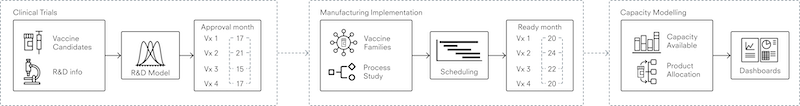

Building greater resilience in vaccine manufacturing

Public-health crises have vaulted to the top of national agendas over the past two years. Even as COVID-19 enters the endemic stage in the United States and Europe, 1 “ When will the COVID-19 pandemic end? ,” McKinsey, July 28, 2022. the monkeypox outbreak has been declared a public-health emergency of international concern by the World Health Organization (WHO). 2 “WHO director-general declares the ongoing monkeypox outbreak a Public Health Emergency of International Concern,” WHO, July 23, 2022; note: WHO is actively working with partners and experts around the world to rename monkeypox.

Preparing for the next pandemic is a priority for many national public-health leaders and requires them to lay the groundwork to mount an effective vaccine response. COVID-19 laid bare the gaps in the global vaccine supply, 3 Celynne A. Balatbat, Victor J. Dzau, and Anaeze C. Offodile II, “Closing the global vaccine equity gap: Equitably distributed manufacturing,” Lancet , May 21, 2022, Volume 399, Number 10339. shifting expectations of what is possible in development and manufacturing and highlighting immunization as a viable path to protect populations quickly. This suggests that creating more resilient vaccine ecosystems—ones that allow a country or region to develop and trade expertise and resources and collaborate with partners to secure enough vaccine doses when they need them—is likely to play a critical role in readiness in the future. The US government, for example, recently launched an initiative aimed at ensuring that biotechnology manufacturing capabilities are available in the country. 4 The United States has launched an initiative focused on manufacturing in biotechnology. For more, see “Fact sheet: President Biden to launch a National Biotechnology and Biomanufacturing Initiative,” The White House, September 12, 2022.

There are no safe bets in vaccine development—and our analysis shows that investments have abated following the surge of capital during the initial COVID-19 crisis, in 2020–21. But the developmental paths of the major COVID-19 vaccines suggest that future vaccines can achieve a radically shortened time to market if there are many candidates and modalities to work with. Vaccine production capacity has expanded significantly, and many countries have started to reverse previous trends toward offshoring. The current challenge for public-health authorities is how to combine insights from the first two years of the pandemic with analysis and actions to produce more robust national and regional vaccine ecosystems for future pandemics and epidemics.

Decision makers could set the stage for vaccine resilience by defining what their countries and regions need; assessing the local capacity to scale production of vaccine doses; identifying gaps and weaknesses in their national and regional vaccine value chains (across multiple technology platforms, such as mRNA and viral vectors); building coordination capabilities; and identifying and sizing the strategic investments required. While the task ahead may be daunting, the payoffs for public health could be significant.

A transformed vaccine landscape

The rapid development of COVID-19 vaccines has reframed expectations for immunizations in four significant areas: time-to-market horizons, competition, production capacity, and onshoring.

Radically shorter time to market

The COVID-19 vaccine was developed in 11 months—a dramatic acceleration compared with the more typical ten years. 5 “ Fast-forward: Will the speed of COVID-19 vaccine development reset industry norms? ,” McKinsey, May 13, 2021. This swiftness showed that with the right basic research, the right investments, and concerted cross-sector collaboration, the vaccine industry can dramatically shorten the vaccine development timeline. 6 For more, see “ Fast-forward ,” May 13, 2021. This precedent has inspired some organizations to try to reduce time to market to 100 days. 7 Melanie Saville et al., “Delivering pandemic vaccines in 100 days—what will it take?,” New England Journal of Medicine , July 14, 2022, Volume 387, Number 2; “100 days,” CEPI, 2022.

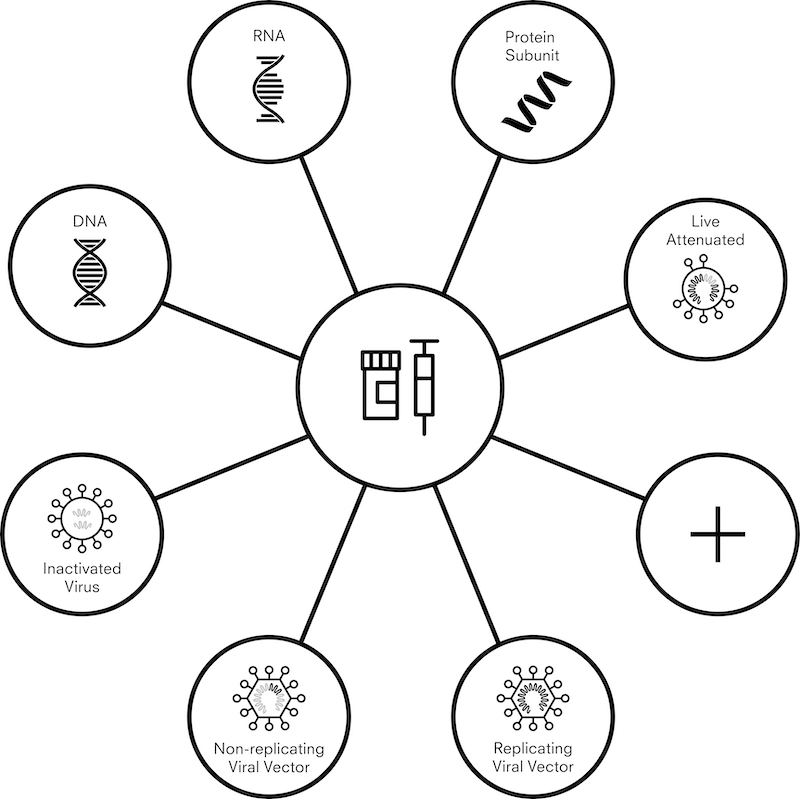

Of course, maintaining robust vaccine development, let alone achieving a regulatory-appproved product in 100 days or less, requires a large and diverse portfolio of modalities and partnerships with a wide variety of producers. Existing research will likely prove critical, as will a willingness from stakeholders across sectors to make investments that may not pay off.

Technological advances and the COVID-19 pandemic have motivated start-ups and established companies alike to strive for the next innovation in vaccines.

Heightened competition

Technological advances and the COVID-19 pandemic have motivated start-ups and established companies alike to strive for the next innovation in vaccines. Consider that effective COVID-19 vaccines came from Moderna, a biotech with no prior commercial launches, and AstraZeneca, a pharmaceuticals company without a broad portfolio of vaccines.

These successes demonstrate that effective vaccines can emerge from a wide variety of modalities and producers. And indeed, more developers are pursuing vaccines. For COVID-19 alone, 276 vaccines were in active development as of July 2022, and several have now gained full regulatory approval in multiple markets. 8 COVID-19 Treatment and Vaccine Tracker, Milken Institute, May 25, 2022. The implications for new entrants are significant. McKinsey analysis shows that in 2019, the four largest vaccine manufacturers accounted for about 90 percent of the market by revenue. Following the entrance of new players into the vaccine market with the advent of multiple COVID-19 vaccines, it is likely that the top four manufacturers’ share of the market will diminish. Industry analysts predict this trend will continue over the next five years, with a variety of players capturing increasing proportions of market share. 9 Evaluate Pharma, Evaluate, May and November 2021.

Increased production capacity

For vaccines with regulatory approval, unprecedented production capacity awaits even though capital expenditures inspired by the initial COVID-19 crisis have started to wane.

By February 2021, more than $10 billion—most of it from the public sector, with contributions from global philanthropic and multilateral organizations 10 Olivier J. Wouters, “Challenges in ensuring global access to COVID-19 vaccines: Production, affordability, allocation, and deployment,” Lancet , March 31, 2021, Volume 397, Number 10278. —had been invested in production capacity for COVID-19 vaccines. This push extended the annualized global capacity to up to 24 billion doses by June 2022. 11 “Momentum of COVID-19 vaccine manufacturing scale up sufficient for step change in distribution,” International Federation of Pharmaceutical Manufacturers & Associations (IFPMA), September 7, 2021. The result has been an estimated 12.66 billion doses administered globally, 12 “Coronavirus (COVID-19) vaccinations,” Our World in Data, updated September 19, 2022. almost three times the volume of vaccines distributed in 2019. 13 “MI4A Vaccine purchase data,” WHO, 2019 data. This increase in capacity is unprecedented and may be advantageous to retain. 14 “Invest in biotech,” BioIndustry Association, August 31, 2022.

Biosecurity and the onshoring of vaccine capabilities

The COVID-19 pandemic has made vaccine manufacturing a biosecurity matter. Because infectious diseases can emerge from all parts of the globe, multiple countries, including the United States, have announced their intentions to scale their domestic vaccine production capabilities. 15 For examples, see “Government of Canada announces agreement with leading COVID-19 vaccine developer Moderna, Inc. to build mRNA vaccine facility in Canada,” Government of Canada, August 10, 2021; “Fact sheet,” September 12, 2022; “Government further boosts UK vaccine manufacturing capacity,” Government of the United Kingdom, August 3, 2020; and “Statement on the remarkable progress made by several African countries as part of the Partnerships for African Vaccine Manufacturing (PAVM),” African Union, July 13, 2021.

This is a reversal of prepandemic trends in biopharma manufacturing and requires a careful examination of the supply of vaccine inputs. 16 “Government of Canada,” August 10, 2021; “Government further boosts,” August 3, 2020. During the initial phases of the COVID-19 pandemic, supply bottlenecks for critical vaccine inputs such as bioreactor bags arose because manufacturing capabilities were concentrated among a small group of suppliers that struggled to keep up with rocketing global demand.

Potential steps toward resilient vaccine production

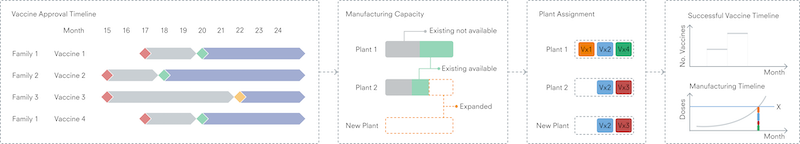

Developing a resilient ecosystem for vaccine production means balancing current needs, short-term pressures, and long-term objectives. National public-health leaders could start by translating vaccine-manufacturing resilience into concrete requirements and then use that information to assess local manufacturing capacity. Next, they could assess the value chain to identify strengths and weaknesses and to coordinate stakeholders throughout the ecosystem. Finally, they could evaluate the options for investment and collaboration against their ability to contribute to local vaccine manufacturing resilience.

Define vaccine resilience

As a starting point, leaders could quantify and define what a resilient in-country vaccine ecosystem should be able to accomplish. For example, decision makers could determine the number of doses needed to elicit a short-term immune response. From there, they could calculate their country’s vaccine requirements. Using the COVID-19 pandemic as a model, a hypothetical country with a population of 40 million people may need more than 80 million doses in a similar pandemic if the population followed a two-dose vaccine regimen.

But in a pandemic, timeliness is paramount. A country of 40 million people would need to distribute more than three million doses per week to achieve full vaccination within six months. With such scenarios in mind, countries could use data from the COVID-19 pandemic on the responsiveness of their vaccine distribution systems to estimate how quickly they could scale up distribution when needed.

Evaluate the local manufacturing base

To assess the local manufacturing base, decision makers may need to evaluate the ease of access to available capacity and determine the flexibility of the manufacturing base in scaling up vaccine manufacturing. Both assessments will likely require a nuanced approach because they involve analysis of the constraints on the domestic vaccine-manufacturing capacity, which comes with technological and regulatory constraints. Strong working relationships between manufacturers and sophisticated regulators will likely be key, and regulators might vary their approaches according to vaccines’ technical requirements. For instance, protein-based and attenuated-virus vaccine technologies are relatively well established, while mRNA-based vaccines saw commercial application for the first time during the COVID-19 pandemic. 17 “Who we are,” Singapore Economic Development Board, accessed September 27, 2022; “Biopharma,” IDA Ireland, accessed September 1, 2022.

High-level decision makers could assess their domestic manufacturing capabilities through the lenses of accessibility, reliability, and scalability.

An emphasis on potential constraints on the national vaccine ecosystem’s ability to scale up production may be important. Specifically, not all capacity will be accessible for a timely response, partly because some capacity cannot be shifted from other therapeutics. Reliability may also be an open question because not all capacity comes with the processes and capabilities required to ramp up rapidly. And additional time would likely be needed to accelerate production, which involves both access and technology transfer (exhibit).

After the active ingredient or drug substance is produced, the process of making the drug could encounter supply chain snags. This step involves combining the drug substance with other materials such as adjuvants (which enhance immune response to antigens) and excipients (inactive ingredients that carry the drug substance) or lipid nanoparticle compounds for mRNA vaccines, all of which have experienced an unprecedented surge in demand. 18 Eric Langer, “Fill/finish capacity use for biologics,” Pharmaceutical Technology , January 2, 2015, Volume 39, Number 1.

The final step of manufacturing, “fill and finish,” could also encounter hurdles. This step prepares the final medical products for distribution. Utilization of fill-and-finish capacity is often high, partly because not all capacity is interchangeable. The risk of bottlenecks can therefore be even greater in times of heightened demand. 19 Eric Langer, “Fill/finish capacity use for biologics,” Pharmaceutical Technology , January 2, 2015, Volume 39, Number 1.

Experience from previous epidemics suggests that leaders will need to make strategic trade-offs. As far back as 2016, in the wake of the Ebola epidemic, industry leaders recognized that there was almost no excess capacity in global vaccine manufacturing. 20 Eric Sagonowsky, “GSK chief: Outbreak prep demands more vaccine production capacity,” Fierce Pharma, December 29, 2016. While this situation improved after the initial COVID-19 crisis, 21 For one example, see “Increase in manufacturing capacity for COVID-19 vaccines from Janssen, Moderna and BioNTech/Pfizer,” European Medicines Agency, December 12, 2021. responding to future outbreaks will likely require sustained investments in preparation, as well as strategic sales and operations planning. For example, it may be important to ensure a minimum level of “warm capacity” that is consistently used and ready to be redeployed quickly. Consider how manufacturers found novel ways to release capacity during the COVID-19 pandemic, such as accelerating advance production of some medicines with long shelf lives to free up capacity for potential vaccine production. 22 Rodney Zemmel, “ The race to create a vaccine: A conversation with Frank D’Amelio ,” McKinsey, December 10, 2021.

Identify capabilities and gaps in the domestic vaccine-manufacturing ecosystem

Few countries and regions have the capacity for end-to-end vaccine manufacturing, which encompasses everything from R&D to final distribution and administration. This scarcity of global capacity suggests that many countries could create more resilient vaccine ecosystems by gaining access to more segments of the vaccine value chain and by strategically focusing on different areas.

Beyond manufacturing, countries could develop the institutional and human-capital infrastructure needed for a robust R&D and innovation pipeline as well as the capabilities to run and process large clinical trials. Both could be worthy medium-term goals.

Countries with strong institutional and intellectual infrastructure—as well as reporting capabilities—may be more responsive to new pathogens. The first coronavirus sequence, for example, was published less than a week after WHO announced the discovery of what was then understood as a new kind of pneumonia. 23 Edward C. Holmes, “Novel 2019 coronavirus genome,” Virological, January 10, 2020; “COVID-19 – China,” WHO, January 5, 2020. This kind of speed requires the capability to collect and transport samples and to sequence whole genomes. It also requires credible ways to disseminate findings to academic and research communities.

Equally important is experience in vaccine development from early-concept platforms to full candidates ready for clinical trials. Oxford’s Jenner Institute and partners, for example, had been focusing on the development of a viral vectored candidate to combat Middle East respiratory syndrome (MERS) before switching their focus to the novel coronavirus. Fostering innovation could increase the chances of having a candidate product (or forging a development collaboration with other countries) and developing and attracting key talent. The ability to recruit, scale, and process data from large clinical trials is also critical for delivering safe products.

Build capabilities to coordinate ecosystem stakeholders

Connecting the public, private, and academic sectors for collaborations is a critical enabler to ensure access to investment and develop domestic capabilities. Both the United States and the United Kingdom brought together leaders from vaccine manufacturers, industry associations, technical experts, public-sector stakeholders, and private-sector experts in adjacent areas as a response to the COVID-19 pandemic. Countries with less access to resources could consider modeling their stakeholder engagement on coalitions such as IDA Ireland and the Economic Development Board in Singapore. 24 “Who we are,” Singapore Economic Development Board, accessed September 27, 2022; “Biopharma,” IDA Ireland, accessed September 1, 2022. Of course, multiparty engagement is critical in building the vaccine value chain, even in non-pandemic times.

Building a domestic talent pipeline is also key to success. Years of global optimization in R&D and manufacturing have led to talent clustering in a handful of locations, effectively locking the rest of the world out of the vaccine ecosystem. Leaders in countries that do not have such talent pools could deploy a range of incentives to attract, develop, and retain highly skilled individuals. 25 For a consideration of developing hubs of talent relevant to the vaccine ecosystem in Africa, see Andrea Gennari, Tania Holt, Emma Jordi, and Leah Kaplow, “ Africa needs vaccines. What would it take to make them here? ,” McKinsey, April 14, 2021. In the longer term, investments and changes to education systems may be required to sustain a pipeline of workers in the vaccine ecosystem.

Connecting the public, private, and academic sectors for collaborations is a critical enabler to ensure access to investment and develop domestic capabilities.

Though vital, tech transfer could be another major obstacle for countries and regions that have historically imported vaccines instead of manufacturing them. Because some local manufacturing capabilities are necessary, these countries could focus on building the infrastructure and capabilities to meet the safety and quality requirements of products that, while potentially lifesaving, have a high bar for efficacy.

Finally, advanced capabilities in data and analytics could support the discovery and development of vaccine candidates. Sharing pathogen information such as outbreak sites and genomic sequencing requires advanced capabilities to gather and analyze data and distribute the resulting insights for the development process. Other than talent, initiatives such as the Three Million African Genomes project 26 Ambroise Wonkam, “Sequence three million genomes across Africa,” Nature , February 10, 2021. and the Fiocruz Genomics Network in Brazil can serve as models for data infrastructure.

Invest and collaborate

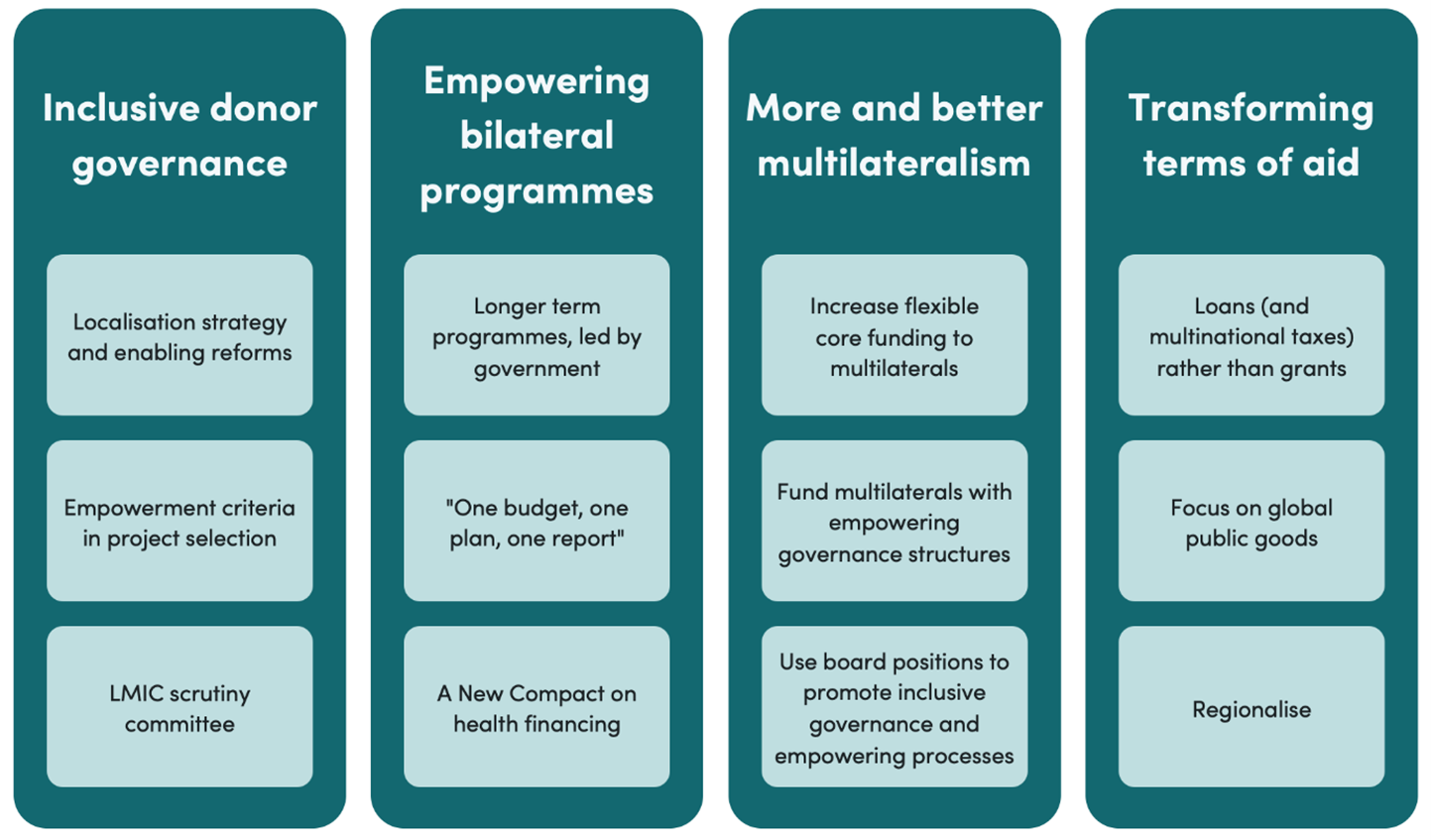

Since most countries cannot handle end-to-end vaccine development within their borders, investments and collaboration with other countries will likely be important.

Potential avenues to explore in investments, for example, include international development funding, philanthropic funds, public funding, and incentives. Historically, incentives such as tax credits, capital write-offs, R&D tax incentives, subsidies, and commitments to purchase set amounts of products in advance have been associated with thriving biopharma industries. Dedicated partnerships between the public and private sectors and leadership from public-sector stakeholders may help countries create deeper connections with the vaccine manufacturing industry and strengthen their vaccine ecosystems. Additionally, planning and advance commitments could help assure access to vaccines.

Partnerships among countries are also likely to play a critical role. For instance, the Access Consortium—which predates the COVID-19 pandemic and includes regulatory authorities from Australia, Canada, Singapore, Switzerland, and the United Kingdom—became a source of strategic information during the pandemic and presented an opportunity to improve operational alignment and efficiency. The member countries have agreed to align regulatory approaches and policies to coordinate efforts and resources in developing and manufacturing vaccines, a move that would benefit the members’ 150 million total residents. 27 “Access Consortium,” Health Sciences Authority, Government of Singapore, updated May 20, 2022.

Beyond sharing the load, international collaboration may make it easier to forecast demand for vaccines of all kinds by pooling data. Better forecasting can be of outsize value to low- and lower-middle-income countries, which are more likely to see changes related to demographic shifts and increasing vaccine uptake. International collaboration can also improve supply chain transparency and help ensure steady supplies, especially when it involves cooperation between public and private sectors. Finally, countries and regions that collaborate can form their own purchasing blocs, aggregating demand and gaining greater bargaining power than individual countries might have on their own.

COVID-19 highlighted a broad lack of readiness and caused major societal disruption, but national and regional leaders now have the opportunity to harness the lessons they’ve learned to build more resilient vaccine ecosystems. If effective, these ecosystems could ensure that when the next pandemic takes hold, nations will be better prepared.

Mitch Cuddihy is a consultant in McKinsey’s Dublin office; Andrea Gennari is a partner in the London office, where Tania Holt is a senior partner and Cormac O’Sullivan is an associate partner.

The authors wish to thank Tommaso Cariati, David Meredith, Tom Neuberger, and Kathrin Skiba for their contributions to this article.

Explore a career with us

Related articles.

Out of the shadows: A brighter future for pharma technical development

A data-driven approach to addressing COVID-19 vaccine uptake in Africa

Four ways to make sure your pharma manufacturing strategy delivers value

Recently Viewed

Listening...

From lab to vaccine vial: The historic manufacturing journey of Johnson & Johnson’s Janssen COVID-19 Vaccine

As the u.s. government announces an agreement between johnson & johnson and merck to collaborate on vaccine production, we trace all the steps it takes—from growing cells in a bioreactor to prepping palettes with high-tech track-and-trace technology—to develop and manufacture a vaccine during a pandemic..

- Copy link Link copied

A Lead Investigational Janssen COVID-19 Vaccine Candidate Is Announced

Global Collaborations Spur Manufacturing

Drug Substance Manufacturing Begins

It’s Time to Fill, Finish and Package the Investigational Janssen COVID-19 Vaccine Candidate

An Equitable Distribution Pledge Is Signed

Process Performance Qualification in Leiden Is Complete

The U.S. Government Announces an Agreement Between Johnson & Johnson and Merck

Stay up to date on johnson & johnson’s janssen covid-19 vaccine.

More from Johnson & Johnson

“I couldn’t speak, walk or sit.” Inside a rare autoimmune disease that attacks the muscles

5 things we now know about bladder cancer

What is IL-23?

ORIGINAL RESEARCH article

Vaccine production in africa: a feasible business model for capacity building and sustainable new vaccine introduction.

- 1 Department of Molecular and Developmental Medicine, University of Siena, Siena, Italy

- 2 GSK Vaccines, Siena, Italy

- 3 Takeda vaccines, Inc., Chicago, IL, United States

- 4 GSK Vaccines Institute for Global Health, Siena, Italy

Africa has the highest incidence of mortality caused by infectious diseases, and remarkably does not have the capacity to manufacture vaccines that are essential to reduce mortality, improving life expectancy, and promoting economic growth. GAVI has significantly helped introduction of new vaccines in Africa but its sustainability is questionable, and new vaccines introduction post-graduation is rare. Conversely, Africa with its high population and economy growth is an increasing potential market for vaccines. This study aimed to investigate how investment for vaccine production in Africa could be triggered and in which way it could be affordable to most African governments or investors. The investigation was based on a literature review and supplemented by online questionnaires directed to global vaccine stakeholders, African governments and regulatory authorities. In-depth interviews with experts in manufacturing capacity implementation and regulatory capacity building in Africa complemented the study. We also developed business plan scenarios including facility costs calculations and a possible investment plan based on expert opinions and publicly available information from pertinent sources. We saw that, governments in Africa, show interest in vaccine production establishments but only with external support for investment. The common regulatory functionality gap was the quality control laboratories to test vaccine lots before regulatory release. The global vaccine stakeholders showed less preference in investment for vaccine production establishment in Africa. The diverse political ambitions among African governments make it difficult to predict and access the market, a prerequisite for competitive production. A feasible solution could be a small production facility that would use technologies with high yield at low costs of goods to cover the regional needs. A respective antigen production facility is estimated to cost USD 25 Million, an affordable dimension for investors or interested African governments. Attractiveness for the African market is deemed to be high when targeting diseases almost exclusively for Africa (e.g., malaria or invasive non-typhoidal salmonella). With a smart 5 years tangible implementation plan, marketing agreements within existing regional collaborations and with a strong political will, an African government alone or together with an investor could convince global vaccine stakeholders and investors to support.

Introduction

Current challenges of concern for africa.

According to the Global Burden of Disease Study, published in 2016 ( 1 ), generally, infectious diseases decreased during the previous decade as a leading cause of death, and much of this decrease was driven by reductions in large contributors to global mortality, including HIV/AIDS, malaria, tuberculosis, and diarrhoeal diseases. However, in African and Asian regions, infectious diseases are still the leading cause of death, especially in children <5 years of age ( 2 ). About 44.4% of children deaths in 2016 occurred in sub-Saharan Africa, and 24·8% in South Asia ( 3 ). Children in low and middle income countries (mostly in Africa and Asia) are at much higher risk, with a 34-fold higher death rate than children in high income countries ( 2 ). Moreover, about half of the burden is contributed by diseases that seem to be almost exclusively reserved in Africa, such as malaria and invasive non-typhoidal salmonella (iNTS), also referred to as diseases of poverty ( 4 ).

Vaccination is one of the most important medical practice ever introduced, it has been essential to reduce mortality, improve life expectancy and economic growth ( 5 – 7 ). Africa is lagging behind in realizing the opportunities of reducing burden of disease by vaccination. Thanks to the Global Alliance for Vaccines and Immunization (GAVI), vaccines are becoming widely introduced ( 8 – 10 ). However, the concern is how to sustain such vaccines and whether countries would afford new vaccine introduction after graduation from GAVI ( 11 , 12 ). Even if economic cost-benefit evaluation is one of the criteria relevant for priority setting in health ( 13 ), decision on vaccine introduction for most African countries would likely depend on pure program cost ( 14 , 15 ). The more vaccines introduced in a country, the more expensive is the country's vaccination programme in terms of vaccine procurement, cold chain capacity and programmatic logistics ( 16 – 19 ). For example, Ethiopia spends USD 150 Million annually on vaccine procurement of which USD 100 Million currently come from donors ( 20 ). Eventually, upon graduation, the Ethiopian government is expected to triple its budget allocated to vaccine importation to sustain its immunization programme ( 21 ). We have seen several countries, such as India, Nigeria, and Thailand, which are now focusing on local production possibilities rather than importation of new vaccines with support from GAVI.

The biological processes with their inherent difficulty to manufacture vaccine batches with consistent characteristics and quality have been a hurdle to capacity expansion. Therefore, transfer of technologies and production processes to facilities located in Africa is a particular challenge ( 22 – 24 ). Brazil and Cuba are good learning examples for vaccine production setup by public institutions ( 25 – 28 ), while India is an example for private manufacturers ( 26 , 29 ). These countries committed to build or shape their own biopharmaceutical manufacturing capacity, initially focused on domestic needs and later expanded to supply international markets through the United Nations Children's Fund (UNICEF) and the Pan American Health Organization (PAHO). This became an important source of income despite of the technology transfer challenges ( 28 , 30 ). The likelihood of success for Africa is favored by the predicted population and thus market growth. The population of the less developed countries was projected to increase to 2.9 Billion in 2100, and four African countries, Ethiopia, the Democratic Republic of the Congo, the United Republic of Tanzania and Uganda, will be among the twenty most populous countries in the world in 2100 ( 31 ). In addition, African economy is growing at a steady rate of 5–6%, led by the East African region (EAC) ( 20 – 26 , 26 – 34 ).

Vaccine Production Concepts for Africa

According to Plotkin et al. ( 24 ) there are particular challenges involved in vaccine production, including process development, process maintenance, lead time, production facilities, equipment, life cycle management, and product portfolio management. The authors emphasized the importance of a robust and stable manufacturing process and consistent component supplies over decades to ensure long life cycle of a vaccine in a market. These areas should be carefully considered when planning vaccine production investment in Africa. Failure to manage these risks can result in costly product recalls, suspensions from the market and penalties may be assessed if a manufacturer fails to fulfill supply agreements ( 24 ). In this view, the choice of production technologies has huge impact on success of vaccine production establishment especially in the current African environment. The technologies for vaccine production, mainly the expression systems, play an important role in the cost of production, in terms of process stability and maintenance, life cycle and lead-time. There are several expression platforms, each with its yield capacity, and some are complex to develop ( 35 – 37 ). They have an important impact on cost of goods (COGs) and thus on the price for an affordable vaccine ( 37 ). Gerke et al. ( 38 ) has shown, production process for outer membrane particles from genetically modified bacteria called Generalized Modules of Membrane Antigens (GMMA), where, even a relatively small production facility (e.g., a 500 L fermenter) could produce in excess of 100,000,000 doses of vaccine per year. Such a technology would be highly favorable for African vaccine production because of its simplicity and the low production costs at a high yield.

Production can be done in either traditional fermenters so called stainless steel fermenters or single-use systems (SUS) ( 39 – 41 ). The choice of SUS or stainless steel or a mixed approach would depend on specific needs and the production scale ( 42 , 43 ), also considering regulatory requirements ( 37 , 44 , 45 ), commissioning ( 46 , 47 ) and facility maintenance. This has to be planned from the early phase of facility construction. A weak National Regulatory Authority (NRA) would create serious difficulties for the national and global business of a vaccine manufacturer. Since 2010, after the World Health Organisation (WHO) assessed NRAs in Africa ( 48 ), there have been great development in African NRAs and some NRA became fully functional, though, usually for oversight of pharmaceuticals only and not yet for biopharmaceuticals like vaccines. For vaccines, they depend on WHO pre-qualification programme (WHO-PQ) or other competent NRA licensure before local marketing authorization ( 48 ). These aspects must be keenly thought through and covered in the implementation plan of facility establishment and maintenance in Africa.

This was a review based on literature and pertinent websites, to investigate how investment for vaccine production in Africa could be triggered. The study was supplemented by online questionnaires developed in Google form and directed to specified organizations and African countries, aimed at determining their interest on vaccine manufacturing capacity implementation in Africa. The online questionnaires were structured differently according to the role of the respondent. The survey was conducted between June and September 2016 and the respondents included:

(1) Local officials of sub Saharan African countries governmental institutions (public health and economy)

(2) NRA officials of sub Saharan African countries and non-African developing countries with vaccine manufacturers

(3) Members of Developing Countries Vaccine Manufacturers (DCVMs)

(4) Global vaccine manufacturers / multinational companies (MNC)

(5) Global vaccine stakeholders (defined as officials from advanced NRAs, Independent consultants who have worked on or pioneered vaccine production or operations in developing countries, and officials from non for profit organizations that do vaccine production and development for developing countries)

(6) WHO-NRA capacity building officials

The online questionnaire was customized to each group, e.g., DCVMs' members received questions on investment costs, benefit of indigenous vaccine production, experience on possible challenges incurred during setup of their facilities, governmental incentives and regulatory capacity building. Information collected from online questionnaires was limited to accessibility of the respondents whose addresses were obtained from attendance list of international meetings, such as the African Vaccine Regulatory Forum (AVAREF), official website for a particular organization (MNC, DVCM, NRA, WHO) or through LinkedIn search. In addition, we conducted in-depth interviews with officials from the Bill and Merinda Gates Foundation (BMGF) and the African Vaccine Manufacturers Initiative (AVMI). This was to gather information on their view on investment in vaccine production, efforts already made and challenges for capacity building in Africa. Results were analyzed descriptively.

In collaboration with subject matter experts, we generated and qualified the business model on manufacturing capacity building in Africa. This included the development of high level planning scenarios for manufacturing capacity implementation, the feasibility evaluation, identification of related needs for regulatory capacity building in Africa and the description of the impact that enhanced manufacturing and regulatory capacity would have on new vaccine introduction in Africa and its sustainability.

The scientific committee of the University of Siena, Italy approved the study. Respondents were treated anonymously and were consented for their participation. Ethical review and approval was not required for this study in accordance with the local legislation and institutional guidelines.

Results From Survey Questionnaires

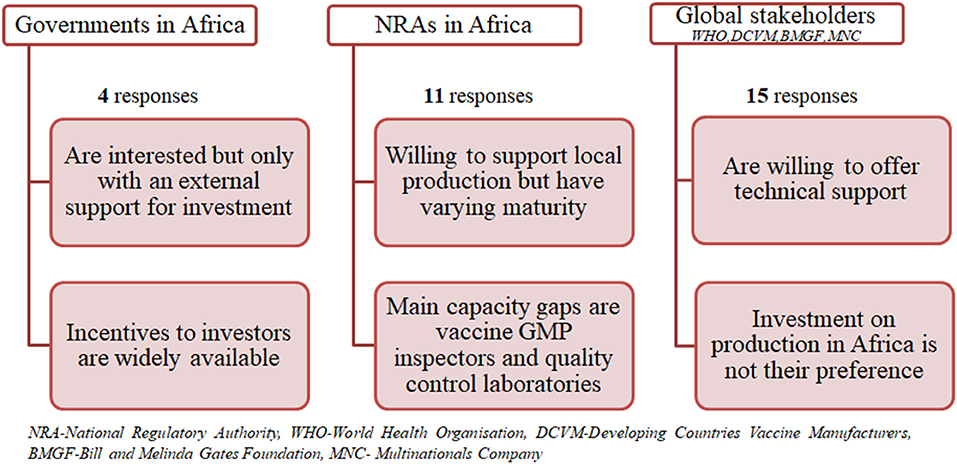

In total 30 responses were collected from various stakeholders including African governments (4 out of 14 contacted), African NRAs (11 out of 22 contacted), WHO (2 responses), MNC (3 out of 5 contacted), DCVM (5 out of 30 contacted), and Global vaccine stakeholders (5 out of 6 contacted). We also had two in-depth interviews, one with three officials from the AVMI and the other one with an official from BMGF.

Figure 1 shows the results summary from the questionnaires grouped into three categories namely governments in Africa, NRAs in Africa and global stakeholders (combining MNC, DVCMs, WHO, and BMGF).

Figure 1 . Summary of results from questionnaires.

Governments Interest and Support

All responders were interested in the establishment of vaccine manufacturing capacity in their countries. However, they would do this only with an external financial and/or technical capacity building support. Thus, they are willing to support an investor at varying levels, such as land, tax incentives, infrastructure provision, and monetary support as a private public partnership. They are also willing to facilitate necessary extra capacity building in their NRA in a form of training or to support collaboration with competent authorities of other countries and the WHO. The latter would help them during an interim phase to cover all regulatory aspects around vaccine manufacturing facility establishment and at the initial stage of product life cycle. All responders expect access to a vaccine at an affordable price and establishment of employment for native experts.

Regulatory Authority Capacity Gaps and Improvements

Capacity gaps vary from country to country; most NRAs would mainly need capacity building in relation to qualification of GMP inspectors, quality control laboratories for vaccine and technical expertise to perform lot release. They would require varying time for filling capacity gaps for indigenous production and supply, depending on availability of funding, from 1 to 5 years. The NRAs are willing to collaborate and rely on WHO and other competent NRAs from other countries to cover an interim period for regulatory need of vaccine manufacturing and batch release oversight. Some NRAs already perform batch release of all imported vaccines, e.g., Zimbabwe. With regard to global vaccine supply from an African country, some have already established regional regulatory collaboration, such as the EAC's Medicines Regulation Harmonization, making it easier for them to support each other in that regard.

Developing Countries Vaccine Manufacturers' Perspective

Developing countries vaccine manufacturers are interested in seeing Africa developing their own manufacturing capacity; some would even expand their capacities to Africa in the future. However, the critical aspects for establishment of vaccine production capacity differ from country to country. Most of them are challenged by the access to expertise, source of raw materials, consumables, equipment, market access, country's import policy, and regulatory shortcomings in GMP inspection and long timelines for dossier review and approval. Other critical aspects included construction of facility, financial support, and acquisition of technology. Some government owned manufacturers would prefer such capacity to come from African government, as it is essential that a government will provide financial support for the project, construction, start-up of production, and commits to use the produced vaccine. The private manufacturers in India got supply of raw materials from the Indian government, which also provided incentives, such as sales tax, excise duty, and customs duty concessions as long as the unit was established in designated economic zones. DCVM acknowledged that indigenous vaccine production has significantly benefited their countries. The state owned manufacturers, such as Brazil base their success on their population (200 Million people with a 3 Million birth cohort) which is large enough for them to offer vaccine at a low price (similar to that of UNICEF) to their national immunization programmes. Hence their local production has provided security, avoiding shortage and strengthens their national technological capacity. Most private manufacturers in India have based their business on supplying vaccines to UNICEF and some claim to have reduced price to even half for indigenous purchase.

Experts From Multinational Companies

As personal opinions, experts from multinational companies pointed out that feasibility for facility investment in Africa depends on the novel nature of the vaccine and the epidemiology of the disease, regulations etc. If a vaccine will provide high benefit in long-term for the majority of the African countries, there might be an opportunity to evaluate further the economic value of the vaccine and public health benefit via a business case. Some experts stressed the importance of research and development (R&D) costs in addition to facility investment costs for consideration when establishing vaccine prices. They also highlighted the importance of significant incentives like benefit of conducting business in a politically stable environment, ease of conducting business activities and regulatory navigation along the development and licensure roadmap, and tax incentives in the long term. Experts suggested that directing focus on Neglected Tropical Diseases (NTD) of particular interest for Africa would possibly lead to easier market development and eventually access to GAVI market.

Global Vaccine Stakeholders

There are stakeholders who showed interest in establishment of vaccine manufacturing in Africa, reasoning that such capacity is needed in Africa, and would reduce cost of vaccines, help overcoming vaccine shortages, make countries better positioned to respond to outbreaks and would be a way for African countries to win their independence from the big pharmaceutical companies. It was suggested that, since no African country has enough inhabitants to justify the establishment of manufacturing capacities of significant size, African countries should identify a champion to build vaccine manufacturing capacities focusing on the needs of all African countries. In terms of support, most stakeholders were interested in investment at different levels. Based on their experience they believe that capital investment is likely substantial and therefore support from several NGOs, foundations, private companies will be crucial to facilitate vaccine manufacturing capacity implementation, including technology transfer and e.g., to establish advanced market commitments by securing financial resources. However, one of the experts was of the opinion that vaccines for Africa can be sourced more economically from countries like India, where a very robust vaccine industry exists.

Role of WHO for Regulatory Capacity Building

The WHO is interested in establishment of vaccine manufacturing capacity in Africa and is willing to support the NRA where such capacity is being built. Basically, a country in which manufacturing capacity is being built should have appropriate technical skills, Quality Management System, market, and political commitment. Moreover, the ability to ensure adherence to international quality standards in a sustainable manner is a critical aspect for consideration. WHO's level of support is mostly technical, they have heavily supported regulatory system development in developing countries with vaccine manufacturing capacities, such as Brazil, India, Indonesia, and Thailand, and they did this through creating institutional development plans based on NRA assessment. In order to speed up regulatory capacity building in Africa, WHO officials suggest improvement on governance in countries and training of staff. There is doubt that global vaccine supply from a country in sub Saharan Africa is feasible from regulatory perspective in near or mid-term future. In any case it will require lots of funding and support by experts to become a reality.

In-depth Interview With Experts

Experts from AVMI explained while there are several entities at various stages of vaccine production the current capacity of vaccine production in sub-Saharan Africa is mainly limited to Senegal's Institute Pasteur of Dakar (IPD), which produces yellow fever vaccine, the only WHO pre-qualified vaccine produced in Africa. Historically, most of the current vaccine facilities in Africa were government owned and competing priorities shifted the focus away from developing further capacity. However, the slow pace of progress in vaccine manufacture in Africa can be accelerated through political choice. Biovac is an example of how, with backing from the South African government and taking a reverse integration approach in building capacity across the value chain through partnering, globally recognized vaccine development and manufacturing capability can be established. It is critically important over the long term to reverse the current situation where <1% of vaccines used in Africa are made in Africa, leaving African countries vulnerable in emergency pandemic events. The same point was raised by the expert from BMGF who pointed out that commitment by African government has been a challenging as governments usually prefer cheaper vaccines from abroad over local ones, making it difficult for a manufacturer in Africa to have economies of scale to compete within the international vaccine market. It is envisaged that commercial agreement between African countries is necessary to ensure relevant local market size for return on investment. Nonetheless, governments' budget allocated to health is so limited and thus unlikely allows larger investment in vaccine manufacturing capacity building. Vaccine manufacturing remains complex and requires a highly integrated set of well-coordinated activities, including a highly skilled workforce, elaborate supply chain for many specialty reagents and consumables, exquisite quality control, and appropriately trained and staffed regulatory agencies. In view of current regulatory environment, it was recommended to first enhance pharmaceutical capacity and only in a second step (mid to long term) to build vaccine manufacturing capacity. BMGF is interested to accelerate availability of largest amount of high impact health products at best quality-price balance. Building manufacturing capacity for vaccines in Africa is not the most direct pathway to reach this objective. With regard to the technical or knowledge capacity building and the parallel development of the regulatory environment toward full functionality, BMGF collaborates strongly with the WHO.

High Level Planning for a Vaccine Manufacturing Capacity Implementation in a Green Field in Africa

With the subsequent planning scenarios African governments and investors are supported to perform their own evaluation on investment feasibility, vaccine affordability, and market access possibilities, especially for vaccines targeted mainly or almost exclusively for Africa, such as malaria or invasive non-typhoidal salmonella.

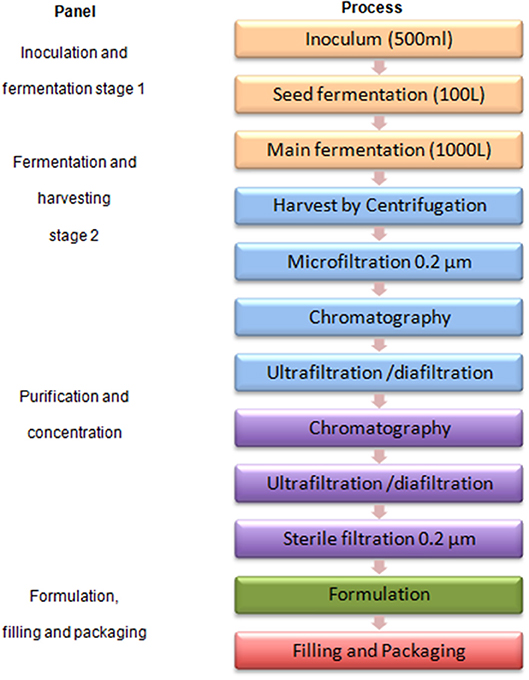

Process Conceptual Plans

In general, a facility conceptual plan requires inputs from R&D and Marketing, especially technical information available at clinical phase 2 and sales forecast based on a clinical data driven initial marketing strategy. The following three production capacity building scenarios were developed based either on typical process-yield assumptions for a recombinant protein vaccine ( 49 ) or on published data for a GMMA based vaccine, all to be available in 2025, the earliest time point for availability of a validated facility, in case planning and implementation would start in 2018. The total yearly demand for an infant or toddler vaccine at a predicted birth cohort of 50 Million in Africa by 2025 ( 50 ), is 121 Million doses under the assumption of a 2-dose schedule, immunization coverage rate of 85% and the vaccine wastage of 30% ( 51 , 52 ).

First scenario

As there is currently no concrete interest for investment, we arbitrarily selected a recombinant protein based vaccine as an example with the following assumptions: An investor in Europe or elsewhere has limited capacity (only one third) for producing and supplying a vaccine to Africa. According to the supply forecast, a yearly capacity to produce 121 Million vaccine doses will be needed by 2025. A fermenter will yield 75 mg/L of protein, if production is at a cycle time of 1 week. The resulting capacity will be ~21 Million doses per 1,000 L fermenter per year at a dose of 50 μg/0.5 ml. If an investor already produces 42 Million doses from an existing facility, which has two 1,000 L fermenters, the additional required capacity in the African country will be 80 Million doses from four production lines, each with a 1,000 L fermenter and respective purification capacity, assuming “like-for-like” technical transfer (this will create a total production capacity of 126 Million doses). The vaccine is adsorbed to aluminum hydroxide and filled into multidose vials. Respective formulation, fill and packaging capacities to produce 121 Million doses per year are required.

Second scenario

The second scenario is based on the first scenario, but here we use a single production line that results in 21 Million doses per year, sufficient to supply the EAC region. Alternatively, if production is targeted for a single country, such as Tanzania with estimated need of 7 Million doses a year, two other similar single antigen vaccines can be produced in campaign during the year.

Figure 2 shows a typical protein antigen vaccine production process to feature first and second scenarios.

Figure 2 . A typical protein antigen vaccine production process.

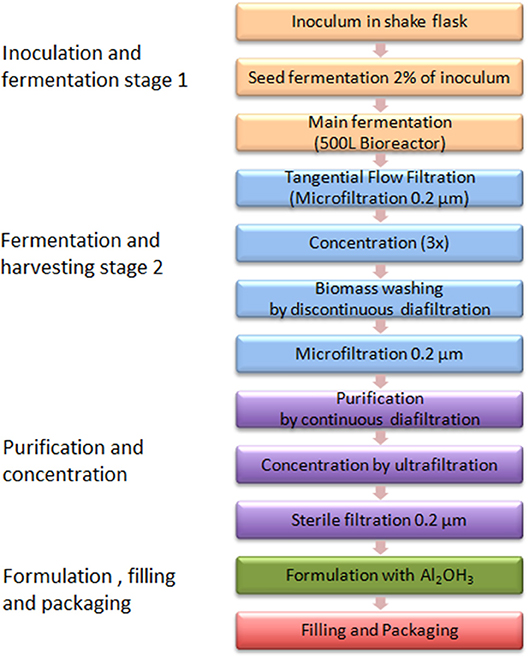

Third scenario

For vaccine production using GMMA technology as described by Gerke et al. ( 38 ), a relatively small production facility (e.g., a 500 L fermenter) could produce in excess of 100 Million doses of vaccine per year ( 38 ). The production time from setting up the inoculum for fermentation to final purified GMMA could be as short as 3 days per batch. Thus, depending on the size of human dose, with this kind of technology, just a single production line with a 500 L fermenter capacity would be almost enough to cover the whole African market need in 2025, assuming a 2-dose schedule infant vaccine.

Figure 3 shows the GMMA based process flow diagram generated from process description by Gerke et al. ( 38 ).

Figure 3 . A GMMA based vaccine production process.

Site Master Plan (SMP)

The SMP for all three scenarios follows the same concept and, in proportion, leads to the same cost estimates. Therefore, only the scenario for a new green-field facility, with a capacity to produce recombinant protein bulk for 84 Million doses and to formulate, fill and package 121 Million doses is planned. As described above, the fermentation technology platform is assumed to be well-known and for scenario 2 a flexible downstream capacity which has a capability to provide a range of recombinant protein vaccine products is required.

The size estimate assumptions for the SMP are developed in consideration of an “ideal site” with 75% of plant usage, providing 50% expansion capacity and production suites completely segregated with dedicated support areas and clean utilities. It is recommended that the facility location has to be well-characterized by considering aspects like land price, geographical conditions (flat, appropriate soil characteristics, easiness and security for foundation), the proximity to public water, energy supplies, sewer, waste disposal capabilities, transport connection, location in trade zones, topography of the site, type of neighbors and analysis of possible contrasts/synergies. The layout designs have to consider distances for personnel movements tailored to location of employees' parking spaces, guardhouse and canteen with respect to production buildings. They also have to describe relationships between buildings for main personnel flows, main material flow and utilities distribution requirements. This will then guide setup for construction phases.

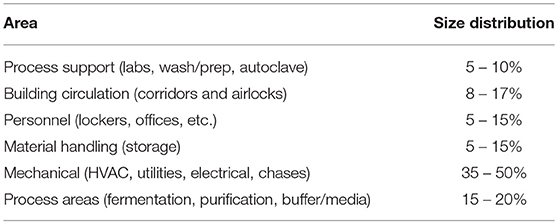

Architectural Size Estimates

The bulk production building will accommodate four production lines with a separated purification suite. The formulation areas need to accommodate ~180 batches per year (44 cycles × 4 production lines). The filling area requires two vial filling lines using disposable flow-paths at a nominal capacity of 24,000 units/h to fill the 180 batches and the packaging area requires two lines, each with a nominal capacity of 12,000 units/h to finish the 121 Million doses. Furthermore, a warehouse, a QC and QA building with a 1:2 QA: QC ratio to accommodate laboratories and offices for 40 people and an animal house for 250 mice, 20 guinea pigs, 60 rabbits and a BSL2 testing room are required. The plan contains also a canteen with 100 seats and a building for administration that can accommodate 50 people. In addition, a guard house and parking lots are included. Space for central utilities, an electrical substation and a waste water treatment (WWT) plant to provide treatment for liquid effluents based on biological demand correspondent to sanitary streams of 1,000 people equivalent as worst case complete the dimension setting for the architectural planning.

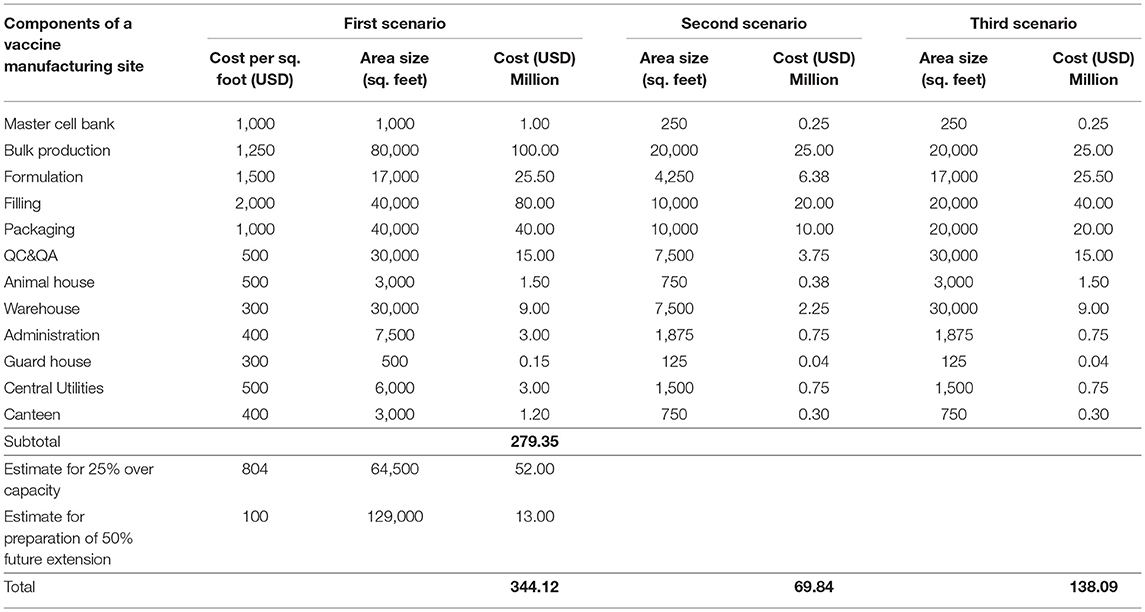

The size of the production buildings was estimated based on a rule of thumb ( 53 ) as described in Table 1 below. For one Drug Substance (DS) production line, a process area of 3,500 sq. feet is estimated. Thus, assuming this process area is 17.5% of total area in a production building, the building for DS ptoduction with four lines will have a total process area of 14,000 sq. feet and hence, a total dimension of 80,000 sq. feet. For the second and third scenario, a single production line facility with process area of 3,500 sq. feet would require 20,000 sq. feet total building area. The areas of the other buildings are calculated following expert opinion and are shown in the Table 2 .

Table 1 . Rule of thumb for area distribution in a drug substance production building.

Table 2 . Size and cost estimates for vaccine manufacturing site scenarios.

Fabrication, Construction, Schedule and Validation

All aspects for fabrication, construction and validation have to be properly addressed linking to regulatory requirements ( 53 ). Therefore, the investor should carefully select experienced engineering companies and consider using pre-fabricated modules for which qualification is in part already performed when they arrive. For construction one has to decide whether to use an onsite (stick built) approach, where assembly of walls, piping, steel, etc. has to be done on site, or an offsite (modular) approach, where the facility modules are built elsewhere and then shipped to site. The other alternative is a hybrid approach where the facility shell is stick built onsite while process equipment are built as skids at the equipment vender. This would allow for concurrent facility and equipment construction. However, the choice has to be made based on costs, validations and qualification steps to be followed for the different cases.

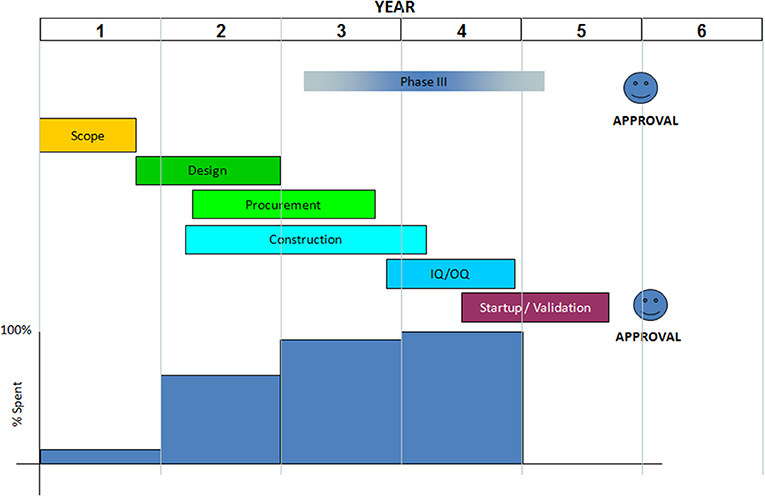

We recommend project schedule to be divided into scope, design, procurement, construction, Installation Qualification and Operation Qualification (IQ/OQ), start-up or Process Qualification (PQ), validation, and approval. The schedule should be timed in view of the date for expected launch of product produced in the new facility. Even though, the schedule duration is typically 5 years (see Figure 4 ), for the first vaccine manufacturing capacity implementation in Africa additional preparative time should be included in the plan. Extremely important will be to build sufficient scientific, technical and regulatory expertise, e.g., by sending scientists, technicians and regulators for training to sites/countries with process and regulatory expertise. For the execution, it is important to receive the building permission early and to plan and manage the construction phases in a way to minimize construction time. It could be better to use several expert companies with sufficient staff to work in parallel on sub-areas of the overall plan for the best and efficient project execution and meanwhile using collaborating institutions for global support on capacity building in human resources, improving NRAs and other aspects of technology transfer in each step.

Figure 4 . A typical vaccine manufacturing facility building schedule.

Cost Estimates for Facility Construction

For Africa a modular type facility will be likely the best choice due to supposedly limited or lack of expertise in biopharmaceutical facility building. With the calculations following expert opinion based on a modular type facility, for which it can be assumed that costs are globally similar, we managed to come up with estimates for each of the three scenarios, which are detailed in Table 2 . It should be taken into consideration that experts' facility cost estimation in the initial planning phase usually should be within an accuracy of ±30%.

The total cost for an ideal facility according to the first scenario would be about USD 344 Million. This could be reduced to about USD 280 Million not considering over capacity and future expansions. The second scenario with a cost of about USD 70 Million has a production capacity of 21 Million doses per year sufficient for regional supply (e.g., the six countries of EAC region). The third scenario costs about USD 138 Million and is able to supply either almost the whole African market with 1 single antigen vaccine or e.g., the EAC region with three different single antigen vaccines to cover the estimated demand in a region. However, only the concrete real scenario plan can provide accurate estimates on key components of a vaccine manufacturing site.

These cost estimates do not include the costs involved in start-up or Process Qualification (PQ) and validation activities. Usually at least 3–5 product batches will be produced during PQ and validation. There are significant costs involved but, ideally, these batches can later be sold. A full cost estimate for PQ and validation requires a detailed product knowledge that enables estimation of the COGs. Each facility project should include respective costs in the overall plan. In addition, facility-running costs should be calculated as they may impact the project as idle cost of the facility, once established and not used. In case of continuous use, these costs are absorbed into the COGs. The larger or complex the facility, the higher the running costs. However, we anticipate that labor costs in Africa would be low compared to Asia and Europe ( 54 ), even though at the beginning costs may even be higher, due to the need of high cost experts from high income countries ( 24 ). The involved cost risk i.e., long burden of start-up costs or idle costs ( 24 ) can be reduced by assuring full size market access in the initial facility establishment plan.

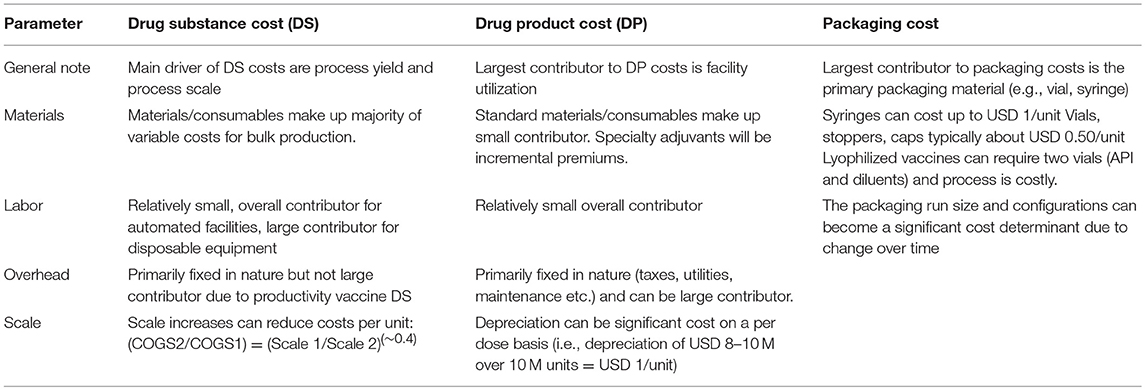

Product Cost Calculations and Marketing

Table 3 gives special considerations for vaccine cost calculations ( 53 ). Applying the respective criteria to the GMMA based technology (third scenario) this technology ensures a competitive vaccine price likely acceptable to UNICEF and affordable to African countries. The technology results in high yield and needs only few steps for purification, labor cost is greatly reduced (few people for few process steps), materials/consumables are highly reduced and due to the high yield there is room for scale increase in reasonable dimension. The other two scenarios will have higher manufacturing costs and are likely not as favorable as a GMMA based vaccine. Concrete estimates ( 24 , 55 ) would be required to determine their competitiveness and acceptability to UNICEF and GAVI.

Table 3 . Typical inputs for product cost calculations.

This study was a review based on literature and pertinent websites, to investigate how investment for vaccine production in Africa could be triggered. The study was supplemented by online questionnaires developed in Google form and directed to specified organizations and African countries, aimed at determining their interest on vaccine manufacturing capacity implementation in Africa. The response rate was limited, e.g., only four out of fourteen contacted African government officials responded. The low response rate had several causes, e.g., the email address was no longer valid as contacted persons had changed tasks or government officials were not comfortable to respond on behalf of their governments. However, in total 30 responses from various organizations were obtained and in-depth interviews with experts in the field complemented the information. We are therefore confident that the results are representative.

Governments in Africa show interest in vaccine production establishments, but only with external support for investment. However, investment for vaccine production establishment in Africa is currently not the preference of global vaccine stakeholders. Therefore, African governments should change their thinking, if they want to realize vaccine manufacturing implementation in their country. The key challenge is to ensure sufficient and assured market access for potential investors. Responses to the survey questionnaire showed that investors, including global vaccine manufacturers, are attracted more by market assurance than by provision of incentives ( 56 , 57 ). Global stakeholders, such as GAVI and UNICEF can be involved to spearhead marketing aspects in the spirit of building capacity in Africa. Solutions in view of future challenges due to growth of African population and GAVI graduation will anyway be needed, and therefore, financial potential coming from projected growth of African economy could be directed into a program for self-sustainability with regard to vaccines. Interested governments can be approached for commitment to access an agreeable market through Africa's regional collaborations, such as EAC, SADC, ECOWAS, and AU, with consideration that a large enough population, like in India, China or Brazil, allows to grow due to an economy of scale. It is expected not to be easy getting neighbor countries to agree on common procurement of vaccines from an African manufacturer, but only this can guarantee a low affordable price and thus an investment with calculable risk. Disunity of African governments has delayed establishment and expansion of manufacturing capacity for both, vaccines and pharmaceuticals in Africa even though African economy and population growth were eminent and invited for investment.

Many African countries lack political will for concrete integration of pharmaceutical manufacturing development into economic development planning. However, e.g., Ethiopia has written and published a pharmaceutical manufacturing development plan ( 57 ) and the African Union Council (AUC) issued the Pharmaceutical Manufacturing Plan for Africa (PMPA) ( 58 ). Unfortunately, the plans do not show concrete political and or economical commitment to support implementation of pharmaceutical manufacturing capacity extension. The establishment of a vaccine policy by countries may assist in identifying how and when to consider local production. In particular, at the beginning, establishing local vaccine manufacturing is not necessarily cost-effective, but vaccines should not be seen purely as commodities. Factors, such as national health security should be considered as well ( 56 ). Committed governments, such as Cuba and Brazil have a requirement for public health delivery written in their constitutions ( 23 , 25 ), despite their different historical backgrounds both countries have found a way to sustain their investment in public facilities and they have become role model in the PAHO region. African countries can learn from them.

Many African NRAs have developed capacities, including capacity for GMP inspection, for pharmaceuticals rather than vaccines due to globally driven traditional ways of vaccine procurement. If a country completely procures vaccines from UNICEF, it would not be cost effective and necessary for them to repeat tests already done by another competent authority. Therefore, such a country will likely remain dormant in NRA capacity development for vaccines unless a facility is established in that country. In Cuba, Brazil and India it was the development of vaccine production that pushed the governments to improve their NRAs. Improvement of regulatory oversight would also be needed in Africa, in particular as nowadays it is expected that a vaccine manufacturing facility implementation will be accompanied and approved by a fully functional NRA. Therefore, an interested African country should prepare early on by using available technical expertise provided by WHO and other stakeholders, such as AVMI for capacity building while a facility is being built in the country. For example, local training and research institutions can establish collaboration with abroad institutions (global vaccine stakeholders) and or companies for special vaccinology courses ( 59 ) and internship programmes aiming at building local capacity in terms of human resource that will work in both, NRAs and industries, with regard to vaccines.

Businesswise, investment in manufacturing capacity for a vaccine produced in a high yield technology, such as GMMA would favor quick return of investment at an affordable vaccine price for most African countries compared to production using a low yield technology. Building up a concrete plan within a specific country in Africa could even significantly lower the cost of investment, if e.g., available capacity from adjacent pharmaceutical industry with established QA/QC, formulation and fill and finish capacity could be built into the planning (brown field). Only the DS production facility for one antigen with a capacity for the whole African market would approximately cost USD 25 Million. Such a cost is affordable for most African governments as long as they include it in their economic plan and deliver within 5 years of implementation plan schedule. In addition, there is the opportunity that facility costs are lower in Africa as it has been shown that facility cost in Europe is even twice as high as in the Asian region (Russia, China, and India) ( 60 – 64 ). The brown field also offers an opportunity for existing private pharmaceutical companies to partner with an interested African government or a private investor for vaccine production tailored to market access.

Technical transfer can either be transfer of a licensed vaccine to extend capacity of a global manufacturer (first scenario) or an early transfer during development before or after proof of clinical concept. The first scenario would likely require an intense phase of vaccine specific knowledge and know how building of African scientists and technicians before or in parallel to the facility building and support by or transfer of key personal of the global manufacturer until robust process routine is achieved. The latter concept could be in collaboration with institutes like the GSK Vaccine Institute for Global Health (GVGH), the International Vaccine Institute (IVI), the Hilleman Laboratories, the Gates Medical Research Institute (GMRI), or other similar Institutes and could use a staggered approach: Building a GMP pilot facility that could be used for early clinical development (even as contract manufacturing site) and then extended to industrial or market scale (full capacity) for vaccine roll out according to demand forecast. This would also ease the technology transfer pathway and provide an opportunity to build staggered knowledge transfer. For a high yield process like GMMA a 250 L fermentation scale could be sufficient as industrial scale and then extended with 1 or 2 further production lines to cover the full African market. This would reduce investment risk and is an opportunity for any interested African country or its institutions to collaborate with global institutions focusing on vaccine development against neglected diseases of developing countries. International funds to support Phase 3 development of candidate vaccines against neglected diseases that have the potential to save many lives of African children will likely be required ( 65 ) in addition to a funding concept for the facility construction.

The Meningitis Vaccine Project (MVP) was a collaboration of the WHO (responsible for surveillance and vaccine introduction) and PATH (responsible for product development), who partnered with Serum Institute of India Private Ltd (SIIL) and public health officials across Africa to develop an affordable, tailor-made vaccine for use against meningitis A in sub-Saharan Africa (MenAfriVac). The project was set up after African leaders called for the development of a vaccine that would eliminate group A meningitis epidemics in Africa ( 66 ). The vaccine MenAfriVac was introduced via mass vaccination campaigns in 2010 and had a dramatic impact in reducing meningitis A epidemic. The project got funds from BMGF in 2001 (USD 70 M later added USD 17 M) to fight Meningitis in the meningitis Belt of Africa. In this collaboration SIIL supplied tetanus toxoid (TT) and Synco Bio Partners BV of Netherlands supplied Meningococcal A polysaccharide (MenA-PS). The FDA-CBER did the conjugation of MenA-PS with the carrier protein (TT) before transferring the production process to Serum Institute of India Limited (SIIL). The UK National Institute for Biological Standards and Control (NIBSC) did the testing of the vaccine batches produced by SIIL. The MVP shows how local institutions collaborated with international organization for capacity building on vaccine clinical development and disease surveillance. It also shows how international stakeholders could be involved for fast vaccine development and introduction, including capacity building and technical transfer. The success of the project mainly came from a strong political will geared by meningitis disease prevalence and mortality in that region. It was a good example showing that funds for clinical development of a vaccine that is almost exclusive for Africa can be obtained. MVP lowered investment costs for the producing industry (SIIL) and SIIL also benefited from the knowledge transfer on conjugation technology as that knowledge could be used to produce other vaccines. Africa definitely needs a partnership like for the MVP; this time as a long term development and/or manufacturing partner and not just as an end user. Such a collaboration project could build African capacity to overcome other problems, such as malaria, HIV, iNTS, etc.

We recommend that African countries should not start a very big complex project plan, which costs a lot of money and require sophisticated expertise and experience in vaccine manufacture. Instead they can make small projects targeting one antigen after another and grow over time. Preference should be given to already well-researched antigens or new antigens, which can be produced with simple, straightforward processes and for which there is no patent infringement. In addition, countries should quickly utilize their available high learning institutions and biotechnology research institutes to build sufficient indigenous technical expertise (human resources) required for vaccine production in collaboration with WHO, PATH, BMGF, and other institutes, which are dedicated to development of vaccines for Developing Countries, such as IVI, Hilleman Laboratories and GVGH. There would also be the opportunity to perform contract manufacturing during clinical development with the option to partner or acquire the project/vaccine at a later stage. This would allow a smooth and low risk phasing into realization of a sustainable vaccine manufacturing capacity and new vaccine introduction in Africa.

Data Availability

The datasets generated on survey via google forms will be made available on request. Otherwise all relevant data is contained within the manuscript.

Author Contributions

GM and JA: conceptualization. GM: writing original draft. GM and JA: data curation. GM, SB, TC, and JA: formal analysis. EM: funding acquisition. GM and JA: investigation. GM, SB, TC, and JA: methodology. SB, EM, TC, and JA: resources. JA: supervision. TC and JA: validation. GM: visualization. SB, EM, TC, JA: writing review and editing. EM: project administration.

The study was funded by the University of Siena, Italy.

Conflict of Interest Statement

During the course of the study, GM spent 6 months as an intern at the GSK Vaccine Institute for Global Health, Siena, Italy in 2016. SB worked as a global operational engineer of GSK, Siena, Italy. TC worked with Takeda vaccines as a global operational engineer, and JA is the head of regulatory affairs at GSK Vaccine Institute for Global Health. TC is currently the Chief Executive Officer of CytoSen Therapeutics, Inc., North Carolina, USA.

The remaining author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Acknowledgments

We would like to thank the University of Siena, who, in collaboration with the Vaccines Academy and the GSK Vaccines Institute for Global Health, Siena, Italy, made this investigation possible and to all who provided contributions, including Dr. Rino Rappuoli (GSK Vaccines Italy). Special thanks go to the experts who participated in this study, which includes: Officials from AVMI for in-depth interview namely Mr. Patrick Tippoo, Dr. Ebrahim Mohamed, and Dr. Seanette Wilson. The official from BMGF, Dr. Rayasam Prasad for his time and contribution on in-depth interview. Officials who responded to questionnaires: Officials from multinational companies, the Global vaccine stakeholders, Independent consultants (from Switzerland and Pakistan). Officials from US FDA, Health Canada and WHO. Officials from Developing countries vaccine manufacturers (Brazil, India, Indonesia and Pakistan). Officials from Africa (Ghana, Malawi, Cameroon, Burundi, Tanzania, Kenya, Zimbabwe, The Gambia, Zambia, and Nigeria).

1. Abajobir AA, Abbafati C, Abbas KM, Abd-Allah F, Abera SF, Aboyans V, et al. Global, regional, and national age-sex specific mortality for 264 causes of death, 1980–2016: a systematic analysis for the Global Burden of Disease Study 2016. Lancet. (2017) 390:1151–210. doi: 10.1016/S0140-6736(17)32152-9

CrossRef Full Text | Google Scholar

2. MacLennan CA, Saul A. Vaccines against poverty. Proc Natl Acad Sci USA. (2014) 111:12307–12. doi: 10.1073/pnas.1400473111

PubMed Abstract | CrossRef Full Text | Google Scholar

3. Wang H, Abajobir AA, Abate KH, Abbafati C, Abbas KM, Abd-Allah F, et al. Global, regional, and national under-5 mortality, adult mortality, age-specific mortality, and life expectancy, 1970–2016: a systematic analysis for the Global Burden of Disease Study 2016. Lancet. (2017) 390:1084–150. doi: 10.1016/S0140-6736(17)31833-0

4. Stevens P. Diseases of poverty and the 90/10 gap. Int Policy Netw. (2004) 16. Available online at: www.policynetwork.net

Google Scholar

5. Andre FE, Booy R, Bock HL, Clemens J, Datta SK, Lee BW, et al. Vaccination greatly reduces disease, disability, death and inequity worldwide. Bull World Health Organ. (2016) 86:140–146. doi: 10.2471/BLT.07.040089

6. Roberts L. Polio: Health Workers Scramble to Contain African Epidemic. Science. (2004) 305:24–5. doi: 10.1126/science.305.5680.24

7. Keiny MP, Girard MP. Human vaccine research and development: an overview. Vaccine. (2005) 23:5705–7. doi: 10.1016/j.vaccine.2005.07.077

8. Zuber PLF, El-ziq I, Kaddar M, Ottosen AE, Rosenbaum K, Shirey M, et al. Sustaining GAVI-supported vaccine introductions in resource-poor countries. Vaccine. (2011) 29:3149–54. doi: 10.1016/j.vaccine.2011.02.042

9. GAVI. Eligibility and Transition Policy . (2015) Available online at: http://www.gavi.org/about/governance/programme-policies/eligibility-and-transition/ (accessed September 5, 2016).

10. GAVI. Transition Process. (2016). Available online at: http://www.gavi.org/support/apply/graduating-countries/ (accessed September 6, 2016).

11. Levine OS, Hajjeh R, Wecker J, Cherian T, O'Brien KL, Knoll MD, et al. A policy framework for accelerating adoption of new vaccines. Hum Vaccin. (2010) 6:1021–4. doi: 10.4161/hv.6.12.13076

12. Sosler S, Kallenberg J, Johnson HL. Gavi's balancing act: accelerating access to vaccines while ensuring robust national decision-making for sustainable programmes. Vaccine. (2015) 33:A4–5. doi: 10.1016/j.vaccine.2014.12.051

13. Musgrove P. Public spending on health care: how are different criteria related? Health Policy. (1999) 47:207–23. doi: 10.1016/S0168-8510(99)00024-X

14. Walker DG, Hutubessy R, Beutels P. WHO Guide for standardisation of economic evaluations of immunization programmes. Vaccine. (2010) 28:2356–9. doi: 10.1016/j.vaccine.2009.06.035

15. World Bank. World Development Report 1993: Investing in Health. (1993). Available online at: http://www-wds.worldbank.org/external/default/WDSContentServer/WDSP/IB/2006/02/02/000160016_20060202161329/Rendered/PDF/351170Benefit0incidence0practitioner.pdf

16. Schutte C, Chansa C, Marinda E, Guthrie TA, Banda S, Nombewu Z, et al. Cost analysis of routine immunisation in Zambia. Vaccine. (2015) 33:A47–52. doi: 10.1016/j.vaccine.2014.12.040

17. Kaufmann JR, Miller R, Cheyne J. Vaccine supply chains need to be better funded and strengthened, or lives will be at risk. Health Aff. (2011) 30:1113–21. doi: 10.1377/hlthaff.2011.0368

18. Bell KN, Hogue CJ, Manning C, Kendal AP. Risk factors for improper vaccine storage and handling in private provider offices. Pediatrics. (2001) 107:E100. Available online at: https://pediatrics.aappublications.org/content/pediatrics/107/6/e100.full.pdf

PubMed Abstract | Google Scholar

19. Zaffran M, Vandelaer J, Kristensen D, Melgaard B, Yadav P, Antwi-agyei KO, et al. The imperative for stronger vaccine supply and logistics systems. Vaccine. (2013) 31 Suppl. 2:B73–80. doi: 10.1016/j.vaccine.2012.11.036

20. Ampofo W. Vaccine manufacturing in Africa. In: Global Vaccine and Immunisation Research Forum . Johannesburg: WHO (2016). Available online at: http://www.who.int/immunization/research/forums_and_initiatives/1_Wlliam_Ampofo_Vaccine_Manufacturing_Africa.pdf?ua=1