

Consider offering incentives such as referral bonuses or discounts to attract new customers and retain existing ones.

- Build Relationships:

Develop a personal relationship with your customers to build trust and loyalty.

It can help increase customer satisfaction and encourage repeat business.

Remember, building a strong customer base takes time and effort.

Be patient, and continue to improve your services to attract and retain customers.

Step 8: Monitor and Evaluate Your Performance

Once your microfinance company is up and running, it is important to monitor and evaluate your performance regularly.

This will help you identify areas of improvement and make necessary adjustments to your operations.

Some key performance indicators to monitor include:

- Loan Portfolio Quality: Monitor the quality of your loan portfolio, including the level of non-performing loans.

- Profitability: Monitor your revenue and expenses to ensure that your company is profitable.

- Customer Satisfaction: Monitor customer feedback to ensure that you are meeting their needs and expectations.

- Regulatory Compliance: Monitor your compliance with regulatory requirements and make necessary adjustments to ensure that you are in compliance at all times.

Step 9: Expand Your Operations

Congratulations on establishing your microfinance company!

You're now on your way to making a positive impact on the lives of people who need financial assistance.

But don't stop there - once you've established a solid foundation for your company, it's time to think about expansion.

Expanding your operations may seem daunting, but it's a necessary step if you want to increase your impact and reach more people.

Here are some exciting possibilities for your microfinance company:

- Explore new markets:

If you're currently operating in one region or locality, consider expanding to other areas.

You could explore neighbouring regions, cities, or even other countries to reach a wider audience.

- Offer new products and services:

If you're only offering one type of microfinance product, consider adding more options to cater to different needs.

For example, you could offer small business loans, education loans, or emergency loans .

- Partner with other organizations:

Consider partnering with other organizations that share your mission and values.

This could include NGOs, government agencies, or other microfinance institutions .

Partnering can help you expand your reach and impact and pool resources to create even more impactful programs.

Remember that expanding your microfinance company requires careful planning and execution.

Make sure you conduct thorough research, develop a detailed business plan, and identify funding sources before taking the plunge.

Once you've expanded, make sure you monitor and evaluate your performance regularly to ensure continued success. Good luck!

Similar Post

CIN Number vs PAN Number | Differences and Usage

How to Start a Clothing Brand | The Ultimate Guide

How To Start An Insurance Company | Expert Guide

10 Common Mistakes of Entrepreneurship

Flat 51% off, on company registration.

Request a call back

- Blog Center

- Term of use

- Privacy Policy

- [email protected]

- For quick query resolution

- +91 9928380610

Registered Office Address:

- 65, Scheme No. 3,Alwar (Delhi NCR)

- PIN Code:301001

Thank you for pre-registering!

You're All Set!

We'll get in touch with you within 24 hours. For Faster response drop us a mail at [email protected]

Keshav Agarwal,

Cofounder, StartEazy Consulting

- 7428818844

- Login

A Complete Checklist for Start a Small Finance Company in India

Shivi Gupta | Updated: Jun 03, 2020 | Category: Microfinance Company , NBFC

India is a rapidly developing economy, with a diverse population and a large bank of talent. However, a significant portion of the country’s population resides in rural and semi-urban areas, where the traditional banking services are yet to make a mark. Individuals and businesses belonging to the lower-income group are unable to find secure channels of credit. Due to this shortage, they are forced to rely on informal financial sources that overcharge them significantly. The introduction of Non-Banking Financial Companies (NBFC) has reduced this gap to a large extend, and the introduction of small finance companies has further allowed lower-income groups to access quality credit for their requirements. This guide lays down the complete checklist on how to start a small finance company in India .

Table of Contents

What is a Small Finance Company in India?

A small finance company or a microfinance institution is a private institution that extends financial services to businesses and individuals belonging to the lower income levels. Small finance companies provide credit services to individuals and businesses that form the lower levels of the income hierarchy.

Many individuals and business are unable to match the requirements of traditional banking institutions that require a credit background and substantial disposable income. Micro or small finance companies provide financial resources to their customers for their personal or professional financial necessities. Individuals, self-employed professionals and businesses can fulfil their entrepreneurial dream or fulfil a personal financial emergency by availing small-size loan from a microfinance company .

Lending Limitations of Small Finance Company in India

Under the RBI Notifications, small finance companies in India are allowed to provide loans of up to INR 50,000 in rural regions and INR 1,25,000 in urban regions to entrepreneurs, businesses, and individuals/households that belong to the low-income group. It provides loans to small businesses, venturers, self-employed professionals, farmers, etc. without any form of collateral security or marginal money. It can extend credit at reasonable rates as laid down by the central government and Reserve Bank of India.

Benefits of Small/Micro Finance Company in India

The benefits of small or microfinance businesses in India can be summed up under the following points:

- A small finance company provides low-income individuals and MSMEs with quality credit assistance.

- A microfinance company promotes entrepreneurial drive and self-financial reliance among individuals.

- Small finance companies in India have more lenient credit appraisal standards and do not need an elaborate credit history of the borrower.

- Such financial institutions offer flexible and affordable loan repayment rates as compared to traditional banking institutions.

- By offering financial assistance to the lower-income groups, these companies promote better living standards and overall economic growth in the country.

Options for Start A Small Finance Company in India

There are two ways to start a small finance company in India:

- Micro Finance Institution (MFI) Non-Banking Finance Company (NBFC) registered with RBI.

- Small finance Company registered under Section 8 of the Companies Act, 2013.

Starting a Small Finance Company as Non-Banking Financial Company- Micro Finance Institution (NBFC-MFI)

Micro Finance Institutions or MFIs are small finance companies that provide financial services similar to the lending services provided by NBFCs in India. MFIs primarily target the weaker and marginalized segments which are unable to access banking services due to the strict eligibility requirements or inaccessibly in their remote regions.

Generally, an MFI or small finance company extends small-sized loans to individuals and businesses of around INR 20,000-30,000 for an array of financial requirements.

An NBFC MFI is a non-deposit taking NBFC. It is mandatory for such a company to have at least 85% of its assets as qualifying assets. The conditionals applicable over a small finance company established as an NBFC-MFI are as follows:

- Loans provided by an NBFC-MFI can be provided to households with an annual income of INR 1 lakh in rural regions, and to households with an annual income of INR 1,60,000 in urban and semi-urban regions.

- Loans provided by an NBFC-MFI are limited to INR 50,000 in the first cycle and INR 1,00,000 in the following cycles.

- The loans can be extended for a minimum period of 24 hours in case of the amount of loans is more than INR 15,000. Additionally, the borrowers have the option of prepayment without penalty in such cases.

- Loans provided by a small finance company are provided without any form of collateral.

- The loan repayment cycle can be weekly, 15-day or monthly. The borrower has the option to select the EMI cycle as per their repaying capacity.

- The processing fee is limited to 1% of the gross loan amount.

- The company is allowed to different rates of interest from its customers as per their portfolio; however, the minimum and maximum rates of interest cannot exceed 4% for individual loans.

- The NBFC-MFI requires a CIBIL membership mandatorily.

Procedure to Start a Small Finance Company as NBFC-MFI

The following process is followed to start an NBFC-MFI in India:

- Business Registration: The first step to start a small finance company as NBFC-MFI is to register the business as a company under the Companies Act 2013. Once the company registration formalities are completed and the business receives its Certificate of Incorporation from the State ROC, it is required to hold a minimum amount of capital as specified by the RBI.

- Capital Requirement: To start a microfinance company in India, a minimum capital of INR 5 crores is required. However, the requirement to start a small finance company in North-Eastern states is INR 2 crores. The business is required to open a bank account and deposit the capital in the form of a fixed deposit.

- RBI Application: The next step is to file an application with the Reserve Bank of India in the given format for NBFC-MFI registration , along with the requisite documents. The RBI allows a Company Application Reference Number, after which a physical (hard) copy of the documents is submitted.

The RBI performs detailed due diligence on the documents submitted by the applicant company such as the incorporation certificate, Banker’s certificate, MOA and AOA , fixed deposit receipt, etc.

Once the applicant clears the checklist of the RBI, the bank issues a Certificate of Incorporation. After receiving the RBI’s incorporation certificate, the company can launch its lending services in India.

Documents Required for Small Finance Company Registration as NBFC-MFI

The following documentation is required to file an application to start a small finance company in the form of NBFC-MFI in India:

- Certified copy of Certificate of incorporation and certificate of commencement of the business.

- Certified copy of the latest Memorandum of Association and Article of Association of the company.

- Certified copy of the Board Resolution allowing the registration of the company as a small/microfinance company.

- Declaration laying down that the company would comply with the rules, regulation and notifications provided by Reserve Bank of India for non-banking financial companies in India.

- Bankers’ report mentioning their dealing with the company.

- Auditor’s report specifying that the applicant fulfils the minimum capital requirements.

- A detailed 5-year business plan that lays down the company’s operational strategies and financial projections.

- Certified copies of educational and professional qualification of all directors and experience certificate in the sector of Financial Services if any.

Starting a Small Finance Company as Non-Profit Micro Finance Business

Another option to start a small finance company in India is by way of establishing a Non-Profit microfinance business or a Section 8 company. As per the RBI regulations, financial activities by a private institution can only be carried by a company registered as a Non-Banking Finance Companies (NBFC).

However, the Reserve Bank of India has granted certain exemptions for businesses to extend financial services up to a limit without getting registered as an NBFC. The RBI issued its master circular: RBI/2015-16/15 DNBR (PD) CC.No.052/03.10.119/2015-16 dated July 01, 2015 allows companies registered under Section 8 of the Companies Act to undertake microfinance activities.

The circular further states that under Para 2 (iii) of the circular, Sections 45-IA, 45-IB, and 45-IC of the Reserve Bank of India Act, 1934 are not applicable over any non-banking financial company which is involved in the following activities:

- Company engaged in microfinance activities, extending credit for up to INR 50,000 to a business enterprise.

- Company engaged in microfinance activities extending credit for up to INR 1,25,000 to fulfil the costs of a housing unit to any poor person and allowing such individuals to elevate their level of income and standard of living.

- A Company registered under Section 8 of the Companies Act, 2013 (section 25 of the Companies Act, 1956).

- A company which is not taking any public deposits as described in paragraph 2(1) (xii) of Notification No. 118 /DG (SPT)-98 dated January 31, 1998.

Under this notification of the Reserve Bank of India, a microfinance company can be started in the form of a trust, society or company. An MFI can, therefore, be registered under any of the following acts to run as a non-profit business:

- As a Trust under the Indian Trust Acts, 1882

- As a Society under the Societies Registration Act, 1860

- As a Section 8 Company under the Companies Act, 2013

Key Features of Section 8 Small/Micro Finance Company

A small finance company registered as a Section 8 company has the following unique features:

- A section 8 Company can be established only for the purposes of promoting commerce, art, science, sports, education, research, social welfare, religion, charity, protection of environment or any such other charitable goals.

- Any forms of profits earned by a Section 8 company can only be used to fulfil its charitable objectives.

- A company registered under Section 8 of the Companies Act cannot declare or pay any form of dividend to its members.

- The small finance company can grant a maximum loan amount up to INR 50,000 for business purposes and INR 1,25,000 for residential dwelling.

Benefits of Small Finance Company Registered Under Section 8

Registering a small finance company under section 8 of the Companies Act, 2013 comes with the following benefits:

- A Section 8 company does not require any separate approvals or registrations from the RBI.

- A Section 8 company does not need to maintain a minimum capital deposit of INR 5 crores.

- The process to start a Section 8 company is fairly simple as compared to an NBFC-MFI.

- The cost of Section 8 company registration is lower than the cost of registering an NBFC .

- The post-registration compliances of a Section 8 company are fewer than a small finance company registered as an NBFC-MFI .

Procedure for Start a Section 8 Small Finance Company in India

The registration process to start a small finance company in the form of a Section 8 company is fairly simple. It includes the following easy steps to start a Section 8 small finance business in India:

- Minimum Requirements: There must be at least two individuals to register a Section 8 company.

- DSC and DIN: Each Director of the company must have a Digital Signature Certificate (DSC) and Directors Identification Number (DIN) for application filing and compliance requirements.

- Naming the Section 8 Company: The application to get the name approval of the company must be filed, mentioning a unique name for the company. The name of Section 8 small finance company must include the words such as foundation, Forum, Association, Federation, Chambers, Confederation, council, Electoral trust or Micro Credit. This makes the nature of the business transparent for the general public.

- Central Government License: Once the name approval is received, the company must obtain the license to operate as a Section 8 company. The license is obtained by submitting the details of the company’s detailed documentation.

- Company Incorporation: Once the documents are submitted and the government approval is received, the company incorporation application must be filed. Upon approval of the documents and application, the company incorporation certificate is issued.

- PAN and TAN: The PAN and TAN of the company must be obtained once the company incorporation is done.

Documents Required for Section 8 Small Finance Company Registration

The following documents are required to obtain the Section 8 company registration in India:

- Latest passport size photographs of all directors or promoters.

- Copy of PAN of all directors or promoters.

- Identity Proof of the Directors such as voter ID card, driving license, passport or Aadhar Card.

- Address Proof of the Directors such as the Bank Statement or the latest Utility Bills such as telephone bill, landline bill or electricity bill.

- Property ownership documents of Registered office such as rent agreement or lease deed, property documents, or electricity bills, etc.

- Certificate by a practising Chartered Account or Company Secretary.

Starting a Small Company: Which Option is Better?

While starting and running a small finance company as a Section 8 company is relatively easier, it is advised by the most experienced finance experts that starting a small finance company in the form of an NBFC-MFI. Starting an NBFC-MFI provides the RBI’s [1] backing to the business to carry out its lending activities securely in the country.

Also, with the RBI’s backing, the chances of default are lesser than the defaults in the case of Section 8 companies. Since registering an NBFC-MFI requires a Banker’s involvement in the Board, the lending activities are executed and backed by subject matter experts. Starting a small finance company in the form of NBFC-MFI if the business has the correct support and guidance of business experts who have prior experience in NBFC registrations at the RBI. Swarit connects you with a team of NBFC experts who can guide you at each step of your business registration and help you establish and operate a successful small finance company in India.

Also, Read: Incorporation of Innovation in the Non-Banking Financial Companies .

Latest Post

- Steps to Register Food Business Online with FSSAI

- Ways to Get an IEC Code for Small Business in India

- How to File Trademark Rectification If Error in Trademark?

- CBDT Clarifies Provisions Regarding TDS Deduction from Salaries for F.Y. 2020-21

- Legal and Security Services under Trademark Class 45

Know the difference between FSSAI and FCI

7 Important Things to Know about FSSAI License Renewal Process

RERA in Gujarat: Process to Register Project and Agent

Medical, Veterinary, & Beauty Services under Trademark Class 44

Start An Online Grocery Store in India: Its Concept and Process

Related Blog

Free Call Back by our Expert

Easy Payment Options Available No Spam. No Sharing. 100% Confidentiality

Related Articles

Dashmeet Kaur | Date: Nov 13, 2019 | Category: NBFC , RBI Advisory

Opportunities and challenges of fintech – reserve bank of india.

Financial technology also abbreviated as FinTech is the technology and innovation which aims to revamp the traditional methods of delivering financial services. From startups to well-established companies dealing in the...

Dashmeet Kaur | Date: Dec 03, 2019 | Category: NBFC

The role of due diligence of nbfc for sale.

NBFC or Non-Banking Financial Company is a financial entity registered under Section 45-I of Reserve Bank of India Act. It is a perfect alternate of traditional lending institution servings various businesses, like micro...

Dashmeet Kaur | Date: Oct 16, 2019 | Category: NBFC , RBI Advisory

How to appeal against nbfc license cancellation.

NBFCs (Non-Banking Financial Companies) are the type of companies which provide banking services like loans and advances, acquisition of stocks/bonds/shares/securities/debentures. They are incorporated as per Companies Act 2013 and regulated...

Ways to Set up a Microfinance Company

Be it an NBFC or a Section 8 company, this article tells you what you need in order to, and how to, set up a microfinance company in India.

Are you looking for how to start a microfinance company? Great decision indeed! Now, there are 2 ways in which you can set up a microfinance company. Before you pick one, read this blog to understand the difference between these two types and the process of setting them up.

This way you get clarity and can set up your company successfully. We also share with you the easiest way to set up a microfinance business in the end.

Table of Contents

The 2 Ways to Set Up a Microfinance Company:

- As an NBFC (Non-Banking Finance Company), registered with the RBI

- As a Section 8 company (formed as per the provisions of Section 8 of the Companies Act, 2013).

Prerequisites for the Registration of a Microfinance Company

You must meet certain prerequisites before starting with the microfinance company registration process.

1. For Registering as an NBFC

- It is mandatory to have RBI approval

- You should have a minimum net owned fund of ₹5 crores

- One of the directors must have over 10 years of experience in the service industry

- You must have maximum a loan limit of 10% of the total assets

- Further, you must follow the due process of forming a company

- You must have a minimum of 7 members to register as a public limited company. 2 members will be enough for a private limited company.

2. For Section 8 Microfinance Company Registration

- RBI approval is not mandatory

- There is no minimum requirement of net owned funds

- No need of any prior experience for the directors

- You can disburse unsecured loans up to ₹50,000 to small businesses. Also, loans up to ₹1.25 lakh can be disbursed to dwelling residence

- You must have a minimum of 2 members for Section 8 microfinance company registration

You need to analyse these requirements and see which type of company is better for you. An NBFC takes a lot of investment and approvals to set up but it provides more flexibility in the loans you can provide and to whom.

On the other hand, a Section 8 company is much easier to set up. However, there are limitations on how much you can lend.

Microfinance Company Registration Process

The process varies depending on whether you want to register as an NBFC or as a Section 8 company. We will discuss the steps involved in both these models.

1. Process for NBFC Registration

Step 1: form a company and register.

To register as an NBFC microfinance company, you should first form a public or private company. A minimum of 7 members is required to form a public company. A minimum capital of ₹1 lakh and 2 members are required to form a private company.

STEP 2: Raise the Minimum NOF

You need to raise a minimum capital of ₹5 crores as the Net Owned Fund (NOF). Further, this amount is ₹2 crores for the north-eastern region.

STEP 3: Deposit the Capital

In this step, you need to deposit the capital as a fixed deposit in a bank. The bank will provide a ‘No Lien’ certificate.

STEP 4: Apply for the License

After that, you must apply online for a license from RBI to provide financial assistance. Similarly, along with the application, you should submit certain documents such as

- Memorandum of Association (MoA)

- Articles of Association (AoA)

- Company incorporation certificate

- Board resolution copy

- Auditor’s report regarding receipt of the fixed deposit receipt

- No lien certificate from the banker stating the net owned fund

- Structure plan of the company

- Recent credit report of the directors

- Professional qualification and education proofs of the directors

- Income proof and KYC of the directors

- Proof of experience of the directors in the financial sector.

After the license is obtained, a hard copy of the same must be submitted to the RBI regional office.

Process for Section 8 Company Registration

Step 1: apply for dsc and din.

The DSC ( Digital Signature Certificate ) and DIN (Director Identification Number) is for the authorisation of the e-forms. So, if the directors of the company don’t have them, the first step is to get these two for the directors of the company.

STEP 2: Apply for name approval

You need to apply for the name approval by filing Form INC-1. Please note that your proposed name must suggest that it is a Section 8 company. The company name must include the words such as ‘foundation’, ‘ micro credit’, or ‘sanstha’.

STEP 3: File AoA and MoA

After you receive the name approval, the next step is to draft the Articles of Association (AOA) and the Memorandum of Association (MOA). These should be filed along with specified documents.

STEP 4: Apply for incorporation

You need to file for company incorporation under Form INC-12. Certain documents will have to be submitted along with. These are listed below:

- PAN card copies of all the directors/promoters

- Identity proof documents

- Address proof documents

- Photographs of all the directors/promoters

- Ownership proof of the registered office ( Rental Agreement or owner NoC for rented premises)

- The stamp duty is applicable in the state concerned.

Microfinance Company Registration Fees

The registration cost for microfinance companies varies depending on the type of company. Moreover, the registration cost for the Section 8 company is ₹25,000. Moreover, the registration fees for the NBFCs hover between ₹4 to 5 lakhs at present.

Easiest Way to Set up Your Section 8 Microfinance Company

If you have decided to set up a Section 8 company and find the process overwhelming, we have the easiest solution for you. Vakilsearch can register your Section 8 company for you! Our experts will take care of the whole process and guide you through it. Further, if you have any questions or doubts about the process, you can contact our support team.

What are the key regulatory requirements for establishing a microfinance company?

Micro-finance companies are governed by the Companies Act of 2013 and the rules and regulations prescribed by the Reserve Bank of India, which is its central regulatory authority.

How can technology be leveraged to streamline operations in a microfinance business setup?

Technology can be leveraged to streamline operations in a microfinance business setup by automating processes, improving customer service, and enhancing transparency and efficiency. This can be achieved through the use of digital platforms, mobile applications, and data analytics to improve lending decisions, track loan performance, and manage risk exposure.

What financial instruments are commonly employed by successful microfinance companies?

Successful microfinance companies in India commonly employ various financial instruments, including microloans, group loans and savings products. These instruments are tailored to the needs of low-income and financially excluded individuals and groups, offering small loans and savings options that cater to their unique financial requirements.

Are there specific qualifications or certifications required to start a microfinance company?

Yes, there are specific qualifications and certifications required to start a microfinance company in India. To know more, request a callback from our experts for a detailed explanation.

In what ways can a microfinance company effectively assess and mitigate risks in its operations?

A microfinance company can effectively assess and mitigate risks in its operations by implementing robust risk management practices, such as credit risk management, market risk management, operational risk management and interest rate risk management.

- Section 8 Company Registration Requirements

- ITR Forms Applicable for Section 8 Company in India

- How to Register Section 8 Company?

Section 8 Company Annual Report

Overview A Section 8 Company is a type of non-profit organization in India that is formed to promote charitable causes,…

What Is The Difference Between Trust, Section-8 Company & Society?

Overview Establishing a charitable or non-profit organisation involves navigating through various legal structures, each serving distinct purposes. Trusts, Section-8 Companies,…

What is the Cost of Section 8 Company Formation and Compliance?

Introduction Establishing a Section 8 company, primarily known as a not-for-profit or non-profit organisation, is a noble endeavour aimed at…

Which ITR is Applicable For Section 8 Companies?

Introduction Income Tax Return (ITR) filing is a crucial aspect of maintaining financial compliance for any business entity, including Section…

Understanding G-Secs and How to Invest in Them for Business?

G-secs refer to government securities or, in other words, loans or capital issued by the government. The biggest advantage associated…

Startups to Continue Receiving a Tax Holiday

Businesses of all sizes and types have been having a tough year courtesy of the coronavirus pandemic. The Indian government…

How the Rupee Depreciation is Enticing NRIs in Real Estate?

The Indian currency has depreciated as much as 5.2% against the US dollar in 2022 so far. The rupee’s depreciation…

Subscribe to our newsletter blogs