- Compensation Management , Performance Management

Crafting a Solid Pay for Performance Plan for Employees

- January 22, 2024

Organizations are constantly seeking innovative strategies to enhance employee motivation, engagement, and overall employee performance. One such approach gaining widespread recognition is the implementation of a robust Pay for Performance plan.

This blog post is your roadmap to crafting a pay for performance plan that inspires, rewards, and delivers results. Hop on!

What is Pay for Performance?

Pay for performance is a compensation strategy that ties an individual’s pay or financial rewards directly to their performance and contributions in the workplace. The fundamental principle behind pay for performance is to create a direct link between an employee’s efforts and achievements, and the compensation they receive.

Types of Pay for Performance

Individual Performance-Based Bonuses : Employees receive bonuses and pay increases based on their individual performance against predetermined goals and KPIs.

Sales Commissions : Sales professionals earn a percentage of the revenue generated from their sales, directly tying their compensation to their sales performance.

Profit-Sharing Plans : Employees receive a share of the company’s profits based on their contribution to the organization’s financial success.

Stock Options : Employees are granted the option to purchase company stock at a predetermined price, providing them with a stake in the company’s performance.

Benefits Of Implementing Pay For Performance In An Organization

Implementing a pay for performance system in an organization can bring about a range of benefits that contribute to the overall success and growth of the company. Here are some key advantages of adopting a pay for performance approach:

Enhanced Employee Motivation:

Pay for performance directly ties financial rewards to individual and team achievements. This creates a powerful incentive for employees to excel in their roles, fostering a motivated and engaged workforce.

Increased Productivity:

The correlation between the employee’s performance and their compensation plan encourages them to strive for higher levels of productivity. Knowing that their efforts directly impact their earnings motivates individuals to work more efficiently and contribute to organizational goals.

Attracting and Retaining Top Talent:

A well-structured pay for performance system can attract high-caliber, quality talent by offering competitive compensation aligned with performance . Additionally, it helps retain top performers who seek recognition and reward for their exceptional contributions.

Alignment with Organizational Goals:

Pay for performance ensures that individual and team efforts are closely aligned with the strategic objectives of the organization. Employees become more attuned to the company’s mission, resulting in a more cohesive and goal-oriented workforce.

Challenges of Implementing a Pay for Performance System

Subjectivity and bias:.

Pay for performance systems can be susceptible to subjective evaluations and unconscious biases, potentially leading to favoritism, discrimination, or inequitable distribution of rewards based on individual relationships rather than objective performance metrics.

However, performance management systems like Peoplebox ensure that performance evaluations are data-backed and unbiased.

Short-Term Focus:

Employees may prioritize short-term goals to maximize immediate rewards, potentially neglecting long-term strategic initiatives that contribute to sustained organizational success. This short-term focus can impact innovation and overall company growth.

With Peoplebox, you wouldn’t have to worry about this as you get a holistic view of the overarching business goals, and each individual goal is tied to these organizational goals.

Employee Burnout:

The pressure to consistently perform at a high level to receive financial rewards can lead to employee burnout. Extended work hours and heightened stress levels may negatively impact well-being, job satisfaction, and overall morale within the workforce.

Collaboration Challenges:

Pay for performance systems often emphasize individual achievements, potentially hindering collaboration and teamwork. Employees may hesitate to share knowledge or resources, creating silos that can impede overall organizational effectiveness.

Unintended Consequences and Unhealthy Competition:

The competitive nature of pay for performance can create an unhealthy work environment, fostering cutthroat competition among employees. This may lead to a lack of cooperation, reduced knowledge sharing, and a focus on personal gain rather than collective success.

Clearly, there are both positive and negatives to implementing the system in your organization. We recommend conducting a thorough analysis of your organizational culture, industry dynamics, and workforce characteristics before making a decision.

The Relationship between Performance Management and compensation

Performance management serves as the foundation for transparent and fair compensation practices, as it provides the framework for setting performance expectations, assessing progress, and providing feedback.

The intrinsic link between performance management and compensation lies in their symbiotic nature. Through performance management processes , organizations can identify high-performing individuals, acknowledge their contributions, and align pay structures accordingly. Clear performance expectations , regular evaluations, and constructive feedback create a meritocratic environment where employees understand that their efforts directly impact their compensation.

This relationship fosters motivation, encourages continuous improvement, and ensures that compensation practices are intricately tied to individual and team performance , promoting equity and fairness within the organization.

Utilizing integrated OKR and performance management tools such as Peoplebox further enhances this relationship by streamlining performance management processes, facilitating real-time feedback, and ensuring a seamless alignment between performance and compensation strategies.

Designing a Pay for Performance Plan

Crafting a robust pay for performance plan is a strategic endeavor that requires careful consideration of organizational goals, individual performance metrics, and the overarching workplace culture. Here are some steps you can take to ensure the successful design and implementation of an effective pay for performance plan:

Understanding Organizational Goals:

Strategic Alignment:

Begin by gaining a profound understanding of your organization’s overarching goals and objectives . Your pay for performance plan should be intricately aligned with these strategic imperatives to ensure that employee efforts contribute directly to the company’s success.

Set ambitious goals that drive performance with Peoplebox

Key Performance Indicators (KPIs):

Identify and define Key Performance Indicators (KPIs) that encapsulate the critical outcomes necessary for achieving organizational goals. These KPIs will serve as the foundation for measuring individual and team performance.

Here’s an example of how KPIs can be identified and defined for different organizational goals:

With Peoplebox, you can effortlessly craft personalized and professional KPI dashboards in minutes.

See Peoplebox in Action

Crafting Individual Performance Metrics:

Clear and Measurable Objectives:

Establish clear and measurable performance objectives for each role within the organization. These objectives should be directly connected to the identified KPIs and contribute to the broader organizational strategy.

OKRs or Objectives and Key Results come in handy for establishing a framework that aligns individual performance objectives with organizational goals. By emphasizing clarity, outcome-focused measurement, and continuous adaptation, OKRs foster a culture of accountability and collaboration. This integration ensures that employees not only comprehend their role in achieving organizational objectives but are also motivated to contribute meaningfully to the collective success of the organization.

If this is the first time you have heard of OKRs, our OKR cheat sheet can help you understand them in depth.

Quantifiable Targets:

Define quantifiable targets for each performance metric. Whether it’s sales targets, project milestones, or customer satisfaction scores, having clear and measurable targets provides focus.

Determining Compensation Structure:

Variable Pay Components:

Design a compensation structure that incorporates variable components directly tied to performance outcomes. Consider elements such as performance bonuses, profit-sharing, or commission structures that fluctuate based on individual and team achievements.

Fair and Transparent Criteria:

Clearly outline the criteria for earning variable compensation. Pay transparency is crucial to build trust among employees. Ensure that the criteria are fair, objective, and consistently applied across all roles.

Communication and Employee Engagement:

Transparent Communication:

Communicate the pay for performance plan transparently to all employees. Clearly articulate how individual performance links to organizational success and how the compensation structure has been designed to reward exceptional contributions.

Employee Involvement:

Involve employees in the goal-setting process. Encourage them to actively contribute to defining their performance objectives, fostering a sense of ownership and accountability in the pay for performance journey.

Did you know, Peoplebox lets you do a LOT right within your favourite collaboration tools?

Continuous Monitoring and Evaluation:

Regular Performance Reviews:

Implement regular performance reviews to assess progress toward the set goals and provide constructive feedback . This ongoing evaluation ensures that employees are aware of their quality of work, performance levels and areas for improvement.

Flexibility for Adjustments:

Design the pay for performance plan with flexibility for adjustments. Business landscapes evolve, and organizational goals may shift. The pay for performance plan should be adaptable to changing circumstances, allowing for modifications as needed.

Employee Development and Recognition:

Professional Development Opportunities:

Integrate opportunities for professional development within the pay for performance plan. Linking performance to learning and professional growth opportunities can further motivate employees to enhance their skills and contribute to organizational success.

Recognition Programs:

Establish recognition programs that celebrate individual and team achievements. Publicly acknowledging outstanding performance creates a positive culture and reinforces the connection between effort and recognition.

Regular Plan Evaluation and Iteration:

Performance Metrics Review:

Periodically review the effectiveness of the chosen performance metrics. If certain metrics are not aligning with organizational goals or proving challenging to measure accurately, be prepared to make adjustments.

Employee Feedback Integration:

Solicit feedback from employees about the pay for performance plan. Their insights can provide valuable perspectives on the plan’s impact, fairness, and areas for improvement. Use this feedback to iteratively enhance the pay for performance design.

Here’s a quick look at how easy it is to create surveys on Peoplebox.

Now that you know how to implement a robust pay for performance plan, let’s dive into some performance management and compensation management strategies you can use.

Performance Management and Compensation Management Strategies

Bridging the gap between performance and compensation can be tricky. Here are some tried and tested strategies you can use for a seamless pay system.

Performance Management and Compensation Strategies for Emphasizing Clear Communication:

Strategic Alignment Communication:Communicate the strategic alignment of individual and team performance with organizational goals. Ensure that employees understand how their contributions directly impact the overarching success of the company. For example, if you leverage a strategy execution platform like Peoplebox, you can easily get a holistic view of the entire organization, which enables seamless communication of the strategic alignment of individual and team performance with organizational goals.

Transparent Criteria Communication:

Clearly communicate the criteria used for performance evaluation and compensation determination. Complete transparency in these processes builds trust, mitigates uncertainties, and fosters a culture of openness. More often than not, there are a few key performance review competencies that come into play when evaluating performance. Determine what works for your organization, and openly communicate these key competencies to employees.

Regular Communication Channels:

Establish regular communication channels to update employees on performance expectations, progress, and any changes in the compensation structure. Consistent communication reinforces a shared understanding of performance objectives.

Prioritizing Fairness in Strategies:

Equitable Evaluation Criteria:

Implement evaluation criteria that are fair, objective, and consistently applied across all roles. This ensures that every employee is assessed based on the same standards, promoting a sense of fairness in the organization. In our recent article, we share 5 ways to improve diversity and inclusion in the workplace . Check it out.

Balanced Reward Allocation:

Design reward allocation systems that strike a balance between individual and team goal achievements. Recognize and celebrate both individual excellence and collaborative efforts, fostering a culture that values collective success.

Merit-Based Compensation:

Prioritize a merit-based compensation system to ensure that rewards are directly linked to individual contributions and accomplishments. This approach reinforces a meritocratic culture where employees are motivated to excel for personal and organizational success.

Fostering Transparency in the Process:

Open Performance Discussions:

Encourage open discussions about performance expectations, their own goals, and outcomes. Creating a transparent environment allows employees to actively engage in their own development and understand the rationale behind compensation decisions.

Clear Evaluation Processes:

Outline and communicate the entire performance evaluation process clearly. From goal setting to assessment methodologies, transparency in the evaluation process ensures that employees have a comprehensive understanding of how their performance is measured.

Accessible Compensation Information:

Make compensation package information accessible and understandable for employees. Transparency in how compensation is calculated, including base pay and any variable components, contributes to a sense of fairness and reduces ambiguity.

Measuring the Impact of Pay for Performance

Measuring the impact of pay for performance plans is crucial for understanding their effectiveness in driving employee engagement, retention, and overall organizational performance. Let’s look at the intricate process of measuring the outcomes of pay for performance initiatives, with a specific focus on their effects on employee engagement, retention, and overall organizational performance.

Assessing Employee Engagement:

Employee Satisfaction Surveys:

Conduct regular surveys to gauge employee satisfaction with the pay for performance system. Inquire about perceived fairness, motivation levels, and the system’s influence on their commitment to organizational goals.

Participation in Performance Programs:

Measure the level of employee engagement by analyzing participation rates in performance improvement programs linked to the pay for performance structure. Higher participation may indicate a positive impact on engagement.

Feedback Mechanisms:

Establish transparent channels for employees to provide feedback on the pay for performance system. Regular feedback sessions can reveal insights into employee perceptions and areas for improvement.

Evaluating Employee Retention:

Retention Rates:

Compare pre-pay for performance and post-pay for performance implementation retention rates. A decrease in turnover may signify that the pay for performance system is contributing to employee satisfaction and loyalty.

Exit Interviews:

Conduct thorough exit interviews to understand both the internal and external factors behind employee departures. Analyze whether dissatisfaction with the pay for performance system is a contributing factor.

Promotion and Advancement:

Track employee promotions and advancements. An increase in internal promotions may indicate that the pay for performance system is recognizing and rewarding high performers in an effective way, contributing to retention.

Gauging Organizational Performance:

Productivity Metrics:

Analyze changes in productivity metrics following the implementation of the pay for performance system. Increased productivity may indicate that employees are motivated to perform at higher levels.

Financial Performance:

Assess the overall financial performance of the organization. A positive correlation between the pay for performance system and financial outcomes may signify the effectiveness of the incentive structure.

Employee Contributions to Organizational Goals:

Evaluate how well individual and team contributions align with organizational objectives. The pay for performance system’s impact on goal alignment can be indicative of its influence on overall organizational performance.

Leveraging Peoplebox for Performance-Driven Compensation

Peoplebox’s performance management features offer a robust platform for creating a seamless and effective pay for performance plan. The platform facilitates goal setting and alignment, enabling organizations to establish OKRs that directly link employee efforts to overarching business goals.

With continuous performance evaluation and data-driven insights, Peoplebox empowers organizations to make informed compensation decisions based on actual performance outcomes, fostering a culture of meritocracy and fairness.

Start your journey towards a high-performing workforce by embracing Peoplebox today. Get in touch with us.

Table of Contents

What’s Next?

Get Peoplebox Demo

Get a 30-min. personalized demo of our OKR, Performance Management and People Analytics Platform Schedule Now

Take Product Tour

Watch a product tour to see how Peoplebox makes goals alignment, performance management and people analytics seamless. Take a product tour

Subscribe to our blog & newsletter

Popular Categories

- One on Ones

- Performance Management

- People Analytics

- Employee Engagement

- Strategy Execution

- Remote Work

Recent Blogs

Performance Review Calibrations Made Easy

A CHRO’s Guide to Buying People Analytics Software

The Beginner’s Guide to Creating an Effective People Strategy

- Performance Reviews

- Performance Reviews in Slack

- OKRs (Aligned Goals)

- 1:1 Meetings

- Business Reviews

- Automated Engagement Survey

- Anonymous Messaging

- Engagement Insights

- Integrations

- Why Peoplebox

- Our Customers

- Customer Success Stories

- Product Tours

- Peoplebox Analytics Talk

- The Peoplebox Pulse Newsletter

- OKR Podcast

- OKR Examples

- One-on-one-meeting questions

- Performance Review Templates

- Request Demo

- Help Center

- Careers (🚀 We are hiring)

- Privacy Policy

- Terms & Conditions

- GDPR Compliance

- Data Processing Addendum

- Responsible Disclosure

- Cookies Policy

Share this blog

The Pros and Cons of a Pay for Performance Model

A pay for performance compensation model is a popular method used by HR departments where you encourage your employees to hit their performance goals by offering them a monetary incentive. This might be in the form of merit pay increases or variable pay programs.

Pay for performance can be a great tool for increasing employee productivity, however, it might not always lead to positive workplace culture. A recent survey suggests that 77% of companies in the U.S. are now using them as part of their employee recognition schemes, but do these plans really work for everyone?

In today’s post, we are going to take a look at how they work to help you find the right model for your business. We’ll compare the pros and cons of using pay for performance, and we’ll discuss whether this compensation method can really help you motivate your employees.

Pay for Performance Definition: What is It?

How does pay for performance work, types of pay for performance models, pay for performance pros and cons, does pay for performance really motivate employees.

- ✅ Performance Management Software for Companies ✅

Pay for performance is a compensation model used as part of a wider continuous performance management initiative.

What does this mean?

The basic idea is that you pay employees based on how well they perform their duties. You do this by setting performance goals for each employee and paying them a bonus when they reach or exceed their objectives. This might be in the form of merit pay, or one of a variety of variable pay programs.

Some view the pay for performance model as a fairer approach to employee salaries. With a more traditional compensation method, all employees at the same level are paid the same amount, regardless of whether they under or over-perform. There’s no real incentive to try harder. In contrast, with a pay for performance program, you motivate your employees to perform to the best of their abilities and strive for continuous improvement by offering them tangible rewards. Many argue that it can encourage engagement and boost top talent retention.

We’ve looked at a basic performance-based compensation definition. Now let’s discuss how it works.

The pay for performance model and processes you implement will depend on a range of factors. To work out which model works best for you, you need to consider your organization’s budget, compensation philosophy, and organizational goals.

What are you hoping to achieve? How often will you reward employees? Do you have an established budget? Which performance-based pay plans would work best in your organization?

Ultimately, the way pay for performance works will depend on your employee performance management system, how you conduct your appraisals, and the employee performance metrics you use to track progress. Do you use a specific assessment model such as the 9 box grid? How do you calculate performance-based pay and conduct performance reviews for remote employees ?

The best way to make sure you collect all the important information during your employee performance reviews is to design a template. This can take time to develop and get right. The questions you ask need to be well thought out, well-executed, and tailored to your organization. This will help you ask the right questions, evaluate the full spectrum of performance, and align it with your pay for performance programs.

If you don’t already have one, you can download and adapt Factorial’s 360 performance appraisal template.

As we mentioned above, there are two primary types of pay for performance programs: merit and variable. You can choose one method or implement both to boost performance and motivate your employees.

The first pay for performance model is merit pay. This is where you increase the base salary of an employee as a result of high performance. If an employee hits their goals or exceeds expectations, you reward them by raising their salary at their next salary review meeting.

This is the most common pay for performance model. Raises are usually implemented on an annual basis and are included in a company’s budget. They are also permanent, so employers usually look for signs of consistent high-performance before rewarding an employee with a merit-based salary increase.

The benefit of merit pay is that it allows you to differentiate and account for individual performance within your teams. The downside is that as salaries are usually only reviewed once a year, a high-performing employee might be tempted by a higher salary elsewhere before you have the chance to reward them for performing consistently well.

Variable Pay

The other type of pay-for-performance model is variable pay. This model includes a range of bonus types that vary according to payout period, eligibility, and employee metrics. They are usually tied into your employee recognition programs and, unlike merit pay, they are not dependent on annual salary reviews.

Bonus types include:

- Discretionary bonuses : Awarded on an ad-hoc basis to employees demonstrating outstanding performance. You wouldn’t usually tie these to specific pre-defined goals. Examples include spot bonuses (where employees are rewarded “on the spot” for achievements that deserve special recognition), project bonuses (where employees are rewarded for successful completion of a project), and retention bonuses (usually awarded to long-tenured employees to encourage retention).

- Non-discretionary bonuses : Awarded when employees meet specific, pre-defined goals and objectives. Non-discretionary bonuses can take the form of short-term incentives (STI) or long-term incentives (LTI). Examples include company-wide bonuses (based on specific improvement goals for the company), team-incentive bonuses (based on team performance/achievements), and individual incentive bonuses (based on predetermined, measurable business objectives).

Performance-based programs can be a great tool for helping you meet your business goals. However, they might not work for everyone, and they are not without their disadvantages , especially if you don’t take the time to design a strategy based on clear guidelines and processes.

Let’s take a look at some of the specific pros and cons to help you decide if the program could be a good fit for your organization.

- Boosts motivation and morale

- Increases productivity

- Helps you nurture a high performance culture

- Clarifies the process of setting achievable goals

- Helps create a strong bond between employee and employer

- Plays a part in creating a healthy performance-based culture

- Establishes company values

- Offers employees more control

- Enables you to attract and retain top talent

- Finally, it can lower costs and help businesses to remain profitable

Disadvantages

- Firstly, it may have a negative effect on teamwork if employees feel they are competing with each other

- Secondly, it can distract from team objectives if employees are more focused on their own skills or productivity.

- If you don’t manage it well, it can result in too much focus on quantity of work, rather than quality. This, in turn, can lead to employee stress

- Moreover, you risk putting too much focus on objective skills that can be measured by quantifiable metrics. This can result in less focus on subjective but equally valuable skills, such as communication and creativity

- An established performance-based compensation plan can be difficult to change or update. It can also be difficult to end if the program is not giving you the results you expected. This can lead to increased turnover if employees feel cheated out of previously offered bonuses

- Finally, if you don’t ensure your managers apply your pay for performance strategy consistently, it can lead to favoritism. It can also highlight potential deficiencies. For example, certain employees might not meet expectations because they do not have sufficient training

If you want to learn more about pay for performance models, check out this video on our YouTube channel:

We’ve looked at the pros and cons of performance-based pay. Ultimately, though, it comes down to one thing: do pay for performance programs really motivate employees?

Studies suggest that aligning compensation with performance can be a highly effective strategy if you do it well. In fact, organizations that embrace pay-for-performance philosophy are 50% more likely to have excellent employee engagement. Not just because of the financial reward, but also because your employees feel that you value and support their professional development. And this, in turn, improves retention rates and helps you attract top talent to your company.

Firstly, the strategy you use should enable your employees to see a clear connection between the work they do every day and the success of the company as a whole. You need to establish clear guidelines for your program and offer rewards that represent a true incentive. You also need to make sure you implement the program consistently and your managers use the same metrics to calculate payouts across teams.

Related: How to Measure Employee Performance Metrics (with template)

Finally, you need to make sure you align your performance compensation model with your performance appraisals and your L&D strategy . It needs to form an integral part of your corporate culture. Your employees need to feel that continuous learning and development is a core value of your business. To conclude, if the pay for performance models are matched with a company-wide growth mentality, the more you will engage and motivate your employees.

Related posts

Suggestion Box for Employee Feedback – How to Make Your Own

Understanding Bereavement Leave Laws for Employers

Boost your HR with software

See how Factorial powers productivity, engagement, and employee retention.

Book a free demo

- Book a Meeting

How to Maximize Results in this Economy: What Makes Pay for Performance Work?

Paying your employees based on their performance is a powerful strategy that can lead to positive results for your business. Not only does it motivate employees to do their best, but it can also help you identify and reward exceptional work aligned with company objectives.

In today's ever-changing business environment, pay for performance is a powerful strategic lever that can have profound impacts on your organization’s success. It goes beyond sales commissions : performance-based pay is all about extra rewards that motivate employees to reach higher levels of productivity and, more importantly, outcomes.

Because it can significantly impact your bottom line, it's worth taking a closer look at what it is and how you can use it in your own organization. This way, you can start putting together plans that ensure your team gets incentivized properly and appropriately — key ingredients when striving toward mutual growth.

This article will dive into the pay-for-performance compensation model and its pros and cons. We’ll also share the impact incentives have on employee performance and close with how CaptivateIQ fits into the picture.

What is pay for performance?

Pay for performance (or performance-related pay) is a variable pay model where employees can receive more compensation when they meet or exceed specific goals, such as sales volume and customer satisfaction, set by their managers or company executives.

It’s a pretty standard strategic lever for business today as it can significantly improve productivity, morale, and cost efficiency. In fact, according to a recent Salary.com survey , 77% of companies in the United States are using variable pay programs.

The pros of pay for performance

Why do three out of four of companies use some form of variable pay (like performance pay)? Simply put: It works!

There are many pay-for-performance benefits with a successfully implemented program. As this Forbes article suggests, pay-for-performance is a game changer.

Here are some of the “game-changing” benefits.

Increased productivity

Doing more with less is the name of the game in today’s business environment. Increasing employee productivity is one avenue for achieving “more with less.”

One of the best levers for improving productivity is to reward effort. When employees know certain actions will be rewarded, they are more likely to put in extra effort and produce better results.

A key advantage of a pay-for-performance model is that it incentivizes continuous achievement and success while aligning compensation with contributions.

Enhanced motivation

Discipline is essential for getting work done and staying on schedule — and motivation can inspire you to make it happen.

But only some in an organization are motivated by the same things. Some excel with intrinsic motivators (doing something because it is enjoyable), while others perform better with extrinsic motivators (doing something for financial incentives). Nevertheless, these tangible rewards can motivate a team to work harder, smarter, and more efficiently.

And there is some data to support this.

Implementing a pay-for-performance compensation model in your workplace can increase motivation and productivity amongst employees.

Improved morale

A motivation-based compensation system helps maintain employee morale by providing recognition and acknowledgment for a job well done.

Greater clarity around roles and responsibilities

A clear delineation of duties leads to improved efficiency and fewer conflicts among team members.

Cost efficiency

Underperforming employees typically require more supervision and resources than high-performing ones. However, letting go of underperformers or offering them lower wages can still be expensive for businesses; paying them based on performance can help avoid this issue altogether.

Competitive advantage

Paying employees based on performance is becoming increasingly common, so those businesses that don't adopt this strategy may find themselves at a disadvantage when competing for top talent.

Higher retention rates

Employees who are rewarded for their work tend to be more engaged and invested in their job. As mentioned above, they are more likely to go the extra mile to do a good job and be productive.

With incentive plans in place, you can provide for your employees in ways beyond just financial compensation. When employees are recognized for their effort AND rewarded for it, they are inspired to continue to develop their careers in that same workplace . Additionally, when employees feel fairly compensated for their work, they are less likely to look for other jobs, leading to lower turnover rates.

The cons of pay for performance

The pay-for-performance model is not all unicorns and rainbows. Like any plan, there can be disadvantages as well.

Here are some of the common problems with pay-for-performance.

Wait. Teamwork is a good thing, right? Not so fast.

Teamwork may be less emphasized and incentivized depending on your compensation model. This can result in individuals focusing on their performance rather than the team's success.

An individual-focused approach may work in some organizations, but as they say, teamwork makes the dream work. While most businesses want a unified workforce, you will quickly create a hostile work environment if you pit your staff against each other for incentives.

Quantity over quality

Quality is almost always the name of the game.

Depending on your incentive system, your team may feel that getting more work done and filling quotas is the right approach for more incentives. When implementing your pay-for-performance plan, emphasize the quality of performance, not the quantity .

Focusing on short-term results (a little too much!)

When people are rewarded based on their short-term performance, they may be more likely to focus on tasks that can be completed quickly and easily instead of longer-term goals that may be more difficult but have a greater payoff. Management might also become overly focused on achieving short-term results, which can take away from their investments in employee development and training and ultimately lead to lower productivity and decreased efficiency.

Setting a standard

Once employees become accustomed to incentives, the pay-for-performance model may become “the new norm.”

That’s not necessarily a bad thing. However, if there is a month/quarter/year where your organization does not provide the pay for performance incentive, you may have a mutiny* on your hands.

*Or just a few unhappy employees.

Be sure to scale your incentives with the reality of your business – anticipating down years.

Impact of incentives on employee performance

The impact of incentives on employee performance is quite clear.

A 2010 meta-analysis conducted [by] the International Society of Performance Improvement (ISPI) found that properly constructed incentive programs increase performance by anywhere between 25 and 44 percent. The same study found that these incentive programs engage participants and help companies attract quality employees. ( Source )

While a pay-for-performance plan may be a deliberate decision on employers' behalf, performance-based incentives examples exist in other places.

For example: In many elementary schools, teachers reward children with toys, stickers, or other forms of motivation for positive behavior. While not the same as more advanced work incentives, the underlying principle is the same. People work harder when they feel their effort is recognized and rewarded.

Performance-based incentives for employees should go beyond stickers and toy box prizes (obviously).

Unfortunately, simply having the idea to implement a pay-for-performance program is not the same as actually implementing an effective one. Unstructured incentives can have serious consequences.

There are plenty of bad incentives examples out there. Take cash bonuses. The bonus only comes through if you meet your set quota. This can create an incentive to overreport sales, which can hurt the company.

Implementing a pay-for-performance system

Pay for performance might be the answer if you're looking to motivate your reps and increase sales output. But cookie-cutter solutions are not the answer — what works wonders for one company could prove utterly ineffective with another business. That’s why it’s critical to tailor commission structures accordingly to ensure maximum impact!

Establishing clear parameters that reflect fair and attainable targets is also critical: you need to provide rewards that feel attainable, so employees remain motivated.

The same concept holds true when considering merit-based raises — be sure they happen often enough so hard work doesn't go unnoticed or unrewarded! If an employee feels like their hard work will only be acknowledged possibly after an intense year of effort, it may make the pursuit of the goal not feel worthwhile, as the incentive would seem very distant.

Here are some other tips to ensure a successful implementation:

- Define what "performance" means for your company and employees. What are your measures of success? Performance metrics often relate to how well an individual or group is meeting expectations, improving skills, and adapting to changing demands in the workplace or marketplace.

- Clearly outline the expectations and goals of the pay-for-performance system to all parties involved. This includes establishing a timeline for measuring results and determining if the system works as intended.

- Make sure both management and employees are on board with the new system. Manage employee expectations by regularly communicating about their progress and how it relates to their pay.

- Periodically assess the system's effectiveness to ensure it meets everyone's needs. Make changes as necessary.

- Celebrate successes and learn from failures together as a team.

The role CaptivateIQ plays in performance-based compensation

Compensation is often your most significant sales expense.

It’s also the single most impactful go-to-market investment your organization makes. If managed effectively and efficiently, it can influence revenue generation more than any other business lever.

Sales reps (95%) agree that the right technology stack is essential to meeting their revenue goals and rank compensation software amongst their most indispensable tools.

That’s why performance-based pay has become one of the most popular forms of incentive compensation. It offers a way to encourage and sustain exemplary performance by providing pay increases based on improvements in productivity, quality of work, or cost savings.

CaptivateIQ empowers businesses to get pay for performance right — for their teams, their goals, and their market — now and in the future.

Learn more about incentive compensation management .

Related Content

The 3-Part Playbook to Becoming a More Strategic Incentive Compensation Leader

Maximizing Performance: The Pros and Cons of Pay For Performance Programs

- Book a Speaker

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Vivamus convallis sem tellus, vitae egestas felis vestibule ut.

Error message details.

Reuse Permissions

Request permission to republish or redistribute SHRM content and materials.

How a Pay-for-Performance Compensation Strategy Pays Off

Next to an organization’s strategic planning efforts, dovetailing the compensation philosophy to support the organization’s goals is paramount to success. For example, if quality, experience and a sophisticated skill set are an organization’s strategic advantages, then it will not be successful hiring employees significantly below the market rate for that position.

It is important to review the organization’s strategic plan at least annually, and to discuss basic strategic pay decisions with senior management to ensure the success of the pay-for-performance compensation strategy and prevent serious consequences, such as employee turnover and lawsuits.

Important considerations that should be a part of this ongoing discussion include the following:

Where does the organization want to be in terms of market competitiveness?

In this competitive job market, it is important to be aware of the organization’s competing firms. An organization can lead, meet or lag the market.

• Lag the market. An organization may choose to offer a compensation package that is valued less than packages offered for a similar job in the labor market. An employer with a “lag the market” philosophy is likely to be at the back of the line when it comes to hiring and retaining employees, especially those with special skills. These problems are the direct result of below-market pay. With the Internet providing pay information with a click of a mouse, employees are less willing to stay and support an organization when they know they are underpaid. Good employees may leave, while less-skilled employees may stay with the organization. Turnover is very expensive. It is estimated to be at least six months’ pay for a non-exempt (hourly) employee and one years’ pay for an exempt (salaried) employee. No organization wants to be a training ground to groom employees for its competitors.

• Meet the market. This is the most common compensation strategy. This level of competitiveness occurs when an organization’s compensation strategy is equal to the labor market for the same position. This is the pay philosophy that makes the most sense for most organizations. By having a base pay strategy that meets the market, an employer can easily add or subtract variable pay and/or fringe benefits. By selecting this level, employers can balance cost pressures and the need to attract and retain employees.

• Lead the market . The “lead the market” pay strategy can be defined as a total compensation package that is above the labor market for a similar position. This strategy may occur because an organization believes that by paying more, it will receive more experienced employees for the same position (although it has not been proven that a higher salary guarantees higher-quality employees) Organizations may choose to lead the market in good financial times, but it can leave them in a tight spot in a downturn.

Mixed Market Position

This market position is becoming more common as employers are realizing that a one-size-fits-all strategy does not suit their workforce. The following are examples of a mixed market pay policy:

• An organization that is several miles outside a major city may be able to pay lower for their lower-level hourly employees to match a lower cost of living, but may have to pay at market or above market to attract employees to a smaller, more remote city. • An organization has a mix of difficult-to-fill clinical positions and easier-to-fill administrative positions. To compete in a market with an extreme shortage, it may make business sense to pay the clinical positions at least at market or above market and pay the administrative positions closer to below market.

What are the strengths and weaknesses of the organization’s current compensation system?

An important component of market competitiveness is to find answers to the following questions:

• Is the organization able to attract the appropriate skill sets and types of employees when needed? • Where is the organization hiring its best employees? • How long do most employees stay at the organization? • Where do employees go when they leave the organization? • What are the organization’s promotion policies? • Are employees frequently asked to take on new tasks without being rewarded for their efforts? • Do employees value the company’s benefits, incentives, work environment? What of these items should be changed or updated? • What is the employee morale? This information can be gathered from managers, exit interviews, employee surveys and other communication tools. Employee survey feedback, in particular, provides valuable information for moving forward. • What mix of base pay, incentive pay, work environment and benefit levels make the most sense for the organization when considering the competition, types of jobs, niche and labor market available?

How is pay distributed?

How does the organization’s current compensation plan link pay with performance on base pay?

• Is there a pay matrix that rewards high-performing employees with a larger annual merit increase? • How well does the organization’s performance appraisal process work? • Are the organization’s promotional pay policies consistent? • Does the organization review where employees fall on the pay range according to experience, performance and longevity?

How is the organization’s pay system administered?

What are the strengths and weaknesses of the current system? How is your system structured and what do you want to change about the following:

• Number of grades. • Separate scales for different types of jobs such as non-exempt, exempt and executive. • Size of jump between grade mid-points. • Placing a newly created job in the pay range. • Determining how and when a job gets reviewed due to changes in responsibilities.

What are some constraints?

It is too easy for an employer to take a shortcut and not acknowledge that all organizations have to work within some important constraints when managing their pay-for-performance system. There are five major constraints: the organization’s ability to pay; legal constraints; union and non-union issues; the internal labor market and the external labor market.

1. Ability to pay. Fancy compensation programs are impressive, but the bottom line is that an organization must be able to afford its pay system. This is true in good and in bad financial times. It is critical that design decisions align with the organization’s financial ability to pay. By partnering with an organization’s chief financial offer, it will be easier to develop a plan that makes sense financially.

2. Legal constraints. In general, base pay plans are regulated by the Fair Labor Standards Act (FLSA), which regulates wages, hours and recordkeeping.

3. Union/non-union issues. For unionized organizations, pay issues are a mandatory bargaining issue that must be negotiated. Organizations must obtain buy in from union leadership early in the negotiation process to be successful in changing the way they pay their employees.

4. Internal labor market. This is where internal equity comes into play. Pay plans must motivate employees to want to stay with the organization and, hopefully, take on management roles or higher-level technical roles in the future. To illustrate, an organization can structure a pay plan that will motivate high-level technical employees to move out of overtime-eligible positions into first-line management positions that do not pay overtime.

5. External labor market. In today’s global market, organizations cannot operate their pay plan in a vacuum. Basic economics of supply and demand affect employee compensation. To illustrate, the amount of education required to become a pharmacist recently changed. To compound the problem, Medicare added a pharmacy plan for senior citizens. This resulted in a shortage in pharmacists and an increase in pay levels for the job.

Collecting information regarding the above compensation questions and issues will give HR professionals a good start in developing a compensation philosophy that can then be shared internally with their employees and externally with the general public, customers and potential applicant pool.

HR professionals should enlist senior management to help champion the compensation philosophy as a working document that can set the stage for the design of a new compensation system.

Sharon K. Koss, SPHR, the author of Solving the Compensation Puzzle , has owned her own HR consulting/compensation firm since 1986. Altogether, she has more than 30 years of HR experience, during which time she completed more than 500 salary plans. Koss speaks regularly on the topics of compensation and general HR and has been on the SHRM Faculty for more than 12 years, and served as chair of the Human Resource Certification Institute.

Related Content

Rising Demand for Workforce AI Skills Leads to Calls for Upskilling

As artificial intelligence technology continues to develop, the demand for workers with the ability to work alongside and manage AI systems will increase. This means that workers who are not able to adapt and learn these new skills will be left behind in the job market.

Employers Want New Grads with AI Experience, Knowledge

A vast majority of U.S. professionals say students entering the workforce should have experience using AI and be prepared to use it in the workplace, and they expect higher education to play a critical role in that preparation.

Advertisement

Artificial Intelligence in the Workplace

An organization run by AI is not a futuristic concept. Such technology is already a part of many workplaces and will continue to shape the labor market and HR. Here's how employers and employees can successfully manage generative AI and other AI-powered systems.

HR Daily Newsletter

New, trends and analysis, as well as breaking news alerts, to help HR professionals do their jobs better each business day.

Success title

Success caption

- Performance Management

- – Small Business Essentials

- – Performance Reviews

- – 360° Feedback

- Vacation Tracking

- Leadership Training

- Team Chartering

- Why SpriggHR?

- Security & Privacy

- Frequently Asked Questions

- Product Videos

- White Papers & Infographics

- Thought Leadership

- Request A Demo

Implementing an Effective Pay-for-Performance Model

Emily Barr March 7, 2020 Compensation , HR Professionals , Performance Culture

Share this Post

Independent Contractor or Employee? - Ask a Lawyer!

Upcoming webinar - april 8, 2:00pm est / 11:00am pst, covid-19 - coping with legislative changes & working from home, upcoming webinar - march 20, 1:00pm est / 10:00am pst.

Implementing an Effective Pay -for – Performance Mode l

Pay-for-performance compensation describes performance-based pay programs where an employee is incentivized and rewarded for achieving goals or objectives.

In a hurry? Take our Implementing an Effective Performance Management White Paper to go!

Pay-for-Performance

Send download link to:

I consent to receive future White Papers, blog updates & other marketing communications from SpriggHR.

What is Pay-for-Performance?

The pay-for-performance model moves away from systematic entitlements when it comes to compensation, and instead signals a more mature and fair approach to employee salaries. It works to drive employee engagement and is also effective in boosting top talent retention. Despite being a complex model that can manifest in several different forms, hinging on budget, goals, company size, and so on, pay-for-performance can be grouped into two principle categories:

Merit Pay Increases

These refer to the increases in an employee’s base pay due to high performance that are typically delivered on an annual basis. They are often already budgeted for, included as part of the annual salary increase budgeting process. This is the most used pay-for-performance model, recognizing employee performance and rewarding top performers with an increased base salary for the following year.

Variable Pay Programs

These encompass an array of both discretionary and non-discretionary bonuses, varying according to the payout period, employee eligibility, and employee measurement metrics. Unlike merit pay increases, variable pay programs are often administered multiple times a year (i.e. once a quarter), and a mix of different programs are often employed.

Some variable pays programs include:

Discretionary Bonuses

These are awarded on an ad-hoc basis to the employees demonstrating outstanding performance, and often without consideration of pre-defined goals. This can include:

- Spot bonuses: reward employees “on the spot” for achievements that deserve special recognition.

- Project bonuses: reward employees for completion or superior completion of a project.

- Retention bonuses: usually awarded to long-tenured employees, or employees in “hot jobs”, to decrease their flight risk.

Nondiscretionary Bonuses

These are awarded when employees, teams, or the entire company meets specific, pre-defined goals. They are based on the duration of the assessment period and are considered either short-term incentives or long-term incentives . This can include:

- Company-wide bonuses: focused around specific improvement goals for the company, rewarding employees based on how much improvement is made on these goals over a certain period of time.

- Team-incentive bonuses: focused around specific improvement goals for one specific team, rewarded based on the performance of that team.

- Individual incentive bonuses: based on predetermined, measurable business objectives (MBOs), that are evaluated periodically based on an individual employee’s performance.

Is Pay-for-Performance Really Working?

Pay-for-performance compensation can come in many different forms depending on an organization’s budget, compensation philosophy, and organizational goals. However, despite their usefulness in building a competitive compensation plan, very few organizations have feasible and effective pay-for-performance models in place.

The Pros and Cons of a Pay-for-Performance Model

Despite embracing its concept, many employers claim that their pay-for-performance programs are failing in driving and rewarding individual or group performance.

In a Talent Management and Rewards Pulse Survey conducted by Willis Tower Watson, a surprisingly large number of North American employers claimed their programs were not accomplishing what they had promised they would do. Specific findings included:

- Only 20% North American companies find pay-for-performance effective in driving higher levels of individual performance at their organization.

- Only 32% claimed that their performance-based pay program is effective in differentiating pay based on individual performance.

- 53% agreed that annual incentives are ineffective in differentiating pay based on how well employees perform.

The survey also pointed out the discrepancies in employee’s understandings of how merit is specifically measured, with their understandings of the merit-influencing values not aligning with their employers. For example, two-thirds (64%) of employees claim the managers at their organization consider the demonstration of knowledge and skills in an employee’s current role when making pay-increase decisions. However, less than half (46%) claim their programs are designed to take these performance indicators into consideration.

Pay-for-performance models can be great tools in driving performance and recognizing and reward top-performing employees, but only when they are designed and implemented correctly. Traditional thinking on merit-based pay is no longer applicable – companies instead need to define what performance means specifically for their organization, and what managers can do to ensure they are driving the right performance. Re-evaluation the objectives of rewards programs can help to realign pay-for-performance models with their benefits, rather than misaligning them and causing detriments.

Implementing an Effective Pay-for-Performance Model

While the concept of constructing and implementing a merit-based compensation model may seem daunting to many organizations, there are several tricks you can use to do it effectively and ensure it is sustainable in the ever-changing job market.

Most employee performance can be classified into one of the two categories:

1. Qualitative Performance – activities related directly to customer experience and outcomes, such as sales, customer satisfaction, employee engagement, employee productivity, etc.

2. Quantitative Performance – activities related to the operations side of the organizations, such as programming, accounting, administration, etc.

Once an employee’s performance is quantified, it becomes much easier to link their performance to rewards, guiding you towards a fair and flexible pay-for-performance model suitable to your organization.

Best Practices in Linking Performance to Rewards

Identify the triggers for top performers..

Not every employee will view higher base pay or bonuses as the ultimate form of reward. Management should recognize what specifically drives engagement and productivity in their top performers, allocating the annual budget to flow into these triggers specifically.

Identify clear-cut objectives for employees.

Pay-for-performance heavily relies on both the employee’s and the employer’s understanding of what good performance actually looks like. When the ‘what’ of performance is clearly articulated, employees will have a better understanding of what they’re working towards, making the measurement of performance against your model much more cohesive.

The Benefit of Linking Pay to Performance

The objective of any pay-for-performance model should be maintaining a structure that rewards the employees who best contribute to organizational and departmental goals. Establishing fair and consistent practices in how you reward and compensate performance is critical.

SpriggHR’s Compensation Tools are an effective solution that helps you to accurately link pay to performance, tracking essential compensation activities and reporting.

Create a fair and consistent approach to your compensation strategy by establishing adjustments that directly link an individual’s pay raise or bonus allotment to the results of their own performance.

Request a Free Demo

We'd love to show you around.

- Name * First Name Last Name

- Company Name *

- Size of Company * Select Size 5-50 51-150 151-300 301-500 501-750 751-1200 1200+

- Company Email *

- Phone This field is for validation purposes and should be left unchanged.

Subscribe to our newsletter...

We'll keep you up to date with useful HR content, tips, and templates!

- First Name *

Privacy Overview

The Pros & Cons of Pay For Performance Model

Need help onboarding international talent?

Key takeaways.

- Pay for performance means an employee is eligible for financial incentives on top of their base salary if they outperform a specific target or goal.

- Performance-based pay can be an excellent tactic to increase employee engagement and motivate employees to exceed expectations.

- Pay-for-performance pay can have drawbacks if implemented without getting regular feedback from employees and relying on HR tech to streamline and facilitate performance management.

Determining the best employee compensation system for a global team is a complex task, given all the factors that may influence your decision: currency fluctuations, local cost of living, tax implications, and employee expectations—just to name a few.

If you’re leaning towards performance-based pay, this guide will help you understand how pay for performance works, its pros and cons, and the best practices for its implementation.

What is pay-for-performance compensation?

Pay for performance, often referred to as P4P, is a strategic compensation approach designed to optimize employee productivity and align it with organizational objectives through a dynamic system of financial incentives.

In this compensation model, employees are motivated to exceed their performance targets as you give them an opportunity to earn more if they outperform the pre-set benchmarks.

Performance-based compensation may include merit-based salary hikes, result-driven bonuses , and variable compensation schemes.

Human resources departments typically participate in the creation of performance-related compensation strategies .

They measure different metrics and KPIs to evaluate the employee’s performance and assign adequate incentive pay to top performers, such as goal attainment, customer satisfaction, or corresponding numerical output (like revenue for sales teams).

💰 Pay-for-performance programs are considered direct compensation and may depend on your employee’s:

- Current type of employee compensation

- Performance goals

Are there different types of performance-based compensation plans?

Yes, there are several types of performance-based incentive pays. The most common are:

- Merit pay: A type of compensation in which a high-performing employee receives a merit-based salary increase , determined by individual performance, achievements, and contributions within the organization.

- Discretionary bonuses: Short-term incentives that an employee receives for outstanding achievement. This type of bonus may include retention bonuses, “on the spot” bonuses, or project bonuses.

- Non-discretionary bonuses: Provided to employees based on specific criteria or conditions established in advance, like achieving certain performance goals (team or individual), meeting sales targets, or attaining other measurable milestones.

Pay your entire team in one click with mass payments

Click one button and pay your global team instantly. They can withdraw funds via bank transfers, crypto, PayPal, and more. Easy operations for you, easy options for your team.

The benefits of using performance-based incentive plans

A 2022 study found that pay incentives can increase job satisfaction, positively affect overall company performance, and reduce HR costs by lowering absenteeism and turnover rates. What are some other benefits of pay-for-performance compensation?

Boosts employee motivation

By directly linking compensation to performance, employees are motivated to excel in their roles and achieve their goals, as their efforts are rewarded with financial incentive programs.

💡 See also: Can You Give an Independent Contractor a Bonus?

Improves talent acquisition and retention

Pay for performance can attract top talent , as high-performing individuals are drawn to organizations that recognize and reward their contributions. It also promotes employee retention by offering a financial incentive to stay with the company for a longer time.

Helps with performance management

To properly implement performance-based pay, you need to establish a robust performance management process, which can help easily identify top performers and those who may be struggling and need specific performance measures to improve.

💡 See also: Performance Management for Remote Teams: All You Need to Know

Enhances productivity

Employees strive to improve their productivity and efficiency to earn higher rewards on top of their base pay , leading to increased overall output and performance levels.

Establishes a culture of continuous improvement

The model sets clear performance expectations and goals, providing employees with a well-defined path to success and advancement. Regular performance reviews and feedback discussions encourage employees to continuously improve their skills and performance, fostering a culture of growth.

Aligns with organizational goals

When compensation is tied to organizational objectives, employees are more likely to focus on tasks that contribute directly to the company's success. This model also fosters a culture of accountability, as employees take ownership of their roles and outcomes.

Allows for a flexible compensation structure

With this compensation model, employees can earn more based on their efforts, meaning greater financial incentives for those who excel. Organizations can tailor incentive structures to align with specific roles, departments, or business goals, creating a customized approach that suits their unique needs.

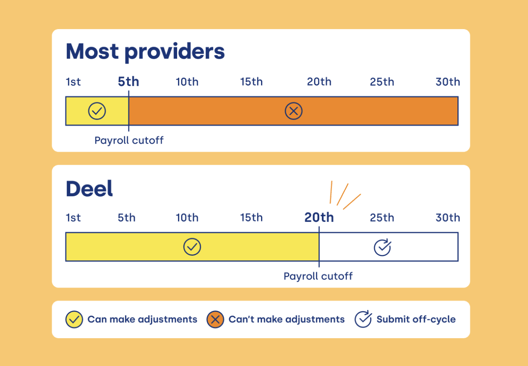

⭐ Did you know? Deel offers On-Demand Payroll that gives EOR customers unmatched payroll flexibility, with extended cutoff dates and off-cycle payments.

The downsides of performance-based compensation

Pay-for-performance compensation structure may not be ideal for every organization. Here are some potential shortcomings of this pay model.

Negative effect on teamwork and company culture

Overemphasis on individual performance and rewards can lead to unhealthy competition among employees, damaging teamwork and collaboration.

Solution: Include team-level performance bonuses to balance individual vs. team performance. Involve teams in setting performance goals that align with the organization's objectives. This fosters a sense of ownership and commitment to working together to achieve common outcomes.

Biased decisions

Evaluating performance objectively can be challenging, leading to potential bias in performance assessments. Managers might unconsciously favor certain employees or focus on easily quantifiable metrics, neglecting other important contributions.

Solution: Focus on behaviors and results rather than employee personality. Combine manager and peer reviews to ensure an objective image of each employee’s past performance. Consider calibration meetings with the company HR and leadership teams to ensure everyone’s evaluated objectively.

Exposure to stress and burnout

The constant pressure to meet performance targets can lead to increased stress and burnout, particularly if the goals are unrealistic or the rewards don't justify the effort.

Solution: Set realistic goals and use a balanced scorecard approach where you’ll evaluate different performance dimensions rather than just financial metrics. This will also help employees avoid becoming narrowly focused on the metrics that are directly tied to rewards and neglecting other important aspects of their roles or the organization's overall goals.

Increased disengagement

If employees feel the performance metrics are unfair, unattainable, or not aligned with their responsibilities, they might become disengaged and unmotivated.

Solution: Nurture honest and transparent communication within your team. Create a streamlined system so that employees can leave anonymous feedback if they have any comments or questions about your pay-for-performance plan. Encourage regular one-on-ones between managers and direct reports so that employees have a safe space to share concerns.

Hold better one-on-ones

Bake in reminders and feedback prompts for focused check-ins right in Slack with 1-on-1’s by Deel

Administration complexities

Designing and managing a fair and effective pay-for-performance system can be complex and time-consuming, requiring well-defined metrics, performance evaluations, and communication strategies.

Solution: Invest in technology solutions that automate data collection, performance tracking, and compensation calculations. This reduces manual effort and minimizes errors. Most HR tech tools also allow you to maintain a centralized database that houses performance data, compensation calculations, and historical records, so the information is readily accessible and organized.

Casey Bailey , Head of People , Deel

Demotivation for average performers

While high performers benefit from the model, average performers might receive minimal increases, leading to decreased motivation and satisfaction.

Solution: Implement tiered pay-for-performance initiatives offering different levels of compensation increases. This ensures that even average performers receive some recognition and motivation. You can also provide a structured plan for employees who are struggling to meet performance expectations and help them progress.

Effortlessly pay your team no matter where they are

Performance-related pay or not, Deel helps you manage compensation for your global workforce in one, unified platform. You can use Deel to:

- Pay your direct employees, international employees, and independent contractors —all under one roof

- Ensure tax compliance no matter where you hire

- Have flexible payroll with extended cutoff dates

- Offer an elevated experience to contractors thanks to Deel Card , Deel Advance, and more

- Manage employee benefits and deductions

- Access new insights with standardized global reporting

And much more!

Download our guide to global employee compensation strategies to compare the most common methods of structuring compensation for an international workforce: based on local rates, your headquarters location, global rates, and benchmark rates with cost of living (COL) adjustments.

Get your guide now

Deel makes growing remote and international teams effortless. Ready to get started?

Legal experts

- Hire Employees

- Hire Contractors

- Run Global Payroll

- Integrations

- For Finance Teams

- For Legal Teams

- For Hiring Managers

- Deel Solutions - Spain

- Deel Solutions - France

- Support hub

- Global Hiring Guide

- Partner Program

- Case Studies

- Service Status

- Worker Community

- Privacy Policy

- Terms of Service

- Whistleblower Policy

- Cookie policy

- Cookie Settings

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

Compensation Packages That Actually Drive Performance

- Boris Groysberg,

- Sarah Abbott,

- Michael R. Marino,

- Metin Aksoy

By aligning executives’ financial incentives with company strategy, a firm can inspire its management to deliver superior results. But it can be hard to get pay packages right. In this article four experts break down the key elements of compensation and explain how to put them together effectively.

When designing packages, boards must make decisions about the proportion of fixed versus variable pay, short-term versus long-term incentives, cash versus equity, and group versus individual rewards. Many look at the copious data available on executive pay and benchmark their plans against those of their industry peers. The mix is also driven by company size, region, culture, and risk appetite.

A good plan always begins with a firm’s strategic goals, however. Is the company striving for profitable growth, a turnaround, or a transformation? Is it trying to compete with public companies as a private entity? Each scenario calls for a different plan design.

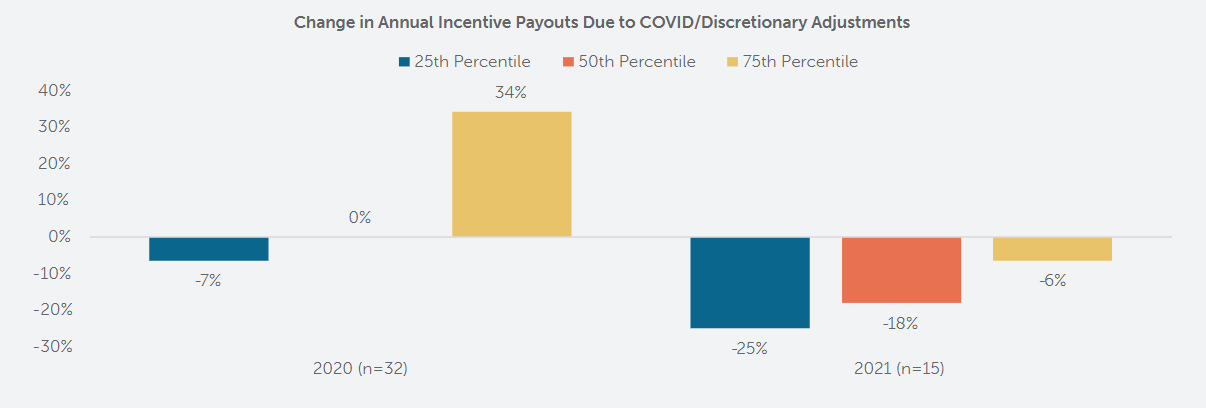

The Covid-related economic crisis may also alter plans. If targets become unachievable, incentives will lose their power and need to be revised—offering firms a chance to incorporate measures that serve stakeholders’ interests better.

Principles for designing executive pay

Idea in Brief

The finding.

When executive pay is structured to align with corporate strategy, it can drive better performance.

The Challenge

Many firms struggle to achieve this alignment, and only a few best practices work in all situations.

The Recommendation

The company must start with a clear strategic objective and then consider several trade-offs as it designs compensation packages.

Decisions about executive pay can have an indelible impact on a company. When compensation is managed carefully, it aligns people’s behavior with the company’s strategy and generates better performance. When it’s managed poorly, the effects can be devastating: the loss of key talent, demotivation, misaligned objectives, and poor shareholder returns. Given the high stakes, it’s critical for boards and management teams to get compensation right.

- BG Boris Groysberg is a professor of business administration in the Organizational Behavior unit at Harvard Business School and a faculty affiliate at the school’s Race, Gender & Equity Initiative. He is the coauthor, with Colleen Ammerman, of Glass Half-Broken: Shattering the Barriers That Still Hold Women Back at Work (Harvard Business Review Press, 2021). bgroysberg

- SA Sarah Abbott is a research associate at Harvard Business School.

- MM Michael R. Marino is a managing director at FW Cook.

- MA Metin Aksoy is a managing director at FW Cook.

Partner Center

Hire, pay and manage your talent in 160+ countries.

Pay for performance: pros and cons of performance-based pay.

Updated on :

Employ contractors and employees in 160+ countries

Table of Content

- Introduction

- What is performance-based compensation?

- Are there different types of performance-based compensation plans?

- The pros of using performance-based incentive plans

- The cons of performance-based compensation models

- Implement successful performance-based pay plans

Building a remote team?

Employ exceptional talent, anywhere, anytime!

.jpg)

Many employers have implemented a pay-per-performance compensation model to boost employee motivation to do great work. By establishing performance-based compensation, employers may drive productivity, as employee performance directly impacts pay. However, employers need to understand how performance-based pay works and the pros and cons of pay for performance.

Additionally, there are strategies for successfully implementing a performance-based compensation model that employers should consider to achieve their desired results. Continue reading to learn more about incentivized pay so you can decide whether a performance-based compensation model is right for your business.

Performance-based compensation , or pay for performance, is a payment model that companies use to pay employees based on their job performance. With this model, companies pay employees additional payments for reaching or exceeding goals and objectives. Bonuses are a common example of performance-based compensation, in which the employer gives an additional lump sum of wages if the employee performs well during a specific time. Earning commission on sales may also be an example of performance-based pay. Employers may implement this payment model to increase employee motivation and productivity, potentially benefiting both parties.

One platform to grow your global team

Hire and pay talent globally, the hassle -free way with Skuad

Working from home avoids commuting, and fewer commuters result in

lower greenhouse gas emissions.

There are various types of pay-per-performance compensation plans or models that employers follow. Three widely-used performance-based compensation models are:

- Discretionary bonuses

- Non-discretionary bonuses

Merit pay is a common payment model that looks like increasing one’s salary based on performance or giving someone a raise. With this model, high performance might be reaching certain financial goals, exceeding expectations, showing excellent leadership skills, and more. With merit pay, raises are typically given yearly to employees who have performed well. Merit pay may also coincide with promotion bonuses.

Discretionary bonuses are a variable pay-per-performance method in which bonuses are awarded for outstanding performance . These bonuses may be allotted if employees go above and beyond their expected duties. With this method, there may not be specific goals employees need to reach to receive bonuses but instead could occur on the spot based on the employer’s discretion.